LOAN AGREEMENT

Exhibit 10.3

THIS LOAN AGREEMENT is entered into effective as of January 31, 2022, by and between SUNNYLAND MHP LLC, a Georgia limited liability company (“Borrower”), and VANDERBILT MORTGAGE AND FINANCE, INC., a Tennessee corporation (“Lender”).

A. Subject to the terms and provisions hereof, Lender has agreed to make available certain credit for the purposes set forth herein; and

B. Borrower and Lender desire to enter into this Agreement in order to set forth the terms, provisions and conditions governing the credit availability and the disbursement of the proceeds described herein.

ARTICLE I

DEFINITIONS

Section 1.1 Definitions. In addition to the other terms defined herein, the following terms shall have the meanings specified below:

“Advance” means any and all extensions of credit made pursuant to this Agreement, the Note, or any Loan Document, including any renewal, amendment, extension or modification thereof. The terms “Advance” and “Loan” (or the plural forms thereof) are used interchangeably in this Agreement.

“Agreement” means this Loan Agreement, including all exhibits hereto, as the same may be amended, modified or supplemented from time to time.

“Affiliate” of any specified Person means any other Person directly or indirectly controlling or controlled by or under direct or indirect common control with such specified Person. For purposes of this definition, “control” when used with respect to any specified Person means the power to direct the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise; and the terms “controlling” and “controlled” have meanings correlative to the foregoing.

“Affiliated Home Owner” means GVEST Sunnyland Homes LLC, a Delaware limited liability company.

“Assignment of Management Agreement” means that certain Assignment of Management Agreement executed by Mobile Home Rentals, LLC, a North Carolina limited liability company, in favor of Lender of even date herewith, as the same may be amended, modified or supplemented from time to time.

“Assignment of Ownership Interests” means that certain Assignment of Ownership Interests executed by the owner of Borrower in favor of Lender of even date herewith, as the same may be amended, modified or supplemented from time to time, granting a lien to Lender upon the Property described therein.

“Business Day” means any day other than a Saturday, Sunday or day on which commercial banks are authorized to close under the laws of the State of Tennessee.

“Closing Date” means the date first above written, or on such other date as the parties elect.

“Code” means the Internal Revenue Code of 1986, as amended and in effect from time to time.

“Community” means the manufactured housing community known as Sunnyland Mobile Home Park located on the Premises owned and operated by Borrower at 0 Xxxxxxx Xxxxx, Xxxxx, Xxxxxxx 00000, consisting of approximately 73 Pad Sites, and certain building improvements and related amenities, landscaping, roads, and infrastructure.

“Community Rules” means written rules and regulations that govern the conduct of tenants for and at the Community.

“Conditions Precedent” means those matters or events that must be completed or must occur or exist prior to Lender’s being obligated to fund the Advance, including, but not limited to, those matters described in Article III hereof.

“Debt” means, with respect to any Person, all obligations of such Person, contingent or otherwise, which in accordance with GAAP would be classified on a balance sheet of such Person as liabilities of such Person, but in any event including (a) liabilities secured by any mortgage, pledge or lien existing on Property owned by such Person and subject to such mortgage, pledge or lien, whether or not the liability secured thereby shall have been assumed by such Person, (b) all indebtedness and other similar monetary obligations of such Person, (c) all guaranties, obligations in respect of letters of credit, endorsements (other than endorsements of negotiable instruments for purposes of collection in the ordinary course of business), obligations to purchase goods or services for the purpose of supplying funds for the purchase or payment of Debt of others and other contingent obligations in respect of, or to purchase, or otherwise acquire, or advance funds for the purchase of, Debt of others, (d) all obligations of such Person to indemnify another Person to the extent of the amount of indemnity, if any, which would be payable by such Person at the time of determination of Debt, and (e) all obligations of such Person under capital leases.

“Debt Service” has the meaning set forth in Section 5.18(b).

“Debt Service Coverage Ratio” has the meaning set forth in Section 5.18(b).

“Default” means the occurrence of any event which except for the passage of time or the delivery of notice with an opportunity to cure would be an Event of Default.

“Default Rate” shall mean the maximum lawful rate of interest permitted by law. The term “maximum lawful rate of interest” as used herein shall mean a rate of interest equal to the higher or greater of the following: (a) the “applicable formula rate” defined in Tennessee Code Annotated Section 47-14-102(3), or (b) such other rate of interest as may be charged under other applicable laws or regulations.

“Environmental Claim” has that meaning ascribed thereto in the Environmental Indemnity.

“Environmental Indemnity” means that certain Environmental Indemnity Agreement executed by Borrower and Guarantors in favor of Lender of even date herewith, as the same may be amended, modified or supplemented from time to time.

“Environmental Laws” has that meaning ascribed thereto in the Environmental Indemnity.

2

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time, including (unless the context otherwise requires) any rules or regulations promulgated thereunder.

“Event of Default” means the occurrence of any event or condition specified in Article VII hereof.

“GAAP” means generally accepted accounting principles in the United States applied on a consistent basis.

“Governmental Authority” means the government of the United States of America, any other nation or any political subdivision thereof, whether state or local, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government.

“Governmental Requirements” means all laws, rules, regulations, ordinances, judgments, decrees, codes, orders, injunctions, notices and demand letters of any Governmental Authority.

“Gross Cash Flow” has the meaning set forth in Section 5.18(b).

“Guarantors” means, collectively, Xxxxxxx X. Xxx, and any other guarantor, surety, or accommodation party with respect to the Loan, and any heir or permitted successor or assign of the foregoing; individually, each is a “Guarantor.”

“Guaranty” or “Guaranties” means, individually and collectively, any guaranty agreement, from a Guarantor to Lender, guarantying the payment and performance of the Note and Loan Documents, as the same may be amended, modified or supplemented from time to time.

“Hazardous Substances” has that meaning ascribed thereto in the Environmental Indemnity.

“Home Owner” means a Person other than Borrower who owns a Manufactured Home located or to be located in the Community.

“Indebtedness” means any and all amounts and liabilities of any nature owing or to be owing by Borrower to Lender from time to time, including, without limitation, the Loan, all fees, expenses, indemnification and reimbursement payments, indebtedness, liabilities, and obligations of Borrower to Lender, whether now existing or hereafter incurred, liquidated or unliquidated, direct or contingent, joint or several, matured or unmatured, and whether in connection with this Agreement or otherwise, or in connection with loans, participation interests, drafts, notes, banker’s acceptances, letters of credit, guarantees, or overdrafts of any of Borrower’s checking, savings, or other accounts maintained with Lender.

“Leases” has that meaning ascribed thereto in the Security Instrument.

“Lien” means any interest in Property securing an obligation owed to, or a claim by, a Person other than the owner of the Property, whether such interest is based on the common law, statute, or contract, and including, but not limited to, the lien or security interest arising from a mortgage, encumbrance, pledge, security agreement, conditional sale, work performed or material supplied upon the Premises, or trust receipt or a lease, consignment, or bailment for security purposes. The term “Lien” shall include reservations, exceptions, encroachments, easements, rights of way, covenants, conditions, restrictions, leases, and other title exceptions and encumbrances affecting the Property, except for the Permitted Encumbrances set forth in the Security Instrument. For the purposes of this Agreement, Borrower shall be deemed to be the owner of any Property that Borrower has acquired or holds subject to a conditional sale agreement, financing lease, or other arrangement pursuant to which title to the Property has been retained by or vested in some other Person for security purposes.

3

“Loan” shall have the meaning set forth in Section 2.1.

“Loan Documents” means, collectively, each document, paper or certificate executed, furnished or delivered in connection with this Agreement (whether before, on, or after the Closing Date), including, without limitation, this Agreement, the Note, the Security Documents, the Guaranties, the Environmental Indemnity, the Assignment of Management Agreement, and all other documents, certificates, reports, and instruments that this Agreement requires or that were executed or delivered (or both) at Lender’s request, all as the same may be amended, modified or supplemented from time to time.

“Loan to Value” has the meaning set forth in Section 5.18(a).

“Manufactured Home” means a “manufactured home” as that term is defined in the Manufactured Housing Construction and Safety Standards Act of 1974 as amended (42 U.S.C. Chapter 70), and in 24 C.F.R Section 3280.2, and any related fixtures and personal property; collectively, “Manufactured Homes.”

“Material Adverse Effect” or “Material Adverse Change” shall mean any event, act, condition or occurrence of whatever nature (including any adverse determination in any litigation, arbitration, or governmental investigation or proceeding), whether singularly or in conjunction with any other event or events, act or acts, condition or conditions, occurrence or occurrences, whether or not related, resulting in the business, results of operations, financial condition, assets, liabilities or prospects of the Borrower being affected in such a manner as is likely to impair (a) the ability of the Borrower or the Guarantors to perform any of their respective obligations under the Loan Documents, (b) the rights and remedies of the Lender under any of the Loan Documents, or (c) the legality, validity or enforceability of any of the Loan Documents.

“Maturity Date” has that meaning ascribed thereto in the Note.

“Net Income” has the meaning set forth in Section 5.18(b).

“Note” means that certain $1,760,000.00 Promissory Note issued of even date herewith by Borrower to the order of Lender, as the same may be amended, modified or supplemented from time to time.

“Obligations” means the obligations and undertakings of Borrower to: (a) pay the Indebtedness; (b) pay the principal of and interest on the Note in accordance with the terms thereof, including any interest accruing after the filing of any petition in bankruptcy or the commencement of any insolvency reorganization or like proceeding relating to the Borrower whether or not claim for post-filing or post-petition interest is allowed in such proceeding, and to satisfy all other liabilities and obligations, reimbursement obligations, fees, expenses, indemnification, and reimbursement payments costs and expenses, including all fees and expenses of counsel to Lender, incurred pursuant to this Agreement or any other Loan Document, whether direct or indirect, absolute or contingent, liquidated or unliquidated, now existing or hereafter arising hereunder or thereunder, together with all renewals extensions modifications or refinancings thereof; (c) repay to Lender all amounts advanced by Lender hereunder, under the Loan Documents or otherwise on behalf of Borrower, including, without limitation, advances for overdrafts, principal or interest payments to secured parties, mortgagees, or lienors, and for taxes, levies, insurance, rent, repairs to the Premises, or expenses related to actions to comply with Environmental Laws; (d) perform all obligations, duties and covenants owing, arising or due from Borrower to Lender of any kind or nature, present or future, howsoever created, which arise under any Loan Document, whether direct or indirect, now existing or hereafter incurred; and (e) to reimburse Lender, on demand, for all of Lender’s costs and expenses as further described herein.

4

“Pad Site” means a lot and all appurtenances thereto designated as a pad site on the Premises that is eligible to be leased to a Person under a Lease and “Pad Sites” means more than one Pad Site.

“PBGC” means the Pension Benefit Guaranty Corporation and any entity succeeding to any or all of its functions under ERISA.

“Permitted Encumbrances” has that meaning ascribed thereto in the Security Instrument.

“Permitted Liens” means the following:

(a) Liens on the Premises securing the Obligations;

(b) Liens for taxes not delinquent or that are being contested in good faith and by appropriate actions and for which adequate reserves in accordance with GAAP have been established on the books of Borrower; and

(c) Liens securing purchase money debt or Debt arising under capitalized leases, which are permitted hereunder; provided that in each case any such Lien attaches only to the specific item(s) of property or asset(s) acquired or financed with the proceeds of the corresponding Debt.

“Person” means any individual, partnership, firm, corporation, association, joint venture, limited liability company, trust or other entity, or any Governmental Authority.

“Plan” means any employee benefit or other plan established or maintained, or to which contributions have been made, by Borrower and covered by Title IV of ERISA or to which Section 412 of the Code applies.

“Premises” means the real property and improvements known as the Community, all as further described as the “Mortgaged Property” in the Security Instrument.

“Principal Office” means the principal office of Lender located at 000 Xxxxx Xxxxx, Xxxxxxxxx, Xxxxxxxxx 00000.

“Property” or “Properties” means any interest in any kind of property or asset, whether real, personal, or mixed, or tangible or intangible, and includes, without limitation, the Premises.

“Rent Roll” has the meaning set forth in Section 4.20.

“Security Agreement” means that certain Security Agreement and Assignment of Rents and Leases executed by Affiliated Home Owner in favor of Lender of even date herewith, as the same may be amended, modified or supplemented from time to time.

“Security Documents” means any and all security agreements, deeds of trust, mortgages, assignments of rents and leases, pledge agreements, or any other agreements, promises, covenants, arrangements, understandings or other agreements, whether created by law, contract, or otherwise, creating, evidencing or providing security at any time for the Obligations, including, without limitation, the Security Instrument, the Assignment of Ownership Interests, and the Security Agreement.

5

“Security Instrument” means that certain Deed to Secure Debt, Assignment of Leases and Rents, Security Agreement and Fixture Filing executed by Borrower in favor of Lender of even date herewith, as the same may be amended, modified or supplemented from time to time, granting a lien to Lender upon the Property described therein.

“Subsidiary” means, at the time as of which any determination is being made, any corporation, company, partnership, or other entity of which more than fifty percent (50%) of the issued and outstanding voting securities is owned or controlled, directly or indirectly, by Borrower.

“Title Policy” means that certain loan policy of title insurance, issued on the date the Security Instrument is first recorded in the applicable real property records, by Xxxxxxx Title Guaranty Company (Commitment No.: 21000140673) in the amount of the Note with Lender named as the insured thereunder, and insuring the first priority lien of the Security Instrument against the Premises, containing only exceptions which are approved by Lender and such endorsements as requested by Lender.

“UCC” means the Uniform Commercial Code as in effect on the date hereof in the State of Tennessee, as it may be amended from time to time; provided that, if by reason of mandatory provisions of law, the perfection or the effect of perfection or non-perfection of a security interest in any Property is governed by the Uniform Commercial Code in effect in another jurisdiction, then “UCC” means the Uniform Commercial Code as in effect in such other jurisdiction for this limited purpose of perfection.

Section 1.2 References. Where the context requires, the use of singular numbers or pronouns shall include the plural and vice versa, and the use of pronouns of any gender shall include any other gender.

ARTICLE II

THE LOAN

Section 2.1 Loan. Subject to the Conditions Precedent and pursuant to the terms of the Loan Documents, Lender agrees to extend credit to Borrower on the Closing Date in the principal amount of One Million Seven Hundred Sixty Thousand and No/100 Dollars ($1,760,000.00) (the “Loan”). The execution and delivery of this Agreement by the Borrower and the satisfaction of all Conditions Precedent shall be deemed to constitute the Borrower’s request to borrow the Loan on the Closing Date. Interest shall accrue on the outstanding principal balance of the Loan as set forth in the Note. All terms and provisions of repayment shall be as set forth in the Note.

Section 2.2 Purpose of Loan. The proceeds of the Loan shall be used by Borrower for the purchase of the Premises and to pay fees and closing costs associated thereto. To the extent that Borrower requests that Lender fund any Advance to any party other than Borrower, such Advance shall be deemed made to Borrower, and Borrower shall be fully liable for repayment thereof in accordance with the terms of the Loan Documents. At Borrower’s request, and in order to accommodate Borrower’s tax considerations, Lender has agreed to specify within this Agreement that Borrower has allocated (or will allocate) on Borrower’s records some amount of the Loan to the Premises purchased and some amount of the Loan to the Manufactured Homes purchased. Borrower has informed Lender that Borrower intends to allocate $____________.00 of the Loan to the Manufactured Homes and the balance of the Loan to the Premises purchased. For avoidance of doubt, Lender is not agreeing to allocate, limit, split, or otherwise modify the Loan on Lender’s records in any way or fashion and nothing in this subsection shall limit Borrower’s or any Guarantor’s joint and several liability and obligations hereunder or under any Loan Document.

6

Section 2.3 Prepayments. Borrower may at any time and from time to time, prepay all or part of the outstanding principal balance of the Note, subject to the payment of certain prepayment premiums as described below (each a “Prepayment Premium”). Payments under this Section may be applied to the obligations of Borrower to Lender in the order and manner as the Lender in its discretion may determine.

(a) In the event Borrower prepays the Note at any time on or prior to the first annual anniversary of the date of the Note, Borrower shall, at the time of prepayment, pay to Lender an exit fee equal to 3.00% of the principal amount being prepaid on the Note.

(b) If the prepayment occurs after the first annual anniversary of the date of the Note but on or prior to the third annual anniversary of the date of the Note, Borrower shall, at the time of prepayment, pay to Lender an exit fee equal to 2.00% of the principal amount being prepaid on the Note.

(c) If the prepayment occurs after the third annual anniversary of the date of the Note but on or prior to the fifth annual anniversary of the date of the Note, Borrower shall, at the time of prepayment, pay to Lender an exit fee equal to 1.00% of the principal amount being prepaid on the Note.

(d) At any time following the fifth annual anniversary of the Note, Borrower may prepay all or any part of the Note without penalty or premium.

Section 2.4 Payments to Principal Office; Debit Authority. The payments under the Note (including any prepayment and payment of interest) shall be made to Lender at its Principal Office for the account of Lender in United States dollars and in immediately available funds. Borrower hereby agrees that, in addition to (and without limitation of) any right of setoff, banker’s lien or counterclaim Lender may otherwise have, Lender shall be entitled, at its option, to offset balances held by Lender at any of its offices against any principal of or interest on the Obligations hereunder which is not paid when due by reason of a failure by Borrower to make any payment when due to Lender (regardless whether such balances are then due to Borrower), in which case Lender shall promptly notify Borrower, provided that its failure to give such notice shall not affect the validity thereof. All payments due under the Note or Loan Documents shall be made without relief from valuation and appraisement laws.

Section 2.5 Usury. Lender and Borrower intend to conform strictly to applicable usury laws as presently in effect. Accordingly, Borrower and Lender agree that, notwithstanding anything to the contrary herein or in any agreement executed in connection with or as security for this Agreement, the sum of all consideration that constitutes interest under applicable law which is contracted for, charged, or received in connection herewith shall under no circumstance, including without limitation any circumstance in which the Obligations have been accelerated or prepaid, exceed the maximum lawful rate of interest permitted by applicable law. Any excess interest shall be credited to the outstanding Obligations or, if the Obligations shall have been paid in full, refunded to Borrower, by the holder hereof.

Section 2.6 Limitation of Advance. The Loan shall not exceed the lesser of (1) $1,760,000.00, or (2) eighty percent (80%) of the “as-is” appraised value of the Premises, or (c) eighty percent (80%) of the purchase price of the Premises and any Manufactured Homes located thereon.

Section 2.7 Security Interest in Manufactured Homes.

(a) Until the Obligations are paid in full and all other obligations of Borrower to be performed under the Loan Documents shall have been paid and/or performed, Affiliated Home Owner shall grant to Lender a security interest in those Manufactured Homes set forth on Schedule 4.21 and such other collateral security as set forth in the Security Agreement.

7

(b) Affiliated Home Owner shall have the right to sell any of its Manufactured Homes and Lender shall release its security interest in such Manufactured Homes, under the following conditions:

(i) there shall be no Event of Default currently existing under this Agreement;

(ii) promptly following the sale of such Manufactured Home, Affiliated Home Owner shall have paid to the Lender an amount equal to $12,000.00 per home, which such amounts shall be applied as a prepayment of the Loan, provided, however that no Prepayment Premium shall be applied to any such prepayment of the Loan made under this Section 2.7(b)(ii).

(c) Promptly following Lender’s receipt of those funds required immediately above, Lender will execute and deliver to Affiliated Home Owner all documents and filings reasonably required by Affiliated Home Owner to release Lender’s security interest in the Manufactured Home and the original certificate of title for the Home held by Lender. Borrower agrees to pay all reasonable fees and expenses of Lender incurred in connection therewith including reasonable outside attorneys’ fees.

ARTICLE III

CONDITIONS PRECEDENT

Section 3.1 Conditions Precedent to Advance. The obligation of Lender to make the Advance to Borrower is subject to the Conditions Precedent that Lender shall have received all of the following, in form and substance reasonably satisfactory to Lender and its legal counsel in their sole discretion:

(a) Closing Statement. A fully executed copy of a detailed closing statement in a form and substance reasonably acceptable to Lender, which includes a complete description of Borrower’s sources and uses of funds on the Closing Date;

(b) Executed Loan Documents. The original counterparts of all Loan Documents fully executed by the applicable parties;

(c) Resolutions/Consents. A copy of the resolutions or written consents of Borrower and each entity that is an owner of Borrower, approving the Loan and Borrower’s purchase of the Premises, and authorizing the execution and delivery of the Loan Documents;

(d) Organizational Documents. A certified copy of the certificate of organization and operating agreement, with all amendments thereto, of Borrower and each entity that is an owner of Borrower, certified to Lender;

(e) Certificate of Existence. Certified certificates of existence and good standing and authority for Borrower and each entity that is an owner of Borrower, from each applicable state of jurisdiction;

(f) Existence and Authority of Other Entities. Those items, documents, and certificates set forth in subsections (c) through (e) above for Affiliated Home Owner and entity property manager of Borrower’s Property;

8

(g) UCC, Bankruptcy, Litigation, Judgment, Tax and Liens Search. A UCC, bankruptcy, litigation, judgment, tax, and Lien search on Borrower and Borrower’s Property;

(h) Financial Statements; Tax Returns. Financial statements and most recent tax returns of Borrower and Guarantors in form and substance reasonably acceptable to Lender and verification of liquidity for each Guarantor;

(i) Certified Rent Roll. The Rent Roll (as defined herein);

(j) Copies of Purchase Documents. If requested by Lender, copies of all fully executed documents, with all statements, schedules, and exhibits, and all amendments thereto, providing Borrower the rights to acquire the Premises and Property and vesting in Borrower legal ownership in the same, including all deeds, bills of sale, and assignments;

(k) Management Agreement. Copies of all fully executed management agreements related to the Premises, the Communities, or the operation and management of Borrowers’ business on the Premises, with all statements, schedules, and exhibits, and all amendments thereto, along with an Assignment of Management Agreement to Lender duly executed by the applicable parties;

(l) Opinion of Counsel. An opinion of counsel for Borrower and each entity that is an owner of Borrower, if any, (which counsel must be reasonably satisfactory to the Lender) with respect to such legal matters relating hereto as the Lender may reasonably request;

(m) Title Insurance. The Title Policy (or a binding commitment from the title insurer to issue the same) with respect to the Premises dated as of the Closing Date and in the form and manner required hereunder, and evidence that all premiums, fees and expenses in respect thereof have been paid;

(n) Flood Certification. A flood certification report covering the Premises;

(o) Survey. A copy of a current ALTA Land Title Survey with the current “minimum standard detail” and such additional “Table A” requirements as Lender may reasonably request all certified to Lender and the title insurance insurer;

(p) Appraisal. A current appraisal of the Premises, along with a review of such appraisal;

(q) Environmental Report. A copy of a Phase 1 Environmental Report in respect of the Premises that is reasonably satisfactory to Lender, together with a reliance letter confirming that Lender may rely fully on the contents thereof;

(r) Property Condition Report. A copy of a property condition report of the Premises;

(s) Additional Reports. A copy of any environmental, soil, traffic, feasibility, or like reports or studies obtained by Borrower or on Borrower’s behalf in connection with the Premises;

(t) Pad Lease. The form of Lease to be used for all future leases of Pad Sites upon the Premises as approved by Lender;

9

(u) Master Lease. A master lease between Borrower and Affiliated Home Owner, and Borrower and any Affiliate of Borrower that owns Manufactured Homes located or to be located upon the Premises;

(v) Guidelines. The application, screening, underwriting, credit, and/or review criteria determined by Borrower in the exercise of Borrower’s prudent business judgment to qualify tenants and/or Home Owners to enter into a Lease, all as approved by Lender;

(w) Community Rules. The form Community Rules to be used for all tenants of Pad Sites upon the Premises as reasonably approved by Lender;

(x) Evidence of Insurance and/or Bond. Satisfactory evidence of all insurance required under Section 5.8 hereof;

(y) Loan Fee. A loan fee equal to $17,600.00 payable upon initial funding of the Loan;

(z) Costs and Expenses. Satisfactory evidence that all costs and expenses required under Section 5.15 hereof have been paid in full;

(aa) Additional Funds. Satisfactory evidence that all additional funds required to purchase the Premises shall have been provided (or will be provided) by Borrower at Closing;

(bb) Releases. Such payoffs, releases, termination statements, and subordination, nondisturbance and attornment agreements required by Lender to assure its priority interest in Borrower’s Property and the Premises; and

(cc) Other. Such other approvals, opinions, documents or instruments as the Lender may reasonably request, including, without limitation, any document requested or required by Lender or Lender’s counsel on any pre-Closing checklists, certificates, or questionnaires.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES

As an inducement to Lender to enter into this Agreement and to extend credit hereunder, Borrower represents and warrants to Lender that as of the date of the execution of this Agreement:

Section 4.1 Existence and Qualification Borrower is a duly organized, validly existing limited liability company in existence under the laws of the State of Georgia.

Section 4.2 Power and Authorization. Borrower has the requisite power and authority to own its Property and to transact the business in which Borrower is now engaged, or proposes to be engaged in, and is duly authorized and empowered to execute and deliver, and to perform and observe the terms and provisions of, this Agreement and the other Loan Documents executed, or to be executed by Borrower, and to carry out the transactions contemplated hereby and thereby. All action on Borrower’s part required to be taken for the due execution, delivery and performance of this Agreement and the other Loan Documents has been duly and effectively taken.

Section 4.3 Validity of Loan. This Agreement constitutes, and each of the other Loan Documents when executed, acknowledged and delivered, as appropriate, will constitute the legal, valid, and binding obligations of Borrower enforceable against Borrower in accordance with their respective terms.

10

Section 4.4 Title to Property; Priority. Borrower has good and marketable title to the Premises and Borrower’s Properties. With the exception of Permitted Liens and the Permitted Encumbrances, Borrower is the owner of its Properties, including without limitation the Premises, free and clear from any lien, security interest, or encumbrance.

Section 4.5 No Default, Legal Bar or Resultant Lien. The execution, delivery and performance by Borrower of this Agreement, the other Loan Documents, and the consummation of the transactions contemplated herein and therein, does not and will not: (a) contravene any provisions of its articles of organization or operating agreement; (b) cause Borrower to be in default under or violate any provision of any law, ordinance, rule, regulation, order, writ, judgment, injunction, decree, determination, or award presently in effect having application to Borrower or to any of its Properties; (c) result in any breach of, or constitute any default under any agreement, contract, lease or instrument to which Borrower is a party or by which Borrower or any of its Properties may be bound or affected; or (d) result in, or require, the creation or imposition of any lien upon or with respect to any of the Property now owned or hereafter acquired by Borrower other than those liens contemplated by the Loan Documents.

Section 4.6 No Consent. With respect to the execution, delivery and performance of this Agreement and the other Loan Documents, Borrower does not and will not require any registration with, consent or approval of, notice to, or action by, any other Person.

Section 4.7 Financial Statements. The financial statements for Borrower delivered to Lender in connection herewith are true, complete and correct in all material respects, and fairly and accurately reflect the assets, liabilities, financial condition and the results of the operations of Borrower as of and for the periods set forth therein, and are consistent with past practices. There have been no Material Adverse Changes in the assets, liabilities, business, or operations of Borrower since the date of the most recent financial statements of Borrower delivered to Lender.

Section 4.8 No Judgments/Litigation. There are no outstanding or unpaid judgments against Borrower. There are no legal, judicial, regulatory, administrative, or arbitration proceedings, investigations, or other claims, actions, suits or proceedings of any nature pending, or, to Borrower’s knowledge and not disclosed in writing to Lender, threatened against or affecting Borrower, and no event has occurred or condition exists, which with the giving of notice, or the passage of time, or both, could give rise to any such claims, actions, suits or proceedings, except claims, actions, suits or proceedings that are fully covered by insurance, or which, if adversely determined, would not have any Material Adverse Effect on the transactions contemplated by this Agreement or the documents executed or delivered pursuant hereto, or upon the business, properties, or condition (financial or otherwise) of Borrower, and would not impair the ability of any Borrower to perform all of its obligations under this Agreement and the other Loan Documents.

Section 4.9 Compliance with Laws. Borrower is in compliance in all material respects with all applicable laws, rules, regulations and orders of any Governmental Authority affecting Borrower or Borrower’s Properties, including without limitation all Environmental Laws.

Section 4.10 Environmental Matters. The Borrower (a) has not knowingly failed to comply with any Environmental Law or to obtain, maintain or comply with any permit, license or other approval required under any Environmental Law, (b) has not become subject to any Environmental Claim, (c) has not received notice of any claim with respect to any Environmental Claim, or (d) knows of no basis for any Environmental Claim.

11

Section 4.11 ERISA. Borrower is in compliance in all material respects with the applicable provisions of ERISA. Borrower has not incurred any material “accumulated funding deficiency” within the meaning of ERISA, and has not incurred any material liability to PBGC in connection with any Plan.

Section 4.12 Condition of Premises. On the Closing Date, Borrower’s Property has not been damaged or injured as a result of any fire, explosion, accident, flood or other casualty.

Section 4.13 Tax Returns/Taxes. All federal, state and local tax returns of Borrower required to be filed have been filed, and all federal, state and local taxes, assessments, fees or other governmental charges imposed upon Borrower, which are due and payable, have been paid, except where Borrower promptly and diligently contests in good faith by appropriate proceedings and Borrower has established adequate reserves therefor in accordance with GAAP consistently applied.

Section 4.14 Broker’s or Finder’s Fee. No broker’s or finder’s fee or commission is or will be payable in connection with this Agreement, the transactions contemplated hereby, or the transactions consummated with the Advances of the Loan. Borrower hereby agrees to save harmless and indemnify Lender from and against any claims, demands, actions, suits, proceedings, or liabilities, including Lender’s reasonable and actual attorneys’ fees and costs of suit, arising out of or in connection with any such fee or commission.

Section 4.15 Insurance. All insurance required hereunder or within any Loan Document is currently in force and paid up.

Section 4.16 Continuing Representations and Warranties. All representations and warranties made by Borrower in this Agreement shall survive the making of the Advance contemplated hereby and the closing, execution, and delivery of this Agreement and the Loan Documents.

Section 4.17 Disclosure. The Borrower has disclosed to the Lender all material agreements, instruments, and partnership or other restrictions to which the Borrower is subject, and all other matters known to it, that, individually or in the aggregate, could reasonably be expected to result in a Material Adverse Change. None of the reports, financial statements, certificates or other information furnished by or on behalf of the Borrower or the Guarantors to the Lender in connection with this Agreement or any other Loan Document contains any material misstatement of fact or omits to state any material fact necessary to make the statements therein, taken as a whole, in light of the circumstances under which they were made, not misleading.

Section 4.18 Community.

(a) The Community is located on the Premises and is lawfully owned and operated by Borrower.

(b) Construction of the Community is complete.

(c) To Borrower’s current actual knowledge, the Community and the use of the Premises comply with all Governmental Requirements applicable to Manufactured Homes and ownership and management of manufactured home communities, including but not limited to any statutes, rules and regulations pertaining to the construction, installation and maintenance of Manufactured Homes and manufactured home communities, including, but not limited to Ga. Code Xxx. § 8-2-130 – 144 (2017) (the Uniform Standards Code for Manufactured Homes Act); Ga. Code Xxx. § 8-2-160, et seq. (2017) (installation of manufactured homes); Ga. Code Xxx. § 8-2-170, et seq. (2017) (installation of pre-owned manufactured homes); et seq.; Ga. Code Xxx. § 8-2-180, et seq. (2017) (standards for manufactured homes); Ga. Code Xxx. § 8-2-349 (priority of liens affecting manufactured homes); Ga. Code Xxx. § 40-11-1 (2017) (abandoned motor vehicles); Ga. Code Xxx. § 44-7-1, et seq. (2017) (landlord tenant law as applicable to manufactured home communities, including, but not limited to, Ga. Code Xxx. § 44-7-59 and § 44-7-82 (2017)); and Ga. Code Xxx. § 00-00-000 (2017) (priority of liens affecting manufactured homes); and equal opportunity, anti-discrimination, fair housing, environmental protection, zoning, density and land use (“legal, non-conforming” status with respect to uses or structures will be considered to comply with zoning and land use requirements for the purposes of this representation).

12

(d) To Borrower’s current actual knowledge, all public and private utilities on the Premises comply with all Governmental Requirements, including, but not limited to local conditions and code requirements.

(e) To Borrower’s current actual knowledge, there is no evidence of any illegal activities at the Community.

(f) To Borrower’s current actual knowledge, Borrower has complied with and is in compliance with all Governmental Requirements applicable to the development, ownership and operation of the Community.

(g) The Community has paved roads.

(h) The Community consists of approximately the number of Pad Sites as set forth in the definition of the Community.

(i) To Borrower’s current actual knowledge, all Manufactured Homes in the Community conform to the requirements of the federal Manufactured Home Construction And Safety Standards of 1974 (42 U.S.C. chap. 70; 24 C.F.R. Part 3280).

(j) The Community has established and has full access to all public utility services necessary for the operation of the Community and such utility services are available through public or private easements or rights of way at the boundaries of the Premises, including water, electricity, telephone facilities, and sewage.

(k) No portion of the Premises is located in an area identified by the Federal Emergency Management Agency (or any successor thereto) as a “Special Flood Hazard Area”.

Section 4.19 Community Operation.

(a) Borrower does not engage in the retail sale or financing of Manufactured Homes.

(b) Neither Borrower nor Affiliated Home Owner rents Manufactured Homes under Leases providing that upon payment of the stipulated rent or a nominal charge, Borrower shall convey title to the Pad Site to the lessee.

(c) Borrower has adopted and implemented Community Rules that are appropriate and enforceable and maintain the viability and physical condition of the Community, a copy of which has been delivered to Lender.

13

(d) There are no other agreements between Borrower and any Home Owner other than the Leases and the Community Rules.

(e) Borrower has complied with all Governmental Requirements applicable to (1) each Home Owner’s application to rent a Pad Site, (2) the advertising, soliciting, leasing and making of each Lease, (3) the development, ownership and operation of the Community, including but not limited to the Federal Trade Commission Act and all rules and regulations promulgated thereunder; 24 C.F.R. Part 201 concerning manufactured home location standards; the Equal Credit Opportunity Act and all rules and regulations promulgated thereunder; the Fair Credit Reporting Act and all rules and regulations promulgated thereunder; the Fair Housing Act and all rules and regulations promulgated thereunder; the Real Estate Settlement Procedures Act, and all other applicable Federal, state, and local laws, regulations, rules, and ordinances, as any of the foregoing from time to time may be amended.

Section 4.20 Leases.

(a) The rent roll attached hereto as Schedule 4.20 (the “Rent Roll”) is true, complete and correct as of the date thereof, and the Premises is not subject to any Leases other than the Leases described in the Rent Roll. Borrower is the owner and lessor of landlord’s interest in the Leases. No Person has any possessory interest in the Premises or right to occupy the same except under and pursuant to the provisions of a Lease. The Leases identified on the Rent Roll are in full force and effect and there are no defaults thereunder by landlord, and to the best of the knowledge of Borrower, any tenant, and, to the knowledge of Borrower, there are no conditions that, with the passage of time or the giving of notice, or both, would constitute defaults thereunder. The forms of the Leases delivered to Lender are true and correct copies of the Lease forms used by Borrower, and there are no oral agreements with respect thereto. Any payments, free rent, partial rent, rebate of rent or other payments, credits, allowances or abatements required to be given by Borrower to any tenant has already been received by such tenant. The tenants under the Leases evidenced by the Rent Roll have accepted possession of and are in occupancy of all of their respective Pad Site and have commenced the payment of full, unabated rent under the Leases. There has been no prior sale, transfer or assignment, hypothecation or pledge of any Lease or of the rents received therein which is still in effect. To Borrower’s knowledge, no tenant listed on the Rent Roll has assigned its Lease or sublet all or any portion of the premises demised thereby, no such tenant holds its leased premises under assignment or sublease.

(b) All Leases for Pad Sites by Home Owners are on forms that are customary for similar manufactured home communities in the same geographical location, and contain terms that: (i) are for initial terms of at least 12 months and not more than 2 years (unless otherwise approved in writing by Lender), (ii) list Borrower as the landlord and owner therein, (iii) subordinate the Lease to the mortgage lien of Lender, (iv) require payment of rents and other amounts payable by Home Owners be payable to Borrower, and (v) are substantially similar in form and substance to those previously delivered and approved by Lender and/or Lender’s counsel. All Leases for Pad Sites by Home Owners include a provision requiring that tenants comply with all laws, rules and regulations applicable to manufactured homes and manufactured home communities, including any laws, rules and regulations promulgated by the U.S. Department of Housing and Urban Development and the Community Rules.

(c) All Leases for Pad Sites by Home Owners are bona fide leases made to Home Owners that are required to locate a Manufactured Home thereon.

14

(d) All Leases for Pad Sites require Home Owners to maintain property damage insurance to ensure the Manufactured Homes are protected from loss or damage from fire and other hazards.

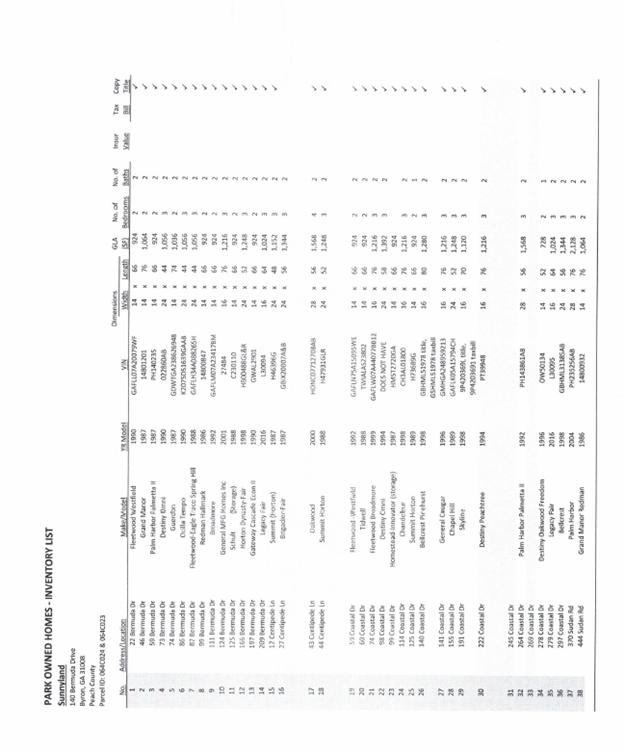

Section 4.21 Affiliate-Owned Manufactured Homes. The Manufactured Homes listed and described on Schedule 4.21 attached hereto are owned by Affiliated Home Owner.

ARTICLE V

AFFIRMATIVE COVENANTS

Borrower hereby covenants and agrees with Lender that:

Section 5.1 Financial Statements.

(a) As soon as available, and in any event within ninety (90) days after the close of Borrower’s fiscal year, Borrower shall furnish Lender with (i) company prepared unaudited financial statements of Borrower, setting forth the balance sheet and the statement of income and cash flow of Borrower for such year, in each case in comparative form to the figures for the previous fiscal year all in reasonable detail and prepared in accordance with sound and consistently applied GAAP and certified as true and correct in all material respects by the manager of Borrower, all as reasonably acceptable to Lender in form and substance, and (ii) a current rent roll and operating statement for the Premises and Community, all in reasonable detail and certified as true and correct in all material respects by the manager of Borrower, all as reasonably acceptable to Lender in form and substance. As soon as available, and in any event within thirty (30) days of when such were due to be filed (or within thirty (30) days after the last date of any extension period, if applicable), Borrower shall furnish Lender with a copy of all tax returns (including all schedules and statements) of Borrower. Borrower shall also furnish to Lender such additional financial information as may be reasonably requested by Lender from time to time but no more frequently than quarterly.

(b) As soon as available, and in any event within ninety (90) days after the close of each calendar year, Borrower shall cause to be furnished to Lender personal financial statements and contingent debt schedules of each Guarantor in each case in comparative form to the figures for the previous year all in reasonable detail and prepared in accordance with sound and consistently applied GAAP, all as reasonably acceptable to Lender in form and substance. As soon as available, and in any event within thirty (30) days of when such were due to be filed (or within thirty (30) days after the last date of any extension period, if applicable), Borrower shall cause to be furnished to Lender copies of all tax returns (including all schedules and statements) of each Guarantor. Borrower shall also cause to be furnished to Lender such additional financial information of each Guarantor as may be reasonably requested by Lender from time to time.

(c) As soon as available, and in any event within thirty (30) days after the end of each calendar quarter, Borrower shall furnish Lender the following: (i) company prepared unaudited financial statements of Borrower, setting forth the balance sheet and the statement of income and cash flow of Borrower for such calendar quarter, in each case in comparative form to the figures for the previous calendar quarter all in reasonable detail and prepared in accordance with sound and consistently applied GAAP and certified as true and correct in all material respects by the manager of Borrower, all as reasonably acceptable to Lender in form and substance; and (ii) a rent roll and delinquency report of all Leases of the Premises, and such other information as Lender may reasonably require all certified as true and correct in all material respects by the manager of Borrower, all as reasonably acceptable to Lender in form and substance.

15

Section 5.2 Notice. Borrower will give Lender written notice of the occurrence of any of the following within ten (10) Business Days of such occurrence, which notice shall be accompanied by a written statement of an officer of Borrower setting forth the details of the event or development requiring such notice and any action taken or proposed to be taken with respect thereto:

(a) the occurrence of a Default or Event of Default hereunder;

(b) the filing or commencement of any action, suit or proceeding by or before any arbitrator or Governmental Authority against or, to the knowledge of the Borrower, affecting the Borrower which, if adversely determined, could reasonably be expected to result in a Material Adverse Change;

(c) the occurrence of any “reportable event” or “prohibited transaction” or the imposition of a “withdrawal liability” within the meaning of ERISA;

(d) the occurrence of any event or any other development by which the Borrower (i) fails to comply with any Environmental Law or to obtain, maintain or comply with any permit, license or other approval required under any Environmental Law, (ii) becomes subject to any Environmental Claim, (iii) receives notice of any claim with respect to any Environmental Claim, or (iv) becomes aware of any basis for any Environmental Claim and in each of the preceding clauses, which individually or in the aggregate, could reasonably be expected to result in a Material Adverse Change;

(e) the receipt by Borrower of any notice, written or oral, from any laborer, contractor or materialman to the effect that any laborer, contractor or materialman has not been paid when due for any labor or materials furnished upon the Premises; and

(f) any other development that results in, or could reasonably be expected to result in, a Material Adverse Change.

Section 5.3 Existence. Borrower shall do or cause to be done all things necessary to preserve, renew, and keep in full force and effect its existence, material rights, licenses, permits and franchises and conduct and operate its business in substantially the manner in which it is presently conducted and operated (subject to changes in the ordinary course).

Section 5.4 Books and Records. Borrower will at all times keep and maintain complete and accurate books and records of its operations in connection with the Premises. Borrower’s books and records shall at all times be maintained at the address for Borrower set forth in this Agreement. Upon not less than three (3) days advanced written notice to Borrower (or twenty-four (24) hours advanced written notice to Borrower upon the occurrence and continuance of an Event of Default), Lender, or any of its agents, employees, or representatives, shall have the right, to visit Borrower’s place or places of business, no more frequently than annually, except upon the occurrence and continuance of an Event of Default, and, without hindrance or delay, to inspect, audit, check, and make extracts from the books, records, journals, orders, receipts, correspondence, and other data relating to Borrower’s operations; Lender shall have the right to discuss such matters with Borrower’s officers and accountants at all times.

16

Section 5.5 Compliance. Borrower will comply in all material respects with all laws, ordinances, rules, regulations, judgments, orders, injunctions, writs and decrees of any Governmental Authority, or any court or similar entity established by any of them, to which Borrower, or any of Borrower’s Property, the Premises, or any other Property described in the Loan Documents is subject (including without limitation all Environmental Laws). In addition, Borrower shall promptly obtain and maintain, from time to time at its own expense, all such governmental licenses, authorizations, consents, permits and approvals as may be required to enable it to comply with its obligations hereunder, the Loan Documents, or to carry on its business in the ordinary course. Notwithstanding the foregoing, as soon as possible, but in no event later than ten (10) business days after the Closing Date, Borrower shall (i) file with the appropriate state agency completed and executed applications for the assignment, conveyance, and/or new issuance of any and all licenses and permits (“Applications”), (ii) pay the required filing fee, and (iii) provide Lender evidence of the foregoing items (i) – (ii). The Applications shall list the Borrower as the licensee thereunder. Lender must receive a copy of all current and valid permits and licenses, within sixty (60) days from the Closing Date, to the extent such permits and licenses have been made available to Borrower from the appropriate Government Authority.

Section 5.6 ERISA Information and Compliance. Except to the extent that a failure to do so will not result in a Material Adverse Change, Borrower will comply with ERISA and all other applicable laws governing any pension or profit sharing plan or arrangement to which Borrower is a party or is otherwise subject.

Section 5.7 Intervening Liens and Encumbrances. Borrower shall satisfy and pay all claims for labor or materials, rents, and other obligations that, if unpaid, will or might become a lien against Borrower’s Property, except where Borrower promptly and diligently contests in good faith by appropriate proceedings and Borrower has established adequate reserves therefor. In the event any such liability or obligation is contested by Borrower in good faith, then upon Lender’s request, Borrower shall establish reserves with Lender.

Section 5.8 Insurance. Borrower will obtain and maintain, in amount, form and substance, and with insurers reasonably satisfactory to Lender, and shall provide to Lender annual evidence of, the following insurance:

(a) Fire and Extended Coverage. Fire, hazard and extended coverage, all-risks insurance protecting against, but not limited to, fire, theft, malicious mischief, vandalism, and such other hazards as Lender may require Borrower to carry for the Premises for the full insurable value thereof on a replacement cost claim recovery basis, containing standard non-contributing mortgagee loss payable clauses and subrogation clauses, and an agreement to notify Lender in writing at least thirty (30) days prior to any cancellation or amendment of any such policy. Copies of such policy, together with appropriate endorsements thereto, and evidence of the payment of the premiums thereon, shall be promptly delivered to Lender upon request. Said insurance shall be carried in full force and effect for the duration of the Loan.

(b) Public Liability. Comprehensive public liability insurance on an “occurrence basis” insuring Borrower and Lender against claims for personal injury, including, without limitation, bodily injury, death or property damage, occurring on, in or about the Premises, and the adjoining streets, sidewalls and passageways in an amount of not less than $2,000,000.00 per occurrence, naming Lender as an additional insured, and containing an agreement to notify Lender in writing at least thirty (30) days prior to any cancellation or amendment of such policy. Copies of such policy, together with appropriate endorsements thereto, and evidence of the payment of the premiums thereon, shall be promptly delivered to Lender upon request. Said insurance shall be carried in full force and effect for the duration of the Loan.

(c) Worker’s Compensation. Worker’s compensation insurance covering Borrower, as required by applicable law, which shall contain an agreement to notify Lender in writing at least thirty (30) days prior to any cancellation or amendment of such policy. Copies of such policy, together with appropriate endorsements thereto, and evidence of the payment of the premiums thereon, shall be promptly delivered to Lender upon request. Said insurance shall be carried in full force and effect for the duration of the Loan.

17

(d) Flood. If any of the Premises is located in an area designated as having special flood hazards, flood insurance insuring the Premises shall contain an agreement to notify Lender in writing at least thirty (30) days prior to any cancellation or amendment of such policy. Copies of such policy, together with appropriate endorsements thereto, and evidence of the payment of the premiums thereon, shall be promptly delivered to Lender upon request. Said insurance shall be carried in full force and effect for the duration of the Loan.

(e) Business Interruption/Loss of Rents Insurance. Business interruption or loss of rents insurance covering Borrower for a term of at least six (6) months which shall contain an agreement to notify Lender in writing at least thirty (30) days prior to any cancellation or amendment of such policy. Copies of such policy, together with appropriate endorsements thereto, and evidence of the payment of the premiums thereon, shall be promptly delivered to Lender upon request. Said insurance shall be carried in full force and effect for the duration of the Loan.

(f) Additional Insurance. Such other insurance, in such amounts and for such terms, as may from time to time be reasonably required by Lender, and is customary for similar properties, insuring against such other casualties or losses which at the time are commonly insured against by those in Borrower’s business or in the case of premises similarly situated, due regard being given to Borrower’s Property, the height and type of the improvements thereon, and the construction, location, use and occupancy thereof.

Section 5.9 Collection of Insurance Proceeds.

(a) In the event of loss pertaining to the Premises (“Loss”), Borrower shall promptly give written notice to the insurance carrier and Lender. All insurance proceeds shall be paid to Lender and shall be placed in a separate trust account with Lender to be disbursed in accordance with this Agreement. In the event that any insurance company fails to disburse directly and solely to Lender, but disburses instead either solely to Borrower or to Borrower and Lender jointly, Borrower agrees to immediately endorse and transfer such proceeds to Lender. Upon failure of Borrower to endorse and transfer such proceeds to Lender, Lender may execute such endorsements or transfers for and in the name of Borrower and Borrower hereby irrevocably appoints Lender as Borrower’s agent and attorney-in-fact so to do. Provided that no Default or Event of Default has occurred and is continuing hereunder or but for the passage of time or the giving of notice, or both, would have occurred and is continuing, (i) Borrower may adjust, compromise and settle any claim hereunder subject to obtaining the prior written consent of Lender, such consent not to be unreasonably withheld, conditioned or delayed, and (ii) after deducting from said insurance proceeds any expenses incurred in collecting or handling the proceeds and paying same to Lender, Borrower may, at Borrower’s option, direct the net proceeds to be applied either (1) as a credit on the principal of the Note, whether then matured or to mature in the future, or (2) to the repair or restoration of the Premises if Borrower complies with the conditions provided in this paragraph. Until disbursed to pay for the cost of repairing or restoring the Premises, Lender shall have a security interest in the insurance proceeds and other funds at any time held by it pursuant to this paragraph.

18

(b) If Borrower elects to direct the net proceeds to be applied to the repair or restoration of the Premises, Lender shall make the insurance proceeds available to Borrower to pay all or a portion of the costs of repairing or restoring the Premises to as nearly as practicable the condition of the Premises immediately preceding the Loss, provided that such funds shall be made available to Borrower only on compliance with the following conditions: (i) within forty-five (45) days of a Loss, Borrower shall notify Lender of Borrower’s intention to use the insurance proceeds to repair or restore the Premises to as nearly as practicable their condition immediately prior to the Loss; (ii) Lender shall have determined, in its reasonable judgment, that sufficient funds (including the insurance proceeds) are available or committed on terms reasonably satisfactory to Lender to complete and pay for the restoration and repair of the Premises in accordance with all then applicable building code requirements; (iii) funds available to Borrower shall be dedicated and sufficient to pay during the period required to restore or repair the Premises the required payments of principal of and interest on the Note and all unabated operating expenses of the Premises; and (iv) the Contractor shall be reasonably approved by Lender and the contract between Borrower and the Contractor shall be submitted to, and reasonably approved by Lender. Any funds required in addition to the insurance proceeds to complete and pay for the cost of restoring the Premises shall be the first funds applied to pay such costs; thereafter, as such restoration or repair progresses, Lender will make periodic payments from the insurance proceeds to Borrower in accordance with the general procedures of Lender applicable to the disbursement of construction loans, to include, in Lender’s sole discretion, the use of a third-party construction inspector at Borrower’s expense to certify the progress of construction. If no election is made by Borrower within sixty (60) days of the Loss, Lender may apply the insurance proceeds as a credit on the Note or any portion thereof, whether then matured or to mature in the future.

(c) Should the Premises or any of Borrower’s Property be materially damaged or destroyed by fire or other casualty, which is not adequately covered by insurance (as reasonably determined by Lender) to effect the full and complete repair or restoration of same, Borrower shall have fourteen (14) days following written notice from Lender of such determination by Lender to establish and fund an account with Lender with adequate reserves (in excess of any insurance proceeds) in Lender’s reasonable discretion to effect the full and complete repair or restoration of the Premises or any of Borrower’s Property.

Section 5.10 Right to Effect Insurance. In case of Borrower’s failure to keep the Premises so insured, Lender or its assigns, may, at its option (but shall not be required to) effect such insurance at Borrower’s expense.

Section 5.11 Indemnification.

(a) Borrower shall indemnify Lender, its successors and assigns, any Person who may acquire any participation or other interest in any Obligation, and every director, officer, employee and affiliate of any thereof (individually, an “Indemnitee”) with respect to, and hold each Indemnitee harmless from and against, any and all liabilities, obligations, losses, damages, penalties, actions, judgments, suits, claims, costs, expenses and disbursements of any kind or nature whatsoever (including, without limitation, the reasonable fees and disbursements of counsel for any Indemnitee in connection with any investigative, administrative or judicial proceeding, whether or not such Indemnitee shall be designated a party thereto but excluding under this Section income tax liabilities) which may be imposed on, incurred by, or asserted against such Indemnitee, in any way relating to or arising out of the Loan or the Loan Documents (“Indemnification Liabilities”); provided that no Indemnitee shall have the right to be indemnified hereunder for its own willful misconduct or gross negligence. Borrower shall reimburse each Indemnitee on demand from time to time for all Indemnification Liabilities incurred by such Indemnitee. Each Indemnitee will promptly notify Borrower of the commencement of any proceeding involving it in respect of which indemnification may be sought pursuant to this Section. Borrower shall not be liable for the cost of any settlement entered into without its consent (which consent shall not be unreasonably withheld). Provided that no Event of Default occurs hereunder, Borrower shall have the right at its expense to select counsel to defend the Indemnification Liabilities. If an Event of Default occurs or has occurred, then Lender in its discretion may employ such counsel at Borrower’s expense. The obligations of Borrower under this Section shall terminate upon the repayment of the loans and termination of this Agreement. Except as a result of Lender’s gross negligence, willful misconduct or bad faith occurring while Lender, any receiver or any third party is in actual possession of the Premises, Borrower hereby indemnifies Lender and holds Lender harmless from and against any and all liabilities, costs, expenses (including reasonable attorneys’ fees), and claims of any and every kind whatsoever paid or incurred by, or asserted against, Lender with respect to, or as a direct or indirect result of, the presence on or under, or the escape, seepage, leakage, spillage, discharge, emission, discharging or release from the Premises of any Hazardous Substances, regardless of whether or not caused by or within the control of Borrower. The foregoing provision shall survive the term of this Agreement and the repayment of the Loan, and shall continue in full force and effect so long as the possibility of such liabilities, claims, or losses exists.

19

(b) Except as a result of Lender’s gross negligence, occurring while Lender is in actual possession of the Premises, Borrower hereby indemnifies Lender and holds Lender harmless from and against any and all liabilities, costs, expenses (including reasonable and actual attorneys’ fees), and claims of any and every kind whatsoever paid or incurred by, or asserted against, Lender with respect to, or as a direct or indirect result of, the presence on or under, or the escape, seepage, leakage, spillage, discharge, emission, discharging or release from the Premises of any Hazardous Substances, regardless of whether or not caused by or within the control of Borrower. The foregoing provision shall survive the term of this Agreement and the repayment of the Loan, and shall continue in full force and effect so long as the possibility of such liabilities, claims, or losses exist.

Section 5.12 Further Assurances. Upon request of Lender, Borrower shall promptly execute and deliver to Lender all such other and further documents, agreements and instruments, and shall do all such other acts or things in compliance with or accomplishment of the terms, provisions, covenants or agreements of Borrower in this Agreement or the other Loan Documents, or to further evidence, secure or more fully describe any collateral intended as security for the Note, or to correct any omissions in this Agreement or in the other Loan Documents, or to more fully state the obligations set out herein or in any of the Loan Documents, or to perfect, protect or preserve any liens created pursuant to any of the Loan Documents, or to make any recordings, to file any notices, or to obtain any consents, all as may be necessary or appropriate in connection therewith.

Section 5.13 Right of Inspection. Annually, at Borrower’s sole cost and expense, unless an Event of Default is then occurring, Borrower shall permit Lender (by its officers, employees and agents) during normal business hours (i.e. 9:00am to 6:00pm local time) and with twenty-four (24) hours prior notice, whether written or oral, to Borrower, to inspect Borrower’s books, financial records, Property, the Premises, and all records related to the foregoing (and to make extracts or copies from such records), and to verify the amount, quality, quantity, value and condition of, or any other matter relating to, the same. Upon or after the occurrence of an Event of Default, and at the expense of Borrower to be added to the Obligations, Lender may at any time and from time to time inspect Borrower’s books, financial records, Property, the Premises, and all records related to the foregoing (and to make extracts or copies from such records), and to verify the amount, quality, quantity, value and condition of, or any other matter relating to, the same, and employ and maintain on Borrower’s premises a custodian who shall have full authority to do all acts necessary to protect Lender’s interests.

Section 5.14 Taxes. Borrower shall pay and discharge promptly all taxes and governmental charges, levies, and assessments affecting Borrower or its Properties, and upon Lender’s request, provide proof thereof, except where such taxes and charges are promptly and diligently contested in good faith by Borrower by appropriate proceedings, and where Borrower has established adequate reserves therefore in accordance with GAAP.

Section 5.15 Costs and Expenses. Borrower will pay all costs and expenses in connection with, and pertaining to, the closing of this Agreement, and all costs and expenses in connection with the preparation, execution, recording, filing, disbursement, transfer, administration, modification, collection and enforcement of this Agreement and the other Loan Documents, including, but not limited to, reasonable legal fees, accounting fees, engineer’s fees, advances, recording expenses, transfer taxes, other filing and recording fees and taxes, surveys, policies of title insurance and other insurance, examination of title and lien searches, appraisals, expenses of foreclosure, and other similar items. In the event of any action at law or suit in equity in connection with this Agreement or the other Loan Documents, or any Default or Event of Default by Borrower under this Agreement or the other Loan Documents, or Lender retains legal counsel in connection with this Agreement or the other Loan Documents, Borrower, in addition to all other sums which such Borrower may be required to pay, shall pay to Lender the reasonable and actual attorney’s fees of Lender. Borrower shall also be responsible for all reasonable and actual attorneys’ fees, costs and expenses that Lender incurs in protecting, preserving, or enforcing its interest in any collateral under the Loan Document.

20

Section 5.16 Community; Manufactured Homes. Until the Obligations are paid in full and all other obligations of Borrower to be performed under the Loan Documents shall have been paid and/or performed:

(a) Borrower shall not allow any Manufactured Homes of Affiliated Home Owner to become affixed to the real estate constituting the Premises. Without Lender’s prior written consent, Borrower shall not move or remove Manufactured Homes of Affiliated Home Owner from the Pad Site upon which such Manufactured Homes of Affiliated Home Owner are presently located.

(b) Borrower shall take appropriate measures to prevent, and shall not engage in or knowingly permit, any illegal activities at the Premises, including those that could endanger tenants or visitors, result in damage to Borrower’s Property, result in forfeiture of the same, or otherwise materially impair the Lien created by any Security Document and any other Loan Documents or Lender’s interest in Borrower’s Property.

(c) Borrower shall not decrease the number of Pad Sites located on the Premises without the consent of the Lender, which shall not be unreasonably withheld, conditioned or delayed.

(d) The Community shall at all times be located on the Premises and shall be owned and operated by Borrower.

(e) The Borrower, the Community and the use of the Premises shall comply with all Governmental Requirements applicable to Manufactured Homes and the ownership and management of manufactured home communities, including but not limited to any statutes, rules and regulations pertaining to the construction, installation and maintenance of Manufactured Homes and manufactured home communities, including, but not limited to Ga. Code Xxx. § 8-2-130 – 144 (2017) (the Uniform Standards Code for Manufactured Homes Act); Ga. Code Xxx. § 8-2-160, et seq. (2017) (installation of manufactured homes); Ga. Code Xxx. § 8-2-170, et seq. (2017) (installation of pre-owned manufactured homes); et seq.; Ga. Code Xxx. § 8-2-180, et seq. (2017) (standards for manufactured homes); Ga. Code Xxx. § 8-2-349 (priority of liens affecting manufactured homes); Ga. Code Xxx. § 40-11-1 (2017) (abandoned motor vehicles); Ga. Code Xxx. § 44-7-1, et seq. (2017) (landlord tenant law as applicable to manufactured home communities, including, but not limited to, Ga. Code Xxx. § 44-7-59 and § 44-7-82 (2017)); and Ga. Code Xxx. § 00-00-000 (2017) (priority of liens affecting manufactured homes); and equal opportunity, anti-discrimination, fair housing, environmental protection, zoning, density and land use (“legal, non-conforming” status with respect to uses or structures will be considered to comply with zoning and land use requirements for the purposes of this representation).

21

(f) All public and private utilities on the Premises shall comply with Governmental Requirements, including code requirements, related to the same.

(g) The Community shall have paved roads.

(h) The Community shall have approximately the number of Pad Sites as set forth in the definition of Community.

(i) All Manufactured Homes in the Community shall conform to the requirements of the federal Manufactured Home Construction And Safety Standards of 1974 (42 U.S.C. chap. 70; 24 C.F.R. Part 3280).

(j) Borrower shall not engage in the retail sale or financing of Manufactured Homes.

(k) The Community shall have Community Rules that are appropriate, enforceable, and shall maintain the viability and physical condition of the Community, an updated copy of which shall be delivered to Lender.

(l) There shall be no other agreements between Borrower and a Home Owner other than the Leases and the Community Rules.

(m) In the event that any portion of the Premises is located in an area identified by the Federal Emergency Management Agency (or any successor thereto) as a “Special Flood Hazard Area”, Borrower shall provide notice to all tenants of the Premises of such designation.

(n) Borrower shall comply with all laws and regulations applicable to (1) each Home Owner’s application to rent a Pad Site, (2) the advertising, soliciting, leasing and making of each Lease, (3) the development, ownership and operation of the Community, including but not limited to the Federal Trade Commission Act and all rules and regulations promulgated thereunder; 24 C.F.R. Part 201 concerning manufactured home location standards; the Equal Credit Opportunity Act and all rules and regulations promulgated thereunder; the Fair Credit Reporting Act and all rules and regulations promulgated thereunder; the Fair Housing Act and all rules and regulations promulgated thereunder; the Real Estate Settlement Procedures Act, and all other applicable Federal, state, and local laws, regulations, rules, and ordinances, as any of the foregoing from time to time may be amended.

(o) All Home Owners of a Manufactured Home, including, without limitation, Affiliated Home Owner, located on a Pad Site within the Community shall have executed in favor of Borrower a Lease.

Section 5.17 Leases.

(a) All Leases for Pad Sites by Home Owners, shall be on forms that are customary for similar manufactured home communities in the same geographical location, and contain terms that: (i) are for initial terms of at least 12 months and not more than 2 years (unless otherwise approved in writing by Lender), (ii) list Borrower as the landlord and owner therein, (iii) subordinate the Lease to the mortgage lien of Lender, (iv) require payment of rents and other amounts payable by Home Owners be payable to Borrower, and (v) are substantially similar in form and substance to those previously delivered and approved by Lender and/or Lender’s counsel.

22

(b) All Leases for Pad Sites by Home Owners, shall include a provision requiring that tenants comply with all laws, rules and regulations applicable to manufactured homes and manufactured home communities, including any laws, rules and regulations promulgated by the U.S. Department of Housing and Urban Development and the Community Rules.

(c) All Leases for Pad Sites by Home Owners, shall be bona fide leases made to Home Owners that are required to locate a Manufactured Home thereon.

(d) All Leases for Pad Sites shall require Home Owners to maintain property damage insurance to ensure the Manufactured Homes are protected from loss or damage from fire and other hazards.

(e) All Leases for Pad Sites shall include a provision that such Leases are governed by the law of the state where the Premises is located.

Section 5.18 Financial Covenants. Until the Obligations are paid in full and all other obligations of Borrower to be performed under the Loan Documents shall have been paid and/or performed, Borrower: