NOTE AND WARRANT PURCHASE AGREEMENT

Exhibit 10.11

NOTE AND WARRANT PURCHASE AGREEMENT

This Note and Warrant Purchase Agreement, dated as of July 1, 2021 (this “Agreement”), is entered into by and among tsu Inc. (d/b/a display), a Delaware corporation (the “Company”), the persons and entities listed on the schedule of investors attached hereto as Schedule I (each a “Lender” and, collectively, the “Lenders”), as such Schedule I may be amended in accordance with Section 7 hereof, and Black, Inc., a Ontario corporation, as collateral agent (in such capacity, the “Collateral Agent”).

RECITALS

A.On the terms and subject to the conditions set forth herein, each Lender is willing to purchase from the Company, and the Company is willing to sell to such Lender, a secured promissory note in the principal amount set forth opposite such ▇▇▇▇▇▇’s name on Schedule I, together with a related warrant to acquire shares of the Company’s capital stock.

B.Capitalized terms not otherwise defined herein shall have the meaning set forth in the form of Note (as defined below) attached hereto as Exhibit A.

AGREEMENT

NOW THEREFORE, in consideration of the foregoing, and the representations, warranties, and conditions set forth below, the parties hereto, intending to be legally bound, hereby agree as follows:

1.The Notes and Warrants.

(a)Issuance of Notes. Subject to all of the terms and conditions hereof, the Company agrees to issue and sell to each of the Lenders, and each of the Lenders severally agrees to purchase, one or more secured promissory notes in the form of Exhibit A hereto (each, a “Note” and, collectively, the “Notes”) in the principal amount set forth opposite the respective Lender’s name on Schedule I. The Company will have the right to require Lenders to purchase the Notes in one installment for all of the principal amount set forth opposite the respective Lender’s name on Schedule I or in multiple installments, in the discretion of the Company. If the Company elects more than one installment, the Lender will purchase Notes within two (2) business days of written demand from the Company in the principal amount demanded; provided that the aggregate of all such installments shall not exceed the principal amount set forth opposite the respective Lender’s name on Schedule I (the “Lender’s Maximum Obligation”). The obligations of the Lenders to purchase Notes are several and not joint and, notwithstanding anything to the contrary contained herein, shall not exceed such Lender’s Maximum Obligation. The aggregate principal amount for all Notes issued hereunder shall not exceed $30,000,000.

(b)Security Agreement. The Collateral Agent will execute a security agreement with the Company in the form of Exhibit B hereto, granting to the Collateral Agent for the benefit of the Lenders a security interest over substantially all of the Company’s assets (the “Security Agreement”). In order to expedite the transactions contemplated by this Agreement, Black, Inc. is hereby appointed to act as Collateral Agent on behalf of the Lenders. Each of the Lenders, and each assignee of any Lender, hereby irrevocably authorizes the Collateral Agent to take such actions on behalf of such Lender, and to exercise such powers as are specifically delegated to the Collateral Agent by the terms and provisions set forth in the Security Agreement and the Notes, together with such actions and powers as are reasonably incidental thereto.

| (i) | Each Lender, by its acceptance of the benefits of the Collateral and of the Secured Obligations (as such terms are defined in the Security Agreement), agrees (a) to reimburse the Collateral Agent, on demand, in the amount of its pro rata |

share (based on the sum of its aggregate available outstanding Notes) of any expenses incurred for the benefit of the Lenders by the Collateral Agent, including reasonable counsel fees, that shall not have been reimbursed by the Company (and without limiting any the Company’s obligation to do so) and (b) to indemnify and hold harmless the Collateral Agent and any of its directors, officers, employees or agents, in the amount of such pro rata share, from and against any and all liabilities, taxes, obligations, losses, damages, penalties, actions, judgments, suits, costs, expenses or disbursements of any kind or nature whatsoever that may be imposed on, incurred by or asserted against it in its capacity as the Collateral Agent or any of them in any way relating to or arising out of the Transaction Documents, or any action taken or omitted by it or any of them under the Transaction Documents, to the extent the same shall not have been reimbursed by the Company (and without limiting any the Company’s obligation to do so); provided, however, that the Company shall be liable to the Collateral Agent or any such other indemnified person for any portion of such liabilities, obligations, losses, damages, penalties, actions, judgments, suits, costs, expenses or disbursements are determined by a court of competent jurisdiction by final and non-appealable judgment to have resulted from the gross negligence or willful misconduct of the Collateral Agent or any of its directors, officers, employees or agents.

(ii)Each Lender, by its acceptance of the benefits of the Collateral and of the Secured Obligations provided under the Security Agreement, acknowledges that it has, independently and without reliance upon the Collateral Agent or any other Lender and based on such documents and information as it has deemed appropriate, made its own credit analysis and decision to enter into the Transaction Documents. Each Lender also acknowledges that it will, independently and without reliance upon the Collateral Agent or any other Lender and based on such Transaction Documents and information as it shall from time to time deem appropriate, continue to make its own decisions in taking or not taking action under or based upon the Transaction Documents or any other loan document, any related agreement or any document furnished hereunder or thereunder.

(iii)Without limiting the foregoing, no Lender shall have any right individually to realize upon any of the Collateral or to enforce the Secured Obligations, it being understood and agreed that all powers, rights and remedies under this Agreement may be exercised solely by the Collateral Agent on behalf of the Lenders in accordance with the terms of the Security Agreement. In the event of a foreclosure by the Collateral Agent on any of the Collateral pursuant to a public or private sale or other disposition, any Lender may be the purchaser of any or all of such Collateral at any such sale or other disposition, and the Collateral Agent, as agent for and representative of the Lender (but not any Lender in its individual capacity) shall be entitled, for the purpose of bidding and making settlement or payment of the purchase price for all or any portion of the Collateral sold at any such sale, to use and apply any of the Secured Obligations as a credit on account of the purchase price for any Collateral payable by the Collateral Agent for the benefit of the Lenders at such sale or other disposition. Each Lender, by its acceptance of the benefits of the Collateral and of the Secured Obligations provided under this Agreement, to have agreed to the foregoing provisions. The provisions of this paragraph are for the sole benefit of the Collateral Agent and shall not afford any right to, or constitute a defense available to, any Lender.

-2-

(c)Issuance of Warrants. Concurrently with the issuance of each Note to the Lenders, the Company will issue to each Lender a warrant to acquire common shares of the Company, par value $0.001 (“Common Shares”) in the form attached hereto as Exhibit C (each, a “Warrant” and, collectively, the “Warrants”) for a number of Common Shares equal to fifteen percent (15%) of the principal amount of each Note (calculated based on a $250 million equity valuation and the actual number of outstanding Common Shares on the day immediately preceding the date of the Note) at the purchase price set forth opposite each Lender’s name on Schedule I hereto; provided that if the Company elects to receive such principal amount in more than one installment, Lender will receive on the first installment date a Warrant for number of shares equal to fifteen percent (15%) of the entire principal amount set forth opposite such ▇▇▇▇▇▇’s name on Schedule I rather than the principal amount of the Note issued at such installment, and such Lender will not receive additional Warrants for Notes issued in the subsequent installments.

(d)Funding Fee. Each Lender will earn a closing fee in an amount equal to one percent (1%) of the principal amount of each Note funded. This funding fee shall be accrued and payable upon maturity or earlier pre-payment.

(e)Delivery. The sale and purchase of the Notes and Warrants shall take place at a closing (the “Closing”) to be held at such place and time as the Company and the Lenders may determine (the “Closing Date”). At the Closing, the Company will deliver to each of the Lenders the Note and Warrant to be purchased by such Lender, against receipt by the Company of the corresponding purchase price set forth on Schedule I (the “Purchase Price”). The Company may conduct one or more additional closings on or before December 31, 2021 (each, an “Additional Closing”) to be held at such place and time as the Company and the Lenders participating in such Additional Closing may determine (each, an “Additional Closing Date”). At each Additional Closing, the Company will deliver to each of the Lenders participating in such Additional Closing the Note and Warrant to be purchased by such Lender, against receipt by the Company of the corresponding Purchase Price. Each of the Notes and Warrants will be registered in such ▇▇▇▇▇▇’s name in the Company’s records. Any Notes issued at an Additional Closing will begin accruing interest as of the date of such Additional Closing.

(f)Use of Proceeds. The proceeds of the sale and issuance of the Notes shall be used for general corporate purposes.

(g)Payments. The Company will make all cash payments due under the Notes in immediately available funds by 4:00 p.m. Eastern time on the date such payment is due at the address specified below each Lender’s name on Schedule I, or at such other address, or in such other manner, as the applicable Lender or other registered holder of a Note may from time to time direct in writing.

2.Representations and Warranties of the Company. The Company represents and warrants to each Lender that:

(a)Due Incorporation, Qualification, etc. The Company (i) is a corporation duly organized, validly existing and in good standing under the laws of the State of Delaware; (ii) has the power and authority to own, lease and operate its properties and carry on its business as now conducted; and (iii) is duly qualified, licensed to do business and in good standing as a foreign corporation in each jurisdiction where the failure to be so qualified or licensed could reasonably be expected to have a material adverse effect on the Company.

(b)Authority. The execution, delivery, and performance by the Company of each Transaction Document to be executed by the Company and the consummation of the transactions

-3-

contemplated thereby (i) are within the power of the Company and (ii) have been duly authorized by all necessary actions on the part of the Company.

(c)Enforceability. Each Transaction Document executed, or to be executed, by the Company has been, or will be, duly executed and delivered by the Company and, assuming due execution and delivery by the other parties thereto, constitutes, or will constitute, a legal, valid, and binding obligation of the Company, enforceable against the Company in accordance with its terms, except as limited by bankruptcy, insolvency or other laws of general application relating to or affecting the enforcement of creditors’ rights generally and general principles of equity.

(d)Non-Contravention. The execution and delivery by the Company of the Transaction Documents executed by the Company and the performance and consummation of the transactions contemplated thereby do not and will not (i) violate the Company’s certificate of incorporation or bylaws or, to the Company’s knowledge, any material judgment, order, writ, decree, statute, rule or regulation applicable to the Company; (ii) violate any provision of, or result in the breach or the acceleration of, or entitle any other Person to accelerate (whether after the giving of notice or lapse of time or both), any material mortgage, indenture, agreement, instrument or contract to which the Company is a party or by which it is bound; or (iii) result in the creation or imposition of any security interest, mortgage, pledge, lien, claim, charge or other encumbrance (“Lien”) upon any property, asset or revenue of the Company or the suspension, revocation, impairment, forfeiture, or nonrenewal of any material permit, license, authorization or approval applicable to the Company, its business or operations, or any of its assets or properties. The assets of the Company are not subject to any Lien (except as permitted by Section 2(i) hereof), and the grant of a security interest pursuant to the Security Agreement will provide the Collateral Agent, for the benefit of the Lenders, with a first priority security interest on the assets of the Company. The Company covenants not to take any action, or fail to take an action, the result of which would have an adverse effect on such first priority security interest.

(e)Subsidiaries. The Company does not own or control, directly or indirectly, any interest in any corporation, partnership, limited liability company, association, or other business entity except its wholly owned subsidiary Tsu Productions, Inc.

(f)Approvals. No consent, approval, order or authorization of, or registration, declaration, or filing with, any governmental authority or other Person (including, without limitation, the shareholders of any Person) is required in connection with the execution and delivery of the Transaction Documents executed by the Company and the performance and consummation of the transactions contemplated thereby, other than such as have been obtained and remain in full force and effect and other than such qualifications or filings under applicable securities laws as may be required in connection with the transactions contemplated by this Agreement. There are no outstanding options, warrants, rights (including conversion or preemptive rights and rights of first refusal or similar rights) or agreements, orally or in writing, to purchase or acquire from the Company any Notes or Warrants.

(g)No Violation or Default. The Company is not in violation of or in default with respect to (i) its certificate of incorporation or bylaws or, to the Company’s knowledge, any material judgment, order, writ, decree, statute, rule or regulation applicable to such Person; or (ii) any material mortgage, indenture, agreement, instrument or contract to which such Person is a party or by which it is bound (nor is there any waiver in effect which, if not in effect, would result in such a violation or default).

(h)Litigation. No actions (including, without limitation, derivative actions), suits, proceedings, or investigations are pending or, to the knowledge of the Company, threatened in writing against the Company at law or in equity in any court or before any other governmental authority that (i) would (alone or in the aggregate) result in a material liability or (ii) seeks to enjoin, either directly or

-4-

indirectly, the execution, delivery or performance by the Company of the Transaction Documents or the transactions contemplated thereby.

(i)Title. The Company owns and has good and marketable title in fee simple absolute to, or a valid leasehold interest in, all real properties and good title to other assets and properties as reflected in the most recent financial statements delivered to Lenders (except those assets and properties disposed of in the ordinary course of business since the date of such financial statements) and all assets and properties acquired by the Company since such date (except those disposed of in the ordinary course of business). Such assets and properties are subject to no Lien other than (i) Liens for current taxes not yet due and payable, (ii) Liens imposed by law and incurred in the ordinary course of business for obligations not past due, (iii) Liens in respect of pledges or deposits under workers’ compensation laws or similar legislation, and (iv) Liens, encumbrances and defects in title that have arisen in the ordinary course of business that do not in any case materially detract from the value of the property subject thereto or have a material adverse effect.

(j)Intellectual Property. To the Company’s knowledge, the Company owns or possesses sufficient legal rights to all patents, trademarks, service marks, trade names, copyrights, trade secrets, licenses, information, processes, and other intellectual property rights necessary for its business as now conducted and as proposed to be conducted.

(k)Financial Statements. The financial statements of the Company that have been delivered to the Lenders (i) are in accordance with the books and records of the Company and have been maintained in accordance with good business practice; (ii) have been prepared in conformity with GAAP except, with respect to the unaudited financial statements, for the absence of footnotes and subject to normal year-end adjustments; and (iii) fairly present the financial position of the Company as of the dates presented therein and the results of operations, changes in financial positions or cash flows, as the case may be, for the periods presented therein. The Company does not have any contingent obligations, liability for taxes or other outstanding obligations which are material in the aggregate, except as disclosed in the most recent financial statements furnished by the Company to Lenders prior to the date hereof.

(l)Accuracy of Information Furnished. None of the Transaction Documents and none of the other certificates, statements, or information furnished to Lenders of the Collateral Agent by or on behalf of the Company in connection with the Transaction Documents or the transactions contemplated thereby contains or will contain any untrue statement of a material fact or omits or will omit to state a material fact necessary to make the statements therein, in light of the circumstances under which they were made, not misleading. The Company does not represent or warrant that it will achieve any financial projections provided to the Lenders and represents only that such projections were prepared in good faith.

3.Representations and Warranties of Lenders. Each Lender, for that Lender alone, represents and warrants to the Company upon the acquisition of a Note and Warrant as follows:

(a)Binding Obligation. Such Lender has full legal capacity, power, and authority to execute and deliver this Agreement and to perform its obligations hereunder. This Agreement and the Transaction Documents, assuming due execution and delivery by the Company, the Collateral Agent and the other Lenders party hereto and thereto, constitute valid and binding obligations of such Lender, enforceable in accordance with their terms, except as limited by bankruptcy, insolvency or other laws of general application relating to or affecting the enforcement of creditors’ rights generally and general principles of equity.

-5-

(b)Securities Law Compliance. Such Lender has been advised that the Notes, the Warrants, and the underlying securities have not been registered under the Securities Act, or any state securities laws and, therefore, cannot be resold unless they are registered under the Securities Act and applicable state securities laws or unless an exemption from such registration requirements is available. Such Lender is aware that the Company is under no obligation to effect any such registration with respect to the Notes, the Warrants, or the underlying securities or to file for or comply with any exemption from registration. Such Lender has not been formed solely for the purpose of making this investment and is purchasing the Notes or Warrants to be acquired by such ▇▇▇▇▇▇ hereunder for its own account for investment, not as a nominee or agent, and not with a view to, or for resale in connection with, the distribution thereof, and ▇▇▇▇▇▇ has no present intention of selling, granting any participation in, or otherwise distributing the same. Such Lender has such knowledge and experience in financial and business matters that such ▇▇▇▇▇▇ is capable of evaluating the merits and risks of such investment, is able to incur a complete loss of such investment without impairing such Lender’s financial condition and is able to bear the economic risk of such investment for an indefinite period of time. Such Lender is an accredited investor as such term is defined in Rule 501 of Regulation D under the Securities Act and shall submit to the Company such further assurances of such status as may be reasonably requested by the Company. Such Lender has furnished or made available any and all information requested by the Company or otherwise necessary to satisfy any applicable verification requirements as to accredited investor status. Any such information is true, correct, timely and complete. The residency of the Lender (or, in the case of a partnership or corporation, such entity’s principal place of business) is correctly set forth beneath such Lender’s name on Schedule I.

(c)Access to Information. Such Lender acknowledges that the Company has given such Lender access to the corporate records and accounts of the Company and to information relating to the Company, has made its officers and representatives available for interview by such ▇▇▇▇▇▇, and has furnished such Lender with all documents and other information required for such Lender to make an informed decision with respect to the purchase of the Notes and the Warrants.

(d)Tax Advisors. Such Lender has reviewed with its own tax advisors the U.S. federal, state, and local and non-U.S. tax consequences of this investment and the transactions contemplated by this Agreement. With respect to such matters, such ▇▇▇▇▇▇ relies solely on any such advisors and not on any statements or representations of the Company or any of its agents, written or oral. Such Lender understands that it (and not the Company) shall be responsible for its own tax liability that may arise as a result of this investment and the transactions contemplated by this Agreement.

4.Conditions to Closing of the Lenders. Each Lender’s obligations at the Closing are subject to the fulfillment, on or prior to the Closing Date, of all of the following conditions, any of which may be waived in whole or in part by the applicable Lender:

(a)Representations and Warranties. The representations and warranties made by the Company in Section 2 shall be true and correct in all material respects on the Closing Date, except that to the extent such representations and warranties are qualified by materiality or “material adverse effect” qualifiers, they shall be true and correct on the Closing Date.

(b)Governmental Approvals and Filings. Except for any notices required or permitted to be filed after the Closing Date with certain federal and state securities commissions, the Company shall have obtained all governmental approvals required in connection with the lawful sale and issuance of the Notes and Warrants.

-6-

(c)Legal Requirements. At the Closing, the sale and issuance by the Company, and the purchase by the Lenders, of the Notes and Warrants shall be legally permitted by all laws and regulations to which the Lenders or the Company are subject.

(d)Proceedings and Documents. All corporate and other proceedings in connection with the transactions contemplated at the Closing and all documents and instruments incident to such transactions shall be reasonably satisfactory in substance and form to the Lenders.

(e)Transaction Documents. The Company shall have duly executed and delivered to the Lenders the following documents (the “Transaction Documents”):

(i)This Agreement;

(ii)The Secured Promissory Note issued hereunder;

(iii)The Warrant issued hereunder and

(iv)The Security Agreement, duly executed by the Company and the Collateral Agent.

5.Conditions to Additional Closings of the Lenders. The obligations of any Lender participating in an Additional Closing are subject to the fulfillment, on or prior to the applicable Additional Closing Date, of all of the following conditions, any of which may be waived in whole or in part by the applicable Lender:

(a)Representations and Warranties. The representations and warranties made by the Company in Section 2 shall be true and correct in all material respects on the Closing Date, without obligation by the Company to update such disclosures as of any Additional Closing Date.

(b)Governmental Approvals and Filings. Except for any notices required or permitted to be filed after the Additional Closing Date with certain federal and state securities commissions, the Company shall have obtained all governmental approvals required in connection with the lawful sale and issuance of the Notes and Warrants at such Additional Closing.

(c)Legal Requirements. At the Additional Closing, the sale and issuance by the Company, and the purchase by the Lenders participating in such Additional Closing, of the Notes and Warrants shall be legally permitted by all laws and regulations to which such Lenders or the Company are subject.

(d)Transaction Documents. The Company shall have duly executed and delivered to the Lenders participating in such Additional Closing each Note and each Warrant to be issued at such Additional Closing and shall have delivered to such Lenders fully executed copies, if applicable, of all documents delivered to the Lenders participating in the initial Closing.

6.Conditions to Obligations of the Company. The Company’s obligation to issue and sell the Notes and Warrants at the Closing and at each Additional Closing is subject to the fulfillment, on or prior to the Closing Date or the applicable Additional Closing Date, of the following conditions, any of which may be waived in whole or in part by the Company:

-7-

(a)Representations and Warranties. The representations and warranties made by the applicable Lenders in Section 3 hereof shall be true and correct when made and shall be true and correct on the Closing Date, without obligation to update such disclosures as of any Additional Closing Date.

(b)Governmental Approvals and Filings. Except for any notices required or permitted to be filed after the Closing Date or the applicable Additional Closing Date, as applicable, with certain federal and state securities commissions, the Company shall have obtained all governmental approvals required in connection with the lawful sale and issuance of the Notes and Warrants.

(c)Legal Requirements. At the Closing and at each Additional Closing, the sale and issuance by the Company, and the purchase by the applicable Lenders, of the Notes and Warrants shall be legally permitted by all laws and regulations to which such Lenders or the Company are subject.

(d)Funding. Each Lender shall have delivered to the Company the Purchase Price for its respective Notes.

7.Miscellaneous.

(a)Waivers and Amendments. Any provision of this Agreement, the Warrants, the Notes, and the Security Agreement may be amended, waived or modified only upon the written consent of the Company and the Collateral Agent; provided, however, that no such amendment, waiver or consent shall: (i) reduce the principal amount of any Note without the affected Lender’s written consent, (ii) reduce the rate of interest of any Note without the affected Lender’s written consent, or (iii) reduce the number of shares subject to the Warrant without the affected Lender’s written consent. Any amendment or waiver effected in accordance with this paragraph shall be binding upon all of the parties hereto. Notwithstanding the foregoing, this Agreement may be amended to add a party as a Lender hereunder in connection with Additional Closings without the consent of any other Lender, by delivery to the Company of a counterparty signature page to this Agreement, together with a supplement to Schedule I. Such amendment shall take effect at the Additional Closing and such party shall thereafter be deemed a “Lender” for all purposes hereunder and Schedule I shall be updated to reflect the addition of such Lender.

(b)Governing Law. This Agreement and all actions arising out of or in connection with this Agreement shall be governed by and construed in accordance with the laws of the State of New York, without regard to the conflicts of law provisions of the State of New York or of any other state.

(c)Jurisdiction and Venue. Each of the parties irrevocably consents to the exclusive jurisdiction of, and venue in, the state courts in New York County in the State of New York (or in the event of exclusive federal jurisdiction, the courts of the Eastern District of New York), in connection with any matter based upon or arising out of this Agreement or the matters contemplated herein and agrees that process may be served upon them in any manner authorized by the laws of the State of New York for such persons.

(d)Survival. The representations, warranties, covenants, and agreements made herein shall survive the execution and delivery of this Agreement.

(e)Successors and Assigns. Subject to the restrictions on transfer described in Section 7(f), the rights and obligations of the Company and the Lenders shall be binding upon and benefit the successors, assigns, heirs, administrators and transferees of the parties.

-8-

(f)Registration, Transfer and Replacement of the Notes. The Notes issuable under this Agreement shall be registered notes. The Company will keep, at its principal executive office, books for the registration and registration of transfer of the Notes. Prior to presentation of any Note for registration of transfer, the Company shall treat the Person in whose name such Note is registered as the owner and holder of such Note for all purposes whatsoever, whether or not such Note shall be overdue, and the Company shall not be affected by notice to the contrary. Subject to any restrictions on or conditions to transfer set forth in any Note, the holder of any Note, at its option, may in person or by duly authorized attorney surrender the same for exchange at the Company’s chief executive office, and promptly thereafter and at the Company’s expense, except as provided below, receive in exchange therefor one or more new Note(s), each in the principal requested by such holder, dated the date to which interest shall have been paid on the Note so surrendered or, if no interest shall have yet been so paid, dated the date of the Note so surrendered and registered in the name of such Person or Persons as shall have been designated in writing by such holder or its attorney for the same principal amount as the then unpaid principal amount of the Note so surrendered. Upon receipt by the Company of evidence reasonably satisfactory to it of the ownership of and the loss, theft, destruction or mutilation of any Note and (a) in the case of loss, theft or destruction, of indemnity reasonably satisfactory to it; or (b) in the case of mutilation, upon surrender thereof, the Company, at its expense, will execute and deliver in lieu thereof a new Note executed in the same manner as the Note being replaced, in the same principal amount as the unpaid principal amount of such Note and dated the date to which interest shall have been paid on such Note or, if no interest shall have yet been so paid, dated the date of such Note.

(g)Fees and Expenses. Promptly following the Closing Date, the Company shall pay the reasonable fees and expenses of Lenders’ counsel in an amount not to exceed $10,000 in the aggregate.

(h)Entire Agreement. This Agreement together with the other Transaction Documents and (with respect to particular investors) any management rights letters entered into in connection with the Transaction Documents, constitute and contain the entire agreement among the Company and Lenders and supersede any and all prior agreements, negotiations, correspondence, understandings, and communications among the parties, whether written or oral, respecting the subject matter hereof.

(i)Notices. All notices and other communications required or permitted hereunder shall be in writing and shall be mailed by registered or certified mail, postage prepaid, sent by facsimile or electronic mail (if to a Lender or any other holder of Company securities) or otherwise delivered by hand, messenger or courier service addressed:

(i)if to a Lender, to the Lender’s address, facsimile number or electronic mail address as shown on Schedule I, as may be updated in accordance with the provisions hereof, with a copy (which shall not constitute notice) to the Collateral Agent;

(ii)if to any other holder of any Notes, to such address, facsimile number or electronic mail address as shown in the Company’s records, or, until any such holder so furnishes an address, facsimile number, or electronic mail address to the Company, then to the address, facsimile number, or electronic mail address of the last holder of such Notes for which the Company has contact information in its records; or

(iii)if to the Company, to the attention of the Chief Financial Officer of the Company at ▇▇ ▇▇▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇ or at such other current address as the Company shall have furnished to the Lenders, with a copy (which shall not constitute notice) to the General Counsel of the Company at ▇▇ ▇▇▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇.

-9-

Each such notice or other communication shall for all purposes of this Agreement be treated as effective or having been given (i) if delivered by hand, messenger or courier service, when delivered (or if sent via a nationally-recognized overnight courier service, freight prepaid, specifying next-business-day delivery, one business day after deposit with the courier), or (ii) if sent via mail, at the earlier of its receipt or five days after the same has been deposited in a regularly-maintained receptacle for the deposit of the United States mail, addressed and mailed as aforesaid, or (iii) if sent via facsimile, upon confirmation of facsimile transfer or, if sent via electronic mail, upon confirmation of delivery when directed to the relevant electronic mail address, if sent during normal business hours of the recipient, or if not sent during normal business hours of the recipient, then on the recipient’s next business day.

(j)Conflicts. In the event of any conflict or inconsistency between the provisions of this Agreement and provisions of any other Transaction Document, the provisions of this Agreement shall control.

(k)Separability of Agreements; Severability of this Agreement. The Company’s agreement with each of the Lenders is a separate agreement and the sale of the Notes to each of the Lenders is a separate sale. Unless otherwise expressly provided herein, the rights of each Lender hereunder are several rights, not rights jointly held with any of the other Lenders. Any invalidity, illegality, or limitation on the enforceability of the Agreement or any part thereof, by any Lender whether arising by reason of the law of the respective Lender’s domicile or otherwise, shall in no way affect or impair the validity, legality, or enforceability of this Agreement with respect to other Lenders. If any provision of this Agreement shall be judicially determined to be invalid, illegal, or unenforceable, the validity, legality and enforceability of the remaining provisions shall not in any way be affected or impaired thereby.

(l)Counterparts. This Agreement may be executed in one or more counterparts, each of which will be deemed an original, but all of which together will constitute one and the same agreement. Copies of signed signature pages delivered by facsimile or in electronic (i.e., “pdf” or “tif”) format will be deemed binding originals.

(Signature page follows)

-10-

The parties are signing this Note and Warrant Purchase Agreement as of the date stated in the introductory clause.

| TSU INC. (D/B/A DISPLAY) | |

| a Delaware corporation | |

| | |

| | |

| By: | /s/ ▇▇▇▇ ▇▇▇▇▇▇▇▇ |

| Name: | ▇▇▇▇ ▇▇▇▇▇▇▇▇ |

| Title: | Chief Financial Officer |

(Signature page for Note and Warrant Purchase Agreement)

The parties are signing this Note and Warrant Purchase Agreement as of the date stated in the introductory clause.

| BLACK, INC. | |

| as Collateral Agent | |

| | |

| | |

| By: | /s/ ▇▇▇▇▇ ▇▇▇▇▇▇ |

| Name: | ▇▇▇▇▇ ▇▇▇▇▇▇ |

| Title: | |

(Signature page for Note and Warrant Purchase Agreement)

The parties are signing this Note and Warrant Purchase Agreement as of the date stated in the introductory clause.

|

| LENDER |

| | |

| | |

| | Black, Inc. |

| | (Print investor name) |

| | |

| | |

| | /s/ ▇▇▇▇▇ ▇▇▇▇▇▇ |

| | (Signature) |

| | |

| | |

| | ▇▇▇▇▇ ▇▇▇▇▇▇ |

| | (Print name of signatory, if signing for an entity) |

| | |

| | |

| | |

| | (Print title of signatory, if signing for an entity) |

| | |

| | |

| | |

| | (Date) |

(Signature page for Note and Warrant Purchase Agreement)

The parties are signing this Note and Warrant Purchase Agreement as of the date stated in the introductory clause.

|

| LENDER |

| | |

| | |

| | Team AJ, LLC |

| | (Print investor name) |

| | |

| | |

| | /s/ ▇▇▇▇ ▇▇▇▇▇▇ |

| | (Signature) |

| | |

| | |

| | ▇▇▇▇ ▇▇▇▇▇▇ |

| | (Print name of signatory, if signing for an entity) |

| | |

| | |

| | |

| | (Print title of signatory, if signing for an entity) |

| | |

| | |

| | |

| | (Date) |

The parties are signing this Note and Warrant Purchase Agreement as of the date stated in the introductory clause.

|

| LENDER |

| | |

| | |

| | ▇▇▇▇ ▇▇▇▇▇▇ |

| | (Print investor name) |

| | |

| | |

| | /s/ ▇▇▇▇ ▇▇▇▇▇▇ |

| | (Signature) |

| | |

| | |

| | ▇▇▇▇ ▇▇▇▇▇▇ |

| | (Print name of signatory, if signing for an entity) |

| | |

| | |

| | NA |

| | (Print title of signatory, if signing for an entity) |

| | |

| | |

| | |

| | (Date) |

SCHEDULE I

SCHEDULE OF LENDERS

Name | Address | Principal Amount | Warrant Exercise |

Black, Inc. | ▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇ ▇▇▇, ▇▇▇▇▇▇▇, ▇▇▇▇▇▇▇, ▇▇▇▇▇▇ ▇▇▇ ▇▇▇ ▇▇▇▇▇: LKrauss@terracap.ca Copy to: ▇▇▇▇▇▇@▇▇▇▇▇▇▇▇.▇▇ | $2,000,000.00 | $1.86 |

▇▇▇▇ ▇▇▇▇▇▇ | ▇▇▇ ▇▇▇▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇ ▇▇▇▇▇: ▇▇▇▇.▇▇▇▇▇▇@▇▇▇▇▇.▇▇▇ ▇▇▇▇ to: j@▇▇▇▇▇▇▇▇▇▇▇▇▇.▇▇▇ | $2,000,000.00 | $1.86 |

▇▇▇▇ ▇▇▇▇▇▇ | ▇ ▇▇▇ ▇▇▇▇▇▇ ▇▇▇▇, ▇▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇ ▇▇▇▇▇: ▇▇▇▇▇▇▇▇▇▇@▇▇▇▇▇.▇▇▇ | $250,000.00 | $1.86 |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

Total | | $4,250,000 | |

1 To be calculated based on a $250 million equity valuation and the actual number of outstanding Common Shares of the Company on the date this Agreement is signed.

FORM OF NOTE

THIS NOTE HAS NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR UNDER THE SECURITIES LAWS OF CERTAIN STATES. THESE SECURITIES MAY NOT BE OFFERED, SOLD OR OTHERWISE TRANSFERRED, PLEDGED OR HYPOTHECATED EXCEPT AS PERMITTED UNDER THE SECURITIES ACT AND APPLICABLE STATE SECURITIES LAWS PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT OR AN EXEMPTION THEREFROM. THE ISSUER OF THESE SECURITIES MAY REQUIRE AN OPINION OF COUNSEL REASONABLY SATISFACTORY TO THE ISSUER THAT SUCH OFFER, SALE OR TRANSFER, PLEDGE OR HYPOTHECATION OTHERWISE COMPLIES WITH THE SECURTIES ACT AND ANY APPLICABLE STATE SECURITIES LAWS.

TSU INC. (D/B/A DISPLAY)

SECURED PROMISSORY NOTE

$ _____________________ __, 2021

1.FOR VALUE RECEIVED, tsu Inc. (d/b/a display), a Delaware corporation (the “Company”), promises to pay to _____________, or its registered assigns (“Lender”), in lawful money of the United States of America, the principal sum of ________________ Dollars ($ _________), or such lesser amount as shall equal the outstanding principal amount hereof, together with simple interest from the date of this Secured Promissory Note (this “Note”) on the unpaid principal balance at a rate equal to 12.5% per annum, computed on the basis of the actual number of days elapsed and a year of 365 days. All unpaid principal, together with any then unpaid and accrued interest and other amounts payable hereunder, shall be due and payable on the earlier of (i) twelve (12) months from the date hereof (the “Maturity Date”), or (ii) when, upon the occurrence and during the continuance of an Event of Default, such amounts are declared due and payable by Lender or made automatically due and payable, in each case, in accordance with the terms hereof.

This Note is one of a series of Secured Promissory Notes issued pursuant to a Note Purchase Agreement, dated as of ____ ___, 2021 (as amended, modified, or supplemented, the “Note Purchase Agreement”), by and among the Company and the Lenders (as defined in the Note Purchase Agreement) party thereto and is entitled to the benefits thereof. Capitalized terms used but not otherwise defined herein shall have the meanings assigned to such terms in the Note Purchase Agreement. Lender will be deemed, by its acceptance hereof, to have agreed to the provisions and to have made the representations and warranties set forth in the Note Purchase Agreement.

The following is a statement of the rights of ▇▇▇▇▇▇ and the conditions to which this Note is subject, and to which ▇▇▇▇▇▇, by the acceptance of this Note, agrees:

2.Payments.

(a)Interest. Interest shall accrue from and including the date of this Note to and including the date on which this Note is paid in full. Accrued interest on this Note shall be payable in arrears quarterly on March 30, June 30, September 30 and December 31 of each year, with the first installment of accrued interest being due and payable on November 1, 2021 (if any such date is not a business day, on the next succeeding business day following such date).

(b)Funding Fee. An amount equal to one percent (1%) of the principal amount of this Note payable at maturity or earlier pre-payment.

(c)Voluntary Prepayment. The principal and accrued interest on this Note may be prepaid without penalty at any time.

3.Mandatory Prepayment. The Company shall be required to prepay all principal and accrued interest on this Note, plus a repayment premium equal to the difference between 12.5% of the outstanding principal amount of this Note and the amount of interest actually accrued on this Note through the date of repayment, immediately prior to the consummation of any of the following events: (a) any consolidation or merger of the Company with or into any other corporation or other entity or person, or any other corporate reorganization, other than any such consolidation, merger or reorganization in which the stockholders of the Company immediately prior to such consolidation, merger or reorganization continue to hold at least a majority of the voting power of the surviving entity in substantially the same proportions (or, if the surviving entity is a wholly owned subsidiary, its parent) immediately after such consolidation, merger or reorganization; (b) any transaction or series of related transactions to which the Company is a party in which in excess of 50% of the Company’s voting power is transferred; and (c) the sale of all, or substantially all, the Company’s assets.

▇.▇▇▇▇▇▇ of Default. The occurrence of any of the following shall constitute an “Event of Default” under this Note and the other Notes, the Warrants, the Security Agreement, and the Purchase Agreement (the “Transaction Documents”):

(a)Failure to Pay. The Company shall fail to pay (i) when due any principal payment on the due date hereunder or (ii) any interest payment or other payment required under the terms of this Note or any other Transaction Document on the date due and such payment shall not have been made within five (5) business days of the Company’s receipt of written notice to the Company of such failure to pay;

(b)Breaches of Covenants. The Company shall fail to observe or perform any other covenant, obligation, condition, or agreement contained in this Note or the other Transaction Documents (other than those specified in Section 4(a)) and such failure shall continue for ten (10) business days after the Company’s receipt of written notice to the Company of such failure;

(c)Representations and Warranties. Any representation, warranty, certificate, or other statement (financial or otherwise) made or furnished by or on behalf of the Company to Lender in writing in connection with this Note or any of the other Transaction Documents, or as an inducement to Lender to enter into this Note and the other Transaction Documents, shall be false, incorrect, incomplete, or misleading in any material respect when made or furnished;

(d)Other Payment Obligations. Defaults shall exist under (i) any agreements of the Company with any third party or parties which consists of the failure to pay any indebtedness for borrowed money at maturity or which results in a right by such third party or parties, whether or not exercised, to accelerate the maturity of such indebtedness for borrowed money of the Company, in each case, in an aggregate amount in excess of One Million Dollars ($1,000,000.00) or (ii) any other Note;

(e)Voluntary Bankruptcy or Insolvency Proceedings. The Company (i) shall apply for or consent to the appointment of a receiver, trustee, liquidator, or custodian of itself or of all or a substantial part of its property, (ii) is unable to pay its debts generally as they mature, (iii) make a general assignment for the benefit of its or any of its creditors, (iv) shall be dissolved or liquidated, (v) shall commence a voluntary case or other proceeding seeking liquidation, reorganization, or other relief with respect to itself or its debts under any bankruptcy, insolvency or other similar law now or hereafter in effect or consent to any such relief or to the appointment of or taking possession of its property by any official in an involuntary case or other proceeding commenced against it, (vi) is unable to pay payables as they come due in the ordinary course of business, or (vi) take any action for the purpose of effecting any of the foregoing;

(f)Involuntary Bankruptcy or Insolvency Proceedings. Proceedings for the appointment of a receiver, trustee, liquidator or custodian of the Company, or of all or a substantial part of the property thereof, or an involuntary case or other proceedings seeking liquidation, reorganization or other relief with respect to the Company or any of its subsidiaries, if any, or the debts thereof under any bankruptcy, insolvency or other similar law now or hereafter in effect shall be commenced and an order for relief entered or such proceeding shall not be dismissed or discharged within 60 days of commencement; or

(g)Judgments. A final judgment or order for the payment of money in excess of One Million Dollars ($1,000,000.00) (exclusive of amounts covered by insurance) shall be rendered against the Company and the same shall remain undischarged for a period of 45 days during which execution shall not be effectively stayed, or any judgment, writ, assessment, warrant of attachment, or execution or similar process shall be issued or levied against a substantial part of the property of the Company or any of its subsidiaries, if any and such judgment, writ, or similar process shall not be released, stayed, vacated or otherwise dismissed within 45 days after issue or levy.

5.Rights of Lender upon Default. Upon the occurrence of any Event of Default (other than an Event of Default described in Section 4(e) or 4(f)) and at any time thereafter during the continuance of such Event of Default, Lender may, with the written consent of Black, Inc. as lead lender (the “Lead Lender”), by written notice to the Company, declare all outstanding obligations payable by the Company hereunder to be immediately due and payable without presentment, demand, protest or any other notice of any kind, all of which are hereby expressly waived, anything contained herein or in the other Transaction Documents to the contrary notwithstanding. Upon the occurrence of any Event of Default described in Section 4(e) or 4(f), immediately and without notice, all outstanding obligations payable by the Company hereunder shall automatically become immediately due and payable, without presentment, demand, protest or any other notice of any kind, all of which are hereby expressly waived, anything contained herein or in the other Transaction Documents to the contrary notwithstanding. In addition to the foregoing remedies, upon the occurrence and during the continuance of any Event of Default, Lender may, with the written consent of the Lead Lender, exercise any other right, power or remedy granted to it by the Transaction Documents or otherwise permitted to it by law, either by suit in equity or by action at law, or both.

▇.▇▇▇▇▇▇▇▇. This Note and all obligations of the Company hereunder are secured by a first priority security interest on all assets of the Company including intellectual property (the “Collateral”) as provided for in the Security Agreement, dated as of the date hereof (as amended, restated, modified, or supplemented from time to time, the “Security Agreement”), entered into by and between the Company and the Collateral Agent (as defined in the Security Agreement).

7.Warrants.

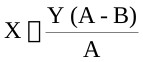

(a)The Lender will receive warrants to acquire that number of common shares of the Company, par value $0.001 (“Common Shares”) having a dollar value equal to fifteen percent (15%) of the principal amount of this Note (the “Warrants”) as set forth in the Warrant to Purchase Common Stock (as amended, restated, modified, or supplemented from time to time, the “Warrant Agreement”), calculated using the following formula: Principal amount of this Note x 15%/$250,000,000 x the number of Common Shares outstanding on the day immediately preceding the date of this Note.

(b)The Warrants will be issued to the Lender concurrently with the execution of this Note, and (i) shall be exercisable until December 31, 2026, (ii) have an exercise price of $1.86 per Warrant share and (iii) have such other terms as provided for in the Warrant Agreement.

8.Miscellaneous.

(a)Successors and Assigns; Transfer of this Note; No Transfers to Bad Actors; Notice of Bad Actor Status.

(i)Subject to the restrictions on transfer described in this Section 8(a), the rights and obligations of the Company and Lender shall be binding upon and benefit the successors, assigns, heirs, administrators, and transferees of the parties.

(ii)With respect to any offer, sale, or other disposition of this Note, Lender will give written notice to the Company prior thereto, describing briefly the manner thereof, together with a written opinion of ▇▇▇▇▇▇’s counsel, or other evidence if reasonably satisfactory to the Company, to the effect that such offer, sale or other distribution may be effected without registration or qualification (under any federal or state law then in effect). Upon receiving such written notice and reasonably satisfactory opinion, if so requested, or other evidence, the Company, as promptly as practicable, shall notify Lender that Lender may sell or otherwise dispose of this Note, all in accordance with the terms of the notice delivered to the Company. If a determination has been made pursuant to this Section 8(a) that the opinion of counsel for ▇▇▇▇▇▇, or other evidence, is not reasonably satisfactory to the Company, the Company shall so notify Lender promptly after such determination has been made. Each Note thus transferred shall bear a legend as to the applicable restrictions on transferability in order to ensure compliance with the Securities Act, unless in the opinion of counsel for the Company such legend is not required in order to ensure compliance with the Securities Act. The Company may issue stop transfer instructions to its transfer agent in connection with such restrictions.

(iii)Subject to Section 8(a)(ii), transfers of this Note shall be registered upon registration books maintained for such purpose by or on behalf of the Company as provided in the Note Purchase Agreement. Prior to presentation of this Note for registration of transfer, the Company shall treat the registered holder hereof as the owner and holder of this Note for the purpose of receiving all payments of principal and interest hereon and for all other purposes whatsoever, whether or not this Note shall be overdue and the Company shall not be affected by notice to the contrary.

(iv)Neither this Note nor any of the rights, interests or obligations hereunder may be assigned, by operation of law or otherwise, in whole or in part, by the Company without the prior written consent of the Lead Lender.

(v)▇▇▇▇▇▇ agrees not to sell, assign, transfer, pledge or otherwise dispose of any securities of the Company, or any beneficial interest therein, to any person (other than the Company) unless and until the proposed transferee confirms to the reasonable satisfaction of the Company that neither the proposed transferee nor any of its directors, executive officers, other officers that may serve as a director or officer of any company in which it invests, general partners or managing members nor any person that would be deemed a beneficial owner of those securities (in accordance with Rule 506(d) under the Securities Act) is subject to any of the “bad actor” disqualifications described in Rule 506(d)(1)(i) through (viii) under the Securities Act, except as set forth in Rule 506(d)(2)(ii) or (iii) or (d)(3) under the Securities Act and disclosed, reasonably in advance of the transfer, in writing in reasonable detail to the Company. ▇▇▇▇▇▇ will promptly notify the Company in writing if Lender or, to ▇▇▇▇▇▇’s knowledge, any person specified in Rule 506(d)(1) under the Securities Act becomes subject to any of the “bad actor” disqualifications described in Rule 506(d)(1)(i) through (viii) under the Securities Act.

(b)Waiver and Amendment. Any provision of this Note may be amended, waived, or modified upon the written consent of the Company and the Lead Lender; provided, however, that no such amendment, waiver or consent shall: (i) reduce the principal amount of this Note without ▇▇▇▇▇▇’s written consent, or (ii) reduce the rate of interest of this Note without ▇▇▇▇▇▇’s written consent.

(c)Notices. All notices and other communications required or permitted hereunder shall be in writing and shall be mailed by registered or certified mail, postage prepaid, sent by facsimile or electronic mail (if to Lender) or otherwise delivered by hand, messenger or courier service addressed:

(i)if to Lender, to ▇▇▇▇▇▇’s address, facsimile number or electronic mail address as shown on Schedule I to the Note Purchase Agreement, as may be updated in accordance with the provisions hereof, or, until such holder so furnishes an address, facsimile number, or electronic mail address to the Company, then to the address, facsimile number, or electronic mail address of the last holder of this Note for which the Company has contact information in its records; or

(ii)if to the Company, to the attention of the Chief Financial Officer of the Company at ▇▇ ▇▇▇▇▇ ▇▇▇▇▇ ▇▇▇▇▇▇, ▇▇▇▇▇▇▇, ▇▇ ▇▇▇▇▇ or at such other current address as the Company shall have furnished to Lender, with a copy (which shall not constitute notice) to General Counsel of the Company the same address.

Each such notice or other communication shall for all purposes of this Note be treated as effective or having been given (i) if delivered by hand, messenger or courier service, when delivered (or if sent via a nationally-recognized overnight courier service, freight prepaid, specifying next-business-day delivery, one business day after deposit with the courier), or (ii) if sent via mail, at the earlier of its receipt or five days after the same has been deposited in a regularly-maintained receptacle for the deposit of the United States mail, addressed and mailed as aforesaid, or (iii) if sent via facsimile, upon confirmation of facsimile transfer or, if sent via electronic mail, upon confirmation of delivery when directed to the relevant electronic mail address, if sent during normal business hours of the recipient, or if not sent during normal business hours of the recipient, then on the recipient’s next business day. In the event of any conflict between the Company’s books and records and this Note or any notice delivered hereunder, the Company’s books and records will control absent fraud or error.

(d)Pari Passu Notes. ▇▇▇▇▇▇ acknowledges and agrees that the payment of all or any portion of the outstanding principal amount of this Note and all interest hereon shall be pari passu in right of payment and in all other respects to any other Notes issued as part of this series of Notes pursuant to the Note Purchase Agreement.

(e)Payment. Payment shall be made in lawful tender of the United States.

(f)Usury. In the event any interest is paid on this Note which is deemed to be in excess of the then legal maximum rate, then that portion of the interest payment representing an amount in excess of the then legal maximum rate shall be deemed a payment of principal and applied against the principal of this Note.

(g)Waivers. The Company hereby waives notice of default, presentment or demand for payment, protest or notice of nonpayment or dishonor and all other notices or demands relative to this instrument.

(h)Governing Law. This Note and all actions arising out of or in connection with this Note shall be governed by and construed in accordance with the laws of the State of New York without regard to the conflicts of law provisions of the State of New York, or of any other state.

(i)Jurisdiction and Venue. Each of Lender and the Company irrevocably consents to the exclusive jurisdiction of, and venue in, the state courts in New York County in the State of New York (or in the event of exclusive federal jurisdiction, the courts of the Eastern District of New York), in connection with any matter based upon or arising out of this Note or the matters contemplated herein, and agrees that process may be served upon them in any manner authorized by the laws of the State of New York for such persons.

The Company has caused this Note to be issued as of the date first written above.

tsu Inc. (d/b/a display)

| a Delaware corporation | |

| | |

| By: | |

| Name: | |

| Title: | |

Exhibit B

FORM OF SECURITY AGREEMENT

SECURITY AGREEMENT

This SECURITY AGREEMENT, dated as of June ___, 2021 (as amended, supplemented, or otherwise modified from time to time in accordance with the provisions hereof, this “Agreement”), made by and among tsu Inc. (d/b/a display), a Delaware corporation (the “Grantor”), in favor of Black, Inc., a Ontario corporation, as collateral agent (the “Collateral Agent”) for the Lenders party to that certain Note and Warrant Purchase Agreement dated as of the date hereof (the “Purchase Agreement”), pursuant to which the Grantor has agreed to issue up to $ ________ in principal amount of Secured Promissory Notes (collectively, the “Notes”), and other holders of the Notes, (collectively, the “Lenders” and each, a “Lender”).

WHEREAS, the Grantor, the Lenders party thereto and the Collateral Agent have entered into that certain Note and Warrant Purchase Agreement dated as of the date hereof (the “Purchase Agreement”), pursuant to which the Grantor has agreed to issue up to $ ________ in principal amount of Secured Promissory Notes (collectively, the “Notes”). Capitalized terms used but not otherwise defined herein shall have the meanings assigned to such terms in the Purchase Agreement;

WHEREAS, to induce the Lenders to make the financial accommodations provided to the Grantor pursuant to each Note, the Grantor has agreed to secure the performance of the Grantor’s obligations under the Notes and the Purchase Agreement, and the Company desires to pledge, grant, transfer and assign to the Collateral Agent for the benefit of the Lenders a security interest in the Collateral (as defined below) to secure the Secured Obligations (as defined below), as provided herein.

NOW, THEREFORE, in consideration of the mutual covenants, terms, and conditions set forth herein, and for other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

1.Definitions.

(a)Unless otherwise specified herein, all references to Sections and Schedules herein are to Sections and Schedules of this Agreement.

(b)Unless otherwise defined herein, terms used herein that are defined in the UCC shall have the meanings assigned to them in the UCC. However, if a term is defined in Article 9 of the UCC differently than in another Article of the UCC, the term has the meaning specified in Article 9.

(c)For purposes of this Agreement, the following terms shall have the following meanings:

“Collateral” has the meaning set forth in Section 2.

“Event of Default” has the meaning set forth in the Note.

“Proceeds” means “proceeds” as such term is defined in section 9-102 of the UCC and, in any event, shall include, without limitation, all dividends or other income from the Collateral, collections thereon, or distributions with respect thereto.

“Secured Obligations” has the meaning set forth in Section 2.(a).

“UCC” means the Uniform Commercial Code as in effect from time to time in the [State of California] or, when the laws of any other state govern the method or manner of the perfection or

enforcement of any security interest in any of the Collateral, the Uniform Commercial Code as in effect from time to time in such state.

2.Grant of Security Interest. The Grantor hereby pledges and grants to the Collateral Agent for the benefit of the Lenders, and hereby creates a continuing lien and security interest in favor of the Collateral agent for the benefit of the Lenders in and to all of its right, title, and interest in and to the following, wherever located, whether now existing or hereafter from time to time arising or acquired (collectively, the “Collateral”):

(a)All “accounts,” as that term is defined in Article 9 of the UCC, including, without limitation, every right to payment for goods or other property of any kind sold or leased or for services rendered or for any other transaction, whether or not the right to payment has been earned by performance, and including, without limitation, every account receivable, all purchase orders, all interest in goods the sale or lease of which gives rise to the right to payment (including returned or repossessed goods and unpaid seller’s rights), and the rights pertaining to such goods, including the right to stoppage in transit, every right to payment under any contract, and every lien, guaranty, or security interest that secures a right to payment for any of the foregoing (“Accounts”);

(b)All code, code repositories, software and applications operating and comprising the display social media app, and all property rights embedded in the software, if any, such as inventions, discoveries, improvements, ideas, trade secrets, know-how or confidential information;

(c)All patents, trademarks, copyrights, domain names, web addresses and other intellectual property.

(d)All chattel paper, consisting of a writing or writings evidencing both a monetary obligation and a security interest in or lease of goods, together with any guarantees, letters of credit, and other security therefore (“Chattel Paper”);

(e)All “deposit accounts,” as defined in the UCC (“Deposit Accounts”);

(f)All “inventory” of whatever kind, as that term is used in the UCC, including, without limitation, all goods held by the Grantor for sale or lease, goods furnished or to be furnished under a contract for service, and supplies, packaging, raw materials, goods in transit, work-in-process, and materials used or consumed or to be used or consumed in the Grantor’s business, or in the processing, packaging, or shipping of same, all finished goods, and all property, the sale or lease of which has given rise to Accounts, Chattel Paper, or Instruments, and that has been returned to the Grantor or repossessed by the Grantor or stopped in transit, and all warranties and related claims, credits, setoffs, and other rights of recovery with respect to any of the foregoing (“Inventory”);

(g)All “equipment,” as that term is used in the UCC, including, without limitation, all equipment, machinery, and other property held for use in or purchased for the Grantor’s business, together with all increases, parts, fittings, accessories, repair equipment, and special tools now or later affixed to, or used in connection with, that property, all transferable rights of the Grantor to the licenses and warranties (express and implied) received from the sellers and manufacturers of the foregoing property, all related claims, credits, setoffs, and other rights of recovery (in each case, excluding any equipment that is subject to a lien or security interest by a third party as of the date of this Agreement) (“Equipment”);

(h)All “instruments,” including, without limitation, every instrument of any kind, as that term is used in the UCC, and includes every promissory note, negotiable instrument, certificated security, or other writing that evidences a right to payment of money, that is not a lease or security agreement, and that is transferred in the ordinary course of business by delivery with any necessary assignment or indorsement (“Instruments”);

9

(i)“Investment property,” as that term is defined in the UCC (“Investment Property”);

(j)All documents, including, without limitation, any paper that is treated in the regular course of business as adequate evidence that the person in possession of the paper is entitled to receive, hold, and dispose of the goods the paper covers, including warehouse receipts, bills of lading, certificates of title, and applications for certificates of title;

(k)All “general intangibles” of any kind, as that term is used in the UCC, and includes without limitation all intangible personal property other than Accounts, Documents, Instruments and Chattel Paper, and includes, without limitation, money, contract rights, corporate or other business records, deposit accounts, inventions, designs, formulas, patents, service marks, trademarks, trade names, trade secrets, engineering drawings, goodwill, rights to prepaid expenses, registrations, franchises, copyrights, licenses, customer lists, computer programs and other software, source code, tax refund claims, royalty, licensing and product rights, all claims under guarantees, security interests or other security held by or granted to the Grantor to secure payment of any of the Accounts by an Account Debtor, all indemnification rights, and rights to retrieval from third parties of electronically processed and recorded data pertaining to any Collateral, things in action, items, checks, drafts, and orders in transit to or from the Grantor, credits or deposits of the Grantor (whether general or special) that are held by the Collateral Agent (“General Intangibles”);

(l)“Supporting obligations,” as that term is defined in the UCC (“Supporting Obligations”); and

(m)To the extent not listed above in clauses (a)-(l), (i) all other assets of the Company, whether tangible or intangible, and (ii) proceeds and products of the foregoing.

Notwithstanding anything to the contrary in the foregoing, the term “Collateral” shall not include any equipment that is subject to a lien or security interest by a third party as of the date of this Agreement.

3.Secured Obligations. The Collateral secures the due and prompt payment and performance of:

(a)the obligations of the Grantor from time to time arising under the Note, this Agreement, or otherwise with respect to the due and prompt payment of (i) the principal of and premium, if any, and interest on the Note (including interest accruing during the pendency of any bankruptcy, insolvency, receivership, or other similar proceeding, regardless of whether allowed or allowable in such proceeding), when and as due, whether at maturity, by acceleration, upon one or more dates set for prepayment, or otherwise and (ii) all other monetary obligations, including fees, costs, attorneys’ fees and disbursements, reimbursement obligations, contract causes of action, expenses, and indemnities, whether primary, secondary, direct or indirect, absolute or contingent, due or to become due, now existing or hereafter arising, fixed or otherwise (including monetary obligations incurred during the pendency of any bankruptcy, insolvency, receivership, or other similar proceeding, regardless of whether allowed or allowable in such proceeding), of the Grantor under or in respect of the Note and this Agreement; and

(b)all other covenants, duties, debts, obligations, and liabilities of any kind of the Grantor under or in respect of the Note, this Agreement, or any other document made, delivered, or given in connection with any of the foregoing, in each case whether evidenced by a note or other writing, whether allowed in any bankruptcy, insolvency, receivership, or other similar proceeding, whether arising from an extension of credit, issuance of a letter of credit, acceptance, loan, guaranty, indemnification, or otherwise, and whether primary, secondary, direct or indirect, absolute or contingent, due or to become due, now existing or hereafter arising, fixed or otherwise (all such obligations, covenants, duties, debts, liabilities, sums, and expenses set forth in this Section 2 being herein collectively called the “Secured Obligations”).

10

4.Perfection of Security Interest and Further Assurances.

(a)The Grantor shall, from time to time, as may be required by the Collateral Agent with respect to all Collateral, take all actions as may be requested by the Collateral Agent to perfect the security interest of the Collateral Agent, for the benefit of the Lenders, in the Collateral, at the sole cost and expense of the Grantor.

(b)The Grantor hereby irrevocably authorizes the Collateral Agent at any time and from time to time to file in any relevant jurisdiction any financing statements and amendments thereto that contain the information required by Article 9 of the UCC of each applicable jurisdiction for the filing of any financing statement or amendment relating to the Collateral, including any financing or continuation statements or other documents for the purpose of perfecting, confirming, continuing, enforcing, or protecting the security interest granted by the Grantor hereunder, without the signature of the Grantor where permitted by law, including the filing of a financing statement describing the Collateral as all assets now owned or hereafter acquired by the Grantor, or words of similar effect. The Grantor agrees to provide all information required by the Collateral Agent pursuant to this Section promptly to the Collateral Agent request.

(c)The Grantor agrees that at any time and from time to time, at the expense of the Grantor, the Grantor will promptly execute and deliver all further instruments and documents, obtain such agreements from third parties, and take all further action, that may be necessary or desirable, or that the Collateral Agent may reasonably request, in order to create and/or maintain the validity, perfection, or priority of and protect any security interest granted or purported to be granted hereby or to enable the Collateral Agent, for the benefit of the Lenders, to exercise and enforce its rights and remedies hereunder or under any other agreement with respect to any Collateral.

5.Representations and Warranties. The Grantor represents and warrants as follows:

(a)At the time the Collateral becomes subject to the lien and security interest created by this Agreement, the Grantor will be the sole, direct, legal, and beneficial owner thereof, free and clear of any lien, security interest, encumbrance, claim, option, or right of others except for the security interest created by this Agreement and other liens permitted by the Notes.

(b)The pledge of the Collateral pursuant to this Agreement creates a valid and perfected first priority security interest in the Collateral, securing the payment and performance when due of the Secured Obligations.

(c)It has power and authority to pledge the Collateral pursuant to this Agreement.

(d)Each of this Agreement and the Note has been duly authorized, executed, and delivered by the Grantor and constitutes a legal, valid, and binding obligation of the Grantor enforceable in accordance with its terms, except as limited by bankruptcy, insolvency or other laws of general application relating to or affecting the enforcement of creditors’ rights generally and general principles of equity.

(e)No authorization, approval, or other action by, and no notice to or filing with, any governmental authority or regulatory body is required for the pledge by the Grantor of the Collateral pursuant to this Agreement or for the execution and delivery of the Note and this Agreement by the Grantor or the performance by the Grantor of its obligations thereunder.

(f)The execution and delivery of the Note and this Agreement by the Grantor and the performance by the Grantor of its obligations thereunder, will not violate the Grantor’s certificate of incorporation or bylaws or, to the Grantor’s knowledge, any material judgment, order, writ, decree, statute, rule or regulation applicable to the Grantor.

11

6.Receivables. If any Event of Default shall have occurred and be continuing, the Collateral Agent may, or at the request and option of the Collateral Agent the Grantor shall, upon three (3) business days’ notice to Grantor, notify account debtors and other persons obligated on any of the Collateral of the security interest of the Collateral Agent, on behalf of the Lenders, in any account, chattel paper, general intangible, instrument, or other Collateral and that payment thereof is to be made directly to the Collateral Agent.

7.Covenants. The Grantor covenants as follows:

(a)The Grantor will not, without providing at least ten (10) days’ prior written notice to the Collateral Agent, change its legal name, identity, type of organization, jurisdiction of organization, corporate structure, location of its chief executive office or its principal place of business, or its organizational identification number. The Grantor will, prior to any change described in the preceding sentence, take all actions reasonably requested by the Collateral Agent to maintain the perfection and priority of the Collateral Agent’s security interest (for the benefit of the Lenders) in the Collateral.

(b)The Grantor shall, at its own cost and expense, defend title to the Collateral and the first priority lien and security interest of the Collateral Agent, for the benefit of the Lenders, therein against the claim of any person claiming against or through the Grantor and (i) shall maintain and preserve such perfected first priority security interest for so long as this Agreement shall remain in effect, (ii) shall not take any action, or omit to take an action, that would adversely affect such first priority lien and security interest of the Collateral Agent.

(c)The Grantor will not sell, offer to sell, dispose of, convey, assign or otherwise transfer, grant any option with respect to, restrict, or grant, create, permit, or suffer to exist any mortgage, pledge, lien, security interest, option, right of first offer, encumbrance, or other restriction or limitation of any nature whatsoever on, any of the Collateral or any interest therein except as expressly provided for herein or with the prior written consent of the Collateral Agent.

8.Collateral Agent Appointed Attorney-in-Fact. The Grantor hereby appoints the Collateral Agent as the Grantor’s attorney-in-fact, with full authority in the place and stead of the Grantor and in the name of the Grantor or otherwise, from time to time during the continuance of an Event of Default in the Collateral Agent’s discretion to take any action and to execute any instrument which the Collateral Agent may deem necessary or advisable to accomplish the purposes of this Agreement (but the Collateral Agent shall not be obligated to and shall have no liability to the Grantor or any third party for failure to do so or take action). This appointment, being coupled with an interest, shall be irrevocable. The Grantor hereby ratifies all that said attorneys shall lawfully do or cause to be done by virtue hereof.

9.Collateral Agent May Perform. If the Grantor fails to perform any obligation contained in this Agreement, the Collateral Agent may itself perform, or cause performance of, such obligation, and the expenses of the Collateral Agent incurred in connection therewith shall be payable by the Grantor; provided that the Collateral Agent shall not be required to perform or discharge any obligation of the Grantor.