FIRST AMENDMENT SECURITIES LENDING AUTHORIZATION AGREEMENT BETWEEN SENTINEL GROUP FUNDS, INC. SENTINEL VARIABLE PRODUCTS TRUST ON BEHALF OF ITS SERIES AS LISTED ON SCHEDULE B AND STATE STREET BANK AND TRUST COMPANY

FIRST AMENDMENT

SECURITIES LENDING AUTHORIZATION AGREEMENT BETWEEN SENTINEL GROUP FUNDS, INC.

SENTINEL VARIABLE PRODUCTS TRUST

ON BEHALF OF ITS SERIES AS LISTED ON SCHEDULE B AND STATE STREET BANK AND TRUST COMPANY

This First Amendment (this "Amendment") dated as of May 25, 2007 is between

SENTINEL GROUP FUNDS, INC and SENTINEL VARIABLE PRODUCTS TRUST, each on behalf of its series as listed on Schedule B, severally and not jointly, each a registered management investment company organized and existing under the laws of Massachusetts (each a "Trust") and STATE STREET BANK AND TRUST COMPANY ("State Street").

Reference is made to a Securities Lending Authorization Agreement dated March 21, 2006 between the Trusts, on behalf of each of the Funds (defined below) and State Street, as otherwise in effect on the date hereof prior to giving effect to this Amendment (the "Agreement"). The Agreement shall be deemed for all purposes to constitute a separate and discrete agreement between State Street and each of the series of shares of the Trusts as listed on Schedule B to the Agreement (each Trust acting on behalf of each such series, a "Fund" and collectively, the "Funds") as it may be amended by the parties, and no series of shares of any Trust shall be responsible or liable for any of the obligations of any other series of any other Trust under this Agreement or otherwise, notwithstanding anything to the contrary contained herein.

WHEREAS, the Trusts, on behalf of the Funds, and State Street each desire to amend the Agreement include an additional Fund on Schedule B.

NOW THEREFORE, for value received, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties mutually agree to amend the Agreement in the following respect:

1. Definitions. All terms used herein and not otherwise defined shall have the meanings set forth in the Agreement.

| 2. | Amendments. |

| (i) Schedule B of the Agreement is hereby deleted in its entirety and the Schedule B attached to this Amendment is substituted in its place. | |

| 3. | Representations and Warranties. Each party hereto represents and warrants that (a) it has |

the power to execute and deliver this Amendment, to enter into the transactions contemplated hereby, and to perform its obligations hereunder; (b) it has taken all necessary action to authorize such execution; delivery, and performance; (c) this Amendment constitutes a legal, valid and binding obligation enforceable against it; and (d) the execution, delivery, and performance by it of this Amendment will at all times comply with all applicable laws and regulations.

| 1 of 2 |

| Amended May 2007 |

| 23. |

26.

4. Miscellaneous. Except to the extent specifically amended by this Amendment, the provisions of the Agreement shall remain unmodified.

This First Amendment to the Securities Lending Authorization Agreement is effective as of the date first written above.

IN WITNESS WHEREOF, the parties hereto execute this Amendment by affixing their authorized signatures below.

| SENTINEL GROUP FUNDS, INC., SENTINEL VARIABLE PRODUCTS TRUST, Each on behalf of its respective series as listed on Schedule B, severally and not jointly |

|

By: /s/ Xxxxxx X. Xxxxxx Name: Xxxxxx X. Xxxxxx |

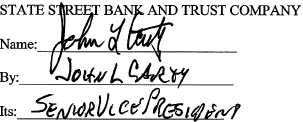

| STATE STREET BANK AND TRUST COMPANY |

| By: /s/ Xxxx X. Xxxxx Name: Xxxx X. Xxxxx, CFA Title: Senior Managing Director |

| Schedule B Effective May 25, 2007 |

28.

This Schedule is attached to and made part of the Securities Lending Authorization Agreement dated the 2!st day of March 2006 between SENTINEL GROUP FUNDS, INC. and SENTINEL VARIABLE PRODUCTS TRUST, EACH ON BEHALF OF ITS RESPECTIVE SERIES AS LISTED ON SCHEDULE B, SEVERALLY AND NOT JOINTLY (the "Funds") and XXXXX XXXXXX XXXX XXX XXXXX XXXXXXX("Xxxxx Xxxxxx").

| Fund Name | Taxpayer Identification Number | Tax Year-End | ||

|

|

|

| ||

| Balanced | 00-0000000 | November 30 | ||

|

|

|

| ||

| Capital Growth | 00-0000000 | November 30 | ||

|

|

|

| ||

| Conservative Allocation | 00-0000000 | November 30 | ||

|

|

|

| ||

| Common Stock | 00-0000000 | November 30 | ||

|

|

|

| ||

| Government Securities | 00-0000000 | November 30 | ||

|

|

|

| ||

| Growth Leaders | 00-0000000 | November 30 | ||

|

|

|

| ||

| High Yield Bond | 00-0000000 | November 30 | ||

|

|

|

| ||

| International Equity | 00-0000000 | November 30 | ||

|

|

|

| ||

| Mid Cap Growth | 00-0000000 | November 30 | ||

|

|

|

| ||

| Mid Cap Value | 00-0000000 | November 30 | ||

|

|

|

| ||

| Short Maturity Government | 00-0000000 | November 30 | ||

|

|

|

| ||

| Small Company | 00-0000000 | November 30 | ||

|

|

|

| ||

| U.S. Treasury Money Market | 00-0000000 | November 30 | ||

|

|

|

| ||

| Georgia Municipal Bond | 00-0000000 | November 30 | ||

|

|

|

| ||

| Variable Products Balanced | 00-0000000 | December 31 | ||

|

|

|

| ||

| Variable Products Bond | 00-0000000 | December 31 | ||

|

|

|

| ||

| Variable Products Common Stock | 00-0000000 | December 31 | ||

|

|

|

| ||

| Variable Products Mid Cap Growth | 00-0000000 | December 31 | ||

|

|

|

| ||

| Variable Products Money Market | 00-0000000 | December 31 | ||

|

|

|

| ||

| Variable Products Small Company | 00-0000000 | December 31 | ||

|

|

|

|

Amended May 2007

SECURITIES LENDING AUTHORIZATION AGREEMENT

| Between |

SENTINEL GROUP FUNDS, INC. SENTINEL PENNSYLVANIA TAX-FREE TRUST

SENTINEL VARIABLE PRODUCTS TRUST

ON BEHALF OF ITS SERIES AS LISTED ON SCHEDULE B

| and |

STATE STREET BANK AND TRUST COMPANY

Legal Fonns\LenderlUSlMutual Fundlindemnified.doc

| TABLE OF CONTENTS | ||||

| PAGE | ||||

| 1. | DEFINITIONS | 1 | ||

| 2. | APPOINTMENT OF STATE STREET | 2 | ||

| 3. | SECURITIES TO BE LOANED | 3 | ||

| 4. | BORROWERS | 3 | ||

| 5. | SECURITIES LOAN AGREEMENTS | 4 | ||

| 6. | LOANS OF AVAILABLE SECURITIES | 5 | ||

| 7. | DISTRIBUTIONS ON AND VOTING RIGHTS WITH RESPECT TO | |||

| LOANED SECURITIES | 5 | |||

| 8. | COLLATERAL | 6 | ||

| 9. | INVESTMENT OF CASH COLLATERAL AND COMPENSATION | 7 | ||

| 10. | FEE DISCLOSURE | 9 | ||

| 11. | RECORDKEEPING AND REPORTS | 9 | ||

| 12. | STANDARD OF CARE | 9 | ||

| 13. | REPRESENTATIONS AND W ARRANTIES | lO | ||

| 14. | BORROWER DEFAULT INDEMNIFICATION | 11 | ||

| 15. | CONTINUING AGREEMENT AND TERMINATION | 12 | ||

| 16. | NOTICES | 13 | ||

| 17. | SECURITIES INVESTORS PROTECTION ACT | 13 | ||

| 18. | AUTHORIZED REPRESENTATIVES | 14 | ||

| 19. | AGENTS | 14 | ||

| 20. | FORCE MAJEURE | 14 | ||

| 21. | NON-US BORROWERS | 14 |

| 29.MISCELLANEOUS | 14 | |

| 30.COUNTERPARTS | 15 | |

| 31.MODIFICATION | 15 |

EXHIBITS AND SCHEDULES

SCHEDULE A (Schedule of Fees)

SCHEDULE B (Funds)

SCHEDULE C (Acceptable Forms of Collateral)

SCHEDULE D (Approved Borrowers)

SECURITIES LENDING AUTHORIZATION AGREEMENT

Agreement dated the 21st day of March, 2006 between SENTINEL GROUP FUNDS, INC., SENTINEL PENNSYLVANIA TAX-FREE TRUST and SENTINEL VARIABLE PRODUCTS TRUST, each on behalf of its series as listed on Schedule B, severally and not jointly, each a registered management investment company organized and existing under the laws of Massachusetts (each a "Trust"), and STATE STREET BANK AND TRUST COMPANY ("State Street"), setting forth the terms and conditions under which State Street is authorized to act on behalf of each Trust with respect to the lending of certain securities of each Trust held by State Street as custodian.

This Agreement shall be deemed for all purposes to constitute a separate and discrete agreement between State Street and each of the series of shares of the Trusts as listed on Schedule B to this Agreement (each Trust acting on behalf of each such series, a "Fund" and collectively, the "Funds") as it may be amended by the parties, and no series of shares of any Trust shall be responsible or liable for any of the obligations of any other series of any other Trust under this Agreement or otherwise, notwithstanding anything to the contrary contained herein.

NOW, THEREFORE, in consideration of the mutual promises and of the mutual covenants contained herein, each of the parties does hereby covenant and agree as follows:

| 1. | Definitions. For the purposes hereof: |

| (a) "Authorized Representative" means any person who is, or State Street reasonably | |

believes to be, authorized to act on behalf of a Fund with respect to any of the transactions contemplated by this Agreement.

(b ) "Available Securities" means the securities of the Funds that are available for

Loans pursuant to Section 3.

(c) "Borrower" means any of the entities to which Available Securities may be loaned under a Securities Loan Agreement, as described in Section 4.

(d) "Collateral" means collateral delivered by a Borrower to secure its obligations under a Securities Loan Agreement.

(e) "Investment Manager" when used in any provision, means the person or entity who has discretionary authority over the investment of the Available Securities to which the provision applies.

(f) "Loan" means a loan of Available Securities to a Borrower.

(g) "Loaned Security" shall mean any "security" which is delivered as a Loan under a Securities Loan Agreement; provided that, if any new or different security shall be exchanged for any Loaned Security by recapitalization, merger, consolidation, or other corporate action, such new or different security shall, effective upon such exchange, be deemed to become a Loaned Security in substitution for the former Loaned Security for which such exchange was made.

(h) "Market Value" of a security means the market value of such security (including, in the case of a Loaned Security that is a debt security, the accrued interest on such security) as determined by the independent pricing service designated by State Street, or such other independent sources as may be selected by State Street on a reasonable basis.

(i) "Replacement Securities" means securities of the same issuer, class and denomination as Loaned Securities.

U) "Securities Loan Agreement" means the agreement between a Borrower and State Street (on behalf of the Funds) that governs Loans, as described in Section 5.

(k) "State Street Affiliates" means any entity that directly or indirectly through one or more intermediaries, controls State Street or that is controlled by or is under common control with State Street.

2. Appointment of State Street.

Each Fund hereby appoints and authorizes State Street as its agent to lend Available Securities to Borrowers in accordance with the terms of this Agreement. State Street shall have the responsibility and authority to do or cause to be done all acts State Street shall determine to be desirable, necessary, or appropriate to implement and administer this securities lending program. Each Fund agrees that State Street is acting as a fully disclosed agent and not as principal in connection with the securities lending program. State Street may take action as agent of the Fund on an undisclosed or a disclosed basis. All fees and income shall be allocated between State Street and the Fund in accordance with the terms of this Agreement. [

3. Securities to be Loaned.

All of the Fund's securities held by State Street as custodian shall be subject to this securities lending program and constitute Available Securities hereunder, except those securities which the Fund or the Investment Manager specifically identifies herein or in notices to State Street as not being Available Securities. In the absence of any such identification herein or other notices identifying specific securities as not being Available Securities, State Street shall have no authority or responsibility for determining whether any of the Fund's securities should be excluded from the securities lending program.

4. Borrowers.

The Available Securities may be loaned to any Borrower identified on the attached Schedule D, as such schedule may be modified from time to time by State Street and the Fund.

State Street shall not be responsible for any statements, representations, warranties or covenants made by any Borrower in connection with any Loan or for any Borrower's performance of or failure to perform the terms of any Loan under the applicable Securities Loan Agreement or any related agreement, including the failure to make any required payments, except as otherwise expressly provided herein.

5. Securities Loan Agreements.

Each Fund authorizes State Street to enter into one or more Securities Loan Agreements with such Borrowers as may be selected by State Street. Each Securities Loan Agreement shall have such terms and conditions as State Street may negotiate with the Borrower. Certain terms of individual Loans, including rebate fees to be paid to the Borrower for the use of cash Collateral, shall be negotiated at the time a Loan is made.

6. Loans of Available Securities.

State Street shall be responsible for determining whether any Loans shall be made (such loans to be made in accordance with the terms of this Agreement) and shall have the authority to terminate any Loan in its discretion, at any time and without prior notice to the Fund. In the event of a default by a Borrower on any Loan (within the meaning of the applicable Securities Lending Agreement) State Street shall not be liable to the Fund in acting in any manner it deems reasonable and appropriate, except as otherwise noted in this Agreement. Upon notice to State Street, the Fund has the right to direct State Street to initiate action to terminate any Loan made under this Agreement.

Each Fund acknowledges that State Street administers securities lending programs for other clients of State Street. State Street will allocate securities lending opportunities among its clients, using reasonable and equitable methods established by State Street from time to time. State Street does not represent or warrant that any amount or percentage of the Fund's Available Securities will in fact be loaned to Borrowers. Each Fund agrees that it shall have no claim against State Street and State Street shall have no liability arising from, based on, or relating to, loans made for other clients, or loan opportunities refused hereunder, whether or not State Street has made fewer or more loans for any other client, and whether or not any loan for another client, or the opportunity refused, could have resulted in loans made under this Agreement.

Each Fund also acknowledges that, under the applicable Securities Loan Agreements, the Borrowers will not be required to return Loaned Securities immediately upon receipt of notice from State Street terminating the applicable Loan, but instead will be required to return such Loaned Securities within such period of time following such notice as is specified in the applicable Securities Loan Agreement and in no event later than the end of the customary settlement period. Upon receiving a notice from the Fund or the Investment Manager that Available Securities which have been loaned to a Borrower should no longer be considered Available Securities (whether because of the sale of such securities or otherwise), State Street shall use its reasonable efforts to notify promptly thereafter the Borrower which has borrowed such securities that the Loan of such Available Securities is terminated and that such Available Securities are to be returned within the time specified by the applicable Securities Loan Agreement and in no event later than the end of the customary settlement period.

7. Distributions on and Voting Rights with Respect to Loaned Securities

Except as provided in the next sentence, all interest, dividends, and other distributions paid with respect to Loaned Securities shall be credited to the Fund's account on the date such amounts are delivered by the Borrower to State Street. Any non-cash distribution on Loaned Securities which is in the nature of a stock split or a stock dividend shall be added to the Loan (and shall be considered to constitute Loaned Securities) as of the date such non-cash distribution is received by the Borrower; provided that the Fund or Investment Manager may, by giving State Street ten (10) business days' notice prior to the date of such non-cash distribution, direct State Street to request that the Borrower deliver such non-cash distribution to State Street, pursuant to the applicable Securities Loan Agreement, in which case State Street shall credit such non-cash distribution to the Fund's account on the date it is delivered to State Street.

Each Fund acknowledges that it will not be entitled to participate in any dividend reinvestment program or to vote with respect to Available Securities that are on loan on the applicable record date for such Available Securities.

Each Fund also acknowledges that any payments of distributions from Borrower to the Fund are in substitution for the interest or dividend accrued or paid in respect of Loaned Securities and that the tax and accounting treatment of such payment may differ from the tax and accounting treatment of such interest or dividend.

If an installment, call or rights issue becomes payable on or in respect of any Loaned Securities, State Street shall use all reasonable endeavors to ensure that any timely instructions from the Fund or its Investment Manager are complied with, but State Street shall not be required to make any payment unless the Fund has first provided State Street with funds to make such payment.

Each Fund acknowledges and agrees that, with respect to a dividend paid during the Loan term by a company that is a resident of France, the Fund will not be entitled to receive,

either from the French company or the Borrower, any additional dividends (sometimes referred to as "complementary coupons") declared and payable by such company that are equivalent to a refund of any prepayment of French tax ("equalization tax" or "precompte") or an additional tax credit adjustment ("credit d'impot").

Each Fund further acknowledges and agrees that the Fund will be required to accept cash in lieu of fractional shares in all instances in which an issuer does not issue fractional shares.

| 8. | Collateral. |

| (a) Receipt of Collateral. Each Fund hereby authorizes State Street (or a third party bank as | |

described in Section 2 above) to receive and to hold, on the Fund's behalf, Collateral from Borrowers to secure the obligations of Borrowers with respect to any Loan of Available Securities made on behalf of the Fund pursuant to the Securities Loan Agreements. All investments of cash Collateral shall be for the account and at the risk of the Fund. Concurrently with or prior to the delivery of the Loaned Securities to the Borrower under any Loan, State Street shall receive from the Borrower Collateral in any of the forms listed on Schedule C Said Schedule may be amended from time to time by State Street and the Fund.

(b) Marking to Market The initial Collateral received shall have (depending on the nature of the Loaned Securities and the Collateral received) a value of 102% or 105% of the Market Value of the Loaned Securities, or such other value, but not less than 102% of the Market Value of the Loaned Securities, as may be applicable in the jurisdiction in which such Loaned Securities are customarily traded.

Pursuant to the terms of the applicable Securities Loan Agreement, State Street shall, in accordance with State Street's reasonable and customary practices, xxxx Loaned Securities and Collateral to their Market Value each business day based upon the Market Value of the Collateral and the Loaned Securities at the close of business employing the most recently available pricing information and receive and deliver Collateral in order to maintain the value of the Collateral at no less than one hundred percent (100%) of the Market Value of the Loaned Securities.

(c) Return of Collateral. The Collateral shall be returned to Borrower at the termination of the Loan upon the return of the Loaned Securities by Borrower to State Street in accordance with the applicable Securities Loan Agreement.

(d) Limitations. State Street shall invest cash Collateral in accordance with any directions, including any limitations established by the Funds and set forth on Schedule A. State Street shall exercise reasonable care, skill, diligence and prudence in the investment of Collateral. Subject to the foregoing limits and standard of care, State Street does not assume any market or investment risk of loss with respect to the investment of cash Collateral. If the value of the cash Collateral so invested is insufficient to return any and all other amounts due

to such Borrower pursuant to the Securities Loan Agreement, the Fund shall be responsible for such shortfall as set forth in Section 9.

9. Investment of Cash Collateral and Compensation.

To the extent that a Loan is secured by cash Collateral, such cash Collateral, including money received with respect to the investment of the same, or upon the maturity, sale, or liquidation of any such investments, shall be invested by State Street, subject to the directions referred to above, if any, in short-term instruments, short term investment funds maintained by State Street, money market mutual funds and such other investments as State Street may from time to time select, including without limitation, investments in obligations or other securities of State Street or of any State Street Affiliate and investments in any short-term investment fund, mutual fund, securities lending trust or other collective investment fund with respect to which Xxxxx Xxxxxx xxx/xx Xxxxx Xxxxxx Affiliates provide investment management or advisory, trust, custody, transfer agency, shareholder servicing and/or other services for which they are compensated. State Street does not assume any market or investment risk of loss associated with any investment or change of investment in any such investments, including any cash collateral investment vehicle designated on Schedule A.

Each Fund acknowledges that interests in such mutual funds, securities lending trusts and other collective investment funds, to which State Street and/or one or more of the State Street Affiliates provide services are not guaranteed or insured by State Street or any of the State Street Affiliates or by the Federal Deposit Insurance Corporation or any government agency. Each Fund hereby authorizes State Street to purchase or sell investments of cash Collateral to or from other accounts held by State Street or State Street Affiliates.

The net income generated by any investment made pursuant to the first paragraph of this Section 9 shall be allocated among the Borrower, State Street, and the Fund, as follows: (a) a portion of such income shall be paid to the Borrower in accordance with the agreement negotiated between the Borrower and State Street; (b) the balance, if any, shall be split between State Street, as compensation for its services in connection with this securities lending program, and the Fund and such income shall be credited to the Fund's account, in accordance with the fee split set forth on Schedule A.

In the event the net income generated by any investment made pursuant to the first paragraph of this Section 9 does not equal or exceed the amount due the Borrower (the rebate fee for the use of cash Collateral) in accordance with the agreement between Borrower and State Street, State Street and the Fund shall, in accordance with the fee split set forth on Schedule A. share the amount equal to the difference between the net income generated and the amounts to be paid to the Borrower pursuant to the Securities Loan Agreement. The Fund shall be solely responsible for any and all other amounts due to such Borrower pursuant to the Securities Loan Agreement and State Street may debit the Fund's account accordingly. In the event debits to the Fund's account produce a deficit therein, State Street shall sell or otherwise liquidate investments made with cash Collateral and credit the net proceeds of such

sale or liquidation to satisfy the deficit. In the event the foregoing does not eliminate the deficit, State Street shall have the right to charge the deficiency to any other account or accounts maintained by the Fund with State Street.

In the event the net income generated by any investment made pursuant to the first paragraph of this Section 9 does not equal or exceed the amount due the Borrower (the rebate fee for the use of cash Collateral) in accordance with the agreement between Borrower and Xxxxx Xxxxxx, Xxxxx Xxxxxx shall make available to the Fund such information on a periodic basis, and shall discuss with the Fund any concerns the Fund may have in relation to such information.

To the extent that a Loan is secured by non-cash Collateral, the Borrower shall be required to pay a loan premium, the amount of which shall be negotiated by State Street. Such loan premium shall be allocated between State Street and the Fund as follows: (a) a portion of such loan premium shall be paid to State Street as compensation for its services in connection with this securities lending program, in accordance with Schedule A hereto; and (b) the remainder of such loan premium shall be credited to the Fund's account.

Each Fund hereby agrees that it shall reimburse State Street for any and all funds advanced by State Street on behalf of the Fund as a consequence of the Fund's obligations hereunder, including the Fund's obligation to return cash Collateral to the Borrower and to pay any fees due the Borrower, all as provided in Section 8 hereof.

10. Fee Disclosure.

The fees associated with the investment of cash Collateral in funds maintained or advised by State Street are disclosed on Schedule A hereto. Said fees may be changed from time to time by State Street upon notice to the Funds. An annual report with respect to such funds is available to the Funds, at no expense, upon request.

11. Recordkeeping and Reports.

State Street will establish and maintain such records as are reasonably necessary to account for Loans that are made and the income derived therefrom. On a monthly basis, State Street will provide the Funds with a statement describing the Loans made, and the income derived from the Loans, during the period covered by such statement. Each party to this Agreement shall comply with the reasonable requests of the other for information necessary to the requester's performance of its duties in connection with this securities lending program.

Each Fund hereby agrees to participate in the Performance Explorer service offered by State Street through Data Explorers Limited and each Fund further agrees that as a condition for its participation in the Performance Explorer service, State Street is authorized by the Fund to provide to Data Explorers information relating to the Fund's Loaned Securities on an

anonymous basis for aggregation into the Data Explorers database, provided that the identity of the Fund as owner of the Loaned Securities is in no way identifiable and provided further that Data Explorers Limited has agreed to treat any such information provided to it confidentially and to use such information solely for the purposes of providing the service.

| 12. | Standard of Care and Indemnification. |

| (a) State Street shall use reasonable care in the performance of its duties hereunder | |

consistent with that exercised by banks generally in the performance of duties arising from acting as agent for clients in securities lending transactions (as appropriate).

(b) Each Fund shall indemnify State Street and hold State Street harmless from any loss or liability (including without limitation, the reasonable fees and disbursements of counsel) incurred by State Street in rendering services hereunder or in connection with any breach of the terms of this Agreement by such Fund, except such loss or liability which results from the State Street's failure to exercise the standard of care required by this Section 12. Nothing in this Section shall derogate from the indemnities provided by State Street in Xxxxxxx 00. Xxxxx Xxxxxx may charge any amounts to which it is entitled hereunder against each Fund's account.

(c) Notwithstanding any express provision to the contrary herein, State Street shall not be liable for any consequential, incidental, special or exemplary damages, even if State Street has been apprised of the likelihood of such damages occurring.

(d) Each Fund acknowledges that in the event that its participation in securities lending generates income for the Fund, State Street may be required to withhold tax or may claim such tax from the Fund as is appropriate in accordance with applicable law.

(e) State Street, in determining the Market Value of Securities, including without limitation, Collateral, may rely upon any recognized pricing service and shall not be liable for any errors made by such service.

13. Representations and Warranties.

Each party hereto represents and warrants that (a) it has and will have the legal right, power and authority to execute and deliver this Agreement, to enter into the transactions contemplated hereby, and to perform its obligations hereunder; (b) it has taken all necessary action to authorize such execution, delivery, and performance; (c) this Agreement constitutes a legal, valid, and binding obligation enforceable against it; and (d) the execution, delivery, and performance by it of this Agreement will at all times comply with all applicable laws and regulations.

Each Fund represents and warrants that (a) it has made its own determination as to the tax and accounting treatment of any dividends, remuneration or other funds received

hereunder; (b) it is the legal and beneficial owner of (or exercises complete investment discretion over) all Available Securities free and clear of all liens, claims, security interests and encumbrances and no such security has been sold, and that it is entitled to receive all distributions made by the issuer with respect to Loaned Securities;

Each Fund further represents and warrants that it will immediately notify State Street orally and by written notice, of the relevant details of any corporate actions, private consent offers/agreements and/or any other off-market arrangements that may require the recall and/or restriction of a security from lending activity, and which such Fund so wishes to recall and/or restrict. Such written notice shall be delivered sufficiently in advance so as to: (a) provide State Street with reasonable time to notify Borrowers of any instructions necessary to comply with the terms of the corporate actions, private consent offers/agreements and/or other off-market arrangements, and (b) provide such Borrowers with reasonable time to comply with such instructions.

The person executing this Agreement on behalf of the Funds represents that he or she has the authority to execute this Agreement on behalf of the Funds.

Each Fund hereby represents to State Street that: (i) its policies and objectives generally permit it to engage in securities lending transactions; (ii) its policies permit it to purchase shares of the State Street Navigator Securities Lending Trust with cash Collateral; (iii) its participation in State Street's securities lending program, including the investment of cash Collateral in the State Street Navigator Securities Lending Trust, and the existing series thereof has been approved by a majority of the directors or trustees which directors and trustees are not "interested persons" within the meaning of section 2( a)(19) of the Investment Company Act of 1940, and such directors or trustees will evaluate the securities lending program no less frequently than annually to determine that the investment of cash Collateral in the State Street Navigator Securities Lending Trust, including any series thereof, is in the Fund's best interest; and (iv) its prospectus provides appropriate disclosure concerning its securities lending activity.

Each Fund hereby further represents that it is not subject to the Employee Retirement Income Security Act of 1974, as amended ("ERISA") with respect to this Agreement and the Securities; that it qualifies as an "accredited investor" within the meaning of Rule 501 of Regulation D under the Securities Act of 1933, as amended; and that the taxpayer identification number(s) and corresponding tax year-end are as set forth on Schedule B.

| 14. | Borrower Default Indemnification. |

| (a) If at the time of a default by a Borrower with respect to a Loan (within the | |

meaning of the applicable Securities Loan Agreement), some or all of the Loaned Securities under such Loan have not been returned by the Borrower, and subject to the terms of this Agreement, State Street shall indemnify the Fund against the failure of the Borrower as follows. State Street shall purchase a number of Replacement Securities equal to the number

of such unreturned Loaned Securities, to the extent that such Replacement Securities are available on the open market. Such Replacement Securities shall be purchased by applying the proceeds of the Collateral with respect to such Loan to the purchase of such Replacement Securities. Subject to the Fund's obligations pursuant to Section 8 hereof, if and to the extent that such proceeds are insufficient or the Collateral is unavailable, the purchase of such Replacement Securities shall be made at State Street's expense.

(b) If State Street is unable to purchase Replacement Securities pursuant to Paragraph 14(a) hereof, State Street shall credit to the Fund's account an amount equal to the Market Value of the unreturned Loaned Securities for which Replacement Securities are not so purchased, determined as of (i) the last day the Collateral continues to be successfully marked to market by the Borrower against the unreturned Loaned Securities; or (ii) the next business day following the day referred to in (i) above, if higher.

(c) In addition to making the purchases or credits required by Paragraphs (a) and (b) hereof, State Street shall credit to the Fund's account the value of all distributions on the Loaned Securities (not otherwise credited to the Fund's accounts with State Street), for record dates which occur before the date that State Street purchases Replacement Securities pursuant to Paragraph (a) or credits the Fund's account pursuant to Paragraph (b).

(d) Any credits required under Paragraphs (b) and (c) hereof shall be made by application of the proceeds of the Collateral, if any, that remains after the purchase of Replacement Securities pursuant to Paragraph (a). If and to the extent that the Collateral is unavailable or the value of the proceeds of the remaining Collateral is less than the value of the sum of the credits required to be made under Paragraphs (b) and (c), such credits shall be made at State Street's expense.

(e) If after application of Paragraphs (a) through (d) hereof, additional Collateral remains or any previously unavailable Collateral becomes available or any additional amounts owed by the Borrower with respect to such Loan are received from the Borrower, State Street shall apply the proceeds of such Collateral or such additional amounts first to reimburse itself for any amounts expended by State Street pursuant to Paragraphs (a) through (d) above, and then to credit to the Fund's account all other amounts owed by the Borrower to the Fund with respect to such Loan under the applicable Securities Loan Agreement.

(f) In the event that State Street is required to make any payment and/or incur any loss or expense under this Section, State Street shall, to the extent of such payment, loss, or expense, be subrogated to, and succeed to, all of the rights of the Fund against the Borrower under the applicable Securities Loan Agreement.

15. Continuing Agreement and Termination.

It is the intention of the parties hereto that this Agreement shall constitute a continuing agreement in every respect and shall apply to each and every Loan, whether now existing or

hereafter made. The Funds and State Street may each at any time terminate this Agreement upon five (5) business days' written notice to the other to that effect. The only effects of any such termination of this Agreement will be that (a) following such termination, no further Loans shall be made hereunder by State Street on behalf of the Funds, and (b) State Street shall, within a reasonable time after termination of this Agreement, terminate any and all outstanding Loans. The provisions hereof shall continue in full force and effect in all other respects until all Loans have been terminated and all obligations satisfied as herein provided. State Street does not assume any market or investment risk of loss associated with the Fund's change in cash Collateral investment vehicles or termination of, or change in, its participation in this securities lending program and the corresponding liquidation of cash Collateral investments.

16. Notices.

Except as otherwise specifically provided herein, notices under this Agreement may be made orally, in writing, or by any other means mutually acceptable to the parties. If in writing, a notice shall be sufficient if delivered to the party entitled to receive such notices at the following addresses:

|

If to the Funds: Sentinel Funds Xxx Xxxxxxxx Xxxx Xxxxx Xxxxxxxxxx, XX 00000 If to State Street: State Street Bank and Trust Company Securities Finance State Street Financial Center Xxx Xxxxxxx Xxxxxx Xxxxxx, XX 0000-0000 |

or to such other addresses as either party may furnish the other party by written notice under this section.

Whenever this Agreement permits or requires the Funds to give notice to, direct, provide information to State Street, such notice, direction, or information shall be provided to State Street on the Funds' behalf by any individual designated for such purpose by the Funds in a written notice to State Street. This Agreement shall be considered such a designation of the person executing the Agreement on the Funds' behalf. After State Street's receipt of such a notice of designation and until its receipt of a notice revoking such designation, State Street shall be fully protected in relying upon the notices, directions, and information given by such designee.

17. Securities Investors Protection Act of 1970 Notice.

EACH FUND IS HEREBY ADVISED AND ACKNOWLEDGES THAT THE PROVISIONS OF THE SECURITIES INVESTOR PROTECTION ACT OF 1970 MAY NOT PROTECT THE FUND WITH RESPECT TO THE LOAN OF SECURITIES HEREUNDER AND THAT, THEREFORE, THE COLLATERAL DELIVERED TO THE FUND MAY CONSTITUTE THE ONLY SOURCE OF SATISFACTION OF THE BROKER'S OR DEALER'S OBLIGATION IN THE EVENT THE BROKER OR DEALER FAILS TO RETURN THE SECURITIES.

18. Authorized Representatives.

Each Fund authorizes State Street to accept and to act on any instructions or other communications, regardless of how sent or delivered, from any Authorized Representative. Each Fund shall be fully responsible for all acts of any Authorized Representative, even if that person exceeds his or her authority, and in no event shall State Street be liable to a Fund or any other third party for any losses or damages arising out of or relating to any act State Street takes or fails to take in connection with any such instructions or other communications.

19. Agents.

State Street may use such agents, including but not limited to, such regulated clearing agents, securities depositaries, nominees, sub-custodians, third party custodians and State Street Affiliates, as State Street deems appropriate to carry out its duties under this Agreement. To the extent the State Street Affiliates act as State Street's agent hereunder, State Street agrees to be responsible for the acts and omissions of such the State Street Affiliates as though performed by State Street directly. The Client agrees that State Street's sole liability for the acts or omissions of any other agent shall be limited to liability arising from State Street's failure to use reasonable care in the selection of such agent.

20. Force Majeure

State Street shall not be responsible for any losses, costs or damages suffered by a Fund resulting directly or indirectly from war, riot, revolution, terrorism, acts of government or other causes beyond the reasonable control or apprehension of State Street.

21. Non-US Borrowers.

In the event a Fund approves lending to Borrowers resident in the United Kingdom ("UK"), the Fund shall provide sufficient documentation, in the form and manner required by the UK Inland Revenue, to establish that the Fund is (1) the beneficial owner of any manufactured dividends received and (2) not a UK recipient for purposes of UK manufactured overseas dividend rules

22. Miscellaneous.

This Agreement supersedes any other agreement between the parties or any representations made by one party to the other, whether oral or in writing,

concerning Loans of Available Securities by State Street on behalf of the Funds. Subject to the foregoing, this Agreement shall be binding upon and shall inure to the benefit of the parties hereto and their respective heirs, representatives,

successors, and assigns. This Agreement shall be governed and construed in accordance with the laws of The Commonwealth of Massachusetts. Each Fund hereby irrevocably submits to the jurisdiction of any Massachusetts state or Federal court sitting in

The Commonwealth of Massachusetts in any action or proceeding arising out of or related to this Agreement and hereby irrevocably agrees that all claims in respect of such action or proceeding may be heard and determined in such Massachusetts state

or Federal court except that this provision shall not preclude any party from removing any action to Federal court. Each Fund hereby irrevocably waives, to the fullest extent it may effectively do so, the defense of an inconvenient forum to the

maintenance of such action or proceeding. Each Fund hereby irrevocably appoints

______

as its agent to receive on its behalf service of copies of the summons and complaint and any other process which may be served in any such action or

proceeding (the "Process Agent"). Such service may be made by mailing or delivering a copy of such process, in care of the Process Agent at the above address. Each Fund hereby irrevocably authorizes and directs the Process Agent to accept such

service on its behalf. As an alternative method of service, each Fund also irrevocably consents to the service of any and all process in any such action or proceeding by the mailing of copies of such process to the Funds at their address specified

in Section 16 hereof. Each Fund agrees that a final judgment in any such action or proceeding, all appeals having been taken or the time period for such appeals having expired, shall be conclusive and may be enforced in other jurisdictions by suit

on the judgment or in any other manner provided by law. The provisions of this Agreement are severable and the invalidity or unenforceability of any provision hereof shall not affect any other provision of this Agreement. If in the construction of

this Agreement any court should deem any provision to be invalid because of scope or duration, then such court shall forthwith reduce such scope or duration to that which is appropriate and enforce this Agreement in its modified scope or

duration.

23. Counterparts.

The Agreement may be executed in any number of counterparts, each of which shall be deemed to be an original, but such counterparts shall, together, constitute only one (1) instrument.

24. Modification

This Agreement shall not be modified except by an instrument in writing signed by the parties hereto.

32.

SENTINEL GROUP FUNDS, INC.

SENTINEL PENNSYLVANIA TAX-FREE TRUST SENTINEL VARIABLE PRODUCTS TRUST Each on behalf of its respective series as listed on Schedule B, severally and not jointly

Name: /s/ Xxxxxx X. Xxxxxx By: Xxxxxx X. Xxxxxx Its: Vice President and Treasurer

| Schedule A |

This Schedule is attached to and made part of the Securities Lending Authorization Agreement, dated the 21 st day of March 2006 between SENTINEL GROUP FUNDS, INC., SENTINEL PENNSYLVANIA TAX-FREE TRUST AND SENTINEL VARIABLE PRODUCTS TRUST, EACH ON BEHALF OF ITS RESPECTIVE SERIES AS LISTED ON SCHEDULE B, SEVERALLY AND NOT JOINTLY (the "Funds") and STATE STREET BANK AND TRUST

COMPANY ("State Street").

| Schedule of Fees |

1. Subject to Paragraph 2 below, all proceeds collected by State Street on investment of cash Collateral or any fee income shall be allocated as follows

- 80 percent (80%) payable to the Fund, and

- 20 percent (20%) payable to State Street.

2. All payments to be allocated under Paragraph 1 above shall be made after deduction of such other amounts payable to State Street or to the Borrower under the terms of this Securities Lending Authorization Agreement.

3. Cash Collateral will be invested in State Street Navigator Securities Lending Prime Portfolio:

On an annualized basis, the management/trustee/custody/fund administration/transfer agent fee for investing cash Collateral in the State Street Navigator Securities Lending Prime Portfolio is not more than 5.00 basis points netted out of yield. The trustee may payout of the assets of the Portfolio all reasonable expenses and fees of the Portfolio, including professional fees or disbursements incurred in connection with the operation of the Portfolio.

| Schedule B |

This Schedule is attached to and made part of the Securities Lending Authorization Agreement, dated the 21st day of March 2006 between SENTINEL GROUP FUNDS, INC., SENTINEL

PENNSYLVANIA TAX-FREE TRUST AND SENTINEL VARIABLE PRODUCTS TRUST, EACH ON BEHALF OF ITS RESPECTIVE SERIES AS LISTED ON SCHEDULE B, SEVERALLY AND NOT JOINTLY (the "Funds") and STATE STREET BANK AND TRUST

COMPANY ("State Street").

| Fund Name | Taxpayer Identification | Tax Year-End | ||

|

|

|

|

||

| Number | ||||

| Balanced | 00-0000000 | November 30 | ||

|

|

|

|

||

| Capital Growth | 00-0000000 | June 30 | ||

|

|

|

|

||

| Capital Markets Income | 00-0000000 | November 30 | ||

|

|

|

|

||

| Capital Opportunity | 00-0000000 | November 30 | ||

|

|

|

|

||

| Common Stock | 00-0000000 | November 30 | ||

|

|

|

|

||

| Government Securities | 00-0000000 | November 30 | ||

|

|

|

|

||

| Growth Leaders | 00-0000000 | June 30 | ||

|

|

|

|

||

| High Yield Bond | 00-0000000 | November 30 | ||

|

|

|

|

||

| International Equity | 00-0000000 | November 30 | ||

|

|

|

|

||

| Mid Can Growth | 00-0000000 | November 30 | ||

|

|

|

|

||

| New York Tax-Free Income | 00-0000000 | November 30 | ||

|

|

|

|

||

| Pennsylvania Tax-Free | 00-0000000 | November 30 | ||

|

|

|

|

||

| Short Maturity Government | 00-0000000 | November 30 | ||

|

|

|

|

||

| Small Company | 00-0000000 | November 30 | ||

|

|

|

|

||

| Tax-Free Income | 00-0000000 | November 30 | ||

|

|

|

|

||

| U.S. Treasury Money Market | 00-0000000 | November 30 | ||

|

|

|

|

||

| Variable Products Balanced | 00-0000000 | November 30 | ||

|

|

|

|

||

| Variable Products Bond | 00-0000000 | November 30 | ||

|

|

|

|

||

| Variable Products Common Stock | 00-0000000 | November 30 | ||

|

|

|

|

||

| Variable Products Growth Index | 00-0000000 | November 30 | ||

|

|

|

|

||

| Variable Products Mid Cap | 00-0000000 | November 30 | ||

|

|

|

|

||

| Variable Products Money Market | 00-0000000 | November 30 | ||

|

|

|

|

||

| Variable Products Small Company | 00-0000000 | November 30 | ||

|

|

|

|

| Schedule C |

This Schedule is attached to and made part of the Securities Lending Authorization Agreement, dated the 21 st day of March 2006 between SENTINEL GROUP FUNDS, INC., SENTINEL

PENNSYLVANIA TAX-FREE TRUST AND SENTINEL VARIABLE PRODUCTS TRUST, EACH ON BEHALF OF ITS RESPECTIVE SERIES AS LISTED ON SCHEDULE B, SEVERALLY AND NOT JOINTLY (the "Funds") and XXXXX XXXXXX XXXX XXX XXXXX

XXXXXXX ("Xxxxx Xxxxxx").

|

Acceptable Forms of Collateral U.S. Cash; |

| Exhibit A |

| QUALIFIED PURCHASER INVESTMENTS |

This Exhibit is designed to assist the Fund in determining which of its assets are Qualified Purchaser Investments and the appropriate method of valuing those assets. Although the definition of Qualified Purchaser Investments includes most of what are ordinarily considered "investments" or "securities" (but excludes assets such as jewelry, artwork, antiques and other similar collectibles), issues may arise as to whether a particular holding falls within the definition. The Fund is encouraged to consult its legal and/or investment advisors for guidance on these issues.

Types of Investments. The term "Qualified Purchaser Investment" includes the investments described below.

| (a) | Cash and cash equivalents (including foreign currency) held for investment purposes, including bank deposits, certificates of deposit, bankers acceptances, and the net cash surrender value of an insurance policy. | |

| (b) | Securities such as | |

| (i) | shares of (and other interests in) mutual funds, closed-end funds, hedge funds, and commodity pools; | |

| (ii) | securities, including common stock, preferred stock and other equity instruments as well as bonds, notes, debentures and other debt obligations, of public companies (including companies listed on certain foreign exchanges); | |

| (iii) | securities, including common stock, preferred stock and other equity instruments as well as bonds, notes, debentures and other debt obligations, of private companies with at least $50 million in shareholders' equity; | |

| (iv) | interests in family-owned or closely-held businesses controlled by the Fund if they fall in one of categories (i)-(iii) above; and | |

| (v) | bonds, notes and similar debt obligations issued by federal, state and local governments and agencies. | |

| (c) | Real estate held for investment purposes (which does not include a place of business used by the | |

Fund or the Subscriber's family, or a personal residence used by the Fund or the Subscriber's family unless the residence is treated as an investment for tax purposes).

(d) Commodity futures contracts, options on commodity futures contracts, and options on physical commodities traded on or subject to the rules of a major commodities exchange held for investment purposes.

(e) Physical commodities such as gold or silver with respect to which a commodity interest is traded on or subject to the rules of a major commodities exchange held for investment purposes:

(t) Financial contracts entered into for investment purposes including swaps and similar contracts.

Valuation. A Qualified Purchaser Investment should be valued at its fair market value as of the most recent practicable date or its cost, provided that commodity interests should be valued at the initial margin or option premium deposited in connection with such interests.

Investments by Subsidiaries. The amount of Qualified Purchaser Investments owned by an Entity other than a so-called "Family Company" may include investments owned by majority owned subsidiaries of the Entity and investments owned by an Entity ("Parent Entity") of which the Entity is a majority-owned subsidiary, or by a majority-owned subsidiary of the Entity and other majority-owned subsidiaries of the Parent Entity.