Appendix Form of Amended and Restated Facilities Agreement Dated 6 August 2004 INVITEL Zrt. Borrower MAGYAR TELECOM B.V. and CERTAIN OF ITS SUBSIDIARIES Guarantors BNP PARIBAS Co-ordinator BNP PARIBAS Mandated Lead Arranger BNP PARIBAS and BNP...

EXHIBIT 10.4

Private & Confidential

Appendix

Form of Amended and Restated Facilities Agreement

Dated 6 August 2004

INVITEL Zrt.

Borrower

MAGYAR TELECOM B.V. and

CERTAIN OF ITS SUBSIDIARIES

Guarantors

BNP PARIBAS

Co-ordinator

BNP PARIBAS

Mandated Lead Arranger

BNP PARIBAS and

BNP PARIBAS, Hungary Branch

Agents

BNP PARIBAS TRUST CORPORATION UK LIMITED

Security Trustee

for EUR 165,000,000 Term and

Multicurrency Revolving Facilities

(as amended and restated pursuant to a

supplemental agreement dated 27 April 2007)

Contents

| Clause |

Page | |||

| SECTION 1 : INTERPRETATION |

1 | |||

| 1 |

Definitions and interpretation |

1 | ||

| SECTION 2 : THE FACILITIES |

34 | |||

| 2 |

The Facilities |

34 | ||

| 3 |

Purpose |

35 | ||

| 4 |

Conditions of Utilisation |

35 | ||

| SECTION 3 : UTILISATION |

37 | |||

| 5 |

Utilisation |

37 | ||

| SECTION 4 : REPAYMENT, PREPAYMENT AND CANCELLATION |

39 | |||

| 6 |

Repayment |

39 | ||

| 7 |

Prepayment and cancellation |

40 | ||

| SECTION 5 : COSTS OF UTILISATION |

47 | |||

| 8 |

Interest |

47 | ||

| 9 |

Interest Periods |

48 | ||

| 10 |

Changes to the calculation of interest |

50 | ||

| 11 |

Fees |

51 | ||

| SECTION 6 : ADDITIONAL PAYMENT OBLIGATIONS |

52 | |||

| 12 |

Tax gross-up and indemnities |

52 | ||

| 13 |

Increased Costs |

54 | ||

| 14 |

Other indemnities |

55 | ||

| 15 |

Mitigation by the Lenders |

56 | ||

| 16 |

Costs and expenses |

57 | ||

| SECTION 7 : GUARANTEE |

58 | |||

| 17 |

Guarantee |

58 | ||

| SECTION 8 : REPRESENTATIONS, UNDERTAKINGS AND EVENTS OF DEFAULT |

62 | |||

| 18 |

Representations and Warranties |

62 | ||

| 19 |

Subordination |

67 | ||

| 20 |

Positive covenants |

68 | ||

| 21 |

Negative covenants |

75 | ||

| 22 |

Financial covenants |

77 | ||

| 23 |

Events of Default |

80 | ||

| SECTION 9 : CHANGES TO PARTIES |

86 | |||

| 24 |

Changes to the Lenders |

86 | ||

| 25 |

Changes to the Obligors |

89 | ||

| SECTION 10 : THE FINANCE PARTIES |

91 | |||

| 26 |

Role of the Agent, the Security Trustee and the Arranger |

91 | ||

| 27 |

Conduct of business by the Finance Parties |

96 | ||

| 28 |

Sharing among the Finance Parties/Enforcement |

96 | ||

| SECTION 11 : ADMINISTRATION |

99 | |||

| 29 |

Payment mechanics |

99 | ||

| 30 |

Set-off |

101 | ||

| 31 |

Notices |

101 | ||

| 32 |

Calculations and certificates |

103 | ||

| 33 |

Partial invalidity |

103 | ||

| 34 |

Remedies and waivers |

103 | ||

| 35 |

Amendments and waivers |

104 | ||

| 36 |

Counterparts |

105 | ||

| SECTION 12 : GOVERNING LAW AND ENFORCEMENT |

106 | |||

| 37 |

Governing law |

106 | ||

| 38 |

Enforcement |

106 | ||

Schedules

| Schedule 1 The Original Parties |

107 | |

| Schedule 2 Conditions precedent |

109 | |

| Schedule 3 Requests |

114 | |

| Schedule 4 Mandatory Cost formulae |

117 | |

| Schedule 5 Form of Transfer Certificate |

119 | |

| Schedule 6 Form of Guarantor Accession Undertaking |

121 | |

| Schedule 7 Form of Resignation Letter |

123 | |

| Schedule 8 Form of Compliance Certificate |

124 | |

| Schedule 9 Principal Agreements |

128 | |

| Schedule 10 LMA form of Confidentiality Undertaking |

130 | |

| Schedule 11 Form of Quarterly Management Accounts |

134 | |

| Schedule 12 Timetables |

135 | |

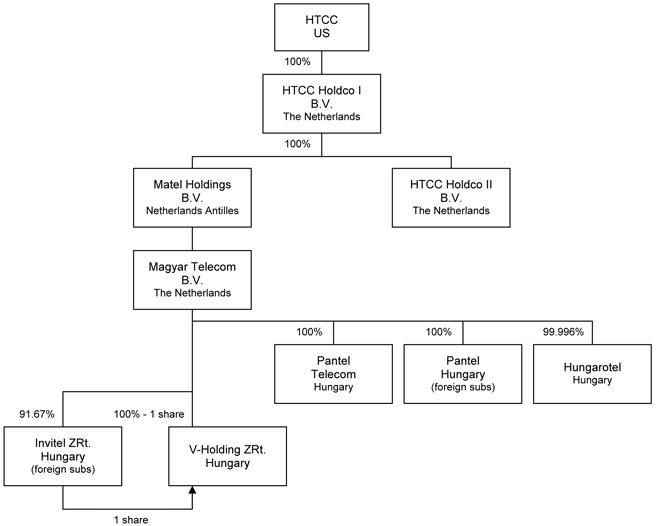

| Schedule 13 Group structure chart |

136 | |

THIS AGREEMENT is dated 6 August 2004 (as amended and restated pursuant to a supplemental agreement dated 27 April 2007) and made between:

| (1) | MAGYAR TELECOM B.V. as the Parent; |

| (2) | INVITEL Zrt. as the Borrower; |

| (3) | THE COMPANIES set out in part A of Schedule 1 (The Original Parties) as Original Guarantors; |

| (4) | BNP PARIBAS as Co-ordinator; |

| (5) | BNP PARIBAS as the Arranger; |

| (6) | THE BANKS AND FINANCIAL INSTITUTIONS whose names and addresses are set out in part B of Schedule 1 (The Original Parties) as Original Lenders; |

| (7) | BNP PARIBAS and BNP PARIBAS, Hungary Branch as the Agents; and |

| (8) | BNP PARIBAS TRUST CORPORATION UK LIMITED as Security Trustee. |

IT IS AGREED as follows:

SECTION 1 : INTERPRETATION

| 1 | Definitions and interpretation |

| 1.1 | Definitions |

In this Agreement:

“Acceptable Bank” means:

| (a) | a Lender; |

| (b) | any bank or financial institution which has a rating for its long-term unsecured and non credit-enhanced debt obligations of A or higher by Standard & Poor’s Rating Services or Fitch Ratings Ltd or Aa1 or higher by ▇▇▇▇▇’▇ Investor Services Limited or a comparable rating from an internationally recognised credit rating agency; or |

| (c) | any other bank or financial institution approved by the Facility Agent (acting reasonably). |

“Account Charges” means the Original Obligor Account Charges, the HTCC Opcos Account Charges and any other charges and/or pledge of bank accounts entered into in favour of the Security Trustee pursuant to clause 25.2 (Additional Guarantors) or clause 21.1.13 (Bank Accounts).

“Acquisition” means the acquisition by Holdco I of the Ultimate Parent on the terms of the Acquisition Documents.

“Acquisition Agreement” means the sale and purchase agreement between HTCC and Invitel Holdings N.V. dated 8 January 2007 relating to the Acquisition.

“Acquisition Documents” means the Acquisition Agreement and the Disclosure Letter and any other document designated as an “Acquisition Document” by the Facility Agent and the Parent.

“Additional Cost Rate” has the meaning given to it in Schedule 4 (Mandatory Cost formulae).

“Additional Guarantor” means an entity company which becomes an Additional Guarantor in accordance with clause 25 (Changes to the Obligors).

1

“Adjusted Twelve Month Consolidated EBITDA” means the Twelve Month Consolidated EBITDA less (i) Twelve Month Consolidated Capital Expenditure during such Twelve Month Period and (ii) any payment in cash of Tax during such Twelve Month Period, but, in respect of all Quarterly Periods and Twelve Month Periods ending on or before 31 December 2008 to the extent the same would otherwise be deducted in calculating Adjusted Twelve Month Consolidated EBITDA, adding back any restructuring expenses or capital expenditure attributable to the Acquisition up to a maximum aggregate amount of Euro 20,000,000 and adding back, to the extent deducted, any Consolidated Capital Expenditure or Taxes in each case to the extent funded by either (a) retained cash at the beginning of the relevant period or (b) Utilisations under Facility D.

“Affiliate” means, in relation to any person, a Subsidiary of that person or a Holding Company of that person or any other Subsidiary of that Holding Company.

“Agent” means the Facility Agent or, in relation to payments in respect of Facility B and HUF Facility C only, the HUF Agent.

“Agreed Base Case Model” means base case financial and operational projections (including the cash flow statement, the profit and loss account and balance sheet) for the HTCC Group produced by HTCC in the agreed form prior to the date of the Supplemental Agreement.

“Annual Budget” means a budget in respect of the HTCC Group for each financial year (other than 2007) in the agreed form or containing such amendments to the agreed form as have been approved in writing by the Borrower and the Facility Agent (acting on the instructions of the Majority Lenders, such Majority Lenders’ approval not to be unreasonably withheld or delayed).

“Arranger” means BNP Paribas of ▇▇ ▇▇▇▇▇ ▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇-▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇.

“Associated Company” of a person means (i) any other person which is directly or indirectly controlled by, under common control with or controlling such person or (ii) any other person owning beneficially and/or legally directly or indirectly 20 per cent. or more of the equity interest in such person or 20 per cent. of whose equity interest is owned beneficially and/or legally directly or indirectly by such person. For the purposes of this definition the term “control” means possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of a person whether through the ownership of interests or voting securities, by contract or otherwise.

“Authorised Officer” means any officer of the Borrower authorised to sign Compliance Certificates, Utilisation Requests, Selection Requests and, in the case of the Borrower or any other Obligor or Security Provider, any other notices, requests or confirmations referred to in this Agreement or relating to the Facilities granted hereunder.

“Availability Period” means:

| (a) | in relation to Facility A, the period from and including the date of this Agreement to and including the date falling one month thereafter; |

| (b) | in relation to Facility B, the period from and including the date of this Agreement to and including the date falling one month thereafter; |

| (c) | in relation to HUF Facility C and Euro Facility C, the period from and including the date of this Agreement to and including 30 June 2010; and |

| (d) | in relation to Facility D, the period from and including the Amendment Effective Date to and including 30 June 2010. |

2

“Available Commitment” means, in relation to a Facility, a Lender’s Commitment under that Facility minus:

| (a) | the Base Currency Amount of its participation in any outstanding Loans under that Facility; and |

| (b) | in relation to any proposed Utilisation, the Base Currency Amount of its participation in any Loans that are due to be made under that Facility on or before the proposed Utilisation Date, |

other than, in relation to any proposed Utilisation under a Revolving C Facility or Facility D only, that Lender’s participation in any Loans under that Revolving C Facility or Facility D (as the case may be) that are due to be repaid or prepaid on or before the proposed Utilisation Date.

“Available Facility” means, in relation to a Facility, the aggregate for the time being of each Lender’s Available Commitment in respect of that Facility.

“Base Currency” means Euro.

“Base Currency Amount” means, in relation to a Loan, the amount specified in the Utilisation Request delivered by the Borrower for that Loan (or, if the amount requested is an amount in Forints, that amount converted into the Base Currency at the HUF Agent’s Spot Rate of Exchange on the date of this Agreement adjusted to reflect any repayment, prepayment, consolidation or division of the Loan.

“Borrowed Money” means Indebtedness (including, for the avoidance of doubt, but without double counting, any guarantees of such Indebtedness) in respect of (i) money borrowed or raised and debit balances at banks, (ii) any bond, note, loan stock, debenture or similar debt instrument, (iii) acceptance or documentary credit facilities, (iv) receivables sold or discounted (otherwise than on a non-recourse basis), (v) payments for assets or services acquired which provide for such payments to be deferred for a period of 180 days or more after the relevant assets or services were supplied and accepted, (vi) hire purchase contracts, (vii) principal elements of rental payments under Finance Leases, (viii) guarantees, bonds, standby letters of credit or other instruments issued in connection with the performance of contracts to the extent that the same are treated as borrowings in accordance with the generally accepted principles and practices used in the preparation of the most recent audited financial statements of the Group delivered to the Facility Agent under this Agreement (ix) derivative transactions entered into in connection with protection against or benefit from fluctuation in any rate or price (and, when calculating the value of any derivative transaction, only the marked to market value shall be taken into account) and any other transaction (including without limitation forward sale or purchase agreements and issues of redeemable shares) having the commercial effect of a borrowing or raising of money entered into for the purpose of financing a person’s operational or capital requirements provided that in making any calculation of Borrowed Money under this Agreement no Indebtedness shall be taken into account more than once.

“Borrower” has the meaning given thereto in Part A of Schedule 1 (The Original Parties).

“Borrower Group” means the Borrower and its Subsidiaries from time to time.

“Borrower Pledge of Receivables Amendment Agreement” means the amendment agreement entered or to be entered into by the Borrower in favour of the Security Trustee in relation to the Pledge of Receivables entered into by the Borrower.

“Break Costs” means the amount (if any) by which:

| (a) | the interest which a Lender should have received for the period from the date of receipt of all or any part of its participation in a Loan or Unpaid Sum to the last day of the current Interest Period in respect of that Loan or Unpaid Sum, had the principal amount or Unpaid Sum received been paid on the last day of that Interest Period; |

3

exceeds:

| (b) | the amount which that Lender would be able to obtain by placing an amount equal to the principal amount or Unpaid Sum received by it on deposit with a leading bank in the Relevant Interbank Market for a period starting on the Business Day following receipt or recovery and ending on the last day of the current Interest Period. |

“BUBOR” means in relation to any Loan in HUF:

| (a) | the arithmetic mean (rounded upwards to four decimal places) of the Budapest interbank offered rates (as offered by relevant banks fixing BUBOR) for the relevant period as displayed and published by the National Bank of Hungary on the appropriate page of the Telerate Screen provided a minimum of two leading banks announces such offered rates (the “BUBOR page Screen Rate”); or |

| (b) | if on such date the offered rates for the relevant period of fewer than two leading banks are so displayed, the arithmetic mean (rounded upwards to four decimal places) of such rates quoted to the HUF Agent by the Reference Banks at the request of the HUF Agent, |

as of the Specified Time on the Quotation Date for the offering of deposits in HUF and for a period comparable to the Interest Period for that Loan.

“Business Day” means a day (other than a Saturday or Sunday) on which banks are open for general business in London, Budapest and Paris and:

| (a) | (in relation to any date for payment or purchase of a currency other than euro) the principal financial centre of the country of that currency; or |

| (b) | (in relation to any date for payment or purchase of euro) any TARGET Day. |

“Cash Equivalent Investments” means at any time:

| (a) | certificates of deposit maturing within one year after the relevant date of calculation and issued by an Acceptable Bank; |

| (b) | any investment in marketable debt obligations issued or guaranteed by the government of the United States of America, the United Kingdom, any member state of the European Economic Area or any Participating Member State or by an instrumentality or agency of any of them having an equivalent credit rating, maturing within one year after the relevant date of calculation and not convertible or exchangeable to any other security; |

| (c) | debt securities maturing within one year after the relevant date of calculation which are not convertible or exchangeable into any other security, are rated either A-1 or higher by Standard & Poor’s Rating Services or Fitch Ratings Ltd or P-1 or higher by ▇▇▇▇▇’▇ Investor Services Limited (or, if no rating is available in respect of the debt securities, the issue of which has, in respect of its long-term debt obligations, an equivalent rating); |

| (d) | open market commercial paper not convertible or exchangeable to any other security: |

| (i) | for which a recognised trading market exists; |

| (ii) | issued by an issuer incorporated in the United States of America, the United Kingdom, any member state of the European Economic Area or any Participating Member State; |

| (iii) | which matures within one year after the relevant date of calculation; and |

| (iv) | which has a credit rating of either A-1 or higher by Standard & Poor’s Rating Services or Fitch Ratings Ltd or P-1 or higher by ▇▇▇▇▇’▇ Investor Services Limited, or, if no rating is available in respect of the commercial paper, the issuer of which has, in respect of its long-term unsecured and non-credit enhanced debt obligations, an equivalent rating; |

4

| (e) | bills of exchange issued in the United States of America, the United Kingdom, any member state of the European Economic Area or any Participating Member State eligible for rediscount at the relevant central bank and accepted by an Acceptable Bank (or any dematerialised equivalent); |

| (f) | any investment accessible within 90 days in money market funds which have a credit rating of either A-1 or higher by Standard & Poor’s Rating Services or Fitch Rating Ltd or P-1 or higher by ▇▇▇▇▇’▇ Investor Services Limited and which invest substantially all their assets in securities of the types described in sub-paragraphs (a) to (e) above; or |

| (g) | any other debt security approved by the Majority Lenders, |

in each case, to which any member of the Group is beneficially entitled at that time and which is not issued or guaranteed by any member of the Group or subject to any Encumbrance (other than one arising under the Security Documents) and is denominated and payable in freely transferable and freely convertible currencies and the proceeds of which are capable of being remitted to a member of the Group.

“Collateral Instruments” means negotiable and non-negotiable instruments, guarantees and any other documents or instruments which contain or evidence an obligation (with or without security) to pay, discharge or be responsible directly or indirectly for, any liabilities of any person and includes any document or instrument creating or evidencing an Encumbrance (including, without limitation, the Security Documents).

“Commitment” means a Facility A Commitment, a Facility B Commitment, a HUF Facility C Commitment, a Euro Facility C Commitment or a Facility D Commitment.

“Commitment Letter” means the commitment letter dated 9 January 2007 from BNP Paribas to HTCC.

“Completion Date” means the date of completion of the Acquisition in accordance with clause 5 of the Acquisition Agreement.

“Compliance Certificate” means either (i) a certificate substantially in the form set out in part A of Schedule 8 (Compliance Certificates) in relation to the compliance (or otherwise) with the undertakings in clause 22 (Financial Covenants) issued by an Authorised Officer in relation to the Quarterly Management Accounts or (ii) a certificate substantially in the form set out in part B of Schedule 8 (Compliance Certificates) in relation to the compliance (or otherwise) with the undertakings in clause 22 (Financial Covenants) issued by the auditors of the Group in relation to annual financial statements.

“Confidentiality Undertaking” means a confidentiality undertaking substantially in a recommended form of the LMA as set out in Schedule 10 (LMA form of Confidentiality Undertaking) or in any other form agreed between the Borrower and the Facility Agent.

“Consolidated Capital Expenditure” means the consolidated HTCC Group capital expenditure on the acquisition or improvement of an asset which would be treated as a capital asset as determined in accordance with US GAAP, as reported in the relevant cash-flow statement of the HTCC Group.

“Consolidated EBITDA” means, in respect of each Quarterly Period or Twelve Month Period, without regard to unrealised exchange losses or gains, the Net Income of the HTCC Group (plus any depreciation, amortisation, other non-cash expenses, tax and interest expense, less any non-cash income and interest income less (to the extent not already deducted in the calculation of Net Income) any payments pursuant to paragraphs (d) or (f) of the definition of Permitted Payments) but (i) excluding any extraordinary income (other than any such income directly related to the performance by a member of the HTCC Group of its specific obligations under any concession contract or any Telecommunications Laws which may otherwise be included as extraordinary income under US GAAP), net of any tax paid or payable in respect of such income, of the HTCC Group during the relevant period and (ii) to the extent the same would

5

otherwise be deducted in calculating Net Income, adding back closing fees in connection with the HY Offering and/or the FRN Offering and/or the FRN Bridge Facility and obtaining the financing under the Facilities and adding back transaction expenses in relation to the Acquisition all as determined in accordance with US GAAP used in the preparation of and as shown in the financial statements or Quarterly Management Accounts in respect of such Quarterly Period or Twelve Month Period, prepared and delivered to the Facility Agent pursuant to clause 20.1.5 or clause 20.1.6 (as the case may be).

“Co-ordinator” means BNP Paribas of ▇▇ ▇▇▇▇▇ ▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇-▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇.

“Current Assets” means, at any relevant time, the aggregate of the current assets (excluding cash and Cash Equivalent Investments) of the Group at such time which would fall to be included as current assets in a consolidated balance sheet of the Group drawn up at such time in accordance with the appropriate accounting principles.

“Current Liabilities” means, at any relevant time, the aggregate of the current liabilities (excluding short term debt (which shall include, for the avoidance of doubt, any long term debt repayable within 12 months) and overdrafts) of the Group at such time which would fall to be included as current liabilities in a consolidated balance sheet of the Group drawn up at such time in accordance with the appropriate accounting principles.

“D&O Insurance Policy” means directors’ and officers’ policies of insurance entered into in relation to the directors and officers of the Borrower.

“Default” means an Event of Default or any event or circumstance specified in clause 23 (Events of Default) which would (with the expiry of a grace period, the giving of notice, the making of any determination under the Finance Documents or any combination of any of the foregoing) be an Event of Default.

“Disclosure Letter” has the meaning given to that term in the Acquisition Agreement.

“Due Diligence Reports” means the Vendor Due Diligence Reports and the Purchaser Due Diligence Reports.

“Dutch Share Securities” means the first ranking pledge and the third ranking pledge over the shares of the Parent entered into by the Ultimate Parent in favour of the Security Trustee (for and on behalf of the Senior Creditors) in the agreed form.

“EBITDA” has the same meaning as Consolidated EBITDA save that the calculations shall apply in respect of a person and a period and not the consolidated Group.

“Effective Date” has the meaning given thereto in the Supplemental Agreement.

“Encumbrance” means any mortgage, charge (whether fixed or floating), pledge, lien, hypothecation, assignment by way of security, trust arrangement or security interest of any kind securing any obligation of any person (including without limitation title transfer and/or retention arrangements having similar effect).

“Enforcement Date” means the date on which the Facility Agent declares in writing that the Security Documents (or any of them) have become enforceable pursuant to clause 23.2.3 (Acceleration).

“Environmental Claim” means any claim, notice of violation, prosecution, demand, action, official warning, abatement or other order (conditional or otherwise), relating to Environmental Matters and any notification or order requiring compliance with the terms of any Environmental Licence or Environmental Law in each case by any competent authority, court or regulatory body.

“Environmental Laws” means all or any laws, statutes, regulations, treaties, and judgments of any governmental authority or agency or any regulatory body in any jurisdiction in which any

6

member of the Group is formed or carries on business relating to Environmental Matters applicable to such member of the Group.

“Environmental Licence” includes any permit, licence, authorisation, consent or other approval required at any time by any Environmental Law.

“Environmental Matters” means: (i) any generation, deposit, disposal, keeping, treatment, transportation, transmission, handling or manufacture of any waste or any Relevant Substance, (ii) nuisance, noise, defective premises, health and safety at work or elsewhere and (iii) the pollution, conservation or protection of the environment (both natural and built) or of man or any living organism supported by the environment (both natural and built).

“EUR”, “euro”, “euros”, “€” and “Euro” mean the single currency of Participating Member States introduced in accordance with the provisions of Article 109(j)4 of the Treaty and in respect of all payments to be made under this Agreement in euros means immediately available, freely transferable.

“EURIBOR” means, in relation to any Loan in euro:

| (a) | the applicable Screen Rate; or |

| (b) | (if no Screen Rate is available for the Interest Period of that Loan) the arithmetic mean of the rates (rounded upwards to four decimal places) as supplied to the Facility Agent at its request quoted by the Reference Banks to leading banks in the European interbank market, |

as of the Specified Time on the Quotation Day for the offering of deposits in euro for a period comparable to the Interest Period of the relevant Loan.

“Euro Facility C” means the euro revolving loan facility made available under the Agreement as described in clause 2 (The Facilities).

“Euro Facility C Commitment” means:

| (a) | in relation to an Original Lender, the amount in Euro set opposite its name under the heading “Facility C Euro Commitment” in part B of Schedule 1 (The Original Parties) and the amount of any other Facility C Euro Commitment transferred to it under this Agreement; and |

| (b) | in relation to any other Lender, the amount in Euro of any Euro Facility C Commitment transferred to it under this Agreement, |

to the extent not cancelled, reduced or transferred by it under this Agreement.

“Euro Facility C Loans” means a loan made or to be made under Euro Facility C or the principal amount outstanding for the time being of that loan.

“Euroweb Hungary” has the meaning given thereto in Part A of Schedule 1 (The Original Parties).

“Euroweb Romania” has the meaning given thereto in Part A of Schedule 1 (The Original Parties).

“Euroweb Romania General Security Agreement” means the general security agreement dated 28 September 2006 entered into by Euroweb Romania in favour of the Security Trustee (on behalf of the Senior Creditors).

“Euroweb Romania General Security Amendment Agreement” means the amendment agreement entered or to be entered into by Euroweb Romania in relation to the Euroweb Romania General Security Agreement.

7

“Euroweb Romania Share Pledge” means the first ranking share pledge dated 28 September 2006 entered into in favour of the Security Trustee on behalf of the Senior Creditors over the shares in Euroweb Romania.

“Euroweb Romania Share Pledge Amendment Agreement” means the amendment agreement entered or to be entered into by the Borrower in relation to the Euroweb Romania Share Pledge.

“Event of Default” means any event or circumstance specified as such in clause 23 (Events of Default).

“Excess Cash Flow” means the Twelve Month Consolidated EBITDA for the Twelve Month Period ending on the last day of the relevant financial year, as shown in the relevant Compliance Certificate less (i) any interest and other charges in respect of any Borrowed Money of the Group, (ii) cash repayments and/or prepayments of any Borrowed Money of the Group, (iii) capital expenditure of any member of the Group and/or any cash amounts disbursed by the Group for Permitted Investments (save to the extent funded by new cash Borrowed Money raised by the Group and/or cash subscription by way of equity) and (iv) the amount of tax payable by the Group (in each case) as has accrued during such Twelve Month Period, (v) any cash held by the Ultimate Parent, Holdco I, Holdco II or HTCC immediately prior to Completion and to the extent included (vi) closing fees in connection with the HY Offering and/or the FRN Offering and obtaining the financing under the Facilities and/or the FRN Bridge Facility and transaction expenses in connection with the Acquisition but after either (i) adding any amount by which Net Working Capital at the commencement of such financial year exceeds Net Working Capital at the close of such financial year or, as appropriate, (ii) deducting any amount by which Net Working Capital at the end of such financial year exceeds Net Working Capital at the commencement of such financial year, provided that, when calculating Excess Cash Flow for the financial year ending on 31 December 2007, any reference in this definition to “Net Working Capital at the commencement of such financial year” shall be construed as a reference to “Net Working Capital at end of the Month in which the Completion Date occurs”.

“Existing Facilities” means the loan facilities for Euro 340,000,000 dated 24 August 2001 (as reduced to €270,000,000 by a supplemental agreement dated 13 May 2003) between, among others, the Borrower, the Guarantors and the Facility Agent.

“Existing Outstandings” means the aggregate principal amount outstanding in respect of the Existing Facilities together with all unpaid interest thereon and any other amounts payable in relation thereto.

“Facilities C” means the HUF Facility C and the Euro Facility C.

“Facility” means Facility A, Facility B, HUF Facility C, Euro Facility C or Facility D and “Facilities” shall mean Facility A, Facility B, Facilities C and Facility D together.

“Facility A” means the euro term loan facility made available under this Agreement as described in clause 2 (The Facilities).

“Facility A Commitment” means:

| (a) | in relation to an Original Lender, the amount in the Base Currency set opposite its name under the heading “Facility A Commitment” in part B of Schedule 1 (The Original Parties) and the amount of any other Facility A Commitment transferred to it under this Agreement; and |

| (b) | in relation to any other Lender, the amount in the Base Currency of any Facility A Commitment transferred to it under this Agreement, |

to the extent not cancelled, reduced or transferred by it under this Agreement.

8

“Facility A Loan” means a loan made or to be made under Facility A or the principal amount outstanding for the time being of that loan.

“Facility Agent” means BNP Paribas of ▇▇ ▇▇▇▇▇ ▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇-▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇ or such other person as may be appointed as Facility Agent pursuant to clause 26.11 (Resignation of the Agents).

“Facility Agent’s Spot Rate of Exchange” means the Facility Agent’s spot rate of exchange available for the purpose of obtaining Forints in the Budapest foreign exchange market with Euro (or vice versa) at or about 11:00 a.m. on a particular day.

“Facility B” means the HUF term loan facility made available under this Agreement as described in clause 2 (The Facilities).

“Facility B Commitment” means:

| (a) | in relation to an Original Lender, the amount in Forints set opposite its name under the heading “Facility B Commitment” in Part B of Schedule 1 (The Original Parties) and the amount of any other Facility B Commitment transferred to it under this Agreement; and |

| (b) | in relation to any other Lender, the amount in Forints of any Facility B Commitment transferred to it under this Agreement. |

“Facility B Loan” means a loan made or to be made under Facility B or the principal amount outstanding for the time being of that loan.

“Facility C Loans” means Euro Facility C Loans and HUF Facility C Loans.

“Facility D” means the euro liquidity line made available under the Agreement as described in clause 2 (The Facilities).

“Facility D Commitment” means:

| (a) | in relation to an Original Lender, the amount in Euro set opposite its name under the heading “Facility D Commitment” in part B of Schedule 1 (The Original Parties) and the amount of any other Facility D Euro Commitment transferred to it under this Agreement; and |

| (b) | in relation to any other Lender, the amount in Euro of any Facility D Commitment transferred to it under this Agreement, |

to the extent not cancelled, reduced or transferred by it under this Agreement.

“Facility D Loans” means a loan made or to be made under Facility D or the principal amount outstanding for the time being of that loan.

“Facility Office” means the office or offices notified by a Lender to the Facility Agent in writing on or before the date it becomes a Lender (or, following that date, by not less than five Business Days’ written notice) as the office or offices through which it will perform its obligations under this Agreement.

“Fee Letter” means any letter or letters dated on or about the date of this Agreement or the Supplemental Agreement between the Co-ordinator and the Borrower (or the Facility Agent and the Borrower or the HUF Agent and the Borrower or the Security Trustee and the Borrower) setting out any of the fees referred to in clause 11 (Fees) of this Agreement or clause 5 of the Supplemental Agreement.

“Finance Document” means this Agreement, the Supplemental Agreement, any Fee Letter, any Guarantor Accession Undertaking, any Security Documents, any Resignation Letter, any Transfer Certificate, the Mandate Letter dated 15 April 2004 between the Co-ordinator, the

9

Parent and the Borrower, the Commitment Letter and any deeds of accession entered into in connection with the Intercreditor Deed and any other document designated as such by the Facility Agent and the Borrower.

“Finance Lease” means a lease treated as a finance lease pursuant to US GAAP.

“Finance Party” means the Arranger, the Security Trustee, an Agent or a Lender.

“Floating Charges” means the Original Floating Charges, the Second Floating Charges, the HTCC Opco Floating Charges and any other floating charges created in favour of the Security Trustee pursuant to clause 25.2 (Additional Guarantors).

“Forints” and “HUF” mean the lawful currency for the time being of Hungary and in respect of all payments to be made under the Finance Documents in Forints mean immediately available, freely transferable cleared funds.

“FRNs” means the senior floating rate notes of the Parent issued in the FRN Offering.

“FRN Bridge Documents” means the FRN Bridge Facility Agreement and the FRN Bridge Security Documents.

“FRN Bridge Facility” means the bridge facility made available to Holdco II by the FRN Bridge Lenders pursuant to the FRN Bridge Facility Agreement and novated to the Parent pursuant to the HTCC Opcos Transfer Agreement.

“FRN Bridge Facility Agreement” means the bridge facility agreement dated on or about the date of the Supplemental Agreement and entered into between Holdco II as borrower and the FRN Bridge Lenders as novated from Holdco II to the Parent pursuant to the HTCC Opcos Transfer Agreement.

“FRN Bridge Lenders” means BNP Paribas, Calyon SA and ▇▇▇▇▇▇▇ ▇▇▇▇▇ International Bank Limited in their capacity as lenders under the FRN Bridge Facility Agreement.

“FRN Bridge Security Documents” means the FRN Security Documents and the following documents, each in favour of the Security Trustee on behalf of the FRN Trustee on behalf of the FRN Bridge Lenders: (i) the second ranking assignment of receivables entered or to be entered into by the Borrower and each HTCC Operating Company; (ii) the second ranking general security agreement entered or to be entered into by Euroweb Romania; (iii) the second ranking account charges entered or to be entered into by each Original Obligor, Euroweb Hungary and each HTCC Operating Company; (iv) the third ranking floating charges entered or to be entered into by each Original Obligor incorporated in Hungary; (v) the second ranking floating charges entered or to be entered into by each HTCC Operating Company; (vi) the third ranking account pledge governed by Dutch law entered or to be entered into by the Parent and (vi) the third ranking pledge of receivables entered or to be entered into by the Ultimate Parent.

“FRN Completion Date” means the later of the date of completion of the FRN Offering and the application of the proceeds therefrom as contemplated by the FRN Offering Documents.

“FRN Funding Loans” means the €55,040,540 and €59,501,657 loans owed by Hungarotel and Pantel Hungary respectively to the Parent representing part of the proceeds of the FRN Bridge Facility and which bear interest at the same rate as the FRN Bridge Facility (or, after the FRN Completion Date, the FRN Offering) together with an additional margin of not more than 0.22 per cent. per annum.

“FRN Funding Loan Agreement” has the meaning given to it in the Intercreditor Deed.

“FRN Offering” means the senior notes issued by the Parent provided that:

| (a) | the scheduled date for maturity is no earlier than the Termination Date in respect of Facility A; |

10

| (b) | the face amount of the notes issued on the FRN Completion Date is no more than €210,000,000; |

| (c) | the scheduled interest payments due in respect of such notes are no more than the original scheduled interest, EURIBOR plus a margin not exceeding 6 per cent. per annum; |

| (d) | the proceeds are used to prepay the FRN Bridge Facility in full; |

| (e) | the guarantees of such notes by the Borrower, V-holding and the HTCC Operating Companies shall constitute senior subordinated obligations of such entities (subject to the terms of the Intercreditor Deed) junior in right of payment to the obligations of such entities under the Facilities and senior in right of payment to such entities’ subordinated obligations; |

| (f) | the security provided in respect of such notes comprises of the FRN Security Documents only; and |

| (g) | such notes shall constitute unsubordinated obligations of the Parent ranking (subject to the terms of the Intercreditor Deed and the Security Documents entered into by the Parent) pari passu with the Parent’s Guarantee of the Facilities. |

“FRN Offering Documents” means documents comprising of the indenture, the offering memorandum and the FRN Security Documents issued or (as the case may be) entered into in relation to the FRN Offering.

“FRN Trustee” means, as applicable, the FRN Bridge Trustee and the FRN Note Trustee, each as defined in the Intercreditor Deed, or any successor trustee acting for the benefit of and on behalf of the holders of the FRN Bridge Lenders or (as the case may be) FRN Notes provided that such successor trustee simultaneously therewith becomes a party to the Intercreditor Deed.

“FRN Security Documents” means (i) the fourth ranking agreed form security document entered or to be entered into in favour of the Security Trustee for and on behalf of the FRN Trustee over the shares of the Parent; (ii) the third and fourth ranking agreed form security documents entered or to be entered into in favour of the Security Trustee for and on behalf of the FRN Trustee over the HY Funding Loan and the FRN Funding Loans; (iii) the Original Obligor Share Securities in respect of shares in the Borrower, V-holding and Euroweb Hungary (as of the effectiveness of the amendments to be made thereto pursuant to the Original Obligor Share Securities Amendment Agreements); (iv) the second ranking agreed form share pledge entered or to be entered into in favour of the Security Trustee on behalf of the FRN Trustee and the HY Trustee over the shares in Euroweb Romania; (v) the HTCC Opco Share Securities; (vi) the Original Obligor Share Securities Amendment Agreements; (vii) any pledge or (as the case may be) charge over the shares of any other Obligor provided that (a) such shares are simultaneously (by way of a first ranking pledge) charged or (as the case may be) pledged to the Senior Creditors and (b) such security is at all times second ranking by and subject to the terms of the Intercreditor Deed; and (viii) the Intercreditor Deed.

“General Security Agreements” means the Euroweb Romania General Security Agreement, the Euroweb Romania Second Ranking General Security Agreement and any other general security agreement created in favour of the Security Trustee pursuant to clause 25.2 (Additional Guarantors).

“Group” means the Parent and its Subsidiaries from time to time.

“Guarantee” means the guarantee of the Guarantors contained in clause 17 (Guarantee) and includes each separate or independent stipulation or agreement by the Guarantors contained therein.

“Guaranteed Liabilities” means all moneys, obligations and liabilities expressed to be guaranteed by all Guarantors in clauses 17.1.1, 17.1.2 and 17.2.

11

“Guarantor” means an Original Guarantor or an Additional Guarantor, unless it has ceased to be a Guarantor in accordance with clause 25 (Changes to the Obligors) and reference to a “Guarantor” means any one of them, as the context may require.

“Guarantor Accession Undertaking” means a guarantor accession undertaking in the form of Schedule 6 (Guarantor Accession Undertaking).

“Hedge Counterparties” has the meaning given thereto in the Intercreditor Deed.

“Hedge Transaction” means any interest rate or currency swap or other hedging arrangement entered into by the Borrower in respect of its own borrowings under this Agreement pursuant to clause 20.1.22(a) and (b).

“Holdco I” means HTCC Holdco I B.V., a company incorporated in the Netherlands with its registered office at ▇▇▇▇▇▇▇▇▇▇▇▇▇ ▇, ▇▇▇▇ ▇▇, ▇▇▇▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇.

“Holdco II” means HTCC Holdco II B.V., a company incorporated in the Netherlands with its registered office at ▇▇▇▇▇▇▇▇▇▇▇▇▇ ▇, ▇▇▇▇ ▇▇, ▇▇▇▇▇▇▇▇▇, ▇▇▇ ▇▇▇▇▇▇▇▇▇▇▇.

“Holding Company” means, in relation to any company or partnership, any person of which the first mentioned company or partnership is a Subsidiary.

“HTCC Operating Companies” means Pantel Technocom, Pantel Hungary and Hungarotel.

“HTCC” means Hungarian Telephone and Cable Corp, a company incorporated in Delaware, with its registered office at 1207 Third Avenue Suite 3400, Seattle, ▇▇▇▇▇▇▇▇▇▇ ▇▇ ▇▇▇▇▇-▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇▇▇▇ of America.

“HTCC Group” means HTCC and its Subsidiaries.

“HTCC Opco Account Charges” means each charge and/or pledge of bank accounts of each HTCC Operating Company entered or to be entered into by the relevant Original Obligor in favour of the Security Trustee (for and on behalf of the Senior Creditors) in the agreed form.

“HTCC Opco Floating Charges” means each floating charge entered into by or to be entered into by each HTCC Operating Company in favour of the Security Trustee (for and on behalf of the Senior Creditors) in the agreed form.

“HTCC Opco Share Securities” means each pledge over the shares of each HTCC Operating Company entered into or to be entered into by the Parent in favour of the Security Trustee in the agreed form.

“HTCC Opcos Transfer Agreement” means the transfer agreement dated on or about the date of the Supplemental Agreement entered into between the Parent and Holdco II pursuant to which, inter alia, Holdco II shall transfer the HTCC Operating Companies to the Parent.

“HUF Agent” means BNP Paribas ▇▇▇▇▇▇▇▇ ▇▇▇▇ ▇▇. ▇▇ ▇-▇▇▇▇ ▇▇▇▇▇▇▇▇, Honvéd ▇.▇▇, ▇▇▇▇▇▇▇ or such other person as may be appointed as HUF Agent pursuant to clause 26.11 (Resignation of the Agents).

“HUF Facility C” means the HUF revolving loan facility made available under this Agreement as described in clause 2 (The Facilities).

“HUF Facility C Loans” means a loan made or to be made under HUF Facility C or the principal amount for the time being of that loan.

“HUF Facility C Commitment” means:

| (a) | in relation to an Original Lender, the amount in HUF set opposite its name under the heading “Facility C HUF Commitment” in Part B of Schedule 1 (The original parties) and |

12

| the amount of any other Facility C HUF Commitment transferred to it under this Agreement; and |

| (b) | in relation to any other Lender, the amount in HUF of any HUF Facility C Commitment transferred to it under this Agreement, |

to the extent not cancelled, reduced or transferred by it under this Agreement.

“Hungarian Account Charges Amendment Agreements” means the amendment agreements entered into by each Original Obligor and the Security Trustee in relation to the Original Obligor Account Charges governed by Hungarian law and the Account Charge entered into by Euroweb Hungary.

“Hungarian Accounting Act” means Act C of 2000 on accounting.

“Hungarian Operating Companies” means, Invitel Rt., V Holding Rt., Euroweb Hungary, the HTCC Operating Companies and any other entity incorporated in Hungary acquired as an operating company pursuant to Permitted Investments (e) and (f).

“Hungarotel” means Hungarotel Távkozlési Részvény-társasag, a company incorporated in Hungary with registration number Cg. ▇▇-▇▇-▇▇▇▇▇▇.

“HY Completion Date” means the later of the date of completion of the HY Offering and the application of the proceeds therefrom as contemplated by the HY Offering Documents.

“HY/FRN Debt” means Borrowed Money incurred in relation to the HY Offering, FRN Bridge Facility or the FRN Offering.

“HY Funding Loan” means the €140,128,440 loans (representing the principal amount at maturity of €142,000,000, issued at a discount of 98.682 per cent.) made by the Parent to the Borrower representing the proceeds of the HY Offering provided that such funding loan bears interest at the same rate as the HY Notes together with an additional margin of not more than 0.22 per cent. per annum.

“HY Funding Loan Agreement” has the meaning given to it in the Intercreditor Deed.

“HY Notes” means the senior notes due 2012 of the Parent issued in the HY Offering.

“HY Offering” means the senior notes issued by the Parent provided that:

| (h) | the scheduled date for maturity is no earlier than 30 June 2012; |

| (i) | the face amount of the notes issued on the HY Completion Date is no more than €142,000,000; |

| (j) | the scheduled interest payments due in respect of such notes are no more than the original scheduled interest, 10.75 per cent. per annum; |

| (k) | the proceeds shall be forthwith on-lent to the Borrower under the HY Funding Loan Agreement; |

| (l) | the guarantees of such notes by the Borrower and V-holding shall constitute senior subordinated obligations of the Borrower and V-holding ranking (subject to the terms of the Intercreditor Deed) junior in right of payment to the obligations of the Borrower and V-holding under the Facilities and senior in right of payment to the Borrower’s and V-holding’s subordinated obligations; |

| (m) | the security provided in respect of such notes comprises of the HY Security Documents only; and |

13

| (n) | such notes shall constitute unsubordinated obligations of the Parent ranking (subject to the terms of the Intercreditor Deed and the Security Documents entered into by the Parent) pari passu with the Parent’s Guarantee of the Facilities. |

“HY Offering Documents” means documents comprising of the indenture, the offering memorandum, the HY Funding Loan Agreement and the HY Security Documents issued or (as the case may be) entered into in relation to the HY Offering.

“HY Trustee” means The Bank of New York of ▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇ ▇▇▇ or any successor trustee acting for the benefit of and on behalf of the holders of the HY Notes provided that such successor trustee simultaneously therewith becomes a party to the Intercreditor Deed.

“HY Security Documents” means (i) the second ranking agreed form security document entered into in favour of the Security Trustee for and on behalf of the HY Trustee over the shares of the Parent; (ii) the second ranking agreed form security documents entered into in favour of the Security Trustee for and on behalf of the HY Trustee over the HY Funding Loan and the FRN Funding Loans; (iii) the fourth ranking agreed form security documents entered into in favour of the Security Trustee for and on behalf of the HY Trustee over the HY Funding Loan and the FRN Funding Loans; (iv) the Original Obligor Share Securities in respect of shares in the Borrower, V-holding and Euroweb Hungary; (v) the third ranking share pledge entered or to be entered into in favour of the Security Trustee in favour of the HY Trustee and the FRN Trustee over the shares in Euroweb Romania; (vi) the HTCC Opcos Share Securities; (vii) the Original Obligor Share Securities Amendment Agreements; (viii) any pledge or (as the case may be) charge over the shares of any other Obligor provided that (a) such shares are simultaneously (by way of a first ranking pledge) charged or (as the case may be) pledged to the Senior Creditors and (b) such security is at all times second ranking by and subject to the terms of the Intercreditor Deed; and (viii) the Intercreditor Deed.

“IFRS” means International Financial Reporting Standards issued and/or adopted by the International Accounting Standards Board.

“Immaterial Subsidiaries” means any member of the HTCC Group (i) whose assets or revenues or EBITDA are less than two per cent. of the HTCC Group’s consolidated assets or consolidated revenues or Consolidated EBITDA, determined by reference to the most recent Quarterly Management Accounts in respect of a Quarter Period ending on a Quarter Day delivered to the Facility Agent under this Agreement, provided that if such Immaterial Subsidiaries taken together on such Quarter Day exceed five per cent. of the HTCC Group’s consolidated assets or consolidated revenues or Consolidated EBITDA then the Immaterial Subsidiary whose total revenues on such Quarter Day are the highest shall be deemed to be a Material Subsidiary for the purpose of this Agreement and (ii) who has not provided a subordinated guarantee under the HY Offering Documents, in respect of the FRN Bridge Facility or under the FRN Offering Documents. In determining Immaterial Subsidiaries and Material Subsidiaries for the purpose of this definition, following any acquisition by a member of the HTCC Group, the consolidated assets, the consolidated revenues and Consolidated EBITDA of the HTCC Group shall be adjusted to take account of the revenues, the assets and the EBITDA attributable to the acquisition in respect of the Quarterly Period ending on such Quarter Day.

“Incapacity” means in relation to a person the insolvency, liquidation, dissolution, winding up, administration, receivership, amalgamation, reconstruction or other incapacity of that person whatsoever (and, in the case of a partnership, includes the termination or change in the composition of the partnership).

“Indebtedness” means any obligation for the payment or repayment of money, whether as principal or as surety and whether present or future, actual or contingent.

“Information Package” means collectively, the Agreed Base Case Model, the Due Diligence Reports and the bank presentation dated February 2007.

“Intellectual Property Rights” means any patent, trade ▇▇▇▇, service ▇▇▇▇, registered design, trade name or copyright required to carry on the business of any member of the Group.

14

“Intercreditor Deed” means the intercreditor deed dated 6 August 2004, entered into by, inter alios, the Security Trustee, the Ultimate Parent, the Obligors, the Hedge Counterparties (as such term is defined in the Intercreditor Deed) and the HY Trustee as amended and restated (or to be amended and restated) pursuant to the Intercreditor Deed Supplemental Deed.

“Intercreditor Deed Supplemental Deed” means the supplemental deed dated on or about the date of the Supplemental Agreement amending and restating the Intercreditor Deed between, inter alios, the Security Trustee, the Ultimate Parent, the Obligors, the Hedge Counterparties, the HY Trustee, the FRN Bridge Trustee (as such term is defined in the Intercreditor Deed Supplemental Deed) and the FRN Note Trustee (as such term is defined in the Intercreditor Deed Supplemental Deed).

“Interest Period” means, in relation to a Loan, each period determined in accordance with clause 9 (Interest Periods) and, in relation to an Unpaid Sum, each period determined in accordance with clause 8.4 (Default interest).

“Intergroup Loan Agreements” means any loan agreements entered into between members of the Group (including, without limitation, the HY Funding Loan Agreement and the FRN Funding Loan Agreement).

“IPO Subsidiary” means any newly incorporated Subsidiary of the Parent, the voting and economic interest of which is held 100 per cent. by the Parent and which is incorporated in Hungary and created solely for the purpose of acting (directly or indirectly) as a 100 per cent. Holding Company of the Borrower Group in connection with an initial public offering of shares.

“Joint Ventures” means any joint venture between any member of the Group and any other person.

“Lender” means:

| (a) | any Original Lender; and |

| (b) | any bank, financial institution, trust, fund or other entity which has become a Party in accordance with clause 24 (Changes to the Lenders), |

which in each case has not ceased to be a Party in accordance with the terms of this Agreement.

“Licences” means the Universal Service Agreements, any notifications under the Act C of 2003 on electronic communications, any licence issued by the Hungarian Communications Authority and any replacement of any of the same required by the Group, any addition or replacement concession or similar contracts, under any Telecommunications Laws to carry on the Business of the Group.

“LMA” means the Loan Market Association.

“Loan” means a Facility A Loan, a Facility B Loan, a Euro Facility C Loan, a HUF Facility C Loan or a Facility D Loan.

“Majority Lenders” means:

| (a) |

if there are no Loans then outstanding, a Lender or Lenders whose Commitments aggregate more than 662/3% of the Total Commitments (or, if the Total Commitments have been reduced to zero, aggregated more than 662/3% of the Total Commitments immediately prior to the reduction); or |

| (b) |

at any other time, a Lender or Lenders whose participations in the Loans then outstanding aggregate more than 662/3% of all the Loans then outstanding. |

15

For the purpose of the Majority Lender definition, the Facility Agent shall calculate (i) in relation to sub-paragraph (a), the Euro amount of any Commitments which are denominated in Forint by using the Facility Agent’s Spot Rate of Exchange on the date of this Agreement and (ii) in relation to sub-paragraph (b), the Euro amount of the Facility B Loans and HUF Facility C Loans by using the Facility Agent’s Spot Rate of Exchange on the date of this Agreement.

“Mandatory Cost” means the percentage rate per annum calculated by the Facility Agent in accordance with Schedule 4 (Mandatory Cost formulae).

“Margin” means the margin calculated in accordance with clause 8.2 (Margin).

“Material Adverse Effect” means (i) a reasonably likely material adverse effect on the ability of the members of the Group (taken as a whole) to perform all or any of the payment obligations under any of the Finance Documents or to comply with the terms of clause 22 (Financial Covenants); or (ii) a reasonably likely material adverse effect on the ability of the Parent to perform all or any of its payment obligations under any of the HY Offering Documents or the FRN Offering Documents.

“Material Group” means the Parent and its Material Subsidiaries from time to time.

“Material Subsidiary” means all Subsidiaries of the Parent, other than the Immaterial Subsidiaries.

“Month” means a period starting on one day in a calendar month and ending on the numerically corresponding day in the next calendar month, except that:

| (a) | (subject to paragraph (c) below) if the numerically corresponding day is not a Business Day, that period shall end on the next Business Day in that calendar month in which that period is to end if there is one, or if there is not, on the immediately preceding Business Day; |

| (b) | if there is no numerically corresponding day in the calendar month in which that period is to end, that period shall end on the last Business Day in that calendar month; and |

| (c) | if an Interest Period begins on the last Business Day of a calendar month, that Interest Period shall end on the last Business Day in the calendar month in which that Interest Period is to end. |

“Necessary Authorisations” means all approvals, authorisations and licences (other than the Licences) from, all rights granted by and all filings, registrations and agreements with any person including, without limitation, any government or other regulatory authority necessary in order to enable each member of the Group to carry out the Telecoms Business which is carried on at the relevant time.

“Net Income” means, for any period, the net profit (or losses) after Tax of the Group arising out of the HTCC Group’s operation of the Telecoms Business for such period as determined in accordance with US GAAP used in the preparation of and as shown in the financial statements or the Quarterly Management Accounts in respect of such period prepared and delivered to the Facility Agent pursuant to clauses 20.1.5 and 20.1.6 (as the case may be).

“Net Working Capital” means, at any time, the aggregate of the Current Assets of the Group at such time less the aggregate of the Current Liabilities of the Group at such time.

“Obligor” means the Borrower and/or a Guarantor.

“Ongoing Funding Costs” means any negative free cash flow of such person (determined on the same basis and as the accumulated sum of “cash flow from operations” and “cash flow from investing activities” and “net financial expenses” is used in the Agreed Base Case Model and including, for the avoidance of doubt, in the case of the acquisition of a mobile licence, any capital expenditure associated with any roll-out requirements) in aggregate until 2011.

16

“Original Floating Charges” means the floating charges entered into by the Borrower and Euroweb Hungary in favour of the Security Trustee (for and on behalf of the Senior Creditors) in the agreed form.

“Original Guarantors” means those companies whose names and registered addresses are set out in part A of Schedule 1 (The Original Parties).

“Original Lender” means the banks and financial institutions listed in part B of Schedule 1 (The Original Parties) and includes their successors in title.

“Original Obligor” means the Borrower or an Original Guarantor.

“Original Obligors” means the Borrower and the Original Guarantors.

“Original Obligor Account Charges” means each charge and/or pledge of bank accounts of each Original Obligor entered or to be entered into by the relevant Original Obligor in favour of the Security Trustee (for and on behalf of the Senior Creditors) in the agreed form (including the Second Account Pledge).

“Original Obligor Share Securities” means each pledge over the shares of each Original Obligor incorporated in Hungary entered into or to be entered into by the shareholder of each Original Obligor incorporated in Hungary in favour of the Security Trustee in the agreed form.

“Original Obligor Share Securities Amendment Agreements” means the amendment agreements entered into by the shareholder of each Original Obligor incorporated in Hungary and the Security Trustee in relation to the Original Obligor Share Securities.

“Original Shareholder” means Vivendi Telecom International S.A., a société anonyme incorporated under the laws of France with its registered office at ▇▇ ▇▇▇▇▇▇ ▇▇ ▇▇▇▇▇▇▇▇▇, ▇▇▇▇▇ ▇▇▇▇▇, ▇▇▇▇▇▇.

“Pantel Hungary” means Pantel Távközlési Korlátolt Felelosségu Társaság, a company incorporated in Hungary with registration number Cg. ▇▇-▇▇-▇▇▇▇▇▇.

“Pantel Technocom” means Pantel Technocom Távközlési Korlátolt Felelosségu Társaság, a company incorporated in Hungary with registration number Cg. ▇▇-▇▇-▇▇▇▇▇▇.

“Parent” has the meaning given thereto in Part A of Schedule 1 (The Original Parties).

“Participating Member State” means any member state of the European Communities that adopts or has adopted the euro as its lawful currency in accordance with legislation of the European Union relating to European Monetary Union.

“Party” means a party to this Agreement.

“Permitted Borrowings” means:

| (a) | any Borrowed Money arising hereunder or under the Finance Documents; |

| (b) | any Borrowed Money approved by the Facility Agent (acting on the instruction of the Majority Lenders); |

| (c) | any Borrowed Money included within Permitted Intra-Group Transactions, Permitted Loans or Permitted Guarantees; |

| (d) | any Borrowed Money arising under the interest and/or currency rate protection arrangements referred to in clause 20.1.22 or clause 21.1.8; |

| (e) | arising under any cash pooling or cash management arrangement but for so long as any such arrangement which exceeds €1,000,000 does not permit credit balances of Obligors |

17

| to be netted or set off against debt balances of members of the Group which are not Obligors; |

| (f) | arising under any arrangements entered into between members of the Group which arrangements are referred to in the Steps Paper; |

| (g) | arising under any netting or set-off arrangement entered into by any member of the Group in the ordinary course of its banking arrangements for the purpose of netting debit and credit balances of members of the Group; |

| (h) | any Subordinated Shareholder Debt; |

| (i) | any Borrowed Money arising under the HY Offering, the FRN Bridge Facility or the FRN Offering provided that such Borrowed Money is at all times subordinated to the Facilities (other than the Parent’s obligations under the HY Notes, the FRN Bridge Facility and the FRNs which will rank (subject to the terms of the Intercreditor Deed and the Security Documents entered into by the Parent) pari passu with the obligations of the Parent under the Guarantee) by and subject to the terms of the Intercreditor Deed; and |

| (j) | any Borrowed Money of the Group (including Borrowed Money arising under Finance Leases) not within paragraphs (a) to (i) above, not exceeding at any time in aggregate Euro 30,000,000 or its equivalent. |

“Permitted Disposals” means:

| (a) | the application of cash in (i) the acquisition of assets or services in the ordinary course of business, not, in any such case, prohibited by the terms of this Agreement or any Security Document, (ii) the making of investments or capital expenditure permitted by clause 21.1.7 or (iii) the repayment of Permitted Borrowings and the servicing thereof provided that the same is not prohibited or otherwise restricted by the terms of this Agreement and/or the Intercreditor Deed; |

| (b) | any disposals approved by the Facility Agent (acting on the instructions of the Majority Lenders); |

| (c) | the disposal of any unnecessary or obsolete assets; |

| (d) | the disposal of assets on bona fide arm’s length commercial terms in the ordinary course of business provided that the proceeds of the disposal are applied in mandatory prepayment of the Loans under clause 7 (Prepayment and cancellation); |

| (e) | the disposal of the assets of an Immaterial Subsidiary as part of any voluntary solvent proceeding which corresponds with, or has an effect equivalent or similar to, any of those mentioned in clauses 23.1.9 to 23.1.13 inclusive of clause 23.1 (Events of Default), provided that the Parent notifies the Facility Agent of the disposal and the proceeds of the disposal are applied in mandatory prepayment of the Loan under clause 7 (Prepayment and cancellation); |

| (f) | the disposal of any shares in any of Pécsi Hirközlési Rt., Székesfehérvári Hírközlési Kft or CableNet Rt.; |

| (g) | to the extent that such disposal is not, and will not lead to, any breach of law the disposal by V-holding of its shares in the Borrower to the Parent provided that such shares remain at all times charged and/or pledged to the Security Trustee pursuant to the Share Securities; |

| (h) | any disposals included within Permitted Intra-Group Transactions; |

18

| (i) | the disposal of shares of any IPO Subsidiary or the Parent provided that, if it is required, the proceeds of the shares are applied in mandatory prepayment of the Loans under clause 7 (Prepayment and cancellation); |

| (j) | a disposal of trading assets made by any member of the Group in the ordinary course of trading of the disposing entity; |

| (k) | a disposal of any asset from an Obligor to a member of the Group which is not an Obligor provided that the aggregate value of all assets so transferred (net of the value of any assets transferred from a member of the Group which is not an Obligor to an Obligor) does not exceed Euro 1,000,000 (or its equivalent) in any financial year of the Borrower; |

| (l) | a disposal constituted by a licence of Intellectual Property entered into in the ordinary course of business or for the purposes of managing the brand portfolio of the Group, but (in the case of any exclusive licence) only if the relevant Intellectual Property is no longer required for the business or operation of the disposing person; |

| (m) | a disposal which is a lease or licence of real property in the ordinary course of business; |

| (n) | a disposal referred to in the Steps Paper; |

| (o) | a disposal arising as a result of any Permitted Encumbrance; |

| (p) | a disposal of receivables on a non-recourse basis where the net consideration receivable (when aggregated with the net consideration receivable for any other such disposal in the same financial year of the Group) does not exceed €3,000,000 (or its equivalent) in any financial year of the Group; |

| (q) | the sale or other disposal of defaulted accounts receivables in the ordinary course of business where such sale or disposal is not as part of an accounts receivables financing transaction and where such sale or disposal is on non-recourse terms to the Group; |

| (r) | a disposal of fixed assets where the proceeds of disposal are applied, committed to be so applied or designated by the Board of Directors of the Borrower to be so applied within 12 months of that disposal or committed to be used within 12 months of receipt to (i) purchase replacement fixed assets used or useful in the business of the Group or (ii) make a Permitted Investment (provided that, in the case of a commitment or designation, they are then so applied within 18 months of receipt of such proceeds); |

| (s) | any disposal of the real property situated at Szt ▇▇▇▇▇▇ ▇▇▇ ▇, ▇▇▇▇▇▇▇▇▇▇, Land Registry No. Belterület 2 or the duct in Székesfehérvár or Pécs owned by the Borrower; |

| (t) | a disposal of assets (other than shares or businesses), in exchange for other assets reasonably comparable or superior as to type, value or quality; |

| (u) | a disposal of cash or Cash Equivalent Investments for cash or other Cash Equivalent Investments; |

| (v) | disposals undertaken as part of any restructuring programme in the period up to 4 years after the Completion Date subject to an aggregate limit in such period of Euro 5,000,000 (or its equivalent); |

| (w) | a disposal of assets for cash where the net consideration receivable (when aggregated with net consideration receivable for any other sale, lease, licence, transfer or other disposal not allowed under the preceding paragraphs) does not exceed Euro 10,000,000 (or its equivalent) in any financial year of the Borrower. |

“Permitted Encumbrances” means:

| (a) | any Encumbrance arising hereunder or under any of the Security Documents; |

19

| (b) | any Encumbrance which the Facility Agent, acting on the instructions of the Majority Lenders, has at any time in writing agreed shall be a Permitted Encumbrance; |

| (c) | any Encumbrance arising in the ordinary course of business by operation of law; |

| (d) | any Encumbrance arising out of title retention provisions in any suppliers contract in the ordinary course of trading; |

| (e) | any Encumbrance given or to be given pursuant to the requirement of any regulatory authority in the ordinary course of its business; |

| (f) | any Encumbrance arising under Finance Leases to the extent amounts outstanding under such Finance Leases fall under paragraph (g) of the definition of Permitted Borrowings; |

| (g) | any Encumbrance arising under paragraph (e) of the definition of Permitted Intra-Group Transactions; |

| (h) | any Encumbrance over any member of the Borrower Group’s bank accounts granted in favour of a Lender and arising in the standard business terms of such Bank or, in the event that the Lenders are not willing to offer the relevant member of the Borrower Group the banking services required on competitive commercial terms, or at all, any Encumbrance over any member of the Borrower Group’s bank accounts granted in favour of any bank or financial institution from which the relevant member of the Borrower Group obtains such services and arising in the standard business terms of such bank or financial institution; |

| (i) | any netting or set-off arrangement entered into by any member of the Group in the ordinary course of its banking arrangements for the purpose of netting debit and credit balances of members of the Group but only so long as such arrangement is not established with the primary purpose of preferring any Lenders; |

| (j) | any Encumbrance arising under any of the HY Offering Documents, the FRN Bridge Security Documents or the FRN Offering Documents; |

| (k) | any Encumbrance arising by operation of law in respect of Taxes being contested in good faith; and |

| (l) | any Encumbrance created by the Group not within paragraphs (a) to (k) above and securing Indebtedness in aggregate not exceeding Euro 5,000,000 or its equivalent at any time that has not been repaid and/or discharged and where the assets the subject of such Encumbrance have an aggregate book value not exceeding Euro 5,000,000 or its equivalent. |

“Permitted Financial Investments” means on any date investments in:

| (a) | euro or HUF denominated securities which are freely negotiable and marketable: |

| (i) | which are rated at least AA by Standard & Poor’s Corporation or Aa2 by ▇▇▇▇▇’▇ Investor Services, Inc.; or |

| (ii) | are issued by the Republic of Hungary. |

| (b) | certificates of deposits, floating rate notes, acceptances issued in euro and HUF and euro and HUF denominated deposit and current accounts of and time deposits with banks which are HUF Lenders or banks which have a credit rating from Standard & Poor’s Corporation or ▇▇▇▇▇’▇ Investor Services Inc. as A or its equivalent or better or euro denominated cash funds managed by any HUF Lender or banks which have a credit rating from Standard & Poor’s Corporation or ▇▇▇▇▇’▇ Investor Services Inc. as A or its equivalent or better, with a maturity, in each case, of not more than twelve months; |

20

| (c) | euro and HUF denominated commercial paper rated at least A1 by Standard & Poor’s Corporation or at least P1 by ▇▇▇▇▇’▇ Investor Services, Inc., with a maturity of not more than six months; or |

| (d) | securities which are Cash Equivalent Investments. |

“Permitted FRN Payments” means any payment by an Obligor to the FRN Bridge Lenders or to the FRN Trustee for the benefit of the noteholders in each case permitted in accordance with the terms of the Intercreditor Deed.

“Permitted Guarantees” means:

| (a) | any guarantees or indemnities arising hereunder or under the Finance Documents; |

| (b) | any guarantees or indemnities approved by the Facility Agent (acting on the instructions of the Majority Lenders); |

| (c) | any guarantees or indemnities included within Permitted Intra-Group Transactions; |

| (d) | any guarantees or indemnities included within Permitted Borrowings; |

| (e) | any guarantees or indemnities given by a member of the Group (other than the Parent) in respect of any Permitted Borrowing of another member of the Group (other than the Parent) and/or by the Parent in respect of any Permitted Borrowing of a member of the Group; |

| (f) | any subordinated guarantee included within the terms of the HY Offering Documents, the FRN Bridge Security Documents or the FRN Offering Documents given by the Borrower, V-holding, Euroweb Hungary, Euroweb Romania or any HTCC Operating Company and any future guarantee granted in accordance with the HY Offering Documents, the FRN Bridge Security Documents or the FRN Offering Documents to the extent allowed by this Agreement and the Intercreditor Deed in favour of the HY Trustee, the FRN Bridge Lenders or the FRN Trustee in connection with the HY Offering, the FRN Bridge Facility or the FRN Notes provided that such guarantees are at all times subordinated to the Facilities by and subject to the terms of the Intercreditor Deed; |

| (g) | any guarantees or indemnities provided to banks providing loans to employees of any member of the Group (other than the Parent) in respect of such loans provided that the aggregate of the maximum liability thereunder (actual or contingent) together with the aggregate outstanding amount of all loans referred to in paragraph (m) of the definition of Permitted Investments does not exceed Euro 3,000,000; |

| (h) | any indemnities provided to the high yield underwriters of the HY Offering given by any Obligor under the purchase agreement entered into in respect of the HY Offering or the FRN Offering; |

| (i) | a guarantee by an Obligor of obligations of a member of the Group which is a non-Obligor provided that the aggregate amount guaranteed does not exceed €5,000,000 (or its equivalent) in aggregate for the Group at any time; |

| (j) | any guarantee made in substitution for an extension of credit permitted under the definition of “Permitted Loan” (other than loans within the category set out in paragraph (f) of that definition) to the extent that the issuer of the relevant guarantee would have been entitled to make a loan in an equivalent amount under the definition of “Permitted Loan” to the person whose obligations are being guaranteed; |

| (k) | any guarantee given in respect of the netting or set-off arrangements permitted pursuant to paragraph (i) of the definition of Permitted Encumbrance; |

21

| (l) | any guarantee granted to the purchaser in connection with a Permitted Disposal, provided that the aggregate amount of all such guarantees outstanding at any time shall not exceed EUR 10,000,000 (or its equivalent); or |

| (m) | any guarantees or indemnities of the Group not included in paragraphs (a) to (h) (inclusive) above provided that the aggregate maximum liability thereunder (actual or contingent) when aggregated with Borrowed Money falling under paragraph (g) of the definition of Permitted Borrowings does not exceed Euro 30,000,000 or its equivalent. |

“Permitted HY Payment” means any payment by any Obligor to the HY Trustee for the benefit of the noteholders under the HY Offering permitted in accordance with the terms of the Intercreditor Deed.

“Permitted Intra-Group Transactions” means:

| (a) | loans or credit made by (i) the Parent to the Borrower (and, following the accession of the relevant company to this Agreement in accordance with clause 5 (Accession of the HTCC Operating Companies) of the Supplemental Agreement, Pantel Hungary, Pantel Technocom or Hungarotel) including, without limitation, the HY Funding Loan and the FRN Funding Loans, in each case, constituting Subordinated Shareholder Debt (as such term is defined in the Intercreditor Deed), (ii) any member of the Group (other than the Parent) to another member of the Group (other than the Parent or any Joint Ventures), (iii) the Borrower to V-holding for no more than the amount set out in the funds flow delivered pursuant to paragraph 29 of part A of Schedule 2 (Conditions precedent) provided that such loan is Subordinated Shareholder Debt (as such term is defined in the Intercreditor Deed) and subject to the terms of a Pledge of Receivables and (iv) V-holding to CableNet Rt. for no more than HUF320,000,000 provided that such loan is used to pay outstanding invoices owed by CableNet Rt. to V-holding; |

| (b) | any transaction approved as a Permitted Intra-Group Transaction by the Facility Agent (acting on the instructions of the Majority Lenders); |

| (c) | the payment or declaration of any dividend, return on capital, repayment of capital contributions or other distributions by any of its Subsidiaries to the Borrower; |