JOINT VENTURE AGREEMENT between EVANDER GOLD MINES LIMITED and TAUNG GOLD HOLDINGS (PROPRIETARY) LIMITED

Exhibit 4.23

between

EVANDER GOLD MINES LIMITED

and

TAUNG GOLD HOLDINGS (PROPRIETARY) LIMITED

TABLE OF CONTENTS

| 1 |

INTERPRETATION | 3 | ||||

| 2 |

RECITALS |

17 | ||||

| 3 |

CONDITIONS PRECEDENT |

18 | ||||

| 4 |

JOINT VENTURE |

18 | ||||

| 5 |

PARTICIPATION |

20 | ||||

| 6 |

JOINT VENTURE EXPENSES |

21 | ||||

| 7 |

NO PARTNERSHIP |

23 | ||||

| 8 |

DURATION |

24 | ||||

| 9 |

WARRANTIES BY THE PARTIES |

24 | ||||

| 10 |

FUNDING |

26 | ||||

| 11 |

MANAGEMENT |

29 | ||||

| 12 |

RESTRICTED MATTERS |

32 | ||||

| 13 |

ADMINISTRATION AND ACCOUNTING |

36 | ||||

| 14 |

PROHIBITION OF ENCUMBRANCE |

38 | ||||

| 15 |

PRE-EMPTIVE RIGHTS |

00 | ||||

| 00 |

XXXXX XXXXXXX |

00 | ||||

| 00 |

TERMINATION AND XXXXXXXXXX |

00 | ||||

| 00 |

XXXX XXXXXX XXXXX |

00 | ||||

| 00 |

CONFIDENTIALITY AND PUBLICITY |

47 | ||||

| 20 |

BREACH |

49 | ||||

| 21 |

DISPUTE RESOLUTION |

49 | ||||

| 22 |

NOTICES AND DOMICILIA |

50 | ||||

| 23 |

BENEFIT OF THE AGREEMENT |

52 | ||||

| 24 |

APPLICABLE LAW AND JURISDICTION |

52 | ||||

| 25 |

SUPPORT |

53 | ||||

| 26 |

FAIRNESS |

53 | ||||

| 27 |

GENERAL |

54 | ||||

| 28 |

COSTS |

55 | ||||

| 29 |

SIGNATURE |

56 | ||||

ANNEXES

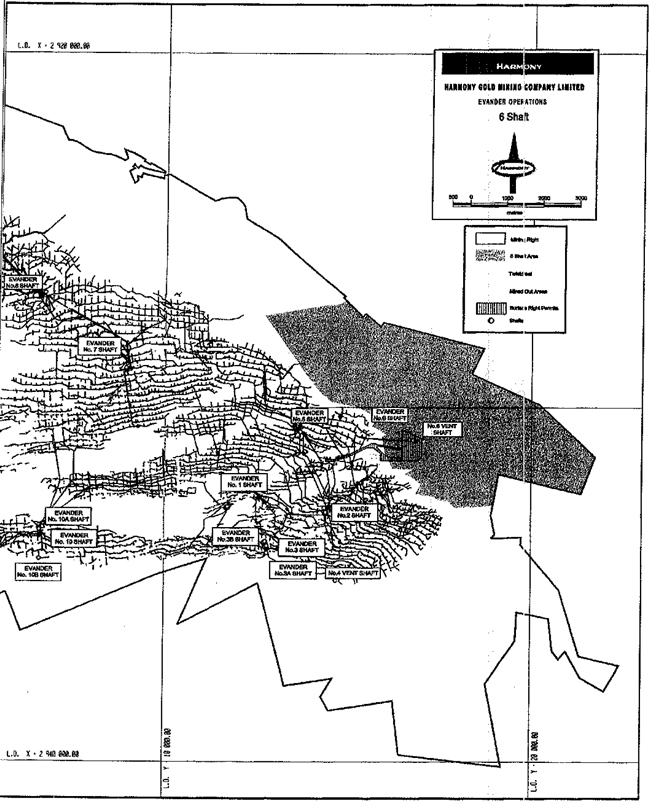

| ANNEXE “A” : | EVANDER 6 SHAFT AREA | |

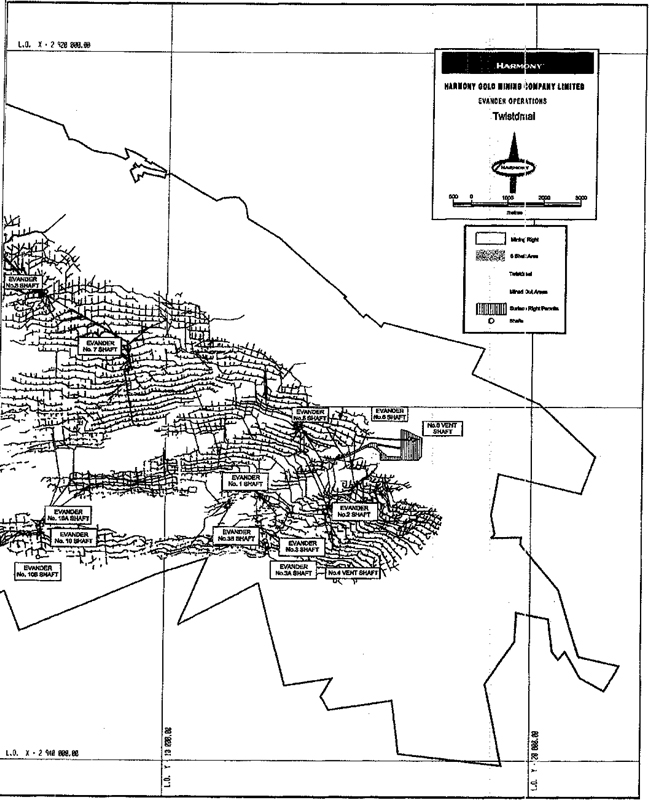

| ANNEXE “B” : | TWISTDRAAI AREA | |

|

|

Page 2

WHEREBY THE PARTIES AGREE AS FOLLOWS:

| 1 | INTERPRETATION |

| 1.1 | In this Agreement - |

| 1.1.1 | clause headings are for convenience only and are not to be used in its interpretation; |

| 1.1.2 | an expression which denotes - |

| 1.1.2.1 | any gender includes the other genders, |

| 1.1.2.2 | a natural person includes a juristic person and vice versa; and |

| 1.1.2.3 | the singular includes the plural and vice versa. |

| 1.2 | In this Agreement, unless the context indicates a contrary intention, the following words and expressions bear the meanings assigned to them and cognate expressions bear corresponding meanings – |

| 1.2.1 | “AFSA” means the Arbitration Foundation of Southern Africa; |

| 1.2.2 | “Annual Budget” means the annual budget of the Joint Venture referred to in clause 13.4; |

| 1.2.3 | “Associated Companies” means the holding company and all subsidiaries of the holding company of Evander or Taung, as the context may require; |

| 1.2.4 | “Auditors” means the auditors from time to time of the Joint Venture; |

| 1.2.5 | “BFS” means a bankable feasibility study, following the PFS, in either |

|

|

Page 3

| of both of the JV Areas (as determined in terms of the Subscription Agreements), comprising a comprehensive description of the design, construction, commissioning, operation, and a marketing plan for The Mine in such form and detail as is normally required by a bank or other financial institution in the Republic of South Africa engaged in project finance (“Bank”), for the purposes of determining whether the Bank shall finance and/or participate in the development of The Mine, The BFS shall include economic, legal, environmental, social, governmental studies and metallurgical studies (but shall not include a bulk sample) and shall contain estimates of both capital and operating costs and shall analyze how to proceed with the construction and operation of The Mine; |

| 1.2.6 | “Claims” means all amounts of any nature whatsoever owing by the Joint Venture to the Participants from time to time, whether by way of loan account or otherwise, whether in contract or in delict, actual or contingent, and includes any interest accrued thereon; |

| 1.2.7 | “Company” means, individually or collectively as the context may require – |

| 1.2.7.1 | Clidet No. 790 (Proprietary) Limited, registration number 2007/027545/07, a limited liability private company duly incorporated in the Republic of South Africa, the name of which shall be changed in due course to “6 Shaft Joint Venture (Proprietary) Limited”, or such other name as may be acceptable to the Parties and the appropriate registering authorities; and |

| 1.2.7.2 | Clidet No. 791 (Proprietary) Limited, registration number 2007/034585/07, a limited liability private company duly incorporated |

|

|

Page 4

| in the Republic of South Africa, the name of which shall be changed in due course to “Twistdraai Joint Venture (Proprietary) Limited”, or such other name as may be acceptable to the Parties and the appropriate registering authorities; |

| 1.2.8 | “Company Assets” means the assets of the relevant Company to be leased to and used by the Joint Venture in terms of the Company Asset Lease/s, including the New Order Mining Right, which assets are more fully described in the Sale Agreements; |

| 1.2.9 | “Company Asset Lease” means individually or collectively as the context may require the written lease agreement or agreements to be entered into between the Company or Companies and the Parties in terms of which inter alia the Company (or each of the Companies, as the case may be) will lease Company Assets to the Joint Venture for the purposes of facilitating the operation of the JV Business; |

| 1.2.10 | “Company Equity” means any and all shares in the relevant Company or Companies (being the Company or Companies that have entered into the Company Asset Lease/s as contemplated in clauses 1.2.13.2.1 and 1.2.13.2,2), and any and all claims (of any amounts of any nature whatsoever, whether by way of loan account or otherwise, whether in contract or in delict, actual or contingent, and includes any interest accrued thereon) against the relevant Company or Companies, held by a Participant; |

| 1.2.11 | “Conditions Precedent” means the suspensive conditions contemplated in clause 3.1; |

| 1.2.12 | “CPIX” means the average annual rate of change (expressed as a |

|

|

Page 5

| percentage) in the Consumer Price Index, excluding interest rates on mortgage bonds, for all metropolitan areas as published in the Government Gazette by Statistics South Africa (or its successor body), or such other index reflecting the official rate of inflation in the Republic of South Africa as may replace it, which annual change shall be determined by comparing the most recently published index with the index published in respect of the corresponding month in the previous calendar year; |

| 1.2.13 | “Decision to Mine Date” means the date on which - |

| 1.2.13.1 | both Evander and Taung have unanimously agreed in writing; to proceed with Mining for Minerals in either or both of the JV Areas contemplated in clauses 1.2.25.1 and 1.2.25.2 (it being acknowledged that neither of them shall be obligated to so agree); and |

| 1.2.13.2 | either or both of the Company Asset Leases (as the case may be) have been duly entered into between the parties thereto and have become unconditional in terms thereof (save in respect of any condition contained in the Company Asset Lease requiring that this Agreement becomes unconditional), it being recorded that – |

| 1.2.13.2.1 | the Parties shall enter into a Company Asset Lease with the Company contemplated in clause 1.2.7.1 if it is decided (as contemplated in clause 1.2.13.1) to proceed with Mining tor Minerals in the J V Area contemplated in clause 1.2.25.1; |

| 1.2.13.2.2 | the Parties shall enter into a Company Asset Lease with the Company contemplated in clause 1.2.7.2 if it is decided (as contemplated in clause 1.2.13.1) to proceed with Mining for Minerals in the JV Area contemplated in clause 1.2.25.2; and |

|

|

Page 6

| 1.2.13.2.3 | the Company Asset Lease/s shall inter alia be conditional upon the Minister of Minerals and Energy approving the provisions thereof to the extent necessary or required in terms of the MPRDA; |

| 1.2.14 | “Effective Date” means the first business day in the month following the month in which all of the Conditions Precedent have been fulfilled or waived (as the case may be); |

| 1.2.15 | “Evander” means Evander Gold Mines Limited, registration number 1963/006226/06, a limited liability public company duly incorporated in the Republic of South Africa; |

| 1.2.16 | “Exploration Phase” means the period during which exploration and prospecting activities are conducted by Taung in respect of the relevant J V Areas in terms of the Subscription Agreements, which activities include the completion of the following studies and the preparation of reports in respect thereof in the following chronological sequence (from first to last), as more particularly described in the Subscription Agreements – |

| 1.2.16.1 | the Scoping Study; |

| 1.2.16.2 | the PFS; and |

| 1.2.16.3 | the BFS; |

| 1.2.17 | “Fair Market Value” means, in respect of any asset or interest, the fair market value thereof as agreed or determined in accordance with clause 18; |

| 1.2.18 | “Financial Year” means a financial year of the Joint Venture, as |

|

|

Page 7

| contemplated in clause 13.1.2 (including any amendment to such financial year made in terms of this Agreement); |

| 1.2.19 | “Gold” means the metal gold, gold ore and any other gold bearing material; |

| 1.2.20 | “IFRS” means the International Financial Reporting Standards formulated by the International Accounting Standards Board (or its successor body), as updated and amended from time to time; |

| 1.2.21 | “Independent Auditors” means such independent auditors as may be agreed between the Participants, or failing agreement within 10 (ten) business days from the date of a request by a Participant for such agreement, appointed by the Chairperson (or equivalent official) for the time being of the South African Institute of Chartered Accountants (or its successor body) from one of the 4 (four) largest independent firms of auditors in the Republic of South Africa at the time; |

| 1.2.22 | “Independent Investment Bank” means an independent investment bank agreed to in writing by the Participants or, or failing agreement within 10 (ten) business days from the date of a request by a Participant for such agreement, appointed by the Chairperson (or equivalent official) of the Johannesburg Bar Association (or its successor body); |

| 1.2.23 | “Indexed” means in relation to any sum, that sum adjusted annually at the end of each Financial Year to take account of year-on-year changes in the CPIX. In the event of a dispute between the Participants as to any adjustment, such dispute will be referred to the Independent Auditors for determination, who shall act as experts and not as arbitrators. If the basis of computation of CPIX is at any time changed from the basis of |

|

|

Page 8

| computation at the Signature Date, then CPIX shall be adjusted as far as possible to take account of such differences in the basis of computation; |

| 1.2.24 | “Joint Venture” means the joint venture established in terms of this Agreement; |

| 1.2.25 | “JV Area” means, individually or collectively as the context may require – |

| 1.2.25.1 | the Evander 6 Shaft Area, being the area indicated by the area shaded in pink on the map attached hereto as annexe “A”; and |

| 1.2.25.2 | the Twistdraai Area, being the area indicated by the area shaded in blue on the map attached hereto as annexe “B”; |

| 1.2.26 | “JV Business” means the business of Mining for Minerals within the JV Area contemplated in clause 1.2.25.1 and/or the JV Area contemplated in 1.2.25.2 (depending on which JV Area/s the Parties agree to Mine as at the Decision to Mine Date, as contemplated in clause 1.2.13.1); |

| 1.2.27 | “Management Committee” means the management committee constituted pursuant to the provisions of clause 11.1; |

| 1.2.28 | “Mine”, when used as a verb, shall bear the meaning ascribed thereto in section 1 of the MPRDA, and “Mining” shall have a corresponding meaning; |

| 1.2.29 | “Minerals” means all metals and minerals that the Company is or shall, as at the Effective Date, be permitted to mine in the relevant JV Area/s in terms of the New Order Mining Right, which includes or shall, as at the Effective Date, include Gold; |

|

|

Page 9

| 1.2.30 | “MPRDA” means the Mineral and Petroleum Resources Xxxxxxxxxxx Xxx, 0000; |

| 1.2.31 | “New Order Mining Right” means, individually or collectively as the context may require, the mining right or mining rights, as contemplated in the MPRDA, to be acquired by – |

| 1.2.31.1 | the Company contemplated in clause 1.2.7.1 in respect of the JV Area contemplated in clause 1.2.25.1; and |

| 1.2.31.2 | the Company contemplated in clause 1.2.7.2 in respect of the JV Area contemplated in clause 1.2.25.2, |

| as more particularly described in the Sale Agreements; |

| 1.2.32 | “Net Smelter Royalty” means a net smelter royalty payable by the Joint Venture to Evander (or its cessionary), in an amount equivalent to 1.5% (one point five percent) of the Net Smelter Revenue, subject to a maximum aggregate amount of R500,000,000.00 (five hundred million rand); |

| 1.2.33 | “Net Smelter Revenue” means the net amounts from time to time received by the Joint Venture from the Refinery, |

| 1.2.34 | “Participant” means any person who holds a Participation Interest in the Joint Venture from time to time; |

| 1.2.35 | “Participation Interest” means in relation to a Participant, the ownership interest, expressed as a percentage, of a Participant in the Joint Venture, including the rights and obligations associated therewith, including losses, liabilities and expenditure; |

|

|

Page 10

| 1.2.36 | “Parties” means the parties to this Agreement, initially being Evander and Taung; |

| 1.2.37 | “PFS” means a work programme in either or both of the JV Areas ( as determined in terms of the Subscription Agreements), following the Scoping Study and preceding the BFS, the objects of which work programme are – |

| 1.2.37.1 | to define Minerals grade, processing and recovery uncertainties; |

| 1.2.37.2 | to conduct a comparative evaluation of the full value and risk profiles of a chosen set of feasible alternatives for the business case relating to Mining for Minerals in the relevant JV Area; and |

| 1.2.37.3 | to select from such alternatives a single preferred “go forward” alternative for further study and optimisation during the BFS |

which programme will include, but will not be limited to -

| 1.2.37.4 | bench scale test work; |

| 1.2.37.5 | the conducting of operational, environmental and financial scoping studies; and |

| 1.2.37.6 | the continuation of exploration work to optimise the sizing of a potential Mining operation within the relevant JV Area, |

but shall exclude a bulk sample;

| 1.2.38 | “Prime Rate” means the publicly quoted basic rate of interest, compounded monthly in arrears and calculated on a 365 (three hundred and sixty five) day year irrespective of whether or not the year is a leap |

|

|

Page 11

| year, from time to time published by ABSA Bank Limited as being its prime overdraft rate, as certified by any representative of that bank whose appointment and designation it will not be necessary to prove; |

| 1.2.39 | “Refinery” means the refinery to which Minerals Mined at The Mine are sold from time to time, as determined by the Management Committee; |

| 1.2.40 | “Related Agreements” means, collectively – |

| 1.2.40.1 | the Sale Agreements; |

| 1.2.40.2 | the Shareholders Agreements; and |

| 1.2.40.3 | the Subscription Agreements; |

| 1.2.41 | “Sale Agreements” means – |

| 1.2.41.1 | the written sale of assets agreement entered into or to be entered into between Evander and the Company contemplated in clause 1.2.7.1 contemporaneously with this Agreement, in terms of which inter alia Evander will sell certain assets pertaining to the JV Area contemplated in clause 1.2.25.1 to that Company; and |

| 1.2.41.2 | the written sale of assets agreement entered into or to be entered into between Evander and the Company contemplated in clause 1.2.7.2 contemporaneously with this Agreement, in terms of which inter alia Evander will sell certain assets pertaining to the JV Area contemplated in clause 1.2.25.2 to that Company; |

| 1.2.42 | “Scoping Study” means separate scoping studies, preceding the PFS, to be conducted in both of the JV Areas in terms of the Subscription Agreements, the primary objective of which studies is to develop and |

|

|

Page 12

| assess an investment opportunity in order to establish strategic fit and likely attractiveness of the business case relating to Mining for Minerals within the those JV Areas. Such a study shall seek inter alia to identify any possible options to be assessed in terms of the PFS, should the said business case warrant further investigation; |

| 1.2.43 | “Shareholders Agreements” means – |

| 1.2.43.1 | the written shareholders agreement entered into or to be entered into between the Parties contemporaneously with this Agreement, in terms of which inter alia the relationship between the Parties as shareholders of the Company contemplated in clause 1.2.7.1, and between that Company and its shareholders, shall be regulated; and |

| 1.2.43.2 | the written shareholders agreement entered into or to be entered into between the Parties contemporaneously with this Agreement, in terms of which inter alia the relationship between the Parties as shareholders of the Company contemplated in clause 1.2.7.2, and between that Company and its shareholders, shall be regulated |

| 1.2.44 | “Signature Date” means the date of signature of this Agreement by the Party last signing; |

| 1.2.45 | “Subscription Agreements” means – |

| 1.2.45.1 | the written subscription agreement entered into or to be entered into between the Parties contemporaneously with this Agreement, in terms of which inter alia Taung agrees to subscribe for shares in the Company contemplated in clause 1.2.7.1; and |

| 1.2.45.2 | the written subscription agreement entered into or to be entered into |

|

|

Page 13

| between the Parties contemporaneously with this Agreement, in terms of which inter alia Taung agrees to subscribe for shares in the Company contemplated in clause 1.2.7.2; |

| 1.2.46 | “Taung” means Taung Gold Holdings (Proprietary) Limited, registration number 2004/023942/07, a limited liability private company duly incorporated in the Republic of South Africa; and |

| 1.2.47 | “The Mine” means the mine excavations and all associated mine workings to be developed by the Joint Venture on, within and/or beneath the JV Area contemplated in clause 1.2.25.1 and/or the JV Area contemplated in 1.2.25.2 (depending on which JV Area/s the Parties agree to Mine as at the Decision to Mine Date, as contemplated in clause 1.2.13.1), including all buildings, structures, machinery, roads and appurtenances used or intended to be used for the purposes of prospecting for, winning and Mining of Minerals within the relevant JV Area/s. |

| 1.3 | Any substantive provision, conferring rights or imposing obligations on a Party and appearing in any of the definitions in this clause 1 or elsewhere in this Agreement, shall be given effect to as if it were a substantive provision in the body of the Agreement. |

| 1.4 | Words and expressions defined in any clause shall, unless the application of any such word or expression is specifically limited to that clause., bear the meaning assigned to such word or expression throughout this Agreement. |

| 1.5 | Subject to clauses 1,6, 1.8, 1.13 and 1.16, defined terms appearing in this Agreement in title case shall be given their meaning as defined, while the same terms appearing in lower case shall be interpreted in accordance with |

|

|

Page 14

| their plain English meaning. |

| 1.6 | The terms “holding company” and “subsidiary” shall bear the meanings assigned thereto in the Companies Act, 1973. |

| 1.7 | A reference to any statutory enactment shall be construed as a reference to that enactment as at the Signature Date and as amended or substituted from time to time. |

| 1.8 | Reference to “days” shall be construed as calendar days unless qualified by the word “business”, in which instance a “business day” will be any day other than a Saturday, Sunday or public holiday as gazetted by the government of the Republic of South Africa from time to time. Any reference to “business hours” shall be construed as being the hours between 08h30 and 17h00 on any business day. Any reference to lime shall be based upon South African Standard Time. |

| 1.9 | Unless specifically otherwise provided, any number of days prescribed shall be determined by excluding the first and including the last day or, where the last day falls on a day that is not a business day, the next succeeding business day. |

| 1.10 | Where figures are referred to in numerals and in words, and there is any conflict between the two, the words shall prevail, unless the context indicates a contrary intention. |

| 1.11 | No provision herein shall be construed against or interpreted to the disadvantage of a Party by reason of such Party having or being deemed to have structured, drafted or introduced such provision. |

| 1.12 | The expiration or termination of this Agreement shall not affect such of the |

|

|

Page 15

| provisions of this Agreement as expressly provide that they will operate after any such expiration or termination or which of necessity must continue to have effect after such expiration or termination, notwithstanding that the clauses themselves do not expressly provide for this. |

| 1.13 | The words “include” and “including” mean “include without limitation” and “including without limitation”. The use of the words “include” and “including” followed by a specific example or examples shall not be construed as limiting the meaning of the general wording preceding; it. |

| 1.14 | Whenever any person is required to act “as an expert and not as an arbitrator” in terms of this Agreement, then – |

| 1.14.1 | the determination of the expert shall (in the absence of manifest error) be final and binding; |

| 1.14.2 | subject to any express provision to the contrary, the expert shall determine the liability for his or its charges, which shall be paid, accordingly; |

| 1.14.3 | the expert shall be entitled to determine such methods and processes as he or it may, in his or its sole discretion, deem appropriate in the circumstances provided that the expert may not adopt any process which is manifestly biased, unfair or unreasonable; |

| 1.14.4 | the expert shall consult with the relevant Parties (provided that the extent of the expert’s consultation shall be in his or its sole discretion) prior to rendering a determination; and |

| 1.14.5 | having regard to the sensitivity of any confidential information, the expert shall be entitled to take advice from any person considered by him |

|

|

Page 16

| or it to have expert knowledge with reference to the matter in question. |

| 1.15 | Any reference in this Agreement to “this Agreement” or any other agreement or document shall be construed as a reference to this Agreement or, as the case may be, such other agreement or document, as amended, varied, novated or supplemented from time to time. |

| 1.16 | This Agreement incorporates the annexes which annexes shall have the same force and effect as if set out in the body of this Agreement. In this Agreement the words “clause” or “clauses” and “annexe” or “annexes” refer to clauses of and annexes to this Agreement. |

| 2 | RECITALS |

| 2.1 | Evander carries on, inter alia, the business of Mining for Gold. |

| 2.2 | Taung carries on, inter alia, the business of exploration and prospecting for Gold. |

| 2.3 | Subject to – |

| 2.3.1 | the successful completion of the Exploration Phase; and |

| 2.3.2 | the Decision to Mine Date occurring, |

the Parties wish to form a joint venture for the purpose of conducting the JV Business.

| 2.4 | The Companies own their respective Company Assets, which the Parties intend to lease in terms of the Company Asset Lease/s, for the purpose of facilitating the operation of the JV Business. |

| 2.5 | The Parties wish to formalise their agreement regarding the Joint Venture |

|

|

Page 17

| and matters ancillary thereto, by recording such agreement in writing, on the terms and conditions contained in this Agreement. |

| 3 | CONDITIONS PRECEDENT |

| 3.1 | Save for clause 1, this clause 3 and clauses 14,19 and 22 to 29 (inclusive) all of which will become effective immediately, this Agreement is subject to the fulfilment of the Conditions Precedent that – |

| 3.1.1 | by not later than 17h00 on 31 March 2008, all of the Related Agreements are duly entered into by the parties thereto; and |

| 3.1.2 | within 30 (thirty) days of the completion of the last BFS (including approval of such BFS by the relevant committees) completed in terms of the Subscription Agreements, the Decision to Mine Date has occurred. |

| 3.2 | All or any of the Conditions Precedent may only be waived if both Parties so agree in writing. |

| 3.3 | Unless all the Conditions Precedent have been fulfilled or waived by not later than the relevant dates for fulfilment thereof set out in clause 3.1 (or such later date or dates as may be agreed in writing between the Parties) the provisions of this Agreement, save for clause 1, this clause 3 and clauses 14, 19 and 22 to 29 (inclusive) which will remain of full force and effect, will never become of any force or effect and the status quo ante will be restored as near as may be and neither of the Parties will have any claim against the other in terms hereof or arising from the failure of the Conditions Precedent. |

| 4 | JOINT VENTURE |

| 4.1 | The Parties hereby enter into a joint venture, which joint venture shall be |

|

|

Page 18

| known as and shall conduct its business under the name and style of “The Evander Taung Twistdraai Joint Venture” or such other name as the Participants may agree in writing from time to time. |

| 4.2 | The Joint Venture shall be deemed to have come into existence on the Effective Date and shall endure for an indefinite period until terminated in accordance with the provisions of this Agreement. |

| 4.3 | The objects of the Joint Venture are – |

| 4.3.1 | to conduct the JV Business; and |

| 4.3.2 | all such other activities as may be necessary or desirable for or ancillary to the purposes of the successful conduct of the Joint Venture. |

| 4.4 | Unless the Participants unanimously otherwise agree in writing, all assets which the Management Committee agree are required for the purposes of the JV Business shall be acquired by the Joint Venture and shall, to the extent permissible in law, when so acquired – |

| 4.4.1 | be deemed to be part of the Joint Venture operations; and |

| 4.4.2 | owned by each of the Participants in undivided shares in their respective Participation Interests. |

| 4.5 | The Mine shall be expeditiously Mined and the Minerals so Mined shall be processed and sold as determined in accordance with the BFS or as otherwise unanimously agreed in writing by the Participants from time to time. |

| 4.6 | For greater clarity, the Joint Venture shall not be terminated by the admission of any new Participant to the Joint Venture, or any adjustment of |

|

|

Page 19

| any Participation Interest/s agreed to by the Parties/Participants in terms of this Agreement. |

| 5 | PARTICIPATION |

| 5.1 | Unless otherwise agreed in writing by the Parties, as at the Effective Date the Participation Interests of the Participants shall be as follows - |

| 5.1.1 | Evander - 48% (forty-eight percent); and |

| 5.1.2 | Taung - 52% (fifty-two percent). |

| 5.2 | Unless otherwise agreed in writing between the Parties, and save as is otherwise contemplated in terms of this Agreement, the Parties shall be the only Participants in the Joint Venture. |

| 5.3 | The profit and/or loss of the Joint Venture shall be shared by the Participants in accordance with the Participation Interests. |

| 5.4 | All income generated by the Joint Venture shall be deposited into a separate bank account held at ABSA Bank Limited in the name of the Joint Venture (or such other bank account as may be unanimously agreed in writing by the Participants) and administered by the Management Committee. The profits of the Joint Venture shall be distributed to the Participants from such bank account in accordance with their respective Participation Interests, as follows - |

| 5.4.1 | one or more prepayments may be made during the course of the Financial Year, as determined by the Management Committee from time to time, based, inter alia, on management accounts, budgeted profits and the availability of cash; and |

|

|

Page 20

| 5.4.2 | the balance if any will be paid upon finalisation of the annual financial statements of the Joint Venture in respect of the relevant Financial Year, subject always to adequate provision being made for the working capital requirements of the Joint Venture, it being recorded that, unless otherwise unanimously agreed in writing by the Participants, the Participants intend for there to be a distribution of at least 50% (fifty percent) of the profits of the Joint Venture during each Financial Year. |

| 5.5 | In the event of any dispute between the Participants in regard to the determination of profits or losses, as to the allocation of a particular cost or expense, or as to any matter arising from the preparation or certification of the annual financial statements of the Joint Venture, such dispute shall be referred for determination by the Independent Auditors. The Independent Auditors in determining the issue shall - |

| 5.5.1 | act as experts and not as arbitrators; and |

| 5.5.2 | have regard to the basis on which such determination was made, allocation was done or accounts were prepared in previous Financial Years. |

| 6 | JOINT VENTURE EXPENSES |

| 6.1 | All the costs and expenses incurred as a result of the conduct of the JV Business shall be an expense of the Joint Venture, including - |

| 6.1.1 | the costs directly attributable to the conduct of the JV Business, including the cost of salaries and wages payable to all appointed employees of the Joint Venture and all employees seconded to the Joint Venture and electricity, water and utilities costs and any other overhead costs |

|

|

Page 21

| associated with the JV Business; |

| 6.1.2 | the Net Smelter Royalty; |

| 6.1.3 | the cost of managing and administering the Joint Venture and of maintaining financial records of the activities of the Joint Venture; and |

| 6.1.4 | interest payable under third party borrowings. |

| 6.2 | The Net Smelter Royalty shall be payable by the Joint Venture to Evander (or its cessionary) in arrears in respect of each completed 3 (three) month period (“Quarter”) for the duration of this Agreement, within 5 (five) business days of the end of each such Quarter. Without in any way limiting the rights of Evander (or its cessionary) in respect of the Net Smelter Royalty, any late payments of the Net Smelter Royalty shall bear interest at the rate that is 200 (two hundred) basis points higher than the Prime Rate, from (and including) the due date for payment thereof to (but excluding) the date of actual payment thereof. The Net Smelter Royalty shall be freely transferable by Evander and Evander shall be entitled to cede its rights in and to the Net Smelter Royalty at any time and to any person or third xxxxx in its sole and absolute discretion (whether pursuant to a sale as contemplated in clause 15, or otherwise). In the event of any such cession. Evander shall notify the other Participants and the Management Committee in writing, as soon as is reasonably possible thereafter, specifying the name of and payment details for the cessionary. |

| 6.3 | Notwithstanding any other provisions of this Agreement, the Net Smelter Royalty shall not exceed an amount of R500,000,000.00 (five hundred million rand) in the aggregate (“Royalty Threshold”). Accordingly, the Net Smelter Royalty payments contemplated in clause 6.2 shall cease when |

|

|

Page 22

| the Royalty Threshold is reached. Any amounts that have been paid by the Joint Venture in terms of clause 6.2 and which exceed the Royalty Threshold shall be refunded by Evander to the Joint Venture within 10 (ten) business days of receipt by Evander of first written request in respect thereof by or on behalf of the Joint Venture. |

| 7 | NO PARTNERSHIP |

The Joint Venture is constituted for the purposes more fully described in clause 4.3 only and accordingly, save as specifically provided herein to the contrary -

| 7.1 | nothing herein contained shall be construed as creating a partnership between the Parties (or between the Participants); |

| 7.2 | each Party shall be responsible only for its obligations as set forth in this Agreement; |

| 7.3 | neither Party shall have any authority to incur any liability on behalf of the other of them or to pledge the credit of the other of them save as specifically otherwise provided for in this Agreement; |

| 7.4 | as against third parties, any Party incurring any liability in connection with the affairs of the Joint Venture shall be solely responsible for the discharge thereof. As between the Parties, each Party shall be entitled to recover from the Joint Venture any payment, debt or liability properly incurred by such Party in terms of this Agreement; and |

| 7.5 | neither Party shall use any money or property of, or bind the credit of the Joint Venture, for any purpose other than the JV Business and subject to the provisions of this Agreement. |

|

|

Page 23

| 8 | DURATION |

| 8.1 | The Joint Venture shall, notwithstanding the Signature Date, be deemed to have been established on the Effective Date and shall, subject to the provisions of clause 16, continue for the duration of the New Order Mining Right, as extended from time to time. |

| 8.2 | After the initial period of the Joint Venture as contemplated in clause 8.1, either Party may withdraw from the Joint Venture on not less than 3 (three) month’s written notice to the other Party. |

| 9 | WARRANTIES BY THE PARTIES |

| 9.1 | Each of the Parties hereby unconditionally gives to and in favour of the other of them the warranties more fully set out below. Each warranty shall - |

| 9.1.1 | be a separate warranty and shall in no way be limited or restricted by inference from the terms of any other warranty; |

| 9.1.2 | continue and remain in force notwithstanding the completion of any or all the transactions contemplated in this Agreement; |

| 9.1.3 | be deemed to be material and to be a material representation inducing the other of them to enter into this Agreement. |

| 9.2 | Each warranting Party will procure that the warranties set out in clause 9.3 will be true and accurate as at the Effective Date, and hereby indemnifies the other of them against any loss, damage or costs which it may suffer or incur as a result of a breach of or failure to comply with any of the warranties, representations or undertakings contained in this Agreement. |

| 9.3 | Each of the Parties hereby warrants to the other of them that - |

|

|

Page 24

| 9.3.1 | it is duly incorporated, registered and existing under the laws of the Republic of South Africa; |

| 9.3.2 | acceptance of this Agreement has been duly and fully authorised by it; |

| 9.3.3 | subject to the provisions of clause 3, this Agreement constitutes obligations that are legal, valid, binding and enforceable against it in accordance with its terms; and |

| 9.3.4 | the provisions of this Agreement are not in conflict with, and will not constitute a breach of the provisions of any other agreement, obligation, restriction or undertaking which is binding on it. |

| 9.4 | Notwithstanding anything to the contrary in this Agreement contained, should any warranty or undertaking herein contained be breached or fail to be true and correct in consequence whereof one or more further or other warranties or undertakings become untrue or incorrect, the liability of the warranting Party shall be limited to such payment or correcting action as may be required to place the other Party in the position in which it would have been had all the warranties and undertakings herein contained been true and correct. |

| 9.5 | Any claim by the Joint Venture in respect of any warranties or indemnities shall be reduced by the aggregate of– |

| 9.5.1 | an amount equal to any tax benefit received as a result thereof; |

| 9.5.2 | any amount recovered from any third party in respect thereof; |

| 9.5.3 | any specific provision or reserve directly relating to the subject matter of such claim; |

|

|

Page 25

| 9.5.4 | to the extent that the subject matter of the claim has been or is made good or otherwise compensated for without cost to the Joint Venture or the relevant subsidiary. |

| 10 | FUNDING |

| 10.1 | It is agreed as a general principle that the Claims of the Participants must at all times he in proportion to their respective Participation Interests, and that all Claims will be repaid by the Joint Venture prior to the Joint Venture distributing any profits as contemplated in clause 5.4. |

| 10.2 | All working capital and cash required by the Joint Venture shall, after exploring alternative funding sources, be funded and contributed by the Participants in proportion to their respective Participation Interests. |

| 10.3 | In the event that a Participant (“Non-Funding Party”) should, in breach of the provisions hereof, fail to contribute its proportionate share of any required funding, and should the Non-Funding Party fail to do so within 10 (ten) business days of receipt of a written notice from the other Participant calling upon the Non-Funding Party to provide such funding then – |

| 10.3.1 | the other Participant shall be entitled, but not obliged, to provide the funding that the Non-Funding Party was required to contribute (“Default Funding”); |

| 103.2 | if the other Participant provides Default Funding – |

| 10.3.2.1 | the Non-Funding Party’s Participation Interest will be recalculated, effective from the date on which the Default Funding is provided by the other Participant (“Dilution Date”), in accordance with the following formula - |

|

|

Page 26

| R |

= |

((FMV(A) x D%) + F) x 100% |

||||

| FMV(B) |

Where:

| R |

= | The Non-Funding Party’s recalculated Participation Interest expressed as a percentage. | ||||

| FMV(A) |

= | the aggregate Fair Market Value of all Participation Interests, immediately prior to the Dilution Date. | ||||

|

|

Page 27

| D% |

= | the Non-Funding Party’s Participation Interest expressed as a percentage, immediately prior to the Dilution Date. | ||||

| F |

= | the funding provided by the Non-Funding Party, if any. | ||||

| FMV(B) |

= | the aggregate Fair Market Value of all Participation interests after the Dilution Date and, for greater certainty, taking into account all funding provided; and | ||||

| 10.3.2.2 | the other Participant’s Participation Interest, expressed as a percentage, shall be increased by the amount of the reduction in the Non-Funding Party’s Participation Interest, expressed as a percentage; |

| 10.3.2.3 | the provisions of clauses 10.3.2.1 and 10.3.2.2 shall apply mutatis mutandis in respect of the Company Equity held by the Participants and, if required to give effect to the aforegoing, the Participants shall procure that shares in the relevant Company or Companies will be allotted and issued as appropriate. |

| 10.4 | Any cost, expenses, debt or liability (“Debt”) incurred by the Joint Venture shall ultimately be the responsibility of the Participants in proportion to their respective Participation Interests and each Party indemnifies the other in respect of any payment or liability for any such Debts in excess of its proportionate share. Notwithstanding Such indemnity, should either Party not timeously pay its proportionate share of any Debt of the Joint Venture, and fail to do so within a further 10 (ten) business days of delivery of written notice from or on behalf of the other Party requiring it to do so, then to the extent that such other Party pays or procures payment of more than its own proportionate share of the Debt in consequence of such failure by the |

|

|

Page 28

| remaining Party, the respective Participation interests of the Parties shall be recalculated mutatis mutandis in accordance with the provisions of clause 10.3.2. |

| 11 | MANAGEMENT |

| 11.1 | Control and management of the Joint Venture shall vest in a management committee to be constituted in accordance with the following provisions - |

| 11.1.1 | Evander shall be entitled at any lime and from time to time to appoint 2 (two) representatives to the Management Committee and to appoint alternates to those representatives and to remove or replace any such representative or alternate at any time and from time to time; |

| 11.1.2 | Taung shall be entitled at anytime and from time to time to appoint 3 (three) representatives to the Management Committee and to appoint alternates to those representatives and to remove or replace any such representative or alternate at any time and from time to time; |

| 11.1.3 | the chairman of the Management Committee shall be appointed by the Management Committee from amongst its members, which chairman shall not be entitled to a second or casting vote in addition to his deliberative vote; |

| 11.1.4 | any appointment, removal or replacement of representatives pursuant to the above provisions shall be by written notice to the other Party and shall be operative as soon as such notice is received at the relevant address determined pursuant to the provisions of clause 22. |

| 11.2 | The Management Committee shall determine all matters of principle in regard to the Joint Venture, subject to the further terms and conditions |

|

|

Page 29

| herein set out. The Participants shall be bound by all decisions of the Management Committee properly taken in accordance with the provisions of this Agreement. |

| 11.3 | Unless otherwise unanimously agreed in writing by the members or the Management Committee, there shall be at least monthly meetings of the Management Committee for the duration of the Joint Venture and, in addition, the Management Committee shall meet when requested to do so on reasonable notice by any of the Participants. The time and place for meetings shall be determined by the Management Committee. |

| 11.4 | Duly appointed alternate representatives shall be entitled to attend meetings of the Management Committee and shall have the right to speak thereat but no alternate shall be entitled to vote if his principal is present at that meeting. |

| 11.5 | A quorum for a meeting of the Management Committee shall be one representative of each of the Participants appointed to the Management Committee, provided that there shall be no quorum unless at least one such representative appointed by each of the Participants is present and provided further that, subject to due and proper notice of the meeting (which shall include the proposed agenda and any resolution to be proposed at the meeting) having been received by all the members of the Management Committee, if within half an hour (or such longer period as those present may agree) after the time appointed for the meeting a quorum is not present, the meeting shall stand adjourned to the same day of the next week at the same time and place, and if at such adjourned meeting a quorum is not present within half an hour (or such longer period as those present may agree) after the time appointed for the meeting, those present shall be a |

|

|

Page 30

| quorum. |

| 11.6 | Each member of the Management Committee shall be entitled to one vote at meetings of the Management Committee. |

| 11.7 | Subject to the provisions of clause 12, questions arising at meetings of the Management Committee shall be decided by a simple majority vote, provided that – |

| 11.7.1 | the requisite quorum for such a meeting shall be present; |

| 11.7.2 | proper notice of the meeting shall have been provided to the Participants, which notice shall stipulate all matters to be considered at the relevant meeting. |

| 11.8 | The Management Committee shall appoint a secretary who shall keep minutes of each meeting of the Management Committee, arrange and co-ordinate each such meeting and keep records of resolutions passed by the Management Committee. The secretary need not be a member of the Management Committee. The secretary may be removed and replaced by the Management Committee. The minutes so kept shall be circulated to the members of the Management Committee within 14 (fourteen) days of each meeting and shall be signed by a member of the Management Committee representing each of the Participants. Such minute book shall at all times be available for inspection by the members of the Management Committee or their duly authorised agents who shall be entitled to take copies thereof or to make extracts therefrom. |

| 11.9 | Any resolution or written decision signed by all the members of the Management Committee (or their alternates, if applicable) shall be as valid |

|

|

Page 31

| and effective as if passed at a meeting of the Management Committee. All such resolutions shall, unless otherwise indicated therein, be deemed to have been passed on the date on which such resolution was signed by the last Management Committee member signing such resolution. |

| 11.10 | Subject to the provisions of clause 12, the powers and duties of the Management Committee may be delegated by the Management Committee to a manager, who shall carry out his or its duties in terms of and in accordance with the policies and decisions of the Management Committee. |

| 12 | RESTRICTED MATTERS |

| 12.1 | No decision of Participants and/or the Management Committee in relation to any of the matters set out in this clause 12 shall be of any force or effect unless all of the Participants first agree thereto in writing and no Participant or member/s of the Management Committee may bind or purport to bind the Joint Venture to, and/or cause the Joint Venture to undertake, any action in respect of the matters set out in this clause 12.1 unless and until such written agreement has been obtained - |

| 12.1.1 | the approval of and changes to the Annual Budgets and strategic and annual business plans and any modification thereof; |

| 12.1.2 | any individual or cumulative expenditure by the Joint Venture in excess of 15% (fifteen percent) of the total annual expenditure approved in terms of the Annual Budget; |

| 12.1.3 | the borrowing of any money or incurring of any debt, other than in accordance with the Annual Budget; |

| 12.1.4 | the creation and modification of mortgages, liens or other charges on the |

|

|

Page 32

| Joint Venture’s assets; |

| 12.1.5 | the making of any loan to any Participant or third party or the payment of any Claims; |

| 12.1.6 | the issuing of guarantees, suretyships, indemnities or letters of comfort (or the like) of any nature whatsoever, other than in accordance with the Annual Budget, unless and to the extent that such guarantees, suretyships, indemnities or letters of comfort (or the like) are required to be furnished in terms of the MPRDA; |

| 12.1.7 | any sale, transfer or disposal of the JV Business or of any assets of the Joint Venture (in the case of assets, otherwise than in the normal course of the JV Business) or any change in the JV Business or the discontinuance of any business activities of the Joint Venture; |

| 12.1.8 | the establishment or the acquisition and purchase by the Joint Venture of other businesses, either directly or indirectly, or the entering into of mergers or amalgamations with other businesses or entities; |

| 12.1.9 | the termination, liquidation or winding-up of the Joint Venture; |

| 12.1.10 | the appointment of any Participant or third party to manage The Mine and/or the JV Business, or the payment of any management fees by the Joint Venture to any Participant or third party, other than in accordance with the Annual Budget; |

| 12.1.11 | the approval of transactions and contracts to be entered into by the Joint Venture outside the ordinary course of the JV Business (other than the Related Agreements and the Company Asset Lease); |

|

|

Page 33

| 12.1.12 | the appointment and removal of the Auditors; |

| 12.1.13 | the approval of the audited annual financial statements of the Joint Venture; |

| 12.1.14 | the appointment or termination of the appointment of any senior employee of the Joint Venture, being an employee earning an annual remuneration (calculated based on the cost thereof to the Joint Venture) in excess of R700,000.00 (seven hundred thousand rand) (Indexed) per annum (“Senior Employee”); |

| 12.1.15 | the alteration of salaries and remuneration of Senior Employees, other than in accordance with the Annual Budget or the payment of salaries, bonuses and/or profit share to the employees of the Joint Venture, other than in accordance with the Annual Budget; |

| 12.1.16 | the authorisation by the Joint Venture of obligations expressed in or amounts payable in foreign currency involving individual or cumulative amounts in excess of USD 100,000.00 (one hundred thousand United States dollars) (Indexed) in any Financial Year; |

| 12.1.17 | any change in the basis of accounting, otherwise than in accordance with IFRS, from those used by the Joint Venture during the immediately preceding Financial Year; |

| 12.1.18 | the purchase, sale, hiring, letting or sub-letting of any immovable property by the Joint Venture otherwise than in accordance with the Annual Budget from time to time; |

| 12.1.19 | the institution of litigation or settlement of any claim by the Joint Venture in excess of R500,000.00 (five hundred thousand rand) |

|

|

Page 34

| (Indexed) or any claim involving technical information or any intellectual property right or seeking relief for an order not sounding in money; |

| 12.1.20 | any decision not to insure the Joint Venture’s assets (or to insure such assets for a lesser amount) against such risks as may be recommended by the Joint Venture’s insurance brokers; |

| 12.1.21 | any agreement (other than the Related Agreements and the Company Asset Lease) with any of the Participants or a company, trust, close corporation or any other entity in which the shareholding of any of the Participants exceeds 25% (twenty-five percent) of the issued share capital of that Company, or the beneficial interest of any of the Participants exceeds 25% (twenty-five percent) of the total beneficial interest in that trust, close corporation or other entity, or any amendment to such agreement; |

| 12.1.22 | the revaluation of any assets of the Joint Venture; |

| 12.1.23 | a compromise generally with the Joint Venture’s creditors; |

| 12.1.24 | the delegation of any powers, duties or function/s of the Management Committee, including the power to re-delegate and any limitations thereon; or |

| 12.1.25 | the decision to suspend Mining operations within the JV Area for a period of more than 6 (six) months. |

| 12.2 | Should the Participants fail to reach agreement on any of the matters contemplated in clause 12.1 then such failure shall not constitute a dispute for the purposes of clause 21, nor shall it constitute a ground for winding-up of the Joint Venture and, unless and until otherwise determined in terms of |

|

|

Page 35

| clause 12.1 or agreed in writing between all of the Participants, no action shall be taken in respect of such matter/s. |

| 13 | ADMINISTRATION AND ACCOUNTING |

| 13.1 | The Joint Venture shall have – |

| 13.1.1 | as its auditors Pricewaterhouse Coopers Inc., or such other auditors as may be appointed in terms of this Agreement from time to time; and |

| 13.1.2 | as its financial year-end, the last day of June in each year. |

| 13.2 | The Management Committee shall ensure that the operations of the Joint Venture will be conducted inter alia on the following basis – |

| 13.2.1 | the Joint Venture’s books, records and accounts will be kept in compliance with IFRS; |

| 13.2.2 | audited accounts will be prepared as soon as is possible after each Financial Year end but in any event by not later than 90 (ninety) days thereafter; |

| 13.2.3 | monthly management accounts will be prepared as soon as is possible after each month end and circulated to all Participants forthwith after completion, but in any event within 15 (fifteen) business days of the relevant month end. |

| 13.3 | Senior accounting personnel and internal auditors of each of the Participants will have access to the books of account, records and vouchers of and pertaining to the Joint Venture at all reasonable times. |

| 13.4 | An annual budget for the conduct of the JV Business during the next |

|

|

Page 36

| Financial Year, in the form and level of detail determined by the Participants from time to time, shall be prepared annually by the Management Committee and submitted to the Participants for approval, by no later than 2 (two) clear calendar months prior to the month in which the new Financial Year commences. |

| 13.5 | The Annual Budget shall include but not be limited to – |

| 13.5.1 | a projected income statement, balance sheet and cash flow statement for the ensuing Financial Year; and |

| 13.5.2 | a capital expenditure programme specifying amounts outstanding on approved capital expenditure brought forward from the prior Financial Year as well as proposed future capital expenditure commitments of the Joint Venture. |

| 13.6 | The Participant’s shall, subject to the provisions of clause 12.1.1, evaluate, amend and finalise the Annual Budget as soon as reasonably possible after receipt. Until such time as the new Annual Budget has been approved by the Management Committee, the previous Annual Budget (Indexed), will be applied by the Management Committee and will be binding on the Participants and the Joint Venture as if it had been approved in terms of clause 12. |

| 13.7 | The Joint Venture shall operate a banking account in the name of the Joint Venture into which all income earned by the Joint Venture shall be deposited. |

| 13.8 | The Joint Venture shall register as a vendor in terms of the Value-Added Tax Act, 1993, as soon as reasonably possible after the Effective Date. |

|

|

Page 37

| 14 | PROHIBITION OF ENCUMBRANCE |

Save as may otherwise be provided in this Agreement and unless the Parties otherwise agree in writing, no Participant shall be entitled to self, donate, lease, transfer, make available to a third party or otherwise alienate or dispose of, or to pledge, cede in security, hypothecate or otherwise encumber or grant a security interest or create a right of participation in its Company Equity, its Participation Interest its interest in any assets of the Joint Venture or my other interest it has in terms of this Agreement.

| 15 | PRE-EMPTIVE RIGHTS |

| 15.1 | Should a Party wish to sell its Participation Interest (or any other interest it has in terms of this Agreement) then it may only do so if, at the same time, it collectively sells all of the following (collectively referred to as its “Sale Interest”) under one indivisible transaction – |

| 15.1.1 | its entire Participation Interest; |

| 15.1.2 | all of its Claims; |

| 15.1.3 | its undivided share in any assets of the Joint Venture (as contemplated in clause 4.4); and |

| 15.1.4 | all of its Company Equity. |

| 15.2 | Should a Party (“Disposer”) wish to dispose of its Sale Interest, the Disposer shall offer (“Offer”) such Sale Interest by notice in wilting to the remaining Party stating – |

| 15.2.1 | the price (in South African currency) at, and the terms and conditions upon which, the Disposer proposes to sell the Sale Interest; and |

|

|

Page 38

| 15.2.2 | to the extent applicable, the name of the proposed transferee to whom the Disposer intends selling and its ultimate holding company (if any), and including a copy of any offer received. |

| 15.3 | Should the Offer not be accepted in full in writing within 20 (twenty) business days of the date upon which the Offer is made, and – |

| 15.3.1 | a proposed transferee has been identified as part of the Offer, then – |

| 15.3.1.1 | the Disposer will be entitled to dispose of its Sale Interest, within a further period of 20 (twenty) business days, to the proposed transferee referred to in clause 15.2.2 at a price not lower and on terms and conditions not more favourable to such person than the price and terms stated in the Offer, provided that the giving of warranties to a third party offeror will not constitute more favourable terms, unless designed to increase the purchase price; and |

| 15.3.1.2 | unless the Disposer disposes of its Sale Interest to the proposed transferee within the said further period of 20 (twenty) business days, it may not thereafter dispose of its Sale Interest without again adopting the procedure referred to herein; |

| 15.3.2 | no proposed transferee has been identified as part of the Offer, then the Disposer may not dispose of its Sale Interest to any third party without again adopting the procedure set out above. |

| 15.4 | The acceptance of any offer in terms of this clause 15 will be subject to the condition precedent that all approvals required by law or regulation to give effect thereto or to the implementation of the transaction contemplated thereby, are obtained. The Parties undertake to do all things, perform all |

|

|

Page 39

| such actions and take all such steps and to procure the doing of all such things, the performance of all such actions and the taking of all such steps as may be open to them and reasonably necessary for or incidental to expediting any regulatory approval process. Any period stipulated in this clause 15 shall be increased by such number of days as may reasonably be necessary in order to obtain any required regulatory approval as aforesaid. |

| 15.5 | The purchaser of any Sale Interest, on successful completion of the sale, shall be deemed to have, inter alia, taken assignment of all of the lights and obligations in and to the Disposer’s interest in this Agreement (together with the Disposer’s Sale Interest). The Parties and the purchaser shall procure that any Joint Venture obligations, to the extent that they pertain to the Disposer, are delegated to the purchaser as soon as possible after, and/or on, the effective date of the sale. |

| 15.6 | Nothing contained in this Agreement shall preclude or be deemed to preclude a shareholder of a Party or Participant from selling or transferring or encumbering its or their shares in or claims against such Party or Participant even if that should result in a change of control of such Party or Participant. |

|

|

Page 40

| 16 | FORCE MAJEURE |

| 16.1 | If either Party is prevented or restricted directly or indirectly from carrying out all or any of its obligations under this Agreement from any cause beyond the reasonable control of that Party (including without limiting the generality of the foregoing, war, civil commotion, riot, insurrection, strikes, lock-outs, fire, explosion, flood and acts of God) (“Force Majeure”) the Party so affected shall – |

| 16.1.1 | be relieved of its obligations hereunder during the period that such event and its consequences continue, but only to the extent so prevented; and |

| 16.1.2 | not be liable for any delay or failure in the performance of any obligations hereunder or any loss or damage (whether general or special, direct or indirect /consequential) which the other Party may suffer due to or resulting from such delay or failure. |

| 16.2 | The provisions of clause 16.1 arc subject to the proviso that written notice shall, within 48 (forty eight) hours of the occurrence constituting Force Majeure, be given of any such inability to perform by the affected Party to the other Party and provided further that the obligation to give such notice shall be suspended to the extent necessitated by such Force Majeure. |

| 16.3 | A Party invoking Force Majeure shall use its commercially reasonable endeavours to mitigate the effects of the Force Majeure event or occurrence and, upon termination of the such Force Majeure event or occurrence, shall forthwith give written notice thereof to the other Party. |

| 16.4 | If the full and proper implementation of this Agreement is precluded by any of the events or a combination of the events contemplated in clause 16.1 for |

|

|

Page 41

| a period of more than 90 (ninety) days at any one time, then the Parties shall endeavour to conclude new arrangements equitable to both of them and, should they fail to agree in writing upon any such new arrangements within a further period of 30 (thirty) days of written notice by either Party calling upon the other to do so, then either Party shall be entitled to terminate this Agreement with immediate effect upon written notice to the other Party. |

| 17 | TERMINATION AND WITHDRAWAL |

| 17.1 | Unless the Participants unanimously otherwise agree in writing, the participation of a Participant (“Terminating Party”) in the Joint Venture shall terminate - |

| 17.1.1 | upon the withdrawal of the Terminating Party on notice given by it in accordance with the provisions of clause 8.2, on the date on which such notice takes effect in compliance with clause 8.2; |

| 17.1.2 | on written notice given by the other Party if: the Terminating Party is deemed to be unable to pay its debts within the meaning of the Companies Act, 173; or if the Terminating Party should enter into or attempt to enter into a compromise with any or all of its creditors; or if the Terminating Party is placed under judicial management, whether provisionally or finally, with effect from the date stipulated in such notice; |

| 17.1.3 | automatically, if the Terminating Party should be liquidated or wound-up, whether provisionally or finally; |

| 17.1.4 | automatically if the shareholding by HDS As in the Terminating Party is reduced for any reason in a manner that will prejudice, or may reasonably |

|

|

Page 42

| be expected to prejudice, the New Order Mining Right held by the Company of which the Terminating Party is a member. For the purposes of this clause 17.1.4 – |

| 17.1.4.1 | “HDSA” means - |

| 17.1.4.1.1 | in relation to an individual, a Historically Disadvantaged South African, qualified as such in terms of the Charter; |

| 17.1.4.1.2 | in relation to a company, a company qualified as such in terms of the Charter, being a company directly or indirectly controlled by one or more persons contemplated in clause 17.1.4.I.I and in which the majority of the board of directors are persons contemplated in clause 17.1.4.1.1; and |

| 17.1.4.1.3 | in relation to an unincorporated association or trust, an unincorporated association or trust controlled by one or more persons contemplated in clause 17.1.4.1.1; and |

| 17.1.4.2 | “Charter” means the Broad-Based Socio-Economic Empowerment Charter for the South African Mining Industry, published in the Government Gazette pursuant to the provisions of section 100(2) of the MPRDA; |

| 17.1.5 | on written notice given by the other Party to the Terminating Party if the Terminating Party should commit a material breach of this Agreement or should continuously breach the provisions of this Agreement and should fail to remedy such material breach or to cease such continuous breaches of this Agreement, within 30 (thirty) business days of the other Party calling upon the Terminating Party to do so (and such notice shall be |

|

|

Page 43

| without prejudice to any other claims or rights which the Party giving such notice may have against the Terminating Party), with effect from the date stipulated in such notice; or |

| 17.1.6 | on written notice given by a Party in terms of clause 16.4. |

| 17.2 | In the event of the termination of the participation of a Party in the Joint Venture, the Joint Venture shall be deemed to have dissolved on the date on which the participation of the Terminating Party ceases and, unless the other Participant (“Remaining Party”) elects to continue the JV Business on its own or in association with or in a joint venture with any other person or third party, the Joint Venture shall be wound-up in accordance with the provisions of clause 17.6. |

| 17.3 | The following provisions shall apply upon termination of the participation of a Party in the Joint Venture in circumstances where the Remaining Party elects to continue the Joint Venture in accordance with clause 17.2 - |

| 17.3.1 | the Parties shall procure the preparation of financial accounts for the Joint Venture as at the date of termination of the Terminating Party’s participation; |

| 17.3.2 | the Remaining Party continuing the Joint Venture shall be deemed to have agreed to purchase the Terminating Party’s Sale Interest (as contemplated in clause 15.1) at a purchase price equivalent to the Fair Market Value thereof, determined in accordance with the provisions of clause 18. The said purchase price shall be paid as soon as is reasonably possible after determination of the Fair Market Value, but in any event within 60 (sixty) business days thereof against constructive delivery by the Terminating Party of its Participation Interest to the Remaining Party; |

|

|

Page 44

and

| 17.3.3 | the Terminating Party shall, until the date of termination of its participation in the Joint Venture, be obliged to fully comply with all of its obligations in terms of this Agreement. |

| 17.4 | If the Remaining Party elects not to continue with the Joint Venture, it shall nevertheless have a right and option, on written notice to the Terminating Party to purchase the Terminating Party's Sale Interest (as contemplated in clause 15.1), at a purchase price equivalent to the Fair Market Value thereof, determined in accordance with the provisions of clause 18. |

| 17.5 | Any purchase by the Remaining Party of the Terminating Party's Sale Interest (as contemplated in clause 15.1) in accordance with the provisions of this clause 17, shall be subject to any and all required regulatory approvals being obtained, and the Parties undertake in favour of each other to cooperate fully in order to obtain the necessary approvals. |

| 17.6 | Unless the Parties otherwise agree in writing, the following provisions shall apply upon the winding-up of the Joint Venture in terms of this Agreement - |

| 17.6.1 | the liquidator of the Joint Venture shall be a partner or director of the Independent Auditors; |

| 17.6.2 | the liquidator, in winding-up the Joint Venture shall - |

| 17.6.2.1 | compile accounts reflecting the assets and liabilities of the Joint Venture; |

| 17.6.2.2 | collect all debts due to the Joint Venture; |

| 17.6.2.3 | in consultation with the Parties, realise the assets owned by the Joint |

|

|

Page 45

| Venture (if any) in whatever manner he may deem fit; |

| 17.6.2.4 | pay the creditors of the Joint Venture; |

| 17.6.2.5 | thereafter, pay the expenses of the realisation of the assets and the costs of liquidation of the Joint Venture; and |

| 17.6.2.6 | thereafter, distribute the remaining proceeds (if any) from the winding-up of the Joint Venture to the Parties in proportion to their respective Participation Interests as at the date of the winding-up. |

| 17.7 | in the event of the proceeds of the realisation of the assets of the Joint Venture proving to be insufficient to meet the liabilities of the Joint Venture, levy a contribution upon the Parties participating in the Joint Venture at the date of its winding-up to contribute to the deficit in proportion to their respective Participation Interests, but taking into account any funding shortfall by either Party or any excess funding contributed by a Party to the Joint Venture. |

| 18 | FAIR MARKET VALUE |

| 18.1 | Whenever the Fair Market Value of an asset or any interest, including any Participation Interest or Sale Interest (as contemplated in clause 15.1), is required to be determined, the Parties shall first attempt to agree such value in writing. |

| 18.2 | Should the Parties fail to so agree in writing the Fair Market Value of the asset or interest within 20 (twenty) business days from the date of a request by either Party for such agreement, the Fair Market Value of the asset or interest will be determined by the an Independent Investment Bank. In so certifying the Independent Investment Bank shall - |

|

|

Page 46

| 18.2.1 | act as an expert and not as an arbitrator; |

| 18.2.2 | value the asset or interest having regard to the price a willing buyer would pay in respect thereof to a willing seller negotiating at arm’s-length; |

| 18.2.3 | not take into account the illiquidity of the such asset or interest; and |

| 18.2.4 | not take into account the fact that the relevant interest may constitute a minority or majority holding in the Joint Venture. |

| 19 | CONFIDENTIALITY AND PUBLICITY |

| 19.1 | The Parties shall take all reasonable steps to minimise the risk of disclosure of confidential information which is proprietary to the Joint Venture or either of the Parties, by ensuring that only their employees and directors and those of the Joint Venture whose duties will require them to possess any such information shall have access thereto, and that they shall be instructed to treat the same as confidential. The foregoing shall not be applicable to the Parties with respect to - |

| 19.1.1 | information which enters the public domain other than as a result of this Agreement; |

| 19.1.2 | information which is lawfully received from a third party not subject to any duty of confidentiality to the applicable Party with respect to such information; |

| 19.1.3 | information which is known other than as a result of a disclosure in breach of any duty of confidentiality to the applicable Party with respect to such information; and |

|

|

Page 47

| 19.1.4 | disclosure made as required by law or enforceable legal process, or by the rules of any securities exchange or regulatory authority having jurisdiction over such person. |

| 19.2 | Notwithstanding the provisions of clause 19.1, the Parties shall be entitled to disclose to their respective consultants and advisors any information required to be kept confidential in terms of clause 19.1 for any bona fide purpose, provided that in such event the disclosing Party shall procure that such consultants and advisors keep such information strictly confidential. |

| 19.3 | Unless otherwise agreed in writing between the Parties, neither of the Parties shall issue or make any public announcement or statement (including any written or oral statement under circumstances where it could reasonably be expected that such statement would be published in any media) or any other disclosure to any third party regarding this Agreement or the transactions contemplated hereby, including, without limitation, any reference to their terms or conditions, unless required by law or enforceable legal process or the rules of any securities exchange or the rules governing the production and publication of audited financial statements or any regulatory authority having jurisdiction over the Parties or either of them. |

| 19.4 | Should a Party wish to negotiate with a bona fide third party (not being a competitor, directly or indirectly, in relation to the Joint Venture) for the possible disposal of any Participation Interest to that bona fide third party, such Party shall be entitled to disclose confidential information concerning the Joint Venture to such bona fide third party provided that such third party has signed and executed a confidentiality undertaking on terms and conditions reasonably acceptable to the other Party and there shall be no obligation on the disclosing Party to reveal the identity of the bona fide third |

|

|

Page 48

| party at that stage. |

| 20 | BREACH |

The Parties agree that (subject to the provisions of clause 16) the cancellation of this Agreement in the event of a breach would be an inappropriate and insufficient remedy and that irreparable damage would occur if the provisions of this Agreement were not complied with. It is accordingly agreed that, in the event of a breach, the aggrieved Party shall be entitled (without prejudice to any other rights which it may have in law, save for the right to cancel the Agreement, and the rights that it has in terms of clause 16) to an order for specific performance and/or to recover any damages which it may have suffered.

| 21 | DISPUTE RESOLUTION |

| 21.1 | In the event of there being any dispute or difference between the Parties arising out of this Agreement, the said dispute or difference shall on written demand by either Party be submitted to arbitration in Johannesburg in accordance with the AFSA rules, which arbitration shall be administered by AFSA. |

| 21.2 | Should AFSA, as an institution, not be operating at that time or not be accepting requests for arbitration for any reason, then the arbitration shall be conducted in accordance with the AFSA rules for commercial arbitration (as last applied by AFSA) (“AFSA Rules”) before an arbitrator appointed by agreement between the parties to the dispute or failing agreement within 10 (ten) business days of the demand for arbitration, then any party to the dispute shall be entitled to forthwith call upon the chairperson of the Johannesburg Bar Council to nominate the arbitrator, provided that the |

|

|

Page 49

| person so nominated shall be an advocate of not less than 10 (ten) years standing as such. The person so nominated shall be the duly appointed arbitrator in respect of the dispute. In the event of the attorneys of the parties to the dispute failing to agree on any matter relating to the administration of the arbitration, such matter shall be referred to and decided by the arbitrator whose decision shall be final and binding on the parties to the dispute. |

| 21.3 | Any party to the arbitration may appeal the decision of the arbitrator or arbitrators in terms of the AFSA Rules. |

| 21.4 | Nothing herein contained shall be deemed to prevent or prohibit a party to the arbitration from applying to the appropriate court for urgent relief or for judgment in relation to a liquidated claim. |

| 21.5 | Any arbitration in terms of this clause 21 (including any appeal proceedings) shall be conducted in camera and the Parties shall treat as confidential details of the dispute submitted to arbitration, the conduct of the arbitration proceedings and the outcome of the arbitration. |

| 21.6 | This clause 21 will continue to be binding on the Parties notwithstanding any termination or cancellation of the Agreement. |

| 21.7 | The Parties agree that the written demand by a party to the dispute in terms of clause 21.1 that the dispute or difference be submitted to arbitration, is to be deemed to be a legal process for the purpose of interrupting extinctive prescription in terms of the Prescription Act, 1969. |

| 22 | NOTICES AND DOMICILIA |

| 22.1 | The Parties select as their respective domicilia citandi et executandi the |

|

|

Page 50

| following physical addresses, and for the purposes of giving or sending any notice provided for or required under this Agreement, the said physical addresses as well as the following telefax numbers - |

| Name |

Physical Address |

Telefax | ||

| Taung | Suite 4A | (012) 665-3641 | ||

| Manhattan Office Park | ||||

| 00 Xxxxxx Xxxxxx | ||||

| Xxxxxxxx Xxxxxx Xxxx | ||||

| Xxxxxxxxx |

Marked for the attention of: The Manager

| Name |

Physical Address |

Telefax | ||

| Evander | Block 00 | (000) 000-0000 | ||

| Xxxxxxxxxxx Xxxxxx Xxxx | ||||

| Xxxxxx Xxxx Xxxx Xxxx and | ||||

| Xxxx Avenue | ||||

| Randfontein |

Marked for the attention of: The Company Secretary

provided that a Party may change its domicilium or its address for the purposes of notices to any other physical address or telefax number by written notice to the other Party to that effect. Such change of address will be effective 5 (five) business days after receipt of the notice of the change.

| 22.2 | All notices to be given in terms of this Agreement will be given in writing, in English, and will - |

| 22.2.1 | be delivered by hand or sent by telefax; |