CROSS-REFERENCE TABLE TIA Indenture Section Section 310(a)(1) ................. ...................................................................... 7.10 (a)(2) ........................................................................ ..................

Exhibit 4.1 and 4.2 XXXXXX OIL USA, INC. AND EACH OF THE GUARANTORS PARTY HERETO 4.750% Senior Notes Due 2029 INDENTURE Dated as of September 13, 2019 UMB BANK, N.A. as Trustee, Registrar and Paying Agent [[DMS:5220981v13:09/13/2019--09:02 AM]]

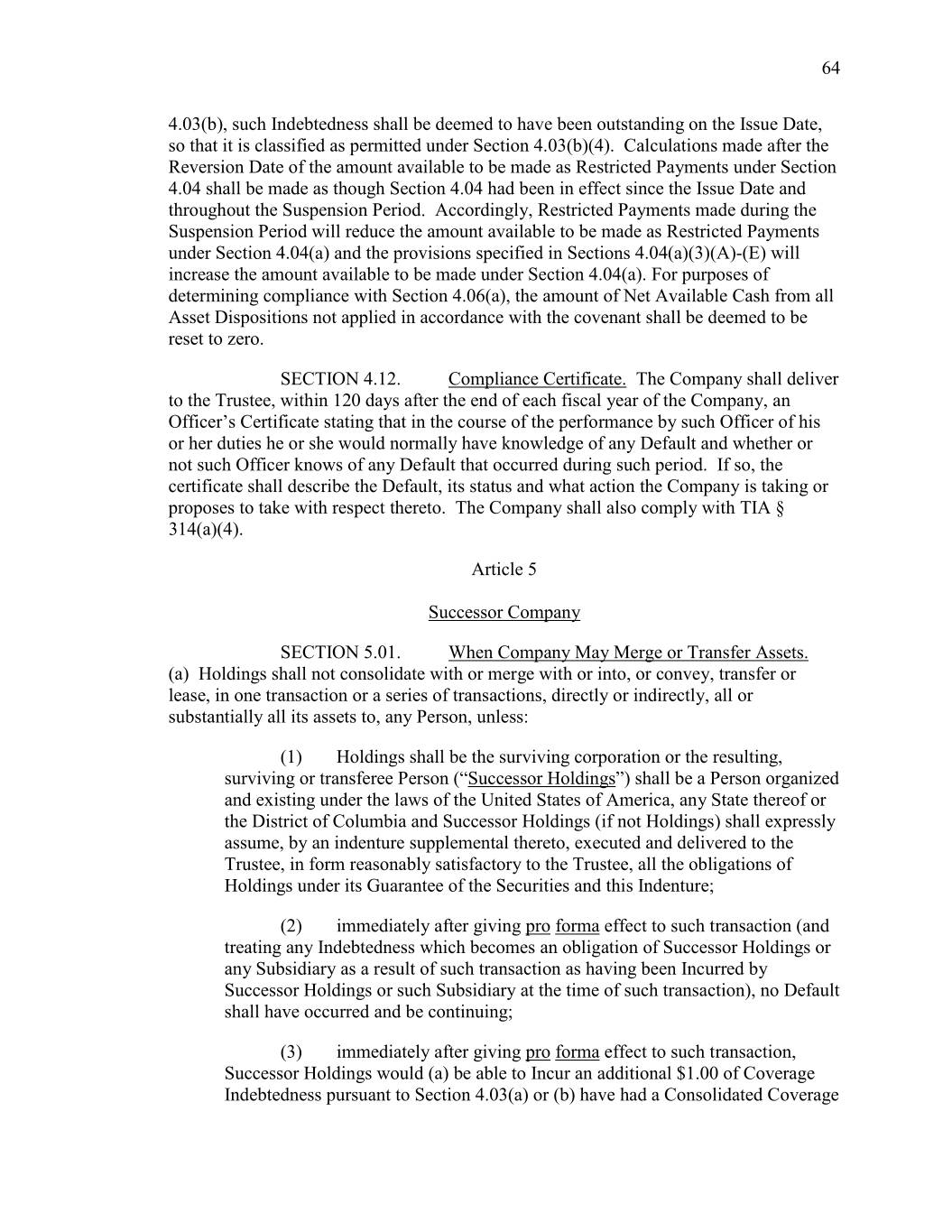

CROSS-REFERENCE TABLE TIA Indenture Section Section 310(a)(1) ....................................................................................... 7.10 (a)(2) ....................................................................................... 7.10 (a)(3) ....................................................................................... N.A. (a)(4) ....................................................................................... N.A. (a)(5) ....................................................................................... 7.10 (b) ....................................................................................... 7.08; 7.10 (c) ....................................................................................... N.A. 311(a) ....................................................................................... 7.11 (b) ....................................................................................... 7.11 (c) ....................................................................................... N.A. 312(a) ....................................................................................... 2.05 (b) ....................................................................................... 11.03 (c) ....................................................................................... 11.03 313(a) ....................................................................................... 7.06 (b)(1) ....................................................................................... 7.06 (b)(2) ....................................................................................... 7.06 (c) ....................................................................................... 11.02 (d) ....................................................................................... 7.06 314(a) ....................................................................................... 4.02; 4.12 (b) ....................................................................................... N.A. (c)(1) ....................................................................................... 11.04 (c)(2) ....................................................................................... 11.04 (c)(3) ....................................................................................... N.A. (d) ....................................................................................... N.A. (e) ....................................................................................... 11.05 (f) ....................................................................................... N.A. 315(a) ....................................................................................... 7.01 (b) ....................................................................................... 7.05 (c) ....................................................................................... 7.01 (d) ....................................................................................... 7.01 (e) ....................................................................................... 6.11 316(a) (last ....................................................................................... 11.06 sentence) (a)(1)(A) ....................................................................................... 6.05 (a)(1)(B) ....................................................................................... 6.04 (a)(2) ....................................................................................... N.A. (b) ....................................................................................... 6.07 (c) ....................................................................................... 9.04 317(a)(1) ....................................................................................... 6.08 (a)(2) ....................................................................................... 6.09 (b) ....................................................................................... 2.04 318(a) ....................................................................................... 11.01 (b) ....................................................................................... N.A. (c) ....................................................................................... 11.01 N.A. means Not Applicable. Note: This Cross-Reference Table shall not, for any purpose, be deemed to be part of this Indenture. [[DMS:5220981v13:09/13/2019--09:02 AM]]

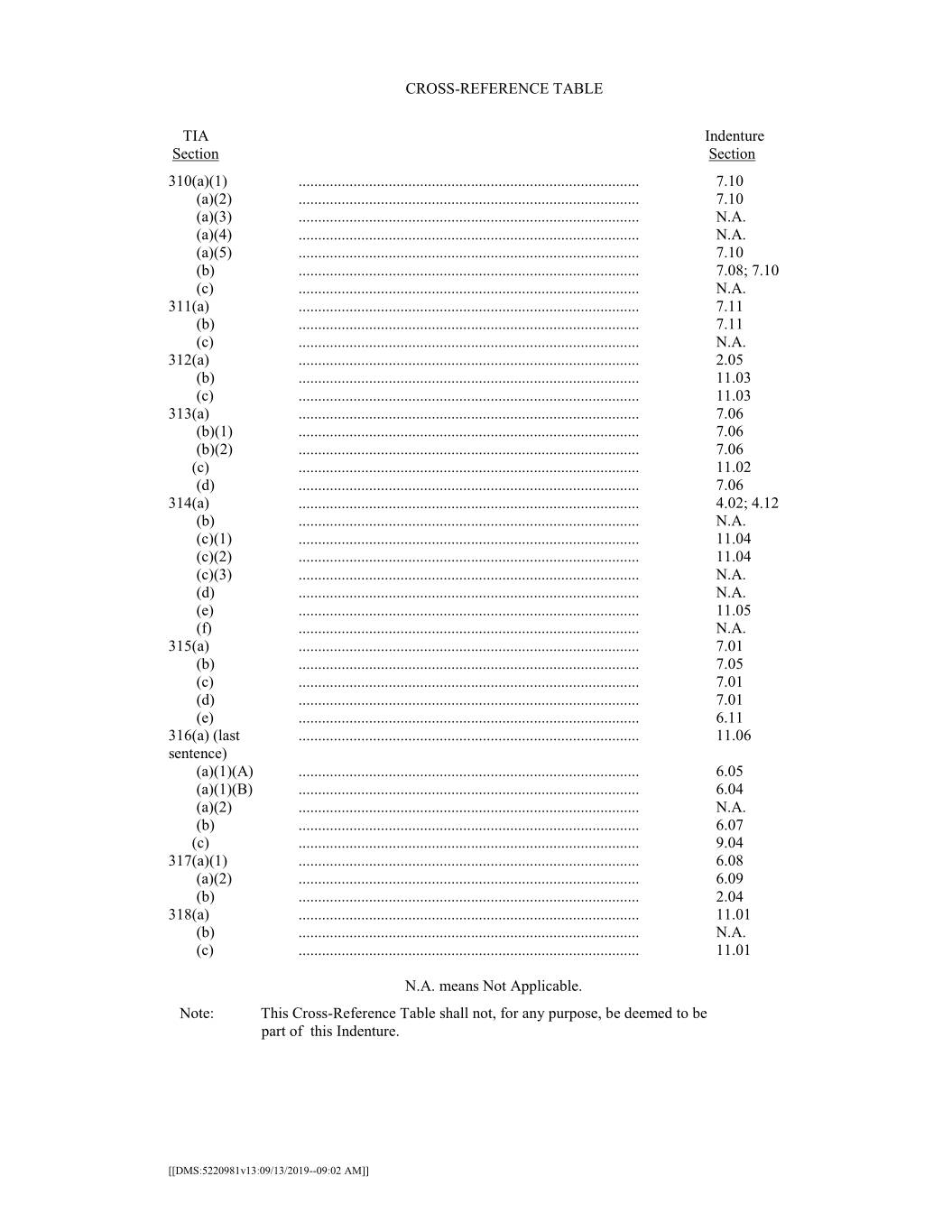

i TABLE OF CONTENTS Page Article 1 Definitions and Incorporation by Reference SECTION 1.01. Definitions........................................................................................1 SECTION 1.02. Other Definitions ...........................................................................35 SECTION 1.03. Incorporation by Reference of Trust Indenture Act .......................35 SECTION 1.04. Rules of Construction ....................................................................36 Article 2 The Securities SECTION 2.01. Form and Dating ............................................................................37 SECTION 2.02. Execution and Authentication ........................................................37 SECTION 2.03. Registrar and Paying Agent ...........................................................38 SECTION 2.04. Paying Agent To Hold Money in Trust .........................................38 SECTION 2.05. Securityholder Lists .......................................................................38 SECTION 2.06. Transfer and Exchange ..................................................................38 SECTION 2.07. Replacement Securities ..................................................................39 SECTION 2.08. Outstanding Securities ...................................................................39 SECTION 2.09. Temporary Securities .....................................................................39 SECTION 2.10. Cancellation ...................................................................................39 SECTION 2.11. Defaulted Interest ...........................................................................40 SECTION 2.12. CUSIP Numbers, ISINs, etc...........................................................40 SECTION 2.13. Issuance of Additional Securities...................................................40 Article 3 Redemption SECTION 3.01. Notices to Trustee ..........................................................................41 SECTION 3.02. Selection of Securities to Be Redeemed ........................................41 SECTION 3.03. Notice of Redemption ....................................................................41 SECTION 3.04. Effect of Notice of Redemption .....................................................43 SECTION 3.05. Deposit of Redemption Price .........................................................43 SECTION 3.06. Securities Redeemed in Part ..........................................................43 Article 4 Covenants SECTION 4.01. Payment of Securities ....................................................................43 SECTION 4.02. SEC Reports ...................................................................................43 [[DMS:5220981v13:09/13/2019--09:02 AM]]

iii SECTION 7.09. Successor Trustee by Merger .........................................................78 SECTION 7.10. Eligibility; Disqualification ...........................................................78 SECTION 7.11. Preferential Collection of Claims Against Company .....................78 Article 8 Discharge of Indenture; Defeasance SECTION 8.01. Discharge of Liability on Securities; Defeasance ..........................78 SECTION 8.02. Conditions to Defeasance ..............................................................79 SECTION 8.03. Application of Trust Money ...........................................................80 SECTION 8.04. Repayment to Company .................................................................81 SECTION 8.05. Indemnity for Government Obligations .........................................81 SECTION 8.06. Reinstatement .................................................................................81 Article 9 Amendments SECTION 9.01. Without Consent of Holders ..........................................................81 SECTION 9.02. With Consent of Holders ...............................................................82 SECTION 9.03. Compliance with Trust Indenture Act ............................................83 SECTION 9.04. Revocation and Effect of Consents and Waivers ...........................83 SECTION 9.05. Notation on or Exchange of Securities ..........................................84 SECTION 9.06. Trustee To Sign Amendments .......................................................84 SECTION 9.07. Payment for Consent ......................................................................84 Article 10 Guarantees SECTION 10.01. Guarantees......................................................................................84 SECTION 10.02. Limitation on Liability ...................................................................86 SECTION 10.03. Successors and Assigns..................................................................86 SECTION 10.04. No Waiver ......................................................................................87 SECTION 10.05. Modification ...................................................................................87 SECTION 10.06. Release of Subsidiary Guarantor ...................................................87 SECTION 10.07. Contribution ...................................................................................87 Article 11 Miscellaneous SECTION 11.01. Trust Indenture Act Controls .........................................................88 SECTION 11.02. Notices ...........................................................................................88 SECTION 11.03. Communication by Holders with Other Holders ...........................89 SECTION 11.04. Certificate and Opinion as to Conditions Precedent ......................89 SECTION 11.05. Statements Required in Certificate or Opinion ..............................89

INDENTURE dated as of September 13, 2019, among XXXXXX OIL USA, INC., a Delaware corporation (the “Company”), XXXXXX USA INC., a Delaware corporation (“Holdings”), each SUBSIDIARY GUARANTOR from time to time a party hereto and UMB BANK, N.A., a national banking association, as trustee (the “Trustee”). Each party agrees as follows for the benefit of the other parties and for the equal and ratable benefit of the Holders of the Initial Securities and the Additional Securities (collectively, the “Securities”): Article 1 Definitions and Incorporation by Reference SECTION 1.01. Definitions. “2027 Notes” means the Company’s $300,000,000 aggregate principal amount of 5.625% Senior Notes due 2027 issued on April 25, 2017. “Additional Assets” means: (1) any property, plant or equipment used in a Related Business; (2) the Capital Stock of a Person that becomes a Restricted Subsidiary as a result of the acquisition of such Capital Stock by Holdings, the Company or another Restricted Subsidiary; or (3) Capital Stock constituting a minority interest in any Person that at such time is a Restricted Subsidiary; provided, however, that any such Restricted Subsidiary described in clause (2) or (3) above is primarily engaged in a Related Business. “Additional Securities” means Securities issued under this Indenture after the Issue Date and in compliance with Section 2.13 and 4.03, it being understood that any Securities issued in exchange for or replacement of any Initial Security issued on the Issue Date shall not be an Additional Security. “Adjusted Treasury Rate” means, with respect to any redemption date, (i) the yield, under the heading which represents the average for the immediately preceding week, appearing in the most recently published statistical release designated “H.15(519)” or any successor publication which is published weekly by the Board of Governors of the Federal Reserve System and which establishes yields on actively traded United States Treasury securities adjusted to constant maturity under the caption “Treasury Constant Maturities”, for the maturity corresponding to the Comparable Treasury Issue (if no maturity is within three (3) months before or after September 15, 2024, yields for the two published maturities most closely corresponding to the [[DMS:5220981v13:09/13/2019--09:02 AM]]

2 Comparable Treasury Issue shall be determined and the Adjusted Treasury Rate shall be interpolated or extrapolated from such yields on a straight line basis, rounding to the nearest month) or (ii) if such release (or any successor release) is not published during the week preceding the calculation date or does not contain such yields, the rate per year equal to the semi-annual equivalent yield to maturity of the Comparable Treasury Issue (expressed as a percentage of its principal amount) equal to the Comparable Treasury Price for such redemption date, in each case calculated on the third Business Day immediately preceding the redemption date, plus 0.50%. “Affiliate” of any specified Person means any other Person, directly or indirectly, controlling or controlled by or under direct or indirect common control with such specified Person. For the purposes of this definition, “control” when used with respect to any Person means the power to direct the management and policies of such Person, directly or indirectly, whether through the ownership of voting securities, by contract or otherwise; and the terms “controlling” and “controlled” have meanings correlative to the foregoing. For purposes of Section 4.04, 4.06 and 4.07 only, “Affiliate” shall also mean any beneficial owner of Capital Stock representing 10% or more of the total voting power of the Voting Stock (on a fully diluted basis) of Holdings or of rights or warrants to purchase such Capital Stock (whether or not currently exercisable) and any Person who would be an Affiliate of any such beneficial owner pursuant to the first sentence hereof. “Applicable Premium” means with respect to a Security at any redemption date the excess of (if any) (A) the present value at such redemption date of (1) the redemption price of such Security on September 15, 2024 (such redemption price being described in the second paragraph of Section 5 of the Securities, exclusive of any accrued interest) plus (2) all required remaining scheduled interest payments due on such Security through September 15, 2024 (but excluding accrued and unpaid interest to the redemption date), computed using a discount rate equal to the Adjusted Treasury Rate, over (B) the principal amount of such Security on such redemption date. “Asset Disposition” means any sale, lease, transfer or other disposition (or series of related sales, leases, transfers or dispositions) by Holdings, the Company or any Restricted Subsidiary, including any disposition by means of a merger, consolidation or similar transaction (each referred to for the purposes of this definition as a “disposition”), of: (1) any shares of Capital Stock of the Company or a Restricted Subsidiary (other than directors’ qualifying shares or shares required by applicable law to be held by a Person other than Holdings, the Company or a Restricted Subsidiary); (2) all or substantially all the assets of any division or line of business of Holdings, the Company or any Restricted Subsidiary; or

3 (3) any other assets of Holdings, the Company or any Restricted Subsidiary outside of the ordinary course of business of Holdings, the Company or such Restricted Subsidiary other than, in the case of clauses (1), (2) and (3) above, (A) a disposition by (x) a Restricted Subsidiary or the Company to Holdings, (y) a Restricted Subsidiary or Holdings to the Company or (z) a Restricted Subsidiary, the Company or Holdings to a Restricted Subsidiary, (B) for purposes of Section 4.06 only, (i) a disposition that constitutes a Restricted Payment (or would constitute a Restricted Payment but for the exclusions from the definition thereof) and that is not prohibited by Section 4.04 and (ii) a disposition of all or substantially all the assets of Holdings in accordance with Section 5.01, (C) a disposition of assets with a Fair Market Value of less than $10,000,000; provided, however, that for purposes of this clause (C), Fair Market Value may be determined by any Officer authorized by Holdings to do so, (D) a disposition of cash or Temporary Cash Investments, (E) the granting, creation or perfection of a Lien not prohibited by Section 4.09 (but not the sale or other disposition of the property subject to such Lien), (F) the disposition of products, services, inventory, equipment, real property and accounts receivable or other assets in the ordinary course of business, including in connection with the compromise, settlement or collection thereof, (G) sales in the ordinary course of business of immaterial assets, (H) the disposition of damaged, obsolete, worn out, uneconomical or surplus property, equipment or assets, (I) licenses and sublicenses by Holdings, the Company or any Restricted Subsidiary of software or intellectual property in the ordinary course of business, (J) any surrender or waiver of contract rights or the settlement, release, recovery one or surrender of contract, tort or other claims of any kind, (K) transfers of property subject to casualty or condemnation proceedings, (L) the voluntary termination of Hedging Obligations, (M) the trade or exchange by Holdings, the Company or any Restricted Subsidiary of any asset for any other asset or assets; provided that the Fair Market Value of the asset or assets received by Holdings, the Company or such Restricted Subsidiary in such trade or exchange (including any cash or Temporary Cash Investments) is reasonably equivalent to the Fair Market Value of the asset or assets disposed of by Holdings, the Company or such Restricted Subsidiary pursuant to such trade or exchange; provided further, that if any cash or Temporary Cash Investments are used in such trade or exchange to achieve an exchange of equivalent value, that the amount of such cash and/or Temporary Cash Investments shall be deemed proceeds of an “Asset Disposition”, (N) any disposition in connection with a Sale/Leaseback Transaction permitted under Section 4.03 and 4.09 or (O) any disposition of the Ethanol Assets or any disposition of shares of Capital Stock of the Ethanol Subsidiary; provided that the Ethanol Subsidiary owns no assets other than the Ethanol Assets. “Attributable Debt” in respect of a Sale/Leaseback Transaction means, as at the time of determination, the present value (discounted at a rate implicit in such transaction, compounded annually) of the total obligations of the lessee for rental payments (other than amounts required to be paid on account of property taxes, maintenance, repairs, insurance, assessments, utilities, operating and labor costs and other items that do not constitute payments for property rights) during the remaining term of the lease included in such Sale/Leaseback Transaction (including any period for which

4 such lease has been extended); provided, however, that if such Sale/Leaseback Transaction results in a Capital Lease Obligation, the amount of Indebtedness represented thereby will be determined in accordance with the definition of “Capital Lease Obligation”. “Average Life” means, as of the date of determination, with respect to any Indebtedness, the quotient obtained by dividing (1) the sum of the products of the numbers of years from the date of determination to the dates of each successive scheduled principal payment of or redemption or similar payment with respect to such Indebtedness multiplied by the amount of such payment by (2) the sum of all such payments. “Board of Directors” means the board of directors of Holdings or any committee thereof duly authorized to act on behalf of such board. “Business Day” means each day which is not a Legal Holiday. “Capital Lease Obligation” means an obligation that is required to be classified and accounted for as a capital lease for financial reporting purposes in accordance with GAAP, and the amount of Indebtedness represented by such obligation shall be the capitalized amount of such obligation determined in accordance with GAAP; and the Stated Maturity thereof shall be the date of the last payment of rent or any other amount due under such lease prior to the first date upon which such lease may be terminated by the lessee without payment of a penalty. For purposes of Section 4.09, a Capital Lease Obligation shall be deemed to be secured by a Lien on the property being leased. “Capital Stock” of any Person means any and all shares, interests (including partnership interests), rights to purchase, warrants, options, participations or other equivalents of or interests in (however designated) equity of such Person, including any Preferred Stock, but excluding any debt securities convertible into such equity. “Change of Control” means the occurrence of any of the following events: (1) any “person” (as such term is used in Sections 13(d)(3) of the Exchange Act) is or becomes the “beneficial owner” (as defined in Rules 13d-3 and 13d-5 under the Exchange Act), directly or indirectly, of more than 50% of the total voting power of the Voting Stock of Holdings; provided that the consummation of any such transaction resulting in such person owning more than 50% of the total voting power of the Voting Stock of Holdings shall not be considered a Change of Control if (a) Holdings becomes a direct or indirect wholly-owned subsidiary of a holding company and (b) immediately following such transaction, (x) the direct or indirect holders of the Voting Stock of the holding company are substantially the same as the holders of Holdings’ Voting Stock immediately prior to such transaction or (y) no person is the beneficial owner, directly or indirectly, of more than 50% of the Voting Stock of such holding company;

5 (2) the adoption by the Board of Directors of a plan relating to the liquidation or dissolution of Holdings; (3) the merger or consolidation of Holdings with or into another Person or the merger of another Person with or into Holdings, or the sale of all or substantially all the assets of Holdings (determined on a consolidated basis) to another Person other than a transaction following which (A) in the case of a merger or consolidation transaction, holders of securities that represented 100% of the Voting Stock of Holdings immediately prior to such transaction (or other securities into which such securities are converted as part of such merger or consolidation transaction) own directly or indirectly at least a majority of the voting power of the Voting Stock of the surviving Person or any direct or indirect parent company of the surviving Person in such merger or consolidation transaction immediately after such transaction and (B) in the case of the sale of all or substantially all the assets of Holdings, each transferee becomes an obligor or a Guarantor in respect of the Securities; or (4) the Company ceases to be a Subsidiary of Holdings. “Code” means the Internal Revenue Code of 1986, as amended. “Company” means the party named as such in this Indenture until a successor replaces it and, thereafter, means the successor and, for purposes of any provision contained herein and required by the TIA, each other obligor on the indenture securities. “Comparable Treasury Issue” means the United States Treasury security selected by the Quotation Agent as having a maturity comparable to the remaining term of the Securities from the redemption date to September 15, 2024, that would be utilized, at the time of selection and in accordance with customary financial practice, in pricing new issues of corporate debt securities of a maturity most nearly equal to September 15, 2024. “Comparable Treasury Price” means, with respect to any redemption date, if clause (ii) of the Adjusted Treasury Rate is applicable, the average of three, or such lesser number as is obtained by the Trustee, Reference Treasury Dealer Quotations for such redemption date. “Consolidated Coverage Ratio” as of any date of determination means the ratio of (1) the aggregate amount of EBITDA for the period of the most recent four (4) full consecutive fiscal quarters for which internal consolidated financial statements of Holdings are available to (2) Consolidated Interest Expense for such four (4) fiscal quarters; provided, however, that:

6 (A) if Holdings, the Company or any Restricted Subsidiary has Incurred any Indebtedness since the beginning of such period that remains outstanding or if the transaction giving rise to the need to calculate the Consolidated Coverage Ratio is an Incurrence of Indebtedness, or both, EBITDA and Consolidated Interest Expense for such period shall be calculated after giving effect on a pro forma basis to such Indebtedness as if such Indebtedness had been Incurred on the first day of such period; (B) if Holdings, the Company or any Restricted Subsidiary has repaid, repurchased, defeased or otherwise discharged any Indebtedness since the beginning of such period or if any Indebtedness is to be repaid, repurchased, defeased or otherwise discharged (in each case other than Indebtedness Incurred under any revolving credit facility unless such Indebtedness has been permanently repaid and has not been replaced) on the date of the transaction giving rise to the need to calculate the Consolidated Coverage Ratio, EBITDA and Consolidated Interest Expense for such period shall be calculated on a pro forma basis as if such discharge had occurred on the first day of such period; (C) if since the beginning of such period Holdings, the Company or any Restricted Subsidiary shall have made any Asset Disposition, EBITDA for such period shall be reduced by an amount equal to EBITDA (if positive) directly attributable to the assets which are the subject of such Asset Disposition for such period, or increased by an amount equal to EBITDA (if negative), directly attributable thereto for such period and Consolidated Interest Expense for such period shall be reduced by an amount equal to the Consolidated Interest Expense directly attributable to any Indebtedness of Holdings, the Company or any Restricted Subsidiary repaid, repurchased, defeased or otherwise discharged with respect to Holdings, the Company and the continuing Restricted Subsidiaries in connection with such Asset Disposition for such period (or, if the Capital Stock of any Restricted Subsidiary is sold, the Consolidated Interest Expense for such period directly attributable to the Indebtedness of such Restricted Subsidiary to the extent Holdings, the Company and the continuing Restricted Subsidiaries are no longer liable for such Indebtedness after such sale); (D) if since the beginning of such period Holdings, the Company or any Restricted Subsidiary (by merger or otherwise) shall have made an Investment in the Company or any Restricted Subsidiary (or any Person which becomes a Restricted Subsidiary) or an acquisition of assets, including any acquisition of assets occurring in connection with a transaction requiring a calculation to be made hereunder, which constitutes all or substantially all of an operating unit of a business, EBITDA and Consolidated Interest Expense for such period shall be calculated after giving pro forma effect thereto (including the Incurrence of any Indebtedness) as if such Investment or acquisition had occurred on the first day of such period; and

7 (E) if since the beginning of such period any Person (that subsequently became a Restricted Subsidiary or was merged with or into Holdings, the Company or any Restricted Subsidiary since the beginning of such period) shall have made any Asset Disposition, any Investment or acquisition of assets that would have required an adjustment pursuant to clause (C) or (D) above if made by Holdings, the Company or a Restricted Subsidiary during such period, EBITDA and Consolidated Interest Expense for such period shall be calculated after giving pro forma effect thereto as if such Asset Disposition, Investment or acquisition had occurred on the first day of such period. For purposes of this definition, (i) whenever pro forma effect is to be given to an acquisition of assets, the amount of income or earnings relating thereto and the amount of Consolidated Interest Expense associated with any Indebtedness Incurred in connection therewith, the pro forma calculations shall be determined in good faith by a responsible financial or accounting Officer of Holdings and (ii) whenever pro forma effect is to be given to a transaction, the pro forma calculations may include cost savings and all other operating expense reductions resulting from such transaction that have been realized or are, in the good faith judgment of a responsible financial or accounting Officer of Holdings, expected to be realized within twelve (12) months of such transaction. If any Indebtedness bears a floating rate of interest and is being given pro forma effect, the interest on such Indebtedness shall be calculated as if the rate in effect on the date of determination had been the applicable rate for the entire period (taking into account any Interest Rate Agreement applicable to such Indebtedness if such Interest Rate Agreement has a remaining term in excess of twelve (12) months). If any Indebtedness is incurred under a revolving credit facility and is being given pro forma effect, the interest on such Indebtedness shall be calculated based on the average daily balance of such Indebtedness for the four (4) fiscal quarters subject to the pro forma calculation. “Consolidated Current Liabilities” of such Person as of the date of determination means the aggregate amount of liabilities of such Person and its consolidated Restricted Subsidiaries which may properly be classified as current liabilities under GAAP (including taxes accrued as estimated), on a consolidated basis, after eliminating: (1) all intercompany items between any of such Person and any Restricted Subsidiary of such Person; and (2) all current maturities of long-term Indebtedness, all as determined in accordance with GAAP consistently applied. “Consolidated Interest Expense” means, for any period, the total interest expense of Holdings, the Company and the consolidated Restricted Subsidiaries (other than non-cash interest expense attributable to convertible indebtedness under Accounting Practices Bulletin 14-1 or any successor provision), plus, to the extent not included in such total interest expense, and to the extent incurred by Holdings, the Company or the Restricted Subsidiaries, without duplication,

8 (1) interest expense attributable to Capital Lease Obligations, the interest portion of rent expense associated with Attributable Debt in respect of the relevant lease giving rise thereto, determined as if such lease were a capitalized lease in accordance with GAAP, and the interest component of any deferred payment obligations; (2) amortization of debt discount (including the amortization of original issue discount resulting from the issuance of Indebtedness at less than par) and debt issuance cost; provided, however, that any amortization of bond premium shall be credited to reduce Consolidated Interest Expense unless, pursuant to GAAP, such amortization of bond premium has otherwise reduced Consolidated Interest Expense; (3) capitalized interest; (4) non-cash interest expense; provided, however, that any non-cash interest expense or income attributable to the movement in the xxxx-to-market valuation of Hedging Obligations or other derivative instruments pursuant to GAAP shall be excluded from the calculation of Consolidated Interest Expense; (5) commissions, discounts and other fees and charges owed with respect to letters of credit and bankers’ acceptance financing; (6) net payments pursuant to Hedging Obligations; (7) all dividends accrued in respect of all Disqualified Stock of Holdings and all Preferred Stock of the Company or any Restricted Subsidiary, in each case, held by Persons other than Holdings, the Company or a Restricted Subsidiary (other than such dividends payable solely in Capital Stock (other than Disqualified Stock) of Holdings); (8) interest accruing on any Indebtedness of any other Person to the extent such Indebtedness is Guaranteed by (or secured by a Lien on the assets of) Holdings, the Company or any Restricted Subsidiary; and (9) the cash contributions to any employee stock ownership plan or similar trust to the extent such contributions are used by such plan or trust to pay interest or fees to any Person (other than Holdings, the Company or a Restricted Subsidiary) in connection with Indebtedness Incurred by such plan or trust. “Consolidated Leverage Ratio” as of any date of determination means the ratio of (1) the aggregate amount of Indebtedness of Holdings, the Company and the Restricted Subsidiaries as of such date of determination to (2) EBITDA for the most recent four (4) full consecutive fiscal quarters for which internal consolidated financial statements of Holdings are available, in each case with such pro forma adjustments to Indebtedness and EBITDA as are consistent with the pro forma adjustment provisions set forth in the definition of Consolidated Coverage Ratio.

9 “Consolidated Net Income” means, for any period, the net income of Holdings and its consolidated Subsidiaries; provided, however, that there shall not be included in such Consolidated Net Income: (1) any net income of any Person (other than Holdings) if such Person is not the Company or a Restricted Subsidiary, except that (A) subject to the exclusion contained in clause (4) below, Holdings’ equity in the net income of any such Person for such period shall be included in such Consolidated Net Income up to the aggregate amount of cash actually paid by such Person during such period to Holdings, the Company or a Restricted Subsidiary as a dividend or other distribution (subject, in the case of a dividend or other distribution paid to a Restricted Subsidiary, to the limitations contained in clause (3) below); and (B) Holdings’ or the Company’s equity in a net loss of any such Person for such period shall be included in determining such Consolidated Net Income up to the aggregate amount of cash actually funded by Holdings or the Company, as the case may be, during such period to such Person; (2) any net income (or loss) of any Person acquired by Holdings or a Subsidiary of Holdings in a pooling of interests transaction (or any transaction accounted for in a manner similar to a pooling of interests) for any period prior to the date of such acquisition, to the extent such net income is not paid in cash as a dividend or other distribution to Holdings, the Company or a Restricted Subsidiary (subject, in the case of a dividend or other distribution paid to a Restricted Subsidiary, to the limitations in clause (3) below); (3) any net income of any Restricted Subsidiary if such Restricted Subsidiary is subject to restrictions, directly or indirectly, on the payment of dividends or the making of distributions by such Restricted Subsidiary, directly or indirectly, to Holdings or the Company, except that (A) subject to the exclusion contained in clause (4) below, Holdings’ equity in the net income of any such Restricted Subsidiary for such period shall be included in such Consolidated Net Income up to the aggregate amount of cash actually paid by such Restricted Subsidiary during such period to Holdings, the Company or another Restricted Subsidiary as a dividend or other distribution (subject, in the case of a dividend or other distribution paid to another Restricted Subsidiary, to the limitation contained in this clause); and (B) Holdings’ equity in a net loss of any such Restricted Subsidiary for such period shall be included in determining such Consolidated Net Income;

10 (4) any gain (or loss) realized upon the sale or other disposition of any assets of Holdings, its consolidated Subsidiaries or any other Person (including pursuant to any sale-and-leaseback arrangement) which are not sold or otherwise disposed of in the ordinary course of business and any gain (or loss) realized upon the sale or other disposition of any Capital Stock of any Person; (5) extraordinary gains or losses; (6) income and losses attributable to discontinued operations; (7) any non-cash compensation expense realized for grants of performance shares, stock options or other rights to officers, directors and employees of Holdings, the Company or any Restricted Subsidiary shall be excluded; provided that such shares, options or other rights can be redeemed at the option of the holder only for Qualified Capital Stock of Holdings, the Company or any Restricted Subsidiary; (8) the cumulative effect of a change in accounting principles; (9) any net after-tax gain (or loss) attributable to the early retirement or conversion of Indebtedness; (10) unrealized gains and losses with respect to Hedging Obligations, including without limitation, those resulting from the application of FASB ASC Topic 815; and (11) non-cash interest expenses attributable to the equity component of convertible debt, including under FASB ASC Topic 470, in each case, for such period. Notwithstanding the foregoing, for the purposes of Section 4.04 only, there shall be excluded from Consolidated Net Income any repurchases, repayments or redemptions of Investments, proceeds realized on the sale of Investments or return of capital to Holdings, the Company or a Restricted Subsidiary to the extent such repurchases, repayments, redemptions, proceeds or returns increase the amount of Restricted Payments permitted under such Section pursuant to Section 4.04(a)(3)(D) or (E). “Consolidated Net Tangible Assets” of a Person as of any date of determination, means the total amount of assets (less accumulated depreciation and amortization, allowances for doubtful receivables, other applicable reserves and other properly deductible items) which would appear on a consolidated balance sheet of such Person and its consolidated Restricted Subsidiaries, determined on a consolidated basis in accordance with GAAP, and after giving effect to purchase accounting and after deducting therefrom Consolidated Current Liabilities and, to the extent otherwise included, the amounts of unamortized debt discount and expenses and other unamortized deferred charges, goodwill, patents, trademarks, service marks, trade names, copyrights, licenses, organization or developmental expenses and other intangible items.

11 “Consolidated Secured Indebtedness” means, as of any date of determination, an amount equal to the Consolidated Total Indebtedness as of such date that is then secured by Liens on property or assets of Holdings, the Company or any Restricted Subsidiary plus, the aggregate additional Indebtedness that Holdings, the Company or any Restricted Subsidiary may Incur as of such date pursuant to Section 4.03(b)(1) for which a financial institution has committed, or is otherwise obligated, to provide. “Consolidated Secured Leverage Ratio” means, as of any date of determination, the ratio of (a) Consolidated Secured Indebtedness to (b) the aggregate amount of EBITDA for the most recently ended four full consecutive fiscal quarters for which internal consolidated financial statements of Holdings are available, in each case with such pro forma adjustments to Consolidated Secured Indebtedness and EBITDA as are consistent with the pro forma adjustment provisions set forth in the definition of Consolidated Coverage Ratio; provided, however, that for purposes of the calculation of the Consolidated Secured Leverage Ratio, in connection with the Incurrence of any Lien pursuant to clause (26) of the definition of “Permitted Liens”, Holdings, the Company or the Restricted Subsidiaries may elect, pursuant to an Officer’s Certificate delivered to the Trustee, to treat all or any portion of the commitment under any Indebtedness which is to be secured by such Lien as being Incurred at such time and any subsequent Incurrence of Indebtedness under such commitment shall not be deemed, for purposes of this calculation, to be an Incurrence at such subsequent time. “Consolidated Total Indebtedness” means, as of any date of determination, an amount equal to the aggregate amount of all outstanding Indebtedness of Holdings, the Company and the Restricted Subsidiaries on a consolidated basis. “Credit Facilities” means one or more debt facilities (including the Senior Credit Agreement), commercial paper facilities, securities purchase agreement, indenture or similar agreement, in each case, with banks or other institutional lenders or investors providing for revolving loans, term loans, receivables financing (including through the sale of receivables to lenders or to special purpose entities formed to borrow from lenders against such receivables), letters of credit or the issuance of securities, including any related notes, guarantees, collateral documents, instruments and agreement executed in connection therewith, and, in each case, as amended, restated, replaced (whether upon or after termination or otherwise), refinanced, supplemented, modified or otherwise changed (in whole or in part, and without limitation as to amount, terms, conditions, covenants and other provisions) from time to time. “Currency Agreement” means any foreign exchange contract, currency swap agreement or other similar agreement with respect to currency values. “Default” means any event which is, or after notice or passage of time or both would be, an Event of Default. “Derivative Instrument” with respect to a Person, means any contract, instrument or other right to receive payment or delivery of cash or other assets to which

12 such Person or any Affiliate of such Person that is acting in concert with such Person in connection with such Person’s investment in the Securities (other than a Screened Affiliate) is a party (whether or not requiring further performance by such Person), the value or cash flows of which (or any material portion thereof) are materially affected by the value or performance of the Securities or the creditworthiness of the Company or any one or more of the Guarantors (the “Performance References”). “Designated Non-cash Consideration” means the Fair Market Value of non-cash consideration received by Holdings, the Company or one of the Restricted Subsidiaries in connection with an Asset Disposition that is so designated as Designated Non-cash Consideration pursuant to an Officer’s Certificate setting forth the basis of such valuation, less the amount of Temporary Cash Investments received in connection with a subsequent sale of such Designated Non-cash Consideration. “Disqualified Stock” means, with respect to any Person, any Capital Stock which by its terms (or by the terms of any security into which it is convertible or for which it is exchangeable at the option of the holder thereof) or upon the happening of any event: (1) matures or is mandatorily redeemable (other than redeemable only for Capital Stock of such Person which is not itself Disqualified Stock) pursuant to a sinking fund obligation or otherwise; (2) is convertible or exchangeable at the option of the holder thereof for Indebtedness or Disqualified Stock; or (3) is mandatorily redeemable or must be purchased upon the occurrence of certain events or otherwise, in whole or in part, in each case on or prior to the first anniversary after the Stated Maturity of the Securities; provided, however, that any Capital Stock that would not constitute Disqualified Stock but for provisions thereof giving holders thereof the right to require such Person to purchase or redeem such Capital Stock upon the occurrence of an “asset sale” or “change of control” occurring prior to the first anniversary after the Stated Maturity of the Securities shall not constitute Disqualified Stock if: (A) the “asset sale” or “change of control” provisions applicable to such Capital Stock are not more favorable to the holders of such Capital Stock than the terms applicable to the Securities under Sections 4.06 and 4.08 of this Indenture and (B) any such requirement only becomes operative after compliance with such terms applicable to the Securities, including the purchase of any Securities tendered pursuant thereto. “DTC” means The Depository Trust Company. “EBITDA” for any period means the sum of Consolidated Net Income, plus the following to the extent deducted in calculating such Consolidated Net Income: (1) all provisions for taxes based on the income or profits of Holdings, the Company and the consolidated Restricted Subsidiaries; plus

13 (2) Consolidated Interest Expense; plus (3) depreciation and amortization expense of Holdings, the Company and the consolidated Restricted Subsidiaries (including amortization of intangibles but excluding amortization expense attributable to a prepaid item that was paid in cash in a prior period); plus (4) any losses attributable to early extinguishment of Indebtedness or under any Hedging Obligation, and any unrealized losses attributable to the application of “xxxx to market” accounting in respect of Hedging Obligations; plus (5) an amount equal to any extraordinary loss plus any net loss realized by Holdings, the Company and the consolidated Restricted Subsidiaries in connection with (A) an Asset Disposition or (B) any disposition of the Ethanol Assets or any disposition of the shares of Capital Stock of the Ethanol Subsidiary; plus (6) all impairments and other non-cash charges or expenses of Holdings, the Company and the consolidated Restricted Subsidiaries (excluding any such impairment and other non-cash charges and expenses to the extent representing an accrual of or reserve for cash expenditures in any future period); less (7) all non-cash items of income of Holdings, the Company and the consolidated Restricted Subsidiaries (other than accruals of revenue by Holdings, the Company and the consolidated Restricted Subsidiaries in the ordinary course of business); less (8) any gains attributable to early extinguishment of Indebtedness or under any Hedging Obligation, and any unrealized gains attributable to the application of “xxxx to market” accounting in respect of Hedging Obligations; less (9) an amount equal to any extraordinary gain plus any net gain realized by Holdings, the Company and the consolidated Restricted Subsidiaries in connection with (A) an Asset Disposition or (B) any disposition of the Ethanol Assets or any disposition of the shares of Capital Stock of the Ethanol Subsidiary, in each case for such period. Notwithstanding the foregoing, the provision for taxes based on the income or profits of, and the depreciation and amortization and non-cash charges of, a Restricted Subsidiary shall be added to Consolidated Net Income to compute EBITDA only to the extent (and in the same proportion, including by reason of minority interests) that the net income or loss of such Restricted Subsidiary was included in calculating Consolidated Net Income and only if a corresponding amount would be permitted at the date of determination to be dividended or otherwise contributed or distributed to Holdings by such Restricted Subsidiary without prior approval (that has not been obtained), pursuant to the terms of its charter and all agreements, instruments,

14 judgments, decrees, orders, statutes, rules and governmental regulations applicable to such Restricted Subsidiary or its stockholders. “Ethanol Assets” means any and all real and personal, tangible and intangible assets and properties, including cash, securities, accounts and contract rights primarily related to the operations of the Ethanol Subsidiary. “Ethanol Subsidiary” means Xxxxxxxxx Holding, LLC. “Exchange Act” means the U.S. Securities Exchange Act of 1934, as amended. “Fair Market Value” means, with respect to any asset or property, the price which could be negotiated in an arm’s-length, free market transaction, for cash, between a willing seller and a willing and able buyer, neither of whom is under undue pressure or compulsion to complete the transaction. Fair Market Value shall be determined in good faith by the Board of Directors, whose determination shall be conclusive and evidenced by a resolution of such Board of Directors; provided, however, that for purposes of Section 4.04(a)(3)(B), if the Fair Market Value of the property or assets in question is so determined to be in excess of $50,000,000, such determination must be confirmed by an Independent Qualified Party. “Fitch” means Fitch Ratings Inc. and any successor to its rating agency business. “Foreign Subsidiary” means any Restricted Subsidiary of Holdings that is not organized under the laws of the United States of America or any State thereof or the District of Columbia. “GAAP” means generally accepted accounting principles in the United States of America as in effect as of the Measurement Date, including those set forth in: (1) the opinions and pronouncements of the Accounting Principles Board of the American Institute of Certified Public Accountants; (2) statements and pronouncements of the Financial Accounting Standards Board; (3) such other statements by such other entity as approved by a significant segment of the accounting profession; and (4) the rules and regulations of the SEC governing the inclusion of financial statements (including pro forma financial statements) in periodic reports required to be filed pursuant to Section 13 of the Exchange Act, including opinions and pronouncements in staff accounting bulletins and similar written statements from the accounting staff of the SEC,

15 except with respect to any reports or financial information required to be delivered pursuant to the covenant set forth under Section 4.02, which shall be prepared in accordance with GAAP as in effect on the date thereof. “Guarantee” means any obligation, contingent or otherwise, of any Person directly or indirectly guaranteeing any Indebtedness of any Person and any obligation, direct or indirect, contingent or otherwise, of such Person (1) to purchase or pay (or advance or supply funds for the purchase or payment of) such Indebtedness of such Person (whether arising by virtue of partnership arrangements, or by agreements to keep-well, to purchase assets, goods, securities or services, to take-or-pay or to maintain financial statement conditions or otherwise); or (2) entered into for the purpose of assuring in any other manner the obligee of such Indebtedness of the payment thereof or to protect such obligee against loss in respect thereof (in whole or in part); provided, however, that the term “Guarantee” shall not include endorsements for collection or deposit in the ordinary course of business. The term “Guarantee” used as a verb has a corresponding meaning. “Guarantor” means Holdings and any Subsidiary Guarantor. “Hedging Obligations” of any Person means the obligations of such Person pursuant to any Interest Rate Agreement, Currency Agreement or similar agreements or arrangements relating to commodity prices. “Holder” or “Securityholder” means the Person in whose name a Security is registered on the Registrar’s books. “Incur” means issue, assume, Guarantee, incur or otherwise become liable for; provided, however, that any Indebtedness of a Person existing at the time such Person becomes a Restricted Subsidiary (whether by merger, consolidation, acquisition or otherwise) shall be deemed to be Incurred by such Person at the time it becomes a Restricted Subsidiary. The term “Incurrence” when used as a noun shall have a correlative meaning. Solely for purposes of determining compliance with Section 4.03: (1) amortization of debt discount or the accretion of principal with respect to a non-interest bearing or other discount security; (2) the payment of regularly scheduled interest in the form of additional Indebtedness of the same instrument or the payment of regularly scheduled dividends on Capital Stock in the form of additional Capital Stock of the same class and with the same terms;

16 (3) the obligation to pay a premium in respect of Indebtedness arising in connection with the issuance of a notice of redemption or the making of a mandatory offer to purchase such Indebtedness; (4) changes in the principal amount of any Indebtedness that is denominated in a currency other than U.S. dollars solely as a result of fluctuations in exchange rates or currency values; and (5) the reclassification of any outstanding Capital Stock as Indebtedness due to a change in accounting principles so long as such Capital Stock was issued prior to, and not in contemplation of, such accounting change shall not be deemed to be the Incurrence of Indebtedness. “Indebtedness” means, with respect to any Person on any date of determination (without duplication): (1) the principal in respect of (A) indebtedness of such Person for money borrowed and (B) indebtedness evidenced by notes, debentures, bonds or other similar instruments for the payment of which such Person is responsible or liable, including, in each case, any premium on such indebtedness to the extent such premium has become due and payable; (2) all Capital Lease Obligations of such Person and all Attributable Debt in respect of Sale/Leaseback Transactions entered into by such Person; (3) all obligations of such Person issued or assumed as the deferred purchase price of property and all conditional sale obligations of such Person, in either case due more than six months after such property is acquired or such sale is completed, and all obligations of such Person under any title retention agreement relating to property acquired by such Person (but excluding (A) accounts payable or other liabilities to trade creditors arising in the ordinary course of business, (B) deferred compensation payable to directors, officers or employees of Holdings, the Company or any other Restricted Subsidiary and (C) any purchase price adjustment or earnout incurred in connection with an acquisition, except to the extent that the amount payable pursuant to such purchase price adjustment or earnout is, or becomes, reasonably determinable); (4) all obligations of such Person for the reimbursement of any obligor on any letter of credit, bankers’ acceptance or similar credit transaction (other than obligations with respect to letters of credit securing obligations (other than obligations described in clauses (1) through (3) above) entered into in the ordinary course of business of such Person to the extent such letters of credit are not drawn upon or, if and to the extent drawn upon, such drawing is reimbursed no later than the tenth Business Day following payment on the letter of credit); (5) the amount of all obligations of such Person with respect to the redemption, repayment or other repurchase of any Disqualified Stock of such

17 Person or, with respect to any Preferred Stock of any Subsidiary of such Person (but excluding, in each case, any accrued dividends); (6) all Guarantees by such Person of (A) obligations of the type referred to in clauses (1) through (5) or (B) dividends of other Persons; (7) all obligations of the type referred to in clauses (1) through (6) of other Persons secured by any Lien on any property or asset of such Person (whether or not such obligation is assumed by such Person), the amount of such obligation being deemed to be the lesser of the Fair Market Value of such property or assets and the amount of the obligation so secured; and (8) to the extent not otherwise included in this definition, Hedging Obligations of such Person. Notwithstanding the foregoing, in connection with the purchase by Holdings, the Company or any Restricted Subsidiary of any business, the term “Indebtedness” shall exclude post-closing payment adjustments to which the seller may become entitled to the extent such payment is determined by a final closing balance sheet or such payment depends on the performance of such business after the closing; provided, however, that, at the time of closing, the amount of any such payment is not determinable and, to the extent such payment thereafter becomes fixed and determined, the amount is paid within thirty (30) days thereafter. The amount of Indebtedness of any Person at any date shall be the outstanding balance at such date of all obligations as described above; provided, however, that in the case of Indebtedness sold at a discount, the amount of such Indebtedness at any time shall be the accreted value thereof at such time. The amount of any Preferred Stock that has a fixed redemption, repayment or repurchase price shall be calculated in accordance with the terms of such Preferred Stock as if such Preferred Stock were redeemed, repaid or repurchased on any date on which the amount of such Preferred Stock is to be determined pursuant to this Indenture; provided, however, that if such Preferred Stock could not be required to be redeemed, repaid or repurchased at the time of such determination, the redemption, repayment or repurchase price shall be calculated as of the first date thereafter on which such Preferred Stock could be required to be so redeemed, repaid or repurchased. If any Preferred Stock does not have a fixed redemption, repayment or repurchase price, the amount of such Preferred Stock shall be its maximum liquidation value. “Indenture” means this Indenture as amended or supplemented from time to time. “Independent Qualified Party” means an investment banking firm, accounting firm or appraisal firm of national standing selected by the Company; provided, however, that such firm is not an Affiliate of Holdings.

18 “Initial Securities” means $500,000,000 aggregate principal amount of 4.750% Senior Notes Due 2029 issued on the Issue Date. “Interest Rate Agreement” means any interest rate swap agreement, interest rate cap agreement or other financial agreement or arrangement with respect to exposure to interest rates. “Investment” in any Person means any direct or indirect advance, loan (other than advances to customers in the ordinary course of business that are recorded as accounts receivable on the balance sheet of the lender) or other extensions of credit (including by way of Guarantee or similar arrangement) or capital contribution to (by means of any transfer of cash or other property to others or any payment for property or services for the account or use of others), or any purchase or acquisition of Capital Stock, Indebtedness or other similar instruments issued by such Person. If Holdings, the Company or any Restricted Subsidiary issues, sells or otherwise disposes of any Capital Stock of a Person that is a Restricted Subsidiary such that, after giving effect thereto, such Person is no longer a Restricted Subsidiary, any Investment by Holdings, the Company or any Restricted Subsidiary in such Person remaining after giving effect thereto shall be deemed to be a new Investment at such time. The acquisition by Holdings, the Company or any Restricted Subsidiary of a Person that holds an Investment in a third Person shall be deemed to be an Investment by Holdings, the Company or such Restricted Subsidiary in such third Person at such time. Except as otherwise provided for herein, the amount of an Investment shall be its Fair Market Value at the time the Investment is made and without giving effect to subsequent changes in value. For purposes of the definition of “Unrestricted Subsidiary”, the definition of “Restricted Payment” and Section 4.04, “Investment” shall include: (1) the portion (proportionate to Holdings’ equity interest in such Subsidiary) of the Fair Market Value of the net assets of any Subsidiary of Holdings at the time that such Subsidiary is designated an Unrestricted Subsidiary; provided, however, that upon a redesignation of such Subsidiary as a Restricted Subsidiary Holdings shall be deemed to continue to have a permanent “Investment” in an Unrestricted Subsidiary in an amount (if positive) equal to (A) Holdings’ “Investment” in such Subsidiary at the time of such redesignation less (B) the portion (proportionate to Holdings’ equity interest in such Subsidiary) of the Fair Market Value of the net assets of such Subsidiary at the time of such redesignation; and (2) any property transferred to or from an Unrestricted Subsidiary shall be valued at its Fair Market Value at the time of such transfer, in each case as determined in good faith by the Board of Directors. “Investment Grade Rating” means a rating equal to or higher than (1) Baa3 (or the equivalent) by Xxxxx’x, (2) BBB- (or the equivalent) by Standard and Poor’s or (3) BBB- (or the equivalent) by Fitch, or an equivalent rating by any other Rating Agency.

19 “Issue Date” means September 13, 2019. “Legal Holiday” means a Saturday, a Sunday or a day on which banking institutions are not required to be open in the State of New York. “Lien” means any mortgage or deed of trust, charge, pledge, lien, security interest, hypothecation, or other encumbrance upon or with respect to any property of any kind (including any conditional sale, capital lease, other title retention agreement or any leases in the nature thereof) real or personal, moveable or immovable, now owned or hereafter acquired; provided, however, that in no event shall an operating lease be deemed to constitute a Lien. A Person shall be deemed to own subject to a Lien any property which it has acquired or holds subject to the interest of a vendor or lessor under any conditional sale agreement, Capital Lease Obligation or other title retention agreement. “Long Derivative Instrument” means a Derivative Instrument (i) the value of which generally increases, or the payment or delivery obligations under which generally decrease, with positive changes to the Performance References or (ii) the value of which generally decreases, or the payment or delivery obligations under which generally increase, with negative changes to the Performance References. “Measurement Date” means April 25, 2017, the issue date of the 2027 Notes. “Xxxxx’x” means Xxxxx’x Investors Service, Inc. and any successor to its rating agency business. “Net Available Cash” from an Asset Disposition means cash payments and the Fair Market Value of any Temporary Cash Investments received therefrom (including any cash payments received by way of deferred payment of principal pursuant to a note or installment receivable or otherwise and proceeds from the sale or other disposition of any securities (other than Temporary Cash Investments) received as consideration, but only as and when received, but excluding any other consideration received in the form of assumption by the acquiring Person of Indebtedness or other obligations relating to such properties or assets or received in any other non-cash form), in each case net of: (1) all legal, accounting and investment banking fees, title and recording tax expenses, commissions and other fees and expenses incurred (including any relocation expenses incurred as a result thereof and any related severance and associated costs), and all Federal, state, provincial, foreign and local taxes required to be accrued as a liability under GAAP, as a consequence of such Asset Disposition; (2) all payments made on any Indebtedness which is secured by any assets subject to such Asset Disposition, in accordance with the terms of any Lien upon or other security agreement of any kind with respect to such assets, or which must by its terms, or in order to obtain a necessary consent to such Asset

20 Disposition, or by applicable law, be repaid out of the proceeds from such Asset Disposition; (3) all distributions and other payments required to be made to minority interest holders in Restricted Subsidiaries as a result of such Asset Disposition; (4) the deduction of appropriate amounts provided by the seller as a reserve, in accordance with GAAP, against any liabilities associated with the property or other assets disposed in such Asset Disposition and retained by Holdings, the Company or any Restricted Subsidiary after such Asset Disposition; and (5) any portion of the purchase price from an Asset Disposition placed in escrow, whether as a reserve for adjustment of the purchase price, for satisfaction of indemnities in respect of such Asset Disposition or otherwise in connection with that Asset Disposition; provided, however, that upon the termination of that escrow, Net Available Cash shall be increased by any portion of funds in the escrow that are released to Holdings, the Company or any Restricted Subsidiary. “Net Cash Proceeds”, with respect to any issuance or sale of Capital Stock or Indebtedness, means the cash proceeds of such issuance or sale net of attorneys’ fees, accountants’ fees, underwriters’ or placement agents’ fees, discounts or commissions and brokerage, consultant and other fees actually incurred in connection with such issuance or sale and net of taxes paid or payable as a result thereof. “Net Short” means, with respect to a Holder or beneficial owner, as of a date of determination, either (i) the value of its Short Derivative Instruments exceeds the sum of the (x) the value of its Securities plus (y) the value of its Long Derivative Instruments as of such date of determination or (ii) it is reasonably expected that such would have been the case were a Failure to Pay or Bankruptcy Credit Event (each as defined in the 2014 International Swaps and Derivatives Association, Inc. Credit Derivatives Definitions, as supplemented by the 2019 Narrowly Tailored Credit Event Supplement) to have occurred with respect to the Company or any Guarantor immediately prior to such date of determination. “Obligations” means, with respect to any Indebtedness, all obligations for principal, premium, interest, penalties, fees, indemnifications, reimbursements and other amounts payable pursuant to the documentation governing such Indebtedness. “Officer” means the Chairman of the Board of Directors, the President, any Vice President, the Treasurer or any Assistant Treasurer, the Secretary or any Assistant Secretary of Holdings. “Officer” of the Company or any other Guarantor has a correlative meaning. “Officer’s Certificate” means a certificate signed by one Officer.

21 “Opinion of Counsel” means a written opinion from legal counsel who is reasonably acceptable to the Trustee. The counsel may be an employee of or counsel to Holdings or the Company (or if such opinion of counsel is in relation to a transaction of any other Guarantor or the Company, counsel to such other Guarantor or the Company). “Performance References” has the meaning set forth for such term in the definition of Derivative Instrument. “Permitted Investment” means an Investment by Holdings, the Company or any Restricted Subsidiary in: (1) Holdings, the Company, a Restricted Subsidiary or a Person that shall, upon the making of such Investment, become a Restricted Subsidiary; (2) another Person if, as a result of such Investment, such other Person is merged or consolidated with or into, or transfers or conveys all or substantially all its assets to, Holdings, the Company or a Restricted Subsidiary; (3) cash and Temporary Cash Investments; (4) receivables owing to Holdings, the Company or any Restricted Subsidiary if created or acquired in the ordinary course of business and payable or dischargeable in accordance with customary trade terms; provided, however, that such trade terms may include such concessionary trade terms as Holdings, the Company or any such Restricted Subsidiary deems reasonable under the circumstances; (5) payroll, commission, travel, relocation and similar advances to cover matters that are expected at the time of such advances ultimately to be treated as expenses for accounting purposes and that are made in the ordinary course of business; (6) loans or advances to directors and employees made in the ordinary course of business consistent with past practices of Holdings, the Company or such Restricted Subsidiary (including, without limitation, loans and advances the net proceeds of which are used solely to purchase Capital Stock of Holdings in connection with restricted stock or employee stock purchase plans, or to exercise stock received pursuant thereto on other incentive plans in a principal amount not to exceed the aggregate exercise or purchase price), or loans to refinance principal and accrued interest on any such loans; (7) Investments received (a) in settlement of debts created in the ordinary course of business and owing to Holdings, the Company or any Restricted Subsidiary, (b) in satisfaction of judgments or (c) in compromise or resolution of litigation, arbitration or other disputes; (8) any Person to the extent such Investment represents the non-cash portion of the consideration received for (a) an Asset Disposition as permitted

22 pursuant Section 4.06 or (b) a disposition of assets not constituting an Asset Disposition (including, for the avoidance of doubt, any disposition of the Ethanol Assets or any disposition of shares of Capital Stock of the Ethanol Subsidiary); (9) any Person where such Investment was acquired by Holdings, the Company or any Restricted Subsidiary (a) in connection with an acquisition, merger, amalgamation or consolidation with or into Holdings, the Company or a Restricted Subsidiary in a transaction that is not prohibited by this Indenture to the extent that such Investment was not made in contemplation of such acquisition, merger, amalgamation or consolidation, (b) in exchange for any other Investment or accounts receivable held by Holdings, the Company or any such Restricted Subsidiary in connection with or as a result of a bankruptcy, workout, reorganization or recapitalization of the Company of such other Investment or accounts receivable or (c) as a result of a foreclosure by Holdings, the Company or any Restricted Subsidiary with respect to any secured Investment or other transfer of title with respect to any secured Investment in default; (10) any Person to the extent such Investments consist of advances, deposits and prepayment for purchases of any assets, prepaid expenses, negotiable instruments held for collection and lease, utility and workers’ compensation, performance and other similar deposits made in the ordinary course of business by Holdings, the Company or any Restricted Subsidiary; (11) any Person in exchange for Qualified Capital Stock of Holdings; (12) any Person to the extent such Investments consist of Hedging Obligations; (13) Guarantees of Indebtedness otherwise permitted under Section 4.03 or Guarantees by Holdings, the Company or any Restricted Subsidiary of operating leases (other than Capital Lease Obligations) or of other obligations that do not constitute Indebtedness, in each case entered into by Holdings, the Company or a Restricted Subsidiary in the ordinary course of business; (14) any Person to the extent such Investment exists on, or any Investment pursuant to a binding agreement that exists on, the Issue Date, and any extension, modification or renewal of any such Investments, but only to the extent not involving additional advances, contributions or other Investments of cash or other assets or other increases thereof (other than as a result of the accrual or accretion of interest or original issue discount or the issuance of pay-in-kind securities, in each case, pursuant to the terms of such Investment as in effect on the Issue Date or as otherwise contemplated pursuant to a binding agreement that exists on the Issue Date); (15) any Person to the extent such Investments result solely from the receipt by Holdings, the Company or a Restricted Subsidiary from any of its Subsidiaries of a dividend or other Restricted Payment in the form of Capital

23 Stock, evidences of Indebtedness or other securities (but not any additions thereto made after the date of receipt thereof); and (16) any Persons to the extent such Investments, when taken together with all other Investments made pursuant to this clause (16) and outstanding on the date such Investment is made, do not exceed the greater of (A) $125,000,000 and (B) 6.5% of Consolidated Net Tangible Assets of Holdings, the Company and the Restricted Subsidiaries determined as of the date of such Investment. For purposes of this definition, in the event that a proposed Investment (or portion thereof) meets the criteria of more than one of the categories of Permitted Investments described in clauses (1) through (16) above, Holdings shall be entitled to classify (but not reclassify) such Investment (or portion thereof) in one or more of such categories set forth above). “Permitted Liens” means, with respect to any Person: (1) pledges or deposits by such Person under worker’s compensation laws, unemployment insurance laws or similar legislation, or good faith deposits in connection with bids, tenders, contracts (other than for the payment of Indebtedness) or leases to which such Person is a party, or deposits to secure public or statutory obligations of such Person or deposits of cash or United States government bonds to secure surety or appeal bonds to which such Person is a party, or deposits as security for contested taxes or import duties or for the payment of rent, in each case Incurred in the ordinary course of business; (2) Liens imposed by law, such as carriers’, warehousemen’s, mechanics’, materialmens’, repairmens’ and other like Liens, in each case for sums not yet due or being contested in good faith by appropriate proceedings or other Liens arising out of judgments or awards against such Person with respect to which such Person shall then be proceeding with an appeal or other proceedings for review and Liens arising solely by virtue of any statutory or common law provision relating to banker’s Liens, rights of set-off or similar rights and remedies as to deposit accounts or other funds maintained with a creditor depository institution; provided, however, that (A) such deposit account is not a dedicated cash collateral account and is not subject to restrictions against access by Holdings in excess of those set forth by regulations promulgated by the Federal Reserve Board and (B) such deposit account is not intended by Holdings, the Company or any Restricted Subsidiary to provide collateral to the depository institution; (3) Liens for taxes, assessments or governmental charges not yet subject to penalties for non-payment or which are being contested in good faith by appropriate proceedings; (4) Liens in favor of issuers of surety bonds or letters of credit issued pursuant to the request of and for the account of such Person in the ordinary

24 course of its business; provided, however, that such letters of credit do not constitute Indebtedness; (5) Liens on specific items of inventory or other goods (and the proceeds thereof) of any Person securing such Person’s obligations in respect of bankers’ acceptances issued or created in the ordinary course of business for the account of such Person to facilitate the purchase, shipment or storage of such inventory or other goods; (6) leases or licenses with respect to the assets or properties of Holdings, the Company or any Restricted Subsidiary, so long as such leases or licenses do not, individually or in the aggregate, interfere in any material respect with the ordinary course of the business of Holdings, the Company or any Restricted Subsidiary; (7) filing of Uniform Commercial Code financing statements (or similar filings under applicable law) regarding operating leases; (8) survey exceptions, minor encumbrances, easements or reservations of, or rights of others for, licenses, rights-of-way, sewers, electric lines, telegraph and telephone lines and other similar purposes, or zoning or other restrictions as to the use of real property or Liens incidental to the conduct of the business of such Person or to the ownership of its properties which were not Incurred in connection with Indebtedness and which do not in the aggregate materially adversely affect the value of said properties or materially impair their use in the operation of the business of such Person; (9) judgment Liens in respect of judgments that do not constitute an Event of Default; (10) Liens securing Indebtedness Incurred to finance the construction, purchase or lease of, or repairs, improvements or additions to, property, plant or equipment of such Person, including Permitted Indebtedness Incurred under Section 4.03(b)(11), provided, however, that the Lien may not extend to any other property owned by such Person or any of its Restricted Subsidiaries at the time the Lien is Incurred (other than assets and property affixed or appurtenant thereto, improvements thereon, accessions thereto, proceeds or replacements in respect thereof); (11) Liens to secure Permitted Indebtedness Incurred under Section 4.03(b)(1); (12) Liens on assets of any Foreign Subsidiary to secure Indebtedness permitted by Section 4.03(b)(13); (13) Liens existing on the Issue Date;