CONFIDENTIAL TREATMENT REQUESTED INFORMATION FOR WHICH CONFIDENTIAL TREATMENT HAS BEEN REQUESTED IS OMITTED AND NOTED WITH “*****”. AN UNREDACTED VERSION OF THIS DOCUMENT HAS ALSO BEEN PROVIDED TO THE SECURITIES AND EXCHANGE COMMISSION. GLOBAL MASTER...

Exhibit 10.2

CONFIDENTIAL TREATMENT REQUESTED

INFORMATION FOR WHICH CONFIDENTIAL TREATMENT HAS BEEN REQUESTED IS

OMITTED AND NOTED WITH “*****”.

AN UNREDACTED VERSION OF THIS DOCUMENT HAS ALSO BEEN PROVIDED TO THE

SECURITIES AND EXCHANGE COMMISSION.

GLOBAL MASTER SERVICE AGREEMENT

Customer: Mercury Payment Systems, LLC

Subject to the terms and conditions of this Service Agreement and such exhibits or attachments as may now or hereafter be attached hereto, please enter my order for Global Payment Systems LLC’s (“Global”) electronic data processing Services or Systems (collectively the “Services”) from the date hereof through July 1, 2018.

| Mercury Payment Systems, LLC | Global Payment Systems LLC | |||||||

| (“Customer” or “Mercury”) | (“Global”) | |||||||

| By: | /s/ ▇▇▇▇ ▇▇▇▇▇▇ |

By: | /s/ ▇▇▇▇▇▇▇ ▇▇▇▇▇ | |||||

| Typed Name: ▇▇▇▇ ▇▇▇▇▇▇ | Typed Name: ▇▇▇▇▇▇▇ ▇▇▇▇▇ | |||||||

| Title: CEO | Title: President | |||||||

| Date: July 1, 2013 | Date: July 1, 2013 | |||||||

| Address: | ||||||||

| ▇▇ ▇▇▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇ | Global Payments Direct, Inc. (for purposes of Section 1(b) only) | |||||||

| ▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇▇ ▇▇▇▇▇ | ||||||||

| Attention: Chief Executive Officer | ||||||||

| By: | /s/ ▇▇▇▇▇▇▇ ▇▇▇▇▇ | |||||||

| Typed Name: ▇▇▇▇▇▇▇ ▇▇▇▇▇ | ||||||||

| Title: President | ||||||||

| Date: July 1, 2013 | ||||||||

| Address: | ||||||||

| ▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇ | ||||||||

| ▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇ | ||||||||

| Attention: Office of Corporate Secretary | ||||||||

1

TERMS AND CONDITIONS

1. GLOBAL SERVICES:

a. According to the terms of this Agreement (“Agreement”), Global will furnish Customer with the services described in Exhibit A-2 attached hereto and incorporated herein by reference, including all services not specifically set forth on Exhibit A-2 but that are required for the proper performance and provision of such services or are an inherent part of or a necessary sub-task included in the services set forth on Exhibit A-2 or that are generally provided by Global to third parties as part of such services (the “Services”). Global hereby agrees to the delivery dates for the Services, and the associated incentives and penalties as set forth in Exhibit A-1. Additional requested services beyond the Services (“Additional Services”), if available, will be furnished to Customer pursuant to the mutual agreement of the parties, including without limitation pricing terms, and in accordance with the terms of the Agreement.

b. Global’s performance of the Services and the Additional Services will be subject to the Service Level Agreements (“SLAs”) set forth in Exhibit A-4.

c. Global warrants that the Services and Additional Services performed hereunder will be performed in a professional manner, in accordance with industry standards then in effect for the Services and Additional Services provided hereunder, by an adequate number of qualified personnel with the necessary experience and expertise to perform the Services and Additional Services. Global and Customer will comply with the Security exhibit attached hereto as Exhibit C, as such Security exhibit may be amended from time to time by mutual agreement of the parties in writing to align with updates to industry and regulatory standards.

d. During the term of this Agreement, and for ***** years after its termination, each of Global and its affiliates is prohibited from utilizing any proprietary information (pursuant to Section 9) to knowingly and directly or indirectly solicit or endeavor to obtain (i) as a customer for itself for credit or debit card processing or related services, or contract with, any merchant or sub-merchant processing under this Agreement or (ii) as a partner for point of sale software integrations or referrals of customers for credit or debit card processing or related services, any dealer, VAR or developer of point of sale software with which at such time Mercury has a contractual relationship and Global or its affiliates do not have a contractual relationship; provided, however, that Customer acknowledges and agrees that a referral to Global of (x) ***** shall not constitute a breach of this Section 1(d) unless ***** or (y) ***** shall not constitute a breach of this Section 1(d) unless *****.

2. VOLUME COMMITMENT: The parties acknowledge and agree that in accordance with the conversion schedule set forth in Section 9 of the Fifteenth Amendment of the MSA (defined below), as amended by Section 2 of the Sixteenth Amendment of the MSA (defined below) (as so amended, the “Conversion Schedule”), or as otherwise mutually agreed to in writing by the parties, Global’s affiliate, Global Payments Direct, Inc. (“Global Direct”), shall convert the processing activity consistent with the Conversion Schedule of the Merchants (as defined in the MSA, defined below) under the Merchant Services Agreement between Global Direct and Customer dated August 10, 2003, as amended (the “MSA”) to Global for back end processing hereunder whereby Customer and ▇▇▇▇▇ Fargo Bank, N.A., or such other sponsor bank as designated by Customer and agreed to by Global in its discretion and as permitted under the terms of the Sixteenth Amendment of the MSA, will respectively be the processor and member bank of such Merchants (the “Conversion”). For the sake of clarity, the MSA shall continue to govern any Merchant processing under the MSA until the Conversion of such Merchant, after which all processing for such Merchant, and all rights and obligations between the parties with regard thereto, shall be governed by the terms herein.

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

2

3. CHARGES: a. Charges for the Services shall be as set forth in Schedule B-2, Service Pricing Schedule. The amount of usage of Services and Additional Services to be paid for by Customer shall be that amount recorded by Global’s computer system. Charges for Additional Services shall, in the absence of prior written agreement, be at a reasonable rate as determined by Global on a basis consistent with the pricing for the Services set forth on Schedule B-2; provided that charges for Additional Services (i) offered to Customer and other indirect customers of Global shall not be ***** and (ii) offered only to Customer shall be *****. In addition, Customer will be charged an amount equal to any taxes, however designated, levied or based on any of the above referred to charges or Services and Additional Services, including State and local taxes paid or payable by Global, excluding any federal, State or local taxes based on Global’s net income or revenue.

b. Customer hereby authorizes Global to charge Customer’s checking account on the 16th business day of each month for all charges incurred by Customer during the previous month, including any charges incurred by Global on Customer’s behalf pursuant to the terms of this Agreement, for Customer’s use of the Services and Additional Services as provided for in this Agreement. Prior to the account being debited, Global will send Customer a statement detailing the amount to be debited to Customer’s account. If Customer’s checking account contains insufficient funds to accommodate such debit, Customer authorizes Global to charge its checking account a one and one-half percent (1 1⁄2%) per month service charge on all amounts that are not paid on the due date. All payments shall be made in United States dollars. In the event that any amount due hereunder is not timely paid as provided herein, Customer agrees to reimburse Global for all costs and expenses, including reasonable attorney’s fees, incurred by Global in enforcing collection of any monies due it under this Agreement. Customer shall have the opportunity and right to dispute any amounts by providing notice to Global within thirty (30) days of Customer’s receipt of such statement; provided, that Customer will not be prohibited from disputing charges despite having paid the amounts set forth on such statement. Disputed charges will be subtracted from the first charge to Customer’s checking account subsequent to such dispute arising. Notwithstanding the above, in no event will Global be obligated to reimburse Customer for any disputed amounts that were billed to Customer more than one (1) year prior to the date Global receives notice of such dispute from Customer.

c. Global and Customer will keep accurate and complete books of account and documents related to this Agreement, including without limitation, those relating to usage of Services and Additional Services and calculation of fees. Not more than once per year, unless the immediate prior audit has determined an overpayment by Customer of more than 5% during the period between consecutive audits or prior to the first audit, in which event Customer may perform an additional audit not less than six (6) months following the audit which revealed such overpayment, Customer may on reasonable prior written notice to Global (but in any event not less than 10 days prior written notice), during business hours and without unreasonable interference with Global’s business, engage a nationally recognized accounting firm that is not at such time Global’s auditor to review and audit Global’s books and records, subject to Global’s obligations of confidentiality in third party/vendor contracts, that are related solely to, and report to Customer information solely related to, the calculation of fees related to Customer’s usage of Services and Additional Services. Customer shall bear all of Customer’s and the accounting firm’s costs of any such audit unless such audit reveals an overpayment by Customer of more than 5% during the period between consecutive audits or prior to the first audit in which case Global shall pay for Customer’s and the accounting firm’s reasonable, out-of-pocket, documented costs in performing such audit.

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

3

4. TERM AND TERMINATION:

a. This Agreement shall remain in full force and effect for the initial term set forth on the cover page, beginning upon the date Global executes the Agreement, and shall be automatically extended for successive two (2) year periods on the same terms and conditions expressed herein, or as may be amended, unless either party gives the other party written notice of termination at least one (1) year prior to the expiration of the initial term or any extensions or renewals thereof. Termination of this Agreement shall not terminate Customer’s obligation to pay Global for all services performed in accordance with the terms of the Agreement prior to discontinuance of performance by Global due to termination.

b. In the event that Global (i) fails in the performance of one or a series of obligations hereunder wherein such failure or failures (cumulatively) has or have, during any 12 month period, a material impact on Customer’s business, or (ii) breaches an SLA and such SLA breach results in a material adverse effect to Customer’s business, Customer may, at its option, give written notice to Global of Customer’s intention to terminate this Agreement, unless such breach or failure in performance is remedied within sixty (60) days of such notice to terminate, which notice shall be given within 30 days of Customer’s awareness of such breach or failure in performance. Global’s failure to remedy such a breach shall make this Agreement terminable by Customer at the end of such sixty (60) day cure period upon written notice to Global. In addition, Customer may terminate this agreement upon prior written notice to Global following: (i) a Change in Control of Global; (ii) the filing of a petition in bankruptcy or for re-organization by Global or the filing of a petition in bankruptcy for reorganization against Global by a third party which is not dismissed within ninety (90) days; an assignment by Global for the benefit of its creditors, or the appointment of a receiver, trustee, liquidator or custodian for all or a substantial part of Global’s assets; or the assignment or encumbrance by Global of this Agreement contrary to the terms hereof; (iii) upon Global’s failure to deliver Full Readiness (as defined in Exhibit A-1) of the Services by May 1, 2014, provided such failure is not solely attributable to Customer or a Customer third-party, (or by such later date as may be agreed in good faith by the parties if the there is a failure to so achieve Full Readiness that is directly attributable to Customer’s, or any third party of the Customer’s, failure to meet its requirements under the implementation plan agreed by the parties); or (iv) upon a material security breach by Global that directly and adversely impacts Customer or that results in a material adverse effect to Customer’s business. For purposes hereof, “Change in Control” shall mean an event or series of events resulting in (A) any Non-Acceptable Purchaser becoming the beneficial owner (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of voting securities of Global representing more than 50% of Global’s outstanding voting securities or rights to acquire such securities; or (B) any sale, lease, exchange or other transfer (in one transaction or a series of transactions) to a Non-Acceptable Purchaser of all or substantially all of the assets of Global. For purposes hereof, “Non-Acceptable Purchaser” shall mean any entity that performs merchant acquiring services for small and medium-sized businesses and markets or sells such services through point of sale software developers or VARs in the United States and for which such services represent at least *****% of such Non-Acceptable Purchaser’s revenues during the last twelve months, or any entity, together with its affiliates, that has a total leverage ratio (consolidated net debt of EBITDA) of ***** or greater on a pro forma combined basis during the last twelve months post any proposed Change in Control.

c. Customer may at any time, upon at least ninety (90) days prior written notice to Global, terminate this Agreement without cause in connection with a Sale of Customer or movement of Customer’s processing volume to Customer’s internal systems; provided that if Customer terminates the Agreement pursuant to this Section 4(c), Customer shall pay on the date of termination, in addition to all other amounts then due and payable by Customer to Global hereunder (except for those amounts that are the subject of a good faith dispute between the parties) but without further liability or obligation as a result of such termination, an amount equal to the product of $***** times the percentage of the initial term remaining as of the termination date calculated using straight line interpolation between the first and last days of the initial term using a 365 day year (i.e., $***** times (1,825 – (the number of days from the commencement of the term through and including the termination date)) divided by 1,825). In connection

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

4

with any termination under this Section 4(c), Global agrees to reasonably assist in the orderly and timely conversion of Merchants, including the performance by Global of its obligations under Section 4(e), and Global further agrees that it shall not require more than ninety (90) days plus additional days taking into consideration Global’s peak periods for the conversion period in any conversion plan to be agreed between the parties pursuant to Section 4(e). The amount payable under this Section 4(c) shall be in lieu of, and not in addition to, any amount that would otherwise be payable under the MSA with respect to the acceleration of assignment of Merchants pursuant to Section F(4)(A)(v) of the MSA. For purposes hereof, “Sale” shall mean any election by Customer to sell or convey fifty-one percent (51%) or more of Customer’s equity interests or substantially all of Customer’s assets to a third party in which no executive, principal, employee, owner or current shareholder of the Customer, or any of the family members of same, whether jointly or severally, has or will have any controlling interest (51% or more) of Customer after any sale or conveyance.

d. Global may terminate this Agreement, in whole but not in part, upon written notice to Customer upon any of the following: (i) Customer fails to pay undisputed amounts in excess of ***** when due and thereafter fails to cure such non-payment within seven (7) days after receiving written notice from Global; (ii) Customer breaches its obligations under Section 6(h) , Section 7, Section 9 or Section 10(b) in a manner that results in a material adverse effect on Global’s business and Customer fails to cure such breach within sixty (60) days of receiving written notice from Global; (iii) the filing of a petition in bankruptcy or for re-organization by Customer or the filing of a petition in bankruptcy for reorganization against Customer by a third party which is not dismissed within ninety (90) days; an assignment by Customer for the benefit of its creditors, or the appointment of a receiver, trustee, liquidator or custodian for all or a substantial part of Customer’s assets; or the assignment or encumbrance by Customer of this Agreement contrary to the terms hereof; (iv) upon a security breach by Customer that results in Global not being in compliance with Section 6(h) that results in a material adverse effect on Global’s business and Customer fails to cure such breach within sixty (60) days of receiving written notice from Global, or such shorter period as required by an authority with enforcement responsibility for applicable Rules, laws or regulations.

e. At the written request of Customer, upon expiration or earlier termination of this Agreement by either party, and provided Customer has paid in full all amounts due to Global (except for those amounts that are the subject of a good faith dispute between the parties), Global will, in addition to continuing to provide the Services and Additional Services and subject to Customer’s ongoing obligation to pay fees, each in accordance with the terms of the Agreement, provide assistance reasonably requested by Customer to convert and transition merchants per the terms of this paragraph to a vendor other than Global or to Customer itself, including but not limited to providing to Customer merchant profile and application data and other types of assistance that Global provides to Customer in the ordinary course, including monthly data merchant extracts based on existing file formats that include all billing attributes on a merchant-by-merchant basis and card/charge type basis, fee values by card/charge type, billing setup variables by card/charge type or by other merchant-specific designation. Within ninety (90) days of expiration or termination of this Agreement, Customer shall provide to Global a reasonable conversion plan that the parties will review and negotiate in good faith and mutually agree upon. Such mutually agreed upon conversion plan will identify when conversion is to commence, the ratable conversion of merchants over the plan period, and the date on which conversion is to be completed, all taking into consideration Global’s peak periods, which shall be a date that is no more than ***** years from the expiration or termination of the Agreement. Global shall be responsible for reasonable, normal and customary periodic conversion costs related to providing such assistance; provided, however, that amounts incurred by Global related to such assistance that (i) are not reasonable, normal and customary due to the type of conversion assistance requested or (ii) arise during any portion of the conversion period that extends beyond one (1) year from the commencement of such period, will be charged at reasonable time and materials costs, which Customer will pay within thirty (30) days of written notice from Global.

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

5

Customer acknowledges and agrees that Global must receive information from Customer in order to convert the merchants, including without limitation a list of MIDs. For the sake of clarification, Customer agrees that the manual or systematic conversion of merchants is the responsibility of Customer, and that Customer will advise Global in its conversion plan if Customer requires technical activities of Global for the applicable conversion. Notwithstanding the foregoing, Global shall not be required to provide any of the foregoing forms of assistance and/or data where the provision of such assistance and/or data is not within Global’s then-current capabilities.

5. CHANGE OF CHARGES: Global shall have the right to modify Schedule B-2 at any time on or after the expiration of the initial term of this Agreement upon one (1) year prior written notice to Customer prior to the end of the initial term or any renewal of the term hereof; provided that such modification shall not (i) include any new fees other than pass-through fees permitted to be charged in accordance with this Section 5 or fees for new Additional Services, or (ii) increase the fees on Schedule B-2 (not to include pass-through fees or Additional Services) by more than the lesser of *****. Notwithstanding the above requirements, Global shall have the right to modify Schedule B-2 at any time, during the initial term or otherwise, if such changes are a result of pass-throughs, and Global will provide Customer with sixty (60) days written notice or such lesser notice as is reasonably practicable under the circumstances. As used in this paragraph, the term “pass-throughs” shall mean *****. Global shall provide to Customer written notice of such pass-throughs prior to charging Customer for the same. The amount of the pass-throughs will nevertheless not exceed the lesser of *****. Except as set forth otherwise in this Agreement, Global’s internal operating costs or normal and customary business expenses will not be included or considered pass-throughs. Finally, if any fees set forth on Schedule B-2 imposed on Global by any pass-through parties are decreased or eradicated, Global shall decrease or eliminate such fee to reflect the value of the reduction or eradication. If Customer desires to perform or directly contract for the performance of a service related to a pass-through fee, Customer shall discuss its intention with Global and the parties shall negotiate in good faith for Customer to be able to do so. In the event Customer does elect to perform (or contract a third party to perform) a service as agreed upon by the parties, the related pass-through fee will be eradicated to the extent Global no longer incurs a cost.

6. USE OF THE SERVICES: a. Customer agrees to utilize the Services and Additional Services in accordance with this Agreement, its exhibits or attachments and Global’s reasonable instructions and specifications and to provide Global with the necessary data in the format reasonably required to enable Global to properly furnish the Services and Additional Services. Customer agrees to provide Global with at least sixty (60) days written notice of any proposed changes in method of employment of the Services and Additional Services which could reasonably be expected to significantly alter the volume.

b. From time to time, Global may discontinue the use of any of its or its third party vendor’s products as used to perform the Services or the Additional Services as described in this Agreement or in any Exhibit. If such discontinuance is or is reasonably likely to impact Customer, Global will provide Customer: (a) as much advance notice as practicable under the circumstances but no less than sixty (60) days; (b) as much advance notice as provided to similarly situated customers and partners under the circumstances; and (c) compatibility with existing functionality used by Customer for at least ***** months from the date the new product(s) is operational and fully available to Mercury. In such event, Global shall utilize or make available to Customer a replacement product that avoids any cessation or material degradation in the Services and Additional Services. Global may not increase any fee or charge for such replacement product as was applied with its discontinued product, except Global may increase fees generally pursuant to Section 4 above. The foregoing obligation in clause (c) above to continue to support existing functionality shall not apply to the discontinuation of products or Services or Additional Services brought on by (i) any change in applicable law, regulation, Rules or industry standard; (ii) the cessation of product sales, support and/or service by a Global third-party vendor; (iii) an adjustment to the price or availability

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

6

of a product or service provided by a Global third-party vendor that renders the continued provision of the products or Services or Additional Services impracticable or commercially unreasonable; or (iv) a credible threat to the security of Global’s systems or information, as determined in Global’s sole and reasonable discretion. Other than where the replacement of a product arises under clauses (i) and (iv) above, if Customer’s use of the Services or Additional Services (including cost of using the Services of Additional Services) is materially adversely impacted by such replacement, Global shall reimburse Customer’s reasonable, actual and documented costs (which shall not include (x) Customer’s normal and customary business expenses or (y) Customer’s costs in upgrading its systems to be compliant with any change in applicable law, regulation, Rules or industry standard) arising as a result of such replacement, not to exceed $***** with respect to any such replacement.

c. Customer agrees to comply with Global’s operating procedures and instructions identified in Exhibit A-3 and all operating instructions pertaining to the Services and Additional Services as issued by Global from time to time, to the extent that such procedures and instructions, as modified from time to time, are substantially similar to the procedures and instructions in effect or proposed for Global’s similarly situated customers. In order to continuously improve the efficiency and quality of the Services and Additional Services, Global reserves the right to make such software, hardware, and operational changes as it shall reasonably deem necessary and which provides for the same or better functionality of the Service and Customer. Global shall notify Customer of any changes (not covered by Section 6(b)) affecting the Services and Additional Services as soon as is reasonably practicable, and shall notify Customer of any upgrades affecting the Services and Additional Services at least thirty (30) days prior to the effective date of such change (or such lesser period as is reasonably practicable for any maintenance related changes), unless such changes do not adversely impact Customer’s use of the Services and Additional Services. Customer acknowledges that Global shall provide the Services and Additional Services using such software and hardware, whether owned by Global or others, as Global in its sole discretion determines appropriate. Other than where such change is due to (i) any change in applicable law, regulation, Rules or industry standard; (ii) the cessation of product sales, support and/or service by a Global third-party vendor; (iii) an adjustment to the price or availability of a product or service provided by a Global third-party vendor that renders the continued provision of the products or Services or Additional Services impracticable or commercially unreasonable; or (iv) a threat to the security of Global’s systems or information, as determined in Global’s sole and reasonable discretion, Global shall reimburse Customer’s reasonable, actual, documented costs arising as a result of such change, which shall not include (x) Customer’s normal and customary business expenses, or (y) Customer’s costs in upgrading its systems to be compliant with any change in applicable law, regulation, Rules or industry standard. For clarity, changes subject this Section 6.c. shall under no circumstances include the discontinuance of products and related changes described in Section 6.b.

d. Global will provide, on or before the dates required therefor, modifications to the Services and Additional Services so that the Services and Additional Services permit Customer to comply with mandatory changes required by changes in laws, regulations, or the Rules. Global shall make such modifications at its cost, except to the extent such changes are made solely for Customer’s use of the Services and Additional Services and not for use of services by other Global customers, in which case such modification shall be at Customer’s cost calculated in accordance with Schedule B-2.

In the event that Global is required to modify the Services or Additional Services as a result of a change in applicable law, regulation, Rules or industry standard, then Global shall use commercially reasonable efforts to provide Customer with Global’s own timeline and operational specifications and requirements for the implementation of such changes. Global shall provide to Customer communications generally provided to its other similarly situated customers. For the sake of clarity, in no event shall Global be responsible for Customer’s internal operating costs or normal and customary business expenses, or Customer’s costs in upgrading its systems to be compliant with any such mandatory changes required by changes in laws, regulations, or the Rules.

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

7

e. Customer is solely responsible for providing, installing, and maintaining all telecommunications lines and equipment, including terminals and control units, data lines to connect itself to Global’s Systems providing the Services and Additional Services hereunder (“Equipment”). Customer shall bear the complete responsibility including, but not limited to, the costs of procurement, operation, installation, and maintenance of such equipment, although Global may, at Customer’s request and in Global’s sole discretion, advise Customer in the selection process. If authorized by Customer, Global shall arrange for and coordinate installation of such equipment in conjunction with Customer’s conversion to Global’s Systems for a mutually agreeable fee. All equipment provided by Customer shall be reasonably acceptable to Global. Until such time as Customer has direct connections to Hewlett-Packard, Global will provide at a cost set forth on Schedule B-2 the necessary file transfers between Customer’s front end systems and Global’s MAS.

f. In order to help Global properly perform the Services and Additional Services, Customer will reasonably inspect, and review those daily reports that are produced in the ordinary course of business in conjunction with the Services and Additional Services and are created from information transmitted from and/or delivered by Global to Customer. If either party notices any errors, deficiencies, or irregularities, such party shall inform the other within two (2) business days after receipt thereof for daily reports and within seven (7) business days after receipt thereof for other than daily reports. Notwithstanding the foregoing time limits, Customer shall promptly inform Global of any errors, deficiencies, or irregularities reflected in any such reports or other statements that Customer discovers. Customer’s failure to inform Global of any errors, deficiencies, or irregularities in any such statements or other reports shall not relieve Global of any of its obligations or reduce or waive any of Customer’s rights under this Agreement.

g. Each of the parties hereto will cooperate with the other to accommodate reasonable changes or modifications to each other’s systems which may occur from time to time.

h. Each party will comply with (A) all applicable state and federal laws and regulations and shall be solely responsible for its own compliance with Regulation Z, Fair Credit Reporting Act, or any other state or federal law or regulation, (B) applicable by-laws and regulations of VISA U.S.A., Inc., Visa International and MasterCard International Incorporated, American Express and Discover Financial Services, LLC, the debit networks, and other third party payment networks and without limiting the foregoing, the rules and standards promulgated by the PCI Security Standards Council, including Payment Card Industry (PCI) Data Security Standard (DSS) requirements and Payment Application Data Security Standard (PA DSS) (each of A and B collectively, “Rules”), and (C) Global’s operating policies and procedures identified in Exhibit A-3. Customer will (i) use written material, advice and technical information provided by Global in connection with the Services and Additional Services, (ii) effect all collections of its accounts, (iii) bear all losses from uncollected accounts, all costs or expenses incurred in connection with the collection of accounts, and costs or expenses incurred in connection with accounts with respect to which there is any controversy, claim, or dispute, and (iv) arrange for such action as may be appropriate or necessary because of misuse or abuse in the use of any account opened or accepted by it, and other terms and conditions applicable to transactions effected through it. Customer is further responsible for the compliance of the merchants processing hereunder with applicable Rules and the rules and standards promulgated by the PCI Security Standards Council, including without limitation PCI DSS requirements and, if applicable, PA DSS requirements.

i. Customer is responsible for the quality and accuracy of all data input by Customer and the merchants to Global. The parties shall, prior to the execution of this Agreement, agree upon all data format, input sequence and other data specifications reasonably required to perform the Services and Additional Services

8

and Customer will ensure that such data submitted by Customer and the merchants remains organized in such agreed upon format unless otherwise mutually agreed to by the parties. Any data submitted by Customer for processing which is incorrect, illegible, or otherwise not in the agreed upon format may be, at Global’s option, returned to Customer for correction before processing. In the event Customer fails to furnish its data to Global in the form and in accordance with the schedule agreed upon, Global will use all reasonable efforts to reschedule and process the work as promptly as possible, it being understood that reasonable and unavoidable expenses to Global occasioned by such failure will be borne by Customer.

7. OWNERSHIP: a. Customer agrees that (1) the Systems (which are defined as the computer programs, including without limitation, software, firmware, application programs, operating systems, files, and utilities used to provide the Services and Additional Services), (2) supporting documentation for such computer programs, including without limitation, input and output formats, program listings, narrative descriptions, operating instructions and programming instructions, and (3) any tangible media upon which such programs are recorded, including without limitation, chips, tapes, disks, any diskettes and which includes all changes, additions and/or enhancements to any of the foregoing) supplied or made available to it by Global or used by Global to provide the Services and Additional Services are the exclusive property of Global, its agents, suppliers, or contractors. Customer further agrees that the Systems or any part thereof will not be copied or used in any manner or for any purpose or by any entity other than that specifically authorized by this Agreement and shall not be used in connection with the systems or services of any entity other than Global. Unless otherwise specified in a written SOW signed by the parties, the Systems and all computer tapes, disks, programs, specifications and enhancements developed in connection with the Services and Additional Services are and shall remain at all times during and after the term of this Agreement the exclusive property of Global; provided that any merchant and transaction data, proprietary information or trade secrets of Customer incorporated into or used to develop the same shall be and remain the sole and exclusive property of Customer. Except as otherwise specified in a written SOW or amendment signed by the parties, Customer hereby assigns all its rights, title and interest, if any, in such tapes, disks, programs, specifications and enhancements to Global. All rights not expressly granted to Customer hereunder shall be retained and reserved by Global. Without limiting the foregoing, except as expressly permitted herein, Customer may not: (x) copy, display, transfer, adapt, modify, or distribute (electronically or otherwise) the Systems (or any component or portion thereof); (y) reverse assemble, reverse compile, otherwise translate, or reverse engineer the Systems’ underlying code; or (z) purport to sublicense, grant third party access to or permit any third party to access or utilize the Systems (or any component or portion thereof); provided that Customer may, with Global’s written consent (not to be unreasonably withheld, delayed or conditioned) provide reasonable access to the Systems to its subcontractors or agents as necessary in connection with Customer’s use of the Services and the Additional Services, provided further that such subcontractors or agents shall be required to enter into confidentiality agreements with Global and Customer shall be responsible for the compliance with such subcontractors and agents with the terms hereof and shall be liable for the conduct of such subcontractors and agents as if undertaken by Customer itself.

b. Unless otherwise specified in a written SOW signed by the parties, all software, firmware, application programs, operating systems, files and utilities and all related documentation and tangible media created or provided by Customer in relation to Customer’s systems and processes shall be and remain the sole and exclusive property of Customer.

c. Global and Customer acknowledge and agree that, as between Global and Customer, Customer shall own and retain exclusive right, title and interest in and to (i) all contracts between Customer and those merchants with whom Customer has a current agreement for the provision of card processing services (“Mercury Merchants” and “Merchant Agreements”), (ii) information and data supplied by or on behalf of Customer or Mercury Merchants for purposes of Customer’s receipt of the Services or Additional Services, and (iii) transaction data relating exclusively to Mercury Merchants, which data was

9

created as a result of the provision of Services or Additional Services hereunder to Customer, provided however that, notwithstanding the foregoing, in no event shall Customer own or obtain rights or interest in (iv) data relating to the operation or performance of Global’s systems, (v) any metrics or measurements related thereto, (vi) data relating to merchants who are not Mercury Merchants, (vii) data independently developed or obtained by Global without reference to any information or data supplied by or on behalf of Customer, or (viii) Global’s provision of merchant processing services and other services to other entities. Customer hereby grants a non-transferable license to Global for its use during the term of this Agreement solely to provide the Services and Additional Services to (ii) and (iii) above, which data shall be referenced cumulatively and exclusive of (iv), (v), (vi), (vii) and (viii) as “Customer Data.” Global will utilize Customer for all communications, written or oral, with all Mercury Merchants. Customer will administer and control the Merchant Agreements and the relationship created thereby, including without limitation decisions regarding the continuance, amendment, assignment or termination of such Merchant Agreements. Notwithstanding Customer’s ownership of such Merchant Agreements and Customer Data, Global shall be responsible for using commercially reasonable measures consistent with industry standards to secure and maintain the confidentiality of all Merchant Agreements and Customer Data while resident on Global’s systems or otherwise in Global’s possession or custody and in connection with Global’s transmission of the same. For the avoidance of doubt, the provisions of this paragraph are intended to convey all Merchant Agreements, all Customer Data, and the revenue derived therefrom (which shall not limit Customer’s obligation to pay fees hereunder) fully to Customer such that neither category of property shall, at any time, be deemed to be the property of Global nor any successor or receiver of Global, nor any part of any Global bankruptcy or receivership estate, and is not intended as security.

d. Nothing contained in this Agreement shall restrict either party from the use of any ideas, concepts, know-how, methodologies, processes, technologies, algorithms or techniques relating to the Services and Additional Services which either party, individually or jointly, (i) owns prior to the date hereof, or (ii) develops or discloses under this Agreement, (iii) develops or obtains independently during the Term, or (iv) incidentally learns or develops in the course of performance and retains in the unaided memories of its personnel, provided that in doing so such party does not breach its obligations of confidentiality or infringe the intellectual property rights of the other party, or third parties, who have licensed or provided materials to the other party. Except for the license rights expressly granted under this Agreement, neither this Agreement nor any disclosure made hereunder imputes any license rights to either party under any patents or copyrights of the other party. Each party reserves all rights in its ideas, concepts, know-how, methodologies, processes, technologies, algorithms, techniques and other intellectual property of every kind and description (except as otherwise expressly agreed in writing) and no provision of this Agreement shall be construed to transfer any of such party’s rights in such intellectual property.

8. LIMITATION OF LIABILITY/INDEMNIFICATION:

a. Global shall not be liable for failure to provide the Services and/or Additional Services if such failure is due to any cause or condition beyond its reasonable control taking into account reasonably customary business continuity and disaster recovery plans. Such causes or conditions shall include but shall not be limited to, acts of God or of the public enemy, acts of the Government in either its sovereign or contractual capacity, fires, floods, epidemics, quarantine restrictions, freight embargoes, unusually severe weather, electrical power failures, telecommunication failures, or other similar causes beyond Global’s control and Global shall have no liability for losses, expenses or damages, ordinary, special or consequential resulting directly or indirectly from such causes. If Global’s failure to provide the Services and/or Additional Services is caused by the default of a Global subcontractor, and if such default arises out of causes beyond the control of both Global and the subcontractor, Global shall not be liable unless the supplies or Services and Additional Services to be furnished by the subcontractor were obtainable

10

from other sources on commercially reasonable terms and in sufficient time to permit Global to fulfill its obligations hereunder. In the event of such events or conditions, Global will promptly provide notice to Customer and exercise commercially reasonable efforts to overcome or cure such events or conditions. In the event that such events or conditions continue for more than seven (7) days, Customer may temporarily seek alternative services or terminate this Agreement with no penalties or liability obligations to Global as a result of the force majeure event.

b. Global agrees to use its commercially reasonable efforts at all times to provide prompt and efficient services; however, Global makes no warranties or representations regarding the Services or Additional Services except as specifically set forth in this Agreement. Global shall use due care in providing the Services and Additional Services hereunder and agrees that it will, at its expense, correct any errors which are due to malfunction of Global’s computers, operating systems or programs, or errors by Global’s employees or agents. Correction shall be limited to rerunning of the job or jobs and/or recreating of data or program files. Global shall not be responsible in any manner for errors or failures of or errors in proprietary systems and programs other than those of Global or its affiliates or agents performing services on behalf of Global, nor shall Global be liable for errors or failures of Customer’s software or operational systems to the extent not caused or contributed to by the Services or Additional Services or Systems. THIS WARRANTY IS EXCLUSIVE AND IS IN LIEU OF ALL OTHER WARRANTIES, AND CUSTOMER HEREBY WAIVES ALL OTHER WARRANTIES, EXPRESS, IMPLIED, OR STATUTORY INCLUDING, BUT NOT LIMITED TO, ANY WARRANTY OF MERCHANTABILITY OR FITNESS FOR USE FOR A PARTICULAR PURPOSE.

Due to the nature of the services being performed by Global, it is agreed that in no event will Global be liable for any claim, loss, liability, correction, cost, damage or expense caused by Global’s performance or failure to perform hereunder which is not reported by Customer within one (1) year of such failure to perform or which occurred more than one (1) year prior to Global’s receipt of such report by Customer.

c. Customer agrees to defend, indemnify and hold Global, its parent, affiliates, and their respective officers, directors, employees, successors and assigns (“Global Indemnitees”) harmless from and against any third party claims, actions, threatened actions, or legal proceeding and any and all losses, damages, liabilities, settlement, costs or expense arising from (i) Customer’s breach of any representation or obligation under this Agreement, and (ii) any third party claim which alleges any software, firmware, application program, operating system, files and utilities and all related documentation provided by Customer to Global hereunder infringes upon a United States patent, trademark or copyright or misappropriates trade secrets protected under United States law, and (iii) against any and all expenses including judgments, fines, amounts paid in settlement, and any losses or damages resulting therefrom. This indemnification obligation includes the obligation to pay reasonable attorneys’ and other professionals’ fees and expenses and shall survive termination of this Agreement. Notwithstanding the foregoing, Customer shall not be obligated to defend, indemnify or hold the Global Indemnitees harmless from any claim of infringement or misappropriation to the extent it (i) is asserted by a parent, subsidiary or affiliate of Global, (ii) results from the negligence of Global or its affiliates and their respective officers, directors, successors and assigns, or (iii) results from Global’s Services and Additional Services, systems or data or Customer’s use thereof, provided Customer use complies with Global’s operating procedures and operating instructions with respect to the Services and Additional Services. This Section 8(a) states the entire liability of Customer and Global’s sole and exclusive remedies for patent, trademark or copyright infringement and trade secret misappropriation.

d. Global agrees to defend, indemnify and hold Customer and its affiliates and their respective officers, directors, employees, successors and assigns (“Customer Indemnitees”) harmless from and against any third party claims, actions, threatened actions, or legal proceeding and any and all loss,

11

damages, liabilities, settlement, costs or expense arising from (i) Global’s breach of any representation or obligation under this Agreement (except for a breach related to a delivery date for the Services or Additional Services), (ii) any third party claim which alleges that the Services and Additional Services or their use by Customer hereunder infringes upon a United States patent, trademark or copyright or misappropriates trade secrets protected under United States law, and (iii) against any and all expenses including judgments, fines, amounts paid in settlement, and any losses or damages resulting therefrom. This indemnification obligation includes the obligation to pay reasonable attorneys’ and other professionals’ fees and expenses and shall survive termination of this Agreement. Notwithstanding the foregoing, Global shall not be obligated to defend, indemnify or hold the Customer Indemnitees harmless from any claim of infringement or misappropriation to the extent it (i) is asserted by a parent, subsidiary or affiliate of Customer, (ii) results from the negligence of Customer or its affiliates and their respective officers, directors, customers, agents, successors and assigns, or such parties’ noncompliance with Global’s operating procedures and operating instructions with respect to the Services and Additional Services or (iii) results solely from Customer Data, Customer’s Equipment, or Customer’s software, firmware, application programs, operating systems, files and utilities and all related documentation and tangible media created or provided by Customer. This Section 8(d) states the entire liability of Global and Customer’s sole and exclusive remedies for patent, trademark or copyright infringement and trade secret misappropriation.

e. The party claiming indemnification shall: (a) promptly notify the indemnifying party in writing of any claim in respect of which the indemnity may apply; (b) relinquish control of the defense of the claim to the indemnifying party; and (c) provide the indemnifying party with all assistance reasonably requested in defense of the claim. The indemnifying party shall be entitled to settle any claim without the written consent of the indemnified party so long as such settlement only involves the payment of money by the indemnifying party and in no way affects any rights of the indemnified party.

f. Except for each party’s indemnification obligations or a breach of a party’s obligations under Sections 7 or 9, in no event shall either party be liable to the other party for any special, consequential, or indirect damages in connection with this Agreement; provided that the liability of either party for any third party special, consequential or indirect damages arising in respect of a party’s indemnification obligations (even if subsequently characterized as direct damages to the indemnitee) shall in no event exceed $***** in any twelve month period.

9. PROPRIETARY INFORMATION:

a. All proprietary information disclosed by either party to the other in connection with this Agreement shall be identified as such in writing if not already identified as such herein, including but not limited to the information described in Section 7.c., and shall be protected by the recipient party from disclosure to others, and shall not be used by the recipient for any purpose other than to carry out its obligations under the Agreement. All Systems (and their components) provided by Global under this Agreement or used by Global to provide the Services or Additional Services are herein identified as the proprietary information of Global and Customer may not transfer, modify, reverse engineer, emulate, copy or use in any way other than as specifically authorized in this Agreement. Any software, firmware, application programs, operating systems, files and utilities and all related documentation furnished by or on behalf Global to Customer in connection with this Agreement is identified as the proprietary information of Global, and any access to such items is authorized solely as necessary in conjunction with Customer’s receipt of Services or Additional Services hereunder. Any files and related documentation furnished by or on behalf of Customer to Global in connection with this Agreement is identified as the proprietary information of Customer, but may be retained by Global until performance under this Agreement is completed or until this Agreement is terminated, at which time such information and all copies thereof shall be destroyed or returned to Customer upon request.

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

12

b. Global and Customer acknowledge that all proprietary information disclosed by either party to the other party for the purpose of work, or which comes to the attention of one of the parties, its employees, officers, and agents during the course of such work, constitutes a valuable asset. Therefore, Global and Customer agree to hold such information in confidence and shall not, except in the performance of the duties under this Agreement or with the express prior written consent of the other party, disclose or permit access to or use of any such information to or by any person, firm or corporation other than persons, firms or corporations authorized by that party or as necessary in conjunction with the provision and/or receipt of Services and Additional Services hereunder, and Global and Customer shall cause their officers, employees, agents, and representatives to take such action as shall be necessary or advisable to preserve and protect the confidentiality of such information during the term of the Agreement and for a period of ***** years following termination of the Agreement.

c. Global’s and Customer’s obligations and agreements under this paragraph shall not apply to any information supplied that:

(1) is already in the possession of the receiving party and not subject to an existing agreement of confidence between the parties; or

(2) is or becomes available to the public other than by breach of this Agreement; or

(3) otherwise becomes lawfully available on a nonconfidential basis from a third party who is not under an obligation of confidence to either party; or

(4) which is disclosed pursuant to a requirement or request of a court of competent jurisdiction or a government agency (provided that the receiving party notifies the disclosing party regarding the receipt of such request prior to its provision of information to the requesting party); or

(5) which is independently developed by the receiving party (without use of the information provided hereunder).

10. COMPLIANCE; REPRESENTATIONS:

a. In addition to and without limiting the requirements set forth in Exhibit C, Global represents, warrants and covenants that the Services and Additional Services and the Global Processing Resources (as defined in Exhibit C) shall be compliant with (i) all applicable laws, rules, and regulations, and (ii) all applicable security requirements of the Payment Brands (as defined herein), including without limitation rules promulgated by the PCI Security Standards Council, in each case, as such may be amended, modified, supplemented, or replaced from time to time (“Security Requirements”).

b. In addition to and without limiting the requirement set forth in Exhibit C, Customer represents, warrants and covenants that Mercury Information Systems (as defined in Exhibit C) shall be compliant with (i) all applicable laws, rules, regulations and standards, and (ii) all applicable security requirements of the Payment Brands (as defined herein), including without limitation the Security Requirements.

c. Global will provide an Attestation of Compliance with PCI DSS for the Services and Additional Services, where and when applicable. In connection with its performance of the Services and Additional Services hereunder, Global acknowledges that Global is responsible for the privacy and security of any and all Cardholder Data (as such term is defined in the PCI DSS) that Global, at any time, accesses,

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

13

stores, or otherwise possesses pursuant to this Agreement. “Payment Brands” means the PCI Security Standards Council, LLC, American Express, Visa, U.S.A., Inc., MasterCard International, Inc., Discover Financial Services, LLC, and any other credit card, debit card, or other payment network.

d. Customer will provide an Attestation of Compliance with PCI DSS its activities related to the Services and Additional Services, where and when applicable. In connection with its receipt of the Services and Additional Services hereunder, Customer acknowledges that Customer is responsible for the privacy and security of any and all Cardholder Data (as such term is defined in the PCI DSS) that Customer, at any time, accesses, stores, transmits or otherwise possesses pursuant to this Agreement.

e. Each party represents and warrants to the other as follows:

(a) It is duly organized and validly existing under the laws of its jurisdiction of organization.

(b) It is qualified to carry on its business wherever qualification is necessary for the conduct of its business.

(c) It has all necessary organizational power to carry on its business, enter into this Agreement and perform its obligations hereunder.

(d) The execution, delivery and consummation of all transactions contemplated in this Agreement have been duly authorized by all necessary organizational action on its part.

(e) This Agreement constitutes a legal, valid and binding obligation of the relevant party, enforceable against it in accordance with its terms.

(f) Its execution and performance of this Agreement will not, to its knowledge, (i) violate any law or regulation, or breach the terms of any judgment, instrument, agreement, charter or by-law provision, authorization or license to which it or its assets are subject; (ii) violate or infringe any proprietary rights of third parties; or (iii) create circumstances that would, with notice or lapse of time, or both, constitute violation, breach or infringement of any of the foregoing.

11. MISCELLANEOUS:

a. This Agreement shall be construed in all respects under the laws of the State of Georgia, without giving effect to conflicts of laws provisions.

b. Customer shall have the right to request in writing that Global provide the Services and Additional Services to any of its United States-based Affiliates (as defined below) upon the same terms and conditions and, with respect to each such Affiliate, in the event that such Affiliate receives the Services and Additional Services, subject to the same rights, obligations and limitations as are applicable to Customer. Global shall consider such request in good faith and respond within a reasonable time following such request. “Affiliate” means any corporation, partnership, limited liability company or other entity (i) that owns, directly or indirectly through one or more other entities, more than fifty percent (50%) of the voting securities of Customer, or (ii) in which Customer or any entity described in (i) above owns, directly or indirectly through one or more other entities, more than fifty percent (50%) of the voting securities, or (iii) is under common control with Customer. An entity shall be considered an Affiliate for purposes of the preceding sentence for only such time as the requirements of the preceding sentence continue to be met.

c. This Agreement contains the full understanding of the parties with respect to the subject matter hereof and supersedes and replaces any prior agreements relating to similar subject matter, and no waiver, alteration or modification of any of the provisions hereof, except for new Service Pricing Schedule(s) as permitted under Section 3, shall be binding unless in writing and signed by officers of both parties. In the

14

event Customer issues a purchase order or memorandum or other instrument covering the Services and Additional Services herein offered and provided, it is hereby specifically agreed and understood that such purchase order or memorandum or instrument is for Customer’s internal purposes only and any and all terms and conditions contained therein, whether printed or written, shall be of no force or effect.

d. If any part of this Agreement shall be held to be void or unenforceable, such part will be treated as severable, leaving valid the remainder of this Agreement notwithstanding the part or parts found to be void or unenforceable.

e. Except as otherwise provided in this Agreement, notices required to be given pursuant to this Agreement shall be effective when received, and shall be sufficient if given in writing, hand delivered, sent by telegraph or First Class United States Mail, postage prepaid and addressed to the appropriate party at the address set forth on the cover page hereof.

The parties hereto may change the name and address of the person to whom all notices or other documents required under this Agreement must be sent at any time by giving written notice to the other party.

f. Neither party to this Agreement may assign its rights or obligations under this Agreement without the express written consent of the other party, except that the obligations of Global under this Agreement may be provided or fulfilled by any parent, subsidiary, affiliate, successor corporation or subcontractor of Global so long as Global assumes full responsibility for such obligations; provided further that Global shall notify Customer in the event it elects to subcontract a material portion of the services provided under this Agreement to the extent that the subcontracting of such services with such subcontractor was not in effect on the date of this Agreement. In the event that Customer merges, consolidates with any other person or entity, transfers substantially all of its assets to another person or entity, or otherwise undertakes a corporate reorganization the result of which is that Customer is not the surviving entity, the rights, obligations and liabilities under this Agreement shall survive and be binding upon such successor.

IN WITNESS WHEREOF, the parties hereto have caused this Agreement to be executed by their duly authorized officers and to be effective as of the date executed by Global.

15

EXHIBIT A-1

Mercury – Global Agreement for Back-end Services

Implementation Timeline and Milestones

| Implementation Milestone |

Target Date |

Incentive for Achieving Date (if applicable) | ||

| Mercury Front End to Global ISO Back End Full Readiness | ***** , 2013 | ***** | ||

| Dedicated MAS Full Readiness | ***** days from the execution date of Indirect MSA | ***** | ||

| Implementation complete

• Oracle System Full Readiness

• Mercury Front End to Global Indirect Back End Full Readiness |

***** days from the execution date of the of the Indirect MSA | If Full Readiness is achieved on or prior to the Target Date, Global will receive an additional bonus payment of $***** | ||

“Full Readiness” means that the systems or functionality have been placed into production with all features functioning properly, including tested and validated interfaces between Mercury Front End and Global Indirect Backend, regardless of whether or not Mercury is utilizing the functionality. Global shall use commercially reasonable efforts to achieve Full Readiness of the identified systems or functionality on or before the Target Dates set forth above. Any incentive for date achievement will be debited to Customer under the Agreement.

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

EXHIBIT A-2

SERVICE DESCRIPTION FOR MERCHANT ACCOUNTING SERVICES

For purposes of this Exhibit A-2, defined terms used herein will have the meanings ascribed thereto in the Agreement.

1. SYSTEM INSTALLATION

Customer and Global acknowledge their mutual intent to install the Services as soon as reasonably practicable, and in any event in accordance with the implementation schedule and milestones set forth in Exhibit A-1. Global will provide to Customer frequent updates as to the status of its installation efforts. Customer shall pay the conversion charges for such initial installation in accordance with Pricing Schedule B-2.

2. TRAINING & SUPPORT

Global shall provide to Customer a training program conducted at Global’s or Mercury’s facilities for the purpose of training Customer’s personnel in the proper use of Global’s procedures, systems, and reports. The training program will include Global personnel competent to train Customer personnel on the use of the Services for up to seven (7) business days at no charge to Customer. Three (3) additional days available with Customer absorbing travel, lodging and meal expense for Global personnel if onsite at Customers facilities. Customer shall provide competent personnel for such training and shall cooperate with Global in properly scheduling such training in conjunction with Customer’s conversion to the Services. If requested by Customer, additional training will be provided at mutually agreeable rates, plus all related expenses which may include without limitation, the costs of air fare, meals, lodging, and rental car. In the event Customer desires to have the initial training conducted at Customer’s location, Customer agrees to reimburse Global for the related travel and lodging expenses (as described above) of the Global personnel conducting the training. Global shall provide Customer on-going support related to the training program for a period of up to six (6) months. The support will include, but is not limited to, prompt email response to inquiries and requests, telephone support and web conferencing as needed.

3. BASIC MERCHANT SERVICES

| (a) | Global will provide a back-end processing merchant data base system (Merchant Accounting System or. MAS) for Customer to access on-line account information for inquiry and update. The Merchant Accounting System facilitates settlement and billing processes based on transactional data fed into the system. |

| (b) | Global will maintain and perform daily data processing and update cycles for the merchant accounting records of Customer maintained by Global, in accordance with established procedures. Full documentation of which will be provided throughout the implementation process. |

| (c) | Global will provide sales transaction data processing services including: |

| (i) | receiving electronic files in accordance with Global’s published specifications, containing monetary transaction data from Customer for data processing of account data; and |

Rev. 7/13

| (ii) | creating, based on files received and verification performed by Global’s system, and transmitting outgoing interchange fees and settlement in accordance with association cutoff times |

| (iii) | processing, loading and Global’s iBalance system and retention of incoming interchange fees and settlement; and |

| (iv) | transmission of sales transaction files to 3rd parties as requested by customer; and |

| (iv) | creating and transmitting outgoing ACH files to sponsor bank in accordance with cutoff time to be agreed upon during implementation.. |

| (d) | Global will provide sales billing processing services including: |

| (i) | calculating merchant fees and/or discount rates, |

| (ii) | creating and transmitting the ACH debit file to bank, |

| (iii) | preparing merchant account statements and related transmission files; and |

| (iv) | providing applicable reports to Customer and any 3rd party requested by Customer. |

| (e) | Global will receive electronic files containing authorization data from third party point-of-sale vendors or Customers front end system at Customer’s direction and in accordance with Global’s published specifications. |

| (f) | Customer shall pay the reasonable charges of Global for reruns necessitated by incorrect or incomplete data or erroneous instructions supplied to Global and for correction of programming, operator, and other processing errors caused solely by Customer, its merchants, or their employees or agents. |

| (g) | Global shall be responsible for any costs associated with reruns necessitated by system or file transmission processing errors if said error stems solely from a Global error. |

| (h) | Global shall provide a dedicated instance of their Oracle Financials system for Customer to access for on-line account information and inquiry. |

| (i) | Global shall maintain connectivity between the Merchant Accounting System and the Oracle system as well as facilitate agreed upon feeds between systems on a consistent basis. |

| (j) | Global shall receive return and reject files from bank, upload into appropriate systems and create auto reserves or take other agreed upon action based on these files. |

| (k) | Global shall provide necessary assistance and coordinate any assistance required by 3rd party vendors to resolve for transactions resulting in rejects, downgrades or other processing errors. |

| (l) | Global shall provide customer with cycle monitoring reports indicating file transmission metrics and success |

Rev. 7/13

| (m) | Global shall provide customer with manuals, specifications and run books as available and updated. |

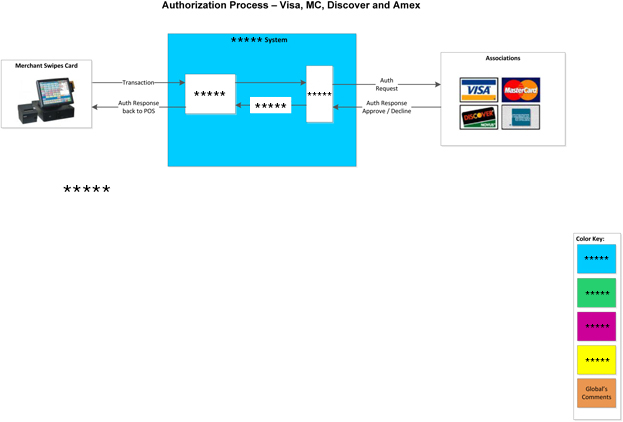

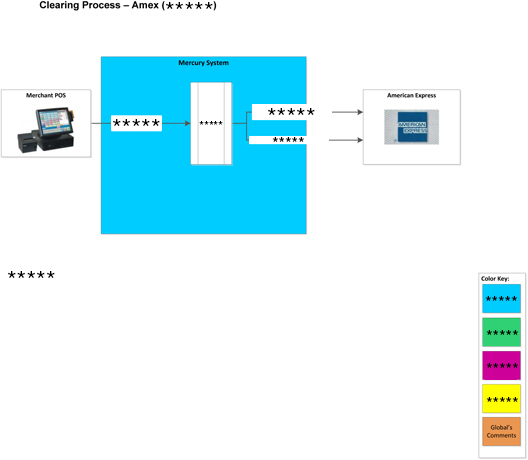

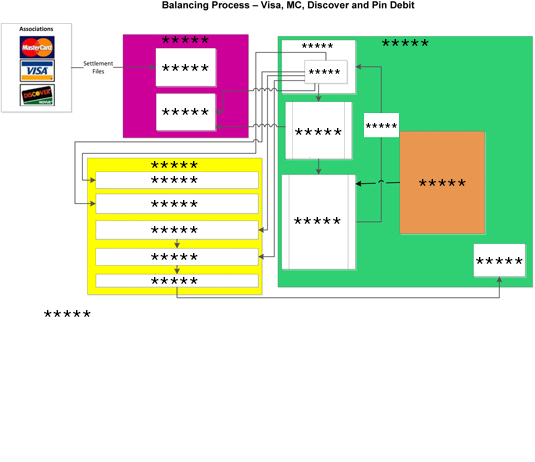

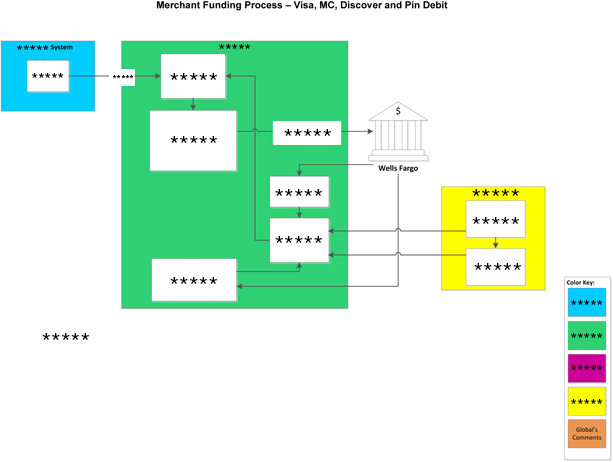

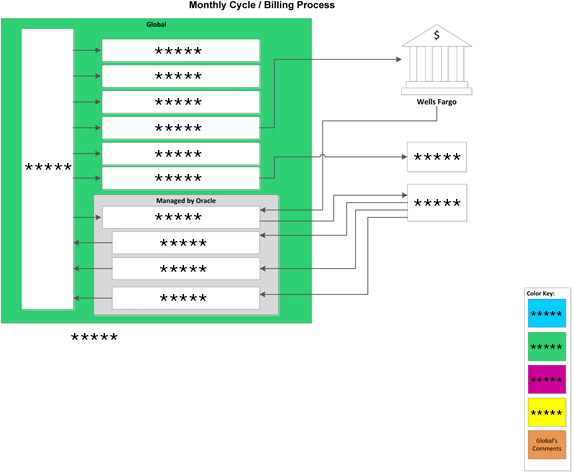

| (n) | Attached as Schedule I to this Exhibit are process flow diagrams reflecting the parties’ mutual understanding of the provision of, access to and use of the Services. |

| (o) | Attached as Schedule II to this Exhibit is the Global / Mercury Indirect Implementation and Conversion Plan reflecting the parties’ mutual understanding of the provision of, access to and use of the Services. |

4. OPTIONAL SERVICES

| (a) | Global will perform merchant plastic and imprinter plate preparation services upon request by Customer. |

| (b) | Global will provide voice authorization services for Customer’s merchants to be billed in accordance with charges listed in Schedule B-2, Service Pricing Schedule. |

| (c) | Global may provide computer systems and computer programming services in response to specific requests from Customer which is not otherwise provided as part of the Basic Services. These services would be provided at a mutually agreed upon cost between Global and Customer. |

| (d) | Customer has the option of utilizing a Global Payments Merchant Fraud Management System. This is a risk management system that executes fraud review of merchant daily transactions, based on customizable customer-defined fraud parameters. |

| (e) | Ad Hoc Reporting can be requested by Customer. The ad hoc tables are housed on a ***** which contains data from the *****. Compatible with most current reporting software. |

| (f) | Global will provide ***** processing on behalf of Customer to be billed in accordance with Schedule B-2. As well as take action necessary to support ***** processing. |

| (i) | Global will also provide the system and/or staff support for collection letters, compliance cases, and arbitrations. |

| (ii) | Global will perform the necessary steps to enter any adjustments into the Merchant Accounting System to enable *****. |

| (iii) | Global will load necessary billing data into system. |

| (g) | Merchant account statements will be provided by Global. Distribution and delivery shall be in accordance with methods and prices agreed upon by both parties. |

| (h) | Global will provide on-going services following the transition and training periods for any processes performed using the Systems at the rates set forth in Schedule B-2, Service Pricing Schedule. |

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

Rev. 7/13

| (i) | Global shall make available to Customer any service enhancements, functionality or features offered by Global generally to its customers, including those developed in response to new payment systems. Customer shall have the right to request that Global update or modify its services to address additional or changing needs of Customer, including in connection with new payment systems and at mutually agreed on cost to Customer or in accordance with rates set forth in Schedule B-2 Service Pricing Schedule. |

6. PASS THROUGH SERVICES

Global shall provide select Services on a pass-through cost basis, as defined in Schedule B-2.

7. PRICING

The pricing for the services set forth in this Exhibit A-2 which are provided to Customer are set forth in Schedule B-2.

Customer:

| GLOBAL PAYMENT SYSTEMS LLC | ||||||

| By: /s/ ▇▇▇▇ ▇▇▇▇▇▇ |

By: /s/ ▇▇▇▇▇▇▇ ▇▇▇▇▇ | |||||

| Print Name: CEO | Print Name: ▇▇▇▇▇▇▇ ▇▇▇▇▇ | |||||

| Title: CEO | Title: General Counsel | |||||

| Date: 7/12/13 | Date: | |||||

Rev. 7/13

Schedule 1

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

Rev. 7/13

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

Rev. 7/13

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

Rev. 7/13

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

Rev. 7/13

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

Rev. 7/13

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

Rev. 7/13

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

Rev. 7/13

Schedule II to Exhibit A-2

|

MERCURY INDIRECT IMPLEMENTATION & CONVERSION PLAN | Open Items | ||||||||||||||

| (M) Milestone | ||||||||||||||||||||

| Task # |

Task |

Status | Target Start Date |

Target End Date |

Actual Start Date |

Actual End Date |

Comments | Owner | ||||||||||||

| I |

PROJECT STRATEGY | |||||||||||||||||||

| 1 |

***** | GP / Mercury | ||||||||||||||||||

| 2 |

***** | GP / Mercury | ||||||||||||||||||

| 3 |

***** | Global | ||||||||||||||||||

| 4 (M) |

***** | Global | ||||||||||||||||||

| 5 |

***** | Global | ||||||||||||||||||

| a | ***** | Global | ||||||||||||||||||

| 6 |

***** | Global | ||||||||||||||||||

| 7 |

***** | Global | ||||||||||||||||||

| 8 |

***** | Global | ||||||||||||||||||

| 9 |

***** | Global | ||||||||||||||||||

| 10 |

***** | Global | ||||||||||||||||||

| II |

LEGAL / ASSOCIATION PAPERWORK | |||||||||||||||||||

| 1 (M) |

***** | GP / Mercury | ||||||||||||||||||

| 2 |

***** | GP / Mercury | ||||||||||||||||||

| 3 |

***** | |||||||||||||||||||

| 4 (M) |

***** | GP / Mercury | ||||||||||||||||||

| a | ***** | Mercury | ||||||||||||||||||

| b | ***** | Mercury | ||||||||||||||||||

| c | ***** | Mercury | ||||||||||||||||||

| d | ***** | Mercury | ||||||||||||||||||

| e | ***** | Mercury | ||||||||||||||||||

| 5 |

***** | GP / Mercury | ||||||||||||||||||

| a | ***** | GP / Mercury | ||||||||||||||||||

| 6 (M) |

***** | GP / Mercury | ||||||||||||||||||

***** Information for which confidential treatment has been requested is omitted from this page and has been provided separately to the Securities and Exchange Commission.

| Indirect Implementation Plan | 7/10/2013 |

| (M) Milestone |

||||||||||||||||||||||

| Task # |

Task |

Status | Target Start Date |

Target End Date |

Actual Start Date |

Actual End Date |

Comments | Owner | ||||||||||||||

| III |

SETTLEMENT | |||||||||||||||||||||

| 1 |

***** | GP / Mercury | ||||||||||||||||||||

| 2 |

***** | Global | ||||||||||||||||||||

| 3 |

***** | GP / Mercury | ||||||||||||||||||||

| a | ***** | GP / Mercury | ||||||||||||||||||||

| b | ***** | GP / Mercury | ||||||||||||||||||||

| 4 |

***** | Mercury | ||||||||||||||||||||

| 5 |

***** | Mercury | ||||||||||||||||||||

| a | ***** | Mercury | ||||||||||||||||||||

| b | ***** | Mercury | ||||||||||||||||||||

| 6 |

***** | Mercury | ||||||||||||||||||||

| 7 |

***** | Mercury | ||||||||||||||||||||

| 8 |

***** | Mercury | ||||||||||||||||||||

| a | ***** | Mercury | ||||||||||||||||||||

| b | ***** | Mercury | ||||||||||||||||||||

| 10 |

***** | GP / Mercury | ||||||||||||||||||||

| a | ***** | Mercury | ||||||||||||||||||||

| b | ***** | GP / Mercury | ||||||||||||||||||||

| 11 |

***** | Global | ||||||||||||||||||||

| 12 |

***** | GP / Mercury | ||||||||||||||||||||

| 13 |