LIMITED LIABILITY COMPANY AGREEMENT OF JP-KBS RICHARDSON HOLDINGS, LLC

Exhibit 10.24

LIMITED LIABILITY COMPANY AGREEMENT

OF JP-KBS RICHARDSON HOLDINGS, LLC

This LIMITED LIABILITY COMPANY AGREEMENT OF JP-KBS RICHARDSON HOLDINGS, LLC (this “Agreement”), is entered into effective as of November 22, 2011, by and between JP-XXXXXXXXXX, LLC, a Delaware limited liability company (“JV Member”), and KBS SOR RICHARDSON PORTFOLIO JV, LLC, a Delaware limited liability company (“KBS” or “Co-Managing Member”). JV Member and KBS may hereinafter be referred to herein collectively, as the “Members” or individually as a “Member.”

ARTICLE I

FORMATION

1.01. Formation. The limited liability company created pursuant to this Agreement and the filing of that certain Certificate of Formation dated October 6, 2011 (the “Company”) was formed under and pursuant to the Act. The term “Act” means the Delaware Limited Liability Company Act, 6 Delaware Code, Sections 18-101 et. seq., as hereafter amended from time to time.

1.02. Names and Addresses. The name of the Company is JP-KBS RICHARDSON HOLDINGS, LLC. The principal office of the Company shall be 00000 Xxxxxx Xxxxx, Xxxxx 000, Xxxxxx, Xxxxx 00000, until changed by the Managing Member with written notice to all of the Members. The name and address of the registered agent of the Company in the State of Delaware currently is Corporation Services Company, 0000 Xxxxxxxxxxx Xxxx, Xxxxx 000, Xxxxxxxxxx, Xxxxxxxx 00000. The names and addresses of the Members are set forth on Exhibit A attached hereto.

1.03. Nature of Business. The express, limited and only purposes of the Company shall be (i) to acquire certain real property located in Richardson, Texas commonly known as 0000 X. Xxxxxxx Xxxxxxxxxx, 0000 X. Xxxxxxx Xxxxxxxxxx, 0000 Xxxxxxxx Xxxxxxxxx, 0000 Xxxxxxxx Xxxxxxxxx, 0000 Xxxxxxxx Xxxxxxxxx and various vacant lots, and described more particularly on Exhibit B attached hereto (each, individually a “Property”, and collectively, the “Properties”), including the improvements currently and as from time to time may be located on each Property (collectively, the “Improvements”) (a Property and the Improvements located thereon shall sometimes be collectively referred to as, a “Project” and all the Properties and Improvements shall be sometimes collectively referred to as the “Projects”) at the Closing currently scheduled for November 1, 2011 (the “Closing”), (ii) to transfer the Properties to the Property Owners (herein defined) immediately after Closing, (iii) to acquire, own, manage and hold the membership interests of the Property Owners, which Property Owners shall own, lease, hold for investment, sell, exchange, dispose of and otherwise realize the economic benefit from the Projects, and (iv) to conduct such other activities with respect to the Projects as are appropriate to carrying out the foregoing purposes and to do all things incidental to or in furtherance of the above-enumerated purposes. The Company shall be the sole member of the limited liability companies listed in Exhibit B attached hereto (each, a Property Owner” and

1

collectively, the “Property Owners”), which shall acquire and own the Projects as described in Exhibit B attached hereto immediately after the Closing.

1.04. Term of Company. The term of the Company shall commence on the date the Certificate of Formation for the Company is filed with the Office of the Secretary of State of the State of Delaware and shall continue until dissolved pursuant to Article VIII. The existence of the Company as a separate legal entity shall continue until the cancellation of the Company’s Certificate of Formation.

ARTICLE II

MANAGEMENT OF THE COMPANY

2.01. Management of the Company.

(a) Generally. JV Member is hereby designated as the managing member (the “Managing Member”) of the Company and shall serve as the Managing Member of the Company unless and until it resigns or is removed pursuant to Section 2.06. Subject to the restrictions set forth in this Agreement, Managing Member shall manage and administer the day- to-day business and affairs of the Company. Managing Member shall at all times faithfully perform its duties and responsibilities in compliance with all applicable laws, the Business Plan, the Annual Budgets and this Agreement, and in an efficient, thorough, businesslike manner, devoting such time, efforts and managerial resources to the business of the Company as is reasonably necessary for the operation of the day-to-day business and affairs of the Company. In the performance of its duties in this Agreement, Managing Member shall regularly consult with the Co-Managing Member. Managing Member may engage in business efforts and affairs which are not related to the Company, and will not be precluded from owning and operating other businesses and/or real estate projects and neither the Company nor the other Members shall have any interest in such businesses or real estate projects.

(b) Specific Day to Day Duties. Without limiting the generality of the foregoing, Managing Member shall perform the following duties with respect to the Projects, all to be carried out in accordance with this Agreement, the Annual Budgets and the Business Plan:

(i) Use reasonable commercial efforts to be obtain and cause to be maintained all governmental and agency approvals, permits and other entitlements necessary for ownership, renovation, operation, management and leasing of the Projects.

(ii) Coordinate the services of all employees, supervisors, architects, engineers, accountants, attorneys, real estate brokers, advertising personnel and other persons necessary or appropriate for the ownership, renovation, operation, management and leasing of the Projects.

(iii) Supervise the performance of all work in connection with the ownership, renovation, operation, management and leasing of the Projects.

(iv) Use reasonable efforts to enforce all of the Company’s and the Property Owners’ rights and cause performance of all of the Company’s and the Property Owners’ obligations arising in connection with any contract or agreement entered into in

2

connection with the Projects, excluding de minimis obligations where the cost to pursue the obligation exceeds the benefit to be gained.

(v) Deliver to the Members copies of any written notices or other written materials received by Managing Member (irrespective of whether such notice or materials were sent directly to Managing Member, the Company or a Property Owner) in connection with any material dispute or material claims relating to the Projects.

(vi) Otherwise diligently perform those duties and services that are reasonably necessary in order to acquire, own, renovate, operate, manage and lease each Project in accordance with the Business Plan, the applicable Annual Budget and this Agreement.

As used in this Agreement, the term “Loan” means the loan to the Company in the maximum aggregate amount of $46,100,000 from General Electric Capital Corporation (“GECC”), and secured by the Projects pursuant to loan documents approved by the Members and the term “Refinance” means any refinance, modification, extension or substitution of the Loan, or any new loan affecting any or all of the Projects. The Loan will be assumed by the Property Owners upon transfer of the Projects to the Property Owners.

(c) Additional Duties. Without limiting the generality of the foregoing, Managing Member shall have the following additional duties with respect to the overall operation of the Company and the ownership by the Company of the Property Owners, which in turn will own the Projects, all to be carried out in accordance with this Agreement:

(i) Provide operating reports and financial statements in accordance with Article IX.

(ii) Notify Co-Managing Member of such matters and render such reports to Co-Managing Member from time to time as Co-Managing Member may reasonably request in writing, including, without limitation, at all times and in each event no less frequently than monthly, keeping Co-Managing Member informed of material information relating to the Projects by (1) notifying Co-Managing Member in advance of public hearings and other proceedings relating to any existing or proposed entitlements, mapping, subdivision or material permits for the Projects and (2) notifying Co-Managing Member within five (5) business days and promptly delivering to Co-Managing Member copies of any written offers to purchase or otherwise acquire any or all of the Projects, or any interest therein, and of any written indications of interest, written invitations to deal, written solicitations of sales which represent bona fide offers specifically tailored to any or all of the Projects, and which shall specifically exclude generic or cold call type letters seeking to purchase properties generally.

(iii) Complying with the Annual Budgets, as they may be modified under Section 2.10 below; provided however that Managing Member shall be entitled to incur expenditures not provided in any Annual Budget which do not exceed (1) the sum of $5,000 as to any single expenditure, and (2) the sum of $75,000 as to any such expenditures in the aggregate for any calendar year which shall be reported to Co-

3

Managing Member by no later than the delivery of the next monthly operating report (such expenditures may hereinafter be referred to as the “De Minimis Expenditures”).

(d) Affiliate Agreements; Special Powers of KBS Regarding Affiliate Agreements.

(i) JV Member may not cause the Company or any Property Owner to enter into any Affiliate Agreement or amend, modify or terminate any such Affiliate Agreement after the entry by the Company or a Property Owner, as applicable, into such Affiliate Agreement without the prior consent of Co-Managing Member.

(ii) Notwithstanding anything to the contrary contained herein but subject to Section 2.06(d) below, Co-Managing Member shall have the right, in its sole but reasonable discretion upon prior written notice to JV Member, to take all actions on behalf of the Company or a Property Owner, as applicable, with respect to: (A) the determination of the existence of any default by any Affiliate of JV Member under any Affiliate Agreements made between the Company or a Property Owner, as applicable, and any Affiliate of JV Member, (B) the enforcement of all rights and remedies of the Company or a Property Owner, as applicable, under any Affiliate Agreements made between the Company or a Property Owner, as applicable, and any Affiliate of JV Member, and (C) termination of any Affiliate Agreements made between the Company and any Affiliate of JV Member (subject to the terms and conditions set forth therein for notice of defaults and applicable cure periods). JV Member will cooperate in good faith with Co-Managing Member in the exercise by Co-Managing Member of the foregoing rights and actions hereunder.

(iii) As used in this Agreement, the term “Affiliate” means any person or entity which, directly or indirectly through one (1) or more intermediaries, controls or is controlled by or is under common control with another person or entity. The term “control” as used herein (including the terms “controlling,” “controlled by,” and “under common control with”) means the possession, direct or indirect, of the power (i) to vote 51% or more of the outstanding voting securities of such person or entity, or (ii) to otherwise direct management policies of such person by contract (at commercially reasonable rates) or otherwise. The term “Affiliate Agreement” means any agreement for the provision of goods and/or services between the Company or a Property Owner and any Affiliate of Managing Member or any other person or entity in which Managing Member (or any person or entity having a direct or indirect interest therein) owns a direct or indirect interest therein.

4

2.02. Major Decisions. Notwithstanding anything contained in this Agreement to the contrary, Managing Member shall not take, or cause or permit the Company or any Property Owner to enter into any agreement to take, any of the following actions on behalf of the Company or any Property Owner (in each case the taking of which hereinafter shall be referred to as a “Major Decision”) without the prior written consent of Co-Managing Member, which may be given or withheld in Co-Managing Member’s sole and absolute discretion.

(a) Annual Budgets; Business Plan. Subject to Section 2.01(c)(iii) deviate in from, amend or replace the Business Plan or deviate from, amend or replace any Annual Budget (including any Renovation Budget) except as provided in Section 2.10 below.

(b) Sale of the Company or the Project. Subject to Articles VI and VII, sell, convey, exchange, hypothecate, pledge, encumber or otherwise transfer any portion of or any interest in the Company, a Property Owner or a Project, or enter into any agreement to sell, convey, exchange, hypothecate, pledge, encumber or otherwise transfer any portion or any interest in the Company, a Property Owner or a Project.

(c) Management and Leasing Agreements. Amend, modify, terminate, or waive any rights under, the Management Agreement or the Leasing Agreement (as each term is defined below) (and with respect to the Leasing Agreement, after approval of the Leasing Agent and Leasing Agreement by Co-Managing Member pursuant to Section 2.11(b) below), or enter into any replacement management agreement or leasing agreement.

(d) Acquire Real Property or Ownership Interest. Purchase or otherwise acquire any interest in real property or in any entity other than the Company’s interest in the Property Owners.

(e) Financing. Cause the Company or a Property Owner to finance or refinance the operations of the Company or a Property Owner, as applicable, and/or any of the assets of the Company and the Property Owners (including, without limitation, any acquisition, development, construction, interim and long-term financing or refinancing in connection with a Project or the improvement, renovation or expansion thereof), enter into any Refinance, or retain any mortgage bankers or brokers on behalf of the Company or the Property Owners, as applicable, in connection therewith or enter into any modifications, amendments or other agreements regarding the Company’s or the Property Owners’ financing or to amend or modify in any respect the Loan or any Refinance.

(f) Indemnity. Make, execute or deliver on behalf of the Company or the Property Owners any indemnity bond or surety bond or obligate the Company, a Property Owner or any other Member as a surety, guaranty, guarantor or accommodation party to any obligation or grant any lien or encumbrance on any of the assets of the Company or the Property Owners, including the Projects.

(g) Loans. Lend funds belonging to the Company or a Property Owner to any Member or its Affiliate or to any third party, or extend any person, firm or corporation credit on behalf of the Company or a Property Owner or cause any Member Loan to be made to the Company or a Property Owner as provided in Section 3.04.

5

(h) Distributions. Based on cash flow projections and analysis prepared by Managing Member, determine whether or not there is sufficient Net Cash so that distributions may be made to the Members in accordance with this Agreement, and make any distribution to the Members. As used in this Agreement, the term “Net Cash” means the gross cash receipts of the Company from all sources as of any applicable date of determination, less the portion thereof used to pay (i) all cash disbursements (inclusive of any guaranteed payment within the meaning of Section 707(c) of the Code paid to any Member, including, without limitation, any reimbursements made to any Member and any amounts applied to repay any Member Loans, of the Company prior to that date); and (ii) all reserves, established by the Annual Budgets or otherwise approved by the Members for anticipated cash disbursements that will have to be made before additional cash receipts from third parties will provide the funds therefor, including for payment of debt service, capital improvements and other anticipated contingencies and expenses of the Company and the Property Owners.

(i) Expenditures. Except for De Minimis Expenditures, take any action or make any expenditure or incur any obligation by or on behalf of the Company or a Property Owner which is not included in the Annual Budgets (including, without limitation, obligating the Company or a Property Owner to pay for any goods or services in excess of the foregoing), in addition, in the event that the then current Loan or Refinance is within ninety (90) days of its stated maturity, or after its term has expired, or is in default, Managing Member may not reallocate any excess funds among line items or make any expenditures from any reserves without Co-Managing Member’s consent.

(j) Duties. Delegate any of the duties of Managing Member set forth herein except as set forth in the Management Agreement or the Leasing Agreement or any other approved contract with an Affiliate under the terms of this Agreement or to the officers and employees of Managing Member.

(k) Assignment Benefiting Creditors. Make, execute or deliver on behalf of the Company or any Property Owner an assignment for the benefit of creditors; file, consent to or cause the Company, a Property Owner, a Member’s Interest, or any Project, or any part thereof or interest therein, to be subject to the authority of any trustee, custodian or receiver or be subject to any proceeding for bankruptcy, insolvency, reorganization, arrangement, readjustment of debt, relief of debtors, dissolution or liquidation or similar proceedings.

(1) Partition of Company Assets. Partition all or any portion of the assets of the Company or a Property Owner, or file any complaint or institute any proceeding at law or in equity seeking such partition.

(m) Governmental Proposals. Make application to, or enter into, or cause the Company or any Property Owner to enter into any agreements with, any government officials relating to mapping, development, zoning, subdivision, environmental or other land use or entitlement matters which may affect the Projects.

(n) Purchase Assets. Except as may be provided in the then-applicable Annual Budgets, purchase any automobiles or vehicular equipment on behalf of or in the name

6

of the Company or a Property Owner or purchase any fixed assets on behalf of or in the name of the Company or a Property Owner.

(o) Commence Renovations or On or Off-Site Improvements. Commence the Renovations (defined below) unless and until the applicable detailed Renovation Budget (defined below) has been approved by Co-Managing Member pursuant to Section 2.10(b) below. Except as otherwise expressly provided for in any Business Plan, Annual Budget (and/or the Renovation Budget after approval by Co-Managing Member as set forth herein) or in any lease approved by the Co-Managing Member, undertake any Renovations (defined below) or significant construction on any Project (including, without limitation, any tenant improvements) or any significant off-site improvement work, any environmental remediation on any Project, except tenant improvements allowed within the Leasing Guidelines attached hereto as Exhibit H.

(p) Confess Judgments: Legal Actions. Confess a judgment against the Company; settle or adjust any claims against the Company or a Property Owner; or commence, negotiate and/or settle any legal actions or proceedings brought by the Company or a Property Owner against unaffiliated third parties; provided however that Managing Member may settle or adjust any claim which is not the subject of a legal action or proceeding of $10,000 or less.

(q) Dissolve the Company. Except as provided in this Agreement, dissolve, terminate or liquidate the Company or any Property Owner.

(r) Acts Making Business Impossible. Do any act that would make it impossible to carry on the business of the Company or any Property Owner.

(s) Material Agreements. Except as provided in the Annual Budgets or in the express terms of this Agreement or the Management Agreement, cause the Company to enter into any agreement obligating the Company or any Property Owner to pay an amount of more than $10,000 and any amendment, modification or termination of any such agreement, including, without limitation, any agreement providing for the payment of any commission, fee or other compensation payable in connection with the sale of any Project.

(t) Limited Liability Company Act. Take any other action for which the consent of the Members is required under the Act.

(u) Leases. Cause or permit the Company or a Property Owner to enter into any new space or other lease affecting a Project, or amend, modify, terminate, or waive rights under any existing leases, for space in any of the Projects, except that the Managing Member may lease space to new tenants or modify leases for existing tenants in accordance with the Leasing Guidelines attached hereto as Exhibit H.

(v) Insurance; Accounting. Change the insurance program for the Company, a Property Owner or a Project in a manner inconsistent with the Business Plans or inconsistent with the insurance requirements set forth in Section 2.05 below or alter or change the reporting, accounting and/or auditing systems and/or procedures for the Company, a Property Owner, or a Project.

7

(w) Employees. Employ any individuals as an employee of the Company or a Property Owner.

(x) Awards and Proceeds. Settle, apply or dispose of any casualty insurance proceeds or any condemnation award, any insurance company or any condemning authority, as applicable.

(y) No REIT Prohibited Transactions. Take, or permit to be taken, any action that is or results in a REIT Prohibited Transaction.

(z) Pledge and Assignment. Subject to the provisions of Article VI below, sell, transfer or pledge JV Member’s interests in the Company. Sell, transfer, encumber, or pledge the Company’s interests in the Property Owners.

(aa) Consultants. Retain or dismiss on behalf of the Company or a Property Owner any accountants, auditors, property managers or leasing agents.

(bb) Additional Capital Contributions. Except as expressly set forth in Section 3.01 below or otherwise approved by the Members in writing, require any additional capital contributions of the Members.

(cc) Member Loans. Except as expressly set forth in Section 3.04 or otherwise approved by the Members in writing, require or request any Member Loan.

The Members agree that the Major Decisions set forth in this Section 2.02 require the prior written consent of the Co-Managing Member in its sole and absolute discretion. Failure by Co-Managing Member to approve any Major Decision in writing within ten (10) days after Co-Managing Member’s receipt of a request therefor from Managing Member shall be deemed a disapproval of such Major Decision. The disapproval (or deemed disapproval) of a Major Decision shall not be construed as a dispute, controversy or a disagreement under this Agreement between the Members and shall not be subject to the arbitration provision set forth in Section 10.07 below.

2.03. Company Funds. No funds, assets, credit or other resources of the Company or the Property Owners of any kind or description shall be paid to, or used for, the benefit of any Member, except as specifically provided in this Agreement or the Annual Budgets or after the written approval of all the Members has been obtained. All funds of the Company and the Property Owners shall be deposited only in such federally insured checking and savings accounts with banks and other financial institutions having not less than $1,000,000,000 in assets as the Co-Managing Member shall approve in writing, shall not be commingled with funds of any other person or entity, and shall be withdrawn only upon such signature or signatures as may be designated in writing from time to time by Managing Member after receiving approval of the Co-Managing Member. Co-Managing Member hereby pre-approves Frost Bank N.A. as the initial holder of the Company’s bank accounts.

2.04. Employees. Neither the Company nor the Property Owners shall have employees. Each Member shall be solely responsible for all wages, benefits, insurance and payroll taxes with respect to any of its employees. Each Member agrees to perform its duties

8

under this Agreement as an independent contractor and not as the agent, employee or servant of the Company. Each Member shall be solely responsible for its own acts and those of its subordinates, employees and agents during the term of this Agreement and, subject to, and without the waiver of the benefits of, the provisions of Section 2.09, each Member hereby indemnifies and holds harmless the Company and each other Member from any liabilities, damages, costs and expenses (including, without limitation, reasonable attorneys fees) arising from the acts of any such subordinates, employees and agents of such Member.

2.05. Insurance.

(a) Company Policies. Managing Member shall purchase and maintain, or shall cause to be purchased and maintained, for and at the expense of the Company, policies of insurance (i) for the Company’s operations, (ii) for the protection of the Company’s assets (including the Projects), and (iii) as may be reasonably required to comply with third-party requirements in accordance with guidelines approved by Co-Managing Member, and shall provide the Members upon request with the certificates or other evidence of insurance coverage as provided therein.

(b) Contractor’s Insurance Obligations. Managing Member shall require the Projects’ general contractors and all subcontractors to obtain and maintain at all times during performance of work for the Company and the Property Owners, as applicable, an occurrence form commercial general liability policy on a primary and non-contributing basis with a minimum of $1,000,000 per occurrence/$1,000,000 annual aggregate, or in each case, in such other amounts as may be approved by the Co-Managing Member, on which the Company and the applicable Property Owner is named as an additional insured. In addition, Managing Member shall require that the Project’s general contractors and all subcontractors carry worker’s compensation coverage as required by law.

(c) D&O Insurance. Managing Member may purchase and maintain insurance on behalf of the executive officers of Managing Member (and if requested by Co-Managing Member, executive officers of Co-Managing Member) against liability asserted against such Person and incurred by such Person arising out of such Persons’ actions on behalf of Managing Member (or Co-Managing Member, as applicable) under this Agreement; provided that the cost of such insurance is included in the approved Annual Budgets for the applicable year and such coverage is available at commercially reasonable rates.

2.06. Election, Removal, Resignation.

(a) Number, Term and Qualifications. The Company shall have one Managing Member, which shall initially be JV Member. Other than in circumstances in which JV Member as Managing Member is removed pursuant to Section 2.06(b) or resigns pursuant to Section 2.06(c), a new Managing Member may not be appointed except as set forth in Section 2.06(d) below. Managing Member shall be a Member, but need not be an individual, a resident of the state in which the Property is located, or a citizen of the United States.

(b) Removal. Except as provided in this Section 2.06(b) with respect to JV Member as Managing Member, Managing Member may not be removed as Managing Member

9

of the Company. Managing Member may be removed as Managing Member (but not as a Member) solely as a result of the occurrence of a Just Cause Event at any time upon thirty (30) days prior written notice (“Removal Notice”) from KBS to JV Member.

For purposes of this Section 2.06(b), “Just Cause Event” shall mean:

(i) JV Member or any principal, officer, executive or employee of JV Member has committed fraud related to the Company, a Property Owner or a Project or has embezzled funds of the Company or a Property Owner.

(ii) JV Member or any principal, officer, executive or employee of JV Member has committed an act of gross negligence or willful misconduct in the performance of its obligations under this Agreement.

(iii) JV Member has materially breached its obligations as Managing Member under this Agreement and such breach was not timely cured within thirty (30) days of written notice from Co-Managing Member.

(iv) The filing of any bankruptcy, insolvency or receivership proceedings affecting JV Member which is not dismissed within ninety (90) days, or any assignment for the benefit of creditors by JV Member.

(c) Resignation. Managing Member may resign as Managing Member (but not as a Member) upon ten (10) days prior notice to the other Member; provided, however, that if JV Member in its capacity as Managing Member delivers a notice of resignation after either (i) a Removal Notice from KBS has been delivered but before the 30-day removal period has expired, or (ii) a notice of a Just Cause Event from KBS has been delivered but before any cure period has expired, JV Member’s resignation shall not alter, limit or circumvent, or be construed to alter, limit or circumvent, the effect of the occurrence of the applicable Just Cause Event under this Agreement, including under Section 2.06(d) below and, if applicable, the application of Section 5.02 below, by virtue of the fact that JV Member may have resigned prior to its formal removal as Managing Member.

(d) Effect of Removal or Resignation. Upon the removal or resignation of JV Member as Managing Member (but not as a Member) in accordance with Section 2.06(b) or Section 2.06(c), as applicable, KBS (or its designee) may:

(i) terminate any agreement between the Company or any Property Owner and JV Member or Affiliates of JV Member;

(ii) replace JV Member as Managing Member with itself (or its designee) and KBS (or such designee) shall have all of the duties and obligations of Managing Member under this Agreement; provided, however, that KBS (or its designee) shall not thereafter be required to obtain the consent or approval of JV Member to any Major Decision); and

(iii) if JV Member is removed as Managing Member as a result of a Just Cause Event described in Section 2.06(b)(i) or (ii), then from and after the date of

10

such removal, any and all Net Cash of the Company thereafter shall be distributed in accordance with the provisions of Section 5.02.

2.07. Members Have No Managerial Authority. The Members shall have no power to participate in the management of the Company, except as expressly authorized by this Agreement.

2.08. Meetings. The Company shall not be required to hold regular meetings of Members. Any Member may call a meeting of Members for the purpose of discussing Company business. Unless otherwise approved by the Members, any meeting of Members shall be held during normal business hours either telephonically or in person at the Company’s principal office on such day and at such time as are reasonably convenient for the Members.

2.09. Liability and Indemnity. No Member (nor any officer, director, member, manager, constituent partner, agent or employee of a Member) shall be liable or accountable in damages or otherwise to the Company or to any other Member for any good faith error of judgment or any good faith mistake of fact or law in connection with this Agreement, or the services provided to the Company except in the case of willful misconduct or gross negligence. To the maximum extent permitted by law, the Company does hereby indemnify, defend and agree to hold each Member (and each such officer, director, member, manager, constituent partner, agent or employee) wholly harmless from and against any loss, expense or damage (including, without limitation, attorneys’ fees and costs) suffered by such Member (and/or such officer, director, member, manager, constituent partner, agent or employee) by reason of anything which such Member (and/or such officer, director, member, manager, constituent partner, agent or employee) may do or refrain from doing hereafter for and on behalf of the Company and in furtherance of its interest; except in the case of willful misconduct or gross negligence. To the maximum extent permitted by law, each Member does hereby indemnify, defend and agree to hold the Company and each other Member wholly harmless from and against any loss, expense or damage (including, without limitation, attorneys’ fees and costs) suffered by the Company or such other Member as a result of such indemnifying Member’s willful misconduct or gross negligence in performing or failing to perform such indemnifying Member’s duties hereunder.

2.10. Business Plan and Annual Budgets.

(a) Attached hereto as Exhibit C is a plan which sets forth the general description of the overall business plan of the Company with respect to the Projects (the “Business Plan”), which has been prepared by Managing Member on behalf of the Company, and which is hereby approved by the Co-Managing Member. Notwithstanding the approval of such Business Plan by the Co-Managing Member, in the event of any conflict or inconsistency between any provision of the Business Plan and any provision of this Agreement, the provisions of this Agreement shall control and supersede the provisions of the Business Plan. On or before the Update Date (defined below) in any year, Managing Member shall prepare an update and any other necessary modifications to the Business Plan for Co-Managing Member’s review and approval.

11

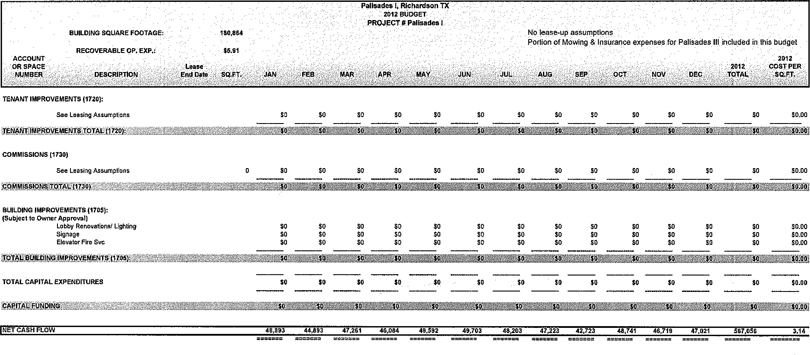

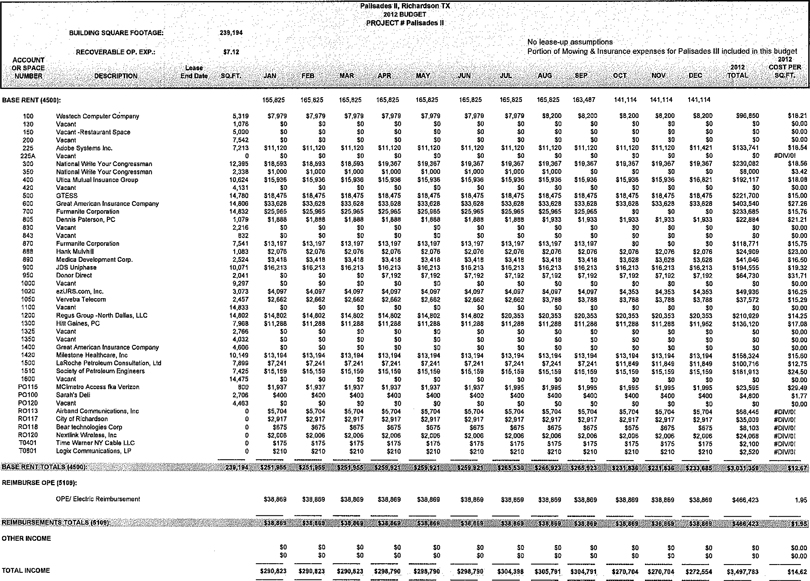

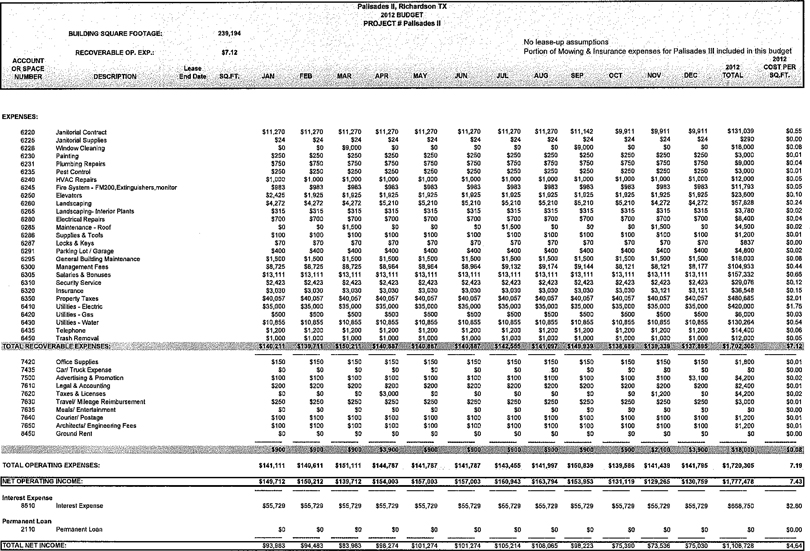

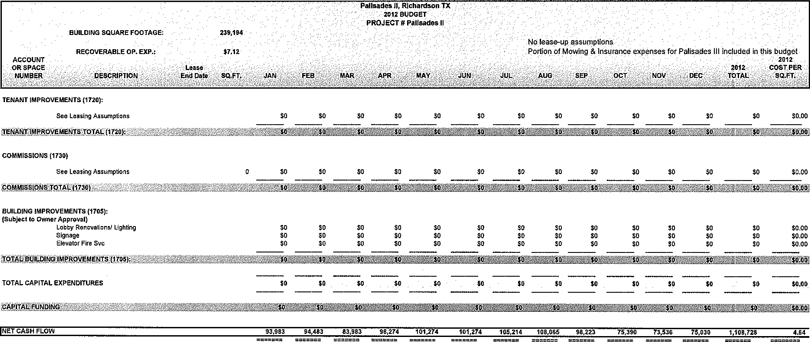

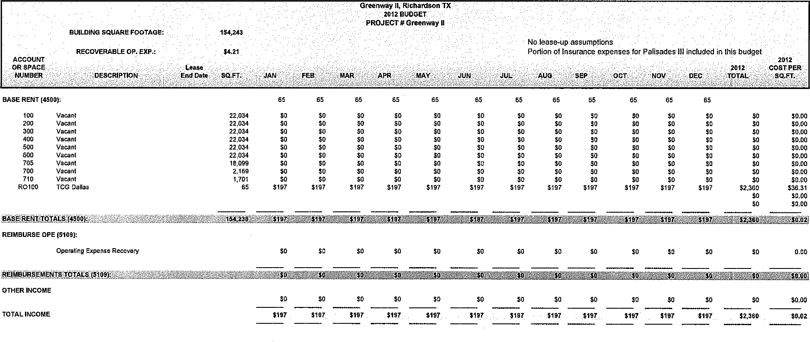

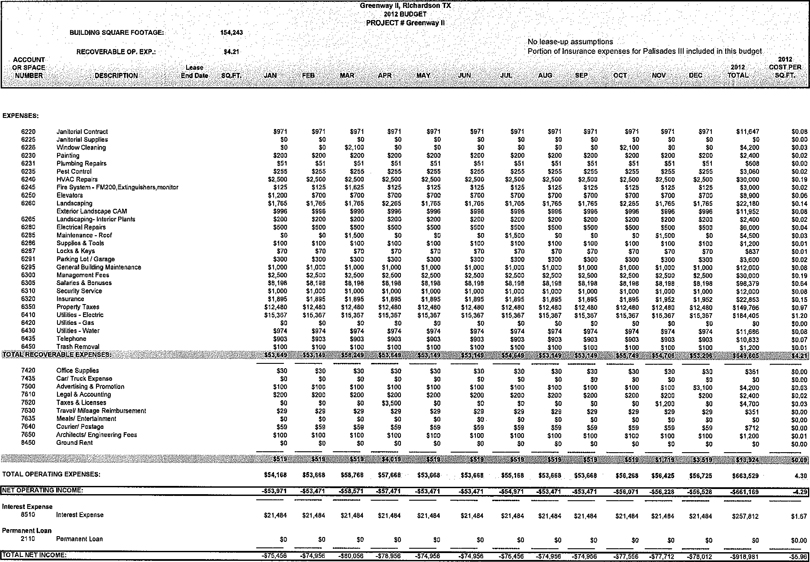

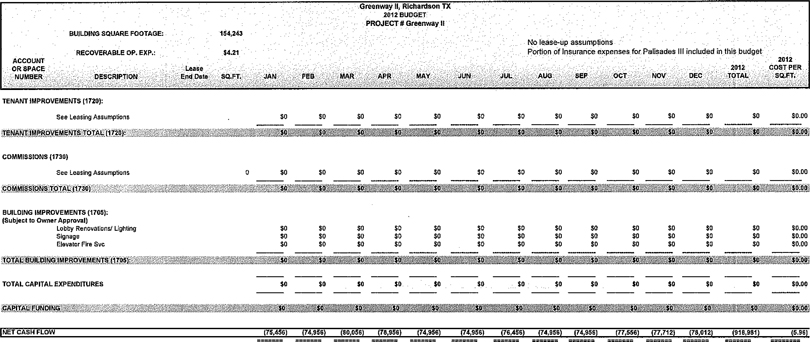

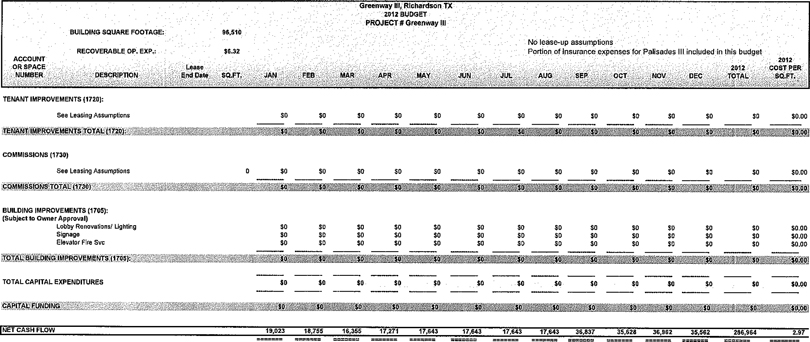

(b) Attached hereto as Exhibit D is an “Annual Budget” for each Project (collectively, the “Annual Budgets”) that have been approved by the Co-Managing Member (except as set forth in this Section 2.10(b)) and sets forth, by category, the estimated costs that are projected to be incurred for the remainder of the 2011 fiscal year in connection with the ownership, renovation, construction, and leasing of the applicable Projects. The initial Annual Budgets (and each subsequent Annual Budget to the extent applicable until the completion of the renovations to be made by the Company at the Project as described in the Business Plan (the “Renovations”)) includes a budget setting forth the estimated renovation costs to be incurred by the Company in connection with the renovation and construction of the Project (the “Renovation Budget”). On or before November 30, 2011, and on or before the last business day of November of each year thereafter (each an “Update Date”), Managing Member shall prepare new Annual Budgets for the Projects which shall be required to be approved by the Co-Managing Member, which shall set forth, (A) by individual category, the costs and expenses projected to be incurred by the Company and/or the applicable Property Owner for the ensuing fiscal year.

(c) If any Annual Budget (excluding any portion which constitutes the Renovation Budget), or any category thereof, is not approved by the Members for any fiscal year as of the commencement of such fiscal year (or other period), then the approved categories of such proposed Annual Budget shall be in effect, but as to the categories which were disapproved, one hundred five percent (105%) of the applicable approved Annual Budget line items, shall be in effect until the Co-Managing Member approves the new Annual Budget as to such categories. Adjustments to the last approved Annual Budget shall automatically be made to reflect actual increases in real property taxes, insurance premiums, utility charges and payments required under contracts to which the Company or the applicable Property Owner, as applicable, is a party at the time of the expiration of the Annual Budget, and shall not require KBS consent.

(d) The Managing Member shall have the right at any time during the year to propose a revised or updated any Annual Budget (each, a “Revised Annual Budget”) for the balance of the fiscal year. The Managing Member shall circulate the Revised Annual Budget to the Co-Managing Member for its consent. If the Co-Managing Member consents in writing to the Revised Annual Budget, it will become the Annual Budget for the applicable Project for the balance of the fiscal year; otherwise, the applicable approved Annual Budget shall continue in effect.

(e) Managing Member shall have the right, power and authority, without the consent of any other Member, to cause the Company or a Property Owner to incur emergency expenditures not included in the Annual Budgets to the extent Managing Member reasonably believes that such expenditures are necessary following a casualty or other comparable event to prevent imminent damage to persons or property on or about the Projects (and shall notify each other Member prior to making such expenditures to the extent reasonably possible under the circumstances). With respect to any Renovation Budget, Managing Member may, (i) to the extent covered by contingency funds in the Renovation Budget, with respect to any line item in such Renovation Budget, allocate from such contingency funds the lesser of 10% of such line item and $25,000, and (ii) if after the completion of any item, as certified by Managing Member to KBS, there remains an excess undisbursed balance, reallocate from such excess balance to any other line item in such Renovation Budget whose funds are insufficient to complete such item, so

12

long as such amount does not exceed the lesser of 10% of such line item and $25,000; provided, however, in no event may any line item (contingency or otherwise) be reallocated to pay any fees or expenses to Managing Member.

(f) Except as otherwise provided in this Agreement and subject to the terms and conditions herein, Managing Member shall have the right, power and authority to expend funds on behalf of the Company (with Company funds) or a Property Owner (with Property Owner funds) for any of the items set forth in, and with respect to, the period covered by an approved Annual Budget, without the further consent of KBS.

2.11. Management and Leasing Agreements.

(a) The Company shall cause each Property Owner to enter into a property management agreement substantially in the form of Exhibit E attached hereto (the “Management Agreement”) with Sooner National Property Management, L.P. (the “Property Manager”) or such other entity approved by the Managing Member and the Co-Managing Member. The fee payable to Property Manager shall be as set forth in the Management Agreement. Co-Managing Member hereby approves the Property Manager and Exhibit E as the Management Agreement.

(b) The Company shall also cause each Property Owner to enter into a leasing agreement substantially in the form of Exhibit F attached hereto (the “Leasing Agreement”) with J&P Realty Services, Inc. (the “Leasing Agent”) or such other entity approved by the Managing Member and the Co-Managing Member. The fee payable to Leasing Agent shall be as set forth in the Leasing Agreement. Co-Managing Member hereby approves the Leasing Agent and Exhibit F as the Leasing Agreement.

(c) Each of the initial Property Manager and the initial Leasing Agent is an Affiliate of JV Member, and therefore, the initial Management Agreement and the initial Leasing Agreement are Affiliate Agreements for purposes of Section 2.01 (d)

2.12. Reimbursement and Fees.

(a) Reimbursements.

Except as otherwise provided by this Agreement, none of the Members (or their respective Affiliates and/or other representatives) shall be paid any compensation for rendering services to the Company. Each Member shall be reimbursed for any costs and/or expenses incurred by such Member on behalf of the Company that relate to the business and affairs of the Company to the extent such Member had authority to act on behalf of the Company (without reduction to such Member’s capital account in the Company maintained in accordance with Treasury Regulations Section 1.704(b)(2)(iv) (each a “Capital Account”)); provided, however, that except as otherwise provided in this Agreement or in any Annual Budget no Member shall be reimbursed for any such costs and/or expenses that exceed an aggregate amount of $2,000 during any calendar year without Approval of the Members. As used in this Agreement, the term: “Treasury Regulation” means any proposed, temporary, and/or final federal income tax regulation promulgated by the United States Department of the Treasury as heretofore and

13

hereafter amended from time to time (and/or any corresponding provisions of any superseding revenue law and/or regulation).

(b) Acquisition Fee. The JV Member shall be paid an acquisition fee in an amount equal to $476,550, which represents 1% of the purchase price of the Projects. Such fee shall be payable upon the closing of the escrow for the acquisition of the Projects.

(c) Reimbursement for Pre-Formation Costs. At or within 5 business days after the acquisition of the Projects by the Company, the Company shall reimburse KBS and JV Member for any and all legal and accounting fees, organizational costs and any other formation and due diligence costs incurred by KBS and JV Member (and/or any Affiliate or representative thereof) in connection with the formation of the Company, the negotiation and documentation of this Agreement and the acquisition of the Projects. The foregoing reimbursements shall not be debited to or otherwise reduce any Member’s Capital Account. KBS and JV Member shall use good faith commercially reasonable efforts to cause all such amounts to be reimbursed hereunder to be included in the Company’s final escrow closing statement for the acquisition of the Projects.

2.13. Limited Liability. Except as otherwise provided by the Act, the debts, obligations and liabilities of the Company, whether arising in contract, tort or otherwise, shall be solely the debts, obligations and liabilities of the Company, and the Members shall not be obligated personally for any such debt, obligation or liability of the Company solely by reason of being a Member of the Company.

ARTICLE III

MEMBERS’ CONTRIBUTIONS TO COMPANY

3.01. Initial Capital Commitments.

(a) JV Member. JV Member shall commit to contribute to the capital of the Company, in cash, an aggregate amount equal to 10% of the initial equity necessary to acquire the Projects and capitalize the Company which shall be equal to $1,632,601.16 based on the sources and uses schedule attached hereto as Exhibit G.

(b) KBS. KBS shall commit to contribute to the capital of the Company, in cash, an aggregate amount equal to 90% of the initial equity necessary to acquire the Projects and capitalize the Company which shall be equal to $14,693,410.46 based on the sources and uses schedule attached hereto as Exhibit G.

3.02. Additional Capital Commitments. If any Mandatory Operating Expenses and/or Approved Capital Expenditures (as each such term is defined below) incurred, or expected to be incurred, for any period shall exceed the funds that the Company has, or will have, available during such period, then at the written request of either Member, Managing Member shall require additional capital contributions (“Additional Operating Contributions”) from the Members in an aggregate amount sufficient to cover such shortfall. Additionally, if at any time, Managing Member (with the approval of the Co-Managing Member) determines that additional capital contributions are needed for Uncovered Operating Expenses (defined below),

14

the Managing Member may require (with the approval of the Co-Managing Member) from time to time additional capital contributions to the Company (“Additional Uncovered Operating Contributions” and, together with Additional Operating Contributions, “Additional Capital Contributions”) from the Members in amounts necessary to fund such Uncovered Operating Expenses. Each Member shall contribute to the Company its share of Additional Capital Contributions under this Section 3.02 in accordance with its Percentage Interest in cash on or before the due date specified in the notice from the Managing Member, which due date shall not be less than fifteen (15) days from the date of such written notice. No Member shall be obligated to fund Additional Capital Contributions authorized under this Section 3.02 more often than once during any calendar month.

The term “Mandatory Operating Expenses” shall mean (a) all monthly principal and interest payments payable from time to time under the Loan or any Refinance approved under Section 2.02(e) above, (b) except as otherwise provided below in this paragraph, any payment due at the maturity date of the Loan or any Refinance approved under Section 2.02(e) above (a “Maturity Payment”), (c) all real estate taxes payable for the Projects, and (d) all insurance premiums payable with respect to insurance carried or the Projects. The term “Approved Capital Expenditures” shall mean all capital expenditures approved in any Annual Budget and/or required to be incurred pursuant to the terms of any lease entered into by the Company in accordance with the provisions of this Agreement. The term “Uncovered Operating Expenses” shall mean all operating expenses of the Projects that are not considered Mandatory Operating Expenses or Approved Capital Expenditures. Notwithstanding the foregoing, a Maturity Payment shall not be a Mandatory Operating Expense for the purposes of this Agreement if Co-Managing Member has disapproved a Refinance requested by Managing Member pursuant to Section 2.02(e) above and such disapproved Refinance was on commercially reasonable market and customary terms and did not require a guaranty, indemnity or other undertaking from Co-Managing Member or any Affiliate of Co-Managing Member.

3.03. Default in Capital Commitment. If JV Member or KBS (as applicable, the “Defaulting Member”) shall fail to contribute any amounts required to be contributed pursuant to Sections 3.01 or 3.02 and such failure shall continue for at least five (5) business days following notice to the Defaulting Member, KBS or JV Member, as applicable, (the “Non-Defaulting Member(s)”) may, but shall not be obligated to, contribute some or all of the amount required to be contributed by the Defaulting Member. If the Non-Defaulting Member contributes capital on behalf of the Defaulting Member, the Percentage Interests of the Members shall be adjusted (effective on the date the Non-Defaulting Member makes such contribution) as if the Non-Defaulting Member contributed 150% of the amount of capital actually contributed by the Non-Defaulting Member in the manner described in the remainder of this Section. The Percentage Interest of the Defaulting Member shall automatically be reduced (effective as of the date the Non-Defaulting Member makes the Defaulting Member’s share the Additional Capital Contribution) by the number of percentage points determined by multiplying the Percentage Interest of the Defaulting Member immediately prior to the Non-Defaulting Member’s making the entire Additional Capital Contribution by a fraction, the numerator of which is 1.5 times the amount of the Additional Capital Contribution made on behalf of the Defaulting Member and the denominator of which is all of the Additional Capital Contributions made by the Defaulting Member, and the Percentage Interest of the Non-Defaulting Member making the Additional Capital Contribution of the Defaulting Member shall be increased by an equal number of

15

percentage points. Additionally, if the Defaulting Member is the JV Member, JV Member shall no longer receive the 10% promote set forth in Section 5.01(b)(iii) below and the 15% promote set forth in Section 5.01(c)(iii) below; however, GECC shall continue to be entitled to receive the Assigned Distributions as provided in Sections 5.01 (b)(ii) and (c)(ii) or Sections 5.02(b)(ii) and (c)(ii), as applicable.

[remainder of page left intentionally blank]

16

THE PROVISIONS OF THIS SECTION 3.03, WHICH MAY CAUSE A REDUCTION IN THE PERCENTAGE INTEREST OF A DEFAULTING MEMBER (AND A CORRESPONDING INCREASE TO THE PERCENTAGE INTEREST OF A NON-DEFAULTING MEMBER) IN THE EVENT THAT THE NON-DEFAULTING MEMBER FUNDS A DISPROPORTIONATE SHARE OF ADDITIONAL CAPITAL CONTRIBUTIONS, IS NOT INTENDED AS A FORFEITURE OR PENALTY BUT AS COMPENSATION TO THE NON-DEFAULTING MEMBER FOR THE ADDED RISK ASSUMED IN PROVIDING A DISPROPORTIONATE SHARE OF THE CAPITAL REQUIRED BY THE COMPANY. EACH MEMBER ACKNOWLEDGES THAT THE ADJUSTMENTS PROVIDED IN THIS SECTION 3.03 ARE FAIR COMPENSATION TO A NON-DEFAULTING MEMBER THAT FUNDS A DISPROPORTIONATE SHARE OF ADDITIONAL CAPITAL CONTRIBUTIONS AND A REASONABLE ESTIMATE OF THE DAMAGES CAUSED TO THE OTHER MEMBER BY THE FAILURE OF THE DEFAULTING MEMBER TO FUND ITS PROPORTIONATE SHARE OF ANY ADDITIONAL CAPITAL CONTRIBUTIONS, PARTICULARLY IN LIGHT OF THE UNCERTAIN FINANCIAL CONDITION OF THE COMPANY THAT IS LIKELY TO EXIST IF THE COMPANY REQUIRES ADDITIONAL CAPITAL CONTRIBUTIONS AND THE NEED TO PROVIDE FOR A SIGNIFICANT RETURN ON INVESTMENT UNDER THOSE CIRCUMSTANCES. THE INDIVIDUAL EXECUTING THIS AGREEMENT ON BEHALF OF EACH MEMBER HAS SPECIFICALLY ACKNOWLEDGED THE PROVISIONS OF THIS SECTION 3.03 BY THE PARTY FOR WHOM HE/SHE IS ACTING.

| /s/ Authorized Signatory |

/s/ Authorized Signatory |

|||||

| JV MEMBER |

KBS |

3.04. Member Loans. In the event Managing Member determines, in its reasonable discretion, that funds in addition to those otherwise obtained pursuant to Sections 3.01 are necessary for the Company to meet the Annual Budgets, Business Plan, then Managing Member shall deliver written notice of such actual or projected cash deficit to KBS and JV Member requesting that they agree that a loan (a “Member Loan”) should be made to the Company and the interest rate to be paid to the Company. Within 10 business days following the effective date of such notice, each such Member shall notify Managing Member (a) whether or not such Member agrees that Member Loan(s) to the Company should be made in the amount specified in Managing Member’s notice, and (b) whether such Member elects, in its sole and absolute discretion, to make such Member Loan. If KBS and JV Member (y) agree that a Member Loan in the amount specified in Managing Member’s notice should be made, and (z) elect to advance such funds to the Company, such funds shall be advanced by Members in proportion to their respective percentage set forth opposite such Member’s name under the column labeled “Percentage Interest” on Exhibit A attached hereto (the “Percentage Interests”) (or as such Members otherwise agree). Any and all advances made by any Member to the Company pursuant to this Section 3.04 shall be treated as a Member Loan with recourse only to the assets of the Company (and not to the assets of any Member), and shall bear annual interest as set forth in Managing Member’s notice. If, from any circumstances whatsoever, the Company ever receives as interest under a Member Loan in an amount which would exceed the highest lawful rate, such amount which would be excessive interest shall be applied to the reduction of

17

the unpaid principal balance due under such Member Loan and not to the payment of interest. Any and all Member Loans shall be due and payable from the first available funds of the Company and in any event upon the liquidation of the Company. The repayment of any Member Loan shall be made prior to any distributions of Net Cash or other cash proceeds to the Members, but shall be subordinate to any fees or reimbursements required to be made to the Members and/or their Affiliates pursuant to Section 2.13. Accordingly, notwithstanding the provisions of Articles V and VIII, until any and all Member Loans are repaid in full, the Members shall draw no further distributions from the Company and all cash or property otherwise distributable with respect to the Interests of the Members shall be paid to the Member(s) making Member Loan(s) in proportion to, and as a reduction of, the outstanding balance(s) of such Member Loan(s), with such funds being applied first to reduce any interest accrued thereon, and then to reduce the principal amount thereof. As used in this Agreement, the term “Interest” means in respect to any Member, all of such Member’s right, title and interest in and to the Net Profits, Net Losses, Net Cash, and capital of the Company, and any and all other interests therein in accordance with the provisions of this Agreement and the Act. As used in this Agreement, the terms “Net Profits” and “Net Losses” mean, for each fiscal year or other period, an amount equal to the Company’s taxable income or loss, as the case may be, for such year or period, determined in accordance with Code Section 703(a) (for this purpose, all items of income, gain, loss and deduction required to be stated separately pursuant to Code Section 703(a)(1) shall be included in taxable income or loss); provided, however, for purposes of computing such taxable income or loss, (i) such taxable income or loss shall be adjusted by any and all adjustments required to be made in order to maintain Capital Account balances in compliance with Treasury Regulation Section 1.704-1(b), and (ii) any and all items of gross income or gain and/or partnership and/or partner “nonrecourse deductions” specially allocated to any Member pursuant to Section 4.02 shall not be taken into account in calculating such taxable income or loss. If KBS does not approve a Member Loan, such disapproval shall not be construed as a dispute, controversy or a disagreement under this Agreement between the applicable Members and shall not be subject to the arbitration provision set forth in Section 10.07 below.

3.05. Determination of IRR Returns. The IRR Return described in Section 5.01 below shall be determined based upon internal rate of return of KBS and JV Member. As used in this Agreement, the term “IRR Return” means for each of KBS and JV Member the annual discount rate that when compounded quarterly results in a net present value equal to zero when the discount rate is applied to all capital contributions by each such Member and all distributions made by the Company to each such Member pursuant to this Agreement. The IRR Return shall be calculated using the IRR function provided in Microsoft Office Excel or any replacement software issued by Microsoft to compute internal rate of return, utilizing an annual compounding period. It is understood by the Members that the achievement of a particular IRR Return requires both a return of all capital contributions plus a cumulative return on such capital contributions at the applicable percentage IRR Return.

3.06. Capital Contributions in General. Except as otherwise expressly provided in this Agreement or as otherwise agreed to by all Members in writing (i) no Member may withdraw all or any portion of any contribution that such Member may have made to the capital of the Company without each other Member’s consent, (ii) no Member shall be entitled to receive interest on such Member’s contributions to the capital of the Company, and (iii) no Member shall be required or entitled to contribute additional capital to the Company.

18

ARTICLE IV

ALLOCATION OF PROFITS AND LOSSES

4.01. In General.

(a) Net Profits and Net Losses shall be allocated among the Members in such a manner so as, to the maximum extent possible, to make each Member’s Capital Account as of the close of each year (increased by the Member’s share of “partnership minimum gain” as defined in Treasury Regulation Section 1.704-2(b)(2) and “partner nonrecourse debt minimum gain” as defined in Treasury Regulation Section 1.704-2(i)(5)) equal the amount that the Member would receive if, as of the close of such year, all the assets of the Company were sold for their Deemed Book Values (as determined immediately before such deemed sale), the proceeds were applied to pay all Company liabilities and the remaining net proceeds were distributed to the Members in accordance with Section 5.01 or Section 5.02, as then applicable at the time of such allocations. As used in this Agreement, the term “Deemed Book Value” means the book value of the Company’s assets as determined under Treasury Regulation Section 1.704-1(b)(2)(iv) (i.e., the adjusted tax basis of such assets unless there has been a revaluation of book value under Treasury Regulation Section 1.704-1(b)(2)(iv)(f)).

(b) The Company shall maintain “Capital Accounts” for each Member in accordance with Treasury Regulation Section 1.704-1(b)(2)(iv). The Company shall make all adjustments required under Treasury Regulation Section 1.704-1(b)(2)(iv), including the adjustments contained in Section 1.704-1(b)(2)(iv)(g), relating to Section 704(c) Property as set forth in Section 4.03, below.

4.02. Special Allocations.

(a) Minimum Gain Chargeback. Notwithstanding any other provision of this Agreement, if there is a net decrease in partnership minimum gain for a Company taxable year, each Member shall be allocated, before any other allocation of Company items for the taxable year, items of gross income and gain for the year (and, if necessary, for subsequent years) in proportion to, and to the extent of, the amount of the Member’s share of the net decrease in Minimum Gain during the year. The income allocated under this Section 4.02(a) in any taxable year shall consist first of gains recognized from the disposition of property subject to one or more nonrecourse liabilities of the Company, and any remainder shall consist of a pro rata portion of other items of income or gain of the Company. The allocation otherwise required by this Section 4.02(a) shall not apply to a Member to the extent not required, as provided in Treasury Regulation Section 1.704-2(f)(2) through (5).

(b) Qualified Income Offset. Notwithstanding any other provision of this Agreement, if a Member unexpectedly receives an adjustment, allocation or distribution described in Treasury Regulation Section 1.704-1(b)(2)(ii)(d)(4), (5) or (6) that causes or increases an Adjusted Capital Account Deficit with respect to the Member, items of Company gross income and gain shall be specially allocated to the Member in an amount and manner sufficient to eliminate such Adjusted Capital Account Deficit as quickly as possible.

19

(c) Gross Income Allocation. If at the end of any Company taxable year, a Member has an Adjusted Capital Account Deficit, the Member shall be specially allocated items of Company income or gain in an amount and manner sufficient to eliminate the Adjusted Capital Account Deficit as quickly as possible.

(d) Nonrecourse Deductions. Any “nonrecourse deductions” (as defined in Treasury Regulation Section 1.704-2(b)(1)) shall be allocated among the Members in accordance with their Percentage Interests.

(e) Partner Nonrecourse Debt. Notwithstanding any other provision of this Agreement, any “partner nonrecourse deductions” (as defined in Treasury Regulation Section 1.704-2(i)(2)) shall be allocated to those Members that bear the economic risk of loss for the applicable partner nonrecourse debt, and among those Members in accordance with the ratios in which they share the economic risk, determined in accordance with Treasury Regulation Section 1.704-2(i). If there is a net decrease for a Company taxable year in any partner nonrecourse debt minimum gain, each Member with a share of such partner nonrecourse debt minimum gain as of the beginning of such year shall be allocated items of gross income and gain in the manner and to the extent provided in Treasury Regulation Section 1.704-2(i)(4).

(f) Adjusted Capital Account Deficit. As used in this Agreement, “Adjusted Capital Account Deficit” means, with respect to any Member, the deficit balance, if any, in the Member’s Capital Account as of the end of the relevant taxable year, after giving effect to the following adjustments: (i) crediting thereto (A) the amount of the Member’s shares of partnership minimum gain and partner nonrecourse debt minimum gain, and (B) the amount of Company liabilities allocated to the Member under Section 752 of the Code with respect to which the Member bears the economic risk of loss (as defined in Treasury Regulation Section 1.752-2(a)), to the extent such liabilities do not constitute partner member nonrecourse debt under Treasury Regulation Section 1.752-2 and (ii) reduced by all reasonably expected adjustments, allocations and distributions described in Treasury Regulation Sections 1.704-1(b)(2)(ii)(d)(4), (5) and (6).

(g) Interpretation. The foregoing provisions of this Section 4.02 are intended to comply with Treasury Regulation Sections 1.704-1(b) and 1.704-2 and shall be interpreted consistently with this intention. Any terms used in such provisions that are not specifically defined in this Agreement shall have the meaning, if any, given such terms in the Regulations cited above.

4.03. Differing Tax Basis; Tax Allocation.

(a) Except as otherwise provided in this Section 4.03, items of income, gain, loss and deduction of the Company to be allocated for income tax purposes shall be allocated among the Members on the same basis as the corresponding book items are allocated under Sections 4.01 and 4.02.

(b) Depreciation and/or cost recovery deductions and gain or loss with respect to each item of property treated as contributed to the capital of the Company or revalued under Treasury Regulation Section 1.704-1(b)(2)(iv)(f) shall be allocated among the Members for

20

federal income tax purposes in accordance with the principles of Section 704(c) of the Code and the Treasury Regulations promulgated thereunder, and for state income tax purposes in accordance with comparable provisions of the applicable law in the state in which the Property is located and the regulations promulgated thereunder, so as to take into account the variation, if any, between the adjusted tax basis of such property and its book value (as determined for purposes of the maintenance of Capital Accounts in accordance with this Agreement and Treasury Regulation Section 1.704-1(b)(2)(iv)(g)). For purposes of this Agreement, the term “Code” means the Internal Revenue Code of 1986, as heretofore and hereafter amended form time to time (and/or any corresponding provision of any superseding revenue laws).

ARTICLE V

DISTRIBUTION OF CASH FLOW

5.01. Distribution of Net Cash Prior to Removal of JV Member. Prior to any removal of the JV Member pursuant to Sections 2.06(b)(i) or (ii) of this Agreement), Net Cash shall be determined and distributed quarterly (or at such other times as are determined in the reasonable discretion of the Managing Member and Co-Managing Member, taking into account the reasonable business needs of the Company) in the following order of priority:

(a) First, 100% to KBS and JV Member, pari passu in proportion to their Percentage Interests (“Pari Passu”), until KBS has received an IRR Return of 13%;

(b) Second, (i) 80% to KBS and JV Member, Pari Passu, (ii) 10% to GECC in payment of the Assigned Distributions (defined below), and (iii) 10% to JV Member, until KBS has received an IRR Return of 20%; and

(c) Third, (i) 70% to KBS and JV Member, Pari Passu, (ii) 15% to GECC in payment of the Assigned Distributions (defined below), and (iii) 15% to JV Member.

Reference is made to that Assignment of Limited Liability Company Distributions between JV Member, as Assignor, and GECC, as Assignee (the “Assignment of Distributions”), in which JV Member, in consideration for the consent by GECC to the acquisition of the Properties by the Company, has agreed that GECC will receive a portion of the distributions from the Company that would have otherwise been paid to directly JV Member under this Agreement (the “Assigned Distributions”). The Assigned Distributions are set forth in Sections 5.01(b)(ii) and (c)(ii) above and in Sections 5.02(b)(ii) and (c)(ii) below are subject to Section 5.03 below and the Assignment of Distributions.

5.02. Distribution of Net Cash After Removal of the JV Member. After any removal of JV Member pursuant to Sections 2.06(b)(i) or (ii) of this Agreement, Net Cash shall be determined and distributed quarterly (or at such other times as are determined in the reasonable discretion of the Members, taking into account the reasonable business needs of the Company) to the Members in the following order of priority:

(a) First, 100% to KBS and JV Member, Pari Passu, until KBS has received an IRR Return of 13%;

21

(b) Second, (i) 90% to KBS and JV Member, Pari Passu, and (ii) 10% to GECC in payment of the Assigned Distributions until KBS has received an IRR Return of 20%; and

(c) Third, (i) 85% to KBS and JV Member, Pari Passu, and (ii) 15% to GECC in payment of the Assigned Distributions.

5.03. Limitation on Distributions. Notwithstanding any other provision contained in this Agreement, the Company shall not make any distributions of Net Cash (or other proceeds) to any Member if such distribution would violate the Act or other applicable law.

5.04. In-Kind Distribution. Subject to Section 10.06, assets of the Company (other than cash) shall not be distributed in kind to the Members without approval of the Co-Managing Member. In the event of any distribution of real property in kind, each Member hereby waives any right of partition in respect thereof.

5.05. Tax Distributions. Unless this provision is waived by KBS, to the fullest extent possible but consistent with the distribution provisions of this Article 5, the Managing Member shall use best efforts to cause the Company to distribute KBS’s portion of the Company’s cash to KBS by the end of each fiscal year no less than 100% of the taxable income (including any net capital gain) allocated, directly or indirectly, to KBS for federal income tax purposes for each such fiscal year so that KBS or any owner of KBS that is a REIT may satisfy the requirements of Section 857(a)(1) of the Code for its taxable year with respect to the income and gain allocated to that owner from KBS for the taxable year, and otherwise distribute 100% of its taxable income and net capital gain.

5.06. Credit to Assigned Distributions. Notwithstanding anything to the contrary contained in Section 5.01 or Section 5.02 of this Agreement, as and to the extent that GECC shall charge and receive any Make Whole Breakage Amount, under and as defined in that Loan Agreement between GECC and the Company, evidencing and governing the Loan, for any prepayment of the Loan (the “Make Whole Breakage Amount”), an amount equal to the lesser of (a) the Make Whole Breakage Amount, and (b) $500,000 shall be credited to and reduce the amount of the Assigned Distributions payable to GECC under this Agreement, and any amount so credited shall be distributed to KBS and JV Member Pari Passu.

ARTICLE VI

RESTRICTIONS ON TRANSFERS OF COMPANY INTERESTS

6.01. Limitations on Transfer. Except as set forth in Section 6.02 below, no Member shall be entitled to sell, exchange, assign, transfer or otherwise dispose of, pledge, hypothecate, encumber or otherwise grant a security interest in, directly or indirectly (collectively, a “Transfer”), all or any part of such Member’s Interest, without the prior written consent of the non-transferring Members (which consent may be withheld in such Member’s sole and absolute discretion). Any attempted Transfer in violation of the restrictions set forth in this Article VI shall be null and void ab initio and of no force or effect. Each Member shall indemnify, defend and hold the other Members and the Company harmless from and against any and all costs, expenses and losses associated with any Transfer (including any Permitted

22

Transfer), including without limitation any transfer taxes and any increase in real estate or other taxes incurred as a result of such transfer.

6.02. Permitted Transfers. Any Member and/or any direct or indirect constituent owner of any Member may transfer all or any portion of such Member’s Interest and/or such constituent owner’s direct or indirect ownership interest in such Member as follows (each a “Permitted Transfer”) to a person or entity described below (a “Permitted Transferee”) without complying with the provisions of Section 6.01:

(a) Transfer Between Members. Notwithstanding anything stated to the contrary in this Agreement, any Member may sell, assign or otherwise transfer all or any part of its Interest to any other Member on such terms as are agreed to by both Members.

(b) KBS Indirect Transfers. Notwithstanding anything stated to the contrary in this Article VI or elsewhere in the Agreement, any Transfer of equity interests or other interests in KBS, or in any of the direct or indirect owners of KBS (including, without limitation, KBS SOR Acquisition VIII, LLC, KBS SOR Properties, LLC, KBS Strategic Opportunity Limited Partnership or KBS Strategic Opportunity REIT, Inc.) shall not be prohibited (and shall be expressly permitted) provided that KBS Strategic Opportunity REIT, Inc. continues to own, either directly or indirectly, at least fifty-one percent (51%) of the ownership interests in KBS.

(c) KBS Transfers. KBS shall have the right to Transfer all of its Interest (a) to a KBS Affiliate (defined below) without Manager Member’s approval, and (b) subject to any approval required under any financing secured by liens encumbering the Projects, to another entity that is not a KBS Affiliate with Managing Member’s approval, which approval may be withheld in Managing Member’s reasonable discretion. Managing Member’s failure to respond to KBS’s request for the approval of a Transfer within five (5) business days following delivery of KBS’s written request for such consent shall be deemed to constitute Managing Member’s consent. A “KBS Affiliate” is any entity in which at least fifty-one percent (51%) of the ownership interests is owned, directly or indirectly, through one or more intermediaries, by KBS Strategic Opportunity REIT, Inc.

(d) JV Member Transfers. Any direct or indirect constituent owner of JV Member may transfer all or any portion of such constituent owner’s direct or indirect ownership interest in JV Member so long as Xxxx Xxxxxx continues to serve as the Manager of JV Member.

In the event of any Permitted Transfer, any such Permitted Transferee shall receive and hold such Interest, such ownership interest or portion thereof subject to the terms of this Agreement and to the obligations hereunder of the transferor and there shall be no further transfer of such Interest, such ownership interest or portion thereof except to a person or entity to whom such Permitted Transferee could have transferred such Interest, such ownership interest or portion thereof in accordance with this Section 6.02 had such Permitted Transferee originally been a Member or a constituent owner of a Member as of the date hereof or otherwise in accordance with the terms of this Agreement. Notwithstanding any provision of this Agreement to the contrary, unless approved by all of the Members, no Member and/or any direct or indirect constituent owner of any Member shall transfer all or any portion of such Member’s Interest or

23

permit the transfer of any direct or indirect ownership interest in such Member if such transfer would be a default under the Loan or any Refinance.

6.03. Admission of Substituted Members. If any Member transfers such Member’s Interest to a transferee in accordance with Sections 6.01 or 6.02, then such transferee shall only be entitled to be admitted into the Company as a substituted Member if (i) the Members approve such admission in writing and this Agreement is amended to reflect such admission; (ii) the non-transferring Member approves the form and content of the instrument of transfer; (iii) the transferor and transferee named therein execute and acknowledge such other instruments as the non-transferring Member may deem reasonably necessary to effectuate such admission; (iv) the transferee in writing accepts and adopts all of the terms and conditions of this Agreement, as the same may have been amended; (v) the transferor pays, as the non-transferring Member may reasonably determine, all reasonable expenses incurred in connection with such admission, including, without limitation, legal fees and costs; and (vi) to the extent required the lender under the Loan or any Refinance has consented to such transfer. To the maximum extent permitted by applicable law, any transferee of an Interest who does not become a substituted Member shall have no right to require any information or account of the Company’s transactions, to inspect the Company books, or to vote on any of the matters as to which a Member would be entitled to vote under this Agreement. Any such transferee shall only be entitled to share in such Net Profits and Net Losses, to receive such distributions, and to receive such allocations of income, gain, loss, deduction or credit or similar items to which the transferor was entitled, to the extent transferred. A Member that transfers such Member’s Interest pursuant to Section 6.02 shall not cease to be a Member of the Company until the admission of the transferee as a substituted Member in accordance with this Agreement and, except as provided in the preceding sentence, shall continue to be entitled to exercise, and shall continue to be subject to, all of the other rights, duties and obligations of such Member under this Agreement.

6.04. Election; Allocations Between Transferor and Transferee. Upon the transfer of the Interest of any Member or the distribution of any property of the Company to a Member, the Company shall file, in the reasonable discretion of the Members, an election in accordance with applicable Treasury Regulations, to cause the basis of the Company property to be adjusted for federal income tax purposes as provided by Sections 734 and 743 of the Code. Upon the transfer of all or any part of the Interest of a Member as hereinabove provided, Net Profits and Net Losses shall be allocated between the transferor and transferee on the basis of a computation method that is in conformity with the methods prescribed by Section 706 of the Code and Treasury Regulation Section 1.706-1(c)(2) and approved by the Members affected by the method.

6.05. Waiver of Withdrawal and Purchase Rights. In accordance with the Act, each Member acknowledges and agrees that such Member may not voluntarily withdraw, resign or retire from the Company without the prior written consent of each other Member, which consent may be withheld in each such other Member’s sole and absolute discretion. Each Member further acknowledges and agrees that such Member shall not be entitled to receive the fair market value of such Member’s Interest in the Company pursuant to the Act.

ARTICLE VII

KBS’S RIGHT TO CAUSE SALE OF THE PROJECTS

24

7.01. KBS’s Right to Sell the Projects.

(a) At any time after the second anniversary of the date hereof, Co-Managing Member shall have the continuing right to solicit offers from third parties to sell any or all of the Projects in one or more transactions; provided that prior to soliciting any such offers the Co-Managing Member shall provide written notice to JV Member (a “Sale Notice”) of its intent to solicit offers for any or all of the Projects. Each Sale Notice shall set forth the proposed sales price (the “Proposed Project Value”) of the applicable Project(s) that Co-Managing Member desires to sell (each a “Proposed Sale Project”). For thirty (30) days following receipt of a Sale Notice, JV Member may elect to buy the Proposed Sale Project(s) described in the applicable Sale Notice from the Company (a “Purchase Election”). If a Purchase Election is timely made, the closing of the purchase and sale of the applicable Proposed Sale Project(s) shall take place on a date agreed upon by KBS and JV Member, which date may not be later than sixty (60) days following the date of the applicable Sale Notice (a “Purchase Closing Date”). To be effective, the Purchase Election must be accompanied by (a) a non refundable (but applicable to the purchase price) cash deposit (the “Deposit”) made to KBS equal to five percent (5%) of the Proposed Project Value, and (b) a draft sales agreement (a “Purchase Agreement”) to be executed by KBS and the JV Member containing such terms to which such parties may agree that are consistent with the provisions of this Section 7.01 and that provides for the transfer of the applicable Proposed Sale Project(s) free and clear of the Loan or any Refinance applicable to such Proposed Sale Project(s). KBS and JV Member shall use their good faith diligent efforts to execute the Purchase Agreement within ten (10) business days thereafter. Notwithstanding anything stated to the contrary herein, if the parties are unable to agree upon the Purchase Agreement after good faith and diligent efforts to do so or the JV Member fails to close the purchase of the applicable Proposed Sale Project(s) on or before the applicable Purchase Closing Date, KBS shall have the right to terminate the Purchase Agreement (if executed) and retain the Deposit as liquidated damages (whether or not the Purchase Agreement is executed), and the Purchase Agreement shall so provide, and thereafter, KBS shall have the right to cause the Company to sell the applicable Proposed Sale Project(s) pursuant to this Section 7.01.