LIMITED WAIVER TO CREDIT AGREEMENT

Exhibit 10.3

EXECUTION COPY

LIMITED WAIVER TO CREDIT AGREEMENT

This Limited Waiver (the “Waiver”) to Credit Agreement is entered into as of November 8, 2021 (the “Waiver Effective Date”), by and among TPI COMPOSITES, INC., a Delaware corporation (the “Borrower”) and the financial institutions party hereto as lenders pursuant to that certain Credit Agreement, dated as of April 6, 2018 (as amended, restated, supplemented or otherwise modified from time to time, the “Credit Agreement”; capitalized terms used but not defined herein have the meanings given to such terms in the Credit Agreement) by and among the Borrower, the financial institutions party thereto from time to time as lenders and JPMORGAN CHASE BANK, N.A., as the Administrative Agent (the “Administrative Agent”).

RECITALS

WHEREAS, the Borrower has requested that the requisite Lenders and the Administrative Agent agree to temporarily waive an Event of Default under the Credit Agreement as described in Section 2.1 below and subject the terms set forth in Section 2 below; and

WHEREAS, the Borrower, the Lenders party hereto and the Administrative Agent have so agreed on the terms and conditions set forth herein;

NOW THEREFORE, in consideration of the premises and the mutual covenants herein contained, the parties hereto hereby agree as follows:

Section 1. Section References. Unless otherwise expressly stated herein, all Section references herein shall refer to Sections of the Credit Agreement.

Section 2. Limited Waiver.

2.1 The Borrower has informed the Lenders that an Event of Default has occurred as a result of the Borrower’s failure to comply with Section 6.12(a) of the Credit Agreement due to the Total Net Leverage Ratio for the period of four (4) consecutive fiscal quarters of the Borrower ending September 30, 2021 exceeding 2.75 to 1.00 (such specific Event of Default, the “Specified Default”). In reliance on the representations and warranties of the Borrower set forth in Section 5 below and subject to the satisfaction of the conditions precedent set forth in Section 3 below, solely during the Waiver Period (as defined below) and not at any other time, (a) the Lenders hereby agree to temporarily waive the Specified Default and the right to accelerate the Secured Obligations as a result thereof and (b) the Specified Default shall be deemed not to have occurred or be continuing, and the Administrative Agent and the Lenders shall have no right to enforce rights or exercise remedies solely with respect to the Specified Default. The waivers provided pursuant to the terms of this Waiver shall automatically and without further action or notice by any party expire on the Limited Waiver Termination Date (as defined below).

2.2 This Waiver is a limited waiver and no waiver provided herein shall remain in effect after the Limited Waiver Termination Date. Upon the Limited Waiver Termination Date, the Specified Default shall be deemed to be an Event of Default in full force and effect, having occurred as of September 30, 2021 and continuing uninterrupted thereafter for all purposes, and the Administrative Agent and the Lenders shall retain all of the rights and remedies related thereto. This Waiver shall not have the effect of tolling or extending any

applicable cure period beyond the period that would have applied absent this Waiver. Nothing in this Waiver shall be deemed to constitute a waiver by the Administrative Agent or the Lenders of any Default or Event of Default, whether now existing or hereafter arising, or of any right or remedy the Administrative Agent or the Lenders may have under any of the Loan Documents or applicable law, except to the extent expressly set forth herein, nor shall the Lenders’ execution and delivery of this Waiver establish a course of dealing among the Lenders and the Borrower or in any way obligate the Lenders to hereafter provide any further waiver of any kind, to provide any further time prior to the enforcement of their rights or to provide any other financial accommodations to or on behalf of the Borrower or any other Loan Party.

2.3 Notwithstanding anything to the contrary herein, the Lenders do not now waive, nor do they agree that they will waive in the future, any further Default or Event of Default. Neither this Waiver nor any course of dealing or delay or failure of the Lenders in exercising any right, remedy, power or privilege under or in connection with any Event of Default shall affect any other or future exercise thereof or the existence of any other right, remedy, power or privilege, except to the extent expressly set forth herein; nor shall any single or partial exercise of any such right, remedy, power or privilege or any abandonment or discontinuance of the steps to enforce any such right, remedy, power or privilege (pursuant to this Waiver or otherwise) preclude any further exercise thereof or of any other right, remedy, power or privilege, except to the extent expressly set forth herein.

2.4 It is expressly understood and agreed that, unless otherwise agreed in writing by the Required Lenders in their sole discretion, no Credit Event shall be requested by the Borrower or made by the Lenders on and after the Waiver Effective Date; provided that, for the avoidance of doubt, it is further understood and agreed that the Waiver provided in Section 2.1 above shall be deemed not to apply to Section 4.02 of the Credit Agreement.

For the purposes hereof:

“Limited Waiver Termination Date” means the earlier to occur of:

| (i) | 11:59 p.m. (New York City time) on December 8, 2021; or |

| (ii) | the date on which a Limited Waiver Termination Event occurs. |

“Limited Waiver Termination Event” means any of the following:

| (i) | the occurrence of any Event of Default or Default other than the Specified Default; |

| (ii) | any representation or warranty made by any Loan Party in connection with this Waiver shall prove to be false in any material respect as of the date when made; or |

| (iii) | the failure of any Loan Party to comply with any term, condition or covenant set forth in this Waiver (including but not limited to the covenants set forth in Section 4 hereof). |

“Waiver Period” means the period beginning on the Waiver Effective Date and ending on the Limited Waiver Termination Date.

2

Section 3. Conditions Precedent. The effectiveness of this Waiver is subject to the conditions precedent that the Administrative Agent shall have received (i) counterparts of this Waiver duly executed by the Borrower and the Required Lenders, (ii) an executed copy of a Suspension of Rights Agreement by and between the Borrower and the Administrative Agent, in form and substance reasonably satisfactory to the Administrative Agent, which agreement (x) suspends the availability of euro and Pounds Sterling as Agreed Currencies under the Credit Agreement and (y) suspends the availability of two month Interest Periods under the Credit Agreement, (iii) payment and/or reimbursement of the Administrative Agent’s and its affiliates’ fees and expenses (including, to the extent invoiced prior to the Waiver Effective Date, the reasonable fees and expenses of counsel for the Administrative Agent) in connection with this Waiver and the other Loan Documents and (iv) payment, for the account of each Lender that consents to this Waiver and delivers its executed signature page hereto by no later than the date and time specified by the Administrative Agent, a work fee in an amount that has previously been disclosed to the Lenders.

Section 4. Covenants.

4.1 The Borrower will not permit (x) Available Domestic Liquidity (defined below) to be less than $20,000,000 or (y) Available Global Liquidity (as defined below) to be less than $50,000,000, in each case as of the close of business on each Friday of each calendar week (commencing on Friday, November 5, 2021).

4.2 No later than 12:00 p.m. noon (Los Angeles Time) on the Wednesday of each calendar week (commencing on Wednesday, November 10, 2021), a certificate of a Financial Officer of the Borrower setting forth (x) reasonably detailed calculations demonstrating compliance with Section 4.1 hereof for the immediately preceding calendar week (which delivery may, unless the Administrative Agent (including at the request of any Lender to the Administrative Agent) requests executed originals, be by electronic communication including fax or email and shall be deemed to be an original authentic counterpart thereof for all purposes), (y) projections of the weekly cash flows for the 13-week period commencing on the first day of such fiscal week (the “13-Week Cash Flow Projections”), in form and detail acceptable to the Administrative Agent, prepared by the Borrower in consultation with the Financial Advisor (as defined below), subject to the proviso set forth in Section 4.3 hereof, after the Financial Advisor has been engaged, that reflect the Borrower’s and its Subsidiaries’ consolidated projected cash receipts and cash expenditures for their corporate and other operations and (z) a variance report, in form and detail satisfactory to the Administrative Agent, comparing, for each line of such 13-Week Cash Flow Projections, the actual disbursements and receipts for the previous reporting week and the percentage variance of such actual results from those projected for such previous reporting week on the most current 13-Week Cash Flow Projections delivered under the terms of this Waiver prior to such date (it being understood and agreed that the 13-Week Cash Flow Projections are due on Wednesday, November 10, 2021 regardless of whether the Financial Advisor has been engaged on or prior to such date).

4.3 No later than November 12, 2021, the Borrower shall engage a financial advisor (the “Financial Advisor”) reasonably acceptable to the Administrative Agent to assist the Borrower in complying with the covenants set forth in Section 4.2 above, which engagement shall be pursuant to an engagement letter between the Borrower and the Financial Advisor in form and substance acceptable to the Administrative Agent; provided, however, that in the event that the Borrower has received cash proceeds after the Waiver Effective Date from the issuance of Equity Interests by the Borrower in an aggregate amount not less than $300,000,000, the obligations of the Borrower under this Section 4.3 shall automatically terminate and cease to have any force or effect.

3

4.4 The Borrower will not permit any Subsidiary that is not a Loan Party to incur any Indebtedness on and after the Waiver Effective Date.

4.5 The Borrower will not, and will not permit any other Loan Party to, make any Investment in, or Disposition to, any Subsidiary that is not a Loan Party, other than Investments in aggregate amount not to exceed $5,000,000.

For purposes of this Section 4, (x) “Available Domestic Liquidity” means, as of any date of determination, the sum of (i) Unrestricted Cash, plus (ii) the aggregate Available Revolving Commitments, in each case, as of such date and (y) “Available Global Liquidity” means, as of any date of determination, the sum of (i) Unrestricted Global Cash, plus (ii) the aggregate Available Revolving Commitments, in each case, as of such date.

Section 5. Representations and Warranties of the Loan Parties. Each Loan Party hereby represents and warrants as follows:

5.1 This Waiver is within such Loan Party’s organizational powers and has been duly authorized by all necessary organizational action, and this Waiver has been duly executed and delivered by such Loan Party.

5.2 This Waiver constitutes the legal, valid and binding obligation of such Loan Party, enforceable in accordance with its terms, subject to applicable bankruptcy, insolvency, reorganization, moratorium or other laws affecting creditors’ rights generally and subject to general principles of equity, regardless of whether considered in a proceeding in equity or at law.

5.3 As of the date hereof and after giving effect to the terms of this Waiver, (i) no Default or Event of Default has occurred and is continuing and (ii) the representations and warranties of the Borrower set forth in the Credit Agreement are true and correct in all material respects (except to the extent such representation or warranty is qualified by materiality or Material Adverse Effect, in which case such representation and warranty is true and correct in all respects).

Section 6. Reaffirmation of Grant. Each Loan Party hereby represents and warrants to the Administrative Agent and the Lenders that, as of the Waiver Effective Date immediately after giving effect to this Waiver, (a) all Loan Documents to which such Loan Party is a party are and remain legally valid, binding obligations of such Loan Party, enforceable against each such Loan Party in accordance with their respective terms, except as may be limited by bankruptcy, insolvency, reorganization, moratorium or similar laws relating to or limiting creditors’ rights generally or by equitable principles relating to enforceability and (b) each of the Loan Documents to which such Loan Party is a party pursuant to which a Lien has been granted in favor of the Administrative Agent and all of the Collateral described therein do and shall continue to secure the payment of all Secured Obligations as set forth in such respective Loan Documents. Each Loan Party that is a party to any Collateral Document or any of the Loan Documents pursuant to which a Lien has been granted in favor of the Administrative Agent hereby reaffirms its grant of a security interest in the Collateral to the Administrative Agent for the ratable benefit of the Secured Parties, as collateral security for the prompt and complete payment and performance when due of the Secured Obligations.

4

Section 7. Release; Covenants; Acknowledgement.

7.1 In consideration of, among other things, Administrative Agent’s and the Lenders’ execution and delivery of this Waiver, each Loan Party, on behalf of itself and its agents, representatives, officers, directors, advisors, employees, subsidiaries, affiliates, successors, and assigns (each a “Releasor” and collectively the “Releasors”), hereby absolutely, unconditionally and irrevocably releases and forever discharges the Administrative Agent, each Lender, each other Secured Party and each of their respective affiliates, subsidiaries, shareholders and “controlling persons” (within the meaning of the federal securities laws), and their respective successors and assigns and each and all of the officers, directors, partners, employees, agents, attorneys, insurers, and other representatives of each of the foregoing (each a “Released Party” and collectively the “Released Parties”), from any and all claims, demands or causes of action of any kind, nature or description (including, without limitation, crossclaims, counterclaims, rights of set-off, and recoupment), whether arising in law or equity or upon contract or tort or under any state or federal law or otherwise, which any Loan Party has had, now has or has made claim to have against any such person for or by reason of any act, omission, matter, cause or thing whatsoever in connection with the Credit Agreement arising from the beginning of time to and including the Waiver Effective Date, whether such claims, demands and causes of action are matured or unmatured or known or unknown, in each case, other than directly arising as a result of the fraud or willful misconduct of such Released Party (as determined by a court of competent jurisdiction by final and non-appealable judgment). It is the intention of each Loan Party in providing this release that the same shall be effective as a bar to each and every claim, demand and cause of action specified in the immediately preceding sentence. Each Loan Party acknowledges that it may hereafter discover facts different from or in addition to those now known or believed to be true with respect to such claims, demands, or causes of action and agree that this instrument shall be and remain effective in all respects notwithstanding any such differences or additional facts. Each Loan Party understands, acknowledges and agrees that the release set forth above may be pleaded as a full and complete defense and may be used as a basis for an injunction against any action, suit or other proceeding which may be instituted, prosecuted or attempted in breach of the provisions of such release.

7.2 Each Loan Party, on behalf of itself and its successors, assigns, and other legal representatives, hereby absolutely, unconditionally and irrevocably, covenants and agrees with and in favor of each Released Party above that it will not xxx (at law, in equity, in any regulatory proceeding or otherwise) any Released Party on the basis of any claim released, remised and discharged by any Loan Party pursuant to the above release. If any Loan Party or any of their successors, assigns or other legal representatives violates the foregoing covenant, each Loan Party, for itself and its successors, assigns and legal representatives, agrees to pay, in addition to such other damages as any Released Party may sustain as a result of such violation, all reasonable attorneys’ fees and out-of-pocket costs incurred by such Released Party as a result of such violation.

7.3 Each Loan Party represents and warrants that, as of the date hereof, there are no liabilities, claims, suits, debts, liens, losses, causes of action, demands, rights, damages or costs, or expenses of any kind, character or nature whatsoever, known or unknown, fixed or contingent, which any Loan Party may have or claim to have against any Released Party arising with respect to the Secured Obligations, the Credit Agreement, this Waiver or any other Loan Document.

5

7.4 The provisions of this Section 7 (the “Release Provisions”) shall survive the termination of this Waiver, the Credit Agreement, and the other Loan Documents and payment in full of the Secured Obligations. The Borrower and the other Loan Parties acknowledge and agree that the Administrative Agent and the Lenders are entering into this Waiver in reliance upon, and is consideration for, among other things, the general releases and indemnities contained in the Release Provisions and the other covenants, agreements, representations, and warranties of the Borrower and the other Loan Parties hereunder.

Section 8. Survival. All representations and warranties made in this Waiver or any other Loan Document shall survive the execution and delivery of this Waiver, and no investigation by the Administrative Agent or the Lenders shall affect the representations and warranties or the right of the Administrative Agent and the Lenders to rely upon them.

Section 9. Reference to Agreement. The Credit Agreement is hereby amended so that any reference in the Loan Documents to the Credit Agreement, whether direct or indirect, shall mean a reference to the Credit Agreement as amended hereby. This Waiver shall constitute a Loan Document under the Credit Agreement.

Section 10. Governing Law. THIS WAIVER SHALL BE CONSTRUED IN ACCORDANCE WITH AND GOVERNED BY THE LAWS OF THE STATE OF NEW YORK.

Section 11. Execution. This Waiver may be executed in counterparts (and by different parties hereto on different counterparts), each of which shall constitute an original, but all of which when taken together shall constitute a single contract. The words “execution,” “signed,” “signature,” “delivery,” and words of like import in or relating to this Waiver and/or any document to be signed in connection with this Waiver and the transactions contemplated hereby shall be deemed to include Electronic Signatures (as defined below), deliveries or the keeping of records in electronic form, each of which shall be of the same legal effect, validity or enforceability as a manually executed signature, physical delivery thereof or the use of a paper-based recordkeeping system, as the case may be. As used herein, “Electronic Signatures” means any electronic symbol or process attached to, or associated with, any contract or other record and adopted by a person with the intent to sign, authenticate or accept such contract or record.

Section 12. Limited Effect. This Waiver relates only to the specific matters expressly covered herein, shall not be considered to be a waiver of any rights, claims or remedies any Lender may have under the Credit Agreement or under any other Loan Document (except as expressly set forth herein) or under applicable law, and shall not be considered to create a course of dealing or to otherwise obligate in any respect any Lender to execute similar or other amendments or grant any waivers under the same or similar or other circumstances in the future.

Section 13. Ratification by Subsidiary Guarantors. Each of the Subsidiary Guarantors acknowledges that its consent to this Waiver is not required, but each of the undersigned nevertheless does hereby agree and consent to this Waiver and to the documents and agreements referred to herein. Each of the Subsidiary Guarantors agrees and acknowledges that (i) notwithstanding the effectiveness of this Waiver, such Subsidiary Guarantor’s guaranty under the Guaranty shall remain in full force and effect without modification thereto and (ii) nothing herein shall in any way limit any of the terms or provisions of such Subsidiary Guarantor’s guaranty or any other Loan Document executed by such Subsidiary Guarantor (as the same may be amended, supplemented or otherwise modified from time to time), all of which are hereby ratified, confirmed and affirmed in all respects. Each of the Subsidiary Guarantors hereby agrees and acknowledges that no other agreement, instrument, consent or document shall be required to give effect to this section. Each of the Subsidiary Guarantors hereby further acknowledges that

6

the Borrower, the Administrative Agent and any Lender may from time to time enter into any further amendments, modifications, terminations and/or waivers of any provisions of the Loan Documents without notice to or consent from such Subsidiary Guarantor and without affecting the validity or enforceability of such Subsidiary Guarantor’s guaranty or giving rise to any reduction, limitation, impairment, discharge or termination of such Subsidiary Guarantor’s guaranty.

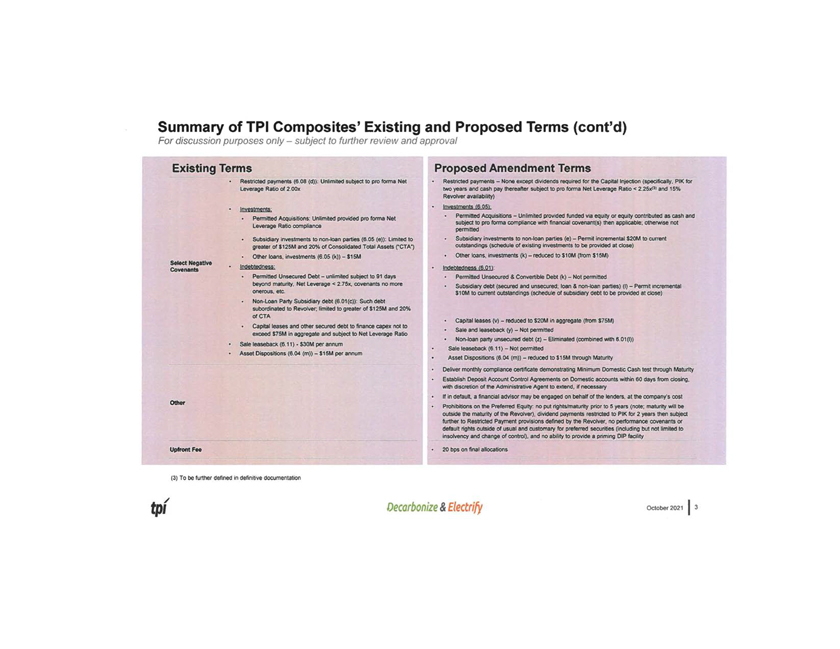

Section 14. Third Amendment. The Borrower, the Administrative Agent and the Lenders party hereto agree that, as soon as commercially reasonable following the Waiver Effective Date, such parties shall negotiate in good faith to enter into a definitive amendment to the Credit Agreement (the “Third Amendment”) substantially consistent with the indicative business terms set forth on Exhibit A hereto, it being understood and agreed that (x) the entry into the Third Amendment shall be subject to all necessary approvals from the Administrative Agent and the Lenders, and execution and delivery of definitive documentation satisfactory to the Borrower, the Administrative Agent and the Lenders party thereto and (y) this paragraph does not constitute a commitment or offer to commit by the Administrative Agent and the Lenders to enter into the Third Amendment.

[signature pages follow]

7

IN WITNESS WHEREOF, the parties hereto have caused this Waiver to be executed by their respective officers thereunto duly authorized, as of the date first above written.

| as Borrower | ||||||

| By: | /s/ Xxxxx Xxxxxxxxx | |||||

| Name: Xxxxx Xxxxxxxxx | ||||||

| Title: Chief Financial Officer | ||||||

| COMPOSITE SOLUTIONS, INC., | ||||||

| TPI ARIZONA, LLC, | ||||||

| TPI INTERNATIONAL, LLC, | ||||||

| TPI APAC, LLC, | ||||||

| TPI, INC., | ||||||

| TPI IOWA, LLC, | ||||||

| TPI IOWA II, LLC, | ||||||

| TPI MEXICO, LLC, | ||||||

| TPI MEXICO III, LLC, | ||||||

| TPI MEXICO V, LLC, | ||||||

| PONTO ALTO HOLDINGS, LLC, | ||||||

| TPI HOLDINGS MEXICO, LLC, | ||||||

| TPI TECHNOLOGY, INC., | ||||||

| TPI TURKEY, LLC, | ||||||

| TPI TURKEY IZBAS, LLC, | ||||||

| TPI APAC II, INC., as Subsidiary Guarantors | ||||||

| By: | /s/ Xxxxx Xxxxxxxxx | |||||

| Name: Xxxxx Xxxxxxxxx | ||||||

| Title: Chief Financial Officer | ||||||

Signature Page to Limited Waiver

| JPMORGAN CHASE BANK, N.A., individually as a Lender and as Administrative Agent | ||||

| By: | /s/ Xxxx Xxxxx | |||

| Name: Xxxx Xxxxx | ||||

| Title: Executive Director | ||||

Signature Page to Limited Waiver

| XXXXX FARGO BANK, NATIONAL ASSOCIATION, as a Lender | ||||

| By: | /s/ Xxxx Xxxxxxxx | |||

| Name: Xxxx Xxxxxxxx | ||||

| Title: Senior Vice President | ||||

Signature Page to Limited Waiver

| CAPITAL ONE, NATIONAL ASSOCIATION, as a Lender | ||

| By: | /s/ Xxxx Xxxx | |

| Name: Xxxx Xxxxx | ||

| Title: Director | ||

Signature Page to Limited Waiver

| BANK OF AMERICA, N.A., as a Lender | ||||

| By: | /s/ Xxxxx Xxxxxxx | |||

| Name: Xxxxx Xxxxxxx | ||||

| Title: Vice President | ||||

Signature Page to Limited Waiver

| BMO XXXXXX BANK, as a Lender | ||

| By: | /s/ Xxxxx X. Xxxx III | |

| Name: Xxxxx X. Xxxx III | ||

| Title: Director | ||

Signature Page to Limited Waiver

EXHIBIT A

Attached