EMPLOYMENT AGREEMENT

Exhibit 10.1

AGREEMENT by and between Motorola, Inc. (“Motorola”), and ▇▇▇▇▇▇ ▇. ▇▇▇ (the “Executive”), dated as of the 4th day of August 2008 (the “Effective Date”).

WHEREAS, the Board of Directors of Motorola (the “Motorola Board”) has determined that it is in the best interests of Motorola and its stockholders to employ the Executive as the Co-Chief Executive Officer of Motorola and the Chief Executive Officer of Motorola’s Mobile Devices Business (“MDB”);

WHEREAS, Motorola has announced a plan to create two independent publicly traded companies, one of which would consist of MDB (the “Separation Event”);

WHEREAS, it is possible that a different transaction could occur involving a sale, joint venture or other disposition of MDB as a result of which (a) MDB is not a separate publicly traded company and (b) is not at least 50% owned or controlled by Motorola or one of its subsidiaries (“Other Transaction Event”);

WHEREAS, for purposes of this Agreement, (a) prior to the Separation Event or an Other Transaction Event, all references to the “Company” shall mean Motorola, (b) from and after the Separation Event, all references to the “Company” shall mean the publicly traded corporation (“MDB Public”) that then owns or controls MDB, whether it is the spun-off entity or the surviving entity, and (c) from and after any Other Transaction Event, all references to the “Company” shall mean the ultimate parent entity (“MDB Other”) of the corporation or other legal entity that then owns or controls MDB;

WHEREAS, the Company desires to employ the Executive and to enter into an agreement embodying the terms of such employment; and

WHEREAS, the Executive desires to enter into this Agreement and to accept such employment, subject to the terms and provisions of this Agreement;

NOW, THEREFORE, in consideration of the premises and mutual covenants contained herein and for other good and valuable consideration, the receipt of which is mutually acknowledged, the Company and the Executive (individually a “Party” and together the “Parties”) agree as follows:

1. Effective Date; Commencement Date. This Agreement shall be effective as of the Effective Date. “Commencement Date” shall mean the date the Executive commences employment with the Company which shall not be later than August 4, 2008.

2. Employment Period. The Company hereby agrees to employ the Executive, and the Executive hereby agrees to be employed by the Company, subject to the terms and conditions of this Agreement, for the period commencing on the Commencement Date and ending on the third anniversary thereof (the “Initial Term”); provided that, on the third anniversary and each anniversary of the Commencement Date thereafter, the employment period shall be extended by one year unless at least sixty (60) days prior to such anniversary, the Company or the Executive delivers a written notice (a “Notice of Non-Renewal”) to the other Party that the employment period shall not be extended (the Initial Term as so extended, the “Employment Period”).

3. Terms of Employment. (a) Position and Duties.

(i) During the Employment Period and prior to the occurrence of the Separation Event or any Other Transaction Event (the “Motorola Service Period”): (A) the Executive shall serve as the Chief Executive Officer of MDB and the Co-Chief Executive Officer of Motorola in the Office of the Chief Executive Officer (the “OC”), with such duties, responsibilities and authority as are commensurate with such positions, reporting directly to the Motorola Board, (B) (1) Motorola’s General Counsel, (2) Motorola’s Chief Financial Officer, (3) the head of Motorola’s Supply Chain, (4) the head of Motorola’s Public Affairs/Communications Department and (5) the head of Motorola’s Human Resources Department (clauses (1) through (5), the “Dual Reporting Group”) shall report directly to the OC; provided, however, that (x) employees of MDB shall have direct line reporting relationships to the Executive or his designees (including any applicable member of the Dual Reporting Group) and (y) employees of Motorola’s business segments other than MDB shall have direct line reporting relationships to Motorola’s other Co-Chief Executive Officer or his designees (including any applicable member of the Dual Reporting Group) (items (x) and (y), together, the “Reporting Rules”), (C) Motorola shall cause the Executive to be elected to the Motorola Board as of the Commencement Date, and thereafter, subject to Section 4(g), the Executive shall be nominated by Motorola to remain on the Motorola Board, (D) Executive shall devote substantially all of his business time, energies and talents to serving as Motorola’s Co-Chief Executive Officer and MDB’s Chief Executive Officer, perform his duties subject to the lawful directions of the Motorola Board, and in accordance with Motorola’s corporate governance and ethics guidelines, conflict of interests policies, code of conduct and other written policies (collectively, the “Motorola Policies”), (E) the Motorola Board (or such committee of the Motorola Board as the Motorola Board shall duly designate) shall resolve any disagreement between Executive and Motorola’s other Co-Chief Executive Officer, (F) in the event that Executive becomes the sole Chief Executive Officer of Motorola, (1) he shall continue to report directly to the Motorola Board, with such duties, responsibilities and authority as are commensurate with such position, (2) the Reporting Rules shall cease to apply, and (3) he shall devote substantially all of his business time, energies and talents to serving as Motorola’s Chief Executive Officer and shall perform his duties in accordance with the Motorola Policies and (G) in the event that the Separation Event or an Other Transaction Event does not occur on or prior to December 31, 2010, unless the Parties agree otherwise in writing, (1) Executive’s employment with the Company shall terminate, (2) such termination shall be treated as a termination without Cause and (3) the other Co-Chief Executive Officer shall become the sole Chief Executive Officer.

(ii) During the Employment Period and following the Separation Event (the “MDB Public Service Period”), the Executive shall serve as the Chief Executive Officer of MDB Public, with such duties, responsibilities and authority as are commensurate with the position of chief executive officer of a company similar to the size and type of MDB Public (as it may evolve over time), reporting directly to the Board of Directors of MDB Public (the “MDB Public Board”). During the MDB Public Service Period, subject to applicable law and regulation, (A) the Executive shall be appointed to the MDB Public Board simultaneously with the appointment of “outside directors” to the MDB Public Board, and (B) thereafter during the MDB Public Service Period, subject to Section 4(g), the Executive shall be nominated by MDB Public to remain on the MDB Public Board. During the MDB Public Service Period, Executive shall devote substantially all of his business time, energies and talents to serving as MDB Public’s Chief Executive Officer and perform his duties subject to the lawful directions of the MDB Public Board and in accordance with MDB Public’s corporate governance and ethics guidelines, conflict of interests policies, code of conduct and other written policies (collectively, the “MDB Public Policies”).

-2-

(iii) During the Employment Period and following an Other Transaction Event (the “MDB Other Service Period”), the Executive shall serve as the Chief Executive Officer of MDB Other, with such duties, responsibilities and authority as are commensurate with the position of chief executive officer of a company similar to the size and type of MDB Other (as it may evolve over time), reporting directly to the Board of Directors of MDB Other (the “MDB Other Board”). In addition, during the MDB Other Service Period, (A) MDB Other shall cause the Executive to be elected to the MDB Other Board as soon as reasonably practicable following the completion of an Other Transaction Event, and (B) thereafter during the MDB Other Service Period, subject to Section 4(g), the Executive shall be nominated by MDB Other to remain on the MDB Other Board, and shall perform his duties as a director of MDB Other. During the MDB Other Service Period, Executive shall devote substantially all of his business time, energies and talents to serving as MDB Other’s Chief Executive Officer and perform his duties subject to the lawful directions of the MDB Other Board and in accordance with MDB Other’s corporate governance and ethics guidelines, conflict of interests policies, code of conduct and other written policies (collectively, the “MDB Other Policies”).

(iv) The Executive’s principal location of employment shall be at the principal headquarters of MDB; provided, that the Executive may be required under reasonable business circumstances to travel outside of such location in connection with performing his duties under this Agreement.

(v) During the Employment Period, it shall not be a violation of this Agreement for the Executive, subject to the requirements of Section 7, to (A) serve on civic or charitable boards or committees and, with the consent of the Company Board (as defined below) (such consent not to be unreasonably withheld or denied), no more than one corporate board unrelated to the Company, (B) deliver lectures or fulfill speaking engagements and (C) manage personal investments, so long as such activities (individually or in the aggregate) do not significantly interfere with the performance of the Executive’s responsibilities as set forth in this Section 3(a) or the Executive’s fiduciary duties to the Company. For purposes of this Agreement, “Company Board” shall mean (x) the Motorola Board prior to the occurrence of the Separation Event or an Other Transaction Event, (y) the MDB Public Board on and after the occurrence of the Separation Event and (z) the MDB Other Board on and after the occurrence of an Other Transaction Event.

(b) Compensation.

(i) Base Salary. During the Employment Period, the Executive shall receive an annualized base salary (“Annual Base Salary”) of not less than $1,200,000, payable pursuant to the Company’s normal payroll practices. During the Employment Period, the current Annual Base Salary shall be reviewed for increase only at such time as the salaries of senior officers of the Company are reviewed generally; provided that the Executive’s first such review shall occur no earlier than calendar year 2009.

(ii) Annual Bonus. For each fiscal year completed during the Employment Period, the Executive shall be eligible to receive an annual cash bonus (“Annual Bonus”) based upon performance targets that are established by the Company Committee (as defined below); provided, however, that the Executive’s target Annual Bonus (the “Target Bonus”) shall be not less than 200% of his Annual Base Salary, subject to pro ration for any partial year; provided, further, however, that with respect to fiscal year 2008, Executive’s Annual Bonus shall be $2,400,000 and shall not be subject to pro ration and with respect to fiscal year 2009, Executive shall be entitled to a minimum Annual Bonus of $1,200,000. To the extent earned and payable, the Annual Bonus shall be paid in the

-3-

calendar year following the calendar year in which such bonus is earned. For purposes of this Agreement, “Company Committee” shall mean (x) the Compensation and Leadership Committee of the Motorola Board prior to the occurrence of the Separation Event or an Other Transaction Event, (y) the Compensation and Leadership Committee (or committee performing similar functions) of the MDB Public Board on and after the occurrence of the Separation Event and (z) the Compensation and Leadership Committee (or committee performing similar functions) of the MDB Other Board on and after the occurrence of an Other Transaction Event.

(iii) Equity Awards.

(A) Generally. As determined by the Company Committee, the Executive shall be eligible for grants of equity compensation awards under the Company’s long term incentive compensation arrangements in accordance with the Company’s policies, as in effect from time to time at levels commensurate with other senior executives of the Company (with due regard for his position); provided, however, that the Company shall have no obligation to grant any additional equity compensation awards under this Agreement (other than the awards specifically contemplated by this Agreement) until at least twelve months following the Separation Event.

(B) Make-Whole Restricted Stock Units. On the Commencement Date, the Executive shall be granted an award of 2,304,653 restricted stock units corresponding to shares of common stock of Motorola (the “Motorola Common Stock”) (the “Make-Whole Restricted Stock Units”). The Make-Whole Restricted Stock Units shall vest in equal annual installments on July 31, 2009, July 31, 2010 and July 31, 2011, subject, in each case, to Executive’s continued employment with the Company through the applicable vesting date. Except as specifically provided herein, the terms and conditions of the Make-Whole Restricted Stock Units shall be subject to the terms of Motorola’s Omnibus Incentive Plan of 2006 (the “Motorola Omnibus Plan”) and the award agreement evidencing the grant of the Make-Whole Restricted Stock Units, a copy of the form of which is attached as Exhibit A to this Agreement.

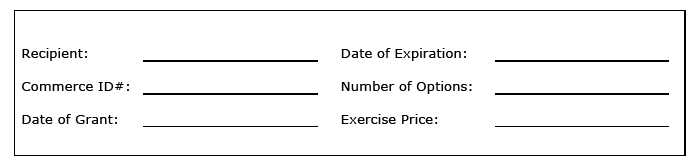

(C) Make-Whole Stock Option. On the Commencement Date, the Executive shall be granted an option (the “Make-Whole Stock Option”) to purchase 10,211,226 shares of Motorola Common Stock. The Make-Whole Stock Option shall have a per share exercise price equal to the closing price of a share of Motorola Common Stock on the date of grant as reported for the New York Stock Exchange-Composite Transactions in the Wall Street Journal at ▇▇▇.▇▇▇▇▇▇.▇▇▇.▇▇▇ (the “Fair Market Value”), a ten-year term and a vesting schedule such that the Make-Whole Stock Option will become exercisable in equal annual installments on July 31, 2009, July 31, 2010 and July 31, 2011; provided that the Executive remains in the employ of the Company through each such vesting date. Except as specifically provided herein, the terms and conditions of the Make-Whole Stock Option shall be subject to the terms of the Motorola Omnibus Plan, the award agreement evidencing the grant of the Make-Whole Stock Option, a copy of the form of which is attached as Exhibit B to this Agreement and the related stock option consideration agreement, a copy of the form of which is attached as Exhibit C to this Agreement.

(D) Inducement Restricted Stock Units. On the Commencement Date, the Executive shall be granted an award of 1,362,769 restricted stock units corresponding to shares of Motorola Common Stock (the “Inducement Restricted

-4-

Stock Units”). The Inducement Restricted Stock Units shall vest in equal annual installments on July 31, 2009, July 31, 2010 and July 31, 2011, subject to Executive’s continued employment with the Company through each such vesting date. Except as specifically provided herein, the terms and conditions of the Inducement Restricted Stock Units shall be subject to the terms of the Motorola Omnibus Plan and the award agreement evidencing the grant of the Inducement Restricted Stock Units, a copy of the form of which is attached as Exhibit A to this Agreement.

(E) Inducement Stock Option. On the Commencement Date, the Executive shall be granted an option (the “Inducement Stock Option”) to purchase 6,383,658 shares of Motorola Common Stock. The Inducement Stock Option shall have a per share exercise price equal to the Fair Market Value, a ten-year term and a vesting schedule such that the Inducement Stock Option shall become exercisable in equal annual installments on July 31, 2009, July 31, 2010 and July 31, 2011; provided that the Executive remains in the employ of the Company through each such vesting date. Except as specifically provided herein, the terms and conditions of the Inducement Stock Option shall be subject to the terms of the Motorola Omnibus Plan, the award agreement evidencing the grant of the Inducement Stock Option, a copy of the form of which is attached as Exhibit B to this Agreement and the related stock option consideration agreement, a copy of the form of which is attached as Exhibit C to this Agreement.

(F) Registration. With respect to equity grants under this Agreement made pursuant to the New York Stock Exchange inducement grant exception, the Company will use its commercially reasonable best efforts to register all shares covered by such grants as soon as administratively practicable following the applicable grant date.

(G) Equity Treatment in the Event of the Separation Event. Upon the occurrence of the Separation Event, all of Executive’s outstanding equity awards that relate to Motorola Common Stock will be adjusted to take into account the Separation Event such that following the Separation Event such awards relate solely to shares of common stock of MDB Public (“MDB Public Common Stock”), such adjustment to be made based on the methodology determined by the Motorola Board in accordance with the terms of the Motorola Omnibus Plan and applicable legal requirements, including compliance with Section 409A of the Internal Code of 1986, as amended (the “Code”) and the regulations thereunder (“Section 409A”); it being understood that if equity awards that relate to Motorola Common Stock held by other MDB executive officers are generally adjusted into awards that relate solely to MDB Public Common Stock, the adjustment methodology applicable to Executive shall be no less favorable than the adjustment methodology applicable to such other MDB executive officers; provided that such requirement shall apply solely with respect to the applicable type of equity (e.g., options or restricted stock units) with respect to which any such adjustment methodology applies.

(H) Certain Change of Control Transactions. In the event of a Change of Control of Motorola or an Other Transaction Event (subject to the limitation that Executive’s Motorola stock options shall not (without Executive’s consent) be “cashed out” in connection with an Other Transaction Event occurring prior to October 31, 2010), if Executive’s Motorola equity awards are not “cashed out” in connection with such transaction or are not converted into (or remain) awards with respect to shares that are traded on a national or international securities

-5-

exchange, then, subject to consummation of such transaction: (1) each of Executive’s outstanding vested (and unexercised) and unvested Motorola stock options shall be cancelled in consideration of a lump-sum payment (less applicable withholdings) equal to the product of (x) the difference, if any, between the closing price of a share of Motorola Common Stock on the last trading day prior to the completion of such transaction (as reported for the New York Stock Exchange-Composite Transactions in the Wall Street Journal at ▇▇▇.▇▇▇▇▇▇.▇▇▇.▇▇▇), and the per share exercise price of such Motorola stock option, and (y) the number of shares of Motorola Common Stock subject to such stock option, such payment to be made as soon as reasonably practicable (but in no event more than ten (10) days) following completion of such transaction; provided, however, that if an Other Transaction Event occurs prior to October 31, 2010, Executive’s unvested Motorola stock options shall immediately vest and thereafter Executive’s vested Motorola stock options shall remain outstanding and exercisable for two years following the Other Transaction Event (and thereafter shall be forfeited), notwithstanding any termination of Executive’s employment hereunder upon or following such Other Transaction Event, and (2) each of Executive’s Motorola restricted stock units shall be converted into the right to receive a cash payment (subject to the immediately following sentence), less applicable withholdings, equal to the closing price of a share of Motorola Common Stock on the last trading day prior to the completion of such transaction (as reported for the New York Stock Exchange-Composite Transactions in the Wall Street Journal at ▇▇▇.▇▇▇▇▇▇.▇▇▇.▇▇▇) (each, an “RSU Cash-Out Payment”), it being understood that in no event shall Executive’s Motorola restricted stock units be “cashed out” in connection with a Change of Control of Motorola or an Other Transaction Event unless such Change of Control of Motorola or Other Transaction Event constitutes a “change in control event” within the meaning of Section 409A for the Executive and such cash-out is permitted under Section 409A. The RSU Cash-Out Payment will vest and be paid out in installments on the same vesting dates that applied to each Motorola restricted stock unit underlying the RSU Cash-Out Payment immediately prior to the Change of Control of Motorola or Other Transaction Event, subject to the Executive’s continued employment through the applicable vesting dates and other applicable terms and conditions, including but not limited to those relating to Executive’s termination of employment with the Company. Each RSU Cash-Out Payment shall bear interest from the date of the Change of Control of Motorola or Other Transaction Event until the date of payment at a rate equal to the average of the applicable federal rate provided for in Section 7872(f)(2)(A) of the Code and the prime rate as published in the Wall Street Journal (the “Blended Rate”), each such rate as in effect on the last business day prior to completion of the Change of Control of Motorola or Other Transaction Event.

(I) MDB Public Stock Option. If Executive has not become entitled to the Additional Payment (as defined below), subject to (1) the occurrence of the Separation Event and (2) Executive’s employment with MDB Public on the date of the occurrence of the Separation Event, as soon as reasonably practicable following the occurrence of the Separation Event, MDB Public will grant to the Executive an option (the “MDB Public Stock Option”) to purchase a number of shares of MDB Public Common Stock (rounded to the nearest whole share) calculated in accordance with Exhibit D. The MDB Public Stock Option shall have a per share exercise price equal to the closing price of a share of MDB Public Common Stock on the date of grant as reported for the New York Stock Exchange-Composite Transactions in the Wall Street Journal at ▇▇▇.▇▇▇▇▇▇.▇▇▇.▇▇▇, a ten-year term and a vesting schedule such that the MDB Stock Option will become exercisable as set forth below; provided that the Executive remains in the employ of the Company through each such vesting date:

-6-

| Percentage of MDB Public | |

| Vesting Date | Stock Option that Vests |

| The later to occur of (x) the Milestone Date and (y) the one year anniversary of the grant date. |

33 1/3% (rounded to the nearest whole share) |

| The later to occur of (x) the Milestone Date and (y) the two year anniversary of the grant date. |

33 1/3% (rounded to the nearest whole share) |

|

The later to occur of (x) the Milestone Date and (y) the three year |

Remainder |

For purposes of this Agreement, “Milestone Date” shall mean the date on which the average closing price of MDB Public Common Stock for any fifteen consecutive trading days is 110% or greater than the average closing price of MDB Public Common Stock for the first fifteen trading days following the Separation Event (including the closing price of MDB Public Common Stock on the date of the Separation Event if the stock trades on that date). Except as specifically provided herein, the terms and conditions of the MDB Public Stock Option shall be subject to the terms of MDB Public’s equity plan and the award agreement evidencing the grant of the MDB Public Stock Option; provided that the terms of the MDB Public Stock Option to the extent not otherwise specifically provided for in this Agreement shall be no less favorable to Executive than the terms applicable to the Make-Whole Stock Option (other than with respect to “clawback” and “recoupment” provisions which the MDB Public Stock Option shall be subject to on a basis no less favorable to Executive than the provisions set forth in Sections 2 and 3 of the stock option consideration agreement, a copy of the form of which is attached as Exhibit C to this Agreement). Executive acknowledges that (1) he shall not be entitled to the grant of the MDB Public Stock Option unless and until the Separation Event occurs and subject to Executive’s employment with MDB Public on the date of the occurrence of the Separation Event and (2) he shall not be entitled to the grant of the MDB Public Stock Option if he has become entitled to the Additional Payment. For purposes of this paragraph (I), closing prices of MDB Public Common Stock will be as reported for the New York Stock Exchange-Composite Transactions in the Wall Street Journal at ▇▇▇.▇▇▇▇▇▇.▇▇▇.▇▇▇.

(J) MDB Public Restricted Shares. If Executive has not become entitled to the Additional Payment, subject to (1) the occurrence of the Separation Event and (2) Executive’s employment with MDB Public on the date of the occurrence of the Separation Event, as soon as reasonably practicable following the occurrence of the Separation Event, MDB Public will grant to the Executive a number of shares of restricted MDB Public Common Stock (the “MDB Public Restricted Shares”) calculated in accordance with Exhibit E. The MDB Public Restricted Shares will become exercisable as set forth below; provided that the Executive remains in the employ of the Company through each such vesting date:

-7-

| Percentage of MDB Public | |

| Vesting Date | Restricted Shares that Vest |

|

The later to occur of (x) the |

33 1/3% |

|

The later to occur of (x) the |

33 1/3% |

|

The later to occur of (x) the Milestone Date and (y) the three year anniversary of the grant date. |

Remainder |

Except as specifically provided herein, the terms and conditions of the MDB Public Restricted Shares shall be subject to the terms of MDB Public’s equity plan and the award agreement evidencing the grant of the MDB Public Restricted Shares; provided that the terms of the MDB Public Restricted Shares to the extent not otherwise specifically provided for in this Agreement shall be no less favorable to Executive than the terms applicable to the Make-Whole Restricted Stock Units (other than with respect to “clawback” and “recoupment” provisions which the MDB Public Restricted Shares shall be subject to on a basis no less favorable to Executive than the provisions set forth in Sections 2(c) and (d) of the form of award agreement attached as Exhibit A to this Agreement), with appropriate adjustments to take into account the fact that the MDB Public Restricted Shares are restricted stock rather than restricted stock units. Executive acknowledges that (1) he shall not be entitled to the grant of the MDB Public Restricted Shares unless and until the Separation Event occurs and subject to Executive’s employment with MDB Public on the date of the occurrence of the Separation Event and (2) he shall not be entitled to the grant of the MDB Public Restricted Shares if he has become entitled to the Additional Payment. For purposes of this paragraph (J), closing prices of MDB Public Common Stock will be as reported for the New York Stock Exchange-Composite Transactions in the Wall Street Journal at ▇▇▇.▇▇▇▇▇▇.▇▇▇.▇▇▇.

(iv) Other Benefits. During the Employment Period, the Executive shall be eligible for participation in the welfare, perquisites, fringe benefit, and other benefit plans, practices, policies and programs, as may be in effect from time to time, for senior executives of the Company generally; provided, that this Agreement alone shall govern Executive’s rights to severance payments or benefits to be received upon a termination of Executive’s employment. For the avoidance of doubt, notwithstanding anything to the contrary contained in this Agreement, Executive shall not participate in the Motorola, Inc. Senior Officer Change in Control Severance Plan, as amended from time to time, and Executive shall not participate in any Motorola Long-Range Incentive Plan.

(v) Expenses. During the Employment Period, the Executive shall be eligible for prompt reimbursement of business expenses reasonably incurred by the Executive in accordance with the Company’s policies, as may be in effect from time to time, for its senior executives generally. All taxable payments and reimbursements related to business expenses paid pursuant to this Section 3(b)(v), shall be paid in accordance with Section 14(c) hereof.

-8-

(vi) Vacation. During the Employment Period, the Executive shall be eligible for paid vacation in accordance with the Company’s policies, as may be in effect from time to time, for its senior executives generally but no less than four weeks per year.

(vii) Relocation. Executive shall maintain a residence in the greater Chicago, Illinois area following the Commencement Date, and thereafter, during the Employment Period. In connection with the Executive’s commencement of employment with Motorola and the Executive’s relocation to Illinois from California, Motorola will reimburse the Executive in accordance with Motorola’s relocation policy (without regard to the limitations contained therein with respect to reimbursable amounts thereunder) for all of the normal, customary and documented relocation expenses the Executive incurs (including full tax gross-up so the Executive shall have no after-tax cost); provided, that Executive shall not be entitled to any loans available under Motorola’s relocation policy. Relocation expenses shall include without limitation temporary housing through the earlier of (A) the date on which the Separation Event occurs and (B) October 31, 2010, and coverage for any loss on the sale of his current home in San Diego, California. Any tax gross-up payment pursuant to the immediately preceding sentence shall be made promptly, but in any event no later than the end of the Executive’s taxable year next following the Executive’s taxable year in which the Executive remits the related taxes.

(viii) Additional Payment. Subject to Executive’s continued employment with the Company through October 31, 2010, if (A) the Separation Event has not occurred on or prior to October 31, 2010 or (B) the Company consummates an Other Transaction Event on or prior to October 31, 2010, the Company shall pay to Executive $30 million (the “Additional Payment”) on November 15, 2010, to the extent not theretofore paid.

(ix) The Company shall provide to Executive use of the Company’s aircraft for security purposes for business and personal travel and Executive shall be entitled to a tax gross-up with respect to income tax (if any) attributable to the difference between (A) the imputed income actually imputed to Executive as a result of such personal usage absent a qualifying security analysis and individualized security plan approved by the Company Board and (B) the imputed income that would have been imputed to Executive as a result of such personal usage if the Company had in effect a qualifying security analysis and individualized security plan approved by the Company Board. Any tax gross-up payment pursuant to the immediately preceding sentence shall be made promptly, but in any event no later than the end of the Executive’s taxable year next following the Executive’s taxable year in which the Executive remits the related taxes.

(c) Other Entities. As used in this Agreement, the term “affiliate” shall include any entity controlled by, controlling, or under common control with the Company. The Executive agrees to serve, without additional compensation, as an officer and director for each of the Company’s subsidiaries, partnerships, joint ventures, limited liability companies and other affiliates, so long as such service is covered by Sections 11 and 12 hereof (collectively, the Company and such entities, the “Affiliated Group”), as determined by the Company Board.

4. Termination of Employment. (a) Death or Disability. The Executive’s employment shall terminate automatically upon the Executive’s death during the Employment Period. If the Company determines in good faith that the Disability of the Executive has occurred during the Employment Period (pursuant to the definition of Disability set forth below), it may provide the Executive with written notice in accordance with Section 10(b) of this Agreement of its intention to terminate the Executive’s

-9-

employment. In such event, the Executive’s employment with the Company shall terminate effective on the 30th day after receipt of such notice by the Executive (the “Disability Effective Date”), provided that, within the 30-day period after such receipt, the Executive shall not have returned to full time performance of the Executive’s duties. For purposes of this Agreement, “Disability” shall mean the Executive having not performed his duties with the Company on a full-time basis for 180 consecutive or intermittent days in any one-year period as a result of incapacity due to mental or physical illness which is determined to be total and permanent by a licensed physician selected by the Company or its insurers and reasonably acceptable to the Executive or the Executive’s legal representative. If the Parties cannot agree on a licensed physician, each Party shall select a licensed physician and the two physicians shall select a third who shall be the approved licensed physician for this purpose. Notwithstanding the foregoing, in the event that as a result of absence because of mental or physical incapacity the Executive incurs a “separation from service” within the meaning of such term under Section 409A, the Executive shall on such date automatically be terminated from employment because of Disability.

(b) Cause. The Company may terminate the Executive’s employment during the Employment Period with or without Cause. For purposes of this Agreement, “Cause” shall mean:

(i) the Executive’s willful and continued failure to substantially perform his duties under this Agreement, other than any such failure resulting from incapacity due to physical or mental illness, which failure has continued for a period of at least 30 days following delivery to the Executive of a written demand for substantial performance specifying the manner in which the Executive has willfully and continuously failed to substantially perform;

(ii) the Executive’s willful engagement in any malfeasance, dishonesty, fraud or gross misconduct that is intended to or does result in a material detrimental effect on the Company’s reputation or business;

(iii) the Executive’s indictment for, or plea of guilty or nolo contendere to a felony in the United States or outside the United States (excluding cases based solely on Executive’s vicarious liability for the conduct of the Company or others), which, regardless of where such felony occurs, has had or will have a detrimental effect on the Company’s reputation or business or the Executive’s reputation; or

(iv) the Executive’s material breach of Section 7 or Section 13 of this Agreement.

A termination of employment of the Executive shall not be deemed to be for Cause unless and until there shall have been delivered to the Executive a copy of a resolution duly adopted by the affirmative vote of not less than a majority of the entire membership of the Company Board (not including the Executive) at a meeting of the Company Board called and held for such purpose (after at least ten days’ written notice is provided to the Executive and the Executive is given an opportunity, together with counsel, to be heard before the Company Board), finding that, in the good faith opinion of the Company Board, the Executive is guilty of the conduct described in one or more of the clauses of Section 4(b) above, and specifying the particulars thereof in detail. Notwithstanding the foregoing, if the Executive challenges a termination of employment for Cause under this Section 4(b) in a court of competent jurisdiction, the Company Board’s decision shall be reviewed “de novo” by the court and no deference shall be given towards such decision.

-10-

(c) Good Reason. The Executive’s employment may be terminated by the Executive for Good Reason (including Safe Harbor Good Reason, as defined below) if (x) an event or circumstance set forth in the clauses of this Section 4(c) below (or in the definition of Safe Harbor Good Reason) shall have occurred and the Executive provides the Company with written notice thereof within 45 days (5 days in the case of clause (vii) below) after the Executive has knowledge of the occurrence or existence of such event or circumstance, which notice shall specifically identify the event or circumstance that the Executive believes constitutes Good Reason (or Safe Harbor Good Reason), (y) the Company fails to correct the circumstance or event so identified within 30 days after the receipt of such notice, and (z) the Executive resigns effective within 90 days after the date of delivery of the notice referred to in clause (x) above. For purposes of this Agreement, “Good Reason” shall mean, in the absence of the Executive’s written consent (and except in consequence of a prior termination of the Executive’s employment), the occurrence of any of the following:

(i) a material reduction by the Company in the Executive’s Annual Base Salary or a material reduction in the Executive’s aggregate annual cash compensation opportunity, which for this purpose shall include, without limitation, Annual Base Salary and target bonus opportunities;

(ii) a material reduction in the aggregate level of employee benefits made available to the Executive under this Agreement, unless, prior to a Change of Control, such reduction is applicable to senior executives of the Company generally;

(iii) any diminution in the Executive’s title or a material diminution in the Executive’s position, authority, duties or responsibilities (other than as required by applicable law or regulation or as a result of the Executive’s physical or mental incapacity which impairs his ability to materially perform his duties or responsibilities as confirmed by a doctor reasonably acceptable to the Executive or his representative and such diminution lasts only for so long as such doctor determines such incapacity impairs the Executive’s ability to materially perform his duties or responsibilities);

(iv) the failure to appoint, elect or reelect the Executive to the Company Board or removal of the Executive from the Company Board (other than pursuant to a termination of Executive’s employment for death, Disability or Cause);

(v) a material change in the Executive’s reporting relationship that is inconsistent with the terms of this Agreement;

(vi) the Company requiring the Executive’s principal location of employment to be at any office or location more than 50 miles from Libertyville, Illinois (other than to the extent agreed to or requested by the Executive in writing);

(vii) the Separation Event or an Other Transaction Event has not occurred on or prior to October 31, 2010;

(viii) the failure of a successor of MDB to assume this Agreement in writing and to deliver such assumption to the Executive; or

(ix) any other action or inaction that constitutes a material breach by the Company of this Agreement.

For purposes of this Agreement “Safe Harbor Good Reason” means, unless otherwise agreed to in writing by the Executive (and except in consequence of a prior termination of

-11-

the Executive’s employment), (A) a material diminution in Executive’s Base Salary; (B) a material diminution in Executive’s authority, duties, or responsibilities, (C) a requirement that Executive report to a corporate officer or employee of the Company instead of reporting directly to the Company Board, (D) a material change in the geographic location at which Executive must perform the services or (E) any other action or inaction that constitutes a material breach by the Company of this Agreement.

(d) Voluntary Termination. The Executive may voluntarily terminate his employment without Good Reason (other than due to death, Disability or retirement) on written notice to the Company, and such termination shall not be deemed to be a breach of this Agreement.

(e) Notice of Termination. Any termination by the Company for Cause, or by the Executive for Good Reason, shall be communicated by Notice of Termination to the other Party hereto given in accordance with Section 10(b) of this Agreement. For purposes of this Agreement, a “Notice of Termination” means a written notice which (i) indicates the specific termination provision in this Agreement relied upon, (ii) to the extent applicable, sets forth in reasonable detail the facts and circumstances claimed to provide a basis for termination of the Executive’s employment under the provision so indicated and (iii) if the Date of Termination (as defined below) is other than the date of receipt of such notice, specifies the termination date (which date shall be not more than thirty days after the giving of such notice). The failure by the Executive or the Company to set forth in the Notice of Termination any fact or circumstance which contributes to a showing of Good Reason or Cause shall not waive any right of the Executive or the Company, respectively, hereunder or preclude the Executive or the Company, respectively, from asserting such fact or circumstance in enforcing the Executive’s or the Company’s rights hereunder.

(f) Date of Termination. “Date of Termination” means (i) if the Executive’s employment is terminated by the Company for Cause, or by the Executive for Good Reason, the date of receipt of the Notice of Termination or any later date specified therein within 30 days of such notice, as the case may be, (ii) if the Executive’s employment is terminated by the Company other than for Cause or Disability, or if the Executive voluntarily resigns without Good Reason, the date on which the terminating Party notifies the other Party that such termination shall be effective, provided that on a voluntary resignation without Good Reason, the Company may, in its sole discretion, make such termination effective on any date, it elects in writing, between the date of the notice and the proposed date of termination specified in the notice, (iii) if the Executive’s employment is terminated by reason of death, the date of death of the Executive, (iv) if the Executive’s employment is terminated by the Company due to Disability, the Disability Effective Date, or (v) if the Executive’s employment is terminated by the Executive or the Company as a result of a Notice of Non-Renewal, the end of the applicable Employment Period.

(g) Resignation from All Positions. Notwithstanding any other provision of this Agreement, upon the termination of the Executive’s employment for any reason, unless otherwise requested by the Company Board, the Executive shall immediately resign as of the Date of Termination from all positions that he holds with the Company and any other member of the Affiliated Group (and with any other entities with respect to which the Company has requested the Executive to perform services), including, without limitation, the Company Board and all boards of directors of any member of the Affiliated Group. The Executive hereby agrees to execute any and all documentation to effectuate such resignations upon request by the Company, but he shall be treated for all purposes as having so resigned upon termination of his employment, regardless of when or whether he executes any such documentation.

-12-

5. Obligations of the Company upon Termination. (a) Good Reason or Other than for Cause Outside of the Change of Control Protection Period. If, during the Employment Period (other than during the Change of Control Protection Period (as defined below)), (x) the Company shall terminate the Executive’s employment other than for Cause, death or Disability, or (y) the Executive shall terminate employment for Good Reason:

(i) the Company shall pay to the Executive in a lump sum in cash within 60 days (except as specifically provided in Section 5(a)(i)(A)(3) and Section 5(a)(i)(C)) after the Date of Termination the aggregate of the following amounts:

(A) the sum of (1) the Executive’s Annual Base Salary and any accrued vacation pay through the Date of Termination, (2) the Executive’s business expenses that are reimbursable pursuant to Section 3(b)(v) but have not been reimbursed by the Company as of the Date of Termination, and (3) the Executive’s Annual Bonus for the fiscal year immediately preceding the fiscal year in which the Date of Termination occurs if the relevant measurement period has concluded as of the Date of Termination but the bonus has not been paid as of the Date of Termination (payable at the time such Annual Bonus would otherwise have been paid); and

(B) the amount equal to the product of (1) two and (2) the sum of (x) Executive’s Annual Base Salary and (y) the Target Bonus for the year of termination; and

(C) a pro-rata Annual Bonus based on actual performance during the year in which termination has occurred and based on the number of days of employment during such year relative to 365 days (payable at the time such Annual Bonus would otherwise have been paid); and

(D) if (1) the Separation Event has not yet occurred, (2) Executive’s Date of Termination is on or prior to October 31, 2010 and (3) (x) the Company has terminated Executive without Cause or (y) Executive has terminated employment for Safe Harbor Good Reason, the Additional Payment, to the extent not theretofore paid; and

(ii) for two years after the Executive’s Date of Termination, the Company shall continue medical benefits to the Executive and, if applicable, the Executive’s family at least equal to those that would have been provided to them in accordance with the plans, programs, practices and policies of the Company if the Executive’s employment had not been terminated; provided, however, that the Executive continues to make all required contributions; provided, further, however, that, the medical benefits provided during such period shall be provided in such a manner that such benefits (and the costs and premiums thereof) are excluded from the Executive’s income for federal income tax purposes and, if providing continued coverage under one or more of its health care benefit plans contemplated herein could be taxable to the Executive, the Company shall provide such benefits at the level required hereby through the purchase of individual insurance coverage; provided, further, however, that, if the Executive becomes re-employed with another employer and is eligible to receive substantially equivalent health benefits under another employer-provided plan, the health benefits described herein shall no longer be provided by the Company; and

(iii) (A) the Make-Whole Restricted Stock Units (including RSU Cash-Out Payments in respect of the Make-Whole Restricted Stock Units), the Make-Whole

-13-

Stock Option, the Inducement Restricted Stock Units (including RSU Cash-Out Payments in respect of the Inducement Restricted Stock Units) and the Inducement Stock Options immediately shall vest, (B) for two years after the Executive’s Date of Termination, all other outstanding equity-based awards granted to the Executive on or after the Effective Date (including RSU Cash-Out Payments in respect of Motorola restricted stock units granted to the Executive prior to the Separation Event or an Other Transaction Event, but excluding MDB Public Restricted Shares) shall continue to vest and, with respect to stock options and other awards that are not immediately exercisable, become exercisable pursuant to their respective terms on the applicable scheduled vesting dates, so long as the Executive complies with the provisions of Section 7 of this Agreement and any other applicable provisions of the applicable award agreement and the applicable incentive plan, including satisfaction of applicable performance goals, but excluding any continued service requirements; all such awards shall remain exercisable by the Executive following vesting until the earlier of (I) eighteen months following the later to occur of (x) the applicable vesting date of such award or (y) the Executive’s Date of Termination or (II) the expiration of the scheduled term of such award, as applicable; (C) if the MDB Public Restricted Shares are granted and outstanding, and (1) the Company has terminated Executive without Cause or (2) Executive has terminated employment for Safe Harbor Good Reason, for two years after the Executive’s Date of Termination, all MDB Public Restricted Shares shall continue to vest in accordance with their terms, so long as the Executive complies with the provisions of Section 7 of this Agreement and any other applicable provisions of the applicable award agreement and the applicable incentive plan, including satisfaction of applicable performance goals, but excluding any continued service requirements; provided, however, that a number of MDB Public Restricted Shares shall vest proportionately upon such termination solely to the extent necessary to satisfy any tax payable by Executive under the Federal Insurance Contributions Act (the “FICA Amount”) and applicable income tax on wages imposed under Section 3401 of the Code or the corresponding withholding provisions of applicable state, local or foreign tax laws as a result of the payment of the FICA Amount, and to pay the additional income tax at source on wages attributable to the pyramiding Code Section 3401 wages and taxes as a result of treatment of the MDB Public Restricted Shares upon such termination; and (D) all other equity awards shall be forfeited; and

(iv) to the extent not theretofore paid or provided, the Company shall timely pay or provide to the Executive any other amounts or benefits required to be paid or provided or which the Executive is eligible to receive under any plan, program, policy or practice or contract or agreement (other than any severance plan, program, policy or practice or contract or agreement) of the Company and its affiliates (such amounts and benefits, the “Other Benefits”) in accordance with the terms and normal procedures of each such plan, program, policy or practice, based on accrued benefits through the Date of Termination.

Except with respect to payments and benefits under Sections 5(a)(i)(A)(1), 5(a)(i)(A)(2) and 5(a)(iv), all payments and benefits to be provided under this Section 5(a) shall be subject to the Executive’s execution and non-revocation of a release substantially in the form attached hereto as Exhibit F. Any amounts due under this Section 5(a) which are conditioned on the foregoing release shall not be paid prior to the sixtieth (60th) day after the Date of Termination notwithstanding when the release is executed and delivered (but in all cases subject to the execution, delivery and non-revocation of the release) and any amounts otherwise due prior thereto shall be paid on such sixtieth (60th) day (but in all cases subject to the execution, delivery and non-revocation of the release). Notwithstanding the immediately preceding sentence or Section 5(a)(i), in the event that the Executive is a “specified employee” within the meaning of Section 409A (a “Specified Employee”), amounts that are non-qualified deferred compensation under Section 409A

-14-

that would otherwise be payable, restricted stock units that would otherwise have been settled, RSU Cash-Out Payments that would otherwise have been made and benefits that would otherwise be provided under Section 5(a)(i) during the six-month period immediately following the Date of Termination shall instead be paid, with interest on any delayed payment at the Blended Rate based on the rates in effect on the Date of Termination (“Interest”), or settled, or made, or provided, on the first business day after the earlier of the date that is six months following the Executive’s “separation from service” within the meaning of Section 409A and the date of the Executive’s death (the “Delayed Payment Date”). Delivery by the Company of a Notice of Non-Renewal shall constitute a termination of Executive’s employment without Cause effective at the end of the then current Employment Period.

(b) Good Reason or Other than for Cause During the Change of Control Protection Period. If, during the Employment Period and during the Change of Control Protection Period (as defined below), (x) the Company shall terminate the Executive’s employment other than for Cause, death or Disability, or (y) the Executive shall terminate employment for Good Reason:

(i) the Company shall pay to the Executive in a lump sum in cash within 60 days (except as specifically provided in Section 5(b)(i)(A)(3) and Section 5(b)(i)(C)) after the Date of Termination the aggregate of the following amounts:

(A) the sum of (1) the Executive’s Annual Base Salary and any accrued vacation pay through the Date of Termination, (2) the Executive’s business expenses that are reimbursable pursuant to Section 3(b)(v) but have not been reimbursed by the Company as of the Date of Termination, and (3) the Executive’s Annual Bonus for the fiscal year immediately preceding the fiscal year in which the Date of Termination occurs if the relevant measurement period has concluded as of the Date of Termination but the bonus has not been paid as of the Date of Termination (payable at the time such Annual Bonus would otherwise have been paid); and

(B) the amount equal to the product of (1) three and (2) the sum of (x) Executive’s Annual Base Salary and (y) the Target Bonus for the year of termination; and

(C) a pro-rata Annual Bonus based on actual performance during the year in which termination has occurred and based on the number of days of employment during such year relative to 365 days (payable at the time such Annual Bonus would otherwise have been paid); and

(D) if (1) the Separation Event has not yet occurred, (2) Executive’s Date of Termination is on or prior to October 31, 2010 and (3) (x) the Company has terminated Executive without Cause or (y) Executive has terminated employment for Safe Harbor Good Reason, the Additional Payment, to the extent not theretofore paid; and

(ii) for three years after the Executive’s Date of Termination, the Company shall continue medical benefits to the Executive and, if applicable, the Executive’s family at least equal to those that would have been provided to them in accordance with the plans, programs, practices and policies of the Company if the Executive’s employment had not been terminated; provided, however, that the Executive continues to make all required contributions; provided, further, however, that, the medical benefits provided during such

-15-

period shall be provided in such a manner that such benefits (and the costs and premiums thereof) are excluded from the Executive’s income for federal income tax purposes and, if providing continued coverage under one or more of its health care benefit plans contemplated herein could be taxable to the Executive, the Company shall provide such benefits at the level required hereby through the purchase of individual insurance coverage; provided, further, however, that, if the Executive becomes re-employed with another employer and is eligible to receive substantially equivalent health benefits under another employer-provided plan, the health benefits described herein shall no longer be provided by the Company;

(iii) (A) all outstanding equity-based awards of the Company granted to the Executive on or after the Commencement Date (including RSU Cash-Out Payments in respect of Motorola restricted stock units granted to the Executive prior to the Separation Event, but excluding MDB Restricted Shares) shall become immediately vested and exercisable (any such awards with respect to which the number of shares underlying the award depends upon performance shall vest at target unless the measurement period for such awards has ended on or prior to the Date of Termination, in which case such awards shall vest based on actual results; provided, however, that the MDB Public Stock Option, to the extent then granted and outstanding, shall vest without regard to the occurrence of the Milestone Date or any other vesting conditions); vested stock options shall remain exercisable by the Executive following vesting until the earlier of (1) eighteen months following the Date of Termination and (2) the expiration of the scheduled term of such award, as applicable; and (B) if the MDB Public Restricted Shares are granted and outstanding and (1) the Company has terminated Executive without Cause or (2) Executive has terminated employment for Safe Harbor Good Reason, all MDB Public Restricted Shares shall become immediately vested without regard to the occurrence of the Milestone Date or any other vesting conditions;

(iv) to the extent not theretofore paid or provided, the Company shall timely pay or provide to the Executive the Other Benefits in accordance with the terms and normal procedures of each such plan, program, policy or practice, based on accrued benefits through the Date of Termination.

Except with respect to payments and benefits under Sections 5(b)(i)(A)(1), 5(b)(i)(A)(2) and 5(b)(iv), all payments and benefits to be provided under this Section 5(b) shall be subject to the Executive’s execution and non-revocation of a release substantially in the form attached hereto as Exhibit F. Any amounts due under this Section 5(b) which are conditioned on the foregoing release shall not be paid prior to the sixtieth (60th) day after the Date of Termination notwithstanding when the release is executed and delivered (but in all cases subject to the execution, delivery and non-revocation of the release) and any amounts otherwise due prior thereto shall be paid on such sixtieth (60th) day (but in all cases subject to the execution, delivery and non-revocation of the release). Notwithstanding the immediately preceding sentence or Section 5(b)(i), in the event that the Executive is a Specified Employee, amounts that are non-qualified deferred compensation under Section 409A that would otherwise be payable, restricted stock units that would otherwise have been settled, RSU Cash-Out Payments that would otherwise have been made and benefits that would otherwise be provided under Section 5(b)(i) during the six-month period immediately following the Date of Termination shall instead be paid, with Interest, settled, or made or provided on the Delayed Payment Date. Delivery by the Company of a Notice of Non-Renewal shall constitute a termination of Executive’s employment without Cause effective at the end of the then current Employment Period.

-16-

(c) Cause; Other than for Good Reason. If the Executive’s employment shall be terminated for Cause or the Executive terminates his employment without Good Reason during the Employment Period, or the Executive’s employment terminates by reason of the Executive providing to the Company a Notice of Non-Renewal, this Agreement shall terminate without further obligations to the Executive other than the obligation to pay or provide to the Executive an amount equal to the amount set forth in clauses (1) and (2) of Section 5(a)(i)(A) above, and the timely payment or provision of the Other Benefits, in each case to the extent theretofore unpaid. For the avoidance of doubt, (i) upon a termination of Executive’s employment for Cause, Executive immediately shall forfeit all Company equity awards (including RSU Cash-Out Payments) and (ii) upon a termination of Executive’s employment by the Executive pursuant to this Section 5(c), Executive immediately shall forfeit all unvested Company equity awards (including RSU Cash-Out Payments); pursuant to this clause (ii), vested stock options shall remain exercisable until the earlier of (A) 180 days following the Date of Termination and (B) the expiration of the scheduled term of such stock options, as applicable, immediately following which time any such unexercised stock options shall be cancelled.

(d) Death. If the Executive’s employment is terminated by reason of the Executive’s death during the Employment Period, this Agreement shall terminate without further obligations to the Executive’s legal representatives under this Agreement, other than (i) the obligation to pay or provide to the Executive’s beneficiaries an amount equal to the amount set forth in clauses (1), (2) and (3) of Section 5(a)(i)(A) above, and (ii) the vesting of each stock option, restricted share, restricted stock unit award, and RSU Cash-Out Payment that is outstanding as of the Date of Termination (any such awards with respect to which the number of shares underlying the award depends upon performance shall vest at target unless the measurement period for such awards has ended on or prior to the Date of Termination, in which case such awards shall vest based on actual results) and continued exercisability of each stock option by the Executive’s beneficiaries until the earlier of (A) one year after the Date of Termination or (B) the end of the scheduled term of such option (the “Stock Benefits”).

(e) Disability. If the Executive’s employment is terminated by reason of the Executive’s Disability during the Employment Period, this Agreement shall terminate without further obligations to the Executive, other than (i) the obligation to pay or provide to the Executive an amount equal to the amount set forth in clauses (1), (2) and (3) of Section 5(a)(i)(A) above, (ii) the provision of the Stock Benefits, and (iii) the timely payment or provision of Other Benefits, including any applicable disability benefits. In the event that the Executive is a Specified Employee, the settlement of any restricted stock units or payment of any RSU Cash-Out Payments that would otherwise have been settled or made during the six-month period immediately following the Date of Termination shall instead be settled or made on the Delayed Payment Date.

(f) Certain Definitions.

(i) “Change of Control” means (A) any “person” or “group” (as such terms are used in Section 13(d) and 14(d) of the Exchange Act) is or becomes the “beneficial owner” (as defined in Rule 13d-3 under the Exchange Act), directly or indirectly, of securities of the Company representing 20% or more of the combined voting power of the Company’s then outstanding securities (other than the Company or any employee benefit plan of the Company; and, for purposes of this Agreement, no Change of Control shall be deemed to have occurred as a result of the “beneficial ownership,” or changes therein, of the Company’s securities by either of the foregoing), or (B) there shall be consummated (1) any consolidation or merger of the Company in which the Company is not

-17-

the surviving or continuing corporation or pursuant to which shares of the Company’s common stock would be converted into or exchanged for cash, securities or other property, other than a merger of the Company in which the holders of the Company’s common stock immediately prior to the merger have, directly or indirectly, at least a 65% ownership interest in the outstanding common stock of the surviving corporation immediately after the merger, or (2) any sale, lease, exchange or other transfer (in one transaction or a series of related transactions) of all, or substantially all, of the assets of the Company other than any such transaction with entities in which the holders of the Company’s common stock, directly or indirectly, have at least a 65% ownership interest, or (C) the stockholders of the Company approve any plan or proposal for the liquidation or dissolution of the Company, or (D) as the result of, or in connection with, any cash tender offer, exchange offer, merger or other business combination, sale of assets, proxy or consent solicitation (other than by the Company Board), contested election or substantial stock accumulation (a “Control Transaction”), the members of the Company Board immediately prior to the first public announcement relating to such Control Transaction shall thereafter cease to constitute a majority of the Company Board or (E) the consummation of an Other Transaction Event. For the avoidance of doubt, the Separation Event shall not constitute a Change of Control.

(ii) “Change of Control Protection Period” means the period beginning upon the occurrence of a Change of Control through and until the two-year anniversary of the occurrence of the Change of Control.

(g) Contemplation. If, at a time outside of the Change of Control Protection Period, the Company terminates the Executive’s employment other than for Cause, death or Disability, or the Executive terminates employment for Good Reason, Section 5(a) shall apply; provided that if (i) within six (6) months after the Date of Termination a Change of Control occurs and (ii) it is reasonably demonstrated by the Executive that such termination of employment (including a termination of employment by Executive for Good Reason) arose in connection with, or in anticipation of a Change of Control, the amounts due under Section 5(a) shall remain due in the form and at the time specified therein and, in addition to such amounts, upon the Change of Control, the Executive shall also receive a payment equal to the sum of his Annual Base Salary and Target Bonus as in effect on the Date of Termination, Section 5(b)(ii) shall apply in lieu of Section 5(a)(ii) and Section 5(b)(iii) shall apply in lieu of Sections 5(a)(iii). The equity awards that would otherwise have been forfeited upon the termination of employment shall not be forfeited until it is determined if a Change of Control occurs within six (6) months thereafter; provided, however, that no such awards shall be exercisable or settled during such six (6) month period and all such awards immediately shall be forfeited on the six (6) month anniversary of the Date of Termination if clauses (i) and (ii) of this Section 5(g) are not satisfied).

(h) Change of Control Equity Vesting. To the extent any Company equity-based awards generally vest for executive officers of the Company upon a Change of Control, the Executive’s Company equity-based awards shall also vest.

6. Full Settlement. In no event shall the Executive be obligated to seek other employment or take any other action by way of mitigation of the amounts payable to the Executive under any of the provisions of this Agreement and such amounts shall not be reduced as a result of a mitigation duty whether or not the Executive obtains other employment. In addition, the Company’s obligation to make any severance payment provided for herein shall not be subject to set-off, counterclaim or recoupment of amounts owed by the Executive to the Company or its Affiliates under this Agreement or otherwise. To the extent permitted by applicable law, the Company shall pay directly to the Executive

-18-

all reasonable legal fees and expenses reasonably incurred by the Executive in connection with the negotiation and preparation of this Agreement, and the Company shall promptly reimburse the Executive for all legal costs and expenses reasonably incurred (and documented in invoices) in connection with any dispute under this Agreement; provided, however, that Executive shall be obligated to repay any such reimbursements unless the Executive prevails in such dispute on at least one material issue. In order to comply with Section 409A, in no event shall the payments by the Company under this Section 6 be made later than the end of the calendar year next following the calendar year in which such fees and expenses were incurred, provided, that the Executive shall not be entitled to reimbursement unless he has submitted an invoice for such fees and expenses at least 10 days before the end of the calendar year next following the calendar year in which such fees and expenses were incurred. The amount of such legal fees and expenses that the Company is obligated to pay in any given calendar year shall not affect the legal fees and expenses that the Company is obligated to pay in any other calendar year, and the Executive’s right to have the Company pay such legal fees and expenses may not be liquidated or exchanged for any other benefit. In addition, the Company shall indemnify and hold the Executive, harmless on an after-tax basis, for any income tax, and all other applicable taxes imposed as a result of the Company’s payment of any legal fees contemplated herein in connection with the preparation and negotiation of this Agreement. Any tax gross-up payment pursuant to the immediately preceding sentence shall be made by the end of the Executive’s taxable year next following the Executive’s taxable year in which the Executive remits the related taxes.

7. Covenants. For purposes of this Section 7, Motorola shall mean Motorola and its subsidiaries, MDB Public shall mean MDB Public and its subsidiaries, and MDB Other shall mean MDB Other and its subsidiaries. For purposes of this Section 7, “subsidiary” of Motorola, MDB Public or MDB Other, as applicable, means any corporation or other entity in which Motorola, MDB Public or MDB Other, as applicable, holds, directly or indirectly, a 50 percent or greater interest (economic or voting). For purposes of this Section 7, “Applicable Service Period” shall mean the Motorola Service Period, the MDB Public Service Period or the MDB Other Service Period, as applicable.

(a) Confidential Information. During the Motorola Service Period and thereafter, Executive shall not use or disclose any Motorola Confidential Information, except on behalf of Motorola in furtherance of the Executive’s good faith performance of his duties during the Motorola Service Period and with due regard to Executive’s fiduciary duties to Motorola. During the MDB Public Service Period and thereafter, Executive shall not use or disclose any MDB Public Confidential Information, except on behalf of MDB Public in furtherance of Executive’s good faith performance of his duties during the MDB Public Service Period and with due regard to Executive’s fiduciary duties to MDB Public. During the MDB Other Service Period and thereafter, Executive shall not use or disclose any MDB Other Confidential Information, except on behalf of MDB Other in furtherance of the Executive’s good faith performance of his duties during the MDB Other Service Period and with due regard to Executive’s fiduciary duties to MDB Other. With respect to each of Motorola, MDB Public and MDB Other (each, solely for purposes of this Section 7, “Such Company”), “Confidential Information” means information concerning Such Company and its business that is not generally known outside of Such Company, and includes (i) trade secrets; (ii) intellectual property; (iii) Such Company’s methods of operation and processes of Such Company; (iv) information regarding Such Company’s present and/or future products, developments, processes and systems, including invention disclosures and patent applications; (v) information on customers or potential customers, including customers’ names, sales records, prices, and other terms of sales and Such Company’s cost information; (vi) Such Company’s personnel data; (vii) Such Company’s business plans,

-19-

marketing plans, financial data and projections; and (viii) information received in confidence by Such Company from third parties. The foregoing shall not apply to information that (A) was known to the public prior to its disclosure to the Executive; (B) becomes generally known to the public subsequent to disclosure to the Executive through no wrongful act of the Executive or any representative of the Executive; or (C) the Executive is required to disclose by applicable law, regulation or legal process. Information regarding products, services or technological innovations in development, in test marketing or being marketed or promoted in a discrete geographic region, which information Such Company or one of its affiliates is considering for broader use, shall not be deemed generally known until such broader use is actually commercially implemented.

(b) Non-Recruitment of Affiliated Group Employees. During the periods specified below, the Executive shall not (i) hire, recruit, solicit, induce, or cause, or (ii) aid others to hire, recruit, solicit, induce, or cause or (iii) be involved in hiring, recruiting, soliciting, inducing, or causing, with respect to each of clauses (i), (ii) and (iii) of this sentence, any employee of Such Company to terminate his/her employment with Such Company and/or to seek employment with Executive’s new or prospective employer, or any other company. This Section 7(b) shall apply to employees of Motorola during the Motorola Service Period and the two years following Executive’s termination of employment with Motorola for any reason and Motorola shall have the right to enforce this Section 7(b) with respect to employees of Motorola during such periods. This Section 7(b) shall apply to employees of MDB Public during the MDB Public Service Period and the two years following Executive’s termination of employment with MDB Public for any reason and MDB Public shall have the right to enforce this Section 7(b) with respect to employees of MDB Public during such periods. This Section 7(b) shall apply to employees of MDB Other during the MDB Other Service Period and the two years following Executive’s termination of employment with MDB Other for any reason and MDB Other shall have the right to enforce this Section 7(b) with respect to employees of MDB Other during such periods. This Section 7(b) shall not apply to (x) the Executive’s personal administrative staff who perform secretarial-type functions or (y) the soliciting or hiring of any Company employee (1) during the MDB Public Service Period, to become employed by MDB Public or (2) during the MDB Other Service Period, to become employed by MDB Other, in the case of clauses (1) and (2), in accordance with any written agreement between Motorola on the one hand and MDB Public or MDB Other, as applicable, on the other hand. Additionally, neither a general employment advertisement by an entity of which the Executive is a part, nor Executive providing a reference on behalf of a former employee at such employee’s request and with respect to an employer unaffiliated with Executive, will constitute a violation of this Section 7(b). Furthermore, during the Employment Period, absent any other conduct by Executive in violation of this Section 7(b), this Section 7(b) shall not be violated by the Executive’s termination of employment (whether actual or suggested) of any employee of the Company so long as such termination of employment (whether actual or suggested) is in furtherance of Executive’s good faith performance of his duties with the Company.

(c) No Competition.

(i) During the Applicable Service Period, Executive shall not, on behalf of any business, person or entity, compete with Such Company or its subsidiaries by directly or indirectly engaging in any business or activity, whether as an employee, consultant, partner, principal, agent, representative or stockholder or in any other individual, corporate or representative capacity, or render any services or provide any advice or substantial assistance to any business, person or entity, if such business, person or entity, directly or indirectly, competes with Such Company or its subsidiaries. During the two-year period following the Date of Termination, Executive shall not, on behalf of any

-20-

Listed Company, directly or indirectly, engage in any business or activity, whether as an employee, consultant, partner, principal, agent, representative or stockholder or in any other individual, corporate or representative capacity, or render any services or provide any advice or substantial assistance to any Listed Company. This paragraph applies in countries in which Executive has physically been present performing work for Such Company at any time during the two years preceding termination of Executive’s employment. Motorola may enforce this Section 7(c)(i) during the Motorola Service Period and the two years following Executive’s termination of employment with Motorola for any reason; provided, however, that Motorola may no longer enforce this Section 7(c)(i) if Executive becomes an employee of MDB Public by virtue of the Separation Event or an employee of MDB Other by virtue of an Other Transaction Event. MDB Public may enforce this Section 7(c)(i) during the MDB Public Service Period and the two years following Executive’s termination of employment with MDB Public for any reason. MDB Other may enforce this Section 7(c)(i) during the MDB Other Service Period and the two years following Executive’s termination of employment with MDB Other for any reason.

(ii) For purposes of this Agreement, “Listed Company” shall mean any company identified by the Company as a Listed Company (including the Listed Company’s subsidiaries and any successor to such Listed Company or to all or substantially all of such Listed Company’s handheld mobile or smart phone devices business, which successor shall replace such Listed Company); provided, however, that (1) there shall be no more than seventeen (17) Listed Companies at any one time, (2) until December 31, 2010, the Company may unilaterally replace one Listed Company per calendar year based on its good faith belief that any new Listed Company engages in the handheld mobile or smart phone device business (but there will be no replacement pursuant to this clause (2) during calendar year 2008), (3) after December 31, 2010, the Company may unilaterally replace up to three Listed Companies per calendar year based on its good faith belief that any new Listed Company engages in the handheld mobile or smart phone device business, (4) the addition of any Listed Company by the Company shall not be effective until sixty (60) days after it is so listed and (5) the Company may not revise the list of Listed Companies on or after the Date of Termination (and no change made during the sixty (60) day period preceding termination of Executive’s employment shall be effective). The Chief Human Resources Officer shall maintain and make available to Executive the current list of Listed Companies. The initial list of Listed Companies is set forth as Schedule A to this Agreement.