SUBSCRIPTION FOR SECURITIES AND AGREEMENT TO PURCHASE ADDITIONAL SECURITIES

Exhibit 10.13

SUBSCRIPTION FOR SECURITIES AND AGREEMENT TO

PURCHASE ADDITIONAL SECURITIES

| TO: | PERU COPPER INC. (the “Corporation”) | |

| AND TO: | BMO XXXXXXX XXXXX INC. (“BMO”) | |

| AND TO: | XXXXXXX SECURITIES INC. (“Xxxxxxx” and together with BMO and each of their U.S. Affiliates (as defined below), the “Agents”) | |

| AND TO: | Xxxxxxxxx XxxXxxx-Xxxxxxx, Ranchu Copper Investments Limited, Fisherking Holdings Ltd., Xxxxxx Mineral Exploration, LLC, Sunbeam Opportunities Limited, Campania Holding, Inc. and Tangent International Limited (collectively, the “Selling Shareholders”) | |

The undersigned (the “Subscriber”) hereby irrevocably subscribes for and agrees to purchase units of the Corporation (the “Units”) at a price of US$1.40 per Unit for an aggregate consideration of US$ (the “Subscription Price”), on the terms and conditions set out in sections 1 to 27 below.

By subscribing for the Units set out above, the Subscriber irrevocably agrees to purchase from the Selling Shareholders on the Second Closing Date (as defined below) 0.35 of an additional Note (each an “Additional Note”) for each one Unit subscribed for at a price of US$1.40 per Additional Note on the terms and conditions set out in sections 1 to 27 below.

Each Unit will consist of one unsecured, non-interest bearing convertible note of the Corporation (“Note”) plus one-half of a special share purchase warrant of the Corporation (“Special Warrant”). Each Note is convertible at the election of the holder into one common share in the capital of the Corporation (“Common Share”) at any time for no additional payment before the completion of an IPO and upon completion of an IPO, each Note then issued and outstanding shall automatically convert into one Common Share. Each whole Special Warrant is exercisable to acquire one share purchase warrant of the Corporation (“Warrant”) without payment of further consideration at the election of the holder at any time before the completion of an IPO and upon completion of an IPO, each Special Warrant then issued and outstanding shall automatically be exercised for one Warrant. Each whole Warrant will entitle the holder to acquire one Common Share at a price of US$2.00 per Common Share for a period of 24 months following the closing of the Treasury Offering.

The Units will comprise part of a treasury offering of up to 8,571,429 Units for gross proceeds of up to US$12,000,000 (the “Treasury Offering”) and the Additional Notes sold by the Selling Shareholders will comprise part of a secondary offering of up to 3,000,000 Additional Notes for gross proceeds of up to US$4,200,000 by the Selling Shareholders (the “Secondary Offering”, and together with the Treasury Offering, the “Offering”). The Offering is being conducted in Canada through BMO and Xxxxxxx, and in the United States through their U.S. Affiliates.

No prospectus, registration statement or similar offering document will be filed at or prior to the Closing Time, and no commitment made to file a prospectus, registration statement or similar offering document at any later time. with any Securities

- 1 -

Regulator in any jurisdiction with respect to the Units, the Additional Notes or the other Securities (as defined below).

A copy of the term sheet outlining certain details of the Offering is attached hereto as Schedule “A”. In the event of any inconsistency between the provisions of Schedule “A” and the remainder of this Subscription Agreement, the provisions of the remainder of this Subscription Agreement shall apply.

The Units, the Notes and the Special Warrants comprising the Units, the Warrants which may be received on exercise of the Special Warrants, and the Common Shares which may be received on the exercise of the Warrants or on conversion of the Notes are collectively referred to as the “Treasury Securities”. The Additional Notes and the Common Shares which may be acquired on conversion of the Additional Notes are herein referred to as the “Secondary Securities” and together with the Treasury Securities, are referred to as the “Securities”.

DATED at , in the of , this day of , 2004.

| (Name of Subscriber - please print) |

Subscriber’s Address | |||||||

| By: | ||||||||

| (Official Capacity or Title - please print) |

||||||||

| Authorized Signature |

(Telephone Number) | |||||||

| (Please print name of individual whose signature appears above if different than the name of the Subscriber printed above). | (Facsimile Number) | |||||||

- 2 -

| Details of Beneficial Subscriber If Not Same as Subscriber: | ||||||||

| (Name - please print) |

(Beneficial Subscriber’s Address) | |||||||

| (if space is inadequate please attach a schedule containing the necessary information) | ||||||||

| Registration Instructions: | Delivery Instructions: | |||||||

| Name | Name | |||||||

| Account reference, if applicable | Account reference, if applicable | |||||||

| Address | Contact Name | |||||||

| Address | ||||||||

| Telephone Number | ||||||||

| Facsimile Number | ||||||||

* * * *

- 3 -

This Subscription Agreement is accepted by Peru Copper Inc. and the Selling Shareholders this day of , 2004.

| PERU COPPER INC. | ||

| Per: |

||

| Authorized Signatory | ||

| SELLING SHAREHOLDERS | ||

| Per: |

||

| Authorized Signatory on behalf of the Selling Shareholders | ||

- 4 -

1. Defined Terms.

In addition to the terms defined above, the following capitalized terms used in this Subscription Agreement have the following meanings:

“Additional Notes” has the meaning given on the first page of this Subscription Agreement;

“Agency Agreement” means the agency agreement to be entered into between the Corporation and the Agents in connection with this Offering.

“Agents” means BMO Xxxxxxx Xxxxx Inc., Xxxxxxx Securities Inc. and each of their U.S. Affiliates; and

“Broker Options” has the meaning given in Section 13 of this Subscription Agreement;

“Broker Warrants” has the meaning given in Section 13 of this Subscription Agreement;

“Business Day” means a day which is not a Saturday, Sunday or a statutory or civic holiday in the City of Vancouver, Province of British Columbia;

“Closing” means the closing on the First Closing Date of the transaction of purchase and sale in respect of the Units as contemplated by this Subscription Agreement and the Agency Agreement;

“Closing Time” means 11:00 a.m. (Toronto time) on the First Closing Date or Second Closing Date, as applicable, or such other time as the Agents and the Corporation may agree;

“Common Share” has the meaning given on the first page of this Subscription Agreement;

“Corporation” means Peru Copper Inc.;

“First Closing Date” means March 18, 2004, or such other date as agreed to by the Agents and the Corporation;

“IPO” means either a Qualified IPO or a Non-qualified IPO;

“Non-qualified IPO” means (i) an initial public offering of Common Shares of the Corporation with an offering amount of less than US$25 million, or a reverse-take over transaction, pursuant to which the Common Shares of the Corporation (in the case of an initial public offering) or common shares of the acquiring company (in the case of a reverse take-over) are listed on the TSX or another internationally recognized stock exchange, provided that the prospectus (the “Prospectus”) with respect to the Non-Qualified IPO qualifies the Common Shares issuable upon conversion of the Notes and the Warrants or the common shares of the acquiring company issued on the exchange of the Notes and the Warrants in a reverse take-over transaction such that those securities are freely tradable; or (ii) a merger, amalgamation, arrangement, take-over or other form of corporate transaction pursuant to which an arm’s length third party acquires voting control of the Corporation, provided that such transaction is accepted by holders of not less than 662/3% of the Notes and 66 2/3% of the Common Shares and further provided that the holders of 662/3% of the Common Shares and 662/3% of the Notes receive either cash and/or freely tradeable

- 5 -

equity securities that are listed on an internationally recognized stock exchange in connection with such transaction;

“Note” has the meaning given on the first page of this Subscription Agreement;

“Offering” has the meaning given on the first page of this Subscription Agreement;

“Qualified IPO” means (i) an initial public offering of Common Shares of the Corporation with a minimum offering amount of US$25 million, or a reverse-take over transaction, pursuant to which the Common Shares of the Corporation (in the case of an initial public offering) or common shares of the acquiring company (in the case of a reverse take-over) are listed on the TSX or another internationally recognized stock exchange, provided that the prospectus (the “Prospectus”) with respect to the Qualified IPO qualifies the Common Shares issuable upon conversion of the Notes and the Warrants or the common shares of the acquiring company issuable upon the conversion of the Notes and the Warrants in a reverse take-over transaction such that those securities are freely tradable; or (ii) a merger, amalgamation, arrangement, take-over or other form of corporate transaction pursuant to which an arm’s length third party acquires voting control of the Corporation, provided that such transaction is accepted by holders of not less than 662/3% of the Notes and 662/3% of the Common Shares and further provided that the holders of 662/3% of the Common Shares and 662/3% of the Notes receive either cash and/or freely tradeable equity securities that are listed on an internationally recognized stock exchange in connection with such transaction;

“Second Closing” means the closing on the Second Closing Date of the transaction of purchase and sale in respect of the Additional Notes as contemplated by this Subscription Agreement and the Agency Agreement;

“Second Closing Date” means April 30, 2004 or such other date as agreed to by the Agents and the Corporation;

“Secondary Offering” has the meaning given on the first page of this Subscription Agreement;

“Secondary Securities” has the meaning given on the second page of this Subscription Agreement;

“Securities” has the meaning given on the second page of this Subscription Agreement;

“Securities Laws” means the securities laws, regulations and rules, and the blanket rulings and policies and written interpretations of, and multilateral or national instruments adopted by, the Securities Regulators of all of the Selling Jurisdictions or, as the context may require, anyone or more of the Selling Jurisdictions;

“Securities Regulators” means the securities commissions or other securities regulatory authorities of all of the Selling Jurisdictions or the relevant Selling Jurisdiction as the context so requires;

“Selling Jurisdictions” means the Provinces of British Columbia and Ontario, the United States and such other jurisdictions in Canada and outside of Canada which are agreed to by the Corporation and the Agents or otherwise permitted under the Agency Agreement; and “Selling

- 6 -

Jurisdiction” means, in the case of any Subscriber, the province of Canada, the United States or other jurisdiction in which such Subscriber is resident;

“Selling Shareholders” has the meaning given on the first page of this Subscription Agreement;

“Special Warrant” has the meaning given on the first page of this Subscription Agreement;

“Subscription Agreement” means the agreement resulting from the acceptance by the Corporation and the Selling Shareholders of the Subscriber’s offer constituted hereby;

“Subscription Price” has the meaning given on the first page of this Subscription Agreement;

“Treasury Offering” has the meaning given on the first page of this Subscription Agreement;

“Treasury Securities” has the meaning given on the second page of this Subscription Agreement;

“TSX” means the Toronto Stock Exchange;

“U.S. Affiliates” means Xxxxxx Xxxxxxx Corp. and Xxxxxxx Securities (USA) Inc., the United States broker-dealer affiliates of BMO and Xxxxxxx, respectively, through which the Offering is being conducted in the United States and to U.S. Persons;

“Unit” has the meaning given on the first page of this Subscription Agreement;

“Warrant” has the meaning given on the first page of this Subscription Agreement;

All references herein to monetary amounts are to lawful money of the United States of America, unless otherwise specified.

2. Delivery and Payment for Treasury Offering. The Subscriber agrees to deliver to the Agents at the following address:

BMO Xxxxxxx Xxxxx Inc.

000 Xxxx Xxxxxxx Xxxxxx, Xxxxx 0000

Vancouver, BC V6C 3E8

| Attn: |

Xxxxx Xxxxxx |

|||||

| Tel: |

(000) 000-0000 |

|||||

| Fax: |

(000) 000-0000 |

as soon as possible and, in any event, not later than 12:00 noon (Vancouver time) on the date which is two days before First Closing Date the following:

| (a) | a completed and duly executed copy of this Subscription Agreement; |

| (b) | if the Subscriber resident in the Province of Ontario or is otherwise subject to the Securities Laws of the Province of Ontario, a completed and duly executed |

- 7 -

| copy of Ontario Accredited Investor Certificate which is attached hereto as Schedule “B”; |

| (c) | whether or not the Subscriber is resident in the Province of British Columbia, a completed and duly executed copy of the British Columbia Accredited Investor Certificate which is attached here to as Schedule “C”; |

| (d) | if the Subscriber is a resident of the United States or otherwise subject to the Securities Laws of the United States, a complete and duly executed copy of the U.S. Accredited Investor Certificate which is attached to the Subscription Agreement as Schedule “D”; |

| (e) | unless other arrangements acceptable to the Agents and the Corporation are made, a certified cheque or bank draft made payable to BMO Xxxxxxx Xxxxx Inc. in same day freely transferable Canadian funds at par, representing the aggregate purchase price payable by the Subscriber for the Units set out on the first page of this Subscription Agreement; and |

| (f) | all other documents as may be required. |

3. Closing. The Closing will be held at the offices of Xxxxxxx Xxxxx & Xxxxxxxxx LLP, Suite 0000, 00 Xxxx Xxxxxx Xxxx, Xxxxxxx, Xxxxxxx X0X 0X0 at the Closing Time on the First Closing Date, all in accordance with the Agency Agreement.

The Subscriber acknowledges that the Units will be available for delivery upon the Closing against payment of the amount of the aggregate purchase price for the Units provided that the Subscriber has satisfied the requirements of paragraph 2 hereof and the Corporation and the Selling Shareholders have accepted this Subscription Agreement.

BMO is hereby appointed as the Subscriber’s agent to represent the Subscriber at the Closing for the purposes of all closing matters and deliveries of documents and Units and is hereby authorized by the Subscriber, for and on behalf of the Subscriber, to negotiate and approve, among other things, the form and content of the Units and the indentures governing the Notes, the Special Warrants and the Warrants and to extend such time periods and modify or waive such conditions as may be contemplated herein or in the Agency Agreement or, in its absolute discretion, as it deems appropriate; provided, however, that BMO shall not take any action that would reasonably be expected to be detrimental to the Subscriber. Without limiting the generality of the foregoing, BMO is specifically and exclusively authorized to waive any representations and warranties, covenants or conditions for the benefit of the Subscriber contained in the Agency Agreement. In addition, the Subscriber acknowledges that each of the Agents is entitled to exercise or not to exercise, in its absolute discretion, the rights of termination in the Agency Agreement on and subject to the terms and conditions contained therein.

It is a condition of Closing that all documents required to be completed and signed in accordance with Section 2 hereof be received prior to the First Closing Date.

- 8 -

4. Delivery and Payment for Secondary Offering. The Subscriber agrees to deliver to the Agents at the following address:

BMO Xxxxxxx Xxxxx Inc.

000 Xxxx Xxxxxxx Xxxxxx, Xxxxx 0000

Vancouver, BC V6C 3E8

| Attn: |

Xxxxx Xxxxxx |

|||||

| Tel: |

(000) 000-0000 |

|||||

| Fax: |

(000) 000-0000 |

as soon as possible and, in any event, not later than 12:00 noon (Vancouver time) on the date which is two days before the Second Closing Date (provided that the Subscriber shall have been notified of the date of the Second Closing Date not later than three days before the Second Closing Date) the following:

| (a) | unless other arrangements acceptable to the Agents and the Corporation are made, a certified cheque or bank draft made payable to BMO Xxxxxxx Xxxxx Inc. in same day freely transferable Canadian funds at par, representing the aggregate purchase price payable by the Subscriber for that number of Additional Notes to be purchased by the Subscriber pursuant to the Secondary Offering, calculated as set out on the first page of this Subscription Agreement; and |

| (b) | all other documents as may be required. |

5. Second Closing. The Second Closing will be held at the offices of Xxxxxxx Xxxxx & Xxxxxxxxx LLP, Suite 0000, 00 Xxxx Xxxxxx Xxxx, Xxxxxxx, Xxxxxxx X0X 0X0 at the Closing Time on the Second Closing Date, all in accordance with the Agency Agreement.

The Subscriber acknowledges that the Additional Notes will be available for delivery upon the Second Closing against payment of the amount of the aggregate purchase price for the Additional Notes provided that the Subscriber has satisfied the requirements of Section 4 hereof and the Corporation and the Selling Shareholders have accepted this Subscription Agreement.

BMO is hereby appointed as the Subscriber’s agent to represent the Subscriber at the Second Closing for the purposes of all closing matters and deliveries of documents and Additional Notes and is hereby authorized by the Subscriber, for and on behalf of the Subscriber, to negotiate and approve, among other things, the form and content of the Additional Notes and to extend such time periods and modify or waive such conditions as may be contemplated herein or in the Agency Agreement or, in its absolute discretion, as it deems appropriate; provided, however, that BMO shall not take any action that would reasonably be expected to be detrimental to the Subscriber. Without limiting the generality of the foregoing, BMO is specifically and exclusively authorized to waive any representations and warranties, covenants or conditions for the benefit of the Subscriber contained in the Agency Agreement. In addition, the Subscriber acknowledges that each of the Agents is entitled to exercise or not to exercise, in its absolute discretion, the rights of termination in the Agency Agreement on and subject to the terms and conditions contained therein.

- 9 -

It is a condition of Second Closing that all documents required to be completed and signed in accordance with Section 4 hereof be received prior to the Second Closing Date.

6. Subscriber’s Acknowledgements. The Subscriber acknowledges and agrees (on its own behalf and, if applicable, on behalf of each beneficial purchaser for whom the Subscriber is contracting hereunder) with the Corporation, the Selling Shareholders and the Agents (which acknowledgements and agreements shall survive the Closing and the Second Closing) that as of the date the Subscriber first executed this Subscription, as of the First Closing Date and as of the Second Closing Date:

| (a) | no agency, governmental authority, regulatory body, stock exchange or other entity has made any finding or determination as to the merit for investment of, nor have any such agencies or governmental authorities, regulatory bodies, stock exchanges or other entities made any recommendation or endorsement with respect to, any of the Securities or the Offering; |

| (b) | the Corporation is not a “reporting issuer” or the equivalent in any jurisdiction; |

| (c) | the issuance, sale and delivery of the Units and the sale and delivery of the Additional Notes is conditional upon such issuance and sale being exempt from the prospectus filing or registration requirements and the requirement to deliver an offering memorandum in connection with the distribution of the Units and of the Additional Notes under the Securities Laws or upon the issuance of such orders, consents or approvals as may be required to permit such sale without the requirement of filing a prospectus or registration statement; |

| (d) | each of the Securities is subject to an indefinite hold period and to resale restrictions under the Securities Laws unless such Securities are sold with the benefit of a prospectus and by a registered dealer or unless further exemption from the prospectus or registration requirements of the applicable Securities Laws is available, and each of the Securities is otherwise subject to all of the terms, conditions and provisions of the Agency Agreement, the articles of the Corporation and this Subscription Agreement and the Subscriber (and, if applicable, others for whom it is contracting hereunder) will comply with all relevant Securities Laws concerning any resale of any of the Securities and will consult with its legal advisors with respect to complying with all restrictions applying to such resale. The Subscriber acknowledges and further agrees that until the Corporation becomes a reporting issuer in the Selling Jurisdiction in which the Subscriber resides each of the Securities may be required to be held indefinitely unless the Securities are sold with the benefit of a prospectus and by a registered dealer, or unless further exemption from the prospectus or registration requirements of the applicable Securities Laws is available. It is the responsibility of the Subscriber to determine the applicable resale restrictions of the Securities at the relevant time; |

| (e) | none of the Securities have been or will be registered under the United States Securities Act of 1933 (the “1933 Act”) or the securities laws of any state and may not be offered or sold, directly or indirectly, in the United States to, or for the |

- 10 -

| account or benefit of, a U.S. person (as defined in-Rule 902 of Regulation S promulgated under the 1933 Act (“Regulation S”), which definition includes, but is not limited to, an individual resident in the United States and an estate or trust of which any executor or administrator or trustee, respectively, is a U.S. Person and any partnership or company organized or incorporated under the laws of the United States) (a “U.S. Person”) unless registered under the 1933 Act and the securities laws of all applicable states or unless an exemption from such registration requirements is available, and the Corporation and the Selling Shareholders have no obligation or present intention of filing a registration statement under the 1933 Act in respect of any of the Securities; |

| (f) | the Subscriber (and, if applicable, others for whom it is contracting hereunder) may not offer, sell or transfer any of the Securities within the United States or to, or for the account or benefit of, a U.S. Person, unless the Securities being so offered, sold or transferred are registered under the 1933 Act and the securities laws of all applicable states or an exemption from such registration requirement is available; |

| (g) | the purchase of the Units and the Additional Notes has not been and will not be made through or as a result of any general solicitation or general advertising or any seminar or meeting whose attendees have been invited by general solicitation or general advertising and the distribution of the Units and the Additional Notes has not been and will not be accompanied by any advertisement, including, without limitation, in printed public media, radio, television or telecommunications, including electronic display or as part of a general solicitation or general advertising; |

| (h) | no prospectus or offering memorandum within the meaning of the Securities Laws or other similar document has been delivered to or summarized for or seen by the Subscriber (and, if applicable, others for whom it is contracting hereunder) in connection with the Offering and the Subscriber (and, if applicable, others for whom it is contracting hereunder) is not aware of any prospectus, offering memorandum or other similar document having been prepared by or on behalf of the Corporation or the Selling Shareholders; |

| (i) | in purchasing the Units, the Subscriber (and, if applicable, others for whom it is contracting hereunder) has relied solely upon this Subscription Agreement and the Agency Agreement and not upon any verbal or written representation as to any fact or otherwise made by or on behalf of the Corporation, the Selling Shareholders or the Agents or any employee, agent or affiliate thereof or any other person associated therewith. The Agents assume no responsibility or liability of any nature whatsoever for the accuracy or adequacy of the information upon which the Subscriber’s investment decision has been made or as to whether all information concerning the Corporation required to be disclosed by the Corporation or the Selling Shareholders has been disclosed. The Subscriber, on its own behalf and on behalf of others for whom the Subscriber is contracting hereunder, has acknowledged that the decision to purchase the Units and the |

- 11 -

| Additional Notes was made on the basis of the information contained in this Subscription Agreement and the Agency Agreement; |

| (j) | the Units and the Additional Notes are being offered for sale on a “private placement” basis and, in connection therewith, the Corporation, the Selling Shareholders and the Agents will enter into the Agency Agreement pursuant to which the Agents will receive from the Corporation and the Selling Shareholders the commission and warrants described in Section 13 of this Subscription Agreement; |

| (k) | (i) the Subscriber (or, if applicable, others for whom it is contracting hereunder) is solely responsible for obtaining such tax and legal advice as it considers appropriate in connection with the execution, delivery and performance by it of this Subscription Agreement and the transactions contemplated hereunder (including the resale and transfer restrictions referred to in the Section below entitled “Representations, Warranties and Covenants”); and (ii) the Agents’ counsel is acting as counsel to the Agents and not as counsel to the Subscriber; |

| (1) | in accepting this Subscription Agreement, each of the Corporation, the Selling Shareholders and the Agents is relying upon the representations and warranties and acknowledgements of the Subscriber set out herein including, without limitation, in connection with determining the eligibility of the Subscriber or (if applicable) the eligibility of others on whose behalf the Subscriber is contracting hereunder to purchase Units and Additional Notes under the Securities Laws. The Subscriber hereby agrees to notify the Corporation and the Agents immediately of any change in any representation, warranty, covenant or other information relating to the Subscriber or the beneficial purchaser contained in this Subscription Agreement which takes place prior to the Closing or the Second Closing; |

| (m) | the certificates evidencing each of the Securities will bear a legend regarding restrictions on transfer as required pursuant to applicable Securities Laws, including federal and state securities laws of the United States as set out in Schedule “D” hereto, as applicable; |

| (n) | no person has made to the Subscriber any written or oral representations: |

| (i) | that any person will resell or repurchase the Units, the Additional Notes or any of the other Securities; |

| (ii) | that any person will refund the purchase price of the Units or the Additional Notes; |

| (iii) | as to the future price or value of any of the Units, the Additional Notes or any of the other Securities; or |

| (iv) | that any of the Units, the Additional Notes or any of the other Securities will be listed and posted for trading on any stock exchange or that application has been made therefore; and |

- 12 -

| (o) | any of the Agents, the Selling Shareholders and the Corporation may be required to provide the Securities Regulators with a list setting forth the identities of the beneficial purchasers of the Units and the Additional Notes. Notwithstanding that the Subscriber may be purchasing Units and the Additional Notes as agent on behalf of an undisclosed principal, the Subscriber agrees to provide, on request, particulars as to the identity of such undisclosed principal as may be required by any of the Agents, the Selling Shareholders or the Corporation in order to comply with the foregoing. |

7. Conditions of Closing and of Second Closing. The Subscriber acknowledges and agrees that the Corporation’s obligation to sell the Units to the Subscriber and that the obligation of the Selling Shareholders to sell the Additional Notes to the Subscriber is subject to, among other things, the condition that it (or, if applicable, any others for whom it is contracting hereunder) sign and return to the Corporation, the Selling Shareholders and/or the Agents all relevant documentation required by the Securities Laws.

In the event that the purchase of the Units pursuant to the provisions of this Subscription Agreement does not occur, the Subscription Agreement will be returned to the Subscriber, together with any payment that has been made in respect of the Units without interest or deduction, and the obligations of the parties hereto shall thereupon terminate.

8. Acceptance of Offer to Purchase. The acceptance by the Corporation and the Selling Shareholders of the Subscriber’s irrevocable offer to purchase the Units and the Additional Notes shall constitute an agreement by the Corporation and the Selling Shareholders with the Subscriber that the Subscriber shall have, in respect of such Units and Additional Notes, the benefits of the representations, warranties and covenants of the Corporation and the Selling Shareholders made by the Corporation and the Selling Shareholders and the conditions of Closing and Second Closing not waived by the Agents contained in the Agency Agreement.

9. Representations, Warranties and Covenants. The Subscriber (on its own behalf and, if applicable, on behalf of those for whom the Subscriber is contracting hereunder) hereby represents, warrants to, and covenants with the Corporation, the Selling Shareholders and the Agents (and acknowledges that the Corporation, the Selling Shareholders and the Agents are relying on these representations, warranties and covenants) which representations, warranties and covenants shall survive the Closing and the Second Closing and shall continue in full force and effect following the Closing and the Second Closing, that as of the date of execution of this Subscription Agreement, as of the First Closing Date and as of the Second Closing Date:

| (a) | the Subscriber and any beneficial purchaser for whom it is acting are resident in the province or jurisdiction set out on the first or second page of this Subscription Agreement above as the “Subscriber’s Address” or the “Beneficial Subscriber’s Address”, as the case may be; |

- 13 -

| (b) | the Subscriber and any beneficial purchaser for whom it is acting has received the Term Sheet attached to this Agreement as Schedule “A” and incorporated herein setting out the principle terms of the Offering ; |

| (c) | either: |

| (i) | the Subscriber is purchasing the Units and the Additional Notes as principal for its own account and not for the benefit of any other person, and not with a view to the resale or distribution of all or any of the Securities; or |

| (ii) | if the Subscriber is acting as agent or trustee for one or more beneficial purchasers whose identity is disclosed or undisclosed or identified by account number only, each beneficial purchaser is purchasing as principal for its own account and not for the benefit of any other person, and not with a view to the resale or distribution of all or any of the Securities, and each beneficial purchaser complies with such of subparagraphs (d) as are applicable to it by virtue of its place of residence and paragraphs (e) through (g) below; or |

| (iii) | the Subscriber is deemed to be purchasing as principal pursuant to applicable Securities Laws by virtue of the fact that the Subscriber is a resident of or otherwise subject to the Securities Laws of the Province of: |

| A. | British Columbia, and it is (I) a trust company or an extra-provincial trust company authorized under the Financial Institutions Act (British Columbia) to carry on trust business or deposit business or both and is purchasing the Units and the Additional Notes as agent or trustee for accounts that are fully managed by it; or (II) a trust company authorized under the laws of a province or territory of Canada other than British Columbia to carry on business in that province or territory and it is purchasing the Units and Additional Notes as an agent or trustee for accounts that are fully managed by it; or (III) an insurance company or extra-provincial insurance company authorized to carry on insurance business under the Financial Institutions Act (British Columbia) and is purchasing the Units and the Additional Notes as agent or trustee for accounts that are fully managed by it; or (IV) an insurance company authorized under the laws of a province or territory of Canada other than British Columbia to carry on business in that province or territory and is purchasing Units and the Additional Notes as agent or trustee for accounts that are fully managed by it; or (V) a portfolio manager registered as a portfolio manager under the Securities Act (British Columbia) or exempt from such registration and is purchasing the Units and the Additional Notes as agent for accounts that are fully managed by it; or (VI) a portfolio manager registered or exempt from registration in a province or territory of Canada other than British |

- 14 -

| Columbia, and it is purchasing the Units and the Additional Notes as an agent for accounts that are fully managed by it; provided that, as used herein, an account is “fully managed” by a person only if the person makes the investment decisions for the account and has full discretion to purchase or sell securities for the account without requiring the client’s express consent to a transaction; |

| B. | British Columbia and, for the purposes of reliance on the accredited investor exemption in Multilateral Instrument 45-103 - Capital Raising Exemptions (“MI 45-103”), it is a trust company or trust corporation registered or authorized to carry on business under the Trust and Loan Companies Act (Canada) or under comparable legislation in a jurisdiction of Canada or a foreign jurisdiction, trading as a trustee or agent on behalf of a fully managed account (as defined in MI 45-103) (except a trust company or trust corporation registered under the laws of Xxxxxx Xxxxxx Island that is not registered under the Trust and Loan Companies Act (Canada) or under comparable legislation in another jurisdiction in Canada) or it is a person or company trading as agent on behalf of a fully managed account if that person or company is registered or authorized to carry on business under the securities legislation (as defined under National Instrument 14-101-Definitions) of a jurisdiction of Canada or a foreign jurisdiction as a portfolio manager or under an equivalent category of adviser or is exempt from registration as a portfolio manager or the equivalent category of advisor; |

| (d) | each of the Subscriber and the beneficial purchaser is: |

| (i) | whether or not it is a resident of or otherwise subject to the securities legislation of the Province of British Columbia, an accredited investor as defined in MI 45-103 such that one or more of the categories set forth in Schedule “C” attached hereto correctly and in all respects describes the Subscriber and the beneficial purchaser, and the Subscriber has so indicated such categories by checking the box opposite each category on such Schedule “C” and the Subscriber acknowledges that by signing this Subscription Agreement it is certifying that the statements made by checking the appropriate categories are true; and |

| (ii) | the Subscriber or, if the Subscriber is contracting hereunder as agent for one or more beneficial purchasers, each beneficial purchaser has been disclosed, and the beneficial purchaser is purchasing as principal, is a resident of or otherwise subject to the securities legislation of the Province of Ontario and it is an “accredited investor”, as such term is defined in Ontario Securities Commission Rule 45-501 such that one or more of the categories set forth in Schedule “B” attached hereto correctly and in all respects describes the Subscriber, and the Subscriber has so indicated such categories by checking the box opposite each category on |

- 15 -

| such Schedule “B” and the Subscriber acknowledges that by signing this Subscription Agreement it is certifying that the statements made by checking the appropriate accredited investor categories are true; and |

| (e) | unless the Subscriber has completed and delivered the U.S. Accredited Investor Certificate attached as Schedule “D” hereto (in which case the Subscriber makes the representations, warranties and covenants therein), the Subscriber acknowledges and agrees that the offer to purchase the Units and the Additional Notes was not made to the Subscriber when the Subscriber was in the United States or when the Subscriber was a U.S. Person and at the time the Subscriber’s subscription for Units and the Additional Notes was delivered to the Corporation, the Subscriber was outside the United States and was not a U.S. Person and that: |

| (i) | the Subscriber is not and will not be purchasing the Units and the Additional Notes, directly or indirectly, for the account or benefit of a U.S. Person or any person in the United States and the Subscriber does not have any agreement or understanding (either written or oral) with any U.S. Person or a person in the United States respecting: |

| (A) | the transfer or assignment of any rights or interests in any of the Securities; |

| (B) | the division of profits, losses, fees, commissions, or any financial stake in connection with this Subscription Agreement; or |

| (C) | the voting of the Common Shares; |

| (ii) | the current structure of this transaction and all transactions and activities contemplated hereunder is not a scheme to avoid the registration requirements of the 1933 Act and applicable state securities laws; and |

| (iii) | the Subscriber has no intention to distribute either directly or indirectly any of the Units, the Additional Notes or the other Securities in the United States or to U.S. Persons, except in compliance with the 1933 Act; |

- 16 -

| (f) | if the Subscriber or beneficial purchaser, as the case may be, is not a purchaser identified under (c) or (d) above, it is purchasing pursuant to an exemption from any prospectus or securities registration requirements (particulars of which are enclosed herewith) available to the Corporation, the Selling Shareholders and the Subscriber under all applicable Securities Laws and shall deliver to the Corporation, the Selling Shareholders and the Agents such further particulars of the exemption and the Subscriber’s qualification thereunder as the Corporation, the Selling Shareholders or the Agents may reasonably request; |

| (g) | if the Subscriber is resident outside of Canada and the United States, the Subscriber: |

| (i) | is knowledgeable of, or has been independently advised as to, the applicable Securities Laws having application in the jurisdiction in which the Subscriber is resident (the “International Jurisdiction”) which would apply to the acquisition of the Subscriber’s Units, the Additional Notes and the other Securities; |

| (ii) | the Subscriber is purchasing the Subscriber’s Units and the Additional Notes pursuant to exemptions from prospectus or equivalent requirements under applicable Securities Laws or, if such is not applicable, the Subscriber is permitted to purchase the Units and the Additional Notes under the applicable Securities Laws of the Securities Regulators in the International Jurisdiction without the need to rely on any exemptions; |

| (iii) | the applicable Securities Laws of the Securities Regulators in the International Jurisdiction do not require the Corporation, the Selling Shareholders or the Agents to make any filings or seek any approvals of any kind whatsoever from any Authority of any kind whatsoever in the International Jurisdiction in connection with the issue and sale, conversion, exchange or resale of the Subscriber’s Units, the Additional Notes and the other Securities; and |

| (iv) | the purchase or acquisition of the Subscriber’s Units, the Additional Notes and the other Securities by the Subscriber does not trigger: |

| (A) | any obligation to prepare and file a prospectus or similar document, or any other report with respect to such purchase in the International Jurisdiction; or |

| (B) | any continuous disclosure reporting obligation of the Corporation in the International Jurisdiction; and |

the Subscriber will, if requested by the Corporation or the Selling Shareholders, deliver to the Corporation or the Selling Shareholders as requested a certificate or opinion of local counsel from the International Jurisdiction which will confirm the matters referred to in subparagraphs

- 17 -

(ii), (iii) and (iv) above to the satisfaction of the Corporation or the Selling Shareholders, acting reasonably;

| (h) | neither the Subscriber nor any party on whose behalf it is acting has been created or is being used primarily to permit the purchase of the Units, the Additional Notes and the other Securities without a prospectus in reliance on an exemption from the prospectus requirements of applicable Securities Laws; |

| (i) | if the Subscriber is an individual, the Subscriber has attained the age of majority in the applicable Selling Jurisdiction and has the legal capacity and competence to enter into and be bound by this Subscription Agreement and to take all actions and fulfill the covenants and obligations required pursuant hereto and this Subscription Agreement upon acceptance by the Corporation and the Selling Shareholders will constitute a legal, valid and binding agreement of the Subscriber enforceable against the Subscriber in accordance with its terms, and if the Subscriber is not an individual, this Subscription Agreement has been authorized, executed and delivered by, and upon acceptance by the Corporation and the Selling Shareholders will constitute a legal, valid and binding agreement of, the Subscriber enforceable against the Subscriber in accordance with its terms, and if the Subscriber is a corporation, it has been duly incorporated and validly exists under the laws of its jurisdiction of incorporation or continuance and this Subscription Agreement has been duly authorized by all necessary corporate action and upon acceptance by the Corporation and the Selling Shareholders will constitute a legal, valid and binding agreement of the Corporation enforceable against the Subscriber in accordance with its terms; |

| (j) | if the Subscriber is acting as trustee or agent for a beneficial purchaser, the Subscriber is duly authorized to execute and deliver the Subscription Agreement and all other necessary documents in connection with the Offering on behalf of such beneficial purchaser, and such beneficial purchaser is purchasing as principal for its own account, not for the benefit of any other person and not with a view to the resale or distribution of the Units, the Additional Notes and the other Securities; |

| (k) | if the Subscriber is acting as trustee or agent for a beneficial purchaser, this Subscription Agreement has been duly authorized, executed and delivered by or on behalf of such beneficial purchaser, and upon acceptance by the Corporation and the Selling Shareholders will constitute a legal, valid and binding agreement of such beneficial purchaser enforceable against the beneficial purchaser in accordance with its terms; |

| (l) | the Subscriber and any beneficial purchaser for whom it is acting has such knowledge in financial and business affairs as to be capable of assessing and evaluating the risks and merits of this investment and the Subscriber or, where it is not purchasing as principal, each beneficial purchaser is able to bear the economic loss of its investment; |

- 18 -

| (m) | this Subscription Agreement has been duly and validly authorized, executed and delivered by and upon acceptance by the Corporation and the Selling Shareholders will constitute a legal, valid, binding and enforceable obligation of the Subscriber; |

| (n) | each of the delivery of this Subscription Agreement, the acceptance of it by the Corporation and the Selling Shareholders, the issuance of the Units to the Subscriber, the sale of the Additional Notes to the Subscriber and the acquisition of the Units, the Additional Notes and the other Securities by the Subscriber and any beneficial purchaser for whom the Subscriber is acting, the exercise of the Special Warrants for Warrants, the exercise of the Warrants for Common Shares, the conversion of the Notes into Common Shares, and the conversion of the Additional Notes into Common Shares complies with all applicable laws of the Selling Jurisdiction and all other applicable laws and will not cause the Corporation to become subject to or comply with any disclosure, prospectus or reporting requirements under any such applicable laws; |

| (o) | the Subscriber is at arm’s length (within the meaning of the Securities Laws) with the Corporation; |

| (p) | the Subscriber is not a “control person” of the Corporation or the equivalent as defined in the applicable Securities Laws, will not become a “control person” or the equivalent by virtue of this purchase of any of the Units or the Additional Notes, the exercise of the Special Warrants for Warrants, the exercise of the Warrants for Common Shares, the conversion of the Notes into Common Shares, or the conversion of the Additional Notes into Common Shares, and does not intend to act in concert with any other person to form a control group of the Corporation; |

| (q) | neither the Subscriber any party on whose behalf it is acting is an investment club; |

| (r) | the Subscriber (or others for whom it is contracting hereunder) has been advised to consult its own legal and tax advisors with respect to applicable resale restrictions and tax considerations, and it (or others for whom it is contracting hereunder) is solely responsible for compliance with applicable resale restrictions and applicable tax legislation and the Subscriber (or others for whom it is contracting hereunder) shall comply with applicable resale restrictions and applicable tax legislation; |

| (s) | none of the funds the Subscriber is using to purchase the Units or the Additional Notes are, to the knowledge of the Subscriber, proceeds obtained or derived, directly or indirectly, as a result of illegal activities; |

| (t) | the entering into of this Agreement and the completion of the transactions contemplated hereby will not result in the violation of any of the terms and provisions of any law, order, decree or judgment applicable to, or the constating documents or resolutions of, the Subscriber or of any agreement, written or oral, |

- 19 -

| to which the Subscriber may be a party or by which he is or may be bound or the termination of any such agreement; |

| (u) | other than the Agents, there is no person acting or purporting to act in connection with the transactions contemplated herein who is entitled to any brokerage or finder’s fee. If any person establishes a claim that any fee or other compensation is payable in connection with the subscription for Units and Additional Notes, the Subscriber covenants to indemnify and hold harmless the Corporation and the Selling Shareholders with respect thereto and with respect to all costs reasonably incurred in the defence thereof; |

| (v) | the Subscriber and any beneficial purchaser for whom it is acting will execute, deliver, file and otherwise assist the Corporation, the Selling Shareholder and the Agents in filing such reports, undertakings and other documents with respect to the Offering as may be required, and within the required time periods, under applicable law; and |

| (w) | the Subscriber hereby agrees to notify the Corporation and the Agents immediately of any change in any representation, warranty, covenant or other information relating to the Subscriber or the beneficial purchaser contained in this Subscription Agreement which takes place prior to the Closing or the Second Closing. |

10. Covenants of the Corporation. The Corporation covenants and agrees with the Subscriber as follows:

| (a) | the Corporation will promptly comply with all filing and other requirements under all applicable Securities Laws; and |

| (b) | on the First Closing Date, the Corporation will have taken all necessary steps to duly and validly create and issue the Units, the Notes and the Special Warrants forming part of the Units, to duly and validly create and reserve for issuance the Warrants issuable upon exercise of the Special Warrants, to duly and validly create, allot and reserve for issuance the Common Shares issuable upon exercise of the Warrants in accordance with the terms of the Warrants, the Common Shares issuable upon conversion of the Notes and the Additional Notes, and the Additional Notes issuable to the Selling Shareholders in accordance with the terms of the Agency Agreement, all in accordance with the terms and provisions of this Subscription Agreement and the Agency Agreement. |

11. Appointment of Agents. The Subscriber, on its own behalf (or, if applicable, on behalf of others for whom the Subscriber is contracting hereunder), hereby:

| (a) | irrevocably authorizes the Agents, in their sole discretion, to act as the Subscriber’s representative at the Closing and the Second Closing, to receive certificates representing the Subscriber’s Units and Additional Notes and to execute in its name and on its behalf all closing receipts and documents required; |

- 20 -

| (b) | irrevocably authorizes the Agents to negotiate and settle the form of any agreement to be entered into in connection with the Offering and to waive on its own behalf and, if applicable, on behalf of the other subscribers for Units, in whole or in part, or extend the time for compliance with, any of the representations, warranties, covenants or closing conditions under this Subscription Agreement or the Agency Agreement in such manner and on such terms and conditions as the Agents may determine, acting reasonably, without in any way adversely affecting the Subscriber’s obligations or the obligations of such others hereunder; |

| (c) | acknowledges and agrees that the Agents, the Selling Shareholders and the Corporation may vary, amend, alter or waive, in whole or in part, one or more of the conditions or covenants set forth in this Subscription Agreement or the Agency Agreement in such manner and on such terms and conditions as they may determine, acting reasonably, without affecting in any way the Subscriber’s or such others’ obligations hereunder; and |

| (d) | irrevocably authorizes the Agents to swear, accept, execute, file and record any documents (including receipts) necessary to accept delivery of the certificates representing the Units on the Closing and representing the Additional Notes on the Second Closing and to exercise or not to exercise, as the Agents determine in their sole discretion, the rights of termination in the Agency Agreement. |

12. Acknowledgements and Indemnity. The representations, warranties, acknowledgements and covenants contained in this Subscription Agreement are made by the Subscriber with the intent that they may be relied upon by each of the Corporation, the Selling Shareholders, the Agents and each of their respective legal counsel in determining its eligibility or the eligibility of any others on whose behalf the Subscriber is contracting hereunder to purchase the Units and the Additional Notes, and the Subscriber agrees to indemnify each of the Corporation, the Selling Shareholders, the Agents and each of their and its legal counsel against all losses, claims, costs, expenses, and damages or liabilities that each of them may suffer or incur, caused or arising from their reliance thereon. The Subscriber further agrees that by accepting the Units and that by accepting the Additional Notes, the Subscriber shall be representing and warranting that the representations, warranties and acknowledgements are true as at the Closing and the Second Closing, respectively, with the same full force and effect as if they had been made by the Subscriber at both the Closing and the Second Closing, respectively, and that they and the covenants set forth in this Subscription Agreement shall continue in full force and effect notwithstanding any subsequent disposition in whole or in part by it of the Units, the Additional Notes or other Securities.

13. Compensation of Agents. The Subscriber understands that, in connection with the issue and sale of Units pursuant to the Treasury Offering, the Agents will receive from the Corporation on Closing:

| (a) | a cash commission equal to 6% of the aggregate gross proceeds of the Treasury Offering, payable in cash; and |

- 21 -

| (b) | warrants (the “Broker Warrants”) equal to 5% of the number of Notes included in the Units sold in the Treasury Offering excluding up to $1,100,000 worth of Units that may be sold to persons designated by the Selling Shareholders and excluding certain additional Units which may be issued to Subscribers after the Closing of the Treasury Offering in compliance with the terms and conditions of the Agency Agreement. Each Broker Warrant shall be exercisable at any time and automatically upon completion of an IPO without payment of further consideration for one broker option (the “Broker Options”). Each Broker Option will entitle the holder to purchase one Note, if exercised prior to completion of an IPO and one Common Share if exercised after completion of an IPO, at a price of US$1.40 per Note or Common Share, respectively, for a period of three years from the First Closing Date. |

The Subscriber understands that, in connection with the issue and sale of Additional Notes pursuant to the Secondary Offering, the Agents will receive from the Selling Shareholders on Closing a cash commission equal to 6% of the aggregate gross proceeds of the Secondary Offering, payable in cash.

No other fee or commission is payable by the Corporation or the Selling Shareholders in connection with the completion of the Offering. However, the Corporation will pay certain fees and expenses of the Agents in connection with the Offering as set out in the Agency Agreement.

14. Nature of Subscription. This subscription is irrevocable except that the Subscriber reserves the right to withdraw this subscription and to terminate its obligations hereunder at any time before the First Closing Date if the Agents terminate their obligations with respect to this Offering under the Agency Agreement. The Subscriber hereby appoints the Agents as its agents for the purpose of notifying the Corporation and the Selling Shareholders of the withdrawal or termination of this subscription.

15. Delivery of Certificates. The Subscriber hereby authorizes and directs the Corporation, the Selling Shareholders and the Agents to deliver certificates representing the Units and the Additional Notes to be issued to the Subscriber pursuant to this Subscription Agreement either (a) to the address for delivery indicated in this subscription or if no such address for delivery is indicated, (b) directly to the Subscriber’s account, if any, maintained with the Agents.

16. Return of Subscription Funds. The Subscriber hereby authorizes and directs the Corporation, the Selling Shareholders and the Agents to return any funds for unaccepted subscriptions to the same account from which the funds were drawn, without interest or penalty, including any customer account maintained with any of the Agents.

17. Acceptance of Subscription. This subscription may be accepted in whole or in part by the Corporation and the right is reserved to the Corporation at its sole discretion to allot to any Subscriber less than the amount of Units subscribed for. Confirmation of acceptance or rejection of this subscription will be forwarded to the Subscriber promptly after the acceptance or rejection of the subscription by the Corporation. If this subscription is rejected in whole or is accepted only in part the portion of the purchase price representing that portion of the

- 22 -

subscription for Units which is not accepted will promptly be returned the Subscriber, in accordance with Section 16 hereof.

18. Costs. All costs and expenses incurred by the Subscriber (including any fees and disbursements of any special counsel obtained by the Subscriber) relating to the sale of the Units and the Additional Notes to the Subscriber shall be borne by the Subscriber.

19. Execution of Subscription Agreement. The Corporation, the Selling Shareholders and the Agents shall be entitled to rely on delivery by facsimile machine of an executed copy of this subscription, and acceptance by the Corporation and the Selling Shareholders of such facsimile copy shall be equally effective to create a valid and binding agreement between the Subscriber and the Corporation in accordance with the terms hereof.

20. Governing Law. The contract arising out of this subscription shall be governed by and construed in accordance with the laws of the Province of Ontario and the laws of Canada applicable therein.

21. Waiver. The Subscriber (and others for whom it is contracting hereunder) xxxxxx xxxxxx and releases the Corporation and the Selling Shareholders from, to the fullest extent permitted by law, all rights of withdrawal to which the Subscriber (and others for whom it is contracting hereunder) might otherwise be entitled under applicable Securities Laws.

22. Assignment. The terms and provisions of this Subscription Agreement shall be binding upon and enure to the benefit of the Subscriber, the Corporation and the Selling Shareholders and the Agents and their respective heirs, executors, administrators, successors and assigns; provided however, that: (a) this Subscription Agreement may not be assigned by the Subscriber without the consent of each of the Agents, the Corporation and the Selling Shareholders, each of which may withhold its consent for any reason in its sole discretion, other than the assignment by a Subscriber who is acting as nominee or agent to the beneficial owner for which the Subscriber is so acting; and (b) the Agents cannot consent to the assignment of this Subscription Agreement without the consent of the Subscriber, acting reasonably. The benefits and the obligations of this Subscription Agreement, insofar as they apply to the Subscriber, shall pass with any assignment or transfer of the Units, the Additional Notes or the other Securities.

23. Entire Agreement and Headings. This Subscription Agreement (including the schedules hereto which are incorporated herein by reference and which form part of this Subscription Agreement) constitutes the entire agreement between the Subscriber, the Selling Shareholders and the Corporation relating to the subject matter hereof and there are no representations, warranties, covenants, understandings or other agreements relating to the subject matter hereof except as stated or referred to herein. This Subscription Agreement may amended or modified in any respect by written instrument only. The headings contained herein are for convenience only and shall not affect the meanings or interpretation hereof.

24. Effective Date. The Subscription Agreement is intended to and shall take effect on the effective date of the Agency Agreement, notwithstanding its actual date of execution, provided that it has been accepted by the Corporation and the Selling Shareholders.

25. Time of Essence. Time shall be of the essence of this Subscription Agreement.

- 23 -

26. Currency. Except where otherwise expressly provided, all amounts in this Subscription Agreement are stated and will be paid in United States currency.

27. Headings. The headings contained herein are for convenience only and will not affect the meaning or interpretation of this Subscription Agreement.

- 24 -

SCHEDULE “A”

TERM SHEET

PRIVATE PLACEMENT

March 5, 2004

Marketed Private Placement of Units and Convertible Notes

Term Sheet

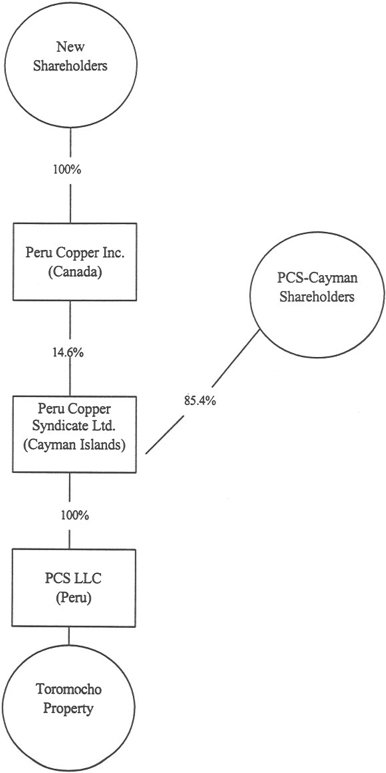

| Issuer: | Peru Copper Inc. (“Peru Copper” or the “Company”). The corporate structure of the Company, PCS-Cayman (as defined below) and its affiliates, is set out in Appendix A hereto. | |

| Agents: | BMO Xxxxxxx Xxxxx Inc. (as to 85%) and Xxxxxxx Securities Inc. (as to 15%) | |

| Treasury Offering: | Private placement (the “Treasury Offering”) of up to US$12 million aggregate principal amount of units of the Company (“Units”). Each Unit will consist of one unsecured convertible note of the Company (“Notes”) and one-half of one fully paid special share purchase warrant (“Special Warrant”). | |

| The value attributed to the Note included in each Unit is US$1.33 and the value attributed to the one-half of a Special Warrant in each Unit is US$O.07. While not binding on the Canada Revenue Agency, management believes this is a reasonable allocation reflective of the fair value of the Special Warrant and the Note. | ||

| The Notes will have the attributes set forth below under “Attributes of the Notes”. | ||

| Each one-half of one Special Warrant is exercisable from time to time, and will automatically be exercised upon completion of an IPO (as defined below), without payment of further consideration, into one-half of one warrant (“Warrant”). Each whole Warrant will entitle the holder to acquire one common share of the Company at a price of US$2.00 per share for a period of 24 months after the First Closing Date. | ||

| Secondary Offering: | Private placement (the “Secondary Offering”) of up to US$4.2 million aggregate principal amount of Notes to be sold by PCS-Cayman Shareholders (“Selling Shareholders”). Selling Shareholders wishing to sell will sell shares of PCS-Cayman owned by them to the Company for Notes of the Company and then will sell those Notes under the Secondary Offering. The Secondary Offering will be taken up pro rata by subscribers in the Treasury Offering. | |

- 25 -

| Right to Maintain Pro Rata Interest: | Subscribers in the Treasury Offering and the Secondary Offering (“Subscribers”) will have the right to maintain their pro rata interest in the Company in any subsequent offerings up to and including an IPO. For greater clarity, any securities issued under this Pro Rata Right will be subject to the commission being paid to the underwriters under the terms of such offering, and a firm indication of intention to exercise such rights must be provided by the Subscriber prior to commencement of marketing of any such offering. | |

| Subscription Price: | Treasury Offering: US$1.40 per Unit (based on the Company owning upon completion of the Treasury Offering 8,571,429 shares of Peru Copper Syndicate, Ltd. (“PCS-Cayman”), representing 14.6% of the outstanding capital of PCS-Cayman, calculated on a fully diluted basis and without considering the Secondary Offering). | |

| Secondary Offering: US$1.40 per Note. | ||

| Offering Amount: | Up to US$16.2 million, assuming completion of both the Treasury Offering and the Secondary Offering. | |

| Use of Proceeds: | The net proceeds to the Company from the Treasury Offering will be used to purchase 8,571,429 shares of PCS-Cayman, representing 14.6% of the outstanding capital of PCS-Cayman on a fully diluted basis. The net proceeds will in turn be used by PCS-Cayman or its affiliates (i) to replace the sum of US$2.0 million that was provided by a PCS-Cayman Shareholder on behalf of PCS-Cayman under a letter of credit in favour of Centromin Peru at the time it signed the Option Agreement dated June 10, 2003 in respect of the Toromocho Property, plus interest in the amount of US$150,OOO (the “Interest Amount”) on the said US$2.0 million; (ii) to fulfil its first year expenditure commitments under the terms of the option agreement in respect of the Toromocho Property in Peru by conducting the first stage drilling and metallurgical testing on the Toromocho Property as recommended in the technical report prepared for Minera Peru Copper Syndicate S.A. by Independent Mining Consultants, Inc. dated February 13, 2004 and (iii) for general corporate purposes. | |

| The Interest Amount may be paid by the Company at Closing by the issuance of Units at the Subscription Price. | ||

| Exchange of Shares of PCS-Cayman: | Prior to completion of an IPO each of the then outstanding shares of PCS-Cayman will be exchanged on a share for share basis for Common Shares of the Company, such that upon completion of the share exchange, and assuming conversion of the Notes, the Subscribers under this Offering will own 14.6% (19.7% if the Secondary Offering is completed in full) of the then outstanding capital of the Company and the former shareholders of PCS-Cayman will own the remaining 85.4% (80.3% if the Secondary Offering is completed in full), all on a basic as opposed to fully diluted basis, and the Company will own all of the outstanding shares of PCS-Cayman. | |

| A “Qualified IPO” means” (i) an initial public offering of Common Shares of the Company with a minimum IPO offering of US$25 million or a reverse-take over | ||

- 26 -

| transaction, pursuant to which the common shares of the Company (in the case of an initial public offering) or common shares of the acquiring company (in the case of a reverse take-over) ate listed on the Toronto Stock Exchange (“TSX”) or another internationally recognized stock exchange, and provided also that the prospectus (the “Prospectus”) with respect to the Qualified IPO qualifies the Common Shares issuable pursuant to the automatic conversion of the Notes and the Warrants issued on the automatic exercise of the Special Warrants, or the common shares of the acquiring company in a reverse take-over transaction such that those shares are freely tradable; or (ii) a merger, amalgamation, arrangement, take-over or other form of corporate transaction pursuant to which an arm’s length third party acquires voting control of the Company, provided that such transaction is accepted by holders of not less than 662/3% of the Common Shares and holders of not less than 662/3% principal amount of the Notes, and further provided that the holders of Notes, Special Warrants and Common Shares receive either cash and/or freely tradeable equity securities that are listed on an internationally recognized stock exchange in connection with such transaction. | ||

| A “Non-Qualified IPO” is an initial public offering of Common Shares of the Company that satisfies the definition of “Qualified IPO” except that it is for a minimum IPO offering of less than US$25 million. An “IPO” is either a Qualified IPO or a Non-Qualified IPO. | ||

| Attributes of the Notes: | The Notes have the following attributes: | |

| (a) issued under a note indenture; | ||

| (b) unsecured obligations of the Company; | ||

| (c) non-interest bearing; | ||

| (d) convertible in full at the option of the holder at any time, and automatically converted upon completion of an IPO, into common shares of the Company (“Common Shares”) on the basis of one Common Share for each Note; | ||

| (e) the Notes are repayable on demand by the holder, provided that the Company may repay the Notes by the issuance of Common Shares on the basis of one Common Share for each Note; | ||

| (f) holders of Notes are entitled to vote on all matters in conjunction with the holders of Common Shares and are entitled to one vote per Common Share into which each Note is convertible; | ||

| (g) in the event any dividend is declared on the Common Shares, the holders of Notes shall be entitled to participate rateably in such dividend, by way of the payment of interest on the Notes in the amount of the dividend, based on the number of Common Shares into which the Notes are then convertible, and the holder of Notes shall receive payment in priority to the holders of Common Shares; | ||

| (h) in the event of any liquidation, dissolution or winding-up of the Company, | ||

- 27 -

| the holders of Notes shall be entitled to receive, in cash, in preference to holders of Common Shares of the Company, an amount equal to the original purchase price, plus any declared but unpaid dividends; and | ||

| (i) the Notes will contain standard anti-dilution provisions in the event that any change is made to the Common Shares. | ||

| Form of Offering: | Private placement in British Columbia, Ontario and other provinces designated by BMO Xxxxxxx Xxxxx to accredited investors pursuant to applicable laws. Private placement into the U.S. to accredited institutional investors pursuant to Rule 506 of Regulation D. | |

| Shareholders’ Agreement: | Each of Xxxxxxxxx XxxXxxx-Xxxxxxx (as to 10%), Ranchu Copper Investments Limited (as to 25%), Fisherking Holdings Ltd. (as to 15%), Xxxxxx Mineral Exploration, LLC (as to 25%), Sunbeam Opportunities Limited (as to 8.33%), Campania Holding, Inc. (as to 8.33%) and Tangent International Limited (as to 8.33%), (collectively, the “PCS-Cayman Shareholders”) and PCS-Cayman and the Company and BMO Xxxxxxx Xxxxx will, concurrently with Closing, enter into a shareholders’ agreement (the “Shareholders’ Agreement”) providing for, among other things, the following: | |

| (a) the agreement of each of the PCS-Cayman Shareholders that, prior to the Company completing either a Qualified IPO or a Non-Qualified IPO, they will each exchange all of the shares owned by them of PCS-Cayman for an equal number of common shares of the Company; | ||

| (b) if the Company grants stock options or other rights to purchase shares of the Company after Closing and prior to the completion of either a Qualified IPO or a Non-Qualified IPO, other than incentive stock options to purchase up to 1,500,000 shares, the Company will either adjust the ratio at which the Notes are converted to Common Shares or will concurrently issue to the subscribers hereunder additional Units (in the case of Subscribers under the Treasury Offering) or Notes (in the case of Subscribers under the Secondary Offering), in either case for no additional consideration, so that the fully diluted interests of the Subscribers immediately prior to the completion of a Qualified IPO or a Non-Qualified IPO will not be less than the percentages set forth herein; | ||

| (c) PCS-Cayman will not, and each of the PCS-Cayman Shareholders will agree that they will cause PCS-Cayman not to, do any of the following without the prior approval of the holders of at least 662/3% principal amount of the Notes: | ||

| (i) issue any shares of any class or right to acquire shares of any class of PCS-Cayman or any affiliate of PCS-Cayman; | ||

| (ii) effect any change in the charter documents, by-laws or capitalization of any of PCS-Cayman or any affiliate of PCS-Cayman; or | ||

| (iii) enter into any material contract, or permit any of its affiliates to enter into any material contract, outside the ordinary course of business; | ||

- 28 -

| and | ||

| (d) each of the PCS-Cayman Shareholders will agree: | ||

| (i) to use their commercially reasonable best efforts to cause the Company to effect a Qualified IPO as soon as possible after Closing of this Offering; and | ||

| (ii) not to sell or otherwise transfer any of their shares or rights to acquire shares of PCS- Cayman, other than to the Company upon an exchange of shares on a one-for-one basis or to a wholly-owned corporation, retirement savings or similar investment vehicle for personal tax planning reasons. | ||

| Company Lock-Up Covenant: | Other than pursuant to the Offering, a Qualified IPO, a Non-Qualified IPO or the grant of management stock options (which shall not exceed options to purchase up to 1,500,000 shares at an exercise price of no less than US$ 1.40 per share), the Company shall not directly or indirectly, offer, issue or sell, grant any option for the sale of, or enter into any derivative transaction relating to or otherwise dispose of (or announce any intention do any of the foregoing), any Notes, Common Shares or other equity securities, or securities convertible, exchangeable or exercisable for any Common Shares or equity securities of the Company from Closing of the Offering until 6 months following the closing of a Qualified IPO or a Non-Qualified IPO without the consent of BMO Xxxxxxx Xxxxx, such consent not to be unreasonably withheld. | |

| PCS-Cayman Shareholder Lock-Up Covenant: | Each of the PCS-Cayman Shareholders agrees that for the period from Closing until six months after closing of an IPO they will not sell any of the shares of the Company or PCS-Cayman owned by them without the prior written consent of BMO Xxxxxxx Xxxxx, such consent not to be unreasonably withheld. | |

- 29 -

| Listing: | The Company is a private company that is not listed on any stock exchange in any jurisdiction. | |

| The Company will use its commercially reasonable best efforts to complete a Qualified IPO within six months following the Closing of this Offering. In the event that the Company does not complete a Qualified IPO within six months following the Closing, Subscribers will be issued by the Company additional Units equal to 10% of the number of Units and Notes purchased by them under this Offering for no additional consideration. In the event that the Company has not completed either a Qualified IPO or a Non-Qualified IPO within six months after Closing, then Subscribers will be issued by the Company additional Units equal to 1% of the number of Units and Notes purchased by them under this Offering for no additional consideration until the Company completes either a Qualified IPO or a Non-Qualified IPO. The maximum number of additional Units to be issued as a result of the Company’s failure to complete a Qualified IPO or Non-Qualified IPO will be 20% of the total number of Units issued and Notes sold under the Treasury Offering and the Secondary Offering. | ||

| If the Company does not complete a Qualified IPO or a Non-Qualified IPO within 12 months following the Closing, then the Company will use its commercially reasonable best efforts to facilitate a secondary offering of any Notes, or Common Shares acquired on the conversion of Notes, held by investors under this Offering within a period of 30 days following the 12th month after the Closing, if so requested. | ||

| The Notes sold under this Offering will not be freely tradeable and will be subject to resale restrictions. | ||

| Commission: | The Agents shall receive a commission of 6% of the gross proceeds of the Treasury Offering and the Secondary Offering. The Agents will also be entitled to reimbursement by the Company of its reasonable costs and expenses incurred in connection with the Offering. | |

| In addition, the Agents will receive on Closing broker warrants (the “Broker Warrants”) equal to 5% of the total number of Notes included in the Units sold under the Treasury Offering, (other than in respect of up to US$1,100,000 worth of Units (representing up to 785,714 Common Shares issuable upon conversion of the Notes) included in the Offering that are sold to persons designated by the PCS-Cayman Shareholders and other than additional Notes issued in the circumstance described under “Listing” above). Each Broker Warrant will entitle the Agents to purchase, at a price of US$ 1.40 per share, up to an equivalent number of Notes (if exercised prior to completion of an IPO, and Common Shares if exercised thereafter) at any time during the period commencing on Closing and ending three years following the Closing. The Notes or Common Shares underlying the Brokers' Warrants will be qualified under the IPO prospectus. | ||

| Closing: | No later than March 18, 2004 (the “First Closing”) for the Treasury Offering and no later than April 30, 2004, or such other date as may be agreed by the parties, for the Secondary Offering (the “Second Closing”). | |

- 30 -

Appendix A

Peru Copper Syndicate Ltd.

Proposed Structure (assuming no secondary offering and on a basic basis)

- 31 -

SCHEDULE “B”

To be completed by Ontario Accredited Investors1

The Subscriber or, if the Subscriber is contracting hereunder as agent for one or more beneficial purchasers, each beneficial purchaser has been disclosed, and each such beneficial purchaser is purchasing as principal, is a resident of or otherwise subject to the securities legislation of Ontario and is an “accredited investor”, as such term is defined in Ontario Securities Commission Rule 45-501 – Exempt Distribution (“OSC Rule 45-501”), as at the Closing Time by virtue of being (Please check one or more. as applicable):

| ¨ | (a) | a bank listed in Schedule I or II of the Bank Act (Canada), or an authorized foreign bank listed in Schedule III of that Act; | ||

| ¨ | (b) | the Business Development Bank incorporated under the Business Development Bank Act (Canada); | ||