SUBORDINATION AGREEMENT THIS SUBORDINATION AGREEMENT (“Agreement”), dated as of January 31, 2024, is made and given by CARDINAL ETHANOL, LLC, and Indiana limited liability company (“Junior Creditor”), in favor of FIRST NATIONAL BANK OF OMAHA (together...

SUBORDINATION AGREEMENT THIS SUBORDINATION AGREEMENT (“Agreement”), dated as of January 31, 2024, is made and given by CARDINAL ETHANOL, LLC, and Indiana limited liability company (“Junior Creditor”), in favor of FIRST NATIONAL BANK OF OMAHA (together with its successors and assigns, “Senior Creditor”). A. Cardinal Colwich, LLC, a Kansas limited liability company (“Borrower”), is or will be indebted to Junior Creditor on account of intercompany loans and financial accommodations extended from time to time by Junior Creditor to Borrower, including such loans financed with Advances under the Loan Agreement (as defined below, and all of such loans and indebtedness being referred to in this Agreement as the “Subordinated Debt”). The Subordinated Debt may be secured by a Lien on certain assets of Xxxxxxxx, including personal, real, and mixed property. Any such Liens are collectively referred to in this Agreement as the “Junior Lien”. X. Xxxxxxxx and Junior Creditor are indebted to Senior Creditor under the Loans, Obligations, and other extensions of credit by Senior Creditor to Junior Creditor and Borrower under that certain Second Amended and Restated Construction Loan Agreement dated of even date with this Agreement (as the same may be amended, restated, or otherwise modified from time to time, the “Loan Agreement”). X. Xxxxxxxx’s and Junior Creditor’s Obligations to Senior Creditor are secured by a first priority security interest in substantially all of the assets of Borrower and Junior Creditor, all as more fully described in the Loan Agreement and the other Loan Documents, and which include, among other Collateral, the Mortgage, Security Agreement, and Control Agreements defined in the Loan Agreement. In addition, the Obligations and Senior Debt is supported by the unconditional and unlimited Guaranties of Borrower, Junior Creditor, and the other Guarantor, with such Guaranties secured by the Senior Liens (as defined below). D. Junior Creditor acknowledges that the Loans or advance of monies or other extensions of any financial accommodation or credit to Borrower, and the continuation thereof, by Senior Creditor is of value and benefit to Junior Creditor. NOW, THEREFORE, for good and valuable consideration, receipt of which is hereby acknowledged by Junior Creditor, and in order to induce Senior Creditor to extend and continue the Senior Debt to Borrower, or to grant such renewals or extensions thereof as Senior Creditor may deem advisable, and to better secure Senior Creditor in respect of the foregoing, Junior Creditor hereby agrees as follows: Section 1. Definitions, Rules of Constructions. For purpose of this Agreement, in addition to the terms defined above, the following terms shall have the following meanings: “Bankruptcy Code” means 11 U.S.C. Section 101 et seq., as amended from time to time. “Event of Default” means any Event of Default under the Loan Agreement (as therein defined) or any other Loan Document (as defined in the Loan Agreement). “Permitted Payments” shall have the meaning set forth in Section 2(b) below.

“Person” means an individual, corporation, limited liability company, association, partnership, limited partnership, trust, organization, or government or any governmental agency or any political subdivision thereof. “Senior Debt” means all indebtedness, liabilities, and Obligations of Borrower to Senior Creditor howsoever created, arising, or evidenced, whether now existing or hereafter created, whether direct or indirect, absolute or contingent, due or to become due, and including but not limited to the indebtedness, liabilities, and Obligations incurred in connection with the Loans extended under the Loan Agreement and the Notes executed in connection therewith, and all amendments, modifications, restatements, refinancings, and replacements of the foregoing, and any and all interest accruing on any of foregoing, notwithstanding any provision or rule of law which might restrict the rights of Senior Creditor, as against Borrower or anyone else, to collect such Senior Debt. “Senior Lien” collectively means Senior Creditor’s now existing and hereafter created Lien on and security interest in essentially all the assets and property of Borrower, including but not limited to that described in the Loan Documents, all of which secure the Senior Debt. Capitalized terms not otherwise defined herein are as defined in the Loan Agreement. Section 2. Standby: Subordination; Permitted Payments. (a). The payment and performance of the Subordinated Debt is hereby subordinated to the payment and performance of the Senior Debt, and except for the Permitted Payments, Junior Creditor will not ask, demand, sue for, take, or receive from Borrower or any other Person liable for all or any part of the Senior Debt by setoff or in any other manner, the whole or any part of the Subordinated Debt, or any monies which may now or hereafter be owing in respect of the Subordinated Debt (whether such amounts represent principal or interest, or obligations which are due or not due, direct or indirect, absolute or contingent), including, without limitation, taking any security for any of the foregoing or the taking of any negotiable instrument therefor, unless and until all of the Senior Debt shall have been fully and finally paid and satisfied and the Senior Lien and all financing arrangements representing Senior Debt among Borrower, Junior Creditor, and Senior Creditor have been terminated. Junior Creditor agrees that until Borrower has indefeasibly paid in full all of the Senior Debt, all financing arrangements among Borrower, Junior Creditor, and Senior Creditor have been terminated, and the Senior Lien has been released and terminated (i) all Liens and security interests of Junior Creditor in any assets of Borrower securing the Subordinated Debt or otherwise shall be and hereby are subject, subordinated, and junior to the Senior Lien, and (ii) Junior Creditor shall have no right to possession of any such assets or to foreclose upon any such assets, whether by judicial action or otherwise. Any Lien or security interest which Junior Creditor may have shall be and remain subject, subordinate, and junior to the Senior Lien irrespective of (1) the order or method of attachment or perfection of any Liens of Senior Creditor and Junior Creditor (including, without limitation, the possession of Collateral, the order of filing or recording of any mortgage, financing statements or other security documents evidencing, creating, attaching, or perfecting any such Liens and any rights Junior Creditor may have as the holder of a purchase-money security interest or similar Lien right), or (2) the failure of Senior Creditor to perfect, or to maintain the perfection of, any security interests or Liens created or purported to be created by the Loan Documents. Junior Creditor acknowledges and agrees that, to the extent the terms and provisions of this Agreement are inconsistent with any agreement or understanding between Junior Creditor and Borrower, such agreement or understanding shall be subject to this Agreement. Junior Creditor shall not challenge, and irrevocably waives any right it may have to challenge, the validity, enforceability or priority of the Senior Debt and Senior Lien in any judicial, administrative, or alternative dispute resolution proceeding.

Prior to the payment in full and discharge of the Senior Debt and the termination of all financing arrangements representing Senior Debt among Borrower, Junior Creditor, and Senior Creditor, (y) Junior Creditor shall have no right to enforce any claim against Borrower with respect to the Subordinated Debt or any Junior Lien, or to take any action against Borrower or the property of Borrower or any other Person liable for all or any part of the Senior Debt and (z) Junior Creditor will not join with any creditor (unless Senior Creditor shall so join) in bringing any proceeding against Borrower under any bankruptcy, reorganization, readjustment of debt, arrangement of debt, receivership, liquidation, or insolvency law or statute of the federal or any state government. Junior Creditor acknowledges and agrees that, to the extent the terms and provisions of this Agreement are inconsistent with any agreement or understanding between Junior Creditor and Borrower, such agreement or understanding shall be subject to this Agreement. The Subordinated Debt and Junior Lien shall continue to be subordinated to Senior Debt and Senior Lien even if the Senior Debt or Senior Lien is subordinated, avoided, or disallowed under the Bankruptcy Code or other applicable law. Junior Creditor shall not challenge, and irrevocably waives any right it may have to challenge, the validity, enforceability, or priority of the Senior Debt and/or Senior Lien in any judicial, administrative, or alternative dispute resolution proceeding. (b) Notwithstanding any other provision of this Agreement, until Senior Creditor gives Junior Creditor written notice (in the manner set forth below) of the occurrence of an Event of Default, and provided that: (i) there shall not then exist any breach of this Agreement by Junior Creditor which has not been waived, in writing, by Senior Creditor; (ii) at the time of the payment described below no Event of Default exists and is continuing or would arise as a result of such payment; and (iii) | none of the events described in Section 4 has occurred, Borrower may only make payment of principal and interest payments on the Subordinated Debt when due (the “Permitted Payments”). No effect under this Agreement shall be given to any amendments of the payment provisions of the Subordinated Debt which increase the frequency or amount of the payments due thereunder unless Senior Creditor has approved and consented to such amendments in writing. Borrower may not make to Junior Creditor, and Junior Creditor may not receive, any payments other than the Permitted Payments. Section 3. Subordinated Debt Owed Only to the Junior Creditor. Junior Creditor warrants and represents that Junior Creditor has not previously assigned or distributed any interest in the Subordinated Debt or any Junior Lien, that no other Person owns an interest in the Subordinated Debt or any Junior Lien (whether as joint holders of Subordinated Debt, participants, or otherwise) and that the entire Subordinated Debt is owing only to Junior Creditor. Junior Creditor further covenants that the entire Subordinated Debt shall continue to be owing only to Junior Creditor unless it is distributed or assigned with the prior written consent of Senior Creditor to a Person who agrees with Senior Creditor to be bound by the subordination provisions set forth in this Agreement. Section 4. Priority. In the event of (a) any distribution, division, or application, partial or complete, voluntary or involuntary, by operation of law or otherwise, of all or any part of the assets of Borrower or the proceeds thereof to the creditors of Borrower or to their claims against Borrower or (b) any readjustment of the debt or obligations of Borrower; whether by reason of liquidation, bankruptcy, arrangement, receivership, assignment for the benefit of creditors generally, or any other action or proceeding involving the readjustment of all or any part of the Senior Debt or Subordinated Debt, or the application of the assets of Borrower to the payment or liquidation thereof, or (c) the dissolution or other

winding up of the business of Borrower or (d) the sale of all or substantially all of the assets of Borrower, then, and in any such event, Senior Creditor shall be entitled to receive payment in full of all of the Senior Debt prior to the payment by Borrower of all or any part of the Subordinated Debt. Section 5. Grant of Authority to Senior Creditor. Solely for the purpose of enabling Senior Creditor to enforce its rights under this Agreement in any of the actions or proceedings described in Section 4 above, Senior Creditor is hereby irrevocably authorized and empowered, in its discretion, to file and present for and on behalf of Junior Creditor such proofs of claims or other motions or pleadings as Senior Creditor may deem expedient or proper to establish Senior Creditor’s entitlement of payment from, or on behalf of, Junior Creditor with respect to the Subordinated Debt and any Junior Lien and to vote such proofs of claims in any such proceeding and to demand, sue for, receive and collect any and all dividends or other payments or disbursements made thereon in whatever form the same may be paid or issued and to apply the same on account of any of the Senior Debt. Solely for such purposes, Junior Creditor irrevocably authorizes and empowers Senior Creditor to demand, sue for, collect, and receive each of the payments and distributions described in Section 4 above and give acquittance therefor and to file claims and take such other actions, in Senior Creditor’s own name or in the name of Junior Creditor or otherwise, as Senior Creditor may deem necessary or advisable for the enforcement of this Agreement. To the extent that payments of distributions are made in property other than cash, Junior Creditor authorizes Senior Creditor to sell such property to such buyers and on such terms as Senior Creditor, in its sole discretion, shall determine, free and clear of any Junior Lien. Junior Creditor will execute and deliver to Senior Creditor such powers of attorney, assignments, terminations, releases, and other instruments or documents, including debentures (together with such assignments or endorsements as Senior Creditor shall deem necessary), as may be reasonably requested by Senior Creditor in order to enable Senior Creditor to enforce its rights under this Section in any actions or proceedings described in Section 4 above. Section 6. Payments Received by Junior Creditor. Except for Permitted Payments, if Junior Creditor receives any payment or distribution or security or instrument or proceeds thereof upon or with respect to the Subordinated Debt prior to the payment in full of the Senior Debt and termination of all financing arrangements representing Senior Debt between Borrower and Senior Creditor, Junior Creditor shall receive and hold the same in trust, as trustee, for the benefit of Senior Creditor and shall forthwith deliver the same to Senior Creditor in precisely the form received (except for the endorsement or assignment by Junior Creditor where necessary), for application on any of the Senior Debt, due or not due and, until so delivered, the same shall be held in trust by Junior Creditor as the property of Senior Creditor. In the event of the failure of Junior Creditor to make any such endorsement or assignment to Senior Creditor, Senior Creditor, or any of its officers or employees, is hereby irrevocably authorized to make the same. Section 7. Continuing Nature of Subordination. This Agreement shall be effective and may not be terminated or otherwise revoked by Junior Creditor until the Senior Debt (including any new Senior Debt created hereafter) shall have been fully and finally paid and discharged and all financing arrangements representing Senior Debt between Borrower, Junior Creditor, and Senior Creditor have been terminated. This is a continuing agreement of subordination and Senior Creditor may continue, at any time and without notice to Junior Creditor or the consent of Junior Creditor, to extend credit or other financial accommodations and loan monies to or for the benefit of Borrower in reliance hereon. No obligation of Junior Creditor hereunder shall be affected by the dissolution, termination of existence, death or incapacity of, or written revocation by, Junior Creditor or any other subordinated party, pledgor, endorser, or guarantor, if any. Section 8. Additional Agreements Between Senior Creditor and Borrower. Senior Creditor, at any time and from time to time, may enter into such agreement or agreements with Borrower or any other Person as Senior Creditor may deem proper, extending the time of payment of or renewing or otherwise 4

altering Xxxxxxxx’s obligation to repay the Senior Debt or affecting any security underlying any or all of the Senior Debt, and may exchange, sell, release, surrender, or otherwise deal with any such security, without in any way thereby impairing or affecting this Agreement. Without limiting the generality of the foregoing, Senior Creditor may, at any time and from time to time, without the consent of or notice to Junior Creditor and without incurring responsibility to Junior Creditor or impairing or releasing any of Senior Creditor’s rights or any of Junior Creditor’s obligations hereunder: (a) change the interest rate or change the amount of payment or extend the time for payment or renew or otherwise alter the terms of any Senior Debt or any instrument evidencing the same in any manner; (b) sell, exchange, release, or otherwise deal with any property at any time securing payment of the Senior Debt or any part thereof; (c) release any Person liable in any manner for the payment or collection of the Senior Debt or any part thereof; (d) exercise or refrain from exercising any right against Borrower, Junior Creditor, Guarantors, or any other Person; and (e) apply any sums received by Senior Creditor, by whomsoever paid and however realized, to the Senior Debt in such manner as Senior Creditor shall deem appropriate. Section 9. Bankruptcy Issues. All allocations of payments between Senior Creditor and Junior Creditor shall continue to be made after the filing of a petition under the Bankruptcy Code on the basis provided in this Agreement. To the extent that Senior Creditor receives payments on, or proceeds of any collateral for, the Senior Debt which are subsequently avoided, invalidated, declared to be fraudulent or preferential, set aside, and/or required to be repaid to a trustee, receiver, or any other party under any Bankruptcy law, state or federal law, common law, or equitable cause, then, to the extent of such payment or proceeds received, the Senior Debt, or part thereof, intended to be satisfied shall be revived and continue in full force and effect as if such payments or proceeds had not been received by Senior Creditor. Section 10. Instrument Legend: No Amendments to Subordinated Instruments. Any agreement or instrument evidencing the Subordinated Debt, or any portion thereof, which has been or is hereafter executed by Borrower will, on the date hereof or the date of execution, be inscribed with a legend conspicuously indicating that payment thereof is subordinated to the claims of Senior Creditor pursuant to the terms of this Agreement. Junior Creditor will not agree to any amendment, restatement, or other modification of the Subordinated Debt, or any such instrument or agreement or any other agreement or document evidencing the Subordinated Debt without the prior written consent of Senior Creditor. Section 11. Waivers. The Senior Debt shall be deemed to have been made or incurred in reliance upon this Agreement. Junior Creditor expressly waives all notice of the acceptance by Senior Creditor of the subordination and other provisions of this Agreement and all other notices not specifically required pursuant to the terms of this Agreement or the other Loan Documents whatsoever, and Junior Creditor expressly waives reliance by Senior Creditor upon the subordination and other agreements as herein provided. Junior Creditor agrees that Senior Creditor has made no warranties or representations with respect to the due execution, legality, validity, completeness or enforceability of the Loan Agreement or any other Loan Document, or the collectability of the Senior Debt, and that Senior Creditor shall be entitled to manage and supervise its Loans and other financial accommodations to Borrower without regard to the existence of any rights that Junior Creditor may now or hereafter have in or to any of the

assets of Borrower. Junior Creditor agrees that Senior Creditor shall have no liability to Junior Creditor for, and waives any claim which Junior Creditor may now or hereafter have against, Senior Creditor arising out of any and all actions which Senior Creditor in good faith takes or omits to take (including, without limitation, actions with respect to any security for the Senior Debt, actions with respect to the occurrence of an Event of Default, actions with respect to the foreclosure upon, sale, release, or depreciation of, or failure to realize upon, any security for the Senior Debt and actions with respect to the collection of any claim for all or any part of the Senior Debt from any guarantor or other party) with respect to the Loan Agreement or any other agreement related to any Senior Debt or to the collection of the Senior Debt or the valuation, use, protection or release of any security for the Senior Debt. Junior Creditor hereby waives any and all right to require the marshalling of assets in connection with the exercise of any of the remedies permitted by applicable law or agreement. Section 12. Waivers. No waiver shall be deemed to be made by Senior Creditor or Junior Creditor of any of their rights hereunder unless the same shall be in writing signed on behalf of Senior Creditor or Junior Creditor as the case may be, and each waiver, if any, shall be a waiver only with respect to the specific instance involved and shall in no way impair the rights of the waiving party in any other respect at any other time. Section 13. Notices. All communications and notices provided under this Agreement to any party shall be given in writing by personal delivery, overnight courier or United States first class certified mail, return receipt requested, to such party’s address shown on the signature page hereof, or to any party at such other address as may be designated by such party in a notice to the other parties. All periods of notice shall be measured from the date of delivery thereof if personally delivered, from the first business day after the date of sending if sent by overnight courier, or from four days after the date of mailing if mailed. Section 14. Governing Law and Construction. THE VALIDITY, CONSTRUCTION AND ENFORCEABILITY OF THIS AGREEMENT SHALL BE GOVERNED BY THE INTERNAL LAWS OF THE STATE OF NEBRASKA, WITHOUT GIVING EFFECT TO CONFLICT OF LAWS PRINCIPLES THEREOF. Section 15. Severability. Wherever possible, each provision of this Agreement shall be interpreted in such manner as to be effective and valid under applicable law, but if any provision of this Agreement shall be prohibited by or invalid under applicable law, such provision shall be ineffective to the extent of such prohibition or invalidity, without invalidating the remainder of such provision or the remaining provisions of this Agreement. Section 16. Miscellaneous. (a) This Agreement and the terms, covenants and conditions hereof shall inure to the benefit of Senior Creditor and its participants, successors and assigns and shall burden Junior Creditor and Junior Creditor’s successors, assigns, and distributees. Nothing contained in this Agreement, expressed or implied, is intended to confer upon any Person other than the parties hereto and thereto any rights, remedies, obligations, or liabilities hereunder or thereunder. (b) This Agreement sets forth the entire understanding of the parties hereto relating to the subject matter hereof, and all prior understandings and negotiations, written or oral, are merged into and superseded by this Agreement. Any modification, amendment, or waiver of this Agreement or any provision herein shall be binding only if contained in a writing signed by Senior Creditor and Junior Creditor. No failure on the part of Senior Creditor or Junior Creditor to exercise and no delay in exercising any power or right hereunder, shall operate as a waiver thereof; nor shall any single or partial

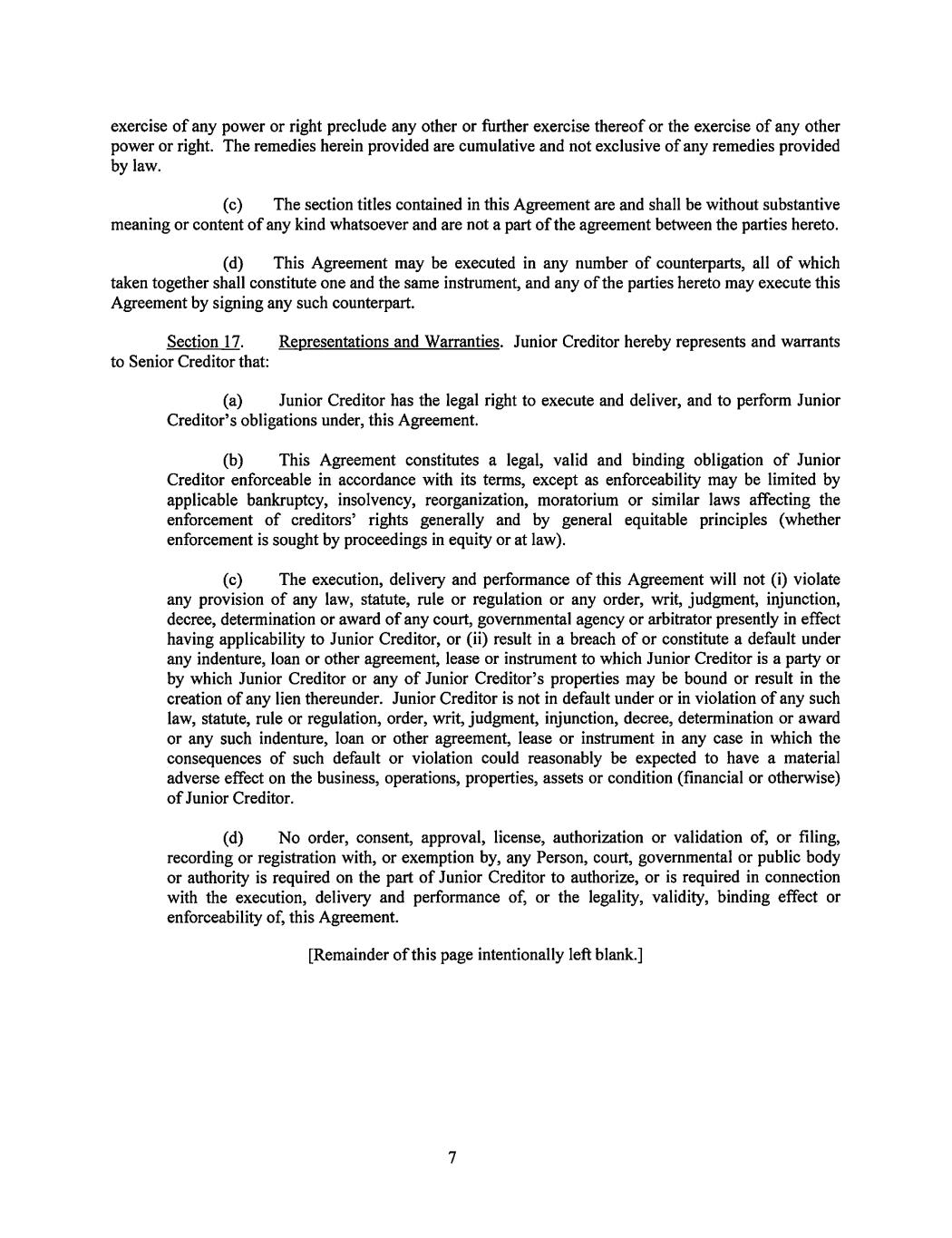

exercise of any power or right preclude any other or further exercise thereof or the exercise of any other power or right. The remedies herein provided are cumulative and not exclusive of any remedies provided by law. (c) The section titles contained in this Agreement are and shall be without substantive meaning or content of any kind whatsoever and are not a part of the agreement between the parties hereto. (d) This Agreement may be executed in any number of counterparts, all of which taken together shall constitute one and the same instrument, and any of the parties hereto may execute this Agreement by signing any such counterpart. Section 17. Representations and Warranties. Junior Creditor hereby represents and warrants to Senior Creditor that: (a) Junior Creditor has the legal right to execute and deliver, and to perform Junior Creditor’s obligations under, this Agreement. (b) This Agreement constitutes a legal, valid and binding obligation of Junior Creditor enforceable in accordance with its terms, except as enforceability may be limited by applicable bankruptcy, insolvency, reorganization, moratorium or similar laws affecting the enforcement of creditors’ rights generally and by general equitable principles (whether enforcement is sought by proceedings in equity or at law). (c) The execution, delivery and performance of this Agreement will not (i) violate any provision of any law, statute, rule or regulation or any order, writ, judgment, injunction, decree, determination or award of any court, governmental agency or arbitrator presently in effect having applicability to Junior Creditor, or (ii) result in a breach of or constitute a default under any indenture, loan or other agreement, lease or instrument to which Junior Creditor is a party or by which Junior Creditor or any of Junior Creditor’s properties may be bound or result in the creation of any lien thereunder. Junior Creditor is not in default under or in violation of any such law, statute, rule or regulation, order, writ, judgment, injunction, decree, determination or award or any such indenture, loan or other agreement, lease or instrument in any case in which the consequences of such default or violation could reasonably be expected to have a material adverse effect on the business, operations, properties, assets or condition (financial or otherwise) of Junior Creditor. (d) No order, consent, approval, license, authorization or validation of, or filing, recording or registration with, or exemption by, any Person, court, governmental or public body or authority is required on the part of Junior Creditor to authorize, or is required in connection with the execution, delivery and performance of, or the legality, validity, binding effect or enforceability of, this Agreement. [Remainder of this page intentionally left blank.]

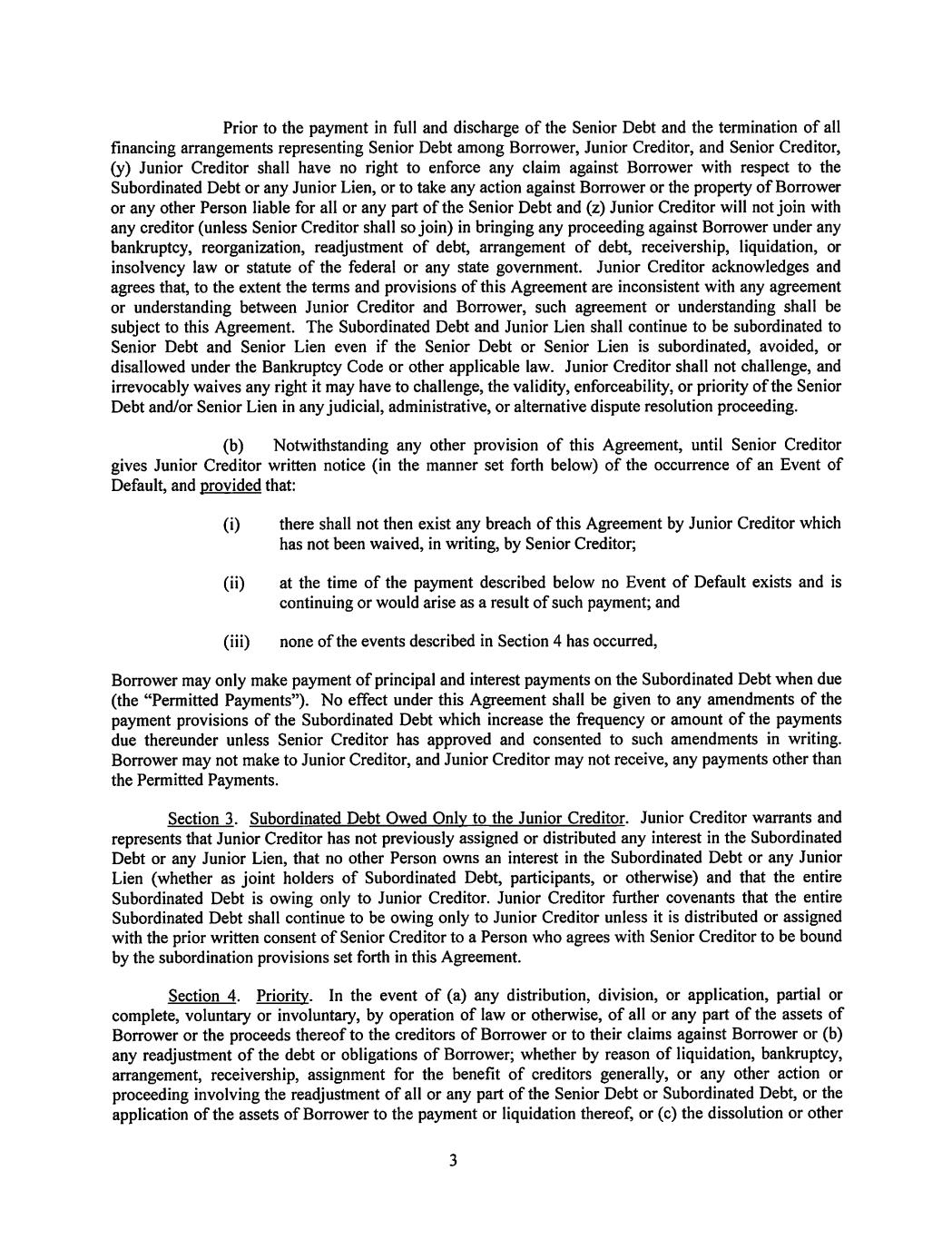

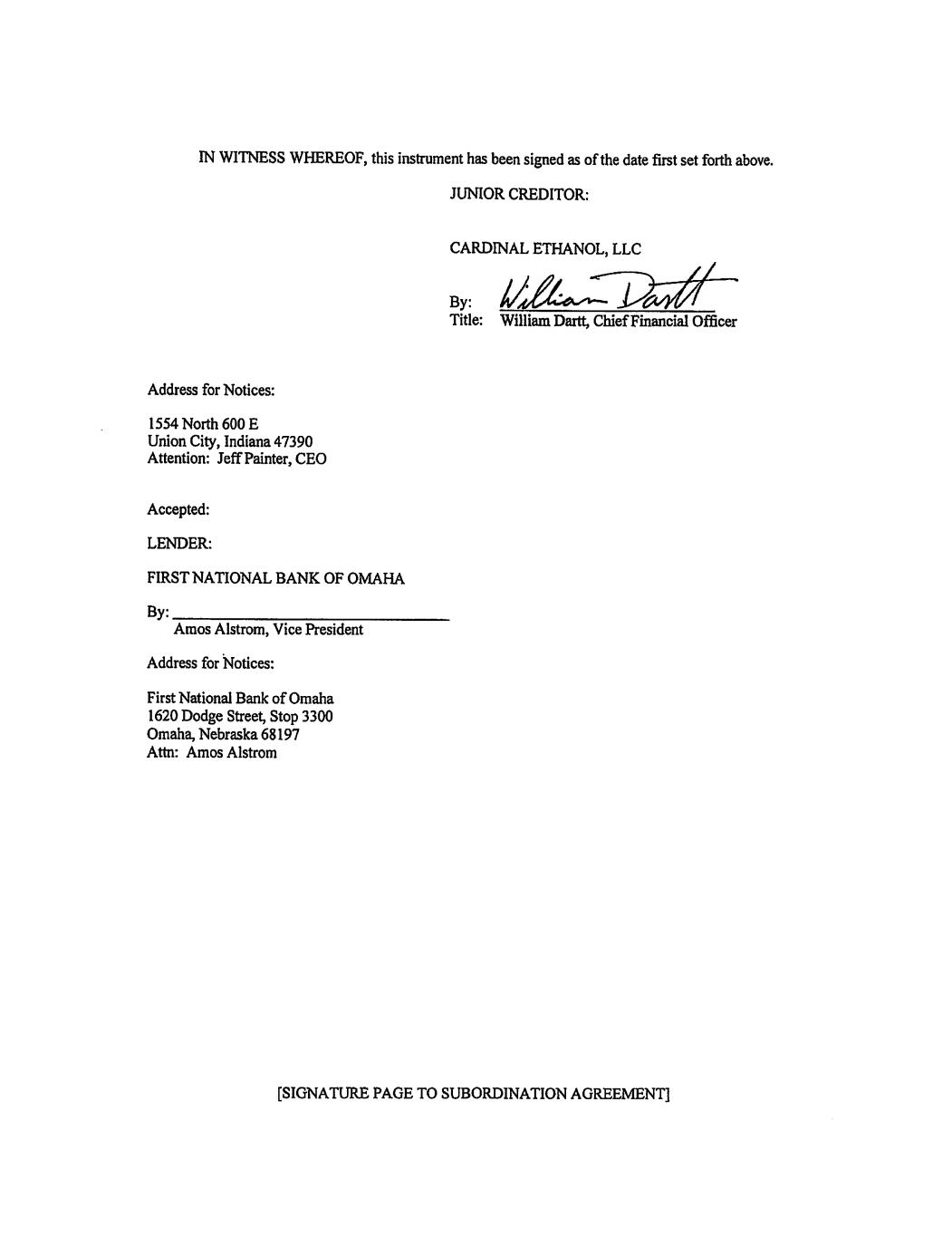

IN WITNESS WHEREOF, this instrument has been signed as of the date first set forth above. Address for Notices: 0000 Xxxxx 000 X Xxxxx Xxxx, Xxxxxxx 00000 Attention: Xxxx Xxxxxxx, CEO Accepted: LENDER: FIRST NATIONAL BANK OF OMAHA By: JUNIOR CREDITOR: CARDINAL ETHANOL, LLC » Vllox Dtt ~ Title: Xxxxxxx Xxxxx, Chief Financial Officer Xxxx Xxxxxxx, Vice President Address for Notices: First National Bank of Omaha 0000 Xxxxx Xxxxxx, Xxxx 0000 Xxxxx, Xxxxxxxx 00000 Attn: Xxxx Xxxxxxx [SIGNATURE PAGE TO SUBORDINATION AGREEMENT]

IN WITNESS WHEREOF, this instrument has been signed as of the date first set forth above. JUNIOR CREDITOR: CARDINAL ETHANOL, LLC By: Title: Address for Notices: 0000 Xxxxx 000 X Xxxxx Xxxx, Xxxxxxx 00000 Attention: Xxxx Xxxxxxx, CEO Accepted: LENDER: FIRST NATIONAL BANK OF OMAHA By:_ gf —eZ—____— cé&mosAdstro ms Vice President Xxxx Xxx.xxx— Address for Notices: First National Bank of Omaha 0000 Xxxxx Xxxxxx, Xxxx 0000 Xxxxx, Xxxxxxxx 00000 Attn: Xxxx Xxxxxxx [SIGNATURE PAGE TO SUBORDINATION AGREEMENT]

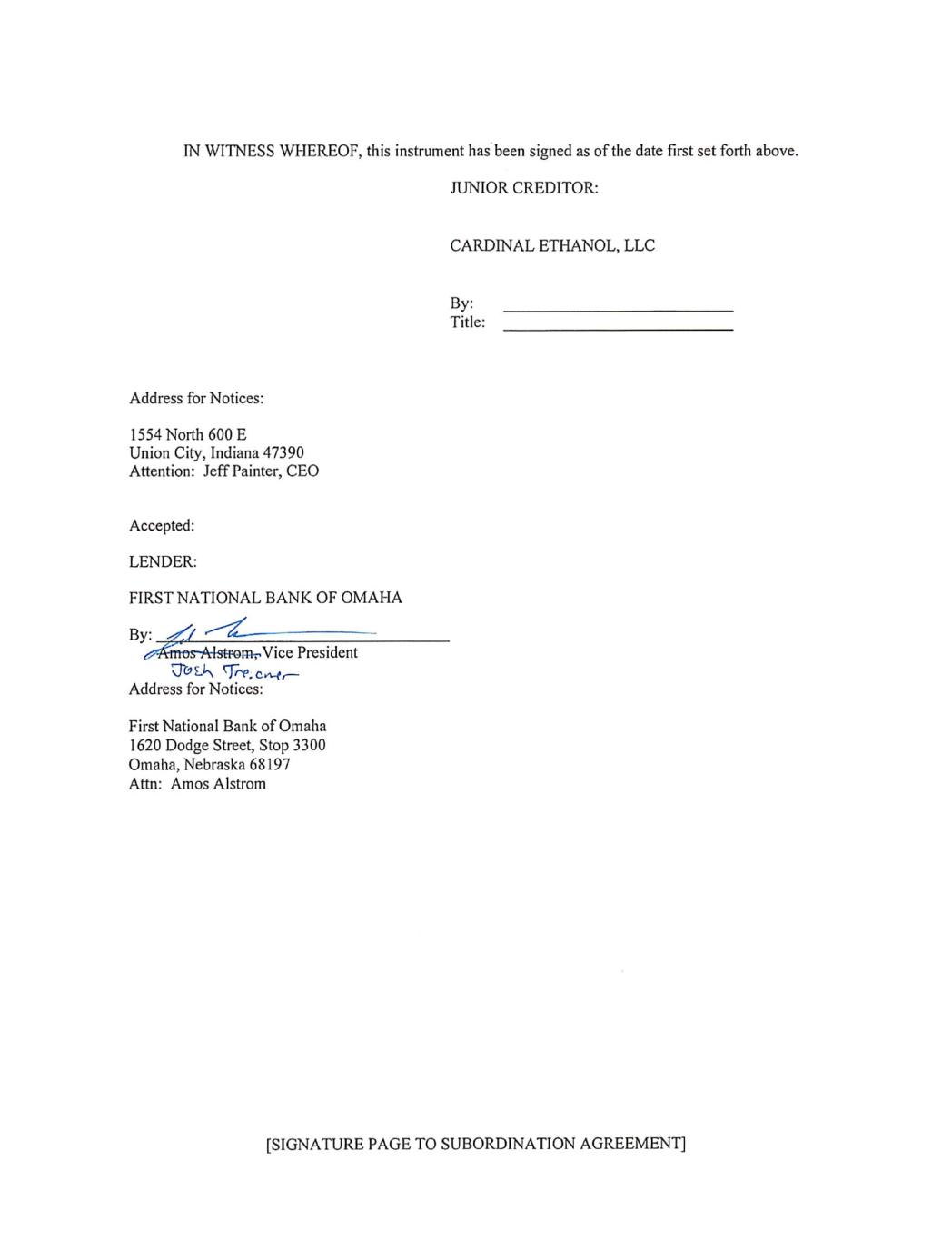

ACCEPTANCE AND ACKNOWLEDGMENT. Borrower hereby accepts, and acknowledges receipt of a copy of, the foregoing Subordination Agreement and agrees that it will not pay any of the “Subordinated Debt” (as defined in the foregoing Agreement) or grant any security therefor, except as the foregoing Agreement provides. CARDINAL COLWICH, LLC oy ULbe< Led — Title: Xxxxxxx Xxxxx, Treasurer [SIGNATURE PAGE TO SUBORDINATION AGREEMENT}