EX-4.1 2 dex41.htm FIRST AMENDMENT TO CREDIT AGREEMENT Execution Copy FIRST AMENDMENT TO CREDIT AGREEMENT

Exhibit 4.1

Execution Copy

FIRST AMENDMENT TO CREDIT AGREEMENT

THIS FIRST AMENDMENT TO CREDIT AGREEMENT (this “Amendment”), dated as of September 1, 2010, is entered into among AMN HEALTHCARE, INC., a Nevada corporation (the “Borrower”), AMN HEALTHCARE SERVICES, INC., a Delaware corporation (the “Parent”), the Subsidiary Guarantors identified on the signature pages hereto, the lenders identified on the signature pages hereto (the “Lenders”) and BANK OF AMERICA, N.A., as Administrative Agent (the “Administrative Agent”).

W I T N E S S E T H

WHEREAS, the Borrower, the Parent, the Subsidiary Guarantors, the Lenders party thereto, the Administrative Agent and the Syndication Agent (as defined therein) have entered into that certain Credit Agreement dated as of December 23, 2009 (as amended, amended and restated, modified and supplemented in accordance with the terms thereof, the “Existing Credit Agreement”);

WHEREAS, the Borrower has advised the Lenders that it intends to acquire NF Investors, Inc., a Delaware corporation (the parent company of Nursefinders, Inc. (d/b/a Medfinders)) and its Subsidiaries (the “Acquisition”) pursuant to the terms of that certain Agreement and Plan of Merger by and among AMN Healthcare Services, Inc., Nightingale Acquisition, Inc., Nightingale Acquisition, LLC, NF Investors, Inc. and GSUIG, L.L.C. (in its capacity as the representative), dated as of July 28, 2010, as it may be amended on or prior to the First Amendment Effective Date;

WHEREAS, in connection with the Acquisition, the Borrower has requested that the Lenders amend certain provisions of the Existing Credit Agreement in order to, (a) extend the Revolving Maturity Date from December 23, 2012 to August 31, 2014, (b) extend the Maturity Date with respect to the Tranche B Loan from December 23, 2013 to June 23, 2015 (for Tranche B Lenders agreeing to such extension), (c) increase the Tranche B Loan by an additional $77,750,000, (d) adjust certain of the financial covenants set forth in Section 7.11 of the Existing Credit Agreement, (e) permit the incurrence of the Second Lien Credit Agreement (as defined below) and (f) provide for such other modifications as set forth herein;

WHEREAS, simultaneously with this Amendment, the Borrower is entering into a Second Lien Credit Agreement in the principal amount of $40,000,000 dated as of the date hereof (as amended, amended and restated, modified and supplemented in accordance with the terms thereof, the “Second Lien Credit Agreement”) with the Parent, each Subsidiary Guarantor party thereto, the lenders party thereto (the “Second Lien Lenders”) and Bank of America, N.A. as administrative agent (in such capacity, the “Second Lien Administrative Agent”);

WHEREAS, the Requisite Lenders, each Revolving Lender, each Additional Tranche B Lender and each Extended Tranche B Lender have agreed to amend the Existing Credit Agreement in accordance with such requests and as provided herein; and

NOW, THEREFORE, in consideration of the agreements hereinafter set forth, and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, the parties hereto agree as follows:

1

PART 1

DEFINITIONS

SUBPART 1.1 Certain Definitions. Unless otherwise defined herein or the context otherwise requires, the following terms used in this Amendment, including its preamble and recitals, have the following meanings:

“Amended Credit Agreement” means the Existing Credit Agreement as amended hereby.

“First Amendment” has the meaning set forth in Part 3.

SUBPART 1.2 Other Definitions. Unless otherwise defined herein or the context otherwise requires, terms used in this Amendment, including its preamble and recitals, have the meanings provided in the Amended Credit Agreement.

PART 2

AMENDMENTS TO EXISTING CREDIT AGREEMENT

Effective on (and subject to the occurrence of) the First Amendment Effective Date, the Existing Credit Agreement is hereby amended in accordance with this Part 2.

SUBPART 2.1 Designation of Syndication Agents and Joint Lead Arrangers and Joint Book Managers. General Electric Capital Corporation and SunTrust Bank are hereby designated as Co-Syndication Agents for the Lenders under the Amended Credit Agreement. ING Capital LLC is hereby designated as Documentation Agent for the Lenders under the Amended Credit Agreement. Banc of America Securities LLC, GE Capital Markets, Inc., SunTrust Xxxxxxxx Xxxxxxxx, Inc. and ING Capital LLC are hereby designated as Joint Lead Arrangers and Joint Book Managers for the Lenders under the Amended Credit Agreement.

SUBPART 2.2 Amendments to Section 1.1.

(a) The definition of “Administrative Agent’s Fee Letter” is hereby amended and restated in its entirety to read as follows:

“Administrative Agent’s Fee Letter” means that certain letter agreement, dated as of July 28, 2010, among the Administrative Agent, Banc of America Securities LLC, the Borrower and the Parent, as amended, modified, restated or supplemented from time to time.

(b) The definition of “Applicable Percentage” is hereby amended and restated in its entirety to read as follows:

“Applicable Percentage” means, for purposes of calculating (a) the applicable interest rate for any day for any Revolving Loan bearing interest at (i) the Base Rate, shall be 4.50% and (ii) the Eurodollar Rate, shall be 5.50%, (b) the applicable rate of the Unused Fee for any day for purposes of Section 3.5(a), shall be 0.75% and (c) the Letter of Credit Fee for any day for purposes of Section 3.5(b)(i), shall be 5.50%.

(c) The definition of “Arrangers” is hereby amended and restated in its entirety to read as follows:

“Arrangers” means, collectively, Banc of America Securities LLC, GE Capital Markets, Inc., SunTrust Xxxxxxxx Xxxxxxxx, Inc. and ING Capital LLC, in their capacities as joint lead arrangers and book managers, and “Arranger” means any one of them.

2

(d) The proviso appearing at the end of the definition of “Consolidated Cash Interest Expense” is hereby amended and restated in its entirety to read as follows:

provided, however, that (a) Consolidated Cash Interest Expense for the twelve month period ending as of September 30, 2010 shall be based on Consolidated Cash Interest Expense for the one month period then ended multiplied by 12, (b) Consolidated Cash Interest Expense for the twelve month period ending as of December 31, 2010 shall be based on Consolidated Cash Interest Expense for the one fiscal-quarter period then ended multiplied by 4, (c) Consolidated Cash Interest Expense for the twelve month period ending as of March 31, 2011 shall be based on Consolidated Cash Interest Expense for the two fiscal-quarter period then ended multiplied by 2 and (d) Consolidated Cash Interest Expense for the twelve month period ending as of June 30, 2011 shall be based on Consolidated Cash Interest Expense for the three fiscal-quarter period then ended multiplied by 1 1/3.

(e) The definition of “Consolidated EBITDA” is hereby amended and restated in its entirety to read as follows:

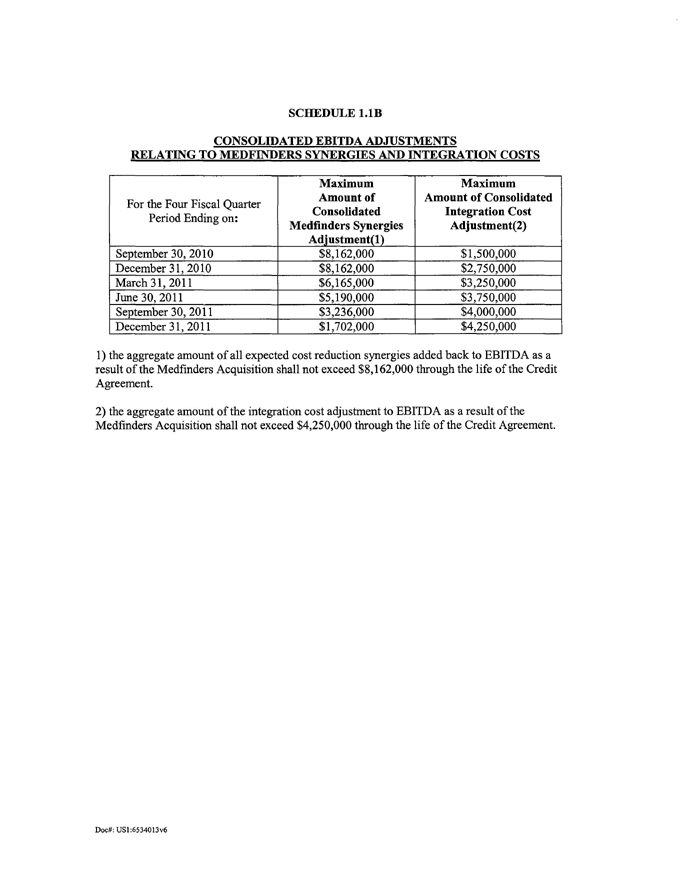

“Consolidated EBITDA” means, as of any date for the four fiscal quarter period ending on such date with respect to the Consolidated Parties on a consolidated basis, the sum of (i) Consolidated Net Income, plus (ii) an amount which, in the determination of Consolidated Net Income, has been deducted for, without duplication, (A) interest expense, (B) total Federal, state, local and foreign income, value added and similar taxes, (C) depreciation and amortization expense and (D) Consolidated Non-Cash Charges, plus (iii) with respect to each of December 31, 2009, March 31, 2010, June 30, 2010 and September 30, 2010, the Consolidated EBITDA Adjustment for such fiscal quarter plus (iv) an aggregate amount not to exceed $7,600,000 during the term of this Agreement which, in the determination of Consolidated Net Income, has been deducted for, without duplication, costs, charges and expenses relating to, and in preparation of, the Transactions, plus (v) expected but unrealized cost reduction synergies in connection with the Medfinders Acquisition in an amount not to exceed the amounts set forth on Schedule 1.1E for the four fiscal quarter period ending on such date plus (vi) an amount which, in the determination of Consolidated Net Income, has been deducted for, without duplication, cash integration charges relating to reductions in the workforce, one-time incentives related to the Transactions, the termination of leases and third-party consulting costs incurred through such period in an aggregate amount not to exceed the amounts set forth on Schedule 1.1E for the period since the First Amendment Effective Date minus (vii) Consolidated Non-Cash Gains, all as contained within the financial statements prepared in accordance with GAAP.

(f) The parenthetical appearing at the end of clause (b)(ii) contained in the definition of “Consolidated Fixed Charge Coverage Ratio” is hereby amended and restated in its entirety to read as follows:

(other than Consolidated Scheduled Funded Debt Payments for any period prior to the First Amendment Effective Date)

(g) The definition of “Consolidated Funded Indebtedness” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended by adding a new subclause (iii) to clause (a) thereof to read as follows, and by making the necessary grammatical changes thereto:

and (iii) the Backstopped Letters of Credit,

3

(h) Clause (iii) contained in the definition of “Consolidated Scheduled Funded Debt Payments” and the proviso appearing at the end of such definition are hereby amended and restated in their entirety to read as follows:

(iii) shall not include any voluntary prepayments or mandatory prepayments required pursuant to Section 3.3 or Section 3.3 of the Second Lien Credit Agreement; provided, however, that (a) Consolidated Scheduled Funded Debt Payments for the twelve month period ending as of September 30, 2010 shall be $9,250,000, (b) Consolidated Scheduled Funded Debt Payments for the twelve month period ending as of December 31, 2010 shall be based on Consolidated Scheduled Funded Debt Payments for the one fiscal-quarter period then ended multiplied by 4, (c) Consolidated Scheduled Funded Debt Payments for the twelve month period ending as of March 31, 2011 shall be based on Consolidated Scheduled Funded Debt Payments for the two fiscal-quarter period then ended multiplied by 2 and (d) Consolidated Scheduled Funded Debt Payments for the twelve month period ending as of June 30, 2011 shall be based on Consolidated Scheduled Funded Debt Payments for the three fiscal-quarter period then ended multiplied by 1 1/3.

(i) The definition of “Credit Documents” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Credit Documents” means a collective reference to this Credit Agreement, the Notes, the LOC Documents, each Joinder Agreement, the Administrative Agent’s Fee Letter, the GE Fee Letter, the ING Fee Letter, the SunTrust Fee Letter, the Collateral Documents, the Intercreditor Agreement and all other related agreements and documents issued or delivered hereunder or thereunder or pursuant hereto or thereto (in each case as the same may be amended, modified, restated, supplemented, extended, renewed or replaced from time to time), and “Credit Document” means any one of them.

(j) The definition of “Eurodollar Rate” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Eurodollar Rate” means for any Interest Period with respect to a Eurodollar Loan, a rate per annum determined by the Administrative Agent pursuant to the following formula:

| Eurodollar Rate = | Interbank Offered Rate | |||||

| 1.00 – Eurodollar Reserve Requirement |

Notwithstanding the foregoing, solely for purposes of Tranche B Loans, the Eurodollar Rate shall in no event be less than (a) with respect to Non-Extended Tranche B Loans, 2.25% per annum at any time and (b) with respect to Extended Tranche B Loans, 1.75% per annum at any time.

(k) The definition of “Excess Cash Flow” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended by adding a new subclause (iii) and a new subclause (iv) to clause (h) thereof to read as follows and by renumbering existing subclause (iii) contained in clause (h) thereof to read subclause (v).

(iii) expected but unrealized cost reduction synergies in connection with the Medfinders Acquisition in an amount not to exceed the amounts set forth on Schedule 1.1(E) for the four fiscal quarter period ending on such date, (iv) for the fiscal year ending December 31, 2010 only, cash on hand of the Credit Parties used on the Closing Date to consummate the Medfinders Acquisition

4

(l) The definition of “Excluded Taxes” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended by adding a new clause (e) to the end thereof to read as follows, and by making the necessary grammatical changes thereto:

and (e) any taxes imposed on any “withholdable payment” payable to such recipient as a result of the failure of such recipient to satisfy the applicable requirements as set forth in FATCA after December 31, 2012.

(m) The definition of “Maturity Date” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Maturity Date” means (i) with respect to the Revolving Loans, Swingline Loans and Letters of Credit, the Revolving Maturity Date and (ii) with respect to the Tranche B Loans, the applicable Tranche B Maturity Date.

(n) The definition of “Permitted Acquisition” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Permitted Acquisition” means (i) the Medfinders Acquisition occurring on the First Amendment Effective Date and (ii) any other Acquisition by the Borrower or any Subsidiary of the Borrower, provided that (a) the Property acquired (or the Property of the Person acquired) in such Acquisition (x) is used or useful in the same or a similar line of business as the Borrower and its Subsidiaries were engaged in on the Closing Date (or any reasonable extensions or expansions thereof) and (y) has earnings before interest, taxes, depreciation and amortization for the prior four fiscal quarters in an amount greater than $0, (b) the Administrative Agent shall have received all items in respect of the Capital Stock or Property acquired in such Acquisition required to be delivered by the terms of Section 7.12 and/or Section 7.13, (c) in the case of an Acquisition of the Capital Stock of another Person, the board of directors (or other comparable governing body) of such other Person shall have duly approved such Acquisition, (d) the Borrower shall have delivered to the Administrative Agent a Pro Forma Compliance Certificate demonstrating that, upon giving effect to such Acquisition on a Pro Forma Basis, no Default or Event of Default would exist as the result of a violation of Section 7.11(a) or Section 7.11(b), (e) the representations and warranties made by the Credit Parties in any Credit Document shall be true and correct in all material respects at and as if made as of the date of such Acquisition (after giving effect thereto) except to the extent such representations and warranties expressly relate to an earlier date, (f) if such transaction involves the purchase of an interest in a partnership between the Borrower (or a Subsidiary of the Borrower) as a general partner and entities unaffiliated with the Borrower or such Subsidiary as the other partners, such transaction shall be effected by having such equity interest acquired by a holding company directly or indirectly wholly-owned by the Borrower newly formed for the sole purpose of effecting such transaction and (g) the total Qualifying Consideration for all such Acquisitions occurring after the Closing Date (other than the Medfinders Acquisition) shall not exceed (x) $50,000,000 or (y) to the extent the Borrower has provided a certificate in form and substance satisfactory to the Administrative Agent to the effect that, after giving effect to any such Acquisition on a Pro Forma Basis, the Consolidated Leverage Ratio shall be 0.50 less than the then applicable level set forth in Section 7.11(a), $125,000,000; provided, further, however, prior to and after giving effect to all Permitted Acquisitions (other than the Medfinders Acquisition), on a pro forma basis, the Unused Revolving Committed Amount shall not be less than $10,000,000.

(o) The definition of “Permitted Liens” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended by adding a new clause (xix) to the end thereof to read as follows, and by making the necessary grammatical changes thereto:

| (xix) | Liens arising under the Second Lien Collateral Documents to the extent such Liens (and related Indebtedness) are subject to the terms of the Intercreditor Agreement. |

5

(p) The last sentence of the first paragraph of the definition of “Pro Forma Basis” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

In connection with any calculation of the Consolidated Leverage Ratio, Consolidated First Lien Leverage Ratio and the Consolidated Fixed Charge Coverage Ratio upon giving effect to a transaction on a Pro Forma Basis:

(q) Clause (a) contained in the definition of “Pro Forma Compliance Certificate” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

(a) the Consolidated Leverage Ratio, the Consolidated First Lien Leverage Ratio and the Consolidated Fixed Charge Coverage Ratio as of the most recent fiscal quarter end preceding the date of the applicable transaction with respect to which the Administrative Agent shall have received the Required Financial Information and

(r) The definition of “Revolving Maturity Date” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Revolving Maturity Date” means August 31, 2014.

(s) The definition of “SunTrust Fee Letter” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

“SunTrust Fee Letter” means that certain letter agreement, dated as of July 28, 2010, among SunTrust Bank, SunTrust Xxxxxxxx Xxxxxxxx, Inc., the Borrower and the Parent, as amended, modified, restated or supplemented from time to time.

(t) The definition of “Syndication Agent” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Syndication Agent” means, collectively, General Electric Capital Corporation and SunTrust Bank, in their capacities as Syndication Agents under this Agreement, and their successors and permitted assigns.

(u) The definition of “Tranche B Loan” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Tranche B Loan” shall mean the Initial Tranche B Loan and/or the Additional Tranche B Loan, as appropriate.

(v) The definition of “Tranche B Loan Committed Amount” set forth in Section 1.1 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

“Tranche B Loan Committed Amount” shall mean the Initial Tranche B Loan Committed Amount and/or the Additional Tranche B Loan Committed Amount, as appropriate.

6

(w) The following new definitions are hereby added to Section 1.1 of the Existing Credit Agreement in their appropriate alphabetical order:

“Acquired Company” means NF Investors, Inc., a Delaware corporation (the parent company of Nursefinders, Inc. (d/b/a Medfinders)) and its Subsidiaries.

“Acquisition Agreement” means the Agreement and Plan of Merger by and among AMN Healthcare Services, Inc., Nightingale Acquisition, Inc., Nightingale Acquisition, LLC, NF Investors, Inc. and GSUIG, L.L.C. (in its capacity as the representative), dated as of July 28, 2010, as it may be amended on or prior to the First Amendment Effective Date.

“Additional Tranche B Lender” means those Lenders providing Additional Tranche B Loans on the First Amendment Effective Date.

“Additional Tranche B Loan” shall have the meaning set forth in Section 2.4(a).

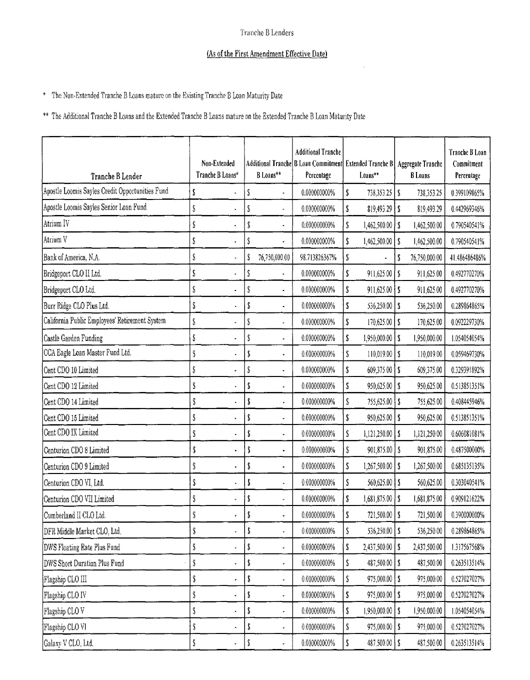

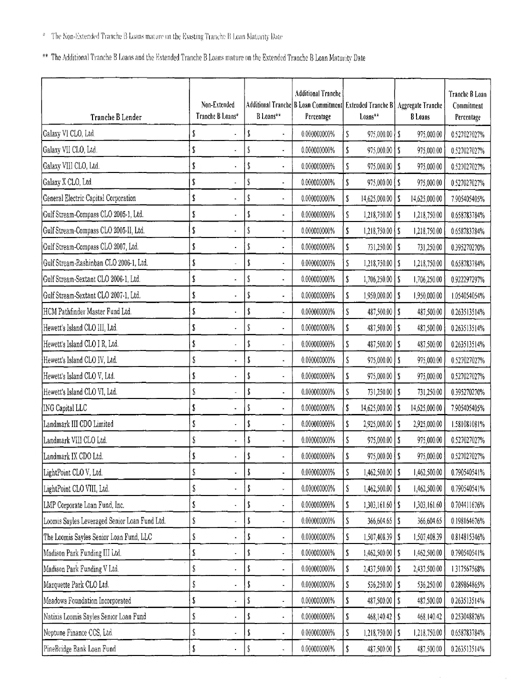

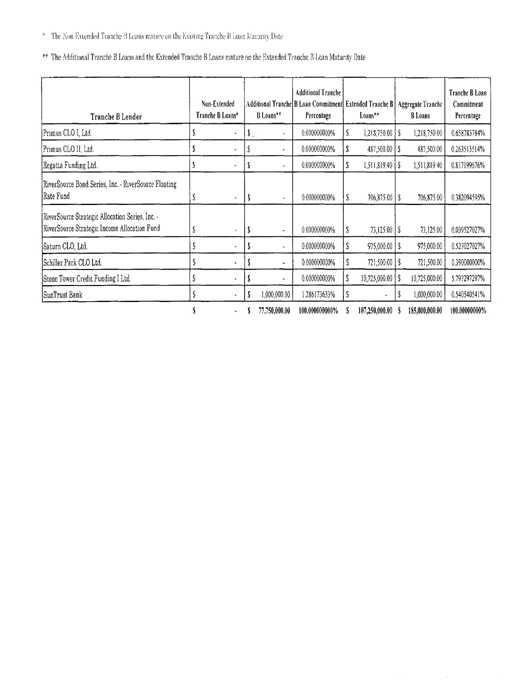

“Additional Tranche B Loan Commitment Percentage” shall mean, for any Additional Tranche B Lender, the percentage identified as its Additional Tranche B Loan Percentage on Schedule 2.1(a).

“Additional Tranche B Loan Committed Amount” shall have the meaning set forth in Section 2.4(a).

“Backstopped Letters of Credit” shall mean those certain letters of credit set forth on Schedule 1.1F.

“Consolidated First Lien Leverage Ratio” means, as of the end of any fiscal quarter of the Consolidated Parties for the four fiscal quarter period ending on such date with respect to the Consolidated Parties on a consolidated basis, the ratio of (a) Consolidated Funded Indebtedness of the Consolidated Parties on a consolidated basis, other than Indebtedness attributable to the Second Lien Financing, on the last day of such period to (b) Consolidated EBITDA for such period.

“Existing Tranche B Loan Maturity Date” shall have the meaning set forth in the definition of Tranche B Loan Maturity Date.

“Extended Tranche B Lender” means those Lenders with (a) Additional Tranche B Loans and/or (b) Initial Tranche B Loans that mature on the Extended Tranche B Loan Maturity Date.

Extended Tranche B Loans” means (a) the Additional Tranche B Loans and/or (b) the Initial Tranche B Loans that, as indicated on Schedule 2.1(a), mature on the Extended Tranche B Maturity Date.

“Extended Tranche B Loan Maturity Date” shall have the meaning set forth in the definition of Tranche B Loan Maturity Date.

“FATCA” means Sections 1471 through 1474 of the Code and any regulations or official interpretations thereof.

“First Amendment” means that certain First Amendment to Credit Agreement, dated as of the First Amendment Effective Date, by and among the Borrower, the Parent, the Subsidiary Guarantors, the Requisite Lenders, the Revolving Lenders, the Additional Tranche B Lenders, the Extended Tranche B Lenders and the Administrative Agent.

7

“First Amendment Effective Date” means September 1, 2010.

“GE Fee Letter” means that certain letter agreement, dated as of July 28, 2010, among the General Electric Capital Corporation, GE Capital Markets, Inc., the Borrower and the Parent, as amended, modified, restated or supplemented from time to time.

“ING Fee Letter” means that certain letter agreement, dated as of August 19, 2010, among ING Capital LLC, the Borrower and the Parent, as amended, modified, restated or supplemented from time to time.

“Initial Tranche B Loan” shall have the meaning set forth in Section 2.4(a).

“Initial Tranche B Loan Committed Amount” shall have the meaning set forth in Section 2.4(a).

“Intercreditor Agreement” means an intercreditor agreement in substantially the form of Exhibit A to the First Amendment, dated as of the First Amendment Effective Date by and among the Administrative Agent, the Second Lien Administrative Agent and the Borrower, as amended, modified, restated or supplemented from time to time.

“Liquidity” means, as of any date of determination, for the Consolidated Parties on a consolidated basis, the sum of all cash and Cash Equivalents of the Consolidated Parties as of such date plus the actual amount as of such date by which the Revolving Committed Amount exceeds the aggregate amount of Revolving Loans and Letters of Credit then outstanding.

“Medfinders Acquisition” means the Acquisition of the Acquired Company pursuant to the Acquisition Agreement.

“Non-Extended Tranche B Lender” means those Lenders with Initial Tranche B Loans that mature on the Existing Tranche B Loan Maturity Date.

“Non-Extended Tranche B Loans” means the Initial Tranche B Loans that, as indicated on Schedule 2.1(a), mature on the Existing Tranche B Maturity Date.

“Refinancing Event” means the incurrence by any Credit Party of any Indebtedness (including, without limitation, any new or additional term loans under this Credit Agreement, whether incurred directly or by way of the conversion of Loans into a new tranche of replacement term loans under this Credit Agreement) having an effective interest rate (to be calculated after giving effect to margins, upfront or similar fees or original issue discount shared with all lenders or holders thereof, but excluding the effect of any arrangement, structuring, syndication or other fees payable in connection therewith that are not shared with all lenders or holders thereof) as of the date of such incurrence that is by the express terms of such Indebtedness (and not by virtue of any fluctuation in Eurodollar Rate or Base Rate), less than the effective interest rate of (to be calculated on the same basis as above) the Extended Tranche B Loans as of the date of such incurrence.

“Second Lien Administrative Agent” shall mean Bank of America, N.A., in its capacity as administrative agent for the Second Lien Lenders, together with its successors and assigns.

“Second Lien Credit Agreement” shall mean that certain Second Lien Credit Agreement dated as of the First Amendment Effective Date among the Parent, the Borrower, each Subsidiary Guarantor party thereto, the lenders party thereto and the Second Lien Administrative Agent, as amended, amended and restated, modified or supplemented from time to time.

8

“Second Lien Collateral Documents” means a collective reference to the “Security Agreement” and “Pledge Agreement”, each delivered pursuant to the Second Lien Credit Agreement and such other documents executed and delivered in connection with the attachment and perfection of the Second Lien Administrative Agent’s security interests and liens arising thereunder, including, without limitation, UCC financing statements, account control agreements and patent and trademark filings.

“Second Lien Financing” shall mean the $40 million senior secured second lien financing incurred by the Borrower pursuant to the Second Lien Credit Agreement.

“Second Lien Lenders” shall mean those certain banks and other financial institutions from time to time party to the Second Lien Credit Agreement as lenders.

“Tranche B Loan Maturity Date” shall mean (a) with respect to all Initial Tranche B Loans held by Non-Extended Tranche B Lenders, December 23, 2013 (the “Existing Tranche B Maturity Date”) and (b) with respect to all Extended Tranche B Loans, June 23, 2015 (the “Extended Tranche B Maturity Date”).

“Transaction” means (i) the Medfinders Acquisition, (ii) the entering into of the First Amendment by the Borrower and the Guarantors, (iii) the entering into of the Second Lien Credit Agreement by the Borrower and the Guarantors, (iv) the entering into of the other “Credit Documents” as defined in the Second Lien Credit Agreement by the Borrower and the Guarantors, (v) the repayment, with proceeds of the Loans hereunder, of all Indebtedness of the Acquired Company and (vi) the related financings and other transactions contemplated by this Credit Agreement, the Second Lien Credit Agreement and the Acquisition Agreement.

SUBPART 2.3 Amendment to Section 1.2(a). Section 1.2(a) of the Existing Credit Agreement is hereby amended in the following respects:

(a) The reference to “the fiscal year ended December 31, 2008” in such section is hereby amended to read “the fiscal year ended December 31, 2009.”

(b) The reference to “September 30, 2009” in such section is hereby amended to read “June 30, 2010.”

SUBPART 2.4 Amendment to Section 2.4(a). Section 2.4(a) of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

(a) Tranche B Loan Commitment. Subject to the terms and conditions hereof and in reliance upon the representations and warranties set forth herein each Lender with a Tranche B Loan Commitment on the Closing Date made available to the Borrower on the Closing Date such Lender’s Commitment Percentage of a term loan in Dollars (the “Initial Tranche B Loan”) in the aggregate principal amount of ONE HUNDRED TEN MILLION DOLLARS ($110,000,000) (the “Initial Tranche B Loan Committed Amount”). The aggregate outstanding principal amount of the Initial Tranche B Loan as of the First Amendment Effective Date is equal to ONE HUNDRED SEVEN MILLION TWO HUNDRED FIFTY THOUSAND DOLLARS ($107,250,000). Subject to the terms and conditions hereof and in reliance upon the representations and warranties set forth herein each Additional Tranche B Lender severally agrees to make available to the Borrower on the First Amendment Effective Date such Additional Tranche B Lender’s Additional Tranche B Loan Commitment Percentage of a term loan in Dollars (the “Additional Tranche B Loan”, together with

9

the Initial Tranche B Loan, the “Tranche B Loan”) in the aggregate principal amount of SEVENTY SEVEN MILLION SEVEN HUNDRED FIFTY THOUSAND DOLLARS ($77,750,000) (the “Additional Tranche B Loan Committed Amount”, together with the Initial Tranche B Loan Committed Amount, the “Tranche B Loan Committed Amount”). The Tranche B Loan may consist of Base Rate Loans or Eurodollar Loans, or a combination thereof, as the Borrower may request; provided, however, that no more than six (6) Eurodollar Loans which are Tranche B Loans shall be outstanding hereunder at any time (it being understood that, for purposes hereof, Eurodollar Loans with different Interest Periods shall be considered as separate Eurodollar Loans, even if they begin on the same date, although borrowings, extensions and conversions may, in accordance with the provisions hereof, be combined at the end of existing Interest Periods to constitute a new Eurodollar Loan with a single Interest Period). Amounts prepaid or repaid on the Tranche B Loan may not be reborrowed.

SUBPART 2.5 Amendment to Section 2.4(b). Section 2.4(b) of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

(b) Borrowing Procedures. The Borrower shall submit an appropriate Notice of Borrowing to the Administrative Agent with respect to (i) the Initial Tranche B Loan not later than 12:00 Noon (Charlotte, North Carolina time) on the Closing Date and (ii) the Additional Tranche B Loan not later than 12:00 Noon (Charlotte, North Carolina time) on the First Amendment Effective Date in the case of a Base Rate Loan or on the third Business Day prior to the First Amendment Effective Date in the case of a Eurodollar Loan; provided that with respect to any Eurodollar Loan requested by the Borrower on the First Amendment Effective Date, the Borrower shall provide a funding indemnity letter in form and substance reasonably acceptable to the Administrative Agent contemporaneously with the delivery of the Notice of Borrowing. Such Notices of Borrowing shall be irrevocable. Each (i) Tranche B Lender with a Tranche B Loan Commitment on the Closing Date made its Commitment Percentage of the Initial Tranche B Loan and (ii) each Additional Tranche B Lender shall make its Additional Tranche B Commitment Percentage of the Additional Tranche B Loan available to the Administrative Agent for the account of the Borrower at the office of the Administrative Agent specified in Schedule 2.1(a), or at such other office as the Administrative Agent may designate in writing, by 2:00 P.M. (Charlotte, North Carolina time) on (i) with respect to the Initial Tranche B Loan, the Closing Date in Dollars and in funds immediately available to the Administrative Agent and (ii) with respect to the Additional Tranche B Loan, the First Amendment Effective Date in Dollars and in funds immediately available to the Administrative Agent; provided, however, that the Administrative Agent shall, if requested by the Borrower and agreed to by the Administrative Agent, make the Additional Tranche B Loan available to the Borrower as provided above prior to the Administrative Agent’s receipt of corresponding amounts from the Additional Tranche B Lenders.

SUBPART 2.6 Amendment to Section 2.4(d). Section 2.4(d) of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

(d) Repayment of Tranche B Loan.

(i) Repayment of Initial Tranche B Loans held by Non-Extended Tranche B Lenders.

[No longer applicable.]

10

(ii) Repayment of Extended Tranche B Loans. The principal amount of Extended Tranche B Loans shall be payable in installments on the dates and in the amounts set forth in the table below, unless accelerated sooner pursuant to Section 9.2:

| Payment Dates | Principal Amortization Payment | |

| September 30, 2010 | $2,312,500 | |

| December 31, 2010 | $2,312,500 | |

| March 31, 2011 | $2,312,500 | |

| June 30, 2011 | $2,312,500 | |

| September 30, 2011 | $4,625,000 | |

| December 31, 2011 | $4,625,000 | |

| March 31, 2012 | $4,625,000 | |

| June 30, 2012 | $4,625,000 | |

| September 30, 2012 | $6,937,500 | |

| December 31, 2012 | $6,937,500 | |

| March 31, 2013 | $6,937,500 | |

| June 30, 2013 | $6,937,500 | |

| September 30, 2013 | $6,937,500 | |

| December 31, 2013 | $6,937,500 | |

| March 31, 2014 | $6,937,500 | |

| June 30, 2014 | $6,937,500 | |

| September 30, 2014 | $9,250,000 | |

| December 31, 2014 | $9,250,000 | |

| March 31, 2015 | $9,250,000 | |

| Extended Tranche B Loan Maturity Date | $74,000,000 or the

remaining outstanding principal amount of the Extended Tranche B Loans |

SUBPART 2.7 Amendment to Section 2.4(e). Section 2.4(e) of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

(e) Interest. Subject to the provisions of Section 3.1, the Tranche B Loan shall bear interest at a per annum rate equal to:

(i) Base Rate Loans. (A) During such periods as the Non-Extended Tranche B Loans shall be comprised in whole or in part of Base Rate Loans, such Base Rate Loans shall bear interest on the outstanding principal amount thereof from the applicable borrowing date at a rate per annum equal to the sum of the Base Rate plus 3.00% and (B) during such periods as the Extended Tranche B Loans shall be comprised in whole or in part of Base Rate Loans, such Base Rate Loans shall bear interest on the outstanding principal amount thereof from the applicable borrowing date at a rate per annum equal to the sum of the Base Rate plus 4.50%.

(ii) Eurodollar Loans. (A) During such periods as the Non-Extended Tranche B Loans shall be comprised in whole or in part of Eurodollar Loans, such Eurodollar Loans shall bear interest on the outstanding principal amount thereof for each Interest Period at a rate per annum equal to the sum of the Eurodollar Rate for such Interest Period plus 4.00% and (B) during such periods as the Extended Tranche B Loans shall be comprised in whole or in part of Eurodollar Loans, such Eurodollar Loans shall bear interest on the outstanding principal amount thereof for each Interest Period at a rate per annum equal to the sum of the Eurodollar Rate for such Interest Period plus 5.50%.

11

Interest on the Tranche B Loan shall be payable in arrears on each applicable Interest Payment Date (or at such other times as may be specified herein).

SUBPART 2.8 Amendment to Section 2.5. Section 2.5 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

2.5 Reserved.

SUBPART 2.9 Amendments to Section 3.3.

(a) The last sentence appearing at the end of clause (a) is hereby amended and restated in its entirety to read as follows

All prepayments under this Section 3.3(a) shall be subject to Section 3.3(c) and Section 3.12, but otherwise without premium or penalty, and shall be accompanied by interest on the principal amount prepaid through the date of prepayment.

(b) A new clause (c) is hereby added to Section 3.3 of the Existing Credit Agreement to read as follows:

(c) Prepayment Premiums. In connection with any prepayment of the Extended Tranche B Loans with the proceeds of any Refinancing Event consummated prior to the first anniversary of the First Amendment Effective Date, the Borrower agrees to pay a premium in an amount equal to 1.0% of the aggregate principal amount of the Extended Tranche B Loans prepaid in connection with such Refinancing Event (it being understood that the incurrence of Indebtedness shall only be a Refinancing Event to the extent of the proceeds thereby used to prepay the Extended Tranche B Loans and not to the extent the proceeds are generated from other sources).

SUBPART 2.10 Amendment to Section 3.11(e). Section 3.11(e) of the Existing Credit Agreement is hereby amended by adding a new clause (iv) to the end thereof to read as follows:

(iv) Each Foreign Lender shall deliver to the Borrower and the Administrative Agent such documentation reasonably requested by the Borrower and the Administrative Agent sufficient for the Administrative Agent and the Borrower to comply with their obligations under FATCA and to determine whether payments to such Lender hereunder requirements are subject to withholding under FATCA.

SUBPART 2.11 Amendment to Section 3.12(a). The reference to “Closing Date” contained in subclause (i) of Section 3.12(a) of the Existing Credit Agreement is hereby amended to read “First Amendment Effective Date.”

SUBPART 2.12 Amendment to Section 6.1(a). Section 6.1(a) of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

6.1 Financial Condition.

(a) The audited consolidated balance sheets and income statements of the Consolidated Parties for the fiscal year ended December 31, 2009 (including the notes thereto) (i) have been audited by (A) with respect to the Acquired Company, Ernst & Young and (B) with respect to the other Consolidated Parties, KPMG LLP, (ii) have been prepared in accordance with GAAP consistently applied throughout the periods covered thereby and (iii) present fairly in all

12

material respects (on the basis disclosed in the footnotes to such financial statements) the consolidated financial condition, results of operations and cash flows of each of the Consolidated Parties referred in clauses (A) and (B) of this paragraph as of such date and for such periods, it being understood that each of the Acquired Company and the other Consolidated Parties were independent businesses and not aggregated for purposes of preparing consolidated financial statements for periods prior to the First Amendment Effective Date. The unaudited interim balance sheets of each of the Consolidated Parties referred in clauses (A) and (B) of this paragraph as at the end of, and the related unaudited interim statements of earnings and of cash flows for, each fiscal quarterly period ended after December 31, 2009 and prior to the First Amendment Effective Date (i) have been prepared in accordance with GAAP consistently applied for interim financial statements throughout the periods covered thereby, and (ii) present fairly in all material respects the consolidated and consolidating financial condition, results of operations and cash flows of the of each of the Consolidated Parties referred in clauses (A) and (B) of this paragraph as of such date and for such periods except that they do not contain the materials and disclosures to be found in notes to financial statements prepared in accordance with GAAP nor do they reflect year-end adjustments. Other than the Medfinders Acquisition, during the period from December 31, 2009 to and including the First Amendment Effective Date, there has been no sale, transfer or other disposition by any Consolidated Party of any material part of the business or property of the Consolidated Parties, taken as a whole, and no purchase or other acquisition by any of them of any business or property (including any Capital Stock of any other Person) material in relation to the consolidated financial condition of the Consolidated Parties, taken as a whole, in each case, which is not reflected in the foregoing financial statements or in the notes thereto.

SUBPART 2.13 Amendment to Section 6.2. Section 6.2 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

6.2 No Material Change.

Since the date the Parent’s Form 10-K was filed with the SEC for the fiscal year ended December 31, 2009, there has been no development or event relating to or affecting any Consolidated Party (other than the Acquired Company) which has had or could reasonably be expected to have a Material Adverse Effect and since the First Amendment Effective Date, there has been no development or event relating to or affecting any Consolidated Party (including the Acquired Company) which has had or could reasonably be expected to have a Material Adverse Effect.

SUBPART 2.14 Amendment to Section 6.7. The reference to “September 30, 2009” appearing in Section 6.7 of the Existing Credit Agreement is hereby amended to read “June 30, 2010”.

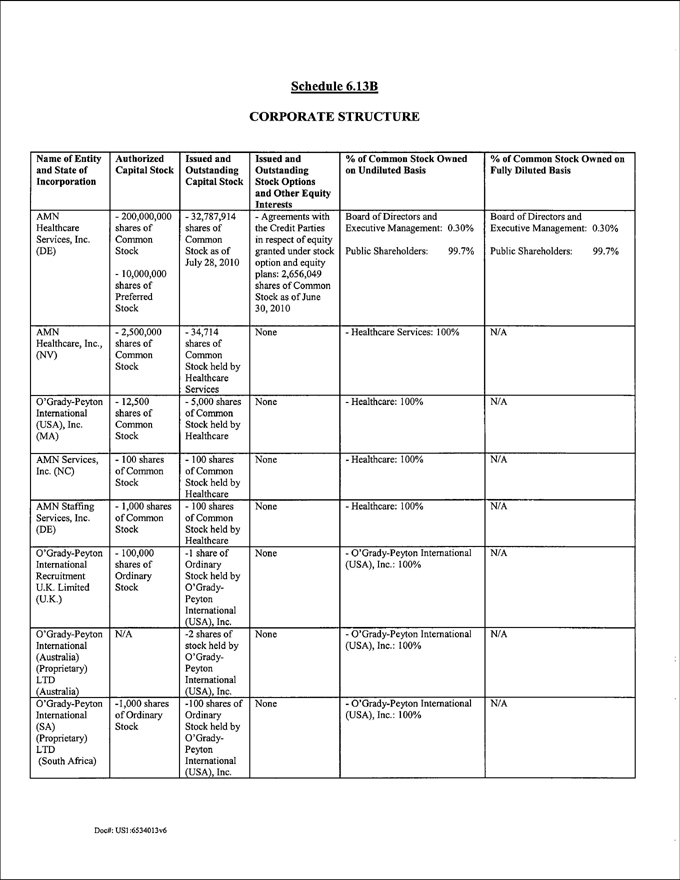

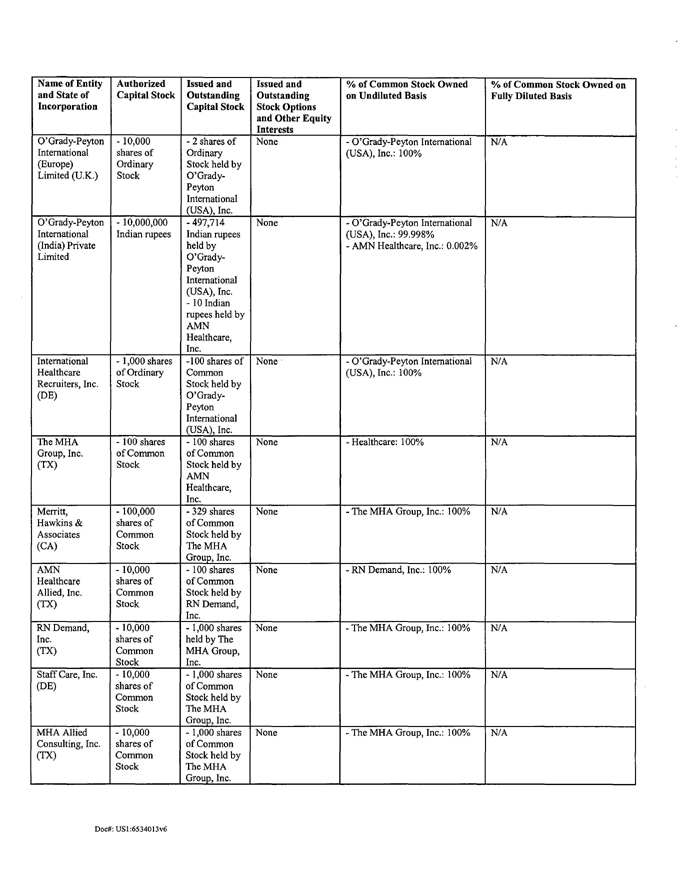

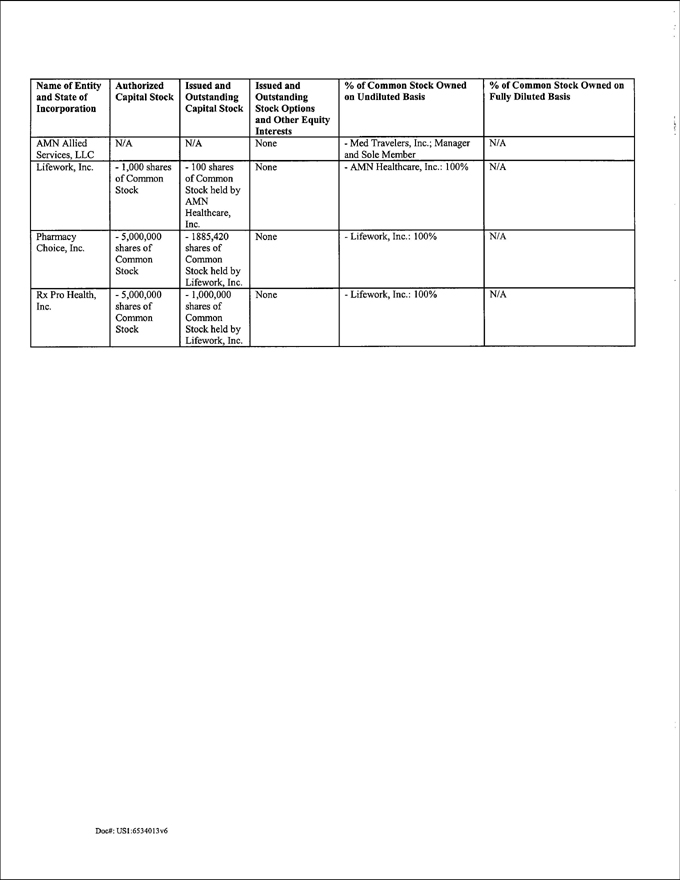

SUBPART 2.15 Amendment to Section 6.13. Section 6.13 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

6.13 Corporate Structure; Capital Stock, etc.

The capital and ownership structure of the Consolidated Parties as of the First Amendment Effective Date is as described in Schedule 6.13A. Set forth on Schedule 6.13B is a complete and accurate list as of the First Amendment Effective Date with respect to the Borrower and each of its direct and indirect Subsidiaries of (i) jurisdiction of incorporation, (ii) number of shares of each class of Capital Stock outstanding, (iii) number and percentage of outstanding shares of each class owned (directly or indirectly) by the Consolidated Parties and (iv) number and effect, if exercised, of all outstanding options, warrants, rights of conversion or purchase and all other similar rights with respect thereto. The outstanding Capital Stock of all such Persons is

13

validly issued, fully paid and non-assessable and as of the First Amendment Effective Date is owned by the Consolidated Parties, directly or indirectly, in the manner set forth on Schedule 6.13B, free and clear of all Liens (other than Permitted Liens). As of the First Amendment Effective Date, other than as set forth in Schedule 6.13B, neither the Borrower nor any of its Subsidiaries has outstanding any securities convertible into or exchangeable for its Capital Stock nor does any such Person have outstanding any rights to subscribe for or to purchase any options for the purchase of, or any agreements providing for the issuance (contingent or otherwise) of, or any calls, commitments or claims of any character relating to, its Capital Stock.

SUBPART 2.16 Amendment to Section 6.15. Section 6.15 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

6.15 Purpose of Loans and Letters of Credit.

The Borrower will use the proceeds of the Loans to (a) provide for working capital, capital expenditures and general corporate purposes of the Borrower and its Subsidiaries (including, without limitation, Permitted Acquisitions), (b) on the Closing Date to refinance the Existing Credit Agreement, (c) on the Closing Date to cash collateralize certain letters of credit issued under the Existing Credit Agreement in accordance with the Cash Collateral Agreement, (d) on the First Amendment Effective Date to consummate the Medfinders Acquisition and the other Transactions and (e) pay fees and expenses relating to any of the foregoing. The Letters of Credit shall be used only for or in connection with appeal bonds, reimbursement obligations arising in connection with surety and reclamation bonds, reinsurance, domestic or international trade transactions and obligations not otherwise aforementioned relating to transactions entered into by the applicable account party in the ordinary course of business.

SUBPART 2.17 Amendment to Section 6.19. Section 6.19 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

6.19 Business Locations.

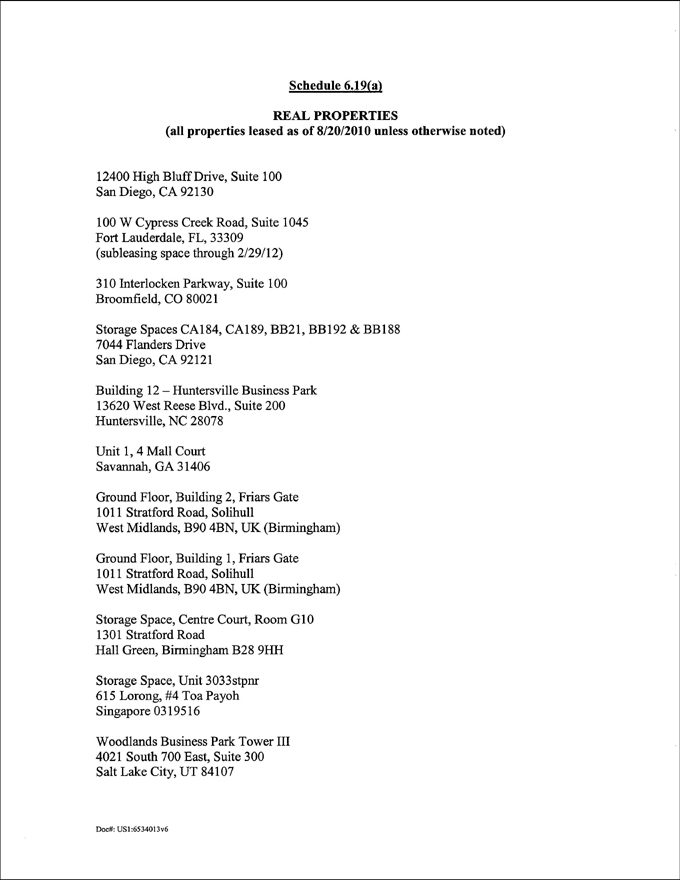

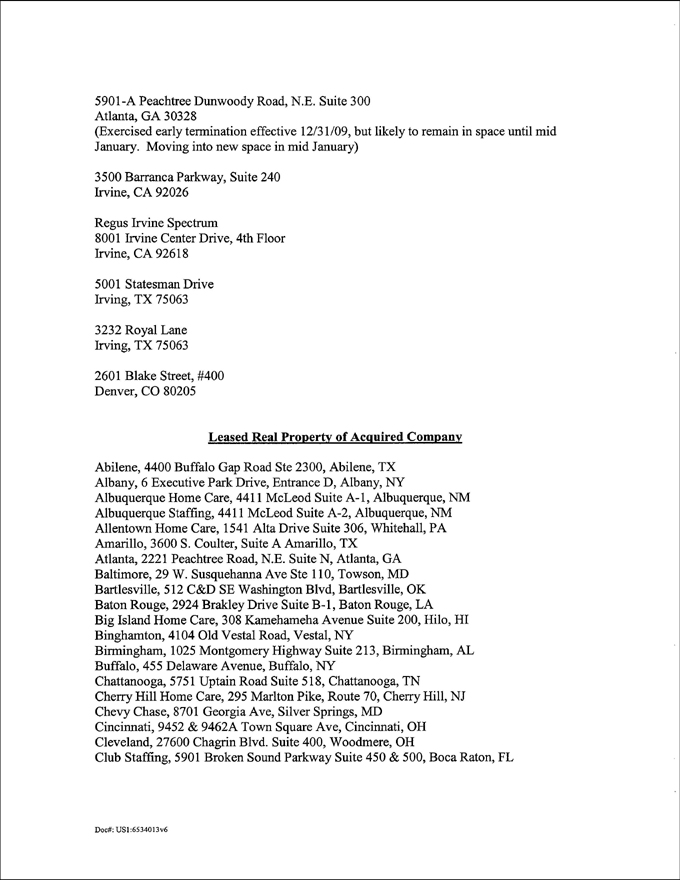

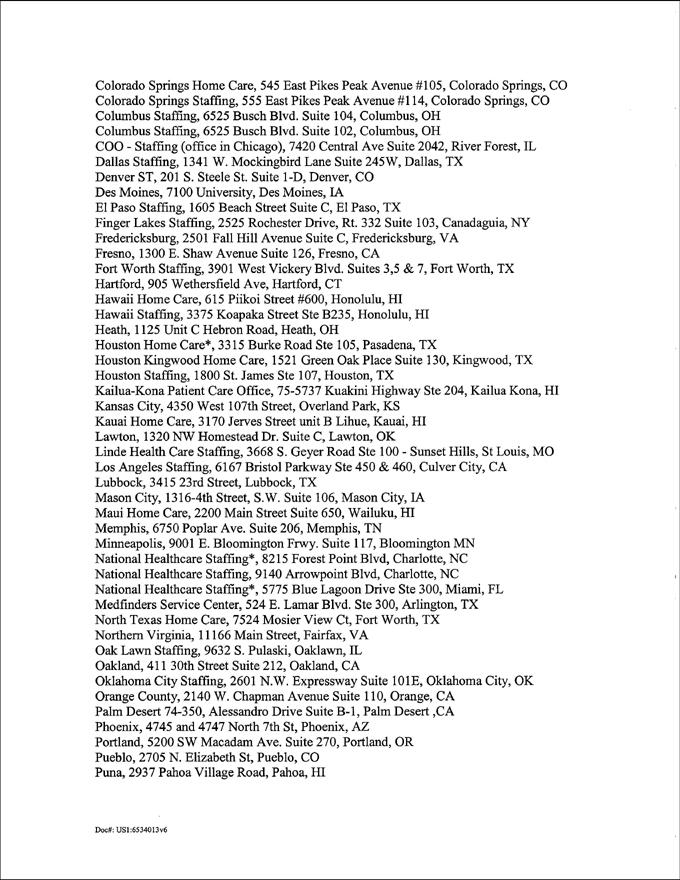

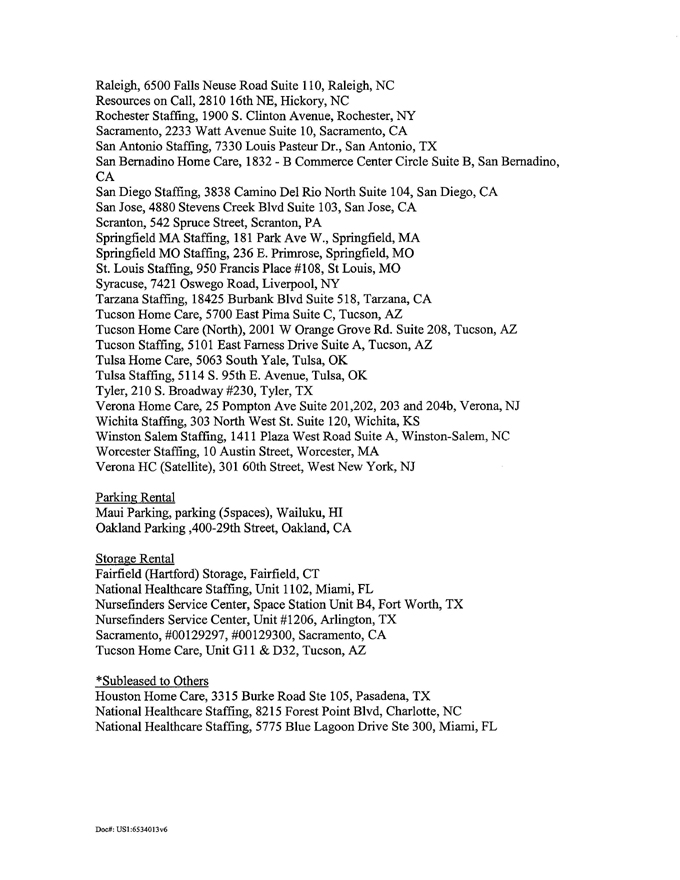

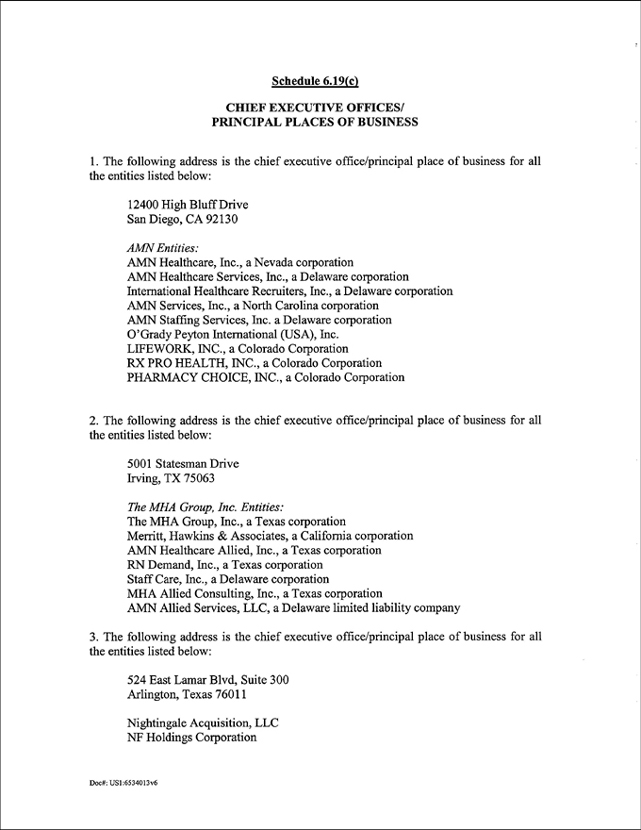

Set forth on Schedule 6.19(a) is a list as of the First Amendment Effective Date of all real property located in the United States and owned or leased by any Credit Party with street address and state where located. Set forth on Schedule 6.19(b) is a list as of the First Amendment Effective Date of all locations where any tangible personal property of a Credit Party is located, including street address and state where located. Set forth on Schedule 6.19(c) is the chief executive office and principal place of business of each Credit Party as of the First Amendment Effective Date.

SUBPART 2.18 Amendment to Section 6.24. Section 6.24 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

6.24 Nature of Business.

As of the First Amendment Effective Date, the Consolidated Parties are engaged in the business of providing temporary healthcare staffing services, workforce management solutions, physician permanent placement services and home healthcare services.

SUBPART 2.19 Amendment to Section 6.25. Section 6.25 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

6.25 Solvency.

As of the First Amendment Effective Date, the Borrower is Solvent, and the Credit Parties are Solvent on a consolidated basis.

14

SUBPART 2.20 Amendments to Section 7.11.

(a) Section 7.11(a) of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

(a) Consolidated Leverage Ratio. The Credit Parties shall not permit the Consolidated Leverage Ratio as of the last day of any fiscal quarter of the Consolidated Parties to be greater than:

| Fiscal Year | March 31 | June 30 | September 30 | December 31 | ||||

| 2010 | N/A | N/A | 4.25 to 1.0 | 4.25 to 1.0 | ||||

| 2011 | 4.25 to 1.0 | 4.25 to 1.0 | 4.00 to 1.0 | 3.75 to 1.0 | ||||

| 2012 | 3.75 to 1.0 | 3.50 to 1.0 | 3.50 to 1.0 | 2.50 to 1.0 | ||||

| 2013 | 2.50 to 1.0 | 2.50 to 1.0 | 2.50 to 1.0 | 2.25 to 1.0 | ||||

| 2014 and thereafter | 2.25 to 1.0 | 2.25 to 1.0 | 2.25 to 1.0 | 2.25 to 1.0 |

(b) A new Section 7.11(c) is hereby added to the Existing Credit Agreement to read as follows:

(c) Minimum Liquidity. The Credit Parties shall not permit Liquidity at any time following the First Amendment Effective Date to be less than $15,000,000.

(c) A new Section 7.11(d) is hereby added to the Existing Credit Agreement to read as follows:

(d) Consolidated First Lien Leverage Ratio. The Credit Parties shall not permit the Consolidated First Lien Leverage Ratio as of the last day of any fiscal quarter of the Consolidated Parties to be greater than:

| Fiscal Year | March 31 | June 30 | September 30 | December 31 | ||||

| 2010 | N/A | N/A | 3.75 to 1.0 | 3.75 to 1.0 | ||||

| 2011 | 3.75 to 1.0 | 3.75 to 1.0 | 3.50 to 1.0 | 3.00 to 1.0 | ||||

| 2012 | 3.00 to 1.0 | 2.71 to 1.0 | 2.71 to 1.0 | 2.00 to 1.0 | ||||

| 2013 and thereafter | 2.00 to 1.0 | 2.00 to 1.0 | 2.00 to 1.0 | 2.00 to 1.0 |

SUBPART 2.21 Amendment to Section 8.1. Section 8.1 of the Existing Credit Agreement is hereby amended by adding new clauses (m) and (n) to the end thereof to read as follows, and by making the necessary grammatical changes thereto:

(m) Indebtedness incurred in connection with the Second Lien Financing in an aggregate amount not to exceed $40,000,000; and

(n) Indebtedness with respect to the Backstopped Letters of Credit (to the extent constituting Indebtedness).

15

SUBPART 2.22 Amendment to Section 8.7. Section 8.7 of the Existing Credit Agreement is hereby amended to (i) amend and restate clause (a) thereof in its entirety to read as follows and (ii) by adding a new clause (k) to the end thereof to read as follows, and by making the necessary grammatical changes thereto:

(a) to make dividends or other distributions payable to any Credit Party (directly or indirectly through Subsidiaries); provided that the proceeds of any dividends or distributions made to the Parent in reliance of this clause (a) are subsequently contributed by the Parent to a Credit Party,

and (k) the Borrower may use a portion of the proceeds of the Loan to make a dividend to the Parent on the Closing Date to allow the Parent to concurrently fund a portion of the Transactions.

SUBPART 2.23 Amendment to Section 8.8. Section 8.8 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

8.8 Other Indebtedness, etc.

The Credit Parties will not permit any Consolidated Party to (a) if any Default or Event of Default has occurred and is continuing or would be directly or indirectly caused as a result thereof, (i) after the issuance thereof, amend or modify any of the terms of any Indebtedness (other than the Second Lien Credit Agreement or this Agreement) of any such Person if such amendment or modification would add or change any terms in a manner adverse to such Person, or shorten the final maturity or average life to maturity or require any payment to be made sooner than originally scheduled or increase the interest rate applicable thereto or change any subordination provision thereof, or (ii) make (or give any notice with respect thereto) any voluntary or optional payment or prepayment or redemption or acquisition for value of (including without limitation, by way of depositing money or securities with the trustee with respect thereto before due for the purpose of paying when due), refund, refinance or exchange of any other Indebtedness (other than the Second Lien Credit Agreement or this Agreement) of such Person, (b) shorten the final maturity of any Subordinated Indebtedness or amend or modify any of the subordination provisions of any Subordinated Indebtedness, (c) make interest payments in respect of any Subordinated Indebtedness in violation of the subordination provisions of the documents evidencing and/or governing such Subordinated Indebtedness or (d) except as otherwise permitted under Section 8.7, make (or give any notice with respect thereto) any voluntary or optional payment or prepayment, redemption, acquisition for value or defeasance of (including without limitation, by way of depositing money or securities with the trustee with respect thereto before due for the purpose of paying when due), refund, refinance or exchange of any Subordinated Indebtedness.

SUBPART 2.24 Amendment to Section 8.10. Section 8.10 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

8.10 Organizational Documents; Fiscal Year; Second Lien Credit Agreement.

The Credit Parties will not permit any Consolidated Party to (i) amend, modify or change its articles of incorporation (or corporate charter or other similar organizational document) or bylaws (or other similar document) in any manner materially adverse to the Lenders, (ii) change its fiscal year or (iii) amend, modify or change any term or condition of the “Credit Documents” as defined in the Second Lien Credit Agreement in any manner which would be adverse in any material way to the Lenders.

SUBPART 2.25 Amendment to Section 8.11. Section 8.11 of the Existing Credit Agreement is hereby amended by adding the words “Except as contemplated in the Intercreditor Agreement or the Second Lien Credit Agreement,” at the beginning of such section, and by making the necessary grammatical changes thereto.

16

SUBPART 2.26 Amendment to Section 8.12. Clause (b) contained in Section 8.12 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

(b) The Parent shall not (i) hold any material assets other than (A) the Capital Stock of the Borrower or any Wholly-Owned Subsidiary of the Parent that is a Credit Party or an Excluded Subsidiary, (B) the Capital Stock of the Parent repurchased, redeemed or otherwise acquired or retired for value by the Parent to the extent permitted by Section 8.7 and (C) cash to the extent permitted by Section 8.7, (ii) have any liabilities other than (A) Indebtedness permitted under Section 8.1, (B) tax liabilities in the ordinary course of business, (C) loans, advances and payments permitted under Section 8.9, (D) corporate, administrative and operating expenses in the ordinary course of business and (E) other liabilities under (1) the Credit Documents and the Second Lien Credit Agreement, (2) the documents evidencing and/or governing any Subordinated Indebtedness, (3) registration rights agreements, (4) stock option plans (including, without limitation, those in existence on the Closing Date), or (5) any other agreement, document or instrument related to any of the foregoing or (iii) engage in any business other than (A) owning the Capital Stock of the Borrower or any Wholly-Owned Subsidiary of the Parent that is a Credit Party or an Excluded Subsidiary and activities incidental or related thereto, (B) acting as a Guarantor hereunder and pledging its assets to the Administrative Agent, for the benefit of the Lenders, pursuant to the Collateral Documents to which it is a party and the Second Lien Credit Agreement, (C) activities related to its obligations under the Securities Laws, (D) acting as a borrower or guarantor, as applicable, in respect of Indebtedness permitted under Section 8.1, (E) in connection with the exercise of its rights under and its compliance with the obligations applicable to it under the documents listed in clause (ii)(E) above and (F) activities relating to any repurchase, redemption or other acquisition or retirement for value of any Capital Stock or any option to acquire Capital Stock of the Parent to the extent permitted by Section 8.7.

SUBPART 2.27 Amendment to Section 8.14. Section 8.14 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

8.14 Capital Expenditures.

The Credit Parties will not permit Consolidated Capital Expenditures for any fiscal year to exceed $16,000,000 plus the unused amount available for Consolidated Capital Expenditures under this Section 8.14 for the immediately preceding fiscal year (excluding any carry forward available from any prior fiscal year).

SUBPART 2.28 Amendment to Section 8.15. Section 8.15 of the Existing Credit Agreement is hereby amended by adding a new clause (e) to the end thereof to read as follows, and by making the necessary grammatical changes thereto:

and (e) pursuant to the Second Lien Credit Agreement and the Second Lien Collateral Documents.

SUBPART 2.29 Amendment to Section 10.10. Clause (b) contained in Section 10.10 of the Existing Credit Agreement is hereby amended and restated in its entirety to read as follows:

(b) to subordinate any Lien on any property granted to or held by the Administrative Agent under any Credit Document to the holder of any Lien on such property that is permitted by clause (vii), (viii) or (xix) of the definition of Permitted Liens; and

17

SUBPART 2.30 Amendment to Section 10.10. Section 10.10 of the Existing Credit Agreement is hereby amended by adding a new clause (d) to the end thereof to read as follows, and by making the necessary grammatical changes thereto:

(d) (i) enter into the Intercreditor Agreement and (ii) to subordinate or release any Lien on any property granted to or held by the Administrative Agent under any Credit Document in accordance with the terms of the Intercreditor Agreement.

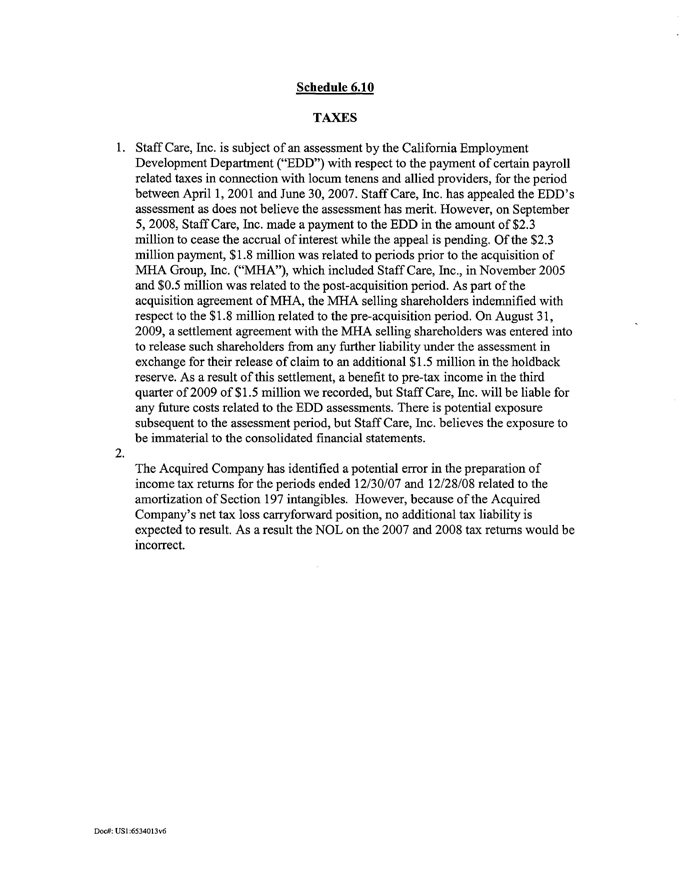

SUBPART 2.31 Closing Date References. All references to “Closing Date” set forth in clause (iv) of the definition of Permitted Investments, clause (xvi) of the definition of Permitted Liens and in Sections 6.10, 6.13. 6.19, 6.23, 7.6, 8.1 and 8.9, as such references relate to the corresponding schedules set forth in such sections, are hereby amended to read “First Amendment Effective Date”.

SUBPART 2.32 New Schedule 1.1E. A new Schedule 1.1E is hereby added to the Existing Credit Agreement in the form of Schedule 1.1E attached hereto.

SUBPART 2.33 New Schedule 1.1F. A new Schedule 1.1F is hereby added to the Existing Credit Agreement in the form of Schedule 1.1F attached hereto.

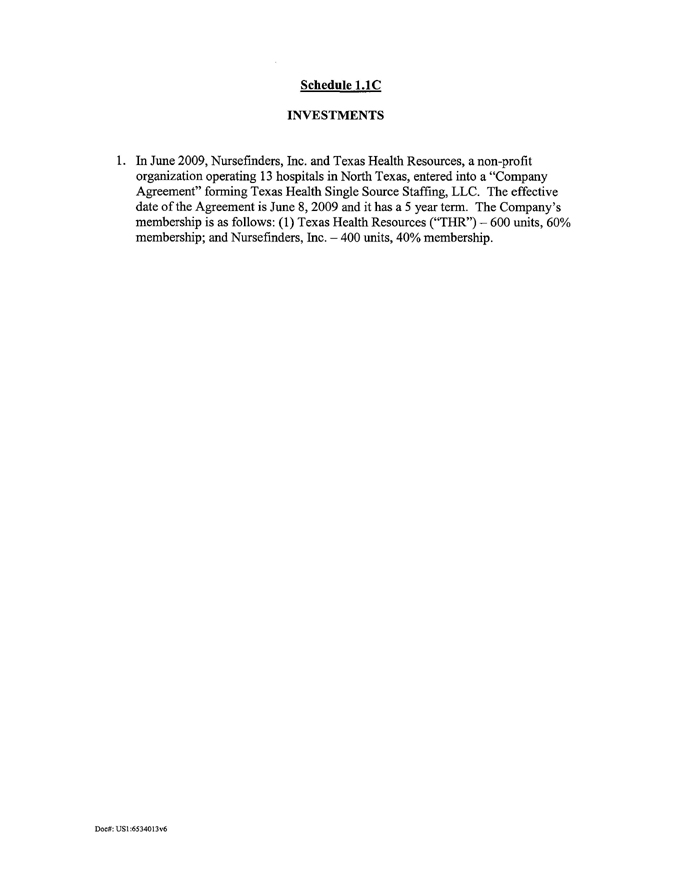

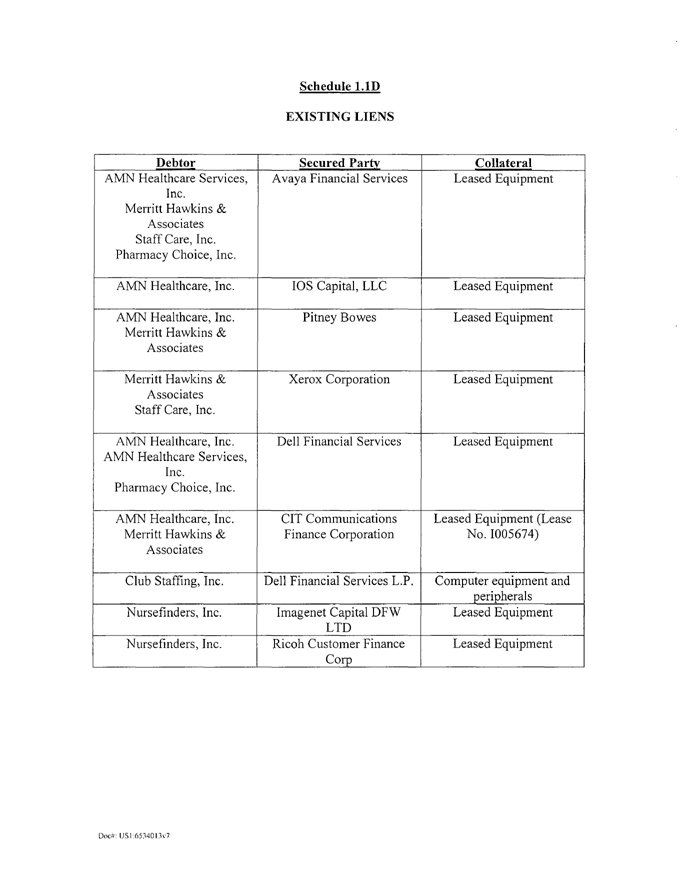

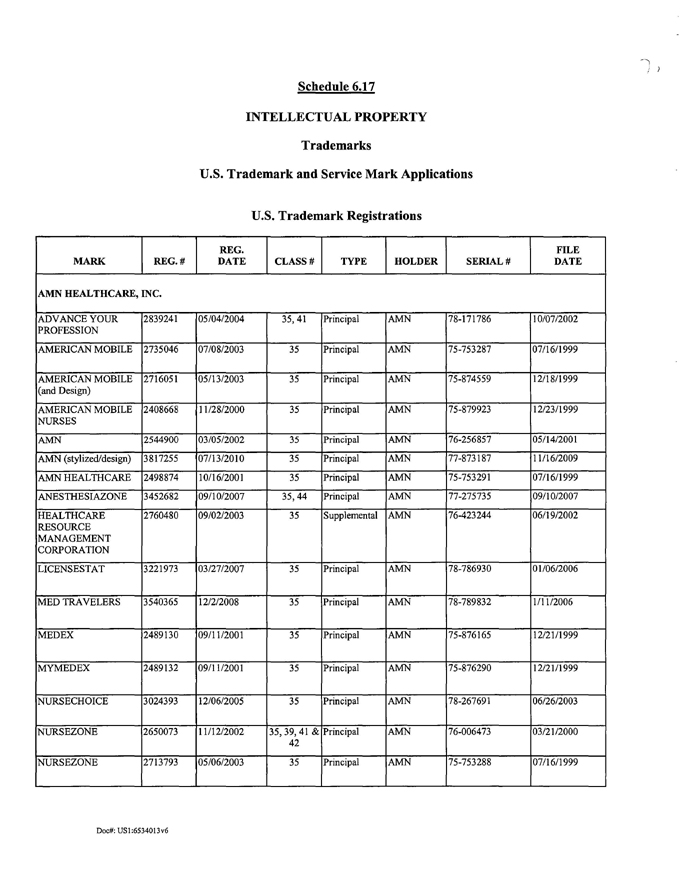

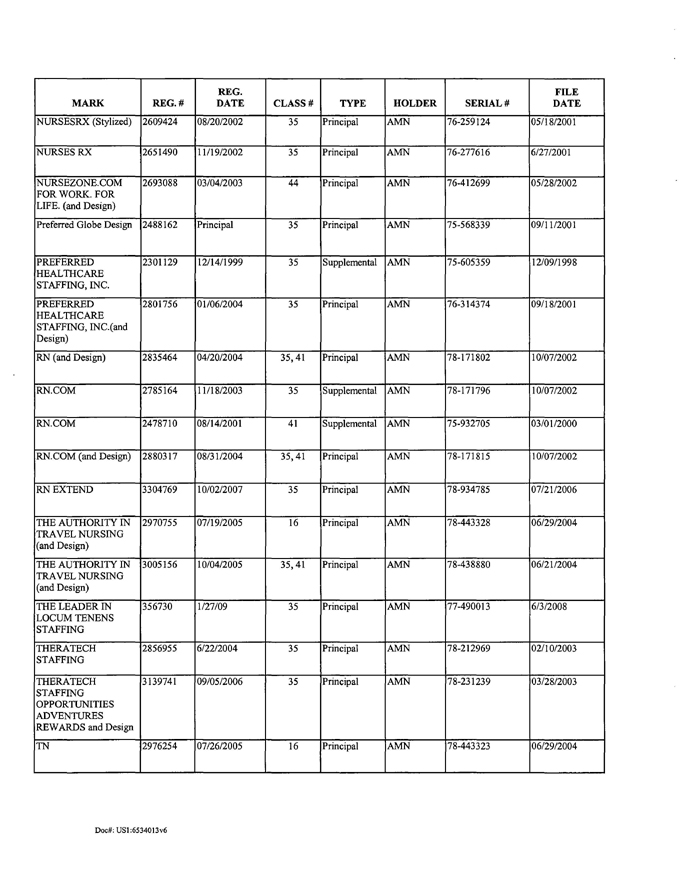

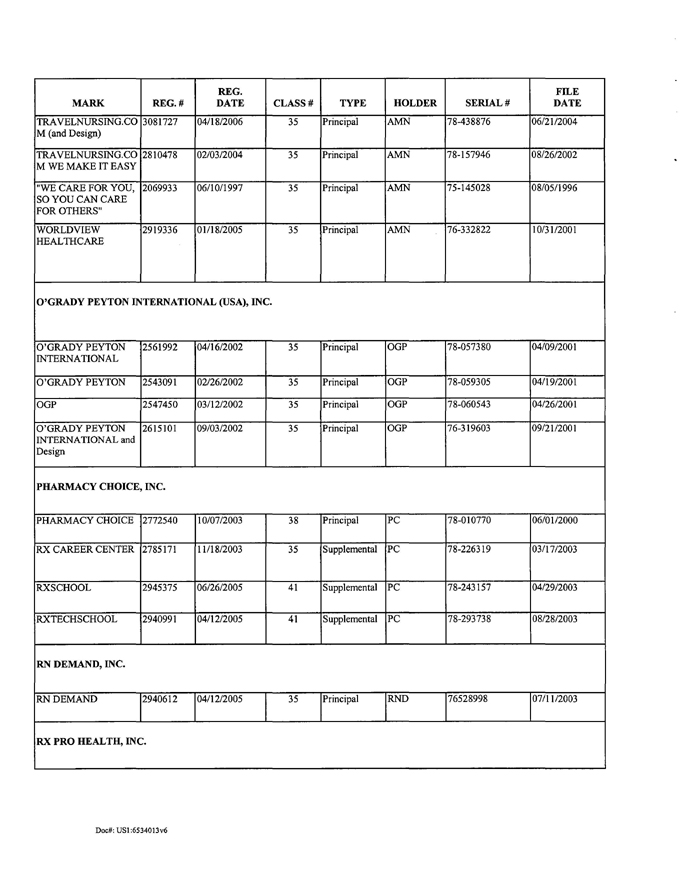

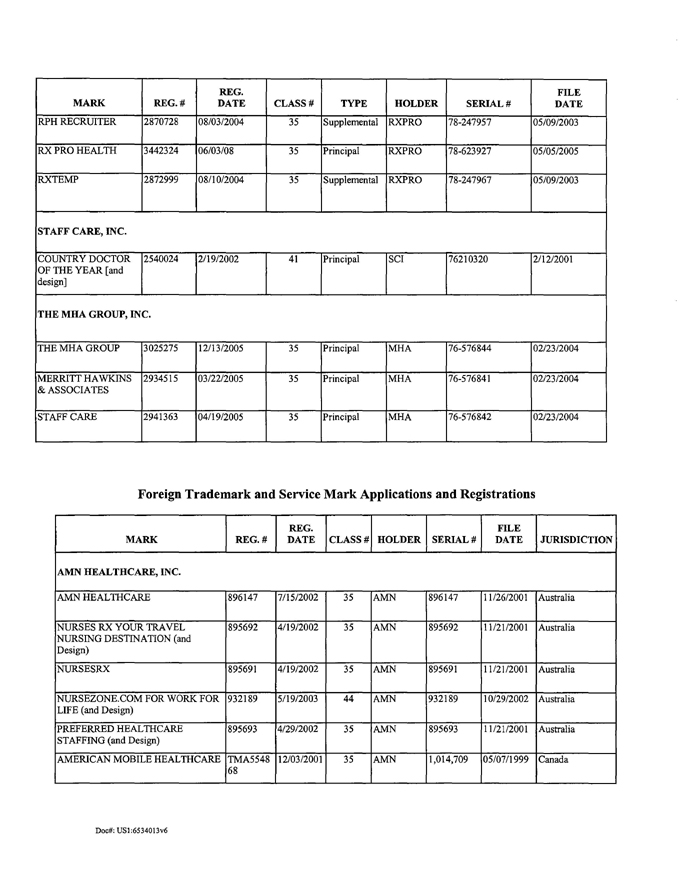

SUBPART 2.34 Replacement Schedules. Schedules 1.1A, 1.1B, 1.1C, 1.1D, 2.1(a), 6.4, 6.10, 6.13A, 6.13B, 6.17, 6.19(a), 6.19(b), 6.19(c), 6.24, 7.6, 8.1, 8.9 and 11.1 of the Existing Credit Agreement are hereby deleted in their entirety and new schedules in the form of the corresponding schedules attached hereto are substituted therefor. Such schedules have been revised to give effect to the Transactions and the joinder agreement for the Acquired Company referred to in Subpart 4.5.

SUBPART 2.35 Replacement of Exhibit 7.1(c). Exhibit 7.1(c) of the Existing Credit Agreement is hereby deleted in its entirety and a new exhibit in the form of Exhibit 7.1(c) attached hereto is substituted therefor.

SUBPART 2.36 Replacement of Exhibit 11.3(b). Exhibit 11.3(b) of the Existing Credit Agreement is hereby deleted in its entirety and a new exhibit in the form of Exhibit 11.3(b) attached hereto is substituted therefor.

PART 3

LENDER JOINDER

From and after the First Amendment Effective Date, by execution of this Amendment, each Person identified on the signature pages hereto as an Additional Tranche B Lender hereby acknowledges, agrees and confirms that, by its execution of this Amendment, such Person will be deemed to be a party to the Amended Credit Agreement and a “Lender” for all purposes of the Amended Credit Agreement, and shall have all of the obligations of a Lender thereunder as if it had executed the Amended Credit Agreement. Such Person hereby ratifies, as of the date hereof, and agrees to be bound by, all of the terms, provisions and conditions applicable to the Lenders contained in the Amended Credit Agreement.

PART 4

CONDITIONS TO EFFECTIVENESS

SUBPART 4.1 First Amendment Effective Date. This Amendment shall be and become effective as of the date hereof (the “First Amendment Effective Date”) when all of the conditions set forth in this Part 4 shall have been satisfied, and thereafter this Amendment shall be known, and may be referred to, as the “First Amendment”.

18

SUBPART 4.2 Execution of Counterparts of Amendment. The Administrative Agent shall have received counterparts of this Amendment, which collectively shall have been duly executed on behalf of each of the Borrower, the Parent, the Subsidiary Guarantors, the Requisite Lenders, each of the Revolving Lenders, each of the Additional Tranche B Lenders, each of the Extended Tranche B Lenders and the Administrative Agent.

SUBPART 4.3 Second Lien Financing. The Lenders shall be reasonably satisfied with the terms and conditions of the Second Lien Financing. The Administrative Agent shall have received satisfactory evidence that simultaneously with the making of the initial Loans hereunder, the Borrower shall receive not less than $40 million in gross cash proceeds from the Second Lien Financing.

SUBPART 4.4 Execution of Counterparts of Intercreditor Agreement. The Administrative Agent shall have received counterparts of the Intercreditor Agreement, which collectively shall have been duly executed on behalf of each of the Borrower, the Administrative Agent and the Second Lien Administrative Agent and shall be in form and substance reasonably satisfactory to the Lenders.

SUBPART 4.5 Collateral. All filings, recordations and searches reasonably necessary or desirable in connection with the liens and security interests of the Borrower and its Subsidiaries forming part of the Lenders’ Collateral (including, without limitation, the Acquired Company) shall have been duly made (including, applicable joinder agreements with respect to the Acquired Company); all filing and recording fees and taxes shall have been duly paid. The Lenders shall be satisfied with the amount and types of all insurance maintained by the Borrower and its Subsidiaries (including, without limitation, the Acquired Company); and the Administrative Agent shall have received endorsements naming the Administrative Agent, on behalf of the Lenders, as an additional insured or loss payee, as the case may be, under all insurance policies to be maintained with respect to the properties of the Borrower and its Subsidiaries (including, without limitation, the Acquired Company) forming part of the Lenders’ Collateral.

SUBPART 4.6 Corporate Documents. Receipt by the Administrative Agent of the following:

(i) Charter Documents. Copies of the articles or certificates of incorporation or other charter documents of each Credit Party (other than Xxxxxxx, Xxxxxxx & Associates) certified to be true and complete as of a recent date by the appropriate Governmental Authority of the state or other jurisdiction of its incorporation and certified by a secretary or assistant secretary of such Credit Party to be true and correct as of the First Amendment Effective Date. With respect to Xxxxxxx, Xxxxxxx & Associates, the Administrative Agent shall receive articles or certificates of incorporation or other charter documents certified by a secretary or assistant secretary of Xxxxxxx, Xxxxxxx & Associates to be true and correct as of the First Amendment Effective Date.

(ii) Bylaws. A copy of the bylaws of each Credit Party certified by a secretary or assistant secretary of such Credit Party to be true and correct as of the First Amendment Effective Date.

(iii) Resolutions. Copies of resolutions of the Board of Directors or other governing body of each Credit Party approving and adopting the Credit Documents to which it is a party, the transactions contemplated therein and authorizing execution and delivery thereof, certified by a secretary or assistant secretary of such Credit Party to be true and correct and in force and effect as of the First Amendment Effective Date.

(iv) Good Standing. Copies of (A) certificates of good standing, existence or its equivalent with respect to each Credit Party certified as of a recent date by the appropriate Governmental Authorities of the state or other jurisdiction of incorporation and the state or other jurisdiction of the chief executive office or principal place of business and (B) to the extent available, a certificate indicating payment of all corporate or comparable franchise taxes certified as of a recent date by the appropriate governmental taxing authorities.

19

(v) Incumbency. An incumbency certificate of each Credit Party certified by a secretary or assistant secretary to be true and correct as of the First Amendment Effective Date.

SUBPART 4.7 Opinions of Counsel. The Administrative Agent shall have received, in each case dated as of the First Amendment Effective Date:

(i) a legal opinion of Xxxx, Weiss, Rifkind, Xxxxxxx & Xxxxxxxx LLP, in form and substance reasonably satisfactory to the Administrative Agent;

(ii) a legal opinion of special Nevada counsel Xxxxxx Xxxxxx & Xxxxxxx, in form and substance reasonably satisfactory to the Administrative Agent;

(iii) a legal opinion of special California counsel Xxxxxx Godward Kronish LLP with respect to Xxxxxxx, Xxxxxxx & Associates, in form and substance reasonably satisfactory to the Administrative Agent;

(iv) a legal opinion of special Texas counsel Xxxxx Lord Bissell & Lidell LLP with respect to The MHA Group, Inc., AMN Healthcare Allied, Inc. and RN Demand, Inc., in form and substance reasonably satisfactory to the Administrative Agent; and

(v) a legal opinion of special Missouri counsel Xxxxxxxxx, Raskas, Pomerantz, Xxxxx & Xxxxxxx, L.L.C. with respect to Linde Health Care Staffing, Inc., in form and substance reasonably satisfactory to the Administrative Agent.

SUBPART 4.8 Officer’s Certificates. The Administrative Agent shall have received a certificate or certificates executed by an Executive Officer of the Borrower as of the First Amendment Effective Date, in form and substance reasonably satisfactory to the Administrative Agent, stating that (i) all governmental and third party consents and approvals (including, without limitation, the Board of Directors of the Borrower and the Parent), if any, with respect to this Amendment and the transactions contemplated thereby have been obtained, (ii) there shall not have occurred a (x) Material Adverse Effect with respect to the Parent and its Subsidiaries taken as a whole since the date the Parent’s Form 10-K for the fiscal year ended December 31, 2009 was filed with the SEC or (y) a “Material Adverse Effect” (as defined in the Acquisition Agreement) with respect to the Acquired Company and its Subsidiaries taken as a whole since January 3, 2010, (iii) no action, suit, investigation or proceeding is pending or, to the knowledge of the Borrower, threatened in any court or before any arbitrator or governmental instrumentality that purports to affect any Credit Party or any transaction contemplated by the Credit Documents, if such action, suit, investigation or proceeding could reasonably be expected to have a Material Adverse Effect, (iv) the Medfinders Acquisition has been consummated and (v) immediately after giving effect to the Transaction, (A) no Default or Event of Default exists, (B) all representations and warranties contained in the Amended Credit Agreement and in the other Credit Documents are true and correct in all material respects as of the First Amendment Effective Date (except for those which expressly relate to an earlier date, in which case, they were true and correct in all material respects as of such earlier date), (C) the Credit Parties, on a consolidated basis, are Solvent, and (D) (1) the Consolidated Leverage Ratio of the Consolidated Parties as of the First Amendment Effective Date (which Consolidated Leverage Ratio shall be calculated reflecting the Medfinders Acquisition on a Pro Forma Basis as of the first day of such period as if the Medfinders Acquisition occurred as of such date) was not greater than 3.60 to 1.0 for the twelve month period ending on June 30, 2010 and (2) the Consolidated EBITDA of the Consolidated Parties (which Consolidated EBITDA shall be calculated reflecting the Medfinders Acquisition on a Pro Forma Basis as of the first day of such period as if the Medfinders Acquisition occurred as of such date) will be at least $65 million for the twelve months ended June 30, 2010.

20

SUBPART 4.9 Financial Statements. The Administrative Agent shall have received copies of audited consolidated financial statements for the Acquired Company and its subsidiaries for the three fiscal years most recently ended for which financial statements are available and interim unaudited financial statements for each quarterly period ended since the end of the most recent fiscal year for which financial statements are available.

SUBPART 4.10 Consummation of Acquisition. The Acquisition shall have been consummated in accordance with the terms of the Acquisition Agreement and in material compliance with applicable law and regulatory approvals. The Administrative Agent shall have approved the Acquisition Agreement (it being understood that the draft of the Acquisition Agreement dated July 28, 2010 is acceptable to the Administrative Agent) and all other material agreements, instruments and documents relating to the Medfinders Acquisition, which agreements and documents shall provide for an aggregate purchase price (including assumption of Indebtedness) not in excess of $270 million (excluding any earn out payments). The Administrative Agent shall have received an officer’s certificate from the Parent (A) confirming that there have been no material modifications to the Acquisition Agreement without the consent of the Administrative Agent, to the extent such modifications could reasonably be expected to materially adversely effect the Lenders, (B) attaching a certified copy of the Acquisition Agreement, with all amendments, modifications, supplements and attachments and (C) confirming that the Medfinders Acquisition has been, or contemporaneously with the making of the initial Loans hereunder, will be consummated in accordance with the terms of the Acquisition Agreement and in compliance with material applicable law and regulatory approvals and that the Parent and/or the Borrower shall have used not less than $33.1 million of cash-on-hand (immediately prior to the Transaction) to fund the cash portion of the Acquisition consideration.

SUBPART 4.11 Repayment of Acquired Company Indebtedness. The Administrative Agent shall have received reasonably satisfactory evidence that the repayment of all Indebtedness (other than the Backstopped Letters of Credit) of the Acquired Company shall have occurred.

SUBPART 4.12 Ratings. The Parent shall have received (i) a current corporate family rating and a current corporate rating, respectively, from each of Xxxxx’x Investors Service, Inc. (“Moody’s”) and Standard & Poor’s Ratings Services, a division of The XxXxxx-Xxxx Companies, Inc. (“S&P”) and (ii) a current facility rating with respect to the Tranche B Loan from each of Moody’s and S&P.

SUBPART 4.13 Fees and Expenses. The Administrative Agent shall have received from the Borrower (i) the aggregate amount of all fees and expenses payable to the Administrative Agent and the Arrangers in connection with the consummation of the transactions contemplated hereby, (ii) for the account of each Revolving Lender approving this Amendment by 12:00 noon Eastern Time on August 20, 2010, an amendment fee in an amount equal to 25 basis points on such Lender’s Revolving Commitment held immediately prior to the First Amendment Effective Date, (iii) for the account of each Revolving Lender agreeing to extend the maturity of its Revolving Commitment, the fees agreed upon among the Borrower, the Arrangers and the respective Revolving Lenders, as the case may be, (iv) for the account of each Tranche B Lender approving this Amendment by 12:00 noon Eastern Time on August 20, 2010, an amendment fee in an amount equal to 25 basis points on such Lender’s Tranche B Loans held immediately prior to the First Amendment Effective Date, (v) for the account of each Tranche B Lender agreeing to provide the Additional Tranche B Loans and/or extend the maturity of its Initial Tranche B Loans the fees agreed upon among the Borrower, the Arrangers and the respective Tranche B Lenders, as the case may be and (vi) all reasonable and documented out-of-pocket costs and expenses of the Administrative Agent and the Joint Lead Arrangers in connection with the preparation, execution and delivery of this Amendment, including without limitation the reasonable fees and expenses of (i) Xxxxx & Xxx Xxxxx PLLC, special counsel to the Administrative Agent and certain Joint Lead Arrangers and (ii) Xxxxxx & Xxxxxxx LLP, special counsel to a Joint Lead Arranger.

21

PART 5

MISCELLANEOUS

SUBPART 5.1 Representations and Warranties. The Borrower hereby represents and warrants to the Administrative Agent and the Lenders that, (a) no Default or Event of Default exists under the Existing Credit Agreement, after giving effect to this Amendment and (b) the representations and warranties set forth in Section 6 of the Amended Credit Agreement are, subject to the limitations set forth therein, true and correct in all material respects as of the date hereof (except for those which expressly relate to an earlier date, in which case, they were true and correct in all material respects as of such earlier date).

SUBPART 5.2 Cross-References. References in this Amendment to any Part or Subpart are, unless otherwise specified, to such Part or Subpart of this Amendment.

SUBPART 5.3 Instrument Pursuant to Existing Credit Agreement. This Amendment is executed pursuant to the Existing Credit Agreement and shall (unless otherwise expressly indicated therein) be construed, administered and applied in accordance with the terms and provisions of the Existing Credit Agreement.

SUBPART 5.4 References in Other Credit Documents. At such time as this Amendment shall become effective pursuant to the terms of Subpart 4.1, all references to the “Credit Agreement” shall be deemed to refer to the Amended Credit Agreement.

SUBPART 5.5 Counterparts. This Amendment may be executed by the parties hereto in several counterparts, each of which shall be deemed to be an original and all of which shall constitute together but one and the same agreement. Delivery of executed counterparts of the Amendment by facsimile or other electronic transmission shall be effective as an original and shall constitute a representation that an original shall be delivered upon the request of the Administrative Agent.

SUBPART 5.6 Governing Law. THIS AMENDMENT SHALL BE DEEMED TO BE A CONTRACT MADE UNDER AND GOVERNED BY THE LAWS OF THE STATE OF NEW YORK.

SUBPART 5.7 Acknowledgment. The Guarantors acknowledge and consent to all of the terms and conditions of this Amendment and agree that this Amendment does not operate to reduce or discharge the Guarantors’ obligations under the Amended Credit Agreement or the other Credit Documents. The Guarantors further acknowledge and agree that the Guarantors have no claims, counterclaims, offsets, or defenses to the Credit Documents and the performance of the Guarantors’ obligations thereunder or if the Guarantors did have any such claims, counterclaims, offsets or defenses to the Credit Documents or any transaction related to the Credit Documents, the same are hereby waived, relinquished and released in consideration of the Lenders’ execution and delivery of this Amendment. Each Guarantor also hereby confirms and agrees that notwithstanding the effectiveness of this Amendment, the Collateral Documents to which each of the undersigned is a party and all of the Collateral described therein do, and shall continue to, secure the payment of all of the Credit Party Obligations.

22

SUBPART 5.8 Binding Effect. This Amendment, the Existing Credit Agreement as amended by this Amendment and the other Credit Documents embody the entire agreement between the parties and supersede all prior agreements and understandings, if any, relating to the subject matter hereof. These Credit Documents represent the final agreement between the parties and may not be contradicted by evidence of prior, contemporaneous or subsequent oral agreements of the parties. Except as expressly modified and amended in this Amendment, all the terms, provisions and conditions of the Credit Documents shall remain unchanged and shall continue in full force and effect.

SUBPART 5.9 Successors and Assigns. This Amendment shall be binding upon and inure to the benefit of the parties hereto and their respective successors and assigns.

SUBPART 5.10 General. Except as amended hereby, the Existing Credit Agreement and all other credit documents shall continue in full force and effect.

SUBPART 5.11 Severability. If any provision of this Amendment is determined to be illegal, invalid or unenforceable, such provision shall be fully severable and the remaining provisions shall remain in full force and effect and shall be construed without giving effect to the illegal, invalid or unenforceable provisions.

[Remainder of Page Intentionally Left Blank]

23

IN WITNESS WHEREOF, the parties hereto have executed this Amendment as of the date first above written.

| BORROWER: | AMN HEALTHCARE, INC. | |||||||

| By: | /s/ Xxxx X. Xxxxxx | |||||||

| Name: | Xxxx X. Xxxxxx | |||||||

| Title: | Treasurer | |||||||

| PARENT: | AMN HEALTHCARE SERVICES, INC. | |||||||

| By: | /s/ Xxxx X. Xxxxxx | |||||||

| Name: | Xxxx X. Xxxxxx | |||||||

| Title: | Treasurer | |||||||

| SUBSIDIARY GUARANTORS: | AMN SERVICES, INC. | |||||||

| By: | /s/ Xxxx X. Xxxxxx | |||||||

| Name: | Xxxx X. Xxxxxx | |||||||

| Title: | Treasurer | |||||||

| X’XXXXX-XXXXXX INTERNATIONAL (USA), INC. | ||||||||

| By: | /s/ Xxxx X. Xxxxxx | |||||||

| Name: | Xxxx X. Xxxxxx | |||||||

| Title: | Treasurer | |||||||

| INTERNATIONAL HEALTHCARE RECRUITERS, INC. | ||||||||

| By: | /s/ Xxxx X. Xxxxxx | |||||||

| Name: | Xxxx X. Xxxxxx | |||||||

| Title: | Treasurer |

FIRST AMENDMENT

AMN HEALTHCARE, INC.

| AMN STAFFING SERVICES, INC. | ||

| By: | /s/ Xxxx X. Xxxxxx | |

| Name: | Xxxx X. Xxxxxx | |

| Title: | Treasurer | |

| THE MHA GROUP, INC. | ||

| By: | /s/ Xxxx X. Xxxxxx | |

| Name: | Xxxx X. Xxxxxx | |

| Title: | Treasurer | |

| XXXXXXX, XXXXXXX & ASSOCIATES | ||

| By: | /s/ Xxxx X. Xxxxxx | |

| Name: | Xxxx X. Xxxxxx | |

| Title: | Treasurer | |

| AMN HEALTHCARE ALLIED, INC. | ||

| By: | /s/ Xxxx X. Xxxxxx | |

| Name: | Xxxx X. Xxxxxx | |

| Title: | Treasurer | |

| RN DEMAND, INC. | ||

| By: | /s/ Xxxx X. Xxxxxx | |

| Name: | Xxxx X. Xxxxxx | |

| Title: | Treasurer | |

| STAFF CARE, INC. | ||

| By: | /s/ Xxxx X. Xxxxxx | |

| Name: | Xxxx X. Xxxxxx | |

| Title: | Treasurer | |

| MHA ALLIED CONSULTING, INC. | ||

| By: | /s/ Xxxx X. Xxxxxx | |

| Name: | Xxxx X. Xxxxxx | |

| Title: | Treasurer |

FIRST AMENDMENT

AMN HEALTHCARE, INC.

| AMN ALLIED SERVICES, LLC | ||

| By: | /s/ Xxxx X. Xxxxxx | |

| Name: | Xxxx X. Xxxxxx | |

| Title: | Treasurer | |

| LIFEWORK, INC. | ||

| By: | /s/ Xxxx X. Xxxxxx | |

| Name: | Xxxx X. Xxxxxx | |

| Title: | Treasurer | |

| PHARMACY CHOICE, INC. | ||

| By: | /s/ Xxxx X. Xxxxxx | |

| Name: | Xxxx X. Xxxxxx | |

| Title: | Treasurer | |

| RX PRO HEALTH, INC. | ||

| By: | /s/ Xxxx X. Xxxxxx | |

| Name: | Xxxx X. Xxxxxx | |

| Title: | Treasurer |

FIRST AMENDMENT

AMN HEALTHCARE, INC.

| ADMINISTRATIVE AGENT: | BANK OF AMERICA, N. A., | |||||||

| in its capacity as Administrative Agent | ||||||||

| By: | /s/ Xxxxxx Xxxxxxxxxxx | |||||||

| Name: | Xxxxxx Xxxxxxxxxxx | |||||||

| Title: | Vice President | |||||||

| LENDERS: | BANK OF AMERICA, N. A., | |||||||