EX-10.1 2 d901596dex101.htm EX-10.1 Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has been...

Exhibit 10.1

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

LICENSE AND COLLABORATION AGREEMENT

This LICENSE AND COLLABORATION AGREEMENT (this “Agreement”) is made as of March 27, 2015 (the “Execution Date”), by and between Intrexon Corporation, a corporation organized and existing under the laws of Virginia, having its principal place of business at 00000 Xxxxxx Xxxxxxx Xxxxxxx, Xxxxxxxxxx, XX 00000, XXX (“Intrexon”), ARES TRADING Trading S.A., a corporation organized and existing under the laws of Switzerland, having offices at Xxxx Xxxxxxxxxxxx xx XxXxxxxxxxx, 0000 Xxxxxxx, Xxxxxxxxxxx (“ARES TRADING”), and ZIOPHARM Oncology, Inc., a corporation organized and existing under the laws of Delaware, having its principal place of business at One First Avenue, Xxxxxx Building 00, Xxxx Xxxx Xxxxx, Xxxxxx, XX 00000, XXX (“ZIOPHARM”). ARES TRADING, ZIOPHARM and Intrexon are referred to in this Agreement individually as a “Party” and collectively as the “Parties.”

RECITALS

WHEREAS, Intrexon has expertise in and owns or controls proprietary technology relating to genetically engineering cells to target and destroy cancer cells;

WHEREAS, ARES TRADING is a pharmaceutical company that develops and commercializes products in oncology, among other areas;

WHEREAS, Intrexon and ZIOPHARM are parties to that certain Exclusive Channel Partner Agreement, dated January 6, 2011, as amended (the “ZIOPHARM Agreement”), pursuant to which ZIOPHARM and Intrexon are developing and commercializing certain products for treating cancer in humans;

WHEREAS, Intrexon, ZIOPHARM and The University of Texas MD Xxxxxxxx Cancer Center (hereinafter “MD Xxxxxxxx”) entered into a license agreement including an exclusive sublicensing agreement through MD Xxxxxxxx for intellectual property developed at the University of Minnesota (hereinafter the “MD Xxxxxxxx Agreement”) dated January 13, 2015 and the parties to the MD Xxxxxxxx Agreement aim to allow them to create CAR-T cells by combining their respective technologies;

WHEREAS, Intrexon, ZIOPHARM and ARES TRADING desire to establish a collaboration for the research and development and, if successful, commercialization of pharmaceutical products for the treatment of cancer in humans, utilizing CAR-T therapeutic approaches, all under the terms and conditions set forth herein;

WHEREAS, Intrexon and ZIOPHARM have agreed to modify the terms of the ZIOPHARM Agreement to permit the formation of this collaboration and to provide ARES TRADING with access to Intrexon technologies, some of which are subject to the ZIOPHARM Agreement;

WHEREAS, Intrexon and ZIOPHARM shall include their respective rights within the collaboration under this Agreement with respect to CAR-T cells and their production acquired under the MD Xxxxxxxx Agreement; and

1

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

WHEREAS, ARES TRADING will obtain access to the technologies related to this Agreement through its collaboration with Intrexon and ZIOPHARM.

NOW, THEREFORE, in consideration of the foregoing premises and the mutual covenants contained herein, the receipt and sufficiency of which are hereby acknowledged, ARES TRADING, ZIOPHARM and Intrexon hereby agree as follows:

ARTICLE 1

DEFINITIONS

Unless the context otherwise requires, the terms in this Agreement with initial letters capitalized, shall have the meanings set forth below, or the meaning as designated in the indicated places throughout this Agreement.

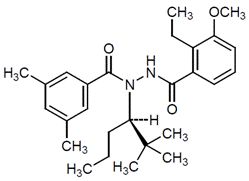

1.1 “Activator Ligand” or “AL” means a chemical entity selected and paired with a responsive gene construct which in the presence or absence of the chemical entity results in the expression of the protein encoded by such gene construct.

1.2 “Affiliate” means, with respect to a Party, any Person that controls, is controlled by, or is under common control with that Party. For the purpose of this definition, “control” (including, with correlative meaning, the terms “controlled by” and “under the common control”) means the actual power, either directly or indirectly through one or more intermediaries, to direct or cause the direction of the management and policies of such Person, whether by the ownership of more than fifty percent (50%) of the voting stocking of such Person, by contract or otherwise.

1.3 “Alliance Manager” is defined in Section 3.1.

1.4 “Allogeneic Cell Therapy” means [*****].

1.5 “Allogeneic Cell Therapy Criteria” means criteria that the Allogeneic Cell Therapy is required to meet, [*****].

1.6 [*****].

1.7 “Allogeneic Cell Therapy Research Program” is defined in Section 4.3(b).

1.8 “ARES TRADING Indemnitee” is defined in Section 13.1.

2

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

1.9 “ARES TRADING IP” means all ARES TRADING Patent Rights and ARES TRADING Know-How. ARES TRADING IP shall include ARES TRADING’s rights in any Joint IP.

1.10 “ARES TRADING Know-How” means the Know-How that is (a) developed by ARES TRADING pursuant to the Agreement or otherwise Controlled by ARES TRADING and incorporated into a Product or used in the Development of a Product or its method of use or manufacture and (b) reasonably necessary for the Development and Commercialization of Product. ARES TRADING Know-How shall include ARES TRADING’s interest in any Joint Know-How.

1.11 “ARES TRADING Patents” means the Patent Rights claiming ARES TRADING Know-How. ARES TRADING Patents shall include ARES TRADING Sole Patents and ARES TRADING’s interest in any Joint Patents.

1.12 “ARES TRADING Sole Patent” is defined in Section 9.2(c)(i).

1.13 “Calendar Year” means the period beginning on the 1st of January and ending on the 31st of December of the same year, provided however that (i) the first Calendar Year of the Term shall commence on the Effective Date and end on December 31, 2015, and (ii) the last Calendar Year of the Term shall commence on January 1 of the Calendar Year in which this Agreement terminates or expires and end on the date of termination or expiration of this Agreement.

1.14 “Calendar Quarter” means each three (3) month period commencing January 1, April 1, July 1 or October 1, provided however that (i) the first Calendar Quarter of the Term shall extend from the Effective Date to the end of the first full Calendar Quarter thereafter, and (ii) the last Calendar Quarter of the Term shall end upon the expiration of this Agreement.

1.15 “CEOs” is defined in Section 3.7.

1.16 “Chimeric Antigen Receptor” or “CAR” means [*****]. For the avoidance of doubt, a TCR, including a native or affinity modified alpha beta chain of the TCR receptor with or without a native or contrived modified intracellular domain is not included in the meaning of a CAR.

1.17 “Chimeric Antigen Receptor Alternative” or “CAR Alternative” means [*****].

3

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

1.18 “Chimeric Antigen Receptor T-Cell Product” means [*****].

1.19 “Claims” means all Third Party demands, claims, actions, proceedings and liability (whether criminal or civil, in contract, tort or otherwise) for losses, damages, reasonable legal costs and other reasonable expenses of any nature.

1.20 [*****].

1.21 “Clinical Trial” means a clinical trial in human subjects that has been approved or allowed by a Regulatory Authority and is designed to measure the safety and/or efficacy of a Product. Clinical Trials shall include Phase 1 Clinical Trials, Phase 2 Clinical Trials and Phase 3 Clinical Trials.

1.22 “Commercialization” means all activities directed to using, making or having made, manufacturing, marketing, holding or keeping (whether for disposal or otherwise) or otherwise disposing of, distributing, detailing offering for sale or selling a Product in the Field (as well as importing and exporting activities in connection therewith), all activities directed to obtaining Pricing Approvals, and all activities directed to Phase 4 Studies. “Commercialize” shall mean to perform the act of Commercialization.

1.23 “Commercially Reasonable Efforts” means: (a) where applied to carrying out specific tasks and obligations of a Party under this Agreement, expending reasonable, diligent, good faith efforts and resources to accomplish such task or obligation as such Party (on its own and/or acting through any of its Affiliates, sublicensees or subcontractors) would normally use to accomplish a similar task or obligation under similar circumstances; and (b) where applied to Development, manufacture or Commercialization of a Product, the use of reasonable, diligent, good faith efforts and resources, in an active and ongoing program, as normally used by such Party for a product discovered or identified internally by such Party, which product is at a similar stage in its development or product life and is of similar market potential, taking into account, without limitation, commercial, legal and regulatory factors, target product profiles, product labeling, past performance, the regulatory environment and competitive market conditions in the therapeutic area, safety and efficacy of the Product, the strength of its proprietary position and such other factors as such Party may reasonably consider, all based on conditions then prevailing. For clarity, Commercially Reasonable Efforts will not mean that a Party guarantees that it will actually accomplish the applicable task or objective.

4

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

1.24 “Committee” means the JSC, the IPC or any subcommittee as may be established under Section 3.2(vi), as applicable.

1.25 “Competitive Product” means a cell targeting an Out-of-Scope Target in the Field that, [*****], appears to be likely to offer [*****] compared with any Product being developed or commercialized by ARES TRADING under this Agreement against a tumor type that is a [*****] Indication for such Product in the Field or an Indication for which such Product is [*****].

1.26 “Competitive Program” is defined in Section 2.5(b).

1.27 “Confidential Information” of a Party means all proprietary Know-How, unpublished patent applications and other information and data of a financial, commercial, business, operational or technical nature that is: (a) disclosed by or on behalf of such Party or any of its Affiliates or otherwise made available to the other Party or any of its Affiliates, whether made available orally, in writing or in electronic form; or (b) learned by the other Party in the course of the collaboration under this Agreement, in each case including information comprising or relating to concepts, discoveries, inventions, data, designs or formulae in relation to this Agreement. For clarity, information that is developed under this Agreement shall be Confidential Information of the Party “owning” the information even if the information has been generated by the other Party and is thus not “disclosed” by one Party to the other Party.

1.28 “Confidentiality Agreement” is defined in Section 14.8.

1.29 “Control” or “Controlled” means, with respect to any Know-How, Patent Rights or other intellectual property rights, that a Party has the legal authority or right (whether by ownership, license or otherwise) to grant a license, sublicense, access or right to use (as applicable) under such Know-How, Patent Rights, or other intellectual property rights to the other Party on the terms and conditions set forth herein, in each case without breaching the terms of any agreement with a Third Party.

1.30 “Develop” or “Development” means all non-clinical, preclinical and post-IND filing development activities for any Product in the Field, including all clinical testing and studies of any Product, toxicology studies, distribution of Product for use in clinical trials (including placebos and comparators), statistical analyses, and the preparation, filing and prosecution of any Marketing Authorization Application for any Product, as well as all regulatory affairs related to any of the foregoing, in each case following the JSC’s determination to file an IND for a Product pursuant to Section 4.6. Except as otherwise foreseen in this Agreement, Development shall not include the research, design, modification or genetic engineering of Products or any development activities specified in a Research Plan.

1.31 “Development Plan” is defined in Section 5.2.

5

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

1.32 “Disclosing Party” is defined in Section 10.1(a).

1.33 “Divest” means, as it relates to a Competitive Program: (i) the sale of all right, title and interest in such Competitive Program, including all technology, intellectual property and other assets relating solely thereto, to a Third Party, without the retention or reservation of any rights, license or interest (other than solely an economic interest) by the selling entity or its Affiliates; or (ii) the complete termination and/or shut-down of such Competitive Program such that no technology, intellectual property or other asset solely relating thereto is used by the terminating entity or its Affiliates.

1.34 “Dollar” means the U.S. dollar, and “$” shall be interpreted accordingly.

1.35 “Effective Date” is defined in Section 14.1.

1.36 “EMA” means the European Medicines Agency or any successor entity thereto.

1.37 “Exclusive Activator Ligand” or “EAL” means an Activator Ligand which ARES TRADING requests Intrexon to develop for exclusive ARES TRADING use.

1.38 “Exploit” means (a) the research, (b) all non-clinical, preclinical and post-IND filing development activities for any product in the Field, including all clinical testing and studies of any product, toxicology studies, distribution of product for use in clinical trials (including placebos and comparators), statistical analyses, and the preparation, filing and prosecution of any marketing authorization application for any product, as well as all regulatory affairs related to any of the foregoing; and (c) all activities directed to using, making or having made, manufacturing, marketing, holding or keeping (whether for disposal or otherwise) or otherwise disposing of, distributing, detailing offering for sale or selling a product in the Field (as well as importing and exporting activities in connection therewith), all activities directed to obtaining Pricing Approvals, and all activities directed to Phase 4 Studies; all of (a), (b) and (c) with respect to Out-of-Scope Products in each case not inconsistent with the license granted herein under Article 2.

1.39 “FDA” means the United States Food and Drug Administration or any successor entity thereto.

1.40 “Field” means the prophylactic, therapeutic, palliative or diagnostic use for cancer in humans.

1.41 “First Commercial Sale” means, with respect to any Product in any country or jurisdiction in the Territory, the first commercial transfer or disposition for value of such Product to a Third Party by ARES TRADING, an Affiliate of ARES TRADING or a sublicensee in such country or jurisdiction after the Regulatory Approvals have been obtained for such Product in such country or jurisdiction.

6

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

1.42 “Government Authority” means any federal, state, national, state, provincial or local government, or political subdivision thereof, or any multinational organization or any authority, agency or commission entitled to exercise any administrative, executive, judicial, legislative, police, regulatory or taxing authority or power, or any court or tribunal (or any department, bureau or division thereof, or any governmental arbitrator or arbitral body).

1.43 “IFRS” means the International Financial Reporting Standards, the set of accounting standards and interpretations and the framework in force on the Effective Date and adopted by the European Union as issued by the International Accounting Standards Board (IASB) and the International Financial Reporting Interpretations Committee (IFRIC), as such accounting standards may be amended from time to time.

1.44 “IND” means any investigational new drug application, clinical trial application, clinical trial exemption or similar or equivalent application or submission for approval to conduct human clinical investigations filed with or submitted to a Regulatory Authority in conformance with the requirements of such Regulatory Authority.

1.45 “Indemnified Party” is defined in Section 13.3.

1.46 “Indemnifying Party” is defined in Section 13.3.

1.47 “Indication” means a generally acknowledged disease or condition, a significant manifestation of a disease or condition, or symptoms associated with a disease or condition or a risk for a disease or condition. For the avoidance of doubt, all variants of a single disease or condition (e.g., variants of colon cancer or variants of prostate cancer), whether classified by severity or otherwise, shall be treated as the same Indication for purposes of this Agreement.

1.48 “Initiation” means, with respect to a clinical trial of a Product, the first dosing of the [*****] human subject for such Clinical Trial.

1.49 “Intrexon Indemnitee” is defined in Section 13.2.

1.50 “Intrexon IP” means all Intrexon Patents and Intrexon Know-How. Intrexon IP shall include Intrexon’s rights in any Joint IP.

1.51 “Intrexon Know-How” means the Know-How and Intrexon Platform Technology that are (a) Controlled by Intrexon as of the Effective Date or during the Term (including Know How and Intrexon Platform Technology developed by Intrexon pursuant to this Agreement) and (b) reasonably necessary or useful for the Development and/or Commercialization of Product in the Field. “Intrexon Know-How” shall include Intrexon’s interest in any Joint Know-How.

1.52 “Intrexon Materials” means the genetic code and associated gene constructs used alone or in combination with other proprietary reagents including but not limited to plasmid vectors, virus stocks, nucleases, cells and cell lines in each case that are reasonably required or provided to MERCK.

7

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

1.53 “Intrexon Patents” means the Patent Rights that are claiming Intrexon Know-How that are (a) Controlled by Intrexon as of the Effective Date or during the Term and (b) reasonably necessary or useful for the Development and/or Commercialization of Product in the Field. Intrexon Patents shall include Intrexon Sole Patents and Intrexon’s interest in any Joint Patents.

1.54 “Intrexon Platform Technology” means Intrexon’s platform of research tools and technology necessary for Intrexon to perform its tasks directed towards the design, identification, culturing, and/or production of genetically modified cells consistent with this Agreement, including without limitation the technology embodied in the Intrexon Materials and the Intrexon Patents, and specifically including without limitation the following of Intrexon’s platform areas and capabilities: (1) UltraVector®, (2) LEAP®, (3) DNA and RNA MOD engineering, (4) protein engineering, (5) transcription control chemistry, (6) genome engineering, (7) cell system engineering, (8) Endometrial Regenerative Cells, (9) the RheoSwitch® technology and RheoSwitch Therapeutic System®, and (10) MD Xxxxxxxx XX Technologies.

1.55 “Intrexon Program” means a research program initiated under Section 4.5 of this Agreement for Out-of-Scope Products.

1.56 “Intrexon Program Option” means ARES TRADING’s right as set forth in Section 4.5 of this Agreement.

1.57 “Intrexon Program Option Payment” means the payment upon exercise of the Intrexon Program Option as set forth in Section 4.5 and 8.2 (c) of this Agreement.

1.58 “Intrexon Sole Patent” is defined in Section 9.2(a)(i).

1.59 “Invention” shall mean any process, method, composition of matter, article of manufacture, discovery or finding, patentable or otherwise, that is invented as a result of a Party exercising its rights or carrying out its obligations under this Agreement, including all rights, title and interest in and to the intellectual property rights therein.

1.60 “IP Committee” or “IPC” means the committee formed in accordance with Section 3.3.

1.61 “Joint IP” is defined in Section 9.1.

1.62 “Joint Know-How” is defined in Section 9.1.

1.63 “Joint Patents” is defined in Section 9.1.

1.64 “Joint Steering Committee” or “JSC” is defined in Section 3.2.

1.65 “Know-How” means any information and materials, including discoveries, improvements, modifications, processes, methods, protocols, formulas, data, inventions, know-how and trade secrets, patentable or otherwise, but excluding any Patent Rights.

8

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

1.66 “Law” means any federal, state, local, foreign or multinational law, statute, standard, ordinance, code, rule, regulation, resolution or promulgation, or any order by any Government Authority, or any license, franchise, permit or similar right granted under any of the foregoing, or any similar provision having the force or effect of law.

1.67 “MAA” or “Marketing Authorization Application” means an application to the appropriate Regulatory Authority for approval to market a Product (but excluding Pricing Approval) in the Field in any particular jurisdiction and all amendments and supplements thereto.

1.68 “MD Xxxxxxxx” is defined in the preamble.

1.69 “MD Xxxxxxxx Agreement” is defined in the preamble.

1.70 “MD Xxxxxxxx XX Technologies” means the rights and licenses licensed to Intrexon or ZIOPHARM under the MD Xxxxxxxx Agreement.

1.71 “MD Xxxxxxxx Product” is defined in Section 4.6.

1.72 “Net Sales” means, with respect to any Product, the gross amount invoiced by ARES TRADING or its Affiliate or sublicensee for sales of such Product to independent or unaffiliated Third Party purchasers less the following deductions, with respect to such sales to the extent that such amounts are either included in the billing as a line item as part of the gross amount invoiced, or otherwise documented in accordance with IFRS to be specifically attributable to actual sales of such Product,:

(a) trade discounts, including trade, cash and quantity discounts or rebates, credits or refunds (including inventory management fees, discounts or credits);

(b) allowances or credits actually granted upon claims, returns or rejections of products, including recalls, regardless of the party requesting such recall;

(c) bad debts or provisions for bad debts, provided that if any bad debt is subsequently collected, it shall be added to Net Sales;

(d) charges included in the gross sales price for freight, insurance, transportation, postage, handling and any other charges relating to the sale, transportation, delivery or return of such Product;

(e) customs duties, sales, excise and use taxes and any other governmental charges (including value added tax) actually paid in connection with the transportation, distribution, use or sale of such Product (but excluding what is commonly known as income taxes);

9

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

(f) rebates and chargebacks or retroactive price reductions made to federal, state or local governments (or their agencies), or any Third Party payor, administrator or contractor, including managed health organizations; and

(g) commissions related to import, distribution or promotion of the Product paid to Third Parties (specifically excluding any commissions paid to sales personnel, sales representatives and sales agents who are employees or consultants of the selling Party or its Affiliates or any sublicensees).

For the avoidance of doubt, if a single item falls into more than one of the categories set forth in clauses above, such item may not be deducted more than once.

Sales between ARES TRADING and its Affiliates and sublicensees shall be disregarded for purposes of calculating Net Sales except if such purchaser is an end user.

In the case of any pharmaceutical composition, branded or generic, containing a Product in combination with any other clinically active ingredient(s) that is not a Product, whether packaged together or in the same therapeutic formulation, in any country, Net Sales for such combination product in such country shall be calculated as follows:

If a Product under this Agreement is sold in form of a Combination Product, then Net Sales for such Combination Product shall be determined on a country-by-country basis by mutual agreement of the Parties in good faith taking into account the respective market prices of all components described in the single package insert or equivalent (a “Combination Product”). In case of disagreement, an independent expert agreed upon by both Parties or, failing such agreement, designated by the International Chamber of Commerce, shall determine such relative value contributions and such determination shall be final and binding upon the Parties.

In the event a Product is “bundled” for sale together with one or more other products in a country (a ‘“Product Bundle”), then Net Sales for such Product shall be determined on a country-by-country basis by mutual agreement of the Parties in good faith taking into account the relative value contributions of the Product and the other products in the Product Bundle, as reflected in their individual sales prices. In case of disagreement, an independent expert agreed upon by both Parties or, failing such agreement, the International Chamber of Commerce shall determine such relative value contributions and such determination shall be final and binding upon the Parties.

For clarification, sale of Products by ARES TRADING, its Affiliates or sublicensee to another of these entities for resale by such entity to a Third Party shall not be deemed a sale for purposes of this definition of “Net Sales”. Further, transfers or dispositions of the Products:

| (i) | in connection with patient assistance programs, |

| (ii) | for charitable or promotional purposes, |

| (iii) | for preclinical, clinical, regulatory or governmental purposes or under so-called “named patient” or other limited access programs, or |

10

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

| (iv) | for use in any tests or any other pre- and post-approval studies reasonably necessary to comply with any Law, regulation or request by a Regulatory Authority shall not, in each case, be deemed sales of such Products for purposes of this definition of “Net Sales.”. For clarification, any post-approval study materials shown as Net Sales by ARES TRADING in its external reporting shall be deemed as Net Sales. |

1.73 “Out-of-Scope Product(s)” shall have the meaning as set forth in Section 4.5(a).

1.74 “Out-of-Scope Target” shall have the meaning set forth in Section 4.5 (a).

1.75 “Patent Rights” means all patents and patent applications (which for the purpose of this Agreement shall be deemed to include certificates of invention and applications for certificates of invention), including all divisionals, continuations, substitutions, continuations-in-part, re-examinations, reissues, additions, renewals, revalidations, extensions, registrations, pediatric exclusivity periods and supplemental protection certificates and the like of any such patents and patent applications, and any and all foreign equivalents of the foregoing.

1.76 “Person” means any individual, partnership, limited liability company, firm, corporation, association, trust, unincorporated organization or other entity.

1.77 “Pharmacovigilance Agreement” is defined in Section 5.7.

1.78 “Phase 1 Clinical Trial” means a Clinical Trial in which the Product is administered to human subjects with the primary purpose of determining safety, metabolism, and pharmacokinetic and pharmacodynamic properties of the Product, and which is consistent with 21 U.S. CFR § 312.21(a) or any other applicable Laws.

1.79 “Phase 2 Clinical Trial” means a Clinical Trial that would satisfy the requirements of 21 U.S. CFR § 312.21(b) or any other applicable Laws.

1.80 “Phase 3 Clinical Trial” shall mean a controlled or uncontrolled human clinical trial of a Product that would satisfy the requirements of 21 CFR 312.21(c), regardless of whether such trial is referred to as a “phase 3 clinical trial” in the Development Plan.

1.81 “Phase 4 Study” means any study or data collection effort in respect to any Product for a particular Indication that is initiated after receipt of Regulatory Approval for such Product for such Indication.

1.82 “Pricing Approval” means such mandatory governmental approval, agreement, determination or decision establishing prices for the Product that can be charged and/or reimbursed in regulatory jurisdictions where the applicable Governmental Authorities approve or determine the price and/or reimbursement of pharmaceutical products.

1.83 “Product” means (a) any pharmaceutical product containing a Chimeric Antigen Receptor T-Cell Product developed by Intrexon under a Research Program for which the JSC determines pursuant to Section 4.6 to file an IND or under a research program under Section 4.5 for which ARES TRADING has exercised the Intrexon Program Option or (b) any pharmaceutical product containing a Chimeric Antigen Receptor T-Cell Product developed by or on behalf of ARES TRADING that is a derivative of or is otherwise developed from or based upon a Chimeric Antigen Receptor T-Cell Product described in clause (a).

11

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

1.84 “Product Infringement” is defined in Section 9.3(a).

1.85 “Product Marks” has the meaning set forth in Section 9.4.

1.86 “Program Initiation Payment” means each payment under Section 8.2(b).

1.87 “Product Specific Invention” is defined in Section 9.3(c).

1.88 “Receiving Party” is defined in Section 10.1(a).

1.89 “Regulatory Approval” means all approvals, including Pricing Approvals, necessary for the commercial sale of a Product in the Field in a given country or regulatory jurisdiction.

1.90 “Regulatory Authority” means any applicable Government Authority responsible for granting Regulatory Approvals for Products, including the FDA, the EMA and any corresponding national or regional regulatory authorities.

1.91 “Regulatory Materials” means any regulatory application, submission, notification, communication, correspondence, registration and other filings made to, received from or otherwise conducted with a Regulatory Authority in connection with the Development, manufacture, marketing, sale or other Commercialization of a Product in the Field in a particular country or jurisdiction. “Regulatory Materials” includes any IND, Marketing Approval Application and Regulatory Approval.

1.92 “Remainder” is defined in Section 9.3(f).

1.93 “Remedial Action” is defined in Section 5.9.

1.94 “Research Phase” means for each Product the period starting with the establishment of a Research Program and up to but excluding the IND filing for such Product under the respective Research Plan.

1.95 “Research Plan” is defined in Section 4.1.

1.96 “Research Program” is defined in Section 4.1.

1.97 “Research Program Payment” is defined in Section 8.2(a).

1.98 “Royalty Term” has the meaning set forth in Section 8.6(b).

12

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

1.99 “Strategic IP Plan” means, for each Research Plan and for the Allogeneic Cell Therapy Program, the plan mutually agreed between the Parties that sets out the overall strategy that the Parties intend to follow for the protection by means of Patent Rights generated under this Agreement and such further Patent Rights as the Parties may agree on as part of such Strategic IP Plan. The Strategic IP Plan for each Research Plan and the Allogeneic Cell Therapy Program shall be established, agreed, updated, revised and executed as set out in Section 3.3.

1.100 “Supply Agreement” means a Clinical Supply Agreement or a Commercial Supply Agreement.

1.101 “Target” means a unique molecular species or combination thereof (or naturally occurring allelic variant, glycosylation variant, or mutant thereof,) that (a) is chemically distinct from other molecules, (b) is a human peptide, protein, polysaccharide or lipid, and (c) wherein a binding entity derives recognized therapeutic value from binding such molecular species.

1.102 “Target Information Package” shall have the meaning as set forth in Section 4.3(a).

1.103 “Tax” or “Taxes” means any federal, state, local or foreign income, gross receipts, license, payroll, employment, excise, severance, stamp, occupation, premium, windfall profits, environmental, customs duties, capital stock, franchise, profits, withholding, social security, unemployment, disability, real property, personal property, sales, use, transfer, registration, value added, alternative or add-on minimum, estimated, or other tax of any kind whatsoever, including any interest, penalty, or addition thereto, whether disputed or not.

1.104 “TCR” means T-cell receptor complex.

1.105 “Term” is defined in Section 11.1.

1.106 “Territory” means all countries of the world.

1.107 “Third Party” means any Person other than a Party or an Affiliate of a Party.

1.108 “Third Party License Agreement” means any agreement entered into after the Effective Date with a Third Party, or any amendment or supplement thereto, whereby royalties, fees or other payments are to be made to such Third Party in connection with the grant of rights under Patent Rights Controlled by a Third Party in a country, which Patent Rights are necessary to Develop, manufacture, have made, import, export, use or Commercialize the Product. For clarity, if an option under an already existing agreement with a Third Party is exercised and with such option, additional payments are due for using the “opt-in intellectual property”, such option exercise shall be deemed an “agreement entered into after the Effective Date with a Third Party” as foreseen in this definition and payments for the “opt-in intellectual property” shall be considered deductible in accordance with the terms of this Agreement.

1.109 “United States” or “US” means the United States of America including its territories and possessions.

13

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

1.110 “Valid Claim” means: (a) a claim of an issued and unexpired patent (as may be extended through supplementary protection certificate or patent term extension or the like) that has not been revoked, held invalid or unenforceable by a patent office, court or other governmental agency of competent jurisdiction in a final and non-appealable judgment (or judgment from which no appeal was taken within the allowable time period) and which claim has not been disclaimed, denied or admitted to be invalid or unenforceable through reissue, re-examination or disclaimer or otherwise; or (b) a pending claim of an unissued patent application, which application has not been pending for more than seven (7) years since its earliest claimed priority date, provided that such seven (7)-year period shall be tolled for the duration of any proceeding (e.g., an opposition or interference proceeding) with respect to such patent application.

1.111 Interpretation. In this Agreement, unless otherwise specified:

(a) “includes” and “including” shall mean respectively includes and including without limitation;

(b) words denoting the singular shall include the plural and vice versa and words denoting any gender shall include all genders, and the word “or” is used in the inclusive sense (and/or);

(c) words such as “herein”, “hereof”, and “hereunder” refer to this Agreement as a whole and not merely to the particular provision in which such words appear; and

(d) the Exhibits and other attachments form part of the operative provision of this Agreement and references to this Agreement shall include references to the Exhibits and attachments.

ARTICLE 2

LICENSES

2.1 Licenses to ARES TRADING Under Intrexon IP. Subject to the terms and conditions of this Agreement, Intrexon and Ziopharm, as applicable, hereby grant to ARES TRADING an exclusive (even as to Intrexon and Ziopharm except as provided in Section 2.3(a) and 2.3(b) below), royalty-bearing, sub-licensable (solely as provided in Section 2.2) license, under the Intrexon IP in the Territory in the Field,

(a) to generate and test Chimeric Antigen Receptor T-Cell Products solely for the Development, Regulatory Approval and Commercialization of Products containing such Chimeric Antigen Receptor T-Cell Products pursuant to the licenses granted in Sections 2.1(b) and (c);

(b) to Develop and Commercialize Products in the Field in the Territory, provided that such Products are not Out-of-Scope Products pursuant to Section 4.5 where ARES TRADING has not exercised its Option according to Section 4.5(e); and

14

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

(c) to Commercialize the Chimeric Antigen Receptor for Products.

For clarity, the foregoing license does not include the right to practice the Intrexon IP to generate and test Chimeric Antigen Receptor T-Cell Products other than as foreseen in Section 2.1 (a).

2.2 Sublicense Rights. Subject to the terms and conditions of this Agreement:

(a) ARES TRADING may exercise its rights and perform its obligations under this Agreement by itself or through the engagement of any of its Affiliates without the prior written consent of Intrexon.

(b) ARES TRADING may sublicense the rights granted to it under Section 2.1 (a), (b), and (c) to one (1) or more Third Parties without the prior written consent of Intrexon. Subject to Sections 2.2(c) and 14.15, ARES TRADING may subcontract to Third Parties the performance of tasks and obligations with respect to the Development and manufacture of any Product as ARES TRADING deems appropriate, and grant a limited sublicense to such Third Parties solely for the purpose of performing such tasks and obligations, without the prior written consent of Intrexon.

(c) ARES TRADING shall remain responsible for all of its obligations under this Agreement that have been delegated, subcontracted or sublicensed to any of its Affiliates, sublicensees or subcontractors.

2.3 Intrexon’s Retained Rights; Licenses to Intrexon.

(a) Intrexon’s Retained Rights. Intrexon and its Affiliates hereby retain the right under the Intrexon IP to: (i) practice the Intrexon IP to exercise its rights and perform its obligations under this Agreement; (ii) conduct research related to the Intrexon Platform Technology, including the conduct of the Allogeneic Cell Therapy Research Program and (iii) practice and license Intrexon IP outside the scope of the licenses granted to ARES TRADING under Section 2.1, including to develop products for the purpose of obtaining regulatory approval outside the Field, to make and have made products for use outside the Field, and to use, import, export, offer for sale and sell products outside the Field; in each case of the foregoing, subject to and without prejudice to Section 2.5.

(b) License to Intrexon under ARES TRADING IP. Subject to the terms and conditions of this Agreement, ARES TRADING hereby grants to Intrexon a fully paid, non-exclusive, worldwide license under the ARES TRADING IP (i) to conduct Intrexon’s obligations under the Research Plans and (ii) to comply with all other obligations of Intrexon under this Agreement.

2.4 No Implied Licenses; Negative Covenant. Except as set forth herein, no Party shall acquire any license or other intellectual property interest, by implication or otherwise, under any trademarks, patents or patent applications of any other Party. For clarity, the license granted to a Party under any particular Patent Rights or Know-How Controlled by another Party

15

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

shall confer exclusivity to the Party obtaining such license only to the extent the Party granting such license Controls the exclusive rights to such Patent Rights or Know-How. Each Party shall not, and shall not permit any of its Affiliates or sublicensees to, practice any Patent Rights or Know-How licensed to it by another Party outside the scope of the license granted to it under this Agreement.

2.5 Exclusivity.

(a) Obligation.

(i) Intrexon and ZIOPHARM. During the Term and in the Field, subject to Section 2.5(b), neither Intrexon nor ZIOPHARM shall, directly or indirectly (excluding MD Xxxxxxxx work outside of the MD Xxxxxxxx Agreement), clinically develop or commercialize any CAR or Chimeric Antigen Receptor T-Cell Products other than under a Research Program, or grant any Third Party the right to research, develop or commercialize any CAR or Chimeric Antigen Receptor T-Cell Products, other than pursuant to a Research Program as foreseen under Section 14.15, or, in the case of Intrexon, pursuant to its rights of independent development in Section 4.5. In addition, neither Intrexon nor ZIOPHARM shall, directly or indirectly, clinically develop or commercialize any CAR or Chimeric Antigen Receptor T-Cell Products against a Target in animal health.

(ii) ARES TRADING. If ARES TRADING fails to exercise its Intrexon Program Option under Section 4.5(e), ARES TRADING shall not directly or indirectly, clinically develop or commercialize any Chimeric Antigen Receptor T-Cell Product against such Out-of-Scope Target under this Agreement.

(b) Change of Control.

(i) If Intrexon or ZIOPHARM (the “Acquiring Party”) acquires a Third Party that, as of the effective date of such acquisition, is engaged, directly or indirectly, in any activities that, if carried out by the Acquiring Party would cause such Acquiring Party to breach its exclusivity obligations set forth in Section 2.5(a) above (such activities, a “Competitive Program”), then the Competitive Program and the further development and commercialization of products included in such Competitive Program shall not be a breach of Section 2.5(a) so long as within (30) days after the closing of such acquisition, the Acquiring Party notifies the other Parties, in writing, (1) of such event, describing in reasonable detail, to the extent permitted by applicable Law and without disclosing any proprietary information or otherwise breaching any applicable contractual restrictions, the nature of any such Competitive Program, including the stage of clinical development or commercialization of the products in such program, and (2) of its decision, at the Acquiring Party’s sole discretion, to either (A) Divest such Competitive Program within twelve (12) months of the date of such notice or (B) to include all products being clinically developed or commercialized under such Competitive Program as Out-of-Scope Products under this Agreement. Such Out-of-Scope Products shall be offered to ARES TRADING as set forth in Section 4.5 (a) as if they were Targets to be included in the collaboration if their status is prior to the status set forth in Section 4.5 (c) of the Intrexon

16

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

Program Option. If such Out-of-Scope Product is already beyond the Intrexon Program Option exercise timepoint, then ARES TRADING shall at the time of the decision under this 2.5 (b) (i) (2) (B) be granted the option as foreseen under Section 4.5 (c) for Out-of-Scope Products. The further rights and obligations as set forth in Section 4.5 shall apply to such Out-of-Scope Products. After any election under clause (A) of the preceding sentence, the Acquiring Party shall take appropriate measures to keep separate any information and personnel related to such Competitive Program in the manner contemplated in Section 2.5(b)(ii). If the Acquiring Party elects to Divest such Competitive Program but fails to do so within such twelve (12)-month period, then all Competitive Program products that are not Divested by the end of such twelve (12)-month period and then being clinically developed or commercialized under such Competitive Program shall be handled as set forth in this Section 2.5 (b) (i) (2) (B) above.

(ii) If Intrexon, ZIOPHARM or ARES TRADING (the “Acquired Party”) merges or consolidates with or is acquired by a Third Party and if such Third Party, as of the effective date of such transaction or thereafter, is engaged, directly or indirectly, in a Competitive Program, then Section 2.5(a) shall not apply to or otherwise restrict the conduct of such Person or its affiliates (except for the Acquired Party or its Affiliates existing prior to the transaction) with respect to the Competitive Program, including the further development and commercialization of products included in such Competitive Program, so long as: (A) such Competitive Program does not use any intellectual property of the Acquired Party, (B) such Person and its affiliates (other than the Acquired Party and its Affiliates existing prior to such transaction) establish and enforce internal processes, policies, procedures and systems to strictly segregate information relating to any such Competitive Program from any information related to the Research Programs or any Products and (C) no personnel who were employees or consultants of the Acquired Party or its Affiliates at any time prior to or after the transaction and are or were involved in performing any Research Program-related activities shall conduct any activities under such Competitive Program.

2.6 ZIOPHARM Acknowledgment. ZIOPHARM acknowledges and agrees that the license granted by Intrexon to ARES TRADING hereunder may include certain intellectual property that was licensed to ZIOPHARM under the ZIOPHARM Agreement. ZIOPHARM further acknowledges and agrees that, to the extent any such licensing has occurred, ZIOPHARM consents to the licensing of such intellectual property to ARES TRADING in accordance with the terms and scope of this Agreement.

ARTICLE 3

GOVERNANCE

3.1 Alliance Managers. Within thirty (30) days following the Effective Date, each of ARES TRADING and Intrexon shall appoint (and notify the other Party of the identity of) a representative to act as its alliance manager under this Agreement (“Alliance Manager”). The Alliance Managers shall serve as the primary contact points between the Parties and shall be primarily responsible for facilitating the flow of information, interaction and collaboration between the Parties. Each of Intrexon and ARES TRADING may replace its respective Alliance Manager on written notice to the other Party.

17

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

3.2 Joint Steering Committee. ARES TRADING and Intrexon shall establish a joint steering committee (the “Joint Steering Committee” or the “JSC”), composed of each such Party’s Alliance Manager and two (2) senior executives of each such Party. The JSC shall during the Research Phase: (i) oversee the Research Plans in the Field in the Territory; (ii) review and approve each Research Plan and each amendment to a Research Plan; (iii) determine the information to be included in the Target Information Package; (iv) approve each Chimeric Antigen Receptor T-Cell Product developed by Intrexon under a Research Plan for IND filing; (v) review each Development Plan up to (but excluding) IND filing; (vi) establish joint subcommittees as appropriate; (vii) discuss Intrexon Programs and receive information and notices with regard to Intrexon Programs, and (viii) consider and act upon such other matters as specified in this Agreement. For clarity, after the Research Phase, ARES TRADING shall be solely responsible for the further Development of Product and shall make decisions at its sole discretion.

3.3 Intellectual Property Committee. Within thirty (30) days after the Effective Date, ARES TRADING and Intrexon will establish and convene an intellectual property committee (the “IP Committee” or the “IPC”) to evaluate intellectual property issues in connection with the Research Programs and other activities under this Agreement and to provide guidance to the JSC on any such issues. The IPC will be composed of at least one (1) patent attorney from each of ARES TRADING and Intrexon. Activities of the IPC shall include (i) for each Research Plan a draft and proposed Strategic IP Plan to the JSC which may be amended from time to time, detailing at a minimum the countries of filing and a patent filing strategy, such strategy (1) shall be aligned between the Parties to secure maximum protection of Products and Intrexon Platform Technology, and (2) shall in cases where any proposed filing of a Product Specific Patent discloses a species generically covered by an Intrexon Patent or Intrexon Sole Patent covering Intrexon Platform Technology, ARES TRADING and Intrexon will use good faith efforts to coordinate filings with respect to such Patents, (ii) oversee the drafting, filing, prosecution and maintenance of all Patents generated from activities under this agreement in accordance with the Strategic IP Plan and Section 9; and (iii) provide guidance and input into the Research Plans of the Research Programs and Allogeneic Cell Therapy Program based on the patent landscape relevant to the respective Research Programs and consider whether it is necessary to enter into any License agreements with a Third Party pursuant the activities undertaken in the respective Programs. Intrexon will provide to the IPC information related to Intrexon Materials and Intrexon Patents reasonably required or provided to ARES TRADING associated with each of the Research Plans and/or Products for review and discussion at the IPC.

3.4 Membership. Within thirty (30) days following the Effective Date with respect to the JSC and IPC, and within thirty (30) days after establishment of any JSC subcommittee, ARES TRADING and Intrexon shall each designate its initial members to serve on such Committee. Each Party may replace its representatives on each Committee on written notice to the other Party. Each Party shall appoint one (1) of its representatives on each Committee to act as a co-chairperson. The co-chairpersons shall jointly prepare and circulate agendas and reasonably detailed minutes for each Committee meeting.

18

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

3.5 Meetings. Each Committee shall hold meetings at such times as it elects to do so, but in no event shall meetings of the JSC be held less frequently than once every three (3) months. Meetings of each Committee may be held in person, by audio or video teleconference. In person Committee meetings shall be held at locations selected alternately by ARES TRADING and Intrexon. ARES TRADING and Intrexon shall each be responsible for all of its own expenses of participating in each Committee. No action taken at any meeting of any Committee shall be effective unless a representative of each of ARES TRADING and Intrexon is participating.

3.6 Non-Member Attendance. ARES TRADING and Intrexon may each from time to time invite a reasonable number of participants, in addition to its representatives, to attend the Committee meetings in a non-voting capacity; provided that if either Party intends to have any Third Party (including any consultant) attend such a meeting, such Third Party shall be identified to the other Party in advance of the meeting, shall be bound by confidentiality and non-use obligations consistent with the terms of this Agreement, and shall be under written obligation to assign to the Party inviting such non-member (or grant a fully-paid, exclusive, royalty-free, fully sub-licensable, worldwide license to such Party, under) inventions made by such non-member in the course of or as a result of attending any such meeting.

3.7 Decision-Making.

(a) During the Research Phase. All decisions of each Committee during the Research Phase for a Product shall be made by unanimous vote, with each of ARES TRADING’s and Intrexon’s representatives collectively having one (1) vote. If after reasonable discussion and good faith consideration of each Party’s view on a particular matter before a Committee, the representatives cannot reach an agreement as to such matter within thirty (30) days after such matter was brought to such Committee for resolution or after such matter has been referred to such Committee, such disagreement shall be referred to the JSC (in the case of disagreement of a JSC subcommittee) or the Chief Executive Officer of Intrexon and Senior Executive Officers of ARES TRADING (the “CEOs”) (in the case of disagreement of the IPC or JSC) for resolution. If the CEOs cannot resolve such matter within thirty (30) days after such matter has been referred to them, then ARES TRADING shall have the final say, provided that ARES TRADING shall pay Intrexon for any additional activities triggered by any substantial deviation from the standard Research Plan deliverables listed in Schedule 4.1.

(b) After the Research Phase. After the Research Phase for each Product, ARES TRADING shall have the final say, except that unresolved disputes resulting from the IPC shall be subject to resolution in accordance with the provisions of Article 9.

(c) For the Allogeneic Cell Therapy. All decisions regarding the Allogeneic Cell Therapy Research Program and Allogeneic Cell Therapy Criteria shall be made by unanimous vote, with each of Merck’s and Intrexon’s representatives collectively having one (1) vote. If after reasonable discussion and good faith consideration of each Party’s view with respect to either Allogeneic Cell Therapy Research Program or Allogeneic Cell Therapy Criteria, the representatives cannot reach an agreement as to such matter within thirty (30) days after such matter was brought to the Committee for resolution or after such matter has been referred to the Committee, Intrexon shall have the final say for the Allogeneic Cell Therapy Research Program.

19

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

3.8 Limitation of Authority. Each Committee shall only have the powers expressly assigned to in this Article 3 and elsewhere in this Agreement and shall not have the authority to: (a) modify or amend the terms and conditions of this Agreement; (b) waive any Party’s compliance with the terms and conditions of under this Agreement; (c) purport to resolve any dispute involving a breach or alleged breach of this Agreement; (d) determine any such issue in a manner that would conflict with the express terms and conditions of this Agreement; or (e) require any Party to perform any act that is inconsistent with applicable Laws.

3.9 Discontinuation of Participation on a Committee. The activities to be performed by each Committee shall solely relate to governance under this Agreement, and shall not involve the delivery of services. Each Committee shall continue to exist until ARES TRADING and Intrexon mutually agree to disband the committee. Once the Parties mutually agree to disband such Committee, such Committee shall have no further obligations under this Agreement and, thereafter, the Alliance Mangers shall be the contact persons for the exchange of information under this Agreement and decisions of such Committee shall be decisions as between ARES TRADING and Intrexon, subject to the other terms and conditions of this Agreement.

3.10 Communication with ZIOPHARM. Intrexon shall be responsible for keeping ZIOPHARM apprised of the activities and decisions of the Committees pursuant to this Article 3 in as much as it is required under the Ziopharm Agreement.

ARTICLE 4

RESEARCH

4.1 General. Subject to the terms and conditions of this Agreement, the Parties desire to establish a research collaboration under which Intrexon will conduct research activities pursuant to research plans to be approved by the JSC, each of which plan will be directed to (a) the development of Products in the Field that are directed to a particular Target or (b) the development of an allogeneic cell therapy for use in developing Products in the Field (each such research plan, a “Research Plan”, and all activities under a Research Plan, a “Research Program”). Intrexon shall be responsible for all research under this Agreement in accordance with the Research Plan up to but excluding IND filing for a Product under a Research Plan, whereas ARES TRADING shall assume full responsibility for Product Development and Commercialization from IND filing onwards. For clarification, research under research plans for Intrexon Programs as set forth in Section 4.5 shall not be considered “Research Programs” and such research plans shall not be considered “Research Plans.” In addition, ARES TRADING may request Intrexon to develop an EAL for use in a Research Program wherein such development and costs will be detailed in a research plan.

20

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

4.2 Research Plans. All research activities under this Agreement shall be conducted by Intrexon pursuant to a Research Plan. Except for the Allogeneic Cell Therapy Research Plan, each Research Plan will describe the activities to be conducted to develop a Chimeric Antigen Receptor T-Cell Product directed to the applicable Target, through JSC approval of such Product as a drug candidate ready for the filing of an IND and Intrexon’s delivery to ARES TRADING of information to be included in the IND for such Product. Each Research Plan shall set forth the type of Chimeric Antigen Receptor T-Cell Product to be developed and the timeline and details of the research activities to be conducted. Each Research Plan will also specify whether or not any ARES TRADING Know-How, or subject matter covered by any ARES TRADING Patents, will be included in such Research Program. From time to time during the conduct of each Research Program, the Parties shall prepare, for the JSC’s review and approval, updates and amendments, as appropriate, to the then-current Research Plan for such Research Program. Once approved by the JSC, such revised Research Plan shall replace the prior Research Plan. If the terms of any Research Plan contradict, or create inconsistencies or ambiguities with, the terms of this Agreement, then the terms of this Agreement shall govern.

4.3 Initial Research Programs.

(a) Target-Based. Within thirty (30) days after the Effective Date, ARES TRADING shall select the first two (2) Targets, for which Intrexon will conduct initial Research Programs, by providing Intrexon with written notice of such Targets, along with a reasonably detailed description of the Target and any data and information reasonably determined by ARES TRADING to be necessary or useful for preparing the associated Research Plans (the “Target Information Package”). Thereafter, ARES TRADING and Intrexon will meet to discuss the Target Information Package through a meeting of the JSC, including any technical or other concerns Intrexon may have with respect to any such Target. After such discussion and agreement to proceed, ARES TRADING will pay Intrexon the Research Program Payment according to Section 8.2 (a). Intrexon will prepare a Research Plan for such Target for review and approval by the JSC. A Target will not be considered a Target until such Target has been approved by ARES TRADING and ARES TRADING has approved the payment in accordance with Section 8.2 (a).

(b) Allogeneic Cell Therapy. Promptly after, and in any event within thirty (30) days after, the Effective Date, ARES TRADING and Intrexon shall prepare a research plan for Intrexon’s development of the Allogeneic Cell Therapy (the “Allogeneic Cell Therapy Research Program”) for submission to the JSC for review and approval. The Allogeneic Cell Therapy Research Program will be based on Allogeneic Cell Therapy Criteria. The Parties intend that once developed, the Allogeneic Cell Therapy will subsequently be used (in other Research Programs) to develop Chimeric Antigen Receptor T-Cell Products.

4.4 Subsequent Research Programs. After election of the initial two (2) Targets in 4.3(a), but not later than forty-five (45) days from the Effective Date, ARES TRADING shall provide an 18 month rolling forecast of projected additional Targets for planning that may be updated quarterly. ARES TRADING may select additional Targets per calendar year during the Term, and for each new Target, ARES TRADING and Intrexon will conduct a Research

21

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

Program under this Article 4. To select each Target, ARES TRADING shall provide a Target Information Package to Intrexon and ARES TRADING and Intrexon shall promptly meet to discuss such Target Information Package, including any technical or other concerns Intrexon may have with respect to any such new target. Within sixty (60) days after each such discussion Intrexon will prepare a Research Plan for such Target for review and approval by the JSC. Each such Research Plan will set forth the activities to be conducted to develop a Chimeric Antigen Receptor T-Cell Product. A Target will not be considered a Target until such Target has been approved by ARES TRADING for such subsequent Research Programs and ARES TRADING has approved the payment in accordance with Section 8.2 (b).

4.5 Intrexon Rights of Independent Development in an Intrexon Program.

(a) Intrexon Programs. Intrexon may propose by written notice to ARES TRADING a Target for inclusion in a Research Program. Within sixty (60) days thereafter, ARES TRADING shall notify Intrexon of its decision whether or not to include such Target for a Research Program, resulting in a new Target pursuant to Section 4.4. If ARES TRADING decides not to include such Target in a Research Program (an “Out-of-Scope Target”), then Intrexon shall have the right, but not the obligation to pursue such Out-of-Scope Target alone or with a Third Party, to Exploit such out-of-scope product or products directed toward such Out-of-Scope Target (the “Out-of-Scope Product”) at its own costs (an “Intrexon Program”), in each case subject to ARES TRADING’s non-exercise of its Intrexon Program Option as set forth below in Section 4.5 (c) and (e). If Intrexon does not within sixty days (60) of ARES TRADING’s decision not to pursue such Out-of-Scope Target execute on a research plan for such Out-of-Scope Target, the Out-of Scope Target shall then be available for selection as a Target again.

(b) Intrexon may concurrently Exploit Out-of-Scope Products outside this collaboration with ARES TRADING provided that (i) Intrexon complies with its other obligations under the Research Plans, (ii) the Parties shall agree acting reasonably and in good faith with respect to the timing of such development to avoid any adverse impact on Development and/or Commercialization of the Products under this Agreement, (iii) Intrexon must have proposed each such Target as set forth above in this Section 4.5(a) to ARES TRADING, and (iv) ARES TRADING does not exercise its Intrexon Program Option as set forth in Section 4.5(c) and (e). Such Out-Of-Scope Product activities will not be deemed a breach of Section 2.5; provided that Intrexon shall not have the right under this Section 4.5(b) to develop any such Out-of Scope Product that is a Competitive Product to one that is being Developed or Commercialized by ARES TRADING under this Agreement. In all such cases of development of Out-of-Scope Products, Intrexon shall report the status of development at least each Calendar Quarter. If safety concerns related to the Out-of-Scope Products arise from such development, Intrexon must inform ARES TRADING immediately. Intrexon shall bear all costs and expenses related to its Exploitation of such Out-of-Scope Products.

(c) Intrexon Program Option. At the stage of finalization of the first Phase 1 Clinical Trial enrollment of the first Out-of-Scope Product related to the Out-of-Scope Target, ARES TRADING can opt to elect the Out-of-Scope Target and associated Out-of-Scope Product

22

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

under the terms of this Agreement (the “Intrexon Program Option”). Intrexon must notify ARES TRADING and provide the Phase 1 Clinical Trial results to ARES TRADING in writing, such results to include clinical summary data for the last patient of the expansion cohort, including cycle 1 response and safety up to that point for all other patients. ARES TRADING shall then notify Intrexon about the exercise of the Intrexon Program Option (the “Opt-In”) within sixty (60) days after receipt of the results as described in the previous sentence and will then have to pay Intrexon the Intrexon Program Option Payment within thirty (30) days of receipt of the corresponding invoice by ARES TRADING. In such an event, the Out-of-Scope Product shall be deemed a Product.

(d) Intrexon Program Option Payment and Intrexon Program Royalty. Subject to Section 8.2 (c) of this Agreement, ARES TRADING shall pay to Intrexon per each Intrexon Program for which ARES TRADING exercises its Intrexon Program Option a one-time payment of [*****]. In addition, the royalties for such Product shall increase as further set forth in Section 8.4. The Parties shall after the Effective Date agree on general terms on how to transfer an Out-of-Scope Product to ARES TRADING after ARES TRADING has exercised the Opt-In, including on how to transfer IND filing, and other aspects of such transfer of development.

(e) Non-exercise of Intrexon Program Option. If ARES TRADING does not exercise its Intrexon Program Option, Intrexon shall be entitled to further Exploit such Out-of-Scope Target and Out-of-Scope Product independently from ARES TRADING but subject to the restrictions pursuant to this Agreement, such as – without limitation – the obligation not to develop a Competitive Product. For such Intrexon Programs, ARES TRADING shall be entitled to receive [*****] percent ([*****]%) of all financial and non-financial considerations received (i.e. payments coming from a collaboration such as upfront, milestones, royalties, revenues, profit split, equity, fees or sales) for or in connection with the Out-of-Scope Product by Intrexon up to the amount of [*****], (the “One-Time Intrexon Program Option Fee”). For clarity, such payments shall not include payments made for services rendered under any such agreement. Intrexon shall notify ARES TRADING promptly after receipt of any payment for the Out-of-Scope Target and Out-of-Scope Product and shall pay the corresponding amount to ARES TRADING within thirty (30) days. Once Intrexon has paid the One-Time Intrexon Program Option Fee in full, ARES TRADING shall be entitled to receive a credit equal to [*****] percent ([*****]%) of all additional financial and non-financial considerations received (i.e. payments coming from collaboration such as upfront, milestones, royalties, revenues, profit split, equity, fees or sales) for or in connection with the Out-of-Scope Target and Out-of-Scope Product by Intrexon until the later of the last to expire Valid Claim or [*****] years after first commercial sale of an Out-of-Scope Product. Such credits for Out-of-Scope Product will receive the same reductions, deductions and reimbursements as those outlined in 8.4(c). ARES TRADING shall deduct the corresponding amount from subsequent payments to Intrexon under this Agreement. If, upon the termination of this Agreement and any payment obligations by ARES TRADING hereunder, credits accrued under this Section 4.5(e) remain unreimbursed by ARES TRADING, Intrexon shall pay ARES TRADING the amount of such credits up to a maximum amount of the aggregate payments received by Intrexon under Sections 8.1(a) and 8.4 of this Agreement, less the amount of any payments already made to ARES TRADING under this Section 4.5(e) and the amount of any deductions already made by ARES TRADING under this Section 4.5(e) within thirty (30) days after each Calendar Quarter.

23

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

4.6 MD Xxxxxxxx Agreement and MD Xxxxxxxx Products. MD Xxxxxxxx Products are those products listed in Schedule 4.6 as amended from time to time. Intrexon and Ziopharm shall report on each new product under the MD Xxxxxxxx Agreement. MD Xxxxxxxx Products shall be considered Out-of-Scope Products in accordance with Section 4.5 (a) and ARES TRADING shall have the Intrexon Program Option for such MD Xxxxxxxx Products as set forth in Section 4.5 (c) and depending on whether ARES TRADING opts in or opts out Section 4.5 (d) or (e) shall apply respectively to such MD Xxxxxxxx Products. For clarity, MD Xxxxxxxx Products are Products under this Section 4.6 independent of whether they are transferred from MD Xxxxxxxx to Ziopharm or to Intrexon. Further, Intrexon shall also keep ARES TRADING reasonably informed on any issues of the MD Xxxxxxxx Agreement that could materially affect the rights that Intrexon and Ziopharm provide to ARES TRADING under this Agreement.

4.7 Nomination and Approval of Products. Upon completion of research activities under each Research Plan (other than the Allogeneic Cell Therapy Research Plan), Intrexon shall provide the JSC with a data package summarizing the data and results generated under such Research Plan with respect to the applicable Chimeric Antigen Receptor T-Cell Product. The JSC will thereafter at its next quarterly meeting review such data and results and determine whether or not to file an IND for such Chimeric Antigen Receptor T-Cell Product. If the JSC decides not to file an IND for such Chimeric Antigen Receptor T-Cell Product, the JSC shall provide Intrexon with a written description of the reasons for such decisions and the JSC shall prepare a plan of specific activities to be conducted by Intrexon at no additional cost to ARES TRADING with respect to such Chimeric Antigen Receptor T-Cell Product, with the intention that upon completion of such activities, an IND will be filed for such Chimeric Antigen Receptor T-Cell Product. Following Intrexon’s completion of such additional activities, Intrexon shall provide an updated data package to the JSC, which the JSC will review and discuss at its next quarterly meeting to determine whether or not to file an IND for such Chimeric Antigen Receptor T-Cell Product; provided that Intrexon shall not thereafter be obligated to conduct any additional activities with respect to such Chimeric Antigen Receptor T-Cell Product or the applicable Research Program. Upon the JSC’s decision to file such IND, such Chimeric Antigen Receptor T-Cell Product will be deemed a Product, and ARES TRADING will thereafter be solely responsible for Developing and Commercializing such Product as further detailed in this Agreement.

4.8 [*****].

4.9 Conduct of Research. Intrexon shall use Commercially Reasonable Efforts to carry out the activities assigned to it in each Research Plan, once approved by the JSC, and shall conduct such activities in good scientific manner, and in compliance with all applicable Laws. Intrexon shall keep the other Party reasonably informed as to the progress of the conduct of the

24

Portions herein identified by [*****] have been omitted pursuant to a request for confidential treatment

under Rule 24b-2 of the Securities Exchange Act of 1934, as amended. A complete copy of this document has

been filed separately with the Securities and Exchange Commission.

Confidential

Research Plans through meetings of the JSC. Except for the payments set forth in Article 8 and payment obligations of ZIOPHARM to Intrexon under the ZIOPHARM Agreement, each of ARES TRADING and Intrexon shall be solely responsible for all costs it incurs to conduct its activities under a Research Plan.