EX-10.35 4 a2227553zex-10_35.htm EX-10.35 AMENDED AND RESTATED MONARCH OIL PIPELINE, LLC GATHERING AND TRANSPORTATION SERVICES AGREEMENT

Exhibit 10.35

AMENDED AND RESTATED MONARCH OIL PIPELINE, LLC

GATHERING AND TRANSPORTATION SERVICES AGREEMENT

THIS AMENDED AND RESTATED GATHERING AND TRANSPORTATION SERVICES AGREEMENT (“Agreement”), is made and entered into the 23rd day of October, 2015 (“Effective Date”) by and between MONARCH OIL PIPELINE, LLC, a Delaware limited liability company (“Monarch”), and Xxxxx Energy, LLC, a limited liability company (“Shipper”). Monarch and Shipper are each sometimes hereinafter individually referred to as a “Party” and together referred to as the “Parties”.

1. Shipper and Monarch have entered into the Gathering and Transportation Services Agreement, dated as of September 26, 2014 (the “Original Agreement”).

2. Monarch intends to construct, own, and operate a pipeline gathering system with an initial projected capacity of 30,000 Barrels of Crude Oil per Day (“BPD”) that will transport Crude Oil from Central Receipt Point(s) (“CRPs”) in the South Lipscomb Area in Xxxxxxxx County, Texas to the Xxxxx Station in Section 161 in Xxxxxxxx County, Texas (“Gathering System”); to construct, own, and operate the “Xxxxx Station,” a facility located at the terminus of the Gathering System consisting of inlet meters (measuring all Crude Oil entering the Xxxxx Station from the Gathering System), a minimum of four (4) automated truck unloading facilities, a minimum of 10,000 BPD of Crude Oil operational storage tank facilities, vapor recovery equipment, and a crude oil heater that may be utilized as necessary in the event Crude Oil is delivered that does not meet the specifications herein; and to construct, own and operate pipeline transportation facilities consisting of an 8-inch pipeline capable of transporting approximately 30,000 BPD of Crude Oil from the Xxxxx Station to Plains Pipeline, LP’s (“Plains”) Reydon Station located in Xxxxx Xxxxx County, Oklahoma (“Transportation System”), which facilities collectively are referred to as the “Pipeline.”

3. The entirety of the Pipeline, when used by Shipper to transport Crude Oil from the CRP(s) to Plains is a “Common Carrier” subject to the jurisdiction of the Federal Energy Regulatory Commission (“FERC”), which regulates the interstate transportation of Crude Oil under authority set forth in the Interstate Commerce Act (“ICA”).

4. Shipper holds certain oil and gas leases located in Xxxxxxxx and Hemphill Counties, Texas (as described on Exhibit B), and has Crude Oil production therefrom that it desires to have gathered and transported by Monarch on and through the Pipeline.

5. In exchange for Shipper’s commitment to ship Crude Oil produced from its oil and gas leases for a specified term, Monarch is willing to gather and transport a specified volume of Crude Oil for Shipper for a specified term and at a committed transportation fee on the Pipeline, subject to and upon the terms and conditions of this Agreement.

6. The Parties desire to amend and restate the Original Agreement in its entirety to read as set forth below.

In consideration of the mutual covenants, promises and agreements in this Agreement, and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Parties agree as follows:

SECTION I

DEFINITIONS

A. The following capitalized terms used in this Agreement and the attached exhibits and schedules shall have the meaning set forth below:

i. “Actual Shipments” means the volumes of Crude Oil tendered by Shipper at the Receipt Point(s) for ultimate delivery to the Delivery Point(s) for the account of Shipper.

ii. “Affiliate” means any Person, corporation, partnership, limited partnership, limited liability company, or other legal entity, whether of a similar or dissimilar nature, which (i) controls, either directly or indirectly, a Party, or (ii) is controlled, either directly or indirectly, by such Party, or (iii) is controlled, either directly or indirectly, by a Person or entity which directly or indirectly controls such Party. As used in this definition, “control” means the ownership of (or the right to exercise or direct) fifty percent (50%) or more of the voting rights in the appointment of directors of such entity, or fifty percent (50%) or more of the interests in such entity.

iii. “Agreement” shall have the meaning set forth in the initial paragraph.

iv. “API Gravity” or “Gravity” means Gravity determined in accordance with the ASTM International (formerly known as the American Society for Testing and Materials) (“ASTM”) Designation D-287-82 or the latest revision thereof.

v. “Applicable Law” means with respect to any Person, property or matter, any of the following applicable thereto: any statute, law, regulation, ordinance, rule, judgment, rule of common law, order, decree, governmental approval, concession, grant, franchise, license, agreement, directive, ruling, guideline, policy, requirement or other governmental restriction or any similar form of decision of, or determination by, or any interpretation, construction or administration of any of the foregoing, by any Governmental Authority, in each case as amended.

vi. “Area of Mutual Interest” or “AMI” means the areas depicted on Exhibit B and described as (i) “South Xxxxxxxx” and located in Xxxxxxxx and Hemphill Counties, Texas and a two (2) mile radius surrounding the South Lipscomb Area, and (ii) “Hemphill” and located in Xxxxxxxx County, Texas, and a two (2) mile

radius surrounding the Hemphill Area, and from which Shipper’s Crude Oil is dedicated to this Agreement.

vii. “Barrel” or “bbl” means forty-two (42) gallons of 231 cubic inches per gallon at 60 degrees Xxxxxxxxxx (00x F).

viii. “BPD” shall have the meaning set forth in the Recitals.

ix. “BS&W” means basic sediment, water and other impurities.

x. “Business Day” means any day other than a Saturday, Sunday or other day on which banks in the State of Texas are permitted or required to close.

xi. “Xxxxx Station” shall have the meaning set forth in the Recitals.

xii. “Central Receipt Point” or “CRPs” means inlet flange of Monarch’s facilities at the receipt points located along the Gathering System for the purpose of receiving Shipper’s Crude Oil, and any other points mutually agreed upon in the future at which Monarch will receive Shipper’s Crude Oil. Each CRP shall be equipped with (i) automated communication equipment to allow for remote monitoring and control of Gathering System pumps at each such location and (ii) a LACT Unit. The CRPs are described on Exhibit F.

xiii. “Commencement Date” means the Pipeline’s in-service date which shall be the first Day of the Month following the date Monarch notifies Shipper that Monarch has obtained all required operating permits and/or necessary regulatory approvals and the required amounts of line and tank fill have been delivered by Shipper to Monarch in accordance with Monarch’s Tariff to the extent necessary to commence Crude Oil commercial service.

xiv. “Committed Rate” shall have the meaning set forth in Section VIII.A.

xv. “Committed Shipper” means a Shipper entering into this Agreement with Monarch, a pro forma version of which shall be made available in the open season that Monarch shall hold beginning Fourth Quarter, 2014 (“Open Season”), provided that Shipper commits a Dedication to the Pipeline for a set term in exchange for a Committed Volume, as set forth in Exhibit A to this Agreement. A Committed Shipper may also be referred to herein as a “Dedicated Firm Shipper.”

xvi. “Committed Volume” means the maximum volume of Crude Oil (stated in BPD) that Monarch commits to gather and/or transport for Shipper in exchange for a Committed Shipper’s Dedication, as set forth in Exhibit A to this Agreement.

xvii. “Connection Timing Commitment” shall have the meaning set forth in Section VI.C.ii.

xviii. “Crude Oil” means naturally occurring, unrefined petroleum product composed of hydrocarbon deposits of varying grades.

xix. “Day” means a period of twenty-four (24) consecutive hours commencing at 12:01 A.M. and ending at 12:00 A.M. prevailing Central Time.

xx. “Dedication” means Shipper’s dedication, subject to Section VI.A, to Monarch and/or its Affiliates, for the Term except and to the extent released hereunder, of all of Shipper’s recoverable Crude Oil or Shipper’s Affiliate’s recoverable Crude Oil produced from oil and gas xxxxx located within the Area of Mutual Interest in which Shipper or its Affiliates now or hereafter owns, controls, acquires, and has the right to sell, market (as such marketing rights may change from time to time), or otherwise dispose of and that is not subject to a Prior Dedication as of the Effective Date (or, for subsequently acquired interests within the Area of Mutual Interest, that is not subject to a Prior Dedication as of the date of acquisition). Shipper agrees that the entirety of Shipper’s Crude Oil subject to Shipper’s Dedication shall be delivered by Shipper to Monarch and/or its Affiliates either at the CRP(s) or at the automated truck unloading stations at the Xxxxx Station or at the well site(s) as governed by the Intrastate Agreement where Monarch and/or its Affiliates shall receive the Crude Oil for its transportation in accordance with this Agreement.

xxi. “Delivery Point(s)” means the outlet flange of Monarch’s facilities at or near the Plains Reydon Station interconnect in Xxxxx Xxxxx County, Oklahoma and each point on Monarch’s System identified as a point where Monarch can deliver Crude Oil out of its System. The Delivery Point(s) are described on Exhibit C.

xxii. “Disclosing Party” shall have the meaning set forth in Section XXII.A.

xxiii. “Excess Volume” shall have the meaning set forth in Section VI.B.i.

xxiv. “Expedited Temporary Release” shall have the meaning set forth in Section VI.A.v.b.

xxv. “Expedited Temporary Release Period” shall have the meaning set forth in Section VI.A.v.b.

xxvi. “Facilities” means the interstate Pipeline facilities described in the Recitals.

xxvii. “FERC” shall have the meaning set forth in the Recitals.

xxviii. “Force Majeure” shall have the meaning set forth in Section XVI.

xxix. “Gathering System” shall have the meaning set forth in the Recitals.

xxx. “General Commodity Rate” means the rate paid by an Uncommitted Shipper to use the Pipeline.

xxxi. “Governmental Authority” means any court, government (federal, tribal, state, local, or foreign), department, political subdivision, commission, board, bureau, agency, official, or other regulatory, administrative, or governmental authority.

xxxii. “Governmental Authorizations” means any authorization, approval or permit from any national, regional, state, local or municipal government, or any political subdivision, agency, commission or authority thereof (including any maritime authorities, port authority or any quasi-governmental agency) having jurisdiction over a Party or its Affiliates, the Pipeline, or any of the activities contemplated by this Agreement pursuant to this Agreement.

xxxiii. “Xxxxxxxx Area” means the lands identified on Exhibit B as “Xxxxxxxx”.

xxxiv. “Information Receiving Party” shall have the meaning set forth in Section XXII.A.

xxxv. “Initial Committed Rate Period” shall have the meaning set forth in Exhibit A.

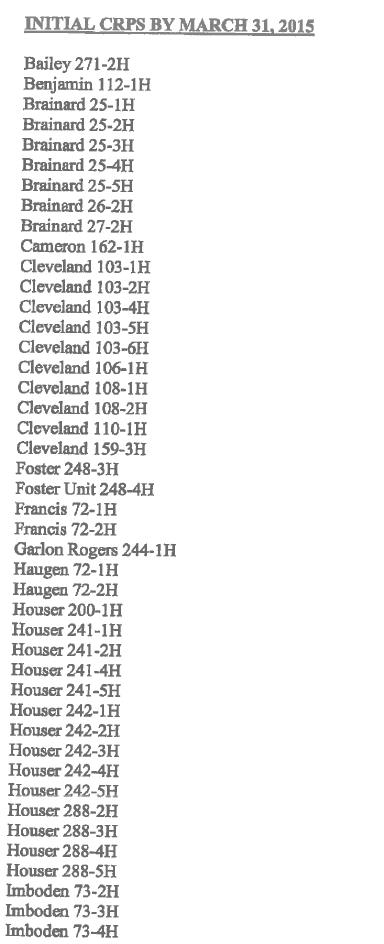

xxxvi. “Initial CRP(s)” means the 119 CRPs identified in Exhibit F. For purposes of this Agreement, the locations specified on Exhibit F shall become Initial CRPs on the date at such time they become connected to the Gathering System.

xxxvii. “Interruption” and “Curtailment” shall have the meaning set forth in Monarch’s Rules and Regulations Tariff, or any successor thereto, which was filed initially in FERC Docket No. IS15-618.

xxxviii. “Interstate Commerce Act” shall have the meaning set forth in the Recitals.

xxxix. “Intrastate Agreement” shall have the meaning set forth in Section IV.D.

xl. “LACT Unit” means an oil industry standard lease automated custody transfer unit comprised of a Coriolis mass measurement meter and BS&W monitor, as well as other necessary controls.

xli. “Losses” means all losses, liabilities, damages, claims, demands, fines, penalties, costs, or expenses, including reasonable attorneys’ fees and court costs.

xlii. “Month” means a calendar month beginning at 12:01 am on the first day of the calendar month and ending at 12:01 am on the first day of the next calendar month.

xliii. “Monarch” shall have the meaning set forth in the introduction and shall include its heirs, successors, and assignees.

xliv. “Ninety Percent Cap” shall have the meaning set forth in Section VI.A.ii.b.

xlv. “Notice(s)” shall have the meaning set forth in Section XXII.B.

xlvi. “Party” or “Parties” shall have the meaning set forth in the initial paragraph.

xlvii. “Person” shall be broadly interpreted to include, without limitation, any corporation, company, partnership, trust, governmental authority or individual.

xlviii. “Pipeline” shall have the meaning set forth in the Recitals.

xlix. “Plains” shall have the meaning set forth in the Recitals.

l. “Primary Point” means the Delivery Point(s) identified as a “Primary Point” on Exhibit A.

li. “Primary Term” shall have the meaning set forth in Section IV.A.

lii. “Prior Dedication” shall have the meaning set forth in Section VI.A.vii.

liii. “Proration” shall have the meaning set forth in Monarch’s Rules and Regulations Tariff, or any successor thereto.

liv. “Prorationed Capacity” shall have the meaning set forth in Section VII.A.

lv. “Receipt Point(s)” means the point at which Crude Oil is accepted into the Pipeline listed in Monarch’s Rates Tariff, or hereafter designated by Monarch. The CRPs are Receipt Point(s) on Monarch’s Pipeline.

lvi. “Secondary Term” shall have the meaning set forth in Section IV.A.

lvii. “Services” shall mean the transportation of Crude Oil and other related services for Shipper’s account on the Monarch Pipeline from the Receipt Point(s) to the Delivery Point(s) as specified in Shipper’s nomination.

lviii. “Shipper” shall have the meaning set forth in the introduction and shall include its heirs, successors, and assignees.

lix. “Shipper’s Crude Oil” means the Crude Oil produced from oil and gas xxxxx in which Shipper or its Affiliates owns or controls an interest and has the right to market.

lx. “South Xxxxxxxx Area” means the lands identified on Exhibit B as “South Xxxxxxxx” and located in Xxxxxxxx and Hemphill Counties, Texas.

lxi. “System” means the facilities, including the pipeline, tanks, pumps and other associated facilities that Monarch owns an interest in, and to which this TSA applies.

lxii. “Tariff” shall have the meaning set forth in Section V.

lxiii. “Term” shall have the meaning set forth in Section IV.A.

lxiv. “Temporary Release” shall have the meaning set forth in Section VI.A.v.

lxv. “Total Average Daily Delivered Volumes” shall mean the average quantity of Barrels of Crude Oil delivered each Day to the Delivery Point(s) and to all delivery points connected to the Gathering System off of pipelines owned by Monarch and/or its Affiliate(s), by Shipper during a consecutive three (3) Month period (excluding any Temporary Release periods); except that, for the fourth (4th), fifth (5th), and sixth (6th) Months following the Commencement Date, the Total Average Daily Delivered Volumes shall be based on the average quantity of Barrels of Crude Oil delivered each Day to the Delivery Point(s) and to all delivery points connected to the Gathering System off of pipelines owned by Monarch and/or its Affiliate(s) by Shipper during a one (1) Month period (excluding any Temporary Release periods).

lxvi. “Transportation System” shall have the meaning set forth in the Recitals.

lxvii. “Treating Fee” shall have the meaning set forth in Section IX.A.

lxviii. “Uncommitted Shipper” means a shipper that is not a Committed Shipper.

lxix. “Uneconomic” shall have the meaning set forth in section IV.B.

B. Rules of Interpretation

i. Unless otherwise specified therein, all terms defined in this Agreement shall have the defined meanings when used in any certificate or other document made or delivered pursuant hereto.

ii. As used herein, and in any certificate or other document made or delivered pursuant hereto, (i) the words “include”, “includes” and “including” shall be deemed to be followed by the phrase “without limitation”, (ii) the word “incur” shall be construed to mean incur, create, issue, assume, become liable in respect of or suffer to exist (and the words “incurred” and “incurrence” shall have correlative meanings), and (iii) references to agreements or other contracts shall, unless otherwise specified, be deemed to refer to such agreements or contracts as amended, supplemented, restated or otherwise modified from time to time.

iii. The words “hereof”, “herein” and “hereunder” and words of similar import, when used in this Agreement, shall refer to this Agreement as a whole and not to any particular provision of this Agreement, and Section, Schedule and Exhibit references are to this Agreement unless otherwise specified.

iv. The meanings given to terms defined herein shall be equally applicable to both the singular and plural forms of such terms.

SECTION II

REQUEST FOR SERVICE

In exchange for Shipper’s Dedication, Shipper hereby requests that Monarch provide gathering and transportation services so that Shipper’s Crude Oil may move over and through the Pipeline from the Receipt Point(s) to the Delivery Point(s).

SECTION III

AGREEMENT TO PROVIDE SERVICE

A. In consideration of the terms and conditions herein and in response to such request, Monarch agrees, subject to Applicable Law and any applicable termination rights set forth herein, to provide interstate gathering and/or transportation service of Crude Oil from the Receipt Point(s) to the Delivery Point(s).

B. Execution of this Agreement, without material modification, provides sufficient commercial justification for the Pipeline project to move forward. Shipper acknowledges that non-material modifications may be necessary as a result of the Open Season process, to be consistent with FERC policy. If the FERC requires modifications to the Agreement, then the Parties shall negotiate in good faith to revise necessary elements of the Agreement in order to satisfy applicable FERC requirements.

C. Additional Open Season. Monarch shall have the right, but not the obligation, to conduct additional open seasons for the Pipeline in order to contract with new or existing shippers for uncommitted or expansion capacity or capacity that has been made available due to the termination or expiration of Pipeline transportation services agreements.

SECTION IV

TERM

A. This Agreement shall commence on the Commencement Date and continue in effect for a period of ten (10) years (the “Primary Term”). Thereafter, the Agreement shall automatically renew for consecutive one year periods (each, a “Secondary Term” and together with the Primary Term, the “Term”). Either Party may terminate this Agreement

by written Notice to the other Party not less than one (1) year prior to expiration of the Primary Term or any Secondary Term.

B. Monarch reserves the right, on a not unduly discriminatory or preferential basis, to reject or seek renegotiation of the terms under which Monarch shall continue the gathering of Shipper’s Crude Oil on the Gathering System should Monarch determine that gathering Shipper’s Crude Oil at any CRP becomes Uneconomic because of insufficient volume, or if all or part of Monarch’s Gathering System receiving Shipper’s Crude Oil becomes Uneconomic to operate, maintain, or repair because of the delivery of insufficient volumes of Crude Oil. Monarch has the right to deem a CRP and any associated part of the Gathering System “Uneconomic” if the average BPD over a ninety (90) Day period at a particular CRP is less than twenty (20) BPD for a CRP with one production well behind the CRP and thirty (30) BPD for a CRP with more than one production well behind the CRP; provided, however, that no Initial CRP or any part of the Gathering System connecting the Initial CRPs to the Delivery Point(s) as of the Commencement Date, as such Gathering System and Initial CRPs are set forth on Exhibit F, shall ever be deemed Uneconomic during the Primary Term. In the event of a CRP or part of the Gathering System being declared Uneconomic, Monarch shall have the right to suspend receipt of a Shipper’s Crude Oil at that CRP or part of the Gathering System, without liability as long as such condition exists, by giving Shipper ninety (90) Days advance written Notice of such suspension. During the ninety (90) Day Notice period, the Parties agree to meet to discuss and negotiate in good faith new terms for the applicable CRP or part of the Gathering System under which Monarch would continue to gather Shipper’s Crude Oil for transportation on the Gathering System. If the Parties are unable to reach agreement as to a remedy to such condition within thirty (30) Days of the end of the Notice period, either Shipper or Monarch may cause the CRP(s) or part(s) of the Gathering System in question and any part of the Dedication intended for delivery to such CRP(s) or part(s) of the Gathering System shall be permanently released from this Agreement.

C. During any Secondary Term, in the event Monarch declares all or part of Monarch’s Gathering System Uneconomic, Monarch shall have the right to suspend operations of the Gathering System or the affected part thereof without liability as long as such condition exists by providing Shipper with ninety (90) Days advance written Notice of the suspension. The Parties agree to meet within fifteen (15) Days after receipt of such Notice to discuss and negotiate in good faith alternative terms to remedy such Uneconomic Gathering System condition. If the Parties are unable to reach agreement as to a remedy to such condition within thirty (30) Days of the end of the Notice period, Monarch may elect to terminate gathering operations with respect to all of its Gathering System if it has been declared Uneconomic or such part as has been declared Uneconomic and shall provide Shipper thirty (30) Days prior written Notice of its intent to terminate such operations. If Monarch terminates all or part of its gathering operations pursuant to this Section IV.C, either Shipper or Monarch shall have the right to and may so cause the Dedication impacted by such termination to be permanently released from this Agreement.

D. Notwithstanding anything to the contrary in Sections IV.B or IV.C, Monarch shall have the right to take a LACT unit out of service at a particular CRP and remove such CRP

from this Agreement, pursuant to the terms set forth in the Amended and Restated Firm Crude Oil Gathering and Transportation Agreement dated October 23, 2015 (“Intrastate Agreement”). Promptly after removing any such CRP in accordance with this Section IV.D, Monarch shall amend Exhibit F to reflect the removal of such CRP from this Agreement. All non-pipeline and trucking activities for Shipper’s Crude Oil from the CRPs listed on Exhibit F and any non-CRP-connected xxxxx located within the AMI shall be governed by the Intrastate Agreement.

SECTION V

MONARCH FACILITY OBLIGATIONS

A. Monarch will operate the Pipeline, to the extent it provides service in interstate commerce, as an interstate common carrier oil pipeline as defined by the Interstate Commerce Act.

B. Monarch shall use commercially reasonable efforts to place the Pipeline in service by November 1, 2015. If the Pipeline is not in service by November 1, 2015, then Shipper shall have the right to contract for alternative transportation of Shipper’s Crude Oil for consecutive ninety (90) Day periods until such time as the Pipeline is in service, provided that if the Pipeline goes in service during one such ninety (90) Day period, Shipper shall have no obligation to transport Shipper’s Crude Oil on the Pipeline until the expiration of that ninety (90) Day period.

C. Prior to the Commencement Date, Monarch shall file with FERC a tariff applicable to pipeline gathering and transportation under this Agreement containing the rules and regulations governing the gathering and transportation of Crude Oil in the Pipeline and a tariff governing the gathering and transportation rates (collectively “Tariff,” which shall include any and all supplements thereto and successive issues thereof). All shipments of Crude Oil on the Pipeline by Shipper shall be governed by the Tariff and all applicable statutes, rules and regulations governing common carrier pipelines and related facilities; provided, however, that this understanding shall not be deemed to lessen or impair any of Shipper’s obligations hereunder. Shipper expressly agrees to abide by the terms of the Tariff. Monarch may revise the Tariff from time to time, so long as such revisions do not materially conflict with the terms of this Agreement. To the extent there is any conflict between the provisions of the Tariff and the terms of this Agreement, the terms of the Tariff shall govern.

SECTION VI

TRANSPORTATION SERVICES

A. Dedication Obligations.

i. In exchange for Shipper’s Dedication, Shipper shall become a Committed Shipper and shall have a priority right to its Committed Volume at the Committed Rate.

Only Shipper’s Crude Oil shall be eligible for shipment as part of Shipper’s Committed Volume.

ii. A Dedicated Firm Shipper shall be permitted to adjust its Committed Volume subject to the following conditions:

a. After the first five (5) years of the Primary Term, Monarch will annually downward adjust a Dedicated Firm Shipper’s Committed Volume based upon 120% of Shipper’s deliveries of Barrels of Crude Oil to the Pipeline averaged for the immediate prior calendar year, if applicable based upon Shipper’s deliveries of Crude Oil in the prior calendar year.

b. After the first five (5) years of the Primary Term, if capacity is available, a Dedicated Firm Shipper will be permitted to adjust its Committed Volume upward based upon 120% of Shipper’s deliveries of Barrels of Crude Oil to the System averaged for the immediate prior calendar year, provided that the aggregate Committed Volumes of Committed Shippers cannot exceed ninety percent (90%) of the normal operating capacity of the Pipeline (“Ninety Percent Cap”). If Monarch receives a request from a single Dedicated Firm Shipper, and such request would result in Monarch exceeding the Ninety Percent Cap, Monarch will allocate the requested volume to the single Dedicated Firm Shipper up to the level that reaches the Ninety Percent Cap. If Monarch receives simultaneous upward adjustment requests from two or more Dedicated Firm Shippers, and such requests would result in Carrier exceeding the Ninety Percent Cap, Monarch will allocate such upward adjustment volume requests pro rata to each of the Dedicated Firm Shippers in accordance with the increased volume each such Dedicated Firm Shipper elects to adjust, not to exceed the Ninety Percent Cap in aggregate. Notwithstanding anything to the contrary in this provision, Monarch may accept an upward adjustment request that exceeds the Ninety Percent Cap upon agreement by Monarch to undertake and complete an expansion of its Pipeline, and the volume of such upward adjustment that exceeds the Ninety Percent Cap will become part of such Dedicated Firm Shipper’s Committed Volume effective on the date such expansion is completed and available for service. Any upward adjustment to a Dedicated Firm Shipper’s Committed Volume will take effect on first day of the Month following the adjustment request.

iii. Shipper warrants that it has the authority to make such Dedication. Shipper covenants that (i) no subsequent transfer of any interest in the AMI shall be made without being made subject to this Dedication obligation, as set forth in Section VI.A.vii and (ii) prior to the effectiveness of any such transfer, Shipper shall provide to Monarch transferee’s acknowledgement of this Dedication.

iv. Shipper reserves the following rights: (i) to operate the xxxxx producing from the AMI as a reasonably prudent operator; (ii) to operate separation and tankage

facilities on the well site at surface production facilities on or well the well(s) producing from the AMI; (iii) to pool, communitize, or unitize Shipper’s interests in the AMI; (iv) to use Crude Oil for lease operations (excluding any type of major secondary or tertiary recovery projects); and (v) to distribute Crude Oil in-kind to various third parties as required by contractual obligations of Shipper in effect prior to the date hereof (or, for any later acquired interests, prior to the date of the acquisition), including lessors and royalty owners as required by the applicable provisions of any such oil and gas lease.

v. During any event(s) of Force Majeure as defined in Section XVI herein, Extended Force Majeure Event, Prorationed Capacity, or Interruption and Curtailment affecting Monarch’s ability to accept Shipper’s Dedication for a period in excess of seven (7) Days, Shipper shall have a temporary release from this Dedication, but only for those Barrels: (1) not accepted by the Gathering System or Transportation System; or (2) intended for delivery to the Receipt Point(s) affected by such Force Majeure, Extended Force Majeure Event, Prorationed Capacity or Interruption and Curtailment (“Temporary Release”); except that, if the cause of any event(s) of Force Majeure, Extended Force Majeure Event, Prorationed Capacity, or Interruption and Curtailment is due solely to the individual or collective gross negligence of Shipper and/or any Affiliate, agent, or subcontractor thereof, Shipper shall be granted a Temporary Release, but shall be required to pay Monarch the Committed Rate as though the Barrels subject to the Temporary Release constituted Actual Shipments over and through the Gathering System and/or Transportation System, a notarized accounting of which shall be provided to Monarch within fifteen (15) Days of Shipper resuming deliveries to the Gathering System and/or Transportation System following the end of such Temporary Release.

a. For the duration of any such Temporary Release, Shipper will be free to dispose of released Crude Oil volumes under other arrangements in Shipper’s sole discretion, provided that Shipper shall make commercially reasonable efforts to sell Shipper’s released Crude Oil volumes to the owner of the pipeline(s) immediately downstream of the Delivery Point(s), and/or its affiliates. To the extent Shipper was able to sell Shipper’s released Crude Oil volumes to the owner of the pipeline(s) immediately downstream of the Delivery Point(s), and/or its affiliates, Shipper shall resume deliveries of released Crude Oil volumes to the Gathering System or Pipeline no later than the third (3rd) Day following delivery of Notice by Monarch stating that the Force Majeure, Extended Force Majeure, Prorationed Capacity, or Interruption and Curtailment has ended and Monarch is able to accept delivery of all such released volumes. For all other temporarily released volumes, Shipper’s temporary release from the Dedication shall end, and Shipper shall resume deliveries of released Crude Oil volumes to the Gathering system or Transportation System, no later than the first (1st) Day of the fourth (4th) month following delivery of Notice by Monarch stating that the Force Majeure, Extended Force

Majeure, Prorationed Capacity or Interruption and Curtailment has ended and Monarch is able to accept delivery of all such released volumes of Shipper’s Crude Oil.

b. Notwithstanding the requirements in Section VI.A.v, above, Shipper’s Temporary Release shall commence prior to the expiration of the seven (7) Day period if waiting the full seven (7) Days will cause Shipper to shut in production xxxxx within the AMI and expediting the release is the only way to avoid the shut in (“Expedited Temporary Release”). The Expedited Temporary Release period shall last only until the expiration of the seven (7) Day waiting period set forth in Section VI.A.v (“Expedited Temporary Release Period”). Shipper may sell its Crude Oil at the affected CRP(s) or at the Xxxxx Station to third-parties through the end the Expedited Temporary Release period only. The provisions in Section VI.A.v.a, above, shall not apply until the Expedited Temporary Release Period has expired. Shipper shall provide Notice to Monarch prior to releasing Shipper’s Crude Oil in an Expedited Temporary Release. The Notice shall state that the release meets the criteria of this Section VI.A.v.b for an Expedited Temporary Release.

vi. Within twenty-one (21) Days of any event(s) of Force Majeure or Interruption and Curtailment affecting Monarch’s ability to accept Crude Oil produced from Shipper’s Dedication, Monarch shall provide Shipper with Notice to the extent Monarch anticipates such event(s) will last longer than one hundred and eighty (180) Days (the “Extended Force Majeure Event”). Monarch’s notification shall include a good faith estimate of the length of the Extended Force Majeure Event and when Monarch anticipates it again will be able to accept Crude Oil produced from Shipper’s Dedication. Shipper and Monarch will work together in good faith to find alternative gathering and/or transportation services for Crude Oil produced from Shipper’s Dedication and affected by the Extended Force Majeure Event. The term of any such alternative gathering and/or transportation service agreement must end no later than the first (1st) Day of the second (2nd) full or calendar Month following Monarch’s notification’s estimated end date for the Extended Force Majeure Event.

vii. The Dedication does not include any Crude Oil that has previously been dedicated to another pipeline or market prior to the Effective Date (or in the case of subsequently acquired interests, prior to the date of such acquisition) (the “Prior Dedication”). Shipper shall not extend marketing or transportation agreements governing Crude Oil subject to a Prior Dedication(s) beyond the end of the longest primary contract term associated with the transportation and/or marketing of that particular Crude Oil. Upon termination of such agreements, all Crude Oil subject to the Prior Dedication(s) shall be deemed part of Shipper’s Dedication hereunder for the remaining Term of this Agreement.

viii. If any Shipper transfers any right, title, or interest in the Dedication, such transfer shall be made subject to this Agreement and any such transfer shall not impair the Dedication herein to Monarch. Shipper shall notify Monarch of any such transfer within ten (10) Business Days of the effective date thereof. Shipper shall notify in writing any transferee that such acreage remains dedicated to Monarch pursuant to this Agreement and Shipper shall ensure that any such transfer is accompanied with appropriate contractual language requiring the transferee to deliver Crude Oil subject to the Dedication to Monarch during the Term of and in accordance with this Agreement. Any such transfer or Shipper’s failure to notify Monarch thereof shall not impair Monarch’s rights under this Agreement as against Shipper; provided that Monarch shall release and waive any rights under this Agreement it may have against Shipper if and to the extent the transferee enters into an agreement with Monarch on substantially the same terms as those provided herein in respect of the transferred rights, title or interest in Crude Oil subject to the Dedication.

ix. If Shipper transfers any right, title, or interest in some, but not all of the Dedication, in addition to the requirements of VI.A.viii above, any right, title, or interest retained by Shipper shall remain subject to this Agreement and the Dedication, and Shipper’s Committed Rate and right to make a Priority Capacity Election, as set forth in Exhibit A to this Agreement, shall not be affected by the transfer. All of Shipper’s right, title, or interest in Crude Oil subject to the Dedication will continue to be subject to the Dedication and Shipper’s Committed Volume and Committed Rate will remain unchanged.

x. On thirty (30) Days prior written Notice, Monarch shall have the right at its expense, at reasonable times during business hours, to audit the books and records of Shipper to the extent necessary to verify the accuracy of any statement or representation of Shipper related to Shipper’s Dedications, Prior Dedications or other prior obligations.

B. Rights to Unutilized Capacity

i. Subject to available capacity, Shipper shall have the right during each Month of the Term, but not the obligation, to ship Shipper’s Crude Oil in excess of Shipper’s Committed Volume (“Excess Volume”) at its Committed Shipper rate. Monarch agrees to transport such Excess Volume subject to available capacity and the provisions set forth in Monarch’s Tariff including, but not limited to, Monarch’s prorationing provisions. If Shipper delivers any quantities of Crude Oil that do not constitute Shipper’s Crude Oil, it shall nominate those quantities separately, and Monarch is only obligated to gather and/or transport those quantities subject to available capacity at the General Commodity Rate.

ii. Shipper agrees that, to the extent it does not utilize its Committed Volume in any Month, Monarch may utilize such unused capacity for the provision of Services to other shippers without impacting the payment or Dedication obligations of

Shipper under this Agreement. Any unused Committed Volume will be made available on a first-come, first-serve basis for Committed Shippers’ Excess Volume prior to being made available subject to the rules and regulations in Monarch’s Tariff.

C. Provision of Services

i. Subject to the terms and conditions of this Agreement and to the extent permitted by Applicable Law, Monarch agrees, as of the Commencement Date and continuing thereafter during the Term, to receive each Month from Shipper volumes of Crude Oil at the Receipt Point(s), as properly nominated and tendered by Shipper, up to Shipper’s Committed Volume and to redeliver equivalent volumes of Crude Oil to Shipper at one or more of the Delivery Point(s). To the extent Shipper has a contractual obligation to sell Shipper’s Crude Oil to Plains at one or more of the Primary Point(s) beginning on the Commencement Date, Shipper agrees to transport through Monarch’s Facilities to the Primary Point(s) at least sixty-five percent (65%) of such Crude Oil volumes governed by that agreement.

ii. Monarch agrees to connect to the Gathering System any future newly-drilled xxxxx drilled by Shipper within the South Xxxxxxxx Area and located within one (1) mile of the Gathering System, within five (5) Days of completion of any such well, and prior to first production, subject to events of Force Majeure (the “Connection Timing Commitment”). The Connection Timing Commitment will only apply to xxxxx for which Shipper notifies Monarch of the completion date at least forty-five (45) Days in advance of completion. In the event that Shipper does not notify Monarch at least forty-five (45) Days in advance of the completion date for a well, then Gatherer will commit to connecting the new well within forty-five (45) Days of receiving the Notice from Shipper. Monarch may, in its sole discretion connect any future newly-drilled well located further than one (1) mile from the Gathering System (or received by truck Shipper’s Crude Oil produced from such well and transport and deliver such Shipper’s Crude Oil at its own expense as provided in the Intrastate Agreement), provided that Monarch has no obligation connect or receive from such well as set forth above in this sentence, then the Parties may negotiate in order to attempt to reach mutually agreeable terms to connect such well under an alternate fee structure and the Parties will amend this Agreement to memorialize any such agreement. If the Parties are unable to mutually agree on terms to connect any future newly-drilled well located in the AMI and subject to the Dedication in accordance with the foregoing, then Shipper shall deliver Shipper’s Crude Oil produced from such well to the Xxxxx Station, or an Affiliated system point, as applicable, by means other than through the Gathering System for further transportation on facilities owned and operated by Monarch and/or its Affiliates.

iii. Monarch’s duty to provide Services under this Section VI.C shall be subject to the provisions of the Tariff. In addition, Monarch may refuse to accept any Barrels of

Crude Oil from Shipper for Services if Shipper is in violation of the Tariff or if Shipper is in breach of this Agreement at the time the volumes of Crude Oil are tendered to Monarch.

D. This Agreement does not govern any commercial storage services. Monarch has working tanks that are needed by Monarch to transport Crude Oil, but has no other tanks and, therefore, does not have facilities for rendering, nor does it offer, a commercial storage service. Monarch will use its operational storage facilities, as necessary, to manage the Pipeline to allow for the gathering and transportation of Shipper’s Crude Oil pursuant to Shipper’s confirmed nominations for transportation to the Delivery Point(s). Monarch will not accept for gathering or transportation any Crude Oil volumes for which Shipper has not made the necessary arrangements for shipment beyond the Delivery Point(s) or has not provided the necessary facilities for receiving said Crude Oil as it arrives at the Delivery Point(s). Provisions for storage during transit in facilities furnished by Shipper at points on Monarch’s system will be permitted to the extent authorized by Monarch.

SECTION VII

PRIORITY CAPACITY ELECTION

A. Monarch will follow a Proration policy as set forth in the Tariff when the amount of Crude Oil nominations properly submitted by all system shippers exceeds the Pipeline’s capacity for a given Month. The capacity available for service during the Month of allocation (design capacity less any reduction in capacity because of Interruption and Curtailment or Force Majeure as defined in the Rules and Regulations Tariff) is the “Prorationed Capacity.”

B. Monarch will maintain ninety percent (90%) of the Prorationed Capacity for a Committed Shipper Priority Capacity Election program. Shipper is eligible to make a Priority Capacity Election should the Pipeline enter into a period of Proration. Subject to reduced Pipeline capacity (as a result of, for example, Interruption and Curtailment or Force Majeure), Priority Capacity will be available to Shipper during periods of proration up to the level of Shipper’s Committed Volume for Shipper’s Crude Oil. Shipper may elect and secure Priority Capacity by paying a one cent ($0.01) per Barrel premium over the General Commodity Rate set forth in the Tariff. In the event that the Prorationed Capacity is less than design capacity (as a result of, for example, Interruption and Curtailment or Force Majeure), the Priority Capacity available for each Committed Shipper will be allocated pro rata in accordance with each Committed Shipper’s respective Committed Volume.

SECTION VIII

TARIFF RATES AND CHARGES

A. Committed Rate. The “Committed Rate” is the rate per Barrel that Shipper agrees to pay for its Actual Shipments of Committed Volumes during the Term, as that rate may be

changed from time to time during the Term in accordance with the provisions of this Agreement. The Committed Rate that Shipper agrees to pay as of the Commencement Date is set forth in Exhibit A attached hereto. The Committed Rate will be published in Monarch’s Tariff and shall at all times be less than the General Commodity Rate, except when Shipper makes a Priority Capacity Election, and at those times, only to the extent necessary to secure capacity in excess of the capacity to which Shipper is entitled by operation of the Proration policy in the absence of a Priority Capacity Election. The Committed Rate is not required to be cost-based to meet a statutory “just and reasonable” standard as long as the rate is set in a manner that is not unduly preferential or discriminatory.

B. Excess Volumes. Shipper shall pay the Committed Rate then applicable to Shipper for any Excess Volumes above its Committed Volume that Shipper ships in a Month.

C. General Commodity Rate. Shipper shall pay the General Commodity Rate for any Barrels that Shipper ships in a Month that do not constitute Shipper’s Crude Oil.

D. Settlement Rates. To the extent permitted by Applicable Law, Monarch may, at its election, file the Committed Rate, including the initial Committed Rate and any subsequent changes thereto pursuant to the terms of this Agreement, as Settlement Rates in the Rates Tariff under 18 C.F.R. § 342.4(c) and Shipper expressly agrees to support such filings.

E. Fees and Charges of General Application. Shipper shall be subject to fees and charges set forth in the Tariff.

F. Monarch shall have the right to adjust the rates set forth herein, including the Committed Rates, each July 1 in accordance with FERC indexing methodology as described in 18 C.F.R. § 342.3, subject to the following qualifications. In a given index year (July 1 through June 30), Monarch’s maximum annual rate adjustment shall be the lesser of (a) the generally applicable index adjustment as published by FERC for that given index year and (b) three percent (3%). In the event that application of the generally applicable index adjustment as published by FERC for a given index year would result in a rate decrease, Monarch shall not be required to decrease its rates by more than three percent (3%). Any such rate adjustment shall be prorated for the first index year Monarch is in service by multiplying (i) the lesser of the index adjustment or three percent (3%) by (ii) a fraction, the numerator of which is the number of Days between the Commencement Date and June 30 of the index year and the denominator of which is 365. The Committed Rate shall never be lower than the rate agreed to in this Agreement, as set forth in Exhibit A to this Agreement.

SECTION IX

NOMINATIONS, QUALITY, AND PRORATIONING

A. Nominations. Shipper shall follow the nomination procedures set forth in the Tariff.

B. Quality. Quality provisions in the Tariff, or its successor, shall be applicable to the Crude Oil delivered by Shipper. Shipper acknowledges that Shipper’s Crude Oil may be commingled with other Crude Oil produced by third parties and that the Crude Oil delivered by Monarch at the Delivery Point(s) will not necessarily be the identical Crude Oil delivered by Shipper at the Receipt Point(s). Monarch agrees to keep Shipper whole should commingling result in a deviation in Shipper’s average Gravity delivered to the Pipeline through implementation of a Quality Bank as set forth in Monarch’s Rules and Regulations Tariff. Shipper agrees to a Crude Oil “Treating Fee” in the event Shipper delivers out of spec Crude Oil which contaminates the Pipeline, as set forth in the Rules and Regulations Tariff. Monarch’s obligation to treat Shipper’s Crude Oil is limited to the use of Facilities described in this Agreement. Monarch is not obligated to purchase or construct any such additional facilities after the Commencement Date to treat Shipper’s Crude Oil.

C. Line Fill and Tank Fill. The Line Fill and Tank Fill provisions in Monarch’s Rules and Regulations Tariff, or its successor, shall be applicable to the Crude Oil delivered hereunder.

D. Prorationing. Capacity on the Monarch Pipeline shall be allocated in accordance with Monarch’s Rules and Regulations Tariff or its successor.

SECTION X

MEASUREMENT, MANAGEMENT, CUSTODY, AND RISK OF LOSS OF CRUDE OIL

A. Monarch and Shipper shall measure Crude Oil delivered hereunder as provided in accordance with Monarch’s Rules and Regulations Tariff and pursuant to the Quality Bank set forth in Monarch’s Rules and Regulations Tariff.

B. Control and possession of the Crude Oil received under this Agreement shall pass from Shipper to Monarch at the Receipt Point(s).

C. Control and possession of the Crude Oil delivered under this Agreement shall pass from Monarch to Shipper at the Delivery Point(s).

D. Each Shipper shall be allocated a pro-rata share of actual volumetric losses incurred on the Pipeline due to evaporation, measurement, and other losses in transit (“Line Loss” or “Pipeline Loss Allowance) Pipeline adjustments will be made on the basis of total quantities received and will be assessed at the CRP(s).

SECTION XI

DUTY TO SUPPORT

A. Shipper’s Duty to Support Prior to Commencement Date. To the extent not inconsistent with Applicable Law, Shipper hereby agrees prior to the Commencement Date: (a) to reasonably support and cooperate — and not to oppose, obstruct or otherwise interfere in any manner, direct or indirect — with the efforts of Monarch to obtain all governmental, regulatory and other authorizations and approvals necessary for the construction and operation of the Pipeline in the form and manner proposed by Monarch; ; and (b) to not take, directly or indirectly, any action that (i) is designed to delay review or approval of any petitions or applications to any Governmental Authorities related to the Pipeline, or (ii) would materially and adversely affect the Pipeline or this Agreement. Notwithstanding the foregoing, nothing herein shall prevent Shipper from (i) protesting any regulatory or other filings that are in conflict with the terms of this Agreement, and (ii) proceeding in any manner consistent with Applicable Law if this Agreement is terminated or if the Pipeline has been abandoned by Monarch.

B. Shipper’s Duty to Support Tariff Filings. To the extent consistent with Applicable Law, Shipper hereby agrees during the Term of this Agreement not to protest, complain, or take any action, nor recommend or cause any affiliated entity or other entity to protest, complain, or take any action, that is designed to or may delay review or approval of the filing of the Tariff, including the Committed Rate, with FERC or any other governing body, unless such tariff filings are in conflict with the terms of this Agreement.

SECTION XII

EVENTS OF DEFAULT

A Party becomes a “Defaulting Party” and the following actions shall constitute “Default” if the Defaulting Party shall (i) make an assignment or any general arrangement for the benefit of creditors; (ii) file a petition or otherwise commence, authorize, or acquiesce in the commencement of a proceeding or case under any bankruptcy or similar law for the protection of creditors or have such petition filed or proceeding commenced against it; (iii) otherwise become bankrupt or insolvent (howsoever evidenced); (iv) be unable to pay its debts as they fall due; (v) have a receiver, provisional liquidator, conservator, custodian, trustee or other similar official appointed with respect to it or substantially all of its assets; or (vi) consolidate or amalgamate with, or merge with or into, or transfer all or substantially all of its assets to another entity and, at the time of such consolidation, amalgamation, merger or transfer, the resulting, surviving or transferee entity fails to assume all of the obligations of the Party under this Agreement by operation of law or pursuant to another agreement reasonably satisfactory to the other Party (“Non-Defaulting Party”), then the Non-Defaulting Party, in addition to any and all other remedies available hereunder or pursuant to law, shall have at its sole election and upon Notice thereof to the Defaulting Party, the right to immediately withhold, refuse or suspend performance under this Agreement or the Tariff and the right to terminate this Agreement by designating in any such Notice the effective date of termination (which effective date of termination shall not be earlier than the Day such Notice is given and not later than twenty (20) Days after such Notice is given).

SECTION XIII

ADEQUATE ASSURANCES

If at any time Shipper assigns the Agreement in connection with the sale of all or substantially all of its assets, or in connection with a merger, consolidation, or other reorganization, at the time of and following such assignment, by Notice to Shipper, Monarch may require any of the following (individually and collectively, “Adequate Assurance”) prior to Monarch’s obligation to continue to provide services hereunder: (1) prepayment of estimated Fees to be held by Monarch without interest accruing thereon in advance of a delivery month; (2) a cash deposit in an amount satisfactory to Monarch; (3) a letter of credit at Shipper’s expense in an amount and from a financial institution satisfactory to Monarch; or (4) a guaranty in an amount and from a third party acceptable to Monarch. Shipper shall provide such Adequate Assurance within two (2) Business Days of demand therefore.

SECTION XIV

TAXES

Shipper shall pay or cause to be paid, and agrees to indemnify and hold harmless Monarch from and against the payment of, all excise, gross production, severance, sales, occupation, and all other taxes; and all charges, or impositions of every kind and character required by statute or by any Governmental Authority with respect to Shipper’s Crude Oil (other than margin or franchise taxes or taxes imposed upon income, profits or gains of Monarch) and the handling thereof prior to receipt by Monarch. Monarch shall pay or cause to be paid all taxes and assessments, if any, imposed upon Monarch for the activity of gathering and/or transporting Shipper’s Crude Oil after receipt and prior to its redelivery by Monarch at the Delivery Point(s). Neither Party shall be responsible or liable for any taxes or other statutory charges levied or assessed against the facilities of the other Party used for the purpose of carrying out the provisions of this Agreement. Shipper shall indemnify and save Monarch harmless from and against all loss, cost, damage, and expense of every character and in kind resulting from any adverse claims made with respect to all Crude Oil, royalties, taxes, payments or other charges, and Monarch has the right to suspend its receipt of any of Shipper’s Crude Oil subject to such claims until they are resolved to Monarch’s satisfaction.

SECTION XV

LAWS AND REGULATIONS

A. The Parties acknowledge that the Pipeline is subject to regulation by FERC and may be subject to regulation by other Federal or State agencies with jurisdiction over the facilities to be constructed and the transaction contemplated by this Agreement, or any of their successors. The Parties agree to comply with all such Applicable Laws, rules and regulations.

B. The Parties acknowledge that Monarch is a common carrier for hire, and this Agreement and all gathering and transportation services performed by it on the Gathering System

and/or Transportation System for Shipper pursuant to this Agreement in interstate commerce, shall be subject to the rules and regulations in Monarch’s Tariff and its successors; provided, as between Monarch and Shipper, if there is a conflict between the terms and conditions of this Agreement and the Tariff, the Tariff will govern and control. Monarch shall be responsible for filing with FERC all necessary tariffs and/or amendments to the Tariff in order to provide to Shipper the gathering and transportation services contemplated by this Agreement. For purposes of the Tariff, this Agreement shall be deemed: (i) a term contracted Transportation Service Agreement (“TSA”) with Monarch whereby Shipper has agreed to terms and conditions associated with supporting the initial construction of a pipeline of Monarch, and shall enjoy all of the rights and benefits provided to such agreements in the Tariff and pursuant to FERC rules and regulations. The Committed Rate set forth in this TSA is not required to be cost-based to meet a statutory “just and reasonable” standard as long as the rate is set in a manner that is not unduly preferential or discriminatory

SECTION XVI

FORCE MAJEURE

A. The term “Force Majeure,” shall mean any cause or event not reasonably within the control of the Party whose performance is sought to be excused thereby, including (1) acts of God, strikes, lockouts, or other industrial disputes or disturbances, acts of the public enemy, wars, blockades, insurrections, riots, epidemics, landslides, lightning, earthquakes, fires, tornadoes, hurricanes, storms, severe winter weather, and warnings for any of the foregoing which may necessitate the precautionary shut-down of xxxxx, plants, pipelines, the Pipeline, truck unloading facilities; (2) failure of any parties downstream of the Delivery Point(s) (except for downstream parties that are Affiliates of Monarch) to timely install or provide interconnection or receipt facilities, or other related facilities; (3) floods, washouts, arrests and restraints of governments and people, civil disturbances, explosions, sabotage, breakage or accidents to equipment, machinery, plants, truck unloading facilities, other related facilities, or lines of pipe; (4) the making of repairs or alterations to lines of pipe, the Pipeline, truck unloading facilities, plants or equipment; (5) freezing of xxxxx or lines of pipe; (6) electric power shortages; (7) necessity for compliance with any court order, or any law, statute, ordinance, regulation or order promulgated by a Governmental Authority having or asserting jurisdiction, unless such necessity arises as a result of Monarch’s or its Affiliates’ failure to comply with any Applicable Law (provided that Monarch shall be permitted to resist in good faith the application to it of any such law by all reasonable legal means) ; (8) inability to obtain necessary permits, rights of way or materials for construction, maintenance or operations provided same were timely and diligently pursued; (9) inclement weather that necessitates extraordinary measures and expense to construct facilities or maintain operations; and (10) any other causes, whether of the kind enumerated herein or otherwise, not reasonably within the control of the Party claiming suspension, including any such cause or event occurring with respect to the facilities, services, equipment, goods, supplies or other items necessary to the performance of such Party’s obligations hereunder. “Force Majeure” also includes any event of Force Majeure occurring with

respect to the facilities or services of either Party’s Affiliates or service providers providing a service or providing any equipment, goods, supplies or other items necessary to the performance of such Party’s obligations hereunder.

B. If Party is rendered unable, wholly or in part, by Force Majeure to carry out its obligations under this Agreement (other than the obligation to make payments of monies due hereunder), then Party shall give prompt written Notice of the Force Majeure stating facts supporting such claim of inability to perform. Thereupon, Party’s obligation to perform shall be suspended during the period it is unable to perform because of the Force Majeure, but for no longer period, and this Agreement shall otherwise remain unaffected. Party shall use due diligence to remove the cause of Force Majeure, where commercially practicable, with all reasonable dispatch; provided, however, that this provision shall not require the settlement of strikes, lockouts, or other labor difficulty, when such course is determined inadvisable by Party.

C. During any event(s) of Force Majeure affecting Monarch’s ability to transport Shipper’s Dedication, Shipper shall be released from its obligation hereunder to deliver the Crude Oil to Monarch at the Receipt Point(s) pursuant to Sections VI.a.v and XX.x.xx.

SECTION XVII

MAINTENANCE

A. Monarch shall have the exclusive responsibility, control and management over the operation, maintenance and repair of the Facilities. Monarch shall perform its obligations under this Agreement in a good and workmanlike manner, in its judgment as a reasonably prudent operator, and in conformity with the practices in the industry and particular circumstances operating in Xxxxxxxx County, Texas and Xxxxx Xxxxx County, Oklahoma.

B. Monarch may interrupt its performance for a reasonable period of time for the purpose of making necessary or desirable inspections, alterations, and repairs (“Maintenance”) and Monarch shall give Shipper reasonable Notice of its intention to suspend its performance, except in cases of emergency where such Notice is impracticable or in cases where the operations of Shipper will not be affected. Monarch shall endeavor to arrange such interruptions so as to inconvenience Shipper as little as possible. For these circumstances, the provisions of Item No. 110(a) of the Rules and Regulations, or its successor, shall apply.

C. During any event(s) of Maintenance affecting Monarch’s ability to transport Shipper’s Dedication for a period in excess of seven (7) Days, such Maintenance shall be deemed an Interruption and Curtailment event and Shipper shall be released from its obligation hereunder to deliver the Crude Oil to Monarch at the Receipt Point(s) pursuant to Sections VI.a.v and XX.x.xx.

SECTION XVIII

A. Except as otherwise provided in this Section XVIII, neither Party may assign all or a portion of its rights and obligations under this Agreement without the prior written consent of the non-assigning Party, provided that such consent shall not be unreasonably withheld or delayed.

B. Notwithstanding Section XVIII.A, either Party shall have the right without the prior consent of the other Party to: (i) assign its rights and obligations under this Agreement (in whole or in part) to an Affiliate; (ii) mortgage, pledge, encumber, or otherwise impress a lien, create a security interest or otherwise assign as collateral its rights and interests in and to the Agreement to any lender; (iii) make a transfer pursuant to any security interest arrangement described in (ii) above, including any judicial or non-judicial foreclosure and any assignment from the holder of such security interest to another Person; or (iv) assign the Agreement in connection with the sale of all or substantially all of its assets, or in connection with a merger, consolidation, or other reorganization. If a Party assigns its rights and obligations under this Agreement (in whole or in part) pursuant to clauses (i) or (iv) above, such Party shall require the assignee to assume such Party’s obligations hereunder and become a signatory to this Agreement, and such assignee shall be bound by the terms herein.

C. If Monarch desires to sell the Pipeline to an unaffiliated third party prior to its completion, including through a change of control (excepting a public offering of equity or other ownership by Monarch), Monarch will require the buyer of the Pipeline to assume Monarch’s obligations under this Agreement, along with any future modification to the Facilities contemplated in this Agreement.

SECTION XIX

LIMITATION ON LIABILITY AND INDEMNITY

A. Shipper’s Liability and Indemnification.

i. Shipper shall be in control and possession of the Crude Oil until delivered to Monarch at the Receipt Point(s) and following delivery of the Crude Oil by Monarch at the Delivery Point(s). Monarch shall be in control and possession of the Crude Oil following delivery by Shipper at the Receipt Point(s) and prior to re-delivery to Shipper at the Delivery Point(s).

ii. Shipper agrees to indemnify, defend, and hold harmless Monarch from any and all Losses arising from or out of personal injury or property damage attributable to Shipper’s Crude Oil when Shipper shall be deemed to be in control and possession of Shipper’s Crude Oil as provided in Section XIX.A.i. Monarch agrees to indemnify, defend, and hold harmless Shipper from all Losses arising from or out of personal injury or property damage attributable to Shipper’s Crude Oil when Monarch shall be deemed to be in control and possession of Shipper’s Crude Oil as provided in Section XIX.A.i. THE INDEMNITIES SET FORTH IN THIS SECTION XIX.A.ii ARE TO BE CONSTRUED WITHOUT REGARD TO

THE CAUSES THEREOF, INCLUDING THE NEGLIGENCE OF ANY INDEMNIFIED PARTY, WHETHER SUCH NEGLIGENCE BE SOLE, JOINT, OR CONCURRENT, OR ACTIVE OR PASSIVE, OR THE STRICT LIABILITY OF ANY INDEMNIFIED PARTY OR OTHER PERSON. Each Party agrees that its voluntary and mutual indemnity agreement will be supported by insurance and that such insurance shall not be deemed to be a cap on liability.

B. Disclaimer of Damages. A PARTY’S LIABILITY HEREUNDER SHALL BE LIMITED TO DIRECT ACTUAL DAMAGES ONLY. SUCH DIRECT ACTUAL DAMAGES SHALL BE THE SOLE AND EXCLUSIVE REMEDY, AND ALL OTHER REMEDIES OR DAMAGES AT LAW OR IN EQUITY ARE WAIVED. NEITHER PARTY SHALL BE LIABLE HEREUNDER TO THE OTHER PARTY OR ITS AFFILIATES FOR SPECIAL, CONSEQUENTIAL, INCIDENTAL, PUNITIVE, EXEMPLARY, OR INDIRECT DAMAGES, LOST PROFITS (OTHER THAN DIRECT, ACTUAL LOST PROFITS), OR OTHER BUSINESS INTERRUPTION OR SIMILAR DAMAGES, BY STATUTE, IN TORT, OR CONTRACT, UNDER ANY INDEMNITY PROVISION OR OTHERWISE. IT IS THE INTENT OF THE PARTIES THAT THE LIMITATIONS HEREIN IMPOSED ON REMEDIES AND THE MEASURE OF DAMAGES BE WITHOUT REGARD TO THE CAUSE OR CAUSES RELATED THERETO, INCLUDING THE STRICT LIABILITY OR NEGLIGENCE OF ANY PARTY, WHETHER SUCH STRICT LIABILITY OR NEGLIGENCE BE SOLE, JOINT, OR CONCURRENT, OR ACTIVE OR PASSIVE.

SECTION XX

REPRESENTATIONS AND WARRANTIES

A. Representations and Warranties of Shipper. Shipper represents and warrants that:

i. It is duly organized and validly existing under the laws of the jurisdiction of its organization or incorporation and has all requisite legal power and authority to execute, deliver and perform its obligations and duties in this Agreement;

ii. This Agreement constitutes the valid, legal and binding obligation of Shipper, enforceable in accordance with the terms contained in this Agreement;

iii. The execution, delivery and performance by Shipper of this Agreement does not and will not conflict with or result in any breach or contravention of, or the creation of any lien or other encumbrance under, any contractual obligation to which Shipper is a party or to which the Crude Oil is subject.

iv. There are no actions, suits or proceedings pending before any court or administrative body that are likely to materially adversely affect the ability of Shipper to meet and carry out its obligations under this Agreement.

v. The Crude Oil that Shipper gathers and transports subject to its Committed Volume is produced from Shipper’s Dedication.

vi. That Shipper controls or has the right to market the interest in the Crude Oil, and has the right to ship and/or market said Crude Oil, free from all liens and adverse claims of title and Monarch has the right to suspend its receipt of any of Shipper’s Crude Oil subject to any title claims until they are resolved to Monarch’s satisfaction.

vii. Shipper will release, indemnify and defend Monarch from and against any and all damages, claims, actions, expenses, penalties and liabilities, including attorney’s fees, arising from any breach of the foregoing representations and warranties.

viii. The representations and warranties in this Agreement shall survive the execution of this Agreement and shall remain in full force and effect for the entire Term.

B. Representations and Warranties of Monarch. Monarch represents and warrants that:

i. It is duly organized and validly existing under the laws of the jurisdiction of its organization or incorporation and has all requisite legal power and authority to execute, deliver and perform its obligations and duties in this Agreement;

ii. This Agreement constitutes the valid, legal and binding obligation of Monarch, enforceable in accordance with the terms contained in this Agreement;

iii. The execution, delivery and performance by Monarch of this Agreement does not and will not conflict with or result in any breach or contravention of, or the creation of any lien or other encumbrance under, any contractual obligation to which Monarch is a party or to which the Crude Oil is subject.

iv. There are no actions, suits or proceedings pending before any court or administrative body that are likely to materially adversely affect the ability of Monarch to meet and carry out its obligations under this Agreement.

v. Monarch will release, indemnify and defend Shipper from and against any and all damages, claims, actions, expenses, penalties and liabilities, including attorney’s fees, arising from any breach of the foregoing representations and warranties.

vi. The representations and warranties in this Agreement shall survive the execution of this Agreement and shall remain in full force and effect for the entire Term of this Agreement.

SECTION XXI

FUTURE EXPANSIONS OF THE PIPELINE

Subject to Monarch’s rights and obligations pursuant to the Interstate Commerce Act and other Applicable Law, Monarch shall have the right, at its sole discretion, to expand the capacity of all or parts of the Pipeline at any time or from time to time; provided, however, that no such expansion shall degrade the Services provided hereunder. Monarch reserves the right to hold an additional open season and to enter into transportation services agreements for the capacity added during any expansion at terms to be determined by Monarch. Any such expansion shall not affect the obligations established in this Agreement.

SECTION XXII

A. Confidentiality. A Party that receives information (“Information Receiving Party”) shall maintain in the strictest confident, for the benefit of the other Party (“Disclosing Party”), all information pertaining to the financial terms of or payments under this Agreement, the Disclosing Party’s methods of operation, methods of the Facility, and the like, whether disclosed by the Disclosing Party or discovered by the Information Receiving Party, unless such information either (i) is in the public domain through no act or omission of the Information Receiving Party or its employees or agents, (ii) was already known to the Information Receiving Party at the time of disclosure and which the Information Receiving Party is free to use or disclose without breach of any obligation to any person or entity, (iii) is required to be disclosed by Applicable Law, or (iv) is disclosed to regulators in furtherance of obtaining regulatory approval, provided that such disclosure is provided under seal. Neither Party shall use such information for its own benefit, publish or otherwise disclose it to others, or permit its use by others for their benefit or to the detriment of the other Party. Notwithstanding the foregoing, the Information Receiving Party may disclose such information to any auditor or to the Information Receiving Party’s lenders, attorneys, accountants and other personal advisors; any prospective purchaser of the Facility; or pursuant to lawful process, subpoena or court order; provided the Information Receiving Party, in making such disclosure, advises the party receiving the information of the confidentiality of the information and obtains the agreement of said party not to disclose the information.

B. Notice. Except for nominations submitted pursuant to Section IX.A, all notices and other communications required or permitted under this Agreement (each, a “Notice”) shall be in writing and addressed as set forth herein. Any Notice shall be deemed to have been duly made and the receiving Party charged with receipt of such Notice (i) if personally delivered, when received, (ii) if sent by electronic mail, telecopy or facsimile transmission, on the Business Day on or which such electronic mail, telecopy, or

facsimile is successfully transmitted and received, or if such electronic mail, telecopy, or facsimile transmission was successfully transmitted and received after 5:00 pm local time of the receiving party, then the next Business Day, (iii) if mailed by certified mail, return receipt requested, the fifth (5th) Business Day after mailing, or (iv) if sent by overnight courier, on the day such Notice is successfully delivered to the receiving party. All Notices shall be addressed as follows

|

|

Notices and Correspondences: |

|

|

|

|

Shipper: |

Xxxxx Energy, LLC |

|

|

Attn: Xxxxxx Xxxxxxx |

|

|

000 Xxx Xxxxx Xxxxxxx, Xxxxx 000 |

|

|

Xxxxxx, Xxxxx 00000 |

|

|

Telephone: (000) 000-0000 |

|

|

Facsimile: |

|

|

E-mail: xxxxxxxx@xxxxxxxxxxx.xxx |

|

|

|

|

Monarch: |

Monarch Oil Pipeline, LLC |

|

|

Attn: Xxxxxx Xxxxxxxx |

|

|

0000 XXX Xxxxxxx, Xxxxx 000 |

|

|

Xxxxxxxxx Xxxxxxx, Xxxxxxxx 00000 |

|

|

Telephone: (000) 000-0000 |

|

|

Facsimile: (000) 000-0000 |

|

|

E-mail: xxxxxxxxx@xxxxxx.xxx |

Any Party may, by written Notice so delivered to the other Party, change the address or individual to which delivery shall thereafter be made in accordance with this Section XXII.B.

C. Memorandum of Agreement. The Parties agree to promptly execute and record a Memorandum of Crude Oil Gathering and Transportation Agreement substantially in the form of Exhibit D following the execution of this Agreement.

D. Governing Law: Venue and Jurisdiction. This Agreement shall be construed, enforced, and interpreted according to the laws of the State of Texas, without regard to the conflicts of law rules thereof. Any action brought in respect of this Agreement must be brought in the state or federal courts sitting in Xxxxxx County, Texas.

E. Waiver. No waiver of any breach of this Agreement by a Party shall be held to be a waiver of any other or subsequent breach.

F. Amendments. This Agreement may not be amended nor any rights hereunder waived except by an instrument in writing signed by the Party to be charged with such amendment or waiver and delivered by such Party to the Party claiming the benefit of such amendment or waiver.

G. Counterparts. This Agreement may be executed in any number of counterparts, each of which shall be deemed an original instrument, but all of which together shall constitute but one and the same instrument. Facsimile signatures shall be considered binding.

H. Entire Agreement. This Agreement constitutes the entire understanding among the Parties with respect to the subject matter hereof, superseding all negotiations, prior discussions and prior agreements and understandings relating to such subject matter. The terms and conditions of this Agreement shall supersede any previous oral or written agreements between the Parties.

I. Binding Effect. This Agreement shall be binding upon, and shall inure to the benefit of the Parties hereto and their respective permitted successors and assigns.

J. Severability. If any part of this Agreement is held to be void or unenforceable by any court or under any law, that part shall be deemed stricken and all remaining provisions shall continue to be valid and binding upon the Parties.

K. No Third-Party Beneficiaries. This Agreement is intended to benefit only the Parties hereto and their respective permitted successors and assigns.

L. Contract Revision. Notwithstanding anything in this Agreement to the contrary, whether express or implied, the Parties do not intend for this Agreement or any provision of this Agreement to be subject to revision by any Governmental Authority, including FERC.

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the Effective Date.

|

XXXXX ENERGY, LLC |

| |

|

SHIPPER |

| |

|

|

| |

|

By: |

/s/ Xxxxx Xxxxx |

|

|

Name: |

Xxxxx Xxxxx |

|

|

Title: |

Chief Executive Officer |

|

|

|

| |

|

|

| |

|

MONARCH OIL PIPELINE, LLC |

| |

|

PIPELINE |

| |

|

|

| |

|

By: |

/s/ Xxxxx Xxxxx |

|

|

Name: |

Xxxxx Xxxxx |

|

|

Title: |

President and COO |

|

EXHIBIT A

ATTACHMENT TO THE

AMENDED AND RESTATED

TRANSPORTATION AND GATHERING SERVICES AGREEMENT

Between

MONARCH OIL PIPELINE, LLC

and

XXXXX ENERGY, LLC

as of the 23rd day of October, 2015

COMMITTED SHIPPER PROGRAM