4 - Gold Fields_Addendum to RMB RCF Agreement_Execution II(14662205.7) 3. AMENDMENTS TO THE REVOLVING CREDIT FACILITY AGREEMENT With effect from the Signature Date, the Parties agree that the Revolving Credit Facility Agreement be amended in the...

Execution version ADDENDUM TO THE ZAR REVOLVING CREDIT FACILITY AGREEMENT between GFI JOINT VENTURE HOLDINGS PROPRIETARY LIMITED and GOLD FIELDS OPERATIONS LIMITED (as Original Borrowers) GOLD FIELDS LIMITED (as Parent) THE SUBSIDIARIES OF THE PARENT LISTED IN SCHEDULE 1 (as Original Guarantors) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) (as Mandated Lead Arranger) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) (as Original Lender) and FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) (as Facility Agent) Exhibit 4.9 - i - CONTENTS 1. DEFINITIONS AND INTERPRETATION ....................................................................................................................... 3 2. INTRODUCTION ....................................................................................................................................................... 3 3. AMENDMENTS TO THE REVOLVING CREDIT FACILITY AGREEMENT ...................................................................... 4 4. CONTINUITY AND FURTHER ASSURANCE ............................................................................................................... 6 5. ADDITIONAL REPRESENTATIONS AND WARRANTIES ............................................................................................. 6 6. OBLIGORS CONFIRMATIONS ................................................................................................................................. 6 7. GENERAL ................................................................................................................................................................. 7 SCHEDULE 1 THE ORIGINAL PARTIES ............................................................................................................................... 19 SCHEDULE 2 CONFORMED COPY OF REVOLVING CREDIT FACILITY AGREEMENT....................................................... 20 - 2 - Gold Fields_Addendum to RMB RCF Agreement_Execution II(14662205.7) PARTIES: This Agreement is made between: (1) GOLD FIELDS LIMITED, a public company incorporated under the laws of South Africa with registration number 1968/004880/06 (the Parent); (2) GFI JOINT VENTURE HOLDINGS PROPRIETARY LIMITED, a private company incorporated under the laws of South Africa with registration number 1998/023354/07, as borrower (GFI Joint Venture); (3) GOLD FIELDS OPERATIONS LIMITED, a public company incorporated under the laws of South Africa with registration number 1959/003209/06, as borrower (Gold Fields Operations, together with GFI Joint Venture, the Original Borrowers); (4) THE SUBSIDIARIES of the Parent listed in Schedule 1 (The Original Parties) as guarantors (together with the Parent, the Original Guarantors); (5) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION), a registered bank and public company incorporated under the laws of South Africa with registration number 1929/001225/06, as mandated lead arranger (the Mandated Lead Arranger); (6) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION), a registered bank and public company incorporated under the laws of South Africa with registration number 1929/001225/06, as lender (the Original Lender); and (7) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION), a registered bank and public company incorporated under the laws of South Africa with registration number 1929/001225/06, as facility agent (the Facility Agent). WHEREAS The Parties hereto have agreed to amend the Revolving Credit Facility Agreement (as defined below) on the terms and subject to the conditions set out in this Addendum (as defined below). - 3 - Gold Fields_Addendum to RMB RCF Agreement_Execution II(14662205.7) IT IS AGREED AS FOLLOWS: 1. DEFINITIONS AND INTERPRETATION Definitions In this Addendum (as defined below) words and expressions defined in the Revolving Credit Facility Agreement (as defined below), shall have the same meanings unless otherwise defined in this Addendum (as defined below). In addition, unless the context dictates otherwise, the words and expressions set forth below shall bear the following meanings and cognate expressions shall bear corresponding meanings: Addendum means this addendum to the Revolving Credit Facility Agreement; Parties means the parties to this Addendum, and Party means any one of them as the context may require; Revolving Credit Facility Agreement means the written agreement entitled “ZAR Revolving Credit Facility Agreement” entered into between the Parties on or about 18 April 2023; Signature Date means the date of the last signature of this Addendum by a Party, the other Parties already having signed; and Windfall means Gold Fields Windfall Holdings Inc. (also referred to as Gestion Gold Fields Windfall Inc.), a wholly owned subsidiary of the Parent, incorporated in accordance with the laws of Canada under Ontario corporation number 1000516306. Revolving Credit Facility Agreement The provisions of clause 1.2 (Construction), clause 1.4 (Third party rights), clause 30 (Notices), clause 38 (Counterparts) and clauses 40 (Sole Agreement) to 45 (Jurisdiction) of the Revolving Credit Facility Agreement apply to this Addendum as though they were set out in full in this Addendum, except that references to the Revolving Credit Facility Agreement are to be construed as references to this Addendum. This Addendum and the rights and obligations of the Parties shall in all respects be subject to the terms and conditions of the Revolving Credit Facility Agreement and in the event of any conflict between the provisions of this Addendum (including, without limitation, terms defined herein) and the provisions of the Revolving Credit Facility Agreement, the provisions of this Addendum shall prevail. 2. INTRODUCTION The Parties wish to amend the Revolving Credit Facility Agreement to permit Financial Indebtedness incurred by Windfall by amending the definition of “Permitted Financial Indebtedness” on the terms and subject to the conditions set out in this Addendum.

25th October /s/ Xxxxxx Xxxxxx 25th October /s/ Xxxxxx Xxxxxx 25th October /s/ Xxxxxx Xxxxxx 25th October /s/ Xxxxxx Xxxxxx

25th October /s/ Xxxxxx Xxxxxx 25th October /s/ Xxxxxx Xxxxxx 25th October /s/ Xxxxxx Xxxxxx 25th October /s/ Xxxxx Xxxxxx Who warrants

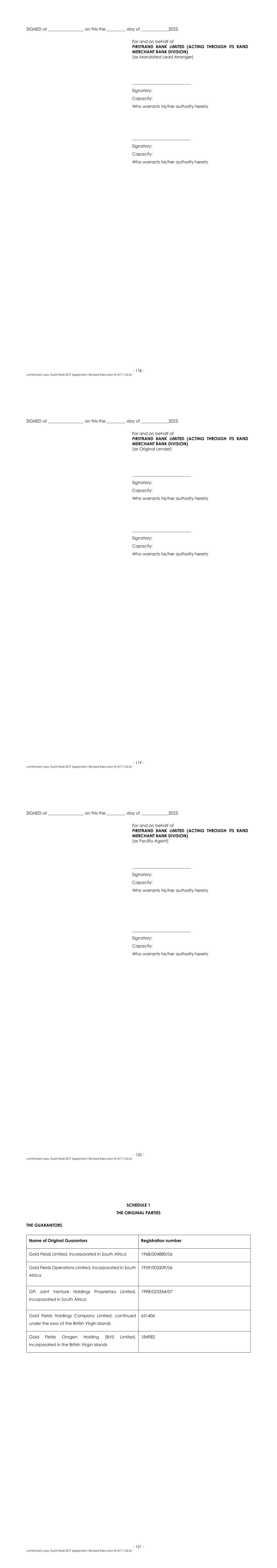

- 16 - Gold Fields_Addendum to RMB RCF Agreement_Execution II(14662205.7) SIGNED at _________________ on this the _________ day of _____________2023. For and on behalf of FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) (as Mandated Lead Arranger) ____________________________ Signatory: Capacity: Who warrants his/her authority hereto ____________________________ Signatory: Capacity: Who warrants his/her authority hereto OctoberSandton 24th Authorised signatory Xxxxxx Xxxxxxx Authorised signatory Xxxx Arran Xxxxxxxx /s/ Xxxx Arran Xxxxxxxx /s/ Xxxxxx Xxxxxxx - 17 - Gold Fields_Addendum to RMB RCF Agreement_Execution II(14662205.7) SIGNED at _________________ on this the _________ day of _____________2023. For and on behalf of FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) (as Original Lender) ____________________________ Signatory: Capacity: Who warrants his/her authority hereto ____________________________ Signatory: Capacity: Who warrants his/her authority hereto Sandton October24th Xxxx Arran Xxxxxxxx Authorised signatory Authorised signatory Xxxxxx Xxxxxxx /s/ Xxxx Arran Xxxxxxxx /s/ Xxxxxx Xxxxxxx - 18 - Gold Fields_Addendum to RMB RCF Agreement_Execution II(14662205.7) SIGNED at _________________ on this the _________ day of _____________2023. For and on behalf of FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) (as Facility Agent) ____________________________ Signatory: Capacity: Who warrants his/her authority hereto ____________________________ Signatory: Capacity: Who warrants his/her authority hereto Signed by:Xxxx Arran Xxxxxxxx Signed at:2023-10-23 20:17:34 +02:00 Reason:I approve this document Signed by:Xxxxxx Xxxxxxx Signed at:2023-10-24 09:06:50 +02:00 Reason:I approve this document Sandton Authorised signatory Authorised signatory /s/ Xxxx Arran Xxxxxxxx /s/ Xxxxxx Xxxxxxx Xxxxxx Xxxxxxx Xxxx Arran Xxxxxxxx - 19 - Gold Fields_Addendum to RMB RCF Agreement_Execution II(14662205.7) SCHEDULE 1 THE ORIGINAL PARTIES THE GUARANTORS Name of Original Guarantors Registration number Gold Fields Limited, incorporated in South Africa 1968/004880/06 Gold Fields Operations Limited, incorporated in South Africa 1959/003209/06 GFI Joint Venture Holdings Proprietary Limited, incorporated in South Africa 1998/023354/07 Gold Fields Holdings Company Limited, continued under the laws of the British Virgin Islands 651406 Gold Fields Orogen Holding (BVI) Limited, incorporated in the British Virgin Islands 184982

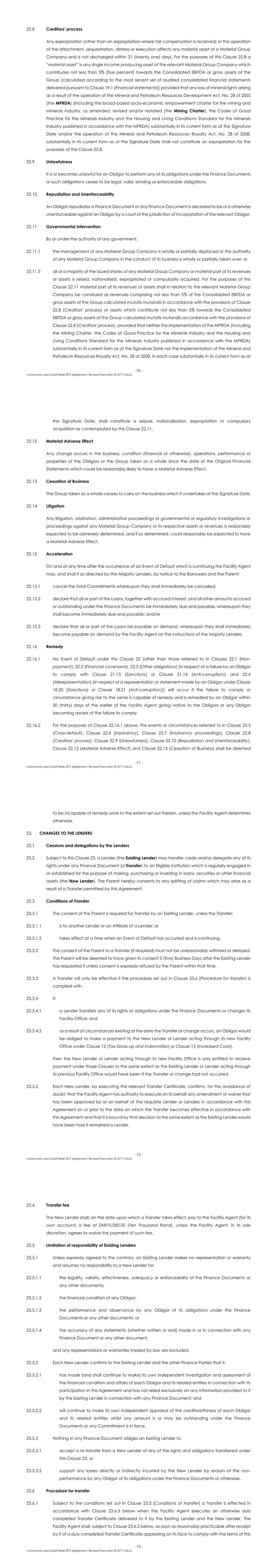

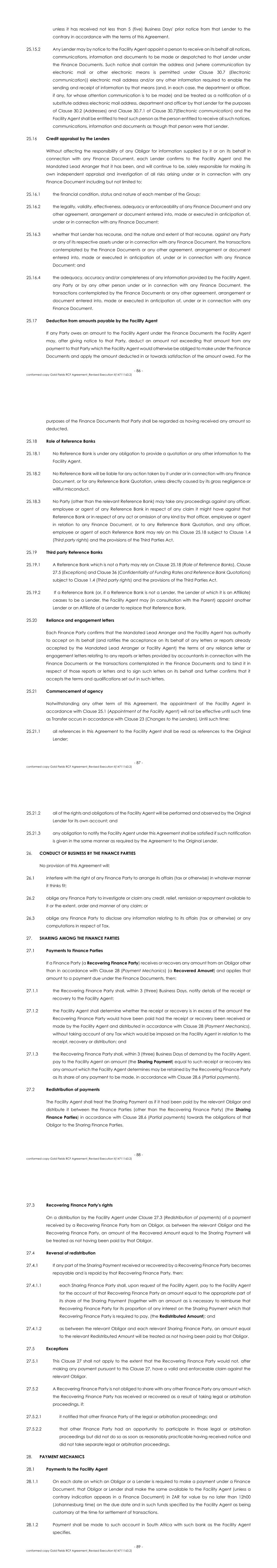

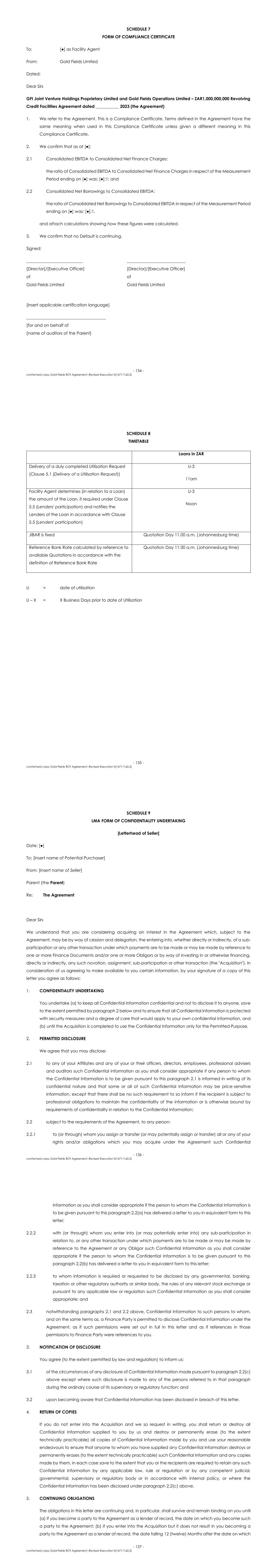

- 20 - Gold Fields_Addendum to RMB RCF Agreement_Execution II(14662205.7) SCHEDULE 2 CONFORMED COPY OF REVOLVING CREDIT FACILITY AGREEMENT Execution Version ZAR REVOLVING CREDIT FACILITY AGREEMENT GFI JOINT VENTURE HOLDINGS PROPRIETARY LIMITED and GOLD FIELDS OPERATIONS LIMITED (as Original Borrowers) GOLD FIELDS LIMITED (as Parent) THE SUBSIDIARIES OF THE PARENT LISTED IN SCHEDULE 1 (as Original Guarantors) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) (as Mandated Lead Arranger) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) (as Original Lender) and FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION) (as Facility Agent) - i – conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) CONTENTS 1. DEFINITIONS AND INTERPRETATION ....................................................................................................................... 2 2. THE FACILITY .......................................................................................................................................................... 27 3. PURPOSE ................................................................................................................................................................ 29 4. CONDITIONS OF UTILISATION .............................................................................................................................. 29 5. UTILISATION ........................................................................................................................................................... 30 6. REPAYMENT ........................................................................................................................................................... 31 7. PREPAYMENT AND CANCELLATION .................................................................................................................... 32 8. INTEREST................................................................................................................................................................. 36 9. INTEREST PERIODS ................................................................................................................................................. 37 10. CHANGES TO THE CALCULATION OF INTEREST ................................................................................................... 37 11. FEES........................................................................................................................................................................ 38 12. TAX GROSS-UP AND INDEMNITIES ....................................................................................................................... 39 13. INCREASED COSTS ................................................................................................................................................ 45 14. OTHER INDEMNITIES .............................................................................................................................................. 47 15. MITIGATION BY THE LENDERS ............................................................................................................................... 49 16. COSTS AND EXPENSES .......................................................................................................................................... 49 17. GUARANTEE AND INDEMNITY .............................................................................................................................. 50 18. REPRESENTATIONS ................................................................................................................................................ 53 19. INFORMATION UNDERTAKINGS ........................................................................................................................... 58 20. FINANCIAL COVENANTS ...................................................................................................................................... 62 21. GENERAL UNDERTAKINGS .................................................................................................................................... 64 22. EVENTS OF DEFAULT .............................................................................................................................................. 67 23. CHANGES TO THE LENDERS .................................................................................................................................. 72 24. CHANGES TO THE OBLIGORS ............................................................................................................................... 76 25. ROLE OF THE FACILITY AGENT, THE MANDATED LEAD ARRANGER AND THE REFERENCE BANKS .................... 77 26. CONDUCT OF BUSINESS BY THE FINANCE PARTIES ............................................................................................. 88 27. SHARING AMONG THE FINANCE PARTIES ........................................................................................................... 88 28. PAYMENT MECHANICS......................................................................................................................................... 89 29. SET-OFF .................................................................................................................................................................. 93 30. NOTICES ................................................................................................................................................................ 93 31. CALCULATIONS AND CERTIFICATES .................................................................................................................... 97 32. PARTIAL INVALIDITY .............................................................................................................................................. 98 33. REMEDIES AND WAIVERS ...................................................................................................................................... 98 34. AMENDMENTS AND WAIVERS .............................................................................................................................. 98 35. CONFIDENTIAL INFORMATION ........................................................................................................................... 102 36. CONFIDENTIALITY OF FUNDING RATES AND REFERENCE BANK QUOTATIONS ............................................... 106 37. RENUNCIATION OF BENEFITS.............................................................................................................................. 107 38. COUNTERPARTS ................................................................................................................................................... 107 39. WAIVER OF IMMUNITY ........................................................................................................................................ 108 40. SOLE AGREEMENT ............................................................................................................................................... 108 41. NO IMPLIED TERMS.............................................................................................................................................. 108 42. EXTENSIONS AND XXXXXXX ............................................................................................................................... 108 43. INDEPENDENT ADVICE........................................................................................................................................ 108 44. GOVERNING LAW ............................................................................................................................................... 108 45. JURISDICTION ..................................................................................................................................................... 108 SCHEDULE 1 THE ORIGINAL PARTIES ............................................................................................................................. 121 SCHEDULE 2: PART I: CONDITIONS PRECEDENT TO INITIAL UTILISATION .................................................................... 122 PART II: CONDITIONS PRECEDENT REQUIRED TO BE DELIVERED BY AN ADDITIONAL BORROWER ............................ 125 PART III: CONDITIONS PRECEDENT REQUIRED TO BE DELIVERED BY AN ADDITIONAL GUARANTOR ......................... 127 SCHEDULE 3 UTILISATION REQUEST ............................................................................................................................... 129 SCHEDULE 4 FORM OF TRANSFER CERTIFICATE ............................................................................................................ 130 SCHEDULE 5 FORM OF ACCESSION LETTER .................................................................................................................. 132 SCHEDULE 6 FORM OF RESIGNATION LETTER ................................................................................................................ 133 SCHEDULE 7 FORM OF COMPLIANCE CERTIFICATE ..................................................................................................... 134 SCHEDULE 8 TIMETABLE .................................................................................................................................................. 135 SCHEDULE 9 LMA FORM OF CONFIDENTIALITY UNDERTAKING ................................................................................... 136 SCHEDULE 10 FORM OF INCREASE CONFIRMATION ................................................................................................... 141 - 1 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) PARTIES: This Agreement is made between: (1) GOLD FIELDS LIMITED, a public company incorporated under the laws of South Africa with registration number 1968/004880/06 (the Parent); (2) GFI JOINT VENTURE HOLDINGS PROPRIETARY LIMITED, a private company incorporated under the laws of South Africa with registration number 1998/023354/07, as borrower (GFI Joint Venture); (3) GOLD FIELDS OPERATIONS LIMITED, a public company incorporated under the laws of South Africa with registration number 1959/003209/06, as borrower (Gold Fields Operations, together with GFI Joint Venture, the Original Borrowers); (4) THE SUBSIDIARIES of the Parent listed in Schedule 1 (The Original Parties) as guarantors (together with the Parent, the Original Guarantors); (5) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION), a registered bank and public company incorporated under the laws of South Africa with registration number 1929/001225/06, as mandated lead arranger (the Mandated Lead Arranger); (6) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION), a registered bank and public company incorporated under the laws of South Africa with registration number 1929/001225/06, as lender (the Original Lender); and (7) FIRSTRAND BANK LIMITED (ACTING THROUGH ITS RAND MERCHANT BANK DIVISION), a registered bank and public company incorporated under the laws of South Africa with registration number 1929/001225/06, as facility agent (the Facility Agent).

- 6 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) determination under the Finance Documents or any combination of any of the foregoing) be an Event of Default; Defaulting Lender means any Lender: 1.1.32.1 which has failed to make its participation in a Loan available or has notified the Facility Agent that it will not make its participation in a Loan available by the Utilisation Date of that Loan in accordance with Clause 5.4.1 (Lenders' participation); 1.1.32.2 which has otherwise rescinded or repudiated a Finance Document; or 1.1.32.3 with respect to which an Insolvency Event has occurred and is continuing, unless, in the case of Clause 1.1.32.1 above: 1.1.32.4 its failure to pay is caused by: 1.1.32.4.1 administrative or technical error; or 1.1.32.4.2 a Disruption Event; and 1.1.32.4.3 payment is made within 5 (five) Business Days of its due date; or 1.1.32.5 the Lender is disputing in good faith whether it is contractually obliged to make the payment in question; Disruption Event means either or both of: 1.1.33.1 a material disruption to those payment or communications systems or to those financial markets which are, in each case, required to operate in order for payments to be made in connection with the Facility (or otherwise in order for the transactions contemplated by the Finance Documents to be carried out) which disruption is not caused by, and is beyond the control of, any of the Parties; or 1.1.33.2 the occurrence of any other event which results in a disruption (of a technical or system-related nature) to the treasury or payments operations of a Party preventing that, or any other Party: 1.1.33.2.1 from performing its payment obligations under the Finance Documents; or 1.1.33.2.2 from communicating with other Parties in accordance with the terms of the Finance Documents, and which (in either such case) is not caused by, and is beyond the control of, the Party whose operations are disrupted; Eligible Institution means any Lender or other bank, financial institution, trust, fund or other entity (other than a member of the Group) selected by the Parent; Encumbrance means any mortgage, pledge, lien, assignment or cession conferring security, hypothecation, a security interest, preferential right or trust arrangement or other encumbrance of the like securing any obligation of any person; - 7 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) Environment means humans, animals, plants and all other living organisms including the ecological systems of which they form part and the following media: 1.1.36.1 air (including, without limitation, air within natural or man-made structures, whether above or below ground); 1.1.36.2 water (including, without limitation, territorial, coastal and inland waters, water under or within land and water in drains and sewers); and 1.1.36.3 land (including, without limitation, land under water); Environmental Claim means any claim, proceeding or investigation by any person in respect of any Environmental Law; Environmental Law means any law applicable to the business conducted by a Material Group Company at the relevant time in any jurisdiction in which that Material Group Company conducts business which relates to the pollution, degradation or protection of the Environment or harm to or the protection of human health or the health of animals or plants; Environmental Permits means any permit, licence, consent, approval and other authorisation and the filing of any notification, report or assessment required under any Environmental Law for the operation of the business of any Material Group Company conducted on or from the properties owned or used by that Material Group Company; Event of Default means any event or circumstance specified as such in Clause 22 (Events of Default); Existing Orogen Notes means: 1.1.41.1 the US$500,000,000 5.125% guaranteed notes due 2024; and 1.1.41.2 the US$500,000,000 6.125% guaranteed notes due 2029, in each case issued by Gold Fields Orogen Holding (BVI) Limited on 9 May 2019; Existing Lender has the meaning given to it in Clause 23.1 (Cessions and Delegations by the Lenders); Existing RCF Agreement means the written agreement entitled “ZAR Revolving Credit Facility Agreement” entered into between, inter alios, the Original Borrowers, the Parent, the Original Guarantors and FirstRand Bank Limited (acting through its Rand Merchant Bank division) (as Mandated Lead Arranger, Original Lender and Facility Agent) on or about 15 April 2020; Facility means the revolving credit facility made available to the Borrowers under this Agreement as described in Clause 2 (The Facility); Facility Office means the office(s) notified by a Lender to the Facility Agent in writing on or before the date it becomes a Lender (or, following that date, by not less than 5 (five) Business Days' written notice) as the office(s) through which it will perform its obligations under this Agreement; - 8 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) FATCA means: 1.1.46.1 sections 1471 to 1474 of the Code and any associated regulations; 1.1.46.2 any treaty, law or regulation of any other jurisdiction, or relating to an intergovernmental agreement between the US and any other jurisdiction, which (in either case) facilitates the implementation of any law or regulation referred to in Clause 1.1.46.1 above; and 1.1.46.3 any agreement pursuant to the implementation of any treaty, law or regulation referred to in Clauses 1.1.46.1 or 1.1.46.2 above with the US Internal Revenue Service, the US government or any governmental or taxation authority in any other jurisdiction; FATCA Application Date means: 1.1.47.1 in relation to a “withholdable payment” described in section 1473(1)(A)(i) of the Code (which relates to payments of interest and certain other payments from sources within the US), 1 July 2014; or 1.1.47.2 in relation to a “passthru payment” described in section 1471(d)(7) of the Code not falling within Clause 1.1.47.1 above, the first date from which such payment may become subject to a deduction or withholding required by FATCA; FATCA Deduction means a deduction or withholding from a payment under a Finance Document required by FATCA; FATCA Exempt Party means a Party that is entitled to receive payments free from any FATCA Deduction; Fee Letter means any letter or letters dated on or about the Signature Date between the Mandated Lead Arranger or the Facility Agent and the Original Borrowers setting out any of the fees referred to in Clause 11 (Fees); Finance Document means: 1.1.51.1 this Agreement; 1.1.51.2 any Fee Letter; 1.1.51.3 any Accession Letter; 1.1.51.4 any Resignation Letter; and 1.1.51.5 any other document designated as such by the Facility Agent and the Parent; Finance Party means the Facility Agent, the Mandated Lead Arranger or a Lender; Financial Indebtedness means (without double counting) any indebtedness for or in respect of: 1.1.53.1 moneys borrowed; - 9 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) 1.1.53.2 any amount raised by acceptance under any acceptance credit facility or dematerialised equivalent; 1.1.53.3 any amount raised pursuant to any note purchase facility or the issue of bonds, notes, debentures, loan stock or any similar instrument; 1.1.53.4 the amount of any liability in respect of any lease or hire purchase contract which would, in accordance with GAAP, be treated as a balance sheet liability; 1.1.53.5 receivables sold or discounted (other than any receivables to the extent they are sold on a non- recourse basis); 1.1.53.6 the amount of liability in respect of any purchase price for assets or services the payment of which is deferred where the deferral of such price is either: 1.1.53.6.1 used primarily as a method of raising credit; or 1.1.53.6.2 not made in the ordinary course of business; 1.1.53.7 any agreement or option to re-acquire an asset if one of the primary reasons for entering into such agreement or option is to raise finance; 1.1.53.8 any amount raised under any other transaction (including any forward sale or purchase agreement) which would, in accordance with GAAP, be treated as a borrowing; 1.1.53.9 for the purposes of Clause 22.5 (Cross-default) only, any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price (and, when calculating the value of any derivative transaction, only the marked to market value shall be taken into account); 1.1.53.10 any counter-indemnity obligation in respect of a guarantee, indemnity, bond, standby or documentary letter of credit or any other instrument issued by a bank or financial institution in respect of the liabilities of an entity which is not a member of the Group and which would otherwise constitute Financial Indebtedness; 1.1.53.11 any amount raised by the issue of redeemable shares to the extent such shares are redeemable prior to the Termination Date; and 1.1.53.12 the amount of any liability in respect of any guarantee or indemnity for any of its items referred to in Clauses 1.1.53.1 to 1.1.53.11 above; Financial Year means, at any time, the financial year of the Group ending on 31 December in each calendar year; Funding Rate means any individual rate notified by a Lender to the Facility Agent pursuant to Clause 10.2 (Market Disruption); GAAP means the generally accepted accounting principles set out in IFRS;

- 10 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) GF Holdings means Gold Fields Holdings Company Limited, a company incorporated with limited liability under the laws of the British Virgin Islands with company number 651406; GF Orogen means Gold Fields Orogen Holding (BVI) Limited, a company incorporated with limited liability under the laws of the British Virgin Islands with company number 184982; Ghanaian Companies means Gold Fields Ghana Limited and Abosso Goldfields Limited; Group means the Parent and each of its Subsidiaries from time to time; Group Company means a member of the Group; 1.1.61A Group Facility Agreement means the US$1,200,000,000 facility agreement dated 25 May 2023 entered into between inter alia the Parent and Windfall as amended from time to time; Guarantor means an Original Guarantor or an Additional Guarantor unless, in the case of an Additional Guarantor, it has ceased to be a Guarantor in accordance with Clause 24 (Changes to the Obligors); Holding Company means, in relation to a company or corporation, any other company or corporation in respect of which it is a Subsidiary; IFRS means International Accounting Standards, International Financial Reporting Standards and related Interpretations, together with any future standards and related interpretations issued or adopted by the International Accounting Standards Board, in each case as amended and to the extent applicable to the relevant financial statements; Impaired Facility Agent means the Facility Agent at any time when: 1.1.65.1 it has failed to make (or has notified a Party that it will not make) a payment required to be made by it under the Finance Documents by the due date for payment; 1.1.65.2 the Facility Agent otherwise rescinds or repudiates a Finance Document; 1.1.65.3 (if the Facility Agent is also a Lender) it is a Defaulting Lender under Clauses 1.1.32.1 and 1.1.32.2 of the definition of Defaulting Lender; or 1.1.65.4 an Insolvency Event has occurred and is continuing with respect to the Facility Agent; unless, in the case of Clause 1.1.65.1 above: 1.1.65.5 its failure to pay is caused by: 1.1.65.5.1 administrative or technical error; or 1.1.65.5.2 a Disruption Event; and 1.1.65.5.3 payment is made within 5 (five) Business Days of its due date; or 1.1.65.6 the Facility Agent is disputing in good faith whether it is contractually obliged to make the payment in question; - 11 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) Increase Confirmation means a confirmation substantially in the form set out in Schedule 10 (Form of Increase Confirmation); Increased Costs has the meaning given to it in Clause 13.1.2.2 of Clause 13.1 (Increased costs); Increase Lender has the meaning given to that term in Clause 2.2 (Increase); Indebtedness for Borrowed Money means Financial Indebtedness, save for any indebtedness for or in respect of Clauses 1.1.53.9 and 1.1.53.10 of the definition of Financial Indebtedness; Information has the meaning given to such term in Clause 18.11.1 of Clause 18.11 (No misleading information); Insolvency Event in relation to an entity, means that entity: 1.1.71.1 is dissolved (other than pursuant to a consolidation, amalgamation or merger); 1.1.71.2 becomes insolvent or is unable to pay its debts or fails or admits in writing its inability generally to pay its debts as they become due; 1.1.71.3 makes a general assignment, arrangement or composition with or for the benefit of its creditors; 1.1.71.4 institutes or has instituted against it, by a regulator, supervisor or any similar official with primary insolvency, rehabilitative or regulatory jurisdiction over it in the jurisdiction of its incorporation or organisation or the jurisdiction of its head or home office, a proceeding seeking a judgment of insolvency or bankruptcy or any other relief under any bankruptcy or insolvency law or other similar law affecting creditors’ rights, or a petition is presented for its winding-up or liquidation by it or such regulator, supervisor or similar official; 1.1.71.5 has instituted against it a proceeding seeking placement into business rescue, a judgment of insolvency or bankruptcy or any other relief under any bankruptcy or insolvency law or other similar law affecting creditors’ rights, or a petition is presented for its winding-up or liquidation, and, in the case of any such proceeding or petition instituted or presented against it, such proceeding or petition is instituted or presented by a person or entity not described in Clause 1.1.71.4 above and: 1.1.71.5.1 results in a judgment of insolvency or bankruptcy or the entry of an order for relief or the making of an order for its winding-up or liquidation; or 1.1.71.5.2 is not dismissed, discharged, stayed or restrained in each case within 30 (thirty) days of the institution or presentation thereof; 1.1.71.6 seeks or becomes subject to the appointment of a curator pursuant to Chapter V of the Banks Act 1990 and/or has instituted against it a bank insolvency proceeding pursuant to that act; 1.1.71.7 has a resolution passed for its business rescue, winding-up, official management or liquidation (other than pursuant to a consolidation, amalgamation or merger); - 12 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) 1.1.71.8 seeks or becomes subject to the appointment of an administrator, provisional liquidator, conservator, receiver, trustee, custodian, business rescue practitioner or other similar official for it or for all or substantially all its assets (other than, for so long as it is required by law or regulation not to be publicly disclosed, any such appointment which is to be made, or is made, by a person or entity described in Clause 1.1.71.4 above); 1.1.71.9 has a secured party take possession of all or substantially all its assets or has a distress, execution, attachment, sequestration or other legal process levied, enforced or sued on or against all or substantially all its assets and such secured party maintains possession, or any such process is not dismissed, discharged, stayed or restrained, in each case within 30 (thirty) days thereafter; 1.1.71.10 causes or is subject to any event with respect to it which, under the applicable laws of any jurisdiction, has an analogous effect to any of the events specified above; or 1.1.71.11 takes any action in furtherance of, or indicating its consent to, approval of, or acquiescence in, any of the foregoing acts; Interest Period means, in relation to a Loan, each period determined in accordance with Clause 9 (Interest Periods) and, in relation to an Unpaid Sum, each period determined in accordance with Clause 8.3 (Default interest); JIBAR means, for the relevant Interest Period of any Loan or Unpaid Sum: 1.1.73.1 the applicable Screen Rate; or 1.1.73.2 if no Screen Rate is available for the Interest Period of that Loan or Unpaid Sum, the arithmetic mean of the rates (rounded upwards to four decimal places) as supplied to the Facility Agent, at its request, quoted by the Reference Banks to leading banks in the Johannesburg Interbank Market, as of 11.00 a.m. on the Quotation Day for the offering of deposits in Rand for a period comparable to that Interest Period; JIBAR Overnight Deposit Rate means, for a Broken Interest Period in relation to any Loan or an Unpaid Sum: 1.1.74.1 the applicable Screen Rate; or 1.1.74.2 (if no Screen Rate is available for the Broken Interest Period of the Loan or Unpaid Sum) the arithmetic mean of the rates (rounded upwards to four decimal places), as supplied to the Lender at its request, quoted by the Reference Banks to leading banks in the Johannesburg Interbank Market, as of 11.00 a.m. on the Quotation Day for the offering of overnight deposits in Rand; Johannesburg Interbank Market means the South African interbank market; Legal Opinion means any legal opinion delivered to the Facility Agent under Clause 4.1 (Initial conditions precedent) or Clause 24 (Changes to the Obligors); - 13 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) Legal Reservations means: 1.1.77.1 the principle that equitable remedies may be granted or refused at the discretion of a court and the limitation of enforcement by laws relating to insolvency, reorganisation and other laws generally affecting the rights of creditors; 1.1.77.2 the Prescription Act, 1969; 1.1.77.3 similar principles, rights and defences under the laws of any jurisdiction in which an Obligor is incorporated; and 1.1.77.4 any other matters which are set out as qualifications or reservations as to matters of law of general application in the Legal Opinions; Lender means: 1.1.78.1 the Original Lender; and 1.1.78.2 any bank or financial institution which has become a Party as a Lender in accordance with Clause 2.2 (Increase) or Clause 23 (Changes to the Lenders), which in each case has not ceased to be a Lender as such in accordance with the terms of this Agreement; LMA means the Loan Market Association; Loan means a loan made or to be made under the Facility or the principal amount outstanding for the time being of that loan; Majority Lenders means: 1.1.81.1 at any time, there are only three Lenders, a Lender or Lenders whose Commitments aggregate 66⅔% or more of the Total Commitments (or, if the Total Commitments have been reduced to zero, aggregated 66⅔% or more of the Total Commitments immediately prior to the reduction); and 1.1.81.2 at any other time, a Lender or Lenders whose Commitments aggregate more than 66⅔% of the Total Commitments (or, if the Total Commitments have been reduced to zero, aggregated more than 66⅔% of the Total Commitments immediately prior to the reduction); Margin means 1.90% per annum; Market Capitalisation means the product obtained as a result of multiplying (A) by (B), where (A) is the average closing price for the issued shares of the Parent on the Johannesburg Stock Exchange during the 30 (thirty) day period prior to the date the relevant Obligor or Material Group Company has entered into a legally binding commitment to make the relevant acquisition or investment or the relevant sale, lease, transfer or other disposal (as applicable) and (B) is the total number of shares (including, without double counting those represented by American depository receipts) issued by the Parent;

- 14 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) Material Adverse Effect means a material adverse effect on: 1.1.84.1 the business or financial condition of the Group taken as a whole; or 1.1.84.2 the ability of an Obligor to perform its payment obligations or financial covenant obligations under any Finance Document to which it is a party; or 1.1.84.3 the validity or enforceability of the Finance Documents or any of them; Material Group Company means: 1.1.85.1 the Obligors; and 1.1.85.2 any member of the Group from time to time that is not a Non-Material Group Company; and Material Group Companies means, as the context requires, all of them; Mining Charter has the meaning given to it in Clause 22.8 (Creditors' process); Month means a period starting on one day in a calendar month and ending on the numerically corresponding day in the next calendar month, except that: 1.1.87.1 (subject to Clause 1.1.87.3 below) if the numerically corresponding day is not a Business Day, that period shall end on the next Business Day in that calendar month in which that period is to end if there is one, or if there is not, on the immediately preceding Business Day; 1.1.87.2 if there is no numerically corresponding day in the calendar month in which that period is to end, that period shall end on the last Business Day in that calendar month; and 1.1.87.3 if an Interest Period begins on the last Business Day of a calendar month, that Interest Period shall end on the last Business Day in the calendar month in which that Interest Period is to end; Clauses 1.1.87.1, 1.1.87.2 and 1.1.87.3 above will only apply to the last Month of any period; Moody's means Xxxxx'x Investor Services Inc., or any successor to its rating agency function; MPRDA has the meaning given to it in Clause 22.8 (Creditors' Process); New Lender has the meaning given to it in Clause 23.1 (Cessions and Delegations by the Lenders); Newshelf means Newshelf 899 Proprietary Limited, a company incorporated under the laws of South Africa; Non-Material Group Company means, at any time, a member of the Group (other than an Obligor) which had EBITDA (determined on the same basis as Consolidated EBITDA) and gross assets in its most recently ended Financial Year (on a consolidated basis taking into account it and its Subsidiaries only) less than 10% of Consolidated EBITDA (but including, for these purposes only, the net income of any Project Finance Subsidiaries) and gross assets of the Group (calculated according to the most recent set of audited consolidated financial statements delivered pursuant to Clause 19.1 (Financial Statements)). Compliance with the aforementioned condition shall be - 15 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) determined by reference to the latest audited financial statements of such member of the Group (consolidated in the case of a member of the Group which itself has Subsidiaries), provided that: 1.1.92.1 if, in the case of any member of the Group which itself has Subsidiaries, no consolidated financial statements are prepared and audited, its consolidated EBITDA and gross assets shall be determined on the basis of pro forma consolidated financial statements of the relevant member of the Group and its Subsidiaries, prepared for this purpose by the Parent; 1.1.92.2 if any intra-Group transfer or re-organisation takes place, the audited financial statements of the Group Company and all relevant members of the Group shall be adjusted by the Parent in order to take into account such intra-Group transfer or re-organisation; and 1.1.92.3 the audited financial statements of the Group and any relevant member of the Group shall be adjusted in such a manner as the Auditors think fair and appropriate to take account of the acquisition or disposal of any member of the Group or any business of any member of the Group, after the date or at which the audited financial statements of the Group are made up; Should there be any dispute regarding whether any member of the Group is or is not a Non-Material Group Company such dispute shall be referred, at the request of the Facility Agent, to the Auditors and a report by the Auditors that a member of the Group is or is not a Non-Material Group Company shall, in the absence of manifest error, be conclusive and binding on all Parties. The costs of obtaining the report by the Auditors will be borne by the unsuccessful party to the dispute; Obligor means a Borrower or a Guarantor; Original Financial Statements means the audited consolidated financial statements of the Parent for the Financial Year ended 31 December 2022; Party means a party to this Agreement; Permitted Disposal means any sale, lease, transfer or other disposal: 1.1.96.1 by an Obligor or any member of the Group of obsolete or redundant assets which are no longer required for the efficient operation of the business of such Obligor or such member of the Group; 1.1.96.2 by an Obligor or any member of the Group in the ordinary course of its day-to-day business if that sale, lease, transfer or other disposal is not otherwise restricted by a term of any Finance Document; 1.1.96.3 by an Obligor to another Obligor (other than to an Additional Obligor); 1.1.96.4 by an Obligor to an Additional Obligor or to a member of the Group that is not an Obligor if such sale, lease, transfer or other disposal is concluded at arm's length or on terms that are more favourable to the relevant Obligor; 1.1.96.5 by a member of the Group that is not an Obligor to another member of the Group; 1.1.96.6 for which the Facility Agent has given its prior written consent (acting on the instructions of the Majority Lenders); or - 16 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) 1.1.96.7 by any member of the Group to any other person where the higher of the market value or consideration receivable when aggregated with the higher of the market value or consideration receivable for any other sale, lease, transfer or other disposal by any Material Group Company (other than a sale, lease, transfer or other disposal referred to in the preceding Clauses) does not exceed (at the time of the relevant disposal) 30% of Market Capitalisation in any Financial Year and does not exceed (at the time of the relevant disposal), in aggregate during the period from the Signature Date to the Termination Date, 40% of Market Capitalisation; Permitted Encumbrance means: 1.1.97.1 any Encumbrance created prior to the Signature Date which (i) is disclosed in the Original Financial Statements and (ii) in all circumstances secures only indebtedness outstanding or a facility available at the Signature Date to the extent that the principal amount or original facility thereby secured is not increased after the Signature Date; 1.1.97.2 any title transfer or retention arrangement entered into by any member of the Group in the normal course of its trading activities and on terms not materially worse for that member of the Group than the standard terms of the relevant supplier; 1.1.97.3 any netting or set-off arrangement entered into by any member of the Group in the ordinary course of its banking arrangements (which shall include, for the avoidance of doubt, those pursuant to hedging arrangements in relation to gold, silver, copper and other commodity prices, foreign exchange rates and interest rates where such arrangements are entered into for the purposes of providing protection against fluctuation in such rates or prices in the ordinary course of business), for the purpose of netting debit and credit balances; 1.1.97.4 any lien arising by operation of law and in the ordinary course of trading and not by reason of any default (whether in payments or otherwise), of any member of the Group; 1.1.97.5 any Encumbrance over or affecting (or transaction described in Clauses 21.3.2 of Clause 21.3 (Negative pledge) (Quasi-Encumbrance) affecting) any asset acquired by a member of the Group after the Signature Date if: 1.1.97.5.1 the Encumbrance or Quasi-Encumbrance was not created in contemplation of the acquisition of that asset by a member of the Group; 1.1.97.5.2 the principal amount secured has not been increased in contemplation of, or since the acquisition of that asset by a member of the Group; and 1.1.97.5.3 the Encumbrance or Quasi-Encumbrance is (other than an Encumbrance or Quasi- Encumbrance otherwise permitted pursuant to Clauses 1.1.97.2, 1.1.97.3 and 1.1.97.4 above or, 1.1.97.6, 1.1.97.7, 1.1.97.8, 1.1.97.9 or 1.1.97.10 below) removed or discharged within 6 (six) Months of the date of acquisition of such asset; 1.1.97.6 any Encumbrance or Quasi-Encumbrance over or affecting any asset of any company which becomes a member of the Group after the Signature Date, where the Encumbrance or Quasi- - 17 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) Encumbrance is created prior to the date on which that company becomes a member of the Group, if: 1.1.97.6.1 the Encumbrance or Quasi-Encumbrance was not created in contemplation of the acquisition of that company; 1.1.97.6.2 the principal amount secured has not increased in contemplation of or since the acquisition of that company; and 1.1.97.6.3 the Encumbrance or Quasi-Encumbrance is (other than an Encumbrance or Quasi- Encumbrance otherwise permitted pursuant to Clauses 1.1.97.2, 1.1.97.3, 1.1.97.4 or 1.1.97.5 above or 1.1.97.7, 1.1.97.9 or 1.1.97.10 below) removed or discharged within six (6) Months of that company becoming a member of the Group; 1.1.97.7 any Encumbrance or Quasi-Encumbrance granted in respect of Project Finance Borrowings over assets of, or the shares in, a Project Finance Subsidiary (other than the Cerro Corona Subsidiary); 1.1.97.8 any Encumbrance or Quasi-Encumbrance resulting from the rules and regulations of any clearing system or stock exchange over shares and/or other securities held in that clearing system or stock exchange; 1.1.97.9 in respect of Encumbrances or Quasi-Encumbrances over or affecting any asset of any Material Group Company (other than the Cerro Corona Subsidiary), any Encumbrance or Quasi- Encumbrance securing Financial Indebtedness the principal amount of which (when aggregated with the principal amount of any other indebtedness which has the benefit of any Encumbrance or Quasi-Encumbrance other than any permitted under Clauses 1.1.97.1 to 1.1.97.8 above and 1.1.97.10 and 1.1.97.11 below), does not at any time exceed 15% of Consolidated Tangible Net Worth (or its equivalent in another currency) (but adjusted to include the net value of new assets acquired since the last date of the latest set of consolidated annual financial statements of the Group); 1.1.97.10 any other Encumbrance or Quasi-Encumbrance as agreed by the Facility Agent (acting on the instructions of the Majority Lenders) in writing; or 1.1.97.11 any Encumbrance or Quasi-Encumbrance granted in respect of Financial Indebtedness incurred in connection with the Cerro Corona Operation over the business or assets of the Cerro Corona Subsidiary or over the Ownership Interests in the Cerro Corona Subsidiary provided that the amount outstanding of all Financial Indebtedness secured by all such Encumbrances or Quasi-Encumbrances permitted by this Clause 1.1.97.11 does not at any time in aggregate exceed $200,000,000 (Two Hundred Million Dollars) (or its equivalent). In this Clause 1.1.97.11, Ownership Interests means (i) the shares issued by the Cerro Corona Subsidiary, (ii) any shareholder loans made to the Cerro Corona Subsidiary (iii) to the extent required by Peruvian law, the shares in the Holding Company which directly owns the shares issued by the Cerro Corona Subsidiary provided that such Holding Company's sole assets are shares issued by, and any loans made by it to, the Cerro Corona Subsidiary and its sister company, Minera Gold Fields S.A.;

- 18 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) Permitted Financial Indebtedness means any Financial Indebtedness: 1.1.98.1 arising under the Finance Documents; 1.1.98.2 arising under any environmental bond which any member of the Group is required to issue by any applicable law; 1.1.98.3 arising in connection with the Cerro Corona Operation provided that, the aggregate amount of all such Financial Indebtedness does not at any time exceed $200,000,000 (Two Hundred Million Dollars) (or its equivalent); 1.1.98.4 arising under any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price but not for speculative purposes; 1.1.98.5 of the Group existing and available on the Signature Date (or, of any person that becomes a member of the Group from time to time, provided that, such Financial Indebtedness existed at the time such person became a member of the Group and was not created in anticipation thereof); 1.1.98.6 arising under the guarantees given by Gold Fields Ghana Holdings (BVI) Limited in respect of the Existing Orogen Notes; 1.1.98.7 arising under any guarantee: 1.1.98.7.1 of any Financial Indebtedness of any member of the Group; or 1.1.98.7.2 given in respect of the netting or set-off arrangements permitted pursuant to Clause 1.1.97.3 of the definition of Permitted Encumbrance; or 1.1.98.7.3 any guarantee constituting Financial Indebtedness which is not prohibited by Clause 21.11 (Financial Indebtedness); 1.1.98.8 incurred by Gruyere Holdings Pty Ltd to the extent that the aggregate amount of all such Financial Indebtedness does not at any time exceed A$600,000,000 (Six Hundred Million Australian Dollars); 1.1.98.9 between Group Companies; 1.1.98.10 in respect of any lease or hire purchase contract entered into at any time which: 1.1.98.10.1 would, in accordance with GAAP, be treated as a balance sheet liability; and 1.1.98.10.2 would not, in accordance with GAAP in force immediately before the adoption of IFRS 16, have been treated as a balance sheet liability; 1.1.98.11 incurred pursuant to any counter-indemnity obligation in respect of any guarantee, indemnity, bond, standby or documentary letter of credit or any other instrument issued by a bank or financial institution in favour of Tshiamiso Trust to the extent that the aggregate amount of all such Financial Indebtedness does not at any time exceed ZAR357,500,000 (Three Hundred and Fifty Seven Million Five Hundred Thousand Rand); - 19 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) 1.1.98.12 not falling within the preceding Clauses 1.1.98.1 to 1.1.98.11 provided that the aggregate amount of all Financial Indebtedness (excluding, for the avoidance of doubt, any Financial Indebtedness incurred by a Guarantor or a Project Finance Subsidiary permitted under this Clause 1.1.98 does not at any time exceed $500,000,000 (Five Hundred Million Dollars) (or its equivalent)); or 1.1.98.13 incurred by Windfall under the Group Facility Agreement to the extent that that the aggregate principal amount outstanding of all such Financial Indebtedness does not at any time exceed C$800,000,000; Project Finance Borrowings means: 1.1.99.1 any indebtedness to finance (or re-finance) a project comprised of the ownership, development, construction, refurbishment, commissioning and/or operation of assets which is incurred by a Project Finance Subsidiary in connection with such project and in respect of which the recourse of the person(s) making any such finance (or re-finance) available to that Project Finance Subsidiary for the payment, repayment and prepayment of such indebtedness is limited to (i) the Project Finance Subsidiary and its assets and/or the shares in that Project Finance Subsidiary and/or (ii) during the period prior to successful completion of the relevant completion tests applicable to such project guarantees from any one or more members of the Group; or 1.1.99.2 any indebtedness the terms and conditions of which have been approved by the Facility Agent and which the Facility Agent has agreed in writing (acting on the instructions of the Majority Lenders) to treat as a Project Finance Borrowing for the purposes of the Finance Documents; Project Finance Subsidiary means a single purpose company or other entity (excluding the Obligors) whose sole business is a project comprised of the ownership, development, construction, refurbishment, commissioning and/or operation of an asset which has incurred Project Finance Borrowings; Qualifying Lender has the meaning given to it in Clause 12 (Tax Gross-up and Indemnities); Quotation Day means, in relation to any period for which an interest rate is to be determined, the first day of that period, unless market practice differs in the Johannesburg Interbank Market, in which case the Quotation Day will be determined by the Facility Agent in accordance with market practice in the Johannesburg Interbank Market (and if quotations would normally be given by leading banks in the Johannesburg Interbank Market on more than one day, the Quotation Day will be the last of those days); Recipient has the meaning given to it in Clause 12.2.1 of Clause 12.7 (Value added tax); Recovered Amount has the meaning given to it in Clause 27.1 (Payments to Finance Parties); Recovering Finance Party has the meaning given to it in Clause 27.1 (Payments to Finance Parties); Redistributed Amount has the meaning given to it in Clause 27.4 (Reversal of redistribution); - 20 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) Reference Bank Quotation means any quotation supplied to the Facility Agent by a Reference Bank; Reference Bank Rate means the arithmetic mean of the rates (rounded upwards to four decimal places) as supplied to the Facility Agent at its request by the Reference Banks as either: 1.1.108.1 if: 1.1.108.1.1 the Reference Bank is a contributor to the Screen Rate; and 1.1.108.1.2 it consists of a single figure, the rate (applied to the relevant Reference Bank and the relevant currency and period) which contributors to the Screen Rate are asked to submit to the relevant administrator; or 1.1.108.2 in any other case, the rate at which the relevant Reference Bank could fund itself in ZAR for the relevant period with reference to the unsecured wholesale funding market; Reference Banks means the principal Johannesburg offices of such banks as may be appointed by the Facility Agent in consultation with the Parent at the relevant time and provided that such banks have accepted such appointment; Related Fund in relation to a fund (the first fund), means a fund which is managed or advised by the same investment manager or investment adviser as the first fund or, if it is managed by a different investment manager or investment adviser, a fund whose investment manager or investment adviser is an Affiliate of the investment manager or investment adviser of the first fund; Repeating Representations means each of the representations set out in Clause 18.1 (Status) to Clause 18.20 (Sanctions) inclusive, other than Clause 18.3 (Binding obligations), Clause 18.6 (Governing law and enforcement), Clause 18.7 (Deduction of Tax), Clause 18.8 (No filing or stamp taxes), Clause 18.11 (No misleading information), Clause 18.12 (Financial statements), Clause 18.14 (No proceedings pending or threatened), Clause 18.15 (Insurance), Clause 18.18 (Ownership of Material Group Companies), Clause 18.19 (No Material Adverse Effect) and Clause 18.20.2 of Clause 18.20 (Sanctions); Replacement Lender has the meaning given to it in Clause 34.6.1 of Clause 34.6 (Replacement of a Defaulting Lender); Representative means any delegate, agent, manager, administrator, nominee, attorney, trustee or custodian; Resignation Letter means a letter substantially in the form set out in Schedule 6 (Form of Resignation Letter); Retiring Guarantor has the meaning given to it in Clause 17.8 (Release of Guarantors' right of contribution); - 21 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) Rollover Loan means one or more Loans: 1.1.116.1 made or to be made on the same day that a maturing Loan is due to be repaid; 1.1.116.2 the aggregate amount of which is equal to or less than the amount of the maturing Loan; and 1.1.116.3 made or to be made to the same Borrower for the purpose of refinancing a maturing Loan; Sanctioned Country means a country, territory or region that is the target of Sanctions; Sanctions means any economic, financial or trade sanctions laws, regulations, embargoes or restrictive measures administered, enacted or enforced by: 1.1.118.1 the United States government (including, without limitation, the Office of Foreign Assets Control of the U.S. Department of the Treasury or the U.S. Department of State and including, without limitation, the designation as a specially designated national or blocked person); 1.1.118.2 the United Nations Security Council; 1.1.118.3 the European Union; 1.1.118.4 the government of Australia; 1.1.118.5 the government of Canada; 1.1.118.6 the government of Japan; 1.1.118.7 the government of the United Kingdom (including, without limitation His Majesty's Treasury); 1.1.118.8 the government of the Republic of France; 1.1.118.9 the government of South Africa, and any of their governmental authorities, or any other relevant sanctions authority which replaces, or is a successor to, any of the foregoing; Screen Rate means the mid-market rate for deposits in ZAR for the relevant period which appears on the Reuters Screen SAFEY Page alongside the caption YIELD at the applicable time (or any replacement Reuters page which displays that rate, or on the appropriate page of such other information service which publishes that rate from time to time in place of Reuters). If such page or service ceases to be available, the Facility Agent may specify another page or service displaying the appropriate rate after consultation with the Parent; Sharing Finance Parties has the meaning given to it in Clause 27.2 (Redistribution of payments); Sharing Payment has the meaning given to it in Clause 27.1 (Payments to Finance Parties); Signature Date means the date of the signature of the Party last signing this Agreement in time, provided that all Parties have signed this Agreement; South Africa means the Republic of South Africa;

- 22 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) South African Obligors means: 1.1.124.1 the Parent; 1.1.124.2 the Original Borrowers; or 1.1.124.3 any Additional Obligor incorporated in South Africa; Specified Time means a time determined in accordance with Schedule 8 (Timetable); Standard & Poor's means Standard & Poor's, a division of the XxXxxx-Xxxx Companies Inc., or any successor to its rating agency function; Subject Party has the meaning given to it in Clause 12.2.2 of Clause 12.7 (Value added tax); Subsidiary means, in relation to any company or corporation, a company or corporation: 1.1.128.1 which is controlled, directly or indirectly, by the first mentioned company or corporation; 1.1.128.2 in respect of which more than half the issued share capital is beneficially owned, directly or indirectly by the first mentioned company or corporation; or 1.1.128.3 which is a Subsidiary of another Subsidiary of the first mentioned company or corporation, and for this purpose, a company or corporation shall be treated as being controlled by another if that other company or corporation is able to direct its affairs and/or to control the composition of its board of directors or equivalent body; Supplier has the meaning given to it in Clause 12.2.2 of Clause 12.7 (Value added tax); Tax means any tax, levy, impost, duty or other charge or withholding of a similar nature (including, without limitation, any penalty or interest payable in connection with any failure to pay or any delay in paying any of the same); Tax Credit has the meaning given to it in Clause 12 (Tax Gross-up and Indemnities); Tax Declaration has the meaning given to it in Clause 12 (Tax Gross-up and Indemnities); Tax Deduction means a deduction or withholding for or on account of Tax from a payment under a Finance Document, other than a FATCA Deduction; Tax Payment means either the increase in a payment made by an Obligor to a Finance Party under Clause 12.2 (Tax gross-up) or a payment under Clause 12.3 (Tax Indemnity); Termination Date means the 5th (fifth) anniversary of the CP Satisfaction Date; Third Parties Act means the Contracts (Rights of Third Parties) Act, 1999; Total Commitments means the aggregate of the Commitments, being ZAR1,000,000,000 (One Billion Rand) at the Signature Date; - 23 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) Transfer Certificate means a certificate substantially in the form set out in Schedule 4 (Form of Transfer Certificate) or any other form agreed between the Facility Agent and the Parent; Transfer Date means, in relation to a transfer: 1.1.139.1 the proposed Transfer Date specified in the relevant Transfer Certificate; or 1.1.139.2 in the event that no Transfer Date is specified in the relevant Transfer Certificate, the date on which the Facility Agent executes the relevant Transfer Certificate; Treaty Lender has the meaning given to it in Clause 12 (Tax Gross-up and Indemnities); Treaty State has the meaning given to it in Clause 12 (Tax Gross-up and Indemnities); Unpaid Sum means any sum due and payable but unpaid by an Obligor under the Finance Documents; US means the United States of America; Utilisation means a utilisation of the Facility; Utilisation Date means the date of a Utilisation, being the date on which the relevant Loan is to be made; Utilisation Request means a notice substantially in the form set out in Schedule 3 (Utilisation Request); VAT means any value added tax as provided for in the South African Value Added Tax Act, 1991 and any other tax of a similar nature; and Windfall means Gold Fields Windfall Holdings Inc. (also referred to as Gestion Gold Fields Windfall Inc.), a wholly owned subsidiary of the Parent, incorporated in accordance with the laws of Canada under Ontario corporation number 1000516306. Construction Unless a contrary indication appears any reference in this Agreement to: 1.2.1.1 the Facility Agent, the Mandated Lead Arranger, any Finance Party, any Lender, any Obligor or any Party shall be construed so as to include its successors in title, permitted assigns and permitted transferees to, or of, its rights and/or obligations under the Finance Documents; 1.2.1.2 arm's length means terms that are fair and reasonable to the counterparty of a transaction and no more or less favourable to the other party to the relevant transaction as could reasonably be expected to be obtained in a comparable arm's length transaction with a person that is not the ultimate Holding Company of such counterparty or an entity of which such counterparty or its ultimate Holding Company has direct or indirect control, or owns directly or indirectly more than 20% of the share capital or similar rights of ownership; - 24 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) 1.2.1.3 an amendment includes an amendment, modification, supplement, novation, re-enactment, replacement, restatement or variation and amend will be construed accordingly; 1.2.1.4 assets include present and future properties, revenues and rights of every description; 1.2.1.5 audited means, in respect of any financial statement, those financial statements as audited by the Auditors; 1.2.1.6 authorisations mean any authorisation, consent, registration, filing agreement, notarisation, certificate, licence, approval, resolution, permit and/or authority or any exemption from any of the aforesaid, by, with or from any authority (including, without limitation, any approvals required from the South African Reserve Bank in relation to any Finance Document or any transaction contemplated under any Finance Document); 1.2.1.7 a Clause or Schedule shall, subject to any contrary indication, be construed as a reference to a Clause or Schedule of this Agreement; 1.2.1.8 a Finance Document or any other agreement or instrument is a reference to that Finance Document or other agreement or instrument as amended, novated, supplemented, extended, replaced or restated; 1.2.1.9 a group of Lenders includes all the Lenders; 1.2.1.10 a guarantee means (other than in Clause 17 (Guarantee and Indemnity)), any guarantee, letter of credit, bond, indemnity or similar assurance against loss, or any obligation, direct or indirect, actual or contingent to purchase or assume any indebtedness of any person or to make any investment in or loan to any person or to purchase assets of any person where, in each case, such obligation is assumed in order to maintain or assist the ability of such person to meet its indebtedness; 1.2.1.11 indebtedness shall be construed so as to include any obligation (whether incurred as principal or as surety) for the payment or repayment of money, whether present or future, actual or contingent; 1.2.1.12 the use of the word including followed by specific examples will not be construed as limiting the meaning of the general wording preceding it, and the eiusdem generis rule must not be applied in the interpretation of such general wording or such specific examples; 1.2.1.13 law shall be construed as any law (including statutory, common or customary law), statute, constitution, decree, judgment, treaty, regulation, directive, by-law, order, other legislative measure, directive, requirement, request or guideline (whether or not having the force of law but, if not having the force of law, is generally complied with by the persons to whom it is addressed or applied) of any government, supranational, local government, statutory or regulatory or self-regulatory or similar body or authority or court and the common law, as amended, replaced, re-enacted, restated or reinterpreted from time to time; 1.2.1.14 the words other and otherwise shall not be construed eiusdem generis with any foregoing words where a wider construction is possible; - 25 - conformed copy Gold Fields RCF Agreement_Revised Execution II(14711163.2) 1.2.1.15 a person includes any individual, firm, company, corporation, government, state or agency of a state or any association, trust, joint venture, consortium, partnership or other entity (whether or not having separate legal personality); 1.2.1.16 a regulation includes any regulation, rule, official directive, request or guideline (whether or not having the force of law but complied with generally) of any governmental, intergovernmental or supranational body, agency, department or regulatory, self-regulatory or other authority or organisation; 1.2.1.17 a provision of law is a reference to that provision as amended or re-enacted; and 1.2.1.18 a time of day is a reference to Johannesburg time. The determination of the extent to which a rate is for a period equal in length to an Interest Period shall disregard any inconsistency arising from the last day of that Interest Period being determined pursuant to the terms of this Agreement. Section, Clause and Schedule headings are for ease of reference only. Unless a contrary indication appears, a term used in any other Finance Document or in any notice given under or in connection with any Finance Document has the same meaning in that Finance Document or notice as in this Agreement. Unless inconsistent with the context or a contrary indication appears, in this Agreement: 1.2.5.1 if any provision in a definition is a substantive provision conferring rights or imposing obligations on any Party to this Agreement, notwithstanding that it appears only in a definition, effect shall be given to it as if it were a substantive provision of this Agreement; 1.2.5.2 when any number of days is prescribed in this Agreement, same shall be reckoned exclusively of the first and inclusively of the last day unless the last day falls on a day which is not a Business Day, in which case the last day shall be the next succeeding Business Day; 1.2.5.3 where any Party to this Agreement is required to provide any consent or approval or agree to the actions of any other Party to this Agreement, the request for such consent or approval or agreement shall be in writing and such consent or approval or agreement, in order to be an effective consent, approval or agreement for the purposes of this Agreement, shall be in writing; and 1.2.5.4 any obligation of an Obligor not to do something under this Agreement shall include an obligation not to vote in favour of or to exercise any discretion or to contract, agree or take any action with a view to bringing that thing about (unless such contract or agreement is conditional upon the consent of the Facility Agent). A Default is continuing if it has not been remedied or waived. The headings to the Clauses and Schedules of this Agreement are for reference purposes only and shall in no way affect or govern the interpretation of nor modify nor amplify the terms of this Agreement nor any Clause or Schedule hereof.