INDUSTRIAL BUILDING LEASE

Exhibit 10.2

This Industrial Building Lease is made the 30th day of September, 2008, between XXXXXXXXXX VENICE, LLC, an Illinois limited liability company, XXX XXXXXXXXXX VENICE, LLC, an Illinois limited liability company, RES XXXXXXXXXX VENICE, LLC, an Illinois limited liability company, MSP XXXXXXXXXX VENICE, LLC, an Illinois limited liability company, as tenants in common (hereinafter referred to collectively as “Landlord”), having Landlord’s principal office at c/o HSA Commercial Real Estate, 000 Xxxxx Xxxxxx Xxxxx, Xxxxx 000, Xxxxxxx, Xxxxxxxx 00000, and BWAY CORPORATION, as successor by merger to Bway Manufacturing, Inc., a Delaware corporation, (hereinafter referred to as “Tenant”).

WHEREAS, Tenant is in occupancy and possession of the Premises (as such term is defined below) pursuant to that certain Sublease dated December 5, 2003 between Tenant (as Sublessee) and Xxxxx Lines, Inc., an Illinois corporation (as Sublessor), as amended by First Amendment dated June 28, 2005 (the “Sublease”) and Landlord has acquired a fee simple interest and owns the Premises;

WHEREAS, the Sublease, and the Master Lease to which the Sublease is subject, have been terminated by written agreement of Tenant, the Sublessor and Master Lease Lessor effective immediately prior to the making of this Lease;

WHEREAS, the parties hereto desire that Tenant enter into a new lease directly with Landlord on the terms and conditions contained herein;

NOW, THEREFORE, Landlord does hereby demise and lease to the Tenant 100,000 square feet of space (as depicted on Exhibit “A” attached hereto and incorporated herein by reference) in the Building located at 00000 Xxxxxx Xxxxxx, Xxxxxxxxxx, Xxxxxxxxx, which Building consists of a total of 196,875 square feet of warehouse space (the leased space depicted on Exhibit “A” hereto being hereafter referred to as the “Premises,” and the Building and accompanying land, driveways and parking areas being hereafter referred to as the “Project”), upon the following Terms, Covenants and Conditions.

| 1. | TERM |

(a) Initial Term – The initial term of this Lease shall commence as of October 2, 2008 (the “Commencement Date”) and shall terminate February 28, 2014 (the “Initial Term”). As used herein, “Term” shall mean the Initial Term, together with any Extended Term agreed to by the parties pursuant to subparagraph (b) below.

| (b) | Option to Extend Initial Term: |

(i) Tenant shall have the right and option to extend the Initial Term subject to all the provisions contained in this Lease, except for Fixed Rent (which shall be calculated as set forth in Section l(b)(ii) below), for up to two (2) consecutive extensions (each, an “Extension Option”) of five (5) years each (each, an “Extended Term”), provided that Tenant is not in default

1

hereunder beyond the expiration of any notice and cure periods herein provided at the time of the exercise of the option and provided the cure is made timely. For each Extended Term, Tenant must elect to continue leasing all of the square footage of the Premises it is then leasing upon the expiration of the Initial Term, or if applicable, the immediately preceding Extended Term. Tenant shall exercise an Extension Option by delivering written notice to Landlord no later than 270 days prior to the expiration of the Initial Term, or if applicable, the immediately preceding Extended Term. Upon determination of Tenant’s new Fixed Rent for an Extended Term (as determined pursuant to Section 1 (b)(ii) below), the Extended Term shall commence without notice or further documentation upon the expiration of the Initial Term, or if applicable, the immediately preceding Extended Term, except that the parties hereto shall execute an amendment to the Lease evidencing the new Fixed Rent payment schedule for the Extended Term.

(ii) Fixed Rent for each Extended Term shall be at the then “Prevailing Market Rate,” determined in the manner described as follows: Together with delivery of Tenant’s notice of its exercise of an Extension Option, Tenant also shall specify Tenant’s selection of a real estate appraiser who shall act on Tenant’s behalf in determining the Prevailing Market Rate as described herein. Within ten (10) days after Landlord’s receipt of Tenant’s selection of a real estate appraiser, Landlord, by written notice to Tenant, shall designate a real estate appraiser, who shall act on Landlord’s behalf in the determination of the prevailing market lease rate for comparable leases of space in Racine County, WI (herein referred to as the “Prevailing Market Rate”). Within twenty (20) days of the selection of Landlord’s appraiser, the two (2) appraisers shall render a joint written determination of the Prevailing Market Rate, which determination shall take into consideration the following factors: (a) the creditworthiness of Tenant; (b) prevailing market incentives such as tenant fix-up allowances and rent concessions; (c) the cost of all improvements to the Premises made by or on behalf of Tenant, either made at Tenant’s sole cost and expense, or for which Tenant has reimbursed Landlord, or is obligated to reimburse Landlord; (d) the leasehold transaction being consummated with no liability to either Landlord or Tenant for any real estate broker’s or finder’s commission; (e) any differences between the Building and comparable buildings located in the Racine County, WI market area, including without limitation, age, location, height, ceiling height, number and location of truck loading bays, and type of building; (f) amenities offered; (g) the cost and provision of parking spaces, (h) size of the Premises; and (i) length of term. If the two (2) appraisers are unable to agree upon a joint written determination within said twenty (20) day period, each appraiser shall render its written determination of the Prevailing Market Rate and the two appraisers shall select a third appraiser within such twenty (20) day period. Within twenty (20) days after appointment of the third appraiser, the third appraiser shall render a written determination of the Prevailing Market Rate. If the third appraiser does not agree with either of the rates determined by the two prior appraisals, then the median of the three (3) determinations shall be final, conclusive and binding, and such median determination shall constitute the Prevailing Market Rate hereunder. All appraisers selected in accordance with this Section shall have at least ten (10) years’ prior experience in the commercial/industrial leasing market of the market area and shall be members of the American Institute of Real Estate Appraisers or similar professional organization. If either Landlord or Tenant fails or refuses to select an appraiser, the other appraiser shall alone determine the Prevailing Market Rate. Landlord and Tenant agree that they shall be bound by the determination of the Prevailing Market Rate pursuant to this Section l(b)(ii). Landlord shall bear the fees and expenses of its appraiser; Tenant shall bear the fees and expenses of its appraiser; and

2

Landlord and Tenant shall share equally the fees and expenses of the third appraiser, if any. Notwithstanding any of the foregoing, however, in no event shall the Prevailing Market Rate as determined pursuant to this Section, be less than the Fixed Rent for the last month of the preceding term.

(iii) Additional Rent shall continue to be payable during any Extended Term pursuant to the provisions of Sections 2(b) and (c) below.

2. RENT - Tenant hereby covenants and agrees to pay to Landlord at its office or such other place as Landlord may from time to time designate, as rent, including Fixed Rent and Additional Rent, for the Premises during the Initial Term of this Lease, a rental as set forth below. Fixed Rent is payable monthly in advance on the first day of each and every month. Additional Rent is payable in the same manner as Fixed Rent. Installments of Fixed Rent and Additional Rent will be due and owing from Tenant commencing October 2, 2008.

(a) Fixed Rent. Fixed Rent shall be payable in equal monthly installments as set forth below:

| PERIOD |

$/Sq. Ft/Yr. | Monthly Installment | ||||||

| October 2008 - February 2009 | $ | 4.208 | $ | 35,066.67 | ||||

| March 2009 - February 2010 | $ | 4.334 | $ | 36,116.67 | ||||

| March 2010 - February 2011 | $ | 4.464 | $ | 37,200.00 | ||||

| March 2011 - February 2012 | $ | 4.598 | $ | 38,316.67 | ||||

| March 2012 - February 2013 | $ | 4.736 | $ | 39,466.67 | ||||

| March 2013 - February 2014 | $ | 4.878 | $ | 40,650,00 | ||||

(b) Additional Rent. As Additional Rent, the Tenant will pay its Proportionate Share, as defined below, of all real estate taxes attributable to the Project, its Proportionate Share of all costs of insuring the Building and its Proportionate Share of all common area maintenance charges (hereinafter referred to as “CAM Charges”). CAM Charges include, but are not limited to, costs of grass cutting, landscape and parking lot maintenance, snow removal, exterior painting, utilities for common areas, utilities not separately metered, maintenance of those parts of the fire prevention equipment and sprinkler system that serve the Premises and other parts of the Building in common, management fees, and other operating expenses. As part of CAM charges, Tenant agrees to pay a management fee (“Management Fee”) to Landlord equal to 1.5% of the monthly Fixed Rent due for each and every month of the Initial Term and Extended Term of this Lease. Landlord shall include the Management Fee with the other components of Additional Rent payable by Tenant as outlined below. CAM Charges shall not include the items listed on Exhibit “B” attached hereto and incorporated herein by reference. Tenant’s Proportionate Share is computed by dividing the square

3

feet of the Premises by the total square feet of warehouse and office space in the Building. Tenant’s Proportionate Share is computed to be 50.8%.

(c) Estimates of Additional Rent. In order to provide for current payments of Additional Rent, Landlord shall give Tenant, upon execution of this Lease and from time to time during the Term hereof, written notice of its estimate of Additional Rent which will be due in the calendar year for which written notice of such estimate is given. Tenant shall pay to Landlord, as an Additional Rent deposit, in monthly installments commencing on the first day of the Term of this Lease, and/or the first day of the calendar month following that month in which Landlord notifies Tenant of the estimated Additional Rent, one-twelfth (1/12) of the Additional Rent due in any said calendar year as estimated by Landlord. If at any time it appears to Landlord that the Additional Rent due Landlord for any calendar year will vary from its estimate thereof by more than ten percent (10%), Landlord may, by written notice to Tenant, revise its estimate for such year. Subsequent Additional Rent deposits by Tenant for such year shall be based on the revised estimate. Tenant shall pay Landlord the Additional Rent deposit in the same manner as Fixed Rent.

After the end of the calendar year for which estimates of Additional Rent were made, actual Additional Rent due for such year shall be calculated. If the actual Additional Rent exceeds the deposits paid by Tenant based on Landlord’s estimates, Landlord shall xxxx Tenant for the excess amount and Tenant shall pay to Landlord said amount within ten (10) days of billing. If the actual Additional Rent is less than the deposits paid by Tenant based on Landlord’s estimate thereof, Tenant shall receive from Landlord a refund of the excess so paid by Tenant within ten (10) days of the completion of the accounting calculation. This covenant shall survive the expiration or termination of this Lease.

3. SECURITY DEPOSIT – Tenant shall, within five (5) business days after the Commencement Date, deposit with Landlord $27,270.83 in readily available funds as security for the payment of rent and the compliance by Tenant with other terms of this Lease.

4. TAXES - Tenant shall pay, as Additional Rent, its Proportionate Share of all real estate taxes and assessments levied or imposed against the Premises during the Term of this Lease. For the purposes hereof, real estate taxes for any calendar year during the Term shall be real estate taxes which are payable in such year regardless of when such taxes are assessed or become a lien. If a special assessment payable in installments is levied against the Premises, real estate taxes for such calendar year shall include only the installment of such assessment arid any interest payable or paid during such year. Real estate taxes that are payable during the first and last calendar year in the Term shall be prorated between Landlord and Tenant.

5. RECORDING OF LEASE – Recording of the Lease will be done by a Memorandum of Lease, to be executed by Landlord and Tenant and recorded on or prior to the Commencement Date.

6. UTILITIES - Tenant agrees to promptly pay all electric, gas, water and sewer services and other utilities used or consumed on the Premises. As further outlined in Section 26 hereof, Landlord shall arrange and pay for separately metering the electrical and gas service to the Premises. Also as further outlined in Section 26 hereof, Tenant shall arrange and pay for the installation of its own

4

telephone system to serve the Premises. To the extent any utilities at the Premises are not separately metered, Tenant shall pay, as Additional Rent, all charges reasonably allocable to Tenant, as determined by Landlord in Landlord’s sole discretion, by reason of Tenant’s use of the particular utility service. Tenant shall promptly pay all charges for electricity and telephone service directly to the applicable utility authority. If and when any other utility is separately metered, Tenant shall contract for under its own name and promptly pay all charges for such utility use by Tenant to the applicable utility authority.

| 7. | REPAIRS, REPLACEMENT, MAINTENANCE, SECURITY, HOUSEKEEPING, SANITATION. |

(a) Landlord shall, at its cost and expense, be responsible for regular maintenance and repair of the Building roof (including roof membrane and any skylights) and structural elements. The “structural elements” of the Building shall be defined as the foundations, footings, bearing and exterior walls. The unexposed electrical, plumbing and sewerage systems including those portions of the systems lying outside the Premises, gutters and downspouts on the Building, and the parking lot areas shall be maintained by Landlord and the expenses of same shall be included as part of CAM Charges. In addition, Landlord shall be responsible for replacement of the HVAC units which serve only the Premises (which expense shall also be included as part of CAM Charges). Landlord shall conduct, at Tenant’s expense as part of CAM Charges, regular maintenance of the HVAC units, Notwithstanding the foregoing, Tenant shall be responsible, at its sole cost, for any maintenance or repair caused by the negligence or willful act of Tenant or Tenant’s employees. Landlord shall be responsible for performing, but at Tenant’s expense as part of the CAM Charges, snow removal and common driveway and parking lot repair, unless damage to any common driveway or the parking lot is caused by Tenant, in which case Tenant shall be solely responsible.

If Landlord fails to perform any of its repair obligations hereunder for a period of thirty (30) days after receipt of written notice from Tenant to Landlord specifying the needed repair and demanding Landlord’s repair thereof (unless the repair involves a condition dangerous to person or property, or which will become worse if no immediate action is taken to effect such repair, in which event such default shall be cured forthwith upon Tenant’s demand), Tenant may, at its option, cause such repair to be made and Tenant’s reasonable cost of performance shall be paid to Tenant by Landlord within thirty (30) days. The foregoing rights shall not be exclusive of any other right or remedy hereby to which Tenant may be entitled as a result of Landlord’s failure to make required repairs hereunder.

(b) Tenant shall maintain all other portions of the Premises in good repair and shall be responsible for all repairs and replacement of all other building systems which are located exclusive within or which exclusively service the Premises, including, docks and accessories, security system and fire prevention equipment, plumbing and electrical. Tenant will also be responsible for and shall conduct throughout the Term hereof: (a) housekeeping operations to keep the Premises free from dirt and debris, (b) insect and rodent control including trapping not only in the Premises, but also the dock area and building perimeter and (c) trash removal.

5

(c) Landlord will construct and provide to Tenant at Landlord’s sole cost and expense, within sixty (60) days after the date of this Lease, two (2) dumpster enclosures (the “Dumpster Enclosures”) to contain and shelter Tenant’s two steel 7’x8’x6’ dumpsters with plastic covers used for trash and routine waste dumpsters at the Premises (the “Garbage Dumpsters”). The Dumpster Enclosures shall be for Tenant’s exclusive use during the Term, shall become Landlord’s property upon the expiration or early termination of the Lease, and will be located at a location or locations convenient to the Premises as designated by Tenant so long as such location does not hinder the rights of other tenants at the Building or violate local ordinances and subdivision/industrial park covenants and conditions relating to enclosing of dumpsters exterior to buildings (collectively, “Enclosure Requirements”). The Dumpster Enclosures shall be built in accordance with the specifications set forth on Exhibit “D” attached hereto and made a part hereof. The aforesaid sixty day period may be extended as reasonably necessary for delivery of the Dumpster Enclosures, if Landlord has pursued the design and construction of the Dumpster Enclosures diligently, but due to delayed approval by the relevant owners’ association, or other factors out of Landlord’s control, the Dumpster Enclosures cannot be completed within such sixty days. Tenant shall not be deemed to be in default under this Lease for failure to comply with Enclosure Requirements prior to delivery of the Dumpster Enclosures.

(d) In the event that either Tenant or Landlord receives a notice from the Renaissance Association or another organization or association managing the business park in which the Premises is located, indicating that any dumpsters used by Tenant at the Premises, other than the Garbage Dumpsters, are not in compliance with the business park rules or any covenants, conditions and restrictions recorded against the Project (together, the “Project Rules”), and require screening, Tenant shall cause such dumpsters to be screened in accordance with the Project Rules. In the event that such notice is received, Landlord shall reimburse Tenant for the cost of compliance (not to exceed $10,000.00) with such Project Rules on the following terms and conditions: (i) Landlord approves of the design and plans for such screening; (ii) the screening is done in accordance with the Project Rules, the Lease and all applicable laws and regulations; (iii) Landlord receives written confirmation from the Renaissance Association or other organization or association requiring compliance with the Project Rules that the dumpsters have been screened in compliance with the Project Rules; and (iv) Landlord receives satisfactory evidence from Tenant of its out of pocket costs to enclose such dumpsters.

| 8. | INSURANCE |

| (a) | Property. |

(i) Landlord will keep in effect insurance protecting the Building against loss by fire, windstorm and other perils customarily provided under an extended coverage endorsement. Tenant shall pay its Proportionate Share of the cost of such insurance premiums as Additional Rent.

(ii) Tenant shall provide insurance covering Tenant’s inventory and personal property and Tenant’s leasehold improvements for their fall replacement value. Landlord shall not be obligated to provide insurance protection for Tenant’s personal property, inventory, or Tenant’s leasehold improvements.

6

| (b) | Indemnification - Liability Insurance. |

(i) Landlord shall not be liable to Tenant for any loss or damage to Tenant or

to any other person or to the property of Tenant or of any other person except to the extent that such loss or damage shall be caused by the negligence, misconduct or intentionally tortious act of Landlord, or its agents, servants or employees, or by the failure of Landlord to perform its respective obligations hereunder.

(ii) Except as caused by the negligence, misconduct or intentionally tortious act of Landlord, or its agents, servants or employees, or by the failure of Landlord to perform its respective obligations hereunder, Tenant shall and does hereby agree to indemnify and save harmless Landlord, its successors or assigns, from all claims and demands of every kind, that may be brought against Landlord, its successors or assigns or any of them for or on account of any damage, loss or injury to persons or property in or about the Premises and its appurtenances, including damage to the Premises, (A) arising from or out of Tenant’s use or occupancy thereof, or (B) occasioned wholly or in part by any act or omission of Tenant, its agents, servants, contractors, employees or invitees, and from any and all costs and expenses, reasonable counsel fees and other charges which may be imposed upon Landlord, its successors and assigns, or which Landlord, its successors or assigns may incur in consequence thereof. The provisions of this subsection 8(b)(ii) shall survive for a period of one (1) year after the termination of this Lease. Notwithstanding the foregoing, Tenant’s indemnity obligations relating to Hazardous Materials shall be exclusively governed by Section 21(c) below.

(iii) Except as caused by the negligence, misconduct or intentionally tortious act of Tenant, or its agents, servants or employees, or by the failure of Tenant to perform its obligations hereunder. Landlord shall and does hereby agree to indemnify and save harmless Tenant, its successors or assigns, from all claims and demands of every kind, that may be brought against Tenant, its successors or assigns or any of them for or on account of any damage, loss or injury to persons or property in or about the Project (other than the Premises) and its appurtenances, (A) arising from or out of Landlord’s or any other tenant’s use or occupancy thereof or (B) occasioned wholly or in part by any act or omission of Landlord, its respective agents, servants, contractors, employees or invitees, and from any and all costs and expenses, reasonable counsel fees and other charges which may be imposed upon Tenant, its successors and assigns, or which Tenant, its successors or assigns may incur in consequence thereof. The provisions of this subsection 8(b)(iii) shall survive for a period of one (1) year after the termination of this Lease. Notwithstanding the foregoing, Landlord’s indemnity obligations relating to Hazardous Materials shall be exclusively governed by Section 21(c) below.

(iv) Tenant covenants and agrees that Tenant will, throughout the term of this Lease, carry and pay for comprehensive commercial general liability with contractual liability insurance coverage with a company reasonably satisfactory to Landlord, with a minimum limit of $3,000,000.00 combined single limit per occurrence, and will furnish Landlord with an original signed counterpart of the certificate evidencing such coverage. All insurance maintained by Tenant under this Lease shall name Landlord and Landlord’s designee as additional insureds, and shall also contain a provision stating that such policy or policies shall not be canceled or materially altered

7

except after 30 days’ prior written notice to Landlord, and if applicable, Landlord’s designee. If at any time Tenant does not comply with the covenants made in this subsection, in addition to any other remedies to which Landlord may be entitled, Landlord may, at Landlord’s option, cause insurance as aforesaid to be issued, and Tenant agrees to pay the premium for such insurance within 10 days of Landlord’s written demand, together with 15% of such premium for reimbursement to Landlord for Landlord’s ancillary administrative expenses related thereto.

(c) Subrogation. Tenant and Landlord shall have included in all insurance policies relating to the Premises obtained by Tenant and Landlord hereunder, a waiver by the insurer of all right of subrogation against Landlord or Tenant in connection with any loss or damage thereby insured against. To the full extent permitted by law, Tenant and Landlord each waives all right of recovery against the other for, and agrees to release the other from liability for, loss or damage to the extent such loss or damage is covered by valid and collectible insurance in effect at the time of such loss or damage or would be covered by the insurance required to be maintained under this Lease by Tenant or Landlord, including any deductible thereunder. Such waiver also applies to each party’s directors, officers, employees, shareholders, and agents.

| 9. | DEFAULT |

(a) Events of Default. The following events shall be deemed to be events of default by Tenant under this Lease:

(i) Tenant shall fail to pay any installment of rent within fifteen (15) days after the due date. In the event that Tenant fails to pay any installment of rent within five (5) days after the due date, Landlord shall send to Tenant by overnight delivery, notice of the overdue rent installment and of the late charge due Landlord pursuant to Section 9 (b)(i) of this Lease.

(ii) Tenant shall become insolvent, or shall make a transfer in fraud of creditors, or shall make an assignment for the benefit of creditors, all as determined by a court of competent jurisdiction.

(iii) Tenant shall file a petition under any section or chapter of the National Bankruptcy Code, as amended, or under any similar law or statute of the United States or any State thereof; or an order for relief shall be entered against Tenant in any proceedings filed against Tenant thereunder.

(iv) A receiver or trustee shall be appointed for all or substantially all of the assets of Tenant.

(v) Tenant shall vacate all or a substantial portion of the Premises, whether or not Tenant is in default of the rental payments due under this Lease; provided, however, that such event shall not constitute an Event of Default hereunder if (i) Tenant is not otherwise in default hereunder; (ii) Tenant adequately secures the Premises to prevent damage, destruction or vandalism to the Premises; (iii) Tenant continues such utilities to the Premises as will prevent any damage to

8

the Premises; (iv) Tenant continues to provide insurance for the Premises and Tenant pays any increased premium resulting from a lack of a tenant in the Premises.

(vi) Tenant shall fail to discharge any lien placed upon the Premises arising from a debt asserted against Tenant within sixty (60) days after (A) notice by Landlord or (B) such earlier date on which Tenant has actual notice of such lien.

(vi) Tenant shall fail to comply with any term, provision or covenant of this Lease other than the foregoing in this Section 9 and shall not cure such failure within sixty (60) days after written notice thereof to Tenant; provided, however, that if such default is not reasonably capable of cure within sixty (60) days and Tenant commences efforts to cure during such 60-day period and diligently prosecutes such efforts to completion, Tenant shall have such additional time as is reasonably necessary to cure such default.

| (b) | Remedies. |

(i) Upon the occurrence of any of such events of default described in Section 9 hereof, Landlord shall have the option to pursue any one or more of the following remedies without any notice or demand whatsoever:

(A) Unless contrary to the law of the jurisdiction in which the property is located, terminate this Lease, in which event Tenant shall immediately surrender the Premises to Landlord, and if Tenant fails so to do, Landlord may, without prejudice to any other remedy which it may have for possession or arrearage in rent, enter upon and take possession of the Premises and expel or remove Tenant or any other person who may be occupying the Premises or any part thereof, by force if necessary, without being liable for prosecution or any claim of damages therefor.

(B) Unless contrary to the law of the jurisdiction in which the property is located, enter upon and take possession of the Premises and expel or remove Tenant and any other person who may be occupying such Premises or any part thereof, by force if necessary, without terminating this Lease and without being liable for prosecution or any claim for damages therefor, and relet the premises and receive the rent therefor.

(C) Unless contrary to the law of the jurisdiction in which the property is located, enter upon the Premises, by force if necessary, without terminating this Lease and without being liable for prosecution or any claim for damages therefor, and do whatever Tenant is obligated to do under the terms of this Lease; and Tenant agrees to reimburse Landlord on demand for any expenses which Landlord may incur in thus effecting compliance with Tenant’s obligations under this Lease, and Tenant further agrees that Landlord shall not be liable for any damages resulting to the Tenant from such action, whether caused by the negligence of Landlord or otherwise.

(D) Unless contrary to the law of the jurisdiction in which the property is located, alter all locks and other security devices at the Premises without terminating this Lease.

9

In the event Tenant fails to pay any installment of rent hereunder within five (5) days after the date on which such installment is due, to help defray the additional cost to Landlord for processing such late payments Tenant shall pay to Landlord on demand a late charge in an amount equal to five percent (5%) of such installment; and the failure to pay such amount within ten (10) days after demand therefor shall be an event of default hereunder. The provision for such late charge shall be in addition to all of Landlord’s other rights and remedies hereunder or at law and shall not be construed as limiting Landlord’s remedies in any manner.

(ii) Exercise by Landlord of any one or more remedies hereunder granted or otherwise available shall not be deemed to be in acceptance of surrender of the Premises by Tenant, whether by agreement or by operation of law, it being understood that such surrender can be effected only by the written agreement of Landlord and Tenant. To the extent conducted in accordance with applicable law, no such alteration of locks or other security devices and no removal or other exercise of dominion by Landlord over the property of Tenant or others at the Premises shall be deemed unauthorized or constitute a conversion, Tenant hereby consenting, after any event of default, to the aforesaid exercise of dominion over Tenant’s property within the Premises. All claims for damages by reason of such re-entry and/or repossession and/or alteration of locks or other security devices are hereby waived, as are all claims for damages by reason of any distress warrant, forcible detainer proceedings, sequestration proceedings or other legal process. Tenant agrees that any re-entry by Landlord may be pursuant to judgment obtained in forcible detainer proceedings or other legal proceedings or without the necessity for any legal proceedings, as Landlord may elect, and Landlord shall not be liable in trespass or otherwise.

(iii) In the event Landlord elects to terminate the Lease by reason of an event of default, then notwithstanding such termination, Tenant shall be liable for and shall pay to Landlord, at the address specified for notice to Landlord herein: (A) the sum of all rental and other indebtedness accrued to date of such termination; (B) plus, as damages, an amount equal to the difference between (1) the total rental hereunder for the remaining portion of the Lease Term (had such Term not been terminated by Landlord prior to the date of expiration stated in Section 1 and (2) the then present value, computed with a discount rate of 12 percent, of the then fair rental values of the Premises for such period.

(iv) In the event that Landlord elects to repossess the Premises without terminating the Lease, then Tenant shall be liable for and shall pay to Landlord, at the address specified for notice to Landlord herein, all rental and other indebtedness accrued to the date of such repossession, plus rental required to be paid by Tenant to Landlord during the remainder of the Lease Term until the date of expiration of the Term as stated in Section 1 diminished by any net sums thereafter received by Landlord through reletting the Premises during said period (after deducting expenses incurred by Landlord as provided in subsection (v) below.) In no event shall Tenant be entitled to any excess of any rental obtained by reletting over and above the rental herein reserved. Actions to collect amounts due by Tenant to Landlord under this subsection may be brought from time to time, on one or more occasions, without the necessity of Landlord’s waiting until expiration of the Lease term.

10

(v) In case of any event of default by Tenant, or threatened or anticipatory default, Tenant shall also be liable for and shall pay to Landlord, at the address specified for notice to Landlord herein, in addition to any sum provided to be paid above, reasonable brokers’ fees incurred by Landlord in connection with reletting the whole or any part of the Premises (but only to the extent attributable to the remainder of the then-applicable Term), the costs of removing and storing Tenant’s property, the costs of repairing, altering, remodeling or otherwise putting the Premises into condition acceptable to a new tenant or tenants, and all reasonable expenses incurred by Landlord in enforcing or defending Landlord’s rights and/or remedies including actual and reasonable attorney’s fees, whether suit is actually filed or not.

(vi) In the event of the termination of the Lease or repossession of the Premises for an event of default by Tenant, Landlord shall use commercially reasonable efforts to relet or to attempt to relet the Premises, or any portion thereof; and in the event of reletting, Landlord may relet the whole or any portion of the Premises for any period to any tenant and for any use and purpose.

(vii) If Tenant should fail to make any payment or cure any default hereunder within the time herein permitted, Landlord, without being under any obligation to do so and without thereby waiving such default, may make such payment and/or remedy such other default for the account of Tenant (and enter the Premises for such purpose), and thereupon Tenant shall pay Landlord, upon demand, all costs, expenses and disbursements (including reasonable attorney’s fees) reasonably incurred by Landlord in taking such remedial action.

(viii) Landlord shall not have any rights or interest in any of the personal property of Tenant, including, without limitation, statutory rights granted a Landlord with respect to the property of a tenant. Tenant may collaterally assign and grant a leasehold mortgage or security interest in its rights under this Lease to any institutional lender(s) or leasing company(ies) providing financing to Tenant (each, a “Financing Party”), such leasehold mortgage or security interest to be in the form required by such Financing Party, and any such Financing Party(ies) or its or their designee(s) shall have the right in connection with the exercise of remedies under any financing document to receive the benefits and exercise the rights of Tenant under this Lease, but not including occupancy or possession rights, unless such Financing Party or its designee, as the case may be, agrees to comply with the terms of this Lease, and such Financing Party or its designee, as the case may be, assumes occupancy or possession rights, and such Financing Party or designee cures or agrees to cure any then existing default by Tenant, to the extent that such default is capable of cure. Notwithstanding the Financing Party’s or its designee’s assumption of occupancy or possession rights under this Lease, Tenant shall continue to be responsible for its liabilities and obligations under this Lease. Upon Tenant’s request, (a) Landlord shall execute such landlord lien waivers, in reasonable form, as may be requested from time to time by a Financing Party and (b) Landlord shall use its best efforts to obtain the joinder of its mortgagees to such landlord lien waivers.

In the event any Financing Party exercises its remedies under any financing document to remove any property of Tenant from the Premises, then Landlord, without any expense to Landlord, shall cooperate with the Financing Party or its designee to facilitate such action, provided that Financing Party shall repair any damage to the Premises resulting from such removal.

11

(ix) In the event Landlord shall have taken possession of the Premises pursuant to the authority herein granted then, subject to the rights of any Financing Party or other third party having a lien or lessor’s interest in such property and applicable laws, Landlord shall have the right to keep in place and use all of the furniture, fixtures and equipment at the Premises, including that which is owned by or leased to Tenant at all times prior to any foreclosure or repossession thereof by any Financing Party or other third party having a lien or lessor’s interest in such property. Landlord shall also have the right to remove from the Premises (without the necessity of obtaining a distress warrant, writ of sequestration or other legal process) all or any portion of such furniture, fixtures, equipment and other property located thereon and to place same in storage at any premises within the County in which the Premises is located; and in such event, Tenant shall be liable to Landlord for costs incurred by Landlord in connection with such removal and storage. Landlord shall also have the right to relinquish possession of all or any portion of such furniture, fixtures, equipment and other property to any Financing Party or other claimant, to the extent required or ordered pursuant to judgment or order of a court of competent jurisdiction.

10. ASSIGNMENT OR SUBLETTING - Tenant shall not sublet or assign the Lease hereunder except with the written consent of Landlord which consent shall not be unreasonably withheld, except that as a condition to such consent, Tenant agrees that fifty percent (50%) of any rent or other charge to be received by Tenant for the use of the Premises in excess of the rent due hereunder shall be paid to Landlord. Such consent is not necessary if the sublease or assignment is made to a subsidiary, affiliate or parent company of Tenant for the manufacturing, storage and handling of the same products as manufactured, stored and handled by Tenant, but such consent and permission of Landlord must be obtained in the event different products are to be manufactured, stored, and/or handled at the Premises. Consent of the Landlord will not be unreasonably withheld particularly if such products are compatible and do not alter the physical character of the Building. Provided the Tenant performs all its covenants, agreements, and obligations hereunder, the Tenant shall have the peaceful and quiet enjoyment of the Premises without hindrance on the part of Landlord and Landlord will warrant and defend the Tenant in the peaceful and quiet enjoyment of the Premises against the lawful claims of all persons claiming by, through, or under Landlord.

11. ACCESS TO PREMISES - The Landlord and its representatives may, upon notifying Tenant (by telephone call to Tenant’s operations manager at the Premises) at least twenty-four (24) hours in advance thereof, enter the Premises during normal business hours (except as to emergency repairs to be made by Landlord and except as otherwise agreed by Tenant) for the purpose of: examining the same or to make any alterations or repairs to the Premises that the Landlord may deem necessary for safety or preservation of the facility; (b) exhibiting the Premises for sale or mortgage financing, and (c) during the last twelve (12) months of the Term of this Lease, for exhibiting Premises and putting up the usual notice “For Rent”, which notice shall not be removed, obliterated, or hidden by Tenant, provided, however, that any such action by Landlord as aforesaid in this section shall cause as little inconvenience to Tenant as reasonably practicable, and such action shall not be deemed an eviction or disturbance of Tenant nor shall Tenant be allowed any abatement of rent, or damage for an injury or inconvenience occasioned thereby.

| 12. | DAMAGE OR DESTRUCTION |

12

(a) If during the Term of this Lease the Premises are damaged by fire or other casualty, but not to the extent that Tenant is prevented from carrying on business in the Premises, Landlord shall, within one hundred twenty (120) days after such casualty, cause the Premises to be repaired or restored at its sole cost and risk to substantially the condition in which it existed prior to such damage. If such damage renders any portion of the Premises untenantable, the rent reserved hereunder shall be reduced during the period of its untenantability proportionately to the amount by which the area so rendered untenantable bears to the entire area of the Premises, and such reduction shall be apportioned from the date of the casualty to the date when the Premises is rendered fully tenantable. If, as a result of such damage, it is commercially impracticable for Tenant to conduct its business at the Premises (for example, if Tenant cannot conduct all necessary steps of the manufacturing process conducted at the Premises), all rent reserved hereunder shall xxxxx from the date of the casualty to the date when the Premises are restored to a condition which enables Tenant to resume business operations at the Premises. Notwithstanding the foregoing, in the event such fire or other casualty damages or destroys any of Tenant’s leasehold improvements, alterations, betterments, fixtures or equipment Tenant shall cause the same to be repaired or restored at Tenant’s sole expense (other than Tenant’s personal property or equipment, which Tenant may elect, in Tenant’s sole discretion, to repair or restore).

(b) If during the Term of this Lease the Premises are rendered wholly untenantable as a result of fire, the elements, or other casualty, Landlord shall notify Tenant within 45 days of the casualty (i) whether it elects to restore the Premises or terminate the Lease and (ii) if it elects to restore the Premises, the estimated time for completion of such restoration. If Landlord elects to restore the Premises, such restoration shall be completed within one hundred eighty (180) days after the date of the casualty and the rent reserved hereunder shall xxxxx until the Premises are again rendered tenantable. If Landlord elects not to restore the Premises, this Lease shall terminate as of the date of such notice. If the restoration is estimated to take in excess of one hundred eighty (180) days, Tenant may terminate this Lease without fee or penalty upon written notice to Landlord. In addition, if such casualty occurs during the last two (2) years of the then-applicable term, Tenant may terminate this Lease upon written notice to Landlord given within forty-five (45) days of the casualty.

| 13. | CONDEMNATION |

(a) If during the Term of this Lease all or a substantial part of the Premises are taken by or under power of eminent domain, this Lease shall terminate as of the date of such taking, and the rent (Fixed and Additional) shall be apportioned to and xxxxx from and after, the date of taking. Tenant shall have no right to participate in any award or damages for such taking and, subject to Section 13(d) below, hereby assigns all of its right, title and interest therein to Landlord. For the purposes of this Section, “a substantial part of the Premises” shall mean such part that the remainder thereof is rendered inadequate for Tenant’s business and that such remainder cannot practicably be repaired and improved so as to be rendered adequate to permit Tenant to carry on its business with substantially the same efficiency as before the taking, as determined in Landlord’s reasonable judgment.

13

(b) If during the Term of this Lease less than a substantial part of the Premises (as herein above defined) is taken by or under power of eminent domain, this Lease shall remain in full force and effect according to its terms, and Tenant shall not have the right to participate in any award or damages for such taking and Tenant hereby assigns, subject to Section 13(d) below, all of its right, title and interest in and to the award to Landlord. In such event Landlord shall at its expense promptly make such repairs and improvements as shall be necessary to make the remainder of the Premises adequate to permit Tenant to carry on its business to substantially the same extent and with substantially the same efficiency as before the taking. If as a result of such taking any part of the Premises is rendered permanently unusable, the rent reserved hereunder shall be reduced in such amount as may be fair arid reasonable, which amount shall not exceed the proportion which the area so taken or made unusable bears to the total area which was usable by Tenant prior to the taking. If the taking does not render any part of the Premises unusable, there shall be no abatement of rent.

(c) For purposes of this Section “taking” shall include a negotiated sale or lease and transfer of possession to a condemning authority under bona fide threat of condemnation, and both Landlord and Tenant shall have the right to negotiate with the condemning authority and conduct and settle all litigation connected with the condemnation. As used herein, the words “award or damages” shall, in the event of such sale or settlement, include the purchase or settlement price.

(d) Nothing herein shall be deemed to prevent Tenant from claiming and receiving from the condemning authority, if legally payable, compensation for the taking of Tenant’s own tangible property and damages for Tenant’s loss of business, business interruption, or removal and relocation; provided such compensation does not in any way decrease the amount of the award or damages to which Landlord may be entitled by reason of such taking.

14. SUBORDINATION - Provided that a mutually acceptable Subordination, Non-Disturbance and Attornment Agreement (“SNDA”) has been executed by Tenant, Landlord, and the applicable existing and any future mortgageholder, this Lease shall be subject to and subordinate at all times to the lien of any mortgages by Landlord or deeds of trust hereafter made on the Premises and to all advances made or hereafter to be made thereunder. Tenant agrees to negotiate in good faith as to the execution and delivery, within 10 days of Landlord’s request therefor, of a mutually acceptable SNDA.

15. LANDLORD’S RIGHT TO PERFORM TENANT’S COVENANTS - If Tenant shall fail to perform any covenant or duty required of it by this Lease or by law or shall take any action requiring Landlord’s consent without having obtained such consent, upon forty-eight (48) hours advance notice to Tenant, Landlord shall have the right (but not the obligation) to perform such covenant or duty or to take any action to terminate any acts of Tenant undertaken without Landlord’s consent, and if necessary to enter the Premises for such purposes. The cost thereof to Landlord shall be payable by Tenant, within 10 days of Landlord’s demand therefor, including 15% of such cost for reimbursement to Landlord for Landlord’s ancillary administrative expenses, and Landlord shall have the same rights and remedies with respect to such costs.

16. WATER AND OTHER DAMAGE - Unless caused by Landlord’s negligent or intentionally tortious act or failure or Landlord’s failure to perform its obligations hereunder, Landlord shall not

14

be liable for, and Landlord is hereby released and relieved from, and Tenant hereby waives, all claims and demands of any kind by reason of or resulting from, damage or injury to person or property of Tenant, or any other party, directly or indirectly caused by (a) dampness, water, rain or snow, in any part of the Premises or in any part of the Building, the land, or of any portion thereof leased to Tenant (whether attributable to roof leakage or otherwise) and/or (b) any leak or break in any gas or electric line in any part of the Premises, or any leak or break in any pipes, appliances or plumbing, or from sewers, or from any other place or any part of the buildings, land, or any portion thereof leased to Tenant.

17. COVENANT OF QUIET ENJOYMENT - So long as the Tenant pays the rent, and performs all of its obligations in this Lease, the Tenant’s possession of the Premises will not be disturbed by Landlord, or any party acquiring the interest of Landlord hereunder or with respect to the Premises.

18. LIMITATION ON TENANT’S RECOURSE - The Tenant’s sole recourse against the Landlord, and any successor to the interest of the Landlord in the Premises, is to the interest of the Landlord, and any such successor, in the Building. The phrase “the interest of the Landlord in the Building” as used in this paragraph shall be an amount equal to Landlord’s equity in the Building.

The Tenant will not have any right to satisfy any judgment which it may have against the Landlord, or any such successor, from any other assets of the Landlord, or any such successor. In this Section the terms “Landlord”, and “successor” include the shareholders, members, venturers, and partners of “Landlord”, and “successor”. The provisions of this section are not intended to limit the Tenant’s right to seek injunctive relief or specific performance, or the Tenant’s right to claim the proceeds of insurance (if any) specifically required to be maintained by the Landlord hereunder.

19. MISCELLANEOUS - ESTOPPEL CERTIFICATES - Within no more than ten (10) business days after written request by Landlord, Tenant will execute, acknowledge, and deliver to Landlord a certificate, as provided by Landlord to Tenant, stating (a) that this Lease is unmodified and in full force and effect, or, if the Lease is modified, the way in which it is modified accompanied by a copy of the modification agreement, (b) the date to which rental and other sums payable under this Lease have been paid, (c) that no notice has been received by Tenant of any default which has not been cured, or, if such a default has not been cured, what Tenant intends to do in order to effect the cure, and when it will do so, (d) that Tenant has accepted and occupied the Premises, (e) that, to the best of Tenant’s knowledge, Tenant has no claim or offset against Landlord, or, if it does, stating the circumstances which gave rise to the claim or offset, (f) that Tenant is not aware of any prior assignment of this Lease by Landlord, or, if it is, stating the date of the assignment and assignee (if known to Tenant), and (g) such other matters as may be reasonably requested by Landlord. Any such certificate may be relied upon by any prospective purchaser of the Premises and any prospective mortgagee or beneficiary under any deed of trust or mortgage encumbering the Premises.

20. HOLDING OVER - At the termination of this Lease by lapse of time or otherwise, Tenant shall forthwith surrender possession of the Premises or, failing to do so, shall pay, at the election of Landlord, for each day possession is withheld, rent in the amount of 150% of the then applicable Fixed Rent herein to be paid by Tenant hereunder (together with Additional Rent at the standard rate). The provisions of this Section shall not be held to be a waiver by Landlord of any right of re-

15

entry, nor shall the receipt of such holdover rent, or any other act in apparent affirmance of the tenancy, operate to create a periodic tenancy or a tenancy at will or as a waiver of the right to terminate this Lease at any time.

| 21. | USE OF PROPERTY |

(a) Condition of Property at Commencement Date. Tenant has inspected and accepts the Premises in its current “as is” and “where is” condition, and Landlord makes no warranties or representations of any kind as to the condition of the Premises or its fitness for Tenant’s intended use. Landlord has not received written notification of a violation of any environmental laws or regulations affecting the Premises.

(b) Manner of Use. Tenant shall not cause or permit the Premises to be used in any way which constitutes a violation of any applicable law, ordinance, or governmental regulation or order, or business park rule, or which constitutes a nuisance or waste. Tenant shall obtain and pay for all operational permits, including an Occupancy Fee, floor tax or personal property tax, required for or related to Tenant’s occupancy of the Premises and shall promptly take all actions necessary to comply with all applicable statutes, ordinances, rules, regulations, orders and requirements regulating the use by Tenant of the Premises, including the Occupational Safety and Health Act, federal, state and local environmental laws and regulations, and the Americans with Disabilities Act; provided, however, Tenant shall not be responsible for compliance with any laws, regulations, or the like requiring (i) structural repairs or modifications, or (ii) repairs or modifications to the utility or Building service equipment located outside of the Premises and not required solely as a result of Tenant’s use or arising from or related to Tenant’s occupancy or (iii) the installation of new Building service equipment such as fire detection or suppression equipment, unless such repairs, modifications or installations are required either due to Landlord’s alterations or repairs in the Premises or Tenant’s particular manner of use of the Premises (as opposed to office use generally) or due to the negligence or willful misconduct of Tenant or any agent, employee or contractor or Tenant.

Tenant shall use the Premises for the manufacturing, handling and storage of aerosol and other cans and containers, including, but not limited to, aerosol paint cans and shaving cream cans, other types of rigid plastic or metal containers, and other products which are similar to and/or compatible with the use stated herein, together with ancillary uses relating to such products, including without limitation general office uses, shipping, receiving, storage of finished product (whether manufactured at the Premises or at any other location of Tenant or its affiliates) and storage of raw materials and for no other use without Landlord’s prior written approval. Tenant may not store any products or any of Tenant’s personal property or other property outside the Building.

Tenant may not make material changes, alterations, or improvements to the Premises without Landlord’s written approval. Notwithstanding anything contained herein to the contrary, Tenant shall be entitled to perform work within the Premises with notice to, but not the consent of, Landlord as long as (a) the cost of such work does not exceed, in the aggregate, $50,000.00; (b) such work does not adversely affect the structural components of the Building or the Building’s systems; (c) except for exhaust stacks as discussed below, such work is not visible from the exterior of the Premises; and (d) the terms and conditions of this paragraph of the Lease are otherwise complied with. In addition,

16

Landlord expressly agrees that, in connection with the installation of its manufacturing equipment, Tenant shall be entitled to install, at its sole cost and expense, exhaust stacks through the roof of the Building. Such exhaust stacks shall be constructed in a good and workmanlike manner.

| (c) | Hazardous Materials. |

(i) As used in this Lease, the term “Hazardous Materials” means any flammable items, explosives, radioactive materials, hazardous or toxic substances, hazardous waste, including any substances defined as or included in the definition of “hazardous substances”, “hazardous wastes”, “hazardous materials”, “hazardous emissions”, or “toxic substances” now or subsequently regulated under any applicable federal, state or local laws or regulations, including, without limitation, petroleum-based products, paints, solvents, lead, cyanide, DDT, printing inks, acids, pesticides, ammonia compounds and other chemical products, asbestos, PCBs and similar compounds, and including any different products and materials which are subsequently found to have adverse effects on the environment or the health and safety of persons.

(ii) Tenant shall not produce, use, store, emit, or otherwise employ or permit, or suffer there to be produced, used, stored, emitted, or otherwise employed or permitted in or above the Premises any Hazardous Materials in any manner not in compliance with applicable federal, state or local laws and regulations. Landlord acknowledges that certain Hazardous Materials will be used by Tenant in the ordinary course of Tenant’s business, as listed on Exhibit “C” attached hereto and made a part of this Lease, and nothing herein shall prevent such Hazardous Materials from being brought onto the Premises in the ordinary course of Tenant’s business, so long as such presence, handling and use is in compliance with applicable federal, state or local laws and regulations. Tenant agrees to provide Landlord with a list of Hazardous Materials which it will use on the Premises, along with a description of the nature of Tenant’s use of the Hazardous Materials, and an estimate of the quantity of the Hazardous Materials used by Tenant. Tenant shall indemnify Landlord against and from any claims, suits, and causes of action (including without limitation reasonable attorney’s fees) arising out of or relating to the emission, storage or release of Hazardous Materials on any portion of the Premises or in the Project resulting from or arising out of a release, storage or emission that is caused during the Initial Term and/or the Extended Term as a result of Tenant’s use of the Premises. In the event that a release of Hazardous Materials at the Premises resulting from Tenant’s operations occurs during the term, Tenant shall investigate, assess and remediate such release as required by the applicable government agency with jurisdiction over the Premises and the release. Except as hereinafter set forth, the foregoing indemnity shall survive for a period of two (2) years following delivery of the Environmental Reports, defined below, to Landlord.

Promptly after Tenant’s surrender of the Premises at the expiration or termination of this Lease, Tenant shall, at its sole cost and expense, obtain a current Phase I environmental audit of the Premises, as prepared by an environmental consultant reasonably acceptable to Landlord, together with soil sampling and testing for Hazardous Materials of the soil underlying the fabrication and loading areas of the Premises (collectively, the “Environmental Reports”). Such soil samples shall be taken in such locations as may be reasonably necessary to evaluate the condition of the soil underlying the floor of the fabrication and loading areas. Tenant shall, at its sole cost and expense, promptly restore all damage to the Premises caused by the foregoing

17

activities, including without limitation, the patching of holes in the floor of the Premises. Tenant shall deliver a copy of the Environmental Reports, together with all supporting materials, to Landlord. If the Environmental Reports reveal that a release of Hazardous Materials has occurred at the Premises resulting from Tenant’s operations thereon, Tenant shall investigate, assess and remediate such release as required by the applicable governmental agency with jurisdiction over the Premises and the release. If Tenant shall fail to obtain the Environmental Reports, as set forth above, then the two-year survival period for Tenant’s indemnity obligations, as set forth above, shall not be applicable and Tenant’s indemnity obligations set forth in this Section 21(c) shall indefinitely survive the termination of this Lease.

Notwithstanding the foregoing, in the event that, following the expiration or termination of this Lease, Landlord enters into a lease for all or any portion of the Premises to a tenant which will use Hazardous Materials at the Premises (the “New Lease”) then (A) Landlord shall promptly notify Tenant in writing of such event and (B) Tenant may, prior to occupation of the Premises by the new tenant, at its sole cost and in its sole discretion, conduct new environmental testing of the Premises in the same manner described in the immediately preceding paragraph. In the event that the new Environmental Reports do not reveal that a release of Hazardous Materials occurred at the Premises resulting from Tenant’s operations thereon, Tenant’s indemnity set forth in this Section 21(c)(ii) shall expire and be of no further force or effect upon the earlier to occur of occupation of any portion of the Premises by the new tenant or commencement of the term of the New Lease. If Tenant does not elect to conduct such new testing, the two-year survival period for Tenant’s indemnity shall remain in effect.

Tenant’s liabilities and obligations with respect to Hazardous Materials shall be governed exclusively by the provisions of this Section 21(c)(ii)

(iii) Landlord shall not produce, use, store, emit, or otherwise employ or permit, or suffer there to be produced, used, stored, emitted, or otherwise employed or permitted in or above the Building any Hazardous Materials in any manner not in compliance with applicable federal, state or local laws and regulations. Tenant acknowledges that certain Hazardous Materials will be used by Landlord in the ordinary course of Landlord’s business, and nothing herein shall prevent Hazardous Materials from being brought into the Building in the ordinary course of Landlord’s business, so long as such presence, handling and use is in compliance with applicable federal, state or local laws and regulations. Landlord shall indemnify Tenant against and from any claims, suits, and causes of action (including without limitation reasonable attorney’s fees) arising out of or relating to the emission, storage or release of Hazardous Materials on any portion of the Premises resulting from or arising out of a release, storage or emission that is caused during the Initial Term and/or the Extended Term as a result of Landlord’s use of the Building. In the event that a release of Hazardous Materials in the Premises resulting from Landlord’s operations occurs during the term, Landlord shall investigate, assess and remediate such release as required by the applicable government agency with jurisdiction over the Premises and the release. Except as hereinafter set forth, the foregoing indemnity shall survive for a period of two (2) years following the expiration or termination of this Lease.

18

Landlord’s liabilities and obligations with respect to Hazardous Materials shall be governed exclusively by the provisions of this Section 21 (c).

(d) Tenant may, without the consent of Landlord, but at its sole expense and in a good workmanlike manner, erect and affix to the Premises such shelves, bins, machinery and manufacturing equipment, and trade fixtures (collectively “Fixtures”), without altering the structural soundness, aesthetics or basic character of the Premises or its walls, and in any case complying with all applicable governmental laws, ordinances, decisions, orders, decrees, regulations and other requirements. All Fixtures erected or installed by Tenant shall be and remain personal property and shall remain the property of Tenant during the Term of this Lease, regardless of whether such Fixtures are affixed to the Premises or the Building. Tenant shall have the absolute right to remove all Fixtures at the expiration or termination of this Lease. Unless Landlord otherwise elects in writing, Tenant shall remove all Fixtures erected by Tenant at the expiration or termination of this Lease. All removals and restorations by Tenant shall be accomplished in a good and workmanlike manner so as not to damage the Premises or the Building or their structural, aesthetic or functional qualities.

22. ENTIRE AGREEMENT - This Lease contains the entire agreement between the parties and any executory agreement hereafter made shall be ineffective to change, modify or discharge the Lease in whole or in part unless such executory agreement is in writing and signed by both of the parties hereto.

23. FORUM - This Lease shall be interpreted and enforced in accordance with and governed by the laws of the State of Wisconsin, and any litigation which may arise shall be litigated in the State of Wisconsin.

24. NOTICES - Except as otherwise provided herein, notices and demands shall be given by Certified Mail at the addresses below, or at such other address as either party may by notice designate:

| Tenant: | BWAY Corporation | |

| 0000 Xxxxxxx Xxxxx | ||

| Xxxxx 000 | ||

| Xxxxxxx, Xxxxxxx 00000 | ||

| Attn: Xxxxxxx X’Xxxxxxx | ||

| Landlord: | c/o HSA Commercial Real Estate | |

| 000 Xxxxx Xxxxxx Xxxxx | ||

| Xxxxx 000 | ||

| Xxxxxxx, Xxxxxxxx 00000 | ||

| Attn: Xxxxxxxxx Xxxxxxxxx | ||

A copy of any notice of default to Tenant shall also be sent to:

Xxxxxxx X. Xxxxxxx, Esq.

19

Xxxxxx, Xxxxxxx & Xxxxxx, LLP

0000 Xxxxxxxxx Xxxx, X.X.

0000 Xxxxxxx Financial Center

Xxxxxxx, Xxxxxxx 00000

25. SURRENDER OF PREMISES AT END OF TERM - Upon expiration of this Lease, Tenant shall surrender the Premises to Landlord in the same condition in which it was delivered to the Tenant on Commencement Date, reasonable wear and tear excepted.

26. AS IS - Landlord makes no warranties or representations of any kind as to the condition of the Premises or its fitness for Tenant’s intended use. Landlord has provided 50 trailer positions and 75 car spaces at the Building for Tenant’s exclusive use. Landlord has striped such spaces and positions and has provided 12 docks, each with 35,000 pound levelers, dock locks and dock seals for Tenant’s exclusive use and access. Tenant’s occupancy of the Premises shall be conclusive evidence that Tenant has examined the Premises, has determined that the Premises is suitable for its intended use, and accepts the Premises in “as is” condition on the date of such occupancy by Tenant. Tenant has satisfied itself as to the load limits of the Premises’ floor and has determined that the floor is suitable for Tenant’s use and that no damage to the floor will be caused by Tenant’s use. Tenant has satisfied itself as to the conformity of its intended use of the Premises with all federal, state, and local government rules, regulations, ordinances and zoning.

27. Intentionally Omitted

28. Intentionally Omitted

29. BROKERS’FEES - The parties hereto represent and warrant to each other that no broker or finder was instrumental in arranging or bringing about this Lease and that there are no claims or rights for brokerage commissions or finders fees in connection with the transactions contemplated by this Lease. If any other person brings a claim for a commission or finder’s fee based upon any contact, dealings or communication with Landlord or Tenant, the party through whom such person makes his claim shall defend the other parties (the “Indemnified Parties”) from such claim, and shall indemnify the Indemnified Parties and hold the Indemnified Parties harmless from any and all costs, damages, claims, liabilities or expenses (including, without limitation, reasonable attorneys’ fees and disbursements) incurred by the Indemnified Parties in defending against the claim. The provisions of this Section 29 shall survive the expiration or earlier termination of this Lease.

30. SIGNAGE - Tenant, at Tenant’s expense, may place and maintain in and about the Premises such outside and inside signs advertising its business name (including the placement of Tenant’s business name on the existing monument sign that bears Landlord’s name) as it shall desire provided that they comply with any and all federal, state, municipal, and business park laws, ordinances and regulations applicable to the Premises and further provided that any such signage requests be approved in writing by Landlord in advance of installation, such approval not to be unreasonably withheld. Tenant acknowledges and agrees that Landlord’s approval of any signs shall be no indication of whether such signs comply with the foregoing laws, ordinances and regulations. Upon

20

the termination of this Lease, Tenant shall remove any signs and repair any damage to the Premises and the Project caused by the erection, maintenance or removal of such signs.

31. SUCCESSORS AND ASSIGNS. Subject to the provisions of Sections 10 and 18 hereof, the covenants and agreements contained in this Lease shall bind and inure to the benefit of Landlord, Tenant, and their respective successors and assigns.

[execution on following page]

21

IN WITNESS WHEREOF, the parties hereto have caused this Lease to be executed as of the date above first written.

| Landlord: |

||

| XXXXXXXXXX VENICE, LLC, an Illinois limited liability company | ||

| By: |

/s/ Xxxx X. Xxxxxxx | |

| Name: |

Xxxx X. Xxxxxxx | |

| A Member of its Board To Managers | ||

| XXX XXXXXXXXXX VENICE, LLC, an Illinois limited liability company | ||

| By: |

/s/ Xxxx X. Xxxxxxx | |

| Xxxx X. Xxxxxxx, its Manager | ||

| RES XXXXXXXXXX VENICE, LLC, an Illinois limited liability company | ||

| By: |

/s/ Xxxxxx X Xxxxxxxx | |

| Xxxxxx X Xxxxxxxx, its Manager | ||

| MSP XXXXXXXXXX VENICE, LLC, an Illinois limited, liability company | ||

| By: |

/s/ Xxxxxxx X. Xxxxxx | |

| Xxxxxxx X. Xxxxxx, its Manager | ||

| Tenant: |

||

| BWAY CORPORATION | ||

| By: |

| |

| Name: |

| |

| Its: |

| |

IN WITNESS WHEREOF, the parties hereto have caused this Lease to be executed as of the date above first written.

| Landlord: | ||

| XXXXXXXXXX VENICE, LLC, an Illinois limited liability company | ||

| By: |

| |

| Name: |

| |

| A Member of its Board of Managers | ||

| XXX XXXXXXXXXX VENICE, LLC, an Illinois limited liability company | ||

| By: |

| |

| Xxxx X. Xxxxxxx, its Manager | ||

| RES XXXXXXXXXX VENICE, LLC, an Illinois limited liability company | ||

| By: |

| |

| Xxxxxx X. Xxxxxxxx, its Manager | ||

| MSP XXXXXXXXXX VENICE, LLC, an Illinois limited liability company | ||

| By: |

| |

| Xxxxxxx X. Xxxxxx, its Manager | ||

| Tenant: | ||

| BWAY CORPORATION | ||

| By: |

/s/ Xxxxxxx X. X’Xxxxxxx | |

| Name: |

Xxxxxxx X. X’Xxxxxxx |

| Its: |

VP, Treasurer & Secretary |

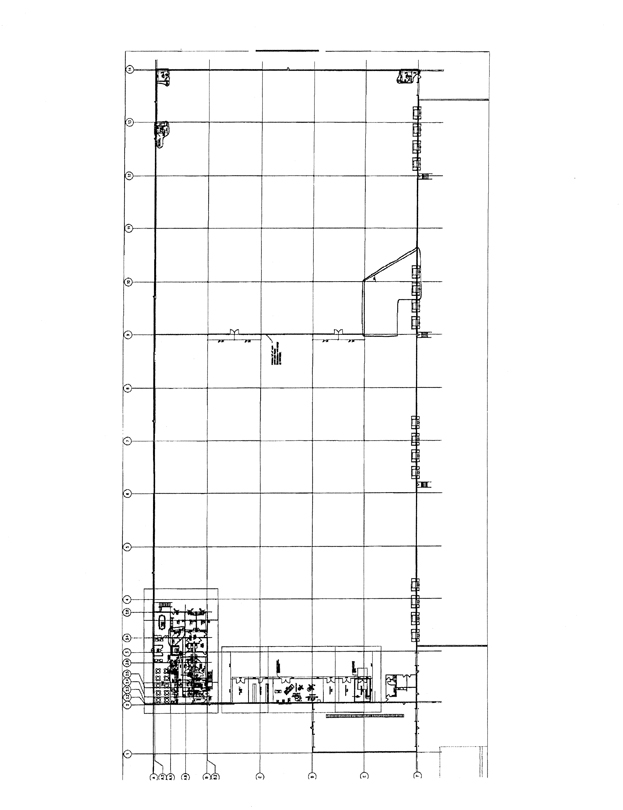

EXHIBIT “A”

ATTACH DRAWING OF PREMISES

23

Exhibit A

EXHIBIT “B”

Exclusions from CAM Charges

The following items shall be excluded from CAM Charges:

| 1. | Leasing commissions, advertising and other promotional costs and expenses, attorneys’ fees, costs and disbursements and other expenses incurred in negotiating or executing leases or in resolving disputes with other tenants, other occupants, or other prospective tenants or occupants of the Building or any portion thereof, collecting rents or otherwise enforcing leases of other tenants of the Building or any portion thereof. |

| 2. | Except for the amortization of the cost of capital investment items which are primarily for the purpose of reducing operating expenses of the Building or for the purpose of complying with governmental requirements enacted after the date of this Lease, operating expenses shall include no cost or expenditure that would be classified as a capital expense under generally accepted accounting principles consistently applied. All such capital expenditures shall be amortized over the useful life of the capital improvement (as determined in accordance with generally accepted accounting principles consistently applied), and with respect to capital improvements made primarily for the purpose of reducing operating expenses, the amount to be included in operating expenses in any calendar year shall be the lesser of (i) the amortized amount determined in accordance with the foregoing, or (ii) the actual or, if not reasonably obtainable, the reasonably-estimated reduction in operating expenses resulting from the capital improvement during the same calendar year. |

| 3. | Depreciation, amortization and other non-cash items. |

| 4. | Costs and expenses incurred by Landlord for which Landlord is actually reimbursed by parties other than tenants of the Building, including, without limitation, insurance proceeds. |

| 5. | Costs and expenses attributable to the correction of any construction defects in the initial construction of the building or the construction of any additions to the Building. |

| 6. | Finance and debt service costs for the Building or any portion thereof and rental under any ground or underlying lease or leases for the Building or any portion thereof. |

| 7. | Costs, fines or penalties incurred due to violations by Landlord of any governmental rule or authority, other than any such cost, fine or penalty (not otherwise paid by Tenant) incurred due to any violation caused by any act or omission of Landlord, its employees or agents. |

| 8. | Costs and expenses associated with the testing for, handling, remediating, or abating hazardous materials or electromagnetic fields, or to remove cholor-flouro carbons (“CFCS”) or accomplish other future retrofitting driven by as-yet-unknown future environmental concerns, or to purchase environmental insurance. |

24

| 9. | Any other expense which is not a fair and reasonable direct operating expense of the Building, or under generally accepted accounting principles, consistently applied, would not be considered a normal maintenance, repair, management or operating expense of the Building. |

25

EXHIBIT C

LIST OF HAZARDOUS MATERIALS USED ON THE PREMISES

BY TENANT

Valspar Code: 5500002

| CAS Number |

Component |

Weight Percent | Weight/Gallon | HAP | ||||

| 112-17-2 | Butyl Cellosolve Acetate | 23.8 | 7.84 | X | ||||

| 2807-30-9 | Ethylene Glycol Monopropyl Ether | 22.4 | 7.59 | X | ||||

| 71-36-3 | Butanol | 8.2 | 6.75 | |||||

| 110-43-0 | Methyl N-Amyl Ketone | 5.7 | 6.80 | |||||

| 123-86-4 | Butyl Acetate | 3.7 | 7.35 | |||||

| 64-17-5 | Ethanol | 1.2 | 6.58 | |||||

| 1330-20-7 | Xylene | 0.6 | 7.23 | X | ||||

| 50-00-0 | Formaldehyde (1) | 0.3 | 11.78 | X | ||||

| 100-41-4 | Benzena Ethyl | 0.1 | 7.25 | X |

Ashland T 216

| Ingredient |

CAS Number | % (by volume) | ||

| TOLUENE |

108-88-3 | 60.0 | ||

| METHYL ETHYL KETONE |

78-93-3 | 30:0 | ||

| METHYL ISOBUTYL KETONE |

108-10-1 | 10.0 |

[To be Confirmed by Bway]

26

EXHIBIT D

Dumpster Enclosure Specifications

Dumpster Enclosures to be located on the south side of the Building near the loading docks.

Two (2) enclosures to be in weather-durable/resistant customary materials, sufficient to enclose each of the two (2) steel 7’x8’x6’ dumpsters with plastic covers used for trash and routine waste

27