agreement between the state (represented by the ministry for commerce and trade) and eksportfinans ASA

Exhibit 4.8

agreement

between

the state (represented by the ministry for commerce and trade)

and

| 1 | BACKGROUND AND OBJECTIVE |

| (i) | In light of the State’s decision of 18 November 2011 to acquire responsibility for Norwegian CIRR-qualifying export financing, the State (represented by NHD), wishes to establish a temporary export financing offer until a permanent government export finance arrangement has been established. |

| (ii) | This agreement establishes and regulates this type of temporary arrangement. The temporary arrangement entails that Eksportfinans shall function as the provider on behalf of the State, while the State shall be the lender in the loan agreements which Eksportfinans enters into on behalf of the State. |

| 2 | DEFINITIONS |

| The Agreement |

This agreement with the following appendices: A. Handbook for Loans (version dated 13 December 2011) B. Remuneration for the Assignment C. Guidelines for pricing of CIRR qualifying loans D. Routines for the establishment of loans E. Routines for ongoing administration of loans F. Routines for IT |

| ”CIRR qualifying loans” | Loans that are granted for loan projects which would have qualified for CIRR loans, however in which the borrower chooses the market interest rate. |

| 1 |

| CIRR loans | Loans which are granted for loan projects which satisfy the qualification rules for CIRR loans pursuant to the applicable rules as described in the Handbook and which are granted as fixed rate loans with interest rates equal to the government bond rate for the relevant currency plus one percent (or in accordance with the minimum interest rates which are stipulated at any time by the OECD in accordance with ”the Consensus arrangement”) and in which the interest rate is set before it is drawn on the loan. |

| Eksportfinans | Eksportfinans ASA |

| The Handbook | Appendix A |

| Loan Agreements | CIRR loans and CIRR qualifying loans which Eksportfinans enters into on behalf of the State after the Agreement enters into force. |

| NHD | The Ministry of Commerce and Trade |

| The Assignment | The services which Eksportfinans shall perform as defined under clause 3.1 |

| The 108-agreement | The “Agreement for interest equalising and exchange rate coverage for Eksportfinans’ deposits and loans” of 6 July 2007. |

| 3 | EKSPORTFINANS’ DUTIES |

| 3.1 | The assignment |

Eksportfinans shall perform the services specified in the Handbook for as long as the service description in the Handbook is suitable for the Assignment, with the additions and adjustments stated in the Agreement and appendices B-F to the Agreement.

In the event of conflict, the Agreement’s main part shall take precedence over the provisions in Appendices A-F and in the event of conflict between the provisions in the appendices, Appendices B to F, in that order, shall take precedence over the Handbook.

| 3.2 | Paramount principles |

Eksportfinans shall perform the Assignment in accordance with the Agreement and the relevant public law regulations.

The assignment must be performed in a professional manner and at a high professional standard.

Eksportfinans shall be entitled to enter into Loan Agreements on behalf of the State with the State as the lender, however the Loan Agreements shall be entered into subject to NHD’s written consent. Eksportfinans does not have the right to make binding pledges about loans or to enter into Loan Agreements without such provisos being included or NHD’s written consent having been received.

| 2 |

With regard to Eksportfinans’ more specific obligations concerning routines for pricing of CIRR-qualifying loans, routines for establishing loans and routines for the ongoing administration of loans, appendices C-E shall apply.

| 3.3 | Credit risk |

With regard to Eksportfinans’ obligations concerning credit risk, Eksportfinans shall, for as long as this is suitable, on behalf of the State continue handling the credit risk within the framework and in accordance with the routines as stated in chapter 3.1 of the Handbook. Restrictions associated with large engagements do not apply. Otherwise, the Assignment entails that when calculating the framework associated with countries, individual opposite parties and banks, the starting point will be the State’s risk exposure such that Eksportfinans’ own engagements are not taken into consideration.

| 3.4 | Reporting |

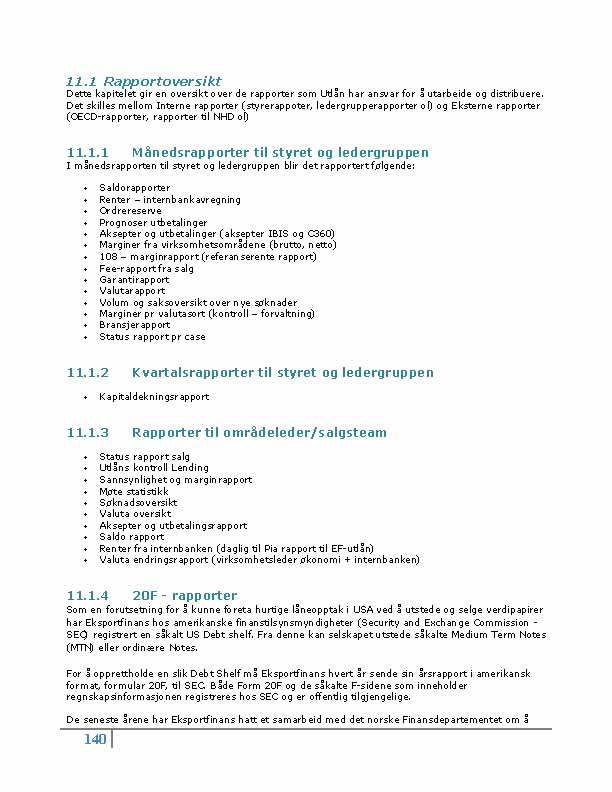

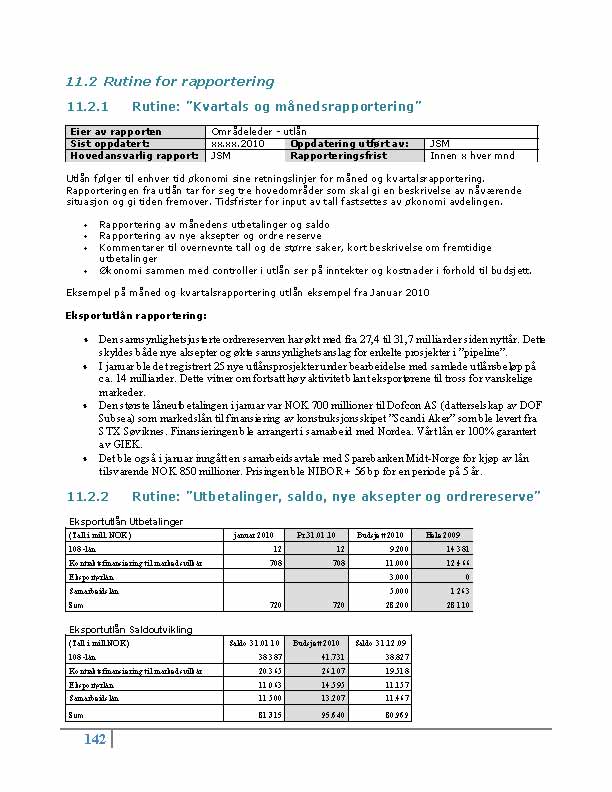

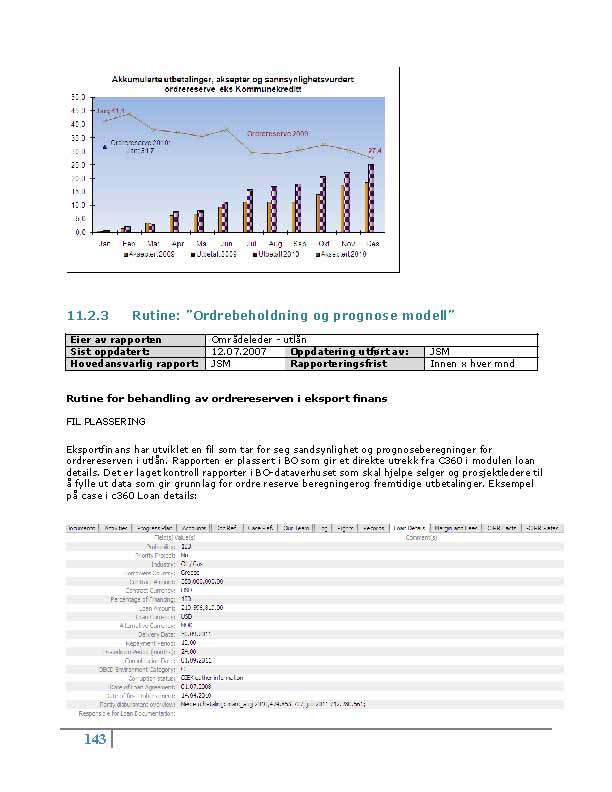

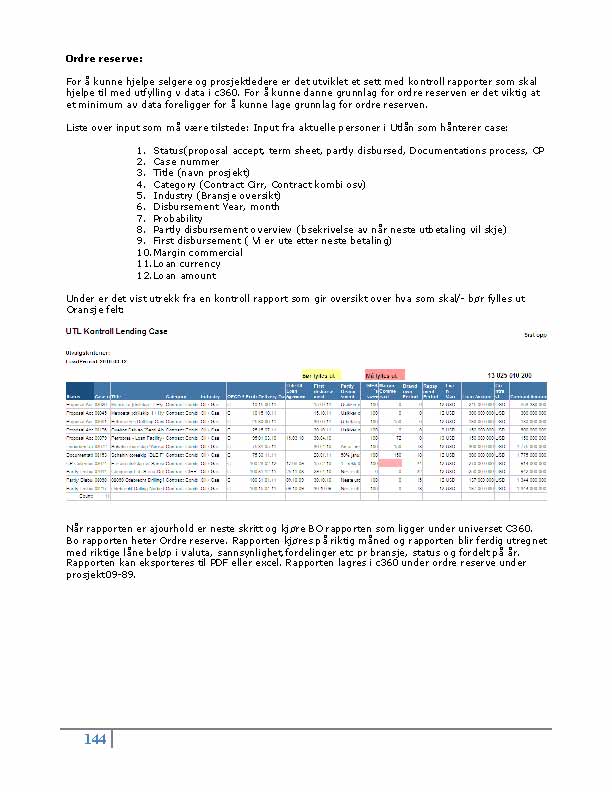

For as long as this is suitable, Eksportfinans shall report to the State to an extent equivalent to the overview provided in section 10.1.1 of the Handbook. Eksportfinans shall send the reports as copies to the State (represented by NHD).

The inter-company information in documents which deal with the management or similar at Eksportfinans shall not come under this reporting obligation.

Upon request from the State, Eksportfinans is also obligated to provide the State (represented by NHD) with ongoing reports and information about the various activities which the different levels in the loan process involve, cf. the description of ”process step” in chapter 3 of the Handbook.

Eksportfinans shall also ensure that the various “process steps” and routines which are stated in the Handbook are documented and the State is granted the right to access such documentation.

| 3.5 | The use of external service providers |

In accordance with the practice stated in the Handbook, Eksportfinans can use external service providers (for example lawyers) for the completion of the Assignment.

In accordance with the provisions in Appendix B, the State is responsible for covering the costs related to external service providers unless the costs are covered by the borrower.

| 3.6 | IT systems |

The parties’ obligations and rights associated with IT matters are stated in Appendix F.

| 4 | THE STATE’S OBLIGATIONS |

| 4.1 | Principal |

With regard to the State’s more specific obligations concerning routines for pricing of CIRR qualifying loans, routines for establishing loans and routines for the ongoing administration of loans, appendices C-E shall apply.

| 4.2 | Authorisation |

The State shall equip Eksportfinans with the necessary authorisation and other documentation that is required for Eksportfinans to be able to enter into Loan Agreements on behalf of the State with the State as lender and to be able to perform its other tasks pursuant to this agreement.

| 3 |

| 4.3 | Remuneration |

The State shall pay Eksportfinans remuneration for the Assignment as specified in Appendix B and in accordance with clause 5 below.

| 5 | PAYMENT |

| 5.1 | Price |

All prices and more specific conditions for the remuneration for the Assignment are stated in Appendix B. All prices are calculated excluding VAT.

| 5.2 | Method of payment |

Remuneration and expenses must be invoiced on the dates stated in Appendix B. Eksportfinans’ invoices must be specified and documented such that NHD can verify the invoice in relation to the agreed remuneration.

| 6 | DISTRIBUTION OF LIABILITY |

| 6.1 | Eksportfinans’ liability |

| 6.1.1 | Breach on the part of Eksportfinans |

There will be breach on the part of Eksportfinans if performance is not in accordance with the functions, requirements and deadlines that are agreed to. There will also be breach if Eksportfinans does not satisfy its other obligations under the Agreement. The State does not have the right to use sanctions or remedies for breach against Ekportfinans or Eksportfinans’ employees and board members other than those stated in the Agreement.

| 6.1.2 | Termination |

If there is serious breach, the State can, after having given Eksportfinans written notice and a deadline of at least thirty days to remedy the situation, terminate the Agreement with immediate effect.

| 6.1.3 | Liability for damages |

Eksportfinans is liable for demonstrating negligence in its performance of the Assignment.

Eksportfinans’ total liability must be limited to the remuneration Eksportfinans has received or has the right to receive pursuant to clause 5 above. Under no circumstances shall Ekportfinans be liable for indirect or consequential loss.

| 6.2 | The State’s liability |

| 6.2.1 | Liability and risk as the lender |

The State has the liability and risk as the lender in the Loan Agreements.

| 6.2.2 | Indemnity |

The State shall indemnify Eksportfinans against:

| (i) | Claims that are made against or which in any other way concern Eksportfinans, and |

| (ii) | All loss, damage, costs, expenses and all liability (collectively “Loss”) which Eksportfinans incurs, |

as a result of or in connection with the Assignment. Indemnity shall include, however not be restricted to, all loss which Eksportfinans incurs in connection with its defence against any claim

| 4 |

which is directly or indirectly made against Eksportfinans, for the procurement of documentation related to any claims or for attempts to limit any Loss Eksportfinans has incurred. Eksportfinans’ rights under this clause shall come in addition to the rights Eksportfinans has pursuant to the background law.

Eksportfinans can not claim to be indemnified for any claim or Loss if the claim or Loss in question were due to gross negligence or intent on the part of Eksportfinans.

The indemnity does not apply to Eksportfinans’ liability for damages to the State, cf. clause 6.1.3.

| 6.2.3 | Breach on the part of the State |

There will be breach on the part of the State if the State does not satisfy its obligations under the Agreement. Eksportfinans does not have the right to use penalties or remedies for breach against the State or the State’s employees other than those stated in the Agreement.

| 6.2.4 | Penalty Interest |

If the State does not pay at the agreed time, Eksportfinans can claim interest on the amount that has fallen due for payment in accordance with the Act of 17 December 1976, no. 100 pertaining to interest on delayed payment etc (Penalty Interest Act).

| 6.2.5 | Termination |

If remuneration that has fallen due and penalty interest have not been paid within thirty calendar days from the deadline, Eksportfinans can send written notice to NHD that the Agreement will be terminated if settlement has not occurred within thirty calendar days after notice has been received. If there are other forms of serious breach, Eksportfinans can, after having given NHD written notice and a reasonable deadline for remedying the situation, terminate the Agreement with immediate effect.

| 6.2.6 | Liability for damages |

The State’s liability for damages follows from the general tort law rules.

| 7 | VARIOUS PROVISIONS |

| 7.1 | Audit |

The State has the right to audit Eksportfinans’ performance of the Assignment.

Eksportfinans must, at the State’s expense, make all documentation that is relevant to the Assignment available for the audit, regardless of whether this is performed under the direction of NHD or the National Audit Office (NO: Riksrevisjonen).

| 7.2 | Confidentiality obligation |

The parties’ employees are subject to a confidentiality obligation with regard to the matters they obtain knowledge about in connection with the implementation of the Agreement as this obligation appears in provisions of the Public Administration Act and the Financial Institutions Act.

| 7.3 | The 108-agreement |

Upon the entering into of the Agreement, the parties agree that the 108-agreement has been terminated with effect for new pledges, cf. clause 22, second paragraph of the 108-agreement. The parties agree that the deadline for notice in clause 22, second paragraph of the 108-agreement shall not apply and that for new pledges this is terminated with immediate effect from when the Agreement enters into force. “New pledges” refers to pledges made by Eksportfinans after the

| 5 |

Agreement has entered into force. In instances in which pledges have been made for loans before the Agreement enters into force, the 108-agreement shall apply.

| 7.4 | Transfers |

Neither of the parties can transfer their rights or obligations under the Agreement.

| 7.5 | Transfer of loans |

If, after the Agreement enters into force, Eksportfinans pays CIRR-loans or CIRR- qualifying loans at its own expense and there is one or more part payments by Eksportfinans for these loans before the Agreement enters into force, the State can acquire these loans based on terms equivalent to those for the State’s acquisition of loans from Eksportfinans that occurred prior to when the Agreement entered into force.

| 8 | DISPUTES/CHOICE OF LAW |

The Agreement is governed by Norwegian law. Disputes concerning the understanding and implementation of the Agreement are under the jurisdiction of the ordinary Norwegian courts.

| 9 | TRANSITION TO PERMANENT ARRANGEMENT |

The State has the responsibility for establishing a new and permanent solution which shall replace the temporary arrangement established through the Agreement. The Parties are obligated to act loyally upon the transition to the permanent arrangement which the State shall establish for the issuing of CIRR loans and CIRR-qualifying loans when the Agreement expires.

| 10 | DURATION |

The Agreement shall apply from the signing date (“The Agreement’s entry into force”) and will run until 30 June 2011 unless otherwise is agreed in writing between the parties.

If major changes occur in Eksportfinans’ financial framework conditions which significantly hinder Eksportfinans’ ability to perform the Assignment, Eksportfinans has the right to terminate the contractual arrangement with thirty days’ written notice, after which Eksportfinans’ rights and obligations under the Agreement will cease.

***

Oslo, 21 December 2011

| The State, represented by the Minisrtry of Commerce and Trade | Eksportfinans XXX |

| Xxxxx Xxxxxx | Xxxxxx Xxxxxxxx |

| 6 |

Appendices:

A. Handbook for Loans (version dated 13 December 2011)

B. Remuneration for the Assignment

C. Guidelines for pricing of CIRR-qualifying loans

D. Routines for establishing loans

E. Routines for ongoing administration of loans

F. Routines for IT

| 7 |

Appendix A

Appendix B:

remuneration for the assignment

(i) The State shall pay Eksportfinans a fixed fee of NOK 8,600,000 per month, excluding any VAT for the services that shall be provided in accordance with the Agreement (the "Remuneration”). The Remuneration will fall due for payment in arrears on the first day of each month after the Agreement comes into effect and until and including the first calendar month after the Agreement is terminated or has expired. Full remuneration shall be paid for the calendar month in which the Agreement comes into effect. For the Calendar month in which the Agreement is terminated or expires there will be a proportionate settlement according to the number of actual days the Agreement has run.

(ii) The State shall cover Eksportfinans’ documented legal fees related to the entering into of the Agreement and the agreement for the transfer of employees.

(iii) The remuneration includes Eksportfinans’ expenses in connection with the establishment of the Assignment (with the exception of the expenses which are referred to under ii) as well as expenses in connection with the performance of the Assignment. Among other things, the Remuneration also includes, however is not limited to, necessary travel, external arrangements, representation etc which are necessary for carrying out the Assignment.

(iv) In addition to the Remuneration, in connection with the performance of the Assignment Eksportfinans can claim coverage of direct expenses for external advisors (lawyers etc.) unless these are covered by the borrower. Expenses under this paragraph which exceed 10% of the Remuneration per month require prior consent from the State.

Eksportfinans can invoice the State for such expenses as these accrue.

***

| 1 |

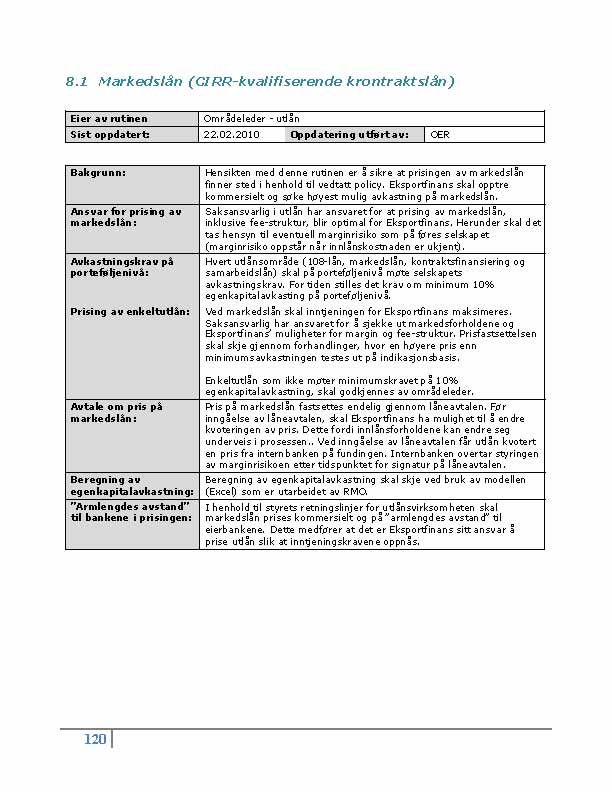

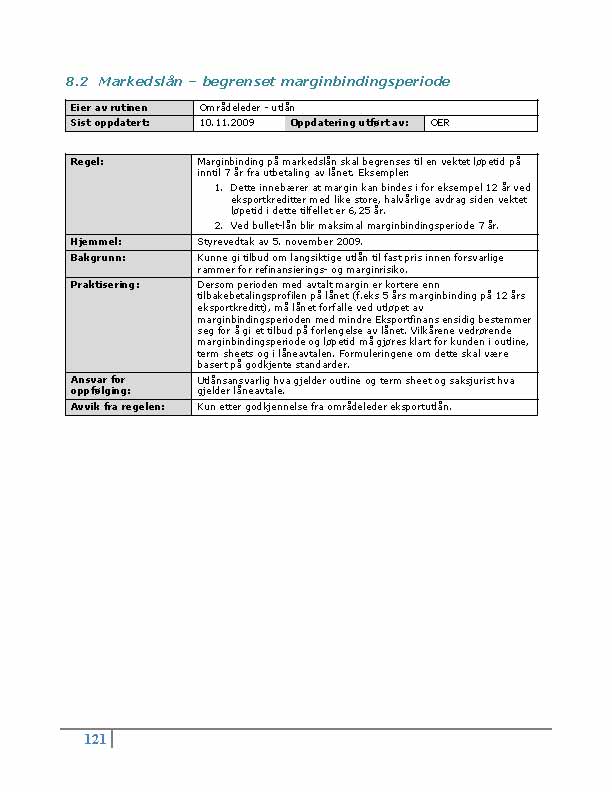

Appendix C: Routines for pricing of market loans during the transitional period

The interest rate that is offered for CIRR-qualified market loans during the transitional period (guarantee premiums come in addition to this) must be the highest of the expected market price, the price for the minimum earnings or the ESA’ reference interest rate. It is noted that the ministry is in talks with the ESA concerning pricing of market loans and that the routines could be changed during the transitional period if feedback from the ESA indicates that changes be made to the routines.

| a) | Expected market price |

| - | Eksportfinans shall ensure that it has sufficient market knowledge to be able to asses what the loan margins must be at any given time such that the price/margin will be the market rate. |

| b) | Price for minimum earnings |

| - | Since Eksportfinans will not accept loans during the transitional period, the starting point will be the average of Eksportfinans’ internal prices in USD for August, September and October 2011 for 0-1 year terms, 1-3 year terms, 3-5 year terms, 5-7 year terms, 7-10 year terms and terms of more than 10 years. |

| - | Positive (negative) swap margins for swaps to other currencies are added (removed) if the loan is to be provided in a currency other than USD. |

| - | The internal prices are adjusted monthly in accordance with observations of the spread development in the second-hand market for bonds for the relevant currency issued by KBN (three year papers). |

| - | A margin of 37.5 bp is added to cover administration costs in connection with loans and earnings. This is equal to a return on Eksportfinans’ equity of 10 percent. |

| c) | ESA’s reference interest rate: |

| - | Calculated in accordance with ESA’s guidelines for the calculation of reference interest: EFTA Surveillance Authority’s State aid Guidelines Part VII: Rules Regarding Applicable Rates – Reference and Discount Rates, i.e..: |

| i. | The base rate: The average of 12 month IBOR for September, October and November for the previous years for the respective currencies. |

| ii. | If the average 12 month IBOR for the past three months deviates by more than 15 percent from the applicable IBOR, an adjustment of the base rate will be made. The new base rate shall apply from the first day in the second month after the observation period. |

| iii. | Margin: Loans shall be 100 percent guaranteed by GIEK and/or a highly rated commercial bank. The margin must be selected from the ESA’s premium matrix based on the guarantor’s rating. |

| - | If the customer requests a fixed margin over 1 month IBOR, 3 month IBOR or 6 month IBOR, Eksportfinans can adjust the reference interest rate by the price of the relevant base swap. The swap margins are set at the same time as the ESA’s reference interest rate in accordance with the price that applies at this time. In the event of changes in connection with point c (ii), consideration must also be made to changes in the base swap. |

| 1 |

APPENDIX D

ROUTINES FOR THE ESTABLISHMENT OF LOANS

| 1 | connection TO THE HANDBOOK |

The routines and guidelines in the Handbook for the establishment of loans shall apply insofar as these are suitable. This entails the following:

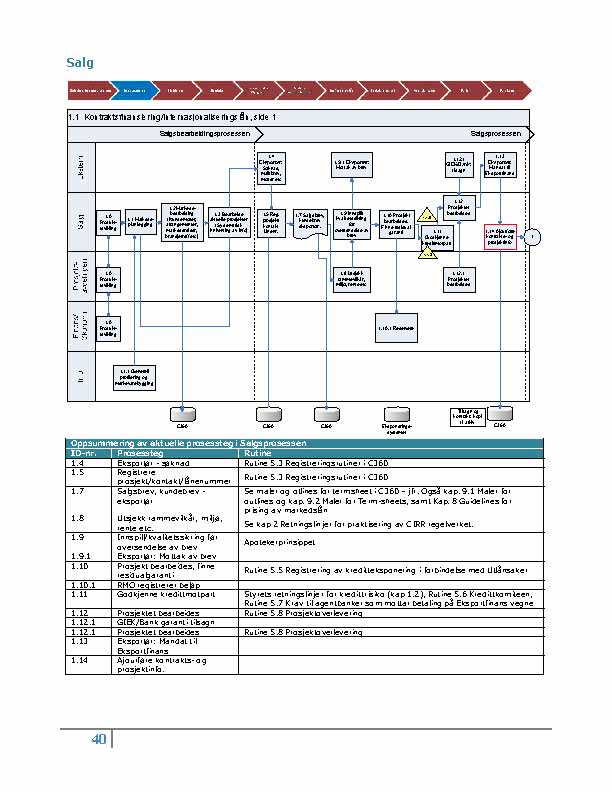

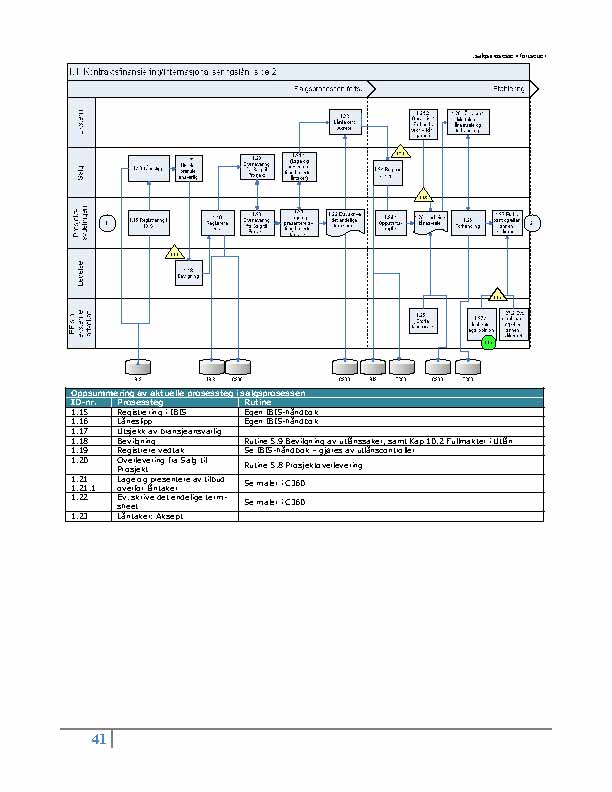

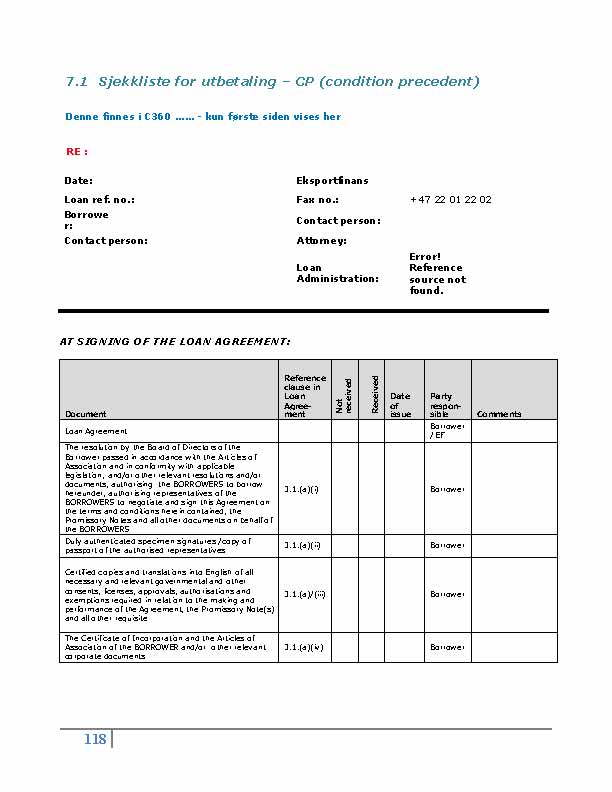

| (i) | During the sales process the Handbook’s ”Summary of potential process steps in the sales process” ID no. 1.18 with accompanying routine 5.9 shall apply such that the State, represented by NHD, receives information as stated under this section. |

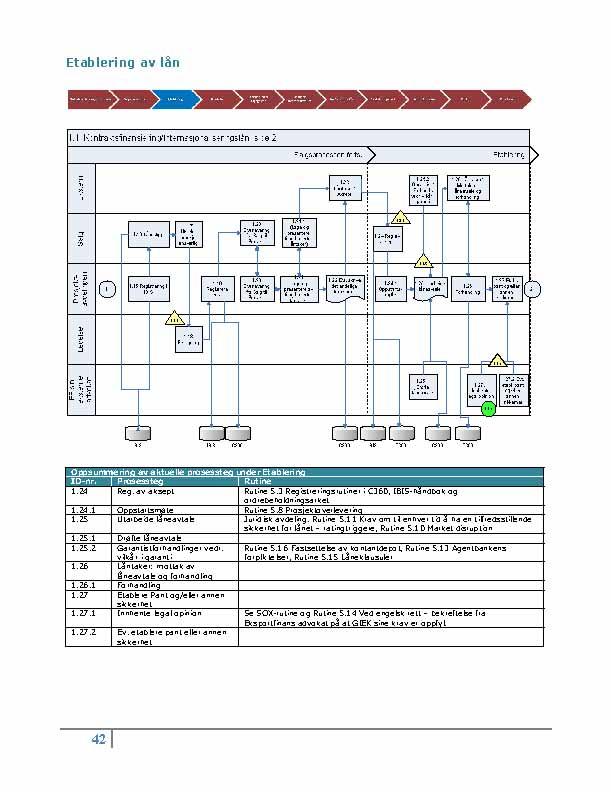

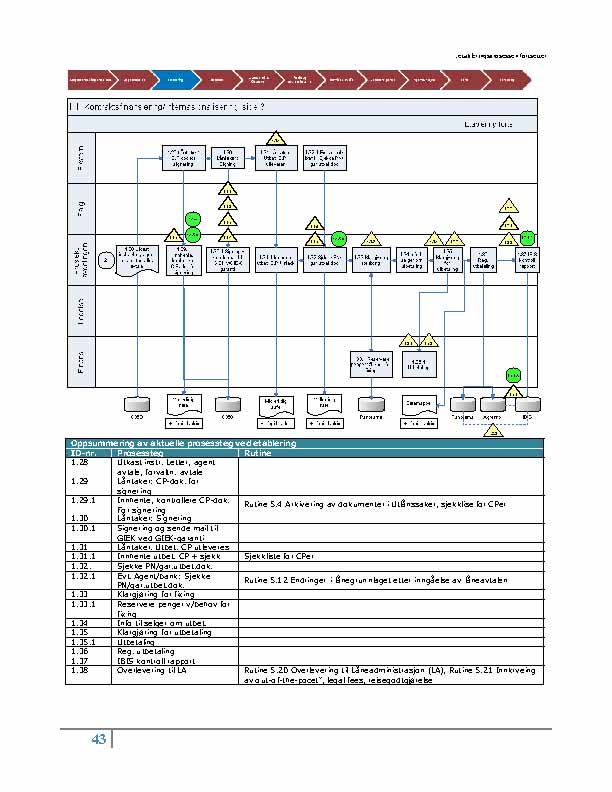

| (ii) | For the signing of loan agreements, the Handbook’s ”Summary of potential process steps during establishment” ID no. 1.24 until and including ID no. 1.30 with the accompanying routines for Eksportfinans’ performance of the Assignment shall apply with the adaptations stated in section 2 below. |

| (iii) | For the payment of loans, the Handbook’s ”Summary of potential process steps during establishment” ID no. 1.31 until and including ID no. 1.37 with the accompanying routines for Eksportfinans’ performance of the Assignment shall apply with the adaptations stated in section 3 below. |

| 2 | signing of loan agreements |

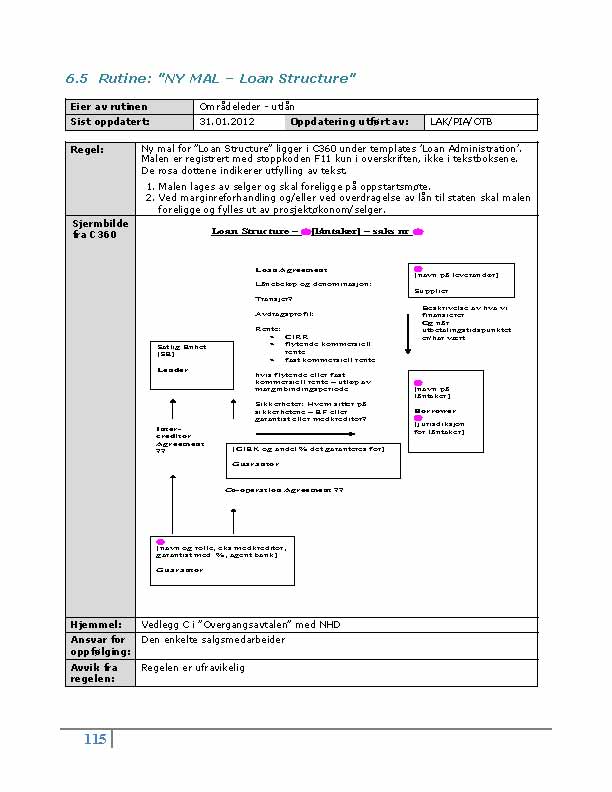

| 2.1 | Negotiation mandate |

Eksportfinans has received a mandate from the State (NHD) to negotiate, on behalf of the State, the Loan Agreement and other documentation that is requested in connection with the individual loan transaction. The State (NHD) has been sent Eksportfinans’ standard loan agreements for ship financing and project financing. Negotiations of Loan Agreements must be based on Eksportfinans’ standard loan agreements and the negotiation of Loan Agreements must be in line with the guidelines and principles which Eksportfinans has practiced for loan transactions before the Agreement entered into force.

Eksportfinans shall be permitted to enter into Loan Agreements on behalf of the State with the State as the lender, however the Loan Agreements must be entered into on condition of NHD’s written consent. Eksportfinans has no right to provide binding statements about loans or to enter into Loan Agreements without such provisos having been included or NHD’s written consent having been received.

| 2.2 | Notice of the agreed date for the signing of the Loan Agreement |

Eksportfinans shall notify the State (NHD) of the agreed signing date for a loan agreement. A complete draft of the loan agreement together with a brief overview of the loan arrangement must be sent to the State (NHD) to be reviewed before signing. If the State (NHD) has important remarks to the loan agreement, these must be sent to Eksportfinans as soon as possible thereafter. Eksportfinans shall then send the remarks from the State (NHD) to the other parties involved in the loan transaction with the objective of obtaining acceptance for these and to have the remarks implemented in the final loan agreement.

| 1 |

| 2.3 | Approval and signing of Loan Agreements |

When a loan agreement has been negotiated, the State (NHD) shall send written confirmation to Eksportfinans that the Loan Agreement and other documentation required in connection with a loan transaction can be signed. The State (NHD) shall equip Eksportfinans with the necessary authority to sign the Loan Agreement and other documentation required in connection with the individual loan transaction on behalf of the State (NHD). Eksportfinans can sign the loan agreement and other documentation required in connection with the individual loan transaction when Eksportfinans has received written confirmation from the State (NHD) that the loan documentation can be signed.

The State (NHD) can set more specific rules for the verification of loan documentation.

| 2.4 | Archiving of loan documentation |

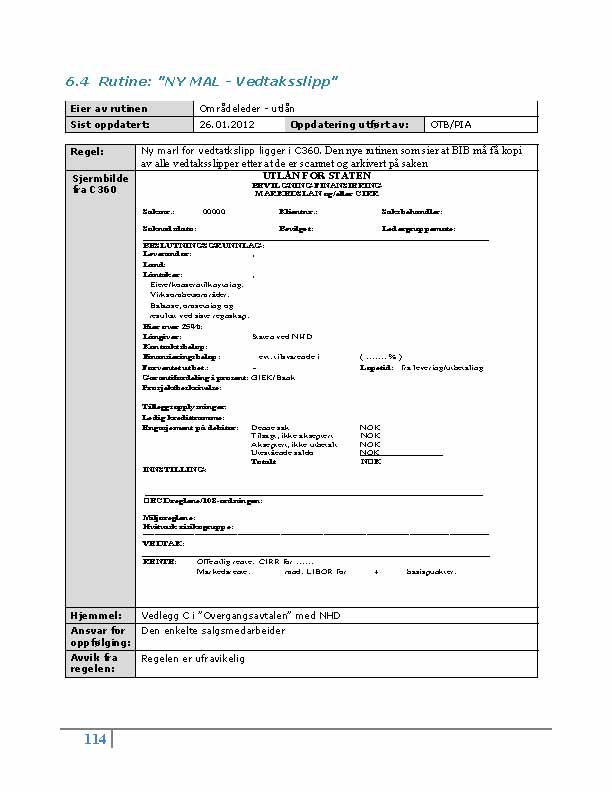

Eksportfinans shall ensure that signed Loan Agreements and other signed documentation related to the individual loan transaction are archived in Eksportfinans’ IT system C360. In each loan case Eksportfinans shall ask an external lawyer to prepare two hard copies of the loan documentation (Bible of Documents). Eksportfinans shall send one copy of the Bible of Documents to the State (NHD) when this has been received by Eksportfinans.

| 3 | payment of loans |

| (i) | Eksportfinans receives a payment request from the lender or agent bank. |

| (ii) | Eksportfinans immediately sends a copy of the payment request to NHD and NHD’s external control function. NHD shall ensure that the correct currency account has coverage for the payment. The payment request must have been received by NHD no later than three days before payment to the customer. For especially large currency amounts which are equivalent to more than NOK 1,200 million, separate notice per payment must be agreed. |

| (iii) | Eksportfinans' case lawyer signs the check list in the loan case. |

| (iv) | The loan administration manager creates an internal form with relevant payment information that is checked out by another employee in Eksportfinans’ loan administration group (the ”Loan Administration”). |

| (v) | The form is sent to an authorised person in Eksportfinans’ loans ddivision (”Loans”) together with the payment request and authority from the State to sign the loan documentation. The authorised person in Loans signs the form. The form must not be signed before the authority from the State is in place. |

| (vi) | The form and the payment request are given to a person in Back Office who registers the payment in Nordea’s internet bank. |

| (vii) | The payment is approved/authorised by a person in Back Office who does not have registration access. |

The Loan Administration has reader access to the State’s accounts via the internet bank. In this way all parties can monitor the interest and instalments that come in for the various loans.

***

| 2 |

APPENDIX e

ROUTINES FOR LOAN ADMINISTRATION

| 1 | SCOPE OF THE LOAN ADMINISTRATION |

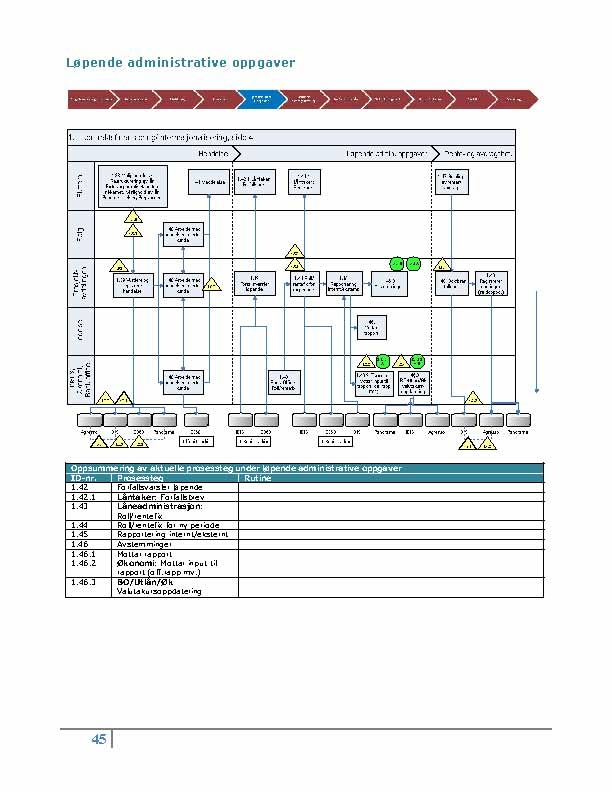

Eksportfinans pledges to mange the loan administration in the manner stated in section 2 for (i) loans with the State as lender established during the Assignment, and (ii) the loans which are transferred from Eksportfinans to the State in accordance with separate transfer agreements between the parties.

| 2 | The execution of the loan administration |

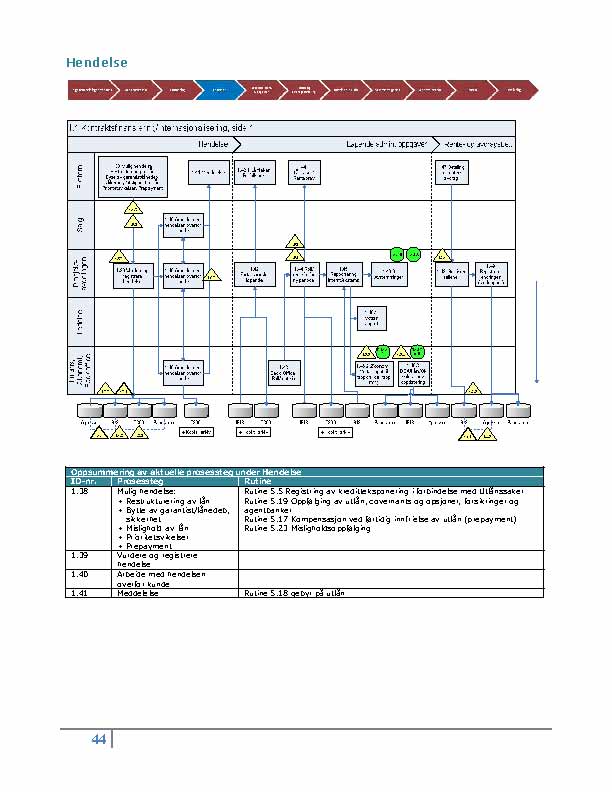

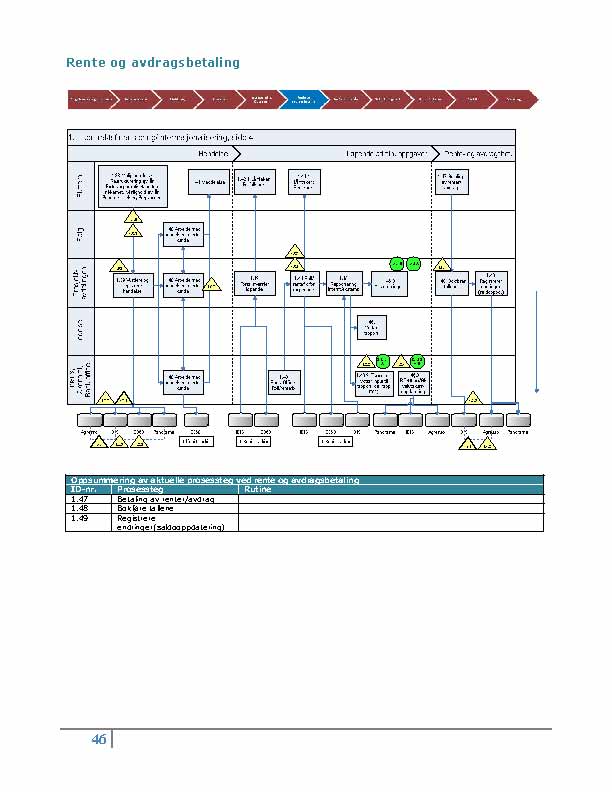

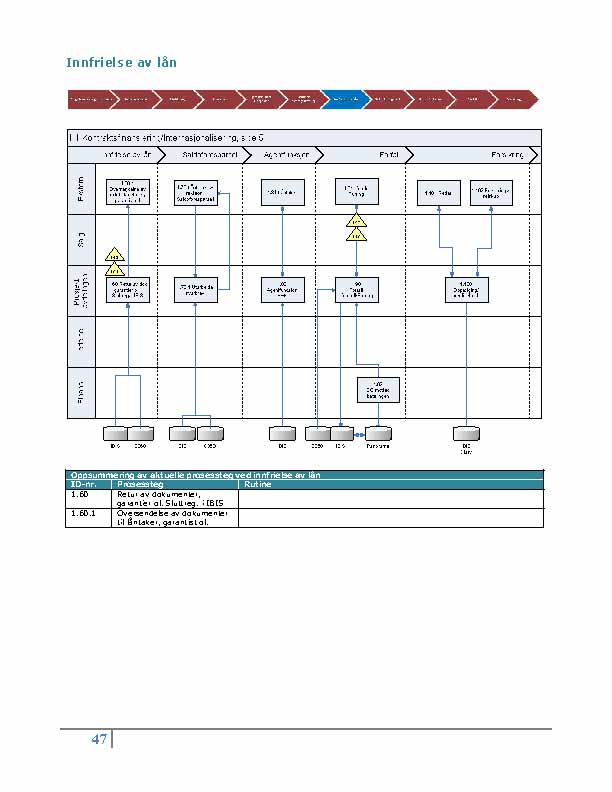

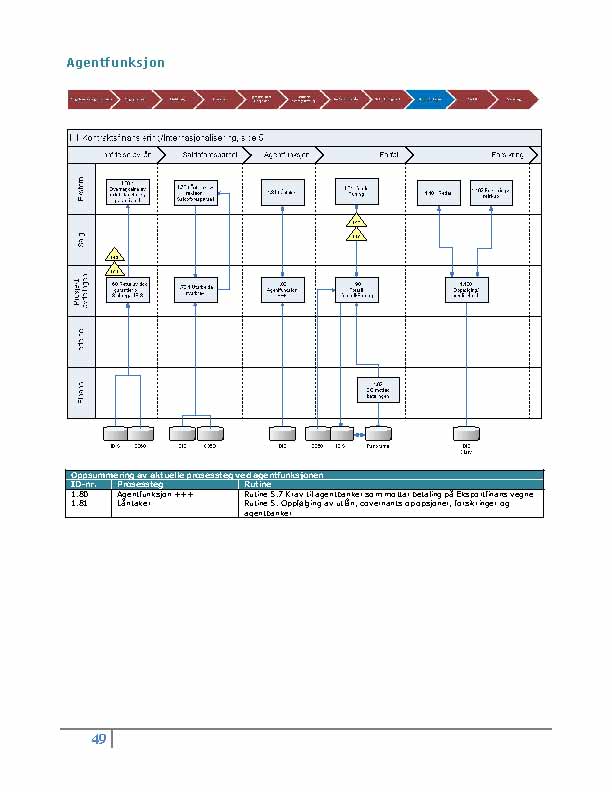

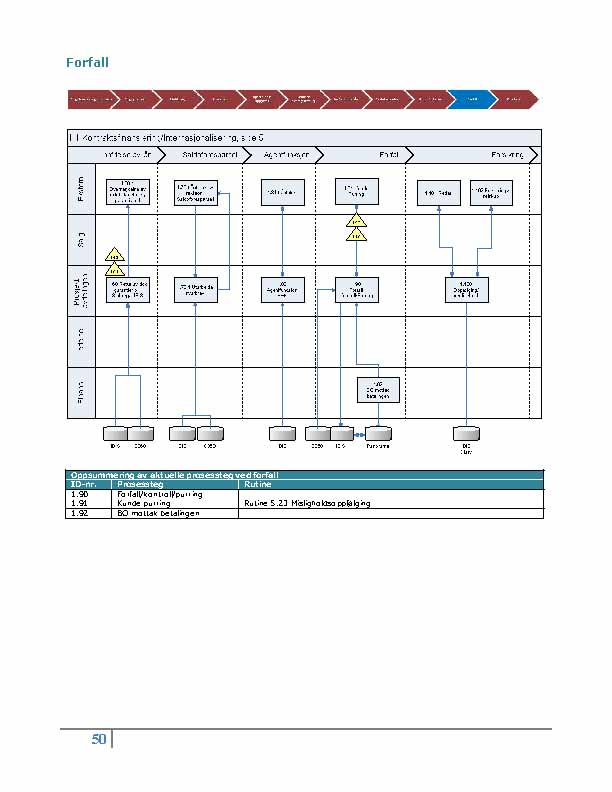

Sections 1.3, 1.4, 1.5, 1.8, 1.12, 1.17, 1.37, 1.39 and 1.40 in the Handbook For Loan Administration, version 1.0, dated 29 July 2011 (”Handbook For Loan Administration”) applies equivalently for Eksportfinans’ loan administration to the extent that these are suitable and must be interpreted and adapted to the Assignment’s special features and objective.

***

| 1 |

Appendix F:

1 IT SYSTEMS

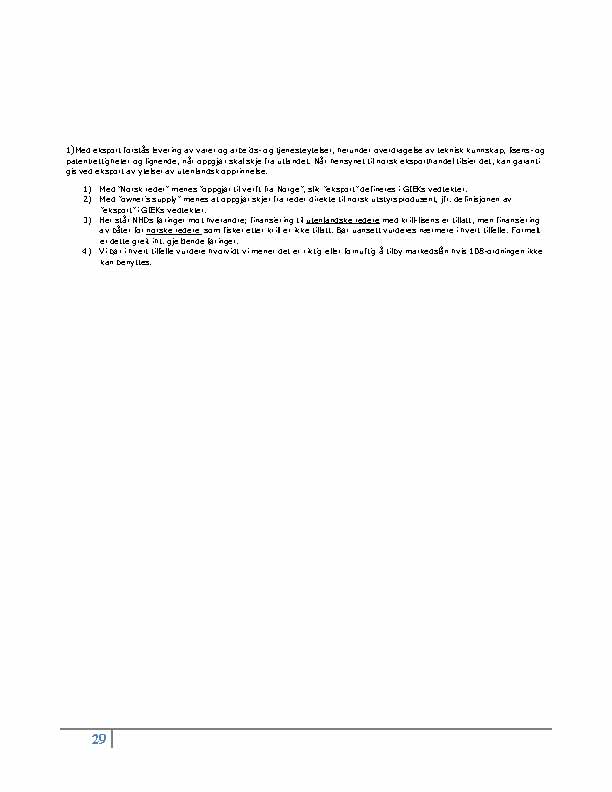

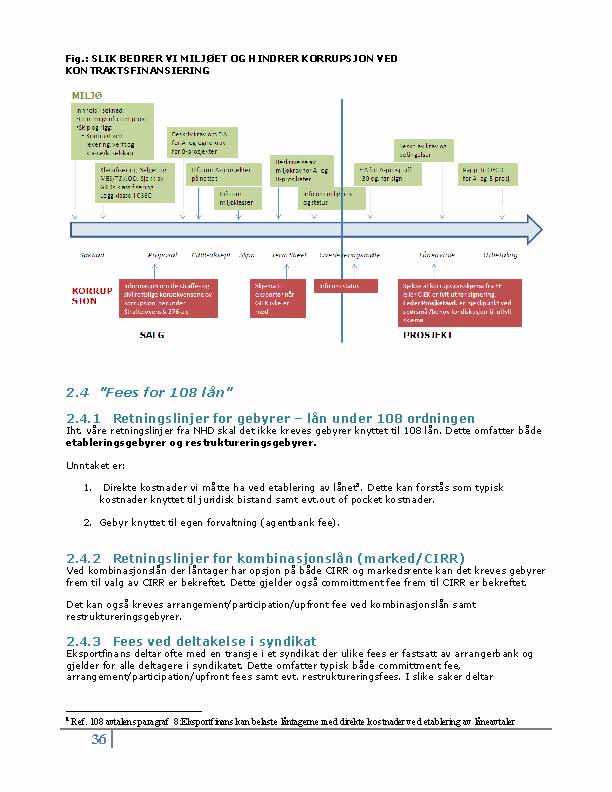

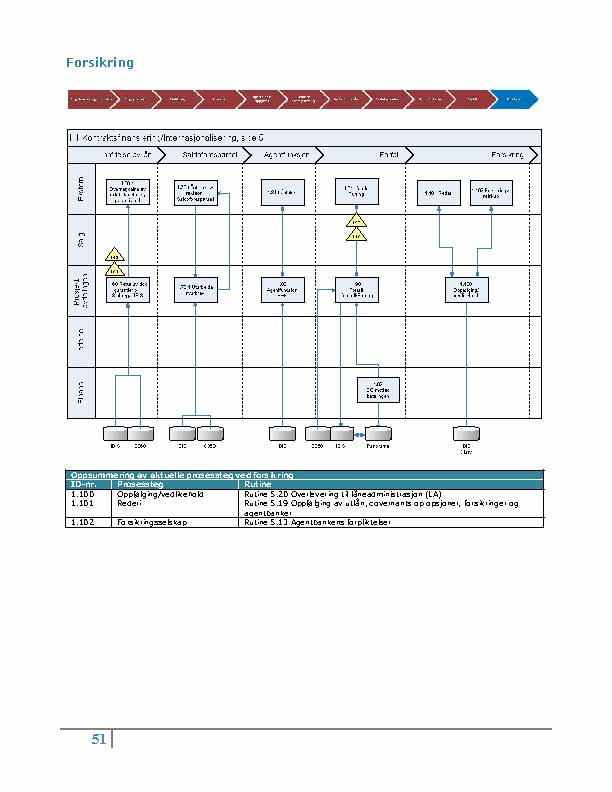

The figure below provides an overview of the IT systems which will be necessary for handling loans for the State during the transitional period.

The next chapters describe each of these systems and the obligations Eksportfinans and NHD have in relation to the operation of these systems during the transitional period.

1.1 Agresso

Both Eksportfinans and NHD use Agresso to compile their own accounts, however since it is NHD that formally grants new loans, during the transitional period the accounts will have to be compiled in accordance with their rules and requirements. NHD will therefore themselves compile the accounts for new loans until a new institution is in place on 1 July, while Eksportfinans’ version of Agresso is not used under the agreement between Eksportfinans and the State. The operation and use of Agresso is therefore NHD’s responsibility during the transitional period.

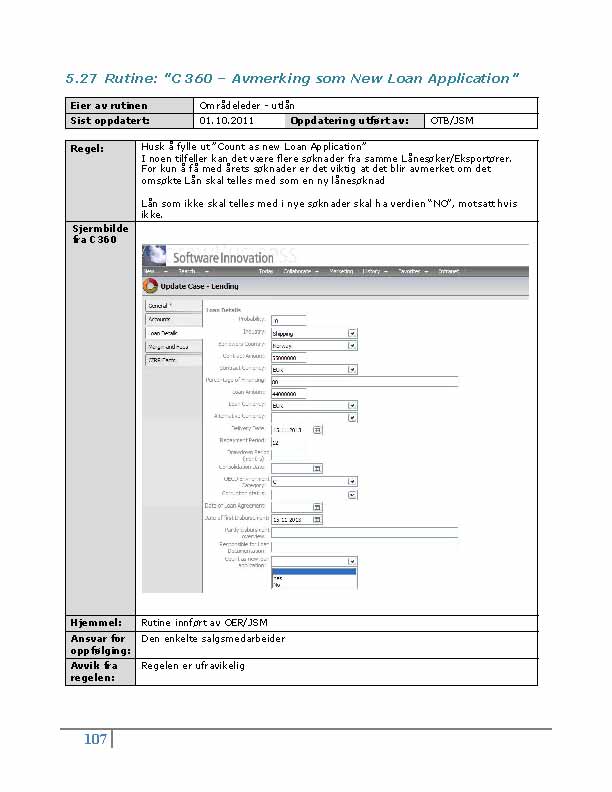

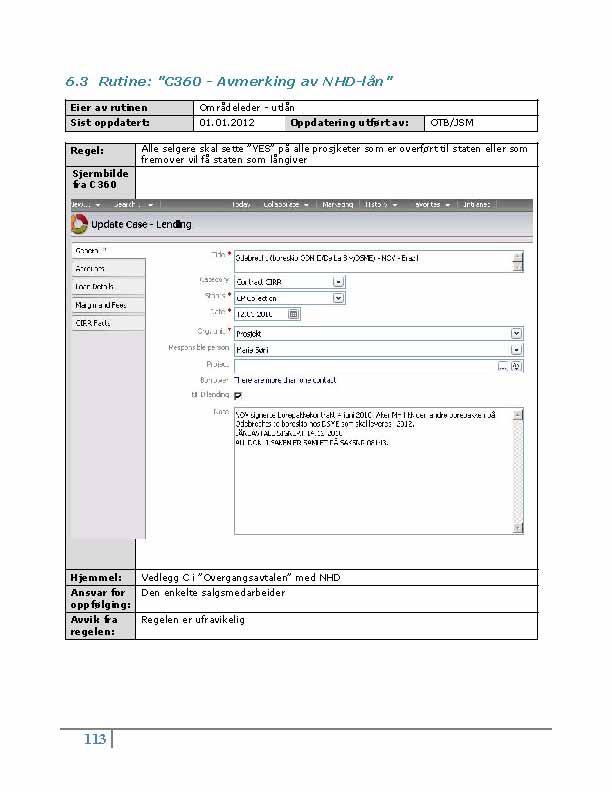

1.2 C360

C360 is presently used to handle the sales process in loan cases in addition to being an electronic archive for all important case documents. The system also has functions for handling contacts,

| 1 |

activities and projects. Like today, C360 will also be used for the cases that shall be handled for the State:

| · | Documents: Important case documents are entered in C360 and assigned to “lending case”. |

| · | Lending Case: A new “lending case” is established for each new loan. The same system that is presently used for case numbering is used, i.e. xxyyy, where xx refers to the final two digits in the year and yyy is a sequential number for which each years starts at 001. All new loans and loans which the State may acquire from Eksportfinans are marked by the field NHD lending being given the value yes. |

| · | Project: Not used in relation to the State |

| · | Activity: Used as before. |

| · | Contracts: New contacts are registered as normal and related to the case. |

During the transitional period Eksportfinans will be responsible for the operation of C360.

1.3 EDB Lending System (ELS)

Eksportfinans uses an old ledger system, IBIS, for the administration of loans. IBIS does not have support from the supplier and it was already planned to replace the system due to, among other things, high operational risk. The system that was to replace this was ELS from EDB Ergo Group and the management of Eksportfinans were ready to commence negotiations for the delivery of this system when the State decided to take over CIRR-qualifying export financing. The requirements which Eksportfinans had, and which are very similar to those a future, state institution will have, have therefore been adapted to ELS. It is expected that a version of the system can be configured in accordance with these requirements in four to six weeks.

Eksportfinans will therefore handle loans with the assistance of Excel in a start phase lasting a few weeks. During this period, only the most necessary data and functions will be handled. After four to six weeks from when the contract is entered into, use of ELS will commence for all loans which are covered by the management agreement. Eksportfinans will operate this system internally and enter into a lease agreement with EDB Ergo Group for the transitional period. As part of the lease agreement, the possibility of an extension for a future, state institution will also be included.

1.4 Outlook

Eksportfinans will continue to the use the internal system for email. During the transitional period electronic communication will therefore take place with existing email addresses in the xxx@xxxxxxxxxxxxx.xx format.

1.5 WEB

Eksportfinans will continue to use its internal website at xxx.xxxxxxxxxxxxx.xx.

2 Integration

Eksportfinans has a high degree of integration between its existing systems. This entails that there will be little need to process the same type of data at more than one location. By commencing use of a new loan system, a different accounting system and a new method for carrying out payments in

| 2 |

and out we will no longer be able to benefit from the present integration solution. However, this will not be particularly problematic during the transitional period because the number of loans will be so low that the additional, manual work will be limited. Alternatively, not having a functioning loan system when the new institution is in place is considered much less practical.

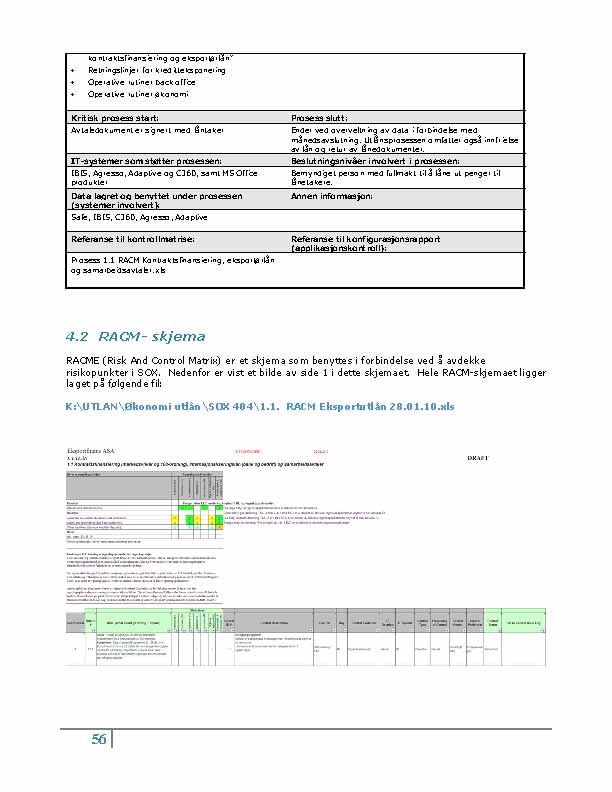

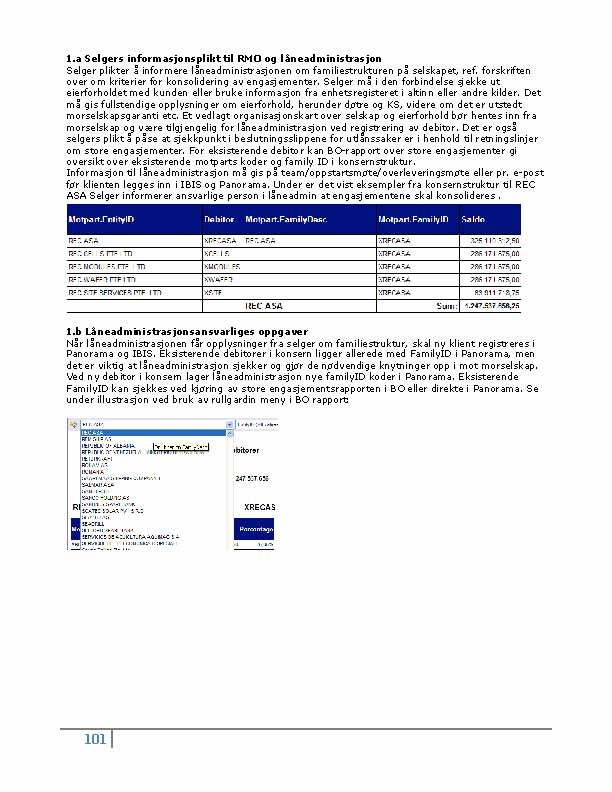

Even though there will not be any automatic integration between the systems, the information must be exchanged between these. The table below provides an overview of how this will occur during the transitional period:

| From | To | Type of data | Description and responsibility |

| C360 | ELS | Case data | Case data obtained from the loan documentation which is stored in “lending case” in C360. Responsibility for updates: Eksportfinans |

| Bank | Agresso | Movements in and out | Information obtained via logging onto internet bank or email from the Bank. NHD shall carry out bookkeeping in Agresso on the same date that the currency account is debited and the payment is made to the borrower/customer. Interest and instalments are entered in the accounts with the same date as the date on which the payment is in the currency account.

|

| Bank | ELS | Movements in and out | Information obtained via logging onto internet bank or email from email from the Bank. Responsibility for updates: Eksportfinans |

| Eksport-finans | NHD | Expected payments

|

Expected payments in the next few weeks obtained from ELS and regularly reported to NHD. For its part, NHD will ensure that necessary currency amounts (NOK,USD,EUR) will be transferred to accounts before payment is required. |

3 Reporting

4 Delivery

At the conclusion of the transitional period Eksportfinans shall deliver what is necessary for the state institution to be able to take over the handling of loans. This chapter describes how delivery will occur for each individual system.

Agresso

The delivery of Agresso to a new institution is not part of the management agreement between Eksportfinans and NHD. The method of delivery must be agreed between NHD and the new institution.

C360

All documents related to the State’s cases (marked NHD lending=”yes”) are taken from C360 and placed in a file structure in which all files belonging to a case are placed in a folder marked by the

| 3 |

case number. Other data registered in lending case and contacts related to lending case are placed in XML files or other formats in accordance with an agreement with the new institution.

ELS

Eksportfinans shall enter into a lease agreement until 01.07.2012 for the use of ELS. This agreement will contain an option to continue to use the system. It will be up to the new institution to decide whether this is desirable. Further use of ELS must be agreed between EDB Ergo Group, Eksportfinans and the new institution.

| 4 |