CERTAIN INFORMATION IN THIS EXHIBIT IDENTIFIED BY [*****] IS CONFIDENTIAL AND HAS BEEN EXCLUDED BECAUSE IT (I) IS NOT MATERIAL AND (II) THE REGISTRANT CUSTOMARILY AND ACTUALLY TREATS THAT INFORMATION AS PRIVATE OR CONFIDENTIAL. SHARE PURCHASE...

CERTAIN INFORMATION IN THIS EXHIBIT IDENTIFIED BY [*****] IS CONFIDENTIAL AND HAS BEEN EXCLUDED BECAUSE IT (I) IS NOT MATERIAL AND (II) THE REGISTRANT CUSTOMARILY AND ACTUALLY TREATS THAT INFORMATION AS PRIVATE OR CONFIDENTIAL. SHARE PURCHASE AGREEMENT Between GOLAR MANAGEMENT (BERMUDA) LIMITED (as Seller) and COOL COMPANY LTD. (as Purchaser) and GOLAR LNG LIMITED (as guarantor)

1 This share purchase agreement has been entered into on this 30th day of June, 2022 by and between: (1) GOLAR MANAGEMENT (BERMUDA) LIMITED, having its registered office at 2nd floor, X.X. Xxxxxxx Building, 0 Xxx-xx-Xxxxx Xxxx, Xxxxxxxx XX00, Xxxxxxx (the "Seller"); (2) COOL COMPANY LTD., having its registered office at 2nd floor, X.X. Xxxxxxx Building, 0 Xxx-xx-Xxxxx Xxxx, Xxxxxxxx XX00, Xxxxxxx (the "Purchaser"); and (3) GOLAR LNG LIMITED, having its registered office at 2nd floor, X.X. Xxxxxxx Building, 0 Xxx-xx-Xxxxx Xxxx, Xxxxxxxx XX00, Xxxxxxx ("Golar"). WHEREAS:- A. The Seller is a wholly owned subsidiary of Golar and the parent in a sub-group of management companies which organises the management functions in the Golar Group. B. The Purchaser is a public limited company incorporated and resident in Bermuda in which Golar holds approx. 31% of the issued shares. C. The Purchaser established its current business in Q1/2022 by, inter alia, acquiring 8 single purpose companies, each of which, at the date hereof, is the owner of an LNG tanker, and The Cool Pool Limited from Golar pursuant to the terms of a share purchase agreement dated 26 January 2022 (as subsequently amended by an amendment agreement dated 25 February 2022) (the "ShipCo SPA"). D. The LNG tankers acquired by the Purchaser pursuant to the ShipCo SPA were, on the date the ShipCo SPA was concluded, commercially and technically managed by Golar Management Ltd., a wholly owned subsidiary of the Seller. X. Xxxxx Management Ltd. was furthermore, on the date of the ShipCo SPA, the commercial and technical manager of 17 other LNG tankers and FSRUs, 14 of which are owned or bareboat chartered by entities in the corporate group headed by New Fortress Energy Inc. and 3 of which are owned or operated by entities in the Golar Group. X. Xxxxx and the Purchaser entered into an agreement dated 26 January 2022 whereby it was agreed, subject to the terms and conditions of such agreement, that the Purchaser should purchase such part of the Golar Group's management organisation as was responsible for the commercial and technical operation of LNG tankers and FSRUs after the same had been carved out of the Golar Group's overall management organisation as a stand alone sub-group with the Seller as parent. G. The Seller, its subsidiary Golar Management Ltd., the Purchaser, the companies acquired as per the ShipCo SPA and The Cool Pool Limited entered into a transitional services agreement on 26 January 2022 (the "TSA"). H. Cool Company Management Ltd. was incorporated by the Seller on 7 January 2022 and is, as of the date hereof, a wholly owned subsidiary of the Seller. I. The carve-out referred to in Recital (F) was completed with economical and accounting effect between the various parties in the Golar Group involved therein on 31 March 2022. J. The Golar Group's organisation responsible for the commercial and technical operation of LNG tankers and FSRUs together with the assets, liabilities and contractual rights and obligations related thereto is thus, as of today, organised in a sub-group of companies in which Cool Company Management Ltd. is the parent. K. The purpose of this agreement is to set out the complete terms upon which the Seller shall sell and the Purchaser shall purchase the sole share in issue in Cool Company Management Ltd.

3 "CoolManMal" means Coolco Management Bhd. Sdn., a Malaysian private limited company having Malaysian organisation number 000 000 000 184 (1453881-0) which, at the date hereof, is a wholly owned subsidiary of CoolManUK. "CoolManNor" means Cool Company Management AS, a Norwegian private limited company having Norwegian organisation number 995 435 705, which, previously, traded under the name "Golar Management Norway AS" and which, at the date hereof, is a wholly owned subsidiary of CoolManUK. "CoolManUK" means Cool Company Management Ltd., a private limited company incorporated in England and Wales with registration number 13835293 which, at the date hereof, is a wholly owned subsidiary of the Seller. "Croatia Transfer Agreement" means a transfer agreement between CoolManCro and GolarVikingMan dated 30 June 2022 documenting an exchange of a number of their respective employees between them with economical effect between these parties from the Restructuring Closing Date. "Data Room" means an electronic data room containing the Management Agreements and such other documents relating to the XxxxXxx Group's business as have been disclosed to the Purchaser up to the close of business GMT on 27 June 2022. "Disclosed" means fairly disclosed in the Data Room. "Encumbrance" any mortgage, charge, pledge, lien, option, right to acquire, right of pre-emption, assignment, trust arrangement, hypothecation, security interest, title retention and any other security interest or arrangement of any kind, or any agreement to create any of the foregoing. "GAAP" means the generally accepted accounting principles of the United States of America. "Golar" has the meaning assigned to the term at the beginning of this Agreement. "Golar Group" means Golar and its Subsidiaries. "GolarCos" means the subsidiaries of Golar parties to the Golar Management Agreements. "GolarManMal" means Golar Management Bhd. Sdn., a Malaysian private limited company, a wholly owned subsidiary of GolarManUK. "GolarManNor" means Golar Management AS, a Norwegian private limited company, a wholly owned subsidiary of GolarManUK. "GolarManUK" means Golar Management Ltd., a private limited company incorporated in England and Wales, a wholly owned subsidiary of the Seller. "Golar Management Agreements" means the agreements identified as such in Schedule 2. "GolarVikingMan" means Golar Viking Management d.o.o., a private limited company incorporated in Croatia and a wholly owned subsidiary of GolarManUK. "Governmental Body" means any local, municipal, regional, national or supranational entity exercising executive, legislative, judicial, regulatory or administrative functions of or relating to government, and any tribunal or arbitrators of a competent jurisdiction. "Holding Company" means, in relation to a company or corporation, any other company, corporation or partnership of which it is a Subsidiary.

4 "Intellectual Property Rights" means (i) copyright, patents, database rights and rights in trademarks, designs, know-how and confidential information (whether registered or unregistered), (ii) applications for registration, and rights to apply for registration, of any of the foregoing rights and (iii) all other intellectual property rights and equivalent or similar forms of protection existing anywhere in the world. "Leakage" means, during the Locked Box Period, any of the following in relation to a XxxxXxx Company: a. any dividend or other distribution (whether in cash or in specie) declared, paid or made whatsoever by such XxxxXxx Company to the Seller's Group; b. any payment made or liability incurred by such XxxxXxx Company for any fees, costs or expenses assumed in connection with this Agreement (including professional advisers' fees, consultancy fees, transaction bonuses, finder's fees, brokerage or other commission); c. any payment of any other nature by such XxxxXxx Company to or for the benefit of the Seller's Group (including royalty payments, management fees, monitoring fees, interest payments, loan payments, service or directors' fees, bonuses or other compensation of any kind); d. any transfer or surrender of assets, rights or other benefits by such XxxxXxx Company to or for the benefit of the Seller's Group; e. the assumption or incurrence by such XxxxXxx Company of any liability or obligation for the benefit of the Seller's Group; f. the provision of any guarantee or indemnity or the incurrence of any Encumbrance by such XxxxXxx Company in favour or for the benefit of the Seller's Group; g. any waiver, discount, deferral, release or discharge by such XxxxXxx Company of (i) any amount, obligation or liability owed to it by the Seller's Group; or (ii) any claim held by such XxxxXxx Company (howsoever arising) against the Seller's Group; and h. any agreement, arrangement or other commitment by such XxxxXxx Company or the Seller's Group to do or give effect to any of the matters referred to in paragraphs (a) to (g) (inclusive) above; provided that the term " Seller's Group" shall also include any employee and related party to such person. "LNG Fleet" means the LNG tankers and FSRUs listed in Schedule 2. "Locked Box Period" means the period from (and including) 1 April 2022 to (and including) the Completion Date. "Malaysia Transfer Agreement" means an agreement dated 30 June 2022 between GolarManMal and CoolManMal documenting the transfer of a number of employees from GolarManMal to CoolManMal with economical effect between them from the Restructuring Closing Date. "Management Agreements" means the Golar Management Agreements, the NFE Management Agreements and the ShipCo Management Agreements. "NFE" means New Fortress Energy Inc. "NFE Management Agreements" means the agreements identified as such in Schedule 2.

5 "Norwegian BTA" means a business transfer agreement dated 30 June 2022 between CoolManNor and GolarManNor documenting the transfer of such part of CoolManNor's business which is not related to the technical and commercial operation of the LNG Fleet to GolarManNor with economical and accounting effect between the parties thereto from the Restructuring Closing Date. "Parties" means the Seller, the Purchaser and Golar. "Permitted Leakage" means, in relation to each member of the XxxxXxx Company, any of the following payments during the Locked Box Period: a. any and all payments made by a XxxxXxx Company to persons or entities outside of the Seller's Group in the ordinary course of trading; b. any and all payments made by a XxxxXxx Company under the Golar Management Agreements made in the ordinary course of trading; c. any and all payments made by a XxxxXxx Company to members of the Seller's Group pursuant to the TSA; d. any and all payments against liabilities to members of the Golar Group which have been specifically accrued or provided for in the XxxxXxx Group Balance Sheet; and e. the assignment by CoolManNor of a patent for a system for controlling a flow of water from a process facility onboard a vessel (identified as Norwegian patent number 344865 and European patent application number 19801014.2) to GolarManNor on the terms of an assignment dated 29 June 2022. "Protocol" means a protocol of agreement between Golar, the Purchaser, GolarManUK, CoolManUK, GolarManNor, CoolManNor, GolarManMal and CoolManMal setting forth certain principles and further commitments from the Golar Group relevant to the establishment of Cool's management organisation. "Purchase Price" has the meaning attributed to the term in Clause 3.1. "Purchaser" has the meaning assigned to the term at the beginning of the Agreement. "Restructuring" means the restructuring of the Golar Group so that on the Restructuring Closing Date: (a) all personnel, assets, liabilities and contracts which are directly associated with the technical and commercial operation of the LNG Fleet are vested in the XxxxXxx Group; and (b) all other personnel, assets, liabilities and contracts are vested in the Seller's Group, it being understood that IT, treasury and accounting services shall remain vested in the Seller's Group. "Restructuring Closing Date" means 31 March 2022. "RSU/Option Agreement" means an agreement between Golar and the entities in the XxxxXxx Group other than CoolManMal dated 30 June 2022 documenting Golar's obligation to reimburse any tax expense incurred by these XxxxXxx Companies as a consequence of the exercise by former employees in the Golar Group who are in these XxxxXxx Group's employment of their rights under the Golar Group's long term incentive program after the Restructuring Closing Date. "Schedules" shall mean the schedules to this Agreement from time to time and any one of them. "Seller" has the meaning assigned to the term at the beginning of the Agreement. "Seller's Group" means the Seller and its Affiliates (excluding the XxxxXxx Companies), and references to a "member of the Seller's Group" shall be construed accordingly.

6 "Share" means the single share issued and allotted in CoolManUK. "ShipCo Management Agreements" means the agreements identified as such in Schedule 2. "ShipCo SPA" has the meaning assigned to the term in Recital (C) above. "Subsidiary" means an entity in which a person has direct or indirect Control. "Tax" means any taxes, levies, imposts, duties, charges and withholdings, however denominated, including without limitation any tax on gross or net income, profits or gains, taxes on sales, use, transfer, customs and other import or export duties, value added and personal property and social security and other payroll taxes and any interest, penalties or additional tax that may become payable by any XxxxXxx Company or for which any XxxxXxx Company will be held liable. "Tax Return" means any return, report, notice or other document or information submitted or required to be submitted to any Governmental Body in connection with the determination, assessment, collection or payment of any Tax or in connection with the enforcement of any law relating to Tax. "Transaction" means the sale and purchase of the Share. "Transaction Documents" means this Agreement, the Transfer Agreements, the Administrative Services Agreement, the RSU/Option Agreement, the Bermuda Services Agreement, the Protocol and any other agreements executed or to be executed by on the date of this Agreement. "Transfer Agreements" means the UK BTA, the Norwegian BTA, the Croatia Transfer Agreement and the Malaysia Transfer Agreement. "TSA" has the meaning assigned to the term in Recital (G). "UK BTA" means a business transfer agreement dated 30 June 2022 between GolarManUK and CoolManUK documenting the transfer of such part of GolarManUK's business as is related to the commercial and technical operation of the LNG Fleet to CoolManUK with economical and accounting effect between the parties thereto from the Restructuring Closing Date. "USD" means the lawful currency for the time being of the United States of America. "Warranties" means the warranties set forth in Clause 7 below. 1.2 In this Agreement: (i) references to a Party include the permitted successors or assigns (immediate or otherwise) of that Party; (ii) any reference to a document or agreement is to that document or agreement as amended, varied or novated from time to time (other than in breach of this Agreement or that document); and (iii) any reference to a person or an entity includes companies, corporations or other body corporates wheresoever incorporated. 2 THE TRANSACTION 2.1 The Seller hereby agrees to sell and the Purchaser hereby agrees to purchase the Share, free and clear of any and all Encumbrances and on the terms otherwise set forth herein.

8 6 COMPLETION 6.1 Completion is subject to the satisfaction or waiver of the Conditions Precedent and shall take place at 10:00 (Oslo time) on the Completion Date (or at such other place, at such other time and/or on such other date as the Parties may agree). 6.2 At Completion, the following steps shall be taken in sequence: (i) the Parties shall confirm that all of the Conditions Precedent have been met or waived; (ii) the Seller shall deliver a certified copy of the resolution adopted by the board of directors of the Seller authorising the execution and delivery by the officers specified in the resolution of this Agreement, any documents necessary to transfer the Share in accordance with this Agreement and any other documents referred to in this Agreement; (iii) the Seller shall document that title to the Share has been legally transferred to the Purchaser without Encumbrances; (iv) the Purchaser shall transfer the Purchase Price to a bank account nominated by the Seller for the purpose of receiving the same; and (v) all directors in the XxxxXxx Companies which are employed by Xxxxx shall resign and all powers of attorneys and other authorities given by the XxxxXxx Companies to employees in the Golar Group shall be terminated. 6.3 As soon as possible after Completion, the Seller shall deliver all material hard copy corporate records, correspondence, documents, files, memoranda and other papers relating to the XxxxXxx Companies to the Purchaser and/or the relevant XxxxXxx Company. 7 WARRANTIES 7.1 The Purchaser enters into this Agreement on the basis of, and in reliance on, the Warranties set out in this Clause. 7.2 The Seller warrants and represents to the Purchaser that, each Warranty is true and not misleading as of the date hereof except (i) as provided by this Agreement, (ii) Disclosed or (iii) to the extent it relates to any Cool Initiated Commitment. 7.3 Each of the Warranties is separate and, unless specifically provided, is not limited by reference to any other Warranty or anything in this Agreement. 7.4 Warranties given so far as the Seller is aware are deemed to be given to the best of the knowledge, information and belief of the Seller after it has made all reasonable and careful enquiries. 7.4.1 Constitutional documents and corporate documents (i) the copy of the memorandum and articles of association (or the equivalent constitutional documents) of each XxxxXxx Company has been Disclosed and is accurate and complete and has annexed or incorporated copies of all resolutions or agreements required in relation to CoolManUK by the Companies Act 2006 and, for the other XxxxXxx Companies, applicable laws to be so annexed or incorporated. (ii) The register of members and other statutory books and registers of each XxxxXxx Company have been properly kept and no notice or allegation that any of them is incorrect or should be rectified has been received.

9 (iii) All returns, particulars, resolutions and other documents which a XxxxXxx Company is required by law to file with or deliver to the registrar of companies or his equivalent have been correctly made up and duly filed or delivered. 7.4.2 Capacity (i) Each of the Seller and Xxxxx has the power to execute and deliver the Transaction Documents to which they are a party and to perform its obligations thereunder; (ii) each of the Seller and Golar has taken all corporate actions necessary to authorise the execution and delivery of the Transaction Documents to which they or members of their Group are a party and the performance of its obligations thereunder; (iii) this Agreement constitutes and the Transaction Documents to which they are a party will constitute legal, valid and binding obligations on each of the Seller and Golar and is enforceable against the Seller and Golar in accordance with their terms; and (iv) all authorisations from and notices or filings with Governmental Bodies which are necessary to enable the Seller and Golar or members of the Seller's Group to execute, deliver and perform its obligations under the Transaction Documents to which they are a party have been obtained or made (as the case may be) and are in full force and effect and all conditions of each such authorisation have been complied with. 7.4.3 Corporate Status - XxxxXxx Group (i) Each XxxxXxx Company is duly incorporated, validly existing and in good standing under the laws of its jurisdiction; (ii) the Share constitutes the whole of the allotted and issued share capital of CoolManUK and is fully paid; (iii) there are no unissued shares, debentures or other unissued securities in CoolManUK or any other XxxxXxx Company; (iv) the Seller is the sole legal and beneficial owner of the Share, and XxxxXxx UK is the sole legal and beneficial owner of the entire issued share capital in each of the other XxxxXxx Companies; (v) the Seller is entitled to transfer the legal and beneficial title to the Share, free from Encumbrances to the Purchaser; (vi) there are no rights of pre-emption or other restrictions on transfer in respect of the Share, whether conferred by the constitutional documents of CoolManUK or otherwise; (vii) the shares of the XxxxXxx Companies are free from all Encumbrances and no person has any right to require, at any time, the transfer, creation, issue or allotment of any further shares or other securities (or any rights or interest in them, including conversion rights and rights or pre-emption) in CoolManUK or any other XxxxXxx Company and the Seller confirms that it has not agreed to confer any such rights on any person and that no person has claimed any such rights; (viii) since the Restructuring Closing Date, none of the XxxxXxx Companies have made any distribution to its shareholders or any other person (including for the avoidance of doubt a purchase of own shares); (ix) none of the XxxxXxx Companies have made any distribution or payment to its shareholders or any other person in contravention of any law;

10 (x) none of the XxxxXxx Companies have any outstanding conditional shareholders' contributions or any equity or other capital contributions of any nature that may involve any payment obligations of any XxxxXxx Company to any person other than a XxxxXxx Company; (xi) none of the following applies to any of the XxxxXxx Companies: a. it is unable or has admitted its inability to pay its debts as they fall due; b. it has suspended making payments on any of its debts or started (or anticipates starting) negotiations with one of more of its creditors; c. the value of its assets is less than the amount of its liabilities, taking into account contingent and prospective liabilities; d. a moratorium has been declared in respect of any of its indebtedness; or e. a corporate action, legal proceedings or other procedure or step has been taken in relation to (a), (b) or (d) above; (xii) none of the XxxxXxx Companies holds or beneficially owns or has agreed to acquire, any shares, loan capital or any other securities; nor has it, at any time, had a. any subsidiary or subsidiary undertaking; b. held a membership in any limited liability partnership, partnership or other unincorporated association, joint venture or consortium; c. controlled or taken part in the management of any company or business organisation (other than the Golar Group) or agreed to do so; or d. established any branch or permanent establishment outside its country of incorporation; save for CoolManUK's ownership to all of the shares in issue in CoolManNor, CoolManCro and CoolManMal; (xiii) none of the XxxxXxx Companies have, at any time, purchased, redeemed, reduced, forfeited or repaid any of its own shares; given any financial assistance in contravention of any applicable laws or regulation or allotted or issued any securities that are convertible into its own shares; (xiv) Completion (and, indirectly, the transfer of ownership to the shares in XxxxXxx Cro, XxxxXxx Xxx and XxxxXxx Nor) will not require the consent of any Governmental Body or any other third party; and (xv) the Transfer Agreements are in compliance with all applicable laws and completion thereunder has been or will be completed in accordance with all applicable laws. 7.4.4 Business and Contracts Since the Restructuring Closing Date: (i) each of the XxxxXxx Companies has conducted its business in the ordinary course and in accordance with past practise, contractual obligations (including but not limited to the obligations pursuant to the Management Agreements), laws, regulations and decisions of Governmental Bodies applicable to it;

11 (ii) all material agreements entered into by the XxxxXxx Companies that are in effect have been Disclosed; (iii) none of the XxxxXxx Companies have entered into any agreement outside the ordinary course of trading, any unusual contract or commitment or undertaken any acquisitions or disposals; (iv) none of the XxxxXxx Companies have entered into any loan agreement or undertaken any similar financial indebtedness; (v) none of the XxxxXxx Companies have entered into any transaction of any kind (including any loans, transfers, sales, gifts, supplies or intra-group trading) resulting in any payments made or to be made by it to the Golar Group or entered into any other agreements with the Golar Group; (vi) none of the XxxxXxx Companies have made any loans to, or investments in other entities; (vii) none of the XxxxXxx Companies have made any amendments to any agreement to which it is party as of the date of this Agreement, including, but not limited to, the Management Agreements; (viii) none of the XxxxXxx Companies have passed any resolution amending its articles of association or bye-laws or other corporate documents; (ix) none of the XxxxXxx Companies have made or proposed any issue of new shares, options, warrants or other similar rights to acquire shares or any other changes in their nominal share capital; (x) none of the XxxxXxx Companies have made or proposed to merge, de-merged, amalgamated or entered into any corporate restructuring, liquidation, dissolution or other business combination; (xi) none of the XxxxXxx Companies have taken any action, or refrained from taking any action, which would result in a breach of any of the Warranties; (xii) none of the XxxxXxx Companies have made any capital expenditure exceeding an amount of USD 50,000 in the individual case or any commitment thereto, other than in connection with the Transfer Agreements to which it is a party; (xiii) none of the XxxxXxx Companies have terminated, amended or waived any provision or right under any material agreement; (xiv) none of the XxxxXxx Companies are in default under any material agreement; (xv) none of the XxxxXxx Companies have received any notice of termination under any agreement; (xvi) none of the XxxxXxx Companies have entered into any material agreement outside the ordinary course of trading; (xvii) none of the XxxxXxx Companies have waived, released, assigned, settled or compromised any material claim or legal action; (xviii) none of the XxxxXxx Companies have established any Encumbrance over any of its assets; and (xix) none of the XxxxXxx Companies have entered into any agreement or commitment to do any of the above; (xx) there has been no Leakage (other than Permitted Leakage) in any of the XxxxXxx Companies or the XxxxXxx Group as a whole;

12 (xxi) the Management Agreements have been concluded in written form and no default has occurred under any of these; and (xxii) NFE has not terminated any NFE Management Agreement or withdrawn any vessel under any NFE Management Agreement as a result of the proposed acquisition of the Share by the Purchaser. 7.4.5 Financial Statements and Assets (i) The XxxxXxx Group Balance Sheet has been prepared in accordance with GAAP, consistently applied, and give a true and fair view of the financial position, assets and liabilities, liquidity and the results of the operations of the XxxxXxx Group for the relevant periods and as of the date of the XxxxXxx Group Balance Sheet; (ii) the XxxxXxx Group Balance Sheet contains either provision adequate to cover, or full particulars in notes of, all Tax (including deferred taxation) and other liabilities (whether quantified, contingent, disputed or otherwise) of the XxxxXxx Companies as at the Restructuring Closing Date; (iii) there were no material liabilities in the XxxxXxx Group at the Restructuring Closing Date not reflected in the XxxxXxx Group Balance Sheet; (iv) there are no material debts, liabilities or obligations of any type, description, kind and nature related to the XxxxXxx Group (fixed, contingent, direct or indirect, un-liquidated or otherwise), which, if known on the Restructuring Closing Date should, pursuant to GAAP, have been reflected or reserved against in the XxxxXxx Group Balance Sheet; (v) at the Restructuring Closing Date, the XxxxXxx Group did not have any obligations, commitments or liabilities, liquidated or non-liquidated, contingent or otherwise, whether for Taxes or otherwise, arising out of events which occurred prior to the Restructuring Closing Date and which are not clearly identified and described in the XxxxXxx Group Balance Sheet; (vi) all of the accounts receivable of the XxxxXxx Group have, with the exception of those arising pursuant to the Transfer Agreements, arisen in the ordinary course of business and all outstanding claims will be collected at full book value within 30 days from the respective invoice date or, if later, when due; (vii) the XxxxXxx Group has not pledged any assets and does not have any commitments or liabilities, whether contingent or not, whatsoever in excess of the commitments and liabilities included in the XxxxXxx Group Balance Sheet; (viii) the XxxxXxx Group has full ownership, free and clear from any Encumbrance, of all assets, tangible and intangible, that is reflected in the XxxxXxx Group Balance Sheet or which is used in its business, including any assets, tangible and intangible, acquired since the Restructuring Closing Date; (ix) the XxxxXxx Group has necessary legal rights to all assets (including Intellectual Property Rights) necessary for the continuation of the business of managing and operating the LNG Fleet, and no assets used or held for use in the conduct or operation of the business of the XxxxXxx Group are owned by the Seller or any member of the Golar Group; (x) at the Completion Date, the XxxxXxx Group (i) will not be using assets in its business which it neither owns nor has the right to use pursuant to written agreements with third parties and (ii) the assets of the XxxxXxx Group will comprise all the assets necessary for carrying on its business fully and effectively to the extent to which it is conducted at date of this Agreement; (xi) there is no agreement, option or other right or privilege outstanding in favour of any third party for the purchase of any of the assets used in the XxxxXxx Group;

13 (xii) there has been no transaction pursuant to or as a result of which (i) any of the shares of the XxxxXxx Companies or (ii) any asset owned, purportedly owned or otherwise held by any XxxxXxx Company is liable to be transferred or re-transferred to another person; and (xiii) all use of the assets by the XxxxXxx Group is in conformity with all laws, requirements and regulations applicable to ownership or use thereof. 7.4.6 Tax (i) Each of the XxxxXxx Companies has filed all Tax Returns which is or was required to be filed by it, and all Tax Returns filed by each XxxxXxx Company are materially true, correct and complete; (ii) each of the XxxxXxx Companies has paid all Taxes required to be paid under applicable laws when due; (iii) all Taxes that each of the XxxxXxx Companies is or was required by applicable laws to withhold or collect have been duly withheld or collected and, to the extent required, have been paid to the relevant Governmental Body; (iv) the Tax Returns of the XxxxXxx Group have been assessed and approved by the relevant Governmental Body through the Tax years up to and including the years for which such assessment and approval is required and no XxxxXxx Company is subject to any dispute with any such authority; (v) all Taxes: a. that have become due have been fully paid or fully provided for in the XxxxXxx Group Balance Sheet and no XxxxXxx Company will be liable for any additional Tax pertaining to the period before the Restructuring Closing Date; and b. for the period after the Restructuring Closing Date have been fully paid when due; (vi) there are no Tax audits, disputes or litigation currently pending with respect to any XxxxXxx Company, and there is no basis for assessment of any deficiency in any Taxes against any XxxxXxx Company which have not been provided for in the XxxxXxx Group Balance Sheet or which have not been paid; (vii) no XxxxXxx Company has been involved in any transactions which could be considered as Tax evasion; (viii) all transactions and agreements entered into between any XxxxXxx Company and the Seller and any other member of the Golar Group have been made on terms and conditions which do not in any way deviate from what would have been agreed between independent parties (i.e. on an arm's length basis); and (ix) no XxxxXxx Company is or has been subject to any taxation outside its fiscal residence. 7.4.7 Compliance (i) The XxxxXxx Companies have: a. complied with all applicable laws, regulations, judgements, decrees and orders, including (without limitation), trade sanctions, anti-money-laundering laws and financial record keeping and reporting requirements, rules, regulations and guidelines, issued or imposed by Governmental Bodies or courts with jurisdiction over the XxxxXxx Companies;

14 b. all licences, consents, permits and authorisations needed to operate the LNG Fleet, and has held, and complied with the terms of, all public and private permits, licences and approvals from all Governmental Bodies and other third parties necessary to carry out its business in its ordinary course, and have taken all actions required to prevent such permits, licences and approvals from lapsing; and c. not violated any applicable anti-bribery or anti-corruption law or regulation enacted in any jurisdiction; (ii) the XxxxXxx Companies hold all licenses, permits and authorisations required to carry on its business as presently conducted and none of them will expire or be revoked or suspended as a result of any transactions contemplated by the Transaction Documents; (iii) neither the Seller nor any XxxxXxx Company has received any formal or informal notice or other communication indicating that permits held by any XxxxXxx Company may be revoked, modified, expire prematurely or not be renewed; (iv) so far as the Seller is aware, there is no current governmental investigation or disciplinary proceeding relating to any alleged breach of any law or permit by any XxxxXxx Company and none is pending or threatened. 7.4.8 Environmental matters So far as the Seller is aware: (i) the XxxxXxx Companies comply and have, at all relevant times, complied with applicable environmental laws and environmental licenses granted to them; (ii) no claim in relation to environmental matters has been made or threatened to be made against any of the XxxxXxx Companies; (iii) each of the XxxxXxx Companies has all environmental permits and approvals that are required for its current operations and such permits and approvals are in full force and effect and none of them will expire or be revoked or suspended as a result of any transactions contemplated by the Transaction Documents; and (iv) no XxxxXxx Company has, other than as permitted under permits held or applicable laws or regulations, disposed of, discharged, released, placed, dumped or emitted any hazardous substances, such as pollutants, contaminants, hazardous or toxic materials, wastes or chemicals into the environment. 7.4.9 Litigation (i) None of the XxxxXxx Companies are engaged in any litigation (whether criminal, civil, administrative or tax), arbitration or alternative dispute resolution process; (ii) so far as the Seller is aware, no litigation, arbitration or dispute resolution process is currently threatened against any of the XxxxXxx Companies; (iii) no XxxxXxx Company has received any claims or complaints and, so far as the Seller is aware, no grounds exist for such claims; (iv) as far as the Seller is aware, no investigation or enquiry is being or has, during the last 3 years, been conducted by any Governmental Body in respect of the affairs of the XxxxXxx Group, and no such investigation is pending, threatened or expected; and

15 (v) the XxxxXxx Companies are not affected by any existing or pending judgments or rulings and have not given any undertakings arising from legal proceedings to a court, governmental agency, regulator or third party. 7.4.10 Employees (i) The names of each person who is a director of each XxxxXxx Company are set out in Schedule 1; (ii) all individuals employed by the XxxxXxx Companies and the particulars of the contract of employment of each individual have been Disclosed; (iii) all individuals who are providing services to the XxxxXxx Companies under an agreement which is not a contract of employment with a Xxxxxxx Company (including, in particular, where the individual acts as a consultant or is on secondment) and the particulars of the terms on which the individual provides services, have been Disclosed; (iv) as of the date hereof, no employee in the XxxxXxx Companies has served notice of termination of his or her current employment; (v) all information on pensions plans and all other benefit plans for employees and all relevant information for the assessment of the XxxxXxx Group's pension liabilities has been Disclosed; (vi) the XxxxXxx Group has complied, in all material respects, with all collective, workforce affecting its relations with, or the conditions of service of, its employees; (vii) no XxxxXxx Company has incurred any liability in connection with any termination of employment of its employees (including redundancy payments), or for failure to comply with any order for the reinstatement or re-engagement of any employee; (viii) no XxxxXxx Company has made or agreed to make a payment, or provided or agreed to provide a benefit to a present or former director, other officer or employee, or to the dependants of any of those people, in connection with the actual or proposed termination or suspension of employment or variation of an employment contract; (ix) each XxxxXxx Company has maintained in all material respects current, adequate and suitable records regarding the service of each of its employees; (x) in so far as they apply to its employees, each XxxxXxx Company has complied in all material respects with any legal obligations (collective agreements included); (xi) no claim in relation to any of the XxxxXxx Company employees or former employees has been made or, so far as the Seller is aware, threatened against any XxxxXxx Company or against any person whom any XxxxXxx Company is or may be liable to compensate or indemnify; (xii) no XxxxXxx Company is involved in any industrial or trade dispute or negotiation regarding a claim with any trade union or other group or organisation representing employees and, so far as the Seller is aware, there is nothing likely to give rise to such a dispute or claim; (xiii) particulars of all collective bargaining or procedural or other agreements or arrangements with any trade union, group or organisation representing employees that relate to any employees of the XxxxXxx Companies (including the crew on board the LNG Fleet) have been Disclosed; (xiv) no enquiry or investigation affecting any XxxxXxx Company has been made or, so far as the Seller is aware, threatened by any governmental, statutory or regulatory authority including any health and safety enforcement body in respect of any act, event, omission or other matter arising out of or in

16 connection with the employment (including terms of employment, working conditions, benefits and practices) or termination of employment of any person; (xv) no employee of any XxxxXxx Company is, or has been, involved in any criminal proceedings relating to the business of any XxxxXxx Company and, so far as the Seller is aware, there are no circumstances which are likely to give rise to any such proceedings; and (xvi) to the extent that any XxxxXxx Company has been a party to a relevant transfer for the purposes of the Transfer of Undertakings (Protection of Employment) Regulations or their equivalent in any jurisdiction in connection with the Restructuring, it has complied with all obligations under those regulations. 7.4.11 Relationship with the Seller (i) Neither the Seller nor any other member of the Seller's Group has any claims against any of the XxxxXxx Companies (other than those arising from the Transaction Documents and the TSA) and none of the XxxxXxx Companies is indebted in any way towards the Seller or any member of the Seller's Group (other than those arising from the Transaction Documents and the TSA); (ii) no payments of any kind, including but not limited to management charges, have been made by any XxxxXxx Company to the Seller or any member of the Seller's Group, save for payments under agreements or arrangements made on an arm's length basis. 7.4.12 Insurance (i) Each of the XxxxXxx Companies has adequate insurance coverage against business interruptions, loss of revenues, liability, injury and other risks normally insured against by persons operating in its field of business; (ii) so far as the Seller is aware there are no material outstanding claims under, or in respect of the validity of, any of those policies and so far as the Seller is aware, there are no circumstances likely to give rise to any claim under those policies; and (iii) all the insurance policies are in full force and effect, are not void or voidable, nothing has been done or not done which could make any of them void or voidable and Completion will not terminate or entitle any insurer to terminate any such policy. 7.4.13 Information (i) All information contained in the Data Room is complete, accurate and not misleading; (ii) the particulars relating to the XxxxXxx Companies in Schedule 1 to this agreement are accurate and not misleading; (iii) the information provided to the Purchaser concerning the XxxxXxx Group and its business (including such business as has or will be taken over under the Transfer Agreements) is true and accurate in all respects and not misleading in any way, and no document (irrespective of form) provided to the Purchaser by or on behalf of the Seller or the XxxxXxx Group, contains any untrue statement of a relevant fact or omits to state a relevant fact necessary not to make the statements contained in the document misleading; and (iv) there are no facts or circumstances concerning the XxxxXxx Group which have not been Disclosed to the Purchaser and which, if Disclosed, might reasonably have been expected to influence the decision of the Purchaser to purchase the Share on the terms set out in this Agreement.

21 14.3 The Put Option shall be exercised only by the Purchaser giving the Seller a notice (the "Exercise Notice") which includes: (i) the date on which the Put Option is exercised; (ii) a statement to the effect that the Purchaser is exercising the Put Option; (iii) a date, which is no less than five after the date of the Exercise Notice, on which Completion is to take place; and (iv) a signature by or on behalf of the Purchaser. 14.4 Upon completion of the transactions contemplated by the Put Option, the Purchaser shall have no further claims against the Seller under this Agreement. 15 TRANSACTION COSTS 15.1 Subject to Clause 15.2, all costs and expenses reasonably and properly incurred in connection with the negotiation and execution of the Transaction Documents shall be borne by the Purchaser. 15.2 Any costs and expenses relating to the Restructuring or any Tax, employment, transfer pricing and other professional advice obtained by the Golar Group in connection with the Transaction or the Restructuring shall be borne by the Golar. 16 CONFIDENTIALITY 16.1 Each Party agrees to treat all documents and other information which it may obtain in connection with this Agreement confidential and shall not make any broadcast, press release, advertisement, public disclosure or other public announcement or statement with respect to this Agreement, unless required by law or the rules of any stock exchange other than: (i) If agreed, press releases by the Purchaser and Golar announcing the completion of the Transaction; and (ii) such information as is required by law or relevant stock exchange regulations to be included in the Purchaser's and Golar's public reports; in both cases in form and substance acceptable to and consistent with such disclosure as the other Party makes. 16.2 The Parties acknowledge that the employees in the XxxxXxx Group on the one side and in the Golar Group on the other side will, during the period in which the Administrative Services Agreement is effective, have access to information relevant to the group in which they are not employed. In view of the fact that both the Purchaser and Golar are listed companies, the Parties undertakes to implement adequate information management routines to avoid the possibility for xxxxxxx xxxxxxx and other breaches of confidentiality. 17 MISCELLANEOUS 17.1 Neither Party shall be liable to the other Party for any indirect or consequential loss. 17.2 The invalidity, illegality or unenforceability of any provision of this Agreement shall not affect the continuation in force of or the remainder of this Agreement. The Parties agree to substitute, for any invalid, illegal or unenforceable provision, a valid or enforceable provision which achieves to the greatest extent possible the same effect as would have been achieved by the invalid, illegal or unenforceable provision.

22 17.3 Neither Party shall assign or transfer any of its rights and/or obligations under this Agreement except with the prior written consent of the other Party and then to such terms and conditions as the other Party may require. 17.4 This Agreement is made for the benefit of the Parties and their respective successors and permitted assigns and is not intended to benefit or be enforceable by anyone else. 17.5 No variation, amendment or addition to this Agreement shall be valid unless agreed in writing by both Parties. 17.6 A failure or delay by a Party to exercise any right or remedy provided under this Agreement or by law shall not constitute a waiver of that or any other right or remedy, nor shall it prevent or restrict any further exercise of that or any other right or remedy. 17.7 This Agreement is made for the benefit of the Parties and their respective permitted successors and assigns and is not intended to benefit or be enforceable by any other party. 17.8 No variation amendment or addition to this Agreement shall be valid unless agreed in writing by both Parties. 17.9 A failure or delay by a Party to exercises any right or remedy provided under this Agreement or by law shall not constitute a waiver of that or any other right or remedy, nor shall it prevent or restrict any further exercise of that or any other right or remedy. 18 CHOICE OF LAW AND ARBITRATION 18.1 This Agreement shall be governed by and construed in accordance with Norwegian law. 18.2 Any dispute arising out of or in connection with this Agreement shall be finally settled by arbitration under the rules of arbitration adopted by the Nordic Offshore and Maritime Arbitration Association in force at the time such arbitration proceedings are commenced by either of the Parties. The association's "Best Practice Guidelines" shall be taken into account.

The place of arbitration shall be Oslo, Norway. The language of the arbitration shall be English. For and on behalf of For and on behalf of Cool Company Ltd. Golar Management (Bermuda) Limited /s/ Xxxx X. Xxxxx /s/ Mi Hong Xxxx Mi Hong Xxxx, Director For and on behalf of Golar LNG Limited /s/ Xxxxxxxx X. Xxxxx Xxxxxxxx X. Xxxxx, Director

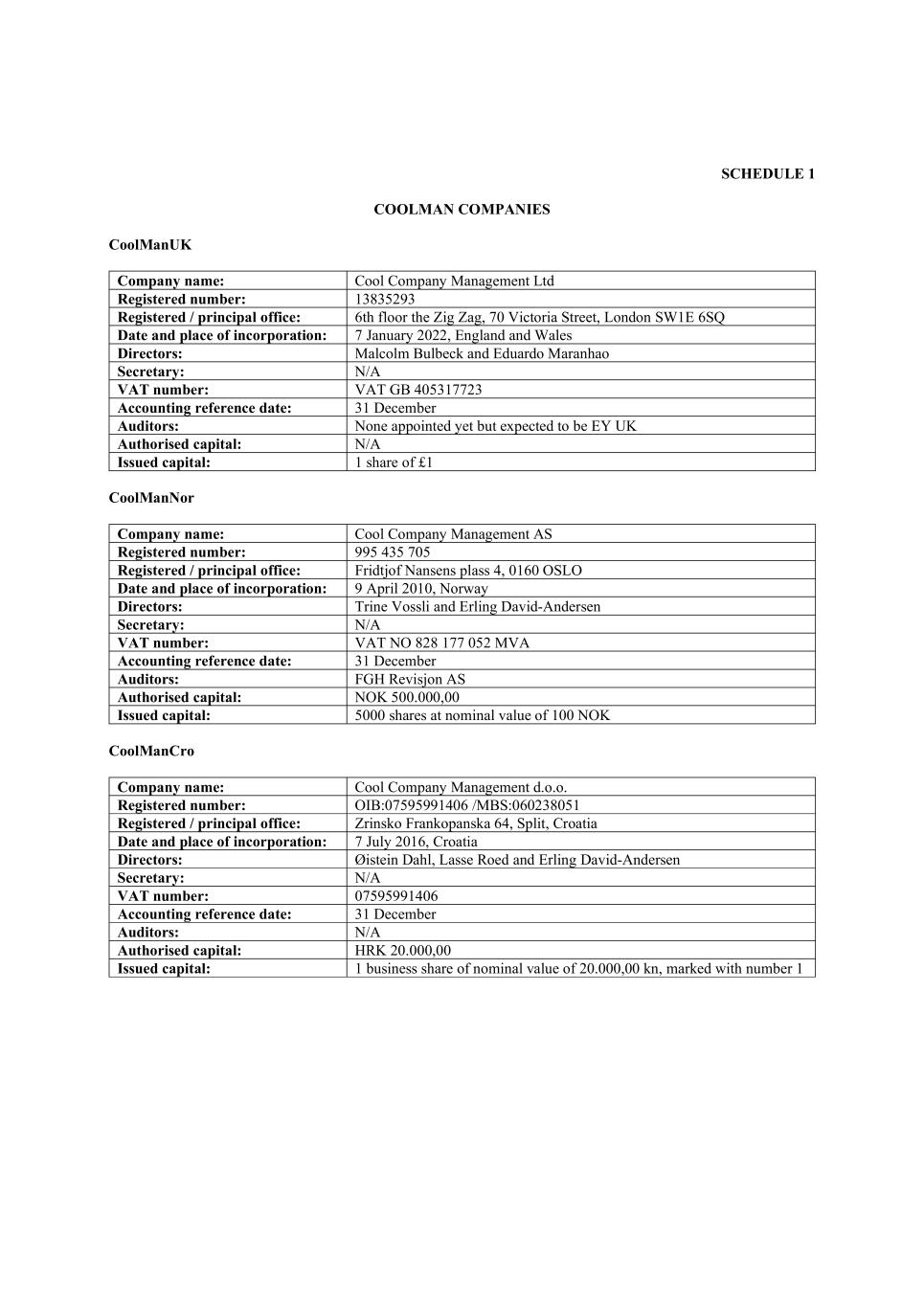

SCHEDULE 1 XXXXXXX COMPANIES CoolManUK Company name: Cool Company Management Ltd Registered number: 13835293 Registered / principal office: 6th floor the Zig Zag, 00 Xxxxxxxx Xxxxxx, Xxxxxx XX0X 0XX Date and place of incorporation: 7 January 2022, England and Wales Directors: Xxxxxxx Xxxxxxx and Xxxxxxx Xxxxxxxx Secretary: N/A VAT number: VAT GB 405317723 Accounting reference date: 31 December Auditors: None appointed yet but expected to be EY UK Authorised capital: N/A Issued capital: 1 share of £1 CoolManNor Company name: Cool Company Management AS Registered number: 995 435 705 Registered / principal office: Fridtjof Xxxxxxx xxxxx 0, 0000 XXXX Date and place of incorporation: 9 April 2010, Norway Directors: Xxxxx Xxxxxx and Xxxxxx Xxxxx-Xxxxxxxx Secretary: N/A VAT number: VAT NO 828 177 052 MVA Accounting reference date: 31 December Auditors: FGH Revisjon AS Authorised capital: NOK 500.000,00 Issued capital: 5000 shares at nominal value of 100 NOK CoolManCro Company name: Cool Company Management d.o.o. Registered number: OIB:07595991406 /MBS:060238051 Registered / principal office: Zrinsko Xxxxxxxxxxxx 00, Xxxxx, Xxxxxxx Date and place of incorporation: 7 July 2016, Croatia Directors: Xxxxxxx Xxxx, Xxxxx Xxxx and Xxxxxx Xxxxx-Xxxxxxxx Secretary: N/A VAT number: 07595991406 Accounting reference date: 31 December Auditors: N/A Authorised capital: HRK 20.000,00 Issued capital: 1 business share of nominal value of 20.000,00 kn, marked with number 1

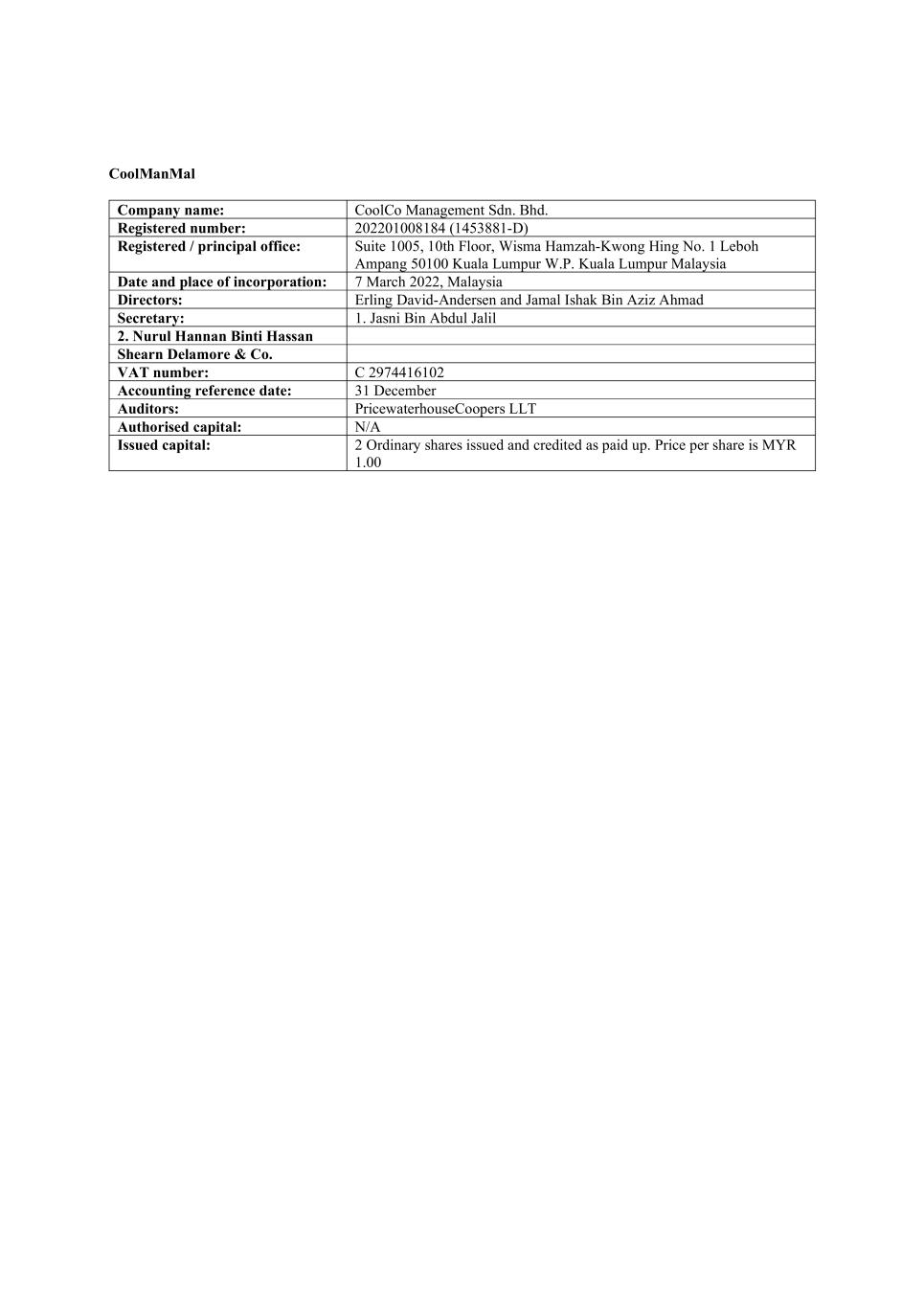

CoolManMal Company name: CoolCo Management Sdn. Bhd. Registered number: 202201008184 (1453881-D) Registered / principal office: Suite 1005, 10th Floor, Wisma Hamzah-Xxxxx Xxxx Xx. 0 Xxxxx Xxxxxx 00000 Xxxxx Xxxxxx X.X. Kuala Lumpur Malaysia Date and place of incorporation: 7 March 2022, Malaysia Directors: Xxxxxx Xxxxx-Xxxxxxxx and Xxxxx Xxxxx Bin Xxxx Xxxxx Secretary: 1. Xxxxx Xxx Xxxxx Xxxxx 2. Xxxxx Xxxxxx Binti Xxxxxx Xxxxxx Xxxxxxxx & Co. VAT number: C 2974416102 Accounting reference date: 31 December Auditors: PricewaterhouseCoopers LLT Authorised capital: N/A Issued capital: 2 Ordinary shares issued and credited as paid up. Price per share is MYR 1.00

SCHEDULE 2 LIST OF MANAGEMENT AGREEMENTS and VESSEL [*****]