ASSET PURCHASE AGREEMENT

Exhibit 99.1

THIS ASSET PURCHASE AGREEMENT (this “Agreement”) is made and entered into as of the 20th day of August, 2010, between Pharmachem Laboratories, Inc., a New Jersey corporation (“Purchaser”) and Forbes Medi-Tech Inc., a corporation organized under the British Columbia Business Corporations Act (“Seller”).

RECITALS

WHEREAS, Seller has certain rights to and markets certain neutraceutical products that are more particularly described and defined herein as the “Products”; and

WHEREAS, subject to the terms and conditions of this Agreement, Seller desires to sell to Purchaser, and Purchaser desires to purchase from Seller, the Products, certain other assets related to, or necessary for continued development and marketing of, the Products and certain other assets.

NOW, THEREFORE, in consideration of the premises and the mutual covenants and promises contained herein, and for other good and valuable consideration, the receipt and sufficiency of which hereby are acknowledged, the Parties hereby agree as follows:

ARTICLE I

CERTAIN MATTERS OF CONSTRUCTION AND DEFINITIONS

Certain matters of construction of this Agreement and the definition of capitalized terms used herein but not otherwise defined in Articles I through X are set forth in Schedule 1.

ARTICLE II

PURCHASE AND SALE OF PURCHASED ASSETS

Section 2.1 Purchase and Sale of Purchased Assets. Subject to the terms and conditions of this Agreement, as of the Closing Date, Seller shall grant, sell, convey, assign, transfer and deliver to Purchaser, and Purchaser shall purchase from Seller, all of its right, title and interest in and to all of the Purchased Assets, wherever situated, free and clear of all Encumbrances other than as set forth on Schedule 4.8.

Section 2.2 Retention of Records. Notwithstanding anything contained in this Agreement to the contrary, Seller may retain a copy of all Books and Records, marketing materials and other documents or materials conveyed hereunder for archival purposes, and for the purpose of fulfilling its obligations under Applicable Laws or applicable industry standards and guidelines but for no other uses or purposes.

Section 2.3 Liabilities Assumed.

(a) Purchaser shall assume and be responsible for the Assumed Liabilities arising after the Closing.

(b) Except as provided in (a) above, Purchaser is assuming no Liabilities of Seller, and Seller expressly agrees to retain all Liabilities with respect to the Purchased Assets arising prior to the Closing.

Section 2.4 Closing. The purchase and sale provided for in this Agreement (the “Closing”) will take place at 10:00 a.m. on August 26, 2010, at the offices of counsel for Purchaser, Moritt ▇▇▇▇ Hamroff & ▇▇▇▇▇▇▇▇ LLP, ▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇, ▇▇ ▇▇▇▇▇, or at such other location as the Parties may agree upon. Subject to the provisions of Article IX, failure to consummate the Contemplated Transactions on the date and time and at the place determined pursuant to this Section 2.4 will not result in the termination of this Agreement and will not relieve any Party of any obligation under this Agreement. In such a situation, the Closing will occur as soon as practicable, subject to Article IX.

Section 2.5 Closing Obligations. In addition to any other documents to be delivered under other provisions of this Agreement, at the Closing:

(a) Seller shall deliver to Purchaser:

(i) a ▇▇▇▇ of sale executed by Seller for all of the Purchased Assets that are personal property in substantially the same form as Exhibit 2.5(a)(i) (the “▇▇▇▇ of Sale”);

(ii) a trademark assignment for each of the Seller’s Trademarks in substantially the same form as Exhibit 2.5(a)(ii) (the “Trademark Assignment”);

(iii) a patent assignment for each of the Seller’s Patents in substantially the same form as Exhibit 2.5(a)(iii) (the “Patent Assignment”);

(iv) a copyright assignment for each of the Seller’s Copyrights in substantially the same form as Exhibit 2.5(a)(iv) (the “Copyright Assignment”);

(v) one or more assignment and assumption agreements executed by Seller for each of the Assumed Contracts (the “Assignment and Assumption Agreements”);

(vi) each of the Consents identified on Schedule 4.3 as a required Consent;

(vii) such other bills of sale, assignments, certificates of title, documents and other instruments of transfer and conveyance as may reasonably be requested by Purchaser, each in form and substance satisfactory to Purchaser and its legal counsel and executed by Seller, including the assignment of any Intellectual Property rights that may have arisen in any independent contractors of the Seller by virtue of work performed by such contractors;

2

(viii) a certificate executed on behalf of Seller as to the accuracy of its representations and warranties as of the date of this Agreement and as of the Closing in accordance with Section 7.1 and as to its compliance with and performance of its covenants and obligations to be performed or complied with at or before the Closing in accordance with Section 7.2; and

(ix) an Escrow Agreement in substantially the same form as Exhibit 2.5(a)(ix) hereto (the “Escrow Agreement”).

(b) Purchaser shall deliver to Seller:

(i) the portion of the Purchase Price described in Section 3.2 other than the Down Payment paid as described in Section 3.1;

(ii) Assignment and Assumption Agreement for the Assumed Liabilities executed by Purchaser;

(iii) a certificate executed by Purchaser as to the accuracy of its representations and warranties as of the date of this Agreement and as of the Closing in accordance with Section 8.1 and as to its compliance with and performance of its covenants and obligations to be performed or complied with at or before the Closing in accordance with Section 8.2; and

(iv) the Escrow Agreement.

Section 2.6 Purchase Price Allocation. Prior to Closing, Purchaser and Seller shall allocate the Purchase Price among the Purchased Assets. Each Party shall report the transaction in accordance with such allocation and shall not take a position inconsistent with such allocation except with the written consent of the other Party, such consent not to be unreasonably withheld or delayed. Purchaser and Seller shall complete IRS Form 8594 and any form required by any Governmental or Regulatory Authority in any Foreign Jurisdiction reflecting such allocation, and Purchaser and Seller will take no position with any Governmental or Regulatory Authority inconsistent therewith.

ARTICLE III

CONSIDERATION

Section 3.1 Down Payment. The Parties acknowledge that Purchaser has paid $200,000 via wire transfer of immediately available funds to an account specified by ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇ LLP, counsel for Seller, in trust, as a down payment (the “Down Payment”) to be held pending execution and delivery of this Agreement by both Parties. On execution and delivery of this Agreement by both Parties, Seller shall terminate the Asset Purchase Agreement dated July 9, 2010 between MHT, LLC (“MHT”) and Seller (the “MHT Agreement”) pursuant to Section 9.1(g) of the MHT Agreement, and ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇ LLP shall pay the Down Payment by trust cheque, bank draft or wire transfer of immediately available funds to MHT in satisfaction of the payment due to MHT pursuant to Section 9.2 of the MHT Agreement. On execution and delivery of this Agreement by both Parties and termination by Seller of the MHT Agreement as aforesaid, the Down Payment is non-refundable (including if the sale and purchase of the Purchased Assets provided for herein is not completed in accordance with the terms and conditions hereof), but is creditable against the Purchase Price if the sale and purchase of the Purchased Assets provided for herein is completed in accordance with the terms and conditions hereof. Nothing in this Section will limit any rights or remedies that Purchaser may have under Section 6.9 of this Agreement, or for damages in the event of breach of this Agreement by Seller.

3

Section 3.2 Purchase Price.

(a) The aggregate purchase price for the Purchased Assets shall be $4,000,000 (the “Purchase Price”) and shall be comprised of:

(i) $200,000 on account of the Down Payment paid as described in Section 3.1;

(ii) $146,899 for the Qualified Inventory transferred to Purchaser by Seller on the Closing Date; and

(iii) $3,653,101 for all other Purchased Assets.

(b) The Purchase Price shall be subject to adjustment as follows:

(i) Seller, Purchaser and Purchaser’s certified public accountants shall complete an inventory as of a date not more than three Business Days prior to the Closing Date to determine the value of the Qualified Inventory to be transferred to Purchaser by Seller on the Closing Date (the “Closing Inventory”). Without limiting the foregoing, the Parties may by mutual agreement from time to time update the Qualified Inventory and Assumed Contracts for any Contracts for the supply or sale of Inventory or Products that Seller may enter into with third parties after the date of this Agreement and prior to the Closing with the knowledge and consent of Purchaser.

For the purposes of calculating the Closing Inventory in this Agreement, Qualified Inventory shall be valued at [Redacted – percentage factor used to value Qualified Inventory] of the original value of the Qualified Inventory determined on the weighted average cost method of accounting for inventory, in accordance with GAAP. The Closing Inventory shall not include the value of Unqualified Inventory.

(ii) At the Closing, if the Qualified Inventory shall exceed $146,899, Purchaser shall pay to Seller at Closing an additional amount equal to such excess, or if the Qualified Inventory shall be less than $146,899, Purchaser shall deduct from the amount paid to Seller at Closing an amount equal to such shortfall, with any such additional amount or deduction valued in the manner stated for Qualified Inventory in the preceding paragraph.

4

(iii) Notwithstanding the foregoing, Purchaser shall retain all rights to indemnification in respect of a breach of the representation made by Seller in Section 4.12.

(c) At the Closing, Purchaser shall deliver to the escrow agent, pursuant to the terms of the Escrow Agreement, $250,000, in the form of a wire transfer in immediately available funds (the “Closing Escrow”), and shall deliver to Seller the amount of the Purchase Price, as adjusted pursuant to Section 3.2(b) and less the Closing Escrow and the Down Payment previously paid by Purchaser to ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇ LLP as described in Section 3.1, via wire transfer in immediately available funds. On the date that is six months after the Closing Date, the Parties will instruct the escrow agent in writing to pay to Seller the then amount held in escrow pursuant to the Escrow Agreement unless any claims have been made by Purchaser pursuant to Section 6.9(a) of this Agreement, in which case an amount equal to the aggregate amount of such unresolved claims will be retained by the escrow agent as provided in the Escrow Agreement and the balance paid to Seller. Any amount so retained by the Escrow Agent will only be paid out in accordance with Sections 3(a) or (b) of the Escrow Agreement.

ARTICLE IV

REPRESENTATIONS AND WARRANTIES OF SELLER

Seller represents and warrants to Purchaser, as follows:

Section 4.1 Organization. Seller is a corporation duly organized, validly existing and in good standing under the laws of British Columbia, Canada and has all requisite power and authority to own and transfer the Purchased Assets.

Section 4.2 Authority of Seller; Seller Board Recommendation.

(a) Seller has all necessary power and authority to enter into this Agreement and, subject to termination of the MHT Agreement and obtaining the approval of the Seller’s stockholders of the sale of the Purchased Assets, to carry out the Contemplated Transactions. Subject to the Seller’s stockholders approving the sale of the Purchased Assets, Seller has, and by the Closing, its stockholders will have, taken all action required by Applicable Laws and Seller’s Organizational Documents, to be taken by them to authorize the execution and delivery of this Agreement by Seller and the consummation of the Contemplated Transactions. This Agreement has been duly and validly executed and delivered by Seller and, when duly authorized, executed and delivered by Purchaser, will constitute a legal, valid, binding and enforceable obligation of Seller.

(b) Seller’s board of directors, at a meeting duly called and held at which a quorum was present throughout, has by the unanimous vote of the directors (i) determined that this Agreement and the Contemplated Transactions are fair to and in the best interests of the Seller’s stockholders and (ii) resolved to recommend that the holders of the shares of Seller’s capital stock entitled to vote thereon approve the sale by Seller of the Purchased Assets (the “Seller Board Recommendation”). As of the date of this Agreement, the Seller Board Recommendation has not been withdrawn, revoked or modified.

5

Section 4.3 Consents and Approvals. No Consents of, or registrations, declarations or filings with, any Governmental or Regulatory Authority, or by any customer, supplier or any other Person, are required by or with respect to Seller in connection with the execution and delivery of this Agreement by Seller or the performance of its obligations hereunder, except for such Consents required from the parties set forth on Schedule 4.3 attached hereto.

Section 4.4 Non-Contravention. The execution and delivery by Seller of this Agreement does not, and the performance by Seller of its obligations under this Agreement and the consummation of the Contemplated Transactions will not:

(a) conflict with or result in a violation or breach of any of the terms, conditions or provisions of Seller’s Organizational Documents, other than such conflicts, violations or breaches as would not have a material adverse effect on Seller or the Purchased Assets;

(b) conflict with or result in a violation or breach of any term or provision of any Applicable Laws applicable to Seller or the Purchased Assets, other than such conflicts, violations or breaches as would not have a material adverse effect on Seller or the Purchased Assets; or

(c) conflict with or result in a breach or default (or an event which, with notice or lapse of time or both, would constitute a breach or default) under, or result in the termination or cancellation of, or create in any Person the right to accelerate, terminate, modify or cancel, or require any notice under any Assumed Contract to which Seller is a party or by which it is bound or to which any of its assets are subject, or result in the creation or imposition of any Encumbrance upon any of the Purchased Assets other than as set forth on Schedule 4.3 attached hereto.

Section 4.5 Intellectual Property Rights.

(a) Seller owns or, as set forth on Schedule 1.3(u), has the right to use pursuant to license, sublicense, agreement, or permission all of Seller’s Patents and the other Intellectual Property, free and clear of all Encumbrances (other than as set forth on Schedule 4.8), and subject to termination of the MHT Agreement is legally entitled to transfer the Intellectual Property, or the right to use the Intellectual Property, to Purchaser, except as set forth on Schedule 4.5. Each item of Intellectual Property owned or used by Seller will be available for use by the Purchaser on identical terms and conditions immediately following the Closing Date. The Intellectual Property constitutes all of such property reasonably necessary for the operation of the Business as presently conducted.

(b) To the best Knowledge of Seller, the Intellectual Property, the use of Intellectual Property and the Products, and the transfer of the foregoing to Purchaser under this Agreement does not infringe, violate, misappropriate or otherwise interfere or conflict with the rights of any Person, and Seller has not received notice from any Person of any claims of superior rights, infringement, misappropriation, or adverse claims with respect thereto.

6

(c) There are no Actions or Proceeding pending or, to the best Knowledge of Seller, threatened, which challenges the legality, validity, enforceability, or use of Seller’s sole ownership of the Intellectual Property and right to transfer same to Purchaser. To the best Knowledge of Seller, there is no basis for a Person to make any demand, bring any Action or Proceeding or to claim that the past, present or continued use of any of the Intellectual Property or Products infringes, violates, misappropriates or otherwise interferes with the rights of any Person.

(d) Seller has timely made all filings, payments of fees by final payment dates and recordations with the applicable Governmental or Regulatory Authority as required by Applicable Laws to maintain its interest in Seller’s Patents and Seller’s Trademarks as set forth on Schedule 4.5(d) other than as set forth in Schedule 4.5(d), and all such registrations and applications remain in full force and effect and have not been abandoned or withdrawn other than as set forth in Schedule 4.5(d). Seller has delivered to Purchaser a correct and complete copy of all registrations, renewals and other filings related to Seller’s Patents and Seller’s Trademarks set forth on Schedule 4.5(d).

(e) Seller has taken all action that would be considered commercially reasonable for a similarly situated business that is not planning or anticipating a liquidation, to maintain and protect its sole ownership rights in the Intellectual Property. Without limiting the generality of the foregoing, Seller has used all commercially reasonable efforts to protect the secrecy of all confidential information and trade secrets. Seller has not licensed or otherwise transferred to any Person any right to review, use or disclose any confidential information or trade secret, except pursuant to a nondisclosure agreement, and, to the best Knowledge of Seller, no Person has breached any such agreement. All confidential information and trade secrets have been reduced to writing in sufficient detail and content to identify, explain and enable a Person reasonably skilled in the Business to use and fully exploit such confidential information and trade secrets without reliance on the special Knowledge or memory of others, and all such writings have been provided to Purchaser.

(f) Seller has made no previous assignment, transfer or agreement constituting a present or future interest in or assignment or transfer of any of the Intellectual Property other than as set forth on Schedule 4.5(f). Seller has granted no release, covenant not to ▇▇▇, or non-assertion assurance to any Person with respect to any part of the Intellectual Property. Except as set forth on Schedule 4.5(f), there are no agreements that restrict or limit the use by Seller or Purchaser, of the Intellectual Property. No intellectual property other than the Intellectual Property (whether owned by Seller or another Person) is necessary for Seller to fully exploit the Intellectual Property prior to the Closing Date for the operation of the Business as presently conducted.

Section 4.6 Litigation. Except as set forth on Schedule 4.6, there are no Actions or Proceedings pending, threatened or reasonably anticipated against Seller or its Affiliates that relate to (a) the Purchased Assets or the Business; (b) this Agreement; or (c) the Contemplated Transactions. Seller is not subject to any Order that could reasonably be expected to materially impair or delay the ability of Seller to perform its obligations hereunder.

7

Section 4.7 Compliance with Law. Seller has not committed, through an act, failure to act or otherwise, any violation of any Applicable Laws with respect to the Products or the Business except as would not have a material adverse effect on Seller or the Purchased Assets, and Seller has not received any written notice from any Person alleging any violation of such Applicable Laws.

Section 4.8 Purchased Assets. Except as set forth on Schedule 4.8 and subject to termination of the MHT Agreement, Seller has good and marketable title to the Purchased Assets free and clear of any Encumbrances and, subject to termination of the MHT Agreement and Seller’s stockholders approving the sale of the Purchased Assets, has the legal right and ability to transfer such assets to Purchaser. The tangible personal property included in the Purchased Assets is, except for ordinary wear and tear, in good condition and repair and usable in the ordinary course of business.

Section 4.9 Brokers. Seller has not retained any broker in connection with the Contemplated Transactions. Purchaser has no, and will have no, obligation to pay any brokers, finders, investment bankers, financial advisors or similar fees in connection with this Agreement or the Contemplated Transactions by reason of any action taken by or on behalf of Seller.

Section 4.10 No Non-Competition Agreements or Preferential Obligations. The Purchased Assets are not subject to any non-competition agreements with, or other agreements granting preferential rights to any Person to purchase or license the Purchased Assets, other than as set forth on Schedule 4.10.

Section 4.11 Products Not Subject of FDA Review. Except as set forth in Schedule 4.11, since June 30, 2007, there has been no correspondence between Seller and the FDA regarding the Products.

Section 4.12 Inventory. As of July 9, 2010, Schedule 4.12 lists and identifies the Inventory that will be transferred to Purchaser by Seller on the Closing Date and its location. All of the Qualified Inventory is merchantable and fit for the purpose for which it was procured or manufactured.

Section 4.13 Contracts. Schedule 4.13 sets forth each Contract other than the MHT Agreement related to or affecting the Purchased Assets. With respect to each such Contract: (A) the Contract is legal, valid, binding, enforceable, and in full force and effect except as set forth on Schedule 4.13; (B) no party is in breach or default, and, to Seller’s Knowledge, no event has occurred which with notice or lapse of time would constitute a breach or default, or permit termination, modification, or acceleration, under the Contract, except as set forth on Schedule 4.13; and (C) no party has repudiated any provision of the Contract. Seller has delivered to Purchaser a correct and complete copy of each Contract listed in Schedule 4.13 and a written summary setting forth the terms and conditions of each oral agreement referred to in Schedule 4.13.

Section 4.14 Undisclosed Liabilities. Seller has no Liability that would materially adversely affect the Purchased Assets. Except for current year ad valorem Taxes not yet due and payable, Seller has no Liabilities, whether accrued, absolute, contingent or otherwise, due or to become due, including Liabilities for federal, state, local or foreign Taxes that, following consummation of the Contemplated Transactions, would be binding upon Purchaser or the Purchased Assets.

8

Section 4.15 Product Liability. Seller has no Liability (and there is no basis for any present or future Action or Proceeding against Seller giving rise to any Liability) arising out of any injury to individuals or property as a result of the ownership, possession, storage, distribution, marketing or sale of any of the Products.

Section 4.16 Product Warranty. All of the Products have been manufactured in conformity in all material respects with all applicable contractual commitments and all express and implied warranties, and Seller has no Liability (and there is no basis for any present or future Action or Proceeding against Seller giving rise to any Liability) for replacement thereof or other damages in connection therewith other than as set forth on Schedule 4.16. None of the Products is subject to any guaranty, warranty, right of return or other indemnity beyond the applicable terms and conditions of the Assumed Contracts and the standard Product return policy of Seller (any obligations incurred thereunder, the “Product Return Obligations”). Schedule 4.16 includes copies of the standard Product return policy of Seller.

Section 4.17 Permits. Seller holds all the franchises, licenses, permits, Consents and other authorizations (collectively, the “Permits”) which are necessary for the operation of the Business in the jurisdictions set forth on Schedule 4.17, including all Permits issued by the FDA or any Governmental or Regulatory Authority. Schedule 4.17 sets forth a complete list of all Permits held by Seller for the jurisdictions set forth on such schedule. Seller is not in default, nor has Seller received any notice of any claim of default, with respect to any of the Permits, or any notice of any other Action or Proceeding, or threatened Action or Proceeding, relating to any of the Permits. All of the Permits are in full force and effect. Except as set forth on Schedule 4.17, the Contemplated Transactions will not result in the cancellation or termination of any of the Permits, and no Consent from, or notice to (other than as set forth on Schedule 4.17, all of which notices set forth on Schedule 4.17 will be the responsibility of Purchaser if required by Purchaser), any Governmental or Regulatory Authority in the jurisdictions set forth on Schedule 4.17 is required to transfer any of the Permits to Purchaser.

Section 4.18 Insurance. Seller has delivered to Purchaser complete and correct copies of all insurance policies maintained (at present or any time during the past three years) by or on behalf of Seller or relating to the Business or the Purchased Assets, together with all riders and amendments thereto and a description of all insurance claims made by the Seller during the three years preceding the date of this Agreement. Set forth on Schedule 4.18 is a list of all the insurance policies in effect as of the date hereof. Such policies are in full force and effect, and all premiums due therein have been paid. Seller has complied in all respects with the terms and provisions of such policies applicable to it. No notice of termination or premium increase has been received under any of the policies. Seller is not in breach or default, and no event has occurred that, with notice or the lapse of time, would constitute such a breach or default or permit termination, modification or acceleration under such policy.

9

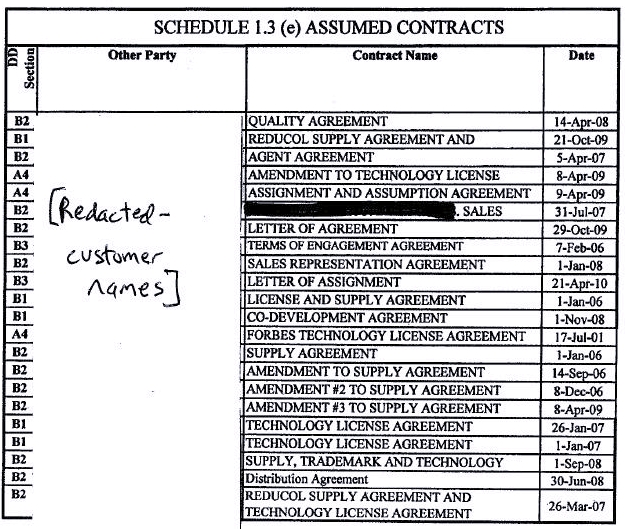

Section 4.19 Accounts Payable. As of the Closing, except for those amounts expressly enumerated in Schedule 1.3(e) (as may be updated by the Parties from time to time) as unpaid accounts payable constituting Assumed Contracts, Seller has no (i) accounts payable that are payable to Persons engaged in the manufacture, shipment or storage of the Inventory other than as set forth in Schedule 4.19 (which amounts set forth on Schedule 4.19 shall be satisfied by Seller as soon as reasonably practicable following the Closing) or (ii) other payables which, if not paid, would reasonably be expected to have a material adverse effect on Purchaser’s conduct of the Business following the Closing.

Section 4.20 Financial Statements. Seller has delivered to Purchaser the following financial statements (collectively the “Financial Statements”): (i) Seller’s audited balance sheets and statements of income and cash flow as of and for the fiscal years ended December 31, 2007, 2008 and 2009 certified by Seller’s accountants and (ii) Seller’s unaudited balance sheets and statements of income and cash flow as of and for the quarter ended March 31, 2010. The Financial Statements (including the notes thereto) have been prepared in accordance with GAAP, except in case of the March 31, 2010 Financial Statements subject to normal year end adjustments and the absence of disclosures normally made in footnotes. The Financial Statements present fairly in all material respects the financial condition of Seller as of such dates and the results of operations of Seller for such periods.

Section 4.21 Survival of Representations and Warranties. The representations, warranties and agreements of Seller set forth in this Agreement are made as of the date of this Agreement (except as otherwise noted) and shall be true, correct, complete and accurate on and as of the Closing Date and at all times between the date of this Agreement (except as otherwise noted) and the Closing Date. The representations and warranties of Seller set forth in this Agreement shall survive the Closing for the period set forth in Section 6.9(d).

Section 4.22 Purchaser’s Acknowledgement. SELLER EXPRESSLY DISCLAIMS, AND PURCHASER ACKNOWLEDGES, THAT EXCEPT FOR THE REPRESENTATIONS AND WARRANTIES IN ARTICLE IV, SELLER HAS NOT MADE NOR HAS PURCHASER RELIED UPON ANY REPRESENTATIONS OR WARRANTIES, EXPRESS OR IMPLIED, RELATING TO SELLER, THE PURCHASED ASSETS, OR THE BUSINESS.

Section 4.23 Disclosure. Neither this Agreement, the Schedules nor any Exhibit, Appendix or Schedule hereto or thereto, contains an untrue statement of a material fact or omits to state a material fact necessary to make the statements contained herein or therein, in light of the circumstances under which they were made and taken as a whole, not misleading. There is no fact which Seller has not disclosed to Purchaser and its counsel in writing and of which Seller is aware to the best Knowledge of Seller which materially and adversely affects or could materially and adversely affect the Purchased Assets, prospects, condition (financial and otherwise), operations, property or affairs of the Business.

10

ARTICLE V

REPRESENTATIONS AND WARRANTIES OF PURCHASER

Purchaser represents and warrants to Seller as follows:

Section 5.1 Organization. Purchaser is a New Jersey corporation duly organized, validly existing and in good standing under the laws of the state of New Jersey and has all requisite power and authority to own its assets and carry on its business as currently conducted by it.

Section 5.2 Authority of Purchaser. Purchaser has all necessary power and authority to enter into this Agreement and to carry out the Contemplated Transactions. Purchaser has taken all action required by Applicable Laws, its Organizational Documents, or otherwise to be taken by it to authorize the execution and delivery of this Agreement by Purchaser and the consummation of the Contemplated Transactions. This Agreement has been duly and validly executed and delivered by Purchaser and, when duly authorized, executed and delivered by Seller, will constitute a legal, valid, binding and enforceable obligation of Purchaser.

Section 5.3 Consents and Approvals. No Consents or authorizations of, or registrations, declarations or filings with, any Governmental or Regulatory Authority are required by Purchaser in connection with the execution and delivery of this Agreement by Purchaser or the performance of its obligations hereunder.

Section 5.4 Non-Contravention. The execution and delivery by Purchaser of this Agreement does not, and the performance by it of its obligations under this Agreement, and the consummation of the Contemplated Transactions will not conflict with or result in a violation or breach of any of the terms, conditions or provisions of Purchaser’s Organizational Documents or conflict with or result in a violation or breach of any term or provision of any Applicable Laws.

Section 5.5 Litigation. There are no Actions or Proceeding pending or, to the Knowledge of Purchaser threatened or reasonably anticipated against Purchaser which if adversely determined would delay the ability of Purchaser to perform its obligations hereunder.

Section 5.6 No Financing Required. Purchaser does not require any financing in order to complete the sale and purchase of the Purchased Assets and to pay the Purchase Price provided for herein in accordance with the terms and conditions hereof.

Section 5.7 Seller’s Representations. To the Knowledge of Purchaser, Purchaser is as of the date of this Agreement not aware of any facts or circumstances relating to the Business or the Purchased Assets which could reasonably form the basis for a claim by Purchaser based upon a breach of any of the representations and warranties of Seller contained in this Agreement.

ARTICLE VI

COVENANTS OF THE PARTIES

11

Section 6.1 Conduct of the Business. The Parties acknowledge that it is the intention of the Seller that the Seller shall seek approval from its stockholders for the dissolution and liquidation of the Seller following the completion of the sale of the Purchased Assets and that, although it is not intended that such liquidation, and the appointment of a liquidator, will take effect until following completion of the sale of the Purchased Assets, Seller has taken or shall take steps, prior to the completion of the sale of the Purchased Assets, to seek authorization from its stockholders of the liquidation of the Seller and the appointment of a Person as liquidator for the Seller, which appointment shall take effect on a date after the date specified for the Closing Date in this Agreement. Pending the Closing, Seller shall use its commercially reasonable efforts in the context of the circumstances described in this Section to work with Purchaser in good faith to operate the Business and to preserve the Business, its goodwill and business relationships. Pending the Closing, in order to maintain the current status quo, and except as contemplated by this Agreement or otherwise expressly consented to or approved in writing by Purchaser, Seller covenants and agrees with Purchaser as follows: Seller shall not: (a) effect any material change to the Business; (b) enter into, terminate, modify or waive any agreement, understanding, commitment, relationship or transaction with respect to the Business except in the ordinary course of the Business consistent with past practices; (c) amend, terminate, modify or waive any terms of the Assumed Contracts; (d) sell, lease, grant a license with respect to or otherwise encumber or dispose of any of the Purchased Assets except in the ordinary course of the Business consistent with past practices; (e) grant, create or suffer an Encumbrance upon any of the Purchased Assets; (f) incur any Liability, contingent or otherwise, except in the ordinary course of the operation of the Business; or (g) defer the payment of any Liability, or satisfy any other obligation in respect of the Business or the Purchased Assets, other than in the ordinary course of the operation of the Business.

Section 6.2 Governmental Filings. Each Party will prepare and file whatever filings, requests or applications that are required to be filed with any Governmental or Regulatory Authority in connection with the consummation of the Contemplated Transactions. Each Party will provide the other a reasonable opportunity to review and comment upon any such filings, requests or applications prior to filing.

Section 6.3 Seller Stockholder Approval. Seller has taken or shall take all action in accordance with Applicable Laws and the Organizational Documents necessary to convene a meeting of Seller’s stockholders, to make the Seller Board Recommendation to Seller’s stockholders, to hold and complete such meeting on the earliest practicable date following the execution of this Agreement, and to consider and vote upon approval of the sale of the Purchased Assets. Except as set forth in Section 9.1(g), neither the Seller’s board of directors nor any committee of the Seller’s board of directors shall withdraw, amend or modify, or propose or resolve to withdraw, amend or modify, in a manner adverse to Purchaser, the Seller Board Recommendation.

Section 6.4 Due Diligence; Cooperation.

(a) During the period commencing on the date hereof and ending on the earlier of (i) the Closing Date and (ii) the date on which this Agreement is terminated pursuant to Section 9.1, Seller shall upon Purchaser’s reasonable notice, afford Purchaser and its representatives, reasonable access during normal business hours to Seller’s books and records and, during such period, Seller shall furnish promptly to Purchaser all information concerning the Purchased Assets and the Business, as Purchaser may reasonably request.

12

(b) Each Party shall reasonably cooperate with the others (in the case of Seller, until the appointment of a liquidator for Seller as described in Section 6.1 which Seller agrees will not occur prior to September 1, 2010, and thereafter, to the extent that such actions are required by this Agreement or the liquidator considers necessary or advisable for the liquidation of Seller until Seller is dissolved) in preparing and filing all notices, applications, submissions, reports and other instruments and documents that are necessary, proper or advisable under Applicable Laws to consummate and make effective the Contemplated Transactions, including Seller’s reasonable cooperation in the efforts of Purchaser to obtain any required Consents and approvals of any Governmental or Regulatory Authority.

(c) Each Party shall reasonably cooperate with the other to continue all manufacturer, vendor, repackager and Governmental and Regulatory Authority relationships and any other relationships necessary for the sale of the Products by the Purchaser after the Closing (in the case of Seller, until the appointment of a liquidator for Seller as described in Section 6.1 which Seller agrees will not occur prior to September 1, 2010, and thereafter, to the extent that such actions are required by this Agreement or the liquidator considers necessary or advisable for the liquidation of Seller until Seller is dissolved).

(d) Seller will cooperate with Purchaser to apply for, obtain, maintain, and enforce all Intellectual Property, including the execution and legalization of documents until the appointment of a liquidator for Seller as described in Section 6.1 which Seller agrees will not occur prior to September 1, 2010, and thereafter, to the extent that such actions are required by this Agreement or the liquidator considers necessary or advisable for the liquidation of Seller until Seller is dissolved, provided that Purchaser shall reimburse Seller for all reasonable costs and expenses relating to the provision of such services.

(e) During the period between the execution of this Agreement and the Closing, Seller shall permit Purchaser and its authorized representatives to contact [Redacted –customer name] to discuss, among other things, the assignment of the License and Supply Agreement by and between Seller and [Redacted – customer name] dated January 1, 2006, as amended (the “[Redacted – customer name] Agreement”). In addition, with the Seller’s prior consent, Seller shall permit Purchaser to meet with Seller’s significant customers and suppliers.

Section 6.5 Bulk Sales. The Parties waive compliance with all Applicable Laws in respect of bulk sales that may be applicable to the Contemplated Transactions.

Section 6.6 Further Assurances. On and after the Closing Date until the appointment of a liquidator for Seller as described in Section 6.1 which Seller agrees will not occur prior to September 1, 2010, and thereafter, to the extent that such actions are required by this Agreement or the liquidator considers necessary or advisable for the liquidation of Seller until Seller is dissolved, Seller shall from time to time, at the request of Purchaser, execute and deliver, or cause to be executed and delivered, such other instruments of conveyance and transfer and take such other actions as Purchaser may reasonably request, in order to more effectively consummate the Contemplated Transactions and to vest in Purchaser good and marketable title to the Purchased Assets, including executing any document necessary to record, maintain or perfect Purchaser’s right and title in the Intellectual Property. Without limiting the foregoing, on and after the Closing Date until the appointment of a liquidator for Seller as described in Section 6.1 which Seller agrees will not occur prior to September 1, 2010, and thereafter, to the extent that such actions are required by this Agreement or the liquidator considers necessary or advisable for the liquidation of Seller until Seller is dissolved, Seller agrees to cooperate with Purchaser and to comply with all formalities prescribed by the relevant patent or trademark office or reasonably required by Purchaser (the “Formalities”) resulting in a document or documents evidencing or establishing the assignment, conveyance and transfer of the Seller’s Patents and Seller’s Trademarks to Purchaser that allows the assignment to be fully effective. Purchaser shall reimburse Seller for any reasonable out of pocket expenses or costs incurred in connection with such cooperation, and Purchaser shall bear all costs and expenses associated with the preparation and presentation of such Formalities and assignment.

13

Section 6.7 Delivery of Inventory. Seller will deliver the Inventory to Purchaser at Seller’s warehouse where the Inventory is stored (as listed on Schedule 4.12). The Inventory will be delivered on the Closing Date. For clarity, Seller fulfills its obligation to deliver when it has made the Inventory available to Purchaser at Seller’s warehouse where the Inventory is stored. Seller is not responsible for loading the Inventory on Purchaser’s carrier or for clearing the Inventory for export.

Section 6.8 Patent and Trademark Prosecution. After the Closing Date, Purchaser shall have the sole right (but not the obligation) to prepare, file, prosecute and maintain all Seller’s Patents and Seller’s Trademarks worldwide at Purchaser’s sole expense (including filing all unfiled confirmatory assignments entered into between Seller (or its predecessors, as the case may be) and ▇▇▇▇’▇ ▇▇▇▇▇▇ Income Corporation (formerly Forbes Medi-Tech Inc., a predecessor to Seller) or Novartis prior to the Closing Data confirming the assignment of Seller’s Patents and Seller’s Trademarks to Seller (or its predecessors, as the case may be) (the “Confirmatory Assignments”).

Section 6.9 Indemnification.

(a) By Seller. Subject to Sections 6.9(d), (e) and (f), Seller shall indemnify, reimburse, and hold harmless Purchaser, its Affiliates, and their respective officers, managers, directors, employees, agents, successors and assigns from and against any and all costs, losses, Liabilities, damages, pending, threatened or concluded lawsuits, deficiencies, claims and expenses (including reasonable fees and disbursements of attorneys) (collectively, the “Damages”) to the extent such Damages are incurred in connection with or arise out of (i) any breach of any covenant or agreement of Seller herein; (ii) the breach of any representation or warranty made by Seller in this Agreement, in each case without giving effect to any limitation in such representation or warranty based upon the absence of a material adverse effect or any other materiality qualification; (iii) Liabilities related to the Products or Purchased Assets arising out of the operation of the Business prior to the Closing Date (excluding the Assumed Liabilities); and (iv) Product Return Obligations for Products sold by Seller prior to the Closing Date.

14

(b) By Purchaser. Subject to Sections 6.9(d), (e) and (f), Purchaser shall indemnify, reimburse, and hold harmless Seller, its Affiliates and their respective officers, directors, employees, agents, successors and assigns from and against any and all Damages to the extent such Damages are incurred in connection with or arise out of (i) any breach of any covenant or agreement of Purchaser herein; (ii) the breach of any representation or warranty made by Purchaser in this Agreement; and (iii) any Assumed Liabilities; and (iv) the ownership or use of the Products and the other Purchased Assets following the Closing Date.

(c) Damages Net of Insurance. The failure of any Purchaser indemnified party to seek available insurance coverage or insurance proceeds for any Damages otherwise reimbursable by Section 6.9 shall not adversely affect such Purchaser indemnified party’s rights to indemnification in respect thereof under Section 6.9. If, however, the Purchaser indemnified party receives insurance proceeds in respect of any such Damages, the amount of such insurance proceeds less any associated costs, including reasonable attorney fees, incurred in obtaining such proceeds, shall be excluded in determining the amount of Damages subject to an indemnification claim.

(d) Limitations.

(i) No Party will have Liability (for indemnification or otherwise) with respect to claims of breach of any representation, warranty or covenant, contained in this Agreement unless on or before the date that is six months following the Closing Date, the otherwise liable Party is notified by the other Party of a claim specifying the factual basis of that claim in reasonable detail to the extent then known, and in the case of liability of Seller, in respect of any claims made after the date that a liquidator is appointed for Seller as described in Section 6.1, such claims shall be subject to the provisions of the Business Corporations Act (British Columbia) and other Applicable Laws applicable to the liquidation and dissolution of Seller. In addition, and notwithstanding anything set forth herein to the contrary, in no event shall a Party’s liability for indemnification claims or other claims with respect to, or in connection with, a breach of a representation or warranty under Article IV or V or any other agreement or covenant contained in this Agreement exceed the Purchase Price, as adjusted pursuant to Section 3.2(b).

(ii) Except for claims based on Seller’s fraud, no indemnified party shall be entitled to indemnification pursuant to this Section 6.9 until the aggregate amount of all Damages suffered, incurred or paid by one or more indemnified parties exceeds $12,500 and thereafter to the extent that any Damages exceed $12,500.

(e) Procedure for Indemnification – Third Party Claims. Promptly after receipt by an indemnified party under Section 6.9(a) or 6.9(b) of notice of commencement of any proceeding against it by a third party (not a Party or Affiliate of a Party to this Agreement), such indemnified party will, if a claim is to be made against an indemnifying party under such Section, give notice to the indemnifying party of the commencement of such claim. If the indemnified party fails to notify the indemnifying party within 30 days of receipt of notice of the third party claim, then the indemnity with respect to the subject matter of such claim shall continue, but shall be limited to the damages that would have nonetheless resulted absent the indemnified party’s failure to notify the indemnifying party in the time required above after taking into account such actions as could have been taken by the indemnifying party had it received timely notice from the indemnified party. If such notice is timely given, the indemnifying party will be entitled to participate in such proceeding and, to the extent that it wishes, may assume the defense of such proceeding with counsel satisfactory to the indemnified party and, after notice from the indemnifying party to the indemnified party of its election to assume the defense of such proceeding with counsel satisfactory to the indemnified party, the indemnifying party will not be liable to the indemnified party under this Section 6.9 for any fees of other counsel or any other expenses with respect to the defense of such proceeding incurred after such notice. If the indemnifying party assumes the defense of the proceeding, (1) it will be conclusively established that for purposes of this Agreement that the claims made in that proceeding are within the scope of and subject to indemnification; and (2) no compromise or settlement of such claims may be effected by the indemnifying party without the indemnified party’s Consent unless (A) there is no finding or admission of any violation of legal requirements or any violation of the rights of any Person and no effect on any other claims that may be made against the indemnified party, and (B) the sole relief provided is monetary damages that are paid in full by the indemnifying party. If notice is given to an indemnifying party of the commencement of any proceeding and the indemnifying party does not, within 30 days after the indemnified party’s notice is given, give notice to the indemnified party of its election to assume the defense of such proceeding, the indemnifying party will be bound by any determination made in such proceeding or any compromise or settlement effected by the indemnified party, provided, however, that the indemnifying party is otherwise obligated to indemnify the indemnified party pursuant to this Section 6.9.

15

(f) Procedure for Indemnification – Other Claims. A claim for indemnification for any matter not involving a third-party claim may be asserted by notice to the Party from whom indemnification is sought.

Section 6.10 Payment of Accounts Payable. Except for those amounts expressly enumerated in Schedule 1.3(e) (as may be updated by the Parties from time to time) as an unpaid accounts payable constituting Assumed Contracts, no later than concurrent with or as soon as reasonably practicable following the Closing, Seller shall pay (i) all of its accounts payable that are payable to Persons engaged in the manufacture, shipment or storage of the Inventory and (ii) any other payables which, if not paid, would reasonably be expected to have a material adverse effect on Purchaser’s conduct of the Business following the Closing.

Section 6.11 Consents. Seller shall use commercially reasonable efforts to obtain for Purchaser all consents listed on Schedule 4.3.

Section 6.12 Financial Statements. Seller acknowledges that following the Closing Purchaser may seek to obtain an audit of the financial statements of the Business, at Purchaser’s expense, for the year ended December 31, 2009 or such other periods as the Purchaser may reasonably require. Following the Closing, Seller will grant Purchaser and its selected accountant reasonable access to the files, books and records of Seller, including any and all information relating to the Business and Seller’s financial condition, as are reasonably necessary to permit Purchaser to obtain such audit. Further, Seller will request its accountants, at Purchaser’s expense, to cooperate reasonably with Purchaser and its accountant in making available all financial information reasonably requested, including the right to examine all working papers pertaining to all Financial Statements prepared by Seller’s accountants. Subject to the Seller’s intention to dissolve and liquidate following the completion of the sale of the Purchased Assets, Seller will also make available to Purchaser and its agents all management and other appropriate personnel during normal business hours, on reasonable prior notice.

16

Section 6.13 Seller Change of Name. On the Closing Date, Seller will file articles of amendment changing its corporate name to one that does not include any trade ▇▇▇▇ or trade name included in the Purchased Assets.

ARTICLE VII

CONDITIONS PRECEDENT TO PURCHASER’S OBLIGATION TO CLOSE

Purchaser’s obligation to consummate the Contemplated Transactions is subject to the satisfaction, at or prior to the Closing, of each of the following conditions (any of which may be waived by Purchaser, in whole or in part): Section 7.1 Accuracy of Representations. All of the representations and warranties of Seller in this Agreement (considered collectively), and each of these representations and warranties (considered individually), shall have been accurate in all material respects as of the date of this Agreement, and shall be accurate in all material respects as of the time of the Closing as if then made.

Section 7.2 Seller’s Performance. All of the covenants and obligations that Seller is required to perform or to comply with pursuant to this Agreement at or prior to the Closing (considered collectively), and each of these covenants and obligations (considered individually), shall have been duly performed and complied with in all material respects.

Section 7.3 Consents; Stockholder Approval. Each of the Consents identified on Schedule 4.3 as a required Consent shall have been obtained and shall be in full force and effect. The sale of the Purchased Assets as contemplated in this Agreement shall have been approved and adopted by the Seller’s stockholders entitled to vote thereon in accordance with all Applicable Laws.

Section 7.4 Additional Documents. Seller shall have caused the documents and instruments required by Section 2.5(a) and the following documents to be delivered (or tendered subject only to Closing) to Purchaser:

(a) Releases of all Encumbrances (other than as set forth on Schedule 4.8) on the Purchased Assets, if any;

(b) all Confirmatory Assignments;

(c) Such other documents as Purchaser may reasonably request for the purpose of:

17

(i) evidencing the accuracy of any of the representations and warranties of Seller;

(ii) evidencing the performance by Seller, or the compliance by Seller with, any covenant or obligation required to be performed or complied with by Seller;

(iii) evidencing the satisfaction of any condition referred to in this Article 7; or

(iv) otherwise facilitating the consummation or performance of any of the Contemplated Transactions.

Section 7.5 No Actions or Proceedings. Since the date of this Agreement, there shall not have been commenced or threatened against Seller or any Affiliate of Seller, any Action or Proceeding other than by MHT or its Affiliates (a) involving any challenge to, or seeking damages or other relief in connection with, any of the Contemplated Transactions, (b) that may have the effect of preventing, delaying, making illegal, imposing limitations or conditions on or otherwise interfering with any of the Contemplated Transactions or (c) that may have a material adverse effect on Seller or the Purchased Assets.

Section 7.6 No Conflict. Neither the consummation nor the performance of any of the Contemplated Transactions will, directly or indirectly (with or without notice or lapse of time), contravene or conflict with or result in a violation of or cause Purchaser or any Affiliate of Purchaser to suffer any adverse consequence under any applicable Applicable Laws, including any law or order that has been published, introduced or otherwise proposed by or before any Governmental or Regulatory Authority.

Section 7.7 Governmental Authorizations. Purchaser shall have received such authorizations from any Governmental or Regulatory Authority as are necessary or desirable to allow Purchaser to sell the Products from and after the Closing.

Section 7.8 No Material Adverse Change. There shall not have occurred any material adverse change in the Business or the Purchased Assets.

Section 7.9 Consideration. Each of Seller and Purchaser acknowledge receipt from the other of $1.00 and other good and valuable consideration and the Parties agree that they shall not have the right to revoke any agreement made hereunder while this Agreement remains subject to the conditions set forth in this Article VII. For greater certainty, nothing in this Section 7.9 shall preclude a Party from exercising any right of termination hereunder.

18

ARTICLE VIII

CONDITIONS PRECEDENT TO SELLER’S

OBLIGATION TO CLOSE

Seller’s obligation to consummate the Contemplated Transactions is subject to the satisfaction, at or prior to the Closing, of each of the following conditions (any of which may be waived by Seller in whole or in part): Section 8.1 Accuracy of Representations. All of Purchaser’s representations and warranties in this Agreement (considered collectively), and each of these representations and warranties (considered individually), shall have been accurate in all material respects as of the date of this Agreement and shall be accurate in all material respects as of the time of the Closing as if then made.

Section 8.2 Purchaser’s Performance. All of the covenants and obligations that Purchaser is required to perform or to comply with pursuant to this Agreement at or prior to the Closing (considered collectively), and each of these covenants and obligations (considered individually), shall have been performed and complied with in all material respects.

Section 8.3 Consents. Each of the Consents identified in Schedule 4.3 as a required Consent shall have been obtained and shall be in full force and effect.

Section 8.4 Additional Documents. Purchaser shall have caused the documents and instruments required by Section 2.5(b) to be delivered and such other documents as Seller may reasonably request for the purpose of:

(a) evidencing the accuracy of any representation or warranty of Purchaser,

(b) evidencing the performance by Purchaser of, or the compliance by Purchaser with, any covenant or obligation required to be performed or complied with by Purchaser; or

(c) evidencing the satisfaction of any condition referred to in this Article 9.

Section 8.5 No Injunction. There shall not be in effect any Applicable Laws, including any injunction or other Order that (a) prohibits the consummation of the Contemplated Transactions and (b) has been adopted or issued, or has otherwise become effective, since the date of this Agreement.

ARTICLE IX

TERMINATION

Section 9.1 Termination Events. By notice given prior to or at the Closing, subject to Section 9.2, this Agreement may be terminated as follows:

(a) by Purchaser if a material breach of any provision of this Agreement has been committed by Seller and such breach has not been cured within 30 days of notice of such Breach or has not been waived by Purchaser;

19

(b) by Seller if a material breach of any provision of this Agreement has been committed by Purchaser and such breach has not been cured within 30 days of notice of such breach or has not has not been waived by Seller;

(c) by Purchaser if any condition in Article 7 has not been satisfied as of September 15, 2010 or if satisfaction of such a condition by such date is or becomes impossible (other than through the failure of Purchaser to comply with its obligations under this Agreement), and Purchaser has not waived such condition on or before such date;

(d) by Seller if any condition in Article 8 has not been satisfied as of September 15, 2010 or if satisfaction of such a condition by such date is or becomes impossible (other than through the failure of Seller to comply with its obligations under this Agreement), and Seller has not waived such condition on or before such date;

(e) by mutual Consent of Purchaser and Seller; or

(f) by Purchaser at any time prior to the Closing Date if a Triggering Event shall have occurred.

(g) By Seller, after complying with the requirements of this Section 9.1(g) and subject in all cases to the provisions of Section 9.2, if Seller approves, endorses or recommends any Acquisition Proposal or enters into any letter of intent or similar document or any Contract contemplating or otherwise relating to any Acquisition Proposal.

(i) Nothing in this Agreement shall prevent Seller’s board of directors from withholding, withdrawing, amending or modifying the Seller Board Recommendation if (A) a Superior Offer is made to Seller and is not withdrawn, (B) Seller shall have provided written notice to Purchaser (a “Notice of Superior Offer”) advising Purchaser that Seller has received a Superior Offer, specifying all of the material terms and conditions of such Superior Offer and identifying the Person making such Superior Offer, (C) Purchaser shall not have, within five Business Days of Purchaser’s receipt of the Notice of Superior Offer, made an offer in writing that Seller’s board of directors by a majority vote determines in its good faith judgment to be at least as favorable to Seller’s stockholders as such Superior Offer (it being agreed Seller’s board of directors shall convene a meeting to consider any such offer by Purchaser as soon as reasonably practicable following the receipt thereof), (D) Seller’s board of directors concludes in good faith, after consultation with its outside counsel, that, in light of such Superior Offer, the withholding, withdrawal, amendment or modification of such Seller Board Recommendation is required in order for Seller’s board of directors to comply with its fiduciary obligations to Seller’s stockholders under Applicable Laws and (E) Seller shall not have violated any of the restrictions set forth in this Section 9.1(g). Seller shall provide Purchaser with at least two Business Days prior notice (or such lesser prior notice as provided to the members of Seller’s board of directors but in no event less than twenty-four hours) of any meeting of Seller’s board of directors at which Seller’s board of directors is reasonably expected to consider any Acquisition Proposal to determine whether such Acquisition Proposal is a Superior Offer.

20

(ii) From and after the date of this Agreement until the Closing Date or termination of this Agreement pursuant to Section 9.1, Seller will not, nor will it authorize or permit any of its respective officers, directors, affiliates or employees or any investment banker, attorney or other advisor or representative retained by it to, directly or indirectly, (A) solicit, initiate, encourage or induce the making, submission or announcement of any Acquisition Proposal, (B) participate in any discussions or negotiations regarding, or furnish to any Person any non-public information with respect to, or take any other action to facilitate any inquiries or the making of any proposal that constitutes or may reasonably be expected to lead to, any Acquisition Proposal, or (C) engage in discussions with any Person with respect to any Acquisition Proposal, except as to the existence of these provisions; provided, however, that prior to the Closing Date, this Section 9.1(g)(ii) shall not prohibit Seller from furnishing information regarding Seller to, or entering into discussions with, any Person or group who has submitted (and not withdrawn) to Seller an unsolicited, written, bona fide Acquisition Proposal that Seller’s board of directors in good faith concludes may constitute a Superior Offer if (1) neither Seller nor any representative of Seller shall have violated any of the restrictions set forth in this Section 9.1(g)(ii), (2) Seller’s board of directors concludes in good faith, after consultation with its outside legal counsel, that such action is required in order for Seller’s board of directors to comply with its fiduciary obligations to Seller’s stockholders under Applicable Laws, (3) prior to furnishing any such nonpublic information to, or entering into any such discussions with, such Person or group, Seller gives Purchaser written notice of the identity of such Person or group and all of the material terms and conditions of such Acquisition Proposal and of Seller’s intention to furnish nonpublic information to, or enter into discussions with, such Person or group, and Seller receives from such Person or group an executed confidentiality agreement, containing terms at least as restrictive with regard to Seller’s confidential information as Section 10.1 of this Agreement, (4) Seller gives Purchaser at least two Business Days advance notice of its intent to furnish such nonpublic information or enter into such discussions, and (5) contemporaneously with furnishing any such nonpublic information to such Person, Seller furnishes such nonpublic information to Purchaser (to the extent such nonpublic information has not been previously furnished by Seller to Purchaser). Seller will immediately cease any and all existing activities, discussions or negotiations with any parties conducted heretofore with respect to any Acquisition Proposal. Without limiting the foregoing, it is understood that any violation of the restrictions set forth in the preceding two sentences by any officer, director or employee of Seller or any investment banker, attorney or other advisor or representative of Seller shall be deemed to be a breach of this Section 9.1(g)(ii) by Seller.

In addition to the obligations of Seller set forth in this Section 9.1(g)(ii), Seller as promptly as practicable shall advise Purchaser orally and in writing of any request for information which Seller reasonably believes would lead to an Acquisition Proposal or of any Acquisition Proposal, or any inquiry with respect to or which Seller reasonably should believe would lead to any Acquisition Proposal, the material terms and conditions of such request, Acquisition Proposal or inquiry, and the identity of the Person or group making any such request, Acquisition Proposal or inquiry. Seller will keep Purchaser informed as promptly as practicable in all material respects of the status and details (including material amendments or proposed amendments) of any such request, Acquisition Proposal or inquiry.

21

Section 9.2 Effect of Termination. Each Party’s right of termination under Section 9.1 is in addition to any other rights it may have under this Agreement or otherwise, and the exercise of such right of termination will not be an election of remedies. If this Agreement is terminated pursuant to Section 9.1, all obligations of the Parties under this Agreement will terminate, except that the obligations of the Parties in this Section 9.2 and Sections 10.1 and 10.12 will survive, provided, however, that, if this Agreement is terminated because of a breach of this Agreement by the nonterminating party or because one or more of the conditions to the terminating party’s obligations under this Agreement is not satisfied as a result of the nonterminating party’s failure to comply with its obligations under this Agreement, the terminating party’s right to pursue all legal remedies will survive such termination unimpaired. Notwithstanding anything to the contrary herein, in the event that this Agreement is terminated by Purchaser or Seller, as applicable, pursuant to Section 9.1(f) or 9.1(g), Seller shall promptly, but in no event later than two Business Days after the date of such termination, pay Purchaser a fee equal to $150,000 in immediately available funds as reimbursement for the fees and expenses incurred by Purchaser in connection with this Agreement and the Contemplated Transactions. Seller acknowledges that the agreements contained in this Section 9.2 are an integral part of the Contemplated Transactions, and that, without these agreements, Purchaser would not enter into this Agreement. Accordingly, if Seller fails to pay in a timely manner the amounts due pursuant to this Section 9.2, and, in order to obtain such payment, Purchaser makes a claim that results in a judgment against Seller for the amounts set forth in this Section 9.2, Seller shall pay to Purchaser its reasonable costs and expenses (including reasonable attorneys’ fees and expenses) in connection with such suit, together with interest on the amounts set forth in this Section 9.2 at the United States prime rate in effect on the date such payment was required to be made (as published in the Wall Street Journal). Payment of the fees described in this Section 9.2 shall not be in lieu of damages incurred in the event of breach of this Agreement.

22

ARTICLE X

MISCELLANEOUS

Section 10.1 Confidentiality Agreement. Purchaser and Seller will maintain in confidence, and will cause the directors, officers, employees, agents, and advisors of Purchaser and Seller to maintain in confidence, any written, oral, or other information obtained in confidence from one another in connection with this Agreement or the Contemplated Transactions, unless (a) such information is already known to such Party or to others not bound by a duty of confidentiality or such information is or becomes publicly available through no fault of such Party, (b) the use of such information is necessary or appropriate in making any filing or obtaining any Consent or approval required for the consummation of the Contemplated Transactions, or (c) the furnishing or use of such information is required by legal proceedings, judicial or administrative process or timely disclosure requirements of law or stock exchange policies, provided the Party making disclosure under this subsection will promptly notify the other Party thereof and allow the other Party reasonable time to review and comment on such proposed disclosure. If the Contemplated Transactions are not consummated, each Party will return or destroy as much of such written information as the other Party may reasonably request.

Section 10.2 Public Announcement. No public announcement or disclosure of the terms and conditions of this Agreement or the execution thereof, or the consummation of the Contemplated Transactions may be made by Seller or its Affiliates without the express written consent of Purchaser, unless otherwise required by Applicable Laws, (provided that Purchaser will, to the extent practicable, be given an opportunity to review and consent to the required statement or release). In connection with the filing of this Agreement with Canadian securities regulators or ▇▇▇.▇▇▇▇▇.▇▇▇, Seller will, to the extent permissible under Applicable Laws, use reasonable commercial efforts to redact and treat as confidential the information set forth in Schedule 4.12.

Section 10.3 Notices. All notices, requests and other communications hereunder must be in writing and will be deemed to have been duly given only if delivered personally against written receipt or by facsimile transmission with answer back confirmation or mailed (postage prepaid by certified or registered mail, return receipt requested) or by internationally recognized overnight courier that maintains records of delivery to the Parties at the following addresses or facsimile numbers:

If to Seller to:

Forbes Medi-Tech Inc.

▇▇▇▇▇ ▇▇▇-▇▇▇ ▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇

▇▇▇▇▇▇▇▇▇, ▇▇, ▇▇▇ ▇▇▇

Canada

Attention: ▇▇▇▇▇▇▇ ▇▇▇▇, President and CEO

Telephone: ▇▇▇-▇▇▇-▇▇▇▇

Facsimile: ▇▇▇-▇▇▇-▇▇▇▇

23

With Copy to:

▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇ LLP

Barristers and Solicitors

▇▇ ▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇

▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇

▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇▇

▇▇▇ ▇▇▇

Attention: ▇▇▇▇▇▇ ▇▇▇▇▇▇

Telephone: ▇▇▇-▇▇▇-▇▇▇▇

Facsimile: ▇▇▇-▇▇▇-▇▇▇▇

Email: ▇▇▇▇▇▇▇@▇▇▇▇▇▇▇▇.▇▇

If to Purchaser to:

Pharmachem Laboratories, Inc.

▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇

▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇

Attention: ▇▇▇▇▇ ▇. ▇▇▇▇▇▇, President

Telephone: ▇▇▇-▇▇▇-▇▇▇▇

Facsimile: 201-246-8105

With a copy to:

▇▇▇▇ ▇. ▇▇▇▇▇▇▇

Moritt ▇▇▇▇ Hamroff & ▇▇▇▇▇▇▇▇ LLP

▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇ ▇▇▇▇▇

▇▇▇▇▇▇ ▇▇▇▇, ▇▇ ▇▇▇▇▇

Telephone: (▇▇▇) ▇▇▇-▇▇▇▇

Facsimile: (▇▇▇) ▇▇▇-▇▇▇▇

Email: ▇▇▇▇▇▇▇▇@▇▇▇▇▇▇▇▇▇▇.▇▇▇

All such notices, requests and other communications will (a) if delivered personally to the address as provided in this Section, be deemed given upon receipt, (b) if delivered by facsimile to the facsimile number as provided in this Section, be deemed given upon receipt by the sender of the answer back confirmation and (c) if delivered by mail in the manner described above or by overnight courier to the address as provided in this Section, be deemed given upon receipt (in each case regardless of whether such notice, request or other communication is received by any other Person to whom a copy of such notice, request or other communication is to be delivered pursuant to this Section). Any Party from time to time may change its address, facsimile number or other information for the purpose of notices to that Party by giving notice specifying such change to the other Party hereto in accordance with the terms of this Section.

Section 10.4 Entire Agreement. This Agreement (and all Exhibits and Schedules attached hereto and all other documents delivered in connection herewith) and the Confidentiality Agreement supersede all prior discussions and agreements, both written and oral, among the Parties with respect to the subject matter hereof and contain the sole and entire agreement among the Parties with respect to the subject matter hereof.

24

Section 10.5 Waiver. Any term or condition of this Agreement may be waived at any time by the Party that is entitled to the benefit thereof, but no such waiver shall be effective unless set forth in a written instrument duly executed by or on behalf of the Party waiving such term or condition. No waiver by any Party of any term or condition of this Agreement, in any one or more instances, shall be deemed to be or construed as a waiver of the same or any other term or condition of this Agreement on any future occasion. All remedies, either under this Agreement or by Applicable Law or otherwise afforded, will be cumulative and not alternative.

Section 10.6 Amendment. This Agreement may be amended, supplemented or modified only by a written instrument duly executed by each Party.

Section 10.7 Third Party Beneficiaries. Except as otherwise expressly set forth herein, the terms and provisions of this Agreement (and all Exhibits and Schedules attached hereto and all other documents delivered in connection herewith) are intended solely for the benefit of each Party and their respective successors or permitted assigns and it is not the intention of the Parties to confer third-party beneficiary rights or remedies hereunder or thereunder upon any other Person.

Section 10.8 Assignment; Binding Effect. Neither this Agreement nor any right, interest or obligation hereunder may be assigned by any Party without the prior written Consent of the other Party; provided, however, that Purchaser may assign its rights and obligations under this Agreement, without the prior written Consent of the Seller, to a Purchaser Affiliate provided that such Affiliate agrees in writing to be bound by this Agreement. Any such consent shall not be unreasonably withheld or delayed. Any permitted assignee shall assume all obligations of its assignor under this Agreement. No assignment shall relieve a Party of its responsibility for the performance of any obligation.

Section 10.9 Headings. The headings used in this Agreement have been inserted for convenience of reference only and do not define or limit the provisions hereof.

Section 10.10 Severability. If any provision of this Agreement is held to be illegal, invalid, or unenforceable under present or future Applicable Laws effective while this Agreement remains in effect, the legality, validity and enforceability of the remaining provisions will not be affected thereby.

Section 10.11 Governing Law and Jurisdiction. This Agreement shall be governed by and construed in accordance with the laws of the State of New York applicable to contracts executed and performed in such state, without giving effect to the conflicts of laws principles. The United Nations Convention on Contracts for the International Sale of Goods will not apply in any way to this Agreement or to the Contemplated Transactions or otherwise to create any rights or to impose any duties or obligations on any Party. Any Action or Proceeding seeking to enforce any provision of, or based on any right arising out of, this Agreement may be brought against any of the Parties in any United States District Court located in the Southern District of New York, and each of the Parties consents to the jurisdiction of such Courts (and of the appropriate appellate courts) in any such Action or Proceeding and waives any objection to venue.

25

Section 10.12 Expenses. Except as otherwise provided in this Agreement, each Party shall pay its own expenses and costs incidental to the preparation of this Agreement and to the consummation of the Contemplated Transactions. In the event of any Action or Proceeding by a Party to enforce its rights hereunder, the prevailing Party in such Action or Proceeding shall be entitled to recover its reasonable attorneys’ fees and costs from the other Party, which shall be in addition to any other amounts to which such Party is entitled in connection with such Action or Proceeding.

Section 10.13 Counterparts. This Agreement may be executed in any number of counterparts and by facsimile, each of which will be deemed an original, but all of which together will constitute one and the same instrument.

Section 10.14 U.S. Currency. All amounts payable hereunder shall be paid in United States dollars.

[Signature Page Next]

26

IN WITNESS WHEREOF, this Agreement has been executed by the Parties hereto all as of the date first above written.

| SELLER | ||

| FORBES MEDI-TECH INC. | ||

| By: | “▇▇▇▇▇▇▇ ▇▇▇▇” | |

| Name: ▇▇▇▇▇▇▇ ▇▇▇▇ | ||

| Title: President and Chief Executive Officer | ||

| PURCHASER | ||

| PHARMACHEM LABORATORIES, INC. | ||

| By: | “▇▇▇▇▇ ▇. ▇▇▇▇▇▇” | |

| Name: ▇▇▇▇▇ ▇. ▇▇▇▇▇▇ | ||

| Title: President | ||

27

SCHEDULE 1

CERTAIN MATTERS OF CONSTRUCTION AND DEFINITIONS

1.1. Construction of this Agreement and Certain Terms and Phrases

(a) Unless the context of this Agreement otherwise requires, (i) words of any gender include each other gender; (ii) words using the singular or plural number also include the plural or singular number, respectively; (iii) the terms “hereof,” "“herein,” “hereby” and derivative or similar words refer to this entire Agreement and not to any particular provision of this Agreement; and (iv) the terms “Article,” “Section,” “Schedule” and “Exhibit” without any reference to a specified document refer to the specified Article, Section, Schedule and Exhibit, respectively, of this Agreement.

(b) The words “including,” “include” and “includes” are not exclusive and shall be deemed to be followed by the words “without limitation”; if exclusion is intended, the word “comprising” is used instead.

(c) The word “or” shall be construed to mean “and/or” unless the context clearly prohibits that construction.

(d) Any reference to any federal, state, local or foreign statute or law, including any one or more sections thereof, shall be deemed also to refer to, unless the context requires otherwise, all rules and regulations promulgated thereunder.