VARIABLE PORTFOLIO ADMINISTRATIVE SERVICES AGREEMENT

XX-00.X.X.xx

VARIABLE PORTFOLIO ADMINISTRATIVE SERVICES AGREEMENT

THIS SERVICES AGREEMENT (Agreement) is made and entered into as of October 17, 2018 (“Effective Date”), by and between CUNA Brokerage Services, Inc. (“Company”) and Columbia Management Investment Services Corp. (“Transfer Agent”).

WHEREAS, Transfer Agent serves as the transfer agent for one or more of the Columbia Variable Portfolios (each a “Fund” and collectively, the “Funds”);

WHEREAS, shares of the Funds (“Shares”) are available to separate accounts of participating insurance companies for variable annuity contracts and /or variable life insurance policies (Contracts) or other eligible investors authorized by the distributor of the Funds.;

WHEREAS, the Funds will be included as underlying investment options for the Contracts issued by the Company pursuant to one or more fund participation agreements previously or contemporaneously entered into by the Company and Columbia Management Investment Distributors, Inc., Columbia Management Investment Advisers, LLC, Columbia Funds Variable Insurance Trust, and Columbia Funds Variable Series Trust II (“Fund Participation Agreement”);

WHEREAS, Company or its designee provide certain administrative services to the owners of the Contracts, and Transfer Agent recognizes substantial savings of administrative expenses as a result of Company performing certain administrative services (“Services”) in connection with Contract owners’ investment in the Funds through the Contracts;

NOW, THEREFORE, Company and Transfer Agent agree as follows:

1. Services. Company agrees to provide Services, as needed, including but not limited to, those set forth in Schedule A for the benefit of the Contracts.

2. Compensation. For its Services under this Agreement, Transfer Agent shall pay Company the fees as set forth in Schedule B. The parties agree that the fees are for Services only, which do not include services that are primarily intended to result in the sale of Shares.

3. Representations.

(a) Company represents, warrants and agrees that:

(i) it (A) has the full power and authority to enter into this Agreement and perform all of its obligations hereunder; (B) this Agreement has been duly executed and delivered;(C) the performance of its obligations shall not conflict with any applicable material provision of its organizational documents; and (D) the performance of its obligations shall not contravene any laws, regulations and rules of self-regulatory or clearing organizations applicable to it in the performance of its obligations under this Agreement, and to the extent applicable ERISA (“Applicable Law”);

(ii) it is duly organized and existing in good standing under the laws of the state of its formation;

1

(iii) it has and will maintain adequate insurance coverage consistent with its duties and obligations under this Agreement; and

(iv) it will promptly notify Transfer Agent in the event that Company is for any reason unable to perform any of its obligations under this Agreement.

(b) Transfer Agent represents, warrants and agrees that:

(i) it (A) has the full power and authority to enter into this Agreement and perform all of its obligations hereunder; (B) this Agreement has been duly executed and delivered; (C) the performance of its obligations shall not conflict with any applicable material provision of its organizational documents; and (D) the performance of its obligations shall not contravene any Applicable Law;

(ii) it is duly organized and existing in good standing under the laws of the state of its formation;

(iii) it has and will maintain adequate insurance coverage consistent with its duties and obligations under this Agreement; and

(iv) it will promptly notify Company in the event that Transfer Agent is for any reason unable to perform any of its obligations under this Agreement.

4. Compliance Matters and Controls.

(a) Company agrees to comply with all Applicable Law and the terms of each Fund’s Prospectus applicable to it in the performance of its obligations under this Agreement.

(b) Company agrees to review at least annually the adequacy of its Late Trading Procedures (as defined in the Fund Participation Agreement) and will change and modify them as necessary to maintain their adequacy.

(c) Company agrees to cooperate fully with any and all efforts by Transfer Agent and/or the Funds to assure themselves that Company has implemented effective compliance policies and procedures administered by qualified personnel including, without limitation: (i) permitting Transfer Agent and/or the Funds to become familiar with Company’s operations and understand those aspects of its operations that expose Transfer Agent and/or the Funds to compliance risks; (ii) permitting Transfer Agent and/or the Funds to maintain an active working relationship with Company’s compliance personnel; (iii) providing Transfer Agent and/or the Funds with periodic and special reports in the event of compliance problems; (iv) providing Transfer Agent and/or the Funds with such certifications as they may require on a periodic or special basis; (v) making Company’s personnel and applicable policies and procedures available to such audit personnel as Transfer Agent and/or the Funds may designate to audit the effectiveness of Company’s compliance controls; and (vi) maintaining and preserving all records necessary to demonstrate compliance with the terms of this Agreement, including records demonstrating the time when each order for purchases and redemptions of Fund Shares contemplated by this Agreement was received by Company.

2

5. Indemnity.

(a) Company agrees to and does release, indemnify and hold Transfer Agent and the Funds and each of their affiliates, directors, officers, employees and agents and each person who controls them (“Transfer Agent Indemnitees”), harmless from and against any and all direct or indirect liabilities, losses, claims, damages, liabilities and expenses (including reasonable attorney’s fees) the Indemnitees incur (“Losses”) insofar as such Losses arise out of or are based upon (i) Company’s negligence, willful misconduct or violation of Applicable Law in the performance of Company’s duties and obligations under this Agreement, or (ii) any material breach by Company of any of its representations, warranties or covenants in this Agreement. Company shall reimburse the Transfer Agent Indemnitees for any legal or other expenses reasonably incurred by such Transfer Agent Indemnitees in connection with investigating or defending against such Losses.

(b) Transfer Agent agrees to and does release, indemnify and hold Company and its affiliates, directors, officers, employees and agents and each person who controls them (“Company Indemnitees”), harmless from and against any and all Losses insofar as such Losses arise out of or are based upon (i) Transfer Agent’s negligence, willful misconduct or violation of Applicable Law in the performance of Transfer Agent’s duties and obligations under this Agreement, or (ii) any material breach by Transfer Agent of any of its representations, warranties or covenants in this Agreement. Transfer Agent shall reimburse the Company Indemnitees for any legal or other expenses reasonably incurred by such Company Indemnitees in connection with investigating or defending against such Losses.

6. Termination; Withdrawal of Offering. Either party may, in its sole discretion, terminate this agreement in its entirety with a minimum of thirty (30) days’ prior written notice to the other party, commencing from the date of receipt of such notice. Notwithstanding the foregoing, the Agreement may be terminated by the non-breaching party immediately following failure by the breaching party to cure a material breach of this Agreement within thirty (30) days of receiving notice of such breach from the non-breaching party.

7. Third Party Beneficiaries. The parties to this Agreement intend for each Fund to be a third party beneficiary for purposes of Section 5 of this Agreement.

8. Non-Exclusivity. Each of the parties acknowledges and agrees that this Agreement and the arrangement described herein are intended to be non-exclusive and that each of the parties is free to enter into similar agreements and arrangements with other entities.

9. Survival. The provisions of Section 5 (Indemnity) and Section 7 (Third Party Beneficiaries ) of this Agreement shall survive termination of this Agreement.

10. Entire Agreement; Prior Agreements Terminated. This Agreement (including the Schedules hereto) constitutes the entire agreement between the parties with respect to the matters dealt with herein. Any agreements, oral or written, by and between Transfer Agent or any of its affiliates and Company effective prior to the Effective Date, which relate to the subject matter of, or services contemplated under, this Agreement (including all Schedules hereto) are terminated as of the Effective Date.

3

11. Amendment; Assignment. Except as otherwise provided herein, this Agreement may not be amended except by a writing signed by each of the parties hereto. This Agreement may not be assigned, either in its entirety or in part, except to affiliates, by either party without the written consent of the other party. All provisions of the Agreement shall remain in effect in the event of a Fund name change.

12. Notices. All notices and other communications hereunder shall be given or made in writing and shall be delivered personally, or sent by facsimile, electronic transmission, express delivery or registered or certified mail, postage prepaid, return receipt requested, to the party or parties to whom they are directed at the following addresses, or at such other addresses as may be designated by notice from such party to all other parties.

| To Company: | CUNA Brokerage Services, Inc. | |

| Attn: Office of General Counsel | ||

| 0000 Xxxxxxx Xxxxx Xxxx | ||

| Xxxxxxx, XX 00000 | ||

| 000-000-0000 | ||

| To Transfer Agent: | Columbia Management Investment Services Corp. | |

| Attn: Dealer File Department | ||

| 225 Franklin Street | ||

| BX25 10320 | ||

| Xxxxxx, XX 00000 | ||

| Telefacsimile: (000) 000-0000 |

Any notice, demand or other communication given in a manner prescribed in this Section 12 shall be deemed to have been delivered upon receipt.

13. Counterparts. This Agreement may be executed in any number of counterparts, all of which taken together shall constitute one agreement, and any party hereto may execute this Agreement by signing any such counterpart.

14. Severability. In case any one or more of the provisions contained in this Agreement should be invalid, illegal or unenforceable in any respect, the validity, legality and enforceability of the remaining provisions contained herein shall not in any way be affected or impaired thereby.

15. Governing Law; Dispute Resolution. This Agreement shall be governed by and construed in accordance with the laws of the Commonwealth of Massachusetts without giving effect to conflict of laws principles.

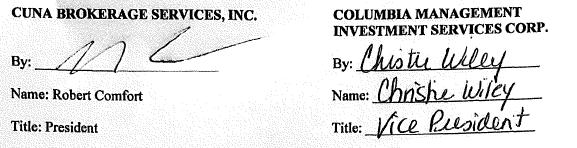

[SIGNATURE PAGE FOLLOWS]

4

IN WITNESS WHEREOF, the undersigned have executed this Agreement as of the Effective Date.

Please execute this Agreement in duplicate

and return both copies to Transfer Agent.

5

Schedule A

SERVICES

Pursuant to the Agreement to which this is attached, and consistent with past practice, Company may perform Services for the Contracts including, but not limited to, as set forth below.

1. Maintaining separate records for each Contract, which shall reflect the units representing Shares purchased and redeemed and Share balances of such Contracts owners.

2. Disbursing or crediting to Contract owners all proceeds of redemptions of units representing Shares and all dividends and other distributions not reinvested in Shares.

3. Preparing and transmitting to Contract owners, as required by law, periodic statements showing the total number of units representing Shares owned by such Contract owners as of the statement closing date, purchases and redemptions of units representing Shares by such Contract owners during the period covered by the statement and the dividends and other distributions paid during the statement period (whether paid in cash or reinvested in Shares,) and such other information, as may be required from time to time.

4. Distributing to each Contract owner, to the extent required by Applicable Law, Funds’ prospectuses, proxy materials, periodic fund reports to shareholders and other materials that the Funds are required by law to provide to their shareholders or prospective shareholders.

5. Maintaining and preserving all records as required by law to be maintained and preserved in connection with providing the Services.

6. Preparing, filing or transmitting all Federal, state and local government information, reports and returns as required by Applicable Law (including the Internal Revenue Code) with respect to such Contracts.

7. Supporting and responding to service inquiries from Contract owners.

8. Transmitting purchase and redemption orders to the Funds on behalf of such Contract owners.

6

Schedule B

COMPENSATION

In consideration of the Services provided by Company pursuant to the Agreement to which this is attached, Transfer Agent shall pay Company an amount equal to 20 bps on Class 1 Shares, 20 bps on Class 2 Shares per annum of the average daily net asset value of Fund Shares attributable to the Contracts each calendar month.

For purposes of this Schedule B, the Asset Base shall exclude shares of index funds and shares of money market funds.

Company shall calculate this payment at the end of each calendar month and shall forward an invoice in a mutually agreeable electronic format to Transfer Agent, along with such other supporting data as may be reasonably requested by Transfer Agent. Such invoice, at a minimum, shall designate the Funds in which assets are invested and shall identify: (1) the account number(s) for each Contract, if applicable, (2) the average daily net asset value of Shares on which the fee is paid, and (3) the amount of such fee. Transfer Agent shall make such payment to Company via check as soon as practicable after receipt of the invoice. Failure to submit such invoice to Transfer Agent within 60 days of quarter end may result in Transfer Agent’s inability to pay Company for Services provided during such quarter.

7