Confidential Treatment Requested. Confidential portions of this document have been redacted and have been filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to this redacted information.

Exhibit 10.1

Confidential Treatment Requested. Confidential portions of this document have been redacted and have been filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to this redacted information.

EXECUTION VERSION

FOURTH AMENDED AND RESTATED AGREEMENT OF LIMITED PARTNERSHIP OF MONOGRAM RESIDENTIAL MASTER PARTNERSHIP I LP (a Delaware limited partnership) |

Dated as of December 20, 2013 |

THE LIMITED PARTNER INTERESTS (THE “INTERESTS”) OF MONOGRAM RESIDENTIAL MASTER PARTNERSHIP I LP HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), THE SECURITIES LAWS OF ANY STATE OR ANY OTHER APPLICABLE U.S. OR NON‑U.S. SECURITIES LAWS, IN EACH CASE IN RELIANCE UPON EXEMPTIONS PROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND SUCH LAWS. THE INTERESTS MAY BE ACQUIRED FOR INVESTMENT ONLY, AND NEITHER THE INTERESTS NOR ANY PART THEREOF MAY BE OFFERED FOR SALE, PLEDGED, HYPOTHECATED, SOLD, ASSIGNED OR TRANSFERRED AT ANY TIME EXCEPT IN COMPLIANCE WITH (I) THE SECURITIES ACT, ANY APPLICABLE STATE SECURITIES LAWS AND ANY OTHER APPLICABLE SECURITIES LAWS, AND (II) THE TERMS AND CONDITIONS OF THIS PARTNERSHIP AGREEMENT. THE INTERESTS WILL NOT BE TRANSFERRED OF RECORD EXCEPT IN COMPLIANCE WITH SUCH LAWS AND THIS PARTNERSHIP AGREEMENT. THEREFORE, PURCHASERS OF THE INTERESTS WILL BE REQUIRED TO BEAR THE RISK OF THEIR INVESTMENT FOR AN INDEFINITE PERIOD OF TIME. |

TO NON‑U.S. INVESTORS: IN ADDITION TO THE FOREGOING, BE ADVISED THAT THE INTERESTS HAVE NOT BEEN REGISTERED UNDER THE SECURITIES ACT AND MAY NOT BE OFFERED OR SOLD IN THE UNITED STATES OR TO U.S. PERSONS UNLESS THE INTERESTS ARE REGISTERED UNDER THE SECURITIES ACT, OR AN EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT IS AVAILABLE. HEDGING TRANSACTIONS (WITHIN THE MEANING OF REGULATION S UNDER THE SECURITIES ACT) INVOLVING THE INTERESTS MAY NOT BE CONDUCTED UNLESS IN COMPLIANCE WITH THE SECURITIES ACT. |

TABLE OF CONTENTS

PAGE | ||||||

ARTICLE 1 | DEFINITION | 2 | ||||

ARTICLE 2 | THE PARTNERSHIP | 25 | ||||

2.1 | Formation of Partnership | 25 | ||||

2.2 | Partnership Name and Principal Office | 25 | ||||

2.3 | Office of and Agent for Service of Process | 25 | ||||

2.4 | Term of the Partnership | 25 | ||||

2.5 | Title to Assets | 25 | ||||

2.6 | Purpose and Powers; Subsidiary REITs and REIT Partner; Sale of Project | 25 | ||||

ARTICLE 3 | PARTNERS AND CAPITAL CONTRIBUTIONS | 29 | ||||

3.1 | General Partner; Capital Contribution During Commitment Period | 29 | ||||

3.2 | Limited Partner; Capital Contribution During Commitment Period | 30 | ||||

3.3 | Capital Calls | 31 | ||||

3.4 | Additional Capital Contributions | 32 | ||||

3.5 | Failure to Make Capital Contributions | 33 | ||||

3.6 | Return of Capital Contributions | 35 | ||||

3.7 | Capital Account | 35 | ||||

3.8 | Transfer of Capital Account | 36 | ||||

3.9 | Tax Matters Partner | 36 | ||||

3.10 | Capital Commitments | 36 | ||||

ARTICLE 4 | ALLOCATIONS | 36 | ||||

4.1 | Allocation of Profits and Losses | 36 | ||||

4.2 | Tax Allocations | 37 | ||||

4.3 | Payment Allocations and Project Capital Contribution Allocations | 38 | ||||

ARTICLE 5 | DISTRIBUTIONS, FEES AND EXPENSES | 38 | ||||

5.1 | Distributions | 38 | ||||

5.2 | Tax Provisions | 39 | ||||

5.3 | Fees Payable to the General Partner | 39 | ||||

5.4 | Priority | 40 | ||||

5.5 | Payments to Partners for Services | 40 | ||||

5.6 | Expenses | 40 | ||||

5.7 | Acquisition Costs | 42 | ||||

ARTICLE 6 | LIMITED PARTNER | 43 | ||||

6.1 | Limited Liability of Limited Partner | 43 | ||||

6.2 | Non‑U.S | 43 | ||||

6.3 | Power of Attorney | 43 | ||||

6.4 | Confidentiality | 44 | ||||

i

TABLE OF CONTENTS

(continued)

PAGE | ||||||

ARTICLE 7 | MANAGEMENT RIGHTS, DUTIES, AND POWERS OF THE GENERAL PARTNER; TRANSACTIONS INVOLVING THE GENERAL PARTNER OR ITS AFFILIATES | 45 | ||||

7.1 | Management of the Partnership | 45 | ||||

7.2 | Investment and Divestments | 47 | ||||

7.3 | Initial and Subsequent Operating Plans | 50 | ||||

7.4 | Business with Affiliates; Other Activities | 51 | ||||

7.5 | Exclusivity Right for Projects | 53 | ||||

7.6 | Initial Projects | 53 | ||||

7.7 | Suspension Period | 54 | ||||

7.8 | Removal | 55 | ||||

7.9 | Maintenance of Domestic Status | 58 | ||||

7.10 | Withholding | 58 | ||||

7.11 | Change in BHMF REIT / Change of Control Event | 59 | ||||

7.12 | General Partner Cause Event | 59 | ||||

7.13 | Successor General Partner Cause Event | 60 | ||||

7.14 | Tax Status | 60 | ||||

7.15 | Subsidiary Net Cash Flow | 61 | ||||

ARTICLE 8 | ADVISORY COMMITTEE | 61 | ||||

8.1 | General | 61 | ||||

8.2 | Functions of the Advisory Committee | 61 | ||||

8.3 | Meetings; Operation of the Advisory Committee | 65 | ||||

8.4 | Expenses | 66 | ||||

8.5 | Reports | 66 | ||||

8.6 | No Liability | 66 | ||||

8.7 | Dispute Resolution Procedure | 66 | ||||

ARTICLE 9 | LIMITATIONS ON LIABILITY AND INDEMNIFICATION | 69 | ||||

9.1 | Limitation of Liability | 69 | ||||

9.2 | Indemnification | 69 | ||||

ARTICLE 10 | TRANSFERS OF PARTNERS' INTERESTS IN THE PARTNERSHIP | 71 | ||||

10.1 | Transfers | 71 | ||||

10.2 | Basis Election | 73 | ||||

10.3 | Void Transfer | 73 | ||||

10.4 | PGGM Purchase Option | 73 | ||||

ARTICLE 11 | DISSOLUTION OF PARTNERSHIP | 74 | ||||

11.1 | Bankruptcy of Partner | 74 | ||||

11.2 | Other Events of Dissolution | 75 | ||||

ii

TABLE OF CONTENTS

(continued)

PAGE | ||||||

11.3 | Distribution Upon Liquidation | 75 | ||||

11.4 | Procedural and Other Matters | 76 | ||||

ARTICLE 12 | REPRESENTATIONS, WARRANTIES AND COVENANTS | 77 | ||||

12.1 | Representations, Warranties and Covenants of the General Partner and Partnership | 77 | ||||

12.2 | Representations and Warranties of the General Partner | 77 | ||||

12.3 | Representations, Warranties and Covenants of the Limited Partner | 79 | ||||

ARTICLE 13 | BOOKS AND RECORDS; REPORTS TO PARTNERS | 81 | ||||

13.1 | Books | 81 | ||||

13.2 | Quarterly Reports | 81 | ||||

13.3 | Annual Reports | 81 | ||||

13.4 | Partnership Budget and Business Plan | 82 | ||||

13.5 | Accountants; Tax Returns | 83 | ||||

13.6 | Control Statement | 83 | ||||

13.7 | Additional Information | 83 | ||||

13.8 | Accounting and Fiscal Year | 83 | ||||

ARTICLE 14 | PORTFOLIO AND PROJECT SALE RIGHTS; SPECIAL SITUATION; FIRPTA EVENT BUY/SELL | 83 | ||||

14.1 | Portfolio Sale Right | 83 | ||||

14.2 | Project Sale Right | 86 | ||||

14.3 | Special Situation | 90 | ||||

14.4 | FIRPTA Event Buy / Sell | 93 | ||||

ARTICLE 15 | MISCELLANEOUS | 94 | ||||

15.1 | Notices | 94 | ||||

15.2 | Execution in Counterparts | 95 | ||||

15.3 | Amendments | 95 | ||||

15.4 | Additional Documents | 95 | ||||

15.5 | Validity | 95 | ||||

15.6 | Governing Law | 95 | ||||

15.7 | Waiver | 95 | ||||

15.8 | Consent and Approval | 96 | ||||

15.9 | Waiver of Partition | 96 | ||||

15.10 | Binding Effect | 96 | ||||

15.11 | Entire Agreement | 96 | ||||

15.12 | Captions | 96 | ||||

15.13 | No Strict Construction | 96 | ||||

15.14 | Identification | 96 | ||||

15.15 | Recourse to the General Partner | 96 | ||||

iii

TABLE OF CONTENTS

(continued)

PAGE | |||||

15.16 | Recourse to the Limited Partner | 96 | |||

15.17 | Remedies Not Exclusive | 97 | |||

15.18 | Use of Behringer Harvard Trade Name | 97 | |||

15.19 | Waiver of Jury Trial | 97 | |||

15.20 | Public Disclousre | 97 | |||

15.21 | PGGM Exclusions Policy, etc. | 98 | |||

15.22 | RIRE | 99 | |||

iv

EXHIBITS | |

Exhibit A | Partners; Addresses; Percentage Interests |

Exhibit B | Investment Guidelines |

Exhibit C | Form of Notice of Commitment |

Exhibit D | Form of Subsidiary REIT Limited Liability Company Agreement |

Exhibit E | Form of New Venture Agreement |

Exhibit F | Form of Control Statement |

Exhibit G | Initial Projects |

Exhibit H | Existing Projects |

Exhibit I | Form of Consent for an Initial Operating Plan |

Exhibit J | Form of Consent for a Subsequent Operating Plan |

Exhibit K | Advisory Committee Members |

Exhibit L | Form of Divestment Proposal |

Exhibit M | List of Existing Ventures |

Exhibit N | Form of Amendment to Existing Venture Agreements |

Exhibit O | Form of Investment Proposal |

Exhibit P | Form of Investment Quick Scan Proposal |

Exhibit Q | Leverage Parameters |

Exhibit R | Form of Notice of PGGM Proportionate Interest |

Exhibit S | Valuation Policy |

Exhibit T | Sample Calculation of Incentive Distributions |

Exhibit U | Baseball Style Arbitration Provisions |

Exhibit V | Property Management, Leasing and Related Services |

Exhibit W | Form of Finance Proposal |

Exhibit X | Form of Initial Operating Plan |

Exhibit Y | Proposed Form of Approved Annual Budget |

Exhibit Z | Proposed Form of Approved Business Plan |

Exhibit AA | Fees, Costs, Reimbursements and Expenses |

Exhibit BB | Form of Amendment to Existing Subsidiary REIT Agreements |

Exhibit CC | Approved Development Costs |

Exhibit DD | Form of Subsequent Operating Plan |

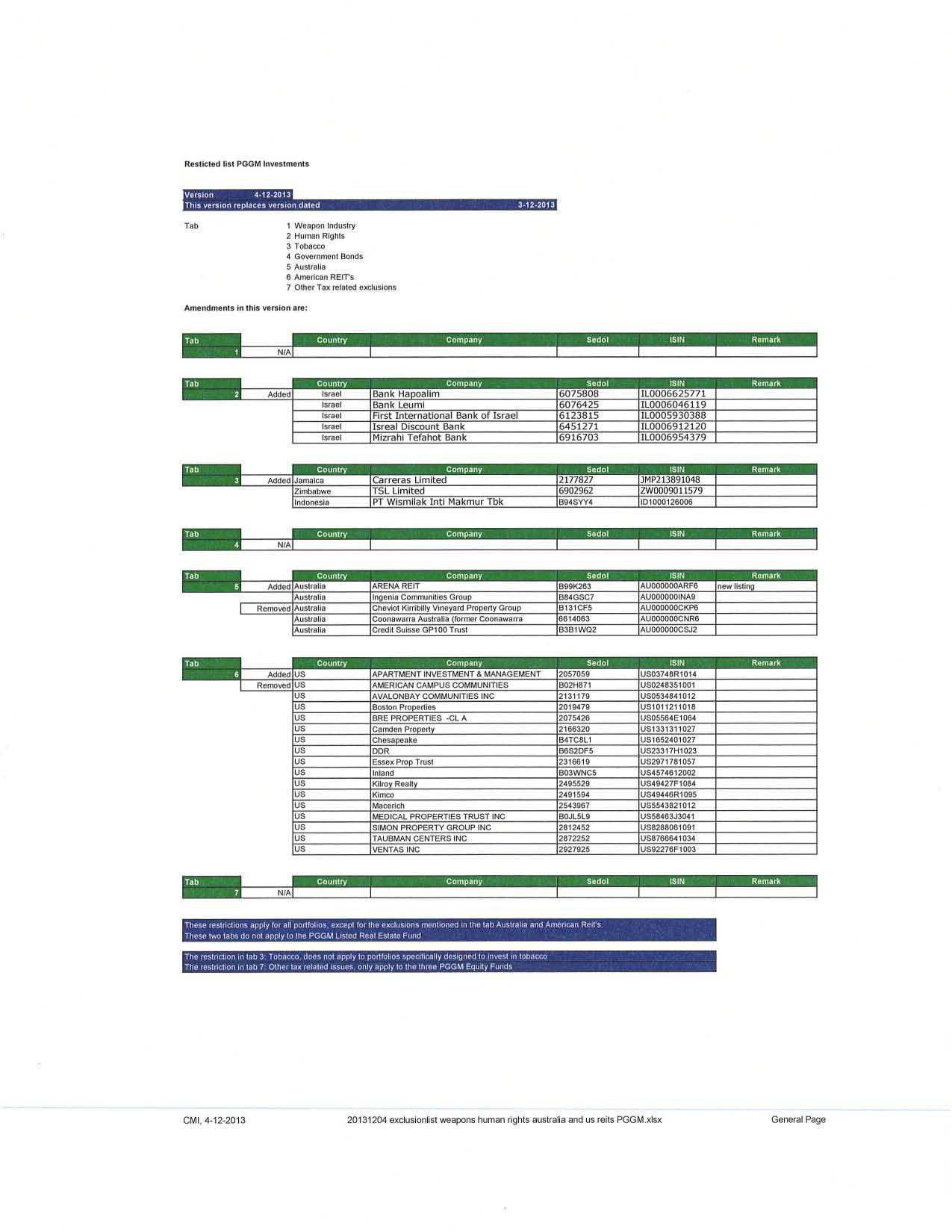

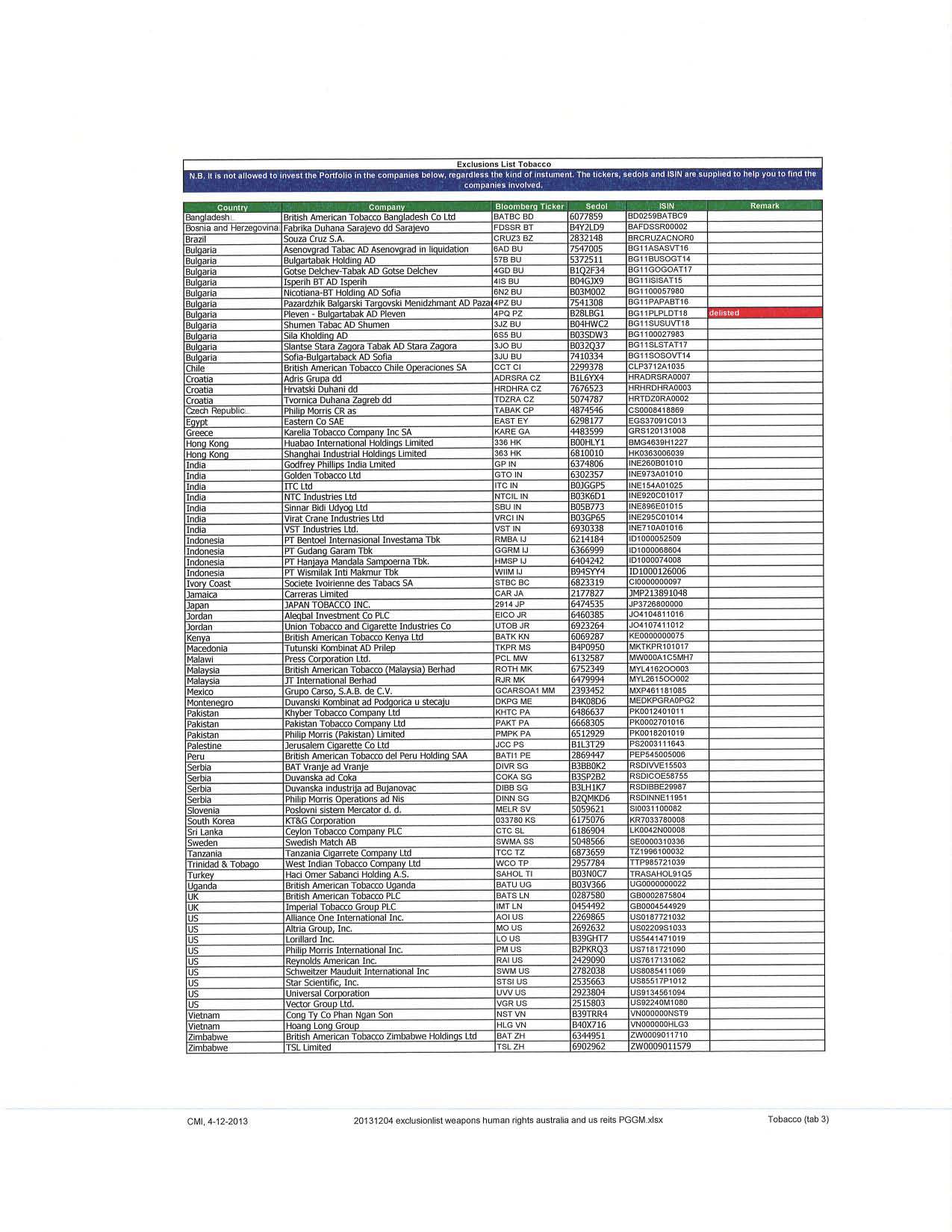

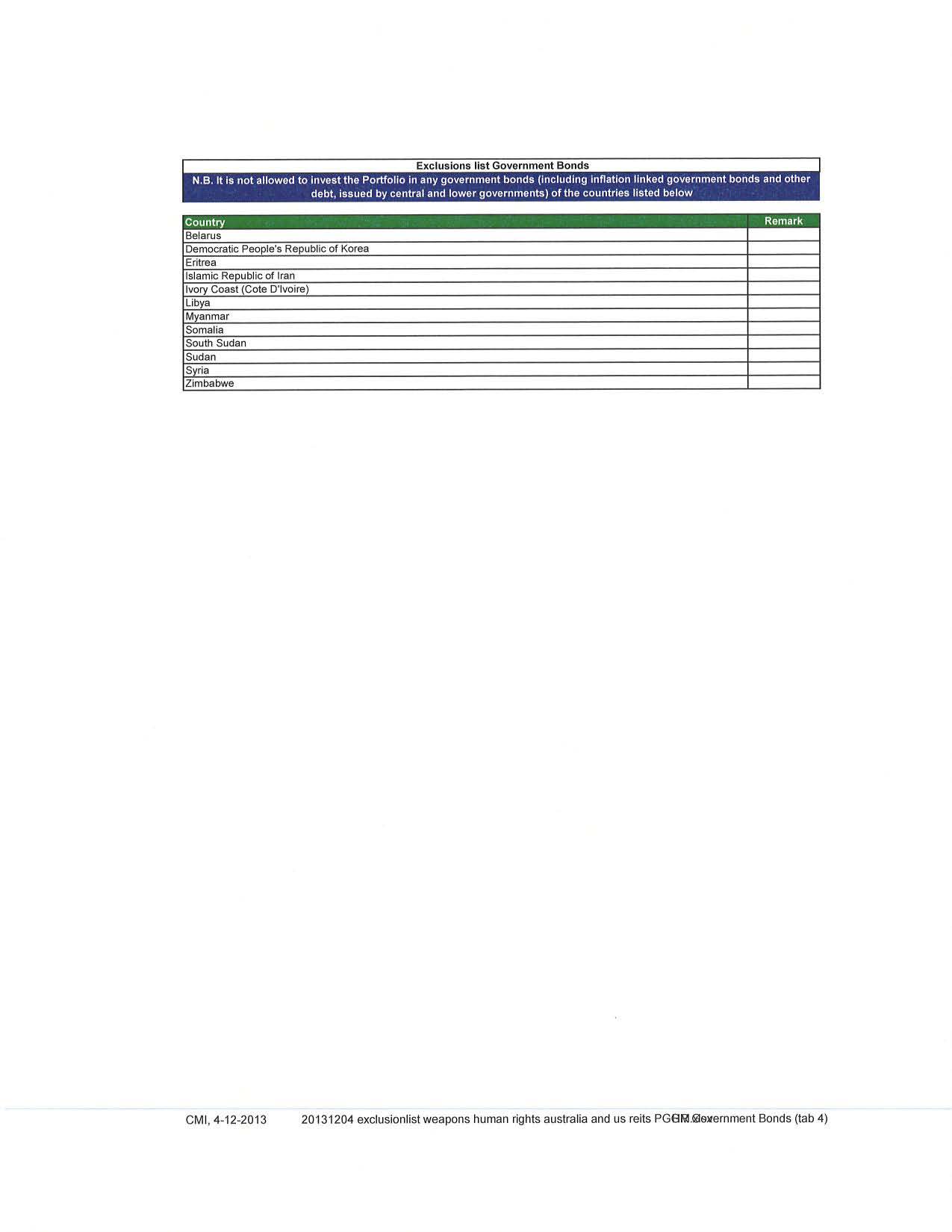

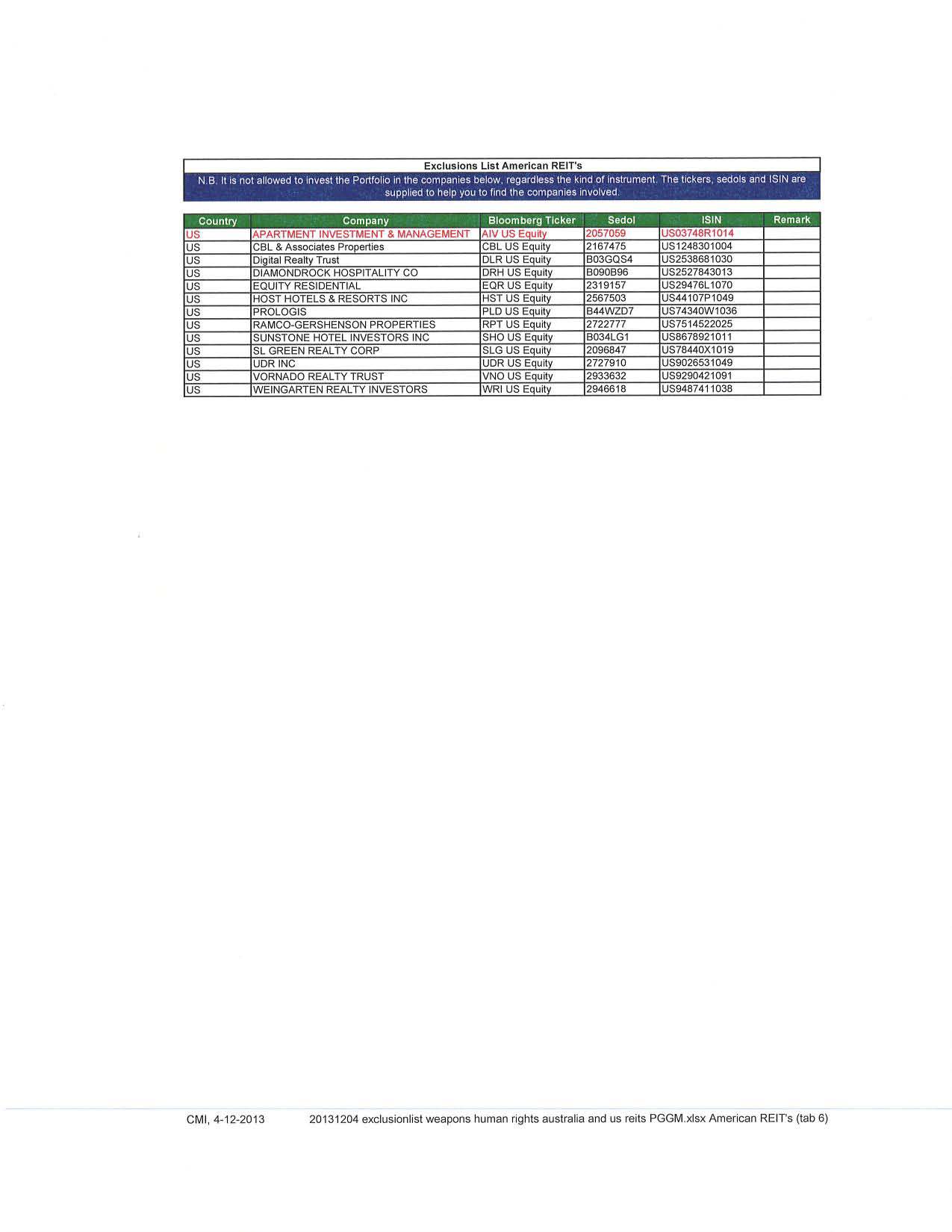

Exhibit EE | PGGM Exclusions Policy |

Exhibit FF | PGGM Responsible Investment Policy for Real Estate |

Exhibit GG | Intentionally Deleted |

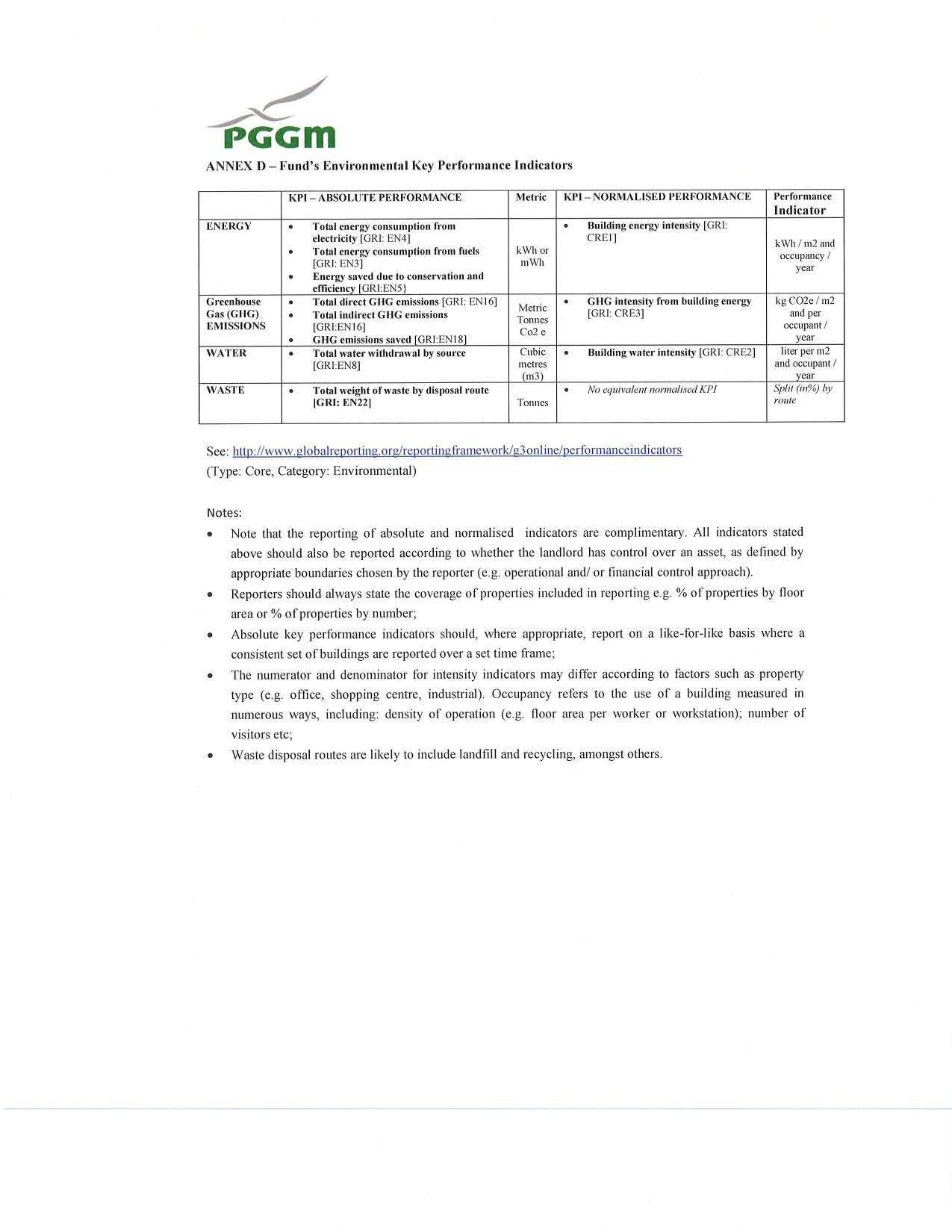

Exhibit HH | PGGM Reporting Guidelines |

v

FOURTH AMENDED AND RESTATED

AGREEMENT OF LIMITED PARTNERSHIP

OF

MONOGRAM RESIDENTIAL MASTER PARTNERSHIP I LP

(a Delaware limited partnership)

AGREEMENT OF LIMITED PARTNERSHIP

OF

MONOGRAM RESIDENTIAL MASTER PARTNERSHIP I LP

(a Delaware limited partnership)

THIS FOURTH AMENDED AND RESTATED AGREEMENT OF LIMITED PARTNERSHIP of MONOGRAM RESIDENTIAL MASTER PARTNERSHIP I LP, a Delaware limited partnership, dated as of December 20, 2013, is entered into by and among REIT MP GP, LLC, a Delaware limited liability company (“BHMF GP”), and an indirect wholly owned subsidiary of Behringer Harvard Multifamily REIT I, Inc., a Maryland corporation (“BHMF REIT”) with its principal office at 00000 Xxxxxx Xxxxxxx, Xxxxx 000, Xxxxxxx, Xxxxx 00000, as general partner, and Stichting Depositary PGGM Private Real Estate Fund (the “Depositary”), a Dutch foundation, acting in its capacity as depositary of and for the account and risk of PGGM Private Real Estate Fund (the “Fund” and together with the Depositary, “PGGM PRE Fund”), a Dutch fund for the joint account of the participants (fonds voor gemene rekening) with its principal office at Noordweg‑Noord 150, X.X. Xxx 000, 0000 XX Xxxxx, Xxx Xxxxxxxxxxx, as limited partner.

W I T N E S S E T H

WHEREAS, Stichting Pensioenfonds Zorg en Welzijn (formerly known as Stichting Pensioenfonds voor de Gezondheid, Geestelijke en Maatschappelijke Belangen, “PFZW”), a Dutch foundation, and Behringer Harvard Institutional GP LP, a Texas limited partnership (“BH Institutional”), entered into an arrangement for the purpose of jointly acquiring, owning and operating first‑class multifamily residential properties through separate Ventures and Subsidiary REITs;

WHEREAS, PFZW and BH Institutional formed the Partnership to be governed by the Act and to establish their respective rights and duties relating to the Partnership and its ownership of interests in the Ventures and, indirectly, the Subsidiary REITs on the terms provided in that certain Agreement of Limited Partnership of the Partnership, dated as of May 7, 2007 (the “Original Agreement”);

WHEREAS, BH Institutional and PFZW entered into an Amended and Restated Agreement of Limited Partnership, dated as of May 7, 2007, and a Second Amended and Restated Agreement of Limited Partnership, dated as of November 7, 2007 (the “Second Amended Agreement”);

WHEREAS, effective as of July 31, 2009, (i) PFZW transferred its Interest to PGGM PRE Fund and withdrew from the Partnership, subject to the terms and conditions of that certain Assignment of Limited Partnership Interest, dated as of July 31, 2009 (the “PGGM PRE Fund Assignment”), and (ii) PGGM PRE Fund was admitted to the Partnership as the Limited Partner, and pursuant to the terms and conditions of the PGGM PRE Fund Assignment, the General Partner agreed to admit PGGM PRE Fund as the Limited Partner;

1

WHEREAS, concurrently with the effectiveness of the Assignment, PGGM PRE Fund and BH Institutional entered into a Third Amended and Restated Agreement of Limited Partnership, dated as of July 31, 2009 (as amended by that certain letter agreement, dated December 18, 2009, and Amendment No. 1 to the Third Amended and Restated Agreement of Limited Partnership, dated November 22, 2011, the “Third Amended Agreement”);

WHEREAS, effective as of July 31, 2013, (i) BH Institutional transferred its Interest to REIT TRS Holding, LLC and withdrew from the Partnership, subject to the terms and conditions of that certain Xxxx of Sale, dated as of July 31, 2013, (ii) REIT TRS Holding, LLC was admitted to the Partnership as the General Partner, and (iii) the Limited Partner agreed to admit REIT TRS Holding, LLC as the General Partner;

WHEREAS, effective as of August 6, 2013, (i) REIT TRS Holding, LLC transferred its Interest to BHMF GP and withdrew from the Partnership, subject to the terms and conditions of that certain Purchase and Assumption Agreement, dated as of August 6, 2013, (ii) BHMF GP was admitted to the Partnership as the General Partner, and (iii) the Limited Partner agreed to admit BHMF GP as the General Partner;

WHEREAS, pursuant to that certain Amendment to Certificate of Limited Partnership filed with the Secretary of State of the State of Delaware on December 16, 2013, the Certificate was amended to change the name of the Partnership from “Behringer Harvard Master Partnership I LP” to “Monogram Residential Master Partnership I LP”; and

WHEREAS, the Partners desire to amend and restate the Third Amended Agreement as hereinafter set forth;

NOW, THEREFORE, in consideration of the mutual promises and agreements herein made and intending to be legally bound hereby, the parties hereby agree as follows:

ARTICLE 1

DEFINITIONS

Capitalized terms used in this Agreement (including, without limitation, Exhibits, Schedules and amendments) have the meanings set forth below or in the Section of this Agreement referred to below, except as otherwise expressly indicated or limited by the context in which they appear in this Agreement. All terms defined in this Agreement in the singular have the same meanings when used in the plural and vice versa. Accounting terms used but not otherwise defined shall have the meanings given to them under U.S. GAAP. References to Sections, Articles and Exhibits and Schedules refer to the sections and articles of, and the exhibits and schedules to, this Agreement, unless the context requires otherwise.

“Act” means the Revised Uniform Limited Partnership Act of the State of Delaware, Del. Code Xxx. tit. 6, §§ 17‑101 et seq., as it may be amended from time to time, and any successor to such statute.

2

“Additional PGGM Exclusions” has the meaning ascribed thereto in Section 15.21.

“Additional Projects” means any Project (other than an Initial Project or an Existing Project), acquired, or to be acquired, as the context may require, by a Venture in accordance with the terms and provisions of this Agreement on or after the date hereof.

“Administrator” means an independent public accounting firm that has not been engaged by either of the Partners or their respective Affiliates within the three‑year period prior to its engagement by the Partnership with substantial experience in providing audit or due diligence services with respect to U.S. based real estate related ventures and real property investments.

“Advisory Committee” has the meaning ascribed thereto in Section 8.1.

“Affiliate” means, with respect to a specified Person, (i) any Person that, directly or indirectly through one or more intermediaries, controls, is controlled by or is under common control with the specified Person or (ii) any Person that is an officer, general partner or trustee of, or serves in a similar capacity with respect to, the specified Person or of which the specified Person serves in a similar capacity and with respect to the PGGM PRE Fund solely for purposes of Article 10, “Affiliate” shall also mean (i) any participant in the PGGM PRE Fund as of the date hereof (which participants are identified in the Participant Letter), (ii) any company, partnership, fund or entity sponsored, managed or advised by PGGM Vermogensbeheer B.V. that is a European “qualified investor” (as that term is defined in the Dutch Financial Market Supervision Act (Wet op het Financieel Toezicht) or any other similarly applicable legislation), (iii) any fund or entity sponsored, managed or advised by PGGM Vermogensbeheer B.V. in which all investors are European “qualified investors” (as that term is defined in the Dutch Financial Market Supervision Act (Wet op het Financieel Toezicht) or any other similarly applicable legislation) and (iv) any company, partnership, fund or entity sponsored, managed or advised by PGGM Vermogensbeheer B.V. and in which Stichting Pensioenfonds Zorg en Welzijn (as PGGM Vermogensbeheer B.V.’s key client) holds an interest exceeding 50%. For this purpose, the term “control” (including, without limitation, the terms “controlling,” “controlled by” and “under common control with”) means the possession, direct or indirect, of the power to direct or cause the direction of the management and policies of a Person, whether through the ownership of voting securities, by contract or otherwise.

“Agreement” means this Fourth Amended and Restated Agreement of Limited Partnership, as amended, modified, supplemented or restated from time to time.

“Alternate” has the meaning ascribed thereto in Section 8.1.

“Applicable Law” means the law in effect from time to time and applicable to a Default Loan that permits the charging and collection of the highest permissible lawful nonusurious rate of interest on a Default Loan, including laws of the United States of America and, to the extent applicable to a given Default Loan, laws of the State of Texas. It is intended that Chapter 303 of the Texas Finance Code, as amended, shall be included in the laws of the State of Texas in determining Applicable Law; and for the purpose of applying said Chapter 303 to a Default Loan, the interest ceiling applicable to such Default Loan under said Chapter 303 shall be the rate determined under Section 303.001, et seq. of the Texas Finance Code.

3

“Applicable Portfolio Sale Projects NAV” has the meaning ascribed thereto in Section 14.1(d).

“Applicable Sale Project NAV” has the meaning ascribed thereto in Section 14.2(f).

“Appraisals” has the meaning ascribed thereto in Section 14.3(b).

“Approved Acquisition Costs” means the contractual purchase price for the Project, not including any third‑party costs such as title costs and third‑party broker costs.

“Approved Annual Budget” has the meaning ascribed thereto in Section 13.4(a).

“Approved Business Plan” has the meaning ascribed thereto in Section 13.4(b).

“Approved Development Costs” means any of the acquisition and developments costs identified on Exhibit CC attached hereto.

“Arbitration” has the meaning ascribed thereto in Section 8.7(b).

“Arbitrator” has the meaning ascribed thereto in Section 8.7(b).

“Asset Management Fee” has the meaning ascribed thereto in Section 5.3(a).

“Award” has the meaning ascribed thereto in Section 8.7(b).

“Bankruptcy” has the meaning ascribed thereto in Section 11.1(c).

“Bankruptcy Event” has the meaning ascribed thereto in Section 11.1(b).

“Beneficial Owner” means a Person who or which is or is treated as a direct or indirect owner of the applicable Subsidiary REIT for purposes of determining the status of the applicable Subsidiary REIT as a domestically‑controlled qualified investment entity under Section 897(h)(4)(B) of the Code.

“Beneficial Ownership” means the interest of a Beneficial Owner.

“Best Efforts” has the meaning ascribed thereto in Section 2.6(b)(iii).

“BH Institutional” has the meaning ascribed thereto in the recitals to this Agreement.

“BHMF GP” has the meaning ascribed thereto in the preamble of this Agreement.

“BHMF GP Buy Notice” has the meaning ascribed thereto in Section 14.3(a).

“BHMF GP Capital Commitment” means the sum of (a) $3,030,303.03, less (b) all BHMF GP Capital Contributions made with respect to New Projects, plus (c) any BHMF GP New Project Returned Amounts.

4

“BHMF GP New Project Returned Amounts” means the sum of any amounts (other than Incentive Distributions and Fees) (1) distributed to BHMF GP pursuant to this Agreement on account of a Capital Transaction with respect to a New Project, and (2) representing unused Capital Contributions returned to BHMF GP in accordance with Section 3.1 of this Agreement, which amounts shall (x) be available for reinvestment in a New Project, and (y) shall be subject to a Subsequent Capital Call.

“BHMF GP Proportionate Interest” means with respect to any direct or indirect percentage ownership interest in a Venture, a Subsidiary REIT or a Project, the difference (expressed as a percentage) between (x) 100% and (y) the PGGM Proportionate Interest in such Venture, Subsidiary REIT or Project.

“BHMF GP Representative” has the meaning ascribed thereto in Section 8.1.

“BHMF GP Trigger Date” has the meaning ascribed thereto in Section 14.3(a).

“BHMF REIT” has the meaning ascribed thereto in the preamble of this Agreement.

“BHMF REIT‑Sponsored Investment Program” means an Entity formed or advised by BHMF REIT or one of its Affiliates to invest in real estate and/or real estate related assets.

“BHMF REIT Venture” means an Entity formed or owned by BHMF REIT or one of its Affiliates and one or more third party investment and/or development partners for the purpose of investing in and/or developing real estate and/or real estate related assets.

“Business Day” means a day other than a Saturday, Sunday or other day on which commercial banks in New York City are authorized or required by applicable law to close.

“Buy / Sell” means the buy / sell rights set forth in Section 8.2 of each Existing Venture Agreement.

“Capital Account” has the meaning ascribed thereto in Section 3.7.

“Capital Call” has the meaning ascribed thereto in Section 3.3.

“Capital Commitment” means, with respect to PGGM PRE Fund, the PGGM Capital Commitment, and with respect to BHMF GP, the BHMF GP Capital Commitment.

“Capital Contribution” means a capital contribution made by a Partner to the Partnership in accordance with Article 3 hereof.

“Capital Transaction” means (i) any sale, exchange, transfer or other disposition of the assets of the Partnership or any entity in which the Partnership owns a direct or indirect interest, including a Venture, a Subsidiary REIT, or an entity in which the Partnership owns a direct or indirect interest and that that holds a direct or indirect interest in a Project, which is not in the ordinary course of the Partnership’s or such entity’s operating business (as applicable), (ii) any Financing or condemnation of a Project, and (iii) any casualty suffered by any Project.

5

“Carried Interest Event” means the occurrence of (i) a Cause Event, (ii) a Change of Control Event or (iii) a Special Situation.

“Cause Event” means the declaration by the Limited Partner that the occurrence of an event or circumstance described in one of the following clauses (i) through (v) constitutes a “Cause Event” as provided in Section 7.12: (i) a material breach of this Agreement by BHMF GP if such breach has had or is reasonably expected to have a material adverse effect on the Partnership, (ii) BHMF GP taking any action which is a Major Decision under any Venture Agreement, requires the Consent of the members of the Advisory Committee pursuant to Section 8.2(b) of this Agreement or requires the consent of the Limited Partner pursuant to this Agreement, in each case if such action has had or is reasonably expected to have a material adverse effect on the Partnership and such action was taken without the prior consent of all or a specific subset of the members of the Advisory Committee or the Limited Partner, (iii) any breach of applicable law or gross negligence by BHMF GP, BHMF REIT, any director of BHMF GP or BHMF REIT, Key Man or any Corporate Level Personnel if such breach of applicable law or gross negligence, has had or is reasonably expected to have a material adverse effect on the Partnership, (iv) any fraud or willful misconduct by BHMF GP, BHMF REIT, any director of BHMF GP or BHMF REIT, Key Man or any Corporate Level Personnel if such fraud or willful misconduct, has had or is reasonably expected to have a material adverse effect on the Partnership, or (v) BHMF GP or BHMF REIT filing either a Chapter 7 or a Chapter 11 bankruptcy proceeding or admitting in writing in any similar proceeding its inability to pay its debts as they mature, but in each of the foregoing clauses (i) through (iv) only if such material breach, action or conduct is not cured (to the extent such material breach, action or conduct is capable of cure) by BHMF GP or BHMF REIT (as applicable) within sixty (60) days following the date on which BHMF GP first obtained knowledge of the occurrence of such material breach, action or conduct (which sixty (60) day period can be extended by sixty (60) days for a total of one hundred twenty (120) days following the date on which BHMF GP first obtained knowledge of the occurrence of such material breach, action or conduct if BHMF GP or BHMF REIT (as applicable) commences to cure such material breach, action or conduct within such initial sixty (60) day period, such material breach, action or conduct remains capable of cure and thereafter BHMF GP or BHMF REIT (as applicable) diligently pursues the cure of such material breach, action or conduct); provided, however, BHMF GP and BHMF REIT shall not have a cure right with respect to the conduct described in the foregoing clause (iv) if such conduct was committed by a Key Man.

“Cause Event Damages” shall mean all losses, costs, expenses and damages actually incurred by the Partnership and/or the Limited Partner on account of a Damages Cause Event.

“Certificate” means the Certificate of Limited Partnership of the Partnership, as originally filed with the office of the Secretary of State of the State of Delaware, as such Certificate may be amended, restated, supplemented or otherwise modified from time to time.

“Chancery Rules” has the meaning ascribed thereto in Section 8.7(b).

“Change of Control” means either (x) a transfer of 50% or more of the economic or voting rights in the capital of BHMF GP or BHMF REIT to any Person or group of Persons (including Persons acting in concert), or (y) the failure of the board of directors of BHMF REIT to be comprised of a majority of Independent Directors, provided that with respect to the foregoing clause (y), if the

6

board of directors of BHMF REIT is not comprised of a majority of Independent Directors solely as a result of the Incapacity, removal or resignation of one or more Independent Directors, a “Change of Control” will only occur if the board of directors of BHMF REIT is not comprised of a majority of Independent Directors on or before the date that is sixty (60) days following the date on which the board of directors of BHMF REIT was not comprised of a majority of Independent Directors as a result of such Incapacity or resignation.

“Change of Control Event” means the declaration by the Limited Partner that the occurrence of a Change of Control constitutes a “Change of Control Event” as provided in Section 7.11.

“Charter” means the Articles of Incorporation of BHMF REIT, as in effect as of the date hereof, as the same may be amended, modified or supplemented from time to time.

“Code” means the Internal Revenue Code of 1986, as amended from time to time (or any corresponding provisions of succeeding law); any reference to any section of the Code shall include any corresponding provision of succeeding laws. Notwithstanding the foregoing, any change in the Code which materially increases the requirements for qualification of any of the Subsidiary REITs as a domestically‑controlled qualified investment entity for purposes of Section 897(h)(4)(B) of the Code, or otherwise causes any of the Subsidiary REITs not to be a domestically‑controlled qualified investment entity for purposes of Section 897(h)(4)(B) of the Code, shall not be included in the definition of “Code” hereunder, it being understood that the Limited Partner will bear the risk of such change; provided, that the General Partner will use commercially reasonable efforts to minimize the financial impact to the Limited Partner of any such change (at the Limited Partner’s expense); but provided further that the same does not adversely affect the General Partner’s tax status. The preceding sentence does not apply to Section 3.3.(b) hereof on the Limited Partner’s right to terminate the Commitment Period or Section 7.10 hereof on withholding.

“Commitment Period” means the period from the date of the Original Agreement through the earlier of (i) the Expiration Date, and (ii) any termination of the Commitment Period in accordance with Section 3.3(e).

“Consent” means the vote, approval or consent, as the case may be, of a Person to do the act or thing for which the vote, approval or consent is solicited, or the act of voting or granting such approval or consent, as the context may require.

“Contribution Agreement” means that certain Contribution Agreement dated as of the date hereof by and among BHMF REIT, the Partnership, Behringer Harvard Multifamily OP I, LP, a Delaware limited partnership and the Contributing Parties (as defined in the Contribution Agreement), providing for the contribution of each of the Initial Projects to a New Venture and subsequent contribution of each of the Initial Projects to the applicable Subsidiary REIT.

“Control Statement” means a certificate substantially in the form of Exhibit F hereto.

“Conversion Right” means the “Conversion Right” under and as defined in each New Venture Agreement.

7

“Corporate Level Personnel” shall mean any person holding the position of “Regional Manager”, “Regional Vice President”, “Vice President”, “Senior Vice President” or “Executive Officer”, within BHMF GP’s or BHMF REIT’s organization.

“Court” has the meaning ascribed thereto in Section 8.7(b).

“Damages Cause Event” shall mean any of the uncured “Cause Events” described in clauses (i) and (ii) of the definition of “Cause Event”.

“Dead Deal Costs” means any fees, expenses or other costs (including, without limitation, legal, accounting, travel, due diligence, third‑party appraisals and valuations and other fees and out‑of‑pocket expenses) incurred directly or indirectly by or on behalf of the Partnership or any New Venture in connection with the potential acquisition of an interest in any Additional Project that is not for any reason consummated.

“Default” has the meaning ascribed thereto in Section 3.5(a).

“Default Loan” has the meaning ascribed thereto in Section 3.5(b).

“Defaulting Partner” has the meaning ascribed thereto in Section 3.5(a).

“Depositary” has the meaning ascribed thereto in the preamble of this Agreement.

“Disposition” means a disposition of all or substantially all of BHMF REIT’s multifamily properties.

“Disposition Fee” has the meaning ascribed thereto in Section 5.3(b).

“Dispute” means any and all disputes, disagreements or claims arising from, relating to or in connection with this Agreement, including those between the Partners or the members of the Advisory Committee, as applicable, in respect of any event, circumstance, condition or matter that requires the approval of (a) the Partners, (b) the members of the Advisory Committee, or (c) the Limited Partner or PGGM PRE, in each case pursuant to the terms and provisions of this Agreement; provided, however, that a Dispute shall not include any matter described in this Agreement for which a resolution mechanism is specified herein. For example, pursuant to Section 7.3(b), the failure of the Advisory Committee to grant its Consent to a Subsequent Operating Plan for a Project prior to the beginning of the fiscal year for which such Subsequent Operating Plan is intended to be used shall not be a Dispute inasmuch as Section 7.3(b) provides that the operations of such Project shall be conducted in all material respects in accordance with the Operating Plan for the immediately preceding fiscal year until a Subsequent Operating Plan is approved.

“Dispute Notice” has the meaning ascribed thereto in Section 8.7(a).

“Divestment Proposal” means a comprehensive proposal in respect of the disposition of a Project prepared by the General Partner and in the form of Exhibit L attached hereto.

8

[***] Confidential material redacted and filed separately with the Securities and Exchange Commission.

“Domestic Status Loss” means a change in the Tax Sensitive Beneficial Owner Group, if the effect thereof would be a disqualification of the applicable REIT as a “domestically‑controlled qualified investment entity” within the meaning of Section 897(h)(4)(B) of the Code.

“Domestically‑Controlled REIT” means a REIT that is a “domestically‑controlled qualified investment entity” for purposes of Section 897(h)(4)(B) of the Code.

“Entity” means a partnership, corporation, business trust, limited liability company, proprietorship, joint stock company, trust, estate, unincorporated association, joint venture, pension fund, governmental entity, cooperative association or other foreign or domestic entity or enterprise.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

“Exclusivity Right” has the meaning ascribed thereto in Section 7.5.

“Existing Project Capital Contributions” means, with respect to a Partner, the Capital Contributions funded from time to time by such Partner that have been invested in and/or allocated to Existing Projects in accordance with Section 4.3(b) of this Agreement.

“Existing Project IRR” means ***.

“Existing Project Incentive Distributions” has the meaning ascribed thereto in Section 5.1(a)(ii).

“Existing Project Incentive Distribution Percent” means ***.

“Existing Project Remaining Percent” means ***.

“Existing Project Value Determination Date” has the meaning ascribed thereto in Section 5.1(d)(i).

“Existing Projects” means the Projects described on Exhibit H attached hereto, which Projects are owned by one or more Ventures as of the date hereof.

“Existing Subsidiary REIT” means, with respect to a particular Existing Venture, a subsidiary that has been formed by such Existing Venture for the purpose of investing in an Existing Project and that has qualified as a REIT. The General Partner shall use all reasonable efforts to obtain any necessary consents to the adoption of an amendment to the limited liability company agreement for each Existing Subsidiary REIT in substantially the form attached hereto as Exhibit BB, and upon obtaining all such necessary consents, to adopt such amendments, within 90 (ninety) days after the date hereof.

9

“Existing Venture” means a partnership or limited liability company governed by an operating agreement in substantially the form of the Existing Venture Agreement that has been formed for the purpose of organizing, owning and operating an Existing Subsidiary REIT and whose partners or members are (i) this Partnership and (ii) BHMF REIT and/or one or more Affiliates of BHMF REIT or BHMF REIT Sponsored Investment Programs. The Existing Ventures are listed on Exhibit M.

“Existing Venture Agreement” means the existing partnership or limited liability company agreement of each Existing Venture, as amended pursuant to an amendment of such existing partnership or limited liability company agreement in substantially the form attached hereto Exhibit N; the General Partner shall use all reasonable efforts to obtain any necessary consents to the adoption of such amendment, and upon obtaining all such necessary consents, to adopt such amendments, within 90 (ninety) days after the date hereof.

“Expiration Date” means December 31, 2023, as the same may be extended pursuant to Section 2.4 hereof, or accelerated pursuant to Article 11 hereof.

“Fair Value Method of Accounting” means investment company accounting as defined by U.S. GAAP.

“Fees” means any or all of the Asset Management Fee and Disposition Fee, as the context may require.

“Finance Proposal” means a comprehensive proposal in respect of a Financing of a Project prepared by the General Partner and in the form of Exhibit W attached hereto.

“Financing” means any financing or refinancing of a Project, whether by a loan or the issuance of preferred equity, securities or otherwise.

“FIRPTA” means the Foreign Investment in Real Property Tax Act of 1980, as amended.

“FIRPTA Event” means the occurrence of any event or circumstance applicable to the Limited Partner (as determined by the Limited Partner in its sole and absolute discretion) that allows the Limited Partner to achieve its tax planning objectives without the need to own its direct or indirect interest in a Project through a Domestically‑Controlled REIT, whether pursuant to a repeal, rescission or change in FIRPTA or otherwise; provided, that a FIRPTA Event shall not occur prior to the date on which the Limited Partner provides the General Partner with written notice of the Limited Partner’s determination that a FIRPTA Event has occurred; provided, further that the Limited Partner shall provide the General Partner with written notice of the Limited Partner’s determination of whether a FIRPTA Event has occurred no later than six (6) months after the General Partner furnishes the Limited Partner with a written request that the Limited Partner consider whether the occurrence of any event or circumstance described in this definition has given rise to a FIRPTA Event.

10

“FIRPTA Buy / Sell” has the meaning ascribed thereto in Section 14.4.

“FIRPTA Event Buy / Sell Election Date” has the meaning ascribed thereto in Section 14.4.

“FIRPTA Event Buy / Sell Election Notice” has the meaning ascribed thereto in Section 14.4.

“FIRPTA Event Buy / Sell Procedures” means the buy / sell procedures set forth in Exhibit G to each New Venture Agreement.

“FIRPTA Event Trigger Date” means the date on which a FIRPTA Event occurs.

“Form 8‑K” has the meaning ascribed thereto in Section 12.2(g).

“Fund” has the meaning ascribed thereto in the preamble of this Agreement.

“General Partner” means BHMF GP, or any permitted successor or assign of BHMF GP in accordance with this Agreement, in such Person’s capacity as a “general partner” of the Partnership within the meaning of the Act.

“Gross Asset Value” has the meaning ascribed thereto in the Investment Guidelines.

“Incapacitated” means, with respect to any Person, that such Person has experienced Incapacity.

“Incapacity” means, with respect to any Person, (i) the adjudication of incompetence or insanity, or (ii) the death, dissolution or termination, as the case may be, of such Person.

“Incentive Distributions” means collectively the Existing Project Incentive Distributions and the New Project Incentive Distributions.

“Indemnified Person” and “Indemnified Persons” have the meanings ascribed thereto in Section 9.2(a).

“Independent Directors” has the meaning set forth in the corporate governance rules of the New York Stock Exchange (or such other national securities exchange on which the shares of common stock of BHMF REIT may be listed), as such definition may be amended from time to time.

“Individual Venture Offer” has the meaning ascribed thereto in Section 14.1(a).

“Initial Operating Plan” has the meaning ascribed thereto in Section 7.3(a).

“Initial Projects” means the Projects described on Exhibit G attached hereto, which are acquired, or are to be acquired, as the context may require, by a New Venture in accordance with the terms and provisions of this Agreement on or after the date hereof. Set forth opposite each Initial Project on Exhibit G attached hereto are (x) the Limited Partner’s required PGGM Proportionate Interest in such Project, and (y) the approved purchase price for such Initial Project

11

(together with all approved closing costs and BHMF GP legal fees and out‑of‑pocket expenses related thereto).

“Interest” means, as to each Partner, the entire ownership interest of such Partner in the Partnership at any particular time, including the right of such Partner to any and all benefits to which such Partner may be entitled as provided in this Agreement, together with the obligations of such Partner to comply with all the terms and provisions of this Agreement.

“Investment Guidelines” means, unless otherwise agreed by the Partners, the investment guidelines for a Project described in Exhibit B.

“Investment Period” means the period from the date hereof until the earlier to occur of (x) the date on which $303,030,303.03 of Capital Commitments has been invested in New Projects, and (y) the date which is three (3) years from the date hereof.

“Investment Period Key Man Event” means a Key Man Event that occurs during the Investment Period.

“Investment Proposal” means a comprehensive proposal in respect of an Additional Project prepared by the General Partner and in the form of Exhibit O attached hereto.

“Investment Quick Scan Proposal” means a proposal in respect of an Additional Project prepared by the General Partner and in the form of Exhibit P attached hereto.

“IRR” means the “internal rate of return” calculated by applying the following formula, which is used in the XIRR Excel function:

“IRR” means the “internal rate of return” calculated by applying the following formula, which is used in the XIRR Excel function:where:

di = the ith, or last, payment date

d1 = the 0th payment date.

Pi = the ith, or last, payment.

d1 = the 0th payment date.

Pi = the ith, or last, payment.

12

The following is an example of the calculation of an IRR.

A | B | |

1 | Values | Dates |

2 | ‑10,000 | January 1, 2008 |

3 | 2,750 | March 1, 2008 |

4 | 4,250 | October 30, 2008 |

5 | 3,250 | February 15, 2009 |

6 | 2,750 | April 1, 2009 |

Formula | Description (Result) | |

=XIRR(A2:A6,B2:B6, 0.1) | The internal rate of return (0.373362535 or 37.34%) | |

“Key Man” means Xxxx X. Xxxxxxx.

“Key Man Event” means (i) the Key Man is no longer employed by BHMF REIT, any of its Affiliates or any successor or assign of any of them, (ii) the Key Man becomes Incapacitated, or (iii) the Key Man does not devote 100% of his business time to the business and activities of BHMF GP and BHMF REIT, including work for BHMF GP, BHMF REIT and the Partnership, provided that the foregoing shall not prevent the Key Man from (A) serving on the boards of directors of non‑profit organizations and other for profit companies, (B) participating in charitable, civic, educational, professional, community or industry affairs, or (C) managing the Key Man’s passive personal investments so long as such activities in the aggregate do not interfere or conflict with the Key Man’s duties hereunder or create a potential business or fiduciary conflict.

“Leverage Parameters” means, unless otherwise agreed by the Partners, the leverage parameters described in Exhibit Q.

“Limited Partner” means PGGM PRE Fund or any permitted successor or assign of PGGM PRE Fund or, in the event of the removal of the General Partner pursuant to Section 7.8, the Removed General Partner, in such Person’s capacity as a “limited partner” of the Partnership within the meaning of the Act.

“Liquidation” means (i) when used with reference to the Partnership, the date upon which the Partnership ceases to be a going concern, and (ii) when used with reference to any Partner, the earlier of (a) the date upon which there is a Liquidation of the Partnership or (b) the date upon which such Partner’s entire Interest in the Partnership is terminated other than by Transfer to a Person other than the Partnership.

“Liquidator” has the meaning ascribed thereto in Section 11.3(a).

“Listing” means the listing of the common shares of BHMF REIT on a national securities exchange.

“Major Decision” has the meaning ascribed thereto in Section 8.2(b)(xiii).

13

“Major Dispute” has the meaning ascribed thereto in each Venture Agreement.

“Major Dispute Event” means the occurrence of a Major Dispute.

“Major Dispute Project Sale Right” means the right of the Partnership under a New Venture Agreement to cause the sale of the New Project owned by such New Venture in accordance with the terms and provisions of such New Venture Agreement.

“Management Fee” has the meaning ascribed thereto in Section 7.4(b).

“Manager” has the meaning ascribed thereto in the applicable Venture Agreement.

“Matching Right” has the meaning ascribed thereto in Section 14.2(g).

“Material Change” means (a) with respect to any Investment Proposal, an aggregate two percent (2%) net increase or decrease in the total investment amount in the Additional Project to which such Investment Proposal relates, (b) with respect to any Divestment Proposal, an aggregate two percent (2%) net increase or decrease in the sales price of the Project to which such Divestment Proposal relates, or (c) with respect to any Finance Proposal, (i) an aggregate two percent (2%) net increase or decrease in the principal balance of the Financing to which such Finance Proposal relates or (ii) an increase in the interest rate applicable to such Financing of more than twenty (20) basis points.

“Maximum Rate” means the maximum lawful nonusurious rate of interest (if any) that under Applicable Law the Non‑defaulting Member is permitted to charge the Defaulting Member on a Default Loan from time to time.

“Merger” means the merger or consolidation of BHMF REIT into or with another Person.

“MSAs” has the meaning ascribed thereto in the Investment Guidelines.

“Net Cash Flow” as of the end of any period, means the cash of the Partnership as of the end of such period, less (without any duplication):

(1)any New Project Capital Contributions and/or Existing Project Capital Contributions (A) then held by the Partnership, (B) not then invested in or allocated to New Projects or Existing Projects (as applicable) and (C) anticipated (in the sole discretion of the General Partner) to be invested in Projects; and

(2) operating reserves for amounts anticipated to be paid during the thirty (30) day period following the end of such period (as determined by the General Partner in its sole discretion), which amounts include, without limitation, Fees, Organizational Expenses, budgeted capital expenditures and Operating Expenses; and

(3) non‑operating reserves (as determined by the General Partner in its sole discretion), which include, without limitation, capital expenditures, projected financing costs, non‑budgeted

14

[***] Confidential material redacted and filed separately with the Securities and Exchange Commission.

expenditures and escrows, but in no event in excess of (A) two percent (2.0%), multiplied by (B) the net asset value of the Partnership’s assets.

“Net Invested Capital” means, with respect to any calendar month, (x) the average aggregate outstanding amount of Capital Contributions during such month contributed by the Partnership to all Ventures for investment in Projects (excluding, for avoidance of doubt, the amount of any fees, Operating Expenses and Organizational Expenses allocated to Projects in accordance with the terms of this Agreement) less (y) with respect to each Project that has been the subject of a Capital Transaction, the amount of proceeds of such Capital Transaction that have been distributed to the Partners hereunder, but not in excess of the total amount of Capital Contributions (excluding the amount of fees, Operating Expenses and Organizational Expenses allocated to such Project) that were contributed to the Project by the Partnership; provided however, once a Project has been sold by the applicable Venture, the Capital Contributions contributed by the Partnership to such Venture shall be deemed $0 until such time as the proceeds of such sale (up to the amount of such Capital Contributions) have been re‑contributed to a Venture in accordance with the terms and provisions hereof.

“New Project Capital Contributions” means, with respect to a Partner, the Capital Contributions funded from time to time by such Partner that have been invested in and/or allocated to New Projects in accordance with Section 4.3(b) of this Agreement.

“New Project Incentive Distributions” has the meaning ascribed thereto in Section 5.1(b)(iv).

“New Project IRR” means either (as then applicable) (i) the New Project Tier 1 IRR, (ii) the New Project Tier 2 IRR or (iii) the New Project Tier 3 IRR.

“New Project Tier 1 Carried Interest Event IRR” means ***.

“New Project Tier 2 Carried Interest Event IRR” means ***.

“New Project Tier 3 Carried Interest Event IRR” means ***.

“New Project Tier 1 Incentive Distributions” has the meaning ascribed thereto in Section 5.1(b)(ii).

“New Project Tier 2 Incentive Distributions” has the meaning ascribed thereto in Section 5.1(b)(iii).

“New Project Tier 3 Incentive Distributions” has the meaning ascribed thereto in Section 5.1(b)(iv).

“New Project Tier 1 Incentive Distribution Percent” means ***.

“New Project Tier 2 Incentive Distribution Percent” means ***.

“New Project Tier 3 Incentive Distribution Percent” means ***.

15

[***] Confidential material redacted and filed separately with the Securities and Exchange Commission.

“New Project Tier 1 IRR” means ***.

“New Project Tier 2 IRR” means ***.

“New Project Tier 3 IRR” means ***.

“New Project Tier 1 Remaining Percent” means the difference (expressed as a percentage) between (x) 100% and (y) the New Project Tier 1 Incentive Distribution Percent.

“New Project Tier 2 Remaining Percent” means the difference (expressed as a percentage) between (x) 100% and (y) the New Project Tier 2 Incentive Distribution Percent.

“New Project Tier 3 Remaining Percent” means the difference (expressed as a percentage) between (x) 100% and (y) the New Project Tier 3 Incentive Distribution Percent.

“New Project Value Determination Date” has the meaning ascribed thereto in Section 5.1(d)(ii).

“New Projects” means the Initial Projects and the Additional Projects that are acquired by a New Venture in accordance with the terms and provisions of this Agreement on or after the date hereof.

“New Subsidiary REIT” means, with respect to a particular New Venture, a subsidiary that may be formed in the future by such New Venture for the purpose of investing in a New Project and that intends to qualify as a REIT. The form of limited liability company agreement for a New Subsidiary REIT is attached hereto as Exhibit D.

“New Venture” means a partnership or limited liability company governed by an operating agreement in substantially the form of the New Venture Agreement that will be formed for the purpose of organizing, owning and operating a New Subsidiary REIT and whose sole partners or members will be (i) this Partnership and (ii) BHMF REIT and/or one or more Affiliates of BHMF REIT, including a BHMF REIT Sponsored Investment Program or a BHMF REIT Venture.

“New Venture Agreement” means a partnership or limited liability company agreement for a New Venture in the form attached hereto as Exhibit E.

“Non‑Damages Cause Event” means any uncured Cause Event that is not a Damages Cause Event.

“Non‑Defaulting Partner” has the meaning ascribed thereto in Section 3.5(a).

“Non‑Reimbursable Expenses” means fees, costs, and expenses incurred by BHMF GP, its Affiliates, or their respective employees or agents in evaluating, negotiating, or structuring any Initial Project or any Additional Project (including, without limitation, market research costs, travel costs, acquisition personnel costs and overhead, senior management personnel costs and overhead, due diligence personnel costs and overhead, and data communication costs); provided that

16

Non‑Reimbursable Expenses shall not include any such fees, costs and expenses that have been approved by the Advisory Committee as part of an Investment Proposal.

“Notice of Commitment” means a notice substantially in the form of Exhibit C.

“Notice of PGGM Proportionate Interest” means a notice substantially in the form of Exhibit R.

“Offset Dispute Notice” has the meaning ascribed thereto in Section 7.8(c).

“Offset Distributions” has the meaning ascribed thereto in Section 7.8(c).

“Offset Notice” has the meaning ascribed thereto in Section 7.8(c).

“Offset Withholding Notice” has the meaning ascribed thereto in Section 7.8(c).

“Operating Expenses” has the meaning ascribed thereto in Section 5.6(b).

“Organizational Expenses” has the meaning ascribed thereto in Section 5.6(a).

“Oversight Fee” has the meaning ascribed thereto in Section 7.4(b).

“Original Agreement” has the meaning ascribed thereto in the recitals to this Agreement.

“Outside Date” has the meaning ascribed thereto in Section 7.6(a).

“Participant Letter” means that certain letter delivered by PGGM PRE Fund to BHMF GP, dated as of the date hereof and which identifies each participant in the PGGM PRE Fund as of the date hereof.

“Partners” means the Limited Partner and the General Partner.

“Partner” shall mean any one of the Partners.

“Partnership” means the limited partnership formed by the Certificate and governed hereby.

“Partnership Agreement Approved Legal Expenses” means the fees and expenses of legal counsel actually incurred by each of the Partners from and after July 2, 2013 for purposes of preparing, drafting, negotiating, finalizing and executing this Agreement.

“Partnership Proportionate Interest” means the Partnership’s proportionate ownership interest as determined by its direct or indirect percentage ownership interest in a Venture, a Subsidiary REIT or a Project, as applicable. By way of example, and not in limitation of the foregoing, if the Partnership’s ownership interest in a Venture is 45%, such Venture’s ownership interest in its Subsidiary REIT is 99.9% and such Subsidiary REIT’s ownership interest in its subsidiary joint venture that owns 100% of a Project is 80%, then the Partnership Proportionate Interest in such Project is 35.96% (i.e., 0.45 multiplied by 0.999 multiplied by 0.8 multiplied by 1.0 = .35964 = 35.964%). Notwithstanding anything to the contrary herein, for purposes of determining the amount

17

of the Disposition Fee payable pursuant to Section 5.3(b), the calculation of the Partnership Proportionate Interest shall not be reduced by any interest in a Project received by a developer or other third party as compensation for its services related to such Project or for which such Person has not otherwise invested a proportionate amount of cash, and such method of calculation shall be applicable commencing with the Original Agreement. By way of example, and not in limitation of the preceding sentence, in the example set forth in the second sentence of this definition, if a developer of such Project had received for its services a promoted interest of 50% in the subsidiary joint venture that owns 100% of the Project, the Partnership Proportionate Interest would be 35.96%, calculated in the same manner as in such example, since the developer’s promoted interest in the subsidiary joint venture would be excluded from the calculation of the Partnership Proportionate Interest. For the avoidance of doubt, the Partnership Proportionate Interest of any item that is to be credited or charged entirely to the Partnership shall be 100%.

“Payor” has the meaning ascribed thereto in Section 7.10.

“Percentage Interest” means, as to each Partner, its percentage ownership interest in the Partnership based on the proportion of the Capital Commitment of such Partner to the aggregate Capital Commitments of all Partners, as the same may be amended from time to time; provided that, in the event of the removal of the General Partner pursuant to Section 7.8, the respective Percentage Interest of each Partner in respect of a Pre‑Removal Project shall mean the percentage ownership interest of such Partner in such Pre‑Removal Project based on the proportion of such Partner’s aggregate Capital Contributions in respect of such Pre‑Removal Project to the aggregate Capital Contributions of all Partners in respect of such Pre‑Removal Project immediately prior to such removal.

“Permitted Temporary Investments” means investments in (i) U.S. government and agency obligations with maturities of not more than one year and one day from the date of acquisition, (ii) commercial paper with maturities of not more than six months and one day from the date of acquisition and having a rating assigned to such commercial paper by Standard & Poor’s Ratings Services or Xxxxx’x Investors Service, Inc. (or, if neither such organization shall rate such commercial paper at such time, by any nationally recognized rating organization in the United States of America) equal to one of the two highest commercial paper ratings assigned by such organization, it being understood that as of the date hereof such ratings by Standard and Poor’s Rating Services are “P1” and “P2” and such ratings by Xxxxx’x Investors Service, Inc. are “Al” and “A2,” (iii) interest bearing deposits in U.S. banks with an unrestricted surplus of at least $250 million, maturing within one year and (iv) money market mutual funds with assets of not less than $500 million, substantially all of which assets are believed by the General Partner to consist of items described in the foregoing clause (i), (ii), or (iii).

“Person” means an individual or Entity.

“PFZW” has the meaning ascribed thereto in the recitals to this Agreement.

“PGGM Capital Commitment” means the sum of (a) $300,000,000.00, less (b) all PGGM PRE Fund Capital Contributions made with respect to New Projects, plus (c) any PGGM New Project Returned Amounts.

18

[***] Confidential material redacted and filed separately with the Securities and Exchange Commission.

“PGGM Exclusions List” has the meaning ascribed thereto in Section 15.21.

“PGGM Exclusions Policy” has the meaning ascribed thereto in Section 15.21.

“PGGM New Project Returned Amounts” means the sum of any amounts (1) distributed to PGGM PRE Fund pursuant to this Agreement on account of a Capital Transaction with respect to a New Project, and (2) representing unused Capital Contributions returned to PGGM PRE Fund in accordance with Section 3.2 of this Agreement, which amounts shall (x) be available for reinvestment in a New Project, and (y) shall be subject to a Subsequent Capital Call.

“PGGM PRE Fund” has the meaning ascribed thereto in the preamble of this Agreement.

“PGGM PRE Fund Assignment” has the meaning ascribed thereto in the recitals to this Agreement.

“PGGM Proportionate Interest” means the Limited Partner’s proportionate ownership interest as determined by its direct or indirect percentage ownership interest in a Venture, a Subsidiary REIT or a Project, as applicable.

“PGGM Representatives” shall have the meaning ascribed thereto in Section 8.1.

“Plan Asset Regulation” means the final regulation promulgated by the U.S. Department of Labor at 29 C.F.R. Section 2510‑101.

“Plan Assets” means any assets deemed to constitute “plan assets” subject to ERISA, Section 4975 of the Code or any substantially similar applicable U.S. federal, state or local law.

“Portfolio Offer” has the meaning ascribed thereto in Section 14.1(a).

“Post‑Investment Period Key Man Event” means a Key Man Event that occurs following the expiration of the Investment Period.

“Pre‑Removal Project” has the meaning ascribed thereto in Section 7.8(b)(iii).

“Premium” means ***. The Premium shall accrue with respect to each Initial Project as BHMF GP or its Affiliates incurs the costs described in clause (x) of the definition of Premium Base in respect of such Initial Project through the date of payment of the Premium applicable to such Initial Project pursuant to Section 7.6.

“Premium Base” means with respect to each Initial Project, the positive difference between (x) the costs then actually incurred by BHMF GP or its Affiliates for the acquisition, development and maintenance of such Initial Project, less (y) all net cash flow of such Initial Project actually distributed to BHMF GP or its Affiliates.

“Prior Operating Plan” has the meaning ascribed thereto in Section 7.3(b).

19

“Profits” or “Losses” means, for each period taken into account under Article 4, an amount equal to the Partnership’s taxable income or taxable loss for such period, determined in accordance with federal income tax principles, adjusted to the extent the General Partner determines that such adjustment is necessary to comply with the requirements of Section 704(b) of the Code.

“Prohibited Partner” means any Person who is (i) a “designated national,” “specially designated national,” “specially designated terrorist,” “specially designated global terrorist,” “foreign terrorist organization,” or “blocked person” within the definitions set forth in the regulations of the U.S. Treasury Department’s Office of Foreign Assets Control; (ii) acting on behalf of, or a Person owned or controlled by, any government against whom the United States maintains economic sanctions or embargoes under the regulations of the United States Treasury Department, including, but not limited to, the “Government of Sudan,” the “Government of Iran” and the “Government of Cuba”; (iii) within the scope of Executive Order 13224 — Blocking Property and Prohibiting Transactions with Persons who Commit, Threaten to Commit, or Support Terrorism, effective September 24, 2001; (iv) subject to additional restrictions imposed by the following statues (or regulations and executive orders issued thereunder): the Trading with the Enemy Act, the Iraq Sanctions Act, the National Emergencies Act, the Antiterrorism and Effective Death Penalty Act of 1996, the International Emergency Economic Powers Act, the United Nations Participation Act, the International Security and Development Cooperation Act, the Nuclear Proliferation Prevention Act of 1994, the Foreign Narcotics Kingpin Designation Act, the Iran and Libya Sanctions Act of 1996, the Cuban Democracy Act, the Cuban Liberty and Democratic Solidarity Act, and the Foreign Operations, Export Financing, and Related Programs Appropriations Act; (v) designated or blocked, associated or involved in terrorism, subject to restrictions under laws, regulations or executive orders similar to, or any other law, regulation or executive order of similar import as, those set forth above under the preceding clauses (i) through (iv), if and to the extent such laws, regulations or executive orders are in effect or (vi) as any of the laws, regulations or executive or other orders in the preceding clauses (i) through (v) may be amended, supplemented, adjusted, modified, reviewed or interpreted from time to time.

“Project” means a traditional “Class A” multifamily residential property, such as a garden apartment, a mid‑rise apartment or a high‑rise apartment complex, that (A)(x) is to be developed or is in the process of being developed or (y) for which development has been completed and a certificate of occupancy issued not more than ten years prior to the Partnership’s acquisition of an interest (through a Venture and a Subsidiary REIT) in such property, (B) meets the Investment Guidelines and (C) meets the Leverage Parameters. For the avoidance of doubt, (x) a Project does not include a residential property for assisted living, student housing or senior housing, unless otherwise agreed by the Partners, and (y) the term “Project” includes all Existing Projects and all New Projects.

“Project Capital Contributions” means, with respect to a Partner, the sum of such Partner’s (x) Existing Project Capital Contributions and (y) New Project Capital Contributions.

“Project Sale Bid Date” has the meaning ascribed thereto in Section 14.2(e).

“Project Sale Offer” has the meaning ascribed thereto in Section 14.2(a).

20

“Project Sale Period” has the meaning ascribed thereto in Section 14.2(c).

“Project Sale Trigger Event” has the meaning ascribed thereto in Section 14.2(a).

“Proposed Value” has the meaning ascribed thereto in Section 14.3(b).

“Purchase Option Trigger Date” has the meaning ascribed thereto in Section 10.4(a).

“Purchase Option” has the meaning ascribed thereto in Section 10.4(a).

“Qualifying Opinion” means a written opinion of outside, reputable tax counsel licensed to practice law in the United States and acting reasonably.

“Real Estate Proceeds” means proceeds from the direct sale of a Project (as opposed to proceeds from the sale of interests in the Subsidiary REIT that owns such Project).

“REIT” means a real estate investment trust under the Code.

“REIT Disposition Requirement” has the meaning ascribed thereto in Section 2.6(b)(ii).

“REIT Partner” means a direct or indirect (through another partnership or limited liability company) Limited Partner that is not a U.S. Person and for whom the direct or indirect receipt of Real Estate Proceeds would have a material adverse tax consequence on such Limited Partner. For the avoidance of doubt, PGGM PRE Fund is a REIT Partner.

“Rejected Project” has the meaning ascribed thereto in Section 7.2(a)(vi).

“Removed General Partner” has the meaning ascribed to such term in Section 7.8(a).

“Respondent” has the meaning ascribed thereto in Section 8.7(b).

“RIRE” has the meaning ascribed thereto in Section 15.22.

“Sale Period” has the meaning ascribed thereto in Section 14.1(b).

“Sale Project” has the meaning ascribed thereto in Section 14.2(c).

“Second Amended Agreement” has the meaning ascribed thereto in the recitals to this Agreement.

“Self‑Management Transaction” has the meaning ascribed thereto in Section 12.(g).

“Senior Executives” has the meaning ascribed thereto in Section 8.7(a).

“Shares” means the shares of beneficial interests (including, for the avoidance of doubt, membership interests) of a particular Subsidiary REIT.

21

“Special Situation” means the board of directors of BHMF REIT has (i) adopted a resolution to begin (a) the process of Listing, (b) a Merger with a person that it not an Affiliate of BHMF REIT, or (c) a Disposition, and (ii) determined that it is in the best interest of BHMF REIT to terminate the Partnership.

“Special Situation Closing” has the meaning ascribed thereto in Section 14.3(d).

“Special Situation Closing Date” has the meaning ascribed thereto in Section 14.3(d).

“Special Situation Right” has the meaning ascribed thereto in Section 14.3.

“Subsequent Operating Plan” has the meaning ascribed thereto in Section 7.3(b).

“Subsidiary REIT” means each Existing Subsidiary REIT and each New Subsidiary REIT.

“Subsidiary Net Cash Flow” as of the end of any period, means the unrestricted cash (i.e. cash of such entity not held for resident security deposits, lender, development or other escrows or restricted accounts) of any entity in which the Partnership owns a direct or indirect interest, including a Venture, a Subsidiary REIT, or an entity in which the Partnership owns a direct or indirect interest and that that holds a direct or indirect interest in a Project as of the end of such period, less (without any duplication):

(1) any capital contributions (A) then held by such entity, (B) not then invested in or allocated to the Project directly or indirectly owned by such entity and (C) anticipated (in the sole discretion of the “Manager” or “General Partner” of such entity) to be invested in Projects; and

(2) operating reserves for amounts anticipated to be paid during the thirty (30) day period following the end of such period (as determined by the “Manager” or “General Partner” of such entity in its sole discretion), which amounts include, without limitation, fees, organizational expenses, budgeted capital expenditures and operating expenses, including amounts necessary to meet periodic real estate tax and insurance installment payments and payments on debt service; and

(3) non‑operating reserves (as determined by the “Manager” or “General Partner” of such entity in its sole discretion), which include, without limitation, capital expenditures, projected financing costs, non‑budgeted expenditures and escrows, but in no event in excess of (A) two percent (2.0%), multiplied by (B) the net asset value of such entity’s assets.

“Substitute Capital” has the meaning ascribed thereto in Section 3.4(b).

“Substituted Limited Partner” means a Person admitted to the Partnership as a Limited Partner in accordance with Section 10.1.

“Successor General Partner” has the meaning ascribed to such term in Section 7.8(a).

“Successor General Partner Cause Event” means the declaration by the Removed General Partner (as a Limited Partner) that the occurrence of an event or circumstance described in one of the following clauses (i) through (v) constitutes a “Successor General Partner Cause Event” as

22

provided in Section 7.13: (i) a material breach of this Agreement by a Successor General Partner if such breach has had or is reasonably expected to have a material adverse effect on the Partnership, (ii) the Successor General Partner taking any action which is a Major Decision under any Venture Agreement, requires the Consent of the members of the Advisory Committee or which requires the Consent of the Limited Partner pursuant to Section 8.2(b) of this Agreement, in each case if such action has had or is reasonably expected to have a material adverse effect on the Partnership and such action was taken without the prior consent of the Advisory Committee, the Limited Partner or BHMF GP, (iii) any breach of applicable law or gross negligence by the Successor General Partner, any director in the organization of the Successor General Partner or any Successor General Partner Corporate Level Personnel if such breach of applicable law or gross negligence, has had or is reasonably expected to have a material adverse effect on the Partnership, (iv) any fraud or willful misconduct by the Successor General Partner, any director in the organization of the Successor General Partner or any Successor General Partner Corporate Level Personnel if such fraud or willful misconduct, has had or is reasonably expected to have a material adverse effect on the Partnership, or (v) Successor General Partner filing either a Chapter 7 or a Chapter 11 bankruptcy proceeding or admitting in writing in any similar proceeding its inability to pay its debts as they mature, but in each of the foregoing cases only if such material breach, action or conduct is not cured (to the extent such material breach, action or conduct is capable of cure) by the Successor General Partner within sixty (60) days following the date on which such Successor General Partner first obtained knowledge of the occurrence of such material breach, action or conduct (which sixty (60) day period can be extended by sixty (60) days for a total of one hundred twenty (120) days following the date on which such Successor General Partner first obtained knowledge of the occurrence of such material breach, action or conduct if such Successor General Partner commences to cure such material breach, action or conduct within such initial sixty (60) day period, such material breach, action or conduct remains capable of cure and thereafter such Successor General Partner diligently pursues the cure of such material breach, action or conduct); provided, however, such Successor General Partner shall not have a cure right with respect to the conduct described in the foregoing clause (iv) if such conduct was committed by a key principal in Successor General Partner’s organization.

“Successor General Partner Corporate Level Personnel” shall mean any person holding the position of “Regional Manager”, “Regional Vice President”, “Vice President”, “Senior Vice President” or “Executive Officer”, or any person holding a similar senior position, within any Successor General Partner’s organization.

“Suspension Period” has the meaning ascribed thereto in Section 7.7(a).

“Tax Matters Partner” has the meaning ascribed thereto in Section 3.9.

“Tax Return” means any report, return or other information required to be supplied to a taxing authority in connection with Taxes.

“Tax Sensitive Beneficial Owner Group” means all Beneficial Owners of Shares other than (i) PGGM PRE Fund, (ii) PGGM PRE Fund’s direct or remote transferees with respect to such Shares, and (iii) the direct or indirect owners of PGGM PRE Fund or its transferees.

23

“Taxes” means all taxes, charges, fees, duties, levies or other assessments, including without limitation, income, gross receipts, net proceeds, ad valorem, turnover, real and personal property (tangible and intangible), sales, use, franchise, excise, value added, stamp, leasing, lease, user, transfer, fuel, excess profits, occupational and interest equalization, windfall profits, severance and employees’ income withholding and Social Security taxes, which are imposed by the United States, or any state, local or foreign government or subdivision or agency thereof, and such term shall include any interest, penalties or additions to tax attributable to such Taxes.

“Termination Event” has the meaning ascribed thereto in Section 14.1(a).

“Third Amended Agreement” has the meaning ascribed thereto in the recitals to this Agreement.

“Transfer” means to give, sell, assign, pledge, hypothecate, devise, bequeath or otherwise dispose of, transfer or permit to be transferred, during life or at death. The term “Transfer” when used as a noun, means any Transfer transaction.

“Unfunded Capital Commitment” means, with respect to any Partner at any time, such Partner’s then unfunded Capital Commitment.

“U.S. GAAP” means U.S. generally accepted accounting principles at the time in effect.

“U.S. Person” means a “U.S. Person” as such term is defined in Section 7701(a)(30) of the Code.

“Unreturned Existing Project Capital Contributions” means, with respect to any Partner, the difference between (x) such Partner’s Existing Project Capital Contributions, and (y) the aggregate distributions to such Partner (that represent a return of such Partner’s Capital Contributions (as opposed to a return on such Partner’s Capital Contributions)) pursuant to Section 5.1(a)(i) of this Agreement.

“Unreturned New Project Capital Contributions” means, with respect to any Partner, the difference between (x) such Partner’s New Project Capital Contributions, and (y) the aggregate distributions to such Partner (that represent a return of such Partner’s Capital Contributions (as opposed to a return on such Partner’s Capital Contributions)) pursuant to Section 5.1(b)(i) of this Agreement.

“Valuation Policy” means the valuation policies attached hereto as Exhibit S.

“Value Determination Date” means (a) with respect to the Existing Projects, the Existing Project Value Determination Date, and (b) with respect to the New Projects, the New Project Value Determination Date.

“Venture” means each Existing Venture and each New Venture.

“Venture Agreement” means each Existing Venture Agreement and each New Venture Agreement.

24

“Venture Parties” has the meaning ascribed thereto in Section 12.2(g).

ARTICLE 2

THE PARTNERSHIP

2.1 Formation of Partnership. The Partners hereby form, or ratify the formation of, a limited partnership pursuant to the provisions of the Act, and the rights and liabilities of the Partners shall be as provided in the Act except as herein otherwise expressly provided.

2.2 Partnership Name and Principal Office. The name of the Partnership shall be “Monogram Residential Master Partnership I LP” or such other name as the General Partner may determine. The principal place of business and the principal administrative office of the Partnership shall be 00000 Xxxxxx Xxxxxxx, Xxxxx 000, Xxxxxxx, Xxxxx 00000. The Partnership may change such office and may have such additional offices as the General Partner may determine.

2.3 Office of and Agent for Service of Process. The registered office of the Partnership in the State of Delaware shall be c/o Corporation Service Company, 0000 Xxxxxxxxxxx Xxxx, Xxxxx 000, in the city of Wilmington, County of New Castle, Delaware and the Partnership’s agent for service of process on the Partnership in the State of Delaware shall be Corporation Service Company. The General Partner may change, at any time and from time to time, the location of such registered office and/or such registered agent upon written notice of the change to the Limited Partner.