ii- ARTICLE VI CONDITIONS TO MAKING LOANS 6.1. Conditions of A&R Closing Date . ............................................................................... ..... 58 6.2. Conditions of Revolving Loans.......................................

Execution Version SEVENTH AMENDED AND RESTATED CREDIT AGREEMENT by and among AIRCASTLE LIMITED, as Borrower, CITIBANK, N.A., XXXXXXX XXXXX BANK USA, JPMORGAN CHASE BANK, N.A., RBC CAPITAL MARKETS1 AND FIFTH THIRD BANK, NATIONAL ASSOCIATION as Joint Lead Arrangers and Joint Bookrunners, XXXXXXX XXXXX BANK USA, JPMORGAN CHASE BANK, N.A. and ROYAL BANK OF CANADA, as Syndication Agents, the other Lenders party hereto from time to time, and CITIBANK, N.A., as Agent, Dated as of December 19, 2012, As amended and restated as of August 2, 2013 As further amended and restated as of March 31, 2014 As further amended and restated as of March 28, 2016 As further amended and restated as of June 27, 2018 As further amended and restated as of October 19, 2018 As further amended and restated as of April 26, 2021 As further amended and restated as of February 8, 2024 1 RBC Capital Markets is a brand name for the capital markets activities of Royal Bank of Canada and its affiliates. Exhibit 10.39

-v- EXHIBIT D Form of Borrowing Notice EXHIBIT E Form of Interest Rate Selection Notice EXHIBIT F Form of Note EXHIBIT G-1 Form of Domestic Counsel Opinion EXHIBIT G-2 Form of Foreign Counsel Opinion EXHIBIT G-3 Form of Chief Legal Officer Opinion EXHIBIT H Quarterly Covenant Compliance Report

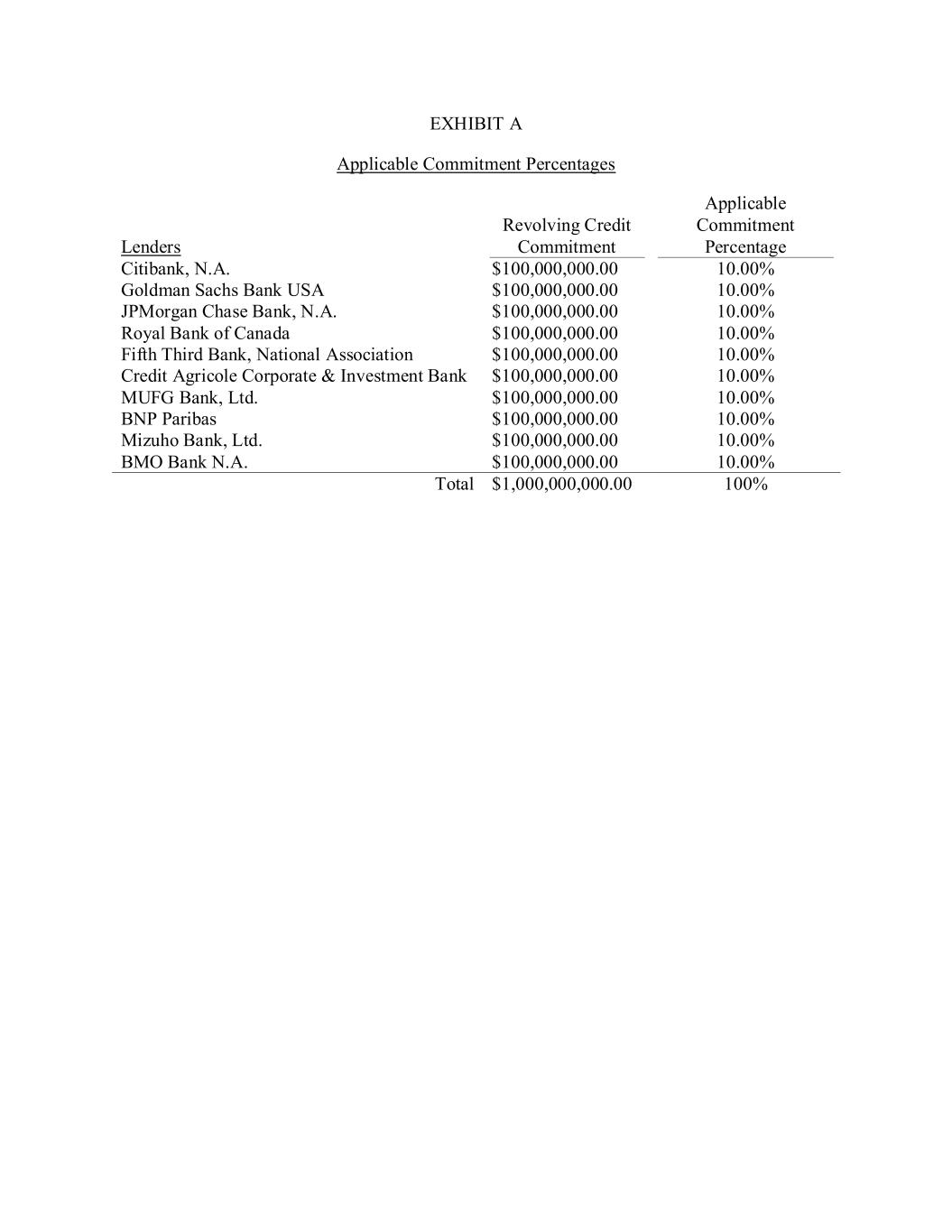

-3- “Applicable Commitment Fee” means, (i) for the period from the A&R Closing Date to and including the date on which the Agent receives a notice from the Borrower of a change in the Public Debt Rating pursuant to Section 8.17, 0.200% per annum and (ii) thereafter, a percentage per annum determined by reference to the Public Debt Rating in effect on such date, as set forth below and subject to the Pricing Level Adjustments: Pricing Level Public Debt Rating Applicable Commitment Fee I ≥ BBB+ / Baa1 / BBB+ 0.150% II BBB / Baa2 / BBB 0.200% III BBB- / Baa3 / BBB- 0.250% IV BB+ / Ba1 / BB+ 0.300% V ≤ BB / Ba2 / BB 0.500% “Applicable Commitment Percentage” means, with respect to each Lender at any time, a fraction, the numerator of which shall be such Lender’s Revolving Credit Commitment and the denominator of which shall be the Total Revolving Credit Commitment, which Applicable Commitment Percentage for each Lender as of the A&R Closing Date is as set forth in Exhibit A; provided that the Applicable Commitment Percentage of each Lender shall be increased or decreased to reflect any assignments to or by such Lender effected in accordance with Section 12.1. “Applicable Lending Office” means, for each Lender and for each Type of Loan, the “Lending Office” for such Lender designated for such Type of Loan on the signature pages hereof or such other office of such Lender as such Lender may from time to time specify to the Agent and the Borrower by written notice in accordance with the terms hereof as the office by which its Loans are to be made and maintained. “Applicable Margin” means, (i) for the period from the A&R Closing Date to and including the date on which the Agent receives a notice from the Borrower of a change in the Public Debt Rating pursuant to Section 8.17, (x) 0.250% per annum, with respect to Base Rate Loans and (y) 1.250% per annum with respect to any SOFR Loan and (ii) thereafter, a percentage per annum determined by reference to the Public Debt Rating in effect on such date, as set forth below and subject to the Pricing Level Adjustment: Pricing Level Public Debt Rating Applicable Margin for Base Rate Loans Applicable Margin for SOFR Loans I ≥ BBB+ / Baa1 / BBB+ 0.125% 1.125% II BBB / Baa2 / BBB 0.250% 1.250% III BBB- / Baa3 / BBB- 0.500% 1.500% IV BB+ / Ba1 / BB+ 0.750% 1.750%

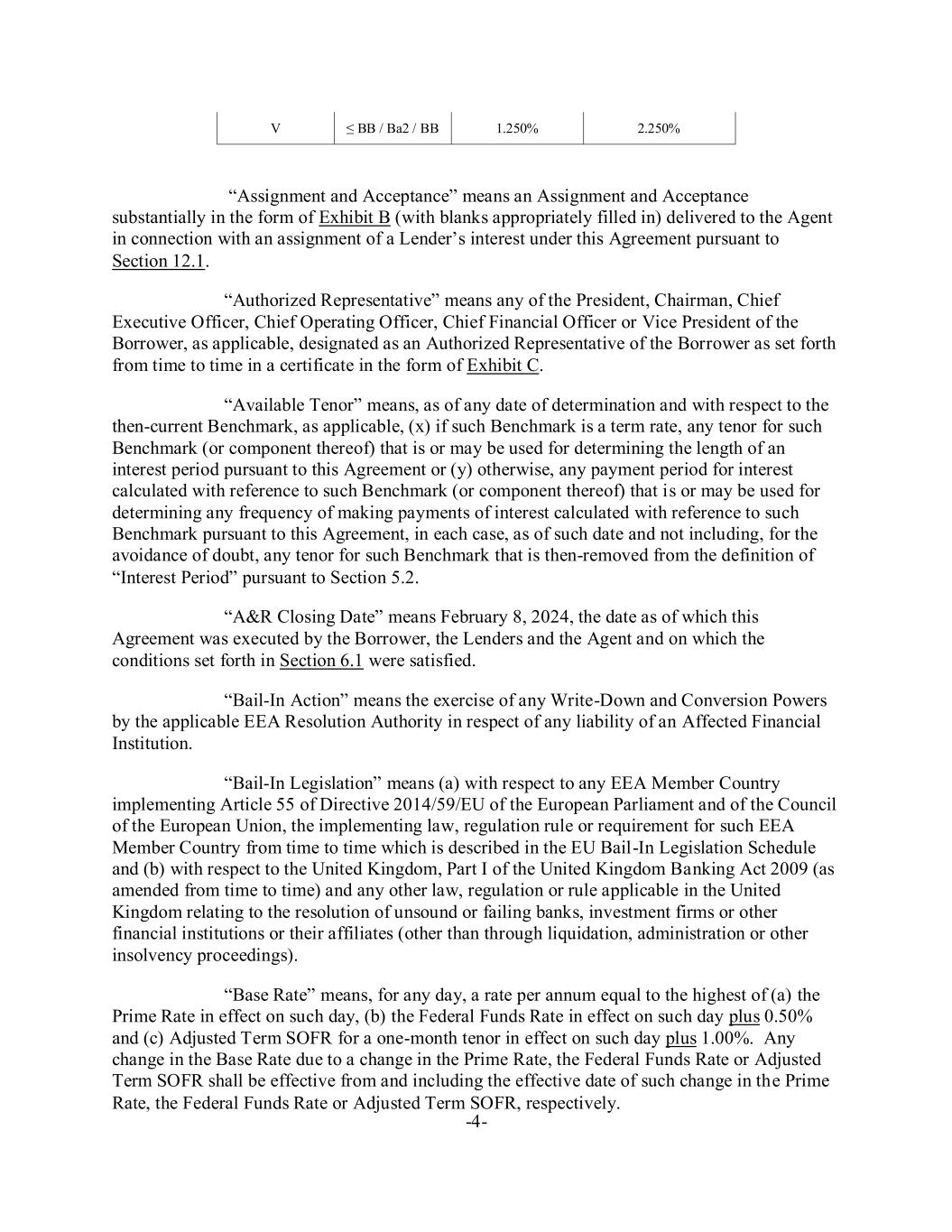

-4- V ≤ BB / Ba2 / BB 1.250% 2.250% “Assignment and Acceptance” means an Assignment and Acceptance substantially in the form of Exhibit B (with blanks appropriately filled in) delivered to the Agent in connection with an assignment of a Lender’s interest under this Agreement pursuant to Section 12.1. “Authorized Representative” means any of the President, Chairman, Chief Executive Officer, Chief Operating Officer, Chief Financial Officer or Vice President of the Borrower, as applicable, designated as an Authorized Representative of the Borrower as set forth from time to time in a certificate in the form of Exhibit C. “Available Tenor” means, as of any date of determination and with respect to the then-current Benchmark, as applicable, (x) if such Benchmark is a term rate, any tenor for such Benchmark (or component thereof) that is or may be used for determining the length of an interest period pursuant to this Agreement or (y) otherwise, any payment period for interest calculated with reference to such Benchmark (or component thereof) that is or may be used for determining any frequency of making payments of interest calculated with reference to such Benchmark pursuant to this Agreement, in each case, as of such date and not including, for the avoidance of doubt, any tenor for such Benchmark that is then-removed from the definition of “Interest Period” pursuant to Section 5.2. “A&R Closing Date” means February 8, 2024, the date as of which this Agreement was executed by the Borrower, the Lenders and the Agent and on which the conditions set forth in Section 6.1 were satisfied. “Bail-In Action” means the exercise of any Write-Down and Conversion Powers by the applicable EEA Resolution Authority in respect of any liability of an Affected Financial Institution. “Bail-In Legislation” means (a) with respect to any EEA Member Country implementing Article 55 of Directive 2014/59/EU of the European Parliament and of the Council of the European Union, the implementing law, regulation rule or requirement for such EEA Member Country from time to time which is described in the EU Bail-In Legislation Schedule and (b) with respect to the United Kingdom, Part I of the United Kingdom Banking Act 2009 (as amended from time to time) and any other law, regulation or rule applicable in the United Kingdom relating to the resolution of unsound or failing banks, investment firms or other financial institutions or their affiliates (other than through liquidation, administration or other insolvency proceedings). “Base Rate” means, for any day, a rate per annum equal to the highest of (a) the Prime Rate in effect on such day, (b) the Federal Funds Rate in effect on such day plus 0.50% and (c) Adjusted Term SOFR for a one-month tenor in effect on such day plus 1.00%. Any change in the Base Rate due to a change in the Prime Rate, the Federal Funds Rate or Adjusted Term SOFR shall be effective from and including the effective date of such change in the Prime Rate, the Federal Funds Rate or Adjusted Term SOFR, respectively.

-5- “Base Rate Borrowing” means, as to any Borrowing, the Base Rate Loans comprising such Borrowing. “Base Rate Loan” means a Loan for which the rate of interest is determined by reference to the Base Rate. “Base Rate SOFR Determination Day” has the meaning specified in the definition of “Term SOFR”. “Benchmark” means, initially, the Term SOFR Reference Rate; provided that if a Benchmark Transition Event has occurred with respect to the Term SOFR Reference Rate or the then-current Benchmark, then “Benchmark” means the applicable Benchmark Replacement to the extent that such Benchmark Replacement has replaced such prior benchmark rate pursuant to Section 5.2. “Benchmark Replacement” means, with respect to any Benchmark Transition Event, the first alternative set forth in the order below that can be determined by the Agent for the applicable Benchmark Replacement Date: (a) the sum of (i) Daily Simple SOFR and (ii) 0.10% (10 basis points); or (b) the sum of: (i) the alternate benchmark rate that has been selected by the Agent and the Borrower giving due consideration to (A) any selection or recommendation of a replacement benchmark rate or the mechanism for determining such a rate by the Relevant Governmental Body or (B) any evolving or then-prevailing market convention for determining a benchmark rate as a replacement to the then-current Benchmark for Dollar-denominated syndicated credit facilities and (ii) the related Benchmark Replacement Adjustment. If the Benchmark Replacement as determined pursuant to clause (a) or (b) above would be less than the Floor, the Benchmark Replacement will be deemed to be the Floor for the purposes of this Agreement and the other Loan Documents. “Benchmark Replacement Adjustment” means, with respect to any replacement of the then-current Benchmark with an Unadjusted Benchmark Replacement, the spread adjustment, or method for calculating or determining such spread adjustment, (which may be a positive or negative value or zero) that has been selected by the Agent and the Borrower giving due consideration to (a) any selection or recommendation of a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement by the Relevant Governmental Body or (b) any evolving or then-prevailing market convention for determining a spread adjustment, or method for calculating or determining such spread adjustment, for the replacement of such Benchmark with the applicable Unadjusted Benchmark Replacement for Dollar-denominated syndicated credit facilities at such time. “Benchmark Replacement Date” means the earliest to occur of the following events with respect to the then-current Benchmark:

-6- (a) in the case of clause (a) or (b) of the definition of “Benchmark Transition Event,” the later of (i) the date of the public statement or publication of information referenced therein and (ii) the date on which the administrator of such Benchmark (or the published component used in the calculation thereof) permanently or indefinitely ceases to provide all Available Tenors of such Benchmark (or such component thereof); or (b) in the case of clause (c) of the definition of “Benchmark Transition Event,” the first date on which all Available Tenors of such Benchmark (or the published component used in the calculation thereof) have been determined and announced by the regulatory supervisor for the administrator of such Benchmark (or such component thereof) to be non-representative; provided that such non-representativeness will be determined by reference to the most recent statement or publication referenced in such clause (c) and even if any Available Tenor of such Benchmark (or such component thereof) continues to be provided on such date. For the avoidance of doubt, the “Benchmark Replacement Date” will be deemed to have occurred in the case of clause (a) or (b) with respect to any Benchmark upon the occurrence of the applicable event or events set forth therein with respect to all then-current Available Tenors of such Benchmark (or the published component used in the calculation thereof). “Benchmark Transition Event” means the occurrence of one or more of the following events with respect to the then-current Benchmark: (a) a public statement or publication of information by or on behalf of the administrator of such Benchmark (or the published component used in the calculation thereof) announcing that such administrator has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof), permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof); (b) a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in the calculation thereof), the Federal Reserve Board, the Federal Reserve Bank of New York, an insolvency official with jurisdiction over the administrator for such Benchmark (or such component), a resolution authority with jurisdiction over the administrator for such Benchmark (or such component) or a court or an entity with similar insolvency or resolution authority over the administrator for such Benchmark (or such component), which states that the administrator of such Benchmark (or such component) has ceased or will cease to provide all Available Tenors of such Benchmark (or such component thereof) permanently or indefinitely, provided that, at the time of such statement or publication, there is no successor administrator that will continue to provide any Available Tenor of such Benchmark (or such component thereof); or (c) a public statement or publication of information by the regulatory supervisor for the administrator of such Benchmark (or the published component used in

-7- the calculation thereof) announcing that all Available Tenors of such Benchmark (or such component thereof) are not, or as of a specified future date will not be, representative. For the avoidance of doubt, a “Benchmark Transition Event” will be deemed to have occurred with respect to any Benchmark if a public statement or publication of information set forth above has occurred with respect to each then-current Available Tenor of such Benchmark (or the published component used in the calculation thereof). “Benchmark Unavailability Period” means the period (if any) (a) beginning at the time that a Benchmark Replacement Date has occurred if, at such time, no Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Loan Document in accordance with Section 5.2 and (b) ending at the time that a Benchmark Replacement has replaced the then-current Benchmark for all purposes hereunder and under any Loan Document in accordance with Section 5.2. “Beneficial Ownership Certification” means a certification regarding beneficial ownership or control as required by the Beneficial Ownership Regulation. “Beneficial Ownership Regulation” means 31 C.F.R. § 1010.230. “Benefit Plan” means any of (a) an “employee benefit plan” (as defined in ERISA) that is subject to Title I of ERISA, (b) a “plan” as defined in and subject to Section 4975 of the Code or (c) any Person whose assets include (for purposes of ERISA Section 3(42) or otherwise for purposes of Title I of ERISA or Section 4975 of the Code) the assets of any such “employee benefit plan” or “plan”. “BHC Act Affiliate” of a party means an “affiliate” (as such term is defined under, and interpreted in accordance with, 12 U.S.C. 1841(k)) of such party. “Board” means the Board of Governors of the Federal Reserve System (or any successor body). “Borrower” has the meaning given to such term in the preamble to this Agreement. “Borrowing Notice” means the notice delivered by an Authorized Representative in connection with a Loan under the Revolving Credit Facility, in the form of Exhibit D. “Business Day” means any day that is not a Saturday, Sunday or other day that is a legal holiday under the laws of the State of New York or is a day on which banking institutions in such state are authorized or required by Law to close. “Capital Stock” means: (1) in the case of a corporation, corporate stock,

-8- (2) in the case of an association or business entity, any and all shares, interests, participations, rights or other equivalents (however designated) of corporate stock, (3) in the case of a partnership or limited liability company, partnership, membership interests (whether general or limited) or shares in the capital of a company, and (4) any other interest or participation that confers on a Person the right to receive a share of the profits and losses of, or distributions of assets of, the issuing Person. “Capitalized Lease Obligation” means, at the time any determination thereof is to be made, the amount of the liability in respect of a capital lease that would at such time be required to be capitalized and reflected as a liability on a balance sheet (excluding the footnotes thereto) in accordance with GAAP. “Cash Equivalents” means: (1) United States dollars, (2) pounds sterling, (3) (a) euro, or any national currency of any participating member state in the European Union, (b) Canadian dollars, or (c) any other local currency held from time to time in the ordinary course of business, (4) securities issued or directly and fully and unconditionally guaranteed or insured by the United States or Canadian government or any agency or instrumentality thereof the securities of which are unconditionally guaranteed as a full faith and credit obligation of such government with maturities of 24 months or less from the date of acquisition, (5) certificates of deposit, time deposits and eurodollar time deposits with maturities of one year or less from the date of acquisition, bankers’ acceptances with maturities not exceeding one year and overnight bank deposits, in each case with any commercial bank having capital and surplus in excess of $500.0 million, (6) repurchase obligations for underlying securities of the types described in clauses (4) and (5) above entered into with any financial institution meeting the qualifications specified in clause (5) above,

-9- (7) commercial paper rated at least P-2 by Moody’s or at least A-2 by S&P and in each case maturing within 12 months after the date of creation thereof, (8) investment funds investing 95% of their assets in securities of the types described in clauses (1) through (7) above, (9) readily marketable direct obligations issued by any state of the United States of America or any political subdivision thereof or any Province of Canada having one of the two highest rating categories obtainable from either Moody’s or S&P with maturities of 24 months or less from the date of acquisition and (10) Indebtedness or preferred stock issued by Persons with a rating of “A” or higher from S&P or “A2” or higher from Moody’s with maturities of 12 months or less from the date of acquisition. Notwithstanding the foregoing, Cash Equivalents shall include amounts denominated in currencies other than those set forth in clauses (1) through (3) above; provided that such amounts are converted into any currency listed in clauses (1) through (3) above as promptly as practicable and in any event within ten Business Days following the receipt of such amounts. “Change of Control” means: (1) any “person” or “group” (as such terms are used in Sections 13(d) and 14(d) of the Exchange Act), other than one or more Permitted Holders, is or becomes the beneficial owner (as defined in Rules 13d-3 and 13d-5 under the Exchange Act), directly or indirectly, of Voting Stock representing more than 50% of the voting power of the total outstanding Voting Stock of the Borrower; (2) (a) all or substantially all of the assets of the Borrower and the Subsidiaries, taken as a whole, are sold or otherwise transferred to any Person other than a Wholly-Owned Subsidiary or one or more Permitted Holders or (b) the Borrower amalgamates, consolidates or merges with or into another Person or any Person consolidates, amalgamates or merges with or into the Borrower, in either case under this clause (2), in one transaction or a series of related transactions in which immediately after the consummation thereof Persons beneficially owning (as defined in Rules 13d-3 and 13d-5 under the Exchange Act) Voting Stock representing in the aggregate a majority of the total voting power of the Voting Stock of the Borrower, immediately prior to such consummation do not beneficially own (as defined in Rules 13d-3 and 13d-5 under the Exchange Act) Voting Stock representing a majority of the total voting power of the Voting Stock of the Borrower, or the applicable surviving or transferee Person; provided that this clause shall not apply (i) in the case where immediately after the consummation of the transactions Permitted Holders beneficially own Voting Stock representing in the aggregate a majority of the total

-10- voting power of the Borrower, or the applicable surviving or transferee Person or (ii) to an amalgamation or a merger of the Borrower with or into (x) a corporation, limited liability company or partnership or (y) a wholly-owned subsidiary of a corporation, limited liability company or partnership that, in either case, immediately following the transaction or series of transactions, has no Person or group (other than Permitted Holders) which beneficially owns Voting Stock representing more than 50% of the voting power of the total outstanding Voting Stock of such entity and, in the case of clause (y), the parent of such wholly-owned subsidiary guarantees the Obligations; (3) the Borrower shall adopt a plan of liquidation or dissolution or any such plan shall be approved by the shareholders of the Borrower; or (4) a “change of control” or any comparable term under, and as defined in, the Recent Indenture shall have occurred. For purposes of this definition, if the Borrower becomes a direct or indirect Subsidiary of a holding company, such holding company shall not itself be considered a Person or group for purposes of clauses (1) and (2) above; provided that (a) such holding company beneficially owns, directly or indirectly, 100% of the Capital Stock of the Borrower and (b) upon completion of such transaction, no Person or group (other than one or more Permitted Holders) beneficially owns more than 50% of the voting power of the total outstanding voting stock of such holding company. “Code” means the Internal Revenue Code of 1986, as amended, and any regulations promulgated thereunder. “Conforming Changes” means, with respect to either the use or administration of Adjusted Term SOFR or the use, administration, adoption or implementation of any Benchmark Replacement, any technical, administrative or operational changes (including changes to the definition of “Base Rate,” the definition of “Business Day,” the definition of “U.S. Government Securities Business Day,” the definition of “Interest Period” or any similar or analogous definition (or the addition of a concept of “interest period”), timing and frequency of determining rates and making payments of interest, timing of borrowing requests or prepayment, conversion or continuation notices, the applicability and length of lookback periods, the applicability of Section 2.16 and other technical, administrative or operational matters) that the Agent decides may be appropriate to reflect the adoption and implementation of any such rate or to permit the use and administration thereof by the Agent in a manner substantially consistent with market practice (or, if the Agent decides that adoption of any portion of such market practice is not administratively feasible or if the Agent determines that no market practice for the administration of any such rate exists, in such other manner of administration as the Agent decides is reasonably necessary in connection with the administration of this Agreement and the other Loan Documents). “Consolidated Depreciation and Amortization Expense” means with respect to any Person for any period, the total amount of depreciation and amortization expense, including any amortization of deferred financing fees, amortization in relation to terminated Hedging

-11- Obligations and amortization of net lease discounts and lease incentives, of such Person and its Subsidiaries for such period on a consolidated basis and otherwise determined in accordance with GAAP. “Consolidated Interest Expense” means, with respect to any Person for any period, the sum, without duplication, of: (a) consolidated interest expense of such Person and its Subsidiaries for such period, to the extent such expense was deducted in computing Consolidated Net Income (including amortization of original issue discount resulting from the issuance of Indebtedness at less than par, non-cash interest payments (but excluding any non-cash interest expense attributable to the movement in the mark to market valuation of or hedge ineffectiveness expenses of Hedging Obligations or other derivative instruments pursuant to Financial Accounting Standards Board Statement No. 133 — “Accounting for Derivative Instruments and Hedging Activities” and excluding non-cash interest expense attributable to the amortization of gains or losses resulting from the termination prior to February 28, 2014 of Hedging Obligations), the interest component of Capitalized Lease Obligations and net payments, if any, pursuant to interest rate Hedging Obligations, and excluding amortization of deferred financing fees and any expensing of other financing fees), and (b) consolidated capitalized interest of such Person and its Subsidiaries for such period, whether paid or accrued less (c) interest income for such period. “Consolidated Net Income” means, with respect to any Person for any period, the aggregate of the Net Income, of such Person and its Subsidiaries for such period, on a consolidated basis, and otherwise determined in accordance with GAAP; provided, however, that: (1) any net after-tax extraordinary, non-recurring or unusual gains or losses (less all fees and expenses relating thereto) or expenses (including, without limitation, relating to severance, relocation and new product introductions) shall be excluded, (2) the Net Income for such period shall not include the cumulative effect of a change in accounting principles during such period, (3) any net after-tax income (loss) from disposed or discontinued operations and any net after-tax gains or losses on disposal of disposed or discontinued operations shall be excluded, (4) any net after-tax gains or losses (less all fees and expenses relating thereto) attributable to asset dispositions other than in the ordinary course of

-12- business, as determined in good faith by the Board of Directors or management of the Borrower, shall be excluded, (5) the Net Income for such period of any Person that is not a Subsidiary or that is accounted for by the equity method of accounting, shall be excluded; provided that Consolidated Net Income of the Borrower shall be increased by the amount of dividends or distributions or other payments that are actually paid in cash (or to the extent converted into cash) to the referent Person or a Subsidiary thereof in respect of such period, (6) [reserved], (7) the effects of adjustments resulting from the application of purchase accounting in relation to any acquisition that is consummated after April 4, 2012, net of taxes, shall be excluded, (8) any net after-tax income (loss) from the early extinguishment of Indebtedness or Hedging Obligations or other derivative instruments shall be excluded, (9) any impairment charge or asset write-off pursuant to Financial Accounting Standards Board Statement No. 142 and No. 144 and the amortization of intangibles arising pursuant to No. 141 shall be excluded, (10) any non-cash compensation expense recorded from grants of stock appreciation or similar rights, stock options or other rights to officers, directors or employees shall be excluded; and (11) unrealized gains or losses relating to Hedging Obligations and mark-to-market of Indebtedness denominated in foreign currencies shall be excluded. “Consolidated Net Worth” means at any date, all amounts that would, in conformity with GAAP, be included on a consolidated balance sheet of the Borrower and its Subsidiaries under stockholders’ equity at such date. “Consolidated Total Debt” means, as at any date of determination, the aggregate amount of all Indebtedness of the Borrower and its Subsidiaries as set forth on the Borrower’s consolidated balance sheet in accordance with GAAP. “Contingent Obligations” means, with respect to any Person, any obligation of such Person guaranteeing any leases, dividends or other obligations that do not constitute Indebtedness (“primary obligations”) of any other Person (the “primary obligor”) in any manner, whether directly or indirectly, including, without limitation, any obligation of such Person, whether or not contingent: (1) to purchase any such primary obligation or any property constituting direct or indirect security therefor,

-13- (2) to advance or supply funds: (A) for the purchase or payment of any such primary obligation or (B) to maintain working capital or equity capital of the primary obligor or otherwise to maintain the net worth or solvency of the primary obligor, or (3) to purchase property, securities or services primarily for the purpose of assuring the owner of any such primary obligation of the ability of the primary obligor to make payment of such primary obligation against loss in respect thereof. “Continue”, “Continuation”, and “Continued” refers to the continuation pursuant to Section 2.8 hereof of a SOFR Loan of one Type as a SOFR Loan of the same Type from one Interest Period to the next Interest Period. “Covered Entity” means any of the following: (i) a “covered entity” as that term is defined in, and interpreted in accordance with, 12 C.F.R. § 252.82(b); (ii) a “covered bank” as that term is defined in, and interpreted in accordance with, 12 C.F.R. § 47.3(b); or (iii) a “covered FSI” as that term is defined in, and interpreted in accordance with, 12 C.F.R. § 382.2(b). “Covered Party” has the meaning assigned to it in Section 12.19. “Convert”, “Conversion”, and “Converted” refers to a conversion pursuant to Section 2.8 or Article V of one Type of Loan into another Type of Loan. “Credit Facilities” means one or more debt facilities, commercial paper facilities, credit agreements, indentures or other agreements, in each case with banks or other institutional lenders, purchasers, investors, trustees or agents providing for revolving credit loans, term loans, receivables financing, including through the sale of receivables to such lenders or to special purpose entities formed to borrow from such lenders against receivables, letters of credit or other extensions of credit or other indebtedness, in each case including any notes, guarantees, collateral documents, instruments and agreements executed in connection therewith, and any amendments, supplements, modifications, extensions, renewals, restatements or refundings thereof and any debt facilities, commercial paper facilities, credit agreements, indentures or other agreements, in each case with banks or other institutional lenders, purchasers, investors, trustees or agents that replace, refund or refinance any part of the loans, notes, other credit facilities or commitments thereunder, including any such replacement, refunding or refinancing facility or indenture that increases the amount borrowable thereunder or alters the maturity thereof. “Credit Party” means, collectively, the Borrower and each Guarantor (if any).

-14- “Daily Simple SOFR” means, for any day, SOFR, with the conventions for this rate (which will include a lookback) being established by the Agent in accordance with the conventions for this rate selected or recommended by the Relevant Governmental Body for determining “Daily Simple SOFR” for syndicated business loans; provided that if the Agent decides that any such convention is not administratively feasible for the Agent, then the Agent may establish another convention in its reasonable discretion. “Debt Fund Affiliate” means an Affiliate of any Person that is primarily engaged in, or is primarily engaged in advising funds or other investment vehicles that are engaged in, making, purchasing, holding or otherwise investing in commercial loans, bonds and similar extensions of credit or securities in the ordinary course. “Default” means any event or condition which, with the giving or receipt of notice or lapse of time or both, would constitute an Event of Default hereunder. “Default Rate” means (i) with respect to each SOFR Loan, until the end of the Interest Period applicable thereto, a rate of two percent (2%) above the Adjusted Term SOFR rate applicable to such Loan, and thereafter at a rate of interest per annum which shall be two percent (2%) above the Base Rate, (ii) with respect to Base Rate Loans, at a rate of interest per annum which shall be two percent (2%) above the Base Rate and (iii) in any case, the maximum rate permitted by applicable law, if lower. “Default Right” has the meaning assigned to that term in, and shall be interpreted in accordance with, 12 C.F.R. §§ 252.81, 47.2 or 382.1, as applicable. “Defaulting Lender” means, subject to Section 2.13(b), any Lender that (a) has failed to (i) fund all or any portion of its Loans within two Business Days of the date such Loans were required to be funded hereunder unless such Lender notifies the Agent and the Borrower in writing that such failure is the result of such Xxxxxx’s determination that one or more conditions precedent to funding (each of which conditions precedent, together with any applicable default, shall be specifically identified in such writing) has not been satisfied, or (ii) pay to the Agent or any other Lender any other amount required to be paid by it hereunder within two Business Days of the date when due, (b) has notified the Borrower or the Agent in writing that it does not intend to comply with its funding obligations hereunder, or has made a public statement to that effect (unless such writing or public statement relates to such Lender’s obligation to fund a Loan hereunder and states that such position is based on such Xxxxxx’s determination that a condition precedent to funding (which condition precedent, together with any applicable default, shall be specifically identified in such writing or public statement) cannot be satisfied), (c) has failed, within three Business Days after written request by the Agent or the Borrower, to confirm in writing to the Agent and the Borrower that it will comply with its prospective funding obligations hereunder (provided that such Lender shall cease to be a Defaulting Lender pursuant to this clause (c) upon receipt of such written confirmation by the Agent and the Borrower), or (d) has, or has a direct or indirect parent company that has, (i) filed a petition or answer seeking liquidation, reorganization, examination or arrangement or similar relief under the federal bankruptcy laws or any other applicable law or statute, (ii) had appointed for it a receiver, custodian, conservator, trustee, administrator, assignee for the benefit of creditors or similar Person charged with reorganization or liquidation of its business or assets, including the Federal

-15- Deposit Insurance Corporation or any other state or federal regulatory authority acting in such a capacity or (iii) become the subject of a Bail-in Action; provided that a Lender shall not be a Defaulting Lender solely by virtue of the ownership or acquisition of any equity interest in that Lender or any direct or indirect parent company thereof by a Governmental Authority so long as such ownership interest does not result in or provide such Lender with immunity from the jurisdiction of courts within the United States or from the enforcement of judgments or writs of attachment on its assets or permit such Lender (or such Governmental Authority) to reject, repudiate, disavow or disaffirm any contracts or agreements made with such Lender. Any determination by the Agent that a Lender is a Defaulting Lender under any one or more of clauses (a) through (d) above shall be conclusive and binding absent manifest error, and such Lender shall be deemed to be a Defaulting Lender (subject to Section 2.13(b)) upon delivery of written notice of such determination to the Borrower and each Lender. “Designated Preferred Stock” means preferred shares of the Borrower (in each case other than Disqualified Stock) that is issued for cash (other than to a Subsidiary) and is so designated as Designated Preferred Stock, pursuant to an Officers’ Certificate on the issuance date thereof. “Disqualified Stock” means, with respect to any Person, any Capital Stock of such Person which, by its terms, or by the terms of any security into which it is convertible or for which it is putable or exchangeable, or upon the happening of any event, matures or is mandatorily redeemable, other than as a result of a change of control or asset sale, pursuant to a sinking fund obligation or otherwise, or is redeemable at the option of the holder thereof, other than as a result of a change of control or asset sale, in whole or in part, in each case prior to the date that is 91 days after the earlier of the Stated Termination Date or the date the Borrower repays all of the Loans and permanently terminates all of the Total Revolving Credit Commitment pursuant to Section 2.7; provided, however, that if such Capital Stock is issued to any plan for the benefit of employees of the Borrower or its Subsidiaries or by any such plan to such employees, such Capital Stock shall not constitute Disqualified Stock solely because it may be required to be repurchased by the Borrower or its Subsidiaries in order to satisfy applicable statutory or regulatory obligations. “Dollars” and the symbol “$” mean dollars constituting legal tender for the payment of public and private debts in the United States of America. “EBITDA” means, with respect to any Person for any period, the Consolidated Net Income of such Person for such period plus (without duplication): (a) provision for taxes based on income or profits, plus franchise or similar taxes, of such Person for such period deducted in computing Consolidated Net Income, plus (b) Consolidated Interest Expense (and other components of Fixed Charges to the extent changes in GAAP after February 28, 2014 result in such components reducing Consolidated Net Income) of such Person for such period to the extent the same was deducted in calculating such Consolidated Net Income, plus

-16- (c) Consolidated Depreciation and Amortization Expense of such Person for such period to the extent such depreciation and amortization were deducted in computing Consolidated Net Income, plus (d) any expenses or charges related to any Equity Offering, Permitted Investment, acquisition, disposition, recapitalization or Indebtedness permitted to be incurred by this Agreement (whether or not successful), including such fees, expenses or charges related to the offering of the notes and the Credit Facilities, and deducted in computing Consolidated Net Income, plus (e) the amount of any restructuring charges, integration costs or other business optimization expenses or costs deducted in such period in computing Consolidated Net Income, including any one-time costs incurred in connection with acquisitions after November 30, 2012, plus (f) any other non-cash charges reducing Consolidated Net Income for such period, excluding any such charge that represents an accrual or reserve for a cash expenditure for a future period, plus (g) the amount of any non-controlling interest expense deducted in calculating Consolidated Net Income (less the amount of any cash dividends paid to the holders of such minority interests), plus (h) any net loss (or minus any gain) resulting from currency exchange risk Hedging Obligations, plus (i) foreign exchange loss (or minus any gain) on debt, plus (j) expenses related to the implementation of an enterprise resource planning system, less (k) non-cash items increasing Consolidated Net Income of such Person for such period, excluding any items which represent the reversal of any accrual of, or cash reserve for, anticipated cash charges in any prior period. “EEA Financial Institution” means (a) any credit institution or investment firm established in any EEA Member Country which is subject to the supervision of an EEA Resolution Authority, (b) any entity established in an EEA Member Country which is a parent of an institution described in clause (a) of this definition, or (c) any financial institution established in an EEA Member Country which is a subsidiary of an institution described in clauses (a) or (b) of this definition and is subject to consolidated supervision with its parent. “EEA Member Country” means any of the member states of the European Union, Iceland, Liechtenstein, and Norway. “EEA Resolution Authority” means any public administrative authority or any person entrusted with public administrative authority of any EEA Member Country (including any delegee) having responsibility for the resolution of any EEA Financial Institution.

-17- “Eligible Assignee” means (i) a Lender, (ii) an affiliate of a Lender, and (iii) any other financial institution approved by the Agent; provided, however, that (x) neither the Borrower nor an affiliate of the Borrower shall qualify as an Eligible Assignee and (y) unless a Default or Event of Default has occurred and is continuing, none of the Persons listed on Schedule 1.1B shall qualify as an Eligible Assignee unless the Borrower shall have consented to such qualification. “Employee Benefit Plan” means, at a particular time, any employee benefit plan that is covered by ERISA and in respect of which the Borrower or any of its ERISA Affiliates is (or, if such plan were terminated at such time, would under Section 4069 of ERISA be deemed to be) an “employer” as defined in Section 3(5) of ERISA. “EMU” means economic and monetary union as contemplated in the Treaty on European Union. “Environmental Laws” means any federal, state or local statute, law, ordinance, code, rule, regulation, order, decree, permit or license regulating, relating to, or imposing liability or standards of conduct concerning, any environmental matters or conditions, environmental protection or conservation, including, without limitation, the Comprehensive Environmental Response, Compensation and Liability Act of 1980, as amended; the Superfund Amendments and Reauthorization Act of 1986, as amended; the Resource Conservation and Recovery Act, as amended; the Toxic Substances Control Act, as amended; the Clean Air Act, as amended; the Clean Water Act, as amended; together with all regulations promulgated thereunder, and any other “Superfund” or “Superlien” law. “Equity Interests” means Capital Stock and all warrants, options or other rights to acquire Capital Stock, but excluding any debt security that is convertible into, or exchangeable for, Capital Stock. “Equity Offering” means any public or private sale of common shares or preferred shares of the Borrower (excluding Disqualified Stock), other than: (a) public offerings with respect to the Borrower’s common shares registered on Form S-8; (b) any such public or private sale that constitutes an Excluded Contribution; and (c) any sales to the Borrower or any of its Subsidiaries. “ERISA” means the Employee Retirement Income Security Act of 1974, as amended from time to time. “ERISA Affiliate” means an entity, whether or not incorporated, that is under common control with the Borrower within the meaning of Section 4001 of ERISA or is part of a group that includes the Borrower and that is treated as a single employer within the meaning of Section 414 of the Code.

-18- “Erroneous Payment” has the meaning assigned to it in Section 11.2(d). “Erroneous Payment Deficiency Assignment” has the meaning assigned to it in Section 11.2(g). “Erroneous Payment Impacted Class” has the meaning assigned to it in Section 11.2(g). “Erroneous Payment Return Deficiency” has the meaning assigned to it in Section 11.2(g). “Erroneous Payment Subrogation Rights” has the meaning assigned to it in Section 11.2(g). “EU Bail-In Legislation Schedule” means the EU Bail-In Legislation Schedule published by the Loan Market Association (or any successor person), as in effect from time to time. “euro” means the single currency of participating member states of the EMU. “Eurocurrency Liabilities” has the meaning assigned to that term in Regulation D of the Board, as in effect from time to time. “Event of Default” means any of the occurrences set forth as such in Section 10.1. “Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations of the Securities and Exchange Commission promulgated thereunder. “Excluded Contribution” means net cash proceeds, marketable securities or Qualified Proceeds received by the Borrower from: (a) contributions to its common equity capital, and (b) the sale (other than to a Subsidiary of the Borrower or to any management equity plan or stock option plan or any other management or employee benefit plan or agreement of the Borrower) of Capital Stock (other than Disqualified Stock and Designated Preferred Stock) of the Borrower, in each case designated as Excluded Contributions pursuant to an Officers’ Certificate of the Borrower on or prior to the date such capital contributions are made or the date such Equity Interests are sold, as the case may be. “Existing Credit Agreement” has the meaning given to such term in the recitals to this Agreement. “Existing Indebtedness” means Indebtedness of the Borrower or the Subsidiaries in existence on the Original Closing Date, plus interest accruing thereon.

-19- “Existing Lenders” has the meaning given to such term in the recitals to this Agreement. “Existing Notes Repayment Date” means the date on which all of the Borrower’s existing senior notes that are outstanding on the A&R Closing Date have been repaid, repurchased in full or otherwise satisfied and discharged and no longer outstanding. “Fair Market Value” means the value that would be paid by a willing buyer to an unaffiliated willing seller in a transaction not involving distress or necessity of either party, determined in good faith by the chief executive officer, chief financial officer, chief accounting officer or controller of the Borrower or its Subsidiaries, which determination will be conclusive (unless otherwise provided in this Agreement). “FATCA” means Section 1471 through 1474 of the Code, as of the date hereof, and any amended or successor version that is substantively comparable and not materially more onerous to comply with, any current or future regulations or official interpretations thereof, any agreement entered into pursuant to current Section 1471(b) of the Code (or any amended or successor version described above) or any intergovernmental agreement (and any related legislation, rules or official administrative practices) implementing the foregoing. “FCPA Compliance” means compliance in all material respects by the Borrower, its Subsidiaries and their respective directors and officers and, to the knowledge of the Borrower, their respective employees, agents and affiliates with the Foreign Corrupt Practices Act, as amended, and rules and regulations thereunder (“FCPA”) and the UK Bribery Act, as amended, including that no part of the proceeds of the Loans be used directly, or to the knowledge of the Borrower, indirectly, in violation of the FCPA or UK Bribery Act, as amended, including, without limitation, for any payments to any governmental official or employee, political party, official of a political party, candidate for political office, or anyone else acting in an official capacity, in order to obtain, retain or direct business or obtain any improper advantage, in violation of the FCPA or the UK Bribery Act, as amended. “Federal Funds Rate” means, for any day, the greater of (a) the rate calculated by the Federal Reserve Bank of New York based on such day’s Federal funds transactions by depositary institutions (as determined in such manner as the Federal Reserve Bank of New York shall set forth on its public website from time to time) and published on the next succeeding Business Day by the Federal Reserve Bank of New York as the Federal funds effective rate and (b) 0%. “Federal Reserve Board” means the Board of Governors of the Federal Reserve System of the United States. “Fee Payment Date” means, for any month in which a commitment fee is due, the twentieth (20th) calendar day of each calendar month (or, if such day is not a Business Day, on the next succeeding Business Day). “Fifth Restatement Date” means October 19, 2018.

-20- “First Restatement Date” means August 2, 2013. “Fiscal Quarter” means (i) from the Fifth Restatement Date through June 30, 2020, each three-month period from January 1 through March 31, April 1 through June 30, July 1 through September 30, and October 1 through December 31 of each calendar year, (ii) the five- month period from July 1, 2020, through November 30, 2020, and (iii) beginning December 1, 2020, each three-month period from March 1 through May 31, June 1 through August 31, September 1 through November 30, and December 1 through the last day of February of the following calendar year “Fiscal Year” means, respectively (i) prior to September 30, 2020, the twelve- month fiscal period of the Borrower and its Subsidiaries commencing on January 1 of each calendar year and ending on December 31 of each calendar year and (ii) from and after September 30, 2020, the twelve-month fiscal period of the Borrower and its Subsidiaries commencing on March 1 of each calendar year and ending on the last day of February of the following calendar year (commencing with the period beginning March 1, 2020). “Fitch” means Fitch Ratings, Inc. and any successor thereto. “Fixed Charge Coverage Ratio” means, with respect to any Person for any period, the ratio of EBITDA of such Person for such period to the Fixed Charges of such Person for such period. “Fixed Charges” means, with respect to any Person for any period, the sum of: (a) Consolidated Interest Expense, (b) all cash dividend payments (excluding items eliminated in consolidation) on any series of preferred stock (including any Designated Preferred Stock) or any Refunding Capital Stock of such Person, and (c) all cash dividend payments (excluding items eliminated in consolidation) on any series of Disqualified Stock. “Floor” means a rate of interest equal to 0.00%. “Foreign Subsidiary” means a Subsidiary not organized or existing under the laws of the United States of America or any state or territory thereof or the District of Columbia and any direct or indirect Subsidiary of such Subsidiary. “Fourth Restatement Date” means June 27, 2018. “GAAP” means generally accepted accounting principles in the United States which are in effect on April 4, 2012. At any time, the Borrower may elect to apply International Financial Reporting Standards (“IFRS”) accounting principles in lieu of GAAP for purposes of calculations hereunder and, upon any such election, references herein to GAAP shall thereafter be construed to mean IFRS (except as otherwise provided in this Agreement); provided that any calculation or determination in this Agreement that requires the application of GAAP for periods

-21- that include Fiscal Quarters ended prior to the Borrower’s election to apply IFRS shall remain as previously calculated or determined in accordance with GAAP. The Borrower shall give notice of any such election made in accordance with this definition to the Agent. If at any time any election by the Borrower to apply IFRS accounting principles in lieu of GAAP as provided under this definition of “GAAP” would affect the computation of any financial ratio or requirement set forth in any Loan Document, and either the Borrower or the Required Lenders shall so request, the Agent, the Lenders and the Borrower shall negotiate in good faith to amend such ratio or requirement to preserve the original intent thereof in light of such election to apply IFRS (subject to the approval of the Required Lenders); provided that, until so amended, (i) such ratio or requirement shall continue to be computed in accordance with GAAP prior to such election to apply IFRS and (ii) the Borrower shall provide to the Agent and the Lenders financial statements and other documents required under this Agreement or as reasonably requested hereunder setting forth a reconciliation between calculations of such ratio or requirement made before and after giving effect to such election to apply IFRS. “Government Securities” means securities that are: (a) direct obligations of the United States of America for the timely payment of which its full faith and credit is pledged, or (b) obligations of a Person controlled or supervised by and acting as an agency or instrumentality of the United States of America the timely payment of which is unconditionally guaranteed as a full faith and credit obligation by the United States of America, which, in either case, are not callable or redeemable at the option of the issuers thereof, and shall also include a depository receipt issued by a bank (as defined in Section 3(a)(2) of the Securities Act), as custodian with respect to any such Government Securities or a specific payment of principal of or interest on any such Government Securities held by such custodian for the account of the holder of such depository receipt; provided that (except as required by law) such custodian is not authorized to make any deduction from the amount payable to the holder of such depository receipt from any amount received by the custodian in respect of the Government Securities or the specific payment of principal of or interest on the Government Securities evidenced by such depository receipt. “Governmental Authority” means the government of the United States of America or any other nation, or of any political subdivision thereof, whether state or local, and any agency, authority, instrumentality, regulatory body, court, central bank or other entity exercising executive, legislative, judicial, taxing, regulatory or administrative powers or functions of or pertaining to government (including any supra-national bodies such as the European Union or the European Central Bank). “Guarantee” has the meaning given to such term in Section 9.12(i)(a). “guarantee” means a guarantee (other than by endorsement of negotiable instruments for collection in the ordinary course of business), direct or indirect, in any manner

-22- (including, without limitation, letters of credit and reimbursement agreements in respect thereof), of all or any part of any Indebtedness or other obligations. “Guarantor” means any Person that executes a Guarantee in accordance with the provisions of this Agreement and its respective successors and assigns. “Hazardous Material” means and includes any pollutant, contaminant, or hazardous, toxic or dangerous waste, substance or material (including without limitation petroleum products, asbestos-containing materials and lead), the generation, handling, storage, transportation, disposal, treatment, release, discharge or emission of which is subject to any Environmental Law. “Hedging Obligations” means, with respect to any Person, the obligations of such Person under: (a) currency exchange, interest rate or commodity swap agreements, currency exchange, interest rate or commodity cap agreements and currency exchange, interest rate or commodity collar agreements; and (b) other agreements or arrangements designed to protect such Person against fluctuations in currency exchange, interest rates or commodity prices. “Increased Amount Date” has the meaning given to such term in Section 2.7. “Increased Commitment Notice” has the meaning given to such term in Section 2.7. “Increased Commitments” has the meaning given to such term in Section 2.7. “Increasing Lender” has the meaning given to such term in Section 2.7. “Indebtedness” means, with respect to any Person: (a) any indebtedness (including principal and premium) of such Person, whether or not contingent (1) in respect of borrowed money, (2) evidenced by bonds, notes, debentures or similar instruments or letters of credit or bankers’ acceptances (or, without double counting, reimbursement agreements in respect thereof), (3) representing the balance deferred and unpaid of the purchase price of any property (including Capitalized Lease Obligations), except (i) any such balance that constitutes a trade payable or similar obligation to a trade creditor, in each case accrued in the ordinary course of business and (ii) any earn-out obligations until such obligation becomes

-23- a liability on the balance sheet of such Person in accordance with GAAP, or (4) representing any Hedging Obligations, if and to the extent that any of the foregoing Indebtedness (other than letters of credit and Hedging Obligations) would appear as a liability upon a balance sheet (excluding the footnotes thereto) of such Person prepared in accordance with GAAP, (b) to the extent not otherwise included, any obligation by such Person to be liable for, or to pay, as obligor, guarantor or otherwise, on the Indebtedness of another Person, other than by endorsement of negotiable instruments for collection in the ordinary course of business, and (c) to the extent not otherwise included, Indebtedness of another Person secured by a Lien on any asset owned by such Person, whether or not such Indebtedness is assumed by such Person; provided, however, that Xxxxxxxxxx Obligations shall be deemed not to constitute Indebtedness; and obligations under or in respect of Receivables Facilities shall not be deemed to constitute Indebtedness (except for the purposes of the covenants contained in Sections 9.16, 9.17 and 9.18); and the term “Indebtedness” shall not include any lease, concession or license of property (or guarantee thereof) that would be considered an operating lease under GAAP as in effect on the A&R Closing Date; provided further that, for the avoidance of doubt, Indebtedness of any Person at any time under a revolving credit or similar facility shall be the total amount of funds borrowed and then outstanding “Indenture” means the Recent Indenture and each other indenture pursuant to which unsecured senior notes are issued by the Borrower. “Independent Financial Advisor” means an accounting, appraisal, investment banking firm or consultant to Persons engaged in Similar Businesses of nationally recognized standing that is, in the good faith judgment of the Borrower, qualified to perform the task for which it has been engaged. “Initial Lien” has the meaning given to such term in Section 9.3(i). “Insolvency” means, with respect to any Multiemployer Plan, the condition that such Multiemployer Plan is insolvent within the meaning of Section 4245 of ERISA. “Interest Coverage Ratio” means, as of the end of any Fiscal Quarter of the Borrower and the Subsidiaries for the Test Period ending on such date, the ratio of (a) EBITDA of the Borrower and the Subsidiaries for such Test Period to (b) Consolidated Interest Expense paid in cash of the Borrower for such Test Period. “Interest Period” means, as to any Borrowing, the period commencing on the date of such Loan or Borrowing and ending on the numerically corresponding day in the calendar

-24- month that is one, three or six months thereafter (in each case, subject to the availability thereof), as specified in the applicable Borrowing Request or Interest Rate Selection Notice; provided that (i) if any Interest Period would end on a day other than a Business Day, such Interest Period shall be extended to the next succeeding Business Day unless such next succeeding Business Day would fall in the next calendar month, in which case such Interest Period shall end on the next preceding Business Day, (ii) any Interest Period that commences on the last Business Day of a calendar month (or on a day for which there is no numerically corresponding day in the last calendar month of such Interest Period) shall end on the last Business Day of the last calendar month of such Interest Period, (iii) no Interest Period shall extend beyond the Revolving Credit Termination Date and (iv) no tenor that has been removed from this definition pursuant to Section 5.2 shall be available for specification in such Borrowing Request or Interest Election Request. For purposes hereof, the date of a Loan or Borrowing initially shall be the date on which such Loan or Borrowing is made and thereafter shall be the effective date of the most recent Conversion or continuation of such Loan or Borrowing. “Interest Rate Selection Notice” means the written notice delivered by an Authorized Representative in connection with the election of a subsequent Interest Period for any SOFR Loan or the Conversion of any Base Rate Loan into a SOFR Loan, in the form of Exhibit E. “Investments” means, with respect to any Person, all investments by such Person in other Persons (including Affiliates) in the form of loans (including guarantees), advances or capital contributions (excluding accounts receivable, trade credit, advances to customers, commission, travel, moving and similar advances to officers, directors and employees), purchases or other acquisitions for consideration of Indebtedness, Equity Interests or other securities issued by any other Person and investments that are required by GAAP to be classified on the balance sheet (excluding the footnotes) of the Borrower in the same manner as the other investments included in this definition to the extent such transactions involve the transfer of cash or other property. “Joint Lead Arrangers” means Citibank, N.A., Xxxxxxx Xxxxx Bank USA, X.X. Xxxxxx Securities LLC, RBC Capital Markets and Fifth Third Bank, National Association. “Lender” has the meaning given to such term in the preamble to this Agreement. “Lien” means, with respect to any asset, any mortgage, lien, pledge, charge, security interest or encumbrance of any kind in respect of such asset, whether or not filed, recorded or otherwise perfected under applicable law, including any conditional sale or other title retention agreement, any lease in the nature thereof, any option or other agreement to sell or give a security interest ; provided that (i) in no event shall an operating lease be deemed to constitute a Lien and (ii) the filing of a financing statement under the Uniform Commercial Code does not, in and of itself give rise to a Lien. “Loan” or “Loans” means any of the Revolving Loans. “Loan Documents” means this Agreement, the Notes (if any), a Guarantee (if any) and all other instruments and documents heretofore or hereafter executed or delivered to or in

-26- capacity) or to any Lender that are required to be paid by the Borrower pursuant thereto) or otherwise. “Officer” means the Chairman of the Board of Directors, the Chief Executive Officer, the President, any Executive Vice President, Senior Vice President or Vice President, the Treasurer or the Secretary of the Borrower. “Officers’ Certificate” means a certificate signed on behalf of the Borrower by an Officer of the Borrower. “Operating Circular” means an operating circular issued by the Federal Reserve Bank. “Organizational Action” means with respect to any corporation, limited liability company, partnership, limited partnership, limited liability partnership, trust or other legally authorized incorporated or unincorporated entity, any corporate, organizational or partnership action (including any required shareholder, trustee, member or partner action), or other similar official action, as applicable, taken by such entity. “Organizational Documents” means with respect to any corporation, limited liability company, partnership, limited partnership, limited liability partnership, trust or other legally authorized incorporated or unincorporated entity, (i) the articles of incorporation, certificate of incorporation, memorandum of association, articles of organization, certificate of limited partnership, trust agreement or other applicable organizational or charter documents relating to the creation of such entity and (ii) the bylaws, bye-laws, operating agreement, partnership agreement, limited partnership agreement or other applicable documents relating to the operation, governance or management of such entity. “Original Closing Date” means December 19, 2012. “Payment Recipient” has the meaning assigned to it in Section 11.2(d). “PBGC” means the Pension Benefit Guaranty Corporation established pursuant to Subtitle A of Title IV of ERISA and any successor thereto. “Periodic Term SOFR Determination Day” has the meaning specified in the definition of “Term SOFR”. “Permitted Holders” means, collectively, Marubeni Corporation, its Affiliates and any Person who, at any time, is the Chairman of the Board, any President, any Executive Vice President or Vice President, any Managing Director, any Treasurer or any Secretary or other executive officer of the Borrower or any Subsidiary of the Borrower at such time. “Permitted Investments” means (a) any Investment in the Borrower or any Subsidiary; (b) any Investment in cash and Cash Equivalents;

-27- (c) any Investment by the Borrower or any Subsidiary of the Borrower in a Person if as a result of such Investment: (1) such Person becomes a Subsidiary; or (2) such Person, in one transaction or a series of related transactions, is merged, consolidated or amalgamated with or into, or transfers or conveys substantially all of its assets to, or is liquidated into, the Borrower or a Subsidiary; (d) any Investment in securities or other assets not constituting cash or Cash Equivalents and received in connection with any disposition of assets; (e) any Investment existing on the Original Closing Date; (f) advances to employees not in excess of $5.0 million outstanding at any one time, in the aggregate; (g) any Investment acquired by the Borrower or any Subsidiary: (1) in exchange for any other Investment or accounts receivable held by the Borrower or any such Subsidiary in connection with or as a result of a bankruptcy, workout, reorganization or recapitalization of the Borrower of such other Investment or accounts receivable; or (2) as a result of a foreclosure by the Borrower or any Subsidiary with respect to any secured Investment or other transfer of title with respect to any secured Investment in default; (h) any Investments in Hedging Obligations entered into in the ordinary course of business; (i) loans to officers, directors and employees for business-related travel expenses, moving expenses and other similar expenses, in each case incurred in the ordinary course of business; (j) any Investment having an aggregate Fair Market Value, taken together with all other Investments made pursuant to this clause (j) that are at that time outstanding, not to exceed the greater of (x) $200.0 million and (y) 3.0% of Total Assets at the time of such Investment (with the Fair Market Value of each Investment being measured at the time made and without giving effect to subsequent changes in value); (k) Investments the payment for which consists of Equity Interests of the Borrower (exclusive of Disqualified Stock); (l) guarantees of Indebtedness permitted under Section 9.4;

-28- (m) any transaction to the extent it constitutes an investment that is permitted and made in accordance with the provisions of Section 9.8(ii); (n) Investments consisting of purchases and acquisitions of inventory, supplies, material or equipment or the licensing or contribution of intellectual property pursuant to joint marketing or similar arrangements; (o) repurchases of Senior Notes; (p) any Investments received in compromise or resolution of (A) obligations of trade creditors or customers that were incurred in the ordinary course of business of the Borrower or any of its Subsidiaries, including pursuant to any plan of reorganization or similar arrangement upon the bankruptcy or insolvency of any trade creditor or customer; or (B) litigation, arbitration or other disputes with Persons who are not Affiliates; (q) any Investment in a Person (other than the Borrower or a Subsidiary) pursuant to the terms of any agreements in effect on the Original Closing Date and any Investment that replaces, refinances or refunds an existing Investment; provided that the new Investment is in an amount that does not exceed the amount replaced, refinanced or refunded (after giving effect to write-downs or write-offs with respect to such Investment), and is made in the same Person as the Investment replaced, refinanced or refunded; (r) endorsements for collection or deposit in the ordinary course of business; (s) Investments relating to any special purpose wholly-owned subsidiary of the Borrower organized in connection with a Receivables Facility that, in the good faith determination of the Board of Directors of the Borrower, are necessary or advisable to effect such Receivables Facility; (t) Investments in a joint venture, when taken together with all other Investments made pursuant to this clause (t) that are at the time outstanding, not to exceed the greater of (x) $200.0 million and (y) 3.0% of Total Assets (with the Fair Market Value of each Investment being measured at the time made and without giving effect to subsequent changes in value); and (u) Investments in aviation assets, including debt Investments secured, directly or indirectly, by commercial jet aircraft or related property and including Investments in entities owning, financing or leasing aviation assets, when taken together with all other Investments made pursuant to this clause (u) that are at the time outstanding, not to exceed 25% of Total Assets (with Fair Market Value of each Investment being measured at the time made and without giving effect to subsequent changes in value). “Permitted Jurisdiction” means any of the United States, any state thereof, the District of Columbia, or any territory thereof, Bermuda, the Cayman Islands, Switzerland, Ireland, Singapore or the Xxxxxxxx Islands. “Permitted Liens” means, with respect to any Person:

-29- (1) Liens existing on the A&R Closing Date; (2) Liens on property or shares of stock of a Person at the time such Person becomes a Subsidiary; provided, however, such Liens are not created or incurred in connection with, or in contemplation of, such other Person becoming such a subsidiary; provided, further, however, that such Liens may not extend to any other property owned by the Borrower or any Subsidiary; (3) Liens on property at the time the Borrower or a Subsidiary acquired the property, including any acquisition by means of an amalgamation or a merger or consolidation with or into the Borrower or any Subsidiary; provided, however, that such Liens are not created or incurred in connection with, or in contemplation of, such acquisition; provided, further, however, that the Liens may not extend to any other property owned by the issuer or any Subsidiary; (4) Liens securing Indebtedness or other obligations of a Subsidiary owing to the Borrower or another Subsidiary permitted to be incurred in accordance with Section 9.4; (5) Liens on specific items of inventory of other goods and proceeds of any Person securing such Person’s obligations in respect of bankers’ acceptances issued or created for the account of such Person to facilitate the purchase, shipment or storage of such inventory or other goods; (6) Liens in favor of the Borrower or any Guarantor; (7) Liens to secure any refinancing, refunding, extension, renewal or replacement (or successive refinancing, refunding, extensions, renewals or replacements) as a whole, or in part, of any Indebtedness secured by any Lien referred to in clauses (1), (2), (3), (4), (6) and (12); provided, however, that (x) such new Lien shall be limited to all or part of the same property that secured the original Lien (plus improvements on such property), (y) the Indebtedness secured by such Lien at such time is not increased to any amount greater than the sum of (A) the outstanding principal amount or, if greater, committed amount of the Indebtedness described under clauses (1), (2), (3), (4), (6) and (12) at the time the original Lien became a Permitted Lien under this Agreement, and (B) an amount necessary to pay any fees and expenses, including premiums, related to such refinancing, refunding, extension, renewal or replacement and (z) the new Lien has no greater priority and the holders of the Indebtedness secured by such Lien have no greater intercreditor rights relative to the Lenders than the original Liens and the related Indebtedness; (8) Liens (i) of a collection bank arising under Section 4-210 of the Uniform Commercial Code, or any comparable or successor provision, on items in the course of collection, (ii) attaching to commodity trading accounts or other commodity brokerage accounts incurred in the ordinary course of business, and (iii) in favor of banking institutions arising as a matter of law encumbering

-30- deposits (including the right of set-off) and which are within the general parameters customary in the banking industry; (9) Liens encumbering reasonable customary initial deposits and margin deposits and similar Liens attaching to commodity trading accounts or other brokerage accounts incurred in the ordinary course of business and not for speculative purposes; (10) Liens that are contractual rights of set-off (i) relating to the establishment of depository relations with banks not given in connection with the issuance of Indebtedness, (ii) relating to pooled deposit or sweep accounts of the Borrower or any of its Subsidiaries to permit satisfaction of overdraft or similar obligations incurred in the ordinary course of business of the Borrower and its Subsidiaries or (iii) relating to purchase orders and other agreements entered into with customers of the Borrower or any of its Subsidiaries in the ordinary course of business; (11) [reserved]; (12) other Liens securing Indebtedness permitted to be incurred, provided that at the time such Indebtedness is incurred (or in the case of unsecured Indebtedness that is subsequently secured by Xxxxx, at the time such Indebtedness becomes secured) the Unencumbered Asset Ratio as of the most recently ended Fiscal Quarter of the Borrower is not less than 1.25 to 1.00 (except that (i) cash and Cash Equivalents” and Indebtedness shall be measured on the applicable date of determination on a pro forma basis, (ii) any Aircraft acquired subsequent to such date may, at the option of the Borrower, be included in the determination of the Unencumbered Assets valued as of the date of acquisition and as determined by the Borrower in good faith and (iii) if the outstanding amount of Indebtedness on the applicable date of determination has been reduced since the end of the applicable quarter with the proceeds of any sale or other disposition of Aircraft, the book value of such Aircraft sold or otherwise disposed of shall be excluded); and (13) any Lien securing obligations other than obligations under any Indebtedness for borrowed money or any Capitalized Lease Obligations of the Borrower or any Guarantor For purposes of determining compliance with this definition, (A) Permitted Liens need not be incurred solely by reference to one category of Permitted Liens described above but are permitted to be incurred in part under any combination thereof and (B) in the event that a Lien (or any portion thereof) meets the criteria of one or more of the categories of Permitted Liens described above, the Borrower may, in its sole discretion, classify or reclassify such item of Permitted Liens (or any portion thereof) in any manner that complies with this definition and the Borrower may divide and classify a Lien in more than one of the types of Permitted Liens in one of the above clauses.

-31- “Person” means any individual, corporation, limited liability company, partnership, joint venture, association, joint stock company, trust, unincorporated organization, government or any agency or political subdivision thereof or any other entity. “preferred stock” means any Equity Interest with preferential rights of payment of dividends or upon liquidation, dissolution, or winding up. “Pricing Level Adjustment” means, for purposes of determining the Applicable Commitment Fee and the Applicable Margin, (a) if there is only one Public Debt Rating established by S&P, Moody’s or Fitch with respect to the Borrower, the Applicable Margin and Applicable Commitment Fee shall be determined with reference to such Public Debt Rating, (b) if the Public Debt Rating established by S&P, Moody’s or Fitch shall fall within different pricing levels, the Applicable Margin and Applicable Commitment Fee shall be determined by either (i) the Public Debt Rating which is the consensus majority of such Public Debt Ratings or (ii) in the event of a different Public Debt Rating from each of S&P, Moody’s and Fitch, the Public Debt Rating which is neither the highest nor lowest of such Public Debt Ratings but rather the Public Debt Rating between the higher and lower of such Public Debt Ratings, (c) if the Borrower has a Public Debt Rating by only two of S&P, Moody’s and Fitch, the Applicable Margin and Applicable Commitment Fee shall be determined by either (i) the equivalent Public Debt Rating of the two of S&P, Moody’s and Fitch that have established a Public Debt Rating for the Borrower, or (ii) in the event of a different Public Debt Rating, (x) the higher of such Public Debt Rating, provided, however, the lower of such Public Debt Rating shall be no greater than one level below the higher of such Public Debt Rating or (y) in the event the lower of such Public Debt Rating is greater than one level below the higher of such Public Debt Rating, the Applicable Margin and Applicable Commitment Fee shall be determined based on the Public Debt Rating which is one level above the lower of such Public Debt Rating. Notwithstanding the foregoing, however, if the Public Debt Rating from either S&P or Fitch (each, a “Specified Ratings Agency”) is BBB- or better and at such time the Public Debt Rating from the other Specified Ratings Agency is not lower than BB+, the Public Debt Rating from Moody's shall no longer be applicable for purposes of determining the Applicable Margin and Applicable Commitment Fee, and the Applicable Margin and Applicable Commitment Fee will be based solely on the Public Debt Rating from the Specified Rating Agencies in accordance with this definition. If the Public Debt Rating established by S&P, Moody’s or Fitch shall be changed, such change shall be effective as of the date on which it is first announced by S&P, Moody’s or Fitch, as applicable, and if none of S&P, Moody’s or Fitch shall have in effect a Public Debt Rating, the Applicable Margin and Applicable Commitment Fee shall be based on Level V. Each change in the Applicable Margin and Applicable Commitment Fee shall apply during the period commencing on the effective date of the applicable change in the Public Debt Rating and ending on the date immediately preceding the effective date of the next such change in the Public Debt Rating. “Prime Rate” means the rate of interest per annum last quoted by The Wall Street Journal as the “Prime Rate” in the U.S. or, if The Wall Street Journal ceases to quote such rate, the highest per annum interest rate published by the Federal Reserve Board in Federal Reserve Statistical Release H.15 (519) (Selected Interest Rates) as the “bank prime loan” rate or, if such rate is no longer quoted therein, any similar rate quoted therein (as determined by the Agent) or any similar release by the Federal Reserve Board (as determined by the Agent). Any change in