CREDIT AGREEMENT

Exhibit 10.10

Execution Version

$20,000,000

Among

AMERICAN BATTERY TECHNOLOGY COMPANY,

as Borrower,

The Several Lenders

from Time to Time Parties Hereto,

and

MERCURIA INVESTMENTS US, INC.,

as Agent

Dated as of May 17, 2023

TABLE OF CONTENTS

| Page | ||

| ARTICLE I DEFINITIONS | 1 | |

| 1.1 | Defined Terms | 1 |

| 1.2 | Other Definitional Provisions | 25 |

| 1.3 | Computation of Time Periods | 25 |

| 1.4 | Rates | 26 |

| 1.5 | Divisions | 26 |

| ARTICLE II AMOUNT AND TERMS OF COMMITMENTS. | 26 | |

| 2.1 | Loan Commitments; Amounts | 26 |

| 2.2 | Procedures for Borrowing | 27 |

| 2.3 | Maturity Date | 27 |

| 2.5 | Repayment of the Loan; Evidence of Debt | 28 |

| 2.6 | Fees | 28 |

| 2.7 | Optional Prepayments | 29 |

| 2.8 | Mandatory Prepayments | 29 |

| 2.9 | Invoice Deduction | 29 |

| 2.10 | Interest Rates, Payment Dates and Computation of Interest and Fees | 30 |

| 2.11 | Application of Payments; Place of Payments. | 31 |

| 2.12 | Taxes | 32 |

| 2.13 | Indemnity | 35 |

| 2.14 | Change of Lending Office | 35 |

| 2.15 | Replacement of Lenders | 35 |

| 2.16 | Original Issue Discount | 36 |

| 2.17 | Changed Circumstances | 36 |

| ARTICLE III REPRESENTATIONS AND WARRANTIES | 39 | |

| 3.1 | Financial Condition | 39 |

| 3.2 | No Change | 39 |

| 3.3 | Corporate Existence; Compliance with Law | 39 |

| 3.4 | Entity Power; Authorization; Enforceable Obligations | 40 |

| 3.5 | No Legal Bar | 40 |

| 3.6 | Existing Indebtedness | 40 |

| 3.7 | No Material Litigation | 40 |

| 3.8 | No Default | 40 |

| 3.9 | Ownership of Property | 40 |

| 3.10 | Insurance | 41 |

| 3.11 | Intellectual Property | 41 |

| 3.12 | Taxes | 41 |

| 3.13 | Federal Regulations | 41 |

| 3.14 | Labor Matters | 41 |

| 3.15 | ERISA Plans | 42 |

| 3.16 | Regulations | 42 |

| 3.17 | Capital Stock; Subsidiaries | 42 |

| 3.18 | Use of Proceeds | 43 |

| 3.19 | Environmental Matters | 43 |

| 3.20 | Accuracy of Information, etc | 44 |

| i |

| 3.21 | Security Documents | 44 |

| 3.22 | Solvency. | 44 |

| 3.23 | Contingent Obligations | 45 |

| 3.24 | Bank Accounts | 45 |

| 3.25 | Material Contracts | 45 |

| 3.26 | No Burdensome Restrictions | 45 |

| ARTICLE IV CONDITIONS PRECEDENT | 46 | |

| 4.1 | Conditions to Closing Date | 46 |

| 4.2 | Each Delayed Draw Term Loan Borrowing | 49 |

| ARTICLE V AFFIRMATIVE COVENANTS | 50 | |

| 5.1 | Financial Statements | 50 |

| 5.2 | Production Report; Collateral Reporting | 51 |

| 5.3 | Certificates; Other Information | 52 |

| 5.4 | Payment of Obligations | 53 |

| 5.5 | Maintenance of Existence; Compliance with Obligations, Requirements, etc | 53 |

| 5.6 | Operation and Maintenance of Property | 53 |

| 5.7 | Insurance | 54 |

| 5.8 | Inspection of Property; Books and Records; Discussions | 54 |

| 5.9 | Notices | 55 |

| 5.10 | Environmental Laws | 55 |

| 5.11 | Collateral Matters | 56 |

| 5.12 | Reserved | 57 |

| 5.13 | Use of Proceeds | 57 |

| 5.14 | Patriot Act Compliance | 57 |

| 5.15 | Further Assurances | 57 |

| 5.16 | Reserved | 58 |

| 5.17 | Company Policies | 58 |

| 5.18 | Post-Closing Covenant | 58 |

| ARTICLE VI NEGATIVE COVENANTS | 58 | |

| 6.1 | Financial Condition Covenants | 58 |

| 6.2 | Indebtedness | 59 |

| 6.3 | Liens | 59 |

| 6.4 | Fundamental Changes | 61 |

| 6.5 | Disposition of Property | 61 |

| 6.6 | Restricted Payments | 62 |

| 6.7 | Transactions with Affiliates | 62 |

| 6.8 | Sale and Leaseback | 63 |

| 6.9 | Changes in Fiscal Periods | 63 |

| 6.10 | Negative Pledge Clauses | 63 |

| 6.11 | Restrictions on Subsidiary Distributions | 63 |

| 6.12 | Lines of Business | 63 |

| 6.13 | ERISA Plans | 63 |

| 6.14 | Hedging Agreements | 63 |

| 6.15 | New Subsidiaries | 64 |

| 6.16 | Use of Proceeds | 64 |

| 6.17 | Amendments to Certain Documents and Agreements | 64 |

| 6.18 | Company Policies | 64 |

| ii |

| 6.19 | Black Mass Production | 64 |

| ARTICLE VII EVENTS OF DEFAULT | 64 | |

| 7.1 | Events of Default | 64 |

| 7.2 | Remedies | 67 |

| ARTICLE VIII THE AGENT | 67 | |

| 8.1 | Appointment | 67 |

| 8.2 | Delegation of Duties | 67 |

| 8.3 | Exculpatory Provisions | 67 |

| 8.4 | Reliance by Agent | 67 |

| 8.5 | Notice of Default | 67 |

| 8.6 | Non Reliance on Agent and Other Lenders | 67 |

| 8.7 | Indemnification | 68 |

| 8.8 | Agent in its Individual Capacity | 69 |

| 8.9 | Successor Agent | 68 |

| 8.10 | Collateral Matters | 68 |

| ARTICLE IX MISCELLANEOUS | 69 | |

| 9.1 | Amendments and Waivers | 69 |

| 9.2 | Notices | 70 |

| 9.3 | No Waiver; Cumulative Remedies | 71 |

| 9.4 | Survival of Representations and Warranties | 71 |

| 9.5 | Payment of Expenses | 71 |

| 9.6 | Indemnification; Waiver | 72 |

| 9.7 | Successors and Assigns; Participations and Assignments | 73 |

| 9.8 | Adjustments; Set off | 76 |

| 9.9 | Counterparts | 76 |

| 9.10 | Severability | 76 |

| 9.11 | Integration; Construction | 76 |

| 9.12 | GOVERNING LAW | 77 |

| 9.13 | Submission To Jurisdiction; Waivers | 77 |

| 9.14 | Acknowledgments | 77 |

| 9.15 | Confidentiality | 78 |

| 9.16 | Release of Collateral and Guarantee Obligations | 78 |

| 9.17 | Interest Rate Limitation | 79 |

| 9.18 | Accounting Changes | 79 |

| 9.19 | WAIVERS OF JURY TRIAL | 80 |

| 9.20 | Customer Identification – USA PATRIOT Act Notice | 80 |

| 9.21 | Creditor-Debtor Relationship | 80 |

| 9.22 | Reserved. | 80 |

| 9.23 | Erroneous Payments | 80 |

| iii |

SCHEDULES:

| 1.1(a) | Equipment |

| 1.1(b) | Commitments |

| 1.1(c) | Mortgaged Properties |

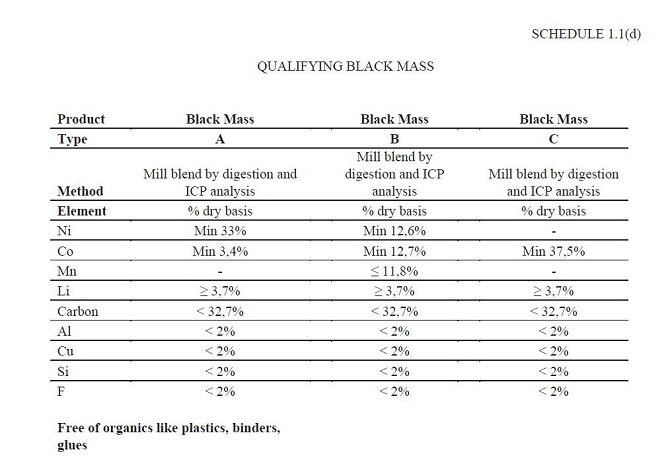

| 1.1(d) | Qualifying Black Mass |

| 3.17 | Capital Stock Ownership |

| 3.21(a) | Security Agreement UCC Filing Jurisdictions |

| 3.21(b) | Mortgage Filing Jurisdictions |

| 3.24 | Bank Accounts |

| 3.25 | Material Contracts |

| 3.26 | Burdensome Restrictions |

| 6.2 | Permitted Indebtedness |

| EXHIBITS: | |

| A | Form of Borrowing Notice |

| B | Form of Compliance Certificate |

| C | Reserved. |

| D | Form of Guarantee and Security Agreement |

| E | Form of Mortgage |

| F | Form of Solvency Certificate |

| G | Form of Note |

| H | Form of Assignment and Acceptance |

| I | Form of U.S. Tax Compliance Certificates |

| iv |

THE LOAN MAY BE ISSUED WITH ORIGINAL ISSUE DISCOUNT FOR PURPOSES OF SECTION 1271 ET SEQ. OF THE CODE. BEGINNING NO LATER THAN 10 DAYS AFTER THE EFFECTIVE DATE OF ANY LOAN, A LENDER MAY OBTAIN THE ISSUE PRICE, AMOUNT OF ORIGINAL ISSUE DISCOUNT, ISSUE DATE AND YIELD TO MATURITY FOR THE LOAN BY SUBMITTING A WRITTEN REQUEST FOR SUCH INFORMATION TO THE BORROWER AT THE FOLLOWING ADDRESS: 000 XXXXXXXXXX XXXXXX, XXXXX #000, XXXX, XXXXXX, 00000.

This CREDIT AGREEMENT, dated as of May 17, 2023, is by and among American Battery Technology Company, a Nevada corporation (“Borrower”), the several banks and other financial institutions or entities from time to time parties to this Agreement (the “Lenders”) and Mercuria Investments US, Inc., as administrative agent and collateral agent (in such capacities, collectively, “Agent”).

W I T N E S S E T H:

WHEREAS, Borrower has requested that the Lenders make one or more term loans to Borrower with total aggregate term loan commitments in an amount equal to $20,000,000, including the Initial Term Loans in an amount equal to $6,000,000 and Delayed Draw Term Loan Commitments in an aggregate amount equal to $14,000,000, with such Delayed Draw Term Loan Commitments subject to the terms and conditions set forth herein, including the delivery of additional Collateral; and

NOW, THEREFORE, in consideration of the premises and the agreements hereinafter set forth, the parties hereto hereby agree as follows:

ARTICLE I

DEFINITIONS

1.1 Defined Terms. As used in this Agreement, the terms listed in this Section 1.1 shall have the respective meanings set forth in this Section 1.1.

“ABR” for any day, a rate per annum equal to the highest of (a) the Prime Rate in effect on such day and (b) the Federal Funds Rate in effect on such day plus 0.50%. Any change in the ABR due to a change in the Prime Rate or the Federal Funds Rate shall be effective from and including the effective date of such change in the Prime Rate or the Federal Funds Rate, respectively.

“ABR Loan” means a Loan that bears interest based on the ABR.

“Acceptable Security Interest” means, in any Property, a Lien which (a) exists in favor of Agent for the benefit of the Secured Parties, (b) is superior to all Liens or rights of any other Person in the Property encumbered thereby (other than Permitted Liens), (c) secures the Obligations, and (d) is perfected and enforceable.

“Accounting Change” has the meaning given to such term in Section 9.18.

“Acquisition Date” means the date on which the Aqua Metals Acquisition is consummated in accordance with the terms of the MIPA.

“Adjusted Term SOFR Rate” means an interest rate per annum equal to the Term SOFR Rate for a three month interest period, plus 0.15%; provided that if the Adjusted Term SOFR Rate as so determined would be less than 1.00%, such rate shall be deemed to be 1.00% for the purposes of this Agreement.

“Affiliate” means, as to any Person, any other Person that, directly or indirectly, is in control of, is controlled by, or is under common control with, such Person. For purposes of this definition, “control” of a Person means the power, directly or indirectly, to direct or cause the direction of the management and policies of such Person, whether by contract or otherwise. Notwithstanding the foregoing, no Lender shall be deemed to be an Affiliate of the Loan Parties.

“Agent” has the meaning given to such term in the preamble hereto.

“Aggregate Exposure” means, with respect to any Lender at any time, an amount equal to the aggregate then unpaid principal amount of such Xxxxxx’s Loan.

“Aggregate Exposure Percentage” means, with respect to any Lender at any time, the ratio (expressed as a percentage) of such Xxxxxx’s Aggregate Exposure at such time to the sum of the Aggregate Exposures of all Lenders at such time.

“Agreement” means this Credit Agreement.

“Applicable Margin” means, for any day, (a) with respect to any SOFR Loan, 6.00%, and (b) with respect to any ABR Loan, 5.00%.

“Approved Electronic Platform” means IntraLinks™, DebtDomain, SyndTrak, ClearPar or any other electronic platform chosen by the Agent to be its electronic transmission system.

“Aqua Metals Acquisition” has the meaning given to such term in Section 3.18.

“Asset Sale” means, any Disposition not otherwise permitted under the Agreement. “Assignee” has the meaning given to such term in Section 9.7(c).

“Assignment and Acceptance” has the meaning given to such term in Section 9.7(c).

“Assignor” has the meaning given to such term in Section 9.7(c).

“Available Cash” means, for any period, (a) the sum (without duplication) of all amounts (other than proceeds from any Loan) that the Borrower and the other Loan Parties is projected to receive in cash or cash equivalents during such period plus (b) without duplication, the Unrestricted Cash held by the Loan Parties on the first date for such period.

“Available Tenor” means, as of any date of determination and with respect to the then-current Benchmark, as applicable, (x) if such Benchmark is a term rate, any tenor for such Benchmark (or component thereof) that is or may be used for determining the length of an interest period pursuant to this Agreement or (y) otherwise, any payment period for interest calculated with reference to such Benchmark (or component thereof) that is or may be used for determining any frequency of making payments of interest calculated with reference to such Benchmark pursuant to this Agreement, in each case, as of such date and not including, for the avoidance of doubt, any tenor for such Benchmark that is then-removed from the definition of “Interest Period” pursuant to Section 2.17(c).

“Benchmark” means, initially, the Term SOFR Reference Rate; provided that if a Benchmark Transition Event has occurred with respect to the Term SOFR Reference Rate or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement to the extent that such Benchmark Replacement has replaced such prior benchmark rate pursuant to Section 2.17(c).

“Benchmark Replacement” means, with respect to any Benchmark Transition Event: the sum of: (a) the alternate benchmark rate that has been selected by the Agent and the Borrower giving due consideration to (i) any selection or recommendation of a replacement benchmark rate or the mechanism for determining such a rate by the Relevant Governmental Body or (ii) any evolving or then-prevailing market convention for determining a benchmark rate as a replacement to the then-current Benchmark for Dollar-denominated syndicated credit facilities at such time and (b) the related Benchmark Replacement Adjustment; provided that, if such Benchmark Replacement as so determined would be less than the Floor, such Benchmark Replacement will be deemed to be the Floor for the purposes of this Agreement and the other Loan Documents.

| 2 |

“Benchmark Replacement Adjustment” means, with respect to any replacement of the then- current Benchmark with an Unadjusted Benchmark Replacement, the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected by the Agent and the Borrower giving due consideration to (a) any selection or recommendation of a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement by the Relevant Governmental Body or (b) any evolving or then-prevailing market convention for determining a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement for Dollar-denominated syndicated credit facilities at such time.

“Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark:

(a) in the case of clause (a) or (b) of the definition of “Benchmark Transition Event,” the later of (i) the date of the public statement or publication of information referenced therein and (ii) the date on which the administrator of such Benchmark (or the published component used in the calculation thereof) permanently or indefinitely ceases to provide all Available Tenors of such Benchmark (or such component thereof); or

(b) in the case of clause (c) of the definition of “Benchmark Transition Event,” the first date on which such Benchmark (or the published component used in the calculation thereof) has been determined and announced by the regulatory supervisor for the administrator of such Benchmark (or such component thereof) to be non-representative; provided that such non-representativeness will be determined by reference to the most recent statement or publication referenced in such clause (c) and even if any Available Tenor of such Benchmark (or such component thereof) continues to be provided on such date.

For the avoidance of doubt, the “Benchmark Replacement Date” will be deemed to have occurred in the case of clause (a) or (b) with respect to any Benchmark upon the occurrence of the applicable event or events set forth therein with respect to all then-current Available Tenors of such Benchmark (or the published component used in the calculation thereof).

“Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark:

(a) a public statement or publication of information by or on behalf of the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that such administrator has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof), permanently or indefinitely; provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof);

(b) a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof), the Board, the SOFR Administrator, an insolvency official with jurisdiction over the administrator for such Benchmark (or such component), a resolution authority with jurisdiction over the administrator for such Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for such Benchmark (or such component), which states that the administrator of such Benchmark (or such component) has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof) permanently or indefinitely; provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof); or

| 3 |

(c) a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that all Available Tenors of such Benchmark (or such component thereof) are not, or as of a specified future date will not be, representative.

For the avoidance of doubt, a “Benchmark Transition Event” will be deemed to have occurred with respect to any Benchmark if a public statement or publication of information set forth above has occurred with respect to each then-current Available Tenor of such Benchmark (or the published component used in the calculation thereof).

“Benchmark Transition Start Date” means, in the case of a Benchmark Transition Event, the earlier of (a) the applicable Benchmark Replacement Date and (b) if such Benchmark Transition Event is a public statement or publication of information of a prospective event, the 90th day prior to the expected date of such event as of such public statement or publication of information (or if the expected date of such prospective event is fewer than 90 days after such statement or publication, the date of such statement or publication).

“Benchmark Unavailability Period” means, the period (if any) (a) beginning at the time that a Benchmark Replacement Date has occurred if, at such time, no Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Loan Document in accordance with Section 2.17 and (b) ending at the time that a Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Loan Document in accordance with Section 2.17.

“Benefitted Lender” has the meaning given to such term in Section 9.8(a).

“Black Mass” means the amalgamation of lithium-ion battery cell electrode metals (including but not limited to cobalt, nickel, manganese, lithium, graphite) along with trace amounts of electrolyte material and scrap metals from other components within the battery, the resulting product being derived from the Borrower’s proprietary strategic de-manufacturing process, in which lithium-ion batteries are broken down into, and separated out at, the elemental level, which product is (x) sold to refiners who are interested in the raw materials therein, and requires further processing to retrieve them and is used in the Borrower’s proprietary hydrometallurgical chemical refining process to produce cathode sulfates and lithium hydroxide, and (y) the filter cake output of the Borrower’s strategic de-manufacturing process; provided, that Black Mass shall not include black-mass derived from LFP battery chemistries (lithium iron phosphate).

“Board” means the Board of Governors of the Federal Reserve System of the United States (or any successor).

“Borrower” has the meaning given to such term in the preamble hereto.

“Borrowing” means a borrowing consisting of the Loan, which is of the same Type and, in the case of a SOFR Borrowing, having the same Interest Period made by the Lenders.

“Borrowing Date” means the Closing Date, which is the date on which Borrower requests the Lenders to make a Loan hereunder.

| 4 |

“Borrowing Notice” means, with respect to any request for borrowing of the Loan hereunder, a notice from Xxxxxxxx, substantially in the form of, and containing the information prescribed by, Exhibit A, delivered to Agent.

“Business Day” means a day other than a Saturday, Sunday or other day on which commercial banks in New York City, New York are authorized or required by law to close.

“Capital Expenditures” means with respect to any Person, the aggregate of all expenditures and costs (whether paid in cash or accrued as liabilities) by such Person which are required to be capitalized under GAAP on a balance sheet of such Person, but notwithstanding and without limiting the foregoing, Capital Expenditures shall also include all (i) Recycling Facility Costs, (ii) expenditures as to the development, construction and placement in service of the Recycling Facility, and (iii) expenditures as to development or other exploitation of lithium reserves.

“Capital Lease” means any lease of a Person with respect to (or other arrangement conveying to a Person the right to use) any Property or a combination thereof, the obligations under which are required to be classified and accounted for as a capital lease on a balance sheet of such Person under GAAP.

“Capital Lease Obligations” means, with respect to any Person, the obligations of such Person to pay rent or other amounts under any Capital Lease and, for the purposes of this Agreement, the amount of such obligations at any time shall be the capitalized amount thereof at such time determined in accordance with GAAP.

“Capital Stock” means any and all shares, interests, participations or other equivalents (however designated) of capital stock of a corporation, any and all equivalent membership, partnership or other ownership interests in a Person (other than a corporation) and any and all warrants, rights or options to purchase any of the foregoing.

“Capitalization” means, as of any date, the sum of (without duplication) (a) Consolidated Total Debt as of such date plus (b) Stockholders’ Equity as of such date.

“Cash Equivalents” means (a) marketable direct obligations issued by, or unconditionally guaranteed by, the United States government or issued by any agency thereof and backed by the full faith and credit of the United States, in each case maturing within one year from the date of acquisition; (b) certificates of deposit, time deposits, eurodollar time deposits or overnight bank deposits having maturities of six months or less from the date of acquisition issued by any Lender or by any commercial bank organized under the laws of the United States of America or any state thereof having combined, at the time of acquisition thereof, capital and surplus of not less than $500,000,000; (c) commercial paper of an issuer rated, at the time of acquisition thereof, at least A-2 by S&P or P-2 by Moody’s, or carrying an equivalent rating by a “nationally recognized statistical rating organization” (within the meaning of proposed Rule 3b- 10 promulgated by the SEC under the Exchange Act), if both of the two named rating agencies cease publishing ratings of commercial paper issuers generally, and maturing within six months from the date of acquisition; (d) repurchase obligations of any Lender or of any commercial bank satisfying the requirements of clause (b) of this definition, having a term of not more than 30 days with respect to securities issued or fully guaranteed or insured by the United States government; (e) securities with maturities of one year or less from the date of acquisition issued or fully guaranteed by any state, commonwealth or territory of the United States, by any political subdivision or taxing authority of any such state, commonwealth or territory, the securities of which state, commonwealth, territory, political subdivision or taxing authority (as the case may be) are rated, at the time of acquisition thereof, at least A by S&P or A by Moody’s; (f) securities with maturities of six months or less from the date of acquisition backed by standby letters of credit issued by any Lender or any commercial bank satisfying the requirements of clause (b) of this definition; and (g) shares of money market mutual or similar funds which invest substantially all in assets satisfying the requirements of clauses (a) through (f) of this definition.

| 5 |

“Cash Flow Available for Debt Service” means, for any measurement period, (a) the sum of Available Cash for such period minus (b) the sum (without duplication) of (i) Capital Expenditures of the Borrower and its Subsidiaries plus (ii) any Operating Expenses of the Borrower and its Subsidiaries for such period.

“Change of Control” means the occurrence of any of the following events:

(a) the acquisition of ownership, directly or indirectly, beneficially or of record, by any “person” or “group” (as such terms are defined in the Securities Exchange Act of 1934, but excluding any employee benefit plan of such person or its subsidiaries, and any person or entity acting in its capacity as trustee, agent or other fiduciary or administrator of any such plan) of Capital Stock representing more than 35% of the aggregate ordinary voting power represented by the issued and outstanding Capital Stock of the Borrower entitled to vote generally in the election of directors of the Borrower; or

(b) during any period of 12 consecutive months, the occupation of a majority of the seats (excluding vacant seats) on the board of directors of the Borrower by persons who were neither (i) nominated by the board of directors of the Borrower or a duly authorized committee thereof nor (ii) appointed or approved by directors so nominated; or

(c) Borrower shall cease to own and control, of record and beneficially, directly or indirectly, 100% of each class of outstanding Capital Stock of each Subsidiary of Borrower, other than pursuant to a transaction permitted under this Agreement.

“Closing Date” means the date on which the conditions precedent set forth in Section 4.1 shall have been satisfied.

“Code” means the Internal Revenue Code of 1986, as amended.

“Collateral” means all Property of the Loan Parties, now owned or hereafter acquired, upon which a Lien is purported to be created by any Security Document.

“Commercial Operations Date” means the first date that the Recycling Facility produces at least 200 metric tons of Qualifying Black Mass over the previous thirty (30) day period.

“Commitment” means the Initial Term Loan Commitment or a Delayed Draw Term Loan Commitment, as the context requires.

“Company Policies” means the written company policies and standards adopted by the management of the Borrower which are material to the business operations of the Borrower and its Subsidiaries, including, without limitation, environmental, health and safety policies of the Borrower and its Subsidiaries.

“Compliance Certificate” means a certificate duly executed by a Responsible Officer, substantially in the form of Exhibit B, which Compliance Certificate shall include a certification describing in reasonable detail the management accounts of the Borrower and its Subsidiaries.

| 6 |

“Conforming Changes” means, with respect to either the use or administration of Term SOFR or the use, administration, adoption or implementation of any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definition of “ABR,” the definition of “Business Day,” the definition of “U.S. Government Securities Business Day,” the definition of “Interest Period” or any similar or analogous definition (or the addition of a concept of “interest period”), timing and frequency of determining rates and making payments of interest, timing of borrowing requests or prepayment, conversion or continuation notices, the applicability and length of lookback periods, the applicability of Section 2.17 and other technical, administrative or operational matters) that the Agent decides may be appropriate to reflect the adoption and implementation of any such rate or to permit the use and administration thereof by the Agent in a manner substantially consistent with market practice (or, if the Agent decides that adoption of any portion of such market practice is not administratively feasible or if the Agent determines that no market practice for the administration of any such rate exists, in such other manner of administration as the Agent decides is reasonably necessary in connection with the administration of this Agreement and the other Loan Documents).

“Connection Income Taxes” means Other Connection Taxes that are imposed on or measured by net income (however denominated) or that are franchise Taxes or branch profits Taxes.

“Consolidated Total Debt” means, on any date, the aggregate principal amount of all Indebtedness of Borrower and its Subsidiaries at such date, determined on a consolidated basis in accordance with GAAP.

“Constituent Documents” means, with respect to any Person, (a) the articles or certificate of incorporation, certificate of formation or partnership, articles of organization, limited liability company agreement or agreement of limited partnership (or the equivalent organizational documents) of such Person,

(b) the by-laws (or the equivalent governing documents) of such Person and (c) any document setting forth the manner of election and duties of the directors or managing members of such Person (if any) and the designation, amount or relative rights, limitations and preferences of any class or series of such Person’s Capital Stock.

“Contingent Obligation” of a Person, means any agreement, undertaking or arrangement by which such Person assumes, guarantees, endorses, contingently agrees to purchase or provide funds for the payment of, or otherwise becomes or is contingently liable upon, the obligation or liability of any other Person, or agrees to maintain the net worth or working capital or other financial condition of any other Person, or otherwise assures any creditor of such other Person against loss, including any comfort letter, operating agreement, take or pay contract or the obligations of any such Person as general partner of a partnership with respect to the liabilities of the partnership.

“Contractual Obligation” means, with respect to any Person, any term, condition or provision of any security issued by such Person or of any agreement, instrument or other undertaking to which such Person is a party or by which it or any of its Property is bound.

“DDTL Commitment Expiration Date” means the earliest to occur of (a) the date on which the Maximum DDTL Amount has been fully drawn, (b) the date on which the Delayed Draw Term Loan Commitments are otherwise terminated and (c) May 24, 2024 (or such later date in the Agent’s and the Lenders’ sole discretion).

“Debt Service” means, for any measurement period, without duplication, all scheduled amortization payments of the outstanding principal amount of the Loan and scheduled interest and fees payable (or required to be paid) under the Loan Documents during such period (other than closing fees and expenses incurred in connection with the Loan Documents).

| 7 |

“Debt Service Coverage Ratio” means, as of any date of determination, the ratio of (a) projected Cash Flow Available for Debt Service of Borrower and its Subsidiaries based on the most recently delivered Projections and determined on a combined basis for the three (3) month period immediately following such date of determination to (b) projected Debt Service of Borrower and its Subsidiaries determined on a combined basis for the three (3) month period immediately following such date of determination; provided, that any and all assumptions used in the calculation thereof shall be reasonably acceptable to the Agent.

“Default” means any of the events specified in Article VII, whether or not any requirement for the giving of notice, the lapse of time, or both, has been satisfied.

“Default Rate” has the meaning given to such term in Section 2.10(b).

“Defensible Title” means good and indefeasible title, free and clear of all Liens other than Permitted Liens.

“Delayed Draw Term Lender” means, as of any date of determination, each Lender having a Delayed Draw Term Loan Commitment or that holds Delayed Draw Term Loans.

“Delayed Draw Term Loan Availability Period” means the period from and including the date on which the Initial Term Loans are paid in full to and including the DDTL Commitment Expiration Date.

“Delayed Draw Term Loan Commitment” means, as to any Lender, the obligation of such Lender, if any, to make a Delayed Draw Term Loan to Borrower hereunder in a principal amount not to exceed the amount set forth under the heading “Delayed Draw Term Loan Commitment” opposite such Lender’s name on Schedule 1.1(b) hereto, or, as the case may be, in the Assignment and Acceptance pursuant to which such Xxxxxx became a party hereto, as the same may be reduced from time to time pursuant to Section 2.4. The original aggregate amount of the Delayed Draw Term Loan Commitments is $14,000,000.

“Delayed Draw Term Loans” means the loans made by the Delayed Draw Term Lenders to the Borrower pursuant to Section 2.1(b).

“Disposition” means, with respect to any Property, any sale, lease, sale and leaseback transaction, assignment, conveyance, transfer or other disposition (including by way of a merger or consolidation and including any unwind of any Hedging Agreement) of such Property or any interest therein (excluding the creation of any Permitted Lien on such Property but including the sale or factoring at maturity or collection by another Person of any accounts or permitting or suffering any other Person to acquire any interest (other than a Permitted Lien) in such Property) or the entering into any agreement to do any of the foregoing (unless the Net Cash Proceeds expected to be received for such sale, lease, sale and leaseback, assignment, conveyance, transfer or other disposition is equal to or greater than the aggregate amount of the Obligations under this Agreement at the time such agreement is entered into); and the terms “Dispose” and “Disposed of” shall have correlative meanings.

“Disqualified Stock” means, as to any Person, any Capital Stock of such Person that by its terms (or by the terms of any security into which it is convertible or for which it is exchangeable) or otherwise (including upon the occurrence of an event) requires the payment of dividends (other than dividends payable solely in Capital Stock which does not otherwise constitute Disqualified Stock) or matures or is required to be redeemed (pursuant to any sinking fund obligation or otherwise) or is convertible into or exchangeable for Indebtedness or is redeemable at the option of the holder thereof, in whole or in part, at any time on or prior to the date that is after the Maturity Date.

“Dollars” and “$” means lawful currency of the United States of America.

| 8 |

“EEA Financial Institution” means (a) any credit institution or investment firm established in any EEA Member Country that is subject to the supervision of an EEA Resolution Authority, (b) any entity established in an EEA Member Country that is a parent of an institution described in clause (a) of this definition, or (c) any financial institution established in an EEA Member Country that is a subsidiary of an institution described in clauses (a) or (b) of this definition and is subject to consolidated supervision with its parent.

“EEA Member Country” means any of the member states of the European Union, Iceland, Liechtenstein, and Norway.

“EEA Resolution Authority” means any public administrative authority or any person entrusted with public administrative authority of any EEA Member Country (including any delegee) having responsibility for the resolution of any EEA Financial Institution.

“Environmental Laws” means any and all applicable laws, rules, orders, regulations, statutes, ordinances, codes, decrees or other legally enforceable requirements (including common law) of any Governmental Authority regulating, relating to or imposing liability or standards of conduct concerning pollution, protection of the environment, natural resources or of human health, or employee health and safety, as has been, is now, or may at any time hereafter be, in effect, including the Comprehensive Environmental Response, Compensation and Liability Act, 42 U.S.C. § 9601 et seq., the Hazardous Materials Transportation Act, 49 U.S.C. § 5101 et seq., the Resource Conservation and Recovery Act, 42 U.S.C. § 6901 et seq., the Clean Water Act, 33 U.S.C. § 1251 et seq., the Clean Air Act, 42 U.S.C. § 7401 et seq., the Toxic Substances Control Act, 15 U.S.C. § 2601 et seq., the Federal Insecticide, Fungicide, and Rodenticide Act, 7 U.S.C. § 136 et seq., the Oil Pollution Act of 1990, 33 U.S.C. § 2701 et seq., the Occupational Safety and Health Act, 29 U.S.C. § 651 et seq., and the regulations promulgated pursuant thereto, and all analogous state or local statutes and regulations.

“Environmental Liability” means any liability, contingent or otherwise (including any liability for damages, costs of medical monitoring, costs of environmental remediation or restoration, administrative oversight costs, attorneys’ fees, consultants’ fees, fines, penalties or indemnities) directly or indirectly resulting from or based upon (a) any violation of any Environmental Law or Environmental Permit, (b) the generation, use, handling, transportation, storage, treatment or disposal of any Materials of Environmental Concern, (c) exposure to any Materials of Environmental Concern, (d) the Release or threatened Release of any Materials of Environmental Concern or (e) any contract, agreement or other consensual arrangement pursuant to which liability is assumed or imposed with respect to any of the foregoing.

“Environmental Permits” means any and all permits, licenses, approvals, registrations, notifications, exemptions and other authorizations required or obtained under any Environmental Law.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

“ERISA Affiliate” means any trade or business (whether or not incorporated) under common control with Borrower, any Guarantor or any of their respective Subsidiaries within the meaning of Section 414(b) or (c) of the Code (and Sections 414(m) and (o) of the Code for purposes of provisions relating to Section 412 of the Code).

| 9 |

“ERISA Event” means (a) any “reportable event”, has the meaning given to such term in Section 4043 of ERISA or the regulations issued thereunder with respect to any ERISA Plan (other than an event for which the 30 day notice period is waived); (b) any failure by Borrower or any ERISA Affiliate to satisfy the minimum funding standard (within the meaning of Section 412 of the Code or Section 302 of ERISA) applicable to any ERISA Plan, in each case whether or not waived; (c) a determination that any ERISA Plan is, or is expected to be, in “at-risk” status (has the meaning given to such term in Section 430(i)(4) of the Code or Section 303(i)(4) of ERISA); (d) the filing of a notice of intent to terminate any ERISA Plan if such termination would require material additional contributions in order to be considered a standard termination within the meaning of Section 4041(b) of ERISA, the filing under Section 4041(c) of ERISA of a notice of intent to terminate any ERISA Plan or the termination of any ERISA Plan under Section 4041(c) of ERISA; (e) the institution of proceedings under Section 4042 of ERISA by the Pension Benefit Guaranty Corporation for the termination of, or the appointment of a trustee to administer, any ERISA Plan; (f) Borrower or an ERISA Affiliate incurring any liability under Title IV of ERISA with respect to any ERISA Plan (other than premiums due and not delinquent under Section 4007 of ERISA); (g) the complete or partial withdrawal of Borrower or any ERISA Affiliate from any ERISA Plan or a Multiemployer Plan; or (h) the receipt by Borrower or any ERISA Affiliates of any notice, of the imposition of withdrawal liability or of a determination that a Multiemployer Plan is, or is expected to be, in “endangered” or “critical” status, within the meaning of Section 305 of ERISA.

“ERISA Plan” means any employee pension benefit plan (other than a Multiemployer Plan) that is covered by Title IV of ERISA, and in respect of which Borrower or any ERISA Affiliate is (or, if such plan were terminated, would under Section 4069 of ERISA be deemed to be) an “employer” has the meaning given to such term in Section 3(5) of ERISA.

“Erroneous Payment” has the meaning given to such term in Section 9.24(a).

“Erroneous Payment Deficiency Assignment” has the meaning given to such term in Section 9.24(d)(i).

“Erroneous Payment Impacted Class” has the meaning given to such term in Section 9.24(d)(i).

“Erroneous Payment Return Deficiency” has the meaning given to such term in Section 9.24(d)(i).

“Erroneous Payment Subrogation Rights” has the meaning given to such term in Section 9.24(e).

“Event of Abandonment” means (i) (A) the actual abandonment of the Recycling Facility or (B) the entry of an injunction, judgment or decree by a Governmental Authority against the Borrower requiring the actual abandonment of the Recycling Facility or all or substantially all of the activities related to the development, construction, conversion, or operation of the Recycling Facility, and such injunction, judgment or decree is not effectively stayed for a period of sixty (60) consecutive days, (ii) the suspension or cessation of, or the entry of an injunction, judgment or decree against the Borrower requiring the suspension or cessation of, all or substantially all of the activities related to the development, construction, conversion, or operation of the Recycling Facility, in each case, for a period in excess of sixty (60) consecutive days unless the Borrower demonstrates to the Agent’s reasonable satisfaction that (A) such cessation or suspension of operations has occurred by reason of force majeure and the Borrower has consented to the cessation or suspension of operations by reason of such force majeure; or (iii) a formal, public announcement by the Borrower of a decision to permanently abandon or indefinitely defer or suspend the development, construction, conversion or operation of the Recycling Facility for any reason.

“Event of Default” means any of the events specified in Article VII; provided that any requirement for the giving of notice, the lapse of time, or both, has been satisfied.

“Exchange Act” means the Securities Exchange Act of 1934, as amended.

| 10 |

“Excluded Assets” means:

(a) any of any Loan Party’s rights or interests in or under any property to the extent that, and only for so long as, such grant of a security interest (i) requires a consent of a Governmental Authority with jurisdiction over such property that is required pursuant to any applicable law of such Governmental Authority and such consent has not been obtained by the Loan Party or (ii) is prohibited by, or constitutes a breach or default under or results in the termination of or requires any consent (other than the consent of any Loan Party) not obtained under, any contract license, agreement, instrument or other document, in each case, that directly evidences or gives rise to such property; provided, that any of the foregoing exclusions shall not apply if (A) such prohibition has been waived or such other party has otherwise consented to the creation hereunder of a security interest in such asset or (B) such prohibition, consent or term in such contract, license, agreement, instrument or other document providing for such prohibition breach, default or termination or requiring such consent is ineffective or would be rendered ineffective under any requirement of a Governmental Authority, including pursuant to Section 9-406, 9-407, 9-408 or 9-409 of Article 9 of the Uniform Commercial Code;

(b) any real property that is not Material Real Property (including, as of the Closing Date, property in Nye County, Nevada, consisting of approximately 113.73 acres and bearing Assessor’s Parcel Number 013- 841-01 and commonly known as Xxxx Ranch and the Recycling Facility);

(c) any Vehicles or Equipment (as defined in the UCC) to the extent that such Vehicles or Equipment (a) is not located on Material Real Property and (b) has not been moved from Material Real Property or otherwise Disposed in a manner not permitted by this Credit Agreement, the Guarantee and Security Agreement and the other Loan Documents; provided, however, in no event shall the Equipment listed on Schedule 1.1(a) constitute Excluded Assets;

(d) any Intellectual Property;

(e) any Capital Stock of any Loan Party;

(f) real property interests and mining claims located in Xxx and Xxxxxxxxx Counties, Nevada, and in Inyo County, California, in each case, to the extent not involved in the recycling of lithium ion batteries; and

(g) any and all water rights or water-related rights owned by any Loan Party.

provided further that it is understood, for the avoidance of doubt, that immediately upon any of the foregoing becoming or being rendered ineffective or any such prohibition, requirement for consent or term lapsing or terminating or such consent being obtained, the applicable Loan Party shall be deemed to have granted a Lien in all its rights, title and interests in and to such property.

“Excluded Taxes” means any of the following Taxes imposed on or with respect to a Recipient or required to be withheld or deducted from a payment to a Recipient: (a) Taxes imposed on or measured by net income (however denominated), franchise Taxes, and branch profits Taxes, in each case, (i) imposed as a result of such Recipient being organized under the laws of, or having its principal office or, in the case of any Lender, its applicable lending office located in, the jurisdiction imposing such Tax (or any political subdivision thereof) or (ii) that are Other Connection Taxes, (b) in the case of a Lender, U.S. federal withholding Taxes imposed on amounts payable to or for the account of such Lender with respect to an applicable interest in a Loan pursuant to a law in effect on the date on which (i) such Lender acquires such interest in the Loan (other than pursuant to an assignment request by the Borrower under Section 2.15) or (ii) such Lender changes its lending office, except in each case to the extent that, pursuant to Section 2.12, amounts with respect to such Taxes were payable either to such Lender’s assignor immediately before such Lender became a party hereto or to such Lender immediately before it changed its lending office, (c) Taxes attributable to such Recipient’s failure to comply with Section 2.12(e) and (d) any U.S. federal withholding Taxes imposed under FATCA.

| 11 |

“FATCA” means Sections 1471 through 1474 of the Code, as of the date of this Agreement (or any amended or successor version that is substantively comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof, any agreements entered into pursuant to Section 1471(b)(1) of the Code and any fiscal or regulatory legislation, rules or practices adopted pursuant to any intergovernmental agreement, treaty or convention among Governmental Authorities entered into in connection with the implementation of the foregoing.

“FCPA” has the meaning given to such term in Section 3.16(c).

“Federal Funds Rate” means, for any day, the greater of (a) the rate calculated by the SOFR Administrator based on such day’s Federal funds transactions by depositary institutions (as determined in such manner as the SOFR Administrator shall set forth on its public website from time to time) and published on the next succeeding Business Day by the SOFR Administrator as the Federal funds effective rate and (b) 0%.

“Floor” means a rate of interest equal to 1.00%

“Foreign Lender” means any Lender that is not a U.S. Person.

“Funding Office” means the office specified from time to time by Agent as its funding office by notice to Xxxxxxxx and the Lenders.

“GAAP” means generally accepted accounting principles in the United States of America as in effect from time to time.

“Governmental Authority” means any nation or government, any state or other political subdivision thereof and any entity exercising executive, legislative, judicial, taxing, regulatory or administrative functions of or pertaining to government, any province, commonwealth, territory, possession, county, parish, town, township, village or municipality, whether now existing or hereafter constituted or existing.

“Granting Lender” has the meaning given to such term in Section 9.7(g).

“Guarantee and Security Agreement” means the Guarantee and Security Agreement to be executed and delivered by Xxxxxxxx, each other party identified as a “Guarantor” or “Grantor” on the signature pages thereto and Agent, substantially in the form of Exhibit D.

| 12 |

“Guarantee Obligation” means, as to any Person (the “guaranteeing person”), any obligation of (a) the guaranteeing person or (b) another Person (including any bank under any letter of credit), if to induce the creation of such obligation of such other Person, the guaranteeing person has issued a reimbursement, counterindemnity or similar obligation, in either case guaranteeing or in effect guaranteeing any Indebtedness, leases, dividends or other obligations (the “primary obligations”) of any other third Person (the “primary obligor”) in any manner, whether directly or indirectly, including any obligation of the guaranteeing person, whether or not contingent, (w) to purchase any such primary obligation or any Property constituting direct or indirect security therefor, (x) to advance or supply funds (i) for the purchase or payment of any such primary obligation or (ii) to maintain working capital or equity capital of the primary obligor or otherwise to maintain the net worth or solvency of the primary obligor, (y) to purchase Property, securities or services, in each case, primarily for the purpose of assuring the owner of any such primary obligation of the ability of the primary obligor to make payment of such primary obligation or (z) otherwise to assure or hold harmless the owner of any such primary obligation against loss in respect thereof; provided that the term Guarantee Obligation shall not include endorsements of instruments for deposit or collection in the ordinary course of business. The amount of any Guarantee Obligation of any guaranteeing person shall be deemed to be the lower of (I) an amount equal to the stated or determinable amount of the primary obligation in respect of which such Guarantee Obligation is made and (II) the maximum amount for which such guaranteeing person may be liable pursuant to the terms of the instrument embodying such Guarantee Obligation, unless such primary obligation and the maximum amount for which such guaranteeing person may be liable are not stated or determinable, in which case the amount of such Guarantee Obligation shall be such guaranteeing person’s maximum reasonably anticipated liability in respect thereof as determined by Borrower in good faith.

“Guarantor” means each Person who is a party as a “Guarantor” and “Grantor” to the Guarantee and Security Agreement, including each Subsidiary of the Borrower that becomes a Guarantor pursuant to Section 5.11.

“Hedging Agreement” means, with respect to any Person, (a) any transaction (including an agreement with respect to any such transaction) now existing or hereafter entered into by such Person that is a rate swap transaction, swap option, basis swap, forward rate transaction, commodity swap, commodity option, equity or equity index swap or option, bond option, interest rate option, foreign exchange transaction, cap transaction, floor transaction, collar transaction, currency swap transaction, cross-currency rate swap transaction, currency option, spot transaction, credit protection transaction, credit swap, credit default swap, credit default option, total return swap, credit spread transaction, repurchase transaction, reverse repurchase transaction, buy/sell-back transaction, securities lending transaction, or any other similar transaction (including any option with respect to any of these transactions) or any combination thereof, whether or not any such transaction is governed by or subject to any master agreement, and (b) any and all agreements of any kind, and the related confirmations, which are subject to the terms and conditions of, or governed by, any form of master agreement published by the International Swaps and Derivatives Association, Inc., any International Foreign Exchange Master Agreement, or any other master agreement (any such master agreement, together with any related schedules, a “Master Agreement”), including any such obligations or liabilities under any Master Agreement.

“Highest Lawful Rate” means, with respect to each Lender, the maximum nonusurious interest rate, if any, that at any time or from time to time may be contracted for, taken, reserved, charged or received on the Loan or on other Indebtedness under laws applicable to such Lender which are presently in effect or, to the extent allowed by law, under such applicable laws which may hereafter be in effect and which allow a higher maximum nonusurious interest rate than applicable laws allow as of the date hereof.

“Illegality Notice” has the meaning given to such term in Section 2.17(b).

“Indebtedness” of any Person at any date, means, without duplication:

(a) all indebtedness of such Person for borrowed money,

(b) all obligations of such Person for the deferred purchase price of Property or services (other than trade accounts and accrued expenses payable in the ordinary course of business and not outstanding for more than 90 days past the original invoice date or the billing date thereof, or if overdue more than 90 days, as to which a dispute exists and adequate reserves in conformity with GAAP have been established on the books of such Person),

(c) all obligations of such Person evidenced by notes, bonds, debentures or other similar instruments,

| 13 |

(d) all indebtedness created or arising under any conditional sale or other title retention agreement with respect to Property acquired by such Person (even though the rights and remedies of the seller or lender under such agreement in the event of default are limited to repossession or sale of such Property),

(e) all Capital Lease Obligations of such Person,

(f) all obligations of such Person, contingent or otherwise, as an account party or applicant under acceptance, letter of credit or similar facilities,

(g) all obligations of such Person in respect of Disqualified Stock of such Person,

(h) all Guarantee Obligations of such Person in respect of obligations of another Person of the kind referred to in clauses (a) through (g) above;

(i) all obligations of the kind referred to in clauses (a) through (h) above secured by (or for which the holder of such obligation has an existing right, contingent or otherwise, to be secured by) any Lien on Property (including accounts and contract rights) owned by such Person, whether or not such Person has assumed or become liable for the payment of such obligation; and

(j) all obligations (netted, to the extent provided for therein) of such Person in respect of Hedging Agreements arising in connection with or as a result of early or premature termination of a Hedging Agreement, whether or not occurring as a result of a default thereunder.

The Indebtedness of a Person shall include the Indebtedness of any other Person (including any partnership in which such Person is a general partner) to the extent such Person is liable therefor as a result of such Person’s ownership interest in or other relationship with such entity, except to the extent the terms of such Indebtedness expressly provide that such Person is not liable therefor.

“Indemnified Liabilities” has the meaning given to such term in Section 9.6(a).

“Indemnified Taxes” means (a) Taxes, other than Excluded Taxes, imposed on or with respect to any payment made by or on account of any obligation of the Borrower under any Loan Document, (b) to the extent not otherwise described in (a), Other Taxes and (c) Taxes imposed as a result of a change in applicable law on or with respect to any Recipient’s loans, loan principal, letters of credit, commitments, or other obligations, or its deposits, reserves, other liabilities or capital attributable thereto that would not otherwise be Indemnified Taxes without regard to this clause (c) (other than (i) Taxes described in clauses (b) through (d) of the definition of Excluded Taxes and (ii) Connection Income Taxes).

“Indemnitee” has the meaning given to such term in Section 9.6(a).

“Independent Accountants” means Xxxxxx LLP, Deloitte & Touche, LLP, Ernst & Young LLP, KPMG LLP, PricewaterhouseCoopers LLP or such other independent certified public accountants reasonably acceptable to Agent.

“Initial Monthly Payment Date” means the earlier of (a) November 17, 2023 and (b) the last Business Day of the calendar month following the month in which the Commercial Operations Date had occurred.

“Initial Supply Contracts” means each supply contract relating to the sale or provision of feedstock for the production of Black Mass to which any Loan Party is party or bound on the Closing Date.

| 14 |

“Initial Term Lender” means, as of any date of determination, each Lender having an Initial Term Loan Commitment or that holds Initial Term Loans.

“Initial Term Loans” means the loans made by the Initial Term Lenders to the Borrower pursuant to Section 2.2.

“Initial Term Loan Commitment” means, as to any Lender, the obligation of such Lender, if any, to make an Initial Term Loan to Borrower hereunder in a principal amount not to exceed the amount set forth under the heading “Initial Term Loan Commitment” opposite such Lender’s name on Schedule 1.1(b) hereto, or, as the case may be, in the Assignment and Acceptance pursuant to which such Lender became a party hereto, as the same may be reduced from time to time pursuant to Section 2.1. The original aggregate amount of the Initial Term Loan Commitments is $6,000,000.

“Intellectual Property” means the collective reference to all rights, priorities and privileges relating to intellectual property, whether arising under United States, state, multinational or foreign laws or otherwise, including copyrights, copyright licenses, patents, patent licenses, trademarks, trademark licenses, service-marks, technology, know-how and processes, licenses or rights to use databases, geological data, geophysical data, engineering data, seismic data, maps, interpretations and other technical information, recipes, formulas, trade secrets and all rights to sue at law or in equity for any infringement or other impairment thereof, including the right to receive all proceeds and damages therefrom.

“Interest Payment Date” means (a) the last day of each March, June, September and December (commencing with the Fiscal Quarter ending June 30, 2023) and (b) the Maturity Date.

“Interest Period” means (a) initially, the period commencing on the Closing Date and ending on the next succeeding Interest Payment Date, (b) each subsequent period commencing on the day after the last Interest Payment Date and ending on the next succeeding Interest Payment Date and (c) the period commencing on the first day of the Fiscal Quarter during which the Maturity Date occurs and ending on the Maturity Date.

“Interest Rate” means (x) in respect of a SOFR Loan, a rate equal to Adjusted Term SOFR Rate plus the Applicable Margin and (y) in respect of an ABR Loan, a rate equal to ABR plus the Applicable Margin.

“Investment” for any Person means:

(a) the acquisition (whether for cash, Property of such Person, services or securities or otherwise) of Capital Stock, bonds, notes, debentures, debt securities, partnership or other ownership interests or other securities of, or any Property constituting an ongoing business of, or the making of any capital contribution to, any other Person or any agreement to make any such acquisition or capital contribution (unless the Obligations will be refinanced at par in connection with the consummation of the transactions contemplated by such agreement),

(b) the purchase or other acquisition (in one or a series of transactions ) of all or substantially all of the property and assets of business of another Person or assets constituting a business unit, line of business or division of such Person,

(c) the making of any advance, loan or other extension of credit to, any other Person (including the purchase of Property from another Person subject to an understanding or agreement, contingent or otherwise, to resell such Property to such Person, but excluding any such advance, loan or extension of credit having a term not exceeding 90 days representing the purchase price of inventory or supplies sold in the ordinary course of business),

| 15 |

(d) the entering into of any Guarantee of, or other Contingent Obligation with respect to, Indebtedness or other liability of any other Person, and

(e) any other investment that would be classified as such on a balance sheet of such Person in accordance with GAAP.

“Invoice Deduction” has the meaning given to such term in Section 2.9.

“IRS” means the U.S. Internal Revenue Service.

“Lenders” has the meaning given to such term in the preamble hereto.

“Lien” means any mortgage, pledge, hypothecation, collateral assignment, deposit arrangement (other than deposit accounts of a Loan Party), encumbrance, lien (statutory or other), charge or other security interest or any preference, priority or other security agreement or preferential arrangement of any kind or nature whatsoever intended to assure payment or performance of any Indebtedness or other obligation (including any conditional sale or other title retention agreement, the interest of a lessor under a Capital Lease, any financing lease having substantially the same economic effect as any of the foregoing and the filing of any financing statement under the UCC or comparable law of any jurisdiction naming the owner of the asset to which such Xxxx relates as debtor).

“Loan Documents” means this Agreement, the Security Documents, the Notes, the Marketing Agreement and each certificate, agreement, instrument, waiver, consent or document executed by a Loan Party and delivered to Agent or any Lender in connection with or pursuant to any of the foregoing. Any reference in this Agreement or any other Loan Document to a Loan Document shall include all appendices, exhibits or schedules thereto, and all amendments, restatements, amendments and restatements, supplements or other modifications thereto, and shall refer to this Agreement or such Loan Document as the same may be in effect at any and all times such reference becomes operative.

“Loan Parties” means Borrower and each Guarantor.

“Loans” means, collectively, the Initial Term Loans and the Delayed Draw Term Loans and “Loan” means any of the foregoing.

“Marketer” means Mercuria Energy America LLC, or its assignee as the Marketer under the marketing Agreement, which assignee may be, but is not limited to, being a Mercuria Party.

“Marketing Agreement” means that certain Marketing Agreement, dated as of the date hereof, between the Borrower, as ABTC and Mercuria Energy America, LLC, as MM.

“Master Agreement” has the meaning given to such term in the definition of “Hedging Agreement”.

“Material Adverse Effect” means a material adverse effect on any of (a) the business, assets, property or condition (financial or otherwise) of the Loan Parties taken as a whole, (b) the value of the Collateral, (c) the legality, validity or enforceability of this Agreement or any of the other Loan Documents or the rights or remedies of Agent or the Lenders hereunder or thereunder, (d) the perfection or priority of the Liens granted pursuant to the Security Documents or (e) the ability of Borrower to repay the Obligations or of the Loan Parties to perform their obligations under the Loan Documents.

| 16 |

“Material Contract” has the meaning given to such term in Section 3.25(i).

“Material Environmental Amount” means an amount or amounts payable or reasonably likely to become payable by any Loan Party or any of its Subsidiaries, in the aggregate in excess of $500,000, for costs to comply with or any liability under any Environmental Law, failure to obtain or comply with any Environmental Permit, costs of any investigation, and any remediation, of any Release of Materials of Environmental Concern, and any other cost or liability, including compensatory damages (including damages to natural resources), punitive damages, fines, and penalties pursuant to any Environmental Law.

“Material Real Property” means (a) on the Closing Date, (i) 000 Xxxxx Xxxx, (ii) 000 Xxxxx Xxxx and (iii) 000 Xxxx Xxxxxx Xxxxx and (b) after the Closing Date, such other real Property of the Borrower or any Subsidiary of the Borrower that is required to become Collateral in accordance with Section 5.11(b) or any other provision hereunder or that is added as Collateral by mutual agreement of the Borrower and the Agent.

“Materials of Environmental Concern” means any petroleum or petroleum products, polychlorinated biphenyls, natural gas or natural gas products, asbestos, per- and polyfluoroalkyl substances, pollutants, contaminants, radioactive materials, hazardous materials, hazardous substances and hazardous wastes, toxic substances, and any other substances or materials of any kind, whether or not any such substance or material is defined as hazardous or toxic under any Environmental Law, that is regulated pursuant to or could give rise to liability under any Environmental Law.

“Maturity Date” means March 17, 2025. “Maximum DDTL Amount” means $14,000,000.

“Mercuria Party” means Mercuria Investments US, Inc., Mercuria Energy America, LLC, Xxxxxxxx Xxxxx HoldCo 1, LLC or any Affiliate of the foregoing.

“MIPA” means that certain Second Amended and Restated Membership Interest Purchase Agreement, dated as of April 21, 2023, between the Borrower and the Seller.

“Monthly Payment Date” means (a) with respect to the Initial Term Loans, (i) the Initial Monthly Payment Date and (ii) the last Business Day of each of the following calendar months after the Initial Monthly Payment Date on and before the twelfth month after the Closing Date and (b) with respect to any Delayed Draw Term Loans, (i) the last Business Day of the month pursuant to which such Delayed Draw Term Loans were borrowed and (ii) the last Business Day of each of the nine (9) months thereafter (or, if there are less than nine (9) months on or prior to the Maturity Date at the time such Delayed Draw Term Loans were borrowed, then each of such remaining months).

“Moody’s” means Xxxxx’x Investors Service, Inc., or its successor. “Mortgage Policies” has the meaning given to such term in Section 5.11(b)(ii).

“Mortgaged Properties” means each of the Real Properties then owned by the Loan Parties listed on Schedule 1.1(c), together with any other Real Property constituting Collateral which Borrower or any of its Subsidiaries may hereafter acquire (but excluding any Real Property disposed of by the Loan Parties in accordance with this Agreement), in each case as to which Agent for the benefit of the Secured Parties is granted a Lien pursuant to one or more Mortgages in accordance with the Loan Documents.

| 17 |

“Mortgages” means each of the mortgages and deeds of trust made by any Loan Party in favor of, or for the benefit of, Agent for the benefit of the Secured Parties, substantially in the form of Exhibit E (with such changes thereto as shall be advisable under the law of the jurisdiction in which such mortgage or deed of trust is to be recorded), which form is acceptable to Agent.

“Multiemployer Plan” means a “multiemployer plan” (has the meaning given to such term in Section 4001(a)(3) of ERISA) that is contributed to by Borrower or any ERISA Affiliate.

“Net Cash Proceeds” means, (a) in connection with any Asset Sale, the proceeds thereof in the form of cash and Cash Equivalents (including any such proceeds received by way of deferred payment of principal pursuant to a note or installment receivable or purchase price adjustment receivable or otherwise, but only as and when received) of such Asset Sale, net of (i) amounts required to be applied to the repayment of Indebtedness secured by a Lien expressly permitted hereunder on any asset that is the subject of such Asset Sale (other than any Lien pursuant to a Security Document), (ii) in the case of an Asset Sale, attorneys’ fees, accountants’ fees, investment bank fees and other reasonable and customary fees and expenses actually incurred in connection therewith and (iii) taxes paid or reasonably estimated to be payable as a result thereof (after taking into account any available tax credits or deductions and any tax sharing arrangements); and (b) in connection with any issuance or sale of debt securities or instruments or the incurrence of Indebtedness for borrowed money, the cash proceeds received from such issuance, sale or incurrence, net of attorneys’ fees, accountants’ fees, investment bank fees, underwriting discounts and commissions and other reasonable and customary fees and expenses actually incurred in connection therewith.

“Note” has the meaning given to such term in Section 2.5(f).

“Obligations” means the unpaid principal of and interest on (including interest accruing after the maturity of the Loan and interest accruing after the filing of any petition in bankruptcy, or the commencement of any insolvency, reorganization or like proceeding, relating to any Loan Party, whether or not a claim for post-filing or post-petition interest is allowed in such proceeding) the Loan, the obligations of any Loan Party owed to Agent or Lender (or affiliate thereof) pursuant to the Marketing Agreement and all other obligations and liabilities of any Loan Party to Agent or to any Lender or other Secured Party, whether direct or indirect, absolute or contingent, due or to become due, or now existing or hereafter incurred, which may arise under, out of, or in connection with, this Agreement, any other Loan Document, or any other document made, delivered or given in connection herewith or therewith, whether on account of principal, interest, fees, reimbursement obligations, indemnities, costs, expenses (including all fees, charges and disbursements of counsel to Agent or to any Lender that are required to be paid by any Loan Party pursuant hereto) or otherwise.

“OFAC” has the meaning given to such term in Section 3.16(b).

“OID” has the meaning given to such term in Section 2.16.

“Operating Expenses” shall mean (a) the projected operating and maintenance costs and expenses of the operations and facilities (including the Recycling Facility and the other Material Real Property) of the Borrower and its Subsidiaries, including all labor, utilities, property taxes, feedstock and other costs and (b) the projected administrative, management and overhead costs and expenses of the Borrower and its Subsidiaries (including (i) franchise and similar Taxes and other fees, Taxes and expenses required to maintain their corporate existence and any amounts related to any Tax penalties and examinations, (ii) indemnity payments in connection with their management and maintenance, (iii) amounts relating to insurance (including the costs of premiums and deductibles and brokers’ expenses), (iv) amounts related to obtaining and maintaining any governmental approvals and (v) legal, accounting, general administrative and other overhead costs and expenses and professional fees (including fees associated with any audit)).

| 18 |

“Other Connection Taxes” means, with respect to any Recipient, Taxes imposed as a result of a present or former connection between such Recipient and the jurisdiction imposing such Tax (other than connections arising from such Recipient having executed, delivered, become a party to, performed its obligations under, received payments under, engaged in any other transaction pursuant to or enforced any Loan Document, or sold or assigned an interest in the Loan or Loan Document).

“Other Taxes” means all present or future stamp, court or documentary, intangible, recording, filing or similar Taxes that arise from any payment made under, from the execution, delivery, performance, enforcement or registration of, from the receipt or perfection of a security interest under, or otherwise with respect to, any Loan Document, except any such Taxes that are Other Connection Taxes imposed with respect to an assignment.

“Participant” has the meaning given to such term in Section 9.7(b).

“Participant Register” has the meaning given to such term in Section 9.7(b).

“Patriot Act” has the meaning given to such term in Section 9.20.

“Payment in Full” means the Commitments have expired or been terminated and the principal of and interest on each Loan and all fees payable hereunder and all other Obligations (other than indemnities and other contingent obligations not then due and payable and as to which no claim has been made and) shall have been paid in full in cash.

“Payment Office” means the office specified from time to time by Agent as its payment office by notice to Borrower and the Lenders; provided all payments becoming due and payable under the Loan Documents or on any Note must be made in New York, New York by wire transfer to a bank and account located in the State of New York specified by Agent. Agent may at any time, by notice to Borrower, change the place of payment of any such payments so long as such place of payment is in the State of New York.

“Payment Recipient” has the meaning given to such term in Section 9.24(a).

“Permits” means the collective reference to (i) Environmental Permits, and (ii) any and all other franchises, licenses, leases, permits, approvals, consents, notifications, certifications, registrations, authorizations, exemptions, variances, qualifications, easements and rights of way of any Governmental Authority or third party.

“Permitted Indebtedness” has the meaning given to such term in Section 6.2.

“Permitted Liens” means the collective reference to (a) in the case of Collateral other than Pledged Stock, Liens permitted by Section 6.3 and (b) in the case of Collateral consisting of Pledged Stock, (i) Liens created under the Loan Documents and (ii) non-consensual Liens permitted by Section 6.3 to the extent arising by operation of law.

“Person” means an individual, partnership, corporation, limited liability company, business trust, joint stock company, trust, unincorporated association, joint venture, Governmental Authority or other entity of whatever nature.

| 19 |

“Pledged Stock” has the meaning given to such term in the Guarantee and Security Agreement.

“Prepayment Date” means, with respect to any prepayment pursuant to Sections 2.7 or 2.8, the date of such prepayment.

“Prime Rate” means a fluctuating interest rate per annum as shall be in effect from time to time equal to the rate of interest published as the prime rate by The Wall Street Journal. Any change in such rate published by The Wall Street Journal shall take effect at the opening of business on the day specified in the publication of such change.

“Pro Forma Balance Sheet” has the meaning given to such term in Section 3.1(a).

“Projections” has the meaning given to such term in Section 5.3(c).

“Property” means any right or interest in or to property of any kind whatsoever, whether real, personal or mixed and whether tangible or intangible. Unless otherwise qualified, all references to Property in this Agreement shall refer to a Property or Properties of the Loan Parties and their Subsidiaries.

“Qualified Replacement Party” means, with respect to any Replacement Material Contract, a Person that has at least substantially similar credit quality (or is otherwise credit supported so that the credit risk of such counterparty is not materially less favorable to the Loan Parties than the existing counterparty) and experience as the counterparty to the Relevant Material Contract that such Person is replacing (measured based on such counterparty’s credit quality and experience on the date on which it entered into the Relevant Material Contract being replaced).

“Qualifying Black Mass” means Black Mass meeting the specification set forth on Schedule 1.1(d).

“Real Property” means the surface, leasehold and other real property rights and interests owned, leased or otherwise held by any Loan Party or its Subsidiaries, including, without limitation, Mortgaged Properties.

“Recipient” means (a) the Agent or (b) any Lender, as applicable.

“Recycling Facility” means that certain battery recycling facility, located in Storey County, Nevada, and having an address of 0000 Xxxx Xxxxx, XxXxxxxx, Xxxxxx, consisting of Real Property, equipment and other Property pursuant to which the Loan Parties intend to recycle lithium-ion batteries into Black Mass.