MASTER SHARE PURCHASE AGREEMENT

Exhibit 4.33

MASTER SHARE PURCHASE AGREEMENT

DATED: 1 APRIL 2021

BETWEEN

RADIANCE RENEWABLES PRIVATE LIMITED

AND

AZURE POWER ROOFTOP PRIVATE LIMITED

AND

AZURE POWER INDIA PRIVATE LIMITED

AND

THE ENTITIES LISTED IN SCHEDULE 1

|

1. |

|

DEFINITIONS AND PRINCIPLES OF INTERPRETATION |

|

5 |

|

2. |

|

SALE AND PURCHASE OF SALE SHARES AND BALANCE RG SALE SHARES |

|

23 |

|

3. |

|

CONSIDERATION |

|

25 |

|

4. |

|

CONDITIONS PRECEDENT |

|

31 |

|

5. |

|

BALANCE RG CONDITIONS PRECEDENT |

|

32 |

|

6. |

|

EXECUTION DATE ITEMS |

|

34 |

|

7. |

|

CONDUCT BETWEEN THE EXECUTION DATE AND THE CLOSING DATE |

|

34 |

|

8. |

|

CLOSING AND POST CLOSING COVENANTS |

|

38 |

|

9. |

|

RG CLOSING |

|

47 |

|

10. |

|

REPRESENTATIONS AND WARRANTIES |

|

48 |

|

11. |

|

INDEMNIFICATION |

|

50 |

|

12. |

|

SETTLEMENT OF GST REFUND AMOUNT AND AZ FORTY FOUR SUBSIDY ▇▇▇▇▇▇ |

|

▇▇ |

|

▇▇. |

|

ANNOUNCEMENTS AND CONFIDENTIALITY |

|

54 |

|

14. |

|

NOTICES |

|

55 |

|

15. |

|

FURTHER ASSURANCES AND UNDERTAKINGS |

|

56 |

|

16. |

|

ANTI BRIBERY AND ANTI CORRUPTION |

|

56 |

|

17. |

|

ASSIGNMENTS |

|

56 |

|

18. |

|

NON-SOLICITATION |

|

56 |

|

19. |

|

PAYMENTS |

|

57 |

|

20. |

|

GENERAL |

|

57 |

|

21. |

|

TERM AND ▇▇▇▇▇▇▇▇▇▇▇ |

|

▇▇ |

|

▇▇. |

|

GOVERNING LAW AND DISPUTE RESOLUTION |

|

59 |

|

SCHEDULE 1 |

|

81 |

||

|

SCHEDULE 2 |

|

83 |

||

|

SCHEDULE 3 |

|

86 |

||

|

SCHEDULE 4 |

|

89 |

||

|

SCHEDULE 5 |

|

90 |

||

|

SCHEDULE 6 |

|

95 |

||

|

SCHEDULE 7 |

|

97 |

||

|

SCHEDULE 8 |

|

126 |

||

|

SCHEDULE 9 |

|

127 |

||

|

SCHEDULE 10 |

|

131 |

||

|

SCHEDULE 11 |

|

134 |

||

|

SCHEDULE ▇▇ |

|

▇▇▇ |

||

|

▇▇▇▇▇▇▇▇ ▇▇ |

|

▇▇▇ |

||

|

SCHEDULE 14 |

|

164 |

||

1

|

|

165 |

|||

|

SCHEDULE 16 |

|

170 |

||

|

SCHEDULE 17 |

|

173 |

||

|

SCHEDULE 18 |

|

175 |

||

|

SCHEDULE 19 |

|

177 |

||

|

SCHEDULE 20 |

|

178 |

||

|

SCHEDULE 21 |

|

179 |

||

|

SCHEDULE 22 |

|

180 |

||

|

SCHEDULE 23 |

|

181 |

||

|

SCHEDULE 24 |

|

184 |

||

|

SCHEDULE 25 |

|

189 |

||

|

SCHEDULE 26 |

|

190 |

||

|

SCHEDULE 27 |

|

196 |

||

|

SCHEDULE 28 |

|

197 |

||

|

SCHEDULE 29 |

|

205 |

||

|

SCHEDULE 30 |

|

206 |

||

|

SCHEDULE 31 |

|

207 |

||

|

SCHEDULE ▇▇ |

|

▇▇▇ |

||

|

▇▇▇▇▇▇▇▇ ▇▇ |

|

▇▇▇ |

||

|

EXHIBIT A |

|

212 |

||

|

EXHIBIT B |

|

214 |

||

|

EXHIBIT C |

|

216 |

||

|

EXHIBIT D |

|

217 |

||

|

EXHIBIT E |

|

218 |

||

2

MASTER SHARE PURCHASE AGREEMENT

This master share purchase agreement (“Agreement”) is made on this 1st day of April 2021 (“Execution Date”) in New Delhi by and amongst:

|

(1) |

RADIANCE RENEWABLES PRIVATE LIMITED, a private limited company incorporated under the laws of India, having CIN U74999MH2018PTC308291 and having its registered office at One Indiabulls Centre, 16th ▇▇▇▇▇, ▇▇▇▇▇ ▇▇, ▇▇▇▇▇▇▇▇ ▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇▇▇▇▇▇ ▇▇▇▇ Mumbai – 400 013 (hereinafter referred to as the “Purchaser”, which expression shall, unless it be repugnant to the subject or context thereof, be deemed to mean and include its successors and permitted assigns); |

AND

|

(2) |

AZURE POWER ROOFTOP PRIVATE LIMITED, a private limited company incorporated and existing under the laws of India, having CIN U40108DL2017FTC315574 and having its registered office at 5th Floor, Southern Park, D-II, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ - ▇▇▇▇▇▇ (hereinafter referred to as “AZR”, which expression shall, unless it be repugnant to the subject or context thereof, be deemed to mean and include its successors and permitted assigns); |

AND

|

(3) |

AZURE POWER INDIA PRIVATE LIMITED, a private limited company incorporated and existing under the laws of India, having CIN U40106DL2008PTC174774 and having its registered office at 5th Floor, Southern Park, D-II, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ - ▇▇▇▇▇▇ (hereinafter referred to as “AZI”, which expression shall, unless it be repugnant to the subject or context thereof, be deemed to mean and include its successors and permitted assigns); |

AND

|

(4) |

THE ENTITIES LISTED IN SCHEDULE 1, having such details as set out in Schedule 1 (hereinafter referred to as “Schedule 1 Entities”, which expression shall, unless it be repugnant to the subject or context thereof, be deemed to mean and include their successors and permitted assigns). |

AZR and AZI are collectively referred to as “Sellers” and individually as a “Seller”. The Schedule 1 Entities, the Purchaser, and the Sellers are collectively referred to as the “Parties” and individually as a “Party”.

WHEREAS:

|

(A) |

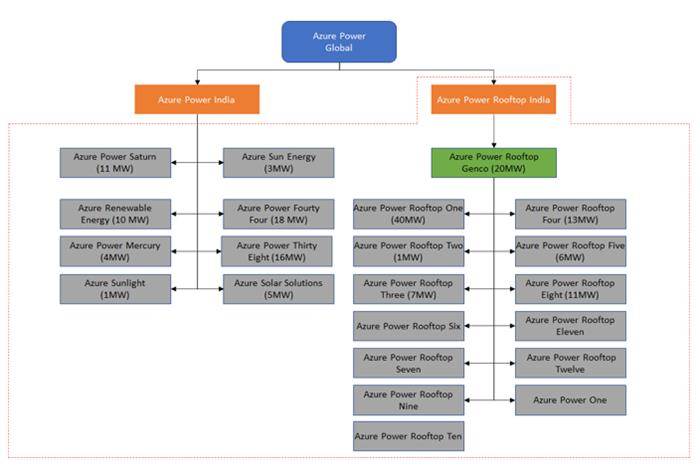

AZR and AZI have incorporated the Group SPVs (as defined hereinafter) as their wholly owned subsidiaries, as more particularly set out in the group structure set out in Part A of Schedule 2 and having the share capital details as set out under Schedule 13, for undertaking, executing, developing, operating and maintaining solar power projects in India. The portfolio of the entire 152.47 MW solar PV assets developed or under construction comprises of 1,247 sites that are owned, operated and maintained by AZI (indirectly through the AZI SPVs (as defined hereinafter)) and AZR (indirectly through AZR Genco and the AZR SPVs (as defined hereinafter)), details of which assets are set out under Part B of Schedule 2 (“Project Assets”). |

|

(B) |

The Purchaser is a wholly owned subsidiary of the Green Growth Equity Fund, an alternative investment fund managed by EverSource Capital and is engaged in the business of development, construction, operation and maintenance of solar power plants in India. |

3

|

and as part of the overall transaction, the Purchaser proposes to acquire the following (on a Fully Diluted Basis (as defined hereinafter)), |

|

|

(i) |

entire equity ownership of AZI SPVs directly, of which 100% (One Hundred Percent) of the equity ownership of the AZI SPVs (other than the RG SPVs) will be acquired on Closing Date, and 100% (One Hundred Percent) of the equity ownership of the RG SPVs will be acquired in 2 (two) tranches with 48.6% (Forty Eight Point Six Percent) of the equity shares of the RG SPVs being acquired on the Closing Date (as defined hereinafter) and the remaining 51.4% (Fifty One Point Four Percent) of the equity shares of the RG SPVs being acquired on the RG Closing Date (as defined hereinafter); and |

|

|

(ii) |

100% (One Hundred Percent) of the equity ownership of AZR SPVs indirectly through acquisition of the entire equity ownership of AZR Genco on the Closing Date (collectively with acquisition of AZI SPVs, including the RG SPVs in two tranches as set out in Recital D and E below, referred to as the “Transaction”). |

|

(D) |

Due to share transfer restrictions under the RG2 Bond Documents (as defined hereinafter), AZI confirms that as on the Closing Date it only has the ability to transfer the First Tranche RG2 Sale Shares and the Purchaser proposes to acquire the First Tranche RG2 Sale Shares, on the Closing Date and the Balance RG2 Sale Shares, on the RG Closing Date in respect of the RG2 SPVs after the RG2 Notes (as defined hereinafter) are redeemed/ repaid in terms of the RG2 Bond Documents by the RG2 Long Stop Date, and subject to the terms and conditions stipulated under this Agreement. In furtherance thereof, AZI, each of the RG2 SPVs and the Purchaser have also agreed to enter into respective Shareholders’ Agreements (defined hereinafter) setting out the rights and obligations of the Purchaser and AZI as shareholders of the RG2 SPVs, effective from the Closing Date until the RG Closing Date in respect of the RG2 SPVs. |

|

(E) |

Additionally, due to the restrictions under the RG1 Bond Documents (as defined hereinafter), AZI confirms that as on the Closing Date it only has the ability to transfer the First Tranche RG1 Sale Shares and the Purchaser proposes to acquire First Tranche RG1 Sale Shares on the Closing Date and Balance RG1 Sale Shares, on the RG Closing Date in respect of the RG1 SPV, after the RG1 Notes (as defined hereinafter) are redeemed/ repaid in terms of the RG1 Bond Documents by the RG1 Long Stop Date and subject to the terms and conditions stipulated under this Agreement. In furtherance thereof, AZI, RG1 SPV and the Purchaser have agreed to enter into a Shareholders’ Agreement setting out the rights and obligations of the Purchaser and AZI as shareholders of the RG1 SPV, effective from the Closing Date until the RG Closing Date in respect of the RG1 SPV. |

|

(F) |

The Parties are now entering into this Agreement to define and record their mutual rights and obligations and set out the terms and conditions in relation to the sale and purchase of the Sale Shares and the Balance RG Sale Shares. |

4

NOW THEREFORE, in consideration of the promises and the mutual covenants set forth herein, the adequacy of which is acknowledged by the Parties to this Agreement, the Parties agree as follows.

IT IS AGREED as follows:

|

1.1 |

Definitions |

Wherever used in this Agreement, the following terms shall have the meanings assigned to them in this Clause 1.1:

“Accounting Standards” means Ind AS;

“Act” means the (Indian) Companies Act, 2013 as amended, modified, supplemented or re-enacted from time to time and/ or the Companies Act, 1956 (as applicable);

“Action” means any governmental or official investigation, inspection or enquiry by or before any Governmental Authority or otherwise, and shall include Litigations;

“Actual Senior Debt” shall mean the aggregate of the secured debt balances of each of the Group SPVs as of the Valuation Date, and determined as per the Management Accounts;

“Adjustment Notice” shall have the meaning given to it in Clause 3.3;

“Affiliate” with respect to any Person, means any other Person, that, alone or together with any other Person, either directly or indirectly Controls, is Controlled by or is under common Control with, such Person and in case of a Person being a natural person, shall in addition also include a ‘relative’ (as defined in the Act) of such Person and any Person Controlled by such “relative”. It is hereby clarified that “Affiliate”, in respect of the Purchaser, shall be deemed to include, any fund, collective investment scheme, trust, special purpose or other investment vehicle or entities, which is Controlled, managed and/or advised by Eversource Capital Private Limited or its Affiliates;

“Agreed Form” in relation to any document means the form, substance and content of such document that has been approved by or on behalf of the Sellers and the Purchaser, and where any other Person is also a party to such document, approved by or on behalf of such Person, and which has been initialled for the purpose of identification by the representatives of the Sellers and the Purchaser, and such other Person;

“Agreement” means this agreement, including the schedules, annexures and exhibits hereto, as amended or modified in writing from time to time;

“Anti-Corruption Obligation” shall have the meaning given to it in Clause 16;

“Applicable Law(s)” means and includes any statute, law, regulation, ordinance, rule, judgment, rule of law (including common law), order, decree, ruling, bye-law, approval of any Government Authority, circulars, directive, guideline, memoranda, policy, clearance, requirement or other governmental restriction or any similar form of decision of or determination by, or any interpretation or administration having the force of law of any of the foregoing by any competent authority having jurisdiction over the matter in question, and includes Approvals and Environment Laws;

“Approval” means any permit, permission, license, approval, exemptions, authorization, authentications, qualifications, designations, declarations, notifications, consent, grant, concession, certificates, Orders, warrants, decrees, confirmations, clearance, exemption or other authorization of whatever nature and by whatever name called which is, or is required to be, granted by any Government Authority and/or required for performance of/ compliance with any obligation or exercise of any right contained in this Agreement by the Parties to this Agreement or as required under Applicable Law, or from any Third Party under any contract or otherwise;

“Articles” means the articles of association of a company, as amended from time to time;

5

“Arm’s Length Basis” shall mean a transaction that is conducted between two parties as if they were unrelated, so that there is no conflict of interest, and that the terms of which are consistent with market practice and those actually made in comparable transactions between independent enterprises and/or third parties under comparable circumstances;

“Assets” means any and all assets and properties of every kind, nature, character, description (whether immovable, movable, tangible, intangible, absolute, accrued, fixed or otherwise) and as operated, hired, rented, owned or leased, including but not limited to Cash, cash equivalents, receivables, securities, accounts and note receivables, real estate, plant and machinery, equipment, intellectual property, raw materials, inventory, furniture, fixtures and insurance policies;

“Auditor” means the statutory auditor of the Group SPVs, as appointed from time to time;

“Auditor’s Certificate” shall mean a certificate provided by the Auditor confirming the items listed in Schedule 15 as of the Valuation Date;

“Authorization” has the meaning given to it in paragraph 2(a)(i) of Schedule 10; “Authority Warranties” shall have the meaning given to it in Clause 10.1;

“AZ Forty Four Subsidy Amount” shall have the meaning given to it in paragraph 1(a)(ii) Schedule 10;

“AZ Saturn” means Azure Power Saturn Private Limited, a private limited company incorporated and existing under the laws of India, having CIN U40300DL2014PTC274382 and having its registered office at ▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇▇▇ ▇▇▇▇, ▇-▇▇, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ – 110017;

“AZ Mercury” means Azure Power Mercury Private Limited, a private limited company incorporated and existing under the laws of India, having CIN U40100DL2014PTC273986 and having its registered office at ▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇▇▇ ▇▇▇▇, ▇-▇▇, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ – 110017;

“AZ Forty Four” means Azure Power Forty Four Private Limited, a private limited company incorporated and existing under the laws of India, having CIN U40300DL2017PTC311196 and having its registered office at ▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇▇▇ ▇▇▇▇, ▇-▇▇, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ – 110017;

“AZ Sun” means Azure Sun Energy Private Limited, a private limited company incorporated and existing under the laws of India, having CIN U40101DL2010PTC209417 and having its registered office at ▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇▇▇ ▇▇▇▇, ▇-▇▇, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ – 110017;

“AZ Thirty Eight” means Azure Power Thirty Eight Private Limited, a private limited company incorporated and existing under the laws of India, having CIN U40300DL2016PTC301837 and having its registered office at ▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇▇▇ ▇▇▇▇, ▇-▇▇, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ – 110017;

“AZ Sunlight” means Azure Sunlight Private Limited, a private limited company incorporated and existing under the laws of India, having CIN U40106DL2012PTC236099 and having its registered office at ▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇▇▇ ▇▇▇▇, ▇-▇▇, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ – 110017;

“AZ Solutions” means Azure Solar Solutions Private Limited, a private limited company incorporated and existing under the laws of India, having CIN U40106DL2012PTC236146 and having its registered office at ▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇▇▇ ▇▇▇▇, ▇-▇▇, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ – 110017;

“AZI Sale Shares” means 100% (One Hundred Percent) of the entire equity share capital of AZI SPVs as on the Closing Date on a Fully Diluted Basis, details of which as of the Execution Date are set out in Schedule 3, and will be updated after the determination of the Purchase Consideration (only to the extent of the additional equity shares issued to AZI on conversion of any Seller Group Loans into equity shares as per Clause 3.16) pursuant to Clause 3 and intimated in writing by the Sellers to the Purchaser pursuant to Clause 3.16;

“AZI SPVs” means AZ Saturn, AZ Mercury, AZ Forty Four, AZ Sun, RG1 SPV, AZ Thirty Eight, AZ Sunlight and AZ Solutions;

6

“AZR Genco” means Azure Power Rooftop Genco Private Limited, a private limited company incorporated and existing under the laws of India, having CIN U40100DL2017PTC315765 and having its registered office at 5th Floor, Southern Park, D-II, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ - ▇▇▇▇▇▇;

“AZR One” means Azure Power Rooftop One Private Limited, a private limited company incorporated and existing under the laws of India, having CIN U40300DL2017PTC316260 and having its registered office at 5th Floor, Southern Park, D-II, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ - ▇▇▇▇▇▇;

“AZR Two” means Azure Power Rooftop Two Private Limited, a private limited company incorporated and existing under the laws of India, having CIN U40300DL2017PTC316102 and having its registered office at 5th Floor, Southern Park, D-II, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ - ▇▇▇▇▇▇;

“AZR Four” means Azure Power Rooftop Four Private Limited, a private limited company incorporated and existing under the laws of India, having CIN U40106DL2017PTC317843 and having its registered office at 5th Floor, Southern Park, D-II, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ - ▇▇▇▇▇▇;

“AZR Five” means Azure Power Rooftop Five Private Limited, a private limited company incorporated and existing under the laws of India, having CIN U40106DL2017PTC317611 and having its registered office at 5th Floor, Southern Park, D-II, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ - ▇▇▇▇▇▇;

“AZR Six” means Azure Power Rooftop Six Private Limited, a private limited company incorporated and existing under the laws of India, having CIN U40106DL2017PTC317742 and having its registered office at 5th Floor, Southern Park, D-II, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ - ▇▇▇▇▇▇;

“AZR Seven” means Azure Power Rooftop Seven Private Limited, a private limited company incorporated and existing under the laws of India, having CIN U40200DL2017PTC317746 and having its registered office at 5th Floor, Southern Park, D-II, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ - ▇▇▇▇▇▇;

“AZR Eight” means Azure Power Rooftop Eight Private Limited, a private limited company incorporated and existing under the laws of India, having CIN U40200DL2017PTC324629 and having its registered office at 5th Floor, Southern Park, D-II, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇ - ▇▇▇▇▇▇;

“AZR Sale Shares” means 100% of the entire equity share capital of AZR Genco as on the Closing Date on a Fully Diluted Basis, details of which as of the Execution Date are set out in Part A of Schedule 3, and will be updated after the determination of the Purchase Consideration (only to the extent of the additional equity shares issued to AZR Genco on conversion of any Seller Group Loans into equity shares as per Clause 3.16) pursuant to Clause 3 and intimated in writing by the Sellers to the Purchaser pursuant to Clause 3.16;

“AZR Senior Lenders” means together, IFC, FMO, Proparco and OeEB;

“AZR SPVs” means collectively, AZR One, AZR Two, AZR Four, AZR Five and AZR Eight;

“AZR SPV Shares” means the 100% (One Hundred Percent) of the entire equity share capital of AZR SPVs on a Fully Diluted Basis, details of which as of the Execution Date are set out in Schedule 13;

“Azure Mauritius” means Azure Power Solar Energy Private Limited;

“Balance RG Conditions Precedent” means the conditions precedent to the sale and purchase of the Balance RG Sale Shares as set out in Schedule 6;

“Balance RG CP Completion Notice” shall have the meaning given to it in Clause 5.3; “Balance RG CP Satisfaction Notice” shall have the meaning given to it in Clause 5.4(a); “Balance RG CP Defects Notice” shall have the meaning given to it in Clause 5.4(b); “Balance RG Sale Consideration” shall have the meaning given to it in Clause 3.9;

“Balance ▇▇▇ ▇▇▇▇ Shares” means the Equity Shares constituting 51.4% (Fifty One Point Four Percent) of the entire paid-up share capital of RG1 SPV held by AZI, details of which as of the Execution Date are set out in Part D of Schedule 4, and will be updated after the determination of the Purchase Consideration (only to the extent of the additional equity shares issued to AZI on conversion of any Seller Group Loans into equity shares

7

as per Clause 3.16) pursuant to Clause 3 and intimated in writing by the Sellers to the Purchaser pursuant to Clause 3.16;

“Balance ▇▇▇ ▇▇▇▇ Shares” shall mean the Equity Shares constituting 51.4% (Fifty One Point Four Percent) of the entire paid-up share capital of each RG2 SPV held by AZI, details of which as of the Execution Date are set out in Part A, B, and C of Schedule 4, and will be updated after the determination of the Purchase Consideration (only to the extent of the additional equity shares issued to AZI on conversion of any Seller Group Loans into equity shares as per Clause 3.16) pursuant to Clause 3 and intimated in writing by the Sellers to the Purchaser pursuant to Clause 3.16;

“Balance RG Sale Shares” means the Balance RG1 Sale Shares and the Balance RG2 Sale Shares;

“Base Consideration” means an amount of INR 154,90,00,000 (Indian Rupees One Hundred and Fifty Four Crore Ninety Lakh);

“Bid Documents” means any requests for proposal, requests for selection or any other tender documents, bid submissions, letters of intent or project allotment documents or other such analogous documents, pursuant to which the Group SPVs have submitted any bids and/or executed any PPAs;

“Big Accounting Firm” means any of PricewaterhouseCoopers LLP, Deloitte Touche Tohmatsu Limited, Ernst & Young LLP, KPMG, ▇▇▇▇▇ ▇▇▇▇▇▇▇▇ or Binder Dijker ▇▇▇▇ (BDO);

“Board of Directors” or “Board” means the board of directors of the relevant Group SPV; “Bond Documents” shall mean the RG1 Bond Documents and the RG2 Bond Documents;

“Business Day” means a day (other than a Saturday or Sunday) on which banks are generally open in New Delhi and Mumbai for normal banking operations; and in the context of a payment being made to or from a bank in any other place, such other place;

“Business Warranties” shall have the meaning given to it in Clause 10.1;

“Business Approvals” shall have the meaning given to it in paragraph 7.1 of Part II of Schedule 7;

“Cash” means, in relation to each Group SPV, the aggregate of its cash in hand or credited to any account with any banking, financial, lending or other similar institution or organisation (and any accrued and outstanding interest thereon) and cash equivalents (liquid or easily realisable stocks, shares, bonds, treasury bills and other such securities) as recorded in the books of accounts of each of the Group SPVs that are free of lien, and shall include any balance in debt service reserve account maintained out of cash flows of any Group SPVs, principal reserves and cash reserves as on the relevant date;

“Cash Shortfall Amount” shall mean any amounts which have been infused by the Seller Group into any of the Group SPVs to fund any shortfall in cash with such Group SPV after the Valuation Date to meet the expenses set out in the Operations Budget, which shortfall in cash is either due to any delay in receipt of receivables under the PPAs or is on account of lower generation of electricity from the Project Assets. It is clarified that if the cash shortfall due to reasons mentioned above is directly attributable to any action, inaction and/or negligence of the Group SPVs and/or the Sellers, then such amount of shortfall in cash that has been infused by the Seller Group shall be to the account of the Sellers and shall be converted into Equity Shares prior to the Closing Date, which shall be transferred to the Purchaser, and no amounts shall be added to the Purchase Consideration for the transfer of such Shares. Further, if there is a cash requirement for the Group SPVs due to the occurrence of a force majeure event (as defined in the respective PPAs) then the Parties shall discuss the manner in which such cash requirements will be addressed and post agreement on its funding, if any such amounts are funded by the Sellers then such amounts shall be added to the Purchase Consideration as Cash Shortfall Amount. The Cash Shortfall Amount shall be in the form of inter- corporate loans extended by the Seller Group which shall carry interest at a rate of 10.6% (Ten Point Six Percent) per annum until its repayment. The Parties have agreed that the Cash Shortfall Amount for the period after the Valuation Date until the Execution Date is as set out in Schedule 20, which amount shall be added to the Purchase Consideration as ‘I’ as referred in Clause 3.1;

8

“Claim” includes any notice, demand, claim, Action or assessment served, made, taken or commenced (as applicable) by any Governmental Authority or any Person whereby any Person: (i) may be placed or is sought to be placed under any obligation; (ii) could incur or suffer any Loss; (iii) may be enjoined or restrained from doing any act or thing; and/or (iv) may be deprived of any relief, allowance, credit or repayment otherwise available;

“Contract” means any agreement, contract, promise, undertaking, subcontract, understanding, or legally binding commitment or undertaking of any nature (whether express or implied);

“Closing” means the sale and purchase of the Sale Shares in accordance with Clause 8; “Closing Date” shall have the meaning given to it in Clause 4.7;

“Company Information” shall have the meaning given to it in Clause 13.1; “Competing Transaction” shall have the meaning given to it in Clause 7.1(c);

“Conditions Precedent” means the conditions precedent to the sale and purchase of the Sale Shares as set out in Schedule 5;

“Constitutional Documents” means the Memorandum and the Articles of a Group SPV;

“Control” with respect to a Person, means directly or indirectly, either acting individually or acting in concert with other Persons, having (a) the power to direct or cause the direction of management and policies of such Person, whether through the ownership, of or more than 50% (Fifty Percent) of the voting securities of such Person, or (b) the power to appoint or remove a majority of the members of the board of directors or equivalent governing body of such Person or (c) the ability to control management or policy decisions of the controlled entity, in each case, whether by operation of law, by contract or otherwise. The terms “Controlling”, “Common Control”, “Controlled by” and “under Common Control with” shall be /construed accordingly;

“CP Completion Notice” shall have the meaning given to it in Clause 4.3; “CP Satisfaction Notice” shall have the meaning given to it in Clause 4.4(a); “CP Defects Notice” shall have the meaning given to it in Clause 4.4(b); “Deduction Mechanism” shall have the meaning given to it Clause 10.6(c)(ii); “Director(s)” means a director on the Board;

“Disclosure Letter” means the Execution Date Disclosure Letter and the Updated Disclosure Letter (if applicable);

“Dispute Notice” shall have the meaning given to it in Clause 3.4; “Draft UDL Date” shall have the meaning given to it in Clause 10.6(a);

“Draft Updated Disclosure Letter” shall have the meaning given to it in Clause 10.6(a);

“Drawndown Settlement Amount” shall have the meaning given to it in Clause 3.1;

“Encumbrance” means any encumbrance including without limitation (a) any claim, charge (fixed or floating), non-disposal undertaking, escrow, power of attorney (by whatever name called), lock- in, easement, mortgage, pledge, hypothecation, lien (statutory or other), deposit by way of security, right to acquire, assignment by way of security or trust arrangement for the purpose of providing security or other security interest of any kind (including any retention arrangement), beneficial ownership (including usufruct and similar entitlements), public right, common right, any provisional, conditional or executional attachment held by a third Person, (b) purchase or option agreement or arrangement, right of pre-emption, right of first refusal, right of first offer or voting agreement; (c) option, or transfer restriction in favour of any Person; (d) any adverse claim as to title, possession or use; (e) any other encumbrance of any kind, whether or not securing or conferring any priority of payment in respect of any obligation of any Person, including without limitation any right granted by a transaction which, in legal terms, is not the granting of security but which has an economic or financial effect similar to the granting of security under Applicable Law and (f) agreement or arrangement to create any of the foregoing or refrain from creating any of the foregoing, including by way of an adverse Order; and the term “Encumber” shall be construed accordingly;

9

“Environment Law” means any Applicable Laws (including, for the avoidance of doubt, common law) whose purpose is to protect, conserve, preserve environment, or prevent pollution of, the environment or to regulate emissions, discharges, or releases of hazardous substances into the environment, or to regulate the use, treatment, storage, burial, disposal, transport or handling of hazardous substances, including, without limitation, the Environment (Protection) Act, 1986, the Air (Prevention and Control of Pollution) Act, 1981 and the Water (Prevention and Control of Pollution) Act, 1974, and any rules, regulations, directions, policies or circulars issued thereunder by any Government Authority;

“Equity Securities” of a company means equity shares of such company and preference shares, debentures, bonds, warrants, rights, options (including any employee stock option plan/ scheme) or other similar instruments or securities which are convertible into or exercisable or exchangeable for, or which carry a right to subscribe for or to purchase equity shares of such company or any instrument or certificate representing a beneficial ownership/interest in the equity shares of such company, or optionally convertible debentures or optionally convertible debt (whether against any instrument or otherwise), but does not include non-convertible debentures or debt, unless any debt which is convertible into any form of equity shares other than on account of an event of default, which debt shall for the purposes of this Agreement be construed to be an ‘Equity Security’;

“Equity Shares” or “Shares” means the fully paid-up equity shares of each of the Group SPVs, each having a face value of INR 10 (Ten) and each carrying 1 (one) vote each;

“Execution Date” means 1st April 2021;

“Existing Encumbrance” means the Encumbrances as listed in Schedule 11;

“Existing Facility Agreements” means the facility agreements executed by each Group SPV in relation to the Project Assets, details of which are set out in Schedule 11;

“Existing Senior Lenders” means the lenders of the Group SPVs, as of the Execution Date, who have extended senior secured loans to the Group SPVs pursuant to the Existing Facility Agreements;

“Existing Share Pledges” shall have the meaning given to it in Clause 2.7;

“Execution Date Disclosure Letter” means the disclosure letter, signed and delivered by the Sellers to the Purchaser in a form and manner acceptable to the Purchaser on the Execution Date providing full, fair and specific disclosures against the specific Warranties (excluding any Fundamental Warranties), including relevant information and adequate details pertaining to such disclosure, as annexed thereto, the receipt of which will be duly acknowledged by the Purchaser by counter signing a copy of the Execution Date Disclosure Letter and providing the same to the Sellers;

“First Tranche RG1 Sale Shares” means the Equity Shares constituting 48.6% (Forty Eight Point Six Percent) of the entire paid-up share capital of RG1 SPV held by AZI, details of which are set out in Part E of Schedule 3;

“First ▇▇▇▇▇▇▇ ▇▇▇ ▇▇▇▇ Shares” means the Equity Shares constituting 48.6% (Forty Eight Point Six Percent) of the entire paid-up share capital of RG2 SPVs held by AZI, details of which are set out in Part G, H, and I of Schedule 3;

“First Tranche RG Sale Shares” means the First Tranche RG1 Sale Shares and First Tranche RG2 Sale Shares;

“FMO” means Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V;

“Foreign Exchange Regulations” means the Foreign Exchange Management Act, 1999 and the rules and regulations notified by Governmental Authorities pursuant thereto;

“Fully Diluted Basis” means a calculation on any given day, based on the assumption that all instruments convertible into or exercisable or exchangeable for Shares (whether optionally or compulsorily convertible), including debentures, options (including employee stock options), warrants, contracts and any other right, or entitlement available to any Person against such company to receive, subscribe to Shares, outstanding on the date

10

of calculation, have been exercised or exchanged for or converted into Shares and all Shares issuable pursuant to contractual or other obligations have been issued;

“Fundamental Warranties” shall mean the Authority Warranties and the RG Warranties;

“Group SPVs” means collectively AZ Saturn, AZ Mercury, AZ Forty Four, AZ Sun, RG1 SPV, AZ Thirty Eight, AZ Sunlight, AZ Solutions, AZR Genco, AZR One, AZR Two, AZR Four, AZR Five, AZR Six, AZR Seven and AZR Eight, and, “Group SPV” means any of them individually;

“Government Authority” means (a) any supra-national, national, central, state, city, municipal or local government, governmental authority or political subdivision thereof, including any department, division, sub-division of such government having or purporting to have jurisdiction; or (b) any entity, authority, commission, board, agency or instrumentality of any of the authorities referred to in (a) above; or (c) any regulatory or administrative authority, body or other organization having or purporting to have jurisdiction, or exercise executive, legislative, judicial, quasi-judicial, regulatory, or licensing functions to the extent that the rules, regulations, standards, requirements, procedures or orders of such authority, body or other organization have the force of Applicable Law; or (d) any court, authority or tribunal having jurisdiction; and (e) the governing body of any stock exchange(s);

“Guarantee” means, in relation to a Person (the “Guarantor”), any obligation, contingent or otherwise, of the Guarantor, guaranteeing or having the economic effect of guaranteeing, providing credit support for, or providing any indemnity with respect to, any Indebtedness or other obligation of any other Person (the “primary obligor”) in any manner, whether directly or indirectly, and including any obligation of the Guarantor, direct or indirect, (a) to purchase or pay (or advance or supply funds for the purchase or payment of) such Indebtedness or other obligation or to purchase (or to advance or supply funds for the purchase of) any security for the payment thereof, (b) to purchase, lease or provide an Encumbrance over Assets, property, securities or services for the purpose of assuring the owner of such Indebtedness or other obligation of the payment thereof, (c) to maintain working capital, equity capital or any other financial statement condition or liquidity of the primary obligor so as to enable the primary obligor to pay such Indebtedness or other obligation or (d) as an account party in respect of any letter of credit or letter of guarantee issued to support such Indebtedness or obligation of the primary obligor;

“GST Refund Amounts” has the meaning given to it in Schedule 10;

“HOTO List” means the handover-takeover list to be provided by the Sellers to the Purchaser containing copies of all the Business Approvals obtained by Group SPVs, all the Material Contracts executed by the Group SPVs and details of Operational Net Metering;

“Holdback Amount” has the meaning given to it in Clause 3.15(a); “Holdback Events” has the meaning given to it in Clause 3.15(a);

“IBC” means the Insolvency and Bankruptcy Code of India, 2016 as applicable, and, as amended from time to time and as supplemented by the rules and regulations issued thereunder;

“IFC” means International Finance Corporation;

“Identified Leakage” shall have the meaning given to it in Clause 3.13(d);

“Ind AS” shall mean the Indian Accounting Standards as prescribed under the Companies (Indian Accounting Standards) Rules, 2015;

“Indebtedness” means any indebtedness with respect to a Person, for or in respect of the following:

|

|

(a) |

all obligations for borrowed money of such Person (whether funded or unfunded), including but not limited to customer advances, vendor advances, principal, for accrued but unpaid interest, premiums, break costs, fees, expenses and penalties relating thereto or with respect to deposits or advances of any kind and monies borrowed under the Existing Facility Agreements and the Seller Group Loans; |

11

|

|

(b) |

any amount raised by acceptance under any acceptance credit, ▇▇▇▇ acceptance or ▇▇▇▇ endorsement facility or dematerialised equivalent; |

|

|

(c) |

all obligations of such Person evidenced by or any amount raised pursuant to a note, bond, debenture, letter of credit, loan stock, debt security or similar instruments; |

|

|

(d) |

that portion of obligations with respect to capital leases that is properly classified as a liability on a balance sheet in conformity with Ind AS; |

|

|

(e) |

the amount of any liability in respect of any lease or hire purchase contract which would, in accordance with the Accounting Standards, be treated as a finance or capital lease; |

|

|

(f) |

notes payable representing extensions of credit; |

|

|

(g) |

all obligations of such Person upon which interest charges are customarily paid in ordinary course; |

|

|

(h) |

assets or liabilities under any interest rate protection agreement, interest rate future agreement, interest rate option agreement, interest rate swap agreement or other similar agreement designed to protect against fluctuations in interest rates; |

|

|

(i) |

all obligations of such Person under conditional sale, deferred purchase price of property related to property acquired by such Person, if applicable; |

|

|

(j) |

receivables sold or discounted (other than any receivables to the extent they are sold on a non-recourse basis); |

|

|

(k) |

all indebtedness of others secured by (or for which the holder of such indebtedness has an existing right to be secured by) any Encumbrances on the property of such Person; |

|

|

(l) |

any counter-indemnity obligation in respect of a guarantee, indemnity, bond, standby or documentary letter of credit or any other instrument issued by a bank or financial institution, save and except as provided in favour of Existing Senior Lenders under the Existing Facility Agreements or in relation to the AZR Senior Lenders, which are covered in point (a) above; |

|

|

(m) |

any amount raised under any other transaction having the commercial effect of a borrowing; and |

|

|

(n) |

all Guarantees in respect of the items set forth in (a) through (m) above; |

“Indemnifying Party” shall have the meaning given to it in Clause 11.1;

“Indemnified Party” shall have the meaning given to it in Clause 11.1;

“Indemnity Claim” shall have the meaning given to it in Clause 11.7(a);

“Indemnity Events” shall have the meaning given to it in Clause 11.1;

“Indemnity Notice” shall have the meaning given to it in Clause 11.7(a);

“Indemnity Objection” shall have the meaning given to it in Clause 11.7(b);

“Information” shall have the meaning given to it in Clause 13.1;

“Interim Period” shall have the meaning given to it in Clause 7.1;

“Insolvency Event” in relation to any Person shall mean, the following:

|

|

(i) |

any action or other steps taken for the suspension of payments, a moratorium of any indebtedness, winding-up, dissolution, administration, provisional supervision or reorganisation (by way of voluntary arrangement, scheme of arrangement or otherwise) of any Person and such action has been admitted by a court of competent jurisdiction; |

|

|

(ii) |

a composition, compromise, assignment or arrangement with any creditor of the Person, as a result of or in connection with a default or a potential default by such Person; |

12

|

|

(iv) |

any action or other steps taken for the attachment, enforcement or distress of any security interest over any assets of the Person; |

|

|

(v) |

initiation of insolvency process (including making a petition or application for insolvency before appropriate Governmental Authority) in relation to the Person; |

|

|

(vi) |

any analogous procedure is taken in any jurisdiction, or any other event occurs which would, under any Applicable Law, have a substantially similar effect to any of the events listed in sub-paragraphs (i) to (v) above; |

|

|

(vii) |

the service of a demand notice or invoice demanding payment by an operational creditor (as defined in the IBC) on the Person under section 8 of the IBC which is: |

|

|

(a) |

not settled fully and unconditionally; or |

|

|

(b) |

in respect of which the Person has not demonstrated or intimated in writing with all relevant evidentiary proof, the existence of a pre-existing dispute in accordance with the provisions of the IBC; |

|

|

(viii) |

the admission of any application by the National Company Law Tribunal or other Governmental Authority having jurisdiction to initiate corporate insolvency resolution process against the Person under the IBC or any other analogous Applicable Law; or |

|

|

(ix) |

the passage of a resolution by the members of the Person to initiate a voluntary liquidation process in relation to such Person under the IBC; |

“Intellectual Property” means: (a) patents, utility models and rights in inventions, products and devices; (b) registered and unregistered trademarks and service marks, rights in logos, trade names, brand names, domain names and copyrights; (c) computer software (including, without limitation, source code, object code, macros, scripts, application tools, objects, routines, modules and other components), data, data bases and documentation thereof; (d) know-how, products, processes, techniques, methods, algorithms, research and development information and results, drawings, specifications, designs, plans, proposals, technical data, marketing plans, customer data, prospect and supplier lists and information; (e) information technology systems, SCADA systems, databases, trade secrets, designs, and technologies which are proprietary in nature; and (f) copyrights and copyrightable works, in each case, (i) anywhere in the world; and (ii) whether registered or unregistered, including applications for registration, and rights to apply for registration;

“IRR” shall mean the internal rate of return calculated on a pre-tax basis using the XIRR function of Microsoft Excel;

“Key Personnel” shall mean the key managerial personnel as defined under the Act including any of the key managerial personnel of the Group SPVs i.e. the Managing Director/Chief Executive Officer, the Chief Financial Officer, Chief Operating Officer, Head of Legal and Compliance/Company Secretary, all the direct reportees to the Managing Director/Chief Executive Officer and such other senior level management personnel of the Group SPV as may be identified by the Purchaser at its sole discretion;

“LCIA” shall have the meaning given to it in Clause 22.2(a);

“Leakage” shall mean, between the Valuation Date and the Closing Date (both inclusive) any payment, assumption of a liability, waiver of rights or transfer by or loss of value from the Group SPVs (including, in each case of the foregoing, any agreement or other commitment (whether or not legally binding) by the Group SPVs in relation to the foregoing, other than a Permitted Leakage. It is clarified for the avoidance of doubt that any Tax payable in respect of any amounts of Leakages shall be included in the amount of Leakage;

13

“Limitations on Liability” shall have the meaning given to it in Clause 11.10;

“Litigation” means all proceedings relating to any suits, civil and criminal actions, arbitral proceedings, investigations, mediations or inquiries, including any claims made or notices issued by any Person, whether initiated or pending before any court, tribunal, arbitrator or other Government Authority or otherwise, in each case involving a Liability or claim by or against any Group SPV;

“Liabilities” means all liabilities, duties and obligations of every description, whether deriving from contract, common law, statute or otherwise, actual or contingent, ascertained or unascertained or disputed and whether owed or incurred severally or jointly or as principal, guarantor or surety;

“Liquidated Damages” shall have the meaning given to it in Clause 8.9(g);

“Long Stop Date” means the date that is next day immediately following the expiry of 180 (one hundred and eighty) days from the Execution Date;

“Losses” means all direct losses, liabilities, damages, obligations, demands and claims, of any nature, including interest, fees and penalties with respect thereto and costs, charges and expenses (including reasonable accountants’ or experts’ fees, reasonable legal costs and taxes) in connection thereof but excludes all remote, punitive and/or exemplary, indirect or consequential losses, loss of opportunity or goodwill and any speculation losses. In the event any Loss occurs on account of termination of PPAs or due to any reduction in tariff, then the Loss would be the proportionate reduction in the equity value of the Group SPVs (inclusive of the Purchase Consideration and the Purchaser Repayment Amount) as have been paid by the Purchaser for the Transaction and any interest and penalties with respect thereto and costs and expenses (including reasonable accountants’ or experts’ fees, reasonable legal costs and taxes) in connection thereof;

“MNRE” shall mean the Ministry of New and Renewable Energy;

“Management Accounts” means the unaudited balance sheet, profit and loss statement, income statement, statement in change of equity and cash flow statement of each Group SPV, for the period commencing from 1 April 2020 and ending on 30 September 2020, prepared in accordance with Ind AS, and as provided by the Sellers and includes the Auditor’s Certificate;

“Material Contracts” means the following Contracts to which any Group SPV is a party or by the terms of which any Group SPV is bound: (i) any Project Agreements; (ii) any Contracts relating to any Indebtedness; (iii) any Contracts or series of related Contracts under which any Group SPV is entitled to receive and/ or liable to pay in aggregate at least INR 15,00,000 (Indian Rupees Fifteen Lakh) in any Financial Year; (iv) any Contracts or series of related Contracts relating to any Group SPV having a contract value in aggregate of at least INR 15,00,000 (Indian Rupees Fifteen Lakh); and (v) any Contracts that are not in the Ordinary Course of Business or otherwise not entered on Arm’s Length Basis. The list of all Material Contracts in respect of the Group SPVs shall be provided through the HOTO List;

“Material Adverse Effect” means any event, circumstance, effect, occurrence, condition, change, claim, damages, litigation, disclosure, development or effect or state of affairs or any combination thereof, which is, or is reasonably likely to:

|

|

(a) |

result in an adverse financial implication on the Group SPVs of a combined equity valuation of the Group SPVs by more than INR 17,50,00,000 (Indian Rupees Seventeen Crore Fifty Lakh) (“Financial Implication”); |

|

|

(b) |

be adverse to the validity, legality, binding nature or enforceability of the Transaction Documents or any of the transactions contemplated thereunder; or |

|

|

(c) |

be adverse to the ability of the Sellers or any of the Group SPVs to perform their obligations under the Transaction Documents; |

14

Provided that Material Adverse Effect that is set out in (a) above (Financial Implication) shall not include adverse financial implications which is directly and solely a consequence of:

|

|

(i) |

acts of the Sellers or the Group SPVs undertaken after the Execution Date: (I) at the insistence or instructions of the Purchaser, or (II) with the written consent of the Purchaser, provided that in each such case the Sellers had provided the Purchasers with all relevant information in respect of such matters, including but not limited to all information as reasonably requested by the Purchaser; or |

|

|

(ii) |

any change in the general financial or economic conditions in India occurring after the Execution Date; or |

|

|

(iii) |

any changes in Applicable Law that has occurred after the Execution Date except if such change has a disproportionately adverse effect on the Group SPVs or their respective business relative to other Persons engaged in a similar industry; provided that any change in Applicable Law occurring after a period of 30 (thirty) days from the Execution Date shall be considered towards determining a Financial Implication as a Material Adverse Effect and shall not be considered as an exclusion to Material Adverse Effect; or |

|

|

(iv) |

any changes in political conditions in India that has occurred after the Execution Date except if such change has a disproportionately adverse effect on the Group SPVs or their respective business relative to other Persons engaged in a similar industry; provided that any change in political conditions in India occurring after a period of 30 (thirty) days from the Execution Date shall be considered towards determining a Financial Implication as a Material Adverse Effect and shall not be considered as an exclusion to Material Adverse Effect; |

“Memorandum” shall mean the memorandum of association of a company, as amended from time to time;

“Net Debt Adjustment Amount” shall mean the Actual Senior Debt less INR 316,51,00,000 (Indian Rupees Three Hundred and Sixteen Crore Fifty One Lakh);

“Net Working Capital Adjustment Amount” shall mean the actual net working capital in aggregate of all Group SPVs as on the Valuation Date, based on the amounts set out in the Management Accounts, being:

|

|

(a) |

the aggregate of the Cash balances, receivables and other current assets of each of the Group SPVs as of Valuation Date; less |

|

|

(b) |

the aggregate of payables and other current liabilities of each Group SPV as of the Valuation Date; |

Provided however that the following amounts shall not be considered (i.e. either added or subtracted) while determining the Net Working Capital Adjustment Amount:

|

|

(a) |

all amount payable to capital creditors of any Group SPV; |

|

|

(b) |

all loans or advances payable to any member of Seller Group by the Group SPVs; and |

|

|

(c) |

all advances paid for capital equipment by the Group SPVs. |

For abundant clarity on Net Working Capital Adjustment Amount, the Parties have agreed on details for the determination of Net Working Capital Adjustment Amount which is set out in Schedule 21, and the methodology of which shall be relied for determination of Purchase Consideration pursuant to Clause 3 including for the determination of any Variance Amount on the basis of the Post Closing Audit;

“Notes” shall mean the RG1 Notes and/or the RG2 Notes, as applicable; “NYSE” shall mean the New York Stock Exchange;

“OeEB” means Oesterreichische Entwicklungsbank AG;

“Offer” means the updated binding offer letter dated 2 December 2020 submitted by the Purchaser to the Sellers;

“Onshore Debt” shall mean the following Indebtedness: (i) in relation to RG2 SPVs, the ‘onshore debt’ as defined under the RG2 Bond Documents, which is extended by Azure Mauritius to RG2 SPVs and (ii) in relation

15

to RG1 SPV, the ‘rupee debt’ as defined under the RG1 Bond Documents, which is extended by Azure Power Energy Limited to RG1 SPV, in each such case as set out as part of the Onshore Debt Documents;

“Onshore Debt Documents” means such Contracts as set out in Part A of Schedule 11 with respect to the RG SPVs;

“Operations Budget” means the budget for each Group SPVs setting out revenues and expenditures for the period between the Valuation Date and Closing Date, as set forth in Schedule 16;

“Operational Net Metering” means the Project Assets where the net metering approval under Applicable Law has not been obtained, but where the relevant Group SPVs owing, operating and maintaining such Project Assets are validly invoicing and receiving payments under the terms of the respective PPAs. A list of the Project Assets that has Operational Net Metering will be provided through the HOTO List;

“OPIC Repayment Amount” means the INR equivalent of the outstanding principal amount which as of the Execution Date is not more than USD 610631 and any interest payable as on the date of repayment of such outstanding principal amount, actually paid by AZ Sunlight towards repayment of entire outstanding loan amount owed to OPIC;

“Order” shall mean any order, direction, judgment, writ, injunction, decree, award or other determination of any Governmental Authority;

“Ordinary Course of Business” means acts or omissions of an entity which are consistent (in their nature, amount and economic value) with past custom and practices, all Applicable Law and prudent management practices having regard to the activities pursued by such entity (including the business) in the normal and usual course;

“Other RG1 SPVs” means Azure Power (Punjab) Private Limited, Azure Urja Private Limited, Azure Power Pluto Private Limited, Azure Surya Private Limited, Azure Power Eris Private Limited, Azure Sunshine Private Limited, Azure Green Tech Private Limited, Azure Clean Energy Private Limited, Azure Power Mars Private Limited, Azure Power (Karnataka) Private Limited, Azure Sunrise Private Limited, Azure Power (Raj.) Private Limited, Azure Photovoltaic Private Limited, Azure Power (Haryana) Private Limited, Azure Power Thirty Seven Private Limited and Azure Power Infrastructure Private Limited and any subsidiary of Azure Power Global Limited acquired by Azure Power Energy Limited or designated by the board of directors of Azure Power Global Limited or Azure Power Energy Limited;

“Other AZI SPVs” means Azure Power Uranus Private Limited, Azure Power Makemake Private Limited, Azure Power Venus Private Limited, Azure Power Thirty Six Private Limited, Azure Power Thirty Three Private Limited, Azure Power Earth Private Limited and Azure Power Thirty Four Private Limited;

“Pass Through Amounts” shall have the meaning given to it in Schedule 10; “Pass Through Processes” shall have the meaning given to it in Schedule 10;

“Person” means any natural person, limited or unlimited liability company, bodies corporate (wherever incorporated), unincorporated associations, partnership (whether limited or unlimited), limited liability partnerships, proprietorship, Hindu undivided family, trust, union, government or any agency or political subdivision thereof or any other entity that may be treated as a person under Applicable Law or in each case whether or not having a separate legal or juristic personality;

“Permitted Leakage” means any of the following transactions undertaken by any Group SPV:

16

|

|

Shortfall Amount shall be considered as a Permitted Leakage and any such extension of inter-corporate loan or advance shall not be an increase or reduction to the Purchase Consideration; |

|

|

(b) |

any repayment to the member of the Seller Group of the Cash Shortfall Amount which have been infused by such Person into any Group SPVs; and |

|

|

(c) |

any Taxes payable by the Group SPV on any of the matters set out in (a) and (b) above; |

“PPA” means power purchase agreement entered into by any Group SPV or other similar Contract by any name for the sale or supply of power;

“PPA Bank Guarantees” shall have the meaning given to it in Clause 8.8(f);

“PPA Restrictions” shall mean the share transfer restrictions and related lock-in obligations prescribed for the relevant Group SPVs under the PPAs and Bid Documents as applicable to them, which are listed in Schedule 22;

“Previous Agreements” shall have the meaning given to it in Clause 8.5;

“Project Agreements” in relation to any Project Assets, means the: (a) PPAs and Bid Documents; (b) any implementation agreements, allotment letters and agreements, in each case issued by or entered into with a Governmental Authority, any nodal agencies for renewable power or any other company incorporated by a Governmental Authority, or the counterparties to any of the PPAs, for the allotment of such Project; (c) supply and works/services agreements, EPC agreements/orders for construction of such Project Assets and its evacuation infrastructure; (d) operation and maintenance agreements; (e) agreements entered into with distribution or transmission utilities for connectivity, evacuation or net-metering; and/or (f) agreements entered into for the acquisition of leasehold rights, rights of way or access to the rooftop premises for such Project Asset. The list of all Project Agreements in respect of the Group SPVs shall be provided through the HOTO List;

“Project Assets” means the solar power projects of the Group SPVs as detailed under Part B of Schedule 2 and includes all Assets of the Group SPVs;

“Proparco” means Société de Promotion et de Participation pour la Coopération Economique;

“Purchase Consideration” shall have the meaning assigned to it in Clause 3.1;

“Purchaser Nominee” means any Affiliate(s) or any individual nominated by the Purchaser to acquire the Sale Shares;

“Purchaser Pledged Shares” shall have the meaning given to it in Clause 2.8;

“Purchaser Repayment Amount” has the meaning given to it in Clause 3.12(e);

“Purchaser Warranties” shall have the meaning given to it in Clause 10.3;

“Related Party” has the meaning given to it under the Act;

“Related Party Transaction” shall have the meaning ascribed to it under paragraph 11.1 of Part II of Schedule 7;

“Released Parties” shall have the meaning ascribed to it under Clause 8.5;

“Releasing Parties” shall have the meaning ascribed to it under Clause 8.5;

“Relevant Group SPVs” has the meaning given to it in Clause 3.12(e);

“Representatives” shall have the meaning given to it in Clause 16;

“Restated Charter Documents” means the restated Articles of the RG SPVs incorporating the terms of the Transaction Documents, in an Agreed Form;

“Revised Balance RG Completion Notice” shall have the meaning given to it in Clause 5.5;

17

“Revised CP Completion Notice” shall have the meaning given to it in Clause 4.4(c);

“RG Closing” means the sale and purchase of the Balance RG Sale Shares in accordance with Clause 9. It is clarified that the closing for the Balance ▇▇▇ ▇▇▇▇ Shares and for the Balance RG2 Sale Shares will be conducted separately and each such closing shall be referred to as RG Closing;

“RG Closing Date” means the date which is 1 (one) Business Day from the date of the receipt of the Balance RG CP Satisfaction Notice, in respect of the RG1 SPV or the RG2 SPVs, as the case may be, that is delivered by the Purchaser to AZI in accordance with Clause 5.4(a), and each such date shall be referred to as RG Closing Date;

“RG Repayment Amount” shall have the meaning given to it in Clause 8.9(b)(ii);

“RG Repurchase Amount” shall have the meaning given to it in Clause 8.9(b)(i);

“RG SPVs” means collectively RG1 SPV and RG2 SPVs;

“RG1 SPV” means Azure Renewable Energy Private Limited;

“RG1 Long Stop Date” shall have the meaning given to it in Clause 5.6;

“RG1 Notes” means the 5.50% (Five Point Five Zero Percent) senior notes issued by Azure Power Energy Limited pursuant to the RG1 Bond Documents to its overseas lenders;

“RG2 Notes” means the 5.65% (Five Point Six Five Percent) senior notes issued by Azure Mauritius pursuant to the RG2 Bond Documents to its overseas lenders;

“RG1 Bond Documents” means Offering Memorandum dated 27 July 2017 read with the Indenture dated 3 August 2017;

“RG2 Bond Documents” means Offering Memorandum dated 17 September 2019 read with the Indenture dated 24 September 2019;

“RG2 Long Stop Date” shall have the meaning give to it in Clause 5.6;

“RG2 SPVs” means collectively AZ Saturn, AZ Mercury and AZ Forty Four;

“RG Warranties” shall have the meaning given to it in Clause 10.2; “Rights” shall have the meaning given to it in Clause 8.5;

“RPT List” shall mean the true and complete list of all subsisting Related Party Transactions as on the Execution Date, details of which shall be provided by the Sellers to the Purchaser within 45 (forty five) days of the Execution Date;

“Rs.” or “Rupees” or “INR” means the lawful currency of the Republic of India;

“Rules” shall have the meaning given to it in Clause 22.2(a);

“Sale Shares” shall mean the AZR Sale Shares and AZI Sale Shares, but excluding the Balance RG Sale Shares;

“Sellers Bank Accounts” shall have the meaning given to it in Clause 19.1;

“Seller Group” means the Sellers and their respective Affiliates other than Group SPVs;

“Seller Group Loans” has the meaning given to it in Clause 3.12(a);

“Sellers’ Nominees” means the Persons listed in Schedule 3, who are holding certain number of Sale Shares on behalf of the Sellers, as indicated against their respective names in Schedule 3;

“Securities” shall mean the Equity Securities and shall include non-convertible debentures and debt or other securities of any class or nature, including debt securities and convertible debt securities which are mandatorily

18

or optionally convertible into or exchangeable or exercisable for Shares and each of them shall be referred to as a “Security”;

“SGL List” shall mean the true and complete list of the Seller Group Loans existing as on the Execution Date, details of which shall be provided by the Sellers to the Purchaser within 45 (forty five) days of the Execution Date;

“Shares Consideration” shall have the meaning given to it in Clause 3.6;

“Shareholder” means any Person holding Equity Securities of a company;

“Shareholders’ Agreement” means each shareholders’ agreement in Agreed Form executed between the Purchaser, AZI and each RG SPV respectively, as on the date of this Agreement, setting out the rights and obligations between and amongst the Purchaser and AZI in respect of each RG SPVs, and each of which shall be effective from the Closing Date;

“Specific Adjustments Amount” shall mean the any amounts outstanding to be paid to capital creditors of any Group SPV that remain outstanding as of the date of delivery of the Adjustment Notice by the Sellers to the Purchaser.

“Specific Indemnity Items” shall have the meaning given to it in Clause 11.1(j); “Subject Obligation” shall have the meaning given to it in Clause 1.2(h);

“Taxation” (including with correlative meaning, the terms “Tax” and “Taxes”) includes all forms of direct and indirect taxes (Indian and where applicable non-Indian), cess, duties, levies, imposts, including without limitation present and future claims for taxes on gross receipts, net profits and gains, sales, turn-over, income tax, withholding tax, dividend distribution tax, capital gains tax, fringe benefit tax, sales tax, customs duty, wealth tax, gift tax, gains, franchise, property, goods and services tax, sales, use, consumption, employment, license, excise duty, service tax, payroll tax, capital, occupation tax, octroi, entry tax, recording, value added or transfer taxes, governmental charges, fees, levies or assessments or other taxes, levies, fees, stamp duties, statutory gratuity and provident fund payments or other employment benefit plan contributions, withholding obligations and similar charges of any applicable jurisdiction and shall include any interest, fines, and penalties related thereto and, with respect to such taxes, and other municipal taxes and duties, environmental taxes and duties and any other type of taxes or duties in any relevant jurisdiction;

“Tax Return” shall mean any report, return, statement, claim for refund, declaration or other information with respect to any Tax required to be filed, permitted to be filed or actually filed with a Governmental Authority, including any schedule or attachment thereto, and including any amendment thereof;

“Taxation Authority” or “Tax Authority” means any taxing or other authority competent to impose, administer or collect any Taxation;

“Tax Status Report” means a report to be obtained by the Sellers from a Big Accounting Firm, which sets out information of the outstanding tax demands and/ or income-tax proceedings pending against the Sellers (if any) under the provisions of the Section 281 of the (Indian) Income Tax Act, 1961;

“Tax Warranties” shall mean the Business Warranties set forth in Paragraph 18 of Part II of Schedule 7;

“Termination Insolvency Event” in relation to any Person shall mean, the following:

|

|

(i) |

any action or other steps taken for the suspension of payments, a moratorium of any indebtedness, winding-up, dissolution, administration, provisional supervision or reorganisation (by way of voluntary arrangement, scheme of arrangement or otherwise) of any Person and such action has been admitted by a court of competent jurisdiction; |

|

|

(ii) |

a composition, compromise, assignment or arrangement with any creditor of the Person, as a result of or in connection with a default or a potential default by such Person; |

19

|

|

(iv) |

any action or other steps taken for the attachment, enforcement or distress of any security interest over any assets of the Person; |

|

|

(v) |

initiation of insolvency process (including making a petition or application for insolvency before appropriate Governmental Authority) in relation to the Person, which proceedings are not disputed, dismissed or annulled within a period of 45 (forty-five) days from the date of initiation; |

|

|

(vi) |

any analogous procedure is taken in any jurisdiction, or any other event occurs which would, under any Applicable Law, have a substantially similar effect to any of the events listed in sub-paragraphs (i) to (v) above; |

|

|

(vii) |

the service of a demand notice or invoice demanding payment by an operational creditor (as defined in the IBC) on the Person under section 8 of the IBC which is: |

|

|

(a) |

not settled fully and unconditionally; or |

|

|

(b) |

in respect of which the Person has not demonstrated or intimated in writing with all relevant evidentiary proof, the existence of a pre-existing dispute in accordance with the provisions of the IBC; or |

|

|

(c) |

the Person provides a confirmation that the same is being disputed in good faith and the demand notice or invoice under section 8 of the IBC has been unconditionally withdrawn, in each case, within 14 (fourteen) days of receipt of such notice; |

|

|

(viii) |

the admission of any application by the National Company Law Tribunal or other Governmental Authority having jurisdiction to initiate corporate insolvency resolution process against the Person under the IBC or any other analogous Applicable Law; or |

|

|

(ix) |

the passage of a resolution by the members of the Person to initiate a voluntary liquidation process in relation to such Person under the IBC. |

“Third Party” means any Person which is not a party to this Agreement;

“Third Party Claim” shall have the meaning given to it in Clause 11.8(a);

“Third Party Claim Notice” shall have the meaning given to it in Clause 11.8(a);

“Third Party Payments” shall have the meaning given to it in Clause 11.8(d)(iii);

“Transfer” (including with correlative meaning, the terms “Transferred”, “Transferred by” and “Transferability”) shall mean to, directly or indirectly, sell, gift, give, assign, transfer, transfer of any interest in trust, mortgage, alienate, hypothecate, pledge, encumber, grant a security interest in, or suffer to exist (whether by operation of Applicable Law otherwise) any Encumbrance on, any Securities or any right, title or interest therein or otherwise dispose of in any manner whatsoever voluntarily or involuntarily;

“Transaction Documents” means the following:

|

|

(a) |

this Agreement; |

|

|

(b) |

Disclosure Letters; |

|

|

(c) |

Shareholders’ Agreements; and |

|

|

(d) |

any other agreement or document which is mutually agreed by the Sellers and the Purchaser as a Transaction Document; |

“Unwinding Amount” shall have the meaning give to it in Clause 8.9(c);

20

|

|

(1) |

in relation to ▇▇▇ ▇▇▇: |

(a)a declaration or occurrence under the RG1 Bond Documents or the Onshore Debt Documents of an ‘Event of Default’ (as defined therein) or declaration or occurrence of an ‘Event of Default’ (as defined therein) under the onshore debt documents of the Other RG1 SPVs, pursuant to which the relevant Existing Senior Lenders call for an ‘Event of Default’ under the Onshore Debt Documents for RG1 SPV, other than solely and directly due to a payment default after the Closing Date by RG1 SPV under its respective Onshore Debt Documents; (b) non-payment of any scheduled payments, including interest, on the RG1 Notes by Azure Power Energy Limited on the dates on which such payment on the RG1 Notes is due and payable, other than solely and directly due to a payment default after the Closing Date by RG1 SPV under its respective Onshore Debt Documents; (c) non-payment of any scheduled payments, including interest, on the non-convertible debentures issued to Azure Power Energy Limited by Other RG1 SPVs on the dates on which such payment for such non-convertible debentures is due and payable, and such non-payment continues for 5 (five) Business Days; (d) non-completion of the Balance RG Conditions Precedent in relation to RG1 SPV to the satisfaction of the Purchaser by the RG1 Long Stop Date; (e) occurrence of any Termination Insolvency Event in relation to AZI after the Closing; (f) occurrence of an insolvency event (as defined in the respective debenture trust deeds for the non-convertible debentures issued to Azure Power Energy Limited by the Other RG1 SPVs) in relation to any Other RG1 SPVs; (g) Sellers are unable or otherwise unwilling to perform their obligations under this Agreement in respect of RG Closing for RG1 SPV; or (h) any other event deemed to be an “Unwinding Event” under the Shareholders Agreements; and

|

|

(2) |

in relation to RG2 SPVs: |

(a)a declaration or occurrence under the RG2 Bond Documents or the Onshore Debt Documents of an ‘Event of Default’ (as defined therein) or declaration or occurrence of an ‘Event of Default’ (as defined therein) under the onshore debt documents of the Other AZI SPVs, pursuant to which the relevant Existing Senior Lenders call for an ‘Event of Default’ under the Onshore Debt Documents for the RG2 SPVs, other than solely and directly due to a payment default after the Closing Date by RG2 SPVs under its respective Onshore Debt Documents; (b) non-payment of any scheduled payments, including interest, on the RG2 Notes by Azure Mauritius on the dates on which such payment on the RG2 Notes is due and payable, other than solely and directly due to a payment default after the Closing Date by RG2 SPVs under its respective Onshore Debt Documents; (c) non- payment of any scheduled payments, including interest, on the non-convertible debentures issued to Azure Mauritius by any of Other AZI SPVs on the dates on which such payment for such non- convertible debentures is due and payable, and such non-payment continues for 5 (five) Business Days; (d) non-completion of the Balance RG Conditions Precedent in relation to RG2 SPVs to the satisfaction of the Purchaser by ▇▇▇ ▇▇▇▇ Stop Date; (e) occurrence of any Termination Insolvency Event in relation to AZI after the Closing; (f) occurrence of an insolvency event (as defined in the respective debenture trust deeds for the non-convertible debentures issued to Azure Mauritius by the Other AZI SPVs) in relation to any Other AZI SPVs; (g) Sellers are unable or otherwise unwilling to perform their obligations under this Agreement in respect of RG Closing for RG2 SPVs; or (h) any other event deemed to be an “Unwinding Event” under the Shareholders Agreements;

“Unwinding Notice” shall have the meaning given to it in Clause 8.9(a);

“Unwinding Long Stop Date” shall have the meaning given to it in Clause 8.9(d);

“Unwinding Steps” shall have the meaning given to it in Clause 8.9(b);

“Updated Disclosure Letter” shall mean the disclosure letter, if any, which sets out full, fair and specific disclosures against specific Business Warranties (excluding Fundamental Warranties) for the period between the Execution Date and the Closing Date, setting out the description of matters disclosed against the Business Warranties (excluding Fundamental Warranties) including relevant information and adequate details pertaining to such disclosure as annexed thereto, signed and delivered by the Sellers to the Purchaser, and accepted by the Purchaser, in the same format of the Execution Date Disclosure Letter, the receipt of which is duly acknowledged

21

by the Purchaser by counter signing a copy of the Updated Disclosure Letter and providing the same to the Sellers. It is hereby clarified that the disclosures contained in the Updated Disclosure Letter (“Updated Disclosure”):

|

|

(a) |

shall be made against the specific Business Warranties (excluding Fundamental Warranties) as set out therein; |

|

|

(b) |

shall only relate to events occurring between the Execution Date and the Closing Date (but may include updates to events disclosed in the Execution Disclosure Letter, which have occurred post the Execution Date, and which update shall only qualify the Business Warranties as made on the Closing Date); |

|

|

(c) |

shall only qualify the Business Warranties made as of the Closing Date; and |

|

|

(d) |

shall not retrospectively modify the Execution Disclosure Letter issued or any of the Business Warranties given as of the Execution Date; |

“Updated Disclosure Notice” shall have the meaning given to it in Clause 10.6(c)(i);

“Valuation Date” means 30 September 2020;

“Valuation Certificate” means a valuation certificate in respect of the Sale Shares and the RG Sale Shares prepared by a licensed chartered accountant or a SEBI registered Category I merchant banker, certifying the price of the Sale Shares and Balance RG Sale Shares prepared in accordance with the Foreign Exchange Regulations;

“Variance Amounts” shall have the meaning given to it in Clause 3.13(e);

“Variance Amount Statement” shall have the meaning given to it in Clause 3.13(e); “Variance Review Notice” shall have the meaning given to it in Clause 3.13(g);

“VDDR” means the legal vendor due diligence report issued by Trilegal dated 9 December 2020;

“Warranties” means collectively the Authority Warranties, Business Warranties and the RG Warranties; and

“Working Capital Loan Amount” shall mean the working capital loans of each Group SPV availed from banks or third-party financiers, outstanding as of the Valuation Date, which is Nil amount.

|

1.2 |

Interpretation |

|

|

(a) |

any reference to any statute or statutory provision shall include: |

|

|

(i) |