Execution Version AMENDMENT NO. 9 TO CREDIT AGREEMENT AMENDMENT NO. 9 TO CREDIT AGREEMENT, dated as of May 29, 2015 (this “Amendment”), among AVAYA INC., a Delaware corporation (the “Borrower”), CITIBANK, N.A., as Administrative Agent (in such...

Execution Version AMENDMENT NO. 9 TO CREDIT AGREEMENT AMENDMENT NO. 9 TO CREDIT AGREEMENT, dated as of May 29, 2015 (this “Amendment”), among AVAYA INC., a Delaware corporation (the “Borrower”), CITIBANK, N.A., as Administrative Agent (in such capacity, the “Administrative Agent”), the Extending Term B-7 Lenders (as defined below), the Refinancing Term B-7 Lenders (as defined below) and the Required Lenders. PRELIMINARY STATEMENTS A. The Borrower, Avaya Holdings Corp. (formerly known as Sierra Holdings Corp.), a Delaware corporation, the Administrative Agent and each lender from time to time party thereto (the “Lenders”) have entered into a Credit Agreement, dated as of October 26, 2007, as amended as of December 18, 2009 by Amendment No. 1, as amended and restated as of February 11, 2011 pursuant to the Amendment Agreement, as amended as of August 8, 2011 by Amendment No. 3, as amended and restated as of October 29, 2012 pursuant to Amendment No. 4, as amended and restated as of December 21, 2012 pursuant to Amendment No. 5, as amended as of February 13, 2013 by Amendment No. 6, as amended as of March 12, 2013 by Amendment No. 7, and as amended as of February 5, 2014 by Amendment No. 8 (as amended, amended and restated, supplemented or otherwise modified from time to time prior to the date hereof, the “Restated Credit Agreement”). B. The Borrower has requested that the Required Lenders consent to certain amendments to the Restated Credit Agreement (the “Term B-7 Related Amendments”) to permit the Borrower to (x) incur Refinancing Term Loans pursuant to Section 2.15 of the Restated Credit Agreement to pay all accrued and unpaid interest in respect of all Existing Term Loans (as defined below) reclassified as Initial Term B-7 Loans (as defined below) pursuant to this Amendment, together with all fees and expenses incurred in connection with the Term Loan Extension (as defined below) pursuant to this Amendment, and (y) prepay any Class or Classes of Revolving Credit Loans (together with all accrued and unpaid interest thereon and fees and expenses incurred in connection such refinancing) with a corresponding dollar-for-dollar permanent reduction in the applicable Class or Classes of Revolving Credit Commitments at its election with the Net Cash Proceeds of any Credit Agreement Refinancing Indebtedness, including Refinancing Term Loans incurred pursuant to Section 2.15 of the Restated Credit Agreement. C. Pursuant to Section 2.16 of the Restated Credit Agreement and subject to the terms of this Amendment, the Borrower desires to obtain Extended Term Loans (the “Initial Term B-7 Loans”) in respect of (a) all of the Term B-3 Loans outstanding under the Restated Credit Agreement as in effect immediately prior to the Extension Effective Date (as defined below) (the “Existing Term B-3 Loans”), (b) all of the Term B-4 Loans outstanding under the Restated Credit Agreement as in effect immediately prior to the Extension Effective Date (the “Existing Term B-4 Loans”), and (c) all of the Term B-6 Loans outstanding under the Restated Credit Agreement as in effect immediately prior to the Extension Effective Date (the “Existing Term B-6 Loans”, and collectively with the Existing Term B-3 Loans and the Existing Term B-4 Loans, the “Existing Term Loans”), and has requested that (i) each Term B-3 Lender extend the maturity of and reclassify all (but not less than all) of its Existing Term B-3 Loans as Initial Term B-7 Loans (the “Term B-3 Extension”, (ii) each Term B-4 Lender extend the maturity of and reclassify all (but not less than all) of its Existing Term B-4 Loans as Initial Term B-7 Loans (the “Term B-4 Extension”) and (iii) each Term B-6 Lender extend the maturity of and reclassify all (but not less than all) of its Existing Term B-6 Loans as Initial Term B-7 Loans (the “Term B-6 Extension”, and collectively with the Term B-3 Extension and the Term B-4 Extension, the “Term Loan Extension”, and each such Term B-3 Lender, Term B-4 Lender and Term B-6 Lender extending the maturity of and reclassifying its Existing Term Loans pursuant hereto, an “Extending Term B-7 Lender”).

D. Immediately following the consummation of the Term Loan Extension and the Term B-7 Related Amendments, pursuant to Section 2.15 of the Restated Credit Agreement and subject to the terms of this Amendment, the Borrower desires to obtain Refinancing Term Loans in the form of additional Term B-7 Loans (the “Refinancing Term B-7 Loans”, and together with the Initial Term B-7 Loans, the “Term B-7 Loans”) to (i) prepay the Existing Term B-3 Loans, the Existing Term B-4 Loans and the Existing Term B-6 Loans, in each case outstanding under the Restated Credit Agreement immediately following the consummation of the Term Loan Extension, together with all accrued and unpaid interest thereon, on a pro rata basis pursuant to Section 2.05(b)(vii) of the Restated Credit Agreement, and pay fees and expenses in connection therewith (including any upfront fees and original issue discount) (the “Term Loan Refinancing”), (ii) pay all accrued and unpaid interest in respect of Existing Term Loans reclassified as Initial Term B-7 Loans in the Term Loan Extension, together with all fees and expenses (including any upfront fees) incurred in connection with the Term Loan Extension and (iii) prepay Revolving Credit Loans (together with all accrued and unpaid interest thereon and fees and expenses incurred in connection such refinancing) with a corresponding dollar-for-dollar permanent reduction in the Revolving Credit Commitments with the Net Cash Proceeds of the Refinancing Term B-7 Loans. E. (x) Each Term B-3 Lender identified on the signature pages to the addendum attached as Annex 1 hereto (the “Lender Addendum”) as an “Extending Term B-7 Lender” has agreed, on the terms and conditions set forth herein, to extend the maturity of all (but not less than all) of such Term B-3 Lender’s Existing Term B-3 Loans as Initial Term B-7 Loans in the Term B-3 Extension, each Term B-4 Lender identified on the signature pages to the Lender Addendum as an “Extending Term B-7 Lender” has agreed, on the terms and conditions set forth herein, to extend the maturity of all (but not less than all) of such Term B-4 Lender’s Existing Term B-4 Loans as Initial Term B-7 Loans in the Term B-4 Extension, and each Term B-6 Lender identified on the signature pages to the Lender Addendum as an “Extending Term B-7 Lender” has agreed, on the terms and conditions set forth herein, to extend the maturity of all (but not less than all) of such Term B-6 Lender’s Existing Term B-6 Loans as Initial Term B-7 Loans in the Term B-6 Extension, and (y) each financial institution identified on the signature pages to the Lender Addendum as a “Refinancing Term B-7 Lender” has agreed, on the terms and conditions set forth herein, to make Refinancing Term Loans in the form of Refinancing Term B-7 Loans to the Borrower, in the case of clause (y), in the aggregate principal amount set forth opposite such Term Lender’s signature on its signature page to the Lender Addendum (such amount of Extended Term B-7 Loans and/or Refinancing Term B-7 Loans, as applicable, with respect to each Term B-7 Lender, the “Term B-7 Loan Amount”). NOW, THEREFORE, in consideration of the premises and for other good and valuable consideration, the sufficiency and receipt of all of which is hereby acknowledged, the parties hereto hereby agree as follows: SECTION 1. Definitions. Capitalized terms used herein and not otherwise defined in this Amendment have the same meanings as specified in the Credit Agreement (as defined below). SECTION 2. Term Loan Extensions. (a) Effective as of the Amendment No. 9 Effective Date, each Extending Term B-7 Lender hereby agrees by its execution and delivery of a Lender Addendum, on the terms and conditions set forth herein and in the Credit Agreement, to extend the maturity of and reclassify all (but not less than all) of its Existing Term B-3 Loans, Existing Term B-4 Loans and/or Existing Term B-6 Loans, as applicable. This Amendment shall constitute an Extension Amendment pursuant to Section 2.16 of the Restated Credit Agreement with respect to the Term Loan Extension described herein, and each Extending Term B-7 Lender shall, effective as of the consummation of the Term Loan Extension on the

Amendment No. 9 Effective Date, become party to the Credit Agreement as a “Term B-7 Lender” with respect to its Initial Term B-7 Loans, and shall have all the rights and obligations of a “Term B-7 Lender” under the Credit Agreement and the other Loan Documents. (b) Each Extending Term B-7 Lender, by delivering its signature page to the Lender Addendum and extending the maturity of and reclassifying the Term B-7 Loan Amount of its Existing Term Loans on the Amendment No. 9 Effective Date, shall be deemed to have acknowledged receipt of, and consented to and approved (effective as of the Amendment No. 9 Effective Date), the Credit Agreement (including the Term B-7 Related Amendments), each Loan Document and each other document required to be delivered to, or be approved by and satisfactory to, the Administrative Agent or any Lender on the Amendment No. 9 Effective Date. (c) The Administrative Agent, the Required Lenders and each Extending Term B-7 Lender party hereto hereby waive any required Term Loan Extension Request pursuant to Section 2.16 of the Credit Agreement. SECTION 3. Refinancing Term B-7 Loan Borrowing. (a) Effective as of the Amendment No. 9 Effective Date, and immediately after giving effect to the Term Loan Extension, each Refinancing Term B-7 Lender hereby agrees, on the terms and conditions set forth herein and in the Credit Agreement, to make Refinancing Term B-7 Loans to the Borrower in the amount (which need not be a whole dollar amount) set forth in the Lender Addendum executed and delivered by it. This Amendment shall constitute a Refinancing Amendment pursuant to Section 2.15 of the Restated Credit Agreement with respect to the Term Loan Refinancing described herein, and each Refinancing Term B-7 Lender shall, effective as of the consummation of the Term Loan Refinancing on the Amendment No. 9 Effective Date, become party to the Credit Agreement as a “Term B-7 Lender”, and shall have all the rights and obligations of a “Term B-7 Lender” under the Credit Agreement and the other Loan Documents. (b) Each Refinancing Term B-7 Lender, by delivering its signature page to the Lender Addendum and funding its Refinancing Term B-7 Loans on the Amendment No. 9 Effective Date, shall be deemed to have acknowledged receipt of, and consented to and approved (effective as of the Amendment No. 9 Effective Date), the Credit Agreement (including the Term B-7 Related Amendments), each Loan Document and each other document required to be delivered to, or be approved by and satisfactory to, the Administrative Agent or any Lender on the Amendment No. 9 Effective Date. (c) Each Refinancing Term B-7 Lender hereby agrees that, at the election of the Borrower, the Refinancing Term B-7 Loans made pursuant to this Amendment will initially bear interest with an Interest Period beginning on the Amendment No. 9 Effective Date and ending on August 26, 2015. (d) The Administrative Agent, the Term B-7 Lenders party hereto and the Existing Consenting Lenders (as defined in the Lender Addendum) party hereto hereby waive (i) any notice of prepayment or termination of the Existing Term B-3 Loans, Existing Term B-4 Loans, Existing Term B-6 Loans and/or Revolving Credit Loans or Revolving Credit Commitments, as applicable, (ii) any required notice of borrowing of the Initial Term B-7 Loans and/or the Refinancing Term B-7 Loans pursuant to Section 2.02 of the Credit Agreement and (iii) any costs payable under Section 3.05 in connection with the transactions contemplated by this Amendment. SECTION 4. Amendment to Restated Credit Agreement. Effective as of the Amendment No. 9 Effective Date and subject to the terms and conditions set forth herein, (i) the Restated

Credit Agreement is hereby amended as set forth in this Section 4 (the Restated Credit Agreement, as so amended by this Section 4, being referred to as the “Credit Agreement”) and (ii)(A) Exhibit C-8 attached to Annex 3 hereto constitutes a new Exhibit to the Credit Agreement and (B) Exhibit A and Exhibit E attached to Annex 3 hereto hereby replace in their entirety the corresponding Exhibits attached to the Restated Credit Agreement as in effect immediately prior to the Amendment No. 9 Restatement Effective Date. The rights and obligations of the parties to the Restated Credit Agreement with respect to the period prior to the Amendment No. 9 Effective Date shall not be affected by such amendments. (a) The following definitions are hereby added to Section 1.01 of the Restated Credit Agreement in their proper alphabetical order: ““Amendment No. 9” means Amendment No. 9 to Credit Agreement, dated as of May 29, 2015, among the Borrower, the Administrative Agent, the Extending Term B-7 Lenders, the Refinancing Term B-7 Lenders and the Required Lenders. “Amendment No. 9 Effective Date” means May 29, 2015. “Extending Term B-7 Lender” has the meaning specified in Amendment No. 9. “Initial Term B-7 Loans” has the meaning specified in Amendment No. 9. “Interpolated Screen Rate” means, for any Interest Period with respect to any Eurocurrency Rate Loan, the rate which results from interpolating on a linear basis between (a) the applicable Screen Rate for the period next longer than the length of such Interest Period and (b) the applicable Screen Rate for the period next shorter than the length of such Interest Period. “London Business Day” means any day on which banks are generally open for dealings in Dollar deposits in the London interbank market. “Refinancing Term B-7 Lender” means any Lender that has submitted an executed lender addendum in connection with Amendment No. 9 as a “Refinancing Term B-7 Lender”. “Refinancing Term B-7 Loans” has the meaning specified in Amendment No. 9. “Screen Rate” means the rate appearing on Reuters Page LIBOR01 (or any successor or substitute page of such Reuters service, or if the Reuters service ceases to be available, any successor to or substitute for such service providing rate quotations comparable to those currently provided on such page of such service, as determined by the Administrative Agent from time to time in consultation with the Borrower, for purposes of providing quotations of interest rates applicable to deposits in Dollars in the London interbank market). “Term B-7 Borrowing” means a borrowing consisting of Term B-7 Loans of the same Type and, in the case of Eurocurrency Rate Loans, having the same Interest Period made by each of the Term B-7 Lenders pursuant to Section 2.01(a)(iii)(F). “Term B-7 Commitment” means, (x) as to each Refinancing Term B-7 Lender, its obligation to provide Term B-7 Loans pursuant to Amendment No. 9 in an aggregate principal amount equal to such Refinancing Term B-7 Lender’s Term B-7 Loan Amount,

and (y) as to each Extending Term B-7 Lender, its obligation to extend the maturity of and reclassify as Term B-7 Loans all of its Term B-3 Loans, Term B-4 Loans and Term B-6 Loans, as applicable. “Term B-7 Lender” means, at any time, any Lender that has a Term B-7 Commitment or a Term B-7 Loan at such time. “Term B-7 Loan” means the Initial Term B-7 Loans and the Refinancing Term B-7 Loans. “Term B-7 Loan Amount” has the meaning specified in Amendment No. 9. “Term B-7 Note” means a promissory note of the Borrower payable to any Term B-7 Lender or its registered assigns, in substantially the form of Exhibit C-8 attached to Annex 3 to Amendment No. 9, evidencing the aggregate Indebtedness of the Borrower to such Term B-7 Lender resulting from the Term B-7 Loans of such Term B-7 Lender. “Term B-7 Repricing Transaction” shall mean (1) the incurrence by the Borrower of any loans (including, without limitation, any new or additional term loans under this Agreement, but excluding, for the avoidance of doubt, any notes, including notes permitted to be issued hereunder constituting Credit Agreement Refinancing Indebtedness) that are secured and are broadly marketed or syndicated to banks and other institutional investors in financings similar to the Term B-7 Loans provided for in this Agreement (i) the net proceeds of which are used to prepay or replace, in whole or in part, outstanding principal of the Term B-7 Loans, and (ii) having an “effective” yield for the respective Type of such loans that is less than the “effective” yield for Term B-7 Loans of the respective Type (with the comparative determinations to be made in the reasonable judgment of the Administrative Agent consistent with generally accepted financial practices, after giving effect to, among other factors, margin, upfront or similar fees or “original issue discount” (with such upfront or similar fees or “original issue discount” being equated to interest rate assuming a 4-year life to maturity) shared with all lenders of such loans or Term B-7 Loans, as the case may be, but excluding the effect of any arrangement, structuring, syndication or other fees payable in connection therewith that are not shared with all lenders of such loans or Term B-7 Loans, as the case may be, and without taking into account any fluctuations in the Eurocurrency Rate) and (2) any amendment to the Term B-7 Loans which reduces the Applicable Rate for Term B-7 Loans. Any determination by the Administrative Agent as contemplated by clause (1)(ii) shall be conclusive and binding on all Lenders holding Term B-7 Loans absent manifest error.” (b) The definition of “Applicable Rate” is hereby amended by inserting the following new clause (VII) in proper numerical order: “(VII) for all periods beginning on and after the Amendment No. 9 Effective Date, with respect to Term B-7 Loans, a percentage per annum equal to (i) for Eurocurrency Rate Loans, 5.25% and (ii) for Base Rate Loans, 4.25%.” (c) The definition of “Assignment and Assumption” is hereby amended by replacing the reference to “Amendment No. 8” contained therein with a reference to “Amendment No. 9”.

(d) The definition of “Class” is hereby amended by inserting references to “Term B- 7 Lenders,”, “Term B-7 Commitments,”, and “Term B-7 Loans,”, in each case immediately after the references to “Term B-6 Lenders,”, “Term B-6 Commitments,”, and “Term B-6 Loans,”, respectively. (e) The definition of “Committed Loan Notice” is hereby amended by replacing the reference to “Amendment No. 8” contained therein with a reference to “Amendment No. 9”. (f) The definition of “Credit Agreement Refinancing Indebtedness” is hereby amended by (x) inserting “or Revolving Credit Loans (with a corresponding dollar-for-dollar permanent reduction in the applicable Revolving Credit Commitments (which such reduction may occur at any time within one month after the Amendment No. 9 Effective Date at the election of the Borrower (and shall automatically occur on such one month date without further action if not occurring prior) with respect to the Revolving Credit Loans repaid on the Amendment No. 9 Effective Date))” immediately after “then existing Term Loans” therein, and (y) inserting the following at the end of clause (i) of the proviso thereto: “or solely in the case of Refinancing Term Loans incurred on the Amendment No. 9 Effective Date, fees and expenses (including upfront fees) incurred in connection with the extension of maturity of and reclassification of Term B-3 Loans, Term B-4 Loans and Term B-6 Loans into Initial Term B-7 Loans on the Amendment No. 9 Effective Date, together with all accrued and unpaid interest thereon to but excluding the Amendment No. 9 Effective Date,”. (g) The definition of “Eurocurrency Rate” is hereby amended and restated in its entirety to read as follows: “Eurocurrency Rate” means, for any Interest Period with respect to any Eurocurrency Rate Loan, (i) the rate per annum equal to the Screen Rate for delivery on the first day of such Interest Period with a term equivalent to such Interest Period, determined as of approximately 11:00 a.m. (London time) two (2) London Business Days prior to the first day of such Interest Period, (ii) if the rate referenced in the preceding clause (i) is not available at such time for such Interest Period, the rate per annum equal to the Interpolated Screen Rate for delivery on the first day of such Interest Period, determined as of approximately 11:00 a.m. (London time) two (2) London Business Days prior to the first day of such Interest Period, or (iii) if the rates referenced in the preceding clauses (i) and (ii) are not available at such time for such Interest Period, the rate per annum equal to (x) the Screen Rate or (y) if the rate referenced in the preceding clause (x) is not available at such time for such Interest Period, the Interpolated Screen Rate, in each case with a term equivalent to such Interest Period quoted for delivery on the most recent London Business Day preceding the first day of such Interest Period for which such rate is available (which London Business Day shall be no more than seven (7) London Business Days prior to the first day of such Interest Period), and in the case of clauses (i) through (iii), if any such rate is below zero, the Eurocurrency Rate shall be deemed to be zero. (h) The definition of “Facility” is hereby amended by inserting “the Term B-7 Loans,” immediately after “Term B-6 Loans,” therein. (i) The definition of “Maturity Date” is hereby amended and restated in its entirety to read as follows: “Maturity Date” means (a) with respect to the Revolving Credit Facilities existing on the Amendment Xx. 0 Xxxxxxxxx Xxxx, Xxxxxxx 00, 0000, (x) with respect to the Term B-1 Loans and the Incremental Term B-2 Loans, the date that is seven years after the Closing Date, (c) with respect to the Term X-0 Xxxxx, Xxxxxxx 00, 0000, (x) with respect to the

Term B-4 Loans, October 26, 2017, (e) with respect to the Term B-6 Loans, March 31, 2018 and (f) with respect to the Term B-7 Loans, May 29, 2020; provided that, in the case of the preceding clauses (c), (d) and (e), such date shall automatically become July 26, 2015 unless (i) the Total Leverage Ratio as of the last day of the most recent Test Period that ended prior to July 26, 2015 is no greater than 5.0 to 1.0 or (ii) on or prior to July 26, 2015, either (x) a Qualifying IPO shall have been consummated or (y) at least $750 million in aggregate principal amount of the Borrower’s 9.75% senior notes due 2015 and/or 10.125%/10.875% senior PIK toggle notes due 2015 shall have been repaid, redeemed, defeased, discharged or refinanced since the issuance thereof or the maturity thereof shall have been extended to a date no earlier than 91 days after (A) in the case of the Term B-3 Loans and the Term B-4 Loans, October 26, 2017, and (B) in the case of the Term B-6 Loans, March 31, 2018; provided, further, that, in each case, if any such day is not a Business Day, the Maturity Date shall be the Business Day immediately preceding such day.” (j) The definition of “Term Commitment” is hereby amended by inserting “Term B- 7 Commitment,” immediately after “Term B-6 Commitment,” therein. (k) The definition of “Term Lender” is hereby amended by inserting “Term B-7 Lender,” immediately after “Term B-6 Lender,” therein. (l) The definition of “Term Loan” is hereby amended by inserting “Term B-7 Loan,” immediately after “Term B-6 Loan,” therein. (m) The definition of “Term Note” is hereby amended by replacing “or Term B-6 Note” therein with the following: “, Term B-6 Note or Term B-7 Note”. (n) Section 2.01(a)(iii) is hereby amended by inserting the following new clause (F) in proper alphabetical order: “(F) On the Amendment No. 9 Effective Date, in accordance with, and upon the terms and conditions set forth in, Amendment No. 9, (x) the Term B-3 Loans, Term B-4 Loans and/or Term B-6 Loans, as applicable, of each Extending Term B-7 Lender outstanding on such date elected to be extended by such Extending Term B-7 Lender shall be automatically reclassified on such date as Initial Term B-7 Loans of such Lender in the principal amount equal to such Extending Term B-7 Lender’s Term B-7 Loan Amount, and (y) each Refinancing Term B-7 Lender made to the Borrower a Refinancing Term B- 7 Loan in the principal amount equal to such Refinancing Term B-7 Lender’s Term B-7 Loan Amount. For the avoidance of doubt, the Initial Term B-7 Loans and the Refinancing Term B-7 Loans shall constitute a single Class of Loans. ” (o) Section 2.01(a)(iv) is hereby amended by inserting the following sentence at the end thereof: “On and after the Amendment No. 9 Effective Date, all Term B-7 Loans shall rank pari passu in right of payment and security with, and otherwise have the same terms, rights and benefits as, the Term B-3 Loans, Term B-4 Loans and Term B-6 Loans outstanding immediately prior to the Amendment No. 9 Effective Date under the Loan Documents, except as expressly provided herein.

(p) The following shall be inserted as new Section 2.01(f) immediately following Section 2.01(e): (f) Special Provisions Relating to Reclassification of Term B-3 Loans, Term B-4 Loans and Term B-6 Loans as Term B-7 Loans on the Amendment No. 9 Effective Date. (i) Notwithstanding anything to the contrary in this Agreement, (A) on the Amendment No. 9 Effective Date, (i) Initial Term B-7 Loans shall be deemed made as Eurocurrency Rate Loans in an amount equal to the principal amount of the Term B-3 Loans, Term B-4 Loans and Term B-6 Loans reclassified as Term B-7 Loans pursuant to Section 2.01(a)(iii)(F)(x) that were outstanding as Eurocurrency Rate Loans at the time of reclassification (such Initial Term B-7 Loans to correspond in amount to Term B-3 Loans, Term B-4 Loans and Term B-6 Loans so reclassified of a given Interest Period), (ii) at the election of the Borrower, the initial Interest Period for the Initial Term B-7 Loans described in clause (i) above shall commence on the Amendment No. 9 Effective Date and end on August 26, 2015, with the Eurocurrency Rate applicable to such Initial Term B-7 Loans during such Interest Period being the Eurocurrency Rate as determined under this Agreement, and (iii) Initial Term B-7 Loans shall be deemed made as Base Rate Loans in amount equal to the principal amount of Term B-3 Loans, Term B-4 Loans and Term B-6 Loans reclassified as Initial Term B-7 Loans pursuant to Section 2.01(a)(iii)(F)(x) that were outstanding as Base Rate Loans at the time of reclassification; (B) all accrued and unpaid interest with respect to the Term B-3 Loans, Term B-4 Loans and Term B-6 Loans from which such Term B-7 Loan was reclassified up to but excluding the Amendment No. 9 Effective Date shall be paid by the Borrower on the Amendment No. 9 Effective Date; and (C) no reclassification of outstanding Term B-3 Loans, Term B-4 Loans or Term B-6 Loans as Term B-7 Loans pursuant to Section 2.01(a)(iii)(F)(x) shall constitute a voluntary or mandatory payment or prepayment for purposes of this Agreement. (ii) On and after the Amendment No. 9 Effective Date, each Extending Term B-7 Lender which holds a Term B-3 Note, Term B-4 Note and/or Term B-6 Note, as applicable, shall be entitled to surrender such Term B-3 Note, Term B-4 Note and/or Term B-6 Note, as applicable, to the Borrower against delivery of a new Term B-7 Note completed in conformity with Section 2.11 evidencing the Term B-7 Loans into which the Term B-3 Loans, Term B-4 Loans and/or Term B-6 Loans of such Lender were reclassified on the Amendment No. 9 Effective Date; provided that if any such Term B-3 Note, Term B-4 Note and/or Term B-6 Note, as applicable, is not so surrendered, then from and after the Amendment No. 9 Effective Date such Note shall be deemed to evidence the Term B-7 Loans into which the Term B-3 Loans, Term B-4 Loans and/or Term B-6 Loans theretofore evidenced by such Note have been reclassified. No costs shall be payable under Section 3.05 in connection with transactions consummated under this Section 2.01(f). (q) Section 2.05(b)(vii) is hereby amended by (x) inserting “, or if applicable, Revolving Credit Loans (with a corresponding dollar-for-dollar permanent reduction in the applicable Revolving Credit Commitments (which such reduction may occur at any time within one month after the Amendment No. 9 Effective Date at the election of the Borrower (and shall automatically occur on such

one month date without further action if not occurring prior) with respect to the Revolving Credit Loans repaid on the Amendment No. 9 Effective Date))” immediately after “prepay Term Loans,” therein, and (y) replacing “or Term B-6 Loans” therein with the following: “, Term B-6 Loans or Term B-7 Loans”. (r) The last sentence of Section 2.06(b) is hereby amended and restated in its entirety to read as follows: “The Term B-6 Commitment of each Replacement Term B-6 Lender was automatically and permanently reduced to $0 upon the making to Borrower of its Replacement Term B- 6 Loan pursuant to Section 2.01(a)(iii)(E).” (s) Section 2.06(b) is hereby amended to add the following sentence at the end thereof: “The Term B-7 Commitment of each Term B-7 Lender shall be automatically and permanently reduced to $0 upon the making to Borrower of its Term B-7 Loan pursuant to Section 2.01(a)(iii)(F).” (t) Clause (i) of Section 2.07(a) is hereby amended and restated in its entirety to read as follows: “(i) The Borrower shall repay to the Administrative Agent for the ratable account of the Term B-1 Lenders, Term B-3 Lenders, Term B-4 Lenders, Term B-6 Lenders and Term B-7 Lenders (as applicable), on the last Business Day of each March, June, September and December, (v) commencing on the last Business Day of March 2008 until the last Business Day of December 2010, an aggregate principal amount equal to 0.25% of the aggregate principal amount of all Term B-1 Loans outstanding on the Closing Date (the “Quarterly Amortization Amount”; provided that, (I) solely with respect to clause (y) below, the Quarterly Amortization Amount shall be calculated as an aggregate principal amount equal to the sum of (A) 0.25% of the aggregate principal amount of all Term B-1 Loans outstanding on the Closing Date plus (B) the Refinancing Term B-5 Loan Increase Amount, and (II) solely with respect to clause (z) below, the Quarterly Amortization Amount shall be calculated as an aggregate principal amount equal to the sum of (A) 0.25% of the aggregate principal amount of all Term B-1 Loans outstanding on the Closing Date plus (B) the Refinancing Term B-5 Loan Increase Amount), (w) commencing on the last Business Day of March 2011 until the last Business Day of September 2012, (1) to the Term B-1 Lenders, a percentage of the Quarterly Amortization Amount equal to the percentage of all outstanding Term B-1 Loans on the Restatement Effective Date not reclassified as Term B-3 Loans, and (2) to the Term B-3 Lenders, a percentage of the Quarterly Amortization Amount equal to the percentage of all outstanding Term B-1 Loans reclassified as Term B-3 Loans on the Restatement Effective Date, (x) on the last Business Day of December 2012, (1) to the Term B-1 Lenders, a percentage of the Quarterly Amortization Amount equal to the percentage of all outstanding Term Loans on the Third Restatement Effective Date constituting Term B-1 Loans not reclassified as Term B-3 Loans, Term B-4 Loans or Term B-5 Loans, (2) to the Term B-3 Lenders, a percentage of the Quarterly Amortization Amount equal to the percentage of all outstanding Term Loans on the Third Restatement Effective Date constituting Term B-3 Loans, (3) to the Term B-4 Lenders, a percentage of the Quarterly Amortization Amount equal to the percentage of all outstanding Term Loans on the Third Restatement Effective Date constituting Term B-4 Loans not reclassified as Term B-5 Loans, and (4) to the Term B-5 Lenders, a percentage of the Quarterly Amortization

Amount equal to the percentage of all outstanding Term Loans on the Third Restatement Effective Date constituting Term B-5 Loans, (y) commencing on the last Business Day of March 2013 and until the last Business Day of March 2015, (1) to the Term B-3 Lenders, a percentage of the Quarterly Amortization Amount equal to the percentage of all outstanding Term Loans on the Amendment No. 7 Effective Date constituting Term B-3 Loans, (2) to the Term B-4 Lenders, a percentage of the Quarterly Amortization Amount equal to the percentage of all outstanding Term Loans on the Amendment No. 7 Effective Date constituting Term B-4 Loans, and (3) solely with respect to amounts paid after the Amendment No. 8 Effective Date, to the Term B-6 Lenders, a percentage of the Quarterly Amortization Amount equal to the percentage of all outstanding Term Loans on the Amendment No. 7 Effective Date constituting Term B-5 Loans, and (z) commencing on the last Business Day of June 2015, (1) to the Term B-3 Lenders, a percentage of the Quarterly Amortization Amount equal to the percentage of all outstanding Term Loans on the Amendment No. 9 Effective Date (prior to giving effect to the Refinancing Term B-7 Loans) constituting Term B-3 Loans not reclassified as Term B-7 Loans, (2) to the Term B-4 Lenders, a percentage of the Quarterly Amortization Amount equal to the percentage of all outstanding Term Loans on the Amendment No. 9 Effective Date (prior to giving effect to the Refinancing Term B-7 Loans) constituting Term B-4 Loans not reclassified as Term B-7 Loans, (3) to the Term B-6 Lenders, a percentage of the Quarterly Amortization Amount equal to the percentage of all outstanding Term Loans on the Amendment No. 9 Effective Date (prior to giving effect to the Refinancing Term B-7 Loans) constituting Term B-6 Loans not reclassified as Term B-7 Loans and (4) to the Term B-7 Lenders, a percentage of the Quarterly Amortization Amount equal to the percentage of all outstanding Term Loans on the Amendment No. 9 Effective Date (prior to giving effect to the Refinancing Term B-7 Loans) constituting Initial Term B-7 Loans (which payments described in this Section 2.07(a) shall be reduced with respect to each Class of Term Loans as a result of the application of prepayments, whether prior to, on or after the Amendment No. 9 Effective Date, in accordance with the order of priority set forth in Section 2.05 or in connection with any Extension as provided in Section 2.16). For the avoidance of doubt, after giving effect to the foregoing and to the issuance of the Refinancing Term B-7 Loans on the Amendment No. 9 Effective Date, and the use of proceeds thereof (i) no percentage of the Quarterly Amortization Amount shall be due in respect of the Term B-3 Loans, Term B-4 Loans or Term B-6 Loans in advance of their respective Maturity Date due to the application of mandatory prepayments with the proceeds of the Refinancing Term B-7 Loans and (ii) the percentage of the Quarterly Amortization Amount due in respect on the Term B-7 Loans shall be equal to the dollar amount $6,293,361.13, which amount shall be payable on the last Business Day of each March, June, September and December commencing on the last Business Day of June 2015 (subject to reduction as a result of the application of prepayments after the Amendment No. 9 Effective Date in accordance with the order of priority set forth in Section 2.05 or in connection with any Extension as provided in Section 2.16).” (u) The last two sentence of Section 2.08(a) are hereby amended and restated in their entirety as follows: “For purposes of clause (i) above, in the event that the actual Eurocurrency Rate for the applicable Interest Period shall be (x) less than 1.25% per annum, the Eurocurrency Rate applicable to the Term B-4 Loans that are Eurocurrency Rate Loans shall be deemed to be 1.25% per annum and (y) less than 1.00% per annum, the Eurocurrency Rate applicable to the Term B-6 Loans and Term B-7 Loans that are Eurocurrency Rate Loans

shall be deemed to be 1.00% per annum (with respect to the Term B-4 Loans and the Term B-6 Loans, as may be increased pursuant to the second proviso of clauses (V) and (VI), respectively, of the definition of Applicable Rate). For purposes of clause (ii) above, in the event that the actual Base Rate from the applicable borrowing date shall be (x) less than 2.25% per annum, the Base Rate applicable to the Term B-4 Loans that are Base Rate Loans shall be deemed to be 2.25% per annum and (y) less than 2.00% per annum, the Base Rate applicable to the Term B-6 Loans and Term B-7 Loans that are Base Rate Loans shall be deemed to be 2.00% per annum (with respect to the Term B-4 Loans and the Term B-6 Loans, as may be increased pursuant to the second proviso of clauses (V) and (VI), respectively, of the definition of Applicable Rate).” (v) Section 2.09(c) is hereby amended by inserting the following new clause (iii) in proper numerical order: “(iii) Notwithstanding anything herein to the contrary, all prepayments of principal of Term B-7 Loans made pursuant to Section 2.05(a)(i), Section 2.05(b)(iii) or Section 2.05(b)(vii), or any amendment to the terms of the Term B-7 Loans, the primary purpose of which is to effect a Term B-7 Repricing Transaction, in each case, after the Amendment No. 9 Effective Date and on or prior to the sixth month anniversary of the Amendment No. 9 Effective Date, will be subject to payment to the Administrative Agent, for the ratable account of each Lender with outstanding Term B-7 Loans, of a fee in an amount equal to 1.0% of the aggregate principal amount of the Term B-7 Loans so prepaid or amended. Such prepayment fees in respect of Term B-7 Loans shall be due and payable upon the date of any such prepayment of Term B-7 Loans pursuant to Section 2.05(a)(i), Section 2.05(b)(iii) or Section 2.05(b)(vii), or any amendment to the terms of the Term B-7 Loans, effecting a Term B-7 Repricing Transaction.” (w) Section 2.15 is hereby amended by (x) inserting “or Revolving Credit Loans” immediately after “all or any portion of the Term Loans,” in the first sentence thereof, and (y) inserting “, or in the case of any Refinancing Term Loans issued to refinance any Revolving Credit Loans, in an aggregate principal amount that is not less than $1,000,000” at the end of the third sentence thereof. (x) Section 6.01 is hereby amended by amending and restating the paragraph immediately after clause (d) in its entirety to read as follows: Notwithstanding the foregoing, the obligations in paragraphs (a) and (b) of this Section 6.01 may be satisfied with respect to financial information of the Borrower and its Subsidiaries by (A) furnishing the applicable financial statements of any direct or indirect parent of the Borrower that holds all of the Equity Interests of the Borrower or (B) filing the Borrower’s or such entity’s Form 10-K or 10-Q, as applicable, with the SEC; provided that, with respect to each of clauses (A) and (B), (i) to the extent such information relates to a parent of the Borrower, such information is accompanied by consolidating information that explains in reasonable detail the differences between the information relating to the Borrower (or such parent), on the one hand, and the information relating to the Borrower and the Restricted Subsidiaries on a standalone basis, on the other hand and (ii) to the extent such information is in lieu of information required to be provided under Section 6.01(a), such materials are accompanied by a report and opinion of PricewaterhouseCoopers LLP or any other independent registered public ac-counting firm of nationally recognized standing, which report and opinion shall be prepared in accordance with generally accepted auditing standards and shall not be subject to any “going concern” or like qualification or exception or any qualification or exception as to the scope of such audit.

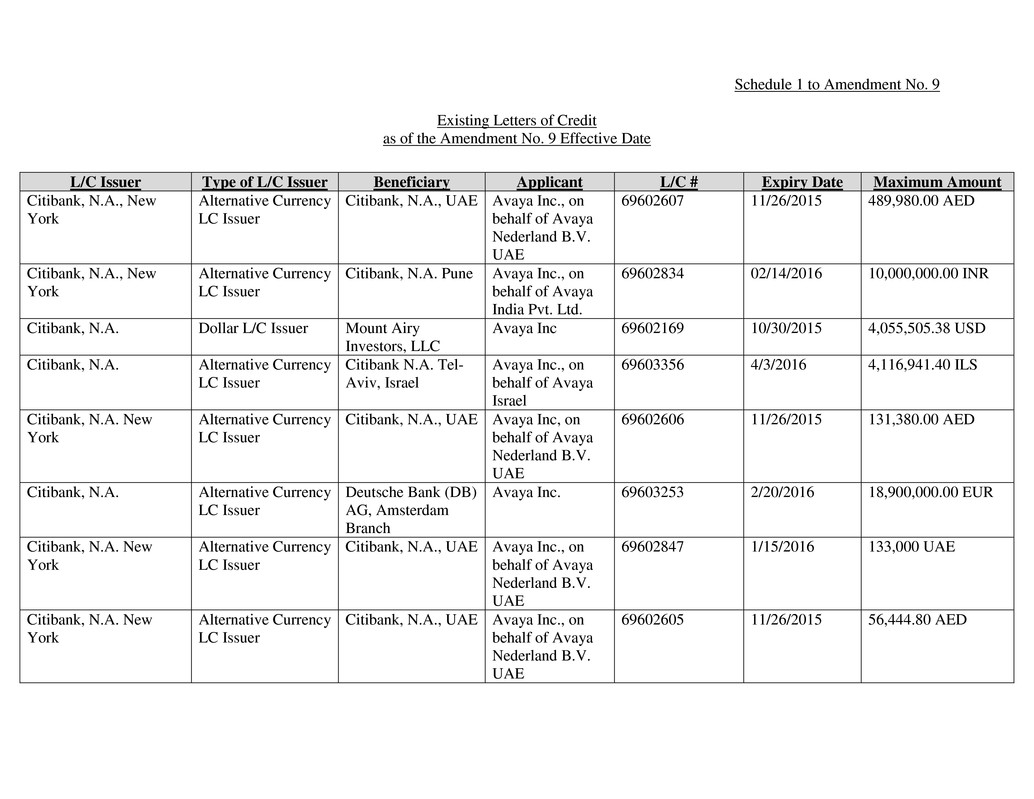

(y) Section 7.10 is hereby amended by inserting the following at the end of the final sentence thereof: “or if applicable, the repayment of principal and accrued and unpaid interest on Revolving Credit Loans (together with all fees and expenses incurred in connection such refinancing) with a corresponding dollar-for-dollar permanent reduction in the applicable Revolving Credit Commitments (which such reduction may occur at any time within one month after the Amendment No. 9 Effective Date at the election of the Borrower (and shall automatically occur on such one month date without further action if not occurring prior) with respect to the Revolving Credit Loans repaid on the Amendment No. 9 Effective Date), or solely in the case of Refinancing Term Loans incurred on the Amendment No. 9 Effective Date, the payment of fees and expenses (including upfront fees) incurred in connection with the extension of maturity of and reclassification of Term B-3 Loans, Term B-4 Loans and Term B-6 Loans into Initial Term B-7 Loans on the Amendment No. 9 Effective Date, together with all accrued and unpaid interest thereon to but excluding the Amendment No. 9 Effective Date . (z) Section 9.15 is hereby amended by adding the following paragraph immediately after the last paragraph in Section 9.15(a) thereof: “Each Term B-7 Lender, by its execution and delivery of Amendment No. 9, and the reclassification of its Term B-3 Loans, Term B-4 Loans and/or Term B-6 Loans into, or its making of, Term B-7 Loans on the Amendment No. 9 Effective Date, hereby (a) confirms its agreement to the provisions of the first paragraph of this Section 9.15(a) and (b) pursuant to Section 5.2(c) of the ABL Intercreditor Agreement, agrees to be bound by the terms of the ABL Intercreditor Agreement as a “Cash Flow Secured Party” (as defined in the ABL Intercreditor Agreement).” (aa) Section 9.15 is hereby amended by adding the following paragraph immediately after the last paragraph in Section 9.15(b) thereof: “Each Term B-7 Lender, by its execution and delivery of Amendment No. 9 , and the reclassification of its Term B-3 Loans, Term B-4 Loans and/or Term B-6 Loans into, or its making of, Term B-7 Loans on the Amendment No. 9 Effective Date, hereby (a) confirms its agreement to the provisions of the first paragraph of this Section 9.15(b) and (b) pursuant to Section 2.08 of the First Lien Intercreditor Agreement, agrees to be bound by the terms of the First Lien Intercreditor Agreement as a “General Credit Facilities Secured Party” (as defined in the First Lien Intercreditor Agreement).” In addition, all Letters of Credit outstanding under the Credit Agreement on the Amendment No. 9 Effective Date, which for the avoidance of doubt are listed on Schedule 1 to this Amendment No. 9, shall be deemed to be no longer outstanding under the Credit Agreement on a date notified by the L/C Issuer to the Administrative Agent within one month from the date hereof and shall instead, automatically and without further action, from the date specified in such notice be deemed outstanding under the ABL Credit Agreement. All accrued Obligations with respect to such Letters of Credit shall be deemed to be Obligations under and as defined in the ABL Credit Agreement from the date specified in such notice and shall no longer be Obligations under the Credit Agreement. SECTION 5. Conditions of Effectiveness. This Amendment shall become effective as of the first date (such date being referred to as the “Amendment No. 9 Effective Date”) when each of the following conditions shall have been satisfied: (a) Execution of Documents. The Administrative Agent shall have received (i) this Amendment, duly executed and delivered by (A) the Borrower, (B) the Administrative Agent, (C) each Extending Term B-7 Lender, (D) each Refinancing Term B-7 Lender and (E) the Required Lenders, and

(ii) a Guarantor Consent and Reaffirmation, in the form of Annex 2 hereto, duly executed and delivered by each Guarantor. (b) Legal Opinion. The Administrative Agent shall have received a satisfactory legal opinion of counsel to the Borrower addressed to it and the Term B-7 Lenders. (c) Certificate of Responsible Officer. The Administrative Agent shall have received (i) a certificate of a Responsible Officer of the Borrower, certifying the conditions precedent set forth in Sections 4.02(a) and (b) of the Restated Credit Agreement shall have been satisfied on and as of the Amendment No. 9 Effective Date and (ii) a certificate attesting to the Solvency of the Borrower and its Subsidiaries (taken as a whole) on the Amendment No. 9 Effective Date before and after giving effect to this Amendment No. 9, from the Chief Financial Officer or Treasurer of the Borrower. (d) Fees. Citigroup Global Markets Inc. shall have received on the Amendment No. 9 Effective Date all fees (including any original issue discount or upfront fees payable for the account of any Term B-7 Lender) separately agreed to with the Borrower. (e) Accrued Interest. All accrued and unpaid interest with respect to (i) the Term B- 3 Loans, Term B-4 Loans and Term B-6 Loans that are either repaid or reclassified as Term B-7 Loans and (ii) the Revolving Credit Loans that are repaid, in each case, up to but excluding the Amendment No. 9 Effective Date shall have been paid by the Borrower. (f) Confirmation of No Change in Legal Name, etc. The Administrative Agent shall have received written confirmation from the Borrower (which may be in the form of an e-mail) that since the delivery to the Administrative Agent of the update to the perfection certificate, dated as of December 22, 2014, pursuant to Section 6.02(d)(i) of the Restated Credit Agreement, no Loan Party has, except to the extent the Administrative Agent has been notified in accordance with the Security Agreement, (i) changed its legal name, jurisdiction of organization or chief executive office or (ii) acquired or formed any new Subsidiary, except as follows: (x) the Borrower incorporated Zod Acquisition Corp., a Delaware corporation (“KnoahSoft Merger Sub”), on February 3, 2015 in connection with the Borrower’s acquisition of KnoahSoft, Inc., a Delaware corporation (“KnoahSoft”), and KnoahSoft’s Subsidiary, KnoahSoft Technologies Private Ltd., an Indian limited company, on February 27, 2015, via merger of KnoahSoft Merger Sub with and into KnoahSoft, (y) Avaya International Sales Limited, a limited liability company incorporated under the laws of Ireland and an indirect Subsidiary of the Borrower, formed Avaya (Shanghai) Enterprise Management Co., Ltd., a Chinese foreign investment enterprise, on January 29, 2015 and (z) on May 13, 2015, the Borrower incorporated 2466241 Ontario Inc., a corporation incorporated under the laws of the Province of Ontario (“2466241”), in connection with the acquisition by 2466241 of Esna Technologies Inc., a company incorporated under the laws of the Province of Ontario (“Esna”), Esna’s Subsidiaries (Esna Technologies Corp., a Delaware corporation and Esna Technologies Ltd., a company incorporated under the laws of the United Kingdom) and 2323888 Ontario Inc., a corporation incorporated under the laws of the Province of Ontario and holding company pursuant to which certain of Esna’s shareholders held their respective shares in Esna (“Holdco”), on May 27, 2015. On May 27, 2015, 2466241 and Holdco amalgamated to form Erbium Amalco Inc. ("Amalco"). On May 28, 2015, Amalco and Esna amalgamated to form an amalgamated company which retained the name of Esna Technologies Inc. as a direct subsidiary of the Borrower. For the avoidance of doubt, no lien searches shall be required. SECTION 6. Representations and Warranties. The Borrower represents and warrants as follows as of the date hereof:

(a) The execution, delivery and performance by the Borrower of this Amendment have been duly authorized by all necessary corporate or other organizational action. The execution, delivery and performance by the Borrower of this Amendment will not (a) contravene the terms of any of the Borrower’s Organization Documents, (b) result in any breach or contravention of, or the creation of any Lien upon any of the property or assets of the Borrower or any of the Restricted Subsidiaries (other than as permitted by Section 7.01 of the Credit Agreement) under (i) any Contractual Obligation to which the Borrower is a party or affecting the Borrower or the properties of the Borrower or any of its Restricted Subsidiaries or (ii) any order, injunction, writ or decree of any Governmental Authority or any arbitral award to which the Borrower or its property is subject, or (c) violate any applicable material Law; except with respect to any breach, contravention or violation (but not creation of Liens) referred to in clauses (b) and (c), to the extent that such breach, contravention or violation would not reasonably be expected to have a Material Adverse Effect. (b) This Amendment has been duly executed and delivered by the Borrower. Each of this Amendment, the Credit Agreement and each other Loan Document to which the Borrower is a party, after giving effect to the amendments pursuant to this Amendment, constitutes a legal, valid and binding obligation of the Borrower, enforceable against the Borrower in accordance with its terms, except as such enforceability may be limited by Debtor Relief Laws and by general principles of equity and principles of good faith and fair dealing. (c) Upon the effectiveness of this Amendment, no Default or Event of Default shall exist. (d) Upon the effectiveness of this Amendment and after giving effect to the transactions contemplated by this Amendment, the Borrower and its Subsidiaries, on a consolidated basis, are Solvent. (e) Each of the representations and warranties of the Borrower and each other Loan Party contained in Article V of the Credit Agreement or any other Loan Document, is true and correct in all material respects on and as of the date hereof; provided that, to the extent that such representations and warranties specifically refer to an earlier date, they are true and correct in all material respects as of such earlier date; provided, further, that any representation and warranty that is qualified as to “materiality,” “Material Adverse Effect” or similar language is true and correct (after giving effect to any qualification therein) in all respects on such respective dates. SECTION 7. Reference to and Effect on the Credit Agreement and the Loan Documents. (a) Except as expressly set forth herein, this Amendment (i) shall not by implication or otherwise limit, impair, constitute a waiver of, or otherwise affect the rights and remedies of the Lenders, the Administrative Agent or the Borrower under the Restated Credit Agreement or any other Loan Document, and (ii) shall not alter, modify, amend or in any way affect any of the terms, conditions, obligations, covenants or agreements contained in the Restated Credit Agreement or any other Loan Document, all of which are ratified and affirmed in all respects and shall continue in full force and effect. Without limiting the generality of the foregoing, the Collateral Documents and all of the Collateral described therein do and shall continue to secure the payment of all Obligations of the Loan Parties under the Loan Documents, in each case, as amended by this Amendment. (b) On and after the effectiveness of this Amendment, this Amendment shall for all purposes constitute a Loan Document.

SECTION 8. Loss of FATCA Grandfathered Status. Solely for purposes of withholding any applicable taxes under FATCA, from and after the Amendment No. 9 Effective Date, the Borrower and the Administrative Agent shall treat the Credit Agreement and all Obligations arising thereunder (including any Obligations outstanding prior to such date) as no longer being grandfathered for FATCA purposes. SECTION 9. Consent to Enter into Agreements. The Term B-7 Lenders hereby authorize the Administrative Agent to take such actions, including making filings and entering into agreements and any amendments or supplements to any Collateral Document, as may be necessary or desirable to reflect the intent of this Amendment. SECTION 10. Costs and Expenses. The Borrower agrees to pay or reimburse the Administrative Agent pursuant to Section 10.04 of the Restated Credit Agreement. SECTION 11. Notes. The Borrower agrees that each Term B-7 Lender executing this Amendment may request through the Administrative Agent, and shall receive, one or more Term B-7 Notes payable to such Term B-7 Lender duly executed by the Borrower in substantially the form of Exhibit C-8 attached to Annex 3 hereto, evidencing such Term B-7 Lender’s Term B-7 Loans. SECTION 12. Execution in Counterparts. This Amendment may be executed in one or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. Delivery by facsimile or electronic transmission of an executed counterpart of a signature page to this Amendment shall be effective as delivery of an original executed counterpart of this Amendment. SECTION 13. Notices. All communications and notices hereunder shall be given as provided in the Credit Agreement. SECTION 14. Severability. If any provision of this Amendment is held to be illegal, invalid or unenforceable, the legality, validity and enforceability of the remaining provisions of this Amendment and the other Loan Documents shall not be affected or impaired thereby. The invalidity of a provision in a particular jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction. SECTION 15. Successors. The terms of this Amendment shall be binding upon, and shall inure for the benefit of, the parties hereto and their respective successors and assigns. SECTION 16. Governing Law. This Amendment shall be governed by, and construed in accordance with, the law of the State of New York. [The remainder of this page is intentionally left blank]

Annex 1 to Amendment No. 9 to Credit Agreement Lender Addendum By executing a signature page hereto: (i) as an Extending Term B-7 Lender, the undersigned institution irrevocably agrees (A) on the terms and subject to the conditions set forth in the Credit Agreement, to extend the maturity of, and reclassify as Term B-7 Loans, all (but not less than all) of such Extending Term B-7 Lender’s Term B-3 Loans, Term B-4 Loans and/or Term B-6 Loans, and (B) to the terms of this Amendment and the Credit Agreement, including for the avoidance of doubt, the Term B-7 Related Amendments; (ii) as a Refinancing Term B-7 Lender, the undersigned institution irrevocably agrees (A) to provide a Refinancing Term Loan in the form of a Term B-7 Loan in the amount reflected on such signature page, and (B) to the terms of this Amendment and the Credit Agreement, including for the avoidance of doubt, the Term B-7 Related Amendments; and/or (iii) if not otherwise signing as an Extending Term B-7 Lender or a Refinancing Term B-7 Lender, the undersigned institution (an “Existing Consenting Lender”) irrevocably agrees to the terms of this Amendment and the Credit Agreement, including for the avoidance of doubt, the Term B-7 Related Amendments. [Signature pages follow]

Annex 2 to Amendment No. 9 to Credit Agreement GUARANTOR CONSENT AND REAFFIRMATION May 29, 2015 Reference is made to (i) Amendment No. 9 to Credit Agreement, dated as of the date hereof, attached as Exhibit A hereto (the “Amendment”), among Avaya Inc. (the “Borrower”), Citibank, N.A., as Administrative Agent, each Extending Term B-7 Lender, each Refinancing Term B-7 Lender and the Required Lenders and (ii) the Credit Agreement, dated as of October 26, 2007, as amended as of December 18, 2009 by Amendment No. 1, as amended and restated as of February 11, 2011 pursuant to the Amendment Agreement, as amended as of August 8, 2011 by Amendment No. 3, as amended and restated as of October 29, 2012 pursuant to Amendment No. 4, as amended and restated as of December 21, 2012 pursuant to Amendment No. 5, as amended as of February 13, 2013 by Amendment No. 6, as amended as of March 12, 2013 by Amendment No. 7, and as amended as of February 5, 2014 by Amendment No. 8 (as amended, amended and restated, supplemented or otherwise modified prior to the date hereof, the “Restated Credit Agreement”), among the Borrower, Avaya Holdings Corp. (formerly known as Sierra Holdings Corp.), Citibank, N.A., as Administrative Agent, Swing Line Lender and L/C Issuer, and each Lender from time to time party thereto. Capitalized terms used but not otherwise defined in this Guarantor Consent and Reaffirmation (this “Consent”) are used with the meanings attributed thereto in the Amendment. Each Guarantor hereby consents to the execution, delivery and performance of the Amendment and agrees that each reference to the Credit Agreement in the Loan Documents shall, on and after the Amendment No. 9 Effective Date be deemed to be a reference to the Credit Agreement in effect in accordance with the terms of the Amendment. Each Guarantor hereby acknowledges and agrees that, after giving effect to the Amendment, all of its respective obligations and liabilities under the Loan Documents to which it is a party, as such obligations and liabilities have been amended by the Amendment, are reaffirmed, and remain in full force and effect. After giving effect to the Amendment, each Guarantor reaffirms each Lien granted by it to the Administrative Agent for the benefit of the Secured Parties under each of the Loan Documents to which it is a party, which Liens shall continue in full force and effect during the term of the Credit Agreement, and shall continue to secure the Obligations (after giving effect to the Amendment), in each case, on and subject to the terms and conditions set forth in the Credit Agreement and the other Loan Documents. Nothing in this Consent shall create or otherwise give rise to any right to consent on the part of the Guarantors to the extent not required by the express terms of the Loan Documents. This Consent is a Loan Document and shall be governed by, and construed in accordance with, the law of the state of New York. [The remainder of this page is intentionally left blank]

IN WITNESS WHEREOF, the parties hereto have duly executed this Consent as of the date first set forth above. AVAYA HOLDINGS CORP. AVAYA CALA INC. AVAYA EMEA LTD. AVAYA FEDERAL SOLUTIONS, INC. AVAYA INTEGRATED CABINET SOLUTIONS INC. AVAYA MANAGEMENT SERVICES INC. AVAYA WORLD SERVICES INC. SIERRA ASIA PACIFIC INC. TECHNOLOGY CORPORATION OF AMERICA, INC. UBIQUITY SOFTWARE CORPORATION VPNET TECHNOLOGIES, INC. AVAYA HOLDINGS LLC AVAYA HOLDINGS TWO, LLC OCTEL COMMUNICATIONS LLC AVAYALIVE INC. By: _____________________________ Name: Title:

Exhibit A to Guarantor Consent and Reaffirmation Amendment No. 9 to Credit Agreement [See attached]

-2- Annex 3 to Amendment No. 9 to Credit Agreement Updated Exhibits to Credit Agreement [See attached]

-3- EXHIBIT A FORM OF COMMITTED LOAN NOTICE To: Citibank, N.A., as Administrative Agent Citigroup Global Loans 0 Xxxxx Xxx, Xxxxx 000 Xxx Xxxxxx, XX 00000 Attention: [ ] [Date] Ladies and Gentlemen: Reference is made to the Credit Agreement dated as of October 26, 2007 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Credit Agreement”), among Avaya Inc. (the “Borrower”), Avaya Holdings Corp. (f/k/a Sierra Holdings Corp.), Citibank, N.A., as administrative agent (in such capacity, the “Administrative Agent”), Swing Line Lender and L/C Issuer, and each lender from time to time party thereto. Capitalized terms used herein and not otherwise defined herein shall have the meanings assigned to such terms in the Credit Agreement. The Borrower hereby gives you notice, irrevocably, pursuant to Section 2.02(a) of the Credit Agreement that it hereby requests (select one): A Borrowing of new Loans A conversion of Loans A continuation of Loans to be made on the terms set forth below: (A) Class of Borrowing1 _______________________ (B) Date of Borrowing, conversion or continuation (which is a Business Day) (C) Principal amount2 _______________________ (D) Type of Loan3 _______________________ 1 Term X-0, Xxxx X-0, Xxxx X-0, Xxxx X-0, Dollar Revolving Credit, Alternative Currency Revolving Credit or Swing Line. 2 Eurocurrency Rate Loans shall be in minimum of $1,000,000 (and any amount in excess of $1,000,000 shall be an integral multiple of $500,000). Base Rate Loans shall be in minimum of $500,000 (and any amount in excess of $500,000 shall be an integral multiple of $100,000).

-4- (E) Interest Period4 _______________________ (F) Currency of Loan _______________________ [The Borrower hereby represents and warrants that the conditions to lending specified in Section[s] 4.02(a) [and (b)]5 of the Credit Agreement will be satisfied as of the date of Borrowing set forth above.]6 [The above request has been made to the Administrative Agent by telephone at [(212)] [ ]]. 3 Specify Eurocurrency or Base Rate. Alternative Currency Revolving Loans and Euro Term Loans must be Eurocurrency. 4 Applicable for Eurocurrency Borrowings/Loans only. 5 Inapplicable for the initial Credit Extensions on the Closing Date. 6 Applicable for Borrowings of new Loans only.

EXHIBIT C-8 )'+&'.# 132 -.(+%(-$) $*,0+/# "132 FORM XX XXXX X-0 XXXX Xxx Xxxx, Xxx Xxxx [Date] FOR VALUE RECEIVED, the undersigned, AVAYA INC., a Delaware corporation (the “Borrower”), hereby promises to pay to the Lender set forth above (the “Lender”) or its registered assigns, in lawful money of the United States of America in immediately available funds at the Administrative Agent’s Office (such term, and each other capitalized term used but not defined herein, having the meaning assigned to it in the Credit Agreement dated as of October 26, 2007 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Credit Agreement”), among the Borrower, Avaya Holdings Corp. (f/k/a Sierra Holdings Corp.), Citibank, N.A., as administrative agent (in such capacity, the “Administrative Agent”), Swing Line Lender and L/C Issuer, and each lender from time to time party thereto) (i) on the dates set forth in the Credit Agreement, the principal amounts set forth in the Credit Agreement with respect to Term B-7 Loans made by the Lender to the Borrower pursuant to Section 2.01(a)(iii)(F) of the Credit Agreement and (ii) on each Interest Payment Date, interest at the rate or rates per annum as provided in the Credit Agreement on the unpaid principal amount of all Term B-7 Loans made by the Lender to the Borrower pursuant to the Credit Agreement. The Borrower promises to pay interest, on demand, on any overdue principal and, to the extent permitted by law, overdue interest from their due dates at the rate or rates provided in the Credit Agreement. The Borrower hereby waives diligence, presentment, demand, protest and notice of any kind whatsoever. The nonexercise by the holder hereof of any of its rights hereunder in any particular instance shall not constitute a waiver thereof in that or any subsequent instance. All borrowings evidenced by this note and all payments and prepayments of the principal hereof and interest hereon and the respective dates thereof shall be endorsed by the holder hereof on the schedule attached hereto and made a part hereof or on a continuation thereof which shall be attached hereto and made a part hereof, or otherwise recorded by such holder in its internal records; provided, however, that the failure of the holder hereof to make such a notation or any error in such notation shall not affect the obligations of the Borrower under this note. This note is one of the Term B-7 Notes referred to in the Credit Agreement that, among other things, contains provisions for the acceleration of the maturity hereof upon the happening of certain events, for optional and mandatory prepayment of the principal hereof prior to the maturity hereof and for the amendment or waiver of certain provisions of the Credit Agreement, all upon the terms and conditions therein specified. This note is secured and guaranteed as provided in the Credit Agreement and the Collateral Documents. Reference is hereby made to the Credit Agreement and the Collateral Documents for a description of the properties and assets in which a security interest has been granted, the nature and extent of the security and guarantees, the terms and conditions upon which the security interest and each guarantee was granted and the rights of the holder of this note in respect thereof.

-2- THIS NOTE MAY NOT BE TRANSFERRED EXCEPT IN COMPLIANCE WITH THE TERMS OF THE CREDIT AGREEMENT. TRANSFERS OF THIS NOTE MUST BE RECORDED IN THE REGISTER MAINTAINED BY THE ADMINISTRATIVE AGENT PURSUANT TO THE TERMS OF THE CREDIT AGREEMENT. THIS NOTE SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAW OF THE STATE OF NEW YORK. [THE REMAINDER OF THIS PAGE IS INTENTIONALLY LEFT BLANK]

-4- LOANS AND PAYMENTS Date Amount of Loan Maturity Date Payments of Principal/Interest Principal Balance of Note Name of Person Making the Notation

EXHIBIT E FORM OF ASSIGNMENT AND ASSUMPTION This Assignment and Assumption (this “Assignment and Assumption”) is dated as of the Effective Date set forth below and is entered into by and between [the] [each]1 Assignor (as defined below) and [the] [each]2 Assignee (as defined below) pursuant to Section 10.07 of the Credit Agreement dated as of October 26, 2007 (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Credit Agreement”), among Avaya Inc., a Delaware corporation (the “Borrower”), Avaya Holdings Corp. (f/k/a Sierra Holdings Corp.), Citibank, N.A., as administrative agent (in such capacity, the “Administrative Agent”), Swing Line Lender and L/C Issuer, and each lender from time to time party thereto, receipt of a copy of which is hereby acknowledged by [the] [each] Assignee. [It is understood and agreed that the rights and obligations of [the Assignors] [the Assignees]3 hereunder are several and not joint.]4 Capitalized terms used in this Assignment and Assumption and not otherwise defined herein have the meanings specified in the Credit Agreement. The Standard Terms and Conditions set forth in Annex 1 attached hereto are hereby agreed to and incorporated herein by reference and made a part of this Assignment and Assumption as if set forth herein in full. For an agreed consideration, [the] [each] Assignor hereby irrevocably sells and assigns to [the Assignee] [the respective Assignees], and [the] [each] Assignee hereby irrevocably purchases and assumes from [the Assignor] [the respective Assignors], subject to and in accordance with the Standard Terms and Conditions and the Credit Agreement, as of the Effective Date inserted by the Administrative Agent as contemplated below, (i) all of [the Assignor’s] [the respective Assignors’] rights and obligations in [its capacity as a Lender] [their respective capacities as Lenders] under the Credit Agreement, any other Loan Documents and any other documents or instruments delivered pursuant to any of the foregoing to the extent related to the amount and percentage interest identified below of all of such outstanding rights and obligations of [the Assignor] [the respective Assignors] under the facility identified below (including participations in any Letters of Credit or Swing Line Loans included in such facility) and (ii) to the extent permitted to be assigned under applicable law, all claims, suits, causes of action and any other right of [the Assignor (in its capacity as a Lender)] [the respective Assignors (in their respective capacities as Lenders)] against any Person, whether known or unknown, arising under or in connection with the Credit Agreement, any other Loan Document or any other documents or instruments delivered pursuant to any of the foregoing or the transactions governed thereby or in any way based on or related to any of the foregoing, including, but not limited to, contract claims, tort claims, malpractice claims, statutory claims and all other claims at law or in equity related to the rights and obligations sold and 1 For bracketed language here and elsewhere in this form relating to the Assignor(s), if the assignment is from a single Assignor, choose the first bracketed language. If the assignment is from multiple Assignors, choose the second bracketed language. 2 For bracketed language here and elsewhere in this form relating to the Assignee(s), if the assignment is to a single Assignee, choose the first bracketed language. If the assignment is to multiple Assignees, choose the second bracketed language. 3 Select as appropriate. 4 Include bracketed language if there are either multiple Assignors or multiple Assignees.

-2- assigned by [the] [any] Assignor to [the] [any] Assignee pursuant to clause (i) above (the rights and obligations sold and assigned pursuant to clauses (i) and (ii) above being referred to herein collectively as [[the] [an] “Assigned Interest”). Such sale and assignment is without recourse to [the] [any] Assignor and, except as expressly provided in this Assignment and Assumption, without representation or warranty by [the] [any] Assignor. 1. Assignor[s] (the “Assignor[s]”): ____________________ 2. Assignee[s] (the “Assignee[s]”): ____________________ Assignee is an Affiliate of: [Name of Lender] Assignee is an Approved Fund of: [Name of Lender] 3. Borrower: Avaya Inc. 4. Administrative Agent: Citibank, N.A. 5. Assigned Interest: Facility Aggregate Amount of Commitment/Loans of all Lenders Amount of Commitment/Loans Assigned Percentage Assigned of Commitment/ Loans5 Dollar Revolving Credit Facility $ $ % Alternative Currency Revolving Credit Facility $ $ % Term B-3 Loans $ $ % Term B-4 Loans $ $ % Term B-6 Loans $ $ % Term B-7 Loans $ $ % Effective Date: 5 Set forth, to at least 8 decimals, as a percentage of the Commitment/Loans of all Lenders thereunder.

-3- The terms set forth in this Assignment and Assumption are hereby agreed to: [NAME OF ASSIGNOR], as Assignor, By: Name: Title: [NAME OF ASSIGNEE], as Assignee, By: Name: Title:

-4- [Consented to and]6 Accepted: CITIBANK, N.A., as Administrative Agent, By: _________________________ Name: Title: [Consented to]7: [ ], as a Principal L/C Issuer, By: _________________________ Name: Title: [Consented to]8: CITIBANK, N.A., as Swing Line Lender, By: _________________________ Name: Title: 6 No consent of the Administrative Agent shall be required for an assignment of all or any portion of a Term Loan to another Lender, an Affiliate of a Lender or an Approved Fund. 7 No consent of the Principal L/C Issuers shall be required for any assignment of a Term Loan or any assignment to an Agent or an Affiliate of an Agent. 8 Only required for any assignment of any of the Dollar Revolving Credit Facility.

-5- AVAYA INC.9 By: _________________________ Name: Title: 9 No consent of the Borrower shall be required for an assignment to a Lender, an Affiliate of a Lender, an Approved Fund or, if an Event of Default under Section 8.01(a) or, solely with respect to the Borrower, Section 8.01(f) of the Credit Agreement has occurred and is continuing, any Assignee.

CREDIT AGREEMENT1 STANDARD TERMS AND CONDITIONS FOR ASSIGNMENT AND ASSUMPTION 1. Representations and Warranties. 1.1 Assignor. [The] [Each] Assignor (a) represents and warrants that (i) it is the legal and beneficial owner of [the] [the relevant] Assigned Interest, (ii) [the] [such] Assigned Interest is free and clear of any lien, encumbrance or other adverse claim and (iii) it has full power and authority, and has taken all action necessary, to execute and deliver this Assignment and Assumption and to consummate the transactions contemplated hereby; and (b) assumes no responsibility with respect to (i) any statements, warranties or representations made in or in connection with the Credit Agreement or any other Loan Document, (ii) the execution, legality, validity, enforceability, genuineness, sufficiency or value of the Loan Documents or any collateral thereunder, (iii) the financial condition of Holdings, the Borrower, or any of their Subsidiaries or Affiliates or any other Person obligated in respect of any Loan Document or (iv) the performance or observance by Holdings, the Borrower, or any of their Subsidiaries or Affiliates or any other Person of any of their respective obligations under any Loan Document. 1.2. Assignee. [The] [Each] Assignee (a) represents and warrants that (i) it has full power and authority, and has taken all action necessary, to execute and deliver this Assignment and Assumption and to consummate the transactions contemplated hereby and to become a Lender under the Credit Agreement, (ii) it meets all the requirements to be an assignee under Section 10.07(b) of the Credit Agreement (subject to such consents, if any, as may be required under Section 10.07(b)(i) of the Credit Agreement), (iii) from and after the Effective Date, it shall be bound by the provisions of the Credit Agreement and, to the extent of [the] [the relevant] Assigned Interest, shall have the obligations of a Lender thereunder, (iv) it is sophisticated with respect to decisions to acquire assets of the type represented by [the] [such] Assigned Interest and either it, or the Person exercising discretion in making its decision to acquire [the] [such] Assigned Interest, is experienced in acquiring assets of such type, (v) it has received a copy of the Credit Agreement, and has received copies of the most recent financial statements delivered pursuant to Section 4.01(g) or 6.01 of the Credit Agreement, as applicable, and such other documents and information as it deems appropriate to make its own credit analysis and decision to enter into this Assignment and Assumption and to purchase [the] [such] Assigned Interest, (vi) it has, independently and without reliance on any Agent or any other Lender and based on such documents and information as it has deemed appropriate, made its own credit analysis and decision to enter into this Assignment and Assumption and to purchase [the] [such] Assigned Interest, (vii) if it is not already a Lender under the Credit Agreement, attached to the Assignment and Assumption is an Administrative Questionnaire, (viii) the Administrative Agent has received a processing and recordation fee of $3,500 as of the Effective Date and (ix) if it is a Foreign Lender, attached to the Assignment and Assumption is any 1 Capitalized terms used herein and not otherwise defined herein shall have the meanings assigned to such terms in the Credit Agreement dated as of October 26, 2007, as amended as of December 18, 2009 by Amendment No. 1 thereto, as amended and restated as of February 11, 2011 pursuant to the Amendment Agreement, as amended as of August 8, 2011 by Amendment No. 3 thereto, as amended and restated as of October 29, 2012 pursuant to Amendment No. 4 thereto, as amended and restated as of December 21, 2012 pursuant to Amendment No. 5 thereto, as amended as of February 13, 2013 by Amendment No. 6 thereto, as amended as of March 12, 2013 by Amendment No. 7 thereto, as amended as of February 5, 2014 by Amendment No. 8 thereto and as amended as of May 29, 2015 by Amendment No. 9 thereto (as amended, restated, amended and restated, supplemented or otherwise modified from time to time, the “Credit Agreement”), among Avaya Inc. (the “Borrower”), Avaya Holdings Corp. (f/k/a Sierra Holdings Corp.), Citibank, N.A., as administrative agent (in such capacity, the “Administrative Agent”), Swing Line Lender and L/C Issuer, and each lender from time to time party thereto.

-2- documentation required to be delivered by it pursuant to Section 3.01 of the Credit Agreement, duly completed and executed by the Assignee and (b) agrees that (i) it will, independently and without reliance upon any Agent, [the] [any] Assignor or any other Lender, and based on such documents and information as it shall deem appropriate at the time, continue to make its own credit decisions in taking or not taking action under the Loan Documents, and (ii) it will perform in accordance with their terms all of the obligations which by the terms of the Loan Documents are required to be performed by it as a Lender. 2. Payments. From and after the Effective Date, the Administrative Agent shall make all payments in respect of [the] [each] Assigned Interest (including payments of principal, interest, fees and other amounts) to [the] [each] Assignor for amounts which have accrued to but excluding the Effective Date and to [the] [each] Assignee for amounts which have accrued from and after the Effective Date. 3. General Provisions. This Assignment and Assumption shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns. This Assignment and Assumption may be executed in any number of counterparts, which together shall constitute one instrument. Delivery of an executed counterpart of a signature page of this Assignment and Assumption by telecopy shall be effective as delivery of a manually executed counterpart of this Assignment and Assumption. This Assignment and Assumption shall be governed by, and construed in accordance with, the law of the State of New York.

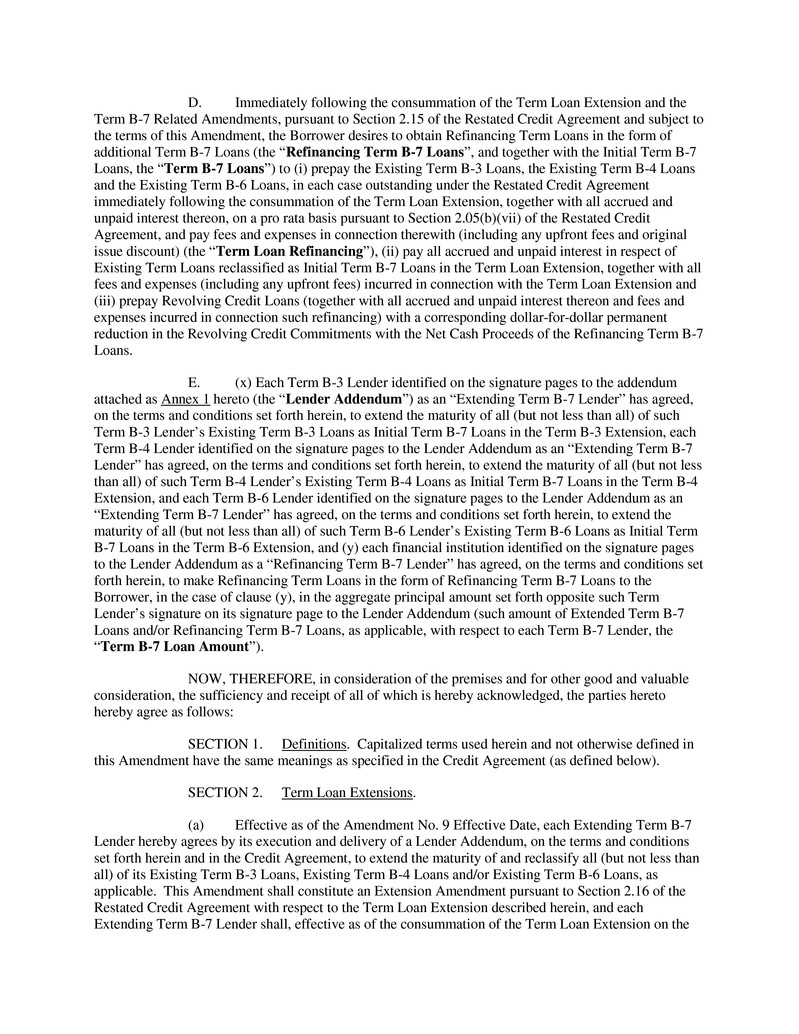

Schedule 1 to Amendment No. 9 Existing Letters of Credit as of the Amendment No. 9 Effective Date L/C Issuer Type of L/C Issuer Beneficiary Applicant L/C # Expiry Date Maximum Amount Citibank, N.A., New York Alternative Currency LC Issuer Citibank, N.A., UAE Avaya Inc., on behalf of Avaya Nederland B.V. UAE 69602607 11/26/2015 489,980.00 AED Citibank, N.A., New York Alternative Currency LC Issuer Citibank, N.A. Pune Avaya Inc., on behalf of Avaya India Pvt. Ltd. 69602834 02/14/2016 10,000,000.00 INR Citibank, N.A. Dollar L/C Issuer Mount Airy Investors, LLC Avaya Inc 69602169 10/30/2015 4,055,505.38 USD Citibank, N.A. Alternative Currency LC Issuer Citibank N.A. Tel- Aviv, Israel Avaya Inc., on behalf of Avaya Israel 69603356 4/3/2016 4,116,941.40 ILS Citibank, N.A. New York Alternative Currency LC Issuer Citibank, N.A., UAE Avaya Inc, on behalf of Avaya Nederland B.V. UAE 69602606 11/26/2015 131,380.00 AED Citibank, N.A. Alternative Currency LC Issuer Deutsche Bank (DB) AG, Amsterdam Branch Avaya Inc. 69603253 2/20/2016 18,900,000.00 EUR Citibank, N.A. New York Alternative Currency LC Issuer Citibank, N.A., UAE Avaya Inc., on behalf of Avaya Nederland B.V. UAE 69602847 1/15/2016 133,000 UAE Citibank, N.A. New York Alternative Currency LC Issuer Citibank, N.A., UAE Avaya Inc., on behalf of Avaya Nederland B.V. UAE 69602605 11/26/2015 56,444.80 AED