SHAREHOLDERS AGREEMENT dated as of January 25, 2013 among Coca-Cola Bottlers Philippines, Inc. Coca-Cola South Asia Holdings, Inc. Coca-Cola Holdings (Overseas) Limited and Controladora de Inversiones en Bebidas Refrescantes, S.L.

Exhibit 4.27

SHAREHOLDERS AGREEMENT

dated as of

January 25, 2013

among

Coca-Cola Bottlers Philippines, Inc.

Coca-Cola South Asia Holdings, Inc.

Coca-Cola Holdings (Overseas) Limited

and

Controladora de Inversiones en Bebidas Refrescantes, S.L.

TABLE OF CONTENTS

| Page | ||||||

| Section 1. |

Definitions |

1 | ||||

| Section 2. |

Corporate Governance |

6 | ||||

| 2.1. |

Size of the Board |

6 | ||||

| 2.2. |

Board Composition |

7 | ||||

| 2.3. |

Failure to Designate a Board Member |

7 | ||||

| 2.4. |

Removal of Board Members |

7 | ||||

| 2.5. |

Consents; Necessary Action |

7 | ||||

| 2.6. |

Board Committees |

7 | ||||

| 2.7. |

Chairman; Secretary |

8 | ||||

| 2.8. |

Quorum |

8 | ||||

| 2.9. |

Meetings |

8 | ||||

| 2.10. |

Special Meetings |

8 | ||||

| 2.11. |

Action Without a Meeting |

8 | ||||

| 2.12. |

Action by Telephonic Conference |

8 | ||||

| 2.13. |

Remuneration and Expenses of Directors |

8 | ||||

| 2.14. |

Specified Actions Requiring Board Approval |

8 | ||||

| 2.15. |

Officers |

11 | ||||

| 2.16. |

Other Matters |

11 | ||||

| Section 3. |

Information Rights |

11 | ||||

| 3.1. |

Delivery of Financial Statements |

11 | ||||

| 3.2. |

Inspection and Consultation |

12 | ||||

| Section 4. |

Company Covenants |

12 | ||||

| 4.1. |

Business Plans |

12 | ||||

| 4.2. |

Deadlock |

13 | ||||

| 4.3. |

Compliance with Laws |

15 | ||||

| 4.4. |

Tax Matters |

15 | ||||

| 4.5. |

Funding Obligations |

15 | ||||

| Section 5. |

Pre-Emptive Right |

16 | ||||

| 5.1. |

Pre-Emptive Right |

16 | ||||

| Section 6. |

Transfer Restrictions |

17 | ||||

| 6.1. |

Transfer Restrictions; Effect of Failure to Comply |

17 | ||||

| 6.2. |

Transfers |

17 | ||||

i

| Section 7. |

Call Right |

17 | ||||

| 7.1. |

CIBR Call Right Defined |

17 | ||||

| 7.2. |

Exercise of CIBR Call Right |

18 | ||||

| 7.3. |

CIBR Call Closing |

18 | ||||

| Section 8. |

Put Right |

18 | ||||

| 8.1. |

CIBR Put Right Defined |

18 | ||||

| 8.2 |

Exercise of CIBR Put Right |

18 | ||||

| 8.3. |

CIBR Put Closing |

19 | ||||

| Section 9. |

Review Period |

20 | ||||

| Section 10. |

Remedies |

20 | ||||

| 10.1. |

Covenants of the Company |

20 | ||||

| 10.2. |

Specific Enforcement |

20 | ||||

| 10.3. |

Remedies Cumulative |

20 | ||||

| Section 11. |

Term |

21 | ||||

| Section 12. |

Confidentiality |

21 | ||||

| Section 13. |

Miscellaneous |

21 | ||||

| 13.1. |

Additional Parties |

21 | ||||

| 13.2. |

Successors and Assigns |

21 | ||||

| 13.3. |

Governing Law |

22 | ||||

| 13.4. |

Counterparts; Facsimile |

22 | ||||

| 13.5. |

Interpretation |

22 | ||||

| 13.6. |

Notices |

22 | ||||

| 13.7. |

Amendment and Waiver |

23 | ||||

| 13.8. |

Delays or Omissions |

24 | ||||

| 13.9. |

Severability |

24 | ||||

| 13.10. |

Entire Agreement |

24 | ||||

| 13.11. |

Manner of Voting |

24 | ||||

| 13.12. |

Further Assurances |

24 | ||||

| 13.13. |

Dispute Resolution |

24 | ||||

Exhibits

Exhibit A – Call Price

Exhibit B – Put Price

Exhibit C – Philippine System White Paper

ii

SHAREHOLDERS AGREEMENT

THIS SHAREHOLDERS AGREEMENT (this “Agreement”) is made and entered into as of this 25th day of January, 2013, by and among Coca-Cola Bottlers Philippines, Inc., a corporation organized under the laws of the Philippines (the “Company”), Coca-Cola South Asia Holdings, Inc., a corporation organized under the laws of Delaware (“KOSAH”), Coca-Cola Holdings (Overseas) Limited, a company organized under the laws of Delaware (“KOHOL” and, together with KOSAH, the “KO Shareholders”) and Controladora de Inversiones en Bebidas Refrescantes, S.L., a sociedad limitada organized under the laws of the Kingdom of Spain (“CIBR” and together with the KO Shareholders, the “Shareholders” and each a “Shareholder”).

RECITALS

WHEREAS, following the consummation of the transactions contemplated by the Share Purchase Agreement, dated as of December 13, 2012 (the “Purchase Agreement”), by and among the Shareholders, CIBR will own 51% of the issued and outstanding shares of capital stock of the Company (“Shares”) from the KO Shareholders, and the KO Shareholders will own the remaining 49% of the Shares;

WHEREAS, in accordance with the Purchase Agreement, the Shareholders have agreed to take, and to cause the Company to take, such actions as may be necessary to amend and restate the Company’s existing Articles of Incorporation and Bylaws (the “Existing Articles and Bylaws” and such amended and restated Articles of Incorporation and Bylaws, the “Revised Articles and Bylaws”); and

WHEREAS, the Shareholders believe that it is in their best interest to set forth certain agreements regarding their interests in, and the operation of, the Company.

NOW, THEREFORE, in consideration of the mutual covenants herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the Company and the Shareholders agree as follows:

Section 1. Definitions. For purposes of this Agreement:

“2013 Annual Business Plan” has the meaning set forth in Section 4.1(a) hereof.

“Accounting Cycle End Date” has the meaning set forth in Section 4.2(c) hereof.

“Adoption Agreement” has the meaning set forth in Section 5.1(e) hereof.

“Affiliate” means, with respect to any Person, any Person directly or indirectly controlling, controlled by or under common control with, such Person. For the purposes of this definition, (a) “control” (including, with correlative meaning, the terms “controlling,” “controlled by” and “under common control with”) means the possession, directly or indirectly, of the power to direct or cause the direction of management and policies of such Person through the ownership of more than 50% of such Person’s voting securities, by contract or otherwise, and (b) the Company and its Subsidiaries shall not be deemed to be “Affiliates” of any Shareholder or any of its Affiliates.

“Agreement” has the meaning set forth in the preamble above.

“Ancillary Agreements” means any of: (i) the Purchase Agreement, (ii) the KO Guarantee, (iii) the KOF Guarantee, (iii) the IT Services Agreement and (iv) the Shared Services Agreement.

“Annual Business Plan” means, together, the Annual Normal Operations Plan and the Annual Extraordinary Plan.

“Annual Extraordinary Plan” means, with respect to any calendar year, the extraordinary business plan of the Company and its Subsidiaries for such calendar year, which business plan shall include any plan or decision that is not contemplated by the Annual Normal Operations Plan, including any plan or decision relating to any Specified Action and any related funding thereof.

“Annual Normal Operations Plan” means, with respect to any calendar year, the ordinary business plan of the Company and its Subsidiaries for such calendar year, which business plan shall provide for a plan to ensure the normal operation and the organic growth of the business of the Company and its Subsidiaries in the Philippines, including all necessary capital investments, capital expenditures, leases and Debt, but excluding any plan or decision relating to any Specified Action and any related funding thereof.

“Anti-Corruption Laws” means the U.S. Foreign Corrupt Practices Act and any other anti-bribery or anti-corruption laws applicable to the Company and/or any of its Subsidiaries or any other Person acting on behalf of the Company and/or any of its Subsidiaries.

“Board” means the Board of Directors of the Company as constituted from time to time.

“Business Day” means any day on which banks are not required or authorized by Law to close in the cities of Manila, Philippines, Mexico City, Federal District, Mexico, Bilbao, Bizkaia, Kingdom of Spain and the City of New York, the State of New York, United States.

“Call Price” has the meaning set forth in Section 7.1 hereof.

“Call Review Period” has the meaning set forth in Section 7.3 hereof.

“CEO” means the chief executive officer of the Company.

“CFO” means the chief financial officer of the Company.

“CIBR” has the meaning set forth in the preamble above.

“CIBR Call Closing Date” has the meaning set forth in Section 7.2 hereof.

“CIBR Call Notice” has the meaning set forth in Section 7.2 hereof.

“CIBR Call Period” has the meaning set forth in Section 7.1 hereof.

“CIBR Call Right” has the meaning set forth in Section 7.1 hereof.

“CIBR Call Shares” has the meaning set forth in Section 7.1 hereof.

“CIBR Directors” has the meaning set forth in Section 2.2(ii) hereof.

“CIBR Put Closing Date” has the meaning set forth in Section 8.2 hereof.

2

“CIBR Put Notice” has the meaning set forth in Section 8.2 hereof.

“CIBR Put Period” has the meaning set forth in Section 8.1 hereof.

“CIBR Put Right” has the meaning set forth in Section 8.1 hereof.

“CIBR Put Shares” has the meaning set forth in Section 8.1 hereof.

“Closing Date Put Price” has the meaning set forth in Section 8.2 hereof.

“Company” has the meaning set forth in the preamble above.

“Consolidation Order” has the meaning set forth in Section 13.13(d) hereof.

“Consumer Price Index” means the primary consumer price index published by the Central Bank of the Philippines.

“Contract” means any agreement, lease, commitment, franchise, license, arrangement, contract, obligation, indenture, deed of trust or other instrument (whether written or oral).

“Deadlocked Matter” has the meaning set forth in Section 4.2(b) hereof.

“Debt” means, with respect to any Person without duplication, (a) all obligations of such Person for borrowed money, (b) all obligations of such Person evidenced by bonds, debentures, notes or similar instruments (other than those evidencing trade accounts payable incurred in the ordinary course of business consistent with past practice), (c) all obligations of such Person as an account party or applicant under or in respect of letters of credit, letters of guaranty, surety bonds, bankers’ acceptances or similar arrangements (solely to the extent drawn and outstanding); (d) all guarantees by such Person in respect of obligations of any other Person of the kind referred to in clauses (a) through (c) above and (e) all obligations of the kind referred to in clauses (a) through (d) above to the extent secured by (or for which the holder of such obligation has an existing right, contingent or otherwise, to be secured by) any lien on property (including accounts and contract rights) owned by such Person, whether or not such Person has assumed or becomes liable for the payment of such obligation.

“Dispute” has the meaning set forth in Section 13.13(a) hereof.

“Dispute Notice” has the meaning set forth in Section 13.13(a) hereof.

“Estimated Call Price” has the meaning set forth in Section 7.3 hereof.

“Estimated Put Price” has the meaning set forth in Section 8.3 hereof.

“Existing Articles and Bylaws” has the meaning set forth in the recitals.

“FEMSA” means Fomento Económico Mexicano, S.A.B. de C.V., which is the indirect parent of CIBR.

“FEMSA CEO” has the meaning set forth in Section 4.2(b) hereof.

“Final Report” has the meaning set forth in Section 9 hereof.

3

“FMV Institution List” means the mutually agreed upon list of internationally recognized institutions from which institutions the Shareholders may select from time to time for purposes of determining KOP Fair Market Value.

“GAAP” means generally accepted accounting principles in the United States.

“Governmental Authority” means any federal, national, supranational, state, provincial, departmental, local or similar government, governmental, regulatory or administrative authority, branch, agency, court of competent jurisdiction or commission or any judicial or arbitral body or any branch of competent jurisdiction, whether judicial, legislative or administrative.

“ICC” has the meaning set forth in Section 13.13(b) hereof.

“ICC Rules” has the meaning set forth in Section 13.13(b) hereof.

“IFRS” means the International Financial Reporting Standards.

“Impasse Matter” has the meaning set forth in Section 4.2(a) hereof.

“Independent Accounting Firm” has the meaning set forth in Section 9 hereof.

“Ineligible Director” has the meaning set forth in Section 2.3 hereof.

“Initial Four-Year Period” means the period commencing on the date hereof and ending on the fourth anniversary of the date hereof.

“KO Call Closing Date” has the meaning set forth in Section 4.2(c) hereof.

“KO Call Right” has the meaning set forth in Section 4.2(c) hereof.

“KO Call Right Notice” has the meaning set forth in Section 4.2(c) hereof.

“KO Directors” has the meaning set forth in Section 2.2(i) hereof.

“KO Shareholders” has the meaning set forth in the preamble above.

“KOF” means Coca-Cola FEMSA, S.A.B. de C.V.

“KOF CEO” has the meaning set forth in Section 4.2(b) hereof.

“KOF Management Committee” means the committee composed of representatives of KOF, FEMSA and TCCC that meets from time to time prior to meetings of the board of directors of KOF.

“KOHOL” has the meaning set forth in the preamble above.

“KOP Fair Market Value” shall mean the equity value amount in United States Dollars that, as of the date on which the Unresolved Deadlock Event shall occur, would be received for all of the Shares owned by CIBR in an arm’s-length transaction between a willing buyer and seller, determined as follows:

(i) Within 30 Business Days of delivery by the KO Shareholders of the KO Call Right Notice, the KO Shareholders and CIBR will each make an independent determination of

4

the KOP Fair Market Value (each an “Original Valuation Determination”) and will concurrently submit such valuation to the Board. If the Original Valuation Determinations differ by an amount which is less than 10% of the smaller Original Valuation Determination, the KOP Fair Market Value will be the average of such Original Valuation Determinations.

(ii) If the difference between the Original Valuation Determinations is an amount which is greater than 10% of the smaller Original Valuation Determination, within 10 Business Days following the date of the Original Valuation Determinations, the KO Shareholders and CIBR will each select a financial institution from the FMV Institution List. Within 30 Business Days of such selection, these two institutions will make their respective determinations of the KOP Fair Market Value (each a “Second Valuation”) and submit them concurrently to the Board. If the Second Valuations differ by an amount which is less than 10% of the smaller Second Valuation, the KOP Fair Market Value will be the average of such Second Valuations.

(iii) If the Second Valuations differ by an amount which is greater than 10% of the smaller Second Valuation, within 10 Business Days of the submission of the Second Valuations, the two aforementioned institutions will select a third institution from the FMV Institution List, which institution shall then make its own determination of the KOP Fair Market Value within 30 Business Days of its selection (the “Third Valuation”). The two Second Valuations and the Third Valuation will be averaged together, and the Original Valuation Determination that is nearest to this average will be deemed to be the KOP Fair Market Value.

For all purposes of this Agreement, the KOP Fair Market Value shall (x) be computed on the assumption that any bottler’s agreements of the Company shall continue in effect from and after the date as of which the KOP Fair Market Value is to be calculated and (y) not, in any event, be increased as a result of any outstanding Debt of the Company and its Subsidiaries.

“KOSAH” has the meaning set forth in the preamble above.

“Law” shall mean any statute, law, constitutional provision, code, regulation, circular (provided that such circular has been published), ordinance, rule, ruling, judgment, decision, order, writ, injunction, jurisprudence, decree, permit, concession, grant, franchise, license, agreement, rule of common law, or other governmental restriction of or determination by, or requirement enacted, promulgated, issued or entered by any Governmental Authority or any interpretation of any of the foregoing by any Governmental Authority.

“New Issue Offer Notice” shall have the meaning set forth in Section 5.1(a) hereof.

“New Securities” means, collectively, equity securities of the Company, whether or not currently authorized, as well as rights, options, or warrants to purchase such equity securities, or securities of any type whatsoever that are, or may become, convertible or exchangeable into or exercisable for such equity securities.

“Notice of Board Impasse” has the meaning set forth in Section 4.2(a) hereof.

“Pacific President” has the meaning set forth in Section 4.2(b) hereof.

“Person” means an individual, company, corporation, trust, association, joint venture, Governmental Authority or any other entity.

“PFRS” means the Philippine Financial Reporting Standards.

5

“Philippine Resident” means an individual that is a resident of the Philippines for all purposes of the Corporation Code (Batas Pambasa 8) of the Philippines.

“Post Closing Put Review Period” has the meaning set forth in Section 8.3 hereof.

“Pro Rata Share” has the meaning set forth in Section 5.1(b) hereof.

“Purchase Agreement” has the meaning set forth in the recitals.

“Put Price” has the meaning set forth in Section 8.1 hereof.

“Put Review Period” has the meaning set forth in Section 8.2 hereof.

“Related Persons” means, with respect to any Person, (a) each Affiliate thereof and (b) each Person that is a director, officer, controlling partner, controlling owner, controlling shareholder or controlling member of any Person included in clause (a) above.

“Representatives” has the meaning set forth in Section 12 hereof.

“Review Period” has the meaning set forth in Section 8.3 hereof.

“Revised Articles and Bylaws” has the meaning set forth in the recitals.

“Sanctions” means any sanctions administered or enforced by the U.S. Office of Foreign Assets Control or the United States Department of State or any sanctions imposed by the United Nations Security Council, the European Union or the United Kingdom Treasury departments.

“Shareholders” has the meaning set forth in the preamble above.

“Shares” has the meaning set forth in the recitals.

“Specified Actions” has the meaning set forth in Section 2.14 hereof.

“Stamp Taxes” has the meaning set forth in Section 4.2(c) hereof.

“Subsidiary” of a Person means a corporation, partnership, joint venture, association, limited liability company or other entity of which such Person owns, directly or indirectly, more than 50% of the outstanding voting stock or other ownership interests.

“TCCC” means The Coca-Cola Company, which is the direct parent of KOSAH and the indirect parent of KOHOL.

“TCCC CEO” has the meaning set forth in Section 4.2(b) hereof.

“Unresolved Deadlock Event” has the meaning set forth in Section 4.2(c) hereof.

Section 2. Corporate Governance.

2.1. Size of the Board. Each of the Shareholders agrees to vote, or cause to be voted, all Shares owned by such Shareholder, or over which such Shareholder has voting control, from time to time and at all times, in whatever manner as shall be necessary to ensure that the size of the Board shall be set and remain at seven (7) directors.

6

2.2. Board Composition. Each Shareholder agrees to vote, or cause to be voted, all Shares owned by such Shareholder, or over which such Shareholder has voting control, from time to time and at all times, in whatever manner as shall be necessary to ensure that at each annual or special meeting of shareholders at which an election of directors is held the following individuals shall be elected to the Board:

(i) three (3) individuals designated by the KO Shareholders, at least one of whom shall be a Philippine Resident (the “KO Directors”); and

(ii) four (4) individuals designated by CIBR, at least three of whom shall be Philippine Residents (the “CIBR Directors”).

2.3. Failure to Designate a Board Member.

(a) In the absence of any designation from the KO Shareholders or CIBR as specified above, the directors previously designated by them and then serving shall be reelected if still eligible to serve as provided herein.

(b) In the event any director previously designated by the KO Shareholders or CIBR, as the case may be, is no longer eligible to serve as provided herein (an “Ineligible Director”), then, subject to applicable Law, the KO Directors, if the Ineligible Director had been designated by the KO Shareholders, or the CIBR Directors, if the Ineligible Director had been designated by CIBR, shall be entitled, acting unanimously with all the existing directors, to designate a new director to replace the Ineligible Director until such time as a special meeting of shareholders at which an election of directors is held or a written consent of the shareholders can be executed. The CIBR Directors, if the new director shall be designated by the KO Shareholders, or the KO Directors, if the new director shall be designated by CIBR, shall support and vote for the designated new director until such time as a special meeting of shareholders at which an election of directors is held or a written consent of the shareholders can be executed.

2.4. Removal of Board Members. Each Shareholder agrees to vote, or cause to be voted, all Shares owned by such Shareholder, or over which such Shareholder has voting control, from time to time and at all times, in whatever manner as shall be necessary to ensure that:

(a) no director elected pursuant to Section 2.2 of this Agreement may be removed from office unless such removal is directed or approved by the respective designator (the KO Shareholders or CIBR, as applicable) entitled under Section 2.2 to designate that director; and

(b) any vacancies created by the resignation, removal or death of a director elected pursuant to Section 2.2 shall be filled by the respective designator (the KO Shareholders or CIBR, as applicable) of such director in accordance with the provisions of this Section 2.

2.5. Consents; Necessary Action. All Shareholders agree to execute any written consents required to effect the purposes of this Agreement, and, at the request of any Shareholder, the Shareholders agree to cause their respective designated directors to call a special meeting of shareholders for the purpose of electing directors.

2.6. Board Committees. Subject to Section 2.14 hereof, the Board shall have right to create an executive committee or any other committee of the Board. The membership of any such committee shall include at least one KO Director, unless otherwise agreed by the KO Directors.

7

2.7. Chairman; Secretary. The CIBR Directors shall appoint the Chairman of the Board, who will preside at all meetings of the shareholders and of the Board. The CIBR Directors shall appoint the secretary of the Board, who will attend all meetings of the shareholders and of the Board, but will not be a director of the Board.

2.8. Quorum. No business shall be transacted at any meeting of the Board unless a quorum is present at the time when the meeting proceeds to business and continues to be present until the conclusion of the meeting. At each initial call for a meeting of the Board the presence of at least one CIBR Director and one KO Director shall be required for a quorum. In case a quorum is not reached at the initial call for any meeting of the Board other than a meeting of the Board during the Initial Four-Year Period to approve an Annual Normal Operations Plan, a second meeting of the Board may be convened pursuant to Section 2.9, in which case a quorum of the Board shall consist of a majority of the Board.

2.9. Meetings. Meetings of the Board shall be held at such place or places, within or outside the Philippines, as the Board may from time to time determine. The parties agree that a meeting of the Board shall be held at least three times each calendar year on such dates and at such times and locations as may be decided by the Board. Notice of any meeting of the Board shall be delivered to the directors at least 15 days prior to the date of such meeting. In case a duly convened Board meeting is not held due to lack of quorum, a second Board meeting shall be convened to discuss the same agenda of such unheld Board meeting, provided a notice thereof is delivered at least 5 days in advance thereof.

2.10. Special Meetings. Special meetings of the Board may be held at any time and place whenever such meetings are required to be called by any director upon 15 days prior written notice to the other directors specifying the proposed date, time and location of the meeting together with the details of the matters to be discussed. A special meeting of the Board may be called upon shorter notice if each of the directors so agrees in writing at or prior to the relevant meeting.

2.11. Action Without a Meeting. To the extent permitted by applicable Law, any action required or permitted to be taken at any meeting of the Board or of any committee thereof may be taken without a meeting if all members of the Board or any committee designated by the Board, as the case may be, consent thereto in writing, and the writing or writings are filed with the minutes or proceedings of the Board or any committee designated by the Board.

2.12. Action by Telephonic Conference. Members of the Board, or any committee designated by the Board, may participate in a meeting of the Board or committee thereof by means of conference telephone, electronic or similar communications equipment by means of which all persons participating in the meeting can hear each other, and participation in such a meeting shall constitute presence in person at such meeting.

2.13. Remuneration and Expenses of Directors. The members of the Board shall not be entitled to any remuneration in their capacity as directors of the Company. However, the parties agree that the Company shall promptly reimburse in full, each director for all of his or her reasonable out-of-pocket expenses incurred in attending each meeting of the Board or any committee thereof.

2.14. Specified Actions Requiring Board Approval.

(a) The approval of a majority of the Board, including the affirmative vote of at least one of the KO Directors and one of the CIBR Directors, shall be required prior to the taking of any of the corporate actions set forth below by the Company or any of its Subsidiaries (“Specified Actions”):

8

(i) Making any change in or amending any articles of incorporation, bylaws or any other governing documents;

(ii) If the Company has any non-operational Debt outstanding, paying or declaring dividends or distributions on the Company’s capital stock;

(iii) If the Company does not have any non-operational Debt outstanding, paying or declaring any dividends or distributions on the Company’s capital stock that, in the aggregate, exceed an amount equal to 20% of the consolidated net income of the Company and its Subsidiaries for the most recent fiscal year;

(iv) Redeeming, purchasing or otherwise acquiring any shares of capital stock, other than (A) a redemption or purchase of the publicly held shares of Cosmos Bottling Corporation and (B) any corporate action expressly contemplated by the Purchase Agreement;

(v) Any guarantee of third party obligations that is not related to the normal operation or not required to ensure the organic growth of the business of the Company and its Subsidiaries in the Philippines;

(vi) Issuing or selling any equity securities (including stock options, warrants or securities convertible or exchangeable into equity securities), entering into any arrangements with respect to the issuance or sale of equity securities or any request for capital contributions not contemplated by an Annual Extraordinary Plan or the Purchase Agreement;

(vii) Entering into any Contract with CIBR or any of its Related Persons;

(viii) Instituting or consenting to or acquiescing in any bankruptcy, reorganization, workout, receivership, liquidation or dissolution proceeding;

(ix) Approving any Annual Extraordinary Plan, including any amendments or updates thereto, or any action to be taken by the Company or any of its Subsidiaries that would be a material deviation from the Annual Extraordinary Plans;

(x) Entering into agreement with respect to, or consummating, any acquisition, directly or indirectly (whether by purchase, merger, consolidation or acquisition of stock or assets or otherwise), of any assets (whether tangible or intangible), securities, properties, interests, or businesses, or approve any investment (whether by purchase of stock or securities, contributions to capital, loans to, or property transfers), unless such acquisition or investment (or series of related acquisitions or investments): (i) is specifically contemplated in the Annual Normal Operations Plan or (ii) if not specifically contemplated in the capital investment budget of the Annual Normal Operations Plan and is related to the normal operation or required to assure the organic growth of the business of the Company and its Subsidiaries in the Philippines, involves an amount of consideration not in excess of US$18 million and does not involve the acquisition of any third party brand;

(xi) Entering into any joint venture, partnership, strategic alliance or any other business acquisition or combination with third parties or equity investment in any Person regardless of structure, unless such acquisition or investment relates to the acquisition of operating assets in the ordinary course of business;

(xii) Entering into any transaction to sell, assign, lease, license, transfer, abandon or permitting to lapse or otherwise disposing of any real property or other properties or assets, real, personal

9

or mixed, whether tangible or intangible, unless such transaction (or series of related transactions): (i) is specifically contemplated in the Annual Normal Operations Plan or (ii) if not specifically contemplated in the Annual Normal Operations Plan and if related to the normal operation or required to assure the organic growth of the business of the Company and its Subsidiaries in the Philippines, involves an amount of consideration not in excess of US$18 million and does not include any material intellectual property;

(xiii) Commencing, prosecuting or settling any litigation, arbitration, investigation or other proceeding other than (i) any of the foregoing involving the Company, on the one hand, and CIBR or any KO Shareholder, on the other hand or (ii) in the ordinary course of business;

(xiv) Approving yearly audited financial statements, including a qualified opinion of an auditor;

(xv) Changing the Company’s auditor;

(xvi) Changing any tax election or fiscal year of the Company or any of its Subsidiaries;

(xvii) The creation of any executive or other committee of the Board;

(xviii) Entering into any new line of business or changing the nature of the Company’s business or the territory in which the Company conducts its business;

(xix) Forming or dissolving any Subsidiary that would result in a material change in the asset value of the Company; or

(xx) Authorizing the Company or any of its Subsidiaries to make any public offering of, or to publicly list or delist, any equity securities (or any securities convertible or exchangeable into equity securities), except for the offer to purchase the publicly-held shares of Cosmos Bottling Corporation.

(b) Only for purposes of the Specified Actions listed in Section 2.14(a), when the term “ordinary course of business” is used, it shall mean the transaction of business according to common customs and practices in the international non-alcoholic beverages business and consistent with past practice of the Company and its Subsidiaries; provided that, without in any way broadening the term “ordinary course of business,” matters involving in excess of 5% of the total assets of the Company and its Subsidiaries (either separately or, if the matter involves a series of transactions, in the aggregate) shall not be considered to be in the ordinary course of business.

(c) Only for purposes of the Specified Actions listed in Section 2.14(a), when the term “non-operational Debt” is used, it shall refer to Debt incurred other than for capital investments, capital expenditures or otherwise in the ordinary course of business to fund the normal operation and organic growth of the Company and its Subsidiaries.

(d) Each Shareholder agrees to vote, or cause to be voted, all Shares owned by such Shareholder, or over which such Shareholder has voting control, from time to time and at all times, in favor of any Specified Action duly approved by the Board in accordance with Section 2.14(a) above to the extent any shareholder action is required to effect such Specified Action.

10

2.15. Officers.

(a) (i) A majority of the Board (which majority may be comprised solely of CIBR Directors) shall approve the appointment or removal of the CEO and (ii) the CEO shall be entitled to appoint and remove any other member of management of the Company (other than the CFO, who shall be appointed and/or removed as provided in paragraph (b) and (c) below, respectively); provided, however, that in the case of each of clauses (i) and (ii), prior to any such appointment or removal, the Board or the CEO, as applicable, shall consult with, and consider in good faith the views of, the KO Directors in connection with such appointment or removal.

(b) The KO Directors shall be entitled to designate for appointment the CFO; provided, however, that prior to any such appointment, the CEO shall be given the opportunity to interview the proposed candidate and the KO Directors shall consult with, and consider in good faith the views of, the CEO in connection with such appointment.

(c) The CEO may request the removal of the CFO for valid commercial reasons and, as promptly as practicable following receipt of such request, the KO Directors shall discuss with the CEO whether the CFO should be removed. Notwithstanding the foregoing, it is acknowledged and agreed that only the KO Directors shall be entitled to remove the CFO; provided, however, that prior to any such removal (whether at the request of the CEO or otherwise) the KO Directors shall consult with, and consider in good faith the views of, the CEO in connection with such removal.

(d) No member of senior management may hold a management position with any entity other than the Company and its Subsidiaries.

2.16. Other Matters.

(a) The Shareholders acknowledge that the Revised Articles and Bylaws provide for certain notice, quorum and voting requirements at annual and special shareholder meetings and agree not to take any action inconsistent with such provisions.

(b) Notwithstanding the Existing Articles and Bylaws, until the effectiveness of the Revised Articles and Bylaws, (i) the Shareholders acknowledge and agree that the provisions of this Agreement and the Revised Articles and Bylaws shall govern the interests of the Shareholders in, and the operation of, the Company, and (ii) the Shareholders agree to take, or to cause to be taken, such actions as may be necessary to give effect to the foregoing clause (i), including by granting any consents or causing their respective director designees to take or not to take any actions.

(c) In the event of any discrepancy or conflict between the Revised Articles and Bylaws and this Agreement, as among the Shareholders, this Agreement shall prevail and, to the extent permitted by applicable Law, the Shareholders shall cause the Company to amend the applicable Revised Articles and Bylaws to eliminate such discrepancy.

Section 3. Information Rights.

3.1. Delivery of Financial Statements.

(a) The Company shall deliver to each Shareholder:

(i) as soon as practicable, but in any event within 60 days after the end of each fiscal year of the Company, (A) a balance sheet as of the end of such year; (B) statements of income and of cash flows for such year; and (C) a statement of shareholders’ equity as of the end of such year, all such financial statements prepared in accordance with PFRS (for statutory purposes only) and IFRS, audited and certified by the Company’s independent auditor (as approved by the Board in accordance with Section 2.14) and including an analysis reconciling such financial statements with GAAP;

11

(ii) as soon as practicable, but in any event within 30 days after the end of each quarter of each fiscal year of the Company, unaudited statements of income and of cash flows for such fiscal quarter, and an unaudited balance sheet and a statement of shareholders’ equity as of the end of such fiscal quarter, all prepared in accordance with IFRS and including an analysis reconciling such financial statements with GAAP;

(iii) as soon as practicable, but in any event within 30 days after the end of each month of each fiscal year of the Company, unaudited statements of income and of cash flows for such month, and an unaudited balance sheet as of the end of such month, all prepared in accordance with IFRS;

(iv) with respect to the financial statements called for in Section 3.1(a)(i) and Section 3.1(a)(ii), an instrument executed by the CFO certifying that such financial statements were prepared in accordance with IFRS, consistently applied with prior practice for earlier periods and fairly present the financial condition of the Company and its results of operation for the periods specified therein (except that such financial statements (A) may be subject to normal year-end audit adjustments and (B) need not contain all notes thereto that may be required in accordance with IFRS); and

(v) such other information relating to the financial condition, business, prospects, or corporate affairs of the Company as the KO Shareholders or CIBR may from time to time reasonably request in order to prepare its own financial statements.

(b) If, for any period, the Company has any Subsidiary whose accounts are consolidated with those of the Company, then in respect of such period the financial statements delivered pursuant to the foregoing sections shall be the consolidated and consolidating financial statements of the Company and all such consolidated Subsidiaries; provided, however, that any consolidating financial statements will be delivered as soon as practicable and will not be subject to the deadlines specified in Section 3.1(a)(i) and Section 3.1(a)(ii).

3.2. Inspection and Consultation. The Company shall permit each Shareholder and its representatives, at such Shareholder’s own cost and expense, to examine the books of account and records of the Company, during normal business hours, as may be reasonably requested by such Shareholder. Furthermore, the Company shall, at a Shareholder’s reasonable request, make available the CFO and other senior financial personnel who are responsible for the supervision of the books of account and records of the Company and representatives (including auditors) to consult with and discuss the Company’s affairs, finances and accounts with such Shareholder’s financial personnel and outside auditors upon reasonable notice and during normal business hours.

Section 4. Company Covenants.

4.1. Business Plans.

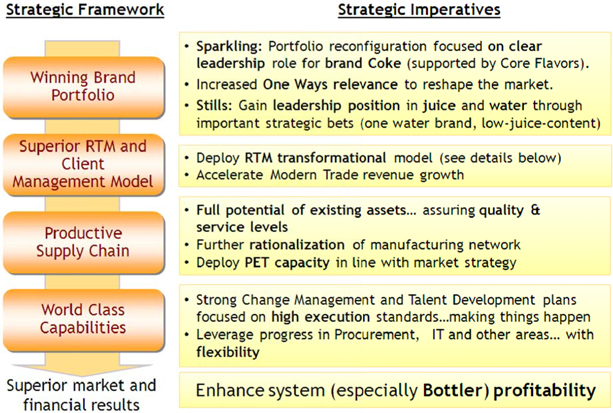

(a) As of the date hereof, the Shareholders have agreed upon the KO-KOF – Philippine System White Paper in the form attached hereto as Exhibit C, which provides a strategic roadmap of the Company for the next three years, and shall as promptly as practicable

12

after the date hereof (but no later than March 31, 2013) agree upon an Annual Business Plan for the year ended December 31, 2013, which will include those matters mutually agreed upon in the operating guidelines letter agreement (the “2013 Annual Business Plan”). The 2013 Annual Business Plan will contain the customary level of detail necessary to satisfy the requirements of an “Annual Business Plan” under this Agreement. During the Initial Four-Year Period, the management of the Company, in full consultation with the KO Directors and on the same schedule as TCCC’s cycle planning, shall prepare and submit the Annual Business Plans for review by, and subject to approval of, the Board, including the affirmative vote of at least one of the KO Directors.

(b) Following the Initial Four-Year Period, the management of the Company, in full consultation with TCCC and on the same schedule as TCCC’s cycle planning, shall prepare and submit each year during such period the Annual Normal Operations Plan and the Annual Extraordinary Plan for review by, and approval of, the Board; provided that the Annual Extraordinary Plan will require the affirmative vote of at least one KO Directors pursuant to Section 2.14(a)(ix) (it being understood and agreed that following the Initial Four-Year Period the Annual Normal Operations Plan can be approved by a majority of the Board (which majority may be comprised solely of CIBR Directors)).

4.2. Deadlock.

(a) In the event that, (i) for any two consecutive duly convened meetings of the Board, the Board is unable to reach a decision by the required vote concerning any Specified Action that was on the agenda for such meetings due to the failure of the KO Directors to approve such Specified Action, or (ii) if during the Initial Four-Year Period, an Annual Normal Operations Plan has not been approved by the KO Directors, either Shareholder may, within 14 days of the occurrence of either (i) or (ii) deliver a written notice (a “Notice of Board Impasse”) to the other Shareholder stating that in its opinion an impasse has occurred and identifying the matter in reasonable detail over which the Shareholders are at an impasse (“Impasse Matter”). During the period in which a Notice of Board Impasse may be delivered by any Shareholder and following delivery of a Notice of Board Impasse until the expiration of the KO Call Right, the right of CIBR to exercise the CIBR Call Right and the CIBR Put Right (if any) shall be suspended.

(b) The Shareholders agree that following delivery of a Notice of Board Impasse, they shall refer the Impasse Matter in the first instance to the Chief Executive Officer of KOF (“KOF CEO”) and the President, Pacific Group of TCCC (“Pacific President”). If the KOF CEO and the Pacific President are unable to resolve the Impasse Matter within 90 days, then the Impasse Matter shall be escalated to the KOF Management Committee, and if the KOF Management Committee is not scheduled to meet during the following 90 day period, the Shareholders shall cause the KOF Management Committee to meet during such period. If the KOF Management Committee (with the participation and approval of the members thereof designated by TCCC) is unable to resolve the Impasse Matter within 90 days or the KOF Management Committee determines that a deadlock has occurred, then such Impasse Matter shall be deemed by the parties to be a “Deadlocked Matter” and such Impasse Matter shall be escalated to the Chief Executive Officer of FEMSA (“FEMSA CEO”) and the Chief Executive Officer of TCCC (“TCCC CEO”). In each escalation, the parties shall take steps in good faith to resolve the matter, including arranging a meeting to discuss the same.

(c) If any Deadlocked Matter is not resolved within 90 days of being referred to the FEMSA CEO and the TCCC CEO (an “Unresolved Deadlock Event”), then the

13

KO Shareholders may at their election, by providing written notice to CIBR within 90 days following the date on which the Unresolved Deadlock Event occurs (the “KO Call Right Notice”), purchase all, but not less than all, of the Shares owned by CIBR at a price equal to the KOP Fair Market Value (the “KO Call Right”). In connection with the exercise of the KO Call Right, the KO Shareholders shall cause all indebtedness for borrowed money of the Company and its Subsidiaries (including accrued interest thereon) owed to CIBR to be repaid. The purchase of Shares pursuant to the KO Call Right shall be consummated (the “KO Call Closing Date”) on the last day of the applicable monthly accounting period of TCCC (the “Accounting Cycle End Date”), which Accounting Cycle End Date shall be no earlier than 10 days after the date on which the KOP Fair Market Value is finally determined in accordance with this Agreement. At the KO Call Closing Date, the KO Shareholders shall deliver to CIBR the price equal to the KOP Fair Market Value net of any applicable withholding (including the original or a certified copy of a receipt, or other evidence satisfactory to CIBR, evidencing payment thereof), and CIBR shall deliver to the KO Shareholders the Shares owned of record by CIBR and all other documents required to effect the sale of the Shares owned by CIBR, free of any liens, including appropriate documentation providing indemnities to the KO Shareholders regarding its title to the Shares held of record by CIBR in form and substance reasonably satisfactory to the KO Shareholders. The KO Shareholders and CIBR shall each pay one-half of any sales, use, value added, stamp, documentary, filing, recordation, registration and other similar taxes, if any, together with any interest, additions, fines, costs or penalties thereon and any interest in respect of any additions, fines, costs or penalties, incurred in connection with such sale (the “Stamp Taxes”), whether levied on the KO Shareholders or CIBR. Unless otherwise required by applicable Laws, CIBR shall be responsible for preparing and timely filing any tax returns required with respect to any such Stamp Taxes. Payment of any such Stamp Taxes by the KO Shareholders to CIBR pursuant to this paragraph shall be made to CIBR no later than two Business Days before the due date of the applicable payment. CIBR shall provide the KO Shareholders with the tax returns required with respect to any Stamp Taxes and proof of payment within five Business Days following the payment of any such Stamp Tax. The KO Shareholders and CIBR shall cooperate with each other in order to minimize applicable Stamp Taxes in a manner that is mutually agreeable and in compliance with applicable Law, and shall in connection therewith execute such documents, agreements, applications, instruments, or other forms as reasonably required, and shall permit any such Stamp Taxes to be assessed and paid in accordance with applicable Law. For the avoidance of doubt, taxes imposed on CIBR with respect to any gain or income on the sale of the Shares to the KO Shareholders shall be borne exclusively by CIBR and CIBR shall be responsible for preparing and timely filing any tax returns required with respect to any such taxes subject to applicable withholding by KO Shareholders, if any.

(d) If during the Initial Four-Year Period the Board is unable to agree by the required vote on an Annual Normal Operations Plan for any period prior to the commencement of such period, the Shareholders agree to cause the Board to take all necessary action to approve a provisional Annual Normal Operations Plan for such period, which provisional Annual Normal Operations Plan shall provide that (i) to the extent the Board agrees by the required vote (which shall include the affirmative vote of the KO Directors) upon individual line items in the proposed Annual Normal Operations Plan, such agreed upon individual line items shall be included in such provisional Annual Normal Operations Plan, and (ii) to the extent that there is no agreement by the required vote with respect to an individual line item in such Annual Normal Operations Plan, the individual line item from the Annual Normal Operations Plan for the immediately preceding corresponding period shall be included, subject to adjustment (without duplication) to reflect increases or decreases resulting from the following events:

(A) the operation of escalation or de-escalation provisions in contracts in effect during the period covered by the prior Annual Normal Operations Plan;

14

(B) increases or decreases in expenses attributable to the annualized effect of employee additions or reductions during the last year of the period covered by the prior Annual Normal Operations Plan;

(C) increases or decreases in expenses attributable to the actual growth of or decline of sales for the fiscal year immediately preceding the period covered by the provisional Annual Normal Operations Plan as compared to the actual sales that served as the basis for the preparation of the prior Annual Normal Operations Plan;

(D) increases in any expenses in an amount equal to the total of the expenses reflected in the last year covered by the prior Annual Normal Operations Plan multiplied by the increase in the Consumer Price Index for the prior year; and

(E) the continuation of the effects of a decision consented to by the KO Directors that are not reflected in the prior Annual Normal Operations Plan if and to the extent the effects of such decision was reasonably foreseeable at the time such decision was consented to by the KO Directors.

For the avoidance of doubt, (i) the provisional Annual Normal Operations Plan pursuant to this Section 4.2(d), including any agreement as to any line item thereto by the KO Directors, shall not be deemed to resolve any Impasse Matter or Deadlocked Matter and (ii) the provisional Annual Normal Operations Plan shall exclude any plan or decision relating to any Specified Action and any funding related thereto.

4.3. Compliance with Laws. The Company and its Subsidiaries shall comply with all Anti-Corruption Laws, anti-money laundering laws and import/export laws applicable to the Company, its Subsidiaries or any Person acting on its or their behalf. The Company and its Subsidiaries shall not engage in any dealings or transactions with any person, or in any country or territory, that is the subject of any Sanctions which CIBR and the KO Shareholders agree (acting reasonably) are applicable to the Company or would cause the Company to be in breach of any Sanctions.

4.4. Tax Matters.

(a) CIBR agrees that any U.S. tax elections made at the request of the KO Shareholders or one of their Affiliates to treat it as an entity that is disregarded from its owner for U.S. federal income Tax purposes may not be changed without prior consultation with the KO Shareholders.

(b) If the Philippines enacts legislation providing for a form of legal entity both suitable for the operation of the business and eligible for treatment as a disregarded or flow-through entity for U.S. income tax purposes, the Company agrees to cooperate in good faith with the Shareholders in considering whether or not the Company and any of its Subsidiaries can and would be converted into such form of legal entity and whether or not to file elections to treat such entities as disregarded or flow-through for U.S. tax purposes.

4.5. Funding Obligations. In the event that any funding or capital requirements arising from the operation of the Company and its Subsidiaries in accordance with the Annual Business Plan are in excess of the resources available to the Company and its Subsidiaries in the ordinary course of business, including borrowings in the ordinary course of business under reasonable market terms from

15

third parties, CIBR and the KO Shareholders shall cooperate in good faith to fund such excess requirements in a manner mutually acceptable to such Shareholders (taking into account any tax or other considerations affecting such Shareholders); provided, however, that (a) (i) during any year in which the Annual Normal Operations Plan was not approved by the KO Shareholders or (ii) during the period from which a Notice of Board Impasse has been delivered with respect to an Impasse Matter until the earlier of (A) such Impasse Matter is resolved in accordance with Section 4.2 and (B) the right of the KO Shareholders to exercise the KO Call Right in respect of an Unresolved Deadlock Event relating to such Impasse Matter has expired, the funding obligations of the KO Shareholders may be suspended by the KO Shareholders until such condition ceases to exist; and (b) each of the Shareholders shall be obligated to fund any capital requirement to the extent such requirement arose from the approval by the Shareholders of a Specified Action pursuant to Section 2.14(a)(vi) or Section 2.14(a)(ix).

Section 5. Pre-Emptive Right.

5.1. Pre-Emptive Right.

(a) Subject to the terms and conditions of this Section 5.1 and applicable securities laws, if the Company proposes to offer or sell any New Securities, the Company shall first offer such New Securities to each Shareholder. The Company shall make such offer by giving written notice (a “New Issue Offer Notice”) to each Shareholder, stating (i) its bona fide intention to offer such New Securities, (ii) the number of such New Securities to be offered, and (iii) the price and terms, if any, upon which it proposes to offer such New Securities.

(b) Each Shareholder shall have the absolute right to purchase that number of New Securities as shall be equal to (i) the number of the New Securities proposed to be sold by the Company multiplied by (ii) a fraction, the numerator of which shall be the number of Shares owned by such Shareholder and the denominator of which shall be the aggregate number of Shares then owned by all of the Shareholders (the “Pro Rata Share”). A Shareholder shall be entitled to apportion its Pro Rata Share of the New Securities among itself and its Affiliates in such proportions as it deems appropriate.

(c) The Shareholders shall have a right of oversubscription such that if any Shareholder fails to purchase its Pro Rata Share of the New Securities proposed to be sold by the Company, the other Shareholder shall have the right to purchase up to the balance of the New Securities not so purchased. Such right of oversubscription may be exercised by a Shareholder by accepting the offer contained in New Issue Offer Notice as to more than its Pro Rata Share. If, as a result thereof, such oversubscriptions exceed the total number of New Securities available in respect of such oversubscription privilege, the oversubscribing Shareholders shall be cut back with respect to their oversubscriptions on a pro rata basis in accordance with their respective Pro Rata Share or as they may otherwise agree among themselves.

(d) If a Shareholder desires to purchase all or any part of the New Securities, such Shareholder shall notify the Company in writing thereof within 10 Business Days of the date of the New Issue Offer Notice, which notice shall state the number of New Securities such Shareholder desires to purchase. Such notice shall, when taken in conjunction with the offer of such New Securities, be deemed to constitute a valid, legally binding, and enforceable agreement for the sale and purchase of such New Securities (subject to the limitations set forth above as to a Shareholder’s right to purchase more than its Pro Rata Share of the New Securities). Subject to compliance with applicable Law, sales of the New Securities to be sold to the purchasing Shareholders pursuant to this Section 5.1 shall be made at the offices of the Company on the 30th Business Day after the date of the New Issue Offer Notice. Such sales shall be effected by the

16

issuance by the Company of a certificate or certificates evidencing the New Securities to be purchased by the purchasing Shareholder, against payment to the Company of the purchase price therefore by such purchasing Shareholder in immediately available funds. New Securities purchased by Shareholders pursuant to this Section 5.1 shall immediately become subject to this Agreement upon completion of such purchase.

(e) If the Shareholders do not purchase all of the New Securities, the New Securities not so purchased may be sold by the Company to any Person at any time within 90 days after the date the New Issue Offer was made. Any such sale shall occur at not less than the price and upon other terms and conditions, if any, not more favorable to the buyer than those specified in the New Issue Offer. The Shareholders acknowledge and agree that it shall be a condition precedent to such purchase that the Person acquiring the New Securities execute and deliver an adoption agreement in form and substance reasonably acceptable to both Shareholders (the “Adoption Agreement”).

Section 6. Transfer Restrictions.

6.1. Transfer Restrictions; Effect of Failure to Comply. No Shareholder may transfer any Shares at any time to any Person except in compliance with all applicable Law and in accordance with the provisions of this Agreement. Subject to Section 6.2 and all applicable Law, no Shareholder may directly or indirectly sell, transfer, pledge or otherwise encumber any Shares without the prior written consent of the other Shareholders. Any sale, transfer, pledge or creation of any encumbrance of Shares not made in compliance with the requirements of this Agreement shall be null and void, shall not be recorded on the books of the Company or its transfer agent and shall not be recognized by the Company. If, notwithstanding the immediately preceding sentence, any transfer of any Shares is held by an arbitral panel or a court of competent jurisdiction to be effective, then the restrictions on transfer of any Shares under this Section 6 applicable to the transferor shall apply to the transferee and to any subsequent transferee as if such transferee were a party hereto. For the avoidance of doubt, no Shareholder may transfer any Shares to any Affiliate without the prior written consent of the other Shareholders (which consent may not be unreasonably withheld, conditioned or delayed with respect to any proposed transfer to a wholly owned Subsidiary of the transferring Shareholder).

6.2. Transfers. In addition to the requirements of Section 6.1, no Shares held by any Shareholder may be transferred unless the transferee shall agree, and it shall be a condition precedent to the Company’s recognition of such transfer that the transferee or assignee shall agree to be subject to each of the terms of this Agreement applicable to Shareholders. Upon the execution and delivery of an Adoption Agreement by any transferee, such transferee shall be deemed to be a party hereto as if such transferee were the transferor and such transferee’s signature appeared on the signature pages of this Agreement and shall be deemed to be a Shareholder. The Company shall not permit the transfer of the Shares subject to this Agreement on its books or issue a new certificate representing any such Shares unless and until such transferee shall have complied with the terms of this Section 6.2.

Section 7. Call Right

7.1. CIBR Call Right Defined. Subject to Section 4.2(a), at any time prior to the seventh (7th) anniversary of the date hereof (the “CIBR Call Period”), CIBR shall have the right to purchase from the KO Shareholders all, but not less than all, of the Shares held by the KO Shareholders (the “CIBR Call Shares”) at the purchase price (the “Call Price”) calculated in accordance with Exhibit A hereto (the “CIBR Call Right”).

17

7.2. Exercise of CIBR Call Right. CIBR may exercise the CIBR Call Right by giving written notice to the Company and the KO Shareholders of its intention to do so (the “CIBR Call Notice”), which CIBR Call Notice shall include CIBR’s estimate of the applicable Call Price (the “Estimated Call Price”) and copies of supporting calculations showing in reasonable detail how CIBR prepared the Estimated Call Price. The purchase of the CIBR Call Shares shall be consummated on the last day of the calendar month that is no earlier than 30 days after the date of effectiveness of the CIBR Call Notice (the “CIBR Call Closing Date”). The CIBR Call Notice shall be and remain irrevocable through the CIBR Call Closing Date.

7.3. CIBR Call Closing. At the CIBR Call Closing Date, CIBR shall deliver to the KO Shareholders the Estimated Call Price net of any applicable withholding (including the original or a certified copy of a receipt, or other evidence satisfactory to the KO Shareholders, evidencing payment thereof), and the KO Shareholders shall deliver to CIBR the CIBR Call Shares and all other documents required to effect the sale of the CIBR Call Shares, free of any liens, including appropriate documentation providing indemnities to CIBR regarding its title to the CIBR Call Shares in form and substance reasonably satisfactory to CIBR. Within 45 days following the CIBR Call Closing Date (the “Call Review Period”), either Shareholder may provide written notice to the other Shareholder that the Estimated Call Price has not been calculated correctly, in which case such dispute shall be resolved pursuant to Section 9 of this Agreement. If the Estimated Call Price is greater than the final Call Price as determined pursuant to Section 9, then the KO Shareholders shall pay to CIBR the amount of such difference no later than five Business Days following the date of determination. If the final Call Price as determined pursuant to Section 9 is greater than the Estimated Call Price, then CIBR shall pay to the KO Shareholders the amount of such difference no later than five Business Days following the date of determination. The KO Shareholders and CIBR shall each pay one-half of any Stamp Taxes, whether levied on KO Shareholders or CIBR. Unless otherwise required by applicable Laws, the KO Shareholders shall be responsible for preparing and timely filing any tax returns required with respect to any such Stamp Taxes. Payment of any such Stamp Taxes by CIBR to the KO Shareholders pursuant to this paragraph shall be made to the KO Shareholders no later than two Business Days before the due date of the applicable payment. The KO Shareholders shall provide CIBR with the tax returns required with respect to any Stamp Taxes and proof of payment within five Business Days following the payment of any such Stamp Tax. The KO Shareholders and CIBR shall cooperate with each other in order to minimize applicable Stamp Taxes in a manner that is mutually agreeable and in compliance with applicable Law, and shall in connection therewith execute such documents, agreements, applications, instruments, or other forms as reasonably required, and shall permit any such Stamp Taxes to be assessed and paid in accordance with applicable Law. For the avoidance of doubt, taxes imposed on the KO Shareholders with respect to any gain or income on the sale of the Shares to CIBR shall be borne exclusively by the KO Shareholders and the KO Shareholders shall be responsible for preparing and timely filing any tax returns required with respect to any such taxes subject to applicable withholding by CIBR, if any.

Section 8. Put Right.

8.1. CIBR Put Right Defined. Subject to Section 4.2(a), at any time from the fifth (5th) anniversary of the date hereof until the sixth (6th) anniversary of the date hereof (the “CIBR Put Period”), CIBR shall have the right to sell all, but not less than all, of the Shares held by CIBR (the “CIBR Put Shares”) to the KO Shareholders at the purchase price (the “Put Price”) calculated in accordance with Exhibit B hereto (the “CIBR Put Right”).

8.2. Exercise of CIBR Put Right. CIBR may exercise the CIBR Put Right by giving written notice to the Company and the KO Shareholders of its intention to do so (the “CIBR Put Notice”), which CIBR Put Notice shall include CIBR’s estimate of the applicable Put Price (the

18

“Estimated Put Price”) and copies of supporting calculations showing in reasonable detail how CIBR prepared the Estimated Put Price. Following delivery of the CIBR Put Notice by CIBR, the KO Shareholders shall have 30 days to review the Estimated Put Price proposed by CIBR and deliver notice of any objection to the Estimated Put Price to CIBR (the “Put Review Period”), and, if the KO Shareholders shall fail to deliver any such notice to CIBR within the Put Review Period, the Estimated Put Price proposed by CIBR in the CIBR Put Notice shall be the amount to be paid on the CIBR Put Closing Date in respect of the CIBR Put Shares (the “Closing Date Put Price”). Notwithstanding anything herein to the contrary, in the event that the KO Shareholders shall dispute the Estimated Put Price as set forth in the CIBR Put Notice during the Put Review Period, the KO Shareholders shall not be obligated to consummate the sale of the CIBR Put Shares pending resolution of such dispute pursuant to Section 9. The purchase of the CIBR Put Shares shall be consummated on the last day of the calendar month that is no earlier than 10 days after the date on which the Closing Date Put Price is finally determined in accordance with this Section 8.2 (the “CIBR Put Closing Date”). The CIBR Put Notice shall be and remain irrevocable through the CIBR Put Closing Date.

8.3. CIBR Put Closing. At the CIBR Put Closing Date, the KO Shareholders shall deliver to CIBR the Closing Date Put Price net of any applicable withholding (including the original or a certified copy of a receipt, or other evidence satisfactory to CIBR, evidencing payment thereof), and CIBR shall deliver to the KO Shareholders the CIBR Put Shares and all other documents required to effect the sale of the CIBR Put Shares, free of any liens, including appropriate documentation providing indemnities to the KO Shareholders regarding its title to the CIBR Put Shares in form and substance reasonably satisfactory to the KO Shareholders. Within 45 days following the CIBR Put Closing Date (the “Post Closing Put Review Period” and together with the Call Review Period and the Put Review Period, a “Review Period”), either Shareholder may provide written notice to the other Shareholder that the Closing Date Put Price has not been calculated correctly, in which case such dispute shall be resolved pursuant to Section 9; provided, however, that in the event there was a dispute regarding the Estimated Put Price, then the Shareholders agree that (i) the Independent Accounting Firm that resolved such dispute shall be the same Independent Accounting Firm to resolve any dispute relating to the Closing Date Put Price and (ii) to the extent any issue relating to the Closing Date Put Price was either agreed upon between the Shareholders on or prior to the CIBR Put Closing Date or determined by the Independent Accounting Firm in calculating the Closing Date Put Price, then the review by such Independent Accounting Firm (with respect to such agreed or determined issue) shall be limited to verifying that the amount included in the Closing Date Put Price related to that issue accurately reflects the resolution of such issue. If the Closing Date Put Price is greater than the final Put Price as determined pursuant to Section 9, then CIBR shall pay to the KO Shareholders the amount of such difference no later than five Business Days following the date of determination. If the final Put Price as determined pursuant to Section 9 is greater than the Closing Date Put Price, then the KO Shareholders shall pay to CIBR the amount of such difference no later than five Business Days following the date of determination. The KO Shareholders and CIBR shall each pay one-half of any Stamp Taxes, whether levied on the KO Shareholders or CIBR. Unless otherwise required by applicable Laws, CIBR shall be responsible for preparing and timely filing any tax returns required with respect to any such Stamp Taxes. Payment of any such Stamp Taxes by the KO Shareholders to CIBR pursuant to this paragraph shall be made to CIBR no later than two Business Days before the due date of the applicable payment. CIBR shall provide the KO Shareholders with the tax returns required with respect to any Stamp Taxes and proof of payment within five Business Days following the payment of any such Stamp Tax. The KO Shareholders and CIBR shall cooperate with each other in order to minimize applicable Stamp Taxes in a manner that is mutually agreeable and in compliance with applicable Law, and shall in connection therewith execute such documents, agreements, applications, instruments, or other forms as reasonably required, and shall permit any such Stamp Taxes to be assessed and paid in accordance with applicable Law. For the avoidance of doubt, taxes imposed on CIBR with respect to any gain or income on the sale of the Shares to the KO Shareholders shall be borne exclusively by CIBR and CIBR shall be responsible for preparing and timely filing any tax returns required with respect to any such taxes subject to applicable withholding by KO Shareholders, if any.

19

Section 9. Review Period. In the event the KO Shareholders timely deliver a notice of an objection to the Estimated Call Price, the Estimated Put Price or the Closing Date Put Price within a Review Period in accordance with the terms hereof, the KO Shareholders and CIBR shall in good faith attempt to reconcile their differences and specify any resolution in writing. Any definitive written resolution by CIBR and the KO Shareholders as to any such disputes shall be final, binding and conclusive on all of the Shareholders. If the KO Shareholders and CIBR are unable to resolve any such dispute within 15 Business Days after CIBR’s receipt of the objection notice, either of the KO Shareholders or CIBR may submit the items remaining in dispute for resolution to any of the New York offices of Deloitte Touche Tohmatsu Limited or PriceWaterhouseCoopers LLP (either such firm, the “Independent Accounting Firm”). If Deloitte Touche Tohmatsu Limited or PriceWaterhouseCoopers LLP are unable or unwilling to serve as the Independent Accounting Firm, KO Shareholders and CIBR shall attempt to agree on another mutually acceptable firm to serve as the Independent Accounting Firm, provided that if the KO Shareholders or CIBR are not able to agree within 30 days after Deloitte Touche Tohmatsu Limited or PriceWaterhouseCoopers LLP, as the case may be, provides notice that it is unable or unwilling to serve, then either Shareholder may request the ICC International Centre for Expertise shall appoint the Independent Accounting Firm. Upon the selection of the Independent Accounting Firm, and in any event within five Business Days following such selection, the KO Shareholders and CIBR shall submit to such Independent Accounting Firm (with a copy to the KO Shareholders or CIBR, as the case may be) documentary materials and analyses that the KO Shareholders or CIBR, as the case may be, believe support their respective position relating to the calculation of the Estimated Call Price, the Estimated Put Price or the Closing Date Put Price, as the case may be, but excluding any work papers of independent certified public accountants. The Independent Accounting Firm shall, within 30 Business Days after receipt of all such submissions by the KO Shareholders and CIBR, make a determination of the amount of the Estimated Call Price, the Estimated Put Price or the Closing Date Put Price, as the case may be, in accordance with standards provided herein and deliver to the KO Shareholders and CIBR a written report (the “Final Report”) containing such Independent Accounting Firm’s determination of the Put Price or the Call Price, as the case may be, provided that failure to provide the Final Report within such time period shall not be a basis to challenge the Final Report. In resolving the amount of the Call Price or the Put Price, as the case may be, the Independent Accounting Firm shall not assign a value greater than the greatest value claimed by either the KO Shareholders or CIBR or less than the smallest value claimed by either the KO Shareholders or CIBR. The determinations of the Independent Accounting Firm that are contained in the Final Report shall be final, binding and conclusive on the Shareholders and may be entered and enforced as a final arbitral award in any court having jurisdiction. The fees and disbursements of the Independent Accounting Firm shall be paid equally by the KO Shareholders, on the one hand, and CIBR, on the other hand. The place of the proceedings shall be New York, New York, and the language of the proceedings shall be English.

Section 10. Remedies.

10.1. Covenants of the Company. The Company agrees to use its best efforts, within the requirements of applicable law, to ensure that the rights granted under this Agreement are effective and that the Shareholders enjoy the benefits of this Agreement. Such actions include, without limitation, the use of the Company’s best efforts to cause the nomination and election of the directors as provided in this Agreement.

10.2. Specific Enforcement. The parties hereto agree that monetary damages would not be an adequate remedy in the event that any of the provisions of this Agreement were not performed in accordance with their specific terms. It is expressly agreed that the parties hereto shall be entitled to equitable relief, including injunctive relief and specific performance of the terms hereof, this being in addition to any other remedies to which they are entitled at law or in equity.

10.3. Remedies Cumulative. All remedies, either under this Agreement or by law or otherwise afforded to any party, shall be cumulative and not alternative.

20

Section 11. Term. This Agreement shall be effective as of the date hereof and shall continue in effect until the sale of all outstanding Shares to CIBR or the KO Shareholders pursuant to this Agreement. The Revised Articles and Bylaws shall be amended to reflect such termination.

Section 12. Confidentiality. Except to the extent provided pursuant to separate written agreements among the Shareholders and their Affiliates, each Shareholder agrees that it will keep confidential and will not disclose, divulge, or use for any purpose (other than to monitor its investment in the Company) any confidential information obtained from the Company or from each other or their respective Affiliates pursuant to the terms of this Agreement, unless such confidential information (a) is known or becomes known to the public in general (other than as a result of a breach of this Section 12 by such Shareholder), (b) is or has been independently developed or conceived by the Shareholder without use of the Company’s confidential information, (c) is or has been made known or disclosed to the Shareholder by a third party without a breach of any obligation of confidentiality such third party may have to the Company and (d) is required pursuant to public reporting obligations of the Shareholder or its Affiliates; provided, however, that a Shareholder may disclose confidential information (i) to its officers, directors, employees, attorneys, accountants, consultants, and other professionals, in each case, so long as such Persons are informed by such Shareholder of the confidential nature of such information and are directed by such Shareholder and agree to treat such confidential information confidentially; (ii) to any Affiliate, partner, member, shareholder, or wholly owned Subsidiary of such Shareholder in the ordinary course of business (such Persons in clauses (i) and (ii), “Representatives”), provided that such Shareholder informs such Representative that such information is confidential and directs such Representative to maintain the confidentiality of such information; (iii) to any relevant Governmental Authority as is reasonably required to obtain required regulatory approvals or (iv) as may otherwise be required by Law or stock exchange regulations, provided that the Shareholder promptly notifies the Company of such disclosure and takes reasonable steps to minimize the extent of any such required disclosure.

Section 13. Miscellaneous.

13.1. Additional Parties. If after the date of this Agreement the Company proposes to issue New Securities to any Person, the Company shall cause such Person, as a condition precedent to such issuance, to become a party to this Agreement by executing an Adoption Agreement, agreeing to be bound by and subject to the terms of this Agreement as a Shareholder and thereafter such person shall be deemed a Shareholder for all purposes under this Agreement.

13.2. Successors and Assigns.

(a) The terms and conditions of this Agreement shall inure to the benefit of and be binding upon the respective successors and assigns of the parties. Nothing in this Agreement, express or implied, is intended to confer upon any party other than the parties hereto or their respective successors and assigns any rights, remedies, obligations, or liabilities under or by reason of this Agreement, except as expressly provided in this Agreement. This Agreement, and the rights and obligations of each Shareholder hereunder, may be assigned by such Shareholder to any person or entity to which Shares are transferred by such Shareholder as permitted herein; provided that such assignment of rights shall be contingent upon the transferee providing a written instrument to the Company notifying the Company of such transfer and assignment and agreeing in writing to be bound by the terms of this Agreement.

(b) The Company may not assign its rights under this Agreement.

21