SHARE PURCHASE AGREEMENT

Exhibit 10.3

THIS SHARE PURCHASE AGREEMENT (the “Agreement”) is made as of this 24 day of March 2021 (the “Effective Date”), by and between Maris Tech Ltd., a company incorporated under the laws of the State of Israel, registration number 514135730, having its principal place of business at 3 Xxxxx Xxxx St., Xxxx Xxxxx, Israel (the “Company”), the persons and entities listed on Exhibit A hereto (each an Investor an collectively, the “Investors”) and Aegis Israel Ltd. (former G.F.N. Pure Ltd.), a company incorporated under the laws of the State of Israel, registration number 514997998, having its principal place of business at 00 Xxxxx Xxxxxxxxxx Xx., Xxx Xxxx, Xxxxxx (the “Placement Agent”). Each of the Company and the Investors may also be referred to herein, individually, as a “Party”, and collectively, as the “Parties”.

| WHEREAS, | the Company is a provider of HW and SW miniature, lightweight, ultra-low power, durable solutions for Video, Audio, Data & Telemetry acquisition, processing and ultra-low-latency streaming from remote sensors; and |

| WHEREAS, | the Investors desire to invest in the Company, pursuant to the terms and conditions more fully set forth in this Agreement; and |

| WHEREAS, | the Board of Directors of the Company (the “Board”) has determined that it is in the best interest of the Company to raise US $1,500,000, by means of the issuance and allotment to the Investors of the Company’s Series A preferred shares, par value ILS 1.0 each (the “Preferred Shares”), at a price per share of US $$0.765601, and to obtain an option to raise, at the Company’s discretion, an additional amount of up to US $500,000 on the same terms, against issuance of additional Preferred Shares. |

NOW, THEREFORE, in consideration of the mutual promises and covenants set forth herein, the Parties hereby agree as follows:

1. TRANSACTION

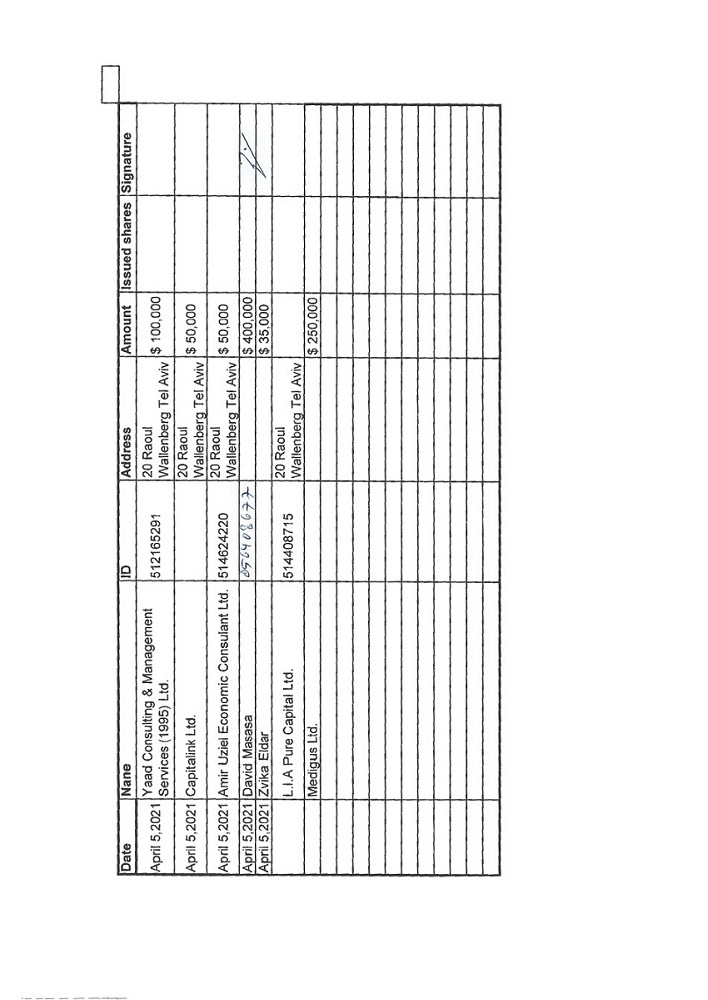

1.1. Purchase and Sale of Shares. Subject to the terms and conditions hereof, the Investors agree to purchase, severally and not jointly, in accordance with the allocation set forth in Exhibit A hereto, and the Company agrees to issue and allot to the Investors, at the Closing (as defined below), up to an aggregate number of 1,959,246 Preferred Shares of the Company (the “Purchased Shares”), in consideration for an aggregate investment amount of US $1,500,000 (the “Investment Amount”), at a price per share equal to US $0.765601 (the “PPS”), reflecting up to 13.04% of the Company’s share capital, on Fully Diluted Basis (as defined below) immediately following the Closing, as set forth in the Cap Table (as defined below).

1.2. The rights attached to the Preferred Shares are set forth in the Amended Articles (as defined in Section 2.2.1.2 below). Without derogating from the generality of any provision of the Amended Articles, the rights attached to the Preferred Shares shall be identical to those attached to the Ordinary Shares, save for full ratchet anti-dilution protection to the holders of the Preferred Shares against a down round investment consummated during the period of 18 months following the Closing Date.

1.3. In this Agreement, the term “Fully Diluted Basis” used throughout this Agreement means assuming (i) the exercise or conversion into ordinary shares, par value ILS 1.0 per share (the “Ordinary Shares”) each of all options, warrants, convertible debentures, convertible securities or any other securities or contractual rights or powers to purchase the Company’s securities, existing as of the Effective Date, including all options promised and/or issuable pursuant to the Company’s Option Plan as described below; and (ii) conversion into ordinary shares of the Company, par value ILS 1.0 each, in 2020 of an aggregate amount of ILS 3,756,944.43, that constituted 50% of the shareholders’ loans outstanding as at the date of conversion.

1.4. Warrants. For each Purchased Share, the Company shall issue to the Investors at the Closing an aggregate of 1,959,246 warrants to purchase up to 1,959,246 of the Company’s Ordinary Shares (collectively, the “Warrants”), in the form attached hereto as Exhibit 1.4. The Warrants shall be exercisable (i) if the IPO (as defined below) is consummated by the Company during a period of 15 months following the Closing Date – during 5 years following the Closing, at an exercise price per share equal to the price per share underlying the IPO, or (ii) if no IPO (as defined below) is consummated by the Company during a period of 15 months following the Closing Date - during 30 months following the Closing Date, at an exercise price per share of US $1.9972, reflecting the Company’s valuation of US $30,000,000 on Fully Diluted Basis immediately following the Closing.

2. CLOSING

2.1. Closing. On the basis of the representations, warranties and covenants contained herein, and subject to the terms and conditions hereof, the issuance and allotment of the Purchased Shares and Warrants, and the purchase thereof by the Investors against payment of the Investment Amount, shall take place at the closing to be held remotely by exchange of documents and signatures (the “Closing”), concurrently with the execution of this Agreement or at such other time and place as the Company and the Investors shall mutually agree in writing (the “Closing Date”).

2.2. Transactions at the Closing. At the Closing Date, the following transactions shall occur, which transactions shall be deemed to take place simultaneously and no transaction shall be deemed to have been completed or any document delivered until all such transactions have been completed and all required documents delivered:

2.2.1. The Company shall deliver to the Investors the following documents or cause the following actions to be completed:

2.2.1.1. A true and correct copy of the written consent of the Company’s Board, in the form attached hereto as Exhibit 2.2.1.1 approving, inter alia: (i) the entering into, execution, delivery and performance of this Agreement, including any exhibits, schedules and ancillary documents hereto and approving all the transactions contemplated herein, therein and thereby; (ii) the issuance and allotment of the Purchased Shares and the Warrants to the Investors against payment of the Investment Amount; (iii) the issuance of the Agent Warrants to the Placement Agent and (iv) the issuance of Ordinary Shares upon conversion of shareholder loans as set forth in Section 2.2.1.8 below.

2.2.1.2. A true and correct copy of the minutes of the general meeting of the shareholders of the Company, approving (i) the entering into, execution, delivery and performance of this Agreement, including any exhibits, schedules and ancillary documents hereto and approving all the transactions contemplated herein, therein and thereby; (ii) the adoption of the Amended and Restated Articles of Association of the Company (the “Amended Articles”), in the form attached hereto as Exhibit 2.2.1.2; (iii) the issuance of the Purchased Shares, the Warrants and the Agent Warrants (as set forth in Section 8.1 below), the issuance of the Ordinary Shares upon the exercise of the Warrants and the Agent Warrants and reserving share capital for the Warrants and the Agent Warrants; and (iv) the issuance of Ordinary Shares upon conversion of shareholder loans as set forth in Section 2.2.1.8 below.

2.2.1.3. Validly executed Warrants, in the form attached hereto as Exhibit 1.4;

2.2.1.4. Validly executed Agent Warrants, in the form attached hereto as Exhibit 8.1;

2.2.1.5. A true and correct copy of the Company’s shareholders register evidencing the issuance of the Purchased Shares, certified by the Company’s Chief Executive Officer, in the form attached hereto as Exhibit 2.2.1.5;

2

2.2.1.6. A waiver signed by each shareholder of the Company, in the form attached hereto as Exhibit 2.2.1.6;

2.2.1.7. A certificate signed by the Chief Executive Officer of the Company stating that the conditions specified in Section 6 of this Agreement have been fulfilled, in the form attached hereto as Exhibit 2.2.1.7;

2.2.1.8. Validly executed loan agreements with the Company’s current shareholders, in the form attached hereto as Exhibit 2.2.1.8, pursuant to which balance of the shareholders’ loans outstanding as of the Effective Date, in an aggregate amount of ILS 3,756,944.43 (after an identical amount was converted into shares in 2020), shall not bear any interest and shall be repaid to the lending shareholders by 24 equal monthly repayments commencing the second anniversary date of the IPO.

2.2.1.9. A copy of indemnity agreement with the person appointed by the Investors as a director of the Company in the form attached as Exhibit 2.2.1.9 (the “Indemnification Agreement”);

2.2.1.10. A copy of validly executed engagement letter between the Company and Aegis Capital Corp. (“Aegis Capital”) providing for engagement by the Company of Aegis Capital services for the purposes of the IPO; and

2.2.1.11. A copy of duly completed and executed notices to the Israeli Companies Registrar with regard to the: (i) adoption of the Amended Articles; (ii) issuance of the Purchased Shares; and (iii) changes to the Company’s Board, in the forms attached hereto as Exhibits 2.2.1.10(i)-(iii).

2.2.2. Each Investor, severally and not jointly, shall cause the transfer of its respective portion of the Investment Amount to the Company, by wire transfer. The wire transfer will be made in US Dollars to the bank accounts designated in writing by the Company within 3 days.

3. CALL OPTION

3.1. At any one or more times within 6 month period following the Closing Date, the Company may require that the Placement Agent (or any third party on its behalf) will invest an additional amount of up to US $500,000 against issuance of additional Preferred Shares, at a price equal to the PPS (the “Call Option”). If the Company wishes to exercise the Call Option, it shall submit to the Placement Agent, in writing, a notice (an “Exercise Notice”) indicating the additional amount (in US dollars) it wishes the Placement Agent (or any third party on its behalf) to invest in the Company (the “Additional Investment Amount”) and the number of additional Preferred Shares to be issued by the Company (the “Additional Purchased Shares”). For each Additional Purchased Share, the Company shall issue to the Placement Agent (or any third party on its behalf) a Warrant.

3.2. The Call Option will be deemed exercised on the date upon which the following transactions shall occur, which transactions shall be deemed to take place simultaneously and no transaction shall be deemed to have been completed or any document delivered until all such transactions have been completed and all required documents delivered:

3.2.1. The Company shall deliver to the Placement Agent (or any third party on its behalf) the following documents or cause the following actions to be completed:

3.2.1.1. The Company shall issue the number of the Additional Purchased Shares as set forth in Exercise Notice;

3

3.2.1.2. The Company shall deliver to the Placement Agent a bring-down certificate signed by the Chief Executive Officer of the Company, in the form attached hereto as Exhibit 3.2.1.2;

3.2.2. The Placement Agent (or any third party on its behalf) shall cause the transfer to the Company of the Additional Investment Amount by wire transfer. The wire transfer will be made in US Dollars to the bank accounts designated in writing by the Company within 3 days.

4. REPRESENTATIONS AND WARRANTIES OF THE COMPANY

The Company hereby represents and warrants to the Investors, and acknowledges that the Investors are entering into this Agreement, inter alia, in reliance thereon, as follows:

4.1. Organization. The Company is a corporation duly incorporated, validly existing and in good standing under the laws of the State of Israel, with full corporate power and authority to enter into and perform its obligations under this Agreement and to own, lease and operate its properties and assets and to conduct its business as now being conducted. The articles of association of the Company as in effect prior to the Closing are attached hereto as Schedule 4.1 (the “Current Articles”) and the Amended Articles shall be in effect upon the Closing.

4.2. Authorization; Approvals. The Company has the full power and authority to execute, deliver and perform this Agreement and the other instruments contemplated hereby or which are ancillary hereto (collectively, the “Transaction Documents”), and to consummate the transactions contemplated hereby and thereby. The Transaction Documents, when executed and delivered by or on behalf of the Company, shall constitute the valid and legally binding obligation of the Company, legally enforceable against the Company, and to the Company’s knowledge against its Shareholders, in accordance with its terms, subject to applicable bankruptcy, insolvency and other laws of general application affecting enforcement of creditors’ rights generally and laws relating to the availability of specific performance, injunctive relief or other equitable remedies. All corporate action on the part of the Company, its shareholders, officers and directors necessary for the authorization, execution, delivery, and performance of all of the Company’s obligations under the Transaction Documents, conversion of shareholders loans (as set forth in Section 1.3 above) and for the authorization, issuance and sale of the Purchased Shares, the Warrants, the Agent Warrants and of the Ordinary Share issuable upon the exercise of the Warrants and the Agent Warrants, has or will be taken prior to the Closing. The Purchased Shares, when issued in accordance with the provisions hereof, shall be validly issued, fully paid, and non-assessable.

4.3. Compliance with Other Instruments. The Company is not in violation or default: (a) of any provision under its Current Articles, or (b) under any note, indenture, mortgage, lease, agreement, contract, purchase order or other instrument, document or agreement to which the Company is a party or by which it or any of its property is bound or affected, or (c) of any law, statute, ordinance, regulation, order, writ, injunction, decree, or judgment of any court or any governmental department or agency, domestic or foreign, which default, in any such case under subsections (a)-(c) above, would adversely affect the Company’s business, condition (financial or otherwise), affairs, operations or assets, or (d) no third party is in default under any agreement, contract or other instrument, document or agreement to which the Company is a party or by which it or any of its property is affected, or (e) the Company is not a party to or bound by any order, judgment, decree or award of any governmental authority, agency, court, tribunal or arbitrator.

4

4.4. Ownership of Shares.

4.4.1. Capitalization. The capitalization table attached hereto as Schedule 4.4.1 represents a capitalization of the Company on Fully Diluted Basis (the “Cap Table”), sets forth the complete and accurate number and class of shares held by each shareholder of the Company, and the complete and accurate total number of securities reserved, promised and granted options, warrants, and all other rights, promises or undertakings to subscribe for, purchase or acquire from the Company any capital of the Company immediately prior to and following a Closing on a Fully-Diluted Basis, including Ordinary Shares issued upon conversion of shareholders loans as set forth in Section 1.3 above and options to be issued to certain service providers in connection with their IPO-related services. No other person or entity owns or has rights to or has been promised to purchase from, or be issued or granted by, the Company any shares of the Company, any securities of the Company or any rights to purchase or be issued or granted shares or securities of the Company. All of the issued and outstanding share capital of the Company has been duly authorized, validly issued, fully paid-up and non-assessable. The Purchased Shares, the Warrants and the Agent Warrants, as well as Ordinary Shares originating from the exercise of the Warrants and Agent Warrants, when issued and allotted and paid for in accordance with this Agreement or the terms of respective Warrants, as the case may be, (i) will be duly authorized, validly issued, fully paid-up, non-assessable and free and clear of all liens, claims, charges, encumbrances, restrictions, rights, options to purchase, proxies, voting trust and other voting agreements, calls or commitments of any kind, (ii) will have the rights, preferences, privileges, and restrictions set forth in the Amended Articles; and duly registered in the name of the Investor in the Company’s shareholders register.

4.4.2. As of the date hereof, there are no outstanding options or other outstanding rights to purchase share capital of the Company, whether actually granted or promised by the Company (in writing, orally or otherwise) under the Company’s 2021 share option plan (the “Option Plan”). The Option Plan and the appointment of the 102 Trustee were filed with the Israeli Tax Authority (“ITA”) on 28 February, 2021.

4.5. Subsidiary. The Company does not own any of the issued and outstanding share capital of any other company or rights thereto, and is not a participant in any partnership, joint venture or other business association.

4.6. Directors, Officers. Schedule 4.6 contains a list of all directors and officers of the Company. Except as set forth in Schedule 4.6 and in the Amended Articles, the Company does not have any agreement, obligation or commitment with respect to the election of any individual or individuals to the Board. To the best of the Company’s knowledge, except as set forth in Schedule 4.6, there is no voting agreement or other arrangement among any of the Company’s shareholders. The Option Plan and all other agreements, commitments and understandings, whether written or oral, with respect to any compensation to be provided to any of the Company’s directors and officers have been provided to the Investor or its counsel.

4.7. Ownership of Assets. The Company has good and marketable title to all of its assets and except as set forth in Schedule 4.7(a) the Company does not own any assets in excess of US $100,000. Except as set forth in Schedule 4.7(b), the Company’s assets are not subject to any secured promissory note, mortgage, pledge, lien, security interest, conditional sale agreement, encumbrance or charge, and are sufficient for the conduct of the Company’s business as now conducted. The Company is in full compliance with the provisions of any secured promissory note, mortgage, pledge, lien, security interest, encumbrance or charge, including that certain promissory note entered between the Company and Bank Mizrahi Tefahot Ltd. on December 23, 2018. Except as set forth in Schedule 4.7(c), the Company does not currently lease or license any real property. The Company is not in default or in material breach of any provision of its leases.

5

4.8. Financial Statements; No undisclosed Liabilities.

4.8.1. The Company has furnished the Investor with its audited financial statements as of December 31, 2019, which are attached hereto as Schedule 4.8.1(a) and with the Company’s audited financial statements as of December 31, 2018, which are attached hereto as Schedule 4.8.1(b) (collectively, the “Financial Statements”). The Financial Statements are true and correct in all material respects, are in accordance with the books and records of the Company and have been prepared in accordance with Israeli generally accepted accounting principles consistently applied and fairly and accurately present (except as may be indicated in the notes thereto) in all material respects the financial position of the Company as of such date and the results of its operations for the period then ended.

4.8.2. Other than as set forth in Schedule 4.8.2 and other than the Company’s operating expenses in the ordinary course of business, since December 31, 2019 and until the Closing Date, there has not been:

4.8.2.1. any material change in the assets, liabilities, condition (financial or otherwise) or business of the Company;

4.8.2.2. any damage, destruction or loss, whether or not covered by insurance, materially and adversely affecting the assets, properties, conditions (financial or otherwise), operating results or business of the Company;

4.8.2.3. any waiver by the Company of a valuable right or of a material debt owed to it;

4.8.2.4. any material change or amendment to a material contract or material arrangement by which the Company or any of its assets or properties is bound or subject;

4.8.2.5. any material change in any compensation arrangement or agreement with any employee of the Company;

4.8.2.6. any loans made by the Company to its employees, officers, or directors other than travel advances made in the ordinary course of business;

4.8.2.7. any sale, transfer or lease of, except in the ordinary course of business, or mortgage or pledge of imposition of lien on, any of the Company’s assets;

4.8.2.8. any change in the accounting methods or accounting principles or practices employed by the Company;

4.8.2.9. any other event or condition of any character that would materially adversely affect the assets, properties, condition (financial or otherwise), operating results or business of the Company; or

4.9. Permits. The Company has all governmental permits, licenses, and any similar authority necessary or required under any law, regulation, rule or ordinance, for the conduct of its business as now being conducted or proposed to be conducted, and the Company is not in default under any of the same.

6

4.10. Intellectual Property.

4.10.1. For the purposes hereof, “Intellectual Property Rights” means any and all statutory and common law rights, in any country in the world, in any of the following: (i) patents and patent applications and equivalent rights in inventions (including all divisions, continuations, continuations-in-part, substitutions, reissues, reexaminations and extensions, and all foreign counterparts related to any of the foregoing), (ii) trademarks, service marks logos and trade names, including all registrations and applications for registrations thereof, (iii) copyrightable subject matter, software and databases, and all registrations thereof and applications therefor, (iv) trade secrets and confidential, technical and business information, and (v) URLs and Internet domain names, including registrations thereof and applications therefor; “Technology” means any technology, inventions (whether patentable or not), proprietary information, know how, technical data, computer software (including any source code, object code, firmware, development tools, files, records and data), user interfaces, content, graphics and other copyrightable works, designs, proprietary processes, algorithms, specifications, websites, URLs and Internet domain names, databases, customer lists and vendor lists, and any tangible embodiments of the foregoing; “Company Intellectual Property” means all Intellectual Property Rights and Technology that are owned or purported to be owned by the Company.

4.10.2. The Company owns as a sole owner, free and clear of any liens and restrictions and claims and third party rights, all of the Company Intellectual Property. Each of the Company’s registered Intellectual Property Rights is valid, enforceable and subsisting, and all required registration, maintenance and renewal fees related to any such registered Intellectual Property Rights, have been timely paid. No procedures have been commenced, are pending or, to the Company’s knowledge currently threatened in any jurisdiction, which could result in the cancellation of any issued patent, trademark or service xxxx, or the failure to issue of any patent, trademark or service xxxx application.

4.10.3. Except as set forth in Schedule 4.10.3, the Company has no outstanding options, licenses, or agreements of any kind relating to any Company Intellectual Property, nor is the Company bound by or a party to any options, licenses or agreements of any kind with respect to Intellectual Property Rights or Technology of any other person or entity (including, without limitation, any software or other material that is distributed as “free software”, “open source software” or under a similar licensing or distribution model).

4.10.4. The Company is not contractually obligated or under any liability to make any payments by way of royalties, fees or otherwise to any owner or licensor of, or other claimant to, any Intellectual Property Right or Technology, with respect to the use thereof or in connection with the conduct of its business as now conducted or as currently proposed to be conducted except as set forth in Schedule 4.10.4.

7

4.10.5. Each past and present employee, officer and consultant of the Company, and any other persons, in each case, who, either alone or in concert with others, developed, invented, discovered, derived, programmed or designed any products or Technology for the Company, or who has access to information about such products or Technology or other confidential or proprietary information of the Company, has executed and delivered to the Company a written proprietary information and invention assignment agreement, substantially in the applicable form made available to Investors or their counsel, effective and enforceable in the jurisdiction in which such employee, officer or consultant resides, that irrevocably assigns to the Company all Intellectual Property Rights associated with any such products or Technology and that appropriately protects the confidentiality of such information. To the Company’s knowledge, no current or former employees, officers or consultants are in violation of their respective proprietary information and invention assignment agreement. No current or former employee, officer or consultant owns or claims to have any rights in any Company Intellectual Property. The Company does not owe any compensation to any current or former employee, officer or consultant in connection with any Company Intellectual Property, including with respect to any patent that is based on an invention of any such employee, officer or consultant, and all such persons have executed irrevocable waivers with respect to the right to receive compensation in connection with “Service Inventions” under Section 134 of the Israeli Patent Law 1967 (and any other equivalent statute, if applicable). No current or former employee, officer or consultant was employed by or has performed services for, was operating under any grants from, or otherwise was subject to any restrictions or invention assignment obligations resulting from his relations with, any governmental authority, government-owned institution, military, university, college, other educational institution or research center, including as an employee, contractor, consultant, soldier or graduate student, during the time such person created or developed, or contributed to the creation or development of any Technology of the Company. It will not be necessary to utilize any inventions of any of the Company’s employees, officers or consultants (or people it currently intends to hire or engage with) made prior to or outside the scope of their employment by or engagement with the Company.

4.10.6. The Company has taken reasonable steps and security measures to protect the secrecy, confidentiality and value of Company Intellectual Property and to protect the status of and its rights in all of its trade secrets. The Company is not aware of acts or omissions by the officers, directors, shareholders, employees or consultants of the Company the result of which would compromise the secrecy, confidentiality or value of any Company Intellectual Property or the rights of the Company to register or enforce appropriate legal protection of any Company Intellectual Property. The Company is in compliance in all material respects with any contractual obligations to protect the trade secrets or confidential or proprietary information of third parties.

4.10.7. The Company has not received any communications, and there is no pending action, alleging that the Company has infringed, misappropriated or violated, or by conducting its business as currently proposed to be conducted, or any product made available by the Company, would infringe, misappropriate or violate, any Intellectual Property Rights of any other person or entity, nor does the Company currently have knowledge of any basis for any such allegation. The Company has not asserted or threatened any action against any third party with respect to infringement, misappropriation or other violation of any Intellectual Property Rights of the Company and the Company is not aware of any such infringement, misappropriation or other violation.

8

4.10.8. The Company has not licensed any of its Technology or Intellectual Property Rights to any person on an exclusive basis, nor has the Company entered into any covenant not to compete in any market, field or application, or geographical area or with any third party.

4.10.9. The Company has not (i) licensed any of the software included in any of its products or Company Intellectual Property in source code form to any third party, or (ii) entered into any escrow agreements with respect to any such software. No event has occurred, and no circumstances or conditions exist, that (with or without notice or lapse of time, or both) will, or would reasonably be expected to, result in the disclosure or delivery by Company of any source code included in any of its products or Company Intellectual Property, other than pursuant to agreements with consultants engaged in development activities for the Company in the ordinary course of business and who are subject to confidentiality obligations to the Company, and solely to the extent each such consultant is required to have access to the source code in the ordinary course of business for the purpose of performing the services for the Company.

4.10.10. The Company uses commercially reasonable efforts and has implemented commercially reasonable safeguards to detect the presence and prevent the inclusion of viruses, worms, Trojan horses and other infections or intentionally harmful routines in Company products.

4.11. Employees.

4.11.1. All employees, service providers and consultants of the Company have signed valid non-competition, assignment of invention and confidentiality undertakings toward the Company. The Company has no deferred compensation covering any of its officers or employees. The Company has materially complied with all applicable employment laws and agreements relating to employment, and complied with the proper withholding and remission to the proper tax and other authorities of all sums required to be withheld from employees under applicable laws. The Company has paid in full to all of its respective employees, wages, salaries, commissions, bonuses, benefits and other compensation due and payable to such employees and provided all contributions to pension or managers funds (including to disability insurance), as applicable, required by law or by any other arrangements between the Company and such employees, on or prior to the date hereof. There is no and has never been any labor dispute, strike or work stoppage against the Company, nor there were any threats in this regard. There are no activities or proceedings of any labor union or activities to organize the employees of the Company. All independent contractors and former independent contractors are and were rightly classified as independent contractors and would not reasonably be expected to be re-classified by the courts or any other authority as employees of the Company. The Section 14 Arrangement of the Severance Pay Law-1963 was properly applied in accordance with the terms of the general permits issued by the Israeli Labor Minister regarding all employees of the Company in accordance with their employment agreements, as required by the law and from their commencement date of employment.

4.11.2. None of the execution or delivery of this Agreement or any of the Transaction Documents, the performance of obligations hereunder and/or the consummation of the transaction hereunder will, individually or together or with the occurrence of some other event (whether contingent or otherwise), (i) result in any payment or benefit (including severance, unemployment compensation, golden parachute, bonus or otherwise) becoming due or payable, or required to be provided, to any current or former employee, director, or contractor, (ii) increase the amount or value of any benefit or compensation otherwise payable or required to be provided to any current or former employee, director or contractor, (iii) result in the acceleration of the time of payment, vesting or funding of any such benefit or compensation or (iv) result in the forgiveness in whole or in part of any outstanding loans made by the Company to any person.

9

4.12. Taxes. The Company has paid, or made adequate provision for the payment of, all taxes which have become due pursuant to income tax returns filed by it or pursuant to any assessment which has been received by it and all other taxes (without regard to whether a tax return is required or an assessment made) for which the Company is otherwise liable that are due and payable, and is not currently liable for any tax (whether income tax, capital gains tax, or otherwise). The Company has not had any tax deficiency proposed or assessed against it, and the Company has not executed any waiver of any statute of limitations on the assessment or collection of any tax or governmental charge. The Company has withheld or collected from each payment made to its employees the amount of all taxes required to be withheld or collected therefrom and has paid all such amounts to the appropriate taxing authorities when due.

4.13. Contracts. The Company is not party to, or bound by, any contract, agreement or commitment which may materially affect the assets, liabilities, condition or business of the Company, other than this Agreement, the schedules hereto and the contracts listed in Schedule 4.13 attached hereto (a “Contract”). All aforesaid Contracts are in full force and effect, are valid and binding on the Company and, to the best of Company’s Knowledge, on the other party or parties thereto. The Company has performed all obligations required to be performed by it under each such Contract in all material respects, and the Company is not in default under any of them, nor is the Company aware of any breach by any other party thereto. No party to any Contract has repudiated any provision thereof or terminated any Contract, and the Company has not received any notice that any other party or parties to any Contract intend to exercise any right of cancellation or termination thereof. True and correct copies of all such Contracts have been delivered to the Investor or its counsel.

4.14. Interested Party Transactions. Except as set forth in Schedule 4.14, there are no existing arrangements or proposed transactions, including any shareholder loans, between the Company and any officer, director, or holder of more than one percent (1%) of the share capital of the Company, or any subsidiary, affiliate or associate of any such person. The outstanding balance of shareholder loans, following the conversion of the loans set forth in Section 2.2.1.8 below, is as set forth in Schedule 4.14.

4.15. Legal proceedings. Except as set forth in Schedule 4.15 hereto, there is no action, suit, proceeding or investigation pending or to the Company’s Knowledge threatened against the Company, or any of the Company’s properties or against any of its officers, directors, or employees (in their capacity as such), or that the Company has or currently intends to initiate.

4.16. Governmental Gr

4.17. ants and Benefits. Except as set forth in Schedule 4.16 hereto, the Company has not applied for and has not received, any grants, incentives, investments, loans, benefits (including tax benefits), subsidies or allowance and applications therefor from any governmental or regulatory authority or any agency thereof, or from any foreign governmental or administrative agency, granted to the Company.

4.18. IPO. The Company’s shareholders are interested in making their holdings liquid and tradeable in the foreseeable future and accordingly, the Company, subject to this Agreement and all transactions contemplated herein, will use its best efforts to effect an initial public offering of its securities on a stock exchange (the “IPO”) within 12 months following the date hereof.

10

4.19. Disclosure. The Company has provided the Investors with all information that the Investors have requested and all information that the Company believes is reasonably necessary to enable the Investors to make their decision to enter into this Agreement. Neither this Agreement (including the Exhibits and/or Schedules hereto) nor any document, information, representation or certificate made or delivered in connection herewith by the Company, contains any untrue statement of a material fact or omits to state a material fact necessary to make the statements herein or therein not misleading, in view of the circumstances in which they were made. There is no material fact or information, relating to the business, prospects, condition (financial or otherwise), affairs, operations, or assets of the Company that the Company is aware of and that has not been set forth in this Agreement, the schedules and exhibits hereto or that otherwise has not been disclosed to the Investors by the Company.

5. REPRESENTATIONS AND WARRANTIES OF THE INVESTORS

Each of the Investor, severally and not jointly, hereby represents and warrants with respect to itself only, as follows:

5.1. Organization. The Investor is duly organized and validly existing under the laws of its jurisdiction of organization.

5.2. Authorization; Enforceability. The Investor has full power and authority to enter into and perform its obligations under this Agreement and any Transaction Document. The Transaction Documents, when executed and delivered by or on behalf of the Investor, shall constitute a valid and legally binding obligation of the Investor, legally enforceable against the Investor in accordance with its terms, subject to applicable bankruptcy, insolvency and other laws of general application affecting enforcement of creditors’ rights generally and laws relating to the availability of specific performance, injunctive relief or other equitable remedies. All corporate action on the part of the Investor, its shareholders, officers and directors necessary for the authorization, execution, delivery, and performance of all of the Investor’s obligations under the Transaction Documents, has or will be taken prior to the Closing.

5.3. No Conflict. The execution, delivery and performance of this Agreement by the Investor do not, and will not (i) conflict with or violate the Investor’s incorporation documents, or (ii) conflict with or violate any contract or law applicable to the Investor.

5.4. Experience. It is an experienced investor in securities of companies in development stage and acknowledges that it is able to fend for itself, can bear the economic risks of such investment in the Ordinary Shares and has such knowledge and experience in financial or business matters that it is capable of evaluating the merits and risks of this investment in the Company. Investor is purchasing the shares for its own account and is aware that the IPO may not go through.

6. CONDITIONS FOR CLOSING BY THE PARTIES

The obligation of the Investors to purchase the Purchased Shares and transfer the Investment Amount, and the obligations of the Company to issue and allot the Purchased Shares, the Warrants and the Agent Warrants, are subject to the fulfillment by the Company or the Investor, as the case may be, at or before the respective Closing, of the following conditions, any or all of which may be waived, in whole or in part, in writing, by the Investors or the Company, at their sole discretion (as applicable):

6.1. Representations and Warranties. The representations and warranties made by the Investors or the Company (as the case may be) in this Agreement shall have been true and correct when made and true and correct as of the Closing as if made on the Closing Date.

6.2. Performance. All covenants, agreements and conditions contained in the Agreement to be performed or complied with by the respective party on or prior to the Closing, shall have been performed or complied with in all respects.

11

6.3. Delivery of Documents; Closing Actions. All of the documents to be delivered by the Company pursuant to Section 2, shall be in forms attached hereto or in a form and substance reasonably satisfactory to the Investors and their counsel, and shall have been delivered to the Investors. All other actions and transactions set forth in Section 2.2 shall have been completed on or prior to the Closing.

7. AFFIRMATIVE COVENANTS BY THE COMPANY

7.1. Corporate Actions. The Company warrants to the Investor that promptly after the Closing and pursuant to the requirements of applicable law, the Company shall fulfill all corporate actions necessary, but not required prior to Closing, in connection with the authorization, execution, delivery, and performance of all of the Company’s obligations under this Agreement and all transactions contemplated herein, and for the authorization, issuance, and allotment of the Purchased Shares, including, inter alia, the filing of all required notices with the Israeli Registrar of Companies (with the Investor providing the Company with the documents required by the Israeli Registrar of Companies in order to register such transactions) and payment of all fees and taxes, if any, subject to the provision of all the required information by the Investor.

7.2. Use of Proceeds. The Company will use $500,000 of the net proceeds from issuance and sale of the Purchased Shares to fund the Company’s expenses related to consummation of the IPO. The Company will use the balance of the proceeds of the issuance and sale of the Purchased Shares for general working capital purposes.

8. PLACEMENT AGENT

8.1. In consideration for the Placement Agent services in connection with the Contemplated Transactions, the Company shall pay the Placement Agent, within 5 business days following receipt of funds herein, a fee equal to 5.0% of the Investment Amount actually received. In addition, the Company shall pay the Placement Agent, a fee equal to 5.0% of the amounts actually received by the Company (i) upon exercise of the Warrants, and (ii) upon exercise of the warrants to be issued, if so issued, by the Company to Aegis Capital under that certain engagement letter referenced in Section 2.2.1.10 above, all within 5 business days following the date on which such amounts were received by the Company. As additional compensation for Placement Agent services, at the Closing the Company shall issue to the Placement Agent or its designees an aggregate of 97,962 warrants to purchase up to 97,962 of the Company’s Ordinary Shares (collectively, the “Agent Warrants”), in the form attached hereto as Exhibit 8. The Agent Warrants shall be exercisable until the earlier of (i) the date of consummation of the IPO, or (ii) lapse of 5 year period following the Closing, at an exercise price per share equal to the PPS.

8.2. In addition to the fees set forth in Section 8.1 above, the Company shall pay an amount of US $20,000 plus VAT to an analyst appointed by the Agent for drafting of a business plan and investors’ presentations for the purposes of the IPO.

12

9. INDEMNIFICATION; SURVIVAL OF REPRESENTATIONS AND WARRANTIES; LIMITATION OF LIABILITY

9.1. The representations, warranties and covenants of the Company contained in or made pursuant to this Agreement shall survive the execution and delivery of this Agreement and Closing and shall in no way be affected by any investigation of the subject matter thereof made by or on behalf of the Investor. Other than with respect to fraudulent or willful misrepresentation by the Company, the representations and warranties of the Company contained in or made pursuant to this Agreement shall survive the execution and delivery of this Agreement and the Closing and shall expire at the earlier of: (i) an IPO, and (ii) 30 months after the Closing, except that the representations and warranties under Sections 4.1 (Organization), 4.2 (Authorization; Approvals), 4.3 (Compliance with Other Instruments) and 4.4 (Ownership of Shares) shall expire at the earlier of: (i) an IPO, and (ii) the lapse of the applicable statute of limitation. Notwithstanding the aforesaid: (i) no claim or claims for indemnification under this Section 9 shall be brought unless the aggregate amount of such claim(s) shall exceed US $50,000, provided that in case of a claim or claims in excess of the aforesaid threshold, the claim can be submitted for the entire amount (and shall be paid from the first US$); (ii) in no event shall the Company be liable for incidental, punitive or consequential damages of any kind; and (iii) no claim shall be brought or made after the applicable survival period. The limitations set forth in sub-sections (i) through (iii) above shall not apply with respect to claims based on fraudulent or willful misrepresentation.

9.2. Subject to the exclusions set forth therein, the remedies under Section 9.1 are the sole and exclusive remedies for any breach of any warranty or representation made by the Company hereunder.

10. MISCELLANEOUS

10.1. Preamble; exhibits. The preamble to this Agreement and all exhibits and schedules attached hereto form an integral part hereof.

10.2. Confidentiality. The provisions of that certain confidentiality agreement between the Parties hereto, dated March, 2021 (the “NDA”), shall apply to any and all information provided to the Company by the Investors, in relation to the transactions contemplated hereunder.

10.3. Further Assurances. Each of the parties hereto shall perform such further acts and execute such further documents as may reasonably be necessary to carry out and give full effect to the provisions of this Agreement and the intentions of the parties as reflected thereby.

10.4. Transfer; Successors and Assigns. The terms and conditions of this Agreement shall inure to the benefit of and be binding upon the respective successors and assigns of the parties. Nothing in this Agreement, express or implied, is intended to confer upon any party other than the parties hereto or their respective successors and assigns any rights, remedies, obligations, or liabilities under or by reason of this Agreement, except as expressly provided in this Agreement. This Agreement and all rights and obligations hereunder may not be assigned or transferred without the prior written consent of the other party.

10.5. Governing Law; Jurisdiction. This Agreement shall be governed by and construed according to the laws of the State of Israel, without regard to the conflict of laws provisions thereof. Any dispute arising under or in relation to this Agreement shall be resolved exclusively in the competent court in the District of Tel Aviv and each of the parties hereby irrevocably submits to the exclusive jurisdiction of such court.

10.6. Counterparts. This Agreement may be executed in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. This Agreement may also be executed and delivered by facsimile or as a PDF file and in two or more counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument.

10.7. Titles and Subtitles. The titles and subtitles used in this Agreement are used for convenience only and are not to be considered in construing or interpreting this Agreement.

10.8. Notices. All notices and other communications given or made pursuant to this Agreement will be in writing and will be deemed effectively given: (a) upon personal delivery to the party to be notified, (b) when sent by confirmed electronic mail or facsimile if sent during normal business hours at the place of the recipient of the recipient, and if not so confirmed, then on the next Business Day, (c) five (5) days after having been sent by registered or certified mail, return receipt requested, postage prepaid, or (d) two (2) days after deposit with a nationally recognized overnight courier, specifying next day delivery, with written verification of receipt. All communications will be sent to the respective parties at their address as set forth above. Notices by email to the Company shall be addressed to the attention of Mr. Israel Bar with a copy to Doron Afik, Esq., which copy shall not constitute notice. Notices by email to the Investors shall be addressed to the attention of Xxxx Xxxxxxxxx with copies to Gregori Irgo, Adv., which copies shall not constitute notice.

13

10.9. Amendments and Waivers. Any term of this Agreement may be amended and the observance of any term hereof may be waived (either prospectively or retroactively and either generally or in a particular instance) only with the written consent of the Company and the Investor.

10.10. Severability. The invalidity or unenforceability of any provision hereof shall in no way affect the validity or enforceability of any other provision.

10.11. Delays or Omissions. No delay or omission to exercise any right, power or remedy accruing to any party under this Agreement, upon any breach or default of any other party under this Agreement, shall impair any such right, power or remedy of such non-breaching or non-defaulting party nor shall it be construed to be a waiver of any such breach or default, or an acquiescence therein, or of or in any similar breach or default thereafter occurring; nor shall any waiver of any single breach or default be deemed a waiver of any other breach or default theretofore or thereafter occurring. Any waiver, permit, consent or approval of any kind or character on the part of any party of any breach or default under this Agreement, or any waiver on the part of any party of any provisions or conditions of this Agreement, must be in writing and shall be effective only to the extent specifically set forth in such writing. All remedies, either under this Agreement or by law or otherwise afforded to any party, shall be cumulative and not alternative.

10.12. Entire Agreement. This Agreement (including the Schedules and Exhibits hereto) constitutes the full and entire understanding and agreement between the parties with respect to the subject matter hereof, and any other written or oral agreement relating to the subject matter hereof existing between the parties.

** Remainder of page is intentionally left blank **

14