FREEPORT 9 OFFICE CENTER OFFICE LEASE AGREEMENT

Section 1.1Landlord.

The Landlord is: Freeport 9 Office Center, L.P., a Texas limited partnership

Section 1.2Tenant.

The Tenant is: WageWorks, Inc., a Delaware corporation

Section 1.3 Date of Lease.

The date of this Lease is March _25__, 2015

SECTION 2

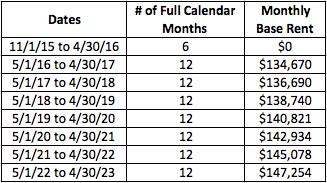

PROJECT AND TERM

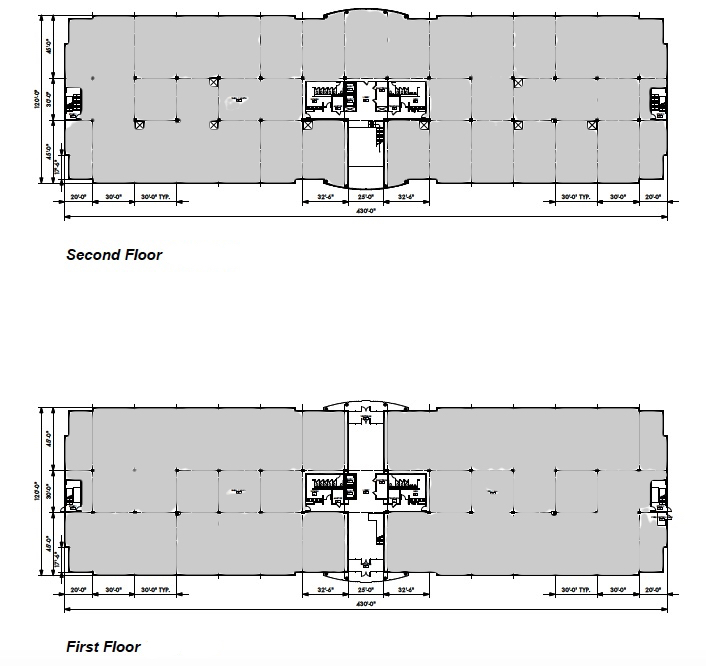

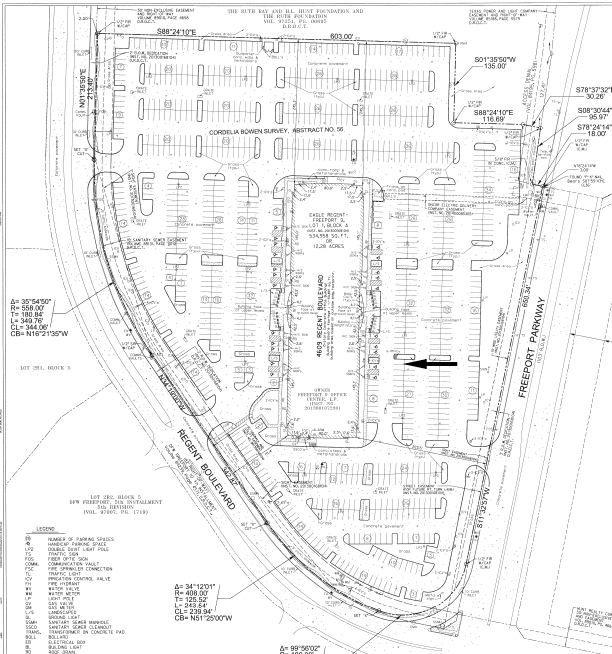

Section 2.1Premises and Project. In consideration of the mutual obligations of Landlord and Tenant set forth herein, Landlord leases to Tenant, and Tenant hereby leases from Landlord (the “Lease”) the 101,319 rentable square feet more particularly outlined on the 1st and 2nd floor plans attached as Exhibit D (the "Premises"). The Premises are part of that three story 153,630 rentable square foot office building (the “Building”) located at 0000 Xxxxxx Xxxx., Xxxxxx, Xxxxx on the approximate 12.28 acre tract of property being a tract of land situated in the Xxxxxxxx Xxxxx Survey, Abstract Number 56, City of Irving, Dallas County, Texas, said tract being all of EAGLE REGENT - FREEPORT 9, LOT 1, BLOCK A, an addition to the City of Irving, Dallas County, Texas as recorded in Instrument Number 201300168104, Official Public Records of Dallas County, Texas (O.P.R.D.C.T.); which real property is known as (the “Land”). The Building and the Land are collectively referred to as the “Project”. This Lease does not include the water, oil, gas and minerals that are under the Project and that may be produced from it provided however, that Landlord shall not have the right of ingress and egress over the surface of the Property for the purpose of drilling for the water, oil, gas or other minerals under the Project. Subject to the obligations of Landlord in this Lease, Tenant accepts the Project in its current AS IS condition, and acknowledges that Tenant is not relying on any representations or warranties by any person regarding the Project other than those specifically set forth in this Lease.

Section 2.2Lease Term. The Lease Term (“Term”) shall be for a period commencing on the Effective Date and expiring 84 full calendar months after the Base Rent Commencement Date, unless sooner terminated pursuant to the terms of the Lease. The (“Effective Date”) or similar references is the date on which Tenant receives a fully executed original of this Lease from Landlord (which has already been signed by Tenant) in the manner set forth in Section 9.21. The “Substantial Completion Date” is the earlier of (i) the date on which the Tenant Improvements are Substantially Completed and Tenant begins use of all or part of the Building for the purpose of conducting business, as evidenced in Tenant’s written notice to Landlord; or (ii) November 1, 2015. The Base Rent Commencement Date is May 1, 2016. When the actual Substantial Completion Date is established, Tenant shall, within ten (10) days after Landlord's request, complete and execute the letter attached hereto as Exhibit C (the “Verification Letter”) and deliver it to Landlord. Tenant’s use of the Project for construction of the Tenant Improvements pursuant to Exhibit B of this Lease shall not constitute use for the purpose of conducting business.

Section 2.3Tenant Improvements. A Work Letter is attached as Exhibit B (the “Work Letter”). Tenant shall perform the construction and make the installations in accordance with the Work Letter. The improvements and installations specified in the Work Letter are the “Tenant Improvements”. The maximum amount Landlord shall be obligated to pay for the Tenant Improvements is equal to the Tenant Improvement Allowance as stated in Exhibit B attached to this Lease. Except as specifically stated in this Lease, all

FREEPORT OFFICE CENTER 9

1

Tenant Improvements shall be owned by Landlord and shall remain at the Project at the expiration or earlier termination of this Lease. Prior to entering the Project, Tenant shall obtain all insurance it is required to obtain by this Lease and shall provide certificates of said insurance to Landlord. Tenant, in compliance with the terms of this Lease, will be permitted access to the Premises beginning on the Effective Date for the purpose of planning, constructing, installing, and outfitting the Premises with Tenant Improvements. Additionally, Tenant, in compliance with the terms of this Lease will be permitted access beginning on the Effective Date to install furniture, fixtures and equipment necessary for its use and occupancy.

Section 2.4 Common Area. The first floor and second floor lobby and restrooms and entry areas; the main electric, phone and sprinkler rooms in the Building; the elevators and the landscape, parking, drive access and sidewalk areas upon the Land are known as the “Common Area”. Landlord shall have the right to modify the Common Area, provided such changed Common Area provides substantially the same function to Tenant as the existing Common Area. Tenant shall have the right, subject to the rights of other tenants and Landlord, to use such Common Area in accordance with the terms of this Lease.

SECTION 3

BASE RENT, BUILDING COSTS AND OTHER SUMS PAYABLE

Section 3.1Tenant Payments. Tenant agrees to pay Base Rent, Building Costs, Property Management Fee and any other sum payable under this Lease to Landlord when due without demand, deduction, credit, adjustment or offset of any kind except as specifically provided in this Lease (collectively the “Monetary Obligations”). All such payments shall be in lawful money of the United States and shall be paid to Landlord at Landlord's address provided for in this Lease, or by direct deposit in accordance with direct deposit instructions provided by Landlord, or to such other place as Landlord may from time to time designate in writing.

Section 3.2Base Rent. The monthly “Base Rent” is specified in Section A-1 of Exhibit A attached to this Lease. Monthly installments of Base Rent shall be paid, without demand and in advance, on or before the first day of each calendar month during the Term pursuant to the schedule in Section A-1 of Exhibit A. The monthly Base Rent installment for any partial month at the beginning or end of the Term shall be prorated.

Section 3.3Building Costs. Tenant agrees to pay as additional rent (beginning upon the Substantial Completion Date and continuing for the full Term of this Lease and any extensions), its Proportionate Share (as defined herein below) or actual share as reasonably determined by Landlord of the following (collectively, “Building Costs”):

|

1. |

Tax Costs (hereinafter defined) payable by Landlord pursuant to Section 4.4 of this Lease; |

|

3. |

Common Area Utility Costs (hereinafter defined) payable by Landlord pursuant to Section 3.5 of this Lease; |

|

4. |

Capital Costs (hereinafter defined) payable by Landlord pursuant to Section 3.5 of this Lease; |

Tenant shall escrow with Landlord an amount equal to 1/12 of the estimated annual cost of its Proportionate Share of the Building Costs. One such monthly installment shall be due and payable beginning on the Substantial Completion Date and then continuing monthly for the full Term of this Lease and any renewals or extensions, except that all payments due hereunder for any fractional calendar month shall be pro–rated. The amount of the initial monthly Building Costs escrow payments are estimated at $53,887 each month.

Tenant authorizes Landlord to use the funds deposited with Landlord under this Section 3.3 to pay such costs. The initial monthly escrow payments are based upon the estimated Building Costs amounts for the year in question and shall be increased or decreased annually to reflect the projected actual Building Costs.

FREEPORT OFFICE CENTER 9

2

If the total Building Costs escrow payments paid by Tenant are less than Tenant's actual Proportionate Share of Building Costs, Tenant shall pay the difference to Landlord within Twenty (20) business days after written request from Landlord to Tenant. If the total Building Costs escrow payments paid by Tenant are more than Tenant's actual Proportionate Share of Building Costs, Landlord shall retain such excess and credit it against Tenant's next annual Building Costs escrow payments. Any excess Building Costs escrow payments paid by Tenant for the last year of the Term of this Lease shall be paid to Tenant within thirty (30) days after the expiration of this Lease.

Landlord shall utilize accounting records and procedures conforming to generally accepted accounting principles, consistently applied, with respect to all aspects of determining the Building Costs.

The payment by Tenant of any of Tenant’s Proportionate Share of Building Costs pursuant to this Lease shall not preclude Tenant from questioning the accuracy of any statement provided by Landlord; but shall not excuse Tenant from paying such costs in accordance with the terms of this Lease.

Landlord shall maintain books and records (including copies of all invoices) relating to the Building Costs charged to Tenant for all Lease years, regardless of whether or not such periods were prior to Landlord’s ownership of the Building/Project, and for one year after the expiration or earlier termination of this Lease (the “Books and Records”). The Books and Records shall include in reasonable and substantial detail for each year the calculations performed to determine Building Costs in accordance with the applicable provisions of the Lease including the total Building Costs by category, and listing gross up adjustments. Tenant or Tenant’s Certified Public Accountant, at Tenant’s sole cost and expense, shall have the right, no more frequently than once per calendar year, and upon 30 days’ advance written notice to Landlord to examine the Books and Records (the “Audit”). Landlord shall reasonably cooperate with Tenant making the Books and Records available to Tenant or Tenant’s Certified Public Accountant for inspection pursuant to the terms of this Lease.

If such Audit discloses the amount paid as Tenant’s Proportionate Share of Building Costs or other rental amounts payable pursuant to this Lease has been overstated by more than five percent (5%), then, in addition to immediately repaying such overpayment to Tenant, with interest (at a rate of Prime plus 2.0%) from the date of overcharge, Landlord shall also pay the reasonable costs incurred by Tenant in connection with such audit (not to exceed $5,000).

In calculating Building Costs, Landlord shall adjust those components of Building Costs which will vary with the rate of occupancy of the Building to the reasonably estimated amount that Landlord would have incurred had the Building been at least ninety-five percent (95%) occupied throughout the calendar year in question so that the proportionate share of Building Costs paid by Tenant, Landlord and other tenants in the Building will reflect the actual share for each party based on the area leased or the vacant area in the case of Landlord.

Landlord shall competitively bid the Major Maintenance Contracts once each calendar year. “Major Maintenance Contracts” are contracts for an amount over $50,000/ calendar year for Building Costs; which are controllable by Landlord. Major Maintenance Contracts shall not include maintenance contracts or Building Costs that cannot be controlled by Landlord (e.g., Common Area Utility Costs, Insurance Costs, Taxes and any other costs that are beyond Landlord's reasonable control or are needed in case of emergency). As used herein, the term “competitively bid” shall be deemed to mean that Landlord shall request bids from at least three (3) qualified contractors.

Tenant's Proportionate Share, (65.95%) as used in this Lease, shall mean a fraction, the numerator of which is the 101,319 sq.ft. space contained in the Premises and the denominator of which is the entire 153,630 sq.ft. of rentable space contained in the Building (the numbers are the final agreement of the parties and not subject to adjustment). For purposes of this Lease Agreement, the rentable square foot space contained in

FREEPORT OFFICE CENTER 9

3

the Building is calculated based on the square foot roof area of the Building times three (roof area sq. ft. x 3). The roof area is calculated based on the exterior dimensions of the exterior walls of the Building

Section 3.4Taxes and Tax Costs.

|

§ |

Landlord shall pay all taxes, assessments and governmental charges of any kind; which are levied, assessed, imposed or become due and payable with respect to the Project including all taxes attributable to taxable margin allocated to the Project levied pursuant to Chapter 171 of the Texas Tax Code or any amendment, adjustment or replacement thereof. (collectively referred to herein as "Taxes"). “Tax Costs” shall mean all costs incurred by Landlord for the Taxes. Tax Costs shall be included in Building Costs. |

|

§ |

If at any time during the Term of this Lease, there shall be levied, assessed or imposed on Landlord a capital levy, franchise, margin or other tax directly on the rents received therefrom and/or a tax, assessment, levy or charge measured by or based, in whole or in part upon such rents from the Project, then all such taxes, assessments, levies or charges or the part, thereof so measured or based, shall be deemed to be included within the term Taxes for the purposes hereof. |

|

§ |

Landlord, at Landlord’s option or upon Tenant’s written request within 30 days prior to the applicable tax protest deadline, shall employ a tax consulting firm (the “Tax Firm”) to attempt to assure a fair tax burden on the Land and the Building and associated improvements within the applicable taxing jurisdiction. The reasonable costs of the Tax Firm (not to exceed $5,000/year) shall be included in Taxes. |

|

§ |

Tenant shall be liable for all taxes levied or assessed against any of Tenant’s personal property, fixtures or improvements placed at the Project by Tenant. If any such taxes are levied or assessed against Tenant or Tenant's property and Landlord pays the same or if the assessed value of the Project is increased by inclusion of such personal property and fixtures and Landlord pays the increased taxes, then Tenant shall reimburse Landlord within 30 days of receiving an invoice from Landlord. |

Section 3.5 Common Utilities. Landlord shall obtain and pay for all water, gas, heat, light, power, telephone, sewer, sprinkler charges and other utilities and services used on or at the Common Area, landscape areas and exterior Building areas, together with any taxes, penalties, surcharges and any maintenance charges for utilities (the “Common Area Utility Costs”). Common Area Utility Costs shall also include water used in the Premises and other tenant space in the Building for coffee bars, water fountains and break room sinks. Landlord shall not be liable for any interruption or failure of utility service on or to the Common Area, landscape areas or exterior Building areas. Common Area Utility Costs shall be included in Building Costs.

Section 3.6 Approved Capital Improvements.

The costs associated with the following Capital Improvements performed by Landlord are “Approved Capital Improvements” and the associated costs are “Capital Costs” and shall be included in Building Costs:

|

· The Annual Amortized Cost of capital improvements made to the Project; which can reasonably be expected to reduce the normal Building Costs. (Example: Repairs to a driveway are costing $2,500/year as part of the Building Costs. Replacing that driveway can be performed at a capital cost of $10,000. The new replaced driveway has a useful economic life of 10 years, thus the Annual Amortized Cost of the new driveway is $1,558/year. The $1,558/year is less than the $2,500/year repair cost of the old driveway, therefore Landlord may include the $1,558/year in the Building Costs. If the Annual Amortized Cost was in excess of the $2,500/year repair cost of the old driveway, only $2,500/year could be included in the Building Costs.); |

|

· The Annual Amortized Cost of capital improvements made to the Project for the safety of the occupants of the Building or in order to comply with any law promulgated by any Governmental Agency, after the Effective Date; |

FREEPORT OFFICE CENTER 9

4

|

· The Annual Amortized Cost is the amortized cost of the capital improvement, using an annual interest rate of seven percent (7%), over the useful economic life of such improvements as reasonably determined by Landlord using generally accepted accounting principles. |

Section 3.7Excluded Costs. Tenant shall not be responsible for the following costs and such costs shall not be included in Building Costs:

|

1. |

capital improvements made to the Building other than (i) Approved Capital Improvements described in Section 3.6 of this Lease and (ii) capital improvements required due to damages caused by Tenant; which costs Tenant shall be responsible for; |

|

2. |

all costs of services, items provided, repairs, replacements and general maintenance of the Project paid by proceeds of the Building insurance specified in Section 6.3 of this Lease or directly paid by Tenant to 3rd parties (as evidenced by written documentation from Tenant and verification by Landlord) or directly paid to 3rd parties by other tenants in the Building (as evidenced by written documentation from tenant and verification by Landlord); |

|

3. |

alterations attributable solely to other tenants of the Building including the amount of any interior finish allowances or free rent or operating expense credits or other amounts paid to or granted to other tenants of the Building; |

|

4. |

interest, amortization or other payments on loans to Landlord; |

|

5. |

depreciation or accelerated cost recovery of the Building or Common Area or any furniture, equipment or personal property ; |

|

6. |

leasing commissions; |

|

7. |

legal expenses, other than those reasonably incurred for the general benefit of all tenants of the Building (e.g., Taxes disputes); |

|

8. |

renovating or otherwise improving space for other tenants of the Building or vacant space (other than the Premises) in the Building to include any cost relating to the marketing, solicitation, negotiation and execution of leases of space in the Building/Project to other tenants, including without limitation, promotional and advertising expenses, real estate licenses and other industry certifications, tickets to special events, commissions, finders fees, and referral fees, all expenses relating to the negotiation and preparation of any lease, license, sublease or other such document, costs of design, plans, permits, licenses, inspection, utilities, construction and clean up of tenant improvements to the premises of other tenants in the Building; |

|

9. |

Any Landlord Repairs and/or repairs to Building Systems as provided in Section 4.2 of this Lease except to the extent such repairs were due to damages caused by Tenant; |

|

10. |

except as provided in Section 3.4 of this Lease, any income taxes imposed on or measured by the income of Landlord from the operation of the Building; to include Landlord’s gross receipts taxes for the Building/Project, personal and corporate income taxes, inheritance and estate taxes, other business taxes and assessments, gift and transfer taxes, and all other real estate taxes relating to a period outside the term of this Lease; |

|

11. |

rent concessions of any kind inclusive of free rent or rent abatement to other tenants of the Building; |

|

12. |

interest or amortization payments except as specifically provided herein; |

|

13. |

all general corporate or partnership overhead or costs of maintaining corporate or partnership existence of Landlord ,Landlord’s Affiliates or the Property Manager; |

|

14. |

advertising and promotional expenses including any form of entertainment expenses, dining expenses, any costs relating to tenant or vendor relation programs including flowers, gifts, luncheons, parties, and other social events; |

|

15. |

special services for other tenants of the Building; to include expenses in connection with special services or other benefits (excluding normal Building Costs); which are only provided to another tenant or occupant of the Building/Project and which do not directly benefit Tenant; |

|

16. |

costs for sculptures, paintings or other art objects, inclusive of ordinary maintenance and repair or the display of such items; |

|

17. |

the cost of any repair to remedy damage caused by or resulting from the actual gross negligence of any other tenants in the Building (which gross negligence is proven to be caused by other

FREEPORT OFFICE CENTER 9 5 |

tenants in the Building), together with the costs and expenses incurred by Landlord in attempting to recover such costs; |

|

18. |

except as provided in this Lease, any reserves of any kind; |

|

19. |

any Building Costs paid to a Landlord Affiliated Party or an employee of the Property Manager to the extent the same is in excess of the reasonable cost of said item or service in an arms' length transaction; |

|

20. |

(i) Landlord’s office costs and general overhead including without limitation costs associated with selling, syndicating, financing, mortgaging or hypothecating any interest in the Building or the Land; costs of any disputes between Landlord and its employees; and disputes between Landlord and the property management company to include mortgage payments, debt costs or other financing charges, (ii) Except as provided in this Lease, the costs of defending any other lawsuits, (iii) Except as provided in this Lease, Landlord’s bad debt loss, rent loss or any reserves thereof, (iv) rental payments and related costs pursuant to any ground lease of land underlying all or any portion of the Building/Project; |

|

21. |

any property management fees except for those specified in Section 3.3 of this Lease and office rental and any parking charges, for the property manager, Landlord or Landlord’s agents or other vendor personnel; |

|

22. |

the (i) cost for phone service in the premises of other tenants in the Building or (ii) the cost of tenant directory displays in the Building; |

|

23. |

(i) fines, penalties, enforcement costs, late charges, interest and liquidated damages for the breach of contracts entered into by Landlord or the Property Manager for the Project, (ii) penalties or related interest charges for late payment of Taxes, (iii) fines and penalties incurred by Landlord or the Property Manager for violation of any legal requirements applicable to the operation of the Building (excluding violations caused by Tenant or associated with the Tenant Improvements); |

|

24. |

markup above utility rates charged to Landlord; |

|

25. |

compensation to any employee of Landlord (except for the Property Management Fee if Landlord elects to manage the Project); to include wages, salaries, fees, fringe benefits, and any other form of compensation paid to any executive employee; |

|

26. |

charges for late payment of Taxes; |

|

27. |

impact and development fees associated with the construction of the shell Building and Common Area or development of the Land; |

|

28. |

costs incurred in connection with Required Corrections including penalties or damages incurred as a result of noncompliance (this paragraph 28 does not apply to the Tenant Improvements or normal Building Costs to maintain Building/Project compliance); |

|

29. |

costs associated with expanding the Building or the Common Area. |

|

30. |

special assessments or special taxes initiated as a means of financing improvements to the Building/Project |

|

31. |

any costs, fees, dues, contributions or similar expenses for political, charitable, industry association or similar organizations, as well as the cost of any newspaper, magazine, trade or other subscriptions; |

|

32. |

any compensation or benefits paid to or provided to clerks, attendants or other persons in commercial food concessions in the Building operated by or on behalf of the Landlord; and |

|

33. |

any expenses incurred by the Landlord in connection with its plans or efforts to obtain or renew any form of certification for energy efficiency or environmental responsibility from organizations or governmental agencies such as the United States Green Building Council’s Leadership in Energy and Environmental Design (LEED) certification, Energy Star, Green Globes, etc., including, without limitation, consulting fees, legal fees, architectural, design and/or engineering fees and submission fees. |

Section 3.8Late Charge. If Tenant fails to make any payment of Monetary Obligations when due under this Lease within 5 business days of when due, in addition to all other rights and remedies available to Landlord, a late charge is then immediately due and payable by Tenant equal to three percent (3%) of the

FREEPORT OFFICE CENTER 9

6

amount of any such payment but Landlord will waive the late charge for the first such failure occurring during any calendar year during the Term. Landlord and Tenant agree that this charge compensates Landlord for the administrative costs caused by the late payment.

Section 3.9Default Rate. Any Monetary Obligations not paid within 5 business days of when due shall bear interest at a rate equal to the lesser of: (a) the published prime or reference rate then in effect at a national banking institution designated by Landlord (the “Prime Rate”), plus three (3) percentage points, or (b) the maximum rate of interest per annum permitted by applicable law (the “Default Rate”).

Section 3.10 Property Management. Landlord or a third party professional property management company hired by Landlord (the “Property Manager”) shall manage the Project as specified in Section 4.1 of this Lease. Tenant on a monthly basis agrees to pay Landlord a management fee for managing the Project (the “Property Management Fee”). The Property Management Fee shall not exceed three percent (3%) of the Base Rent and Tenant’s Proportionate Share of Building Costs. One such monthly installment shall be due and payable beginning on the Substantial Completion Date and then continuing monthly for the full Term of this Lease and any renewals or extensions, except that all payments due hereunder for any fractional calendar month shall be pro–rated. The amount of the monthly Property Management Fee payments are estimated at $3,298 each month during the first year of the initial term.

Section 3.11 Warranties.Roof material warranty for the Building roof, Building elevators and Lennox HVAC compressor warranties for existing HVAC units at the Project and any other Project warranties in effect on the Effective Date are collectively known as the “Project Warranties”. Landlord shall reasonably attempt to enforce such Project Warranties for the benefit of Landlord, Tenant and other tenants at the Project.

SECTION 4

SERVICES, UTILITIES, MAINTENANCE AND REPAIRS

Section 4.1Landlord’s Services.Landlord or a third party professional property management company hired by Landlord (based on sound and prudent property management standards for comparable properties) shall use all reasonable efforts to furnish the following services at the Project (“Project Services”):

|

1. |

Cooled or heated air in the Common Area in season to provide a temperature condition required, in Landlord’s reasonable judgment (in accordance with normal operating temperatures for similar buildings in the Irving, Texas area), for comfortable use of the Common Area daily from 7:00 AM to 6:00 PM (Monday thru Friday) and Saturdays 8:00 AM to 1:00 PM (“Normal Business Hours”). After Normal Business Hours, holidays and Sundays are excluded. |

|

2. |

Lighting in the Common Area in capacity and type, in Landlord’s reasonable judgment, for standard use of the Common Area during Normal Business Hours. Lighting in the Common Area during hours which are not Normal Business Hours (including holidays and Sundays) will be provided at a lower level which will allow for visible exiting of the Building; |

|

3. |

Maintenance of the Building HVAC system. Landlord may, as reasonably determined by Landlord, enter into an HVAC maintenance agreement with a competent and qualified 3rd party contractor for regular care and maintenance consistent with the manufacturer’s guidelines. Special HVAC units for Tenant may be maintained for an additional service fee to Tenant. |

|

4. |

Janitor service (including cleaning and restroom paper supplies) for the Building on weekdays other than holidays in substantial accordance with the Janitorial Standards attached as Exhibit A-5 to this Lease. |

|

5. |

Exterior and interior window washing as may from time to time be reasonably required in Landlord’s judgment but in no event less than two times per year. |

|

6. |

Passenger elevator service and stairway access for the second floor of the Building. |

|

7. |

Replacement of Building standard light bulbs in the Common Area and exterior of the Building (including, without limitation, the parking area) and replacement of fluorescent tubes in the ceiling mounted fixtures; which were installed by Landlord within the Building. |

FREEPORT OFFICE CENTER 9

7

|

8. |

Repairs and maintenance to the Common Area required, in Landlord’s reasonable judgment, for comfortable use of the Common Area. |

|

9. |

Repairs and maintenance of the elevator, roof, plumbing systems, electrical systems, heating and air conditioning systems and equipment within the Common Area. Landlord may, as determined by Landlord, enter into roof, elevator and HVAC maintenance agreements with competent and qualified contractors for regular care and maintenance consistent with the manufacturer’s guidelines. |

|

10. |

Repairs and maintenance of the Building roof. Landlord may, as reasonably determined by Landlord, enter into a roof maintenance agreement with a competent and qualified 3rd party contractor for regular care and maintenance consistent with the manufacturer’s guidelines. |

|

11. |

Engage a third party contractor to provide full time off site monitoring of the fire sprinkler system serving the Building including monitoring of the fire sprinkler flow and tamper switches. |

|

12. |

Maintenance, repairs and replacements of (i) the parking areas and sidewalks associated with the Building, (ii) of all grass, shrubbery, landscape sprinkler and other landscape treatments surrounding the Building, (iii) of the exterior of the Building (including painting), exterior glass replacement, lobby glass and rear entry glass replacement, exterior lights and roof repairs, and (iv) of fire sprinkler systems and sewage lines. |

|

13. |

766 Card keys for utilization of the access system to the exterior doors serving the Common Area after Normal Business Hours, holidays and Sundays, will be provided free of charge prior to commencement of the Lease. Replacement access cards will be provided to Tenant, upon Tenant’s reasonable requests and at Tenant’s expense, which shall not exceed $5 / access card.) |

|

14. |

Sink and toilet facilities in the Common Area for use by Tenant in common with other Tenants of the Building. |

|

15. |

Maintenance, repairs and replacements of plants in the Common Area. |

|

16. |

Except as provided in Section 4.3, any other maintenance, repair or replacement items to the Project, Building or Common Area, in Landlord’s reasonable judgment, which are necessary for standard use of the Project, Building and Common Area. |

Upon prior written notice to Tenant accompanied by reasonable supporting documentation, Landlord reserves the right to reasonably xxxx Tenant separately for specific services related to Tenant’s Premises (e.g. excess janitorial, supplemental HVAC maintenance and the like), extra maintenance, repair or replacement items associated with Tenant’s above standard use or damage of the Building, Premises or Common Area, if any.

Landlord’s services shall not include security for the Building, Premises or Land. Such security shall be provided by Tenant at its expense to the extent Tenant deems necessary. Landlord agrees that Tenant may install its own security card reader system for purposes of further securing the Premises; provided such security card reader system may not affect the Common Area.

Landlord’s obligation to furnish the Project Services shall be subject to the rules and regulations of the suppliers of such services and applicable governmental rules and regulations. Landlord shall use reasonable efforts to restore any Project Services that becomes unavailable; however, such unavailability shall not render Landlord liable for any damages caused thereby, be a constructive eviction of Tenant, constitute a breach of any implied warranty, or entitle Tenant to any abatement of Base Rent nor relieve Tenant from any covenant or agreement hereof.

Section 4.2Landlord’s Repairs.Tenant understands and agrees that Landlord's maintenance, repair and replacement obligations; which are paid by Landlord and not reimbursed by Tenant are limited to those set forth in this Section 4.2. Landlord shall be responsible, at Landlord’s expense, for replacement of the roof of the Building at the end of its useful life; and for repair and replacement of damaged portions of the foundation of the Building and damaged portions of the structural steel and structural members of the exterior walls of the Building that adversely impact Tenant’s use of the Building (the “Landlord Repairs”). The terms "roof" and "walls" as used herein shall not include windows, glass or plate glass, doors, special storefronts or office entries. Tenant shall immediately give Landlord written notice

FREEPORT OFFICE CENTER 9

8

of defect or need for repairs required per the terms of this Lease, after which Landlord shall repair same or cure such defect within thirty (30) days after the first to occur of (i) Landlord’s knowledge of such defect or (ii) Landlord’s receiving written notice from Tenant unless such cure cannot reasonably be accomplished within such thirty (30) day period in which case Landlord shall have such additional time as is reasonably necessary to accomplish such cure provided Landlord promptly commences and diligently prosecutes such cure to completion. Landlord's liability with respect to any defects, repairs, replacement or maintenance for which Landlord is responsible hereunder shall be limited to the cost of such repairs or maintenance or the curing of such defect. To Landlord’s actual knowledge, all windows, mechanical, plumbing and electrical systems at the Project on the Effective Date (“Building Systems”) are in good working order as of the Effective Date. During the period between the Effective Date and November 1, 2016, Landlord shall repair, at Landlord’s expense, any defects in the Building Systems not caused by Tenant that negatively impact the safety or use of the Project by Tenant and that Landlord is made aware of by written notice from Tenant.

Section 4.3Tenant’s Maintenance and Repair Obligations

Except for reasonable wear and tear and for Landlord Repairs specified in Section 4.2 of this Lease, beginning on the Substantial Completion Date and continuing for the full Term of this Lease and any renewals or extensions, Tenant shall keep the Premises in good condition and repair, maintain the Premises, perform all needed repairs and replacements to the Premises, protect the Project from waste or damage and shall comply with applicable Governmental Requirements (“Tenant Repairs”). Tenant shall promptly perform the Tenant Repairs. Tenant Repairs shall be subject to Landlord’s reasonable direction and schedule, if provided by Landlord. Tenant shall cause all contractors performing the Tenant Repairs to maintain insurance coverage, consistent with the requirements in the Work Letter. All Tenant Repairs shall be performed in accordance with all applicable Governmental Requirements and in a good and workmanlike manner so as not to alter the exterior appearance of the Building, damage the Project, the Building's structure or the Building's HVAC or fire sprinkler systems. All such work which may affect the Building's structure or the Building's HVAC or fire sprinkler systems must be approved by Landlord and by the applicable Building's engineer of record, at Tenant's reasonable expense (not to exceed $3,000). All work affecting the roof of the Building must be performed by the original Building roofing contractor and no such work will be permitted if it would void or reduce the warranty on the roof. Notwithstanding the above provisions, beginning on the Effective Date, Tenant shall use care not to damage the Project and Tenant shall be responsible at Tenant’s expense for repairs associated with damages to the Project caused by Tenant or its employees, agents, contractors and invitees. In addition beginning on the Effective Date, Tenant shall be responsible for clean-up and removal of Tenant’s trash related to Tenant Improvements and Tenant Repairs at the Project.

Landlord reserves the right, upon Tenant's default and failure to cure pursuant to the terms of this Lease to perform any items that are otherwise Tenant's obligations pursuant to the terms of this Lease, in which event; Tenant shall be liable for the actual reasonable cost and expense of such repair, replacement, maintenance and other such items.

Section 4.4Utilities. Beginning on the Substantial Completion Date and continuing for the full Term of this Lease and any renewals or extensions, Tenant shall contract for and pay for all telephone, internet, electricity and gas used on or at the Premises, together with any taxes, penalties, surcharges or the like pertaining to Tenant's use of the Premises and any maintenance charges for utilities. Electricity and Gas serving Tenant's Premises shall be separately metered (at Tenant's cost and expense in accordance with terms and provisions of the Work Letter) directly from the public utilities applying service to the Building subject to Tenant's application for services. Landlord shall not be liable for any interruption or failure of utility service on or to the Premises unless such failure was caused by the gross negligence or willful misconduct by Landlord in which case Landlord shall be liable for the actual reasonable cost for repairing the damage to the utility service.

Section 4.5Security. Landlord has no duty or obligation to provide any security services in, on or around the Project, and Tenant recognizes that security services, if any, provided by Landlord will be for the sole benefit of Landlord and the protection of Landlord’s property. Tenant will have the right to install

FREEPORT OFFICE CENTER 9

9

Tenant’s card access system/security system within Tenant’s Premises and to install security cameras in the Premises and Common Areas (the “Tenant Security System”). The Tenant Security System shall be installed as part of the Tenant Improvements and in compliance with the Exhibit B Work Letter.

SECTION 5

Section 5.1Use and Conduct of Business. The Premises is to be used only for general business office uses including call center, printing and mailing activities (the “Permitted Uses”). Tenant shall, at its own cost and expense, obtain and maintain any and all licenses, permits, and approvals necessary or appropriate for its use, occupation and operation of the Premises for the Permitted Uses. Tenant shall not permit or cause any act to be done in or about the Project that will violate any applicable Governmental Requirements or that will increase the existing rate of insurance on the Project. Tenant shall not commit or allow to be committed or exist any waste upon the Project or any public or private nuisance. Tenant shall comply with the rules and regulations of the Project; which are included in Exhibit A-7. Tenant shall be responsible for the compliance with the Permitted Uses and with such rules and regulations by its employees, agents, contractors and invitees. Except as provided in this Lease and subject to Governmental Requirements, Landlord shall not restrict Tenant’s 24/7 access to the Common Area or Premises.

Section 5.2Reasonable Access. Tenant shall permit Landlord and Landlord’s designated representatives to enter into the Premises at mutually agreed upon dates and times on reasonable notice and escorted by an authorized Tenant representative unless otherwise expressly agreed in writing by an authorized Tenant representative (except in case of emergency in which case no notice or Tenant escort shall be required) for the purposes of inspection or for the purpose of performing Landlord’s obligations with respect to this Lease. Landlord shall provide Tenant with a written list of all personnel who entered the Premises in connection with the emergency event within five (5) business days after the emergency event, including full name, title, company, address and phone number).

Section 5.3Compliance with Governmental Requirements. Tenant shall comply with all Governmental Requirements relating to its use, occupancy and operation of the Project. “Governmental Requirements” are any and all statutes, ordinances, codes, laws, rules, regulations, orders and directives of any Governmental Agency as now or later amended, promulgated or issued and all current or future final orders, judgments or decrees of any court with jurisdiction interpreting or enforcing any of the foregoing and all restrictive covenants affecting the Project. A “Governmental Agency” is the United States of America, the State of Texas and any county, city, district, municipality or other governmental subdivision, court or agency or quasi-governmental agency with jurisdiction and any board, agency or authority associated with any such governmental entity. To Landlord’s actual knowledge, as of the Effective Date the Project is in compliance with applicable Governmental Requirements. If, during the term of this Lease, it is determined by a Governmental Agency that the Project was not in compliance with Applicable Governmental Requirements on the Effective Date and such noncompliance is finally determined by a Governmental Agency to require correction for the safety of the occupants of the Building or so that Tenant may continue occupying the Premises (the “Required Corrections”), then Landlord shall be responsible for performing the Required Corrections. “Applicable Governmental Requirements” are Governmental Requirements associated with the Project that were in effect on the Effective Date.

. Tenant shall not make or permit to be made any alterations, additions, improvements or installations in or to the Project or place signs or other displays visible from outside the Premises (individually and collectively “Tenant Alterations”), without first obtaining the consent of Landlord which may be withheld in Landlord’s sole discretion. Tenant shall deliver to Landlord complete plans and specifications for any proposed Tenant Alterations and, if consent by Landlord is given, all such work shall be performed at Tenant’s expense by Tenant consistent with the requirements in Section 4.3 of this Lease. Landlord will notify Tenant at the time of its consent if Landlord requires Tenant to remove such Tenant Alterations upon expiration of the Lease. Tenant shall be authorized to perform Tenant Alterations only to the extent and under such terms and conditions as Landlord, in its reasonable discretion, shall specify. Notwithstanding anything to the contrary in this Section 5.4, Tenant shall have the right to make cosmetic,

FREEPORT OFFICE CENTER 9

10

non-structural alterations, additions or improvements, which consist of installation of furniture, telecommunication and computer systems, pictures, trade fixtures, painting, carpeting or wall papering only (the “Cosmetic Alterations”) to the interior areas of the Premises without obtaining Landlord's prior written consent, provided that Tenant provides Landlord with prior written notice of its intention to make such Cosmetic Alterations and provided that the Cosmetic Alterations are performed consistent with the requirements in Section 4.3 of this Lease.

Section 5.5Surrender of Possession

. No act by Landlord shall be deemed an acceptance of a surrender of the Premises, and no agreement to accept a surrender of the Premises shall be valid unless it is in writing and signed by Landlord. Tenant shall, at the expiration or earlier termination of this Lease, surrender and deliver the Premises to Landlord in as good condition as when received by Tenant from Landlord or as later improved, reasonable use and wear excepted, and free from any tenancy or occupancy by any person.

Section 5.6Removal of Property. Upon the expiration or earlier termination of this Lease, Tenant shall remove its personal property, data and computer cabling and equipment, office supplies and office furniture and equipment and Tenant Alterations for which notice was provided by Landlord under Section 5.4 of this Lease. Such removal shall be completed and Tenant shall immediately repair all damage caused by or resulting from such removal prior to the expiration or earlier termination of this Lease. All Tenant Alterations shall become the property of Landlord and shall remain upon and be surrendered with the Project, unless Landlord requires their removal. If removal of Tenant Alterations is required as provided in Section 5.4, prior to the expiration or earlier termination of this Lease, Tenant shall, at its sole cost and expense, remove all (or such portion as Landlord shall designate) of the Tenant Alterations, repair any damages resulting from such removal and return the Premises to the same condition as existed prior to such Tenant Alterations.

Section 5.7Damage or Destruction.If the Project is damaged by fire, earthquake or other casualty (“Casualty”), Tenant shall give immediate written notice to Landlord. Within 45 calendar days after the date of the Casualty, Landlord will provide Tenant with an estimate of the time needed to repair the damage caused by the Casualty (the “Damage Notice”).

FREEPORT OFFICE CENTER 9

11

Section 5.8Condemnation. If (i) more than five percent (5%) of the Premises is permanently taken by eminent domain or by conveyance in lieu thereof or (ii) if a Governmental Agency permanently occupies (with people) any portion of the Premises by eminent domain or by conveyance in lieu thereof and such area cannot be separately partitioned from Tenant’s remaining Premises or (iii) if more than ten percent (10%) of the Tenant Car Spaces are permanently taken by eminent domain or by conveyance in lieu thereof and substitute spaces within the Project, or in close proximity to the Project (the “Off-Site Spaces”), are not provided within thirty (30) days from the loss of such spaces, then this Lease shall automatically terminate as of the date the physical taking occurs, and all Base Rent and other sums payable under this Lease shall be paid to that date. In the case of any other taking, this Lease shall continue in full force and effect and the Monetary Obligations shall be equitably reduced based on the proportion by which the Rentable Area of the Premises is reduced (but in no event more than the proportion by which the Rentable Area of the Premises is reduced), such reduction in Monetary Obligations to be effective as of the date the physical taking occurs. Landlord shall be responsible for the land rental or land purchase costs if Off-Site Spaces are provided and if such Off-Site Spaces are not located within a reasonable walking distance of the Project, Landlord shall also be responsible for the reasonable cost for a shuttle service between the Project and the Off-Site Spaces location. Landlord reserves all rights to damages or awards for any taking by eminent domain relating to the Project, Building, Land and the unexpired term of this Lease. Tenant assigns to Landlord any right Tenant may have to such damages or award and Tenant shall make no claim against Landlord for damages for termination of its leasehold interest or interference with Tenant’s business. Tenant shall have the right, however, to claim and recover from the condemning authority compensation for any loss to which Tenant may be entitled for Tenant’s moving expenses or other relocation costs if they are awarded separately to Tenant in the eminent domain proceedings and are not claimed by Tenant to be a part of the damages recoverable by Landlord.

Section 5.9Liens. Tenant shall have no authority, express or implied, to create or place any lien or encumbrance of any kind or nature whatsoever upon the interest of Landlord or Tenant in the Project (excluding any prior lien rights Tenant’s lender may have in Tenant personal property, including but not limited to tenant’s furniture and office workstations, located within the Premises) or against Landlord’s interests under this Lease for any Claims in favor of any person dealing with Tenant, including those who may furnish materials or perform labor for any construction or repairs. If any such lien or encumbrance is filed or recorded, Tenant shall cause it to be released or otherwise removed within ten (10) business days by a means or method approved by Landlord, such approval not to be unreasonably withheld or delayed.

Section 5.10Estoppel Certificate. Tenant shall at any time upon not less than ten (10) business days' prior written notice from Landlord execute, acknowledge and deliver to Landlord a statement in writing certifying such information as Landlord may reasonably request including, but not limited to, the following: (a) that this Lease is unmodified and in full force and effect (or, if modified, stating the nature of such modification and certifying that this Lease, as so modified, is in full force and effect) (b) the date to which the Base Rent and other charges are paid in advance and the amounts so payable, (c) that there are not, to Tenant's knowledge, any uncured defaults or unfulfilled obligations on the part of Landlord, or specifying such defaults or unfulfilled obligations, if any are claimed, (d) that all tenant improvements to be constructed by Landlord, if any, have been completed in accordance with Landlord's obligations and (e) that Tenant has taken possession of the Premises. Any such statement may be conclusively relied upon by any prospective purchaser or encumbrancer of the Project. At Landlord's option, and after the provision of a second written notice by Landlord to Tenant that allows for response within three (3) business days’, the failure of Tenant to deliver such statement within such time shall constitute a material default of Tenant hereunder, or it shall be

FREEPORT OFFICE CENTER 9

12

conclusive upon Tenant that (a) this Lease is in full force and effect, without modification except as may be represented by Landlord, (b) there are no uncured defaults in Landlord's performance, (c) not more than one month's Base Rent has been paid in advance, (d) all tenant improvements to be constructed by Landlord, if any, have been completed in accordance with Landlord's obligations and (e) Tenant has taken possession of the Premises.

Section 5.11Holdover. Tenant is not authorized to hold over beyond the expiration or earlier termination of the Lease Term. No payment of money by Tenant to Landlord after the expiration or termination of this Lease reinstates, continues or extends the Term and no extension of this Lease after the termination or expiration is valid unless agreed in writing by Landlord and Tenant. If, for any reason, Tenant retains possession of the Premises after (i) the expiration or termination of this Lease or (ii) if Tenant fails to complete any repairs required hereby, unless the parties hereto otherwise agree in writing, such possession shall establish a month to month tenancy, which shall be subject to termination by either Landlord or Tenant at any time upon not less than ten (10) days advance written notice, and provided all of the other terms and provisions of this Lease shall be applicable during such period, except that Tenant shall pay Landlord from time to time, upon demand, as rental for the period of such possession, an amount computed on a daily basis equal to 125% of the Base Rent and Building Costs in effect on the termination date.

Section 5.12Mortgage.This Lease shall be subject and subordinate to any mortgages and/or deeds of trust now or at any time hereafter constituting a lien or charge upon the Project or the improvements situated thereon; provided, however, that Tenant’s possession of the Premises will not be disturbed, nor Tenant’s rights under this Lease be diminished, as long as Tenant is not in default beyond applicable cure periods under this Lease. Tenant agrees to attorn to any mortgagee, trustee under a deed of trust or purchaser at a foreclosure sale or trustee's sale as Landlord under this Lease. Tenant, at any time hereafter, within ten (10) business days after request by Landlord, shall execute any instruments, releases or other documents that may be reasonably required by any mortgagee for the purpose of subjecting and subordinating this Lease to the lien of any such mortgage provided Tenant is provided a non-disturbance agreement in a form reasonably satisfactory to Landlord and Tenant.

Landlord shall use reasonable efforts to obtain a subordination, non-disturbance and attornment agreement from the current Landlord’s mortgagee.

Section 5.13Building Signage. Landlord agrees that Tenant shall have the non-exclusive right to install Tenant’s name on the exterior wall of the Building (the “Tenant Building Sign”) on the north side of the top of the east exterior wall of the Building. Prior to installing the Tenant Building Sign, Tenant shall submit the proposed signage design, location and specifications to Landlord for Landlord’s reasonable approval. The Tenant Building Sign shall be installed at the expense of Tenant and shall be installed in compliance with the City of Irving, Texas Building Codes and all other Governmental Requirements. The Tenant Building Sign shall not exceed 6’ in height or 30’ in length. In addition, at the expiration or termination of this Lease Agreement, Tenant agrees to remove the Tenant Building Sign and restore the affected areas of the Building where the Tenant Building Sign was installed to the condition as existed prior to the Tenant Building Sign installation. Landlord reserves the right to offer building signage to one other tenant in the Building.

Section 5.14Hazardous Materials. The term “Hazardous Materials", as used in this Lease shall mean pollutants, contaminants, toxic or hazardous wastes, or any other substances, the removal of which is required or the use of which is restricted, prohibited or penalized by any "Environmental Law", which term shall mean any federal, state or local law or ordinance relating to pollution or protection of the environment. Tenant shall not use, generate, store, or dispose of, or permit the use, generation, storage or disposal of Hazardous Materials on or about the Project except in a manner and quantity necessary for the ordinary performance of Tenant's business, and then in compliance with all Governmental Requirements. Tenant shall defend, indemnify, and hold harmless Landlord and its representatives and agents from and against any and all claims, demands, liabilities, causes of action, suits, judgments, damages and expenses including reasonable attorneys' fees and cost of cleanup and remediation arising from Tenant's or a Tenant Affiliated Party’s failure to comply with the provisions of this Section 5.14. A “Tenant Affiliated Party” includes Tenant’s agents, contractors, visitors, invitees and employees. This indemnity provision shall survive termination or expiration of this Lease.

FREEPORT OFFICE CENTER 9

13

If Tenant breaches its obligations under this Section 5.14, Landlord may immediately take any and all action reasonably appropriate to remedy the same, including taking all appropriate action to clean up or remediate any contamination resulting from Tenant's use, generation, storage or disposal of Hazardous Materials and Tenant shall be responsible for reimbursing Landlord for all associated costs. Landlord represents that, as of the Effective Date, to Landlord’s actual knowledge, there are no Hazardous Materials on, in or under the Project in violation of any applicable Environmental Law. Hazardous Materials at the Project, which (i) are in violation of Environmental Law and (ii) were not caused by Tenant or a Tenant Affiliated Party and (iii) are required to be removed or encapsulated by applicable Environmental Law are considered an “Environmental Condition”.

Except to the extent due to the actions of the Tenant or a Tenant Affiliated Party, Landlord, during the Term of this Lease, at Landlord’s sole cost and expense, shall be responsible for pursuing remediation from the 3rd party responsible for such Environmental Condition. If the Project has an Environmental Condition as a result of any actions caused by Landlord or a Landlord Affiliated Party, Landlord shall indemnify, defend and hold Tenant harmless from any and all claims, demands, liabilities, causes of action, suits, judgments, damages and expenses including reasonable attorneys' fees arising during the Term as a result of such Environmental Condition. A “Landlord Affiliated Party” includes Landlord’s agents, contractors, visitors, invitees and employees.

Section 5.15Roof Rights.Tenant shall have the right to use a portion of the roof area of the Building to install, repair and maintain a satellite antenna dish with associated antennae and cables (the “Satellite System”). The Satellite System may be installed and operated at Tenant's sole cost and expense, provided that the Satellite System is not greater than 2’ in diameter, does not protrude above the parapet wall of the Building, the weight of the Satellite System is less than 50 pounds and does not impair the structural integrity of the roof. Prior to the installation of the Satellite System, Tenant shall obtain Landlord's prior approval, which will not be unreasonably withheld, delayed or conditioned, of the location and type of Satellite System. Tenant agrees to hire a roofing contractor approved by Landlord for all penetrations, attachments or other work to the roof. Tenant shall, at its sole cost and expense, comply with all applicable Governmental Requirements including but not limited to securing all necessary permits for the installation and operation of the Satellite System. Tenant shall be solely responsible for the maintenance of the Satellite System. Tenant shall be responsible for liability and property insurance for the Satellite System consistent with the requirements of this Lease. In the event that the Satellite System causes interference to equipment used by Landlord or another tenant in the Building Tenant shall use reasonable efforts, and shall cooperate with Landlord and other tenants, to promptly eliminate such interference. Tenant shall, upon the expiration or termination of this Lease, at its sole cost and expense, remove the Satellite System and repair any damage to the roof or other parts of the Building. Landlord shall not charge Tenant for the use of the roof space for the Satellite System.

Section 5.16Parking.Landlord shall provide Tenant from the Effective Date of this Lease until expiration or early termination of this Lease the non-exclusive use of six hundred ninety(690) car parking spaces on the Land (the “Tenant Car Spaces”). The Tenant Car Spaces include Tenant’s Proportionate Share of (i) visitor spaces “Visitor Spaces” and “Handicap Spaces” located at the Project for use by Tenant and other tenants of the Building. The initial overall parking plan for the Building is shown on the Survey of the Project attached as Exhibit E. Tenant and it’s agents, employees, contractors, vendors, customers and invitees (collectively “Tenant Car Spaces Users”) do not have the right to use any specific parking spaces on the Land but only have the right to use the number of Tenant Car Spaces located in the parking areas on the Land generally. Tenant Car Spaces Users may not use additional parking spaces on the Land. Tenant Car Spaces Users shall not interfere with the rights of Landlord or other tenants of the Building or others entitled to similar use of the parking spaces on the Land. All parking facilities and Tenant Car Spaces furnished by Landlord shall be subject to the reasonable control and management of Landlord who may from time to time, establish, modify, and enforce reasonable rules and regulations with respect thereto. Landlord further reserves the right to change, construct or repair any portion thereof, and to restrict or eliminate the use of any parking areas on the Land without such actions being deemed an eviction of Tenant or a disturbance of Tenant’s use of the Premises and without Landlord being deemed in default hereunder so long as Tenant’s parking rights hereunder are not materially diminished. Tenant Car Spaces Users shall not

FREEPORT OFFICE CENTER 9

14

be required to pay parking lot rent or fees for use of the Tenant Car Spaces. Landlord reserves the right at any time to assign specific parking spaces for Tenant Car Spaces and/or other parking spaces used by others at the Project and Tenant shall thereafter be responsible to insure that Tenant Car Spaces Users park in the specifically designated parking spaces. However, should Landlord assign specific parking spaces for Tenant Car Spaces, Landlord will proportionately assign the spaces around the Building so that Tenant Car Spaces and other Building tenants car spaces are fairly distributed and equal-distant to the Building.. Landlord shall not be liable for any damage of any nature to, or any theft of, vehicles or contents thereof, in on or about the parking facilities on the Land. Tenant Car Spaces Users shall not be allowed to park on the public streets surrounding the Building and the Land. Landlord shall not be responsible for enforcing Tenant Car Spaces Users parking rights against any third parties. Any car parking spaces at the Project utilized by Tenant for uses other than car parking must be approved in writing by Landlord in advance and all such spaces shall reduce the number of Tenant Car Spaces.

SECTION 6

INSURANCE AND INDEMNIFICATION

Section 6.1 Indemnification. Tenant shall indemnify, defend and hold harmless Landlord and Landlord’s Affiliates from and against any and all Claims made against such persons occurring on or in the Project or arising solely out of (a) the possession, use or occupancy of the Project or the business conducted in the Project, (b) any act, omission or actionable neglect of Tenant or Tenant’s Affiliates, or (c) any breach or default under this Lease by Tenant or by any Tenant’s Affiliates. Tenant’s obligations under the previous sentence shall not apply if the Claim arose solely from intentional misconduct by or gross negligence of Landlord or Landlord’s Affiliates. “Landlord’s Affiliates” are a trustee and investment advisor to the Landlord, (ii) Landlord’s lender, Landlord’s property manager and Landlord’s development and leasing agents and (iii) officers, partners and employees of the foregoing. “Tenant’s Affiliates” are all officers, partners, contractors, employees and invitees of Tenant. “Claims” is an individual and collective reference to any and all claims, demands, damages, injuries, losses, liens, liabilities, penalties, fines, lawsuits, actions, and other proceedings and expenses (including reasonable attorneys’ fees and expenses incurred in connection with the proceeding, whether at trial or on appeal). Subject to Section 6.4 of this Lease, Landlord shall indemnify, defend and hold harmless Tenant from and against any and all Claims made against Tenant to the extent caused by Landlord’s or Landlord’s Affiliates’ gross negligence or willful misconduct. Landlord’s obligations under the previous sentence shall not apply to the extent that the Claim arose from intentional misconduct by or gross negligence of Tenant or Tenant’s Affiliates.

Section 6.2 Tenant Insurance. Tenant shall, throughout the Term, at its own expense, keep and maintain in full force and effect each and every one of the following policies, each of which shall be endorsed as needed to provide that the insurance afforded by these policies is primary and that all insurance carried by Landlord is strictly excess and secondary and shall not contribute with Tenant’s liability insurance:

|

§ |

A policy of commercial general liability insurance, including a contractual liability endorsement insuring against claims of bodily injury and death or property damage or loss with a combined single limit of not less than One Million Dollars ($1,000,000.00) per occurrence and Two Million Dollars ($2,000,000.00) general aggregate, which policy shall be payable on an “occurrence” rather than a “claims made” basis. Tenant shall include Landlord, Landlord’s advisor, Landlord’s property manager and Landlord’s lender as additional insureds. |

|

§ |

A policy of excess umbrella liability insurance in the amount of Five Million Dollars ($5,000,000.00) per occurrence, which policy shall be payable on an “occurrence” rather than a “claims made” basis. Tenant shall include Landlord, Landlord’s advisor, Landlord’s property manager and Landlord’s lender as additional insureds. |

|

§ |

“Special Form” property insurance (which is commonly called “all risk”) covering business interruption, Tenant Alterations, and any and all furniture, fixtures, equipment, inventory, improvements and other property in or about the Premises which is not owned by Landlord, for the then, entire current replacement cost of such property. |

|

§ |

A policy of worker’s compensation insurance as required by applicable law and employer’s liability insurance with limits of no less than One Million and No/100 Dollars ($1,000,000.00). |

FREEPORT OFFICE CENTER 9

15

|

§ |

A policy of commercial automobile liability insurance covering Tenant non-owned vehicles used in the course of doing business for Tenant and Tenant hired vehicles with limits of no less than One Million Dollars ($1,000,000.00) per occurrence. |

|

§ |

All insurance policies required under this paragraph shall be with companies having a rating according to Best’s Insurance Key Rating Guide for Property – Casualties of no less than A- Class VIII. Each policy shall provide that it is not subject to cancellation, lapse or reduction in coverage except after thirty (30) days’ written notice to Tenant, and Tenant shall promptly notify Landlord in writing of such cancellation notice, and Tenant shall provide replacement insurance prior to the effective date of such cancellation. Tenant shall deliver to Landlord, on the Effective Date and, from time to time thereafter, certificates evidencing the existence and amounts of all such policies.. Deductibles under policies procured must be reasonable and customary. |

Section 6.3Landlord’s Insurance. Landlord shall, throughout the Term, keep and maintain in full force and effect:

|

§ |

Commercial general liability insurance, insuring against claims of bodily injury and death or property damage or loss with a combined single limit of not less than One Million Dollars ($1,000,000.00) per occurrence and Two Million Dollars ($2,000,000.00) general aggregate, which policy shall be payable on an “occurrence” rather than a “claims made” basis. |

|

§ |

“Special Form” property insurance (which is commonly called “all risk”) covering the Project including the Land, Building and Tenant Improvements for the then, current replacement value of such property. Deductibles under policies procured must be reasonable and customary. |

|

§ |

Landlord may, but shall not be required to, maintain other types of insurance as Landlord deems appropriate. |

|

§ |

“Insurance Costs” means all costs incurred by Landlord for providing the insurance specified in this Section 6.3 of this Lease. Insurance Costs shall also include any applicable deductible payments. Insurance Costs shall be included in Building Costs. Insurance Costs shall not include credit enhancement related insurance for Tenant or other tenants in the Building. Insurance Costs shall not include, if applicable, the portion of the increase in the cost of this Section 6.3 insurance caused by the use of another tenant in the Building other than general business office uses, call center, printing and mailing activities. |

Section 6.4Waiver of Subrogation. Notwithstanding anything in this Lease to the contrary, Landlord and Tenant each waive and release the other from any and all Claims or any loss or damage that may occur to the Land, Building, Project, or personal property located on or in the described Project, by reason of Casualty, but only to the extent of deductibles specified in the insurance policies plus the insurance proceeds paid to such party under its policies of insurance or, if it fails to maintain the required policies, the insurance proceeds that would have been paid to such party if it had maintained such policies. Each party shall cause its insurance carrier to endorse all applicable policies waiving the carrier's rights of recovery under subrogation or otherwise against the other party.

SECTION 7

Section 7.1Assignment and Subletting by Tenant. Tenant shall not have the right, directly or indirectly by change of control or otherwise to assign, transfer, mortgage or encumber this Lease in whole or in part, nor sublet the whole or any part of the Premises, nor allow the occupancy of all or any part of the Premises by another, without first obtaining Landlord’s written consent, which shall not be unreasonably withheld delayed or conditioned. Neither Landlord’s demand for Recapture under Section 7.2 or Landlord’s conditioning of its consent under Section 7.3 shall be deemed unreasonable. No sublease or assignment, including one to which Landlord has consented, shall release Tenant from its obligations under this Lease, unless otherwise specifically agreed in writing by Landlord. It shall not be considered unreasonable if the

FREEPORT OFFICE CENTER 9

16

proposed sublease or assignment denial is based on any of the following criteria (i) proposed tenant not in business that generally leases space in Class A office space comparable to the Project, (ii) proposed tenant will use more than the Tenant Car Spaces, (iii) form of sublease or assignment is not consistent with the terms of this Lease or are not consistent with the terms and requirements of Landlord's loan documents for the Project, (iv) an Event of Default concerning Monetary Obligations exists at the time of Tenant’s request to sublet or assign.

Notwithstanding the foregoing, Tenant shall have the right, without Landlord's consent, upon advance written notice to Landlord, to assign the Lease or sublet the whole or any part of the Premises (i) to any entity or entities which are owned by Tenant, or which owns Tenant or any entity that controls, is controlled by or is under common control with Tenant (which for purposes hereof, “control” shall be deemed to be ownership of more than fifty percent (50%) of the stock or other voting interest of the controlled corporation or other business entity), (ii) in connection with the sale or transfer of substantially all of the assets of the Tenant or the sale or transfer of substantially all of the outstanding ownership interests in Tenant, or (iii) in connection with a merger, consolidation or other corporate reorganization of Tenant (each of the transactions referenced in the above subparagraphs (i), (ii), and (iii) are hereinafter referred to as a "Permitted Transfer," and each surviving entity shall hereinafter be referred to as a "Permitted Transferee"); provided, that such assignment or sublease is subject to the following conditions: (a) Tenant shall remain fully liable under the terms of the Lease; (b) such Permitted Transfer shall be subject to all of the terms, covenants and conditions of the Lease; (c) to the extent the entity constituting the original Tenant does not survive such Permitted Transfer, such Permitted Transferee has an investment grade bond rating; and (d) such Permitted Transferee shall expressly assume the obligations of Tenant under the Lease by a document reasonably satisfactory to Landlord.

Section 7.2Recapture. Landlord shall have the right to recapture all or the applicable portion of the Premises proposed to be assigned or sublet by giving written notice of Landlord’s intention to exercise such right within ten (10) days after delivery of Tenant’s request that Landlord consent to assignment or subletting (“Recapture”). The Recapture shall be effective on the earlier of the date Tenant proposed to assign or sublet or the last day of a calendar month which is at least sixty (60) days after delivery of Tenant’s request that Landlord’s consent to the assignment or subletting. On the effective date of the Recapture, this Lease shall be terminated as to the portion of the Premises subject to the Recapture.

Section 7.3Landlord Share of Revenue Surplus. Landlord may elect to condition its consent to an assignment or subletting on this paragraph. If Landlord so gives conditional consent, Tenant shall pay to Landlord if, as and when received by Tenant, fifty percent (50%) of the consideration received by Tenant for the assignment or subletting to the extent that consideration exceeds Tenant’s obligations under this Lease, after deducting all of Tenant’s third party costs and expenses (e.g., free rent, brokerage commissions, legal fees, architect and engineer fees, marketing fees and tenant finish work) to affect the Transfer (“Landlord Share of Revenue Surplus”).

Section 7.4Assignment by Landlord. Landlord shall have the right to transfer and assign, in whole or in part, its rights and obligations under this Lease and in any and all of the Land or Building. If Landlord sells or transfers any or all of the Building, Landlord and Landlord’s Affiliates shall, upon consummation of such transfer be released automatically from any liability under this Lease for obligations to be performed or observed after the date of the transfer. After the effective date of the transfer, Tenant must look solely to Landlord’s successor-in-interest related to any obligations or liabilities that arise on or after the date of transfer.

SECTION 8

DEFAULTS AND REMEDIES

Section 8.1Tenant Events of Default. The following events, herein individually referred to as a "Event of Default", each shall be deemed to be events of nonperformance by Tenant under this Lease:

FREEPORT OFFICE CENTER 9

17

|

§ |

Tenant shall fail to pay any installment of the Base Rent or Building Costs within five (5) business days of receipt of written notice from Landlord that such payment is past due or any other payment or reimbursement to Landlord required herein within ten (10) calendar days of receipt of written notice from Landlord that such payment is past due. |

|

§ |

The Tenant shall (i) become insolvent; (ii) make a general assignment for the benefit of creditors; (iii) commence any case, proceeding or other action seeking to have an order for relief entered on its behalf as a debtor or to adjudicate it a bankrupt or insolvent, or seeking reorganization, arrangement, adjustment, liquidation, dissolution or composition of it or its debts under any law relating to bankruptcy, insolvency, reorganization or relief of debtors or seeking appointment of a receiver, trustee, custodian or other similar official for it or for all or of any substantial part of its property. |

|

§ |

Any case, preceding or other action against the Tenant hereunder shall be commenced seeking (i) to have an order for relief entered against it as debtor or to adjudicate it a bankrupt insolvent; (ii) reorganization, arrangement, adjustment, liquidation, dissolution or composition of it or its debts under any law relating to bankruptcy, insolvency, reorganization or relief of debtors; (iii) appointment of a receiver, trustee, custodian or other similar official for it or for all or any substantial part of its property, and such case, proceeding or other action (a) results in the entry of an order for relief against it which it is not fully stayed within ten (10) business days after the entry thereof or (b) shall remain undismissed for a period of sixty (60) days. |

|

§ |

Tenant shall fail to discharge or bond around any lien placed upon the Project in violation of Section 5.9 of this Lease within thirty (30) days after written notice to Tenant that any such lien or encumbrance is filed against the Project, unless such lien is contested in good faith by Tenant by appropriate judicial, administrative or other comparable proceedings in which case Tenant shall bond around such lien. |

|

§ |

Tenant shall fail to comply with any term, provision or covenant of this Lease, other than those listed in this Section 8.1 and shall not cure such failure within thirty (30) days after written notice thereof to Tenant unless such cure cannot reasonably be accomplished within such thirty (30) days, in which event Tenant shall have such additional time as is reasonably necessary to accomplish such cure provided Tenant promptly commences and diligently prosecutes such cure to completion. |

Section 8.2Landlord Remedies for Tenant Default.

Upon each occurrence of an Event of Default, Landlord shall have the option to pursue any one or more of the following remedies without any notice or demand:

(1)Terminate this Lease and pursue Tenant for actual damages; and/or

(2)Enter upon and take possession of the Premises without terminating this Lease and/or

(3)Alter all locks and other security devices at the Premises with or without terminating this Lease, deny access to Tenant and pursue, at Landlord's option, one or more remedies pursuant to this Lease.

|

§ |