EX-10.7 12 d717215dex107.htm EX-10.7 DATED 12 DECEMBER 2012 VENDOR LOAN AGREEMENT KIRKLAND & ELLIS INTERNATIONAL LLP London EC3A 8AF Tel: +44 (0) 20 7469-2000 Fax: +44 (0) 20 7469-2001 CONTENTS Clause Page SCHEDULE 1 The Lenders 13 SCHEDULE 2...

Exhibit 10.6

DATED 12 DECEMBER 2012

XXXXXXXX & XXXXX INTERNATIONAL LLP

00 Xx. Xxxx Xxx

Xxxxxx

XX0X 0XX

Tel: x00 (0) 00 0000-0000

Fax: x00 (0) 00 0000-0000

xxx.xxxxxxxx.xxx

CONTENTS

| Clause | Page | |||||

| 1. | Interpretation | 2 | ||||

| 2. | Effective time | 5 | ||||

| 3. | The Loan | 5 | ||||

| 4. | Ranking | 5 | ||||

| 5. | Interest | 5 | ||||

| 6. | Repayment of the Loan | 6 | ||||

| 7. | Xxxx Payments | 7 | ||||

| 8. | Leverage Threshold Event | 7 | ||||

| 9. | Liquidity Events | 8 | ||||

| 10. | Payment | 8 | ||||

| 11. | Information Rights | 8 | ||||

| 12. | Amendments | 8 | ||||

| 13. | Enforcement Action | 8 | ||||

| 14. | Transfers | 9 | ||||

| 15. | Xxxx Equity | 9 | ||||

| 16. | Corporate Structure | 9 | ||||

| 17. | Notices | 9 | ||||

| 18. | General | 10 | ||||

| 19. | Governing Law and Jurisdiction | 10 | ||||

| SCHEDULE 1 The Lenders | 13 | |||||

| SCHEDULE 2 Financial Covenant Definitions | 14 | |||||

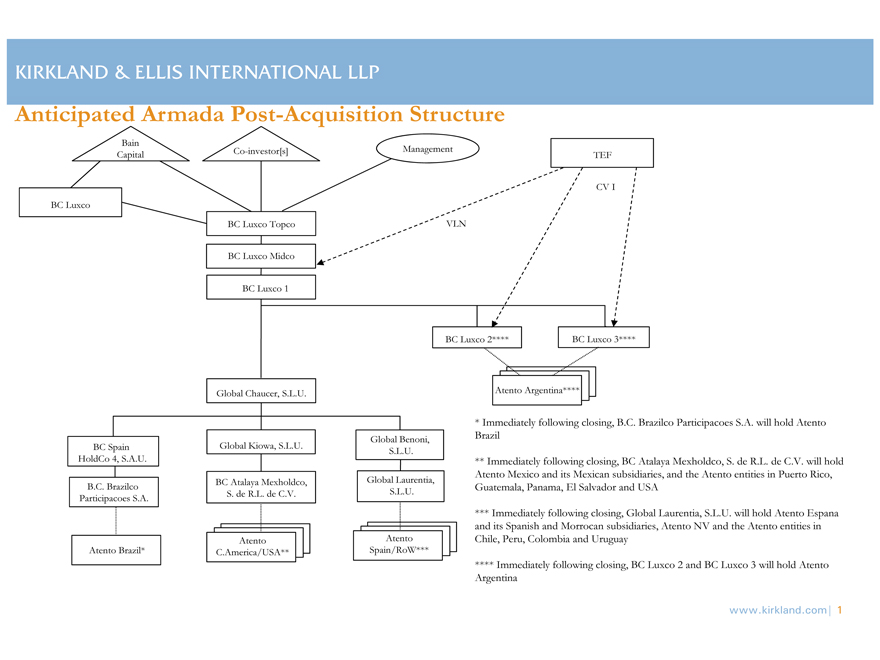

| SCHEDULE 3 Structure Chart | 15 |

THIS AGREEMENT is made on 12 December 2012 with effect from the Effective Date

BETWEEN:

| (1) | Global Laurentia, S.L.U., a company duly incorporated and in existence in accordance with the laws of the Kingdom of Spain, with Tax Identification Number B-86521267 as borrower (“Spain Holdco 2”); and |

| (2) | The entity(ies) listed in Schedule 1 (The Lenders) as lenders (the “Lenders”). |

RECITALS

| (A) | Spain Holdco 2 and certain Affiliates thereof have entered into the Acquisition Agreement (as defined below) in order to acquire substantially all of the assets of Atento Inversiones y Teleservicios S.A. (the “Acquisition”). |

| (B) | Under Section 5.3 of the Acquisition Agreement, the parties thereto have agreed that a portion of the purchase price payable upon the closing of the Acquisition equal to EUR 110,000,000 shall be satisfied by the issuance of a vendor loan note. |

| (C) | This Agreement shall constitute the “Vendor Loan Note” for the purposes of the Acquisition Agreement. |

IT IS AGREED AS FOLLOWS:

| 1. | INTERPRETATION |

| 1.1 | The definitions and rules of interpretation in this clause apply in this Agreement and the schedules to this Agreement. |

“Acquisition Agreement” means the share purchase agreement dated 11 October 2012 between Spain Holdco 2 (and certain Affiliates thereof) and Telefonica, S.A. relating to the sale and purchase substantially all of the assets of Atento Inversiones y Teleservicios S.A.;

“Affiliate” means in relation to any body corporate (i) each of its parent undertakings; and (ii) any subsidiary undertaking of such body corporate or of any of its parent undertakings;

“Atento Group” means BC Luxco Topco S.C.A. and its direct or indirect subsidiaries as of the Effective Date as a consequence of the Acquisition Agreement (but excluding BC Luxco 2 S.á.x.x, XX Xxxxx 3 S.á.x.x and their direct or indirect subsidiaries) and, in any event, all of the companies acquired by the Xxxx Group pursuant to the Acquisition Agreement (other than the Atento Argentina Companies), regardless of which Affiliate of the Xxxx Group controls such companies during the term of this Agreement;

“Atento Group Leverage Ratio” means, as of a certain date, the ratio of (i) Financial Indebtedness as of such date to (ii) the EBITDA of the full 12-month period immediately preceding that date, calculated on the basis of the management accounts for the Atento Group, if available; provided, for the avoidance of doubt, that when calculating the Atento Group Leverage Ratio in relation to a Xxxx Payment, the amount of Financial Indebtedness shall include any Financial Indebtedness incurred by the Atento Group in connection with such Xxxx Payment even if is incurred immediately after such Xxxx Payment is made.

- 2 -

“Xxxx Equity” means approximately 360,000,000, being the amount of equity contributed by the Xxxx Group into the Atento Group in the context of the closing of the Acquisition Agreement.

“Xxxx Fees” means the following transaction, annual management or advisory fees paid by the Atento Group to the Xxxx Group: (i) a EUR 11,000,000 transaction fee paid upon the completion of the Acquisition Agreement; (ii) an annual management or advisory fee paid by the Atento Group to the Xxxx Group, provided such management or advisory fee shall not exceed EUR 5,000,000; and (iii) a transaction fee paid upon the closing of any subsequent transaction (including without limitation acquisitions, disposals and debt financing) in an amount up to 1% of the aggregate value of such transaction;

“Xxxx Group” means each of Xxxx Capital Europe Fund III, L.P., Xxxx Capital Fund X, L.P., BCIP Associates IV, L.P., BCIP Trust Associates IV, L.P., BCIP Associates IV-B, L.P. and BCIP Trust Associates IV-B, L.P. and their respective Affiliates (but excluding the Atento Group);

“Xxxx Payment” means any payment from the Atento Group to the Xxxx Group, including by way of dividends, loans, interests (other than PIK interest), management fees, royalties or any other similar or equivalent distribution or payment, but excluding (x) the Xxxx Fees and (y) any payments made to any portfolio company of the Xxxx Group in the ordinary course of the Atento Group’s trading activities;

“Xxxx Payment Notice” has the meaning given to it in Clause 7.1;

“Business Day” means any day (except Saturdays and Sundays) on which banks are generally open for business in Luxembourg and Madrid;

“Company” means the borrower of the Loan, from time to time (subject always to the provisions of Clause 14.1(i));

“Disagreement Notice” has the meaning given to it in Clause 7.3;

“EBITDA” has the meaning given to that term in Schedule 2 (Financial Covenant Definitions);

“Effective Date” means the time at which the Closing Purchase Price has been paid in accordance with Section 5.3 of the Acquisition Agreement.

“Final Repayment Date” means the date which is ten years from the Effective Date;

“Financial Indebtedness” has the meaning given to that term in Schedule 2 (Financial Covenant Definitions);

“Group Finance Documents” means any finance document or agreement in respect of any Financial Indebtedness of the Atento Group or any finance document or agreement in respect of any refinancing, extension or amendment of the financing under such document);

“Group Financing Default” means any default, event of default or similar provision under any Group Finance Document;

“Head Office Cost” means the lesser of (i) the costs or expenses incurred by the holding companies of the Atento Group during such Interest Period in connection with the

- 3 -

administration or operation of the Atento Group, plus the Xxxx Fees (without double-counting); and (ii) and amount equal to EUR 35,000,000 for the first Interest Period (increased by 3% for each subsequent Interest Period, on a compounding basis);

“Interest Payment Date” has the meaning given to it in Clause 5.3;

“Interest Period” means a period of twelve months, with the first Interest Period starting on the Effective Date;

“Interest Payment Date” has the meaning given to it in Clause 5.3;

“Leverage Threshold” has the meaning given to it in Clause 7.1;

“Leverage Threshold Event” has the meaning given to it in Clause 8.1;

“Loan” means the loan deemed to have been made pursuant to Clause 2 or the principal amount outstanding at any time plus accrued but unpaid interest;

“Majority Lenders” means a Lender or Lenders whose aggregate Participations are more than 50.1 per cent. of the Total Participations;

“Participation” means in respect of a Lender, the amount of the Loan set opposite such Lender’s name under the heading “Participation” in Schedule 1 (The Lenders) and the amount of any other Participation transferred to it under this Agreement (in each case to the extent not cancelled, reduced or transferred by it under this Agreement);

“Parties” means the Company and the Lenders, and “Party” means any one of them;

“Permitted Proceeds” has the meaning given to it in Clause 8.1;

“Public Offering” means a public offering and sale of shares of a company pursuant to an effective registration or an effective listing or qualification on an internationally recognised securities exchange in accordance with applicable requirements;

“Relevant Repayment Amount” means an amount equal to the sum of

BP x 23.40%

where “BP” means the amount of the Xxxx Payment that is to be made and 23.40% being the result of the following formula: (110/110 + Xxxx Equity).

“Sale of the Atento Group” means the direct or indirect sale, transfer, conveyance or other disposition of at least 66.66% of the business and assets of the Atento Group (other than in connection with non-Secondary Public Offerings). For the avoidance of doubt, the direct or indirect sale, transfer, conveyance or other disposition of all of the business and assets of the Atento Group in Spain, Mexico and Brazil shall be deemed a Sale of the Atento Group;

“Secondary Public Offering” means a Public Offering of BC Luxco Topco S.C.A. whereby shareholders of BC Luxco Topco S.C.A. sell shares of BC Luxco Topco S.C.A. in such Public Offering;

“Total Participations” means the aggregate of the Participations, being EUR 110,000,000 (in words: one hundred and ten million Euros) at the Effective Date; and

- 4 -

“Upstream Payments” has the meaning given to it in Clause 5.4.

| 1.2 | Any phrase introduced by the terms “including”, “include” or any similar expression shall be construed as illustrative and shall not limit the sense of the words preceding those terms. |

| 1.3 | Words denoting “persons” shall include corporations, words in the singular shall include the plural and in the plural shall include the singular, and a reference to one gender includes a reference to the other genders. |

| 1.4 | A reference to a clause or a schedule is (unless expressly stated otherwise) a reference to a clause of, or schedule to, this Agreement. |

| 1.5 | The schedules to this Agreement form part of (and are incorporated into) this Agreement. |

| 1.6 | Headings are for convenience only and do not affect the interpretation of this Agreement. |

| 1.7 | Any reference to a Group Finance Document shall include such document to the extent amended, modified or replaced from time to time. |

| 1.8 | Capitalized terms that are used but not otherwise defined herein shall have the meanings ascribed to them in the Acquisition Agreement. |

| 2. | EFFECTIVE TIME |

The Parties agree that this Agreement shall become effective on and from the Effective Date.

| 3. | THE LOAN |

The Lenders are hereby deemed to have made a loan to the Company in an aggregate amount equal to the Total Participations on and subject to the terms and conditions contained in this Agreement.

| 4. | RANKING |

The Loan shall represent a direct and unsecured obligation of the Company and shall rank in right and priority of payment:

| (a) | senior to any debt or equity claim of the equityholders of the Company and any other equity investor in BC Luxco Topco S.C.A. (and any direct or indirect parent company or entity of BC Luxco Topco S.C.A.); |

| (b) | pari passu with ordinary course payables of the Company; and |

| (c) | junior to all other indebtedness of the Company. |

| 5. | INTEREST |

| 5.1 | Interest shall accrue on the principal amount of the Loan from (and including) the Effective Date to (but excluding) the Final Repayment Date at a rate of five per cent. per annum |

- 5 -

| 5.2 | Interest shall be calculated on the basis of the actual number of days elapsed and a three hundred sixty-five day year. |

| 5.3 | Subject to Clause 5.4 below, interest shall be payable in cash on the last day of each Interest Period (“Interest Payment Date”). |

| 5.4 | The Parties acknowledge that in order to make cash interest payments with respect to the Loan, monies need to be upstreamed or otherwise transferred to the Company from a direct or indirect subsidiary of the Company (“Upstream Payments”) and agree that interest on the Loan shall only be payable in cash if and to the extent that: |

| a) | no Group Financing Default (which for the avoidance of doubt shall not include any shareholders loans) is continuing or would arise as a result of such interest payment or any Upstream Payment; |

| b) | since the last Interest Payment Date, the Company has received Upstream Payments equal to at least the Head Office Cost, in which case interest shall only be payable in cash to the extent that the Upstream Payments exceed such amount; and |

| c) | the Upstream Payments can be completed without breaching (or reasonably expecting to breach) any applicable law, including capital maintenance rules, legal restrictions or rules (including as to lack of distributable reserves) and director and officer fiduciary and other duties; |

provided that the Company shall, subject always to items (a) and (c) above, procure that (in order to make a cash interest payment) its direct and indirect subsidiaries upstream or otherwise distribute monies to the Company to the extent possible without incurring withholding taxes in excess of 20%, and provided further that, notwithstanding the occurrence of any of the circumstances set out in this Clause 5.4, the Company may elect at its sole discretion to make a cash payment of interest in whole or in part.

| 5.5 | If on any Interest Payment Date, any portion of the interest payable is not payable in cash for any reason set out in Clause 5.4 above, such portion will be capitalized and added to the outstanding principal amount of the Loan as of that Interest Payment Date. |

| 5.6 | Any accrued interest not paid or capitalised in accordance with Clause 5 shall become due and payable on the Final Repayment Date and shall accrue interest until such date. |

| 6. | REPAYMENT OF THE LOAN |

| 6.1 | The Company may repay the Loan, without any premium or penalty, in whole or in part, at any time prior to the Final Repayment Date, provided that such prepayment shall include all accrued but unpaid interest. |

| 6.2 | Any such early repayment shall be paid to each Lender pro rata to the amount of the Loan then held by such Lender. |

| 6.3 | Unless previously repaid in accordance with this Clause 6, the Loan shall be repaid in full (including all accrued but unpaid interest) on the Final Repayment Date. |

| 6.4 | If any day fixed for repayment of the Loan is not a Business Day, the relevant Loan will be repaid on the next day that is a Business Day. |

- 6 -

| 7. | XXXX PAYMENTS |

| 7.1 | The Atento Group shall be entitled to make Xxxx Payments only if: |

| a) | the Atento Group Leverage Ratio is, immediately prior to making such Xxxx Payment, equal to or less than 2.5:1 (the “Leverage Threshold”); or |

| b) | to the extent permitted pursuant to Clause 8 below in connection with a Leverage Threshold Event; |

provided, in each case, that the Company has complied with the provisions of Clause 7.2.

| 7.2 | The Atento Group shall be entitled to make Xxxx Payments if (x) the Company notifies the Lenders in writing (the “Xxxx Payment Notice”) of the amount of the proposed Xxxx Payment and the current Atento Group Leverage Ratio and (y) an amount equal to the Relevant Repayment Amount is applied in repayment of the Loan, with the balance of such Xxxx Payment available to be paid to the Xxxx Group. The Xxxx Payment (including the Relevant Repayment Amount) may not be paid until the later of (i) the date that is fifteen (15) Business Days following the delivery of the Xxxx Payment Notice and (ii) the final determination of the Atento Group Leverage Ratio in accordance with Clauses 7.3 and 7.4 below. |

| 7.3 | If the Lenders wish to dispute the Company’s calculation of the Atento Group Leverage Ratio, they shall notify the Company within ten (10) Business Days after receiving the Xxxx Payment Notice (a “Disagreement Notice”). If the Lenders do not timely serve a Disagreement Notice, the Atento Group Leverage Ratio set out in the Xxxx Payment Notice shall be final and binding. |

| 7.4 | If the Lenders serve a Disagreement Notice, the Company and the Lenders shall use all reasonable endeavors to meet and reach agreement upon the Atento Group Leverage Ratio. If the Lenders and the Company have not agreed the Atento Group Leverage Ratio within ten (10) Business Days of receipt by the Company of the Disagreement Notice, either the Company or the Lenders may refer the matter to an Independent Expert appointed by the Parties in accordance with paragraph 10 of Schedule V of the Acquisition Agreement. The Independent Expert shall act as an expert and not as an arbitrator and shall make its determination as soon as is reasonably practicable, and in any event within fifteen (15) business days after the date of referral. The Independent Expert’s costs (including any fees and costs of any advisers appointed by the Independent Expert) shall be borne equally by the Company and the Lenders (jointly and severally), or as the Expert may determine. |

| 8. | LEVERAGE THRESHOLD EVENT |

| 8.1 | In the event that the Atento Group completes one or a series of related transactions in which it incurs financial indebtedness that causes the Atento Group Leverage Ratio to cross from below the Leverage Threshold to above the Leverage Threshold (a “Leverage Threshold Event”), the Atento Group may only make Xxxx Payments with those proceeds that would have been available to the Atento Group had the Leverage Threshold Event been completed at a level equal to (but not exceeding) the Leverage Threshold (the “Permitted Proceeds”). Any proceeds of the Leverage Threshold Event in excess of the Permitted Proceeds may not be used by the Atento Group to make any Xxxx Payment unless and until the Loan has been repaid in full. |

| 8.2 | For the avoidance of doubt, any Xxxx Payments made in connection with a Leverage Threshold Event may only be made in accordance with the provisions of Clause 7.2 above. |

- 7 -

| 9. | LIQUIDITY EVENTS |

| 9.1 | A Secondary Public Offering may not be completed unless and until the Loan has been repaid in full. |

| 9.2 | Following the occurrence of a Sale of the Atento Group, the Company shall (subject always to the provisions of Clause 5.4 (a) and (c) above, which shall apply mutatis mutandis hereto) use the net proceeds of such Sale of the Atento Group to repay the Loan. |

| 10. | PAYMENT |

| 10.1 | Payment of principal and interest on the Loan shall be made to any account of the Lender notified to the Company by the Lender at least ten (10) Business Days prior to the relevant Interest Payment Date. |

| 10.2 | All amounts payable under this Agreement shall be paid subject to any deduction or withholding of taxes required by law (and without any requirement to gross-up). |

| 11. | INFORMATION RIGHTS |

Each Lender shall be entitled to receive (i) any quarterly, bi-annual and audited annual financial statements which are prepared by the Company in the ordinary course and (ii) prior to the completion of any Xxxx Payment, information on the proposed Xxxx Payments and the Atento Group Leverage Ratio.

| 12. | AMENDMENTS |

Any term of this Agreement may be amended or waived with the written consent of the Company and the Majority Lenders and any such amendment or waiver will be binding on all Parties.

| 13. | ENFORCEMENT ACTION |

| 13.1 | For the purpose of this Clause 13, “Enforcement Action” means in respect of any obligations owed by the Company under the Loan (the “Liabilities”): |

| (i) | the exercise of any right of set off, account combination or payment netting against the Company in respect of any obligations owed in respect of the Liabilities; |

| (ii) | the suing for, commencing or joining of any legal or arbitration proceedings against the Company or any Affiliate thereof to recover any Liabilities; or |

| (iii) | the petitioning, applying or voting for, or the taking of any steps (including the appointment of any liquidator, receiver, administrator or similar officer) in relation to, the winding up, dissolution, administration or reorganisation of the Company in respect of any of the Liabilities or any analogous procedure or step in any jurisdiction. |

- 8 -

| 13.2 | No Lender may take any Enforcement Action without the consent of all the lenders under the Group Finance Documents. |

| 13.3 | No Lender may take any Enforcement Action at any time against any direct or indirect subsidiary of the Company with respect to this Agreement or the Liabilities. |

| 14. | TRANSFERS |

| 14.1 | The rights and obligations under the Agreement may not be transferred or assigned, in whole or in part, by either the Company or any Lender; provided that: |

| (iv) | the Company may assign its rights and obligations under this Agreement to any of its direct or indirect 100% parent companies. For the avoidance of doubt, upon any such assignment, the assignee shall become (and the assignor shall cease to be) “the Company” for the purposes of this Agreement; and |

| (v) | a Lender may charge or assign its rights and obligations under this Agreement to any of its Affiliates that has agreed in writing with the Company to adhere to the terms hereof, or as security to a bank or financial institution in connection with the provision to such Lender or any Affiliate thereof of any financial indebtedness so long as such Lender has given the Company at least ten (10) Business Days prior notice. |

| 14.2 | Any transfer or assignment made in breach of this Clause 14 shall be void and shall not be binding against the Company. |

| 15. | XXXX EQUITY |

Spain Holdco 2 represents and warrants that the amount of Xxxx Equity amounts to approximately 360,000,000 Euros.

| 16. | CORPORATE STRUCTURE |

Spain Holdco 2 represents and warrants that the corporate structure of the Atento Group as of immediately after the Closing (as defined in the Acquisition Agreement) is in all material respects as shown in Schedule 3 (Structure Chart).

| 17. | NOTICES |

| 17.1 | Any notice (including any approval, consent or other communication) in connection with this Agreement and the documents referred to in it: |

| (a) | must be in writing in the English language; |

| (b) | must be left at the address of the addressee or sent by pre-paid recorded delivery (airmail if posted to or from a place outside Spain) to the address of the addressee or sent by facsimile to the facsimile number of the addressee in each case as specified in this Clause in relation to the Party to whom the notice is addressed, and marked for the attention of the person so specified; and |

| (c) | must not be sent by electronic mail. |

- 9 -

| 17.2 | The relevant details for all Lenders and the Company at the date of this Agreement are: |

The Lenders:

Xxxxx xx xx Xxxxxxxxxxxx

Xxxxxxxx Xxxxxxx

Xxxxxx 0x, x/x 00000 Xxxxxx

| Facsimile: | + 91 727 14 05 | |

| Attention: | Secretario General |

The Company

c/o BC Luxco S.à x.x.

0X, xxx Xxxxxxx Xxxxxxxx

X-0000 Munsbach

Grand Duchy of Luxembourg

| Facsimile: | x000 00 00 00 00 | |

| Attention: | Xxxxxx Xxxxxxxx |

With a copy (which shall not constitute notice) to:

Xxxxxxxx & Xxxxx International LLP

00 Xx Xxxx Xxx

Xxxxxx, XX0X 0XX

| Facsimile: | x00 (0)000 000 0000 | |

| Attention: | Xxx Xxxxxx and Xxxxxx Xxxxxxxxxx |

| 17.3 | Where a notice or other document is served or sent by post, service or delivery will be deemed to be effected 24 hours after the time when the envelope containing the notice or document is posted and, in proving such service or delivery, it shall be sufficient to prove that such envelope was properly addressed, stamped and posted. |

| 18. | GENERAL |

| 18.1 | For the avoidance of doubt, provided that Clause 7 is complied with at all times, nothing in this Agreement shall prohibit the Company or any member of the Atento Group from making any distributions and dividends that are permitted under the Group Finance Documents. |

| 18.2 | The Company’s calculation of any amount (including interest) due on the Loan shall (except in the case of manifest error) be binding on all Lenders and all persons claiming through or under them. |

| 19. | GOVERNING LAW AND JURISDICTION |

| 19.1 | This Agreement shall be governed by, and construed in accordance with, the laws of Spain. |

| 19.2 | The courts of Madrid shall have exclusive jurisdiction to settle any dispute which may arise out of or in connection with this Agreement. |

- 10 -

IN WITNESS WHEREOF, this Agreement has been executed by the Parties, in two original counterparts which, once duly executed, shall have one sole force and effect, all as of the date first above written.

| GLOBAL LAURENTIA S.L.U. | ||

| /s/ Antonio Xxxxxxxx Xxxxx | ||

|

| ||

| Name: | Antonio Xxxxxxxx Xxxxx | |

| Title: | Director |

[Signature Page - Vendor Loan Note]

IN WITNESS WHEREOF, this Agreement has been executed by the Parties, in two original counterparts which, once duly executed, shall have one sole force and effect, all as of the date first above written.

| ATENTO INVERSIONES Y TELESERVICIOS S.A. | ||

| /s/ Xxxxxxxxx Xxxxxx Ample | ||

|

| ||

| Name: | Xxxxxxxxx Xxxxxx Ample | |

| Title: | Chief Executive Officer/Attorney-in-fact |

[Signature Page - Vendor Loan Note]

SCHEDULE 1

THE LENDERS

| Name of Lender | Participation | |||

| Atento Inversiones y Teleservicios S.A. | € | 110,000,000.00 | ||

| Total | € | 110,000,000.00 |

SCHEDULE 2

FINANCIAL COVENANT DEFINITIONS

“EBITDA” means, for a period of 12 months ending on the date the Atento Group Leverage Ratio is to be calculated in accordance with Clause 7, the consolidated operating profits of the Atento Group (but not including EBITDA from any non-Atento Group companies acquired by the Atento Group (or arising from an acquisition of substantially all of the assets of such company) following the date of the Agreement):

| (a) | for the avoidance of doubt, before deducting third party interest payable by any member of the Atento Group (to the extent included in operating profit); |

| (b) | for the avoidance of doubt, before deducting any amount of income tax expensed by any member of the Atento Group (to the extent included in operating profit); and |

| (c) | after adding back (to the extent otherwise deducted) any amount attributable to amortisation of intangible assets or depreciation of tangible assets. |

“Financial Indebtedness” means, at any time, the aggregate outstanding principal of any financial indebtedness of members of the Atento Group for or in respect of:

| (a) | all financial borrowings and other indebtedness of any Atento Group company by way of any overdraft, acceptance, credit or similar facility; |

| (b) | any drawn revolving facility, |

| (c) | any amount raised by acceptance under any acceptance credit facility; |

| (d) | any note purchase facility or the issue of bonds (but not trade agreements), debentures or loan stock, |

| (e) | all interest, fees and penalties accrued on any or all of the financial borrowings detailed above (to the extent not already included in item (a)); |

| (f) | the xxxx to market effect (positive or negative) of all interest rate, foreign exchange and other derivative instruments to which an Atento Group company is party (or with respect to which an Atento Group company has obligations), and any amounts payable on the termination of such arrangements (to the extent not already included in item (a)); |

| (g) | all finance lease obligations of each Subsidiary; |

but excluding (i) unsecured and subordinated shareholder loans of BC Luxco Topco S.C.A., (ii) indebtedness owed by one member of the Atento Group to another member of the Atento Group, (iii) the Loan, (iv) all pension and labour related liabilities; (v) recourse factoring or recourse discounting of receivables by any Atento Group company, and (vi) undrawn credit facilities.

SCHEDULE 3

STRUCTURE CHART