OFFICE LEASE RUBICON IN WINDWARD

Exhibit 10.11

RUBICON IN WINDWARD

0000 XXXXXXXX XXXXXXX

XXXXXXXXXX, XXXXXXX 00000

Landlord: | Rubicon, L.C.; a Georgia Limited Liability Company | |

Tenant: | Alimera Sciences, Inc. | |

Date: | May 27, 2003 | |

TABLE OF CONTENTS

SECTION | ||

Demising clause | ||

Term | ||

1. | Rent | |

2. | Services | |

3. | Quiet Enjoyment | |

4. | Certain Rights Reserved To The Landlord | |

5. | Estoppel Certificates | |

6. | Indemnification And Waiver Of Certain Claims | |

7. | Liability Insurance | |

8. | Holding Over | |

9. | Assignment And Subletting | |

10. | Condition Of Premises | |

11. | Use Of Premises | |

12. | Repairs | |

13. | Untenantability | |

14. | Eminent Domain | |

15. | Landlord’s Remedies | |

16. | Subordination Of Lease | |

17. | Commencement Of Possession | |

18. | Notices And Consents | |

19. | No Estate In Land | |

20. | Invalidity Of Particular Provisions | |

21. | Miscellaneous Taxes | |

22. | Security Deposit | |

23. | Substitute Premises | |

24. | Brokerage | |

25. | Limitation Of Liability | |

26. | Special Stipulations | |

27. | Attorney’s Fees | |

28. | Construction Of Lease | |

29. | Entire Agreement | |

30. | Interpretation And Enforcement | |

31. | Rider | |

32. | Exhibits | |

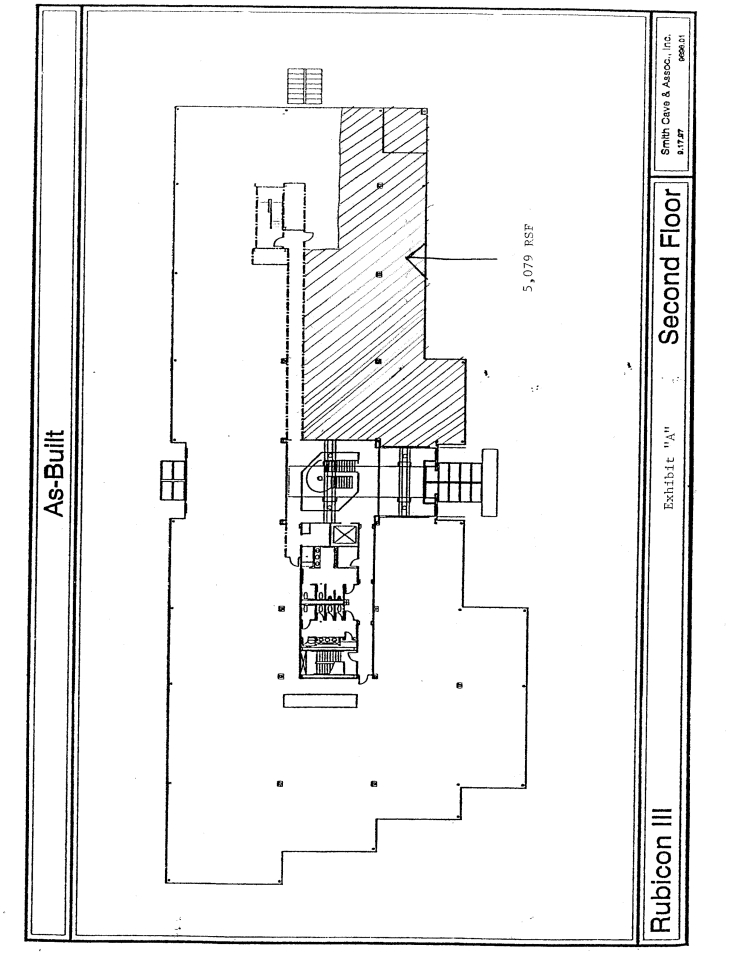

Exhibit “A” - the Premises | ||

Exhibit “B”-Rider | ||

Exhibit “C” -Rules and Regulations | ||

RUBICON IN WINDWARD

LEASE AGREEMENT

This agreement (“Lease”), made and entered into as of this 27 day of May, 2003, by and between Rubicon, L.C., a Georgia limited liability company (“Landlord”) and Alimera Sciences, Inc. (“Tenant”);

Landlord, for and in consideration of the rents, covenants, agreements, and stipulations hereinafter mentioned, reserved and contained, to be paid, kept and performed by the Tenant, and by these presents does lease and rent unto the said Tenant, and said Tenant hereby agrees to lease and take upon the terms and conditions which hereinafter appear, the premises (“Premises”) as shown either outlined or with cross-hatched lines on Exhibit “A” attached hereto and incorporated herein, known as Suite 290 , in the office building (the “Building”) — referred to sometimes herein as “Rubicon in Windward”. The Premises is situated on the 2nd floor(s) of the Building and contains approximately 5,079 rentable square feet. The Building, together with the land containing approximately ten (10) acres on which it is located and all other improvements thereon — sometimes referred to herein as the “Property” and sometimes as the “Project” — is located at 0000 Xxxxxxxx Xxxxxxx xx Xxxxxxxxxx, Xxxxxxx 00000.

The term of this Lease shall be for a period of Three (3) Years beginning on June 1, 2003, and ending at midnight May 31, 2006 hence, except as otherwise expressly provided in this Lease. The term (“Term”) of this Lease shall be for a period of: A) If the Commencement Date occurs on the first day of the Calendar month: 3 years beginning on the Commencement Date and ending at midnight on the day preceding the 3rd anniversary of the Commencement Date; B) if the Commencement Date occurs on any other day of the Calendar month: 3 years and the remainder of the partial month during which the anniversary date of the Commencement Date occurs, beginning on the Commencement Date and ending at midnight on the last day of the calendar month during which the 3rd anniversary of the Commencement Date occurs; except as otherwise expressly provided in this Lease.

The term “Commencement Date” shall mean and refer to the date of the beginning of the Lease as set forth above, except as otherwise set forth in section 17 hereof.

The Premises are to be used for general office use and related purposes and for no other purpose without the prior written consent of Landlord.

1. RENT

(a) The Tenant shall pay to the Landlord as Base Rent, in legal tender, at the Landlord’s office as set forth in Exhibit “B”, or as directed from time to time by Landlord’s notice, the annual amount set forth in Exhibit “B” payable in equal monthly payments as set forth in Exhibit “B” promptly on the first day of every calendar month of the term, except for the first month’s rent which is due and payable on execution of this Lease, and pro rata, in advance for any partial month, without demand, the same being hereby waived and without any set-off or deduction whatsoever. For any rent payment not made when due, Tenant shall pay — except as otherwise provided for herein — a late charge equal to the greater of: i) $100.00 or ii) ten percent (10%) of the overdue amount. The parties agree that such late charge represents a fair and reasonable estimate of the costs Landlord will incur by reason of such late payment. The covenants herein to pay a late charge shall be independent of any other covenant set forth in this Lease and shall be paid without deduction or set-off.

(b) It is understood that the Base Rent specified in Paragraph (a) was negotiated in anticipation that the amount of Operating Expenses on the Property would not exceed $271,970.00 during any calendar year of the term hereof. Therefore, in order that the rental payable throughout the term of the Lease shall reflect any increase in such costs, the parties agree as hereinafter in this Section set forth. The annual Base Rent payable pursuant to Paragraph (a) as increased pursuant to Paragraph (b) of this Section is hereinafter called the “Rent”. Certain terms are defined as follows:

Tenant’s Share: The amount of Tenant’s pro rata share of the increase in Taxes and Operating Expenses over $271,970.00 during each calendar year. Tenant’s pro rata share of such increase is agreed to be 10% .

(A) Operating Expenses shall consist of all expenses, costs and disbursements (but not specific costs billed to specific tenants of the Property) of every kind and nature, computed on the accrual basis, relating to or incurred or paid in connection with the ownership and operation of the Property, including but not limited to, the following:

(i) wages and salaries of all on and off-site employees engaged in the operation, maintenance or access control of the Property, including taxes, insurance and benefits relating to such employees, allocated

1

based upon the time such employees are engaged directly in providing such services;

(ii) all supplies, tools, equipment and materials used in the operation and maintenance of the Property;

(iii) cost of all utilities for the Property including but not limited to the cost of water and power for heating, lighting, air conditioning and ventilating in the common areas;

(iv) cost of all maintenance and service agreements for the Property and the equipment therein, including but not limited to security service, garage operators, window cleaning, elevator maintenance, janitorial service and landscaping maintenance;

(v) cost of management, not to exceed five per cent (5%), of actual base rent received;

(vi) cost of repairs and general maintenance of the Property (excluding repairs, alterations and general maintenance paid by proceeds of insurance or attributable solely to tenants of the Property other than Tenant);

(vii) amortization (together with reasonable financing charges) of the cost of installation of capital investment items which are installed for the purpose of reducing operating expenses, promoting safety, complying with governmental requirements or maintaining the first class nature of the Property, other than capital items installed in connection with Lessor’s initial construction of the Property;

(viii) the cost of all insurance on the Property, including, but not limited to, the cost of casualty, rental abatement and liability insurance applicable to the Property and Lessor’s personal property used in connection therewith; and

(ix) all taxes, assessments and governmental charges, whether or not directly paid by Lessor, whether federal, state, county or municipal and whether they be by taxing districts or authorities presently taxing the Property or by other subsequently created or otherwise, and any other taxes and assessments attributable to the Property or its operation, excluding, however, federal and state taxes on income, death taxes, franchise taxes, and any taxes imposed or measured on or by the income of Lessor from the operation of the Property or imposed in connection with any change of ownership of the Property; provided, however, that if at any time during the term of this Lease, the present method of taxation or assessment shall be so changed that the whole or any part of the taxes, assessments, levies, impositions or charges now levied, assessed or imposed on real estate and the improvements thereof shall be discontinued and as a substitute therefor, or in lieu of an addition thereto, taxes, assessments, levies, impositions or charges shall be levied, assessed and/or imposed wholly or partially as a capital levy or otherwise on the rents received from the Property or the rents reserved herein or any part thereof, then such substitute or additional taxes, assessments, levies, impositions or charges, to the extent so levied, assessed or imposed, shall be deemed to be included within the operating expenses to the extent that such substitute or additional tax would be payable if the Property were the only property of the Lessor subject to such tax.

(B) In order to provide for current payments on account of an increase in the annual Operating Expenses in excess of $271,970.00 , the Tenant agrees, at Landlord’s request, to pay, as additional rent, Tenant’s Share due for the ensuing twelve (12) months, as estimated by Landlord from time to time, in twelve (12) monthly installments, each in an amount equal to 1/12th of Tenant’s Share so estimated by Landlord commencing on the first day of the month following the month, in which Landlord notifies Tenant of the amount of such estimated Tenant’s Share. If, as finally determined, Tenant’s Share shall be greater than or be less than the aggregate of all installments so paid on account to the Landlord for such twelve (12) month period, then Tenant shall pay to Landlord the amount of such underpayment, or the Landlord shall credit Tenant for the amount of such overpayment, as the case may be. It is the intention hereunder to estimate the amount of Operating Expenses for each year and then to adjust such estimate in the following year based on actual Operating Expenses incurred and/or paid by Landlord. The obligation of the Tenant with respect to the payment of Rent shall survive the termination of this Lease. Any payment, refund, or credit made pursuant to this Paragraph (b) shall be made without prejudice to any right of the Tenant to dispute the statement under Paragraph (d) of this Section, or of the Landlord to correct, any item(s) as billed pursuant to the provisions hereof. If the term remaining is less than a full calendar year, then Tenant shall only owe the increase in the Operating Expenses for the full year appropriately adjusted for the period remaining in the Tenant’s Term.

(C) Upon receipt of the Landlord’s statement, Tenant does hereby covenant and agree promptly to pay the increases in Rent pursuant to Paragraph (b) of this Section as and when the same shall become due and payable, without further demand therefore, and without any set-off or deduction whatsoever. Failure to give such statement shall not constitute a waiver by Landlord of its right to require an increase in Rent pursuant to the provisions hereof.

(D) Within thirty (30) days after receipt of such statement, Tenant or its authorized employee shall have the right to inspect the books of Landlord at reasonable times during the business hours of Landlord at Landlord’s office in the

2

Building or, at Landlord’s option, at such other location that Landlord may specify, for the purpose of verifying information in such statement. Unless Tenant asserts specific errors within thirty (30) days after delivery of such statement, the statement shall be deemed to be correct. Such inspection or audit shall be conducted by Tenant or tenant’s employee or Tenant’s auditor; but in no event shall the audit be conducted by a third party whose compensation is contingent upon the results of such audit or the amount of any refund received by Tenant. Tenant hereby agrees to keep the results of any such audit confidential and to require Tenant’s auditor and its employees and each of their respective attorneys and advisors to likewise keep the results of such audit in strictest confidence. In particular, but without limitation, Tenant agrees that: (i) Tenant shall not disclose the results of any such audit to any past, current, or prospective tenant of the Property, and (ii) Tenant shall require, that its auditors, attorneys and anyone associated with such parties shall not disclose the results of such audit to any past, current or prospective tenant in the Property; provided, however, that Landlord hereby agrees that nothing in items (i) or (ii) above shall preclude Tenant from disclosing the results of such audit in any judicial proceeding, or pursuant to any court order or discovery request, or to any agent, representative, or employee or Landlord who or which request the same.

(E) No decrease in Operating Expenses shall reduce Tenant’s Rent below the annual Base Rent set forth in Paragraph (a) of this Section.

(F) All costs and expenses which Tenant assumes or agrees to pay to Landlord pursuant to this Lease shall be deemed additional rent and, in the event of non-payment thereof, Landlord shall have all the rights and remedies herein provided for in case of non-payment of Rent.

2. SERVICES

As long as Tenant is not in default under any of the covenants or provisions of this Lease, Landlord shall maintain the Premises and the public and common areas of the Property, such as lobbies, stairs, atriums, landscaping, corridors and restrooms in good order and condition except for damage occasioned by the act of Tenant, its employees, agents or invitees, and Landlord shall also provide the following services during reasonable and usual business hours for the term of this Lease as follows:

(a) Air conditioning and heat for normal purposes only, to provide in Landlord’s judgment, comfortable occupancy Monday through Friday from 8:00 a.m. to 6:00 p.m. and Saturday from 8:00 a.m. to 12:00 p.m., Sundays and holidays excepted. Tenant agrees not to use any apparatus or device, in or upon or about the Premises which in any way may increase the amount of such services usually furnished or supplied to tenants in the Building, and Tenant further agrees not to connect any apparatus or device with the conduits or pipes, or other means by which such services are supplied, for the purpose of using additional or unusual amounts of such services, without written consent of Landlord. Should Tenant use such services under this provision to excess, Landlord reserves the right to charge for such services. The charge shall be payable as additional rental. Should Tenant refuse to make payment upon demand of Landlord, such excess charge shall constitute a breach of the obligation to pay rent under this Lease and shall entitle Landlord to the rights hereinafter granted for such breach.

(b) Electric power for lighting and operation of office machines, air conditioning and heating as may be required for comfortable occupancy of the Premises between Monday and Friday from 8:00 a.m. to 6:00 p.m., and Saturday from 8:00 a.m. to 12:00 p.m., Sundays and holidays excepted. Electric power furnished by the Landlord is intended to be that consumed in normal office use for lighting, heating, ventilating, air-conditioning and small office machines. Landlord reserves the right, if consumption of electricity exceeds that required for normal office use as specified, to include a charge for such electricity as an addition to the monthly rental with such charge to be based upon the average cost per unit of electricity for this Building applied to the excess use as determined by an independent engineer selected by the Landlord, or at Landlord’s option, to be determined by a submeter to be furnished and installed at Tenant’s expense. If the Tenant refuses to pay upon demand of Landlord such excess charge, such refusal shall constitute a breach of the obligation to pay rent under this Lease and shall entitle Landlord to the rights hereinafter granted for such breach.

(c) Lighting replacement, public restroom supplies, window washing with reasonable frequency, and janitor service to the Premises during the times and in the manner that such janitor services are customarily furnished in general office buildings in the area.

(d) Taxes and insurance on the Premises, except as otherwise provided herein.

(e) Parking will be provided on the parking lots on the Property on an unallocated basis, unless Landlord, within its discretion assigns reserved spaces to some or all tenants or other parties.

(f) Landlord agrees to maintain the exterior and interior of the Building and Property to include lawn and shrub care, snow removal, maintenance of the structure, roof, mechanical and electrical equipment, architectural finish, security, and so on, excluding only those items specifically excepted elsewhere in the Lease.

3

(g) Landlord may (i) close the Building during the period from: 6:00 p.m. until the following 7:00 a.m. each weekday; (ii) open the Building at 8:00 a.m. and close the Building at 12:00 p.m. on Saturday, (iii) close the Building all day Sunday, and reopen the following Monday morning at 7:00 am, (iii) close the Building all holidays, or (iv) close the Building at such other hours as Landlord may from time to time reasonably determine; after which hour admittance may be gained only under such regulations as may from time to time be prescribed by Landlord.

(h) Passenger elevator service, if normally provided for Building, daily from 7:00 a.m. to 6:00 p.m., and Saturday from 8:00 a.m. to 12:00 p.m., Sunday and holidays excepted. Automatic elevator service shall be deemed “elevator services” within the meaning of this paragraph.

Landlord shall make reasonable effort to provide the foregoing services, but in any event, shall not be liable for damages, nor shall the rental herein reserved be abated for failure to furnish or any delay in furnishing any of the foregoing services when there are disturbances or labor disputes of any character, or by inability to secure electricity, fuel, supplies, machinery, equipment or labor, or by the making of necessary repairs or improvements to Premises, or unavailability of utilities due to governmental restrictions or any other conditions beyond Landlord’s control nor shall the temporary failure to furnish any of such services be construed as an eviction of Tenant or relieve Tenant from the duty of observing and performing any of the provisions of this Lease, provided Landlord uses reasonable efforts to cure such interruption.

3. QUIET ENJOYMENT

So long as the Tenant shall observe and perform the covenants and agreements binding on it hereunder, the Tenant shall, at all times during the term herein granted, peacefully and quietly have and enjoy possession of the Premises without any encumbrance or hindrance by, from or through the Landlord.

4. CERTAIN RIGHTS RESERVED TO THE LANDLORD

The Landlord reserves the following rights:

(a) To name the Building and to change the name or street address of the Building.

(b) To install and maintain a sign or signs on the exterior or interior of the Building.

(c) To designate, limit, restrict or prohibit all sources furnishing sign painting and lettering, ice, drinking water, towels, toilet supplies, shoe shining, vending machines, mobile vending service, catering, and like services used on the Premises or in the Building.

(d) During the last ninety (90) days of the term, if during or prior to that time the Tenant vacates the Premises, to decorate, remodel, repair, alter or otherwise prepare the Premises for reoccupancy, without affecting Tenant’s obligation to pay rental for the Premises.

(e) To constantly have pass keys to the Premises.

(f) On reasonable prior notice to the Tenant, to exhibit the Premises to prospective tenants during the last twelve (12) months of the term, and to any prospective purchaser, mortgagee, or assignee of any mortgage on the Property and to others having a legitimate interest at any time during the term.

(g) At any time in the event of an emergency, and otherwise at reasonable times, to take any and all measures, including inspections, repairs, alterations, additions and improvements to the Premises or to the Building, as may be necessary or desirable for the safety, protection or preservation of the Premises or the Building or the Landlord’s interests, or as may be necessary or desirable in the operation or improvement of the Building or in order to comply with all laws, orders and requirements of governmental or other authority.

(h) To install vending machines of all kinds in the Premises, and to provide mobile vending service therefore, and to receive all of the revenue derived therefrom, provided, however, that no vending machines shall be installed by Landlord in the Premises nor shall any mobile vending service be provided therefore, unless Tenant so requests.

5. ESTOPPEL CERTIFICATES

The Tenant shall, within ten (10) days after written request of Landlord, execute, acknowledge, and deliver to the Landlord or to Landlord’s mortgagee, proposed mortgagee, Land Lessor or proposed purchaser of the Property or any part thereof, any estoppel certificates requested by Landlord from time to time, which estoppel certificates shall show whether the Lease is in full force and effect and whether any changes may have been made to the original Lease; whether the term of the Lease has commenced and full rental is accruing; whether there are any defaults by Landlord

4

and, if so, the nature of such defaults, whether possession has been assumed and all improvements to be provided by Landlord have been completed; and whether rent has been paid more than thirty (30) days in advance and that there are no liens, charges, or offsets against rental due or to become due and that the address shown on such estoppel is accurate.

6. INDEMNIFICATION AND WAIVER OF CERTAIN CLAIMS

(a) The Tenant, to the extent permitted by law, waives all claims it may have against the Landlord, and against the Landlord’s agents and employees for damage to person or property sustained by the Tenant or by any occupant of the Premises, or by any other person, resulting from any part of the Property or any equipment or appurtenances becoming out of repair, or resulting from any accident in or about the Property or resulting directly or indirectly from any act or neglect of any tenant or occupant of any part of the Property or of any other person, unless such damage is a result of the negligence of Landlord, or Landlord’s agents or employees, subject, however, to the provisions of paragraph (b) below. If any damage results from any act or neglect of the Tenant, the Landlord may, at the Landlord’s option, repair such damage and the Tenant shall thereupon pay to the Landlord the total cost of such repair. All personal property belonging to the Tenant or any occupant of the Premises that is in or any part of the Property shall be there at the risk of the Tenant or of such other person only, and the Landlord, its agents and employees shall not be liable for any damage thereto or for the theft or misappropriation thereof. The Tenant agrees to hold the Landlord harmless and indemnified against claims and liability for injuries to all persons and for damage to or loss of property occurring in or about the Property, due to any negligent act or failure to act by the Tenant, its contractors, agents or employees, or default by Tenant under this Lease.

(b) Landlord shall not be liable for any damage or loss to fixtures, equipment, merchandise or other personal property of Tenant located anywhere in or on the leased Premises caused by theft, fire, water, explosion, sewer backup or any other hazards, regardless of the cause thereof, and Tenant does hereby expressly release Landlord of and from any and all liability for such damages or loss. Landlord shall not be liable for any damage or loss resulting from business interruption at the leased Premises and Tenant does hereby expressly release Landlord of and from any and all liability for such damages or loss. Landlord shall not be liable for any damages to the leased Premises or any part thereof caused by fire or other insurable hazards, regardless of the cause thereof, and Tenant does hereby expressly release Landlord of and from any and all liability for such damages or loss. To the extent that any of the risks or perils described in this paragraph (b) are in fact covered by insurance, each party shall cause its insurance carriers to waive all rights of subrogation against the other party.

7. LIABILITY INSURANCE

Tenant shall, at its expense, maintain during the term, comprehensive public liability insurance, contractual liability insurance and property damage insurance under policies issued by insurers of recognized responsibility, with limits of not less than $500,000 for personal injury, bodily injury, death, or for damage or injury to or destruction of property (including the loss of use thereof) for any one occurrence. Tenant’s policies shall name Landlord, its agents, servants and employees as additional insureds. Tenant shall furnish at Landlord’s request, a certificate evidencing such coverage.

8. HOLDING OVER

Unless otherwise agreed to in writing by Landlord and Tenant, if the Tenant retains possession of the Premises or any part thereof after the termination of the term, the Tenant shall pay the Landlord Rent at double the monthly rate in effect immediately prior to the termination of the term for the time the Tenant thus remains in possession and, in addition thereto, Tenant shall pay the Landlord for all damages, consequential as well as direct, sustained by reason of the Tenant’s retention of possession. The provisions of this Section do not exclude the Landlord’s rights of re-entry or any other right hereunder. No such holding over shall be deemed to constitute a renewal or extension of the term hereof.

9. ASSIGNMENT AND SUBLETTING

The Tenant shall not, without the Landlord’s prior written consent, (a) assign, convey, mortgage, pledge, encumber or otherwise transfer (whether voluntarily or otherwise) this Lease or any interest under it; (b) allow any transfer thereof by operation of law; (c) sublet the Premises or any part thereof, or (d) permit the use or occupancy of the Premises or any part thereof by anyone other than the Tenant.

If the assignment, transfer, or subletting is approved and rents under the sublease are greater than the rents provided for herein, then landlord shall have the further option either (a) to convert the sublease into a prime lease and receive all of the rents, in which case Tenant will be relieved of further liability hereunder and under the proposed sublease, or (b) to require Tenant to remain liable under this Lease, in which event Tenant shall be entitled to retain such excess rents.

If this Lease is assigned or if the Premises or any part thereof are sublet or occupied by anybody other than the

5

Tenant, Landlord may, after default by Tenant, collect rent from the assignee, subtenant or occupant, and apply the net amount collected to the Rent herein reserved, but no such assignment, subletting, occupancy or collection shall be deemed a waiver of any of the Tenant’s covenants contained in this Lease or the acceptance of such assignee, subtenant or occupant as Tenant, or a release of Tenant from further performance by tenant of covenants on the part of Tenant herein contained.

10. CONDITION OF PREMISES

Except as otherwise agreed to in writing, Tenant’s taking possession of the Premises shall be conclusive evidence as against the Tenant that the Premises were in good order and satisfactory condition when the Tenant took possession. No promise of the Landlord to alter, remodel, repair or improve the Premises or the Building and no representation respecting the condition of the Premises or the Building have been made by Landlord to Tenant, other than as may be contained herein or in a separate agreement signed by Landlord and Tenant. Tenant shall, at the termination or expiration of this Lease or upon Tenant’s abandonment of the Premises, (i) surrender the Premises to Landlord in broom-clean and in good condition and repair, and if not returned to Landlord in broom-clean and good condition, then Tenant shall pay Landlord the cost to restore the Premises to broom-clean and good condition and repair thereof on Landlord’s demand; (ii) return all keys to Landlord; (iii) at its sole expense, remove any equipment which may cause contamination of the property; (vi) clean up any existing contamination in compliance with all Environmental Requirements; and (v) leave the Premises totally free of any Hazardous Substances.

11. USE OF PREMISES

The Tenant agrees to comply with the following rules and regulations and with such reasonable modifications thereof and additions thereto as the Landlord may hereafter from time to time make for the Building. The Landlord shall not be responsible for the nonobservance by any other tenant or any of said rules and regulations.

(a) The Tenant shall not exhibit, sell or offer for sale on the Premises or in the Building any article or thing except those articles and things essentially connected with the stated use of the Premises by the Tenant without the advance consent of the Landlord.

(b) The Tenant will not make or permit to be made any use of the Premises or any parts thereof which would violate any of the covenants, agreements, terms, provisions and conditions of this Lease or which directly or indirectly is forbidden by public law, ordinance or governmental regulation or which may be dangerous to life, limb or property, or which may invalidate or increase the premium cost of any policy of insurance carried on the Building or covering its operation, or which will suffer or permit the Premises or any part thereof to be used in any manner or anything to be brought into or kept therein which, in the judgment of Landlord, shall in any way impair or tend to impair the character, reputation or appearance of the Property as a high quality office building, or which will impair or interfere with any of the services performed by Landlord for the Property.

(c) The Tenant shall not display, inscribe, print, paint, maintain or affix on any place in or about the Building any sign, notice, legend, direction, figure or advertisement, except on the doors of the Premises and on the Directory Board, and then only such name(s) and matter, and in such color, size, place and materials, as shall first have been approved by the Landlord. The listing of any name other than that of the Tenant, whether on the doors of the Premises, on the Building directory, or otherwise, shall not operate to vest any right or interest in this Lease or in the Premises or be deemed to be the written consent of Landlord mentioned in Section 9, it being expressly understood that any such listing is a privilege extended by Landlord revocable at will by written notice to Tenant.

(d) The Tenant shall not advertise the business, profession or activities of the Tenant conducted in the Building in any manner which violates the letter or spirit of any code of ethics adopted by any recognized association or organization pertaining to such business address of the Tenant, and shall never use any picture or likeness of the Building in any circulars, notices, advertisements or correspondence without the Landlord’s consent.

(e) No additional locks or similar devices shall be attached to any door or window without Landlord’s prior written consent. No keys for any door other than those provided by the Landlord shall be made. If more than two keys for one lock are desired, the Landlord will provide the same upon payment by the Tenant. All keys and key cards must be returned to the Landlord at the expiration or termination of the Lease. Tenant shall pay Landlord Landlord’s actual cost for any key cards furnished to Tenant to provide Tenant access to the Building after ordinary hours of operation.

(f) The Tenant shall not make any alterations, improvements or additions to the Premises including, but not limited to, wall coverings and special lighting installations, without the Landlord’s advance written consent in each and every instance. In the event Tenant desires to make any alterations, improvements or additions; Tenant shall first submit to Landlord Plans and Specifications therefor and obtain Landlord’s written approval thereof prior to commencing any such work. All alterations, improvements or additions, whether temporary or permanent in character, made by Landlord or Tenant in or upon the Premises shall become Landlord’s property and shall remain upon the Premises at the termination

6

of this Lease without compensation to Tenant (except only Tenant’s movable office furniture, trade fixtures, office and professional equipment). Any damage caused by or resulting from the removal of Tenant’s office furniture, trade fixtures, and office and professional equipment may be repaired by the Landlord at Tenant’s cost and expense.

(g) All persons entering or leaving the Building after hours on Monday through Friday, or at any time on Saturdays, Sundays, or holidays, may be required to do so under such regulations as the Landlord may impose. The Landlord may exclude or expel any peddler.

(h) The Tenant shall not overload any floor. The Landlord may direct the time and manner of delivery, routing and removal, and the location, of safes and other heavy articles.

(i) Unless the Landlord gives advance written consent, the Tenant shall not install or operate any steam or internal combustion engine, boiler, machinery, refrigerating or heating device or air-conditioning apparatus in or about the Premises, or carry on any mechanical business therein, or use the Premises for housing accommodations or lodging or sleeping purposes, or do any cooking therein, or use any illumination other than electric light, or use or permit to be brought into the Building any inflammable fluids such as gasoline, kerosene, naphtha, and benzine, or any explosives, radioactive materials or other articles deemed extra hazardous to life, limb or property. The tenant shall not use the Premises for any illegal or immoral purpose.

(j) The Tenant shall cooperate fully with the Landlord to assure the effective operation of the Building’s common area air conditioning and heating system; and leave closed, except for purposes of ingress and egress, the doors from the Premises to the common area hallways, and the entrance doors to the Building when the common area’s air-conditioning and heating system is in use.

(k) The Tenant shall not contract for any work or service which might involve the employment of labor incompatible with the building employees or employees of contractors doing work or performing services by or on behalf of the Landlord.

(l) The sidewalks, halls, passages, exits, entrances, elevators and stairways shall not be obstructed by the Tenant or used for any purpose other than for ingress to and egress from its Premises. The halls, passages, exits, entrances, elevators, stairways and roof are not for the use of the general public and the Landlord shall in all cases retain the right to control and prevent access thereto by all persons whose presence, in the judgment of the Landlord, shall be prejudicial to the safety, character, reputation and interests of the Building and its tenants, provided that nothing herein contained shall be construed to prevent such access to persons with whom the Tenant normally deals in the ordinary course of Tenant’s business unless such persons are engaged in illegal activities. Neither Tenant nor any employees or invitees of Tenant shall go upon the roof or mechanical floors of the Building.

(m) Tenant shall not use, keep or permit to be used or kept any foul or noxious gas or substance in the Premises, or permit or suffer the Premises to be occupied or used in manner offensive or objectionable to the Landlord or other occupants of the Building by reason of noise, odors and/or vibrations, or interfere in any way with other tenants or those having business therein, nor shall any animals or birds be brought in or kept in or about the Property.

(n) Tenant shall see that all doors, and windows, if operable, of the Premises are closed and securely locked before leaving the Building and must observe strict care and caution that all water faucets or water apparatus in the Premises are entirely shut-off before Tenant or Tenant’s employees leave the Building, so as to prevent waste or damage.

(o) Tenant agrees that it will not violate any Environmental Requirements or cause or permit any Hazardous Substances to be present, generated, treated, stored, released, used or disposed of in, on, at or under the Premises, Building, or Project. Notwithstanding the foregoing, Tenant may, upon written consent of Landlord (which may be granted or withheld in Landlord’s sole discretion) and solely as an incident to its business operations, use certain materials and substances which may contain Hazardous Substances provided that same are of a type and in the quantities customarily found or used in similar office environments, such as packaging materials, commercial cleaning fluids, photocopier fluids and similar substances and further provided that all such use is in total compliance with all Environmental Requirements. Tenant covenants and agrees to defend, indemnify, and hold harmless Landlord and beneficiaries, Landlord’s lenders or mortgage holders, officers, directors, servants, agents, successors, assigns, and employees thereof, respectively (collectively, “Landlord’s Affiliates”), both in their capacities as corporate representatives and as individuals, from and against any and all liabilities, actions, responsibilities, obligations, environmental impairment damages, fines, losses, damages, and claims, and all costs and expenses (including but not limited to attorneys’ fees and expenses) (collectively, “Losses”) in any manner whatsoever incurred, which: i) relate in any way to Tenant’s failure or alleged failure to comply with any Environmental Requirements; ii) related to the actual or threatened release, generation, treatment, presence, storage, use, or disposition of any Hazardous Substances, pollutants, or contaminants which have resulted from or are related to Tenant’s activities on the Premises; iii) the violation or threatened violation of Tenant’s covenants herein; or iv) otherwise arise pursuant to any Environmental Requirements.

7

(p) Tenant shall also comply with Rules and Regulations as set forth in Exhibit “C”.

The term “Environmental Requirements” shall mean all federal, state, and local laws (including the common law), statutes, ordinances, rules, regulations, and other requirements (including, without limiting the generality of the foregoing, judicial orders, administrative orders, consent agreements, and permit conditions) now or hereafter promulgated, relating to health, safety, welfare, hazardous substances as defined in Section 3.5 of this Lease, or the protection of the environment.

The term “Hazardous Substances” shall mean all substances, elements, materials, compounds, wastes, or byproducts of whatever kind or nature defined or classified as hazardous, dangerous, toxic, radioactive, or restricted under any Environmental Requirements now or hereafter promulgated, or as amended, (including, without limiting the generality of the foregoing. The Comprehensive Environmental Response, Compensation, and Liability Act; The Toxic Substances Control Act; The Resource Conservation and Recovery Act; Rules and Regulations of the Environmental Protection Agency; The Clean Water Act; The Clean Air Act; Superfund Amendments and Reauthorization Act).

In addition to all other liabilities for breach of any covenant of this Section, the Tenant shall pay to the Landlord an amount equal to any increase in insurance premiums payable by the Landlord or any other tenant in the Building, caused by such breach.

Tenant, on its own behalf and on behalf of its successors and assigns, hereby releases and forever discharges Landlord and Landlord’s Affiliates, both in their capacities as corporate representatives and as individuals, for any and all Losses, whether now or hereafter claimed or known, which Tenant now has or may have in the future against the Landlord arising from or relating in any way to releases or threatened releases of Hazardous Substances or violation of any Environmental Requirement which may occur as a result of Tenant’s activities on the Premises, or which arise from Tenant’s failure or alleged failure to comply with any Environmental Requirements.

12. REPAIRS

Tenant shall give to Landlord prompt written notice of any damage, or defective condition, of any part or appurtenance of the Building’s plumbing, electrical, heating, air-conditioning or other systems serving, located in, or passing through the Premises. Subject to the provisions of Sections 2 and 13, the Tenant shall, at the Tenant’s own expense, keep the Premises in good order, condition and repair during the term, and the Tenant, at the Tenant’s expense, shall comply with all laws and ordinances and all rules and regulations of all governmental authorities and of all insurance bodies at any time in force, applicable to the Premises or to the Tenant’s use thereof, except that the Tenant shall not hereby be under any obligation to comply with any law, ordinance, rule or regulation requiring any structural alteration of or in connection with the Premises, unless such alteration is required by reason of a condition which has been created by, or at the instance of, the Tenant, or is required by reason of a breach of any of the Tenant’s covenants and agreements hereunder. Landlord shall not be required to repair any injury or damage by fire or other cause, or to make any repairs or replacements of any panels, decoration, office fixtures, railing, ceiling, floor covering, partitions, or any other property installed in the Premises by the Tenant.

13. UNTENANTABILITY

In the event the Premises, Building or Project are damaged by fire or other insured casualty and the insurance proceeds have been made available therefore by the holder or holders of any mortgages or deeds of trust, the damage shall be repaired by and at the expense of Landlord to the extent of such insurance proceeds available therefore, provided such repairs can, in Landlord’s sole opinion, be made within one hundred twenty (120) days after the occurrence of such damage without the payment of overtime or other premiums. Until such repairs are completed, the rent shall be abated in proportion to the part of the Premises which is unusable by Tenant in the conduct of its business. If repairs cannot, in Landlord’s sole opinion be made within one hundred twenty (120) days, Landlord may at its option make these within a reasonable time and, if agreed to by Tenant, this Lease shall continue in effect. In the case of repairs, which in Landlord’s opinion cannot be made within one hundred twenty (120) days Landlord shall notify Tenant within thirty (30) days of the date of occurrence of such damage as to whether or not Landlord elects to make such repairs and if no such repairs and if no such notice is given, Landlord shall be deemed to have elected to make such repairs. If Landlord elects not to make such repairs or if said repairs cannot be made within one hundred twenty (120) days of notice, then either party may, by written notice to the other, cancel this Lease as of the date of the occurrence of such damage and Tenant must vacate the Premises within thirty (30) days of such notice. Except as provided in this Section, there shall be no abatement of rent and no liability of Landlord by reason of any injury to, damage or interference with Tenant’s business or property arising from any such fire or other casualty or from the making or not making of any repairs, alterations or improvements in or to any portion of the Premises, Building or Project or in or to fixtures, appurtenances and equipment therein. Tenant understands that Landlord will not carry insurance of any kind on Tenant’s furniture or furnishings or on any fixtures or equipment removable by Tenant under the provisions of this Lease

8

and that Landlord shall not be obliged to repair any damage thereto or replace the same. Landlord shall not be required to repair any injury or damage caused by fire or other cause, or to make any repairs or replacements to or of improvements installed in the Premises by or for Tenant.

14. EMINENT DOMAIN

(a) In the event that title to the whole or any part of the Premises shall be lawfully condemned or taken in any manner for any public or quasi-public use, this Lease and the term and estate hereby granted shall forthwith cease and terminate as of the date of vesting of title and the Landlord shall be entitled to receive the entire award, the Tenant hereby assigning to the Landlord the Tenant’s interest therein, if any. However, nothing herein shall be deemed to give Landlord any interest in or to require Tenant to assign to Landlord any award made to Tenant for the taking of personal property or fixtures belonging to Tenant or for the interruption of or damage to Tenant’s business or for Tenant’s moving expenses.

(b) In the event that title to a part of the Building other than the Premises shall be so condemned or taken, the Landlord may terminate this Lease and the term and estate hereby granted by notifying the Tenant of such termination within sixty (60) days following the date of vesting of title, and this Lease and the term and estate hereby granted shall expire on the date specified in the notice of termination, not less than sixty (60) days after the giving of such notice, as fully and completely as if such date were the date hereinbefore set for the expiration of the term of this Lease, and the Rent hereunder shall be apportioned as of such date.

(c) In the event of any condemnation or taking of any portion of the parking area of the Property, which does not result in a reduction of the parking ratio to less than one space for each 375 square feet of leased area, the terms of this Lease shall continue in full force and effect. If more of the Property is taken, either party shall have the right to terminate this Lease upon giving written notice to the other party within thirty (30) days of such taking.

(d) For the purpose of this Section 14, a sale to a public or quasi-public authority under threat of condemnation shall constitute a vesting of title and shall be constructed as a taking by such condemning authority.

15. LANDLORD’S REMEDIES

15.1 The occurrence of any of the following is an event of default under this Lease:

(a) Landlord does not receive punctually on the date due any payment of the full amount of rent (Whether Base Rent, additional rent or any adjustment to rent) or any other sum required to be paid by Tenant.

(b) Tenant fails to fully and punctually comply and fully perform any covenant, agreement, provision or condition of this Lease and such default shall continue for a period of fifteen (15) days after written notice from Landlord to Tenant.

(c) Tenant or any guarantor of Tenant’s obligations under this Lease shall become insolvent or shall make a transfer in fraud of creditors or make an assignment for the benefit of creditors.

(d) The levy of a writ of execution or attachment on or against the property of Tenant that is not released or discharged within thirty (30) days thereafter.

(e) The institution by or against Tenant of a bankruptcy or insolvency proceeding, an assignment for benefit of creditors, reorganization, liquidation or involuntary dissolution by or against Tenant or any guarantor of Tenant’s obligation not dismissed within thirty (30) days.

(f) A receiver, trustee or liquidator has been appointed for the Premises or for all or substantially all of the assets of Tenant or any guarantor of Tenant’s obligations under this Lease and has not been dismissed or discharged within thirty (30) days.

(g) Tenant fails to take possession or occupancy of the Premises or abandons, deserts or vacates all or any portion of the Premises.

(h) Tenant shall do or permit to be done anything which creates a lien or claim of lien on the Premises or Building and the same is not fully released within thirty (30) days.

(i) Tenant shall breach or fail to comply with any of the Rules and Regulations, such breach or failure to continue for more than ten (10) days after notice from the Landlord.

9

(j) Tenant shall violate any law, statute, rule, any Environmental Requirements or any regulation of any governmental authority, bureau, or agency and such violation is not totally cured as required by such law, statute, rule or regulation.

(k) Tenant assigns or subleases all or any part of its interest in this Lease without complying with the provisions of Section 9 hereof.

(l) Tenant has made any materially misleading or untrue statement, representation or warranty to Landlord under this Lease or with respect to the net worth, assets, liabilities, or financial condition of Tenant or any guarantor of Tenant’s obligations under this Lease.

15.2 In the event of a default, Landlord and Landlord’s Affiliates shall have the option to pursue any one or more of the following rights or remedies without notice or demand, which rights or remedies shall be in addition to and shall not waive any other remedies or rights Landlord or Landlord’s Affiliates may have at law, equity or under any Environmental Requirements. All rights and remedies of the Landlord herein enumerated shall be cumulative, and none shall exclude any other right or remedy allowed by law. In addition to the other remedies in this Lease provided, the Landlord shall be entitled to the restraint by injunction of the violation or attempted violation of any of the covenants, agreements or conditions of this Lease.

(a) Landlord may enjoin any failure of Tenant to fully and punctually comply and fully perform any covenant, agreement, provision or condition of this Lease.

(b) Landlord may terminate this Lease without further notice and without prejudice or waiver of any other remedy or right available to Landlord, in which event Tenant shall immediately surrender Premises and, if Tenant fails to do so, Landlord may re-enter upon, take possession of Premises, expel or remove Tenant and any other occupant of Premises or any part thereof and remove all property on the Premises, by force, if necessary, without being liable for prosecution or any claim of damage or injury therefore. Tenant shall indemnify and hold Landlord harmless from any loss, costs, or damages occasioned by Landlord and no entry or re-entry by Landlord shall be considered or construed to be a forcible entry.

(c) Enter upon and take possession of Premises and expel or remove Tenant and any other occupant of the Premises or any part thereof, and remove all property on the Premises, without terminating this Lease, without being liable for prosecution or any claim of damage of injury therefore. Tenant shall indemnify and hold Landlord harmless from any loss, costs, or damages occasioned by Landlord and no entry or re-entry by Landlord shall be considered or construed to be a forcible entry.

(d) Should Landlord elect to re-enter, as herein provided, or should it take possession pursuant to legal proceedings or pursuant to any notice provided for by law; it may either terminate this Lease or it may from time to time, without terminating this Lease, re-let the Premises or any part thereof for such terms and at such rental or rentals and upon such other terms and conditions as Landlord in its sole discretion may deem advisable, with the right to make alterations and repairs to Premises or grant rental or other concessions to any successor tenant. Landlord shall not be responsible for nor required to re-let the Premises and Tenant waives any and all rights to contend that Landlord’s failure to re-let, the terms, conditions or concessions of such re-letting, or the failure to collect rent in any way reduce, diminish or mitigate Tenant’s obligations to Landlord. Landlord may elect in its sole discretion to apply rentals received by it: (i) to the payment of any indebtedness; (ii) to the payment of any cost of such re-letting including but not limited to any broker’s commissions or fees, attorneys fees and costs in connection therewith; (iii) to the payment of the cost of any alterations and repairs to the Premises; (iv) to the payment of rent due and unpaid hereunder; and, (v) the residue, if any, shall be held by Landlord and applied in payment of future rent as the same may become due and payable hereunder. Should such rentals received from such re-letting after application by Landlord to the payments described in foregoing clauses (i) through (v) during any month be less than that agreed to be paid during the month by Tenant hereunder, then Tenant shall pay such deficiency to Landlord. Such deficiency shall be calculated and paid monthly to Landlord by Tenant.

(e) In lieu of electing to receive and apply rentals as provided above, Landlord shall have the right, at Landlord’s election, to recover from Tenant all damages incurred by reason of such Tenant’s default including, without limitation, a sum equal to the then-present value (using a discount rate of seven percent (7%) per annum) of the excess, if any, of the total Base Annual Rent and additional rent and all other sums which would have been payable hereunder by Tenant for the remainder of the Lease Term (as if there had been no default and no termination of the Lease due to Tenant’s default), less (1) the aggregate reasonable rental value of the Premises for the same period, determined as set forth below, plus (2) the costs of recovering and restoring the Premises to the condition set forth in Section 10 hereof at the termination of the Lease, and all other reasonable expenses incurred by Landlord due to Tenant’s default, including, without limitation, reasonable attorney’s fees plus (3) the unpaid Base Annual Rental and additional rental or any other sums due by Tenant under this Lease as of the date of such termination, with interest thereon at the rate of 10 % per annum. In determining the aggregate reasonable rental

10

value pursuant to item (1) above, the parties hereby agree that all relevant factors shall be considered as of the time Landlord seeks to enforce such remedy, including, but not limited to, (A) the length of time remaining in the Lease Term, (B) the then-current market conditions in the general area in which the Premises are located, (C) the likelihood of reletting the Premises for a period of time equal to the remainder of the Lease Term, (D) the net effective rental rates (taking into account all concessions) then being obtained for space of similar type and size in similar type buildings in the general area in which the Premises are located, (E) the vacancy levels in comparable quality buildings in the general area in which the Building is located, and (F) current levels of new construction that will be completed during the remainder of the Lease Term and the degree to which such new construction will likely affect vacancy rates and rental rates in comparable quality buildings in the general area in which the Premises are located. Tenant agrees to pay the total amount calculated as aforesaid under this subparagraph to Landlord within ten (10) calendar days following Landlord’s written demand therefor, together with all Base Annual Rent and additional rent and all charges and assessments theretofore due, at the same address where Tenant is to pay Landlord the Base Rent of this Lease; provided, however, that such payment shall not constitute a penalty or forfeiture but shall constitute liquidated damages for Tenant’s failure to comply with the terms and provisions of this Lease, Landlord and Tenant hereby agreeing that Landlord’s actual damages in such event would be impossible to ascertain and that the amount set forth above is a reasonable estimate thereof.

(f) No such re-entry or taking possession of the Premises by Landlord shall be construed as an election on its part to terminate this Lease unless a written notice of same is given to Tenant or unless the termination thereof be decreed by a court of competent jurisdiction. Notwithstanding any such re-letting without termination, Landlord may at any time thereafter elect to terminate this Lease for such previous breach.

(g) Nothing herein contained shall limit or prejudice the right of Landlord at its option to provide for and obtain as damages by reason of any such termination of this Lease or of possession an amount equal to the maximum allowed by any statute or rule of law in effect at the time when such termination takes place, whether or not such amount be greater, equal to or less than the amounts of damages which Landlord may elect to receive as set forth above.

(h) Landlord may, in addition to any other remedy at law or in equity or elsewhere in this Lease, cure Tenant’s default at reasonable expense, which expense shall be paid to Landlord by Tenant upon demand.

(i) All rights of Landlord under this Lease or at law may be exercised by persons acting on behalf of Landlord, under authority granted by Landlord, with full right of reimbursement. Tenant unconditionally releases and waives any right it has or may have to seek damages for injury to person or property against Landlord or persons acting on Landlord’s behalf by the exercise of the rights granted in this Lease or at law or equity. Tenant covenants and agrees, waiving all rights to assert, and shall not interpose, any counterclaim or claim for offset or deduction in any summary proceeding brought by Landlord to recover possession of the Premises.

(j) Any deposits, rents or funds of Tenant held by Landlord at the time of default by Tenant, may be applied by Landlord to any damages provided herein or at law.

(k) Neither the commencement of any action or proceeding, nor the settlement thereof, nor entry of judgment thereon shall bar Landlord from bringing subsequent actions or proceedings from time to time, nor shall the failure to include in any action or preceding any sum or sums then due be a bar to the maintenance of any subsequent actions or proceedings for the recovery of such sum or sums so omitted.

(l) Tenant hereby appoints as its agent to receive service of all dispossessory or distress proceedings and notices thereunder the person in charge of Premises at the time, and if no person is then in charge of Premises, then such service or notice may be made by attaching the same to the entrance of Premises, provided that a copy of any such proceedings or notices shall be mailed to Tenant at the Premises.

16. SUBORDINATION OF LEASE

This Lease is and shall be subject and subordinate to any and all mortgages or deeds of trust now existing upon or that may be hereafter placed upon the Premises and the Property and to all advances made or to be made thereon and all renewals, modifications, consolidations, replacements or extensions thereof and the lien of any such mortgages, deeds of trust and land leases shall be superior to all rights hereby or hereunder vested in Tenant, to the full extent of all sums secured thereby. This provision shall be self-operative and no further instrument of subordination shall be necessary to effectuate such subordination and the recording of any such mortgage or deed of trust shall have preference and precedence and be superior and prior in lien to this Lease, irrespective of the date of recording. In confirmation of such subordination, Tenant shall on request of Landlord or the holder of any such mortgage or deed of trust execute and deliver to Landlord within ten (10) days any instrument that Landlord or such holder may reasonably request. If Landlord seeks a new loan (“New Loan”) secured by the Property, the Building or the Premises, and obtains a

11

commitment for the New Loan, then Landlord shall make a good faith effort to obtain a non-disturbance agreement (the “Non-disturbance Agreement”) from the lender (“Lender”); but if the Lender, after being requested by Landlord, refuses to enter into a Non-disturbance Agreement for any reason, then Landlord shall not be required to obtain a non-disturbance agreement from the Lender before entering into the New Loan. A “Non-disturbance Agreement” shall mean an agreement - by the Lender or holder of a security deed, mortgage or deed of trust encumbering the Premises and Property - that in the event of foreclosure of such security deed, mortgage or deed of trust, Tenant shall remain undisturbed under this Lease so long as Tenant complies with all of the terms, obligations and conditions hereunder.

17. COMMENCEMENT OF POSSESSION

If the Landlord shall be unable to give possession of the Premises on the date of the commencement of the term hereof because the Premises shall not be ready for occupancy, the Landlord shall not be subject to any liability for the failure to give possession on said date. Under such circumstances, unless the delay is the fault of Tenant, the Rent shall not commence until the Premises are ready for occupancy by the Tenant, and in such event, the beginning and termination dates of the term hereof shall be adjusted accordingly, which adjustment will be evidenced by notice from Landlord to Tenant setting forth the adjusted beginning and termination dates. If, at Tenant’s request the Landlord shall make the Premises available to Tenant prior to the date of commencement of the term for the purpose of decorating, furnishing, and equipping the Premises, the use of the Premises for such work shall not create a Landlord-Tenant relationship between the parties, nor constitute occupancy of the Premises within the meaning of the next sentence, but the provisions of Section 6 of this Lease shall apply. If, with the consent of Landlord, the Tenant shall enter into occupancy of the Premises to do business therein prior to the date of commencement of the term, all provisions of this Lease, including but not limited to the date for expiration of the term thereof, shall apply and the rent shall accrue and be payable at the first rate specified in Paragraph (a) of Section I from the date of occupancy.

18. NOTICES AND CONSENTS

Any notice, demands, requests, consents or approvals from Landlord to Tenant or from Tenant to Landlord must be served by: a) mailing by registered or certified mail, or b) by facsimile sent to the facsimile numbers indicated below with a copy sent on the same day by ordinary mail, or c) by reputable local courier service or overnight delivery service such as Federal Express or Airborne addressed to Tenant as set forth herein or to Landlord at the place from time to time established for the payment of rent, with payment of postage if sent by certified or registered mail or ordinary mail or proper provision for payment if sent by courier or overnight service. Notice shall be deemed made on: (a) the second day after mailing, if sent by registered or certified mail, (b) the first day after being sent by facsimile as long as a copy is sent on the same day by mail, or (c) the first day after delivery to the courier or overnight service. As of the Date of this Lease, unless later changed, notice shall be sent to the Landlord at the address set forth below unless Landlord designates another address, as it may from time to time, by notice to the Tenant.

LANDLORD | TENANT | |

Rubicon, L.C. | Alimera Sciences, Inc. | |

0000 Xxxxxxxxx, X.X., Xxxxx 000 | 0000 Xxxxxxxx Xxxxxxx, Xxxxx 000 | |

Xxxxxxx, Xx. 00000 | Xxxxxxxxxx, XX 00000 | |

Facsimile: 404.816.3601 | Facsimile: | |

Once Tenant takes possession of the Premises, then notice to Tenant may be sent to the Tenant addressed to the address of the Premises, or at such place as Tenant may from time to time designate by notice to the Landlord.

All consents and approvals provided for herein must be in writing to be valid. If the term Tenant as used in this Lease refers to more than one person, any notice, consent, approval, request, xxxx, demand or statement, given as aforesaid to any one of such persons shall be deemed to have been duly given to Tenant.

19. NO ESTATE IN LAND

This contract and Lease shall create the relationship of landlord and tenant between Landlord and Tenant; no estate shall pass out of Landlord; and Tenant has only a usufruct which is not subject to levy and sale.

20. INVALIDITY OF PARTICULAR PROVISIONS

If any clause or provision of this Lease is or becomes illegal, invalid, or unenforceable because of present or later laws or any rule, decision, or regulation of any governmental body or entity, the intention of the parties hereto is that the remaining parts of this Lease shall not be affected thereby.

12

21. MISCELLANEOUS TAXES

Tenant shall pay prior to delinquency all taxes assessed against or levied upon its occupancy of the Premises, or upon the fixtures, furnishings, equipment and all other personal property of Tenant located in the Premises, if nonpayment thereof shall give rise to a lien on the real estate, and when possible Tenant shall cause said fixtures, furnishings, equipment and other personal property to be assessed and billed separately from the property of Landlord. In the event any or all of Tenant’s fixtures, furnishings, equipment and other personal property, or upon Tenant’s occupancy of the Premises, shall be assessed and taxed with the property of Landlord, Tenant shall pay to Landlord its share of such taxes within ten (10) days after delivery to Tenant by Landlord of a statement in writing setting forth the amount of such taxes applicable to Tenant’s fixtures, furnishings, equipment or personal property.

22. SECURITY DEPOSIT

Tenant has deposited with Landlord the sum of Three Thousand seven hundred thirty seven dollars and fifty cents Dollars ($ 3,737.50 ) as security for the full and faithful performance of every provision of this Lease to be performed by Tenant. If Tenant defaults with respect to any provision of this Lease, including but not limited to the provisions relating to the payment of Rent, Landlord may use, apply or retain all or any part of this security deposit for the payment of any Rent or any other sum in default or for the payment of any other amount which Landlord may spend or become obligated to spend by reason of Tenant’s default, or to compensate Landlord for any other loss, cost or damage which landlord may suffer by reason of Tenant’s default. If any portion of said deposit is so use or applied, Tenant shall, within five (5) days after written demand therefore, deposit cash with Landlord in an amount sufficient to restore the security deposit to its original amount and Tenant’s failure to do so shall be a breach of this Lease. Landlord shall not, unless otherwise required by law, be required to keep this security deposit separate from its general funds, nor pay interest to Tenant. If Landlord is required to maintain said deposit in an interest bearing account, Landlord will retain the maximum amount permitted under applicable law as a bookkeeping and administrative charge. If Tenant shall fully and faithfully perform every provision of this Lease to be performed by it, the security deposit or any balance thereof shall be returned to Tenant (or, at Landlord’s option, to the last transferee of Tenant’s interest hereunder) at the expiration of the Lease term and upon Tenant’s vacation of the Premises. In the event the Building is sold, the security deposit will be transferred to the new owner and the new owner will be solely responsible for the return of the security deposit to the Tenant.

23. SUBSTITUTE PREMISES

Landlord shall have the right at any time during the term hereof, upon giving Tenant not less than sixty (60) days prior written notice, to provide and furnish Tenant with space elsewhere in the Building of approximately the same size as the Premises and remove and place Tenant in such space with Landlord to pay all reasonable costs and expenses incurred as a result of such removal of Tenant. Should Tenant refuse to permit Landlord to move Tenant to such new space at the end of said sixty (60) day period, Landlord shall have the right to cancel and terminate this Lease effective ninety (90) days from the date of original notification by Landlord. If Landlord moves Tenant to such new space, this Lease and each and all of its terms, covenants and conditions shall remain in full force and effect and be deemed applicable to such new space, and such new space shall thereafter be deemed to be the Premises as though Landlord and Tenant had entered into an express written amendment of this Lease with respect thereto.

24. BROKERAGE

Tenant represents and warrants that is has dealt with no broker, agent or other person in connection with this transaction except for Lavista Associates and N/A and that no broker, agent or other person brought about this transaction, other than Lavista Associates and N/A , and Tenant agrees to indemnify and hold Landlord harmless from and against any claims by any other broker, agent or other person claiming a commission or other form of compensation by virtue of having dealt with Tenant with regard to this leasing transaction. The provisions of this Section shall survive the termination of this Lease.

25. LIMITATION OF LIABILITY

Landlord’s obligations and liability to Tenant with respect to this Lease shall be limited solely to Landlord’s interest in the Building, and neither Landlord nor any joint venturer, partner, officer, director or shareholder of Landlord or any of the joint venturers of Landlord shall have any personal liability whatsoever with respect to this Lease.

26. SPECIAL STIPULATIONS

(a) No receipt of money by the Landlord from the Tenant after the termination of this Lease or after the service of any notice or after the commencement of any suit, or after final judgment for possession of the Premises shall reinstate,

13

continue or extend the term of this Lease or affect any such notice, demand or suit or imply consent for any action for which Landlord’s consent is required.

(b) No waiver of any default of the Tenant hereunder shall be implied from any omission by the Landlord to take any action on account of such default if such default persists or be repeated, and no express waiver shall affect any default other than the default specified in the express waiver and that only for the time and to the extent therein stated.

(c) The term “Landlord” as used in this Lease, so far as covenants or agreements on the part of the Landlord are concerned, shall be limited to mean and include only the owner or owners of the Landlord’s interest in this Lease at the time in question, and in the event of any transfer or transfers of such interest the Landlord herein named (and in case of any subsequent transfer, the then transferor) shall be automatically freed and relieved from and after the date of such transfer of all personal liability as respects the performance of any covenants or agreements on the part of the Landlord contained in this Lease thereafter to be performed.

(d) It is understood that the Landlord may occupy portions of the building in the conduct of the Landlord’s business. In such event, all references herein to other tenants of the Building shall be deemed to include the Landlord as an occupant.

(e) The term “City” as used in this Lease shall be understood to mean the City and/or County in which the Property is located.

(f) All of the covenants of the Tenant hereunder shall be deemed and construed to be “conditions” as well as “covenants” as though the words specifically expressing or importing covenants and conditions were used in each separate instance.

(g) This Lease shall not be recorded by either party without the consent of the other.

(h) Neither party has made any representations or promises, except as contained herein, or in some further writing signed by the party making such representation or promise.

(i) In event of variation or discrepancy, the Landlord’s original copy of the Lease shall control.

(j) Each provision hereof shall extend to and shall, as the case may require, bind and inure to the benefit of the Landlord and the Tenant and their respective heirs, legal representatives, successors, and assigns.

(k) If because of any act or omission of Tenant, its employees, agents, contractors, or subcontractors, any mechanic’s lien or other lien, charge or order for the payment of money shall be filed against Landlord, or against all or any portion of the Premises, or the Building of which the Premises are a part, Tenant shall, as its own cost and expense, cause the same to be discharged off record, within thirty (30) days after the filing thereof, and Tenant shall indemnify and save harmless Landlord against and from all costs, liabilities, suits, penalties, claims and demands, including reasonable attorney’s fees resulting therefrom.

(l) It is understood and agreed that this Lease shall not be binding until and unless all parties have signed it.

27. ATTORNEY’S FEES

If any person not a party to this Lease shall institute an action against Tenant in which Landlord shall be made a party, Tenant shall indemnify and save Landlord harmless from all liability by reason thereof, including reasonable attorney’s fees, and all costs incurred by Landlord in such action. If any action shall be brought by Landlord to recover any rental under this Lease, or for or on account of any breach of or to enforce or interpret any of the terms, covenants or conditions of this Lease, or for the recovery of possession of the premises, Landlord shall be entitled to recover from the Tenant, as a part of Landlord’s costs, a reasonable attorney fee, the amount of which shall be fixed by the court and shall be made a part of any judgment in favor of the Landlord.

28. CONSTRUCTION OF LEASE

This Lease has been fully negotiated by and between the Landlord and the Tenant. The language in all parts of this Lease shall in all cases be construed as a whole according to its fair meaning and not strictly for or against either Landlord or Tenant. Headings in this Lease are for convenience only and are not to be construed as a part of this Lease or in any way defining, limiting or amplifying the provisions hereof. Time is of the essence of this Lease and of every term, covenant and condition hereof. The words “Landlord” and “Tenant,” as used herein, shall include the plural as well as the singular. The neuter gender includes the masculine and feminine. In the event there is more than one tenant, the

14

obligations to be performed shall be joint and several.

29. ENTIRE AGREEMENT

This Lease, together with any attached exhibits and any written addenda contains the entire agreement between the parties.

30. INTERPRETATION AND ENFORCEMENT

This Lease shall be interpreted, governed and enforced in all respects under the laws of the State of Georgia.

31. RIDER

A rider consisting of One page, with paragraphs number 1 and 2, is attached hereto and made a part hereof. If any conflicts exist between any of the terms of such Rider and any of the printed terms of this Lease Agreement, the terms of such Rider will take precedence and be controlling.

32. EXHIBITS

Exhibits to this Lease agreement are as follows and attached hereto:

Exhibit “A” — The Premises

Exhibit “B” — Rider

Exhibit “C” — Rules and Regulations

LANDLORD: | ||||

Rubicon,L.C., | ||||

A Georgia Limited Liability Company | ||||

By: | /s/ Xxxxxx X. Xxxxxxx | |||

Xxxxxx X. Xxxxxxx | ||||

Its: | Operating Member | |||

TENANT: | ||||

Alimera Sciences, Inc. | ||||

By: | /s/ Xxx Xxxxx | |||

Title: | President/CEO | |||

15

16

EXHIBIT “B”

RIDER

The Lease Agreement between Rubicon, L.C., a Georgia Limited Liability Company, as Landlord and Alimera Sciences, Inc. as Tenant for the Premises containing approximately 5,038 rentable square feet known as Suite 290 at 0000 Xxxxxxxx Xxxxxxx Xxxxxxxxxx, Xxxxxxx 00000.

This Rider to the Lease is made and entered into contemporaneously with the Lease Agreement described above, and is incorporated into the Lease. In the case of any conflict between the terms and conditions of this Rider to the Lease and the terms and conditions of the Lease, the terms and conditions of this Rider shall control. All terms used herein shall be the same as defined in the Lease.

1. | Rental Schedule | ||

The Base Rent for the Premises shall be as follows: | |||

Period | Monthly Amount | Annual Amount | ||

6/1/03-11/31/03 | $3,737.50 | N/A | ||

12/1/03- 5/31/04 | $5,819.69 | N/A | ||

6/1/04-5/31/05 | $5,993.22 | $71,918.64 | ||

6/1/05-5/31/06 | $6,171.00 | $74,052.00 | ||

2. | Termination Option | ||

Provided that Tenant is not in material default of this Lease beyond any applicable cure period, Tenant shall have the Option to Terminate this Lease (the “Termination Option”) on November 30, 2003 by giving Landlord no less than two (2) months advance written notice of Tenant’s intent to exercise its Termination Option. If Tenant gives no notice to Landlord of its intent to exercise its Termination Option Tenant must fulfill its obligations under this Lease throughout the term. In the event Tenant exercises its Termination Option Tenant must pay a Termination Penalty (the “Termination Penalty”) of $10,000.00 at the time Tenant notifies Landlord of its intent to exercise its Termination Option. If Tenant fails to pay the Termination Penalty at the time it notifies Landlord of its intent to exercise its Termination Option the Termination Option shall be null and void and Tenant must fulfill its obligations under this Lease throughout the term. | |||

17

Exhibit “C”

RULES AND REGULATIONS ATTACHED TO