NEXTIER OILFIELD SOLUTIONS INC. EQUITY AND INCENTIVE AWARD PLAN FORM OF PERFORMANCE AWARD AGREEMENT

Exhibit 10.43

EQUITY AND INCENTIVE AWARD PLAN

FORM OF PERFORMANCE AWARD AGREEMENT

This Performance Award Agreement (this “Agreement”) is made and entered into as of January 3, 2022 (the “Grant Date”), by and between NexTier Oilfield Solutions Inc., a Delaware corporation (the “Company”), and _____________ (the “Participant”), who is employed by the Company or one of its subsidiaries on the Grant Date. Capitalized terms not otherwise defined herein or in an Appendix shall have the meanings provided in the NexTier Oilfield Solutions Inc. Equity and Incentive Award Plan, as amended, modified or supplemented from time to time (the “Plan”).

W I T N E S S E T H:

WHEREAS, the Company maintains the Plan; and

WHEREAS, the Company desires to grant Performance Units to the Participant pursuant to the terms of the Plan and the terms set forth herein; and

NOW, THEREFORE, in consideration of the mutual covenants and agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties hereby agree as follows:

1.Grant. Subject to the conditions set forth in the Plan and this Agreement, including Appendix A, the Company grants to the Participant _________ Performance Units.

2.Vesting. The Participant shall become vested in the Performance Units as described in Appendix A. Except as otherwise provided in this Agreement or an Appendix, upon the Participant’s Termination for any reason, the portion of the Performance Units in which the Participant has not become vested shall be cancelled, and forfeited by the Participant, without consideration.

3.Stockholder Rights. The Participant shall not have any voting rights, rights to dividends or any other rights of a stockholder with respect to the Performance Units.

4.Transferability. Except as permitted by the Committee, in its sole discretion, the Performance Units may not be assigned, alienated, pledged, attached, sold or otherwise transferred or encumbered by the Participant other than by will or by the laws of descent and distribution or, subject to the consent of the Committee, pursuant to a domestic relations order, unless and until the Performance Units have been vested and settled and the settlement value paid, and all restrictions applicable to such Performance Units have lapsed, and any such purported assignment, alienation, pledge, attachment, sale, transfer or encumbrance shall be void and unenforceable against the Company; provided that the designation of a beneficiary shall not constitute an assignment, alienation, pledge, attachment, sale, transfer or encumbrance.

5.Taxes. The Participant has reviewed with his or her own tax advisors the federal, state, local and foreign tax consequences of this investment and the transactions contemplated by this Agreement. The Participant is relying solely on such advisors and not on any statements or representations of the Company or any of its agents. The Participant understands that the

Participant (and not the Company) shall be responsible for the Participant’s own tax liability that may arise as a result of the transactions contemplated by this Agreement. To satisfy applicable tax withholding obligations arising from the vesting or settlement of the Performance Units, the Company will withhold a portion of the settlement value to be delivered to the Participant upon settlement of the Performance Units in order to satisfy the Participant’s federal, state, local and foreign income and payroll tax liabilities based on the minimum statutory withholding rates for federal, state, local and foreign income tax and payroll tax purposes that are applicable to such supplemental taxable income.

6.Incorporation by Reference. The terms and provisions of the Plan (as such Plan may be amended, modified or supplemented) are incorporated herein by reference, and the Participant hereby acknowledges receiving a copy of the Plan and represents that the Participant is familiar with the terms and provisions thereof. The Participant accepts this Award subject to all of the terms and conditions of the Plan. In the event of a conflict or inconsistency between the terms of the Plan and the terms of this Agreement, the Plan shall govern and control. Further, the terms and provisions of the Participant’s employment agreement, if any, are incorporated herein by reference. In the event of a conflict or inconsistency between the terms of the Participant’s employment agreement and this Agreement, the Participant’s employment agreement shall govern and control.

(a)Securities Laws and Representations. The Participant acknowledges that the Plan is intended to conform to the extent necessary with all applicable federal, state and foreign securities laws (including the Securities Act and the Exchange Act) and any and all regulations and rules promulgated thereunder by the Securities and Exchange Commission or any other governmental regulatory body. Notwithstanding anything herein to the contrary, the Plan shall be administered only in such a manner as to conform to such laws, rules and regulations. To the extent permitted by applicable law, the Plan and this Agreement shall be deemed amended to the extent necessary to conform to such laws, rules and regulations. Without limiting the foregoing, the Performance Units are being granted to the Participant and this Agreement is being made by the Company in reliance upon the following express representations and warranties of the Participant. The Participant acknowledges, represents and warrants that the Participant has been advised that the Participant may be an “affiliate” within the meaning of Rule 144 under the Securities Act of 1933 (the “Securities Act”) and in this connection the Company is relying in part on the Participant’s representations set forth in herein.

7.Captions. The captions in this Agreement are for convenience of reference only and shall not limit or otherwise affect the meaning of terms contained herein.

8.Entire Agreement. This Agreement (including all Appendices, Exhibits or other attachments) together with the Plan, as any of the foregoing may be amended or supplemented in accordance with their terms, constitutes the entire agreement and understanding of the parties hereto with respect to the subject matter contained herein and therein, and supersedes all prior communications, representations and negotiations in respect thereto, except restrictive covenants contained in other agreements containing separate consideration, which shall survive and continue in accordance with their terms.

9.Successors and Assigns. The terms of this Agreement shall inure to the benefit of and be binding upon the parties hereto and their respective heirs, successors and permitted assigns. The rights and obligations of Participant under this Agreement, being personal, may not be assigned or delegated under this Agreement without the prior written consent of the Company. The Company may assign its rights and obligations to another entity which shall succeed to all or substantially all of the assets and business of the Company.

2

10.Amendments and Waivers. Subject to the provisions of the Plan, the provisions of this Agreement may not be amended, modified, supplemented or terminated, and waivers or consents to departures from the provisions hereof may not be given, without the written consent of each of the parties hereto. The rights and remedies of the Company are cumulative and not alternative. Neither the failure nor any delay by the Company in exercising any right, power, or privilege under this Agreement shall operate as a waiver of such right, power, or privilege, and no single or partial exercise of any such right, power, or privilege shall preclude any other or further exercise of such right, power, or privilege or the exercise of any other right, power, or privilege.

11.Severability. In the event that any provision of this Agreement shall be held illegal or invalid for any reason, such illegality or invalidity shall not affect the remaining parts of this Agreement, and this Agreement shall be construed and enforced as if the illegal or invalid provision had not been included. Without limiting the generality of the foregoing, if any provision of this Agreement shall be found to be illegal, invalid or otherwise unenforceable, the court making such determination shall have the power to reduce the duration, scope, and/or area of such provision to the maximum and/or broadest duration, scope, and/or area permissible by law, and in its reduced form such provision shall then be enforceable.

12.Signature in Counterparts. This Agreement may be signed in counterparts, each which shall constitute an original, with the same effect as if the signatures thereto and hereto were upon the same instrument. Participant agrees to accept all documents and notices via electronic delivery via email, internet or other means and in lieu of paper documents. Participant further agrees to participate in electronic exchange of signatures via click through, electronic signatures or other means. IN CONSIDERATION FOR, AND AS A CONDITION TO, THIS AWARD, THE PARTICIPANT SHALL EXECUTE AND DELIVER THIS AGREEMENT TO THE COMPANY ON OR BEFORE THE EARLIER OF (I) THE SIXTYTH (60) DAY FOLLOWING THE GRANT DATE AND (II) THE DAY BEFORE THE FIRST VESTING DATE. THIS AWARD SHALL BE NULL AND VOID AB INITIO IN THE EVENT THAT THE PARTICIPANT DOES NOT TIMELY EXECUTE THIS AGREEMENT.

13.Notices. Any notice required to be given or delivered to the Company under the terms of the Plan or this Agreement shall be in writing and addressed to the General Counsel and the Secretary of the Company at its principal corporate offices. Any notice required to be given or delivered to the Participant shall be in writing and addressed to the Participant at the address listed in the Company’s personnel files (including email address) or to such other address as the Participant may designate in writing from time to time to the Company. All notices shall be deemed to have been given or delivered upon: personal delivery, three days after deposit in the United States mail by certified or registered mail (return receipt requested), one business day after deposit with any return receipt express courier (prepaid), or one business day after transmission by facsimile or email.

14.Governing Law. This Agreement shall be governed by and construed in accordance with the internal laws of the State of Delaware, without giving effect to any choice of law provision or rule (whether of the State of Delaware or any other jurisdiction) that would cause the laws of any jurisdiction other than the State of Delaware to be applied.

15.Consent to Jurisdiction. Each of the parties hereto hereby irrevocably and unconditionally agrees that any action, suit or proceeding, at law or equity, arising out of or relating to the Plan, this Agreement or any agreements or transactions contemplated hereby shall only be brought in any federal court of the Southern District of Texas or any state court located in Xxxxxx County, State of Texas, and hereby irrevocably and unconditionally expressly submits

3

to the personal jurisdiction and venue of such courts for the purposes thereof and hereby irrevocably and unconditionally waives (by way of motion, as a defense or otherwise) any and all jurisdictional, venue and convenience objections or defenses that such party may have in such action, suit or proceeding. Each party hereby irrevocably and unconditionally consents to the service of process of any of the aforementioned courts.

16.Waiver of Jury Trial. THE PARTIES HERETO HEREBY WAIVE, TO THE EXTENT PERMITTED BY APPLICABLE LAW, TRIAL BY JURY IN ANY LITIGATION IN ANY COURT WITH RESPECT TO, IN CONNECTION WITH, OR ARISING OUT OF THIS AGREEMENT OR THE VALIDITY, INTERPRETATION OR ENFORCEMENT HEREOF. THE PARTIES HERETO AGREE THAT THIS SECTION IS A SPECIFIC AND MATERIAL ASPECT OF THIS AGREEMENT AND WOULD NOT ENTER INTO THIS AGREEMENT IF THIS SECTION WERE NOT PART OF THIS AGREEMENT.

17.No Employment Rights. The Participant understands and agrees that this Agreement does not impact in any way the right of the Company or its Subsidiaries to terminate or change the terms of the employment of the Participant at any time for any reason whatsoever, with or without cause, nor confer upon any right to continue in the employ of the Company or any of its Subsidiaries.

18.Claw-Back Policy. The Performance Units shall be subject to any claw-back policy implemented by the Company.

[Signature page follows]

4

IN WITNESS WHEREOF, the parties hereto have executed this Agreement as of the first date set forth above.

By: ______________________________

Name:

Title:

PARTICIPANT

By: _____________________________

Name: ___________________________

5

Appendix A

Performance Award - Relative TSR Award

(Three Year Vesting Award)

The terms of this Appendix A shall apply to the Performance Units (the “PUs”) awarded to ____________ (the “Participant”) on January 3, 2022 (the “Grant Date”) under the NexTier Oilfield Solutions Inc. Equity and Incentive Award Plan (the “Plan”).

1.General.

(a)Except as provided in Section 4 below, the Participant’s PUs shall become vested based on the satisfaction of both the Time Measure and the Performance Criteria for such PUs, each as outlined below. If vesting occurs, the PUs represent the unfunded, unsecured right of the Participant to receive a cash payment of the Settlement Value (as defined below).

(b)The initial number of PUs fixed as the “target” number of performance units that may be valued for settlement subject to this Appendix shall be ________ (the “Target Number”). Such initial number of PUs shall be adjusted based on the attainment of the Performance Criteria described in Section 3 below.

(c)The “Performance Period” for the PUs subject to this Appendix shall commence on January 1, 2022 and end on December 31, 2024.

2.Time Measure.

The Time Measure shall be satisfied with respect to a PU if the Participant is an employee, consultant or a member of the board of directors (or a similar position) of the Company for the period beginning on the Grant Date and ending on December 31, 2024 (the “Time Vesting Date”).

3.Performance Criteria.

(a)The attainment of the Performance Criteria and Payout Percentage (see table below in Section 3(c)) shall determine (i) the number of Participant’s PUs for which the Forfeiture Restrictions shall lapse on the Measurement Date, and (ii) the Settled Value delivered upon settlement of such PUs. The number of the Participant’s PUs which cease to be subject to Forfeiture Restrictions on the Measurement Date, and the Settlement Value to be delivered with respect to the Participant’s PUs, is based upon the Company’s Annualized Total Stockholder Return (“Annualized TSR”) ranking relative to the TSR Peer Group, which is described in Section 3(h) below, (“Relative TSR Performance Rank”) for the Performance Period. As provided in Section 3(c) below, the Performance Criteria will be satisfied based on the Company’s Relative TSR during the Performance Period, as certified in writing by the Committee following the end of the Performance Period.

(b)The Forfeiture Restriction shall lapse if the Company’s Relative TSR Performance Rank for the Performance Period is at least the 20th percentile; provided that the final number of PUs subject to this Appendix as of the applicable Measurement Date shall be determined based on the Company’s Relative TSR Performance Rank as described in the table below. If the Company’s Relative TSR Performance Rank is between the levels designated in the table below, then the Payout Percentage (shown in the table below) shall be adjusted based

6

on linear interpolation between applicable percentages. For example, (i) if the Company’s Relative TSR is in the 35th percentile, then the Payout Percentage would be 75% of the Target Number, and (ii) if the Company’s Relative TSR is in the 65th percentile, then the Payout Percentage would be 150% of the Target Number.

| Level | Relative TSR Performance Rank | Payout Percentage | ||||||

| Maximum | 80th percentile or ≥ 2nd rank | 200% of Target Number | ||||||

| Target | 50th percentile | 100% of Target Number | ||||||

| Threshold | 20th percentile | 40% of Target Number | ||||||

| Below 20th percentile | 0% | |||||||

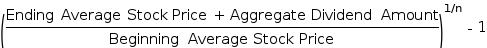

(c)Annualized TSR is a percentage that shall be calculated as follows:

where n represents the number of years over which Annualized TSR is measured.

The “Ending Average Stock Price” shall be calculated as the average Closing Stock Price for the last 20 trading days of the applicable Performance Period.

The “Beginning Average Stock Price” shall be calculated as the average Closing Stock Price for the last 20 trading days prior to the first day of the applicable Performance Period.

The “Closing Stock Price” of a share of common stock shall be the closing quotation on the New York Stock Exchange (“NYSE”) for the applicable date (or an applicable substitute exchange or quotation system if the NYSE is no longer applicable).

“Aggregate Dividend Amount” shall be calculated as the fair market value of the aggregate share dividends or distributions that have been distributed with respect to a share of common stock during the applicable Performance Period.

The Annualized TSR for the TSR Peer Group companies will be determined using the calculation method described above based on information specific to the TSR Peer Group companies.

(d)Notwithstanding Section 3(c) above, the Payout Percentage for the Participant’s PUs shall be subject to the following modifications: (i) if the Company’s Annualized TSR for the Performance Period is a negative amount, then then the Payout Percentage multiplied by the Target Number multiplied by the Closing Stock Price on the Settlement Date shall not exceed the Target Number multiplied by Closing Stock Price on Grant

7

Date; and (ii) if the Company’s Annualized TSR for the Performance Period is at least fifty percent (50%), then the Payout Percentage shall be not less than one hundred percent (100%).

(e)In addition to any other authority or powers granted to the Committee herein or in the Plan, the Committee shall have the authority to interpret and determine the application and calculation of any matter relating to the determination of Annualized TSR and Relative TSR Performance Rank, including any terms in the Agreement or this Appendix. The Committee shall also have the power to make any and all adjustments it deems appropriate to reflect any changes in the Company’s outstanding Common Stock, including by reason of subdivision or consolidation of the Common Stock or other capital readjustment, the payment of a stock dividend on the Common Stock, other increase or reduction in the number of shares of Common Stock outstanding, recapitalizations, reorganizations, mergers, consolidations, combinations, split-ups, split-offs, spin-offs, exchanges or other relevant changes in capitalization. The determination of the Committee with respect to any such matter shall be conclusive.

(f)If a Change in Control occurs during the Performance Period, the Performance Period shall be deemed to have ended on the date such Change in Control occurs for purposes of determining the number of PUs that shall be subject to this Agreement; provided, however, that the Participant shall be required to continue to provide services to the Company until the Time Vesting Date to become vested in such PUs.

(g)TSR Peer Group. The initial TSR Peer Group shall include the companies listed in the chart below.

| Name | Ticker | ||||

| KLX Energy Services Holdings, Inc. | KLXE | ||||

| Liberty Oilfield Services Inc. | LBRT | ||||

| Nine Energy Service, Inc. | NINE | ||||

| Xxxxxxxxx-UTI Energy, Inc. | PTEN | ||||

| ProPetro Holding Corp | PUMP | ||||

| RPC, Inc. | RES | ||||

| Solaris Oilfield Infrastructure, Inc. | SOI | ||||

| U.S. Well Services, Inc. | USWS | ||||

| PHLX Oil Service Sector Index | ^OSX | ||||

The Committee, in its sole discretion, may adjust or change the TSR Peer Group as circumstances warrant during the Performance Period, provided any such change shall be made in good faith and shall not result in an arbitrary increase or decrease in the amount payable under this Agreement. Any such adjustment or change may include, but not be limited to, the following:

(1) If a TSR Peer Group company becomes bankrupt, the bankrupt company will remain in the TSR Peer Group positioned at one level below the lowest performing non-bankrupt TSR Peer Group. In the case of multiple bankruptcies, the bankrupt TSR Peer Group companies will be positioned below the non-bankrupt companies in chronological order by bankruptcy date with the first to go bankrupt at the bottom.

8

(2) If a TSR Peer Group company is acquired by another company, including through a management buy-out or going-private transaction, the acquired TSR Peer Group company will be removed from the TSR Peer Group for the entire Performance Period; provided that if the acquired TSR Peer Group company became bankrupt prior to its acquisition it shall be treated as provided in paragraph (1), above, or if it shall become delisted according to paragraph (5) below prior to its acquisition it shall be treated as provided in paragraph (5).

(3) If a TSR Peer Group company spins-off a portion of its business in a manner which results in the TSR Peer Group company and the spin-off company both being publicly traded, the TSR Peer Group company will not be removed from the TSR Peer Group for the entire Performance Period and the spin-off company will not be added to the TSR Peer Group. In the event the Committee determines that including the spin-off company in the TSR Peer Group instead of the original TSR Peer Group company is consistent with the Committee’s intent in designating the TSR Peer Group company as part of the TSR Peer Group, the Committee may instead elect to include the spin-off company in the TSR Peer Group.

(4) If a TSR Peer Group company acquires another company, the acquiring TSR Peer Group company will remain in the TSR Peer Group for the Performance Period.

(5) If a TSR Peer Group company is delisted from either the New York Stock Exchange (NYSE) or the National Association of Securities Dealers Automated Quotations (NASDAQ), other than as a result of an event described in clauses (1) or (2) above, such that it is no longer listed on either exchange, such delisted TSR Peer Group company will remain in the TSR Peer Group positioned at one level below the lowest performing listed company and above the highest ranked bankrupt TSR Peer Group company (see paragraph (1) above). In the case of multiple delistings, the delisted TSR Peer Group companies will be positioned below the listed and above the bankrupt TSR Peer Group companies in chronological order by delisting date with the first to be delisted at the bottom of the delisted companies. If a delisted company shall become bankrupt, it shall be treated as provided in paragraph (1) above. If a delisted company shall be later acquired, it shall be treated as a delisted company under this paragraph. If a delisted company shall relist during the Performance Period, it shall remain in its relative delisted position determined under this paragraph.

(6) If any TSR Peer Group company’s stock splits (or if there are other similar subdivisions, consolidations or changes in such company’s stock or capitalization), such company’s Annualized TSR performance will be adjusted for the stock split so as not to give an advantage or disadvantage to such company by comparison to the other TSR Peer Group companies.

4.Accelerated Vesting.

(a)In the event of the Participant’s Termination (i) by the Company without Cause (other than as a result of death or Disability) prior to the end of the applicable Performance Period or (ii) by the Participant for Good Reason prior to the end of the applicable Performance Period:

(x) if such Termination occurs within the twelve (12) month period following a Change in Control (a “CIC Period”), then upon the date of such Termination the Participant shall become one hundred percent (100%) vested in the PUs, and

9

(y) if such Termination occurs other than within a CIC Period, then upon the date of such Termination the Participant shall be deemed to have satisfied the Time Measure with respect to a pro-rata portion of the PUs, which amount shall be determined as if the Participant remained employed for a period of twelve (12) month following the date of Termination. The actual amount shall be paid at the time such payments would have been made if the Participant remained continuously employed by the Company through the end of the applicable Performance Period and shall be determined based on the achievement of the applicable Performance Criteria during the applicable Performance Period.

(b)Except as otherwise provided in Section 4(a) above, in the event of the Participant’s Termination (i) due to the Participant’s death or (ii) by the Company due to the Participant’s Disability, then upon the date of such Termination the Participant shall be deemed to have satisfied the Time Measure with respect to a pro-rata portion of the PUs, which amount shall be determined as if the Participant remained employed for a period of twelve (12) month following the date of Termination; provided, however, that the actual amount paid at the time such payments would have been made if the Participant remained continuously employed by the Company through the end of the applicable Performance Period and shall be determined based on the achievement of the applicable Performance Criteria during the applicable Performance Period.

5.Award Settlement.

The Company shall deliver to the Participant (or, in the event of the Participant’s prior death, the Participant’s beneficiary) for each PU in which the Participant becomes vested in accordance with this Agreement an amount (the “Settlement Value”) equal to the product of the number of vested PUs subject to this Agreement and the closing price on the New York Stock Exchange of a share of the Common Stock on December 31, 2024 (or if such date is not a trading day, the immediately preceding trading day); provided that the maximum amount of the Settlement Value of vested PUs in any calendar year is capped at and may not exceed any limitation or cap (as may be amended or modified from time to time) set forth therefor in the Plan. Delivery of the Settlement Value, if any, shall be reduced by any applicable tax withholding, and shall be made as soon as reasonably practicable following the end of the applicable Performance Period, but in no event later than the fifteenth (15th) day of the third month following the end of the calendar year in which the end of the applicable Performance Period occurs (the date of such delivery, the “Settlement Date”). Upon the payment of the Settlement Value in accordance with this Agreement, the PUs shall be extinguished.

6.Definitions

For purposes of this Agreement (including Appendix B) the following definitions shall apply.

(a)“Cause” shall mean (i) in the event that the Participant is subject to a written employment or similar individualized agreement with the Company and/or any of its Subsidiaries that defines “cause” (or words with similar meaning), Cause shall have the meaning set forth in such agreement, and (ii) in the event that the Participant is not subject to a written employment or similar individualized agreement with the Company and/or any of its Subsidiaries that defines “cause” (or words with similar meaning), Cause shall mean (a) the Participant’s indictment for, conviction of, or the entry of a plea of guilty or no contest to, a felony or any other crime involving dishonesty, moral turpitude or theft; (b) the Participant’s conduct in connection with the Participant’s duties or responsibilities with the Company that is fraudulent, unlawful or grossly negligent; (c) the Participant’s willful misconduct; (d) the

10

Participant’s contravention of specific lawful directions related to a material duty or responsibility which is directed to be undertaken from the Board or the person to whom the Participant reports; (e) the Participant’s material breach of the Participant’s obligations under the Plan, this Agreement or any other agreement between the Participant and the Company and its Subsidiaries; (f) any acts of dishonesty by the Participant resulting or intending to result in personal gain or enrichment at the expense of the Company, its Subsidiaries or Affiliates; or (g) the Participant’s failure to comply with a material policy of the Company, its Subsidiaries or Affiliates.

(b)“Disability” means a determination by the Company in accordance with applicable law that as a result of a physical or mental injury or illness, the Participant is unable to perform the essential functions of the Participant’s job with or without reasonable accommodation for a period of (i) ninety (90) consecutive days, or (ii) one hundred twenty (120) days in any one (1) year period.

(c)“Good Reason” shall mean (i) in the event that the Participant is subject to a written employment or similar individualized agreement with the Company and/or any of its Subsidiaries that defines “good reason” (or words with similar meaning), Good Reason shall have the meaning set forth in such agreement, and (ii) in the event that the Participant is not subject to a written employment or similar individualized agreement with the Company and/or any of its Subsidiaries that defines “good reason” (or words with similar meaning), Good Reason shall mean the occurrence of any of the following, without the Participant’s consent: (a) a material diminution of the Participant’s title, duties or authority, or (b) a material reduction in the Participant’s base salary. Any event shall cease to constitute Good Reason unless within ninety (90) days after the Participant’s knowledge of the occurrence of such event that constitutes Good Reason the Participant has provided the Company with at least thirty (30) days’ written notice setting forth in reasonable specificity the events or facts that constitute Good Reason. If the Company timely cures the event giving rise to Good Reason for the Participant’s resignation, the Good Reason shall be deemed not to exist.

11