THIRD AMENDMENT TO SECOND AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT

Exhibit 10.1

THIRD AMENDMENT TO

SECOND AMENDED AND RESTATED LOAN AND SECURITY AGREEMENT

THIS THIRD AMENDMENT to Second Amended and Restated Loan and Security Agreement (this “Amendment”) is entered into as of June 19, 2019, by and between SILICON VALLEY BANK, a California corporation (“Bank”), and INSTRUCTURE, INC., a Delaware corporation (“Borrower”).

A.Bank and Borrower have entered into that certain Second Amended and Restated Loan and Security Agreement dated as of June 22, 2017 (as the same may from time to time be amended, modified, supplemented or restated, including, without limitation, by that certain First Amendment to Second Amended and Restated Loan and Security Agreement dated as of March 30, 2018, and that certain Second Amendment to Second Amended and Restated Loan and Security Agreement dated as of June 28, 2018, collectively, the “Loan Agreement”).

B.Bank has extended credit to Borrower for the purposes permitted in the Loan Agreement.

C.Borrower has requested that Bank amend the Loan Agreement to (i) extend the Revolving Line Maturity Date, and (ii) make certain other revisions to the Loan Agreement as more fully set forth herein.

D.Bank has agreed to so amend certain provisions of the Loan Agreement, but only to the extent, in accordance with the terms, subject to the conditions and in reliance upon the representations and warranties set forth below.

Agreement

1.Definitions. Capitalized terms used but not defined in this Amendment shall have the meanings given to them in the Loan Agreement.

2.Amendments to Loan Agreement.

2.1Section 2.4 (Payment of Interest on the Credit Extensions). Section 2.4(a) of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“(a)Advances. Subject to Section 2.4(b), the principal amount outstanding under the Revolving Line shall accrue interest at a floating per annum rate equal to the greater of (i) one half of one percentage point (0.50%) above the Prime Rate or (ii) five and one half percentage points (5.50%), which interest, in each case, shall be payable monthly in accordance with Section 2.4(d) below.”

2.2Section 6.8 (Operating Accounts). Section 6.8(a) of the Loan Agreement hereby is amended and restated in its entirety to read as follows:

“(a)Maintain its and all of its Subsidiaries’ operating and other deposit accounts and securities accounts with Bank and Bank’s Affiliates; provided, however, notwithstanding the foregoing, Borrower and its Subsidiaries may maintain accounts outside of Bank so long as (I) the aggregate balances in all such accounts do not, at any time, represent more than thirty-five percent (35%) of the dollar value of Borrower’s and its Subsidiaries’ cash and Cash Equivalents in accounts at all financial institutions, including, without limitation, Borrower’s account with another financial institution in order to service its credit cards issued by such financial institution (the “Credit Card Account”), and (II) such accounts outside Bank are comprised of (i) Borrower’s accounts at Bridge Bank numbered xxx-xxxx-102 and xxx-xxxx-046, so long as Borrower closes and transfers the cash in such accounts into the Designated Deposit Account by December 31, 2019, (ii) Borrower’s accounts at Bank of America, so long as such accounts are maintained exclusively for the purpose of funding Borrower’s health care plans, (iii) Borrower’s accounts at PayPal, Stripe, and Venmo, so long as the aggregate balance in such accounts does not exceed One Hundred Thousand Dollars at any time, (iv) the Credit Card Account (v) Borrower and its Subsidiaries’ accounts maintained outside the United States, in each case without Control Agreements and (vi) any other accounts of Borrower or its Subsidiaries maintained within the Unites States, so long as the aggregate balance in such accounts does not exceed Five Hundred Thousand Dollars ($500,000).”

2.3Section 13 (Definitions). The following term and its respective definition hereby is amended and restated in its entirety in Section 13.1 of the Loan Agreement to read as follows:

“Revolving Line Maturity Date” is June 21, 2020.

3.Limitation of Amendments.

3.1The amendments set forth in Section 3, above, are effective for the purposes set forth herein and shall be limited precisely as written and shall not be deemed to (a) be a consent to any amendment, waiver or modification of any other term or condition of any Loan Document, or (b) otherwise prejudice any right or remedy which Bank may now have or may have in the future under or in connection with any Loan Document.

3.2This Amendment shall be construed in connection with and as part of the Loan Documents and all terms, conditions, representations, warranties, covenants and agreements set forth in the Loan Documents, except as herein amended, are hereby ratified and confirmed and shall remain in full force and effect.

4.Representations and Warranties. To induce Bank to enter into this Amendment, Borrower hereby represents and warrants to Bank as follows:

4.1Immediately after giving effect to this Amendment (a) the representations and warranties contained in the Loan Documents are true, accurate and complete in all material respects as of the date hereof (except to the extent such representations and warranties relate to an earlier date, in which case they are true and correct as of such date), and (b) no Event of Default has occurred and is continuing;

4.2Borrower has the power and authority to execute and deliver this Amendment and to perform its obligations under the Loan Agreement, as amended by this Amendment;

2

4.3The organizational documents of Borrower delivered to Bank on the Effective Date remain true, accurate and complete and have not been amended, supplemented or restated and are and continue to be in full force and effect;

4.4The execution and delivery by Borrower of this Amendment and the performance by Borrower of its obligations under the Loan Agreement, as amended by this Amendment, have been duly authorized;

4.5The execution and delivery by Borrower of this Amendment and the performance by Borrower of its obligations under the Loan Agreement, as amended by this Amendment, do not and will not contravene (a) any law or regulation binding on or affecting Borrower, (b) any contractual restriction with a Person binding on Borrower, (c) any order, judgment or decree of any court or other governmental or public body or authority, or subdivision thereof, binding on Borrower, or (d) the organizational documents of Borrower;

4.6The execution and delivery by Borrower of this Amendment and the performance by Borrower of its obligations under the Loan Agreement, as amended by this Amendment, do not require any order, consent, approval, license, authorization or validation of, or filing, recording or registration with, or exemption by any governmental or public body or authority, or subdivision thereof, binding on either Borrower, except as already has been obtained or made; and

4.7This Amendment has been duly executed and delivered by Borrower and is the binding obligation of Borrower, enforceable against Borrower in accordance with its terms, except as such enforceability may be limited by bankruptcy, insolvency, reorganization, liquidation, moratorium or other similar laws of general application and equitable principles relating to or affecting creditors’ rights.

5.Counterparts. This Amendment may be executed in any number of counterparts and all of such counterparts taken together shall be deemed to constitute one and the same instrument.

6.Miscellaneous.

6.1This Amendment shall constitute a Loan Document under the Loan Agreement; the failure to comply with the covenants contained herein shall constitute an Event of Default under the Loan Agreement; and all obligations included in this Amendment (including, without limitation, all obligations for the payment of principal, interest, fees, and other amounts and expenses) shall constitute obligations under the Loan Agreement and secured by the Collateral, subject to any applicable cure periods set forth in Section 8 of the Loan Agreement as to the applicable Event of Default.

6.2Each provision of this Amendment is severable from every other provision in determining the enforceability of any provision.

7.Governing Law. This Amendment and the rights and obligations of the parties hereto shall be governed by and construed in accordance with the laws of the State of California.

8.Effectiveness. This Amendment shall be deemed effective upon: (a) Borrower’s due execution and delivery to Bank of (i) this Amendment, (ii) an updated Perfection Certificate in the form provided by Bank; and (b) Borrower’s payment to Bank of (i) a commitment fee in the amount of Seven Thousand Five Hundred Dollars ($7,500), and (ii) all Bank Expenses incurred through the date of this Amendment, each of which may be debited from any of Borrower's accounts.

[Balance of Page Intentionally Left Blank]

3

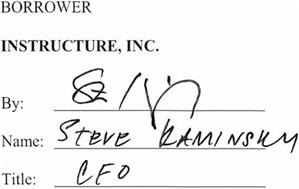

In Witness Whereof, the parties hereto have caused this Amendment to be duly executed and delivered as of the date first written above.

|

|

|

|

[Signature Page to Third Amendment to Second Amended and Restated Loan and Security Agreement]