NOTE PURCHASE AGREEMENT among NEWSTAR STRUCTURED FINANCE OPPORTUNITIES, LLC NEWSTAR FINANCIAL, INC., as Limited Recourse Provider THE INVESTORS PARTY HERETO MMP-5 FUNDING, LLC as Swingline Investor U.S. BANK NATIONAL ASSOCIATION as Trustee and IXIS...

Exhibit 10.11.1

EXECUTION COPY

among

NEWSTAR STRUCTURED FINANCE OPPORTUNITIES, LLC

as Limited Recourse Provider

THE INVESTORS PARTY HERETO

MMP-5 FUNDING, LLC

as Swingline Investor

U.S. BANK NATIONAL ASSOCIATION

as Trustee

and

IXIS FINANCIAL PRODUCTS INC.

as Investor Agent

Dated as of March 21, 2006

$200,000,000

TABLE OF CONTENTS

| Page | ||||

| ARTICLE I DEFINITIONS AND INTERPRETATION |

1 | |||

| Section 1.1 |

Definitions | 1 | ||

| Section 1.2 |

Additional Terms | 31 | ||

| Section 1.3 |

Accounting Terms and Determinations | 32 | ||

| Section 1.4 |

Assumptions and Calculations with Respect to Collateral Debt Securities; Construction | 32 | ||

| Section 1.5 |

Cross-References; References to Agreements | 32 | ||

| ARTICLE II COMMITMENT |

32 | |||

| Section 2.1 |

Commitment to Make Advances | 32 | ||

| Section 2.2 |

Notice of Funding | 33 | ||

| Section 2.3 |

Notice to Investors; Funding of Advances | 33 | ||

| Section 2.4 |

Swingline Advances | 33 | ||

| Section 2.5 |

Notes | 34 | ||

| Section 2.6 |

Maturity of Advances | 35 | ||

| Section 2.7 |

Interest Rates | 35 | ||

| Section 2.8 |

Payments; Reduction and Termination of Commitment | 36 | ||

| Section 2.9 |

Commitment Fee | 38 | ||

| Section 2.10 |

Several Obligations; Remedies Independent | 38 | ||

| Section 2.11 |

General Provisions as to Payments | 38 | ||

| Section 2.12 |

Funding Losses | 38 | ||

| Section 2.13 |

Computation of Interest and Commitment Fees | 39 | ||

| ARTICLE III CONDITIONS TO FUNDINGS |

39 | |||

| Section 3.1 |

Closing | 39 | ||

| Section 3.2 |

Fundings | 40 | ||

| ARTICLE IV REPRESENTATIONS AND WARRANTIES |

41 | |||

| Section 4.1 |

Existence and Power | 41 | ||

| Section 4.2 |

Power and Authority | 41 | ||

| Section 4.3 |

No Violation | 41 | ||

| Section 4.4 |

Litigation | 42 | ||

| Section 4.5 |

Taxes | 42 | ||

| Section 4.6 |

Full Disclosure | 42 | ||

| Section 4.7 |

Solvency | 43 | ||

| Section 4.8 |

Use of Proceeds; Margin Regulations | 43 | ||

| Section 4.9 |

Governmental Approvals | 43 | ||

| Section 4.10 |

Representations and Warranties in Financing Documents | 43 | ||

| Section 4.11 |

Ownership of Assets | 43 | ||

| Section 4.12 |

No Default | 43 | ||

| Section 4.13 |

Subsidiaries | 43 | ||

| Section 4.14 |

Environmental Matters | 43 | ||

| Section 4.15 |

Private Offering by the Issuer | 44 | ||

| Section 4.16 |

Investment Company Act | 44 | ||

| ARTICLE V AFFIRMATIVE AND NEGATIVE COVENANTS |

44 | |||

| Section 5.1 |

Information | 44 | ||

| Section 5.2 |

Payment of Obligations | 45 | ||

| Section 5.3 |

Good Standing | 45 | ||

| Section 5.4 |

Compliance with Laws | 45 | ||

| Section 5.5 |

Inspection of Property, Books and Records | 46 | ||

| Section 5.6 |

Existence | 46 | ||

| Section 5.7 |

Subsidiaries | 46 | ||

| Section 5.8 |

Collateral Debt Securities; Retention of Funds, Etc. | 46 | ||

| Section 5.9 |

Restriction on Fundamental Changes | 46 | ||

| Section 5.10 |

Liens | 47 | ||

| Section 5.11 |

Business Activities | 47 | ||

| Section 5.12 |

Margin Stock | 47 | ||

| Section 5.13 |

Indebtedness | 47 | ||

| Section 5.14 |

Use of Proceeds | 47 | ||

| Section 5.15 |

PIK Security Monitoring | 47 | ||

| Section 5.16 |

Amendments, Modifications and Waivers to Collateral Debt Securities | 47 | ||

| Section 5.17 |

Credit Standards | 47 | ||

| Section 5.18 |

Performance of Obligations | 48 | ||

| Section 5.19 |

Servicing | 48 | ||

| Section 5.20 |

Limitation on Dividends, Return of Capital and Other Equity Payments | 48 | ||

| Section 5.21 |

Sales to Affiliated Persons | 48 | ||

| Section 5.22 |

Ratings | 48 | ||

| ARTICLE VI EVENTS OF DEFAULT; TERMINATION AMOUNTS |

48 | |||

| Section 6.1 |

Events of Default | 48 | ||

| Section 6.2 |

Remedies | 50 | ||

| Section 6.3 |

Termination Amounts | 51 | ||

| Section 6.4 |

Limited Recourse Provider Cure | 51 | ||

| ARTICLE VII SALE OF COLLATERAL LOANS AND INVESTMENT CRITERIA |

51 | |||

| Section 7.1 |

Sale of Collateral Debt Securities | 51 | ||

| Section 7.2 |

Eligibility Criteria | 52 | ||

| ARTICLE VIII CHANGE IN CIRCUMSTANCES |

53 | |||

| Section 8.1 |

Basis for Determining Interest Rate Inadequate or Unfair | 53 | ||

| Section 8.2 |

Increased Cost and Reduced Return | 53 | ||

| Section 8.3 |

Taxes | 55 | ||

| ARTICLE IX THE INVESTOR AGENT |

57 | |||

| Section 9.1 |

Appointment and Authorization | 57 | ||

| Section 9.2 |

Agent and Affiliates | 57 | ||

| Section 9.3 |

Actions by Investor Agent | 57 | ||

| Section 9.4 |

Delegation of Duties; Consultation with Experts | 58 | ||

| Section 9.5 |

Liability of the Investor Agent | 58 | ||

| Section 9.6 |

Indemnification | 58 | ||

| Section 9.7 |

Credit Decision | 58 | ||

| Section 9.8 |

Successor Agent | 59 | ||

| ARTICLE X MISCELLANEOUS |

59 | |||

| Section 10.1 |

Notices | 59 | ||

| Section 10.2 |

No Waivers | 60 | ||

| Section 10.3 |

Expenses; Indemnification | 60 | ||

iii

| Section 10.4 |

Set-Offs | 61 | ||

| Section 10.5 |

Amendments and Waivers | 62 | ||

| Section 10.6 |

Successors and Assigns | 62 | ||

| Section 10.7 |

Governing Law; Submission to Jurisdiction | 63 | ||

| Section 10.8 |

Marshalling; Recapture | 64 | ||

| Section 10.9 |

Counterparts; Integration; Effectiveness | 64 | ||

| Section 10.10 |

WAIVER OF JURY TRIAL | 64 | ||

| Section 10.11 |

Survival | 64 | ||

| Section 10.12 |

Domicile of Advances and the Swingline Advances | 64 | ||

| Section 10.13 |

Limitation of Liability | 64 | ||

| Section 10.14 |

Bankruptcy Non-Petition and Limited Recourse | 64 | ||

| Section 10.15 |

Confidentiality | 65 | ||

| Section 10.16 |

Investment Representations | 66 | ||

| ARTICLE XI CP CONDUITS |

66 | |||

| Section 11.1 |

Special Provisions Applicable to CP Conduits | 66 | ||

| ARTICLE XII THE TRUSTEE |

68 | |||

| Section 12.1 |

Registration; Registration of Transfer and Exchange | 68 | ||

| Section 12.2 |

Duties of Trustee | 70 | ||

| Section 12.3 |

Rights of Trustee | 72 | ||

| Section 12.4 |

Individual Rights of Trustee | 73 | ||

| Section 12.5 |

Trustee’s Disclaimer | 73 | ||

| Section 12.6 |

Compensation and Indemnity | 73 | ||

| Section 12.7 |

Replacement of Trustee | 74 | ||

| Section 12.8 |

Successor Trustee by Merger, Conversion or Transfer | 75 | ||

| Section 12.9 |

Appointment of Separate Trustee or Co-Trustee | 75 | ||

| Section 12.10 |

Eligibility; Disqualification | 76 | ||

| Section 12.11 |

Representation of Trustee | 76 | ||

iv

SCHEDULES AND EXHIBITS

| Schedule A |

- | Moody’s Asset Sectors | ||

| Schedule B |

- | Commitments | ||

| Schedule C |

- | Moody’s Loss Scenario Matrix | ||

| Schedule D |

- | Table of Moody’s Asset Classes | ||

| Schedule E |

- | Additional Terms | ||

| Schedule F |

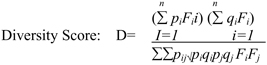

- | Formula for the Calculation of Diversity Score | ||

| Schedule G |

- | Advance Rate Table | ||

| Schedule H |

- | Initial Exempt Portfolio | ||

| Exhibit A |

- | Form of Note | ||

| Exhibit B |

- | Form of Monthly Collateral Report | ||

v

THIS NOTE PURCHASE AGREEMENT dated as of March 21, 2006 is entered into among NewStar Structured Finance Opportunities, LLC, a limited liability company existing under the laws of the State of Delaware (the “Issuer”), NewStar Financial, Inc. (“NewStar”), as limited recourse provider (the “Limited Recourse Provider”), MMP-5 Funding, LLC, as Swingline Investor (the “Swingline Investor”), the Investors party hereto, IXIS Financial Products Inc. (“IXIS FP”), as agent for the Investors hereunder (in such capacity, together with its successors in such capacity, the “Investor Agent”) and U.S. Bank National Association, as trustee (in such capacity, together with its successors and assigns, the “Trustee”);

Accordingly, in consideration of the covenants contained in this Agreement, the parties hereto agree as follows:

ARTICLE I

DEFINITIONS AND INTERPRETATION

Section 1.1 Definitions. The following terms, as used herein, have the following meanings:

“Account Control Agreement” means the Account Control Agreement dated as of March 21, 2006 among the Issuer, the Trustee and the Custodian.

“Adjusted London Interbank Offered Rate” means, with respect to any Interest Period, a rate per annum (expressed as a percentage) equal to the quotient obtained (rounded upward, if necessary, to the next higher 1/16th of 1%) by dividing (a) the applicable London Interbank Offered Rate by (b) 1.00 minus the Euro-Dollar Reserve Percentage.

“Advance Credit Balance” means a running balance (which balance may never be less than zero) that may be increased or decreased, as applicable, by the following procedures:

| i. | On any date a Collateral Debt Security (or multiple Collateral Debt Securities) is purchased by the Issuer and the portion of the Purchase Price funded by an Advance is less than the marginal increase of the Maximum Advance before and after giving effect |

1

| to such purchase, then the excess of the marginal increase over the Advance used for such purchase will be added to the Advance Credit Balance. |

| ii. | On any date that a Xxxxx’x Rating is assigned to a Collateral Debt Security by the receipt of a rating by Moody’s pursuant to clause (g) of the definition of Xxxxx’x Rating and the Xxxxx’x Rating actually assigned is different than the Interim Rating deemed pursuant to such clause (g), an amount designated by NewStar will be added to the Advance Credit Balance not to exceed (x) the Maximum Advance plus Cash on deposit in the Collateral Account minus (y) outstanding Advances, after giving effect to such assigned Xxxxx’x Rating. For the avoidance of doubt, if (x) minus (y) results in a negative number, the Advance Credit Balance will be reduced by such absolute amount thereof. |

| iii. | On any date that the Issuer (or the Collateral Manager on behalf of the Issuer) requests an Advance and designates the Advance (or a portion of such Advance) as an Advance Credit Balance withdrawal (an “Advance Credit Balance Withdrawal”), the proceeds thereof will be transferred to NewStar (or, in the circumstances contemplated by Section 6.4, deposited into the Collateral Account) and the Advance Credit Balance will be reduced accordingly by the amount of each such withdrawal; provided, any Advance will be permitted to be made in accordance with this clause only if, after giving effect to such withdrawal, the Advance Credit Balance is greater than or equal to zero; provided further, that no Limited Recourse Event has occurred. |

“Advances” means the advances made by the Investors to the Issuer pursuant to Section 2.1.

“Advance Rate” means, as of any date, the rate determined according to the calculation of the Average Ratings Distribution as of such date and the Diversity Score as of such date, as found on the table set forth on Schedule G; provided, that if the Diversity Score is not a whole number, the Advance Rate will be linearly interpolated between the whole number Advance Rates above and below the Diversity Score based upon the decimal.

“Affiliate” or “Affiliated” means, with respect to a specified Person, (a) another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the specified Person and (b) any director, officer or employee of such specified Person, of any subsidiary or parent company of such specified Person or of any Person referred to in the foregoing clause (a); provided that for purposes of the definition of Collateral Debt Security, the term Affiliate shall not include any Affiliate relationship which may exist solely as a result of direct or indirect ownership of, or control by, a common owner which is a financial institution, fund or other investment vehicle which is in the business of making diversified investments including investments independent from the Collateral Debt Securities. As used in this definition, “Control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of a Person, whether through the ability to exercise voting power, by contract or otherwise, and “Controlling” and “Controlled” have meanings correlative thereto.

“Agreement” means this Note Purchase Agreement.

“Alternate Base Rate” means, for any day, a rate per annum equal to the greater of (a) the Prime Rate in effect on such day and (b) the Federal Funds Rate in effect on such day plus 1/2 of 1%. Any change in the Alternate Base Rate due to a change in the Prime Rate or the Federal Funds Rate shall be

2

effective from and including the effective day of such change in the Prime Rate or the Federal Funds Rate, respectively.

“Applicable Margin” means 0.75%.

“Applicable Office” means, for each Investor and the Swingline Investor, the office or offices designated as the “Applicable Office” of such Investor or the Swingline Investor (as the case may be) opposite its name in the signature pages hereto or such other office of such Investor or the Swingline Investor as such Investor or the Swingline Investor (as the case may be) may from time to time specify in writing to the Issuer and the Investor Agent.

“Applicable Rate” means, with respect to each Advance (a) so long as MMP-5 or any other CP Conduit is the Investor with respect to such Advance, the Cost of Funds Rate for such Advance, and (b) so long as any other Person is the Investor with respect to such Advance, the sum of the Adjusted London Interbank Offered Rate applicable to such Interest Period plus the Applicable Margin; provided that, if on or prior to the first day of any Interest Period (x) the Investor Agent is unable to obtain a quotation for the London Interbank Offered Rate as contemplated by the definition thereof or (y) the Required Investors shall have notified the Investor Agent pursuant to Section 8.1(b) that the Adjusted London Interbank Offered Rate will not adequately and fairly reflect the cost to such Investors of funding the Advances for such Interest Period (and such Required Investors shall not have subsequently notified the Investor Agent that the circumstances giving rise to such situation no longer exist), the Applicable Rate (other than with respect to Advances made by CP Conduits) shall be a rate per annum equal to the Alternate Base Rate in effect on each day of such Interest Period.

“Assigned Recovery Value” means, with respect to any Collateral Debt Security, on any Measurement Date, (a) the Principal Balance of such Collateral Debt Security multiplied by (b) the Moody’s Recovery Rate (as set forth in Schedule C hereto).

“Authorized Officer” means, with respect to any Person, those of its officers and agents whose signatures and incumbency shall have been certified to the Investor Agent on the Closing Date pursuant to the second sentence of Section 3.1(f) or thereafter from time to time in substantially similar form. Each party may receive and accept a certification of the authority of any other party as conclusive evidence of the authority of any Person to act, and such certification may be considered as in full force and effect until receipt by such party of written notice to the contrary.

“Average Ratings Distribution” is the number determined on any Measurement Date by dividing: (i) the summation of the series of products obtained for each Performing Collateral Debt Security, by multiplying (1) the Principal Balance on such Measurement Date of such Performing Collateral Debt Security by (2) its Xxxxx’x Rating Factor on such Measurement Date by (ii) the aggregate Principal Balance on such Measurement Date of all Performing Collateral Debt Securities and rounding the result to the nearest hundredth.

“Bankruptcy Code” means Title 11 of the United States Code, entitled “Bankruptcy”, as amended from time to time, and any successor statute or statutes.

“Business Day” means a day on which commercial banks and foreign exchange markets settle payments and are open for general business (including dealings in foreign exchange and foreign currency deposits) in New York and in any city where the Corporate Trust Office of the Trustee is located.

“Calculation Agent” means NewStar.

3

“Cash” means such coin or currency of the United States as at the time shall be legal tender for payment of all public and private debts.

“CDO Closing Date” means the date of issuance of the Offered Securities.

“Change in Law” has the meaning set forth in Section 8.2(a).

“Closing Date” means the date on which each of the conditions set forth in Section 3.1 is satisfied or waived by the Investor Agent.

“Code” means the Internal Revenue Code of 1986, as amended, and the United States Department of the Treasury regulations promulgated thereunder.

“Collateral” means “Collateral” as defined in the Security Agreement.

“Collateral Account” has the meaning set forth in the Security Agreement.

“Collateral Debt Security” means (i) any Dollar-denominated security or loan that entitles the holder thereof to receive payments that depend primarily on the cash flow from a specified pool of financial assets, either fixed or revolving, that by its terms converts into cash within a finite time period, together with rights or other assets designed to assure the servicing or timely distribution of proceeds to holders of such security or loan, including any obligation or security issued by an Eligible Collateralized Debt Obligation Fund, (ii) any general corporate loan or bond (whether secured or unsecured) or participation interest in a general corporate loan and (iii) any Synthetic Security;

provided that in no event will a Collateral Debt Security include:

(i) any obligation or security that does not provide for a fixed amount of principal payable in cash no later than its stated maturity;

(ii) any obligation or security that is not eligible under the instrument or agreement pursuant to which it was issued or created to be purchased by the Issuer and pledged to the Investor Agent;

(iii) any obligation or security issued by a collateralized bond obligation fund or collateralized loan obligation fund managed by the Collateral Manager or any of its Affiliates;

(iv) any obligation or security unless it is Registered;

(v) any obligation or security unless, as of its acquisition date, the Issuer will receive payments due under the terms of such obligation or security and proceeds from disposing of such obligation or security free and clear of withholding tax, other than withholding tax as to which the obligor or issuer must make additional payments so that the net amount received by the Issuer after satisfaction of such tax is the amount due to the Issuer before the imposition of any such withholding tax;

(vi) any Revolving Security or Delayed Funding Security except to the extent advances or borrowings have been funded and remain outstanding at the time of its acquisition by the Issuer and the repayment or prepayment of which cannot permit the reborrowing from the Issuer of such repaid or prepaid amount (the unfunded portion of

4

any such Revolving Security or Delayed Funding Security (and any future funding obligation thereof) being herein referred to as a “Retained Security” and the funded portion being a “Funded Security”);

(vii) any obligation or security whose timely payment of principal and interest is subject to substantial non-credit related risk, as determined by the Collateral Manager at the time of purchase by the Issuer;

(viii) any obligation or security that at the time of purchase by the Issuer provides for conversion into or exchange for equity securities or includes any equity securities attached thereto or acquired as a “unit”;

(ix) any obligation or security that pays interest less frequently than semi-annually with the exception of a Deferrable Security;

(x) a Defaulted Security or a Credit Risk Security or a PIK Security that has deferred or capitalized interest that remains unpaid at the time acquired by the Issuer with the exception of a Deferrable Security;

(xi) any obligation that at the time of purchase by the Issuer, is the subject of an Offer or has been called for redemption (except for any repayment under a Revolving Security of amounts that may be reborrowed thereunder pursuant to the applicable Underlying Instruments);

(xii) any obligation that matures after January 2041;

(xiii) any obligation or security unless it is, after the acquisition by the Issuer thereof, owned by the Issuer free and clear of adverse claims (within the meaning given to such term in Article 8 of the Uniform Commercial Code); with respect to which all steps required by Section 6.5 of the Security Agreement have been taken; and in which the Investor Agent, after giving effect to the acquisition thereof by the Issuer, holds a first priority perfected security interest, subject to liens expressly permitted under the Security Agreement;

(xiv) Margin Stock; and

(xv) any obligation or security that does not have a Xxxxx’x Rating.

“Collateral Management Agreement” means the Collateral Management Agreement dated as of March 21, 2006 between the Issuer and the Collateral Manager.

“Collateral Management Fee” means the fee payable to the Collateral Manager on each Payment Date pursuant to Section 2.8(f), in an amount equal to 0.25% per annum of the daily average of the aggregate Principal Balances of all Collateral Debt Securities and Eligible Investments (without regard to whether such Collateral Debt Securities are Defaulted Securities) for the Due Period relating to such Payment Date (as certified by the Collateral Manager to the Investor Agent).

“Collateral Manager” means NewStar Financial, Inc., in its capacity as Collateral Manager under the Collateral Management Agreement.

5

“Collateral Quality Tests” means the Weighted Average Recovery Rate Test, the Weighted Average Spread Test, the Weighted Average Fixed Rate Coupon Test and the Weighted Average Life Test.

“Commercial Paper Funding” means, with respect to any Advance or Swingline Advance, at any time, the funding by MMP-5 or another CP Conduit of all or a portion of the outstanding principal amount of such Advance or Swingline Advance (as the case may be) with funds provided by the issuance of Commercial Paper Notes.

“Commercial Paper Funding Period” means, with respect to any Advance or Swingline Advance, a period of time during which all or a portion of the outstanding principal amount of such Advance or Swingline Advance (as the case may be) is funded by a Commercial Paper Funding.

“Commercial Paper Notes” means commercial paper notes or secured liquidity notes issued by a conduit providing funding to MMP-5 or by another CP Conduit from time to time.

“Commercial Paper Rate” means with respect to any Commercial Paper Funding, a rate per annum equal to the sum of (i) the rate or, if more than one rate, the weighted average of the rates, determined if necessary by converting to an interest-bearing equivalent rate per annum (based on a year of 360 days and actual days elapsed) the discount rate (or rates) at which Commercial Paper Notes are sold by any placement agent or commercial paper dealer of a commercial paper conduit providing funding to MMP-5 or of another CP Conduit, as the case may be, plus (ii) if not included in the calculations in clause (i), the commissions and charges charged by such placement agent or commercial paper dealer with respect to such Commercial Paper Notes and discount on Commercial Paper Notes issued to fund the discount on maturing Commercial Paper Notes, in all cases expressed as a percentage of the face amount thereof and converted to an interest-bearing equivalent rate per annum (based on a year of 360 days and actual days elapsed), plus (iii) the Applicable Margin.

“Commitment” means, as to each Investor, the commitment of such Investor to make Advances to the Issuer pursuant to Section 2.1 and, as to the Swingline Investor, the commitment of the Swingline Investor to make Swingline Advances to the Issuer pursuant to Section 2.4, as such amounts may be reduced from time to time pursuant to Section 2.8(b), terminated pursuant to Section 2.8(a), 2.8(c) or 6.2 or increased or reduced pursuant to Section 10.6. Initially, the aggregate amount of the Commitments is $200,000,000, the amount of the initial Swingline Investor’s Commitment and the amount of the Initial Investor’s Commitment are each as set forth on Schedule B.

“Commitment Percentage” means, as to each Investor, a percentage equal to (a) such Investor’s Commitment divided by (b) the aggregate amount of the Commitments of all Investors.

“Concentration Account” has the meaning set forth in the Intercreditor Agreement.

“Concentration Limitations” means, with respect to any Collateral Debt Security to be acquired by the Issuer, the condition that the following limitations will not be violated after giving effect to the acquisition of such Collateral Debt Security (assuming the numerator used to determine compliance with such limitations equals the aggregate Principal Balances of all Collateral Debt Securities (excluding Defaulted Securities) comprising the relevant category of Collateral Debt Securities) as of the date on which the Issuer commits to acquire such Collateral Debt Security:

(a) not more than 10% of the Maximum Investment Amount may consist of PO Securities;

6

(b) not more than 10% of the Maximum Investment Amount may consist of Deferrable Securities;

(c) not more than 20% of the Maximum Investment Amount may consist of Collateral Debt Securities that are fixed rate obligations other than fixed rate obligations that, as a result of a Hedge Agreement, are swapped to floating rate obligations;

(d) not more than 3.0% of the Maximum Investment Amount may consist of Collateral Debt Securities made to a single Obligor and any Affiliate thereof; provided that the Maximum Investment Amount may include Collateral Debt Securities made to not more than three Obligors and their respective Affiliates in an amount of up to 5% of the Maximum Investment Amount for each such Obligor and its Affiliates; provided, further, that the Maximum Investment Amount may include Collateral Debt Securities made to not more than three Obligors and their respective Affiliates in an amount of up to 6.13% of the Maximum Investment Amount for each such Obligor and its Affiliates so long as such Collateral Debt Security of such Obligor and its Affiliates is assigned a public or private rating by Moody’s of at least B2 or rating estimate provided by NewStar (as contemplated by the definition of “Interim Rating”) of at least Ba3;

(e) not more than 20% of the Maximum Investment Amount may consist of Collateral Debt Securities of Obligors that fall within the same Moody’s Asset Sector; provided that up to 25% (or, if the relevant Moody’s Asset Sector is Moody’s Xxxxx Xxxxxx 00, 00 or 41, as found on Schedule A, 30%) of the Maximum Investment Amount may consist of Collateral Debt Securities of Obligors that fall within no more than one Moody’s Asset Sector; provided further, that not more than 50% of the Maximum Investment Amount may consist of Collateral Debt Securities of Obligors that fall within Moody’s Asset Sectors 39, 40, 41 and 42;

(f) not more than 30% of the Maximum Investment Amount may consist of Collateral Debt Securities that pay interest in Cash less frequently than quarterly;

(g) not more than 5% of the Maximum Investment Amount may consist of NIM Securities and IO Securities;

(h) not more than 10% of the Maximum Investment Amount may consist of Collateral Debt Securities that have the same airline leasing or owning all of the aircraft that comprise the security granted in respect of such Collateral Debt Securities;

(i) not more than 10% of the Maximum Investment Amount may consist of Collateral Debt Securities which are general corporate loans or participation interests in general corporate loans;

(j) not more than 20% of the Maximum Investment Amount may consist of Collateral Debt Securities serviced by any one Person or its Affiliates; provided that one Person or its Affiliates may service Collateral Debt Securities consisting of up to 25% of the Maximum Investment Amount;

(k) not more than 20% of the Maximum Investment Amount may consist of Collateral Debt Securities which are Revolving Securities and Delayed Funding Securities; and

(l) not more than 15% of the Maximum Investment Amount may consist of Synthetic Securities.

7

“Conduit Rating Agencies” means each Rating Agency that is then rating the Commercial Paper Notes related to MMP-5’s funding hereunder or any other CP Conduit’s Commercial Paper Notes at its request.

“Conduit Support Facility” means any Liquidity Facility provided to or for the benefit of MMP-5 or any other CP Conduit by a Conduit Support Provider.

“Conduit Support Provider” means, without duplication, (i) a provider of a Liquidity Facility to or for the benefit of MMP-5 or any other CP Conduit and any guarantor of such provider or (ii) an entity that issues commercial paper or other debt obligations, the proceeds of which are used (directly or indirectly) to fund the obligations of any Investor or the Swingline Investor.

“Consent Security” means any Collateral Debt Security secured by life insurance policies.

“Corporate Trust Office” means the corporate trust office of the Trustee, located at Xxx Xxxxxxx Xxxxxx, 0xx Xxxxx, Xxxxxx, Xxxxxxxxxxxxx 00000, or such other address as the Trustee may designate from time to time by notice to the other parties hereto, or the principal corporate trust office of any successor Trustee.

“Coverage Tests” means the Overcollateralization Ratio Test and the Interest Coverage Ratio Test.

“CP Conduit” means MMP-5 or any other limited-purpose entity established to use the proceeds of the issuance of Commercial Paper Notes to finance financial assets and that is an Investor. For all purposes hereof, including Article XI, the term “CP Conduit”, with respect to MMP-5 only, includes Fenway Capital, LLC and Fenway Funding, LLC.

“Credit Improved Security” means a Collateral Debt Security that has, in the Collateral Manager’s reasonable judgment applying the Servicing Standard, improved in credit quality.

“Credit Risk Security” means a Collateral Debt Security that is not a Defaulted Security but which has, in the reasonable judgment of the Collateral Manager applying the Servicing Standard, a significant risk of declining in credit quality and, with lapse of time, becoming a Defaulted Security.

“Credit Utilization Amount” means, on any date with respect to any Advance to be made hereunder, the sum of the aggregate principal amount of all Advances (including, for purposes of this definition, all Advances to be made on such date) outstanding on such date.

“Custodian” means U.S. Bank National Association in its capacity as Custodian under the Account Control Agreement.

8

“Default” means any condition or event which constitutes an Event of Default or which with the giving of notice or lapse of time or both would, unless cured or waived, become an Event of Default.

“Defaulted Security” means any Collateral Debt Security:

(a) as to which the issuer thereof has defaulted in the payment of principal or interest on the date such payment is due thereon on the Principal Balance thereof, in either case, without regard to any applicable grace period or waiver (except in the case of general corporate loans and Real Estate Loans which shall have a 60 day grace or cure period); provided that a Collateral Debt Security shall not be classified as a “Defaulted Security” under this paragraph (a) if (x) in the case of a failure of the obligor on such security to make interest payments, such security has resumed current payments of interest (including all accrued interest) in cash (provided that no restructuring has been effected), (y) in the case of any default or event of default (other than a default or event of default relating to the failure to pay interest), such default or event of default is no longer continuing or (z) the Collateral Manager certifies to the Investor Agent that, in its judgment (exercised in accordance with the Servicing Standard), such payment default (or failure to pay) is not due to credit-related or fraud-related causes and such default (or failure to pay) does not continue for more than five Business Days (or, if earlier, until the next succeeding Determination Date);

(b) that ranks pari passu with or subordinate to any other material indebtedness for borrowed money owing by the issuer of such security if such security is a corporate obligation (for purposes hereof, “Other Indebtedness”) if such issuer had defaulted (and the Collateral Manager, based upon due inquiry in accordance with the practices and procedures followed by investment managers of recognized standing, has obtained knowledge of such default) in the payment of principal or interest without regard to any applicable grace period or waiver with respect to such Other Indebtedness, unless, in the case of a default or event of default consisting of a failure of the obligor on such security to make required interest payments, such Other Indebtedness has resumed current payments of interest (including all accrued interest) in cash; provided that a Collateral Debt Security shall not be classified as a Defaulted Security under this paragraph (b) if the Collateral Manager, in its judgment, determines that such Collateral Debt Security should not be so classified and gives notice of such determination to the Investor Agent;

(c) as to which any bankruptcy, insolvency or receivership proceeding has been initiated in connection with the issuer thereof, or there has been proposed or effected any distressed exchange or other debt restructuring pursuant to which the issuer thereof has offered the holders thereof a new security or package of securities that the Collateral Manager determines either (i) amounts to a diminished financial obligation of the relevant obligor or (ii) is intended solely to enable the relevant obligor to avoid defaulting in the performance of its obligations under such Collateral Debt Security;

(d) the Xxxxx’x Rating of which is “Ca” or “C” or with respect to which the Xxxxx’x Rating has been withdrawn;

(e) the Standard & Poor’s Rating of which is “CC”, “D” or “SD” or with respect to which the Standard & Poor’s Rating has been withdrawn;

(f) that is a Non-Performing NIM Security or a Non-Performing IO Security;

(g) that is a Synthetic Security referencing a Reference Obligation with respect to which

9

an event or circumstance specified with respect to such Synthetic Security, and that is, or with the passage or lapse of time or both will be, the basis for a reduction in the principal amount payable to the Issuer under such Synthetic Security, has occurred and is continuing (a “Defaulted Synthetic Security”); or

(h) that is a Synthetic Security (other than a Defaulted Synthetic Security) with respect to which (a) the long-term debt or deposit obligations of the Synthetic Security Counterparty are rated less than “A2” by Moody’s or the short-term debt or deposit obligations of the Synthetic Security Counterparty are rated “D” or “SD” by Standard & Poor’s or any such debt or deposit obligations shall cease to be rated; or (b) the Synthetic Security Counterparty has defaulted in the performance of any of its payment obligations under the Synthetic Security.

“Defaulting Party” has the meaning assigned to such term in the TRS.

“Deferrable Security” means any Collateral Debt Security that is contractually permitted to defer interest payments for a period of time that is less than one year; provided that such deferral period occurs continuously and no more than once.

“Delayed Funding Security” means a Collateral Debt Security that is a loan pursuant to which one or more future advances will be required to be made to the Obligor thereunder but which, once all such advances have been made, such advances may not be reborrowed once repaid by the Obligor; provided that such loan shall only be considered to be a Delayed Funding Security for so long as any future funding obligations remain in effect.

“Determination Date” means the last day of any Due Period.

“Diversity Score” is a single number calculated for each Measurement Date with respect to the Performing Collateral Debt Securities that indicates, as of such Measurement Date, collateral concentration in terms of both issuer and industry concentration. The Diversity Score is calculated pursuant to the formula set out in Schedule F attached hereto (as modified and supplemented from time to time) rounded to the nearest decimal.

“Downgraded Security” means a Collateral Debt Security for which the Xxxxx’x Rating has been downgraded since the time of purchase by the Issuer but only for so long as such Collateral Debt Security is downgraded.

“Due Period” means, with respect to any Payment Date, the period commencing on the date immediately following the tenth Business Day prior to the preceding Payment Date (without giving effect to any Business Day adjustment thereto) (or on the Closing Date, in the case of the Due Period relating to the first Payment Date) and ending on the tenth Business Day prior to such Payment Date (without giving effect to any Business Day adjustment thereto) or, in the case of the Due Period that is applicable to the Payment Date relating to the Maturity Date, such Due Period shall end on the day preceding the Maturity Date.

“Eligible Collateralized Debt Obligation Fund” means any ABS CBO Security, High-Diversity CBO Security, High Yield CBO Security, High Yield CLO Security, Low-Diversity CBO Security, Real Estate CBO Security or Synthetic CBO Security, each as defined in Schedule E.

“Eligibility Criteria” has the meaning set forth in Section 7.2.

10

“Eligible Institution” means IXIS FP, any affiliate of IXIS FP, MMP-5, any Conduit Support Provider or any other institution that, in each case, is both (a) a commercial bank or an institution that is an institutional “accredited investor” as defined in Rule 501(a)(1), (2), (3) or (7) under the Securities Act or a qualified institutional buyer as defined in Rule 144A under the Securities Act and (b) a Qualified Purchaser.

“Eligible Investments” means any United States dollar denominated investment that, at the time it is delivered to the Investor Agent (directly or through a financial intermediary or bailee), is one or more of the following obligations or securities (which may include Eligible Investments issued by the Trustee):

(a) direct Registered obligations of, and Registered obligations the timely payment of principal and interest on which is fully and expressly guaranteed by, the United States or any agency or instrumentality of the United States the obligations of which are expressly backed by the full faith and credit of the United States;

(b) demand and time deposits in, certificates of deposit of, trust accounts with, bankers’ acceptances issued by, or federal funds sold by any depositary institution or trust company incorporated under the laws of the United States or any State thereof and subject to supervision and examination by federal and/or State banking authorities so long as the commercial paper and/or the debt obligations of such depositary institution or trust company (or, in the case of the principal depositary institution in a holding company system, the commercial paper or debt obligations of such holding company) at the time of such investment or contractual commitment providing for such investment have a credit rating of not less than “Aa2” by Moody’s and “AA” by Standard & Poor’s, in the case of long-term debt obligations, or “P-1” by Moody’s and “A-1+” by Standard & Poor’s, in the case of commercial paper and short-term debt obligations; provided that in the case of commercial paper and short-term debt obligations with a maturity of longer than 91 days, the issuer thereof must also have at the time of such investment a long-term credit rating of not less than “Aa2” by Moody’s and “AA” by Standard & Poor’s;

(c) unleveraged repurchase obligations with respect to (i) any security described in clause (a) above or (ii) any other security issued or guaranteed by an agency or instrumentality of the United States, in either case entered into with a depositary institution or trust company (acting as principal) described in clause (b) above or entered into with a corporation (acting as principal) whose long-term rating is not less than “Aa2” by Moody’s and “AA” by Standard & Poor’s or whose short-term credit rating is “P-1” by Moody’s and “A-1+” by Standard & Poor’s at the time of such investment or contractual commitment providing for such investment; provided that if such repurchase obligation has a maturity of longer than 91 days, the issuer thereof must also have at the time of such investment or contractual commitment providing for such investment a long-term credit rating of not less than “Aa2” by Moody’s and “AA” by Standard & Poor’s;

(d) Registered securities bearing interest or sold at a discount issued by any corporation incorporated under the laws of the United States or any State thereof that has a credit rating of not less than “Aa2” by Moody’s and “AA” by Standard & Poor’s at the time of such investment or contractual commitment providing for such investment;

(e) commercial paper or other short-term obligations having at the time of such investment or contractual commitment providing for such investment a credit rating of “P-1” by Moody’s and “A-1+” by Standard & Poor’s and that are Registered and either are interest

11

bearing or are sold at a discount from the face amount thereof and have a maturity of not more than 183 days from their date of issuance; provided that if such security has a maturity of longer than 91 days, the issuer thereof must also have at the time of such investment or contractual commitment providing for such investment a long-term credit rating of not less than “Aa2” by Moody’s and “AA” by Standard & Poor’s;

(f) a Reinvestment Agreement issued by any bank (if treated as a deposit by such bank), or a Registered Reinvestment Agreement issued by any insurance company or other corporation or entity, in each case that has a credit rating at the time of investment or contractual commitment providing for such investment of “P-1” by Moody’s and “A-1+” by Standard & Poor’s; provided that if such security has a maturity of longer than 91 days, the issuer thereof must also have at the time of such investment or contractual commitment providing for such investment a long-term credit rating of not less than “Aa2” by Moody’s and “AA” by Standard & Poor’s;

(g) offshore money market funds with a credit rating at the time of investment or contractual commitment providing for such investment of not less than “Aaa” by Moody’s and “AAAm” or “AAAm-G” by Standard & Poor’s;

(h) investments in taxable money market funds or other regulated investment companies with a credit rating at the time of investment or contractual commitment providing for such investment of not less than “Aaa” or “P-1” by Moody’s and “AAAm” or “AAAm-G” by Standard and Poor’s; and

(i) any other investment similar to those described in clauses (a) through (g) above which (i) has, in the case of an investment with a maturity of longer than 91 days, a long-term credit rating at the time of investment or contractual commitment providing for such investment of not less than “Aa2” by Moody’s and “AA” by Standard & Poor’s or, in the case an investment with a maturity of 91 days or less, a credit rating at the time of investment or contractual commitment providing for such investment of “P-1” by Moody’s and “A-1+” by Standard & Poor’s and (ii) has been approved by each Investor;

and, in the case of clauses (a) through (f) and (i) above, with a stated maturity (after giving effect to any applicable grace period) no later than the Business Day immediately preceding the Payment Date next following the Due Period in which the date of investment occurs;

provided that Eligible Investments shall not include (1) any interest-only security, (2) any security purchased at a price in excess of 100% of par, (3) any security whose repayment is subject to substantial non-credit related risk, such as the occurrence of a catastrophe, as determined in the judgment of the Collateral Manager exercised in accordance with the Servicing Standard or (4) any obligation or security that has a rating by Standard & Poor’s that includes the symbol “r” or “t”.

“Engagement Letter” has the meaning set forth in the first Whereas Clause in this Agreement.

“Environmental Laws” means any and all federal, state, local and foreign statutes, laws, judicial decisions, regulations, ordinances, rules, judgments, orders, decrees, plans, injunctions, permits, concessions, grants, franchises, licenses, agreements and other governmental restrictions relating to the environment, the effect of the environment or to emissions, discharges or releases of pollutants, contaminants, Hazardous Substances or wastes into the environment including ambient air, surface water, ground water, or land, or otherwise relating to the manufacture, processing, distribution, use, treatment,

12

storage, disposal, transport or handling of pollutants, contaminants, Hazardous Substances or wastes or the clean-up or other remediation thereof.

“Equity Commitment” means the commitment of NewStar to provide a total of at least $45,000,000 in Issuer’s Equity (excluding, for the avoidance of doubt, amounts that may be contributed pursuant to Section 6.4).

“Euro-Dollar Reserve Percentage” means, for any day, the percentage (expressed as a decimal) which is in effect on such day, as prescribed by the Federal Reserve Board (or any successor) for determining the maximum reserve requirement for a member bank of the Federal Reserve System in New York City with deposits exceeding $5,000,000,000 in respect of “Eurocurrency liabilities” (or in respect of any other category of liabilities which includes deposits by reference to which the interest rate on Advances or Swingline Advances is determined or any category of extensions of credit or other assets which includes loans by a non-United States office of any United States commercial bank to United States residents). The Adjusted London Interbank Offered Rate shall be adjusted automatically on and as of the effective date of any change in the Euro-Dollar Reserve Percentage.

“Event of Default” has the meaning set forth in Section 6.1.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

“Federal Funds Rate” means, for any day, the rate per annum (rounded upward, if necessary, to the nearest 1/100th of 1%) equal to the weighted average of the rates on overnight federal funds transactions with members of the Federal Reserve System arranged by federal funds brokers on such day, as published by the FRBNY on the Business Day next succeeding such day, provided that (a) if such day is not a Business Day, the Federal Funds Rate for such day shall be such rate on such transactions on the next preceding Business Day as so published on the next succeeding Business Day, and (b) if no such rate is so published on such next succeeding Business Day, the Federal Funds Rate for such day shall be the average (rounded upwards, if necessary, to the next 1/100 of 1%) of the quotations for such day of such transactions received by the Investor Agent from three federal funds brokers of recognized standing selected by it.

“Federal Reserve Board” means the Board of Governors of the Federal Reserve System as constituted from time to time.

“Financing Documents” means this Agreement, the Notes, the Security Agreement, the Account Control Agreement and the Collateral Management Agreement.

“FRBNY” means the Federal Reserve Bank of New York.

“Funded Security” has the meaning set forth in the definition of Collateral Debt Security.

“Funding” means a funding hereunder consisting of Advances made to the Issuer at the same time by the Investors or consisting of Swingline Advances made to the Issuer at the same time by the Swingline Investor, in each case pursuant to Article II.

“Funding Agent” means, with respect to each CP Conduit, the CP Conduit’s Program Manager or the bank or other financial institution acting as the agent of such CP Conduit under this Agreement.

13

“GAAP” means generally accepted accounting principles in effect from time to time in the United States.

“Guarantee” of or by any Person (the “guarantor”) means any obligation, contingent or otherwise, of the guarantor guaranteeing any Indebtedness or other obligation of any other Person (the “primary obligor”) in any manner, whether directly or indirectly, and including any obligation of the guarantor, direct or indirect, (a) to purchase or pay (or advance or supply funds for the purchase or payment of) such Indebtedness or other obligation or to purchase (or to advance or supply funds for the purchase of) any security for the payment thereof, (b) to purchase or lease property, securities or services for the purpose of assuring the owner of such Indebtedness or other obligation of the payment thereof, (c) to maintain working capital, equity capital or any other financial statement condition or liquidity of the primary obligor so as to enable the primary obligor to pay such Indebtedness or other obligation or (d) as an account party in respect of any letter of credit or letter of guaranty issued to support such Indebtedness or obligation; provided that the term Guarantee shall not include endorsements for collection or deposit in the ordinary course of business.

“Hazardous Substances” means any toxic, radioactive, caustic or otherwise hazardous substance, identified as such as a matter of Environmental Law.

“Hedge Agreement” means an ISDA Master Agreement (consisting only of interest rate swaps), dated as of the Closing Date, between the Issuer and the relevant Hedge Counterparty, at the direction of the Collateral Manager and, from and after the end of the Reinvestment Period, at the direction of the Investor Agent or the Collateral Manager, for the sole purpose of hedging interest rate risk between the portfolio of Collateral Debt Securities and the Advances, as amended from time to time, and any additional or replacement hedge agreement(s) entered into and ratifying the foregoing (provided that such agreement does not require the Issuer to make any scheduled payment thereunder after the date such agreement was entered into).

“Hedge Counterparty” means a counterparty having, on the date on which it enters into a Hedge Agreement, a (a) long-term senior unsecured debt rating or credit rating of at least “A1” by Moody’s and a short-term credit rating of “P-1” by Moody’s and (b) short-term senior unsecured debt rating or issuer rating of at least “A-1” by Standard & Poor’s or, if such Hedge Counterparty does not have a short-term unsecured debt rating by Standard & Poor’s, a long-term senior secured debt rating or credit rating of at least “A+” by Standard & Poor’s.

“Increased Costs” means any amounts due pursuant to Section 2.12 or Article VIII.

“Indebtedness” of any Person means, without duplication, (a) all obligations of such Person for borrowed money or with respect to deposits or advances of any kind, (b) all obligations of such Person evidenced by bonds, debentures, notes or similar instruments, (c) all obligations of such Person upon which interest charges are customarily paid, (d) all obligations of such Person under conditional sale or other title retention agreements relating to property acquired by such Person, (e) all obligations of such Person in respect of the deferred purchase price of property or services (excluding current accounts payable incurred in the ordinary course of business), (f) all Indebtedness of others secured by (or for which the holder of such Indebtedness has an existing right, contingent or otherwise, to be secured by) any Lien on property owned or acquired by such Person, whether or not the Indebtedness secured thereby has been assumed, (g) all Guarantees by such Person of Indebtedness of others, (h) all obligations, contingent or otherwise, of such Person as an account party in respect of letters of credit and letters of guaranty, (i) all obligations, contingent or otherwise, of such Person in respect of bankers’ acceptances and (j) all payment obligations of such Person under any interest rate protection agreement (including any interest rate swaps, caps, floors, collars and similar agreements) and currency swaps and similar

14

agreements which were not entered into specifically in connection with Indebtedness set forth in clauses (a) through (i) hereof. The Indebtedness of any Person shall include the Indebtedness of any other entity (including any partnership in which such Person is a general partner) to the extent such Person is liable therefor as a result of such Person’s ownership interest in or other relationship with such entity, except to the extent the terms of such Indebtedness provide that such Person is not liable therefor.

“Indemnitee” has the meaning set forth in Section 10.3(b).

“Initial Investor” means MMP-5.

“Initial Exempt Portfolio” means the Collateral Debt Securities listed on Schedule H hereto.

“Insolvency Proceeding” means, with respect to any Person, such Person (a) shall institute or have instituted against it a proceeding seeking a judgment of insolvency or bankruptcy or any other relief under any bankruptcy or insolvency law or other similar law affecting creditors’ rights, or a petition is presented for its winding-up or liquidation, and, in the case of any such proceeding or petition instituted or presented against it, such proceeding or petition (i) results in a judgment of insolvency or bankruptcy or the entry of an order for relief or the making of an order for its winding-up or liquidation or (ii) if not initiated by such Person, is not dismissed, discharged, stayed or restrained in each case within 30 days of the institution or presentation thereof; or (b) shall seek or become subject to the appointment of an administrator, provisional liquidator, conservator, receiver, trustee, custodian or other similar official for it or for all or substantially all its property.

“Intercreditor Agreement” means the Amended and Restated Intercreditor and Concentration Account Administration Agreement dated as of November 30, 2005, among U.S. Bank National Association, as the concentration account bank and as the account custodian, Wachovia Capital Markets, LLC, as the administrative agent under the conduit documents, NewStar as the originator, as the original servicer, as the collateral manager and as the concentration account servicer, and the other parties thereto including each of the parties that from time to time executes a joinder thereto including the Joinder in Amended and Restated Intercreditor and Concentration Account Administration Agreement executed by the Issuer and the Trustee.

“Interest Coverage Ratio” means, as of any Measurement Date, the ratio (expressed as a percentage) obtained by dividing: (a) (i) the sum, without duplication, of (A) the scheduled interest payments and commitment, facility and other similar fees due in the Due Period in which such Measurement Date occurs (in each case, regardless of whether the applicable payment date has yet occurred) (excluding the amount of interest and commitment, facility and other similar fees accrued on Collateral Debt Securities to the date of purchase thereof by the Issuer (except to the extent such accrued interest and commitment, facility and other similar fees were purchased by the Issuer with Interest Proceeds)) on the Collateral Debt Securities including Collateral Debt Securities to be purchased on such Measurement Date (other than, in each case, NIM Securities (except to the extent such payments and fees on such NIM Securities qualify as interest pursuant to the definition of Principal Proceeds), IO Securities (except to the extent such payments and fees on such IO Securities qualify as interest pursuant to the definition of Principal Proceeds) and Defaulted Securities (except to the extent such payments and fees on such Defaulted Securities qualify as interest pursuant to the definition of Principal Proceeds); (B) amounts on deposit in the Collateral Account, including Eligible Investments, representing Interest Proceeds; (C) scheduled interest payments due in the Due Period in which such Measurement Date occurs on Eligible Investments held in the Collateral Account; (D) any periodic amounts received by the Issuer pursuant to Synthetic Securities in the Due Period in which such Measurement Date occurs and (E) any amounts received by the Issuer pursuant to Hedge Agreements in the Due Period in which such

15

Measurement Date occurs minus (ii) the sum, without duplication, of (A) any payments due by the Issuer pursuant to Synthetic Securities in the Due Period in which such Measurement Date occurs and (B) any payments due by the Issuer pursuant to Hedge Agreements in the Due Period in which such Measurement Date occurs; by (b) the sum for such Interest Period of all Interest Expense payable on the related Payment Date.

“Interest Coverage Ratio Test” means a test satisfied on any Measurement Date if the Interest Coverage Ratio is greater than or equal to 120%.

“Interest Expense” means, for any Payment Date, collectively, the sum of (a) all interest due on the Notes, (b) all commitment fees payable by the Issuer on such Payment Date, (c) all other amounts payable by the Issuer on such Payment Date that, in accordance with the provisions of this Agreement and the other Financing Documents, are to be paid prior to, or on a pari passu basis with, interest payments due on the Notes, and (d) Increased Costs payable by the Issuer on such Payment Date.

“Interest Period” means, with respect to each Funding, the period from (and including) the date of such Funding to but excluding the Payment Date following the end of the Due Period in which such Funding is made, and each successive period from and including each Payment Date to but excluding the following Payment Date until the principal of such Funding is repaid.

“Interest Proceeds” means, with respect to any Due Period, the sum (without duplication) of:

(1) all payments of interest on each Collateral Debt Security during such Due Period (excluding (a) interest accrued prior to the date of purchase of such Collateral Debt Security and (b) interest in respect of Defaulted Securities included in Principal Proceeds pursuant to clause (7) of the definition thereof);

(2) all accrued interest received in Cash by the Issuer during such Due Period with respect to each Collateral Debt Security sold by the Issuer (excluding proceeds from the sale of Collateral Debt Securities representing interest received in respect of a Defaulted Security, which, when combined with proceeds representing principal received in respect of such Defaulted Security, equals the outstanding principal amount thereof);

(3) all payments of interest (including any amount representing the accreted portion of a discount from the face amount of an Eligible Investment) on Eligible Investments in the Collateral Account received in Cash by the Issuer during such Due Period and all payments of principal, including repayments, on Eligible Investments purchased with Interest Proceeds received by the Issuer during such Due Period;

(4) all amendment and waiver fees, all late payment fees, all commitment fees and all other fees and commissions received in Cash by the Issuer during such Due Period in connection with such Collateral Debt Securities and Eligible Investments (other than such fees and commissions received in respect of Defaulted Securities and yield maintenance payments included in Principal Proceeds pursuant to clause (8) of the definition thereof);

(5) all payments received pursuant to the Hedge Agreement (excluding any payment that becomes payable under the Hedge Agreement by the Hedge Counterparty upon a default under, or other early termination of, the Hedge Agreement (or the reduction in the notional amount thereof));

16

(6) all periodic payments received by the Issuer pursuant to Synthetic Securities (excluding any payment that becomes payable under any Synthetic Security upon a default under, or other early termination of, the Synthetic Security (or the reduction in the notional amount thereof)); and

(7) all payments made in respect of any NIM Security or IO Security which are considered interest according to the proviso in clause (11) of the definition of Principal Proceeds;

provided that Interest Proceeds shall in no event include any payment or proceeds specifically defined as “Principal Proceeds” in the definition thereof or any payment of proceeds of any Retained Security.

“Interim Rating” means the temporary Xxxxx’x rating assigned to each Collateral Debt Security where a private letter rating has been requested pursuant to clause (II)(g) of the definition of Xxxxx’x Rating. The Interim Rating for a single Collateral Debt Security will be determined by the following procedures:

(a) If the rating estimate determined by NewStar is in the “Baa” category, then the Interim Rating will equal the rating estimate determined by NewStar reduced by three rating subcategories.

(b) If the rating estimate determined by NewStar is in the “Ba” category, then the Interim Rating will equal the rating estimate determined by NewStar reduced by two rating subcategories.

(c) If the rating estimate determined by NewStar is in the “B” category, then the Interim Rating will equal the rating estimate determined by NewStar reduced by one rating subcategory.

(d) If at any point in time there are multiple Collateral Debt Securities subject to clause (II)(g) of the definition of Xxxxx’x Rating, in ascending order of such Collateral Debt Securities’ Principal Balances, the first Collateral Debt Security will be assigned a rating according to the procedure set forth in clauses (a) – (c) above. The next Collateral Debt Security will be assigned a rating according to the procedure set forth in clauses (a) – (c) above, plus one rating subcategory. The third Collateral Debt Security will be assigned a rating according to the procedure set forth in clauses (a) – (c) above, plus two rating subcategories, and so on for all Collateral Debt Securities subject to clause (II)(g) of the definition of Xxxxx’x Rating; provided the aggregate Principal Balance of Collateral Debt Securities subject to the foregoing procedures may not exceed 10% of the Maximum Investment Amount and any Principal Balance of Collateral Debt Securities otherwise subject to clause (II)(g) of the definition of Xxxxx’x Rating in excess thereof shall have an Interim Rating of Caa3; provided further the Interim Rating for any Performing Collateral Debt Security may not be below “Caa3”.

Notwithstanding the foregoing, the Interim Rating for each item of the Initial Exempt Portfolio shall be as set forth in Schedule H unless and until the Issuer shall have advised the Investor Agent that the Interim Rating for such item shall be determined as otherwise provided in this definition.

“Investment Company Act” means the Investment Company Act of 1940, as amended.

17

“Investor” means the Initial Investor and each assignee which becomes an Investor pursuant to Section 10.6, and their respective successors. For purposes of Article VIII and Sections 10.3, 10.5 and 10.13, the term “Investor”, insofar as it includes the Initial Investor or any other CP Conduit, shall also include all Conduit Support Providers and, with respect to MMP-5 only, Fenway Capital, LLC and Fenway Funding, LLC.

“Investor Agent” has the meaning set forth in the introductory paragraph to this Agreement.

“IO Security” means any Collateral Debt Security that depends upon an interest strip from an underlying structured finance investment for payment of its obligations.

“Issue” of Collateral Debt Securities means Collateral Debt Securities issued by the same issuer, having the same terms and conditions (as to, among other things, coupon, maturity, security and subordination) and otherwise being fungible with one another.

“Issuer” has the meaning set forth in the introductory paragraph to this Agreement.

“Issuer Parties” means, collectively, the Issuer and the Collateral Manager.

“Issuer’s Equity” means the aggregate equity in the Issuer certified (as to the Issuer’s Equity as of the Closing Date) to the Investor Agent pursuant to Section 3.1(k).

“IXIS CM” has the meaning set forth in the first Whereas Clause in this Agreement.

“IXIS FP” has the meaning set forth in the introductory paragraph to this Agreement.

“LIBO Rate” means, with respect to a floating rate Collateral Debt Security, the rate of interest applicable to such Collateral Debt Security determined on the basis of the rate at which deposits in dollars are offered to prime banks in the London interbank market.

“LIBOR Business Day” means a day on which commercial banks and foreign exchange markets settle payments and are open for general business (including dealings in foreign exchange and foreign currency deposits) in London.

“LIBOR Determination Date” means, with respect to any Interest Period, the date two LIBOR Business Days before the first day of such Interest Period.

“Lien” means, with respect to any asset, (a) any mortgage, deed of trust, lien, pledge, hypothecation, encumbrance, charge or security interest in, on or of such asset, (b) the interest of a vendor or a lessor under any conditional sale agreement, capital lease or title retention agreement (or any financing lease having substantially the same economic effect as any of the foregoing) relating to such asset and (c) in the case of securities, any purchase option, call or similar right of a third party with respect to such securities.

“Limited Recourse Event” has the meaning specified in Section 6.4.

“Limited Recourse Provider” has the meaning set forth in the introductory paragraph to this Agreement.

18

“Liquidity Facility” means, with respect to any Advance or Swingline Advance, a liquidity loan agreement or other facility that provides, among other things, liquidity and/or credit support for Commercial Paper Notes and any guaranty of any such agreement or facility (it being understood that the TRS shall constitute a Liquidity Facility and shall be the Liquidity Facility with respect to MMP-5).

“Liquidity Funding” means, with respect to any Advance or Swingline Advance, at any time, funding by an Investor or the Swingline Investor of all or a portion of the outstanding principal amount of such Advance or Swingline Advance, as the case may be, with funds provided under a Liquidity Facility.

“Liquidity Funding Period” means, with respect to any Advance or Swingline Advance, a period of time during which all or a portion of the outstanding principal amount of such Advance or Swingline Advance, as the case may be, is funded through a Liquidity Funding.

“Liquidity Funding Rate” means with respect to any Liquidity Funding under a Liquidity Facility, a rate per annum equal to the sum of (a) the Adjusted London Interbank Offered Rate (calculated as if such Liquidity Funding were a Funding hereunder) and (b) the Applicable Margin.

“London Interbank Offered Rate” or “LIBOR” means, with respect to any Interest Period, the rate (expressed as a percentage per annum rounded upwards, if necessary, to the nearest one sixteenth (1/16) of one percent (1%)) for deposits in U.S. dollars for a period comparable to such Interest Period that appears on Telerate Page 3750 (or such page as may replace Telerate Page 3750) as of 11:00 a.m., London time, on the LIBOR Determination Date for such Interest Period. If such rate does not appear on Telerate Page 3750 (or such page as may replace Telerate Page 3750) as of 11:00 a.m., London time, on the LIBOR Determination Date for such Interest Period, the London Interbank Offered Rate will be the arithmetic mean of the offered rates (expressed as a percentage per annum rounded upwards, if necessary, to the nearest one sixteenth (1/16) of one percent (1%)) for deposits in U.S. dollars for a period comparable to such Interest Period that appear on the Reuters Screen LIBO Page as of 11:00 a.m., London time, on the LIBOR Determination Date for such Interest Period, if at least two such offered rates so appear. If fewer than two such offered rates appear on the Reuters Screen LIBO Page as of 11:00 a.m., London time, on any such date, the Investor Agent will request the principal London office of any four major reference banks in the London interbank market selected by the Investor Agent to provide such bank’s offered quotation (expressed as a percentage per annum rounded upwards, if necessary, to the nearest one sixteenth (1/16) of one percent (1%)) to prime banks in the London interbank market for deposits in U.S. dollars for a period comparable to such Interest Period as of 11:00 a.m., London time, on such date for amounts comparable to the then outstanding principal amount of the applicable Advance (if available). If at least two such offered quotations are so provided, LIBOR will be the arithmetic mean of such quotations. If fewer than two such quotations are so provided, the Investor Agent will request any three major banks in New York City selected by the Investor Agent to provide such bank’s rate (expressed as a percentage per annum rounded upwards, if necessary, to the nearest one sixteenth (1/16) of one percent (1%)) for loans in U.S. dollars to leading European banks for a period comparable to such Interest Period as of approximately 11:00 a.m., New York City time, on the LIBOR Determination Date for such Interest Period for amounts comparable to the then outstanding principal amount of the applicable Advance (if available). If at least two such rates are so provided, the London Interbank Offered Rate will be the arithmetic mean of such rates. If fewer than two rates are so provided, then the London Interbank Offered Rate will be the rate provided. If no such rate is provided, the London Interbank Offered Rate for such Interest Period will be the London Interbank Offered Rate in effect for the prior Interest Period. In respect of any Interest Period for which deposits of the comparable period do not appear on the relevant electronic screen display, LIBOR shall be determined through the use of a straight-line interpolation by reference to two rates calculated in accordance with the preceding sentences, one of which rates shall be determined as if the maturity of the applicable deposits referred to therein were the period of time for

19

which rates are available next shorter than the Interest Period and the other of which rates shall be determined as if the maturity of the applicable deposits referred to therein were the period of time for which rates are available next longer than the Interest Period.

“Margin Stock” shall have the meaning provided such term in Regulation U of the Board of Governors of the Federal Reserve Board.

“Market Value” means, with respect to any Collateral Debt Security, (x) during the Reinvestment Period, the fair value estimate assigned to such Collateral Debt Security by the Calculation Agent and (y) from and after the Reinvestment Period, the fair value estimate assigned to such Collateral Debt Security by the Calculation Agent unless the Investor Agent determines a differing fair value estimate, in which case the fair value estimate determined by the Investor Agent will be applied.

“Material Adverse Effect” means any event or circumstance that has, or could reasonably be expected to have, a material adverse effect on (a) the ability of any Issuer Party to perform its obligations under any Financing Document to which it is a party or the rights, interests or remedies of the Investor Agent, the Swingline Investor or the Investors thereunder or (b) the business or financial condition or operations of the Issuer, each as determined in good faith and on a commercially reasonable basis by the Required Investors.

“Maturity Date” means the earlier to occur of (a) the CDO Closing Date and (b) the fifth anniversary of the Closing Date; subject to extension pursuant to Section 2.8(a).

“Maximum Advance” means, as of any date, the lower of (x) the aggregate Commitments as of such date and (y) the product of (i) the Principal Collateralization Amount as of such date and (ii) the Advance Rate as of such date.

“Maximum Investment Amount” means, at any time, $245,000,000.

“Measurement Date” means any Determination Date, any day Collateral Debt Securities are purchased or sold by the Issuer, the date of any Funding or, with at least five Business Days’ notice to the Collateral Manager, any day pursuant to the request of the Required Investors.

“MMP-5” means MMP-5 Funding, LLC, a Delaware limited liability company.

“Monthly Collateral Report” has the meaning set forth in Section 5.1(d).

“Moody’s” means Xxxxx’x Investors Service, Inc.

“Moody’s Asset Sector” means any of the Moody’s asset sectors set forth in Schedule A hereto, and any such sector that may be subsequently established by Moody’s and provided by the Issuer to the Investors.

“Xxxxx’x Rating” means a rating that will be determined as follows:

(I) with respect to any Collateral Debt Security, if such Collateral Debt Security is publicly rated by Moody’s, the Xxxxx’x Rating shall be such rating;

20

(II) with respect to any Collateral Debt Security, if such Collateral Debt Security is not rated by Moody’s, then the Xxxxx’x Rating of such Collateral Debt Security may be determined using any one of the methods below:

(a) with respect to any Collateral Debt Security not publicly rated by Moody’s listed under Class A-1 on the Table of Moody’s Asset Classes attached hereto as Schedule D, if such Collateral Debt Security is publicly rated by Standard & Poor’s, then the Xxxxx’x Rating thereof will be:

(i) one subcategory below the Moody’s equivalent of the Standard & Poor’s Rating if the Standard & Poor’s Rating is “AAA” to “AA-”;

(ii) two rating subcategories below the Moody’s equivalent rating of the Standard & Poor’s Rating if the Standard & Poor’s Rating is “A+” to “BBB-”;

(iii) three rating subcategories below the Moody’s equivalent rating of the Standard & Poor’s Rating if the Standard & Poor’s Rating is below “BBB-”;

(b) with respect to any Collateral Debt Security not publicly rated by Moody’s listed under Class A-2 on the Table of Moody’s Asset Classes attached hereto as Schedule D, if such Collateral Debt Security is publicly rated by Standard & Poor’s, then the Xxxxx’x Rating thereof will be:

(i) one subcategory below the Moody’s equivalent of the Standard & Poor’s Rating if the Standard & Poor’s Rating is “AAA” to “AA-”;

(ii) two rating subcategories below the Moody’s equivalent of the Standard & Poor’s Rating if the Standard & Poor’s Rating is “A+” to “BBB-”;

(iii) four rating subcategories below the Moody’s equivalent of the Standard & Poor’s Rating if the Standard & Poor’s Rating is below “BBB-”;

(c) with respect to any Collateral Debt Security not publicly rated by Moody’s listed under Class B on the Table of Moody’s Asset Classes attached hereto as Schedule D, if such Collateral Debt Security is publicly rated by Standard & Poor’s, then the Xxxxx’x Rating thereof will be:

(i) two subcategories below the Moody’s equivalent of the Standard & Poor’s Rating if the Standard & Poor’s Rating is “AAA” to “AA-”;

(ii) three rating subcategories below the Moody’s equivalent of the Standard & Poor’s Rating if the Standard & Poor’s Rating is “A+” to “BBB-”;

(iii) four rating subcategories below the Moody’s equivalent of the Standard & Poor’s Rating if the Standard & Poor’s Rating is below “BBB-”;

(d) with respect to any Collateral Debt Security not publicly rated by Moody’s listed under Class D on the Table of Moody’s Asset Classes attached hereto as Schedule D, if such Collateral Debt Security is publicly rated by Standard & Poor’s, then the Xxxxx’x Rating thereof will be:

(i) one subcategory below the Moody’s equivalent of the Standard & Poor’s Rating if the Standard & Poor’s Rating is “BBB-” or greater;

21

(ii) two rating subcategories below the Moody’s equivalent of the Standard & Poor’s Rating if the Standard & Poor’s Rating is below “BBB-”;

(e) with respect to any Collateral Debt Security not publicly rated by Moody’s listed under Class E on the Table of Moody’s Asset Classes attached hereto as Schedule D, if such Collateral Debt Security is publicly rated by Standard & Poor’s, then the Xxxxx’x Rating thereof will be: