WHEN RECORDED OR FILED, PLEASE RETURN TO: Tacey Goss PS

Exhibit 99.5

Execution Version

WHEN RECORDED OR FILED,

PLEASE RETURN TO:

Xxxxx Xxxx PS

000 000xx Xxxxxx XX

Xxxxx 000

Xxxxxxxx, XX 00000

Attention: S. Xxxxx Xxxxx

| Space above for County Recorder’s Use |

MASTER ASSIGNMENT, RESIGNATION AND APPOINTMENT AGREEMENT

This MASTER ASSIGNMENT, RESIGNATION AND APPOINTMENT AGREEMENT (this “Agreement”), dated as of May 2, 2017, is entered into by Xxxxx Fargo Bank, National Association (“WFB”), as Administrative Agent (in such capacity, the “Resigning Agent”)and APEG Energy II, LP (“Angelus”), as successor Administrative Agent (in such capacity, the “Successor Agent”) and as sole Lender under the Credit Agreement referred to below.

RECITALS

WHEREAS, Energy One LLC, a Wyoming limited liability company (the “Borrower”), is party to that certain Credit Agreement dated as of July 30, 2010, by and among the Borrower, as borrower, the Resigning Agent, as Administrative Agent, and WFB, as Lender, pursuant to which WFB has made certain Loans to the Borrower;

WHEREAS, in connection with the Credit Agreement, (a) the Borrower entered into those certain mortgages, deeds of trust, supplements, amendments and other instruments listed in Exhibit A hereto and recorded in the office designated for the filing of a record of mortgage in the jurisdictions listed in Exhibit A, for the benefit of the Resigning Agent and the other secured parties referred to therein (collectively, as amended, supplemented, restated, amended and restated or otherwise modified prior to the Effective Date, the “Mortgages”); and (b) the Borrower and the Guarantors (as defined in the Credit Agreement, the “Guarantors”) entered into those other Security Instruments (as defined in the Credit Agreement) listed in Exhibit B hereto (collectively, as amended, supplemented, restated, amended and restated or otherwise modified prior to the Effective Date, the “Security Instruments”, and together with the Mortgages, the Credit Agreement and any other Security Instruments, in each case, as amended, supplemented, restated, amended and restated or otherwise modified prior to the Effective Date, the “Assigned Documents”);

WHEREAS, on April 21, 2017, WFB and Angelus entered into that certain Loan Sale Agreement (the “Loan Sale Agreement”), pursuant to which, as of the effective date set forth therein, WFB irrevocably sold, assigned and transferred to Angelus, and Angelus irrevocably purchased and assumed from WFB, all of WFB’s rights and obligations in its capacity as a Lender under the Credit Agreement;

WHEREAS, in connection with the Loan Sale Agreement, (a) the Resigning Agent has agreed to resign as Administrative Agent under the Credit Agreement, and the Successor Agent has agreed to be appointed Administrative Agent under the Credit Agreement, (b) the Resigning Agent has agreed to assign, and the Successor Agent has agreed to assume, (i) all of the Liens securing the Indebtedness and (ii) all of the Resigning Agent’s rights to hold, maintain and administer the collateral securing the Indebtedness and to enforce the Assigned Documents, in each case as set forth in the Assigned Documents, and all of the Resigning Agent’s rights, interests, duties and obligations as “Administrative Agent”, “Mortgagee”, “Beneficiary” and any equivalent capacity, as applicable, under the Assigned Documents, and (c) the Resigning Agent is willing to assign to the Successor Agent all powers of attorney, Liens and other rights and interests previously granted to the Resigning Agent under all Assigned Documents in each such capacity described above, as applicable, and the Successor Agent has agreed to accept the benefit of all such powers of attorney, Liens and other rights and interests in each such capacity, as applicable, for its benefit and for the ratable benefit of the present and future holders of the Indebtedness, all as more particularly described, and to the extent set forth, herein.

NOW THEREFORE, in consideration of the premises and the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are acknowledged, the parties hereto agree as follows:

AGREEMENT

Section 1. Definitions. Capitalized terms used but not defined herein shall have the meanings ascribed to such terms in the Credit Agreement.

Section 2. Resignation of Resigning Agent; Appointment of Successor Agent; Removal of Prior Trustee.

(a) The parties hereto hereby acknowledge and agree that the Resigning Agent has resigned as the “Administrative Agent” under the Assigned Documents and the other Loan Documents and in any other equivalent capacity under the Assigned Documents and the other Loan Documents, and shall have no further obligations in such capacities under the Assigned Documents and the other Loan Documents (in each case, except to the extent (x) of any obligations expressly stated in such Assigned Documents or Loan Documents as surviving the resignation in such capacity (if any) or (y) expressly set forth in the Loan Sale Agreement). Effective as of 30 days after the date hereof (the “Effective Date”): (A) the Resigning Agent hereby resigns as the “Mortgagee” or “Beneficiary”, as applicable, under each Mortgage and shall have no further obligations in such capacity under the Mortgages (in each case, except to the extent of any obligations expressly stated in such Mortgages as surviving the resignation in such capacity (if any)); (B) Angelus, as sole Lender under the Credit Agreement, and the Resigning Agent hereby appoint, pursuant to and as set forth in the Credit Agreement, the Successor Agent as the “Mortgagee” or “Beneficiary”, as applicable, under each of the Mortgages, and as “Administrative Agent” under each of the Assigned Documents and the other Loan Documents and in any other equivalent capacity under each Assigned Document and each other Loan Document; (C) the Successor Agent hereby accepts its appointment as the “Mortgagee” or “Beneficiary”, as applicable, under each Mortgage and as “Administrative Agent” under the Assigned Documents, and the other Loan Documents and in any other equivalent capacity under each Assigned Document and each other Loan Document; and (D) the parties hereto authorize each of the Resigning Agent and the Successor Agent to enter into, execute, record and/or file any and all notices, certificates, instruments, UCC financing statements and/or other documents or agreements (including, without limitation, filings in respect of any collateral, and assignments, amendments or supplements to any UCC financing statements, mortgages, deeds of trust, security agreements, pledge agreements, intellectual property security agreements, certificates of title, stock powers, account control agreements, intercreditor agreements, or other Assigned Documents), in each case, in a form reasonably acceptable to the Resigning Agent and the Successor Agent, as the Resigning Agent or the Successor Agent deems reasonably necessary or desirable to effect or evidence (of public record or otherwise) the transactions herein contemplated, including but not limited to the resignation of the Resigning Agent, the appointment of the Successor Agent, the assignment of Liens in respect of any and all collateral to the Successor Agent, and any amendments to the Assigned Documents set forth herein, and to maintain the validity, perfection or priority of, or to assign to the Successor Agent, any and all Liens in respect of any and all collateral. Each of the parties hereto hereby agrees to execute and deliver any documentation reasonably necessary or reasonably requested by the Resigning Agent or the Successor Agent, in form and substance reasonably acceptable to the Resigning Agent and the Successor Agent, to evidence such assignment or amendments or to maintain the validity, perfection or priority of, or to assign to the Successor Agent, any such Liens, or to maintain the rights, powers and privileges afforded to the “Mortgagee” or “Beneficiary”, as applicable, under the Mortgages or the “Administrative Agent” under the Assigned Documents and the other Loan Documents or in any other equivalent capacity under each Assigned Document and each other Loan Document.

2

(b) As of the Effective Date, the Successor Agent hereby assumes the rights, interests, duties and obligations of the Resigning Agent under the Assigned Documents and the other Loan Documents and becomes vested with all of the rights, powers, privileges, duties and obligations of the Resigning Agent under the Assigned Documents and the other Loan Documents, and the Resigning Agent is hereby discharged from all of its duties and obligations as the “Mortgagee” and “Beneficiary”, as applicable, under the Mortgages, the “Administrative Agent” under the Assigned Documents and the other Loan Documents and any other equivalent capacity under the Assigned Documents and the other Loan Documents, in each case as of the Effective Date (in each case, except to the extent of any obligations expressly stated in such Assigned Document or other Loan Document as surviving the resignation in such capacity (if any)).

(c) The parties hereto hereby confirm that, as of the Effective Date, all of the protective provisions, indemnities, and expense obligations under the Assigned Documents and the other Loan Documents, to the extent they pertain to the Resigning Agent, its sub-agents and their respective affiliates, officers, directors, trustees, employees, advisors, agents and controlling Persons, continue in effect for the benefit of the Resigning Agent, its sub-agents and their respective affiliates, officers, directors, trustees, employees, advisors, agents and controlling Persons in respect of any actions taken or omitted to be taken by any of them while the Resigning Agent was acting as “Mortgagee” or “Beneficiary” as applicable, under the Mortgages, the “Administrative Agent” under the Assigned Documents and the other Loan Documents or any other similar capacity under any Assigned Documents or other Loan Documents, and inure to the benefit of the Resigning Agent. The parties hereto agree that the Successor Agent shall have no liability for any actions taken or omitted to be taken by the Resigning Agent while it served as the “Mortgagee” or “Beneficiary”, as applicable, under the Mortgages, the “Administrative Agent” under the Assigned Documents and the other Loan Documents or in any other similar capacity under any Assigned Documents and the other Loan Documents, or for any other event or action related to the Loan Documents that occurred prior to the Effective Date. The parties hereto agree that the Resigning Agent shall have no liability for any actions taken or omitted to be taken by the Successor Agent as the “Mortgagee” or “Beneficiary” under the Mortgages, the “Administrative Agent” under the Assigned Documents and the other Loan Documents or in any other similar capacity under any Assigned Documents and the other Loan Documents that occur on or after the Effective Date.

3

(d) The Resigning Agent hereby assigns to the Successor Agent, effective on and after the Effective Date, all powers of attorney, Liens and other rights and interests granted to the Resigning Agent under the Assigned Documents (other than the protective provisions, indemnities, and expense obligations under the Assigned Documents and the other Loan Documents continuing in effect for the benefit of the Resigning Agent as described in Section 2(c) above) and all obligations and duties of the “Administrative Agent”, “Mortgagee”, “Beneficiary” and similar capacities under the Assigned Documents and the other Loan Documents, and the Successor Agent hereby assumes and accepts all such powers of attorney, Liens, other rights and interests, obligations and duties. The parties hereto hereby acknowledge and confirm that the Successor Agent shall act under the Assigned Documents and the other Loan Documents for the benefit of the Lenders and the other secured parties referred to in the Assigned Documents.

(e) On and after the Effective Date, all possessory collateral described in Exhibit C and held by the Resigning Agent for the benefit of the Lenders and the other secured parties referred to in the Assigned Documents shall be deemed to be held by the Resigning Agent as agent and bailee for the Successor Agent for the benefit and on behalf of the Lenders and the other secured parties referred to in the Assigned Documents until such time as such possessory collateral has been delivered to the Successor Agent. Without limiting the generality of the foregoing, any reference to the Resigning Agent in any publicly filed document, to the extent such filing relates to the Liens in any collateral assigned hereby and until such filing is modified to reflect the interests of the Successor Agent, shall, with respect to such Liens, constitute a reference to the Resigning Agent as collateral representative for the Successor Agent. Notwithstanding the foregoing, the parties hereto agree that the Resigning Agent’s role under this Section 2(e) as such collateral representative shall impose no further duties, obligations or liabilities on the Resigning Agent, including, without limitation, any duty to take any type of direction regarding any action to be taken against such collateral (other than the requirements of the Resigning Agent to consummate the assignments effected hereby and the requirement to deliver possessory collateral in accordance with the last sentence of this Section 2(e)), whether such direction comes from the Successor Agent, the Lenders or other secured parties referred to in the Assigned Documents or otherwise, and the Resigning Agent shall have the full benefit of all of the protective provisions of Article XI (The Agents) and Section 12.03 (Expenses, Indemnity; Damage Waiver) of the Credit Agreement while serving in such capacity. The Resigning Agent agrees to deliver all possessory collateral as described in Exhibit C hereto to the Successor Agent on or promptly following the Effective Date, and the Successor Agent agrees to take possession thereof upon such tender by the Resigning Agent.

4

(f) The Resigning Agent shall not be responsible or liable for, and makes no representation or warranty with respect to, (i) the execution, legality, effectiveness, genuineness, validity, enforceability, collectability or sufficiency of any of the Assigned Documents or other Loan Documents, (ii) any representations, warranties, recitals or statements made in any Assigned Document or other Loan Document or made in any written or oral statements or in any financial or other statements, instruments, reports or certificates or any other documents furnished or made to the Successor Agent or by or on behalf of the Borrower, any Guarantor or any Subsidiary or any of their Affiliates to the Resigning Agent or the Successor Agent in connection with the Assigned Documents or any other Loan Documents and the transactions contemplated thereby, (iii) the financial condition or business affairs of the Borrower, any Guarantor or any Subsidiary or any of their Affiliates or any other Person liable for the payment of any Indebtedness or the performance or observance by any Loan Party or other Person of any of its obligations under the Assigned Documents, any other Loan Documents or any other instrument or document furnished pursuant thereto, (iv) the perfection or priority of any lien or security interest created or purported to be created under or in connection with, the Assigned Documents, any other Loan Documents or any other instrument or document furnished pursuant thereto, except as otherwise expressly set forth in this Agreement, (v) the existence or basis for any claim, counterclaim, defense or offset relating to the Loans or the transactions contemplated by the Assigned Documents or the other Loan Documents, (vi) the compliance of the Loans, the Assigned Documents and the other Loan Documents with any applicable laws, ordinances, rulings or regulations of any Governmental Authority, or (vii) the condition or value of any collateral. The Resigning Agent shall not be required to ascertain or inquire as to the performance or observance of any of the terms, conditions, provisions, covenants or agreements contained in any of the Assigned Documents or any other Loan Documents or as to the use of the proceeds of the Loans or as to the existence or possible existence of any Default. The Successor Agent acknowledges that it has made its own independent investigation of the Loan Parties and their Subsidiaries in connection with its decision to succeed the Resigning Agent as successor Administrative Agent. The Resigning Agent shall have no duty or responsibility, either initially or on a continuing basis, to make any investigation on behalf of the Successor Agent or to provide the Successor Agent with any credit or financial information, underwriting files, reports, applications or other information with respect to the Loan Parties, whether coming into its possession before or after the Effective Date. Each of Angelus and the Successor Agent confirms that it is not relying on any representations, warranties or other statements made by the Resigning Agent with respect to the Loan Parties, their business, the Assigned Documents, the other Loan Documents or otherwise, other than the representations and warranties of the Resigning Agent expressly set forth in this Agreement.

(g) Pursuant to Section 6.02 of each of the Mortgages recorded in Texas, the Successor Agent hereby removes Xxxxxxx Xxxx (the “Prior Trustee”) as Trustee under each of the Mortgages recorded in Texas and from its related roles. The parties hereto acknowledge the Prior Trustee’s removal and agree that such removal shall be effective (without the consent of such Prior Trustee) on the Effective Date.

5

Section 3. Assignment and Reaffirmation of Interests and Liens.

(a) Effective as of the Effective Date, the Resigning Agent, as “Administrative Agent”, “Mortgagee”, “Beneficiary”, assignee and in any other similar capacity, as applicable, under each of the Assigned Documents, has CONVEYED, ASSIGNED, TRANSFERRED, SET OVER, and DELIVERED, and does by these presents hereby CONVEY, ASSIGN, TRANSFER, SET OVER, and DELIVER, unto the Successor Agent and to its successors and assigns, for the ratable benefit of the Lenders and the other secured parties referred to in the Assigned Documents, all rights, titles, interests, liens, security interests, pledges, assignments, powers of attorney, privileges, remedies, claims, demands and equities granted to the Resigning Agent, for the benefit of the Lenders and the other secured parties referred to in the Assigned Documents, in its capacity as “Administrative Agent”, “Mortgagee”, “Beneficiary”, assignee and in any other similar capacity, as applicable, existing and to exist under and pursuant to the terms and provisions of the Assigned Documents (hereinafter collectively called the “Assigned Liens”), in each case, WITHOUT RECOURSE AND WITHOUT REPRESENTATIONS OR WARRANTIES, except as otherwise expressly set forth in this Agreement, and the Successor Agent hereby accepts and assumes from the Resigning Agent all of the Assigned Liens.

TO HAVE AND TO HOLD the Assigned Liens unto the Successor Agent and its successors and assigns, forever.

(b) The assignments described in this Agreement are provided on an “AS IS”, “WHERE IS” basis, and the Successor Agent hereby expressly acknowledges that the Resigning Agent MAKES NO REPRESENTATION OR WARRANTY (WHETHER EXPRESS, IMPLIED OR ARISING BY OPERATION OF LAW) WITH RESPECT TO THE ASSIGNED DOCUMENTS OR OTHERWISE.

(c) Without limiting the generality of the foregoing, the power and rights of the Resigning Agent to remove trustees and to designate and appoint substitute or successor trustees under the Mortgages is hereby assigned and transferred to and conferred upon the Successor Agent, its successors and assigns.

(d) Notwithstanding the provisions of this Section 3, the parties hereby expressly agree that if and to the extent that any right, title or interest in or to any Assigned Document or collateral shall continue to be in the name of the Resigning Agent from and after the Effective Date, the Resigning Agent shall, for such limited purpose only, be deemed to be a non-fiduciary agent of the Successor Agent for the purpose of perfecting the security interest in such collateral or holding any right, title or interest in or to such Assigned Document or collateral, as applicable, but shall have no obligation with respect to any or all of such right, title or interest (including any obligations with respect to the exercise or preservation thereof), except for the execution of documents and instruments relating thereto in accordance with Section 2(a).

Section 4. Appointment of Successor Trustee. Effective as of the Effective Date, the Successor Agent does hereby substitute and appoint Xxxx Xxxxxx as “Trustee” under the Mortgages recorded in Texas (in such capacity under such Mortgages, the “Successor Trustee”), and the Successor Trustee’s address for notice hereunder and under the Mortgages recorded in Texas is 0000 Xxxxx Xxxx Xxxxx, Xxxxx 000, Xxxxxx, XX 00000.

Section 5. Privileged Information. It is the intention and understanding of the Resigning Agent and the Successor Agent that any exchange of information under this Agreement that is otherwise protected against disclosure by privilege, doctrine or rule of confidentiality (such information, “Privileged Information”), whether before or after the date hereof, (a) shall not waive any applicable privilege, doctrine or rule of protection from disclosure, (b) shall not diminish the confidentiality of the Privileged Information and (c) shall not be asserted as a waiver of any such privilege, doctrine or rule by the Resigning Agent or the Successor Agent.

6

Section 6. Representations of Resigning Agent. The Resigning Agent hereby represents and warrants that (a) the Resigning Agent has the corporate power and authority to execute and deliver this Agreement and to transfer and convey the Assigned Liens, rights and interests under the Assigned Documents that it is to convey hereunder, and (b) this Agreement constitutes its legal, valid and binding obligation, enforceable against it in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law.

Section 7. Representations of Successor Agent. The Successor Agent hereby represents and warrants that (a) the Successor Agent has the corporate power and authority to execute and deliver this Agreement and perform its obligations hereunder and to accept and assume the Assigned Liens and the rights and interests under the Assigned Documents conveyed hereunder, and (b) this Agreement constitutes its legal, valid and binding obligation, enforceable against it in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law.

Section 8. Miscellaneous.

(a) Each of the parties hereto agrees that this Agreement binds them and their successors and permitted assigns.

(b) All notices and other communications provided to the Successor Agent hereunder and under the Assigned Documents and other Loan Documents shall be delivered to the Successor Agent at:

Angelus Private Equity Group, LLC

Attention: Xxxxxxx Xxxx and Xxxx Xxxxxxx

0000 Xxxxxxxxx, Xxxxx 000

Xxxxxx, Xxxxx 00000

Emails: xxxxx@xxxxxx.xxx and xxxxxxxx@xxxxxx.xxx

With a copy to:

Xxxxx Xxxx PS

Attention: S. Xxxxx Xxxxx

000 000xx Xxxxxx XX

Xxxxx 000

Xxxxxxxx, XX 00000

Email: xxxxx@xxxxxxxxx.xxx

7

(c) This Agreement constitutes a Loan Document executed in connection with the Credit Agreement.

(d) THIS AGREEMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF TEXAS, except to the extent that the assignment of any of the Assigned Liens is mandatorily governed by the laws of the jurisdiction in which the properties subject thereto are located.

(e) This Agreement is being executed in several counterparts, all of which are identical, except that to facilitate recordation in any State requiring that legal descriptions of the mortgaged property be attached hereto, if the mortgaged property under any Mortgage recorded in such State is situated in more than one county, descriptions of only those portions of the mortgaged property located in the county in which a particular counterpart is recorded shall be attached as Exhibit D thereto, and the entire Exhibit D need be attached only to the counterparts retained by the Resigning Agent and the Successor Agent. Each of such counterparts shall for all purposes be deemed to be an original and all such counterparts shall together constitute but one and the same instrument. For the avoidance of doubt, Exhibit D applies only with respect to the recordation of this Agreement in any State requiring that legal descriptions of the mortgaged property be attached hereto and shall not be attached to this Agreement for purposes of recording this Agreement in any other State.

(f) The Successor Agent agrees to reimburse the Resigning Agent for its reasonable and documented fees, costs and expenses (including attorneys’ fees and expenses) incurred from and after the date hereof until the Effective Date in connection with its role as Administrative Agent under the Credit Agreement and the other Loan Documents and all actions taken in connection therewith. The parties hereto agree that all recording and filing costs, expenses, taxes, assessments and other charges payable to any Governmental Authority incurred by the Resigning Agent and/or the Successor Agent in order to record and/or file this Agreement and any UCC-3 financing statement amendment shall be shared equally by the Resigning Agent and the Successor Agent. All amounts due and payable by any party hereto pursuant to this clause (f) shall be due and payable ten (10) days after written demand therefor. For the avoidance of doubt, this clause (f) shall be without prejudice to any rights or remedies of the Resigning Agent and/or the Successor Agent to receive reimbursement or contribution thereof, or indemnification therefor, from the Borrower, any Guarantor, the other Lenders, or any other person or entity under or in connection with the Credit Agreement and the other Loan Documents. Notwithstanding anything to the contrary set forth in this Agreement, this paragraph shall be effective and enforceable on the date hereof.

(g) Any provision of this Agreement held to be invalid, illegal or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such invalidity, illegality or unenforceability without affecting the validity, legality and enforceability of the remaining provisions hereof or thereof; and the invalidity of a particular provision in a particular jurisdiction shall not invalidate such provision in any other jurisdiction.

8

[Remainder of page intentionally blank. Signature page follows.]

9

IN WITNESS WHEREOF, the undersigned have executed this Agreement on the date beneath its signature, and effective as of the Effective Date.

| XXXXX FARGO BANK, NATIONAL ASSOCIATION, | ||

| as the Resigning Agent | ||

| By: | /s/ Xxxxxxx Xxxxx | |

| Xxxxxxx Xxxxx | ||

| Director | ||

| STATE OF TEXAS | § |

| § | |

| COUNTY OF XXXXXX | § |

The foregoing instrument was acknowledged before me this 28 day of April, 2017, by Xxxxxxx Xxxxx, Director of Xxxxx Fargo Bank, National Association.

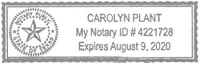

| (Seal) |  |

/s/ Xxxxxxx Plant | |

| Notary Public | |||

My commission expires: 8-9-2020

Signature Page to

Master Assignment, Resignation and Appointment Agreement

| APEG ENERGY II, LP, | ||

| a Texas limited partnership, | ||

| as the Successor Agent and as sole Lender | ||

| By: | APEG Energy II GP, LLC, a Texas limited liability company, its general partner | |

| By: | /s/ Xxxxxxx Xxxx | |

| Name: | Xxxxxxx Xxxx | |

| Title: | Manager | |

| By: | /s/ Xxxx Xxxxxxx | |

| Name: | Xxxx Xxxxxxx | |

| Title: | Manager | |

| STATE OF TEXAS | § |

| § | |

| COUNTY OF XXXXXX | § |

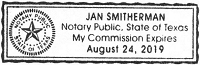

The foregoing instrument was acknowledged before me this 28 day of April, 2017, by Xxxxxxx Xxxx, Manager of APEG Energy II GP, LLC, the general partner of APEG Energy II, LP.

| (Seal) |  |

/s/ Xxx Xxxxxxxxxx | |

| Notary Public | |||

My commission expires: 8/24/19

| STATE OF TEXAS | § |

| § | |

| COUNTY OF XXXXXX | § |

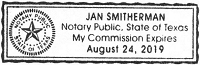

The foregoing instrument was acknowledged before me this 28 day of April, 2017, by Xxxx Xxxxxxx, Manager of APEG Energy II GP, LLC, the general partner of APEG Energy II, LP.

| (Seal) |  |

/s/ Xxx Xxxxxxxxxx | |

| Notary Public | |||

My commission expires: 8/24/19

Signature Page to

Master Assignment, Resignation and Appointment Agreement

EXHIBIT A

Mortgages

| 1. | Mortgage, Mortgage-Collateral Real Estate Mortgage, Deed of Trust, Assignment of As-Extracted Collateral, Security Agreement, Fixture Filing and Financing Statement from Energy One LLC for the benefit of BNP Paribas, as Administrative Agent dated as of July 30, 2010, filed as follows: |

| JURISDICTION | FILING INFORMATION | FILE DATE |

| Lafourche Parish, Louisiana | #1098951, MOB 1453, Page 302 | 9/16/10 |

| Terrebonne Parish, Louisiana | #1353504, MOB 2294, Page 696 | 8/5/10 |

| XxXxxxxx County, North Dakota | #408726 | 10/8/10 |

| Xxxxxxxx County, North Dakota | #694418 | 8/13/10 |

| Matagorda County, Texas | #104188 | 8/5/10 |

| 2. | Mortgage, Mortgage-Collateral Real Estate Mortgage, Deed of Trust, Assignment of As-Extracted Collateral, Security Agreement, Fixture Filing and Financing Statement from Energy One LLC for the benefit of BNP Paribas, as Administrative Agent dated as of April 10, 2012, filed as follows: |

| JURISDICTION | FILING INFORMATION | FILE DATE |

| Dimmit County, Texas | #23052, Vol. 436, Page 283 | 5/9/12 |

| Frio County, Texas | Vol. 0111, Page 379 | 4/25/12 |

| Xxxxxx County, Texas | #084676, Vol. 330, Page 764 | 4/25/12 |

| 3. | First Amendment and Supplement to Mortgage, Mortgage-Collateral Real Estate Mortgage, Deed of Trust, Assignment of As-Extracted Collateral, Security Agreement, Fixture Filing and Financing Statement from Energy One LLC for the benefit of BNP Paribas, as Administrative Agent dated as of April 20, 2012, filed as follows: |

| JURISDICTION | FILING INFORMATION | FILE DATE |

| Lafourche Parish, Louisiana | #1134704, Book 1551, Page 313 | 6/6/12 |

| Terrebonne Parish, Louisiana | #1397683, MOB 2454, Page 573 | 4/25/12 |

| XxXxxxxx County, North Dakota | #434082 | 5/22/12 |

| Xxxxxxxx County, North Dakota | #733718 | 5/7/12 |

| Matagorda County, Texas | #2012-122239 | 4/24/12 |

| 4. | Memorandum of Assignment of Liens and Security Interests dated June 1, 2012, among BNP Paribas, Xxxxx Fargo Bank, National Association and Energy One LLC, filed as follows: |

| JURISDICTION | FILING INFORMATION | FILE DATE |

| Dimmit County, Texas | #24732, Vol. 0446, Page 417 | 8/29/12 |

| Frio County, Texas | Vol. 0118, Page 450 | 8/14/12 |

| Xxxxxx County, Texas | #085518, Vol. 0335, Page 0666 | 8/13/12 |

| 5. | Memorandum of Assignment of Liens and Security Interests dated June 1, 2012, among BNP Paribas, Xxxxx Fargo Bank, National Association and Energy One LLC, filed as follows: |

| JURISDICTION | FILING INFORMATION | FILE DATE |

| Lafourche Parish, Louisiana | #1139400, Book 255, Page 595 | 8/14/12 |

| Terrebonne Parish, Louisiana | #1406244, Book 2482, Page 460 | 8/13/12 |

| XxXxxxxx County, North Dakota | #438242 | 8/14/12 |

| Xxxxxxxx County, North Dakota | #741282 | 8/15/12 |

| Matagorda County, Texas | #2012-124437 | 8/13/12 |

| 6. | First Supplement to Mortgage, Mortgage-Collateral Real Estate Mortgage, Deed of Trust, Assignment of As-Extracted Collateral, Security Agreement, Fixture Filing and Financing Statement by Energy One LLC for the benefit of Xxxxx Fargo Bank, National Association, as Administrative Agent, effective as of May 11, 2015, filed as follows: |

| JURISDICTION | FILING INFORMATION | FILE DATE |

| Dimmit County, Texas | #38220, Vol. 543, Page 706 | 5/27/15 |

| Xxxxxx County, Texas | #091135, Vol. 372, Page 632 | 5/22/15 |

| 7. | Second Supplement to Mortgage, Mortgage-Collateral Real Estate Mortgage, Deed of Trust, Assignment of As-Extracted Collateral, Security Agreement, Fixture Filing and Financing Statement by Energy One LLC for the benefit of Xxxxx Fargo Bank, National Association, as Administrative Agent, effective as of August 11, 2016, filed as follows: |

| JURISDICTION | FILING INFORMATION | FILE DATE |

| Terrebonne Parish, Louisiana | #1514286, Book 2852, Page 681 | 8/16/16 |

| XxXxxxxx County, North Dakota | #494946 | 8/17/16 |

| 8. | Mortgage and Assignment of Rents and Leases, executed as of September 20, 2016, by U.S. Energy Corp. (Mortgagor) to Xxxxx Fargo Bank, National Association (Mortgagee) filed as follows: |

| JURISDICTION | FILING INFORMATION | FILE DATE |

| Fremont County, Wyoming | #2016-1390444 | 9/27/16 |

EXHIBIT B

Security Instruments

| 1. | Guaranty and Pledge Agreement, dated as of July 30, 2010, by the Borrower and U.S. Energy Corp. in favor of the Administrative Agent |

| 2. | Guaranty and Pledge Agreement, dated as of July 30, 2010, by and U.S. Energy Xxxx.xx favor of the Administrative Agent |

| 3. | Deposit Account Control Agreement (Access Restricted After Notice) dated as of August 27, 2015 by and among the Borrower, the Resigning Agent and First Interstate Bank, a Montana corporation, regarding account numbers 0700013022 and 4900036932. |

EXHIBIT C

Possessory Collateral

| 1. | Stock Power in respect of 7,436,505 shares of common stock in Anfield Resources Inc. represented by Certificate Number 00100189ZQ |

| 2. | Certificate Number 00100189ZQ representing 436,505 shares of common stock in Anfield Resources Inc. |

EXHIBIT D

Hydrocarbon Property

See attached.