EXECUTION VERSION SUBSTITUTE INSURANCE REIMBURSEMENT FACILITY AGREEMENT This Substitute Insurance Collateral Facility Agreement (the “Agreement”) effective as of September 29, 2022 (the “Effective Date”) by and between 1970 Group, Inc. (the...

EXECUTION VERSION SUBSTITUTE INSURANCE REIMBURSEMENT FACILITY AGREEMENT This Substitute Insurance Collateral Facility Agreement (the “Agreement”) effective as of September 29, 2022 (the “Effective Date”) by and between 1970 Group, Inc. (the “Company”), a Delaware corporation, having its principal place of business at 000 Xxxxxxx Xxxxxxxxxx, Xxxxx 000, Xxxxxxx, Xxx Xxxx 00000 and TEAM, INC. (the “Customer”), a Delaware corporation, having its principal place of business at 00000 Xxxxx Xxxxxxx Xxxx, Xxxxx 000, Xxxxx Xxxx, Xxxxx 00000 (Company and Customer are individually referred to herein as a “Party” and collectively, as the “Parties”). Additional definitions used in this Agreement are set forth in Schedule B. RECITALS I. Customer is required by its workers’ compensation, commercial automotive and general liability insurance carriers to provide those insurance carriers with letters of credit as collateral for Customer’s workers’ compensation, commercial automotive and/or general liability coverage; II. Customer has requested that Company extend credit in the form of a substitute insurance reimbursement facility to Customer as set forth herein, including in Schedule A hereto, to support Customer’s (or its Subsidiaries’) required letters of credit; III. Subject to the terms and conditions of this Agreement, Company is willing to provide a substitute insurance reimbursement facility to Customer as set forth herein and to obtain for Customer (or its Subsidiaries) letters of credit from an NAIC approved financial institution as collateral for Customer’s (or its Subsidiaries’) workers’ compensation, commercial automotive and/or general liability insurance policies. NOW, THEREFORE, in consideration of the premises and the mutual covenants herein contained, the parties hereto agree as follows: ARTICLE 1 THE SUBSTITUTE INSURANCE REIMBURSEMENT FACILITY Section 1.1 Extension of The Substitute Insurance Reimbursement Facility. Upon the execution of this Agreement, and subject to the terms and conditions hereof, Company shall provide to Customer and any domestic Subsidiaries or Affiliates of Customer a substitute insurance reimbursement facility pursuant to which the Company will arrange for the issuance of letters of credit from an NAIC-approved financial institution designated by the Company (each a “Letter of Credit”) as set forth in Schedule A (the “Substitute Insurance Reimbursement Facility”) to enable Customer to provide credit support under Customer’s (or its Subsidiaries’) workers’ compensation, commercial automotive and general liability insurance policies identified in Schedule A (the “Policies”). In the event any draw is made under a Letter of Credit (a “Draw”), it is understood and agreed that such Draw shall constitute an advance by Company to Customer in a principal amount equal to the amount of the Draw, such advance shall be reimbursable by Customer within five (5) Business Days of the Company providing Customer with notice of such Draw (the

Page 13 of 23 of any rights in this Agreement; (ii) collection of any Obligations; (iii) administration and enforcement of Company’s rights under this Agreement or any other Transaction Document; (iv) any refinancing or restructuring of the Substitute Insurance Reimbursement Facility, whether in the nature of a “work-out,” in any insolvency or bankruptcy proceeding or otherwise, and whether or not consummated; if (a) the Agreement is placed in the hands of an attorney for collection or enforcement or is collected or enforced through any legal proceeding or Company otherwise takes action to collect amounts due under the Agreement or to enforce the provisions of the Agreement or (b) there occurs any bankruptcy, reorganization, receivership of any Customer or other proceedings affecting creditors’ rights and involving a claim under the Agreement, then Customer shall pay the reasonable and documented out-of-pocket costs incurred by Company for such collection, enforcement or action or in connection with such bankruptcy, reorganization, receivership or other proceeding, including, but not limited to, reasonable external attorneys’ fees and disbursements (including such fees and disbursements related to seeking relief from any stay, automatic or otherwise, in effect under any Bankruptcy Law); provided that it is agreed that all such reimbursable costs and expenses in respect of advisors shall be limited to the reasonable fees and expenses of one outside counsel. Section 6.2 Governing Law; Jurisdiction; Jury Trial. All questions concerning the construction, validity, enforcement, and interpretation of this Agreement shall be governed by the internal laws of the State of New York, without giving effect to any choice of law or conflict of law provision or rule (whether of the New York State or any other jurisdictions) that would cause the application of the laws of any jurisdictions other than the State of New York. Each party hereby irrevocably submits to the exclusive jurisdiction of the state and federal courts sitting in New York, for the adjudication of any dispute hereunder or in connection herewith or with any transaction contemplated hereby or discussed herein, and to the extent permitted by applicable law, hereby irrevocably waives, and agrees not to assert in any suit, action or proceeding, any claim that it is not Personally subject to the jurisdiction of any such court, that such suit, action or proceeding is brought in an inconvenient forum or that the venue of such suit, action or proceeding is improper. To the extent permitted by applicable law, each party hereby irrevocably waives Personal service of process and consents to process being served in any such suit, action or proceeding by mailing a copy thereof to such party at the address for such notices to it under this Agreement and agrees that such service shall constitute good and sufficient service of process and notice thereof. Nothing contained herein shall be deemed to limit in any way any right to serve process in any manner permitted by law. TO THE EXTENT PERMITTED BY APPLICABLE LAW, EACH PARTY HEREBY IRREVOCABLY WAIVES ANY RIGHT IT MAY HAVE, AND AGREES NOT TO REQUEST, A JURY TRIAL FOR THE ADJUDICATION OF ANY DISPUTE HEREUNDER OR IN CONNECTION WITH OR ARISING OUT OF THIS AGREEMENT OR ANY TRANSACTIONS CONTEMPLATED HEREBY. Section 6.3 Counterparts. This Agreement may be executed in two or more identical counterparts, all of which shall be considered one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to each other party provided, however, that a facsimile signature or a signature delivered in portable document format (.pdf) shall be considered due execution and shall be binding upon the signatory thereto with the

Page 14 of 23 same force and effect as if the signature were an original, not a facsimile or electronic signature. The words “execution,” “execute”, “signed,” “signature,” and words of like import in or related to this Agreement or any document to be signed in connection with this Agreement and the transactions contemplated hereby shall be deemed to include electronic signatures, the electronic matching of assignment terms and contract formations on electronic platforms approved by the Company, or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature or the use of a paper-based recordkeeping system, as the case may be, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act. Section 6.4 Headings. The headings of this Agreement are for convenience of reference and shall not form part of, or affect the interpretation of, this Agreement. Section 6.5 Severability. If any provision of this Agreement shall be invalid or unenforceable in any jurisdiction, such invalidity or unenforceability shall not affect the validity or enforceability of the remainder of this Agreement in that jurisdiction or the validity or enforceability of any provision of this Agreement in any other jurisdiction. Section 6.6 Entire Agreement; Amendments. This Agreement and the other Transaction Documents supersede all other prior oral or written agreements between Company, Customer, their Affiliates and Persons acting on their behalf with respect to the matters discussed herein and therein, and this Agreement, the other Transaction Documents and the instruments referenced herein and therein contain the entire understanding of the parties with respect to the matters covered herein and therein and, except as specifically set forth herein or therein, neither Customer nor Company makes any representation, warranty, covenant or undertaking with respect to such matters. No provision of this Agreement or any of the other Transaction Documents may be amended or waived other than by an instrument in writing signed by Customer and the Company. Without limiting the foregoing, Customer confirms that, except as set forth in this Agreement, Company has not made any commitment or promise or has any other obligation to provide any financing to Customer or otherwise. Section 6.7 Notices. Any notices, consents, waivers or other communications required or permitted to be given under the terms of this Agreement must be in writing and will be deemed to have been delivered: (i) upon receipt, when delivered Personally; (ii) upon receipt, when sent by facsimile (provided, confirmation of transmission is mechanically or electronically generated and kept on file by the sending party) or e-mail; or (iii) one Business Day after deposit with an overnight courier service, in each case properly addressed to the party to receive the same. The addresses and facsimile numbers for such communications shall be as follows: If to Customer: TEAM, INC. 00000 Xxxxx Xxxxxxx Xxxx, Xxxxx 000 Xxxxx Xxxx, Xxxxx 00000 Attention: Xxxxx X. Xxxxxxxx, Chief Legal Officer

Page 20 of 23 COMPANY: 1970 GROUP, INC. By: _____________________________________ Name: Xxxxxx X. Xxxxxxxx Title: President

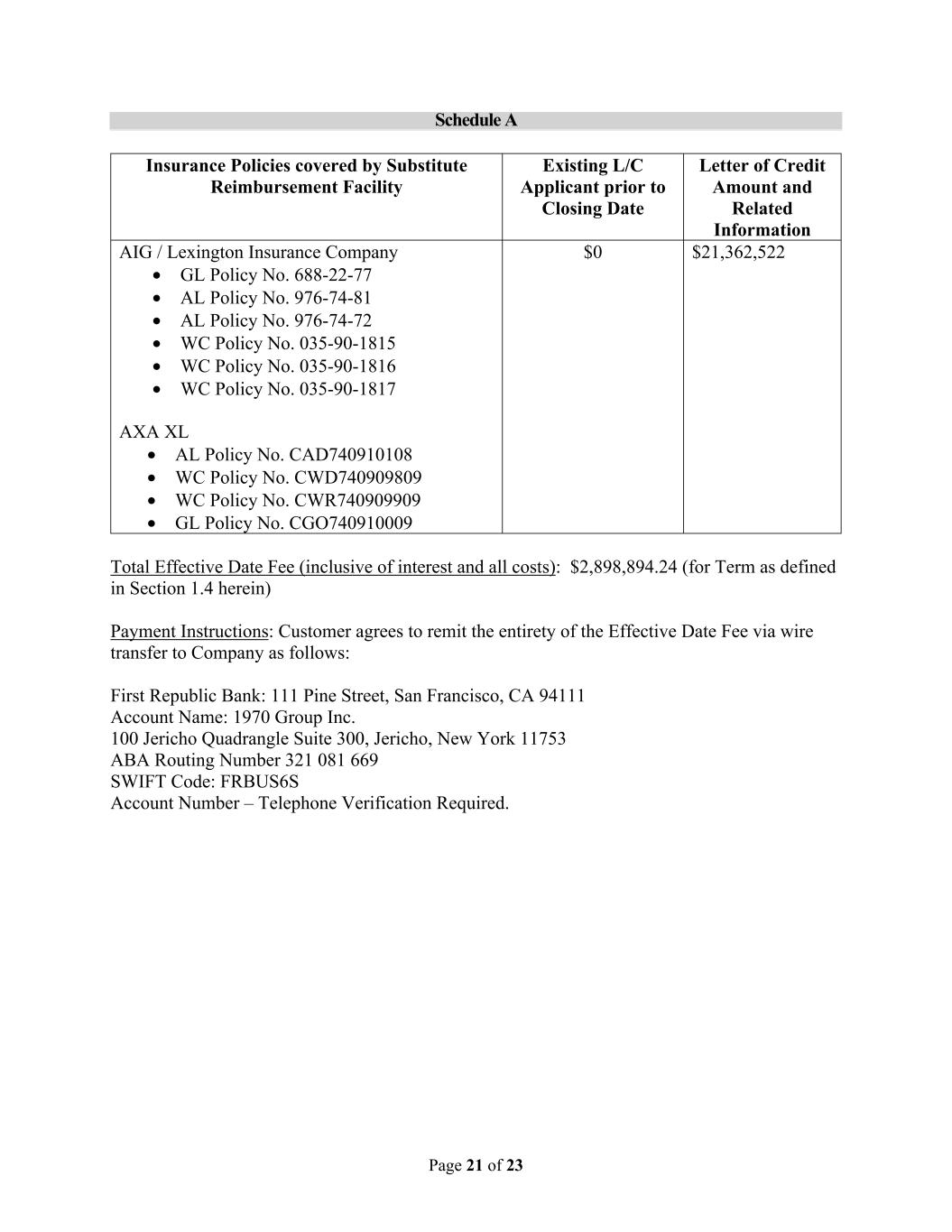

Page 21 of 23 Schedule A Insurance Policies covered by Substitute Reimbursement Facility Existing L/C Applicant prior to Closing Date Letter of Credit Amount and Related Information AIG / Lexington Insurance Company • GL Policy No. 000-00-00 • AL Policy No. 000-00-00 • AL Policy No. 000-00-00 • WC Policy No. 000-00-0000 • WC Policy No. 000-00-0000 • WC Policy No. 000-00-0000 AXA XL • AL Policy No. CAD740910108 • WC Policy No. CWD740909809 • WC Policy No. CWR740909909 • GL Policy No. CGO740910009 $0 $21,362,522 Total Effective Date Fee (inclusive of interest and all costs): $2,898,894.24 (for Term as defined in Section 1.4 herein) Payment Instructions: Customer agrees to remit the entirety of the Effective Date Fee via wire transfer to Company as follows: First Republic Bank: 000 Xxxx Xxxxxx, Xxx Xxxxxxxxx, XX 00000 Account Name: 1970 Group Inc. 000 Xxxxxxx Xxxxxxxxxx Xxxxx 000, Xxxxxxx, Xxx Xxxx 00000 ABA Routing Number 000 000 000 SWIFT Code: FRBUS6S Account Number – Telephone Verification Required.

Page 22 of 23 SCHEDULE B Definitions and Terms Definitions. As used in this Agreement, the following terms have the respective meanings indicated below, such meanings to be applicable equally to both the singular and plural forms of such terms: “Affiliate” means, with respect to a specified person, another person that directly or indirectly through one or more intermediaries, controls, is controlled by or is under common control with the person specified. “Business Day” means any day that is not a Saturday, Sunday, or other day on which commercial banks in New York City are authorized or required by law to remain closed. “Closing Date” means the Effective Date. “Default Rate” means a rate equal to 10% percent. “Governmental Authority” means the government of the United States of America, any other nation, or any political subdivision of any of the foregoing, whether state or local, and any agency, authority, commission, instrumentality, regulatory body, court, central bank, or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government. “Knowledge” of the Company means the actual knowledge of the Company or its senior officers. “Material Adverse Effect” means any material adverse effect on the business, assets, results of operations, or financial condition of Customer or on the ability of Customer to fully and timely perform its material payment obligations under the Transaction Documents to which it is a party or the rights or remedies of Company thereunder. “Obligations” means any and all obligations and liabilities with respect to the Substitute Insurance Reimbursement Facility, including without limitation all sums due hereunder as part of the Substitute Insurance Reimbursement Facility together with all interest thereon (including, but not limited to, interest calculated at the Default Rate and post-petition interest in any proceeding under any Bankruptcy Law), fees, costs, indemnification obligations, expenses and other charges and other obligations under the Transaction Documents, of Customer to Company, or to any Affiliate or Subsidiary of Company (in each case, so long as arising out of the Transaction Documents), of any and every kind and nature, howsoever created, arising or evidenced and howsoever owned, held or acquired, whether now or hereafter existing, whether now due or to become due, whether primary, secondary, direct, indirect, absolute, contingent or otherwise (including, without limitation, obligations of performance), whether several, joint or joint and several, and whether arising or existing under written or oral agreement or by operation of law.