STANDARD INDUSTRIAL LEASE (NET)

*** Information has been omitted pursuant to a request for confidential treatment which has been filed separately with the Securities and Exchange Commission.

Exhibit 10.23

(NET)

| LANDLORD: | OMP PAGE LLC, | |

| a Delaware limited liability company | ||

| TENANT: | SOLYNDRA FAB 2 LLC, | |

| a Delaware limited liability company | ||

| CITY, STATE: | Fremont, California | |

| DATE: | October , 2009 | |

TABLE OF CONTENTS

| Page | ||||

| 1. | BASIC LEASE TERMS | 1 | ||

| 2. | PREMISES | 3 | ||

| 3. | LEASE TERM | 3 | ||

| 4. | POSSESSION; CONDITION OF PREMISES; EARLY ENTRY | 4 | ||

| 5. | RENT | 6 | ||

| 6. | PREPAID RENT | 8 | ||

| 7. | LETTER OF CREDIT | 8 | ||

| 8. | USE OF PREMISES AND FACILITIES | 11 | ||

| 9. | SURRENDER OF PREMISES; HOLDING OVER | 12 | ||

| 10. | SIGNAGE | 13 | ||

| 11. | TAXES | 13 | ||

| 12. | UTILITIES | 14 | ||

| 13. | MAINTENANCE | 14 | ||

| 14. | ALTERATIONS | 16 | ||

| 15. | RELEASE AND INDEMNITY | 18 | ||

| 16. | INSURANCE | 18 | ||

| 17. | DESTRUCTION | 20 | ||

| 18. | CONDEMNATION | 21 | ||

| 19. | ASSIGNMENT OR SUBLEASE | 22 | ||

| 20. | DEFAULT | 24 | ||

| 21. | LANDLORD’S REMEDIES | 25 | ||

| 22. | DEFAULT BY LANDLORD | 26 | ||

| 23. | ENTRY OF PREMISES AND PERFORMANCE BY TENANT | 27 | ||

| 24. | SUBORDINATION | 28 | ||

| 25. | NOTICE | 28 | ||

(i)

| 26. | WAIVER | 29 | ||

| 27. | LIMITATION OF LIABILITY | 29 | ||

| 28. | FORCE MAJEURE | 29 | ||

| 29. | PROFESSIONAL FEES | 30 | ||

| 30. | EXAMINATION OF LEASE | 30 | ||

| 31. | ESTOPPEL CERTIFICATE | 30 | ||

| 32. | RULES AND REGULATIONS | 31 | ||

| 33. | LIENS | 31 | ||

| 34. | MISCELLANEOUS PROVISIONS | 31 | ||

| 35. | LEASE EXECUTION | 33 | ||

EXHIBITS

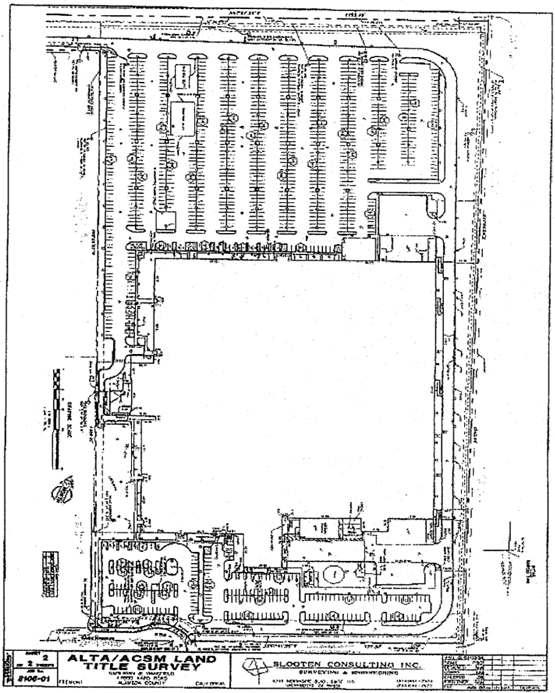

| EXHIBIT A: | DEPICTION OF PREMISES | |

| EXHIBIT B: | DESCRIPTION OF PREMISES LAND | |

| EXHIBIT C: | WORK LETTER AGREEMENT | |

| EXHIBIT D: | NOTICE OF LEASE TERM DATES | |

| EXHIBIT E: | TENANT ESTOPPEL CERTIFICATE | |

| EXHIBIT F: | RULES AND REGULATIONS | |

| EXHIBIT G: | LEASE GUARANTY | |

| EXHIBIT H: | HAZARDOUS MATERIALS ADDENDUM | |

| EXHIBIT I: | HAZARDOUS MATERIALS QUESTIONNAIRE | |

| EXHIBIT J: | REFERENCE PROVISION | |

| EXHIBIT K: | FORM OF LETTER OF CREDIT | |

| EXHIBIT L | DESCRIPTION OF LANDLORD’S WORK |

RIDERS

| RIDER 1: | OPTIONS | |

| RIDER 2: | BUILT-UP ROOFING REPLACEMENT |

(ii)

(NET)

| 1. | BASIC LEASE TERMS. |

(a) DATE OF LEASE EXECUTION: October 26, 2009

(b) TENANT: SOLYNDRA FAB 2 LLC, a Delaware limited liability company

| Address (Premises): | 000 Xxxx Xxxxxx, Xxxxxxx, Xxxxxxxxxx 00000 | |

| Address for Notices: | 00000 Xxxx Xxxx | |

| Fremont, California 94538 | ||

| Attn: X.X. Xxxxxx, Xx., Vice President & Chief Financial Officer | ||

| with a copy to: | ||

| Xxxxxx Xxxxxxx Xxxxxxxx & Xxxxxx | ||

| 000 Xxxx Xxxx Xxxx | ||

| Palo Alto, CA 94304 | ||

| Attn: Xxxx Xxxxxxxxxx, Esq. | ||

(c) LANDLORD: OMP PAGE LLC, a Delaware limited liability corporation

| Address for Rent: | c/o Xxxxxxx Xxxxx Properties | |

| 00000 X. Xxxxxxxx Xxxxxx, Xxxxx 000 | ||

| Gardena, CA 90248 | ||

| Attn: 000 Xxxx Xxxxxx Xxxxxxx, XX Property Manager | ||

| Address for Notices: | c/o Xxxxxxx Xxxxx Properties | |

| 00000 X. Xxxxxxxx Xxxxxx, Xxxxx 000 | ||

| Gardena, CA 90248 | ||

| Attn: 000 Xxxx Xxxxxx, Xxxxxxx, XX Property Manager | ||

| with a copy to: | ||

| c/o XX Xxxxxx Asset Management | ||

| 1999 Avenue of the Stars, Floor 26 | ||

| Los Angeles, CA 90067 | ||

| Attn: Xx. Xxxxxx X. Xxxx | ||

| and | ||

| Xxxxx Xxxxxxx Xxxx Xxxxxx Xxxxxxx & Xxxxxx LLP | ||

| 000 Xxxxx Xxxxxxxx Xxxxxx, 0xx Floor | ||

| Los Angeles, CA 90071 | ||

| Attn: Xxxxxx X. Xxxxxxx, Esq. | ||

(d) TENANT’S PERMITTED USE OF THE PREMISES: General office and research and development, manufacturing, assembly, warehouse and distribution of technology products and equipment (such technology products and equipment may include, without limitation, photovoltaics, solar cells and, solar panels and solar energy related products and tools necessary to assemble solar energy related products), and other legal related uses (subject to obtaining Landlord’s written approval, which shall not be unreasonably withheld).

(e) PREMISES; BUILDING: Approximately 506,490 square feet of space (the “Premises”) comprising the entire building commonly known as 000 Xxxx Xxxxxx, Xxxxxxx, Xxxxxxxxxx 00000, as shown on Exhibit A attached hereto (the “Building”).

TENANT’S SHARE OF THE BUILDING: 100%, which is the ratio that the square footage of the Premises bears to the square footage of the Building.

(f) PREMISES LAND: Approximately 29.89 acres of land on which the Building is located and more particularly described on Exhibit B attached hereto.

(g) TERM; COMMENCEMENT DATE; RENT COMMENCEMENT DATE; EXPIRATION DATE:

Term: One Hundred Fifty (150) months, subject to extension as set forth in Rider 1 attached hereto.

Commencement Date: January 1, 2010.

Rent Commencement Date: July 1, 2010.

Expiration Date: June 30, 2022.

(h) BASIC RENT:

| Months During Term | Basic Rent Per Month | |

| [***] | [***] | |

| [***] | [***] | |

| [***] | [***] | |

| [***] | [***] | |

| [***] | [***] | |

| [***] | [***] | |

| [***] | [***] | |

| [***] | [***] | |

| [***] | [***] | |

| [***] | [***] |

*** Information has been omitted pursuant to a request for confidential treatment which has been filed separately with the Securities and Exchange Commission.

-2-

| [***] | [***] | |

| [***] | [***] |

(i) PREPAID RENT (Basic Rent and estimated additional rent for seventh (7th) month of Term): [***].

(j) LETTER OF CREDIT AMOUNT:[***], subject to adjustment in accordance with the terms of Paragraph 7 below.

(k) BROKER(S): CB Xxxxxxx Xxxxx and Colliers International, representing Landlord; GVA Xxxxxx Xxxxxxx, representing Tenant.

(l) ALLOWANCE: [***] based upon the Premises containing 506,490 square feet of space.

(m) RIDERS: Rider 1 and Rider 2 are attached hereto and made a part hereof.

(n) EXHIBITS: Exhibits lettered A through L, inclusive, are attached hereto and made a part hereof.

(o) GUARANTOR(S): SOLYNDRA, INC., a Delaware corporation.

This Paragraph 1 represents a summary of the basic terms of this Lease. In the event of any inconsistency between the terms contained in this Paragraph 1 and any specific provision of this Lease, the terms of the more specific provision shall prevail.

| 2. | PREMISES. |

(a) Landlord hereby leases to Tenant and Tenant hereby leases from Landlord, the Premises referenced in Paragraph 1 and outlined on the Depiction of Premises attached hereto as Exhibit A and incorporated herein by this reference. The Premises consists of that certain Building located at the address designated in Subparagraph 1(b) and the parcel or parcels of real property described on the Description of Premises Land attached hereto as Exhibit B and incorporated herein by this reference.

(b) The parties agree that the letting and hiring of the Premises is upon and subject to the terms, covenants and conditions herein set forth and Tenant covenants as a material part of the consideration for this Lease to keep and perform each and all of said terms, covenants and conditions by it to be kept and performed and that this Lease is made upon the condition of such performance.

| 3. | LEASE TERM. |

The Term of this Lease shall be for the period designated in Subparagraph 1(g) commencing on the Commencement Date, and ending on the Expiration Date, unless the term hereby demised shall be sooner terminated as herein provided (the “Term”). Notwithstanding the foregoing, if the Commencement Date falls on any day other than the first day of a calendar month then the Term of this Lease shall be measured from the first day of the month following the month in which the Commencement Date occurs. Landlord and Tenant shall execute Exhibit D to confirm the Commencement Date and the Expiration Date and other matters.

*** Information has been omitted pursuant to a request for confidential treatment which has been filed separately with the Securities and Exchange Commission.

-3-

| 4. | POSSESSION; CONDITION OF PREMISES; EARLY ENTRY. |

(a) Delivery of Possession. Except as otherwise expressly provided in clauses (c) and (d) below, Landlord agrees to deliver possession of the Premises to Tenant on the Commencement Date in its “AS-IS,” “WHERE-IS,” with all faults condition. Notwithstanding the foregoing, Landlord shall not be obligated to deliver possession of any portion of the Premises to Tenant until Landlord has received from Tenant all of the following: (i) the Letter of Credit (defined herein below) and Prepaid Rent; (ii) executed copies of policies of insurance or certificates thereof as required under Paragraph 16 of this Lease; (iii) copies of all governmental permits and authorizations required in connection with Tenant’s operation of its business upon the Premises; and (iv) an executed original of the Hazardous Materials Questionnaire in the form attached hereto as Exhibit I.

(b) Condition of Premises. Except as otherwise expressly provided in clauses (c) and (d) below, (i) by taking possession of any portion of the Premises, Tenant will be deemed to have accepted the entire Premises in its “AS-IS,” “WHERE-IS,” with all faults condition on the date of delivery of possession and to have acknowledged that there are no items needing work or repair, and (ii) Tenant acknowledges that neither Landlord nor any agent of Landlord has made any representation or warranty with respect to the Premises or any portions thereof or with respect to the suitability of same for the conduct of Tenant’s business or any other business.

(c) Landlord’s Representation and Warranty; Landlord’s Work.

i) Landlord hereby represents and warrants to Tenant that, as of the date of this Lease, (A) Chiller #6 (defined below) serving the Building, is in good working order, (B) no “actionable mold” (defined below) exists within the interior of the Building (specifically excluding any portion of the roof of the Building, as to which Landlord makes no representation or warranty and as to which Tenant agrees Landlord shall have no responsibility), and, (C) to Landlord’s actual knowledge, the electrical and plumbing systems serving the Premises are in good working order and conditions. For purposes of the immediately preceding sentence, the term “actionable mold” shall be deemed to mean the presence of mold within the Building or indoor air in such concentration or condition as (aa) exceeds any permissible exposure limit established by applicable law or regulation now or hereafter adopted for the protection of health and safety; (bb) requires remediation under any applicable law or regulation now or hereafter adopted; or (cc) in the absence of any such law or regulation, in the written opinion of any public health officer, medical expert, certified industrial hygienist or certified mold abatement expert, requires removal or other abatement work based on the results of sampling and monitoring data in order to avoid potential risk to the health of persons within the Building. Tenant acknowledges and agrees that in the event it is determined that Landlord breached any of the foregoing representations and/or warranties, Tenant’s sole and exclusive remedy shall be to cause Landlord to remedy such breach; provided, however, the representation and warranty of Landlord set forth in clause (B) above shall only survive until December 31, 2009 and shall thereafter be deemed extinguished except to the extent a Mold Notice (defined below) is delivered to Landlord prior to such date. For purposes of this subsection i), the term “Chiller #6” shall be deemed to mean that certain 300 ton chiller referenced in the Xxxx/Xxxxx Associates Report dated 11/20/08.

In accordance with the foregoing, if Tenant reasonably believes that Landlord has breached its representation and warranty in clause (B) above (which reasonable belief shall be based solely upon the results of sampling and monitoring results obtained from a mold survey or assessment performed in the Building by a certified mold hazard assessor on Xxxxxx’s behalf (“Xxxxxx’s Consultant”)), and Tenant timely delivers a written notice to Landlord advising Landlord of such alleged breach (a “Mold Notice”) in accordance with the terms of the immediately preceding paragraph, then Landlord agrees to be responsible to cause such actionable mold condition to be abated and mold-impacted media removed from the interior of the Building in accordance with Tenant’s Consultant’s recommendations; provided, however, if Landlord disputes Xxxxxx’s Consultant’s findings or recommendations, Landlord shall have the right in its sole discretion and at its sole cost, to hire its own certified mold hazard assessor (“Landlord’s Consultant”) to perform a mold survey or assessment within the Building on its behalf. If Xxxxxxxx’s Consultant agrees with the findings or recommendations of Xxxxxx’s Consultant, then Landlord shall perform the work recommended by Xxxxxx’s Consultant as part of Landlord’s Work (defined below) at Landlord’s sole cost and expense; provided, however,

-4-

notwithstanding anything herein to the contrary, under no circumstances shall Landlord be required to expend more than One Million and No/100 Dollars ($1,000,000.00) in connection with the performance of such work (the “Mold Cost Cap”). If Xxxxxxxx’s Consultant disagrees with the findings or recommendations of Xxxxxx’s Consultant, then Xxxxxxxx’s Consultant and Xxxxxx’s Consultant shall agree upon and appoint one independent, unaffiliated certified mold hazard assessor (the “Independent Consultant”) to review both. Xxxxxx’s Consultant’s and Xxxxxxxx’s Consultant’s mold survey and/or assessment, and perform a new mold survey and/or assessment, if such Independent Consultant elects to do so. The decision of the Independent Consultant shall be binding upon Landlord and Tenant and neither party will have the right to reject the determination (provided Xxxxxxxx’s obligation to pay for any work recommended by the Independent Consultant shall under all circumstances be subject to the Mold Cost Cap). The cost of each party’s consultant shall be the responsibility of the party selecting such consultant, and the cost of the Independent Consultant shall be shared equally by Landlord and Tenant. If Xxxxxxxx’s Consultant and Xxxxxx’s Consultant fail to agree upon and appoint the Independent Consultant, both consultants shall be dismissed and the matter to be decided shall be forthwith submitted to binding arbitration under the provisions of the American Arbitration Association.

ii) Following the date of this Lease, Xxxxxxxx agrees to perform, at its sole cost and expense, that certain testing, repair and replacement work more particularly described on Exhibit L attached hereto (collectively, “Landlord’s Work”). Tenant acknowledges that Xxxxxxxx’s Work will be performed in the Premises while Tenant is in occupancy thereof and possibly while Tenant is paying Basic Rent pursuant to the terms of this Lease; provided, however, Landlord agrees to substantially complete Landlord’s Work on or before the Commencement Date (with the exception of Item No. 4 on Exhibit L, which work Xxxxxxxx agrees to complete following the date the Roof Replacement Work is completed by Xxxxxx), extended to the extent of any force majeure delays or delays caused by the Tenant and except for any portion of Landlord’s Work, the completion of which will not materially interfere with Tenant’s use, occupancy or operation from the Premises. Xxxxxx also acknowledges that the performance of Landlord’s Work may interrupt Tenant’s business, or be inconvenient to Tenant, and Xxxxxx agrees that Landlord shall have no responsibility or liability to Tenant therefor so long as Landlord uses its commercially reasonable efforts to minimize any such interruptions and inconveniences. Xxxxxx agrees to make the Premises reasonably available to Landlord and its contractors for the performance of Landlord’s Work. Xxxxxx agrees that the performance of Xxxxxxxx’s Work shall not constitute an eviction of Tenant from the Premises, whether constructive or otherwise, and Tenant shall in all events be required to pay Basic Rent pursuant to the terms of this Lease and possibly during the performance of Xxxxxxxx’s Work. In connection with the performance of the Work, it shall be the responsibility of Tenant at its cost to (A) remove, replace and secure all loose personal property, and (B) disconnect and reconnect, as required, all electrical equipment, trade fixtures, machinery and the like.

(d) Allowance; Xxxxxx’s Work. So long as Tenant is not in Default (as defined in Paragraph 20 below) hereunder, Landlord agrees to provide to Tenant a tenant improvement allowance of [***] based upon the Premises containing approximately 506,490 square feet of space (the “Allowance”). Tenant agrees to use at least [***] of the Allowance to completely replace the existing roof membrane of the Building (the “Roof Replacement Work”), at least [***] of the Allowance to complete the HVAC Chiller Replacement Work and the Transformer Work (both such terms defined herein below), [***] on repairing the irrigation system and replacing certain dead landscaping/trees located upon the Premises Land (the “Irrigation/Landscaping Work”) and the remaining portion of the Allowance to perform other refurbishments and/or tenant improvements within the Building (including, without limitation, the Immediate Occupancy/Seismic Work described in Exhibit C attached hereto [the “Immediate Occupancy/Seismic Work”]), all pursuant to the terms of Exhibit C attached hereto (collectively, “Tenant’s Work”). Tenant further agrees that the exact scope and construction of Tenant’s Work and Xxxxxxxx’s payment of the Allowance to Tenant shall be governed by the terms of the Work Letter Agreement attached hereto as Exhibit C. The Roof Replacement Work is more particularly described on Rider 2 attached hereto. In accordance with the foregoing, as part of Tenant’s Work, Tenant shall perform the following improvements, which shall be paid for by Landlord out of the Allowance pursuant to the terms of Exhibit C and the terms of this Subparagraph 4(d) below:

*** Information has been omitted pursuant to a request for confidential treatment which has been filed separately with the Securities and Exchange Commission.

-5-

i) Tenant shall remove and replace (aa) the five (5) air cooled and water cooled HVAC chiller systems and the two (2) cooling towers (collectively, the “Chillers”) currently serving the Building (collectively, the “HVAC Chiller Replacement Work”), and (bb) the existing transformer serving the Building with a new 5,000/6,250 transformer (the “Transformer Work”). Tenant further acknowledges and agrees that it may only charge the Allowance for the cost to replace the exact Chillers serving the Building with HVAC chiller systems/cooling towers of a similar type and capacity, and that if Tenant desires the HVAC Chiller Replacement Work to include the replacement of the Chillers with upgraded HVAC chiller systems/cooling towers of a different type and/or capacity or additional HVAC chiller systems/cooling towers, then Tenant shall be solely responsible for all costs and expenses attributable to such election.

ii) Although the Transformer Work is being paid for by Landlord as part of the Allowance, Tenant shall be responsible to reimburse Landlord as part of Maintenance Expenses for the portion of the Allowance applicable to the performance of the Transformer Work (i.e., currently estimated to be approximately One Hundred Eleven Thousand One Hundred Four and No/100 Dollars ($111,104.00)), but only to the extent such costs are amortized (including a reasonable interest factor determined by Landlord) over the useful life (as determined in accordance with GAAP [defined below]) of such Transformer Work. In the event that Tenant requests a different transformer than that identified in subsection i) above, Tenant shall pay the additional cost for such Transformer Work over and above the cost to replace the transformer identified in subsection i) above and such costs shall not be amortized hereunder.

iii) In accordance with the foregoing, Landlord and Tenant agree that the existing Chillers are described as follows: (1) 1 - 500 ton Trane water cooled chiller; (2) 1 - 200 ton Trane water cooled chiller; (3) 1 - 125 ton Carrier air cooled chiller; (4) 1 - 200 ton York & Carrier air cooled chiller; (5) 1 - 200 ton York & Carrier air cooled chiller; (6) 1 - 500 ton Marley cooling tower; and (7) 1 - 200 ton Marley/BAC cooling tower.

iv) Tenant shall complete infrared testing of the Building’s electrical distribution switchgear at each of the four (4) substations and make the repairs required or recommended as a result of such testing.

(e) Early Entry. Notwithstanding the fact that the Term of this Lease has not commenced, Xxxxxxxx agrees to permit Tenant to enter the Premises upon mutual execution of this Lease. Such entry shall be subject to all of the conditions set forth in this paragraph below. Such early entry is conditioned upon Tenant and its contractors, employees, agents and invitees working in harmony and not interfering with Landlord and its contractors and Landlord may immediately terminate such early entry in the event of any such interference. Tenant agrees that any such early entry is subject to all of the terms and conditions of this Lease, except for those relating to the payment of rent and other recurring monetary obligations which have a specific commencement time, which provisions will become applicable in accordance with the terms of this Lease. Without limiting the generality of the foregoing, such early occupancy shall be conditioned upon Tenant first delivering to Landlord the items described in Subparagraph 4(a) of this Lease above and Tenant shall be specifically bound by the terms of Paragraphs 8 (Use of Premises and Facilities), 12 (Utilities), 15 (Release and Indemnity) and 16 (Insurance) of this Lease during such early entry period.

| 5. | RENT. |

(a) Basic Rent. From and after the Rent Commencement Date, Xxxxxx agrees to pay Landlord Basic Rent for the Premises at the Basic Rent rate designated in Subparagraph 1(h) in twelve (12) equal monthly installments, each in advance of the first day of each and every calendar month during the Term, except that the Prepaid Rent set forth in Subparagraph 1(i) shall be paid upon the execution of this Lease and applied to the seventh (7th) full calendar month occurring during the Term. If the Term of this Lease commences on a day other than the first day of a calendar month or ends on a day other than the last day of a calendar month, then the rent (as defined below) for such periods shall be prorated in the proportion that the number of days this Lease is in effect during such periods bears to the total number of days in the applicable calendar month, and such rent shall be paid at the commencement of such period. In addition to the Basic Rent, from and after the Rent Commencement Date, Xxxxxx agrees to pay Landlord as additional rent as provided in Paragraph 11 (Taxes), Paragraph 13 (Maintenance), Paragraph 16 (Insurance), the amount of all rental

-6-

adjustments as and when hereinafter provided in this Lease, and a management fee of [***] of the Basic Rent payable by Tenant pursuant to the terms of this Lease to cover Landlord’s management, overhead and administrative expenses related to the operation of the Building, whether performed by Landlord’s personnel or delegated by Landlord to a professional property manager. The Basic Rent, any additional rent payable pursuant to the provisions of this Lease, and any rental adjustments shall be paid to Landlord, without any prior demand therefor, and without any deduction or offset whatsoever (except as otherwise specifically provided for in this Lease) in lawful money of the United States of America, which shall be legal tender at the time of payment, at the address of Landlord designated in Subparagraph 1(c) or to such other person or at such other place as Landlord may from time to time designate in writing. Further, all charges to be paid by Tenant hereunder, including, without limitation, payments for real property taxes, insurance, repairs, and parking, if any, shall be considered “additional rent” for the purposes of this Lease, and the word “rent” in this Lease shall include such additional rent unless the context specifically or clearly implies that only the Basic Rent is referenced, Basic Rent shall be adjusted as provided in Subparagraph 1(h).

(b) Late Payment. Tenant acknowledges that late payment by Tenant to Landlord of any rent or other sums due under this Lease will cause Landlord to incur costs not contemplated by this Lease, the exact amount of such costs being extremely difficult and impracticable to ascertain. Such costs include, without limitation, processing and accounting charges and late charges that may be imposed on Landlord by the terms of any encumbrance or note secured by the Premises. Therefore, if any rent or other sum due from Tenant is not received within five (5) calendar days when due, Tenant shall pay to Landlord an additional sum equal to 5% of such overdue payment; provided, however, Landlord agrees to give Xxxxxx a written notice and five (5) days to cure before such late fee is assessed the first time in any calendar year that Tenant fails to timely pay rent or any other sum. Landlord and Tenant hereby agree that such late charge represents a fair and reasonable estimate of the costs that Landlord will incur by reason of any such late payment. Additionally, all such delinquent rents or other sums, shall bear interest at the lesser of (i) twelve percent (12%) per annum or (ii) the maximum legal interest rate (as applicable, the “Interest Rate”). Any payments of any kind returned for insufficient funds will be subject to an additional handling charge of $25.00.

(c) Audit Right. In the event of any dispute as to the amount of Tenant’s Share of Maintenance Expenses, Real Property Taxes and/or the cost of any insurance maintained by Landlord hereunder (collectively, “Expenses”), Tenant or an accounting firm selected by Xxxxxx and reasonably satisfactory to Landlord (billing hourly and not on a contingency fee basis) will have the right, by prior written notice (“Audit Notice”) given within one (1) year (“Audit Period”) following receipt of the final statement of such Expenses incurred by Landlord during the immediately previous calendar year (an “Actual Statement”) and at reasonable times during normal business hours, to audit Landlord’s accounting records with respect to the Expenses relative to the year to which such Actual Statement relates at the offices of Landlord’s property manager. In no event will Landlord or its property manager be required to (i) photocopy any accounting records or other items or contracts, (ii) create any ledgers or schedules not already in existence, (iii) incur any costs or expenses relative to such inspection, or (iv) perform any other tasks other than making available such accounting records as aforesaid. Neither Tenant nor its auditor may leave the offices of Landlord’s property manager with copies of any materials supplied by Landlord. Tenant must pay Xxxxxx’s Share of Expenses when due pursuant to the terms of this Lease and may not withhold payment of such Expenses or any other rent pending results of the audit or during a dispute regarding Expenses. The audit must be completed within six (6) months of the date of Tenant’s Audit Notice subject to extension for delays caused by Landlord. If Tenant does not comply with any of the aforementioned time frames, then such Actual Statement will be conclusively binding on Tenant. If such audit or review correctly reveals that Xxxxxxxx has overcharged Tenant and Xxxxxxxx agrees with the results of such audit, then within thirty (30) days after the results of such audit are made available to Landlord, Landlord agrees to reimburse Tenant the amount of such overcharge. If the audit reveals that Xxxxxx was undercharged, then within thirty (30) days after the results of the audit are made available to Tenant, Xxxxxx agrees to reimburse Landlord the amount of such undercharge. Xxxxxx agrees to pay the cost of such audit, provided that if the audit reveals that Xxxxxxxx’s determination of the Building’s total Expenses as set forth in the relevant Actual Statement was in error in Landlord’s favor by more than seven percent (7%) of the total amount of such Expenses pursuant to such Actual Statement, then Landlord agrees to pay the reasonable, third-party cost of such audit

*** Information has been omitted pursuant to a request for confidential treatment which has been filed separately with the Securities and Exchange Commission.

-7-

incurred by Tenant. To the extent Landlord must pay the cost of such audit, such cost shall not exceed a reasonable hourly charge for a reasonable amount of hours spent by such third-party in connection with the audit, and in no event will exceed the lesser of the amount of the error or $1,500.00. Tenant agrees to keep the results of the audit confidential and will cause its agents, employees and contractors to keep such results confidential. To that end, Landlord may require Tenant and its auditor to execute a confidentiality agreement provided by Landlord.

| 6. | PREPAID RENT. |

Upon execution of this Lease, Tenant shall pay to Landlord the Prepaid Rent set forth in Subparagraph 1(i), and if Tenant is not in Default of any provision of this Lease, such Prepaid Rent shall be applied during the seventh (7th) full calendar month of the Term with respect to Xxxxxx’s leasing of the Premises. Landlord’s obligations with respect to the Prepaid Rent are those of a debtor and not of a trustee, and Landlord can commingle the Prepaid Rent with Landlord’s general funds. Landlord shall not be required to pay Tenant interest on the Prepaid Rent. Landlord shall be entitled to immediately endorse and cash Tenant’s Prepaid Rent; however, such endorsement and cashing shall not constitute Landlord’s acceptance of this Lease. In the event Landlord does not accept this Lease, Landlord shall return said Prepaid Rent. If Landlord sells the Premises and deposits with the purchaser the Prepaid Rent, Landlord shall be discharged from any further liability with respect to the Prepaid Rent.

| 7. | LETTER OF CREDIT. |

(a) General Provisions. Concurrently with Xxxxxx’s execution of this Lease, Tenant shall deliver to Landlord, as additional collateral for the full performance by Tenant of all of its obligations under this Lease and for all losses and damages Landlord may suffer as a result of any Default by Tenant under this Lease, including, but not limited to, any post lease termination damages under Section 1951.2 of the California Civil Code, a standby, unconditional, irrevocable, transferable letter of credit (the “Letter of Credit”) in the form of Exhibit K attached hereto and containing the terms required herein, in the face amount of [***] (the “Letter of Credit Amount”), naming Landlord as beneficiary, issued by a financial institution acceptable to Landlord in Landlord’s sole discretion (provided Landlord hereby approves the following issuers in advance: Xxxxx Fargo, US Bank, Citibank, XX Xxxxxx Xxxxx and Bank of America), permitting multiple and partial draws thereon, and otherwise in form acceptable to Landlord in its sole discretion. Tenant shall cause the Letter of Credit to be continuously maintained in effect (whether through replacement, renewal or extension) in the Letter of Credit Amount (as the same may be reduced or increased as described in Subparagraph 7(f) below) through the date (the “Final LC Expiration Date”) that is 60 days after the scheduled expiration date of the Term or any renewal Term of this Lease. If the Letter of Credit held by Landlord expires earlier than the Final LC Expiration Date (whether by reason of a stated expiration date or a notice of termination or non-renewal given by the issuing bank), Tenant shall deliver a new Letter of Credit or certificate of renewal or extension to Landlord not later than thirty (30) days prior to the expiration date of the Letter of Credit then held by Landlord. Any renewal or replacement Letter of Credit shall comply with all of the provisions of this Paragraph 7, shall be irrevocable, transferable and shall remain in effect (or be automatically renewable) through the Final LC Expiration Date upon the same terms as the expiring Letter of Credit or such other terms as may be acceptable to Landlord in its sole discretion.

(b) Drawings under Letter of Credit. Landlord shall have the immediate right to draw upon the Letter of Credit, in whole or in part, at any time and from time to time: (i) If a Default occurs and/or to compensate Landlord for any and all damages it suffers upon termination of this Lease (as determined in accordance with Paragraph 21 below); (ii) If the Letter of Credit held by Landlord expires (or is set to expire) earlier than the Final LC Expiration Date (whether by reason of a stated expiration date or a notice of termination or non-renewal given by the issuing bank), and Xxxxxx fails to deliver to Landlord, at least thirty (30) days prior to the expiration date of the Letter of Credit then held by Landlord, a renewal or substitute Letter of Credit that is in effect and that complies with the provisions of this Paragraph 7; or (iii) Tenant either files a voluntary petition, or an involuntary petition is filed against Tenant by an entity

*** Information has been omitted pursuant to a request for confidential treatment which has been filed separately with the Securities and Exchange Commission.

-8-

other than Landlord or an affiliate thereof, under any chapter of the Federal Bankruptcy Code, Xxxxxx executes an assignment for the benefit of creditors or Tenant is placed in receivership or otherwise becomes insolvent. No condition or term of this Lease shall be deemed to render the Letter of Credit conditional to justify the issuer of the Letter of Credit in failing to honor a drawing upon such Letter of Credit in a timely manner. Tenant hereby acknowledges and agrees that Landlord is entering into this Lease in material reliance upon the ability of Landlord to draw upon the Letter of Credit upon the occurrence of any event of Default by Tenant under this Lease or upon the occurrence of any of the other events described above in this Subparagraph 7(b).

(c) Use of Proceeds by Landlord. The proceeds of the Letter of Credit shall constitute Landlord’s sole and separate property (and not Tenant’s property or the property of Tenant’s bankruptcy estate) and Landlord may immediately upon any draw (and without notice to Tenant) apply or offset the proceeds of the Letter of Credit: (i) against any rent payable by Tenant under this Lease that is not paid when due; (ii) against all losses and damages that Landlord has suffered or that Landlord reasonably estimates that it may suffer as a result of any Default by Tenant under this Lease, including any damages arising under Section 1951.2 of the California Civil Code following termination of this Lease (as determined in accordance with Paragraph 21 below); (iii) against any costs incurred by Landlord in connection with this Lease (including attorneys’ fees); and (iv) against any other amount that Landlord may spend or become obligated to spend by reason of Tenant’s Default (subject to the terms of Paragraph 21 below). Provided Tenant has performed all of its surrender obligations and is otherwise not in Default under this Lease, Landlord agrees to pay to Tenant within thirty (30) days after the Final LC Expiration Date the amount of any proceeds of the Letter of Credit received by Landlord and not applied as allowed above; provided that if Tenant fails to perform all of its surrender obligations or is otherwise in Default under this Lease on the Final LC Expiration Date as described above, Landlord shall not be required to pay to Tenant such unapplied proceeds until that date which is thirty (30) days after the date Tenant performs such surrender obligations and/or cures such applicable Default; provided further, that if prior to the date such unapplied proceeds are paid to Tenant a voluntary petition is filed by Tenant or any Guarantor (defined below), or an involuntary petition is filed against Tenant or any Guarantor by any of Tenant’s or Guarantor’s creditors, under the Federal Bankruptcy Code, then Landlord shall not be obligated to make such payment in the amount of the unused Letter of Credit proceeds until either all preference issues relating to payments under this Lease have been resolved in such bankruptcy or reorganization case or such bankruptcy or reorganization case has been dismissed, in each case pursuant to a final court order not subject to appeal or any stay pending appeal.

(d) Additional Covenants of Tenant. If, as result of any application or use by Landlord of all or any part of the Letter of Credit, the amount of the Letter of Credit shall be less than the required Letter of Credit Amount, Tenant shall, within five (5) business days thereafter, provide Landlord with additional letter(s) of credit in an amount equal to the deficiency (or a replacement letter of credit in the total Letter of Credit Amount), and any such additional (or replacement) letter of credit shall comply with all of the provisions of this Paragraph 7, and if Xxxxxx fails to comply with the foregoing, notwithstanding anything to the contrary contained in this Lease, the same shall, at Xxxxxxxx’s election, constitute an uncurable event of Default by Tenant. Tenant further covenants and warrants that it will neither assign nor encumber the Letter of Credit or any part thereof and that neither Landlord nor its successors or assigns will be bound by any such assignment, encumbrance, attempted assignment or attempted encumbrance.

(e) Transfer of Letter of Credit. Landlord may, at any time and without notice to Tenant and without first obtaining Tenant’s consent thereto, transfer all or any portion of its interest in and to the Letter of Credit to Landlord’s mortgagee or a successor to Xxxxxxxx’s leasehold interest in the Premises and/or to have the Letter of Credit reissued in the name of Landlord’s mortgagee. If Landlord transfers its interest in the Building and transfers the Letter of Credit (or any proceeds thereof then held by Landlord) in whole or in part to the transferee (provided such transferee assumes in writing (with a copy to Tenant) all of Landlord’s obligations under this Lease first accruing after the effective date of the transfer), Landlord shall, without any further agreement between the parties hereto, thereupon be released by Tenant from all liability therefor. The provisions hereof shall apply to every transfer or assignment of all or any part of the Letter of Credit to a new landlord. In connection with any such transfer of the Letter of Credit by Landlord, Tenant shall, at Tenant’s sole cost and expense, execute and submit to the issuer of the Letter of Credit such applications, documents and instruments as may be necessary to effectuate such transfer. Tenant shall be responsible for paying the

-9-

issuer’s transfer and processing fees (collectively, the “Issuer’s Fees”) in connection with any transfer of the Letter of Credit and, if Landlord advances any such fees (without having any obligation to do so), Tenant shall reimburse Landlord for any such transfer or processing fees within ten (10)) days after Xxxxxxxx’s written request therefor. Notwithstanding the foregoing, Xxxxxxxx agrees to be responsible for the Issuer’s Fees, but only, to the extent the same do not exceed an amount equal to one-quarter of one percent of the then applicable Letter of Credit Amount.

(f) Modification to Letter of Credit Amount.

(i) Reductions. Subject to the provisions of this Subparagraph 7(f)(i) and provided that Tenant has not been in Default under any provision of this Lease at any time prior to an applicable Reduction Date (defined below), then Tenant shall be entitled to reduce the Letter of Credit Amount effective as of the last day of the twenty-fourth (24th) and thirty-sixth (36th) months of the initial Term (individually, a “Reduction Date” and collectively, the “Reduction Dates”) as follows (with the intent being that the first Reduction Date can only occur at the earliest of such last day of the twenty fourth (24th) month and anytime thereafter and the second Reduction Date can only occur at the earliest of such last day of the thirty sixth (36th) month and anytime thereafter): (A) On the first Reduction Date, Tenant shall be entitled to reduce the Letter of Credit Amount by an amount equal to [***] so long as Tenant’s EBITDA (defined below) equals or exceeds [***]; and (B) On the second and final Reduction Date, Tenant shall be entitled to reduce the Letter of Credit Amount by an amount equal to [***] so long as Tenant’s EBITDA (defined below) equals or exceeds [***]. For purposes of this clause (i) above, the defined term “Tenant’s EBITDA” shall be deemed to mean Tenant’s earnings before interest, taxes, depreciation and amortization, as evidenced (aa) by a certification from Tenant’s certified public accountant, i.e., Price Waterhouse/Coopers, or another “Big 4” accounting firm reasonably acceptable to Landlord, or (bb) if Tenant is a publicly traded company whose stock is listed on a nationally recognized stock exchange, by Xxxxxx’s then most recent annual audited financial statement filed with the Securities and Exchange Commission.

If Tenant is eligible for a Letter of Credit reduction on a Reduction Date, Landlord shall execute any documents reasonably requested by Xxxxxx and the issuing bank to effectuate the applicable release of the Letter of Credit, within fifteen (15) days after Tenant submits such documents to Landlord for execution provided Tenant is not in Default under this Lease.

(ii) Increases. Subject to the provisions of this Subparagraph 7(f)(ii), Tenant shall be required to immediately increase the Letter of Credit Amount as follows: (A) If Tenant fails to substantially complete the Immediate Occupancy/Seismic Work on or before December 31, 2010, the Letter of Credit Amount shall be immediately increased to [***] and (B) if Tenant’s EBITDA fails to equal or exceed [***] at any time during the Term, the Letter of Credit Amount shall be immediately increased back to [***] or, if Tenant fails or previously failed to substantially complete the Immediate Occupancy/Seismic Work on or before December 31, 2010 as described in clause (A) above, the Letter of Credit Amount shall be immediately increased back to [***].

If Tenant is required to increase the Letter of Credit Amount as described above, Tenant shall cause the issuing bank to effectuate the applicable increase of the Letter of Credit Amount (and to deliver a new replacement or supplemental Letter of Credit to Landlord), within fifteen (15) days after written request from Landlord.

(g) Nature of Letter of Credit. Landlord and Tenant (1) acknowledge and agree that in no event or circumstance shall the Letter of Credit or any renewal thereof or substitute therefor or any proceeds thereof be deemed to be or treated as a “security deposit” under any Law applicable to security deposits in the commercial context including Section 1950.7 of the California Civil Code, as such section now exists or as may be hereafter amended or succeeded (“Security Deposit Laws”), (2) acknowledge and agree that the Letter of Credit (including any renewal thereof or substitute therefor or any proceeds thereof) is not intended to serve as a security deposit, and the Security Deposit Laws shall have no applicability or relevancy thereto, and (3) waive any and all rights, duties and obligations either party may

*** Information has been omitted pursuant to a request for confidential treatment which has been filed separately with the Securities and Exchange Commission.

-10-

now or, in the future, will have relating to or arising from the Security Deposit Laws. Tenant hereby waives the provisions of Section 1950.7 of the California Civil Code and all other provisions of law, now or hereafter in effect, which (i) establish the time frame by which Landlord must refund a security deposit under a lease, and/or (ii) provide that Landlord may claim from the Security Deposit only those sums reasonably necessary to remedy Defaults in the payment of rent, to repair damage caused by Tenant or to clean the Premises, it being agreed that Landlord may, in addition, claim those sums specified in this Paragraph 7 and/or those sums reasonably necessary to compensate Landlord for any loss or damage caused by Xxxxxx’s breach of this Lease or the acts or omissions of Tenant or any of the Tenant Parties (defined in Paragraph 1 of Exhibit H attached hereto), including any damages Landlord suffers following termination of this Lease (as determined in accordance with Paragraph 21 below).

| 8. | USE OF PREMISES AND FACILITIES. |

(a) Tenant’s Use of the Premises. Tenant shall use the Premises for the Permitted Use of the Premises set forth in Subparagraph 1(d) above, and shall not use or permit the Premises to be used for any other purpose without the prior written consent of Landlord, which consent Landlord shall not unreasonably withhold. Landlord makes no representations or warranties that said use of the Premises or any other use of the Premises is permitted by any duly constituted public authority having jurisdiction over the Premises or the conduct of Tenant’s business. Xxxxxx acknowledges and agrees that it, and not Landlord, is responsible to confirm whether the Premises is properly zoned for the Permitted Use of the Premises.

(b) Compliance. At Tenant’s sole cost and expense, Tenant shall procure, maintain and hold available for Landlord’s inspection, all governmental licenses and permits required for Tenant’s use of the Premises and the proper and lawful conduct of Tenant’s business from the Premises. Tenant shall at all times during the Term of this Lease, at its sole cost and expense, observe and comply with the certificate of occupancy issued for the Building, the CC&Rs (defined below) and all laws, statutes, zoning restrictions, ordinances, rules, regulations and requirements of any duly constituted public authority having jurisdiction over the Premises now or hereafter in force relating to or affecting the use, occupancy, alteration or improvement of the Premises including, without limitation, the provisions of Title III of the Americans with Disabilities Act of 1990, as amended. Tenant shall not use or occupy the Premises in violation of any of the foregoing. Tenant shall, upon written notice from Landlord, discontinue any use of the Premises which is declared by any governmental and/or quasi-governmental authority having jurisdiction over the Premises to be a violation of law or of said certificate of occupancy. Tenant shall comply with all rules, orders, regulations and, requirements of the Board of Fire Underwriters or any other insurance authority having jurisdiction over the Premises or any present or future insurer relating to the Premises. Tenant shall promptly, upon demand, reimburse Landlord for any additional premium charged for any existing insurance policy or endorsement required by reason of Tenant’s failure to comply with the provisions of this Paragraph 8. Tenant shall not use or allow the Premises to be used for any improper, immoral, unlawful or objectionable purpose, nor shall Tenant cause, maintain or permit any nuisance in, on or about the Premises. Tenant shall comply with all restrictive covenants and obligations, whether created by private contracts or recorded against the Premises and/or the Premises Land, which affect the use and operation of the Premises, including, without limitation, the Rules and Regulations referred to in Paragraph 32 and attached hereto as Exhibit F and those certain covenants, conditions and restrictions set forth in that certain document recorded February 9, 1979 as Document No. 79-026024 in the Official Records of the County in which the Premises is located (as the same may be subsequently amended, the “CC&Rs”). Tenant shall not commit or suffer to be committed any waste in or upon the Premises. Further, Tenant’s business machines and mechanical equipment which cause vibration or noise that may be transmitted to the Building structure or, in the event any other tenant occupies space in the Building, to any other space in the Building, shall be so installed, maintained and used by Tenant as to eliminate or minimize such vibration or noise. Tenant shall be responsible for all structural engineering required to determine structural load, as well as the expense thereof. Notwithstanding anything to the contrary in this Subparagraph 8(b), in the event any statutes, zoning restrictions, ordinances, rules, regulations and requirements of any duly constituted public authority having jurisdiction over the Premises require modification to the Building that is considered a capital item that can be amortized in accordance with Generally Accepted Accounting Principles (“GAAP”), and such requirement does not arise out of, or is not otherwise related to, (i) Tenant’s particular use of the Premises (as distinguished from a general warehousing use), (ii) the

-11-

performance of Tenant’s Work, or (iii) any other alterations to the Premises performed by or on behalf of Tenant, Landlord shall perform and pay for the cost of such modification(s) and Tenant shall reimburse Landlord as part of Maintenance Expenses (defined in Subparagraph 13(c) below) for the cost of performing such modification(s) on an amortized basis (including a reasonable interest factor determined by Landlord) over the useful life of such modification(s) as reasonably determined by Landlord in accordance with GAAP.

(c) Hazardous Materials. Tenant shall not cause or permit any Hazardous Materials to be brought upon, stored, used, generated, released into the environment or disposed of in, on, under or about the Premises by Tenant, its agents, employees, contractors or invitees, in violation of the terms of Exhibit H attached hereto.

(d) Parking. Landlord grants to Tenant and Tenant’s customers, suppliers, employees and invitees, an exclusive license to use all of the vehicle parking spaces within the designated parking areas at the Premises as shown on Exhibit A (i.e., currently totaling 1,220 spaces) for the use of motor vehicles during the Term of this Lease. Landlord reserves the right at any time to promulgate rules and regulations relating to the use of such parking areas, including reasonable restrictions thereon. Overnight parking is prohibited and any vehicle violating this or any other vehicle regulation adopted by Landlord is subject to removal at the owner’s expense.

(e) Survival. The provisions of this Paragraph 8 shall survive any termination of this Lease.

| 9. | SURRENDER OF PREMISES; HOLDING OVER. |

Upon the expiration of the Term of this Lease including any extension periods, Tenant shall surrender to Landlord the Premises and all Tenant Improvements and/or alterations in good condition, except for (i) ordinary wear and tear, (ii) the effects of casualty or condemnation (except as provided hereunder), (iii) Hazardous Materials that are not the responsibility of Tenant hereunder, and (iv) alterations Tenant has the right or is obligated to remove under the provisions of Paragraph 14 herein; provided, however, Tenant acknowledges and agrees that Tenant shall be required, at its sole cost and expense, to remove all of Tenant’s Work (with the exception of the Non-Removal Items defined below) from the Premises if requested by Xxxxxxxx in its sole and absolute discretion. Subject to Paragraph 14, Tenant shall perform all restoration made necessary by the removal of any alterations or Tenant’s personal property before the expiration of the Term, including, for example, restoring all wall surfaces to their condition prior to the commencement of this Lease. Landlord may elect to retain or dispose of in any manner Tenant’s personal property not removed from the Premises by Tenant prior to the expiration of the Term. Tenant waives all claims against Landlord for any damage to Tenant resulting from Xxxxxxxx’s retention or disposition of Xxxxxx’s personal property. Tenant shall be liable to Landlord for Landlord’s costs for storage, removal or disposal of Tenant’s personal property. Notwithstanding anything to the contrary contained in this Lease, any trade fixtures, cranes and other operations related equipment or conveyances installed by Tenant (whether bolted to the floor, attached to process piping or attached by venting, ducting or other similar appurtenances to the Building) shall at all times be and remain the sole property of Tenant and Tenant can remove such equipment from the Premises at any time so long as Tenant repairs alt damage to the Premises caused by such removal to Landlord’s reasonable satisfaction. For purposes of this Paragraph above, the term “Non-Removal Items” shall be deemed to mean the following portions of Tenant’s Work: Roof Replacement Work, Immediate Occupancy/Seismic Work, Transformer Work and HVAC Chiller Replacement Work.

If Xxxxxx, with Xxxxxxxx’s consent, remains in possession of the Premises after expiration or termination of the Term, or after the date in any notice given by Landlord to Tenant terminating this Lease, such possession by Tenant shall be deemed to be a month-to-month tenancy terminable on written thirty (30) day notice at any time, by either party. All provisions of this Lease, except those pertaining to Term and rent, shall apply to the month-to-month tenancy. During such month-to-month tenancy, Tenant shall pay monthly rent in an amount equal to 150% of Basic Rent for the last full calendar month during the immediately preceding Term plus 100% of additional rent as provided in Paragraph 11 (Taxes), Paragraph 13 (Maintenance), Paragraph 16 (Insurance), subject to increase as provided therein. Any such holdover rent shall be paid on a per month basis without reduction for partial months during the holdover. Acceptance by Landlord of rent after such expiration or earlier termination shall not constitute consent to a hold over hereunder or result in an extension of this Lease. This paragraph shall not be construed to create any express or implied right to

-12-

holdover beyond the expiration of the Term or any extension thereof. If Xxxxxx fails to surrender the Premises after expiration or termination of the Term, Tenant shall indemnify, defend and hold harmless Landlord from all reasonably foreseeable loss or liability, including, without limitation, any loss or liability resulting from any claim against Landlord made by any succeeding tenant founded on or resulting from Xxxxxx’s failure to surrender and losses to Landlord due to lost opportunities to lease any portion of the Premises to succeeding tenants, together with, in each case, actual attorneys’ fees and costs.

| 10. | SIGNAGE. |

Tenant shall have the right to install high quality signage in, on and around the Building subject to any required approvals from the City of Fremont and subject to all statutes, laws, rules, CC&Rs and regulations. The cost of the sign(s), including the installation, maintenance and removal thereof, shall be at Tenant’s sole cost and expense. If Tenant fails to install or maintain its sign(s), or if Tenant fails to remove same upon termination of this Lease and repair any damage caused by such removal, including, without limitation, repainting the Building (if required by Landlord, in Landlord’s sole but reasonable judgment), Landlord may do so at Tenant’s expense. Tenant shall reimburse Landlord for all costs incurred by Landlord to effect such installation, maintenance or removal, which amount shall be deemed additional rent, and shall include, without limitation, all sums disbursed, incurred or deposited by Landlord, including Landlord’s costs, expenses and actual attorneys’ fees with interest thereon at the Interest Rate from the date of Landlord’s demand until payment. Any sign rights granted to Tenant under this Lease are personal to Tenant (and any assignee or sublessee occupying the Premises or any portion thereof pursuant to the terms of Paragraph 19 below) and may not be assigned, transferred or otherwise conveyed to any other party without Xxxxxxxx’s prior written consent, which consent Landlord may withhold in its sole and absolute discretion.

| 11. | TAXES. |

(a) Personal Property Taxes. Tenant shall pay before delinquency all taxes, assessments, license fees and public charges levied, assessed or imposed upon its business operations as well as upon all trade fixtures, leasehold improvements, merchandise and other personal property in or about the Premises.

(b) Real Property Taxes. Tenant shall pay, as additional rent, Tenant’s Share of all Real Property Taxes, including all taxes, assessments (general and special) and other impositions or charges which may be taxed, charged, levied, assessed or imposed with respect to any calendar year or part thereof included within the Term upon all or any portion of or in relation to the Premises or any portion thereof, any leasehold estate in the Premises or measured by rent from the Premises, including any increase caused by the transfer, sale or encumbrance of the Premises or any portion thereof. “Real Property Taxes” shall also include any form of assessment, levy, penalty, charge or tax (other than estate, inheritance, net income or franchise taxes) imposed by any authority having a direct or indirect power to tax or charge, including, without limitation, any city, county, state, federal or any improvement or other district, whether such tax is: (1) determined by the area of the Premises or the rent or other sums payable under this Lease; (2) upon or with respect to any legal or equitable interest of Landlord in the Premises or any part thereof; (3) upon this transaction or any document to which Tenant is a party creating a transfer in any interest in the Premises; (4) in lieu of or as a direct substitute in who or in part of or in addition to any real property taxes on the Premises; (5) based on any parking spaces or parking facilities provided at the Premises; or (6) in consideration for services, such as police protection, fire protection, street, sidewalk and roadway maintenance, refuse removal or other services that may be provided by any governmental or quasi-governmental agency from time to time which were formerly provided without charge or with less charge to property owners or occupants. Tenant shall pay Real Property Taxes on the date any taxes or installments of taxes are due and payable as determined by the taxing authority, evidenced by the tax bill. Landlord shall determine and notify Tenant of the amount of Real Property Taxes not less than ten (10) days in advance of the date such tax or installment of taxes is due and payable. In the event Landlord fails to deliver such timely determination and notice to Tenant, then Tenant shall have ten (10) days from receipt of such notice to remit payment of Real Property Taxes to Landlord. The foregoing notwithstanding, upon notice from Landlord, Tenant shall pay, as additional rent, Real Property Taxes to Landlord in advance monthly installments equal to one twelfth (1/12) of Landlord’s reasonable estimate of the Real Property Taxes payable under this Lease, together with monthly installments of Basic Rent, and Landlord shall hold such

-13-

payments in a non-interest bearing account. Landlord shall determine and notify Tenant of any deficiency in the impound account Tenant shall pay any deficiency of funds in the impound account not Less than thirty (30) days in advance of the date such tax or installment of taxes is due and payable. In the event Landlord fails to deliver such timely deficiency determination and notice to Tenant, then Tenant shall have ten (10) days from receipt of such notice to remit payment of such deficiency to Landlord. If Landlord determines that Xxxxxx’s impound account has accrued an amount in excess of the Real Property Taxes due and payable, then such excess shall be credited to Tenant within thirty (30) days from receipt of said notice from Landlord. Notwithstanding anything to the contrary contained in this Lease, (i) in the event that assessments are levied that may be paid over time without penalty, Tenant shall only be required to pay to Landlord on an annual basis the amount of such assessment owed in that calendar year assuming payment of such assessment without penalty over the longest possible term, and (ii) in no event shall the term “Real Property Taxes” include any estate, inheritance or income taxes.

| 12. | UTILITIES. |

Tenant shall pay directly to the utility companies providing such services, the cost of all water, gas, heat, light, power, sewer, electricity, telephone or other service metered, chargeable or provided to the Premises and in accordance with the foregoing, Tenant agrees to cause the applicable utility companies providing such services to the Premises to put such services in Tenant’s name on or before the earlier of the Lease Commencement Date or the date Tenant first enters the Premises pursuant to any early entry right granted hereunder or otherwise. Landlord shall not be liable in damages or otherwise for any failure or interruption of any utility or other service furnished to the Premises. No such failure or interruption shall entitle Tenant to terminate this Lease or xxxxx rent in any manner and Tenant hereby waives the provisions of any applicable existing or future law, ordinance or regulation permitting the termination of this Lease due to an interruption, failure or inability to provide any services (including, without limitation, the provisions of California Civil Code Section 1932(1)). Notwithstanding anything in this Lease to the contrary, if, as a result of the negligent acts or omissions of Landlord or its agents, contractors or employees, for more than five (5) consecutive business days following written notice to Landlord, there is such an interruption of essential utilities and Building services, such as fire protection, electricity or water, that Landlord contracts for, so that any portion of the Premises cannot be and is not used by Tenant, in Tenant’s judgment reasonably exercised, then Xxxxxx’s rent shall thereafter be abated until the Premises are again usable by Tenant in proportion to the extent to which Xxxxxx’s use of the Premises is interfered with; provided, however, that if Landlord is diligently pursuing the repair of such utilities or services and Landlord provides substitute services reasonably suitable for Tenant’s purposes, as for example, bringing in portable air-conditioning equipment, then there shall not be an abatement of rent. This paragraph shall not apply in case of damage to, or destruction of, the Building, which shall be governed by a separate provision of this Lease.

| 13. | MAINTENANCE. |

(a) Performed by Tenant. Except as provided below, Tenant shall maintain, repair and replace (as necessary) the Premises in good condition, including, without limitation, maintaining, repairing and replacing (as necessary) of all of the following: the unexposed electrical, plumbing and sewerage systems, including, without limitation, those portions of the systems lying outside the Premises; the roof membrane portion of the roof of the Premises; walls; floors; ceilings; telephone equipment and wiring; doors; exterior and interior windows and fixtures; window frames, gutters and downspouts on the Building; the heating, ventilating and air conditioning system servicing the Premises; the outside areas of the Premises and every part thereof, including, without limitation, the soil, landscaping (including replacement thereof), sprinkler system, walkways, parking areas (including periodic sweeping), signs, site lighting and pest control as well as any damage to the Premises caused by Tenant, its agents, contractors, employees or invitees (subject to the terms of the second (2nd ) paragraph of Subparagraph 16(c) below). In accordance with the foregoing, Tenant acknowledges and agrees that it shall, (i) once the HVAC Chiller Replacement Work and Transformer Work are completed, enter into a commercially reasonable HVAC maintenance contract (reasonably approved by Landlord) providing for the regular servicing of the HVAC system not less than quarterly, (ii) once the Roof Replacement Work is completed, enter into a commercially reasonable roof maintenance contract (reasonably approved by Landlord) providing for the regular inspection, patching and repair of the roof not less than quarterly, (iii) broom-sweep the parking area located upon the Premises at least once every month, and (iv) repair and maintain all other

-14-

portions of the Premises that are Tenant’s responsibility pursuant to the terms of this Lease to a commercially reasonable standard (taking into account what other institutional landlords of similar properties located within the Comparison Area [defined in Rider 1 attached hereto] of similar age and size require). Tenant shall comply with the provisions of California Health and Safety Code Sections 26142 and 26145. Tenant shall, at its own expense, provide, install and maintain in good condition all of its personal property required in the conduct of its business on the Premises. If Tenant refuses or neglects to repair, replace and maintain the Premises as required hereunder or in the event any Major Capital Replacement (defined below) is requited, Landlord may at any time following ten (10) days from the date on which Landlord shall make a written demand on Tenant to effect such repair, replacement and maintenance (emergencies excepted in which case no such demand shall be required), enter upon the Premises and, so long as Tenant has not commenced the cure of such refusal or neglect and is not then diligently prosecuting the cure of such refusal or neglect to completion, make such repairs, replacements and/or maintenance without liability to Tenant for any loss or damage which might occur to Tenant’s merchandise, fixtures or other property or to Tenant’s business by reason thereof, and upon completion thereof, Tenant shall pay to Landlord, Landlord’s costs for making such repairs plus ten percent (10%) for overhead, upon presentation of a bill therefor. Said bill shall include interest at the Interest Rate on said costs from the date of completion of the maintenance and repairs by Landlord. Landlord shall have no obligation to provide, install or maintain any of Tenant’s personal property located within the Premises. Notwithstanding the foregoing, if any of Tenant’s repair obligations hereunder include the obligation to replace any major capital item, such major replacement is reasonably estimated to cost in excess of Twenty-Five Thousand Dollars ($25,000) to replace, and the same can be amortized in accordance with GAAP (as applicable, a “Major Capital Replacement”), Landlord initially shall pay for such Major Capital Replacement (or take over the performance of the same pursuant to the terms of this paragraph above) and Tenant shall repay Landlord over the useful life of the same (including a reasonable interest factor determined by Xxxxxxxx) as reasonably determined by Landlord in accordance with GAAP; provided, however, as a condition precedent to Landlord’s obligation to initially pay for such Major Capital Replacement performed by Tenant pursuant to the terms of this sentence above, Tenant shall (A) obtain Landlord’s approval (not to be unreasonably withheld), in advance, of the replacement at issue and the total cost to perform the same, (B) obtain at least three (3) bids from contractors reasonably approved by Landlord (and select the bid from the lowest qualified bidder), and (C) provide Landlord with any and all plans and all lien releases reasonably requested by Landlord and related to such Major Capital Replacement.

(b) Performed by Landlord. Subject to reimbursement by Tenant as hereinafter provided, Landlord shall be responsible to maintain, in good condition, the structural parts of the Premises, which shall include only the foundations, bearing and exterior walls (including painting), subflooring; the structural portions of the roof system and skylights (if any) and all other structural portions of the Building; and the paved and hardscaped parking and driveway areas (including resurfacing and restriping). Landlord shall not be liable for any failure to make any such repairs or any maintenance unless such failure shall persist for an unreasonable time after written notice of the need of such repairs or maintenance is given to Landlord by Tenant.

(c) Reimbursement by Xxxxxx. Prior to the commencement of each calendar year, Landlord shall give Tenant a written estimate of the expenses Landlord anticipates will be incurred for the ensuing calendar year with respect to the maintenance and repair to be performed by Landlord as herein described (the “Maintenance Expenses”). Tenant shall pay, as additional rent, such estimated expenses in equal monthly installments in advance on or before the first day of each month concurrent with its payment of Basic Rent. Within ninety (90) days after the end of each calendar year, Landlord shall furnish Tenant a statement showing in reasonable detail the actual expenses incurred for the period in question and the parties shall within thirty (30) days thereafter make payment or allowance as necessary to adjust Tenant’s estimated payments to the actual expenses as shown by applicable periodic statements submitted by Landlord. If Landlord shall reasonably determine at any time that the estimate of expenses for the current calendar year is or will become inadequate to meet all such expenses for any reason, Landlord shall immediately determine the appropriate amount of such inadequacy and issue a supplemental estimate as to such expenses, and Tenant shall pay any increase in the estimated expenses as reflected by such supplemental estimate within ten (10) days following receipt of written request from Landlord.

-15-

Landlord shall keep or cause to be kept separate and complete books of account covering costs and expenses incurred in connection with its maintenance and repair of the Building and outside areas, which costs and expenses shall include, without limitation, the following: (i) the actual costs and expenses incurred in connection with labor and material utilized in performance of the maintenance and repair obligations hereinafter described, public liability, property damage and other forms of insurance which Landlord may, or is required to, maintain; (ii) employment of such personnel as Landlord may deem reasonably necessary for the performance of Landlord’s obligations under this Lease (including a property manager, whether employed by Landlord or utilizing a third party management company, but excluding all other administrative personnel and overhead expenses); (iii) payment or provision for unemployment insurance, worker’s compensation insurance and other employee costs; (iv) the cost of bookkeeping and accounting services; (v) assessments which may be levied against the Premises under any recorded covenants, conditions and restrictions; and (vi) any other items reasonable necessary from time to time to properly repair, replace and maintain the outside areas and any interest paid in connection therewith. Landlord may elect to delegate its duties hereunder to a professional property manager. Notwithstanding the foregoing, the foregoing costs and expenses to be paid by Tenant as part of Maintenance Expenses do not include, and notwithstanding anything to the contrary in this Lease, Tenant shall not be responsible for the performance or payment directly, or to reimburse Landlord for, all or any portion of the following repairs, maintenance, improvements, replacements, premiums, claims, losses, fees, charges, costs and expenses (collectively, “Excluded Costs”): (A) Costs directly related to the negligent act, omission or violation of Law by Landlord or its agents, employees or contractors; (B) Costs occasioned by fire, acts of God, or other casualties (except for Landlord’s insurance deductibles) or by the exercise of the power of eminent domain (except as provided in Paragraph 18 below); (C) Costs for which Landlord has a right of reimbursement and actually receives reimbursement from others; (D) Costs to correct any latent defect in the Premises or the Building or to comply with any CC&R’s, underwriter’s requirement or Law applicable to the Premises or the Building on the date hereof (except as otherwise provided in Subparagraph 8(b) above); (E) Depreciation or other expense reserves; (F) Interest, charges and fees incurred on debt, payments on mortgages and rent under ground leases; or (G) Costs incurred to investigate the presence of any Hazardous Materials existing upon the Premises prior to the date of this Lease, to respond to any claim of such pre-existing Hazardous Materials contamination or damage, or to remove any such pre-existing Hazardous Material from the Building or Premises Land and any judgments or other Costs incurred in connection with any pre-existing Hazardous Materials exposure or releases, except to the extent such condition is exacerbated by Tenant or its agents, representatives, invitees, employees or contractors.

Except as provided in Paragraph 17 hereof, there shall be no abatement of rent and no liability of Landlord by reason of any injury to or interference with Xxxxxx’s business arising from the making of any repairs, alterations or improvements in or to any portion of the Building or the Premises or in or to fixtures, appurtenances and equipment therein. Except as otherwise expressly provided in this Lease, Tenant waives the right to make repairs at Landlord’s expense under Sections 1941 and 1942 of the California Civil Code or any similar law, statute or ordinance now or hereafter in effect and under the provisions of California Health and Safety Code Section 26143 with respect to those maintenance obligations which are Tenant’s responsibility under the terms of this Lease.

(d) Capital Costs. Notwithstanding the terms of Subparagraphs 13(b) and (c) above, Landlord agrees that during the initial Term of this Lease (i.e., the initial 150-month period), Tenant shall only be responsible to reimburse Landlord as part of Maintenance Expenses for any costs which would otherwise be deemed capital in nature pursuant to GAAP (collectively, “Capital Costs”) to the extent such Capital Costs are amortized (including a reasonable interest factor determined by Landlord) over the useful life (as determined in accordance with GAAP) of such capital improvements, repairs or replacements; provided that Tenant shall be responsible to immediately reimburse Landlord as part of Maintenance Expenses (without regard to the amortization process or the initial Term protection described above) for any Capital Costs to the extent the same are attributable to Tenant’s or any of the Tenant Parties’ negligence or willful misconduct.

| 14. | ALTERATIONS. |

(a) Alterations. Subject to the terms of this Paragraph 14, Tenant shall have the right to perform certain alterations to the Premises. Any alterations made shall remain on and be surrendered with the Premises upon expiration of the Term, except that Landlord may, within thirty (30) days after receipt of written request by Xxxxxx (which notice

-16-

may be given by Tenant prior to or subsequent to Xxxxxx’s making of the applicable alterations), elect to require Tenant to remove any alterations which Tenant may have made, or is contemplating making, to the Premises. If Landlord fails to timely make such election, Tenant shall not be required to remove the applicable alterations which Tenant made, or is contemplating making, to the Premises. If Tenant fails to provide Landlord the above described notice, Landlord may, at anytime prior to that date which is thirty (30) days after the expiration of the Term, elect to require Tenant to remove any alterations which Tenant may have made to the Premises. If Landlord so elects, Tenant shall, at its own cost, restore the Premises to the condition reasonably designated by Landlord in its election, before the last day of the Term or within thirty (30) days after notice of its election is given, whichever is later. Notwithstanding the foregoing, Tenant shall not, without Landlord’s prior written approval, be permitted to make alterations to the Premises that affect the structural portions of, or slab of, the Building, materially and adversely affect the Building’s systems and/or materially affect the appearance of the Building or the Premises Land viewed from the exterior, provided that Tenant shall notify Landlord in writing at least fifteen (15) days prior to the commencement of any alteration(s) and within thirty (30) days of completion of the applicable alteration(s) and, if completed, deliver to Landlord a set of the plans and specifications therefor, either “as built” or marked to show construction changes made. The performance of Tenant’s Work shall not be governed by the terms of this Paragraph 14, but shall rather be governed by the terms of Subparagraph 4(d) and Paragraph 9 above and the Work Letter Agreement attached hereto as Exhibit C.