Contract

Exhibit 10.1

THIS SHARE PURCHASE AGREEMENT (THE "AGREEMENT") RELATES INTER ALIA TO THE TRANSFER OF SECURITIES IN AN OFFSHORE TRANSACTION TO PERSONS WHO ARE NOT U.S. PERSONS (AS DEFINED HEREIN) PURSUANT TO REGULATION S ("REGULATION S") UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "1933 ACT").

NONE OF THE SECURITIES TO WHICH THIS AGREEMENT RELATES HAVE BEEN REGISTERED UNDER THE 1933 ACT, OR ANY U.S. STATE SECURITIES LAWS, AND, UNLESS SO REGISTERED, NONE MAY BE OFFERED OR SOLD, DIRECTLY OR INDIRECTLY, IN THE UNITED STATES OR TO U.S. PERSONS (AS DEFINED HEREIN) EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S UNDER THE 1933 ACT, PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE 1933 ACT, OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE 1933 ACT AND IN EACH CASE ONLY IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS.

THIS AGREEMENT made effective as of the 20th day of March, 2009,

AMONG:

CROWN OIL AND GAS INC., a corporation organized under the laws of the State of Nevada, having an office at 000-000 Xxxx Xxxxxxxx Xxxxxx, Xxxxxxxxxx, Xxxxxxxxxx, XXX 00000

("Crown USA")

AND:

XXXXXXXX WORLDWIDE CORP., a corporation organized under the laws of the British Virgin Islands, having an office at Trident Xxxxxxxx, P.O. Box 146, Road Town, Tortola, British Virgin Islands

("Xxxxxxxx")

AND:

BOSHOFF HOLDINGS LTD., a corporation organized under the laws of the British Virgin Islands, having an office at Trident Xxxxxxxx, P.O. Box 146, Road Town, Tortola, British Virgin Islands

(the "Vendor")

WHEREAS:

X. Xxxxxxxx’x indirect, wholly-owned, Russian subsidiaries hold oil and natural gas exploration and development licences for properties located in the Saratov region of the Volga-Urals oil province in Russia;

B. The Vendor is the sole registered shareholder of Xxxxxxxx;

C. Pursuant to the agreement set out in a letter of intent dated January 17, 2008, as amended by a further letter of intent dated March 18, 2008, the Vendor desires to sell, and Crown USA desires to purchase, all of the issued and outstanding shares of Xxxxxxxx on the terms and subject to the conditions hereinafter set out; and

D. At the completion of the said share purchase, Xxxxxxxx will be a wholly-owned subsidiary of Crown USA.

NOW THEREFORE THIS AGREEMENT WITNESSES that in consideration of the mutual covenants and agreements herein contained and other good and valuable consideration (the receipt and sufficiency of which is hereby acknowledged by each of the parties hereto), the parties hereto covenant and agree as follows:

ARTICLE 1

INTERPRETATION

1.1 Definitions. For the purpose of this Agreement, the recitals and the Schedules to this Agreement, unless the context otherwise requires, the following terms shall have the respective meanings set out below and grammatical variations of such terms shall have corresponding meanings:

(a) "Affiliate" has the meaning ascribed thereto in Regulation C under the Securities Act;

(b) "Agreement" means this Agreement, and all the exhibits, schedules and other documents attached to this Agreement, and all amendments and supplements, if any, to this Agreement;

(c) "Annual Financial Statements" means the annual audited consolidated financial statements of Xxxxxxxx for the fiscal year ended December 31, 2007, including the notes thereto and the report of the auditors thereon, as applicable; or the annual audited consolidated financial statements of Crown USA for the fiscal year ended December 31, 2007, including the notes thereto and the report of the auditors thereon, as applicable;

(d) "Applicable Securities Legislation" means all applicable securities legislation in all jurisdictions relevant to the issuance of the Crown USA Shares to the Vendor;

(e) "Artstroy" means Artstroy-XXI LLC, a limited liability company organized under the laws of the Russian Federation (Main State Registration Number (OGRN): 1026402193400), having an office at 410017 Saratov, Russia;

(f) "Associate" has the meaning ascribed thereto in Regulation C under the Securities Act;

(g) "Attik" means Attik LLC, a limited liability company organized under the laws of the Russian Federation (Main State Registration Number (OGRN): 1056405024081), having an office at 410017 Saratov, Russia;

(h) "Attik-Neft" means Attik-Neft LLC, a limited liability company organized under the laws of the Russian Federation (Main State Registration Number (OGRN): 1056405039954), having an office at 410017 Saratov, Russia;

(i) "Bandberg" means Bandberg Holdings Ltd., a company organized under the laws of Cyprus, having an office at Theklas Lysioti, 29 Xxxxxxxxx Centre, 2nd Floor, Xxxx/Xxxxxx 000, 000, X.X. 0000, Xxxxxxxx, Xxxxxx;

(j) "Business" means the business and operations currently and heretofore carried on by the Subsidiaries consisting of the exploration and development of oil and gas resources primarily in the Russian Federation;

(k) "Business Day" means any day except Saturday, Sunday and any day which is a federal legal holiday or a day on which banking institutions in the State of Nevada are authorized or required by law or other government action to close;

(l) "Closing" means the completion of the Transaction in accordance with Article 9 hereof, at which time the Closing Documents will be exchanged by the parties, except for those documents or other items specifically required to be exchanged at a later time;

(m) "Closing Date" means March 31, 2009, or such other date as may be mutually agreed upon by Crown USA and Xxxxxxxx;

(n) "Closing Documents" means the papers, instruments and documents required to be executed and delivered at the Closing pursuant to this Agreement;

(o) "Code" means the Internal Revenue Code of 1986 (United States);

(p) "Contract" means any agreement, indenture, contract, lease, deed of trust, licence, option, instrument or other commitment, whether written or oral;

(q) "Covenlina" means Covenlina Holdings Ltd., a corporation organized under the laws of Cyprus, having an office at Theklas Lysioti, 29 Xxxxxxxxx Centre, 2nd Floor, Xxxx/Xxxxxx 000, 000, X.X. 0000, Xxxxxxxx, Xxxxxx;

(r) "Crown Russia" means Crown Oil & Gas LLC, a corporation organized under the laws of the Russian Federation, having an office at 125493, Flotskaya 5, Building A, Moscow, Russia, which corporation is the legal and beneficial holder of all of the issued and outstanding shares in the capital of each of Attik and Artstroy;

(s) "Crown USA" means Crown Oil and Gas Inc., a corporation organized under the laws of the State of Nevada, whose common shares are traded on the OTC Bulletin Board and which is an Exchange Act filer;

(t) "Crown USA Shares" means those 5,000,000 fully paid and non-assessable common shares of Crown USA to be issued to the Vendor in exchange for the Xxxxxxxx Shares on the Closing Date;

(u) "Encumbrance" means any encumbrance of any kind whatsoever and includes, without limitation, a lien, charge, hypothec, pledge, assignment, mortgage, title retention agreement, security interest of any nature, trust or deemed trust, adverse claim, exception, reservation, easement, restrictive covenant, right of way, restriction, right of occupation, any matter capable of registration against title, option, right of pre-emption, privilege or any Contract to create any of the foregoing;

(v) "Exchange Act" means the Securities Exchange Act of 1934 (United States), as amended from time to time;

(w) "Financial Statements" means the Annual Financial Statements and the Interim Financial Statements;

(x) "GAAP" means generally accepted accounting principles in accordance with International Accounting Standards;

(y) "Intellectual Property" means all trade marks, trade names, business names, patents, inventions, know-how, copyrights, service marks, brand names, industrial designs, websites, URL addresses, email addresses and all other industrial or intellectual property owned or used by Xxxxxxxx or any of the Subsidiaries in carrying on the Business and all applications therefore and all goodwill connected therewith, including, without limitation, all licences, registered user agreements and all like rights used by or granted to either of Xxxxxxxx or any of the Subsidiaries in connection with the Business and all right to register or otherwise apply for the protection on any of the foregoing;

(z) "Interim Financial Statements" means the interim unaudited consolidated financial statements of the referenced entities for the periods subsequent to the Annual Financial Statements;

(aa) "Kikinsko-Gusikhinsky Licence" means mineral licence no. CPT00949HP (SRT00949NR) with the right to conduct detailed prospecting and to produce hydrocarbons from the "Kikinsko-Gusikhinsky Licensed Area", which licence was granted to Artstroy on May 5, 2005 by the Saratov Regional Authority for Subsoil Use of the Russian Federal Agency for Subsoil Use and which licence is valid until May 4, 2030;

(bb) "Krasnoarmeisky-2 Licence" means mineral licence no. CPT01152HP (SRT01152NR) with the right to conduct detailed prospecting and to produce hydrocarbons from the "Krasnoarmeisky-2 Licensed Area", which licence was granted to Attik-Neft on August 20, 2007 by the Saratov Regional Authority for Subsoil Use and which licence is valid until August 19, 2032;

(cc) "Xxxxxxxx" means Xxxxxxxx Worldwide Corp., a corporation organized under the laws of the British Virgin Islands, that holds all of the issues and outstanding shares in the capital of each of Bandberg and Covenlina;

(dd) "Xxxxxxxx Shares" means those 50,000 fully paid and non-assessable common shares of Xxxxxxxx held by the Vendor, being all of the issued and outstanding common shares of Xxxxxxxx;

(ee) "Letter Agreement" means the letter of intent between Crown USA and Xxxxxxxx dated March 18, 2008;

(ff) "Liabilities" includes, any direct or indirect indebtedness, guaranty, endorsement, claim, loss, damage, deficiency, cost, expense, obligation or responsibility, fixed or unfixed, known or unknown, asserted xxxxxx or inchoate, liquidated or unliquidated, secured or unsecured;

(gg) "Losses", in respect of any matter, means all claims, demands, proceedings, losses, damages, Liabilities, deficiencies, costs and expenses (including, without limitation, all legal and other professional fees and disbursements, interest, penalties and amounts paid in settlements) arising directly or indirectly as a consequence of such matter;

(hh) "Mineral Licences" means, collectively, the Tereshkinsky Licence, the Kikinsko-Gusikhinsky Licence and the Krasnoarmeisky-2 Licence;

(ii) "Permitted Encumbrances" means:

(i) liens for taxes, assessments and governmental charges due and being contested in good faith and diligently by appropriate proceedings (and for the payment of which adequate provision has been made);

(ii) liens for taxes either not due and payable or due, but for which notice of assessment has not been given; and

(iii) undetermined or inchoate liens, charges and privileges incidental to current construction or current operations and statutory liens, charges, adverse claims, security interests or encumbrances of any nature whatsoever claimed or held by any governmental authority that have not at the time been filed or registered against the title to the asset or served upon Xxxxxxxx or any of the Subsidiaries or Crown USA, as the case may be, pursuant to law or that relate to obligations not due or delinquent;

(jj) "Promissory Note" means a promissory note evidencing a debt in the amount of $300,000 together with interest computed thereon at the rate of 10% per annum, calculated monthly, payable to the Vendor within six (6) months of the Closing Date;

(kk) "Purchase Price" has the meaning ascribed thereto in Section 2.2 hereof;

(ll) "Publicly Disclosed by Crown USA" means information disclosed by Crown USA in public filings made by it with the SEC or otherwise disclosed through a publicly disseminated news release;

(mm) "Regulation S" means Regulation S under the Securities Act;

(nn) "RosEuroNeft" means RosEuroNeft LLC, a limited liability company organized under the laws of the Russian Federation (Main State Registration Number (OGRN): 1077760011064), having an office at 125493, Xxxxxxxxx 0, Xxxxxxxx X, Xxxxxx, Xxxxxx;

(oo) "Securities Act" means the Securities Act of 1933 (United States), as amended from time to time;

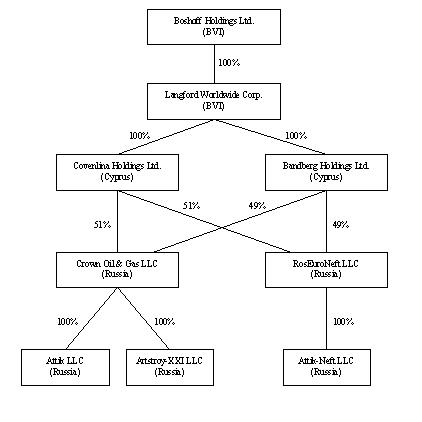

(pp) "Subsidiaries" means the direct or indirect, wholly-owned subsidiaries of Xxxxxxxx, collectively, Bandberg, Covenlina, Crown Russia, RosEuroNeft, Attik, Artrstroy and Attik-Neft, a corporate organizational chart of the Xxxxxxxx group is set out in Schedule 1.1(pp) attached hereto;

(qq) "SEC" means the United States Securities and Exchange Commission;

(rr) "Tereshkinsky Licence" means mineral licence no. CPT01000HP (SRT01000NR) with the right to conduct detailed geological prospecting and to produce hydrocarbons from the "Tereshkinsky Licensed Area", which licence was granted to Attik on September 5, 2005 by the Saratov Regional Authority for Subsoil Use and which licence is valid until September 4, 2030;

(ss) "Transaction" means the purchase of the Xxxxxxxx Shares for the Purchase Price as described in Section 2.1 of this Agreement;

(tt) "U.S. Person" has the meaning ascribed thereto in Regulation S under the Securities Act; and

(uu) "Vendor" means Boshoff Holdings Ltd., a corporation organized under the laws of the British Virgin Islands, that is the sole shareholder of Xxxxxxxx.

1.2 Schedules. The following schedules are attached to and form part of this Agreement:

| Schedule 1.1(pp) | - | Xxxxxxxx Organizational Chart |

| Schedule 2.3 | - | Certificate of Non-U.S. Shareholder |

| Schedule 3.1(o) | - | Mineral Licences |

| Schedule 3.1(q)(ii) | - | Employment Agreements |

| Schedule 3.1(q)(x) | - | Licences |

| Schedule 3.1(r) | - | Permits |

| Schedule 3.1(s) | - | Consents and Approvals |

| Schedule 3.1(aa) | - | Non-Arm’s Length Transactions |

1.3 Sections and Headings. The division of this Agreement into sections and the insertion of headings are for convenience of reference only and shall not affect the interpretation of this Agreement. Unless otherwise indicated, any reference in this Agreement to a section or a Schedule refers to the specified section of or Schedule to this Agreement.

1.4 Number, Gender and Persons. In this Agreement, words importing the singular number only shall include the plural and vice versa, words importing gender shall include all genders and words importing persons shall include individuals, corporations, partnerships, associations, trusts, unincorporated organizations, governmental bodies and other legal or business entities.

1.5 Severability. If any provision of this Agreement is determined by a court of competent jurisdiction to be invalid, illegal or unenforceable in any respect, such determination shall not impair or affect the validity, legality or enforceability of the remaining provisions hereof, and each provision is hereby declared to be separate, severable and distinct.

1.6 Successors and Assigns. This Agreement shall enure to the benefit of and shall be binding on and enforceable by the parties hereto and, where the context so permits, their respective successors and permitted assigns. No party hereto may assign any of its rights or obligations hereunder without the prior written consent of the other parties.

1.7 Amendment and Waivers. No amendment or waiver of any provision of this Agreement shall be binding on any party hereto unless consented to in writing by such party. No waiver of any provision of this Agreement shall constitute a waiver of any other provision, nor shall any waiver constitute a continuing waiver unless otherwise expressly provided.

1.8 Knowledge. The expression "to their knowledge" or "knowledge of" in relation to the representations and warranties made in Article 3 and Article 4 hereof, as applicable, means to the knowledge of the person making such representation and warranty after reasonable inquiry.

1.9 Disclosure. References to a matter being disclosed in a Schedule hereto or Publicly Disclosed by Crown USA mean that a reasonable person would become aware of the matter in question by reading the representation and warranty in question and the applicable Schedule hereto or Publicly Disclosed by Crown USA, and disclosure of any matters in a Schedule hereto or Publicly Disclosed by Crown USA against one representation and warranty shall constitute disclosure of such matters for the purposes of all the representations and warranties in this Agreement.

1.10 Currency. Unless otherwise indicated, all dollar amounts referred to in this Agreement are expressed in United States funds.

1.11 Entire Agreement. This Agreement constitutes the entire agreement between the parties hereto with respect to the subject matter hereof and supersedes all prior agreements, understandings, negotiations and discussions, whether written or oral. There are no conditions, covenants, agreements, representations, warranties or other provisions, express or implied, collateral, statutory or otherwise, relating to the subject matter hereof except as herein provided.

1.12 Time of Essence. Time shall be of the essence of this Agreement.

1.13 Applicable Law. This Agreement shall be constructed, interpreted and enforced in accordance with, and the respective rights and obligations of the parties shall be governed by, the laws of the State of Nevada and the federal laws of the United States applicable therein without giving effect to any choice or conflict of law provision or rule (whether of the State of Nevada or any other jurisdiction) that would cause the application of the laws of any jurisdiction other than the laws of the State of Nevada and the federal laws of the United States applicable therein, and each party hereby irrevocably and unconditionally submits and attorns to the exclusive jurisdiction of the courts of such province and all courts competent to hear appeals therefrom.

ARTICLE 2

PURCHASE OF SHARES

2.1 Purchase of Shares. Subject to the terms and conditions of this Agreement, the Vendor does hereby covenant and agree to sell, assign and transfer to Crown USA, and Crown USA does hereby covenant and agree to purchase from the Vendor all of the Xxxxxxxx Shares held by the Vendor.

2.2 Purchase Price: The purchase price payable by Crown USA to the Vendor for the Xxxxxxxx Shares (the "Purchase Price") will be $11,900,000 and will be paid in full by the:

(a) forgiveness of debt in the amount of $6,600,000 owed by Bandberg and Covenlina to Crown USA;

(b) the issuance of the Promissory Note to the Vendor; and

(c) allotment and issuance of the Crown USA Shares to the Vendor. The Vendor acknowledges and agrees that the Crown USA Shares are being issued pursuant to a safe harbour from the prospectus and registration requirements of the Securities Act. The Vendor agrees to abide by all applicable resale restrictions and hold periods imposed by the Applicable Securities Legislation.

2.3 Non-U.S. Persons. The certificate representing the Crown USA Shares issued on Closing to the Vendor will be endorsed with a restrictive legend substantially in the same form set out below pursuant to the provisions of the Securities Act in order to reflect the fact that the Crown USA Shares are restricted securities and will be issued to the Vendor pursuant to a safe harbor from the registration requirements of the Securities Act:

THE SECURITIES REPRESENTED HEREBY HAVE BEEN OFFERED IN AN OFFSHORE TRANSACTION TO A PERSON WHO IS NOT A U.S. PERSON (AS DEFINED HEREIN) PURSUANT TO REGULATION S UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE "1933 ACT").

NONE OF THE SECURITIES REPRESENTED HEREBY HAVE BEEN REGISTERED UNDER THE 1933 ACT, OR ANY U.S. STATE SECURITIES LAWS, AND, UNLESS SO REGISTERED, MAY NOT BE OFFERED OR SOLD, DIRECTLY OR INDIRECTLY, IN THE UNITED STATES (AS DEFINED HEREIN) OR TO U.S. PERSONS EXCEPT IN ACCORDANCE WITH THE PROVISIONS OF REGULATION S UNDER THE 1933 ACT, PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE 1933 ACT, OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE 1933 ACT AND IN EACH CASE ONLY IN ACCORDANCE WITH APPLICABLE STATE SECURITIES LAWS. IN ADDITION, HEDGING TRANSACTIONS INVOLVING THE SECURITIES MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE 1933 ACT. "UNITED STATES" AND "U.S. PERSON" ARE AS DEFINED BY REGULATION S UNDER THE 1933 ACT.

The Vendor is a non-U.S. Person and hereby agrees to complete and execute a Certificate of Non-U.S. Selling Shareholder in substantially the form set out in Schedule 2.3 attached hereto. The Vendor agrees that the representations set out in the said certificate, as executed by the Vendor will be true and correct as of the Closing Date.

2.4 Restricted Shares. The Vendor acknowledges that the Crown USA Shares issued pursuant to the terms and conditions set forth in this Agreement will have such hold periods as are required under Applicable Securities Legislation and as a result may not be sold, transferred or otherwise disposed of, except pursuant to an effective registration statement under the Securities Act, or pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in each case only in accordance with all Applicable Securities Legislation. The Vendor agrees that it has been given an opportunity to seek and obtain independent legal advice as to the resale restrictions applicable in its jurisdiction of residence, and under U.S. or other Applicable Securities Legislation generally. Crown USA has not undertaken, and will have no obligation, to register any of the Crown USA Shares under the Securities Act.

2.5 Exemptions. The Vendor acknowledges that Crown USA has advised the Vendor that Crown USA is relying on an exemption from the prospectus and registration requirements of the Applicable Securities Legislation, and, as a consequence, the Vendor will not be entitled to certain protections, rights and remedies available under Applicable Securities Legislation, including statutory rights of rescission or damages, and the Vendor will not receive information that would otherwise be required to be provided to the Vendor pursuant to Applicable Securities Legislation.

2.6 Assumption of Loans. Crown USA hereby acknowledges and agrees to assume the obligation for the repayment of the principal and interest accrued thereon in respect of certain loans made to Crown Russia on or about May 16, 2007 in the aggregate amount of $2.6 million.

ARTICLE 3

REPRESENTATIONS AND WARRANTIES OF THE

VENDOR

AND XXXXXXXX

3.1 Each of the Vendor and Xxxxxxxx represents and warrants as follows, and acknowledges that Crown USA is relying on the accuracy and completeness of each of such representations and warranties in connection with the Transaction:

(a) Organization and Good Standing. Xxxxxxxx is duly incorporated, organized, validly subsisting and in good standing under the laws of the British Virgin Islands and has the corporate power to own or lease its property, to carry on the Business as now being conducted by it, to enter into this Agreement and perform its obligations hereunder, and is duly qualified as a corporation to do business in each jurisdiction in which the nature of the Business or the property and assets owned or leased by it makes such qualification necessary. Each of the Subsidiaries is duly incorporated, organized, validly subsisting and in good standing under the laws of Cyprus or the Russian Federation, as applicable, and has the corporate power to own or lease its property, to carry on the Business as now being conducted by it and is duly qualified as a corporation to do business in each jurisdiction in which the nature of the Business or the property and assets owned or leased by it makes such qualification necessary.

(b) Authorization. Xxxxxxxx has the capacity and authority to enter into this Agreement and to perform its obligations hereunder. This Agreement has been duly authorized, executed and delivered by Xxxxxxxx and is a legal, valid and binding obligation of Xxxxxxxx, enforceable against Xxxxxxxx by Crown USA in accordance with its terms, except where such enforcement may be limited by bankruptcy, insolvency and other laws affecting the rights of creditors generally and subject to equitable remedies that may be granted in the discretion of a court of competent jurisdiction.

(c) Issued Capital:

(i) Xxxxxxxx has issued and paid up share capital of $50,000, consisting of 50,000 shares which have been duly issued and are outstanding as fully-paid and non-assessable.

(ii) Bandberg has issued and paid up share capital of $7,100 consisting of 5,000 shares, which have been duly issued and are outstanding as fully-paid and non-assessable.

(iii) Covenlina has issued and paid up share capital of $7,000, consisting of 5,000 shares, which have been duly issued and are outstanding as fully-paid and non-assessable.

(iv) As of March 12, 2009, Crown Russia has issued and paid up share capital of $1,241,900, consisting of two (2) parts, which have been duly issued and are outstanding as fully-paid and non-assessable.

(v) As of March 12, 2009, RosEuroNeft has issued and paid up share capital of $312,896, consisting of two (2) parts, which have been duly issued and are outstanding as fully-paid and non-assessable.

(vi) As of Xxxxx 00, 0000, Xxxxx has issued and paid up share capital of $762,037, consisting of one (1) part, which has been duly issued and is outstanding as fully-paid and non-assessable.

(vii) As of March 12, 2009, Attik-Neft has issued and paid up share capital of $768,872, consisting of one (1) part, which has been duly issued and is outstanding as fully-paid and non-assessable.

(viii) As of March 12, 2009, Artstroy has issued and paid up share capital of $1,239,022, consisting of one (1) part, which have been duly issued and are outstanding as fully-paid and non-assessable.

(d) Ownership of Shares.

(i) The Vendor is the sole registered owner of the Xxxxxxxx Shares, with good and marketable title thereto, free and clear of all Encumbrances, and all such shares are validly issued as fully paid and non-assessable shares and the Vendor is entitled to sell and transfer the Xxxxxxxx Shares to Crown USA. Without limiting the generality of the foregoing, none of the Xxxxxxxx Shares held by the Vendor are subject to any voting trust, shareholder agreement or voting agreement and, upon completion of the transactions contemplated by this Agreement, all such shares shall be owned by Crown USA as the sole legal and beneficial owner, with a good and marketable title thereto, free and clear of all Encumbrances.

(ii) Xxxxxxxx is the sole legal and beneficial holder of the issued and outstanding shares in the capital of Bandberg and Covenlina. Bandberg and Covenlina are the legal and beneficial holders of 49% and 51%, respectively, of the issued and outstanding shares in the capital of Crown Russia and RosEuroNeft with good and marketable title thereto free and clear of all Encumbrances, and all such shares are validly issued as fully paid and non-assessable.

(iii) Crown Russia is the legal and beneficial holder of 100% of the issued and outstanding shares in the capital of each of Attik and Artstroy, with good and marketable title thereto free and clear of all Encumbrances, and all such shares are validly issued as fully paid and non-assessable. RosEuroNeft is the legal and beneficial holder of 100% of the issued and outstanding shares in the capital of Attik-Neft, with good and marketable title thereto free and clear of all Encumbrances, and all such shares are validly issued as fully paid and non-assessable.

(e) No Other Agreements to Purchase. No person, firm or corporation other than Crown USA has any written or oral agreement, arrangement or option or any right or privilege (whether by law, pre-emptive or contractual) capable of becoming an agreement, arrangement or option for the purchase or acquisition from the Vendor of any of the Xxxxxxxx Shares, or for the purchase, acquisition or lease from any of the Subsidiaries of any material part of the property or assets of any of the Subsidiaries or the Business.

(f) Options. No person, firm or corporation has any agreement, arrangement or option or any right or privilege (whether by law, pre-emptive or contractual) capable of becoming an agreement, arrangement or option, including convertible securities, warrants or convertible obligations of any nature, for the purchase, subscription, allotment or issuance of any unissued shares or other securities of Xxxxxxxx or any of the Subsidiaries. Xxxxxxxx does not directly or indirectly have any agreement, arrangement or option or any right or privilege (whether by law, pre-emptive or contractual) capable of becoming an agreement, arrangement or option, including convertible securities, warrants or convertible obligations of any nature, for the purchase, subscription, allotment or issuance of any unissued shares or other securities of any of the Subsidiaries.

(g) Subsidiaries. Except as otherwise disclosed in this Agreement, neither Xxxxxxxx nor any of the Subsidiaries own nor have any agreement of any nature to acquire, directly or indirectly, any shares in the capital of or other equity or proprietary interests in any person, firm or corporation, and neither Xxxxxxxx nor any of the Subsidiaries has any agreement to acquire or lease any property, assets or other business operations from any person, firm or corporation.

(h) No Other Interest of Vendor. Except as described herein, the Vendor has no interest, legal or beneficial, direct or indirect, in any shares of, options to acquire shares of, or the property and assets of any of the Subsidiaries or the Business.

(i) No Other Business. Neither Xxxxxxxx nor any of the Subsidiaries carry on business, and do not have any interest in any property or assets, other than the Business.

(j) No Other Indebtedness. Neither Xxxxxxxx nor any of the Subsidiaries has indebtedness or liability, direct or indirect, absolute or contingent, matured or unmatured other than any indebtedness or liability incurred in the ordinary course of business, which indebtedness or liability shall not exceed $11,000,000.

(k) Restrictions on Doing Business. Neither Xxxxxxxx nor any of the Subsidiaries is subject to any legislation, rule or regulation or any judgment, order or requirement of any authority which is not of general application to persons carrying on business similar to the Business. There are no facts or circumstances which could have a materially adverse effect on the ability of any of the Subsidiaries to continue to operate the Business as presently conducted following the Closing Date.

(l) No Violation. The execution and delivery of this Agreement by Xxxxxxxx and the consummation of the Transaction shall not result in either:

(i) the breach or violation of any of the provisions of, or constitute a default under, or conflict with or cause the acceleration of any obligations of Xxxxxxxx or any of the Subsidiaries under:

A. any Contract to which Xxxxxxxx or any of the Subsidiaries is a party or by which any of their properties are bound

B. any provision of the constituting documents, by-laws or resolutions of the board of directors (or any committee thereof) or shareholder of Xxxxxxxx or any of the Subsidiaries;

C. any judgment, decree, order or award of any court, governmental body or arbitrators having jurisdiction over Xxxxxxxx or any of the Subsidiaries;

D. any licence, permit, approval, consent or authorization held by Xxxxxxxx or any of the Subsidiaries or necessary to the ownership of the Xxxxxxxx Shares or the property or assets of Xxxxxxxx or any of the Subsidiaries or the operation of the Business; and

E. any applicable law, statute, ordinance, regulation or rule;

(ii) the creation or imposition of any Encumbrance on any of the Xxxxxxxx Shares;

(iii) the creation or imposition of any Encumbrance on any of the property or assets of Xxxxxxxx or any of the Subsidiaries; or

(iv) any person, firm or corporation having the right or privilege (whether by law, pre-emptive or contractual) to terminate or cancel, or amend, modify or change, in any way which is adverse to Xxxxxxxx or any of the Subsidiaries, the terms or conditions of any Contract, or result in any acceleration of any right or obligation, or in the loss of any benefit, right or privilege, of Xxxxxxxx or any of the Subsidiaries under any Contract.

(m) Business of the Subsidiaries. The Business is the only business operation carried on by the Subsidiaries, and the property and assets owned or leased by the Subsidiaries are sufficient to carry on the Business. All of the property and assets owned and used by the Subsidiaries are in good operating condition and are in a state of good repair and maintenance, subject to wear and tear in the ordinary course.

(n) Title to Personal and Other Property. The property and assets of the Subsidiaries, including, without limitation, the Mineral Licences, are owned legally and beneficially by the Subsidiaries, as applicable, as the legal and beneficial owner thereof with good and marketable title thereto, free and clear of all Encumbrances, other than the Permitted Encumbrances.

(o) Description of Mineral Licenses. Schedule 3.1(o) attached hereto sets out a description of the Mineral Licences.

(p) Accounts Receivable. All accounts receivable, book debts and other debts due or accruing to Xxxxxxxx or any of the Subsidiaries are bona fide, valid and subsisting claims of Xxxxxxxx or the Subsidiaries and, subject to an allowance for doubtful accounts that has been reflected on the books of Xxxxxxxx or any of the Subsidiaries, as applicable, in accordance with GAAP, are collectible without set-off or counterclaim.

(q) Agreements and Commitments. Neither Xxxxxxxx nor any of the Subsidiaries is a party to or bound by any Contract relating to the property, assets, business or operations of Xxxxxxxx or the Subsidiaries, as applicable, including, without limiting the generality of the foregoing:

(i) any continuing Contract for the purchase of materials, supplies, equipment or services in excess of in aggregate $9,000,000 in respect of all such Contracts;

(ii) any employment or consulting Contract or any other written Contract with any officer, employee or consultant of Xxxxxxxx or any of the Subsidiaries, except as previously disclosed to Crown USA or as set out in Schedule 3.1(q)(ii) attached hereto;

(iii) medical, dental, hospitalization, or health insurance or similar plan or agreement providing benefits to any current or former. director, officer, employee or consultant of Xxxxxxxx or any of the Subsidiaries;

(iv) any trust indenture, mortgage, promissory note, loan agreement, guarantee or other Contract for the borrowing of money or a leasing transaction of the type required to be capitalized in accordance with GAAP, except as previously disclosed to Crown USA;

(v) any commitment for charitable contributions;

(vi) any Contract for capital expenditures in excess of in the aggregate $8,850,000;

(vii) any Contract for the sale of any assets of Xxxxxxxx or any of the Subsidiaries, other than sales of inventory to customers in the ordinary course of business consistent with past practice;

(viii) any Contract pursuant to which Xxxxxxxx or any of the Subsidiaries is a lessor of any machinery, equipment, motor vehicles, office furniture, fixtures or other personal property;

(ix) any confidentiality or non-disclosure Contract (whether Xxxxxxxx or any of the Subsidiaries is a beneficiary or obligor thereunder) relating to any proprietary or confidential information or any non-competition or similar Contract;

(x) any licence, franchise or other agreement that relates in whole or in part to any Intellectual Property, except as set out in Schedule 3.1(q)(x) attached hereto;

(xi) any agreement of guarantee, support, indemnification, assumption or endorsement of, or any other similar commitment with respect to, the obligations, liabilities (whether accrued, absolute, contingent or otherwise) or indebtedness of any other person (except for cheques endorsed for collection); or

(xii) any Contract entered into by Xxxxxxxx or any of the Subsidiaries other than in the ordinary course of business consistent with past practice.

Xxxxxxxx and each of the Subsidiaries has performed all of the obligations required to be performed by it and is entitled to all benefits under, and is not in default or alleged to be in default in respect of, any Contract relating to the Business to which it is a party or by which it is or its property or assets are bound; all such Contracts are in good standing and in full force and effect, and no event, condition or occurrence exists that, after notice or lapse of time or both, would constitute a default under any of the foregoing.

(r) Compliance with Laws; Governmental Authorization. Xxxxxxxx and each of the Subsidiaries have complied with all laws, statutes, ordinances, regulations, rules, judgments, decrees or orders applicable to the Business, Xxxxxxxx or each the Subsidiaries or its property or assets (the "Permits"), a description of which Permits is set out in Schedule 3.1(r) attached hereto. Each Permit is valid, subsisting and in good standing and neither Xxxxxxxx nor any of the Subsidiaries, as applicable, is in any material default or breach of any Permit and no proceeding is pending or threatened to revoke or limit any Permit.

(s) Consents and Approvals. Except as set out in Schedule 3.1(s) attached hereto, there is no requirement to make any filing with, give any notice to or obtain any licence, permit, certificate, registration, authorization, consent or approval of, any governmental or regulatory authority as a condition to the lawful consummation of the transactions contemplated by this Agreement. There is no requirement under any Contract relating to the Business or Xxxxxxxx or any of the Subsidiaries to which Xxxxxxxx or any of the Subsidiaries is a party or by which any of them is bound to give any notice to, or to obtain the consent or approval of, any party to such agreement, instrument or commitment relating to the consummation of the transactions contemplated by this Agreement.

(t) Financial Statements. The Financial Statements of Xxxxxxxx and the Subsidiaries have been prepared in accordance with GAAP, applied on a basis consistent with prior periods, are correct and complete and present fairly the assets, liabilities (whether accrued, absolute, contingent or otherwise) and financial condition of Xxxxxxxx and the Subsidiaries as at their respective dates for the respective periods covered by the Financial Statements of Xxxxxxxx and the Subsidiaries.

(u) Books and Records. The books and records of Xxxxxxxx and the Subsidiaries fairly and correctly set out and disclose in accordance with GAAP the financial position of Xxxxxxxx and the Subsidiaries as at the date of such books and records and all financial transactions of Xxxxxxxx and the Subsidiaries have been accurately recorded in such books and records.

(v) Absence of Changes. Since December 31, 2007, Xxxxxxxx and each of the Subsidiaries have carried on the Business and conducted its operations and affairs only in the ordinary and normal course consistent with past practice and there has not been:

(i) any material adverse change in the condition (financial or otherwise), assets, liabilities, operations, earnings, business or prospects of Xxxxxxxx or any of the Subsidiaries;

(ii) any damage, destruction or loss (whether or not covered by insurance) affecting the property or assets of Xxxxxxxx or any of the Subsidiaries;

(iii) any obligation or liability (whether absolute, accrued, contingent or otherwise, and whether due or to become due) incurred by Xxxxxxxx or any of the Subsidiaries, other than those incurred in the ordinary and normal course and consistent with past practice;

(iv) any payment, discharge or satisfaction of any Encumbrance, liability or obligation of Xxxxxxxx or any of the Subsidiaries (whether absolute, accrued, contingent or otherwise, and whether due or to become due), other than payment of accounts payable and tax liabilities incurred in the ordinary course of business consistent with past practice;

(v) any declaration, setting aside or payment of any dividend or other distribution with respect to any shares in the capital of Xxxxxxxx or any of the Subsidiaries or any direct or indirect redemption, purchase or other acquisition of any such shares;

(vi) any issuance or sale by Xxxxxxxx or any of the Subsidiaries, or any Contract entered into by Xxxxxxxx or any of the Subsidiaries, for the issuance or sale by Xxxxxxxx or any of the Subsidiaries of any shares in the capital of or securities convertible into or exercisable for shares in the capital of Xxxxxxxx or any of the Subsidiaries;

(vii) any licence, sale, assignment, transfer, disposition, pledge, mortgage or granting of a security interest or other Encumbrance (other than Permitted Encumbrances) on or over any property or assets of either Xxxxxxxx or any of the Subsidiaries, other than in the ordinary and normal course of business consistent with past practice;

(viii) any write-off as uncollectible of any accounts or notes receivable or any portion thereof of Xxxxxxxx or any of the Subsidiaries in amounts exceeding $25,000 in the aggregate;

(ix) any cancellation of any debts or claims or any amendment, termination or waiver of any rights of value to Xxxxxxxx or any of the Subsidiaries in amounts exceeding $10,000 in each instance or $25,000 in the aggregate;

(x) any general increase in the compensation of employees of Xxxxxxxx or any of the Subsidiaries (including, without limitation, any increase pursuant to any employee plan or commitment), or any increase in any such compensation or bonus payable to any officer, employee, consultant or agent thereof (having an annual salary or remuneration in excess of $50,000) or the execution of any employment contract with any officer or employee (having an annual salary or remuneration in excess of $50,000), or the making of any loan to, or engagement in any transaction with, any employee, officer or director of Xxxxxxxx or any of the Subsidiaries or any commitment, undertaking or promise to do any of the foregoing;

(xi) any change in the accounting or tax practices followed by Xxxxxxxx or any of the Subsidiaries;

(xii) any change adopted by Xxxxxxxx or any of the Subsidiaries in their depreciation or amortization policies or rates; or

(xiii) any change in the credit terms offered to customers of, or by suppliers to, Xxxxxxxx or any of the Subsidiaries.

(w) Taxes. Xxxxxxxx and each of the Subsidiaries have duly filed on a timely basis all tax returns required to be filed by it and each of Xxxxxxxx and the Subsidiaries has paid all taxes that are due and payable, and all assessments, governmental charges, penalties, interest and fines due and payable by it and has made adequate provision for taxes payable by it for the current period and any previous period for which tax returns are not yet required to be filed. There are no actions, suits, proceedings, investigations or claims pending or threatened against, Xxxxxxxx or any of the Subsidiaries in respect of taxes, governmental charges or assessments, nor are any matters under discussion with any governmental authority relating to taxes, governmental charges or assessments asserted by any such authority in the Russian Federation, Cyprus or the British Virgin Islands. Each of Xxxxxxxx and the Subsidiaries has withheld from each payment made to any of its past or present employees, officers or directors, and to any non-resident of Cyprus or the Russian Federation, as applicable, the amount of all taxes and other deductions required to be withheld therefrom and has paid the same to the proper tax or other receiving officers within the time required under any applicable legislation. Each of Xxxxxxxx and the Subsidiaries has remitted to the appropriate tax authority when required by law to do so all amounts collected by it.

(x) Litigation. There are no actions, suits or proceedings (whether or not purportedly on behalf of Xxxxxxxx or any of the Subsidiaries) pending or, to the knowledge of Xxxxxxxx, threatened against or affecting, either Xxxxxxxx or any of the Subsidiaries at law or in equity, or before or by any federal, state, provincial, municipal or other governmental department, court, commission, board, bureau, agency or instrumentality, domestic or foreign, or by or before an arbitrator or arbitration board. Xxxxxxxx is not aware of any ground on which any such action, suit or proceeding might be commenced with any reasonable likelihood of success.

(y) No Judgments. There are no outstanding judgments, decrees, orders, rulings or injunctions of any court or regulatory body with respect to Xxxxxxxx or any of the Subsidiaries or the Business which might have a materially adverse effect on the Business or the value of the Xxxxxxxx Shares.

(z) Dividends. Since December 31, 2007, Xxxxxxxx has not, directly or indirectly, declared or paid any dividends or declared or made any other distribution on any of its shares of any class, or securities convertible into shares of any class, and Xxxxxxxx has not, directly or indirectly, redeemed, purchased or otherwise acquired any of its outstanding shares of any class, or securities convertible into shares of any class, or agreed to do so.

(aa) Non-Arm’s Length Transactions. Except as set out in Schedule 3.1(aa) attached hereto, neither Xxxxxxxx nor any of the Subsidiaries has, since December 31, 2007, made any payment or loan to, or borrowed any moneys from or is otherwise indebted to, any officer, director, employee, shareholder or any other person not dealing at arm’s length with either Xxxxxxxx or any of the Subsidiaries (within the meaning of the Code), except for usual employee reimbursements and compensation paid in the ordinary and normal course of business consistent with past practice. Except for Contracts of employment and employee plans, neither Xxxxxxxx nor any of the Subsidiaries is a party to any Contract with any officer, director, employee, shareholder or any other person not dealing at arm’s length with Xxxxxxxx or any of the Subsidiaries (within the meaning of the Code). No officer, director, employee or shareholder of Xxxxxxxx or any of the Subsidiaries and no entity that is an Affiliate or Associate of one or more of such individuals:

(i) owns, directly or indirectly, any interest in (except for shares representing less than one per cent of the outstanding shares of any class or series of any publicly traded company), or is an officer, director, employee or consultant of, any person which is, or is engaged in business as, a competitor of the Business or of Xxxxxxxx or any of the Subsidiaries or a lessor, lessee, supplier, distributor, sales agent or customer of the Business or of Xxxxxxxx or any of the Subsidiaries;

(ii) owns, directly or indirectly, in whole or in part, any property or assets that either Xxxxxxxx or any of the Subsidiaries uses in the operation of the Business; or

(iii) has any cause of action or other claim whatsoever against, or owes any amount to, Xxxxxxxx or any of the Subsidiaries in connection with the Business, except for any liabilities reflected in the Annual Financial Statements of Xxxxxxxx and claims in the ordinary and normal course of business, such as for accrued vacation pay and accrued benefits under the employee plans.

(bb) Access to Documents. The documents forwarded by Xxxxxxxx to Crown USA in order to provide disclosure respecting the sale of the Xxxxxxxx Shares and in respect of the Business contain, or make reference to, all information which Xxxxxxxx reasonably considers to be material to the Xxxxxxxx Shares, the Business, Xxxxxxxx and the Subsidiaries, with the information current as of the date set out on such document, and Crown USA has been given access to all such documents.

(cc) Corporate Records. The corporate records and minute books of Xxxxxxxx and each of the Subsidiaries contain complete and accurate minutes of all meetings of directors and shareholders held since the date of incorporation and all such meetings were duly called and held. The share certificates, registers of shareholders, registers of transfers and registers of directors of Xxxxxxxx and the Subsidiaries are complete and accurate in all material respects.

(dd) Full Disclosure. Neither this Agreement nor any document to be delivered pursuant to this Agreement by Xxxxxxxx or the Subsidiaries nor any certificate, report, statement or other document furnished by Xxxxxxxx or the Subsidiaries in connection with the negotiation of this Agreement contains or shall contain any untrue statement of a material fact or omits or shall omit to state a material fact necessary to make the statements contained herein or therein not misleading. There has been no event, transaction, fact or information that has come to the attention of Xxxxxxxx or the Subsidiaries that has not been disclosed to Crown USA in writing that could reasonably be expected to have a material adverse effect on the assets, Business, earnings, prospects, properties or condition (financial or otherwise) of Xxxxxxxx or any of the Subsidiaries or the value of the Xxxxxxxx Shares.

ARTICLE 4

REPRESENTATIONS AND WARRANTIES OF THE VENDOR

4.1 The Vendor represents and warrants as follows, and acknowledges that Crown USA is relying on the accuracy and completeness of each of such representations and warranties in connection with the Transaction:

(a) Organization and Good Standing. The Vendor is duly incorporated, organized, validly existing and in good standing under the laws of the British Virgin Islands and has the requisite corporate power and authority to enter into this Agreement and to perform its obligations hereunder.

(b) Authorization. The Vendor has all requisite corporate power and authority to execute and deliver this Agreement and any other document contemplated by this Agreement to be signed by the Vendor and to perform its obligations hereunder and to consummate the Transaction. The execution and delivery of this Agreement and the consummation of the Transaction has been duly authorized by the Vendor’s board of directors.

(c) Binding Obligation. This Agreement is a legal, valid and binding obligation of the Vendor, enforceable against the Vendor by Crown USA in accordance with its terms, except where such enforcement may be limited by bankruptcy, insolvency and other laws affecting the rights of creditors generally and subject to equitable remedies that may be granted in the discretion of a court of competent jurisdiction.

(d) Securities Regulations. With respect to the receipt of the Crown USA Shares, the Vendor represents and warrants to Crown USA that:

(i) the Vendor is not a U.S. Person and is not acquiring the Crown USA Shares for the account or benefit of, directly or indirectly, any U.S. Person;

(ii) the Vendor is outside the United States when receiving and executing this Agreement;

(iii) the Vendor understands that the Crown USA Shares have not been registered under the Securities Act, or under any state securities or "blue sky" laws or any state or the United States, and, unless so registered, may not be offered or sold in the United States or, directly or indirectly, to U.S. Persons, except in accordance with the provisions of Regulation S, pursuant to an effective registration statement under the Securities Act, or pursuant to an exemption from, or in a transaction not subject to, the registration requirements of the Securities Act and in each case only in accordance with any applicable securities laws; and

(iv) the Vendor is acquiring the Crown USA Shares for investment only and not with a view to resale or distribution and, in particular, the Vendor has no intention to distribute either directly or indirectly any of the Crown USA Shares in the United States or to U.S. Persons, except in compliance with the registration provisions of the Securities Act or an exemption therefrom.

ARTICLE 5

REPRESENTATIONS AND WARRANTIES OF CROWN USA

5.1 Crown USA represents and warrants to the Vendor as follows, and acknowledges and confirms that the Vendor is relying upon the accuracy of each of such representations and warranties in connection with the sale by the Vendor of the Xxxxxxxx Shares and the completion of the other transactions hereunder:

(a) Organization and Good Standing. Crown USA is duly incorporated and organized and validly existing and in good standing under the laws of the State of Nevada and has the corporate power and authority to enter into this Agreement and to perform its obligations hereunder. Except as Publicly Disclosed by Crown USA, Crown USA is duly qualified as a corporation to do business in each jurisdiction in which the nature of the Business of Crown USA or the property and assets owned or leased by it makes such qualification necessary.

(b) Authorization. Crown USA has all requisite corporate power and authority to execute and deliver this Agreement and any other document contemplated by this Agreement to be signed by Crown USA (the "Crown USA Documents") and to perform its obligations hereunder and to consummate the Transaction. The execution and delivery of each of the Crown USA Documents and the consummation by Crown USA of the Transaction has been duly authorized by Crown USA’s board of directors. This Agreement is a legal, valid and binding obligation of Crown USA, enforceable against Crown USA by the Vendor in accordance with its terms, except where such enforcement may be limited by bankruptcy, insolvency and other laws affecting the rights of creditors generally and subject to equitable remedies that may be granted in the discretion of a court of competent jurisdiction.

(c) No Other Agreements to Purchase. Except as Publicly Disclosed by Crown USA, no person, firm or corporation other than the Vendor has any written or oral agreement or option or any right or privilege (whether by law, pre-emptive or contractual) capable of becoming an agreement or option for the purchase or acquisition from Crown USA of any of the shares of the common stock of Crown USA.

(d) Authorized and Issued Capital. The authorized capital of Crown USA consists of 900,000,000 shares of common stock, of which 31,422,800 shares have been duly issued and are outstanding as fully paid and non-assessable.

(e) Validity of Shares. The Crown USA Shares to be issued to the Vendor upon consummation of the Transaction in accordance with this Agreement will, upon issuance, have been duly and validly authorized and, when so issued in accordance with the terms of this Agreement, will be duly and validly issued, fully paid and non-assessable.

(f) Options. Except as Publicly Disclosed by Crown USA, no person, firm or corporation has any agreement or option or any right or privilege (whether by law, pre-emptive or contractual) capable of becoming an agreement or option, including convertible securities, warrants or convertible obligations of any nature, for the purchase, subscription, allotment or issuance of any unissued shares or other securities of Crown USA.

(g) No Violation. The execution and delivery of this Agreement by Crown USA and the consummation of the transactions herein provided for shall not result in either:

(i) the breach or violation of any of the provisions of, or constitute a default under, or conflict with or cause the acceleration of any obligation of Crown USA under:

A. any Contract to which Crown USA is a party or by which it is bound;

B. any provision of the constating documents, by-laws or resolutions of the board of directors (or any committee thereof) or shareholder of Crown USA;

C. any judgment, decree, order or award of any court, governmental body or arbitrator having jurisdiction over Crown USA;

D. any licence, permit, approval, consent or authorization held by Crown USA or necessary to the operation of the Business of Crown USA; or

E. any applicable law, statute, ordinance, regulation or rule; or

(ii) the creation or imposition of any Encumbrance on any of the share capital or any of the property or assets of Crown USA.

ARTICLE 6

ADDITIONAL COVENANTS OF THE PARTIES

6.1 Access to Records. Upon request by Crown USA, the Vendor and Xxxxxxxx shall forthwith provide access to Crown USA and its authorized representatives and, if requested by Crown USA, provide a copy to Crown USA of, all title documents, Contracts, Financial Statements, minute books, share certificates books, share registers, plans, reports, licences, orders, permits, books of account, accounting records, constituting documents and all other documents, information or data relating to the Vendor, Xxxxxxxx, the Subsidiaries and the Business.

6.2 Delivery of Books and Records. At Closing there shall be delivered to Crown USA, by the Vendor and Xxxxxxxx, all of the books and records of and relating to Xxxxxxxx, the Subsidiaries and the Business.

6.3 Conduct Prior to Closing. Without in any way limiting any other obligations of Xxxxxxxx and the Vendor hereunder, during the period from the date hereof to Closing:

(a) Conduct Business in the Ordinary Course. Xxxxxxxx shall cause the Subsidiaries to conduct, and the Subsidiaries shall conduct, the Business and the operations and affairs of the Subsidiaries only in the ordinary and normal course of business consistent with past practice, and the Subsidiaries shall not, without the prior written consent of Crown USA, enter into any transaction or refrain from doing any action that, if effected before the date of this Agreement, would constitute a breach of any representation, warranty, covenant or other obligation of Xxxxxxxx or the Subsidiaries contained herein, and provided further that Xxxxxxxx and the Subsidiaries shall not enter into any material supply arrangements relating to any of the Subsidiaries or make any material decisions or enter into any material Contracts with respect to any of the Subsidiaries without the consent of Crown USA, which consent shall not be unreasonably withheld or delayed;

(b) Discharge Liabilities. Xxxxxxxx shall cause the Subsidiaries to pay and discharge, and the Subsidiaries shall pay and discharge, the liabilities of the Subsidiaries in the ordinary course in accordance and consistent with the previous practice of the Subsidiaries, except those contested in good faith by the Subsidiaries;

(c) Corporate Action. Xxxxxxxx shall use its reasonable best efforts to take and cause the Subsidiaries to take and the Subsidiaries shall use their best efforts to take, all necessary corporate action, steps and proceedings to approve or authorize, validly and effectively, the execution and delivery of this Agreement and the other agreements and documents contemplated hereby and to complete the transfer of the Xxxxxxxx Shares to Crown USA and to cause all necessary meetings of directors and shareholders of Xxxxxxxx and the Subsidiaries to be held for such purpose; and

(d) Best Efforts. Xxxxxxxx shall use its reasonable best efforts to satisfy and cause the Subsidiaries to satisfy, and the Subsidiaries shall use their best efforts to satisfy, the conditions contained in Section 8.1 hereof which are under their control.

6.4 Conduct Prior to Closing. Without in any way limiting any other obligations of Crown USA hereunder, during the period from the date hereof to Closing:

(a) Corporate Action. Crown USA shall use its reasonable best efforts to take all necessary corporate action, steps and proceedings to approve or authorize, validly and effectively, the execution and delivery of this Agreement and the other agreements and documents contemplated hereby and to complete the issuance of the Crown USA Shares pursuant to Section 2.2 hereof to Xxxxxxxx and to cause all necessary meetings of directors and, if required, shareholders of Crown USA to be held for such purpose; and

(b) Best Efforts. Crown USA shall use its reasonable best efforts to satisfy the conditions contained in Section 8.2 hereof which are under its control.

6.5 Negative Covenants of Xxxxxxxx. Except as otherwise specifically contemplated by this Agreement or consented to in writing by Crown USA (such consent not to be unreasonably withheld), from the date of this Agreement until Closing, Xxxxxxxx shall not, and shall cause the Subsidiaries not to, permit the occurrence of any of the following events:

(a) any capital expenditures other than capital expenditures not exceeding $50,000 in the ordinary course of business consistent with past practice;

(b) the taking of any action that would, or would reasonably be expected to, render any representation or warranty made by it in this Agreement untrue or incorrect in any material respect on the Closing Date as if then made;

(c) repay any shareholder loans or indebtedness, or interest or premium thereon, to Xxxxxxxx or otherwise amend their terms;

(d) the alteration of any of the provisions of the constituting documents of Xxxxxxxx or any of the Subsidiaries;

(e) Xxxxxxxx or any of the Subsidiaries declaring or paying any dividend or making any other distribution on any of its shares of any class, or resolving to reduce its share capital in any way or repurchasing, redeeming or otherwise acquiring any of its shares;

(f) Xxxxxxxx or any of the Subsidiaries making an allotment of, or issuing or granting an option to subscribe for, any of its shares, or agreeing to make such an allotment or to issue such shares or to grant such an option or issuing or agreeing to issue convertible securities;

(g) Xxxxxxxx or any of the Subsidiaries purchasing, selling, transferring or otherwise disposing, or agreeing to purchase, sell, transfer or otherwise dispose of, any assets or property forming part of the Business other than in the ordinary course of business consistent with past practice;

(h) Xxxxxxxx or any of the Subsidiaries incurring or becoming liable for or in respect of borrowed money or becoming liable (either directly or by way of guarantee) in respect of obligations of any other person;

(i) Xxxxxxxx or any of the Subsidiaries entering into any agreement or transaction which would result in any Encumbrance, other than a Permitted Encumbrance, on any assets of the Business other than in the ordinary course of business;

(j) Xxxxxxxx or any of the Subsidiaries entering into, extending, renewing or modifying or agreeing to enter into, extend, renew or modify any agreement in respect of the Business except in the ordinary course of business;

(k) Xxxxxxxx or any of the Subsidiaries resolving that it would be wound up;

(l) the appointment of a liquidator, receiver or trustee in bankruptcy for Xxxxxxxx or any of the Subsidiaries or in relation to the assets of the Business, or the making of an order by a court for the winding-up or dissolution of Xxxxxxxx or any of the Subsidiaries;

(m) the establishment, adoption, entering into, making or amendment of any bonus, profit sharing, compensation, stock option, stock ownership, stock compensation, pension, retirement, deferred compensation, employment, termination, severance or other plan, agreement, trust fund, policy or arrangement for the benefit of any directors, officers or employees of Xxxxxxxx or any of the Subsidiaries;

(n) any other change implemented by Xxxxxxxx or any of the Subsidiaries in the business affairs of the Business which is material1y adverse, other than any change in general business conditions or any change in the markets or prices for the principal products of the Business; or

(o) the entering into or modifying of any Contract, agreement, commitment or arrangement with respect to any of the matters set out in this Section 6.5.

ARTICLE 7

SURVIVAL OF COVENANTS, REPRESENTATIONS

AND WARRANTIES

7.1 Survival of Covenants, Representations and Warranties of the Vendor and Xxxxxxxx. To the extent that they have not been fully performed at or prior to Closing, the covenants, representations and warranties of the Vendor and Xxxxxxxx contained in this Agreement and any agreement, instrument, certificate or other document executed or delivered pursuant hereto shall survive the closing of the transactions contemplated hereby until the third anniversary of the Closing Date and, notwithstanding such closing, nor any investigation made by or on behalf of Crown USA, shall continue in full force and effect for the benefit of Crown USA during such period, except that:

(a) the representations and warranties set out in subsections 3.1(a), (b) (c), (d), (e), (f), (g) and (h) hereof (and the corresponding representations and warranties set out in the certificates to be delivered pursuant to Sections 8.1(a) and 8.2(a) hereof (the "Closing Certificates")) shall survive and continue in full force and effect without limitation of time;

(b) the representations and warranties set out in Section 3.1(x) hereof (and the corresponding representations and warranties set out in the Closing Certificates) shall survive the closing of the transactions contemplated hereby and continue in full force and effect until, but not beyond, the expiration of the period, if any, during which an assessment, reassessment or other form of recognized document assessing liability for tax, interest or penalties under applicable tax legislation in respect of any taxation year to which such representations and warranties extend could be issued under such tax legislation to Xxxxxxxx or any of the Subsidiaries provided neither Xxxxxxxx nor any of the Subsidiaries filed any waiver or other document extending such period; and

(c) a claim for any breach of any of the representations and warranties contained in this Agreement or in any agreement, instrument, certificate or other document executed or delivered pursuant hereto involving fraud or fraudulent misrepresentation may be made at any time following the Closing Date, subject only to applicable limitation periods imposed by law.

7.2 Survival of the Covenants, Representations and Warranties of Crown USA. To the extent that they have not been fully performed at or prior to Closing, the covenants, representations and warranties of Crown USA contained in this Agreement shall survive the closing of the transactions contemplated hereby until the second anniversary of the Closing Date.

ARTICLE 8

CONDITIONS OF CLOSING

8.1 Conditions of Closing in Favour of Crown USA. The obligation of Crown USA to consummate the Transaction is subject to the satisfaction or waiver of the conditions set forth below on or before the Closing Date. The Closing will be deemed to mean the satisfaction or waiver of all conditions to Closing. These conditions of Closing are for the exclusive benefit of Crown USA and may be waived by Crown USA in its sole discretion.

(a) Representations and Warranties. The representations and warranties of the Vendor and Xxxxxxxx contained in this Agreement shall be true and correct in all respects at Closing, with the same force and effect as if such representations and warranties were made at and as of such time, and the Vendor and Xxxxxxxx shall have delivered to Crown USA certificates of the Vendor and Xxxxxxxx dated as of the Closing Date to the effect that the representations and warranties made by the Vendor and Xxxxxxxx in this Agreement are true and correct, such certificate to be in form and substance satisfactory to Crown USA, acting reasonably;

(b) Covenants. All of the covenants, obligations and conditions of this Agreement to be complied with or performed by the Vendor and Xxxxxxxx at or before Closing shall have been complied with or performed and certificates of the Vendor and Xxxxxxxx dated as of the Closing Date to that effect shall have been delivered to Crown USA, such certificates to be in form and substance satisfactory to Crown USA, acting reasonably. The Vendor and Xxxxxxxx shall have delivered each of the documents required to be delivered by them pursuant to this Agreement.

(c) Material Adverse Change. There shall have been no material adverse changes in the condition (financial or otherwise), assets, Liabilities, operations, earnings, business or prospects of Xxxxxxxx or any of the Subsidiaries since the date of the Interim Financial Statements of Xxxxxxxx or any of the Subsidiaries;

(d) Financial Statements. Xxxxxxxx shall have delivered to Crown USA audited financial statements in accordance with GAAP for the year ended December 31, 2007, as audited by a member of the Public Company Accounting Oversight Board and unaudited but auditor reviewed financial statements for the interim period ended September 30, 2008 and the comparative period ended September 30, 2007;

(e) Outstanding Shares. Xxxxxxxx will have 50,000 shares of Xxxxxxxx common stock issued and outstanding on the Closing Date;

(f) No Action or Proceeding. No legal or regulatory action, suit or proceeding shall be pending or threatened by any person, firm or corporation to enjoin, restrict or prohibit the purchase and sale of the Xxxxxxxx Shares contemplated hereby; and

(g) No Violations of Laws. No law, ruling, order or decree is in force, and no action has been taken under any law or by any governmental authority that: (i) makes it illegal or otherwise, directly or indirectly, restrains, enjoins or prohibits the completion of the Transaction; (ii) results in a judgment or assessment of damages, directly or indirectly, relating to the Transaction that would have a material adverse effect on Crown USA or the value of the Xxxxxxxx Shares; or (iii) would impose any condition or restriction that, after giving effect to the Transaction, would have a material adverse effect on Crown USA or the value of the Xxxxxxxx Shares.

If any of the conditions contained in this Section 8.1 shall not have been performed or fulfilled at or prior to Closing to the satisfaction of Crown USA, acting reasonably, Crown USA may, by notice to Xxxxxxxx, terminate this Agreement and the obligations of Crown USA under this Agreement, other than the obligations contained in Sections 12.1, 12.4 and 12.5 hereof shall be terminated; provided, that Crown USA may also bring an action pursuant to Article 10 against the Vendor and Xxxxxxxx for damages suffered by Crown USA where the non-performance or non-fulfillment of the relevant condition is as a result of a breach of covenant, representation or warranty by or caused by the Vendor or Xxxxxxxx. Any such condition may be waived in writing in whole or in part by Xxxxxxxx without prejudice to any claims it may have for breach of any covenant, representation or warranty.

8.2 Conditions of Closing in Favour of the Vendor and Xxxxxxxx. The obligation of the Vendor and Xxxxxxxx to consummate the Transaction is subject to the satisfaction or waiver of the following terms and conditions for the exclusive benefit of the Vendor and Xxxxxxxx, to be fulfilled or performed at or prior to Closing:

(a) Representations and Warranties. The representations and warranties of Crown USA contained in this Agreement shall be true and correct at Closing, with the same force and effect as if such representations and warranties were made at and as of such time, and a certificate of the President of Crown USA in his capacity as an officer dated the Closing Date to that effect shall have been delivered to Xxxxxxxx, such certificate to be in form and substance satisfactory to the Vendor, acting reasonably;

(b) Covenants. All of the terms, covenants and conditions of this Agreement to be complied with or performed by Crown USA at or before Closing shall have been complied with or performed and a certificate of the President of Crown USA in his capacity as an officer dated the Closing Date to that effect shall have been delivered to the Vendor, such certificate to be in form and substance satisfactory to Xxxxxxxx, acting reasonably;

(c) Board of Directors of Crown USA. At Closing, the board of directors of Crown USA will consist of three directors, one of whom will be nominated by the Vendor and two of whom will be nominated by Crown USA;

(d) Management of Crown USA. Crown USA will have appointed Xxxxxxxxx Xxxxxxxxx as Chief Operations Officer;

(e) Cancellation of Restricted Stock. The 88,000,000 restricted Crown USA Shares held by the President of Crown USA will have been surrendered for cancellation to the treasury of Crown USA; and

(f) Outstanding Shares. On Closing and except as contemplated in this Agreement, Crown USA will have 36,422,800 shares of common stock issued and outstanding.

If any of the conditions contained in this Section 8.2 shall not have been performed or fulfilled at or prior to Closing to the satisfaction of the Vendor, acting reasonably, the Vendor may, by notice to Crown USA, terminate this Agreement and the obligations of the Vendor under this Agreement, other than the obligations contained in Sections 12.1, 12.4 and 12.5 hereof shall be terminated, provided that the Vendor may also bring an action pursuant to Article 10 against Xxxxxxxx for damages suffered by the Vendor where the non-performance or non-fulfillment of the relevant condition is as a result of a breach of covenant, representation or warranty by or caused by Crown USA. Any such condition may be waived in writing in whole or in part by the Vendor without prejudice to any claims it may have for breach of any covenant, representation or warranty.

ARTICLE 9

CLOSING ARRANGEMENTS

9.1 Place of Closing. The Closing shall take place at Crown USA’s offices at 000-000 Xxxx Xxxxxxxx Xxxxxx, Xxxxxxxxxx, Xxxxxxxxxx, XXX on the Closing Date.

9.2 The Vendor’s Closing Documents. At Closing, the Vendor and Xxxxxxxx, as applicable, shall deliver, or cause to be delivered, the following to Crown USA:

(a) duly executed share transfer forms in favour of Crown USA together with all the issued share certificates representing the Xxxxxxxx Shares duly endorsed for transfer to Crown USA and any necessary documents reasonably required by Crown USA to enable it to stamp or otherwise register the transfer of the Xxxxxxxx Shares;

(b) a certified true copy of the resolutions passed by the directors of Xxxxxxxx:

(i) authorizing the execution and delivery by Xxxxxxxx of this Agreement and all documents required to be executed and delivered by Xxxxxxxx pursuant to this Agreement, and the consummation of the transactions contemplated thereby;

(ii) approving the transfer of the Xxxxxxxx Shares to Crown USA;

(iii) approving the cancellation of the old share certificate issued in the name of the Vendor representing the Xxxxxxxx Shares and the issue of a new share certificate in respect of the Xxxxxxxx Shares in favour of Crown USA; and

(iv) approving the entry into the register of shareholders of Xxxxxxxx, the name of Crown USA as the sole legal and beneficial owner of the Xxxxxxxx Shares and the making of other entries into other corporate records of Xxxxxxxx as may be necessary;

(c) a certified true copy of the resolutions passed by the directors of the Vendor authorizing the execution and delivery by the Vendor of this Agreement and all documents required to be executed and delivered by the Vendor pursuant to this Agreement, and the consummation of the transactions contemplated thereby;

(d) a certified true copy of the resolutions passed by the shareholder of the Vendor authorizing the execution and delivery by the Vendor of this Agreement and all documents required to be executed and delivered by the Vendor pursuant to this Agreement, and the consummation of the transactions contemplated thereby;

(e) certificates of the Vendor and Xxxxxxxx as specified in Sections 8.1(a) and (b) hereof as to the accuracy, as of the Closing Date, of the representations and warranties of the Vendor and Xxxxxxxx and the performance of the covenants to be performed at or before Closing;

(f) the minute books of Xxxxxxxx and the Subsidiaries; and

(g) all other documents and assurances as reasonably requested by Crown USA to effectively complete the Transaction.

9.3 Crown USA’s Closing Documents. At the Closing, Crown USA shall deliver the following to the Vendor:

(a) share certificates representing the Crown USA Shares issued by Crown USA to the Vendor, such share certificate to be legended in accordance with the provisions of Regulation S;

(b) the Promissory Note;

(c) certificate of Crown USA as specified in Sections 8.2(a) and (b) hereof as to the accuracy, as of the Closing Date, of the representations and warranties of Crown USA and the performance of the covenants to be performed at or before Closing; and

(d) all other documents as reasonably requested by the Vendor to effectively complete the Transaction.

9.4 Further Assurances. Each party to this Agreement covenants and agrees that, from time to time subsequent to the Closing Date, it shall at the request and expense of the requesting party, execute and deliver all such documents, including, without limitation, all such additional conveyances, transfers, consents and other assurances and do all such other acts and things as any other party hereto, acting reasonably, may from time request to be executed or done in order to better evidence or perfect or effectuate any provision of this Agreement or of any agreement or other document executed pursuant to this Agreement or any of the respective obligations intended to be created hereby or thereby.

ARTICLE 10

INDEMNIFICATION

10.1 Indemnification the Vendor. The Vendor shall indemnify and save harmless Crown USA from all Losses suffered or incurred by Crown USA as a result of or arising directly or indirectly out of or in connection with:

(a) any breach by the Vendor or Xxxxxxxx of or any inaccuracy of any representation or warranty of the Vendor or Xxxxxxxx contained in this Agreement or in any agreement, certificate or other document delivered pursuant hereto; and