SECURITIES TRANSFER AGREEMENT

SECURITIES TRANSFER AGREEMENT (the "Agreement"), dated as of February 7, 2020, by and between Xxxxxxx Xxxxx ("Seller"), and Trillium Partners LP ("Purchaser").

WHEREAS, the Seller is the holder of certain note obligation, originally dated September 14, 2015 issued by Nutranomics, Inc., a wholly owned subsidiary of the Company (the "Company") for past accrued and earned salary, in the principal amount of $299,382 (the "Original Note"), wherein Holder purchased an amount on March 14, 2018 to decrease the original amount by $25,000; as further amended to purchase an amount on December 19, 2018 to decrease the amount by an additional $25,000; as further amended to purchase an additional amount on January 31, 2019 to decrease the amount by $35,000; as further amended to purchase an additional amount on June 6, 2019 to decrease the amount by $25,000; as further amended to purchase an additional amount on July 11, 2019 to decrease the amount by $20,000; leaving a current principal value equal to $169,382.00.

WHEREAS, the Seller desires to sell to Purchaser, and Purchaser desires to purchase from Seller an additional $25,000.00 in principal of the Original Note, plus all accrued interest on such principal (the "Purchased Note"); such purchase and sale shall be made upon the terms and conditions set forth in this Agreement.

Purchaser and Seller are executing and delivering this Agreement in reliance upon an exemption from securities registration afforded by the Securities Act of 1933, as amended (the "1933 Act");

NOW THEREFORE, in consideration of the premises and the mutual covenants contained herein and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

1.PURCHASE AND SALE OF SELLER'S PURCHASED NOTE.

a.Purchase of the Purchased Note.

(i) On the Transfer Closing Date (as defined below), Seller agrees to sell and deliver to Purchaser, and Purchaser agrees to purchase from Seller, the Purchased Note, for cash consideration equal to $25,000.00.

(ii)Purchaser understands and acknowledges that the rights and privileges relating to the Purchased Note are set forth in the Original Note and Purchaser represents that Purchaser has reviewed the terms and provisions contained therein.

b.Transfer Closing Date. Subject to the satisfaction (or waiver) of the conditions thereto set forth in Section 4 and Section 5 below, the date and time of the sale of the Purchased Note by Seller to Purchaser pursuant to this Agreement ("Transfer Closing Date") shall be no later than July 20, 2019. The closing of the transactions contemplated by this Agreement (the "Closing") shall occur at such other location as may be agreed to by the parties.

c.Form of Payment. On the Transfer Closing Date, (i) Purchaser shall deliver to the Seller $20,000.00 in immediately available funds by wire transfer, and (ii) Seller shall deliver to Purchaser the Purchased Note, duly endorsed to Purchaser.

d.Consent and Acknowledgments of the Company.

(i)The Company, as evidenced by its signature at the foot of this Agreement, hereby represents and warrants that upon Purchaser's delivery to the Company of the Purchased Note (together with endorsement by the Seller) the Company shall promptly cause to be issued to and in the name of Seller (i) issue one or more promissory notes representing the Purchased Note in the name of such Purchaser on or promptly after a Transfer Closing Date. Such replacement note issued to the Purchaser ("Replacement Note") shall have the same terms as the Purchased Note except the Replacement Note (i) shall indicate that it was originally issued to the Seller on September 14, 2015 (the "Issue Date"), (ii) notwithstanding the convertibility of the Original Note, the Replacement Note shall be convertible into the Company's common stock, at any time at the option of the Purchaser, at an initial conversion price per share equal to (a) the lower of $0.001 or (b) first percent (50% (0.50)) (the "Multiplier") of the lowest closing bid price for the Company's common stock during the thirty (30) trading days immediately preceding a conversion date, as reported by Bloomberg (the "Closing Bid Price") ("Initial Conversion Price"); provided that if the closing bid price for the common stock on the Clearing Date (defined below) is lower than the Closing Bid Price, then the Purchase Price shall be adjusted such that the Multiplier shall be multiplied by the closing bid price on the Clearing Date, and the Company shall issue additional shares to Purchaser to reflect such adjusted conversion price, and (iii) the Replacement Note shall have a limitation on conversion equal to 9.99% of the Company's outstanding common stock. For purposes of this Agreement, the Clearing Date shall be on the date in which the conversion shares are deposited into the Purchaser's brokerage account and Purchaser's broker has confirmed with Purchaser the Purchaser may execute trades of the conversion shares. The Company shall bear any and all miscellaneous expenses that may arise as a result of conversion and delivery of shares of common stock in respect of the Replacement Note, including but are not limited to the cost of the issuance of a Rule 144 legal opinion, transfer agent fees, equity issuance and deposit fees, etc. At Purchaser's option, any accrued costs paid by Purchaser may be added to the dollar amount of any conversion of the Replacement Note.

(ii)The signature by the Company also represents the Company's agreement to (x) pay to Purchaser and (y) treat Purchaser as a party to, and having all the rights of, and obligations of, in the place and stead of Seller with respect to the Purchased Note.

(iii)The Company represents that by a date no later than the Issue Date, (w) the Company had accrued payment obligation to Seller equal to the principal amount of the Original Note, and (x) the Original Note had been issued to the Seller. The Company has no information that the Seller did not have continuous and uninterrupted beneficial ownership of the Original Note since the Issue Date through and including the date hereof

(iv)The Company acknowledges that it will take all reasonable steps necessary or appropriate, including providing an opinion of counsel confirming the rights of Purchaser to sell shares of Common Stock issued to Purchaser on conversion of the Replacement Note pursuant to Rule 144 as promulgated by the SEC ("Rule 144"), as such Rule may be in effect from time to time. If the Company does not promptly provide an opinion from Company counsel, and so long as the requested sale may be made pursuant to Rule 144, the Company agrees to accept an opinion of counsel to the Purchaser which opinion will be issued at the Company's expense.

(v)The Company confirms that it has instructed its transfer agent to reserve at least 300,000,000 shares of its Common Stock for issuance to Purchaser on conversion of the Replacement Note.

(vi)The Company confirms that, upon consummation of the transactions contemplated hereby, Purchaser will be entitled to all of the rights held by Seller with respect to the Purchased Note as if Purchaser had been a holder of that portion of the Original Note, all of which, to the best knowledge of the Company, remain in full force and effect as of the date hereof. To the best knowledge of the Company, no payments have been made to Seller on account of any such rights and Seller has not, directly or indirectly, waived or relinquished any of such rights. In furtherance of the foregoing and not in limitation thereof, the Company acknowledges that no liquidated damages have accrued with respect to the Original Note, and (y) all other provisions of the Original Note remain in full force and effect.

(vii)The Company covenants to provided all Current Public Information as defined in Rule 144 (c) and file with the SEC all reports required to be filed under the Securities Exchange Act of 1934 (the "SEC Reports") until such time as the Purchase Note has been paid in full, or converted in full into shares of the Company's common stock.

(viii)Except as specifically disclosed in its SEC Reports, (i) there has been no event, occurrence or development that, individually or in the aggregate, has had or that could reasonably be expected to result in a Material Adverse Effect, (ii) neither the Company nor any of its

Subsidiaries has incurred any material liabilities other than (A) trade payables and accrued expenses incurred in the ordinary course of business consistent with past practice and (8) liabilities not required to be reflected in the Company's financial statements pursuant to GAAP or required to be disclosed in filings made with the SEC, (iii) the Company has not altered its method of accounting or the identity of its auditors, (iv) the Company has not declared or made any dividend or distribution of cash or other property to its stockholders, in their capacities as such, or purchased, redeemed or made any agreements to purchase or redeem any shares of its capital stock (except for repurchases by the Company of shares of capital stock held by employees, officers, directors, or consultants pursuant to an option of the Company to repurchase such shares upon the termination of employment or services), and (v) neither the Company nor any of its Subsidiaries has issued any equity securities to any officer, director or Affiliate, except pursuant to existing Company stock-based plans. No representation or warranty or other statement made by the Company or any Subsidiary in this Agreement or in its SEC Reports, contains any untrue statement or omits to state a material fact necessary to make any such statement, in light of the circumstances in which it was made, not misleading.

(ix)The Company acknowledges that Purchaser is expressly relying on the provisions of this Section 1(d) in entering into this Agreement and consummating the transactions contemplated hereby. Any change of circumstance which would prevent the Company from delivering shares of common stock to Purchaser based upon conversion of the Replacement Note, or prevent the Purchaser from selling such conversion shares pursuant to Rule 144 will be deemed a default of this Agreement.

2. PURCHASER'S REPRESENTATIONS AND WARRANTIES. Purchaser represents and warrants to Seller and to the Company that:

a.Accredited Purchaser; investment Purpose. Purchaser represents that it is an "Accredited Investor" as defined in Regulation D under the Securities Act of 1933. Purchaser is purchasing the Purchased Note for its own account for investment purposes only and not with a view towards, or for resale in connection with, the public sale or distribution thereof, nor with any present intention of distributing or selling the same, and it has no present or contemplated agreement, undertaking, arrangement, obligation, indebtedness or commitment providing for the disposition thereof; provided, however, that by making the representations herein, Purchaser does not agree to hold the Replacement Note or any Common Stock issued upon conversion of or in payment of interest on the Replacement Note for any minimum or other specific term and reserves the right to dispose of the Replacement Note or any of such Common Stock at any time in accordance with or pursuant to a registration statement or an exemption under the 1933 Act and applicable state securities laws.

x.Xxxxxxxx on Exemptions. Purchaser understands that the Purchased Note is being offered and sold to it in reliance upon specific exemptions from the registration requirements of United States federal and state securities laws and that Seller and the Company are relying upon the truth and accuracy of, and Purchaser's compliance with, the representations, warranties, agreements, acknowledgments and understandings of

Purchaser set forth herein in order to determine the availability of such exemptions and the eligibility of the Purchaser to acquire the Purchased Note.

c.Non-affiliate Status. Purchaser is not, and has not for in excess of ninety (90) days been, and subsequent to the Transfer Closing Date will not be, an "Affiliate" of the Company, as that term is defined by Rule 144 under the 1933 Act. Purchaser is not acting in concert with any other person in a manner that would require their sales of securities to be aggregated for purposes of Rule 144 or would cause Purchaser to be considered an "Underwriter" as that term is defined by Section 2 of the 1933 Act.

x.Xxxxxxx Information. Purchaser and its advisors. if any, have been furnished with all materials relating to the business, finances and operations of the Company, including copies of the Company most recent publicly available financial statements as available on the SEC's XXXXX system. Purchaser and its advisors have been afforded the opportunity to ask questions of Seller. Neither such inquiries nor any other due diligence investigation conducted by Purchaser or any of its advisors or representatives shall modify, amend or affect Purchaser's right to rely on Seller's representations and warranties contained in Section 3 below. Purchaser understands that its investment in Purchased Note (and/or in the Common Stock issuable thereunder), involves a significant degree of risk.

e.Governmental Review. Purchaser understands that no United States federal or state agency or any other government or governmental agency has passed upon or made any recommendation or endorsement of the Purchased Note or of the Common Stock issuable thereunder.

f.Transfer or Resale. Purchaser understands that (i) the sale or resale of the Replacement Note and the Common Stock issuable thereunder has not been registered under the 1933 Act or any applicable state securities laws, and the Replacement Note and the Common Stock issuable thereunder may not be transferred unless (a) such security is sold pursuant to an effective registration statement under the 1933 Act, (b) the security is sold or transferred pursuant to an exemption from such registration, (c) the security is sold or transferred to an "affiliate" (as defined in Rule 144 promulgated under the 1933 Act or a successor rule; "Rule 144") of Purchaser who agrees to sell or otherwise transfer the security only in accordance with this Section 2(0 and who is an Accredited Investor, or (d) (i) the Common Stock is sold pursuant to Rule 144, if such Rule is available; (i) any sale of such Common Stock made in reliance on Rule 144 may be made only in accordance with the terms of said Rule and further, if said Rule is not applicable, any resale of such Common Stock under circumstances in which the seller (or the person through whom the sale is made) may be deemed to be an underwriter (as that term is defined in the 0000 Xxx) and may require compliance with some other exemption under the 1933 Act or the rules and regulations of the SEC thereunder.

Authorization; Enforcement. This Agreement has been duly and validly authorized by Purchaser. This Agreement has been duly executed and delivered on behalf of Purchaser, and this Agreement constitutes a valid and binding agreement of Purchaser enforceable in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium,

liquidation or similar laws relating to, or affecting generally, the enforcement of creditors' rights and remedies or by other equitable principles of general application.

x.Xx Brokers. Purchaser has taken no action which would give rise to any claim by any person for brokerage commissions, finder's fees or similar payments relating to this Agreement or the transactions contemplated hereby.

3.REPRESENTATIONS AND WARRANTIES OF SELLER. Seller represents and warrants to Purchaser that:

a.Authorization; Enforcement. (i) Seller has all requisite power and authority to enter into and perform this Agreement and to consummate the transactions contemplated hereby and to sell the Purchased Note in accordance with the terms hereof, (ii) the execution and delivery of this Agreement by Seller and the consummation by it of the transactions contemplated hereby have been duly authorized by Seller and no further consent or authorization of Seller or its members is required, (iii) this Agreement has been duly executed and delivered by Seller, and (iv) this Agreement constitutes a legal, valid and binding obligation of Seller enforceable against Seller in accordance with its terms, except as such enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium, liquidation or similar laws relating to, or affecting generally, the enforcement of creditors' rights and remedies or by other equitable principles of general application.

b.Title. Seller has good and marketable title to the Original Note, free and clear of all liens, pledges and encumbrances of any kind.

x.Xx Conflicts. The execution, delivery and performance of this Agreement by Seller and the consummation by Seller of the transactions contemplated hereby will not (i) violate or conflict with, or result in a breach of any provision of, or constitute a default (or an event which with notice or lapse of time or both could become a default) under, or give to others any rights of termination, amendment, acceleration or cancellation of, any agreement, note, bond, indenture or other instrument to which Seller is a party, or (ii) result in a violation of any law, rule, regulation, order, judgment or decree (including federal and state securities laws and regulations and regulations of any self-regulatory organizations to which Seller is subject) applicable to Seller or by which any property of the Seller are bound or affected. Except as specifically contemplated by this Agreement and as required under the 1933 Act and any applicable federal and state securities laws, neither Seller nor the Company is required to obtain any consent, authorization or order of, or make any filing or registration with, any court, governmental agency, regulatory agency, self regulatory organization or stock market or any third party in order for it to execute, deliver or perform any of its obligations under this Agreement in accordance with the terms hereof. Except for filings that may be required under applicable federal and state securities laws in connection with the issuance and sale of the Original Note, all consents, authorizations, orders, filings and registrations which Seller is required to obtain pursuant to the preceding sentence have been obtained or effected on or prior to the date hereof.

x.Xx Brokers. Seller has taken no action which would give rise to any claim by any person for brokerage commissions, finder's fees or similar payments relating to this Agreement or the transactions contemplated hereby.

e.Rule 144 Matters. Seller, as assignee, has owned the Original Note since the Issue Date. Seller is not, and for a period of at least ninety (90) days prior to the date hereof has not been, an "Affiliate" of the Company, as that term is defined in Rule 144 of the 1933 Act listed immediately below. Subsequent to the Transfer Closing Date. Seller will take no action which would adversely affect the tacking for the benefit of the Purchaser of Seller's holding period under Rule 144.

An Affiliate of an issuer is a person that directly, or indirectly through one or more intermediaries, controls, or is controlled by, or is under common control with, such issuer.

The term person when used with reference to a person for whose account securities are to be sold in reliance upon this section includes, in addition to such person, all of the following persons:

Any relative or spouse of such person, or any relative of such spouse, any one of whom has the same home as such person;

(ii)Any trust or estate in which such person or any of the persons specified in paragraph (i) of this section collectively own 10 percent or more of the total beneficial interest or of which any of such persons serve as trustee, executor or in any similar capacity; and

(iii)Any corporation or other organization (other than the issuer) in which such person or any of the persons specified in paragraph (a)(2)(i) of this section are the beneficial owners collectively of 10 percent or more of any class of equity securities or 10 percent or more of the equity interest.

No Other Representations. Seller makes no representations or warranties with respect to the Company, its financial status, earnings, assets, liabilities, corporate status or any other matter. The Seller acknowledges that Purchaser is relying on Seller's representations as a material condition to entering into this Agreement.

4.CONDITIONS TO SELLER'S OBLIGATION TO SELL. The obligation of Seller hereunder to sell the Purchased Note to the Purchaser on the terms contemplated hereby at the Closing is subject to the satisfaction, at or before the Transfer Closing Date of each of the following conditions thereto, provided that these conditions are for Seller's sole benefit and may be waived by Seller at any time in its sole discretion:

a.Purchaser shall have executed this Agreement and any amendment thereto and delivered the same to Seller.

b.The representations and warranties of such Purchaser shall be true and correct in all material respects as of the date when made and as of the Transfer Closing Date as though made at that time (except for representations and warranties that speak as of a specific date), and Purchaser shall have performed, satisfied and complied in all material respects with the covenants, agreements and conditions required by this Agreement to be performed, satisfied or complied with by Purchaser at or prior to the Transfer Closing Date.

x.Xx litigation, statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated or endorsed by or in any court or governmental authority of competent jurisdiction or any self-regulatory organization having authority over the matters contemplated hereby which prohibits the consummation of any of the transactions contemplated by this Agreement.

5. CONDITIONS TO PURCHASER'S OBLIGATION TO PURCHASE. The obligation of Purchaser hereunder to purchase the Purchased Note on the terms contemplated hereby at the Closing is subject to the satisfaction, at or before the Transfer Closing Date of each of the following conditions, provided that these conditions are for Purchaser's sole benefit and may be waived by such Purchaser at any time in its sole discretion.

a.Seller shall have executed this Agreement and any amendment thereto which shall have been acknowledged and consented by the Company, and delivered the same to Purchaser.

b.Seller shall have delivered to Purchaser the Purchased Note duly endorsed for transfer to Purchaser in accordance with Section 1(c) above.

c.Purchaser shall have received a copy of the Company's letter to its transfer agent reserving shares of common stock for Purchaser as outlined in Section I (d)(v).

d.The representations and warranties of Seller and the Company shall be true and correct in all material respects as of the date when made and as of the Transfer Closing Date as though made at such time (except for representations and warranties that speak as of a specific date) and Seller and the Company shall have performed, satisfied and complied in all material respects with the covenants, agreements and conditions required by this Agreement to be performed, satisfied or complied with by Seller at or prior to the Transfer Closing Date.

x.Xx litigation, statute, rule, regulation, executive order, decree, ruling or injunction shall have been enacted, entered, promulgated or endorsed by or in any court or governmental authority

of competent jurisdiction or any self-regulatory organization having authority over the matters contemplated hereby which prohibits the consummation of any of the transactions contemplated by this Agreement.

6.GOVERNING LAW; MISCELLANEOUS.

a.Governing Law; Jurisdiction. THIS AGREEMENT SHALL BE ENFORCED, GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF CONNECTICUT APPLICABLE TO AGREEMENTS MADE AND TO BE PERFORMED ENTIRELY WITH SUCH STATE, WITHOUT REGARD TO THE PRINCIPLES OF CONFLICT OF LAWS. THE PARTIES HERETO HEREBY SUBMIT TO THE EXCLUSIVE JURISDICTION OF THE UNITED STATES FEDERAL OR STATE COURTS LOCATED IN FAIRFIELD COUNTY, CONNECTICUT WITH RESPECT TO ANY DISPUTE ARISING UNDER THIS AGREEMENT, THE AGREEMENTS ENTERED INTO IN CONNECTION HEREWITH OR THE TRANSACTIONS CONTEMPLATED HEREBY OR THEREBY. BOTH PARTIES IRREVOCABLY WAIVE THE DEFENSE OF AN INCONVENIENT FORUM TO THE MAINTENANCE OF SUCH SUIT OR PROCEEDING. BOTH PARTIES FURTHER AGREE THAT SERVICE OF PROCESS UPON A PARTY MAILED BY FIRST CLASS MAIL SHALL BE DEEMED IN EVERY RESPECT EFFECTIVE SERVICE OF PROCESS UPON THE PARTY IN ANY SUCH SUIT OR PROCEEDING. NOTHING HEREIN SHALL AFFECT ANY PARTY'S RIGHT TO SERVE PROCESS IN ANY OTHER MANNER PERMITTED BY LAW. THE PARTIES AGREE THAT A FINAL NON-APPEALABLE JUDGMENT IN ANY SUCH SUIT OR PROCEEDING SHALL BE CONCLUSIVE AND MAY BE ENFORCED IN OTHER JURISDICTIONS BY SUIT ON SUCH JUDGMENT OR IN ANY OTHER LAWFUL MANNER. THE PARTIES HEREBY WAIVE A TRIAL BY JURY IN ANY ACTION, PROCEEDING OR COUNTERCLAIM BROUGHT BY EITHER OF THE PARTIES HERETO AGAINST THE OTHER IN RESPECT OF ANY MATTER ARISING OUT OF OR IN CONNECTION WITH THIS AGREEMENT.

b.Counterparts; Signatures by Facsimile. This Agreement may be executed in one or more counterparts, each of which shall be deemed an original but all of which shall constitute one and the same agreement and shall become effective when counterparts have been signed by each party and delivered to the other party. This Agreement, once executed by a party, may be delivered to the other party hereto by facsimile transmission of a copy of this Agreement bearing the signature of the party so delivering this Agreement.

c.Headings. The headings of this Agreement are for convenience of reference only and shall not form part of, or affect the interpretation of, this Agreement.

d.Severability. In the event that any provision of this Agreement is invalid or enforceable under any applicable statute or rule of law, then such provision shall be deemed inoperative to the extent that it may conflict therewith and shall be deemed modified to conform with such statute or rule of law. Any provision hereof which may prove invalid or unenforceable under any law shall not affect the validity or enforceability of any other provision hereof.

e.Entire Agreement; Amendments. This Agreement and the instruments referenced herein contain the entire understanding of the parties with respect to the matters covered herein and therein and, except as specifically set forth herein or therein, neither Seller nor Purchaser makes any representation, warranty, covenant or undertaking with respect to such matters. No provision of this Agreement may be waived or amended other than by an instrument in writing signed by the party to be charged with enforcement.

f.Notices. Any notices required or permitted to be given under the terms of this Agreement shall be sent by certified or registered mail (return receipt requested) or delivered personally or by courier (including a recognized overnight delivery service) or by facsimile and shall be effective five days after being placed in the mail, if mailed by regular United States mail, or upon receipt, if delivered personally or by courier (including a recognized overnight delivery service) or by facsimile, in each case addressed to a party. The addresses for such communications shall be as provided in Schedule A annexed hereto. Seller may change its address by notice similarly given to each Purchaser. Each Purchaser may change its address by notice similarly given to Seller.

g.Successors and Assigns. This Agreement shall be binding upon and inure to the benefit of the parties and their successors and assigns. Neither Seller nor Purchaser shall assign this Agreement or any rights or obligations hereunder without the prior written consent of the other. Notwithstanding the foregoing, subject to Section 2(f), Purchaser may assign its rights hereunder to any person that purchases the same in a private transaction from Purchaser or to any of its "Affiliates," without the consent of Seller.

h.Third Party Beneficiaries. This Agreement is intended for the benefit of the parties hereto and their respective permitted successors and assigns, and is not for the benefit of, nor may any provision hereof be enforced by, any other person.

Further Assurances. Each party shall do and perform, or cause to be done and performed, ail such further acts and things, and shall execute and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request in order to carry out the intent and accomplish the purposes of this Agreement and the consummation of the transactions contemplated hereby.

x.Xx Strict Construction. The language used in this Agreement will be deemed to be the language chosen by the parties to express their mutual intent, and no rules of strict construction will be applied against any party.

IN WITNESS WHEREOF each of Seller and Purchaser has caused this Securities Transfer Agreement to be duly executed as of the date first above written.

Dated: February 7, 2020

SELLER

XXXXXXX XXXXX

By: _____________________________

PURCHASER

TRILLIUM PARTNERS LP

By:_____________________________

Company Acknowledgment and Consent

The undersigned acknowledges and agrees to the representations covenants and agreements made by it in Section VA) of this Agreement.

NUTRANOMICS. INC.

By: _____________________________

SCHEDULE A

ADDRESSES FOR NOTICES

Seller;Xxxxxxx Xxxxx

Facsimile:

With a copy to:

Purchaser;Trillium Partners LP

EXHIBIT A

COPY OF ORIGINAL NOTE

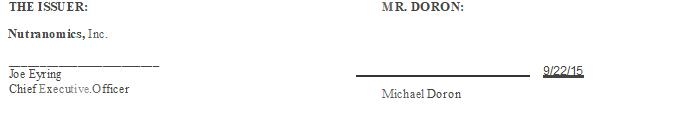

CONVERTIBLE PROMISSORY NOTE

Principal Amount: $299,382 | Issue Date: September 14, 2015 |

In settlement of certain disputes between Nutranomics, Inc., a Nevada corporation (the "Issuer") and Xxxxxxx Xxxxx ("Xx. Xxxxx"), the Issuer issues this convertible promissory note (the "Note") and promises to pay to Xx. Xxxxx or his assignees (the "Holder'') the principal amount of $299,382 (the "Principal Sum"), plus 1 es and any other fees according to the terms herein. This Note will become effective only upon execution by both parties

The maturity date (the "Maturity Date") of this promissory note is 6 months from the issue date referenced above (the "Issue Date") and is the date upon which the Principal Sum, as well as any unpaid interest and other fees, shall be due and payable.

1.Interest. No interest shall be applied to the Principal Sum.

2.Conversion. The Holder has the right, at any time after the Issue Date, at its election. to convert all or part of the outstanding and unpaid Principal Sum, as well as any other fee (pursuant to the terms hereof but not including interest, into shares of fully paid and non-assessable shares of common stock of the Issuer as per the following conversion formula: number of shares receivable upon conversion equals the dollar conversion amount divided by the Conversion Price (as defined hereinafter). The "Conversion Price" shall be 100% of the closing bid price of such common stock on the trading day immediately preceding the conversion. If the shares to be issued upon conversion are ineligible for deposit into the OTC system and only eligible for "Xclearing" deposit, a 10% discount shall apply. Unless otherwise agreed in writing by both parties, at no time will the Holder convert any amount of the Note into common stock that would result in the Holder owning more than 4.99% of the common stock outstanding of the Issuer. Conversions may be delivered to the Issuer by method of the Holder's choice (including but not limited to email, facsimile, mail, overnight courier, or personal delivery). If no objection is delivered from the Issuer to the Holder regarding any variable or calculation of the conversion notice within 24 hours of delivery of the conversion notice, the Issuer shall have been thereafter deemed to have irrevocably confirmed and irrevocably ratified such notice of conversion and waived any objection thereto. The Issuer shall deliver the shares from any conversion to the Holder (in any name directed by the Holder) within three (3) business days of conversion noticedelivery.

3.Conversion Delays. If the Issuer fails to deliver shares in acco rdance with the timeframe stated in Section 2, the Holder, at any time prior to selling all of those shares, may rescind any portion, in whole or in part, of that particular conversion attributable to the unsold shares and have the rescinded conversion amount returned to the Principal Sum with the rescinded conversion shares returned to the Issuer (under the Holder's and the Issuer's expectations that any returned conversion amounts will tack back to the original date of the Note). In addition , for each conversion, in the event that shares are not delivered by the fourth bus iness day (inclusive of the day of conversion), a penalty of$ 100 per da y will be assessed for each day after the third bus iness day (inclusive of the day of the convers ion) until share delivery is made ; and such penalty will be added to the Principal Sum of the Note (under the Holde·r s an d the Issuer's expectations that any xxxx lty amounts will tack back to the original date of the Note).

4.Reservation of Shares. At all times during which this Note is convertible while the Iss uer is able to, the Issuer will reserve from its authorized and unissued common stock to provide for the issuance of common stock upon the full conversion of this Note.

5.Default. The following are events of default under this Note: (i) the Issuer shall fail to pay any shares upon a conversion of this Note when due and payable hereunder; or (ii) a receiver, trustee or other similar official shall be appointed over the Issuer or a material part of its assets and such appointment shall remain uncontested for twenty (20) days or shall not be dismissed or discharged within sixty (60) days; or (iii) theIssuer shall become insolvent or generally fails to pay, or admits in writing its inability to pay, its debts as they become due, subject to applicable grace periods, if any; or (iv) the Issuer shall make a general assignment for the benefit of creditors; or (v) the Issuer shall file a petition for relief under any bankruptcy, insolvency or similar law (domestic or foreign); or (vi) an involuntary proceeding shall be commenced or filed against the Issuer; or (vii) the Issuer shall Xxxx its status as "OTC Eligible," or the Issuer's shareholders shall lose the ability to deposit (either electronically or by physical certificates , or otherw ise) shares into the DTC System; or (viii) the Issuer shall become delinquent in its filing requirements as a fully-reporting issuer registered with the SEC; or (ix) the Issuer shall fail to meet all requirements to satisfy the availability of Rule 144 to the Holder or its assigns including but not limited to timely fulfillment of its filing requirements as a fully-reporting issuer registered with the SEC, requirements for XBRL filings, and requirements for disclosure of financial statements on its website.

6.Remedies. In the event of any default, the outstanding principal amount of this Note, plus accrued but unpaid interest, liquidated damages, fees and other amounts owing in respect thereof through the date of acceleration, shall become, at the Holder' s election, immediately due and payable in cash at the Mandatory Default Amount. The Mandatory Default Amount means the greater of (i) the outstanding principal amount of this Note, plus all accrued and unpaid interest, liquidated damages. fees and other amounts hereon, divided by the Conversion Price on the date the Mandatory Default Amount is either demanded or paid in full, whichever has a lower Conversion Price, multiplied by the VWAP on the date the Mandatory Default Amount is either demanded or paid in full, whichever has a higher VWAP, or (ii) the outstanding principal amount of this Note, plus 100% of accrued and unpaid interest, liquidated damag es, fees and other amo unts hereon. Commencing five (5) days after the occurrence of any event of default that results in the eventual acce lerat ion of this Note, the interest rate on this Note shall accrue at an interest rate equal to the lesser of24% per annum or the maximum rate permitted under applicable law. In connection with such acceleration described herein, the Holder need not provide, and the Issuer hereby waives, any presentment, demand, protest or other notice of any kind, and the Holder may immediately and without expiration of any grace period enforce any and all of its rights and remedies hereunder and all other remedies available to it under applicable law. Such acceleration may be rescinded and annulled by the Holder at any time prior to payment hereunder and the Holder shall have all rights as a holder of the note until such time, if any. as the Holder receives full payment pursuant to this Section 7. No such rescission or annulment shall affect any subsequent event of default or impair any right consequent thereon. Nothing herein shall limit the Holder' s right to pursue any other remedies available to it at law or in equity including, without limitation, a decree of specific performance and/or injunctive relief with respect to the Issuer's failure to timely deliver certificates representing shares of Common Stock upon conversion of the Note as required pursuant to the terms hereof.

0.Xx Shorting. The Holder agrees that so long as this Note from the Issuer to the Holder remains outstanding, the Holder will not enter into or effect "short sales" of the common stock of the Issuer or hedging transactions which establish a net short position with respect to the common stock of the Issuer. The Iss uer acknowledges and agrees that upon delivery of a conversion notice by the Holder, the Holder immediately owns the shares of common stock described in the conversion notice, and any sale of those shares issuable under such conversion notice would not be considered short sales.

8.Assignability. The Issuer may not assign this Note. This Note will be binding upon the Issuer and its successors and will inure to the benefit of the Holder and its successors and assigns and may be assigned by the Holder to anyone without the Issuer's approval.

9.Governing Law. This Note will be governed by, and construed and enforced in accordance with, the laws of the State of Utah, without regard to the conflict of laws principles thereof Any action brought by either party against the other concerning the transactions contemplated by this Agreement shall be brought only in the state courts of Utah or in the federal courts located in Salt Lake County. in the State of Utah. Both parties and the individuals signing this Agreement agree to submit to the jurisdiction of such courts.

I0. Delivery of Process by the Holder to the Issuer. In the event of any action or proceeding by the Holder against the Issuer, and only by the Holder against the Issuer, service of copies of summons and/or complaint and/or any other process which may be served in any such action or proceeding may be made by the Holder via U.S. Mail. overnight delivery service such as FedEx or UPS, email, fax, or process server, or by mailing or otherwise delivering a copy of such process to the Issuer at its last known address as set forth in its most recen t SEC filing.

11.. Attorney Fees. If any attorney is employed by either party with regard to any legal or equ itable ac tion. arbitration or other proceeding brought by such party for enforcement of this Note or because of an alleged dispu te. breach , default or misrepresentation in connection with any of the provisions of this Note, the prevailing party will be entitled to recover from the other party reasonable attorneys' fees and other costs and expenses inc urred, in addition to any other relief to which the prevailing party may be entitled.

12.Notices. Any notice required or permitted hereunder (including Conversion Notices) must be in writing and either personally served, sent by facsimile or email transmission, or sent by overnight courier. Notices will be deemed effectively delivered at the time of transmission if by facsimile or email, and if by overnight courier the bus iness day after such notice is deposited with the courier service for delivery.