Effective as from September 18th, 2008 by and between TEMASEK INVESTMENTS INC. as Optionor and AMAZON GOLDSANDS LTD. as Optionee MINERAL RIGHT OPTION AGREEMENT

Effective

as from September 18th,

2008

by

and

between

TEMASEK

INVESTMENTS INC.

as

Optionor

and

as

Optionee

_________________________________

__________________________________

THIS

MINERAL RIGHT OPTION AGREEMENT (hereinafter the “Agreement”) made effective as

of the 18th day of September, 2008 (hereinafter the “Effective Date”) is

executed by and between:

TEMASEK INVESTMENTS INC., a

company duly incorporated and organized under the laws of Panama with address

for delivery and notice located at Suite 1-A, #5, Calle Xxxxxxx X. Xxxxxxx, El

Cangrejo, Panama City, Panama (hereinafter the "Optionor" or “TEMASEK”) of the

first part; and

AMAZON GOLDSANDS LTD., a

company organized under the laws of Nevada, United States of America, with

address for delivery and notice located at 000 Xxxxx Xxxxxxxx Xxxxxx, 0xx xxxxx,

Xxxx, Xxxxxx, Xxxxxx Xxxxxx of America (hereinafter the “Optionee” or “AMAZON”),

of the second part.

Optionor

and Optionee collectively referred to as the Parties, and individually and

indistinctively referred to as the Party.

WHEREAS

(i) Both

Parties are mining exploration and development companies with experience in the

identification and development of mining projects, particularly in the region of

South America.

(ii) AMAZON

is interested in acquiring the ownership and title of certain claim

applications, claims, and assorted mining rights, including all obligations

arisen therefrom, with respect to certain areas located in Peru as detailed in

Annex I hereto

(hereinafter the “Mineral Rights”) that are of the property and title of Río

Xxxxxxxx Minerales S.A.C., a company duly incorporated and organized under the

laws of Peru (hereinafter “RIO XXXXXXXX”).

(iii) TEMASEK

is the indirect beneficial owner of 100% interest in the Mineral Rights through

the direct and indirect control of different wholly owned subsidiaries, as

detailed below.

(iii) The

ownership of TEMASEK in the Mineral Rights is evidenced through (a) the direct

ownership of 1 share of the shareholding of RIO XXXXXXXX, and (b) the direct

ownership of 100% of the outstanding shareholding in Xxxxxxxxx Holdings Inc., a

company duly incorporated and organized under the laws of Panama, with address

for delivery and notice located at Suite 1-A, #5, Calle Xxxxxxx X. Xxxxxxx, El

Cangrejo, Panama City, Panama (hereinafter “XXXXXXXXX”), being XXXXXXXXX the

registered owner of 999 shares in RIO XXXXXXXX. XXXXXXXXX and TEMASEK are the

registered owners of 100% of the outstanding shareholding in RIO XXXXXXXX

represented in 1,000 shares.

Page 2 of

16

(iv) The

Optionor has agreed to grant four exclusive options (hereinafter, collectively

referred to as the “Options”, and each individually and indistinctively referred

to as the “Option”) to the Optionee, and the Optionee has agreed to receive the

Options, each such Options entitling the Optionor to acquire a twenty-five

percent (25%) undivided interest in and to the Mineral Rights in the manner

hereto below described, for an aggregate interest of a one hundred percent

(100%) undivided interest if all four Options are exercised, as detailed

herein.

NOW THEREFORE THIS AGREEMENT

WITNESSES that in consideration of the covenants and agreements

hereinafter set forth the parties agree that:

REPRESENTATIONS,

WARRANTIES AND COVENANTS

1.1 The

Optionor represents, warrants and covenants (representation, warrants and

covenants that are extensive, when applicable, to the situation of its

subsidiaries XXXXXXXXX and RIO XXXXXXXX) to and with the Optionee

that:

a) it has been duly incorporated and

validly exists as a corporation in good standing under its laws of

origin;

b) it is qualified to do business in

those jurisdictions where it is necessary to fulfil its obligations under this

Agreement, and it has the full power and authority to enter into this Agreement

and any agreement or instrument referred to or contemplated by this

Agreement;

c) it has the requisite power,

authority and capacity to fulfil its obligations under this

Agreement;

d) the execution and delivery of this

Agreement and the agreements contemplated hereby have been duly authorized by

all necessary action on its part;

e) prior to the Effective Date, it has

obtained all authorizations, approvals, including regulatory approval, or

waivers that may be necessary or desirable in connection with the transactions

contemplated in this Agreement;

f) there are no other consents,

approvals or conditions precedent to the performance of this Agreement which

have not been obtained;

g) it is not in breach of any laws,

ordinances, statutes, regulations, by-laws, orders or decrees to which is

subject or which apply to it;

Page 3 of

16

h) the making of this Agreement and the

completion of the transactions contemplated hereby and the performance of and

compliance with the terms hereof does not and will not conflict with or result

in a breach of or violate any of the terms, conditions or provisions of any law,

judgment, order, injunction, decree, regulation or ruling of any court or

governmental authority, domestic or foreign, to which the Optionor is

subject;

i) it is now, and will also be

thereafter at the time of legal transfer of interests in the Mineral Rights when

any of the Options are exercised, the registered and beneficial owner of the

Mineral Rights free and clear of all liens, charges and claims of others and no

taxes, royalties or lease payments or like amounts are due in respect of any of

the mineral claims that comprised the Mineral Rights;

j) there is no adverse claim or

challenge against or to the ownership of or title to the interest it has on

XXXXXXXXX and RIO XXXXXXXX and on the Mineral Rights, nor to its knowledge is

there any basis therefore, and there are no outstanding agreements or options to

acquire or purchase any shares in XXXXXXXXX and RIO XXXXXXXX and on the Mineral

Rights or any portion thereof, and no person other than the Optionor pursuant to

the provisions hereof, has any interest whatsoever in XXXXXXXXX and RIO XXXXXXXX

and in the production from any of the mineral claims comprising the Mineral

Rights;

k) the Mineral Rights have been duly

and validly located and recorded in a good and minerlike manner pursuant to

applicable mining laws in Peru;

l) all permits and licenses covering

the Mineral Rights as they currently stand have been duly and validly issued

pursuant to applicable mining laws in Peru and are in good standing by the

proper doing and filing of assessment work and the payment of all fees, taxes

and rentals in accordance with the requirements of applicable mining laws in

Peru and the performance of all other actions necessary in that regard;

and

m) it requires no third party consent

of any kind to enter into this Agreement and grant the Options contemplated

hereby.

1.2 The

Optionee represents, warrants and covenants to and with the Optionor

that:

a) it has

been duly incorporated and validly exists as a corporation in good standing

under its laws of origin;

b)

neither the execution and delivery of this Agreement by the Optionee nor the

performance by the Optionee of its obligations hereunder conflicts with the

Optionee’s constating documents or any agreement to which it is

bound;

Page 4 of

16

c) the

execution, delivery and performance by the Optionee of this Agreement and any

other agreement or instrument to be executed and delivered by it hereunder and

the consummation by it of all the transactions contemplated hereby and thereby

have been duly authorised by all necessary corporate action on the part of the

Optionee; and

d)

excepting only as otherwise disclosed herein, the Optionee is not subject to, or

a party to, any charter or by-law restriction, any law, any claim, any

encumbrance or any other restriction of any kind or character which would

prevent the execution of its obligations as hereof or the consummation of the

transaction contemplated by this Agreement or any other agreement or instrument

to be executed and delivered by the Optionee hereunder.

The

representations and warranties contained hereof are provided for the exclusive

benefit of the other Party and a breach of any one or more thereof may be waived

by the non-breaching Party in whole or in part at any time without prejudice to

its rights in respect of any other breach of the same or any other

representation or warranty.

GRANT

AND EXERCISE OF OPTIONS

2.1 The

Optionor hereby grants to the Optionee the sole and exclusive right and option

to acquire a one hundred percent (100%) undivided interest in the Mineral

Rights, such 100% interest to be free and clear of all liens, charges,

encumbrances, security interests and adverse claims.

2.2 The

Parties agreed that the Optionee may exercise the Options in four separate

twenty-five percent (25%) increments, as described below, each such increment

being its own Option.

(a) 25%

Option

The

Optionee may exercise the initial twenty-five percent (25%) option to acquire a

25% interest in the Mineral Rights in accordance with the terms set out below

(hereinafter, the “25% Option”).

In order

to exercise the 25% Option the Optionee shall:

(i) pay,

on signing of this Agreement, a non-refundable amount of $ 250,000 (United

States Dollars Two Hundred and Fifty Thousand) to the order and the direction of

the Optionor; and

(ii)

issue, within 5 business days as from the Effective Date, 2,500,000 Optionee

Shares to the order and the direction of the Optionor, or whoever persons the

Optionor indicates; and

Page 5 of

16

(iii)

pay, within 90 days as from the Effective Date, further $ 250,000 (United States

Dollars Two Hundred and Fifty Thousand) to the order and the direction of the

Optionor.

For the

purposes of this Agreement the Optionee is deemed to have fully exercised the

25% Option only once all three obligations described above in points (i), (ii)

and (iii) have been completed.

Upon

exercise of the 25% Option by the Optionee, the Optionor will immediately

proceed to transfer to Optionee, or to the person the Optionee indicates, 25% of

all the outstanding shareholding in XXXXXXXXX.

(b) 50%

Option

Subject

to the prior and due and complete exercise by the Optionee of the 25% Option in

accordance with the paragraph before, the Optionee may exercise the second

twenty-five percent (25%) option to acquire an additional 25% interest in the

Mineral Rights, in accordance with the terms set out below (hereinafter, the

“50% Option”).

In order

to exercise the 50% Option the Optionee, within 6 months as from the Effective

Date, shall:

(i) have

exercised and completed the 25% Option; and

(ii) pay

$ 750,000 (United States Dollars Seven Hundred and Fifty Thousand) to the order

and the direction of the Optionor; and

(iii)

issue 3,500,000 Optionee Shares to the order and the direction of the Optionor,

or whoever persons the Optionor indicates.

For the

purposes of this Agreement the Optionee is deemed to have fully exercised the

50% Option only once all three obligations described above in points (i), (ii)

and (iii) have been completed.

Upon

exercise of the 50% Option by the Optionee, the Optionor will immediately

proceed to transfer to Optionee, or to the person the Optionee indicates, an

additional 25% of all the outstanding shareholding in XXXXXXXXX.

(c) 75%

Option

Subject

to the prior and due and complete exercise by the Optionee of the 50% Option in

accordance with the paragraph before, the Optionee may exercise the third

twenty-five percent (25%) option to acquire an additional 25% interest in the

Mineral Rights, in accordance with the terms set out below (hereinafter, the

“75% Option”).

Page 6 of

16

In order

to exercise the 75% Option the Optionee, within 12 months as from the Effective

Date, shall:

(i) have

exercised and completed the 50% Option; and

(ii) pay

$ 1,250,000 (United States Dollars One Million Two Hundred and Fifty Thousand)

to the order and the direction of the Optionor; and

(iii)

issue 4,500,000 Optionee Shares to the order and the direction of the Optionor,

or whoever persons the Optionor indicates.

For the

purposes of this Agreement the Optionee is deemed to have fully exercised the

75% Option only once all three obligations described above in points (i), (ii)

and (iii) have been completed.

Upon

exercise of the 75% Option by the Optionee, the Optionor will immediately

proceed to transfer to Optionee, or to the person the Optionee indicates, an

additional 25% of all the outstanding shareholding in XXXXXXXXX.

(d) 100%

Option

Subject

to the prior and due and complete exercise by the Optionee of the 75% Option in

accordance with the paragraph before, the Optionee may exercise the fourth and

final twenty-five percent (25%) option to acquire an additional 25% interest in

the Mineral Rights, in accordance with the terms set out below (hereinafter, the

“100% Option”).

In order

to exercise the 100% Option the Optionee, within 18 months as from the Effective

Date, shall:

(i) have

exercised and completed the 75% Option; and

(ii) pay

$ 2,500,000 (United States Dollars Two Million Five Hundred Thousand) to the

order and the direction of the Optionor; and

(iii)

issue 5,500,000 Optionee Shares to the order and the direction of the Optionor,

or whoever persons the Optionor indicates.

For the

purposes of this Agreement the Optionee is deemed to have fully exercised the

100% Option only once all three obligations described above in points (i), (ii)

and (iii) have been completed.

Upon

exercise of the 100% Option by the Optionee, the Optionor will immediately

proceed to transfer to Optionee, or to the person the Optionee indicates, the

final and remaining 25% of all the outstanding shareholding in XXXXXXXXX.

Additionally, upon

Page 7 of

16

exercise

of the 100% Option, the Optionor shall become holder of the one (1) share that

currently holds in RIO XXXXXXXX as nominee and on trust for the exclusive and

sole benefit and interest of the Optionee. The Optionor hereby undertakes to the

Optionee at all times to exercise all rights in respect of the share that holds

in RIO XXXXXXXX strictly in accordance with the Optionee

instructions.

On

completion of the 100% Option the Optionee shall be the owner of one hundred

percent (100%) undivided interest in the Mineral Rights through the direct

ownership of 100% of the outstanding shareholding of XXXXXXXXX and indirect

ownership of 100% of the outstanding shareholding of RIO XXXXXXXX.

NET

RETURNS ROYALTY

3.1 Upon

completion by Optionee of the 100% Option, the Optionee shall recognize to the

Optionor a 2.5% Net Returns Royalty, where Net Returns Royalty has the meaning

set out in Annex

II (hereinafter the “NET RETURN ROYALTY”). The NET RETURN ROYALTY will be

calculated and paid to the Optionor or to its appointed nominees in accordance

with the Annex

II.

3.2 As

from 90 days from the exercise and completion of the 100% Option, the Optionee

shall have the right to acquire 1% of NET RETURN ROYALTY from the Optionor for

the total amount of $ 2,000,000 (United States Dollars Two

Million).

JOINT

VENTURE DEVELOPMENT

4.1 Following

the due and complete acquisition by the Optionee of 50% interest in the Mineral

Rights under this Agreement and with the Optionee failing to acquire the 100%

interest in the Mineral Rights, for any reason whatsoever, the Optionor and the

Optionee will thereby be deemed to form a Joint Venture for the purpose of

carrying out further development work and production on the Mineral Rights and

will, in good faith, negotiate and execute a Joint Venture Agreement, under

which the Optionee will be the operator of the mining project to develop. The

interest of the Parties in the Mineral Rights shall be the interest of the

Parties under the Joint Venture Agreement (hereinafter the “Joint Venture

Development”).

4.2 Under

the Joint Venture Development, the Optionee shall have the whole responsibility

for developing a feasible mining project and all necessary facilities for the

extraction, crushing, processing and beneficiation of commercially valuable

minerals, including all necessary facilities for compliance with the applicable

laws, including environmental laws governing mining activity in Peru

(hereinafter the “Feasible Project”). All necessary costs and investment

required for the developing of a Feasible Project shall be supported exclusively

by the Optionee. Optionor shall have a carried free interest in the Mineral

Rights.

Page 8 of

16

4.3 If

under the Joint Venture Development, a Feasible Project is not developed within

3 years as from the Effective Date, the Optionee shall pay to the Optionor and

advance minimum mining royalty per year of $ 500,000 (United States Dollars Five

Hundred Thousand), that will be deducted from the NET RETURN ROYALTY

(hereinafter the “Advance Minimum Royalty”).

OBLIGATIONS

OF OPTIONOR DURING OPTION PERIOD

5.1 During

the 18 months as from the Effective Date, the Optionor will:

a)

maintain in good standing the Mineral Rights that are in good standing on the

date hereof by the performance of all actions (except for those economic

obligations arisen as from the Effective Date of this Agreement, which shall be

of the responsibility of the Optionee) which may be necessary under Peruvian law

in that regard and in order to keep such Mineral Rights free and clear of all

liens and other charges arising from the Optionee’s activities thereon except

those at the time contested in good faith by the Optionee;

b) maintain in good standing both

XXXXXXXXX and RIO XXXXXXXX, and the shareholding of both companies free and

clear of all liens;

c) restrain from issuing any additional

shares or cause to issue any additional shares either in XXXXXXXXX and/or RIO

XXXXXXXX;

d) restrain from transferring any of

its shares in XXXXXXXXX and/or in RIO XXXXXXXX to any other third party and/or

cause to transfer any shares in RIO XXXXXXXX to any other third party;

and

e) permit

the directors, officers, employees and designated consultants of the Optionee,

at their own risk, access to the Mineral Rights at all reasonable times, and

providing the Optionee agrees to indemnify the Optionor against and to save the

Optionor harmless from all costs, claims, liabilities and expenses that the

Optionor may incur or suffer as a result of any injury (including injury causing

death) to any director, officer, employee or designated consultant of the

Optionee while on the Mineral Rights.

OBLIGATIONS

OF OPTIONEE DURING OPTION PERIOD

6.1 During

the 18 months as from the Effective Date, the Optionee will:

a) do all

work on the Mineral Rights in a good and workmanlike fashion and in accordance

with all applicable laws, regulations, orders and ordinances of any governmental

authority; and

Page 9 of

16

b)

indemnify and save the Optionor harmless in respect of any and all costs,

claims, liabilities and expenses arising out of the Optionee’s activities

through XXXXXXXXX and RIO XXXXXXXX and/or on the Mineral Rights.

ARBITRATION

7.1 All

questions or matters in dispute with respect to the interpretation of this

Agreement will, insofar as lawfully possible, be submitted to arbitration

pursuant to the terms hereof using “final offer” arbitration

procedures.

7.2 It

will be a condition precedent to the right of any party to submit any matter to

arbitration pursuant to the provisions hereof, that any party intending to refer

any matter to arbitration will have given not less than 10 days’ prior written

notice of its intention so to do to the other party together with particulars of

the matter in dispute.

7.3 On

the expiration of such 10 days, the party who gave such notice may proceed to

commence procedure in furtherance of arbitration as provided in this

Section.

7.4 The

party desiring arbitration (the “First Party”) will nominate in writing three

proposed arbitrators, and will notify the other party (the “Second Party”) of

such nominees, and the other party will, within 10 calendar days after receiving

such notice, either choose one of the three or recommend three nominees of its

own. All nominees of either party must hold accreditation as either a lawyer,

accountant or mining engineer. If the First Party fails to choose one of the

Second Party’s nominees then all six names shall be placed into a hat and one

name shall be randomly chosen by the president of the First Party and that

person if he/she is prepared to act shall be the nominee. Except as specifically

otherwise provided in this Section the arbitration herein provided for will be

conducted in accordance with the UNCITRAL Arbitration Rules and the place of

arbitration shall be Reno, Nevada, United States of America. The parties shall

thereupon each be obligated to proffer to the Arbitrator within 21 calendar days

of his/her appointment a proposed written solution to the dispute and the

arbitrator shall within 10 calendar days of receiving such proposals choose one

of them without altering it except with the consent of both

parties.

7.5 The

expense of the arbitration will be paid as specified in the award.

7.6 The

parties agree that the award of the arbitrator will be final and binding upon

each of them.

DEFAULT

AND TERMINATION

8.1 If

at any time during the term of this Agreement either party fails to perform any

obligation hereunder or any representation or warranty given by it proves to be

untrue, then the other party may terminate this Agreement (without prejudice to

any other rights it may have) providing:

Page 10

of 16

|

|

(i)

|

it

first gives to the party allegedly in default a notice of default

containing particulars of the obligation which such has not performed, or

the warranty breached;

|

|

|

(ii)

|

the

other party does not dispute the default, then if it is reasonably

possible to cure the default without irreparable harm to the

non-defaulting party, the defaulting party does not, within 30 calendar

days after delivery of such notice of default, cure such default by

appropriate payment or commence to correct such default and diligently

prosecute the matter until it is

corrected.

|

NOTICES

9.1 All

notices and other communications in connection with this Agreement must be in

writing and given by (i) hand delivery (ii) through a major international

courier service, or (iii) facsimile transmissions, in each case addressed as

specified below or in any subsequent notice from the intended recipient to the

party sending the notice. Such notices and communications will be effective upon

delivery if delivered by hand, upon receipt if sent by international courier

service, or upon receipt if sent by facsimile transmission. Notices shall be

addressed as follows:

AMAZON

000 Xxxxx

Xxxxxxxx Xxxxxx, 0xx

xxxxx,

Xxxx,

Xxxxxx,

Xxxxxx

Xxxxxx of America

Fax:

(000) 000 0000

TEMASEK

Suite

1-A, #5, Calle Xxxxxxx X. Xxxxxxx,

El

Cangrejo, Panama City,

Panama

Fax:

(000) 000 0000

GOVERNING

LAW

10.1 This

assignment agreement and any dispute arising hereunder will be governed by the

laws of the state of Nevada, United States of America, without giving effect to

the conflict of laws provisions thereof.

Page 11

of 16

10.2 Each

of the Optionor and the Optionee hereby irrevocable submits to the exclusive

jurisdiction of the courts of the state of Nevada, United States of America, in

respect of any action or proceeding brought against it by the Optionor or the

Optionee, respectively, arising under this Agreement.

ENTIRE

AGREEMENT

11.1 This

Agreement represents the final agreement between the Parties with respect to the

subject matter hereof and may not be contradicted by evidence of prior,

contemporaneous or subsequent oral agreements of the Parties.

EXECUTION

IN COUNTERPARTS

11.2 This

Agreement is executed in two (2) counterparts and by the Parties hereto in

separate counterparts, each of which when so executed will be deemed to be an

original and both of which when taken together will constitute one and the same

agreement.

IN

WITNESS WHEREOF, the Parties hereto have caused this Agreement to be executed as

of the date first above written.

|

TEMASEK

INVESTMENTS INC.

|

|

|

By: /s/ Xxxxxxxx

Xxxxxxx

Xxxxxxxx Xxxxxxx

|

By:

/s/ Xxxxxx Xxxx

Xxxxx

Xxxxxx

Xxxx Pointe

|

Page 12

of 16

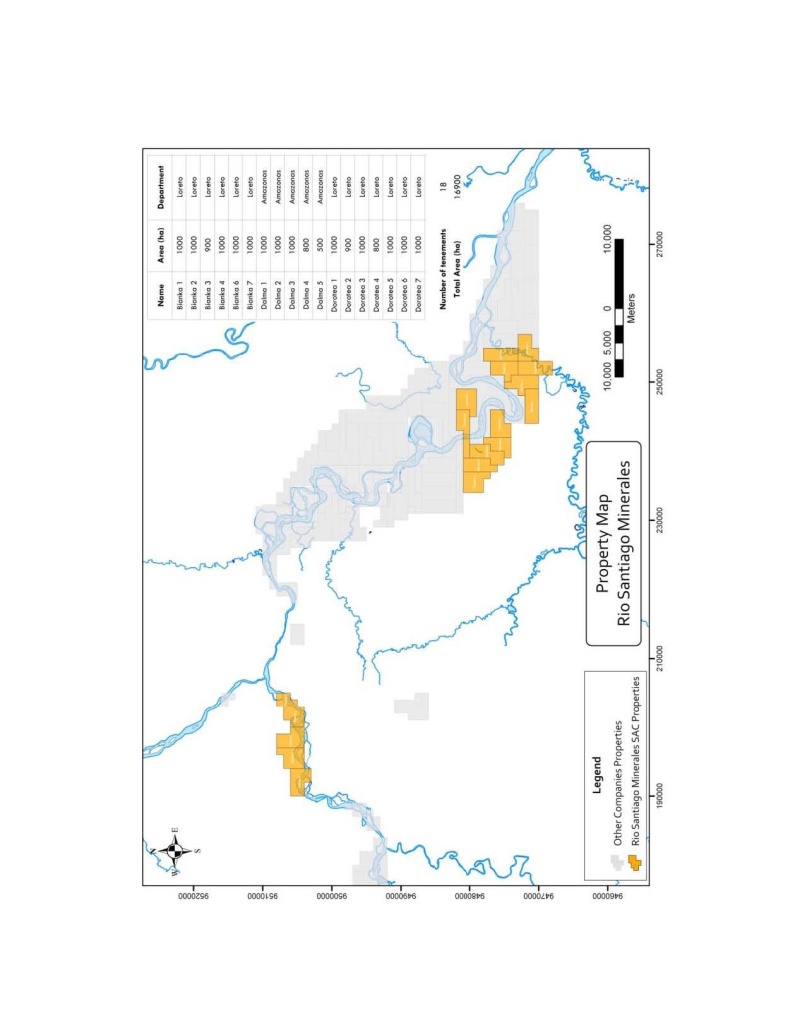

ANNEX

I

|

Name

|

Area

(ha)

|

Departament

|

Province

|

District

|

Observation

|

|

Bianka

1

|

1000

|

Loreto

|

Datem

del Marañon

|

Manseriche

|

|

|

Bianka

2

|

1000

|

Loreto

|

Datem

del Marañon

|

Manseriche

|

|

|

Bianka

3

|

900

|

Loreto

|

Datem

del Marañon

|

Manseriche

|

|

|

Bianka

4

|

1000

|

Loreto

|

Datem

del Marañon

|

Manseriche

|

|

|

Bianka

6

|

1000

|

Loreto

|

Datem

del Marañon

|

Manseriche

|

|

|

Bianka

7

|

1000

|

Loreto

|

Datem

del Marañon

|

Manseriche

|

|

|

Dalma

1

|

1000

|

Amazonas

|

Condorcanqui

|

Xxxxx

|

Partially

overlap Zona de

Amortiguamiento

ANP

|

|

Dalma

2

|

1000

|

Amazonas

|

Condorcanqui

|

Xxxxx

|

Partially

overlap Zona de

Amortiguamiento

ANP

|

|

Dalma

3

|

1000

|

Amazonas

|

Condorcanqui

|

Xxxxx

|

Partially

overlap Zona de

Amortiguamiento

ANP

|

|

Dalma

4

|

800

|

Amazonas

|

Condorcanqui

|

Xxxxx

|

Partially

overlap Zona de

Amortiguamiento

ANP

|

|

Dalma

5

|

500

|

Amazonas

|

Condorcanqui

|

Xxxxx

|

Partially

overlap Xxxx xx

Xxxxxxxxxxxxxxx

XXX

|

|

Xxxxxxx

0

|

0000

|

Xxxxxx

|

Datem

del Marañon

|

Manseriche

|

|

|

Xxxxxxx

2

|

900

|

Loreto

|

Datem

del Marañon

|

Manseriche

|

|

|

Xxxxxxx

3

|

1000

|

Loreto

|

Datem

del Marañon

|

Manseriche

|

|

|

Xxxxxxx

4

|

800

|

Loreto

|

Datem

del Marañon

|

Manseriche

|

|

|

Xxxxxxx

5

|

1000

|

Loreto

|

Datem

del Marañon

|

Manseriche

|

|

|

Xxxxxxx

6

|

1000

|

Loreto

|

Datem

del Marañon

|

Manseriche

|

Partially

overlap Xxxx xx

Xxxxxxxxxxxxxxx

XXX

|

|

Xxxxxxx

0

|

0000

|

Xxxxxx

|

Datem

del Marañon

|

Manseriche

|

Fully

overlap Zona de

Amortiguamiento

ANP

|

Page 13

of 16

Page 14

of 16

ANNEX

II

NET

RETURNS ROYALTY

Pursuant

to the Agreement to which this Exhibit is attached, Optionee (for the purposes

herein the “Payee”) will be entitled to a royalty equal to 2.5% of net returns

(the “Net Returns Royalty”) payable by Optionor (“Payor”) as set forth

below.

Net

Returns Royalty

A. “Net Returns Royalty” means the

aggregate of:

|

|

1.

|

all

revenues from the sale or other disposition of ores, concentrates or

minerals produced from the mineral properties arisen as from the Mineral

Rights (the “Properties”); and

|

|

|

2.

|

all

revenues from the operation, sale or other disposition of any facilities

the cost of which is included in the definition of “Operating Expenses”,

“Capital Expenses” or “Exploration Expenses”; less (without duplication)

Working Capital, Operating Expenses, Capital Expenses and Exploration

Expenses.

|

B. “Working Capital” means the

amount reasonably necessary to provide for the operation of the mining operation

on the Properties and for the operation and maintenance of the Facilities for a

period of six months.

C. “Operating Expenses” means all

costs, expenses, obligations, liabilities and charges of whatsoever nature or

kind incurred or chargeable directly or indirectly in connection with Commercial

Production from the Properties and in connection with the maintenance and

operation of the Facilities, all in accordance with generally accepted

accounting principles, consistently applied, including, without limiting the

generality of the foregoing, all amounts payable in connection with mining,

handling, processing, refining, transporting and marketing of ore, concentrates,

metals, minerals and other products produced from the Property, all amounts

payable for the operation and maintenance of the Facilities including the

replacement of items which by their nature require periodic replacement, all

taxes (other than income taxes), royalties and other imposts and all amounts

payable or chargeable in respect of reasonable overhead and administrative

services.

D. “Capital Expenses” means all

expenses, obligations and liabilities of whatsoever kind (being of a capital

nature in accordance with generally accepted accounting principles) incurred or

chargeable, directly or indirectly, with respect to the development,

acquisition, redevelopment, modernization and expansion of the

Properties

Page 15

of 16

and the

Facilities, including, without limiting the generality of the foregoing,

interest thereon from the time so incurred or chargeable at a rate per annum

from time to time equal to prime rate established by the Bank of America, New

York Branch, New York, plus 2 percent per annum, but does not include Operating

Expenses nor Exploration Expenses.

E. “Exploration Expenses” means

all costs, expenses, obligations, liabilities and charges of whatsoever nature

or kind incurred or chargeable, directly or indirectly, in connection with the

exploration and development of the Properties including, without limiting the

generality of the foregoing, all costs reasonably attributable, in accordance

with generally accepted accounting principles, to the design, planning, testing,

financing, administration, marketing, engineering, legal, accounting,

transportation and other incidental functions associated with the exploration

and mining operation contemplated by this agreement and with the Facilities, but

does not include Operating Expenses nor Capital Expenses.

F. “Facilities” means all plant,

equipment, structures, roads, rail lines, storage and transport facilities,

housing and service structures, real property or interest therein, whether on

the Properties or not, acquired or constructed exclusively for the mining

operation on the Properties contemplated by this Agreement (all commonly

referred to as “infrastructure”).

G. “Commercial Production” means

the operation of the Properties or any portion thereof as a producing mine and

the production of mineral products therefrom (but does not include bulk

sampling, pilot plant or test operations).

Payment

Net Returns shall be calculated for

each calendar quarter in which Net Returns are realized, and payment as due

hereunder shall be made within 30 days following the end of each such calendar

quarter. Such payments shall be accompanied by a statement summarizing the

computation of Net Returns and copies of all relevant settlement sheets. Such

quarterly payments are provisional and subject to adjustment within 90 days

following the end of each calendar year. Within ninety days after the

end of each calendar year, Payor shall deliver to Payee an unaudited statement

of royalties paid to Payee during the year and the calculation thereof. All year

end statements shall be deemed true and correct six months after presentation,

unless within that period Payee delivers notice to Payor specifying with

particularity the grounds for each exception. Payee shall be

entitled, at Payees’s expense, to an annual independent audit of the statement

by a national firm of chartered accountants, only if Payee delivers a demand for

an audit to Payor within four months after presentation of the related year-end

statement.

Page 16

of 16