ASSIGNMENT AND ACCEPTANCE AGREEMENT This Assignment and Acceptance Agreement (this “Assignment Agreement”) between KEYBANK NATIONAL ASSOCIATION (the “Assignor”) and PACIFIC WESTERN BANK (as the successor to Square 1 Bank) (the “Assignee”) is dated as...

ASSIGNMENT AND ACCEPTANCE AGREEMENT This Assignment and Acceptance Agreement (this “Assignment Agreement”) between KEYBANK NATIONAL ASSOCIATION (the “Assignor”) and PACIFIC WESTERN BANK (as the successor to Square 1 Bank) (the “Assignee”) is dated as of June 4, 2019. The parties hereto agree as follows: 1. Preliminary Statement. Assignor is a party to a Credit and Security Agreement dated November 4, 2016, as amended and restated as of March 1, 2019 (as the same may from time to time be amended, restated or otherwise modified, the “Credit Agreement”), among Bandwidth Inc., a Delaware corporation (the “Borrower”), the lenders party thereto (together with their respective successors and assigns, collectively, the “Lenders” and, individually, each a “Lender”), and KEYBANK NATIONAL ASSOCIATION, as the administrative agent for the Lenders (the “Administrative Agent”). Capitalized terms used herein and not otherwise defined herein shall have the meanings attributed to them in the Credit Agreement. 2. Assignment and Assumption. Assignor hereby sells and assigns to Assignee, and Assignee hereby purchases and assumes from Assignor, an interest in and to Assignor’s rights and obligations under the Credit Agreement, effective as of the Assignment Effective Date (as hereinafter defined), equal to the percentage interest specified on Annex 1 hereto (hereinafter, the “Assigned Percentage”) of Assignor’s right, title and interest in and to (a) the Commitment, (b) any Loan made by Assignor that is outstanding on the Assignment Effective Date, (c) Assignor’s interest in any Letter of Credit outstanding on the Assignment Effective Date, (d) any Note delivered to Assignor pursuant to the Credit Agreement, (e) the Credit Agreement and the other Related Writings, and (f) to the extent permitted by applicable law, all suits, claims, causes of action and any other right of the Assignor (as a Lender) against any Person, whether known or unknown, arising under or with respect to the Credit Agreement, any other Related Writings, any other documents or instruments delivered pursuant thereto or the credit transactions governed thereby or otherwise based on or related to any of the foregoing, including, but not limited to, contract claims, statutory claims, tort claims, malpractice claims and all other claims at law or in equity with respect to the rights and obligations sold and assigned pursuant to this Section 2 (the rights and obligations sold and assigned pursuant to clauses (a) through (f) above, collectively, the "Assigned Interest"). After giving effect to such sale and assignment and on and after the Assignment Effective Date, Assignee shall be deemed to have one or more Applicable Commitment Percentages under the Credit Agreement equal to the Applicable Commitment Percentages set forth in subparts II.A and II.B on Annex 1 hereto and an Assigned Amount as set forth on subparts I.A and I.B of Annex 1 hereto (hereinafter, the “Assigned Amount”). 3. Assignment Effective Date. The Assignment Effective Date (the “Assignment Effective Date”) shall be June 4, 2019 (or such other date agreed to by the Administrative Agent). On or prior to the Assignment Effective Date, Assignor shall satisfy the following conditions: (a) receipt by the Administrative Agent of this Assignment Agreement, including Annex 1 hereto, properly executed by Assignor and Assignee and accepted and consented to by

the Administrative Agent and, if necessary pursuant to the provisions of Section 11.10(b) of the Credit Agreement, by the Borrower; (b) receipt by Assignee of a Revolving Credit Note executed and delivered by Borrower in the amount of Ten Million Dollars ($10,000,000); (c) receipt by the Administrative Agent from Assignee of an administrative questionnaire, or other similar document, which shall include (i) the address for notices under the Credit Agreement, (ii) the address of its Lending Office, (iii) wire transfer instructions for delivery of funds by the Administrative Agent, and (iv) such other information as the Administrative Agent shall request; and (d) receipt by the Administrative Agent from Assignor or Assignee of any other information required pursuant to Section 11.10 of the Credit Agreement or otherwise necessary to complete the transaction contemplated hereby. 4. Payment Obligations. In consideration for the sale and assignment of Loans hereunder, Assignee shall pay to Assignor, on the Assignment Effective Date, the amount agreed to by Assignee and Assignor. Any interest, fees and other payments accrued prior to the Assignment Effective Date with respect to the Assigned Amount shall be for the account of Assignor. Any interest, fees and other payments accrued on and after the Assignment Effective Date with respect to the Assigned Amount shall be for the account of Assignee. Each of Assignor and Assignee agrees that it will hold in trust for the other party any interest, fees or other amounts which it may receive to which the other party is entitled pursuant to the preceding sentence and to pay the other party any such amounts which it may receive promptly upon receipt thereof. 5. Credit Determination; Limitations on Assignor’s Liability. Assignee represents and warrants to Assignor, the Borrower, the Administrative Agent and the Lenders (a) that it is capable of making and has made and shall continue to make its own credit determinations and analysis based upon such information as Assignee deemed sufficient to enter into the transaction contemplated hereby and not based on any statements or representations by Assignor; (b) Assignee confirms that it meets the requirements to be an assignee as set forth in Section 11.10 of the Credit Agreement; (c) Assignee confirms that it is able to fund the Loans and the Letters of Credit as required by the Credit Agreement; (d) Assignee agrees that it will perform in accordance with their terms all of the obligations which by the terms of the Credit Agreement and the other Related Writings are required to be performed by it as a Lender thereunder; and (e) Assignee represents that it has reviewed each of the Loan Documents and by its signature to this Assignment Agreement, agrees to be bound by and subject to the terms and conditions of the Loan Documents as if it were an original party thereto. It is understood and agreed that the assignment and assumption hereunder are made without recourse to Assignor and that Assignor makes no representation or warranty of any kind to Assignee other than (i) it is the legal and beneficial owner of the Assigned Interest, (ii) the Assigned Interest is free and clear of any lien, encumbrance or other adverse claim, (iii) it has full power and authority, and has taken all action necessary, to execute and deliver this Assignment and Assumption and to consummate the transactions contemplated hereby and (iv) it is not a Defaulting Lender; and shall not be 2

responsible for (i) the due execution, legality, validity, enforceability, genuineness, sufficiency or collectability of the Credit Agreement or any other Related Writings, (ii) any representation, warranty or statement made in or in connection with the Credit Agreement or any of the other Related Writings, (iii) the financial condition or creditworthiness of the Borrower or any Guarantor of Payment, (iv) the performance of or compliance with any of the terms or provisions of the Credit Agreement or any of the other Related Writings, (v) the inspection of any of the property, books or records of the Borrower, or (vi) the validity, enforceability, perfection, priority, condition, value or sufficiency of any collateral securing or purporting to secure the Loans or Letters of Credit. Assignee appoints the Administrative Agent to take such action as agent on its behalf and to exercise such powers under the Credit Agreement as are delegated to the Administrative Agent by the terms thereof. 6. [RESERVED]. 7. Subsequent Assignments. After the Assignment Effective Date, Assignee shall have the right, pursuant to Section 11.10 of the Credit Agreement, to assign the rights which are assigned to Assignee hereunder, provided that (a) any such subsequent assignment does not violate any of the terms and conditions of the Credit Agreement, any of the other Related Writings, or any law, rule, regulation, order, writ, judgment, injunction or decree and that any consent required under the terms of the Credit Agreement or any of the other Related Writings has been obtained, (b) the assignee under such assignment from Assignee shall agree to assume all of Assignee’s obligations hereunder in a manner satisfactory to Assignor, and (c) Assignee is not thereby released from any of its obligations to Assignor hereunder. 8. Reductions of Aggregate Amount of Commitments. If any reduction in the Total Commitment Amount occurs between the date of this Assignment Agreement and the Assignment Effective Date, the percentage of the Total Commitment Amount assigned to Assignee shall remain the percentage specified in Section 1 hereof and the dollar amount of the Commitment of Assignee shall be recalculated based on the reduced Total Commitment Amount. 9. Acceptance of Administrative Agent; Notice by Assignor. This Assignment Agreement is conditioned upon the acceptance and consent of the Administrative Agent and, if necessary pursuant to Section 11.10 of the Credit Agreement, upon the acceptance and consent of the Borrower; provided that the execution of this Assignment Agreement by the Administrative Agent and, if necessary, by the Borrower is evidence of such acceptance and consent. 10. Entire Agreement. This Assignment Agreement embodies the entire agreement and understanding between the parties hereto and supersedes all prior agreements and understandings between the parties hereto relating to the subject matter hereof. 11. Governing Law. This Assignment Agreement shall be governed by the laws of the State of New York. 3

12. Notices. Notices shall be given under this Assignment Agreement in the manner set forth in the Credit Agreement. For the purpose hereof, the addresses of the parties hereto (until notice of a change is delivered) shall be the address set forth under each party’s name on the signature pages hereof. 13. Counterparts. This Assignment Agreement may be executed in any number of counterparts, by different parties hereto in separate counterparts and by facsimile signature, each of which when so executed and delivered shall be deemed to be an original and all of which taken together shall constitute but one and the same agreement. [Remainder of page intentionally left blank.] 4

4th 4th June June

000 Xxxxxxxxx Xxxxxx, Xxxxx 000 Xxxxxx, XX 00000 Xxxx Xxxx 000-000-0000 000-000-0000 4th 4th June June

4th 4th June June Xxxxxxx X. Xxxxxxx CFO

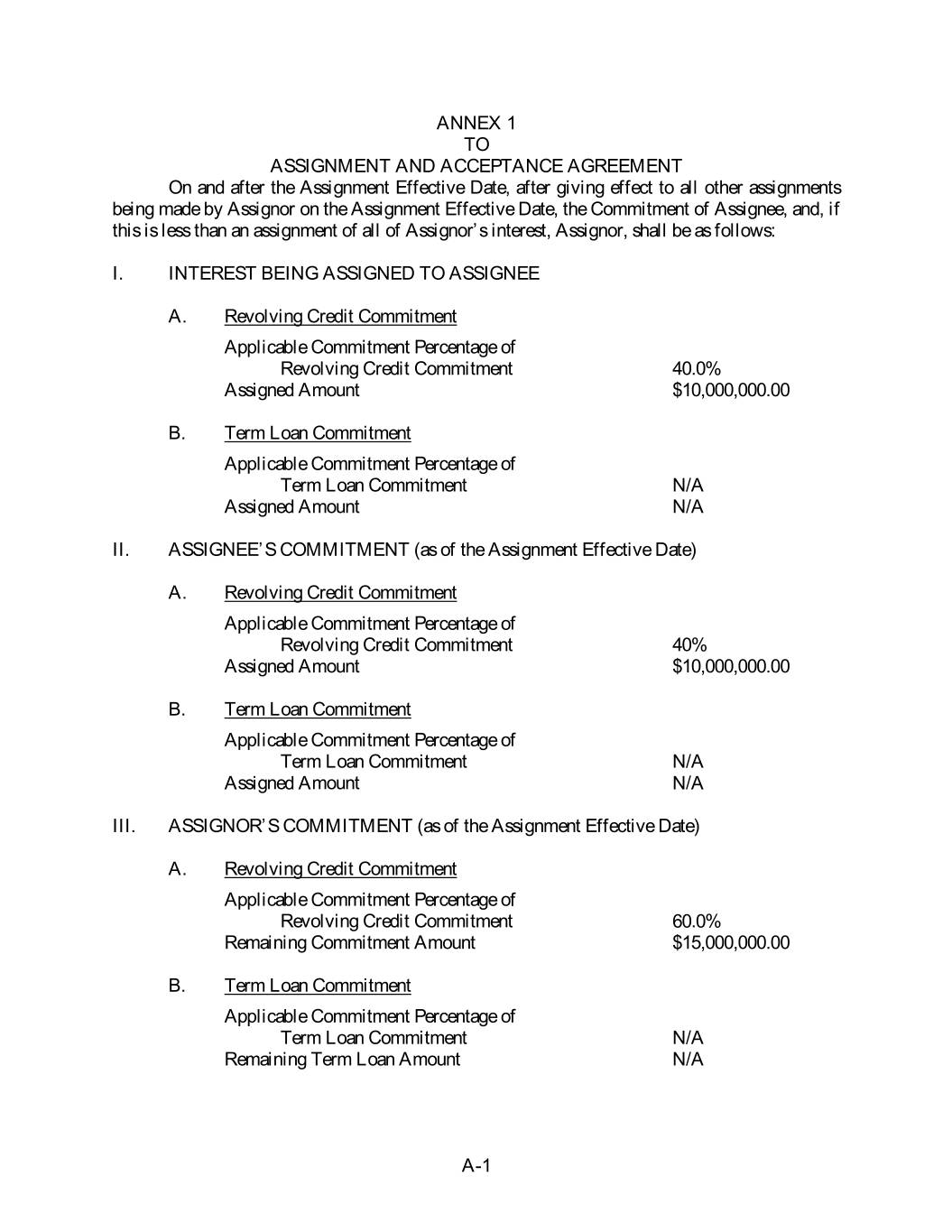

ANNEX 1 TO ASSIGNMENT AND ACCEPTANCE AGREEMENT On and after the Assignment Effective Date, after giving effect to all other assignments being made by Assignor on the Assignment Effective Date, the Commitment of Assignee, and, if this is less than an assignment of all of Assignor’s interest, Assignor, shall be as follows: I. INTEREST BEING ASSIGNED TO ASSIGNEE A. Revolving Credit Commitment Applicable Commitment Percentage of Revolving Credit Commitment 40.0% Assigned Amount $10,000,000.00 B. Term Loan Commitment Applicable Commitment Percentage of Term Loan Commitment N/A Assigned Amount N/A II. ASSIGNEE’S COMMITMENT (as of the Assignment Effective Date) A. Revolving Credit Commitment Applicable Commitment Percentage of Revolving Credit Commitment 40% Assigned Amount $10,000,000.00 B. Term Loan Commitment Applicable Commitment Percentage of Term Loan Commitment N/A Assigned Amount N/A III. ASSIGNOR’S COMMITMENT (as of the Assignment Effective Date) A. Revolving Credit Commitment Applicable Commitment Percentage of Revolving Credit Commitment 60.0% Remaining Commitment Amount $15,000,000.00 B. Term Loan Commitment Applicable Commitment Percentage of Term Loan Commitment N/A Remaining Term Loan Amount N/A A-1