SEPARATION AND DISTRIBUTION AGREEMENT

Exhibit 2.1

THIS SEPARATION AND DISTRIBUTION AGREEMENT (the “Agreement”) is made and entered into as of the _____ day of ________ 2011, by and between Fonix Corporation, a Delaware corporation (“Parent”), and SpeechFX, a Delaware corporation and wholly-owned subsidiary of Parent (“Subsidiary”) (each, a “Party,” and collectively, the “Parties”)

R E C I T A L S

A. The Board of Directors of Parent has determined that it is in the best interests of Parent and its stockholders to separate its speech recognition, text-to-speech, and related technology assets and related business interests currently held by Subsidiary through a tax-free spin-off transaction (the “Separation”);

B. In order to effect the Separation, the Board of Directors of Parent has determined that it is in the best interests of Parent and its stockholders to distribute to Parent’s stockholders, on an as-converted and pro rata basis on terms contained in this Agreement, all of the Subsidiary Common Stock (the “Distribution”);

C. After the Distribution, Parent will not hold any shares of Subsidiary Common Stock;

D. In connection with the Distribution, Subsidiary will assume certain liabilities and obligations of Parent;

E. The Parties intend in this Agreement to set forth the principal corporate arrangements between the Parties with respect to the Separation and the Distribution;

NOW, THEREFORE, in consideration of the foregoing and the terms, conditions, covenants and provisions of this Agreement, the Parties agree as follows:

ARTICLE 1

DEFINITIONS

Section 1.1. General. As used in this Agreement, the following capitalized terms shall have the following meanings:

“Action” means any demand, action, suit, countersuit, arbitration, inquiry, proceeding or investigation by or before any federal, state, local, foreign or international Governmental Authority or any arbitration or mediation tribunal.

“Affiliate” means, when used with respect to a specified Person, a Person that directly or indirectly, through one or more intermediaries, controls, is controlled by or is under common control with such specified Person, including, without limitation, a General Subsidiary (as defined below). As used herein, “control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management and policies of such Person, whether through ownership of voting securities or other interests, by contract or otherwise.

“Agent” shall have the meaning set forth in Section 3.2(a).

“Ancillary Agreements” means all of the agreements, instruments, assignments or other arrangements entered into in connection with the transactions contemplated hereby.

1

“Assets” means assets, properties, claims and rights (including goodwill), wherever located (including in the possession of vendors or other Third Parties or elsewhere on behalf of the owner), of every kind, character and description, whether real, personal or mixed, tangible, intangible or contingent, in each case whether or not recorded or reflected or required to be recorded or reflected on the records or financial statements of any Person.

“Assumed Liabilities” means only those certain existing Liabilities of Parent described and listed in Schedule 2.2(a) attached to this Agreement and by this reference incorporated herein. The Assumed Liabilities include certain Liabilities of Parent identified in Schedule 2.2(a) that will be assumed by Subsidiary, as of the Distribution Date, but which may be compromised or settled by Subsidiary (for itself or on behalf of Parent) (the “Settled Liabilities”), pursuant to settlement and waiver agreements entered into with creditors of Parent or Subsidiary.

“Combined Books and Records” shall have the meaning set forth in Section 5.1(c).

“Commission” means the United States Securities and Exchange Commission or any successor agency thereto.

“Consents” means any consents, waivers or approvals from, or notification requirements to any Third Parties.

“Contract” means any contract, obligation, indenture, agreement, lease, purchase order, commitment, permit, license, note, bond, mortgage, arrangement or undertaking (whether written or oral and whether express or implied) that is legally binding on any Person or any part of its property under applicable Law, but excluding this Agreement and any Ancillary Agreement save as otherwise expressly provided in this Agreement or any Ancillary Agreement.

“Distribution” shall have the meaning set forth in the recitals hereto.

“Distribution Date” means the date upon which the Distribution shall be effective, as determined by the Board of Directors of Parent.

“Effective Time” means 11:59 p.m. Eastern Daylight Time on the Distribution Date at which time the Distribution is effective.

“Exchange Act” means the Securities Exchange Act of 1934, as amended, and the rules and regulations of the Commission thereunder, all as the same shall be in effect at the time that reference is made thereto.

“Form 10” means the registration statement on Form 10 under the Exchange Act filed by Subsidiary with the Commission relating to the Subsidiary Common Stock, as amended from time to time.

“General Subsidiary” means any corporation or other organization of which at least a majority of the securities or interests have voting power to elect at least a majority of the board of directors or others performing similar functions with respect to such corporation or other organization is directly or indirectly owned or controlled by a Person.

“Governmental Approvals” means any notices, reports or other filings to be made, or any consents, registrations, approvals, permits or authorizations to be obtained from, any Governmental Authority.

2

“Governmental Authority” means any federal, state, local, foreign or international court, government department, commission, board, bureau, agency, official or other regulatory, administrative or governmental authority.

“Indemnifying Party” shall have the meaning set forth in Section 4.5(c).

“Indemnitee” shall have the meaning set forth in Section 4.5(c).

“Information” means information, whether or not patentable or copyrightable, in written, oral, electronic or other tangible or intangible forms, stored in any medium, including without limitation, studies, reports, records, books, contracts, instruments, surveys, discoveries, ideas, concepts, know-how, techniques, designs, specifications, drawings, blueprints, diagrams, models, prototypes, samples, flow charts, data, computer data, disks, diskettes, tapes, computer programs or other software, marketing plans, customer names, communications by or to attorneys (including attorney-client privileged communications), memos and other materials prepared by attorneys or under their direction (including attorney work product), communications and materials otherwise related to or made or prepared in connection with or in preparation for any legal proceeding, and other technical, financial, employee or business information or data.

“Intellectual Property” means all intellectual property and industrial property rights of any kind or nature, including all United States and foreign (i) patents, patent applications, patent disclosures, and all related continuations, continuations-in-part, divisionals, reissues, re-examinations, substitutions and extensions thereof, (ii) trademarks and all goodwill associated therewith, (iii) copyrights and copyrightable subject matter, whether statutory or common law, registered or unregistered and published or unpublished, (iv) rights of publicity, (v) moral rights and rights of attribution and integrity, (vi) rights in Software, (vii) trade secrets and all other confidential and proprietary information, know-how, inventions, improvements, processes, formulae, models and methodologies, (viii) rights to personal information, (ix) telephone numbers and internet protocol addresses, (x) applications and registrations for the foregoing, and (xi) rights and remedies against past, present, and future infringement, misappropriation, or other violation of the foregoing.

“Law” means any federal, national, state, provincial, local or similar statute, law, ordinance, regulation, rule, code, order, requirement or rule of law (including common law).

“Liabilities” means any and all debts, liabilities, and obligations, whether accrued or fixed, known or unknown, absolute or contingent, matured or unmatured, reserved or unreserved of any kind or nature whatsoever.

“Operations Data” shall have the meaning set forth in Section 5.2.

“Parent Books and Records” shall have the meaning set forth in Section 5.1(b).

“Parent Business” means all of the business and operations of Parent and its General Subsidiaries, other than the Subsidiary Business.

“Parent Common Stock” means the Class A Common Stock, $0.0001 par value per share, of Parent.

“Parent Common Stock Equivalents” means shares of Parent Common Stock receivable by holders of any shares of Parent Preferred Stock issued and outstanding prior to the Distribution Date, assuming full conversion of such shares of Parent Preferred Stock by their terms.

3

“Parent Liabilities” means the Liabilities of Parent, excluding the Assumed Liabilities. For the avoidance of doubt, Parent Liabilities shall not include any Assumed Liabilities or Subsidiary Liabilities.

“Parent Preferred Stock” means any of the shares of the following preferred classes or series of capital stock of Parent, which by their terms are convertible into shares of Parent Common Stock, and which represent all classes or series of preferred stock of Parent currently issued and outstanding, or issued and outstanding prior to the Record Date:

Series A

Series L

Series M

Series N

Series P

Series O

“Party” shall have the meaning set forth in the preamble hereof.

“Person” means any natural person, firm, individual, corporation, business trust, joint venture, association, company, limited liability company, partnership or other organization or entity, whether incorporated or unincorporated, or any governmental entity.

“Record Date” means the close of business on ______________, 2011, the date determined by the Parent Board of Directors as the record date for the Distribution.

“Separation” shall have the meaning set forth in the recitals hereto.

“Software” means all computer programs (whether in source code, object code or other form), algorithms, databases and data, and technology supporting the foregoing, and all documentation, including flowcharts and other logic and design diagrams, technical, functional and other specifications, and user manuals and training materials related to any of the foregoing.

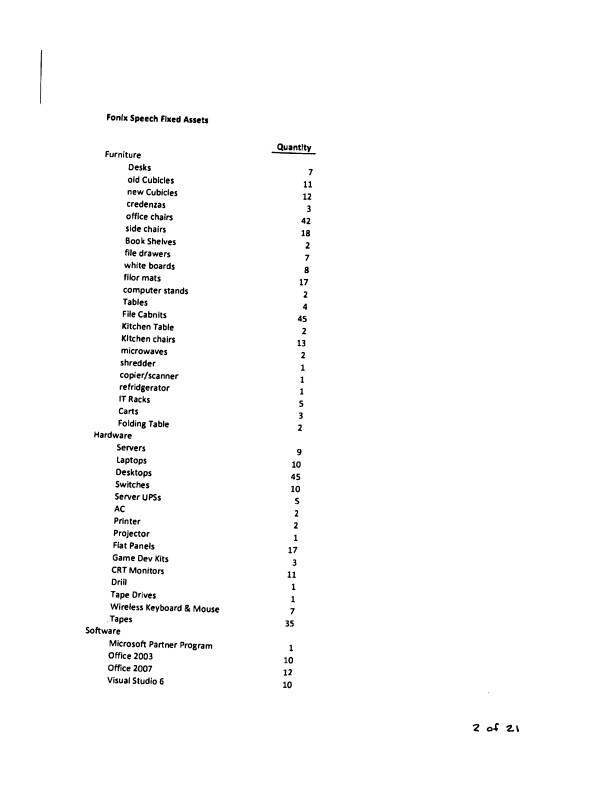

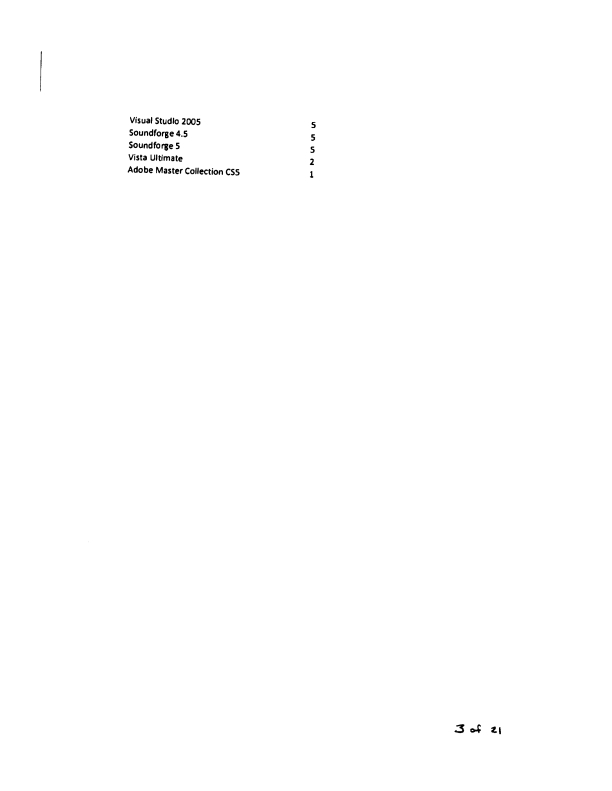

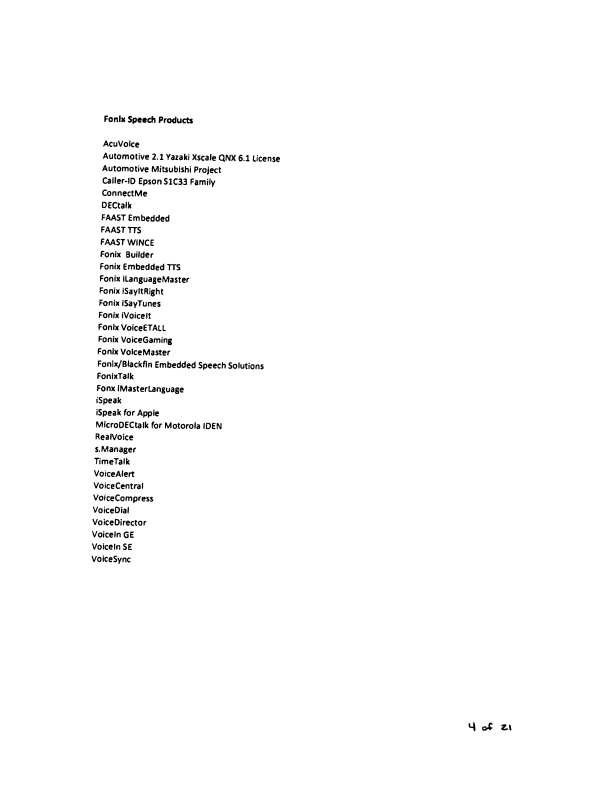

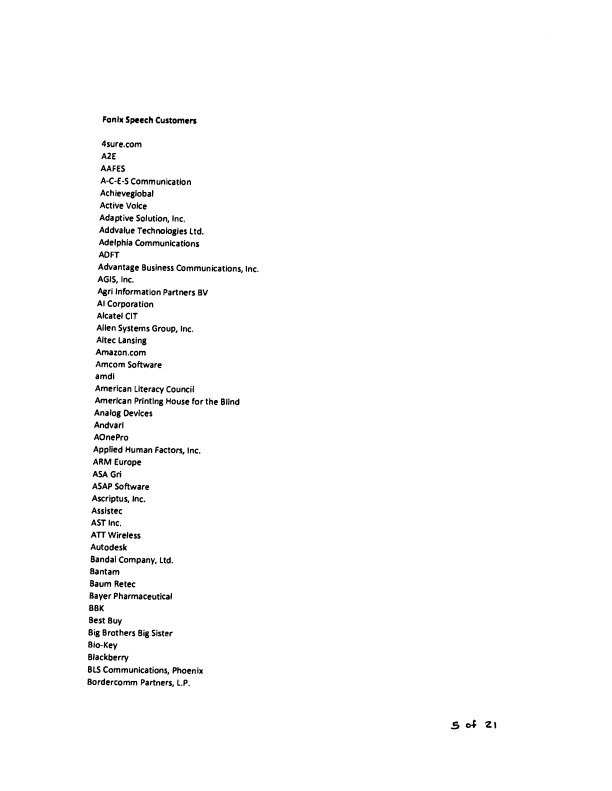

“Subsidiary Assets” means (a) any and all Assets expressly set forth on Schedule 2.1(a) hereto under the caption “Subsidiary Assets,” (b) any and all Assets previously transferred or intended to be transferred from Parent to Subsidiary pursuant to that certain Contribution Agreement dated February 3, 2006 by and between Parent and Subsidiary, (c) any and all Assets reflected in the Subsidiary Balance Sheet, and any and all Intellectual Property used primarily in the Subsidiary Business, which have not been disposed of or removed from the Subsidiary Balance Sheet between the date of the Subsidiary Balance Sheet and the Distribution Date, and (d) any and all Assets acquired by Subsidiary (or Parent on behalf of Subsidiary) after the date of the Subsidiary Balance Sheet that would be reflected in the balance sheet of Subsidiary as of the Distribution Date, if such balance sheet was prepared by Subsidiary in accordance with the same accounting principles under which the Subsidiary Balance Sheet was prepared.

“Subsidiary Balance Sheet” means the unaudited balance sheet of Subsidiary as of March 31, 2011 included in the Form 10 and attached hereto as Schedule 1.1(a).

“Subsidiary Books and Records” shall have the meaning set forth in Section 5.1(a).

“Subsidiary Business” means all of the business and operations of the Fonix Speech technology business of Subsidiary as described in the Form 10.

4

“Subsidiary Common Stock” means the Common Stock, $0.0001 par value per share, of Subsidiary.

“Subsidiary Liabilities” means (a) any and all Liabilities reflected in the Subsidiary Balance Sheet, (b) any and all Liabilities resulting from or accrued in the operation of the Subsidiary Business after the date of the Subsidiary Balance Sheet that would be reflected in the balance sheet of Subsidiary as of the Distribution Date if such balance sheet was prepared by Subsidiary in accordance with the same accounting principles under which the Subsidiary Balance Sheet was prepared, (c) any and all Liabilities asserted before or after the Distribution Date relating to, arising out of, or resulting from any Subsidiary Asset(s) or the operation of the Subsidiary Business or any other business conducted by Subsidiary or any Affiliate of Subsidiary after the Distribution Date, (d) any and all other Liabilities of Subsidiary relating to, arising out of or resulting from Subsidiary’s performance or obligations under any Ancillary Agreement or this Agreement, and (e) any and all Liabilities that are expressly contemplated by this Agreement or any Ancillary Agreement to be transferred to Subsidiary, including the Assumed Liabilities.

“Subsidiary Preferred Stock” means any of the 1,000 shares of the Series B Convertible Preferred Stock of Subsidiary issued by Subsidiary to Sovereign Partners, LP, pursuant to that certain Securities Purchase Agreement dated April 4, 2007 by and among Subsidiary, Parent, and Sovereign Partners, LP.

“Third Party” means any Person other than Parent, Subsidiary or Affiliate thereof.

“Third Party Claim” shall have the meaning set forth in Section 4.5(c).

“Transfer” shall have the meaning set forth in Section 2.1(a).

Section 1.2. References; Interpretation. References in this Agreement to the singular shall include the plural and vice versa and words of one gender shall include the other gender as the context requires. The terms “hereof,” “herein,” and “herewith” and words of similar import shall, unless otherwise stated, be construed to refer to this Agreement as a whole (including all of the Schedules and Exhibits hereto) and not to any particular provision of this Agreement. Article, Section, Exhibit and Schedule references are to the Articles, Sections, Exhibits and Schedules to this Agreement unless otherwise specified. The word “including” and words of similar import when used in this Agreement (or the applicable Ancillary Agreement) means “including, without limitation,” unless the context otherwise requires or unless otherwise specified. The word “or” shall not be exclusive.

ARTICLE 2

THE SEPARATION

Section 2.1. Subsidiary Assets.

(a) As of the date hereof, and immediately prior to the Effective Time, Subsidiary shall retain all Subsidiary Assets, as defined in Section 1.1 above. Subsidiary Assets shall include, but not be limited to, those assets set forth in Schedule 2.1(a) attached hereto and by this reference made a part hereof. To the extent any of the Subsidiary Assets are currently held in the name of Parent, as of the date hereof, and immediately prior to the Effective Time, Parent hereby transfers, contributes, assigns, distributes and conveys to Subsidiary all of Parent’s right, title and interest, if any, in and to the Subsidiary Assets (the “Transfer”). Subsidiary hereby accepts any such Transfer from Parent, effective concurrently therewith.

(b) If at any time (whether prior to or after the Effective Time) either Party hereto shall receive or otherwise possess an Asset that is allocated to any other Person pursuant to this Agreement or any Ancillary Agreement, such Party shall promptly transfer or cause to be transferred, at such Party’s expense, for no additional consideration, such Asset, including any and all economic benefits generated from such Asset after the Effective Time, to such Party hereto.

5

(c) In furtherance of the Transfer, and simultaneously with the execution and delivery of this Agreement, Parent shall execute and deliver, and shall cause its Affiliates to execute and deliver, such bills of sale, stock powers, certificates of title, assignments of contracts and other instruments of transfer, conveyance and assignment as and to the extent necessary to evidence the Transfer.

Section 2.2. Assignment and Assumption of Certain Liabilities.

(a) As of the date hereof and with effect immediately prior to the Effective Time, Parent hereby transfers, contributes, assigns, and conveys to Subsidiary the Assumed Liabilities, including the Settled Liabilities, as set forth in Schedule 2.2(a). Subsidiary hereby accepts and assumes liability and responsibility for the Assumed Liabilities, including the Settled Liabilities. It is anticipated that the Settled Liabilities will be compromised or settled by Subsidiary (for itself or on behalf of Parent) pursuant to settlement and waiver agreements entered into with creditors of Parent or Subsidiary, also effective at the Effective Time.

(b) Except as otherwise specifically set forth in this Agreement or any Ancillary Agreement, Subsidiary shall not accept, assume or be responsible for any Parent Liabilities incurred by Parent prior to or after the Distribution Date.

Section 2.3. Governmental Approvals; Waivers or Consents.

(a) To the extent that the Separation requires any Governmental Approvals, Waivers, or Consents, the Parties shall use commercially reasonable efforts to obtain any such Governmental Approvals, Waivers, or Consents. No Party shall be obligated to pay any consideration to any Third Party from whom any such Waiver or Consent is requested.

(b) If the transfer of any Subsidiary Assets intended to be transferred hereunder is not consummated prior to the Effective Time for any reason, then Parent shall thereafter hold such Subsidiary Asset for the use and benefit of Subsidiary if permitted by law. If and when the Governmental Approvals, Consents, Waivers, or other impediments to transfer, that caused the deferral of transfer of such Asset are obtained or removed, the transfer of the applicable Asset shall be effected in accordance with the terms of this Agreement and/or the applicable Ancillary Agreement.

(c) If the Parties are unable to obtain any required Governmental Approvals, Waivers, or Consents, Parent shall continue to be bound by such Contract, license or other obligation; provided, however, that Parent shall not be obligated to extend, renew or otherwise cause such Contract, license or other obligation to remain in effect beyond the term in effect as of the Effective Time. If and when any such Governmental Approval, Consent or Waiver is obtained or such agreement, lease, license or other rights or obligations shall otherwise become assignable or capable of novation, Parent shall promptly assign, or cause to be assigned, all rights, obligations and other Liabilities thereunder to Subsidiary without payment of any further consideration and Subsidiary, without the payment of any further consideration, shall assume such rights and obligations and other Liabilities.

Section 2.4. Termination of Agreements. Except with respect to this Agreement and the Ancillary Agreements (and agreements expressly contemplated herein or therein to survive by their terms) on behalf of the Parties, the Parties hereby terminate any and all written or oral agreements, arrangements, commitments or understandings, between them, effective as of the Effective Time; and each Party shall, at the reasonable request of the other Party, take, or cause to be taken, such other actions as may be necessary to effect the foregoing.

6

Section 2.5. Disclaimer of Representations and Warranties. ON BEHALF OF THE PARTIES, THE PARTIES UNDERSTAND AND AGREE THAT, EXCEPT AS EXPRESSLY SET FORTH HEREIN OR IN ANY ANCILLARY AGREEMENT, NO PARTY TO THIS AGREEMENT OR ANY OTHER AGREEMENT OR DOCUMENT CONTEMPLATED BY THIS AGREEMENT, IS REPRESENTING OR WARRANTING IN ANY WAY AS TO THE ASSETS, BUSINESSES OR LIABILITIES CONTRIBUTED, TRANSFERRED, DISTRIBUTED OR ASSUMED HEREBY OR THEREBY, AS TO ANY CONSENTS, WAIVERS, OR GOVERNMENTAL APPROVALS REQUIRED IN CONNECTION HEREWITH OR THEREWITH, AS TO THE VALUE OR FREEDOM FROM ANY SECURITY INTERESTS OF, OR ANY OTHER MATTER CONCERNING, ANY ASSETS OF SUCH PARTY, OR AS TO THE ABSENCE OF ANY DEFENSES OR RIGHT OF SETOFF OR FREEDOM FROM COUNTERCLAIM WITH RESPECT TO ANY CLAIM OR OTHER ASSET OF ANY PARTY, OR AS TO THE LEGAL SUFFICIENCY OF ANY CONTRIBUTION, DISTRIBUTION, ASSIGNMENT, DOCUMENT, CERTIFICATE OR INSTRUMENT DELIVERED HEREUNDER TO CONVEY TITLE TO ANY ASSET OR THING OF VALUE UPON THE EXECUTION, DELIVERY AND FILING HEREOF OR THEREOF. EXCEPT AS MAY EXPRESSLY BE SET FORTH HEREIN OR IN ANY ANCILLARY AGREEMENT, ALL SUCH ASSETS ARE BEING TRANSFERRED ON AN “AS IS,” “WHERE IS” BASIS AND, THE TRANSFEREE SHALL BEAR THE ECONOMIC AND LEGAL RISKS THAT (I) ANY CONVEYANCE SHALL PROVE TO BE INSUFFICIENT TO VEST IN THE TRANSFEREE GOOD AND MARKETABLE TITLE, FREE AND CLEAR OF ANY SECURITY INTEREST, AND (II) ANY NECESSARY CONSENTS, WAIVERS, OR GOVERNMENTAL APPROVALS ARE NOT OBTAINED OR THAT THE REQUIREMENTS OF LAWS, CONTRACTS, OR JUDGMENTS ARE NOT COMPLIED WITH.

ARTICLE 3

THE DISTRIBUTION

Section 3.1. Resale Restrictions on Subsidiary Common Stock.

(a) Restriction. Upon execution of this Agreement, and prior to the Distribution Date, Shareholder agrees that until _________, 20___ [two years after the Distribution Date] (the “Restriction Period”), the Shares shall be subject to the following restrictions with respect to their sale: the amount of the Shares sold by the holder thereof, together with all sales any Shares sold for the account of such holder within the preceding three months, shall not exceed one percent (1%) of the shares or other units of the same class of the Subsidiary outstanding as shown by the most recent report or statement published by the Subsidiary. During the Restriction Period, no holder of Shares shall enter into a transaction which would violate the terms hereof, or enter into any swap, hedge or other arrangement that transfers, in whole or in part, any of the economic or voting consequences of ownership of the Shares in violation hereof, whether any such aforementioned transaction is to be settled by delivery of the Shares or such other securities, in cash or otherwise, or publicly disclose the intention to make any such offer, sale, pledge or disposition, or to enter into any such transaction, swap, hedge or other arrangement in violation hereof with respect to the Shares.

(b) Allowable Transfers During Restriction Period. Notwithstanding the terms of Section 3.1(a) above, during the Restriction Period any holder of Shares may:

(i) Transfer the Shares in distribution, without consideration, in a bona-fide dividend or liquidating distribution to all of the equity owners of such holder,

7

(ii) Transfer such holder’s Shares, or any portion thereof, to the Company or its designee,

(iii) Make a bona fide gift or charitable donation of the Shares, or any portion thereof, or

(iv) Transfer such holder’s Shares, or any portion thereof, without consideration, to such holder’s Affiliated Entities,

Provided, however, that any Shares so transferred shall continue to be subject to the terms and conditions of this Section 3.1. For purposes hereof, “Affiliated Entities” shall mean any legal entity, including any corporation, limited liability company, partnership, not-for-profit corporation, estate planning vehicle or trust, which is directly or indirectly owned or controlled by such holder or his descendants or spouse, of which such holder or his descendants or spouse are beneficial owners, or which is under joint control or ownership with any other person or entity subject to a resale restriction agreement regarding the Subsidiary Common Stock with terms substantially identical to Section 3.1 of this Agreement.

(c) Application of Section 3.1 to Shares Sold. Shares that are sold for value in bona-fide, arms-length sales transactions shall thereafter not be subject to the restrictions on sale contained in this Section 3.1. However, any such Shares may continue to be subject to restrictions imposed by federal or state securities laws, or contractual agreements outside of this Agreement.

(d) Legends on Certificates. The certificates representing the Shares shall bear the following legend:

THE SALE, ASSIGNMENT, GIFT, BEQUEST, TRANSFER, DISTRIBUTION, PLEDGE, HYPOTHECATION OR OTHER ENCUMBRANCE OR DISPOSITION OF THE SHARES REPRESENTED BY THIS CERTIFICATE IS RESTRICTED BY AND MAY BE MADE ONLY IN ACCORDANCE WITH THE TERMS OF A SEPARATION AND DISTRIBUTION AGREEMENT DATED ______, 2011 BETWEEN SPEECHFX, INC. AND FONIX CORPORATION, A COPY OF WHICH MAY BE EXAMINED AT THE OFFICE OF SPEECHFX, INC.

(e) Attempted Transfers. Any attempted or purported sale or other transfer by holders of the Shares in violation or contravention of the terms of Section 3.1 of this Agreement shall be null and void ab initio. Subsidiary shall, and shall instruct its transfer agent to, reject and refuse to transfer on its books any Shares that may have been attempted to be sold or otherwise transferred in violation or contravention of any of the provisions of Section 3.1 of this Agreement, and shall not recognize any person or entity claiming to have received rights to the Shares in violation thereof.

(f) Authority of Subsidiary to Waive or Terminate Restrictions. Subsidiary shall have the authority to waive or release the Shares restrictions of Section 3.1 of this Agreement, in whole or in part, upon the majority vote of the board of directors of Subsidiary.

Section 3.2. The Distribution.

(a) Subject to Section 3.3, on or prior to the Distribution Date, for the benefit of and distribution to the holders of Parent Common Stock or Parent Preferred Stock on the Record Date, Parent will deliver stock certificates, endorsed by Parent in blank, to the distribution agent, Continental Stock Transfer and Trust Company (the “Agent”), representing all of the issued and outstanding shares of Subsidiary Common Stock then owned by Parent. Parent shall instruct the Agent to distribute in electronic or certificated form the appropriate number of such shares of Subsidiary Common Stock to each such holder or designated transferee or transferees of such holder.

8

(b) Subject to Section 3.3, each holder of Parent Common Stock or Parent Preferred Stock on the Record Date (or such holder’s designated transferee or transferees) will be entitled to receive in the Distribution as of the Effective Time 0.0001070 share of Subsidiary Common Stock for each one share of Parent Common Stock or Parent Common Stock Equivalents held of record on the Record Date. No fractional shares will be issued. In the event a holder of Parent Common Stock would otherwise be entitled to a fractional share of Subsidiary Common Stock, the number of shares of Subsidiary Common Stock such holder of Parent Common Stock will receive in the Distribution will be rounded up to the nearest whole number of shares of Subsidiary Common Stock. No action by any such stockholder shall be necessary for such stockholder (or such stockholder’s designated transferee or transferees) to receive the shares of Subsidiary Common Stock. Subsidiary and Parent, as the case may be, will provide to the Agent any and all information required in order to complete the Distribution.

Section 3.3. Actions in Connection with the Distribution.

(a) Prior to the Distribution Date, Parent and Subsidiary shall have prepared and mailed to the holders of Parent Common Stock and/or Parent Preferred Stock such information concerning Subsidiary, the Subsidiary Business, operations and management, the Distribution, the Separation and such other matters as Parent shall reasonably determine and as may be required by law.

(b) Subsidiary shall have prepared and, in accordance with applicable Law, filed with the Commission the Form 10, including amendments, supplements and any such other documentation which is necessary or desirable to effectuate the Distribution, and Subsidiary shall have obtained all necessary approvals from the Commission with respect thereto as soon as practicable.

(c) Parent and Subsidiary shall take all such action as may be necessary or appropriate under the securities or blue sky laws of the states or other political subdivisions of the United States or of other foreign jurisdictions in connection with the Distribution.

(d) Subsidiary and/or its market makers shall have prepared and filed an application for the original listing or quotation on the OTC Bulletin Board and/or the OTC Markets Group, Inc. of the Subsidiary Common Stock to be distributed in the Distribution, and such quotations services shall have approved such application and provided the appropriate certification to the Commission.

(e) Parent and Subsidiary shall take all reasonable steps necessary to cause the conditions set forth in Section 3.3 to be satisfied and to effect the Distribution on the Distribution Date.

Section 3.4. Conditions to Distribution. Subject to Section 3.2, the following are conditions to the consummation of the Distribution. The conditions are for the sole benefit of Parent and shall not give rise to or create any duty on the part of Parent or the Board of Directors of Parent to waive or not waive any such condition:

(a) The Form 10 shall have been filed with the Commission for the purpose of registering the Subsidiary Common Stock under the Exchange Act, with no stop order in effect with respect thereto.

(b) An information statement satisfying the requirements of Commission shall have been filed with the Commission and mailed to all holders of Parent Common Stock and Parent Common Stock Equivalents.

9

(c) All Government Approvals and other Consents necessary to consummate the Distribution shall have been obtained and be in full force and effect, except for any such Government Approvals or Consents the failure of which to obtain would not have material adverse effect on the business, operations or condition (financial or otherwise) of either Parent or Subsidiary.

(d) No order, injunction or decree issued by any court or agency of competent jurisdiction preventing the consummation of the Distribution shall be in effect and no other event outside the control of Parent shall have occurred or failed to occur that prevents the consummation of the Distribution.

(e) The Board of Directors of Parent shall have authorized and approved the Distribution and not withdrawn such authorization and approval.

(f) The Board of Directors of Parent shall not have reasonably determined in good faith that the Distribution would not be permitted under the Delaware General Corporation Law, as amended.

(g) Parent and Subsidiary shall have secured waivers and releases of all claims from the current Subsidiary employees with respect the Settled Liabilities.

(h) Parent and Subsidiary shall have entered into an exchange agreement with Sovereign Partners, LP, pursuant to which, effective prior to the Record Date, Sovereign Partners will exchange all shares of Subsidiary Preferred Stock which it currently owns, for shares of Parent Common Stock.

(i) Parent and Subsidiary shall have secured a waiver and release of claims from Southridge Capital Partners (“Southridge”), pursuant to which Southridge terminates and releases any security interest it may have in the technology of Subsidiary arising from the issuance by Parent to Southridge of Preferred Stock of Parent.

(j) No other events or developments shall have occurred that, in the sole discretion of the Board of Directors of Parent, would result in the Distribution having a material adverse effect on Parent, its stockholders or its creditors, or not being in the best interest of Parent, its stockholders and creditors.

ARTICLE 4

COVENANTS

Section 4.1. Post Closing Cooperation. Following the Distribution, Parent and Subsidiary shall cooperate with respect to access to data relevant to their respective businesses, including Subsidiary’s grant to Parent of rights to server storage, and to the use of and access to Subsidiary’s server and files. Parent may also, from time to time, use the services of Subsidiary employees Xxxxx X. Xxxxxx and Xxxxxxx Xxxx, on a limited basis and without cost to Parent.

Section 4.2. Insurance. Parent shall transfer and assign to Subsidiary, for the benefit of Subsidiary’s employees, the following insurance contracts and agreements: United Health Care Insurance Company, Dental Select, Lincoln Financial Group, and Workers Compensation Fund.

Section 4.3. Confidentiality.

10

(a) Notwithstanding any termination of this Agreement and subject to Section 4.3(c), for a period of two (2) years from the Distribution Date, each Party agrees to hold, and to cause its respective Affiliates, directors, officers, employees, agents, accountants, counsel and other advisors and representatives to hold, in strict confidence, and undertake all reasonable precautions to safeguard and protect the confidentiality of, all Information concerning the other Party that is in its possession after the Distribution Date or furnished by the other Party or its respective directors, officers, employees, agents, accountants, counsel and other advisors and representatives at any time pursuant to this Agreement, any Ancillary Agreement or otherwise, and shall not use any such Information other than for such purposes as shall be expressly permitted hereunder or thereunder, except, in each case, to the extent that such Information has been (i) in the public domain through no fault of such Party or any of their respective directors, officers, employees, agents, accountants, counsel and other advisors and representatives, (ii) lawfully acquired from other sources, which are not bound by a confidentiality obligation, by such Party, or (iii) independently generated without reference to any proprietary or confidential Information of the other Party.

(b) Each Party agrees not to release or disclose, or permit to be released or disclosed, any such Information to any other Person, except its directors, officers, employees, agents, accountants, counsel and other advisors and representatives who need to know such Information and who are informed and advised that the Information is confidential and subject to the obligations hereunder, except in compliance with Section 4.3(c). Without limiting the foregoing, when any Information is no longer needed for the purposes contemplated by this Agreement or any Ancillary Agreement, each Party will promptly after request of the other Party either (i) destroy all copies of the Information in such Party’s possession, custody or control (including any that may be stored in any computer, word processor, or similar device, to the extent not commercially impractical to destroy such copies) including, without limitation, any copies, summaries, analyses, reports, extracts or other reproductions, in whole or in part, of such written, electronic or other tangible material or any other materials in written, electronic or other tangible format based on, reflecting or containing Information prepared by such Party, and/or (ii) return to the requesting Party, at the expense of the requesting Party, all copies of the Information furnished to such Party by or on behalf of the requesting Party.

(c) In the event that either Party (i) determines after consultation with counsel, in the opinion of such counsel that it is required by law to disclose any Information or (ii) receives any demand under lawful process or from any Governmental Authority to disclose or provide Information of the other Party that is subject to the confidentiality provisions hereof, such Party shall notify the other Party prior to disclosing or providing such Information and shall cooperate at the expense of the requesting party (and to the extent legally permissible) in seeking any reasonable protective arrangements requested by such other Party. Subject to the foregoing, the Party that received such request may thereafter (1) furnish only that portion of the confidential Information that is legally required, (2) give notice to the other Party of the information to be disclosed as far in advance as is practical, and (3) exercise reasonable best efforts to obtain reliable assurance that the confidential nature of such Information shall be maintained.

Section 4.4. Litigation cooperation.

(a) Each of Parent and Subsidiary agrees that at all times from and after the Effective Time, if an Action currently exists or is commenced by a third-party with respect to which a Party is a named defendant but such Action is otherwise not a Liability allocated to such named Party under this Agreement or any Ancillary Agreement, then the other Party shall use commercially reasonable efforts to cause such named but not liable defendant to be removed from such Action and such defendant shall not be required to make any payments or contribution in connection therewith.

11

(b) Each of Parent and Subsidiary shall each use commercially reasonable efforts to make available to the other, upon written request, its officers, directors, employees and agents, and the officers, directors, employees and agents thereof, as witnesses to the extent that such individuals may reasonably be required in connection with any legal, administrative or other proceedings in which the requesting Party may be involved. The requesting Party shall bear all out-of-pocket expenses in connection therewith. On and after the Effective Time, in connection with any matter contemplated by this Section 4.4, the Parties will maintain any attorney-client privilege or work product immunity of each Party as required by this Agreement or any Ancillary Agreement.

Section 4.5. Indemnification

(a) Except as otherwise provided in this Agreement or any Ancillary Agreement, following the Distribution Date, Subsidiary shall indemnify, defend and hold harmless Parent and its Affiliates, including each of their respective directors and officers, and each of the heirs, executors, successors and assigns of any of the foregoing (collectively, the “Parent Indemnitees”), from and against any and all Liabilities and related losses of the Parent Indemnitees relating to, arising out of or resulting from any of (a) the failure of Subsidiary or its Affiliates or any other Person to pay, perform or otherwise promptly discharge after the Distribution Date any Subsidiary Liabilities incurred after the Distribution in accordance with their respective terms, (b) any untrue statement, alleged untrue statement, omission or alleged omission of a material fact in the Form 10, resulting in a misleading statement, with respect to all information contained in the Form 10, and (c) any breach by Subsidiary of this Agreement or any of the Ancillary Agreements.

(b) Except as otherwise provided in this Agreement or any Ancillary Agreement, following the Distribution Date, Parent shall indemnify, defend and hold harmless Subsidiary, and its Affiliates, including each of their respective directors and officers, and each of the heirs, executors, successors and assigns of any of the foregoing (collectively, the “Subsidiary Indemnitees”), from and against any and all Liabilities and related losses of the Subsidiary Indemnitees relating to, arising out of or resulting from any of (a) the failure of Parent or its Affiliates to pay, perform or otherwise promptly discharge after the Distribution Date any Parent Liabilities, (b) the Parent Liabilities, and (c) any breach by Parent of this Agreement or any of the Ancillary Agreements.

(c) If a party entitled to indemnification hereunder (an “Indemnitee”) shall receive notice or otherwise learn of the assertion by a Third Party (including any Governmental Authority) of any claim or of the commencement by any such Person of any Action (collectively, a “Third Party Claim”) with respect to which a party required to provide indemnification hereunder (an “Indemnifying Party”) may be obligated to provide indemnification to such Indemnitee, such Indemnitee shall give such Indemnifying Party and each Party to this Agreement written notice thereof as soon as reasonably practicable, but no later than thirty (30) days after becoming aware of such Third Party Claim. Any such notice shall describe the Third Party Claim in reasonable detail. If any Party shall receive notice or otherwise learn of the assertion of a Third Party Claim which may reasonably be determined to be a Liability of the Parties, such Party shall give the other Party to this Agreement written notice thereof within thirty (30) days after becoming aware of such Third Party Claim. Any such notice shall describe the Third Party Claim in reasonable detail. Notwithstanding the foregoing, the failure of any Indemnitee or other Party to give notice as provided in this Section 4.5(c) shall not relieve the related Indemnifying Party of its obligations under this ARTICLE 4, except to the extent that such Indemnifying Party is actually prejudiced by such failure to give notice.

(i) An Indemnifying Party shall be entitled to participate in the defense of any Third Party Claim, at such Indemnifying Party’s own expense and by such Indemnifying Party’s own counsel; provided that if the defendants in any such claim include both the Indemnifying Party and one or more Indemnitees and in such Indemnitees’ reasonable judgment a conflict of interest between such Indemnitees and such Indemnifying Party exists in respect of such claim, such Indemnitees shall have the right to employ separate counsel and in that event the reasonable fees and expenses of such separate counsel (but not more than one separate counsel reasonably satisfactory to the Indemnifying Party) shall be paid by such Indemnifying Party. Within thirty (30) days after the receipt of notice from an Indemnitee in accordance with Section 4.5 (or sooner, if the nature of such Third Party Claim so requires), the Indemnifying Party shall notify the Indemnitee of its election whether the Indemnifying Party will assume responsibility for defending such Third Party Claim. After notice from an Indemnifying Party to an Indemnitee of its election to assume the defense of a Third Party Claim, such Indemnitee shall have the right to employ separate counsel and to participate in (but not control) the defense, compromise or settlement thereof, but the fees and expenses of such counsel shall be the expense of such Indemnitee.

12

(ii) With respect to any Third Party Claim, the Indemnifying Party and Indemnitees agree, and shall cause their respective counsel (if applicable), to cooperate fully (in a manner that will preserve all attorney-client privilege or other privileges) to mitigate any such claim and minimize the defense costs associated therewith.

(iii) If an Indemnifying Party fails to assume the defense of a Third Party Claim within thirty (30) days after receipt of written notice of such claim, the Indemnitee will, upon delivering notice to such effect to the Indemnifying Party, have the right to undertake the defense, compromise or settlement of such Third Party Claim on behalf of and for the account of the Indemnifying Party subject to the limitations as set forth in this Section 4.5(c); provided, however, that such Third Party Claim shall not be compromised or settled without the written consent of the Indemnifying Party, which consent shall not be unreasonably withheld, delayed or conditioned. If the Indemnitee assumes the defense of any Third Party Claim, it shall keep the Indemnifying Party reasonably informed of the progress of any such defense, compromise or settlement. The Indemnifying Party shall reimburse all such costs and expenses of the Indemnitee in the event it is ultimately determined that the Indemnifying Party is obligated to indemnify the Indemnitee with respect to such Third Party Claim. In no event shall an Indemnifying Party be liable for any settlement effected without its consent, which consent will not be unreasonably withheld, delayed or conditioned.

(d) Any claim on account of a Liability or related loss which does not result from a Third Party Claim shall be asserted by written notice given by the Indemnitee to the related Indemnifying Party. Such Indemnifying Party shall have a period of thirty (30) days after the receipt of such notice within which to respond thereto. If such Indemnifying Party does not respond within such sixty (60) day period, such Indemnifying Party shall be deemed to have accepted responsibility to make payment. If such Indemnifying Party rejects such claim in whole or in part, such Indemnitee shall be free to pursue such remedies as may be available to such party as contemplated by this Agreement and the Ancillary Agreements.

(e) In the event of payment by or on behalf of any Indemnifying Party to any Indemnitee in connection with any Third Party Claim, such Indemnifying Party shall be subrogated to and shall stand in the place of such Indemnitee as to any events or circumstances in respect of which such Indemnitee may have any right, defense or claim relating to such Third Party Claim against any claimant or plaintiff asserting such Third Party Claim or against any other person. Such Indemnitee shall cooperate with such Indemnifying Party in a reasonable manner, and at the cost and expense (including allocated costs of in-house counsel and other in-house personnel) of such Indemnifying Party, in prosecuting any subrogated right, defense or claim.

(f) In the event of an Action in which the Indemnifying Party is not a named defendant, if the Indemnifying Party shall so request, the Parties shall endeavor to substitute the Indemnifying Party for the named defendant, and add the Indemnifying Party as a named defendant if at all practicable. If such substitution or addition cannot be achieved for any reason or is not requested, the named defendant shall allow the Indemnifying Party to manage the Action as set forth in this section and subject to Section 4.5 with respect to Liabilities, the Indemnifying Party shall fully indemnify the named defendant against all costs of defending the Action (including court costs, sanctions imposed by a court, attorneys’ fees, experts’ fees and all other external expenses, and the allocated costs of in-house counsel and other in-house personnel), the costs of any judgment or settlement, and the costs of any interest or penalties relating to any judgment or settlement.

13

(g) The rights and obligations of each Party and their respective Indemnitees under this Section 4.5 shall survive the sale or other transfer by any Party or its Affiliates of any Assets or businesses or the assignment by it of any and all Liabilities.

ARTICLE 5

ACCESS TO INFORMATION AND SERVICES

Section 5.1. Provision of Corporate Records.

(a) Except as otherwise provided in any Ancillary Agreement, upon the prior written request by Subsidiary for specific and identified books and records which relate to (x) Subsidiary or the conduct of the Subsidiary Business, as the case may be, up through the Distribution Date, or (y) any Ancillary Agreement to which Subsidiary and Parent are parties (the “Subsidiary Books and Records”), Parent shall, at the expense of Subsidiary, provide for the transport of the Subsidiary Books and Records in its possession or control to a location provided by Subsidiary as soon as practicable but no later than thirty (30) days following the date of such request, except to the extent such items are already in the possession of Subsidiary or a Subsidiary Affiliate.

(b) Except as otherwise provided in any Ancillary Agreement, upon the prior written request by Parent for specific and identified books and records which relate to (x) Parent or the conduct of the Parent Business, as the case may be, up through the Distribution Date, or (y) any Ancillary Agreement to which Subsidiary and Parent are parties (the “Parent Books and Records”), Subsidiary shall, at the expense of Parent, provide the transport of the Parent Books and Records in its possession or control to a location provided by Parent as soon as practicable but no later than thirty (30) days following the date of such request, except to the extent such items are already in the possession of Parent or a Parent Affiliate.

(c) With respect to books and records that relate to both the Subsidiary Business and the Parent Business (the “Combined Books and Records”), (i) the Parties shall use good faith efforts to divide such Combined Books and Records into Subsidiary Books and Records and Parent Books and Records, as appropriate, and (ii) to the extent such Combined Books and Records are not so divided, each Party shall each keep and maintain copies of such Combined Books and Records as reasonably appropriate under the circumstances, subject to applicable confidentiality provisions hereof and of any Ancillary Agreement.

Section 5.2. Access to Information. Except as otherwise provided in an Ancillary Agreement, from and after the Distribution Date, Parent shall provide Subsidiary and its authorized accountants, counsel and other designated representatives reasonable access and duplicating rights during normal business hours to all records, books, contracts, instruments, computer data and other data and information relating to pre-Distribution operations of the Subsidiary Business (collectively, “Operations Data”) within Parent’s possession or control (including using reasonable best efforts to give access to persons or firms possessing information) insofar as such access is reasonably required by Subsidiary for the conduct of the Subsidiary Business, subject to appropriate restrictions for classified or privileged information. Similarly, except as otherwise provided in an Ancillary Agreement, Subsidiary shall provide Parent and its authorized accountants, counsel and other designated representatives reasonable access (including using reasonable best efforts to give access to persons or firms possessing information) and duplicating rights during normal business hours to Operations Data, within Subsidiary’s possession, insofar as such access is reasonably required by Parent for the conduct of the Parent Business, subject to appropriate restrictions for classified or privileged information. Operations Data and other documents may be requested under this ARTICLE 5 for the legitimate business purposes of either Party, including, without limitation, audit, accounting, claims (including claims for indemnification hereunder), litigation and tax purposes, as well as for purposes of fulfilling disclosure and reporting obligations and for performing under this Agreement and the transactions contemplated hereby.

14

Section 5.3. Reimbursement. Except to the extent otherwise contemplated in any Ancillary Agreement, a Party providing Operations Data or witness services to the other Party under this ARTICLE 5 shall be entitled to receive from the recipient, upon the presentation of invoices therefor, payments of such amounts, relating to supplies, disbursements and other out-of-pocket expenses (at cost) and direct and indirect expenses of employees who are witnesses or otherwise furnish assistance (at cost), as may be reasonably incurred in providing such Operations Data or witness services.

ARTICLE 6

FURTHER ASSURANCES

Section 6.1. Further Assurances. In addition to and without limiting the actions specifically provided in this Agreement, each of the Parties hereto shall use its reasonable best efforts, prior to, on and after the Distribution Date, to take, or cause to be taken, all actions, and to do, or cause to be done, all things reasonably necessary, proper or advisable under applicable laws, regulations and agreements to consummate and make effective the transactions contemplated by this Agreement and the Ancillary Agreements. Without limiting the foregoing, prior to, on and after the Distribution Date, each Party hereto shall cooperate with the other Party, and without any further consideration, but at the expense of the requesting Party, to execute and deliver, or use its reasonable best efforts to cause to be executed and delivered, all instruments, including instruments of conveyance, assignment and transfer, and to make all filings with, and to obtain all consents, approvals or authorizations of, any Governmental Authority or any other Person under any permit, license, agreement, indenture or other instrument (including any Consents or Governmental Approvals), and to take all such other actions as such Party may reasonably be requested to take by the other Party hereto from time to time, consistent with the terms of this Agreement and the Ancillary Agreements, in order to effectuate the provisions and purposes of this Agreement and the Ancillary Agreements and the transfers of the Subsidiary Assets and the other transactions contemplated hereby and thereby.

ARTICLE 7

TERMINATION

Section 7.1. Termination. Notwithstanding anything to the contrary herein, this Agreement may be terminated and the Distribution may be amended, modified or abandoned at any time prior to the Effective Time by and in the sole discretion of Parent without the approval of Subsidiary or the stockholders of Parent. In the event of such termination, no Party shall have any Liability to the other Party or any other Person. After the Effective Time, this Agreement may not be terminated except by an agreement in writing signed by each of the Parties.

15

ARTICLE 8

MISCELLANEOUS

Section 8.1. Counterparts; Entire Agreement.

(a) This Agreement and each Ancillary Agreement may be executed in one or more counterparts, each of which shall be considered one and the same agreement, and shall become effective when each counterpart has been signed by each of the Parties and delivered to the other Party.

(b) This Agreement, the Ancillary Agreements and the Exhibits and Schedules hereto and thereto contain the entire agreement between the Parties with respect to the subject matter hereof, supersede all previous agreements, negotiations, discussions, writings, understandings, commitments and conversations with respect to such subject matter, and there are no agreements or understandings between the Parties other than those set forth or referred to herein or therein. Except with respect to tax matters, in the event of any conflict between the terms and conditions of this Agreement and the terms and conditions of any Ancillary Agreement, the terms and conditions of this Agreement (including amendments hereto) shall control.

Section 8.2. Governing Law. This Agreement, except as expressly provided herein, and, unless expressly provided therein, each Ancillary Agreement, shall be governed by and construed and interpreted in accordance with the laws of the State of Delaware, irrespective of the choice of laws principles of the State of Delaware as to all matters, including matters of validity, construction, effect, enforceability, performance and remedies.

Section 8.3. Tax Matters. Notwithstanding anything to the contrary in this Agreement, the rights and obligations of the Parties with respect to any and all tax matters shall be exclusively governed by the provisions of the Tax Sharing Agreement, except as set forth therein.

Section 8.4. Assignability. The provisions of this Agreement, each Ancillary Agreement and the obligations and rights hereunder shall be binding upon, inure to the benefit of and be enforceable by (and against) the Parties and their respective successors and permitted transferees and assigns. Notwithstanding the foregoing, this Agreement shall not be assignable, in whole or in part, by any Party without the prior written consent of the other Party, and any attempt to assign any rights or obligations arising under this Agreement without such consent shall be null and void; provided, that a Party may assign this Agreement in connection with a merger transaction in which such Party is not the surviving entity or the sale by such Party of all or substantially all of its Assets, and upon the effectiveness of such assignment the assigning Party shall be released from all of its obligations under this Agreement if the surviving entity of such merger or the transferee of such Assets shall agree in writing, in form and substance reasonably satisfactory to the other Party, to be bound by all terms of this Agreement as if named as a “Party” hereto.

Section 8.5. Third Party Beneficiaries. Except for the indemnification rights under this Agreement of any Parent Indemnitee or Subsidiary Indemnitee in their respective capacities as such, (a) the provisions of this Agreement and each Ancillary Agreement are solely for the benefit of the Parties and are not intended to confer upon any Person except the Parties any rights or remedies hereunder, and (b) there are no Third Party beneficiaries of this Agreement or any Ancillary Agreement and neither this Agreement nor any Ancillary Agreement shall provide any Third Party with any remedy, claim, liability, reimbursement, claim of action or other right in excess of those existing without reference to this Agreement or any Ancillary Agreement.

Section 8.6. Notices. All notices, requests, claims, demands or other communications under this Agreement or any Ancillary Agreement shall be in writing and shall be deemed to be duly given when (a) delivered in person or (b) upon receipt after being deposited in the United States mail or private express mail, postage prepaid, addressed as follows:

16

|

If to Parent, to:

|

If to Subsidiary, to:

|

|

Fonix Corporation

|

Fonix Speech, Inc.

|

|

000 Xxxxx 000 Xxxx

|

387 South 000 Xxxx

|

|

Xxxxx 000

|

Xxxxx 000

|

|

Xxxxxx, Xxxx 00000

|

Xxxxxx, Xxxx 00000

|

|

Attn: Xxxxx X. Xxxxxx

|

Attn: Xxxxxxx Xxxx

|

|

Email: xxx@xxxxx.xxx

|

Email: xxxxxxx@xxxxx.xxx

|

Either Party may, by notice to the other Party, change the address to which such notices are to be given.

Section 8.7. Severability. If any provision of this Agreement or any Ancillary Agreement or the application thereof to any Person or circumstance is determined by a court of competent jurisdiction to be invalid, void or unenforceable, the remaining provisions hereof or thereof, or the application of such provision to Persons or circumstances or in jurisdictions other than those as to which it has been held invalid or unenforceable, shall remain in full force and effect and shall in no way be affected, impaired or invalidated thereby, so long as the economic or legal substance of the transactions contemplated hereby or thereby, as the case may be, is not affected in any manner adverse to any Party. Upon such determination, the Parties shall negotiate in good faith in an effort to agree upon such a suitable and equitable provision to affect the original intent of the Parties.

Section 8.8. Publicity. Prior to the Distribution, each of Subsidiary and Parent shall consult with each other prior to issuing any press releases or otherwise making public statements with respect to the Separation, the Distribution or any of the other transactions contemplated hereby and prior to making any filings with any Governmental Authority with respect thereto.

Section 8.9. Expenses. Except as expressly set forth in this Agreement or in any Ancillary Agreement, whether or not the Separation or the Distribution is consummated, all Third Party fees, costs and expenses paid or incurred in connection with the Separation and Distribution will be advanced by Southridge Partners and ________________ (“Lenders”). All such fees, costs and expenses so advanced shall be repaid by Subsidiary following the Distribution, pursuant to the terms and conditions of Notes executed by Subsidiary in favor of the Lenders.

Section 8.10. Headings. The article, section and paragraph headings contained in this Agreement and in the Ancillary Agreements are for reference purposes only and shall not affect in any way the meaning or interpretation of this Agreement or any Ancillary Agreement.

Section 8.11. Survival of Covenants. Except as expressly set forth in any Ancillary Agreement, all covenants, representations and warranties contained in this Agreement and each Ancillary Agreement, and liability for the breach of any obligations contained herein, shall survive after the Distribution Date and remain in full force and effect in accordance with their applicable terms.

Section 8.12. Waivers of Default. The failure of either Party to require strict performance by the other Party of any provision in this Agreement or any Ancillary Agreement will not waive or diminish such Party’s right to demand strict performance thereafter of that or any other provision hereof.

Section 8.13. Specific Performance. The Parties agree that irreparable damage would occur in the event that the provisions of this Agreement were not performed in accordance with their specific terms. Accordingly, it is hereby agreed that the Parties shall be entitled, in addition to any other remedy or relief to which they may be entitled, to injunctive relief (including provisional or temporary injunctive relief) to enforce specifically the terms and provisions hereof and enforcement of any such award of an arbitral tribunal in any court of the United States, or any other any court or tribunal sitting in any state of the United States or in any foreign country that has jurisdiction.

17

Section 8.14. Amendments. This Agreement may not be modified or amended except by an agreement in writing signed by each of the Parties.

Section 8.15. Waiver of Jury Trial. EACH OF THE PARTIES HEREBY WAIVES TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW ANY RIGHT IT MAY HAVE TO A TRIAL BY JURY WITH RESPECT TO ANY COURT PROCEEDING DIRECTLY OR INDIRECTLY ARISING OUT OF AND PERMITTED UNDER OR IN CONNECTION WITH THIS AGREEMENT. EACH OF THE PARTIES HEREBY (A) CERTIFIES THAT NO REPRESENTATIVE, AGENT OR ATTORNEY OF THE OTHER PARTY HAS REPRESENTED, EXPRESSLY OR OTHERWISE, THAT SUCH OTHER PARTY WOULD NOT, IN THE EVENT OF LITIGATION, SEEK TO ENFORCE THE FOREGOING WAIVER AND (B) ACKNOWLEDGES THAT IT HAS BEEN INDUCED TO ENTER INTO THIS AGREEMENT, AS APPLICABLE, BY, AMONG OTHER THINGS, THE MUTUAL WAIVERS AND CERTIFICATIONS IN THIS Section 8.15.

IN WITNESS WHEREOF, the Parties have caused this Separation and Distribution Agreement to be executed by their duly authorized representatives as of the day and year first above written.

|

Fonix Corporation,

|

SpeechFX, Inc.

|

|

a Delaware corporation

|

a Delaware corporation

|

|

_________________________________

|

|

|

By: ___________________________

|

By: Xxxxx X. Xxxxxx

|

|

Its: ____________________________

|

Its: President and CEO

|

18

Schedule 1.1(a)

Subsidiary Balance Sheet

SPEECHFX, INC. (formerly Fonix Speech, Inc.)

CONDENSED BALANCE SHEETS

(Unaudited)

|

March 31,

|

December 31,

|

|||||||

|

2011

|

2010

|

|||||||

|

ASSETS

|

||||||||

|

Current assets

|

||||||||

|

Cash

|

$ | 4,000 | $ | 26,000 | ||||

|

Total current assets

|

4,000 | 26,000 | ||||||

|

Property and equipment, net of accumulated depreciation of $1,317,000 and $1,315,000, respectively

|

19,000 | 21,000 | ||||||

|

Deposits and other assets

|

12,000 | 12,000 | ||||||

|

Total assets

|

$ | 35,000 | $ | 59,000 | ||||

|

LIABILITIES AND STOCKHOLDERS' DEFICIT

|

||||||||

|

Current liabilities

|

||||||||

|

Accounts payable

|

$ | 952,000 | $ | 923,000 | ||||

|

Accrued liabilities

|

529,000 | 470,000 | ||||||

|

Derivative liability

|

1,274,000 | 1,264,000 | ||||||

|

Related party payable, net

|

5,417,000 | 5,416,000 | ||||||

|

Related party note payable

|

100,000 | - | ||||||

|

Deferred revenue

|

12,000 | 14,000 | ||||||

|

Total current liabilities

|

8,284,000 | 8,087,000 | ||||||

|

Long-term liabilities

|

- | - | ||||||

|

Total liabilities

|

8,284,000 | 8,087,000 | ||||||

|

Commitments and contingencies

|

||||||||

|

Stockholders' deficit

|

||||||||

|

Preferred stock, $0.0001 par value, 100,000,000

|

||||||||

|

shares authorized; Series B convertible; 125 shares outstanding

|

- | - | ||||||

|

Common stock, $0.001 par value, 5,000,000,000 shares

|

||||||||

|

authorized; 75,000,000 shares issued and outstanding, respectively

|

8,000 | 8,000 | ||||||

|

Additional paid-in capital

|

1,313,000 | 1,313,000 | ||||||

|

Accumulated deficit

|

(9,570,000 | ) | (9,349,000 | ) | ||||

|

Total stockholders' deficit

|

(8,249,000 | ) | (8,028,000 | ) | ||||

|

Total liabilities and stockholders' deficit

|

$ | 35,000 | $ | 59,000 | ||||

19

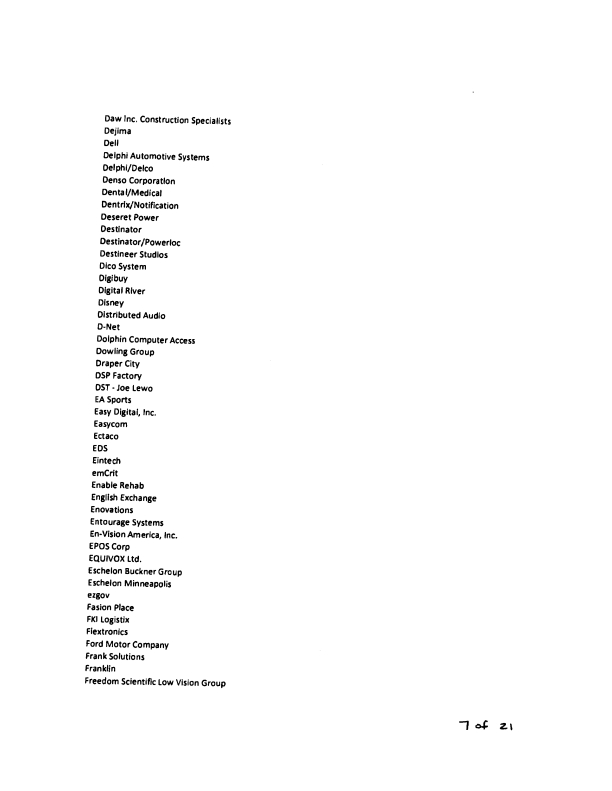

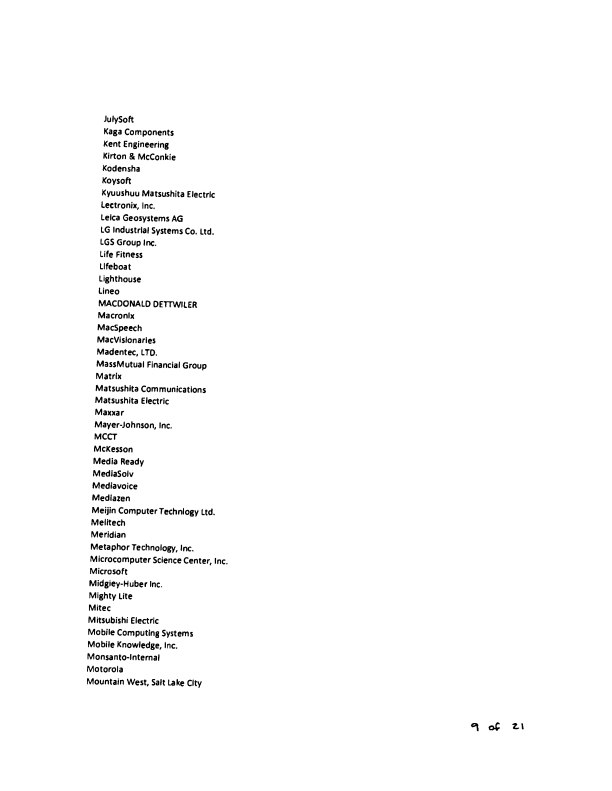

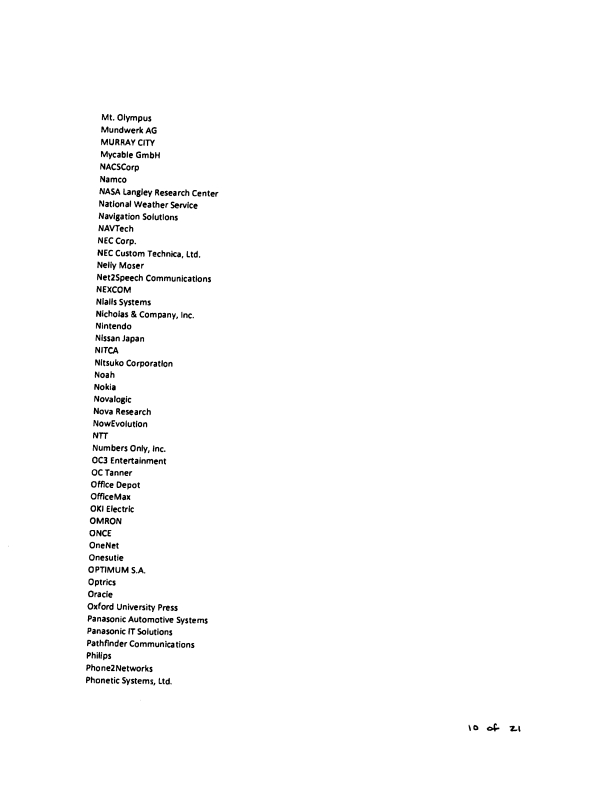

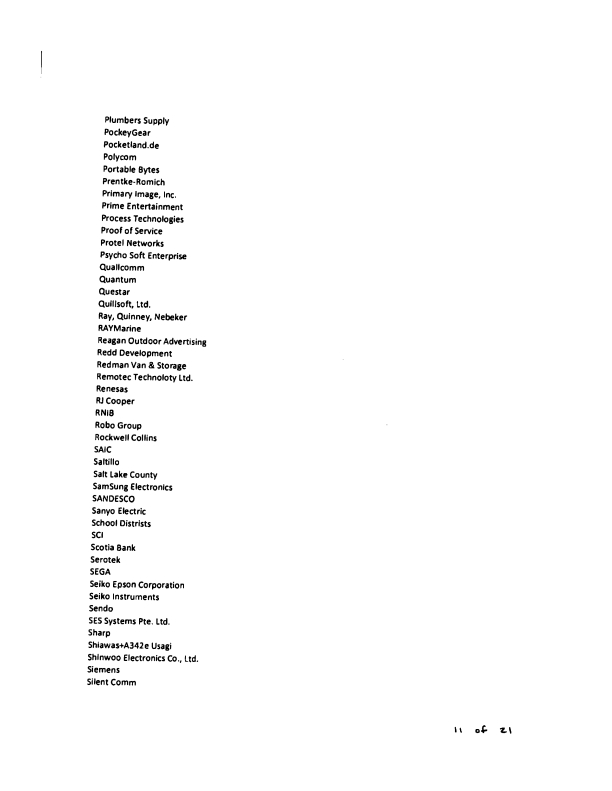

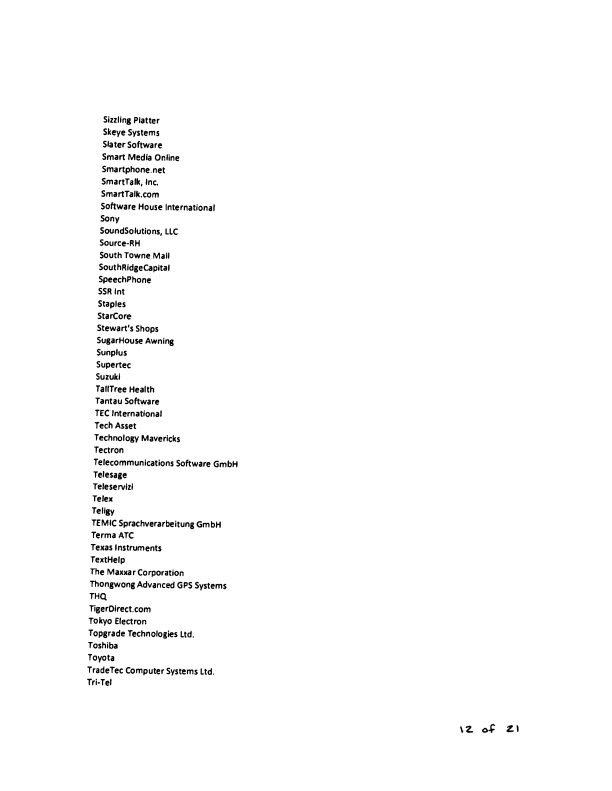

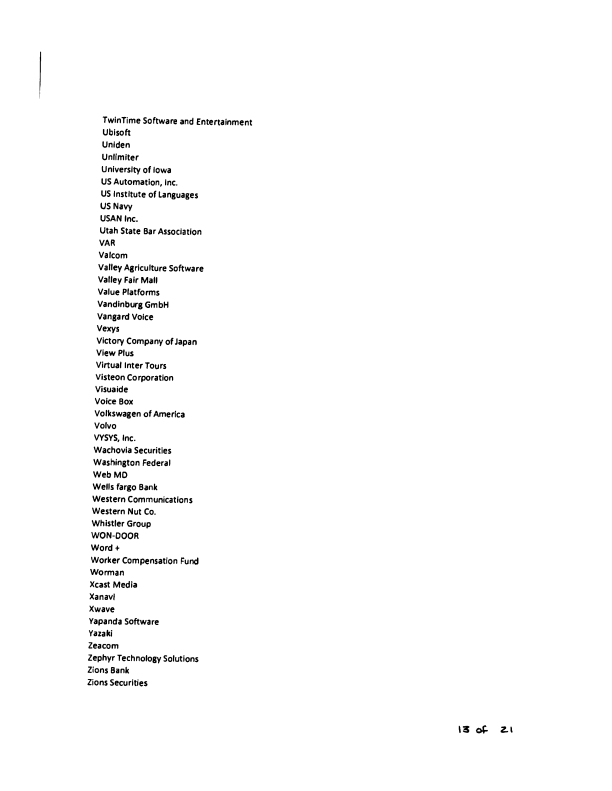

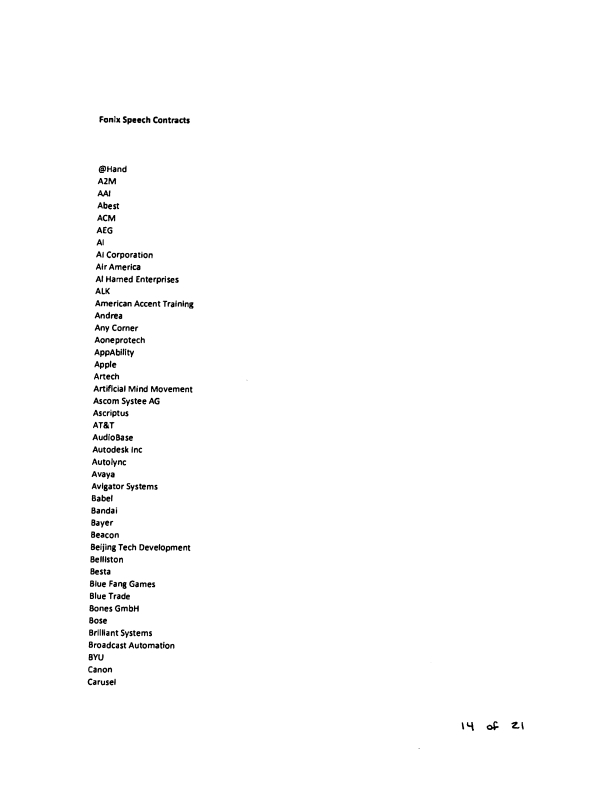

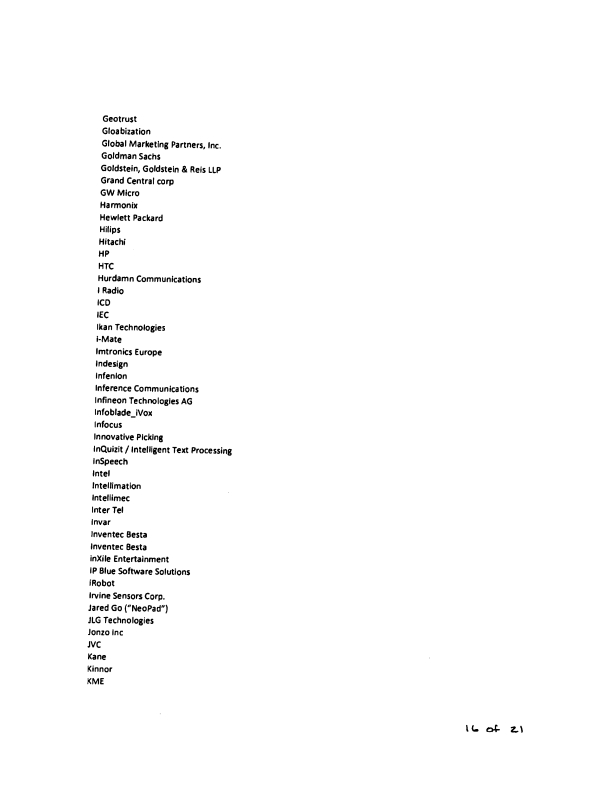

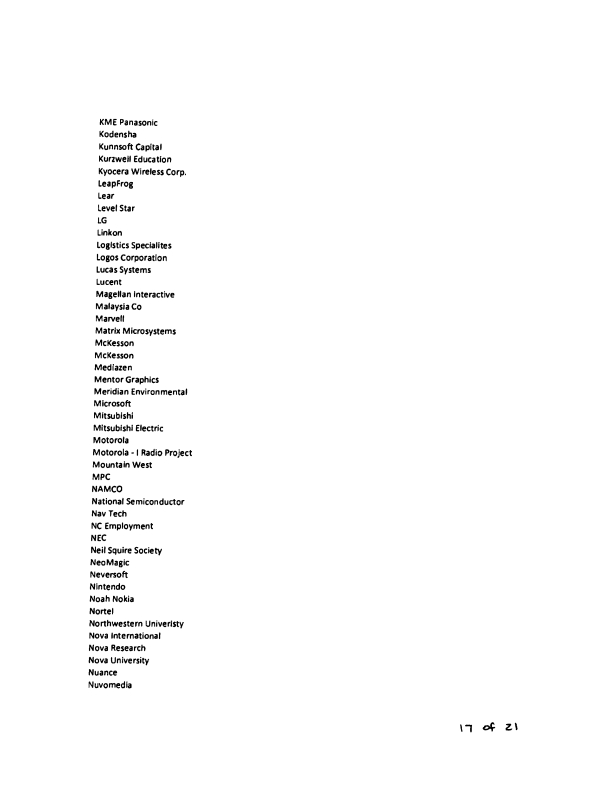

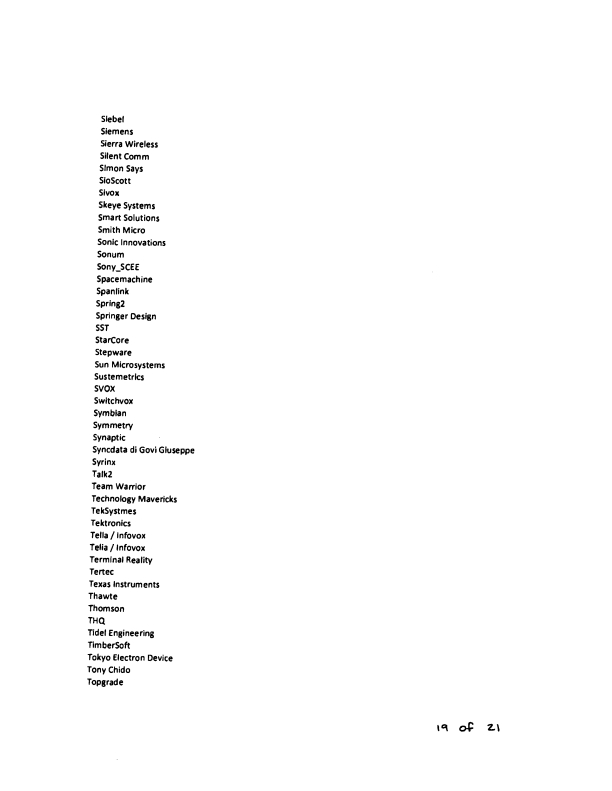

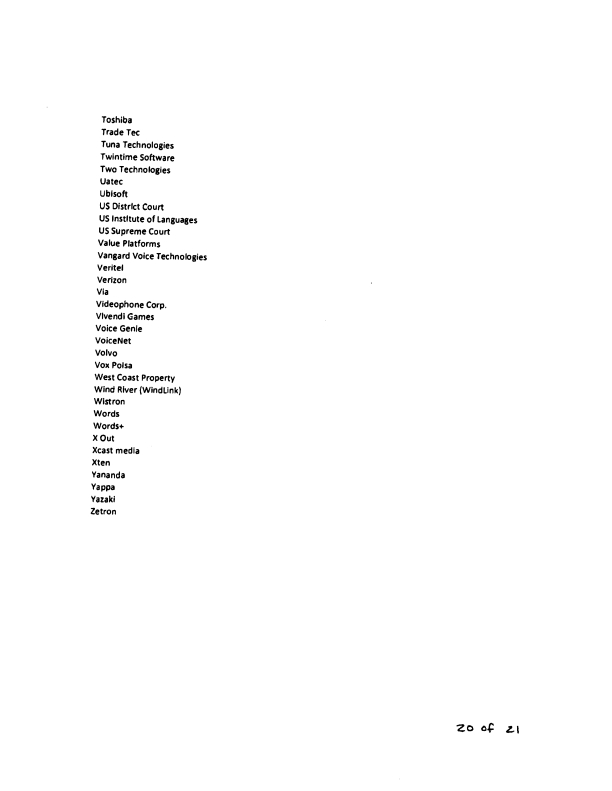

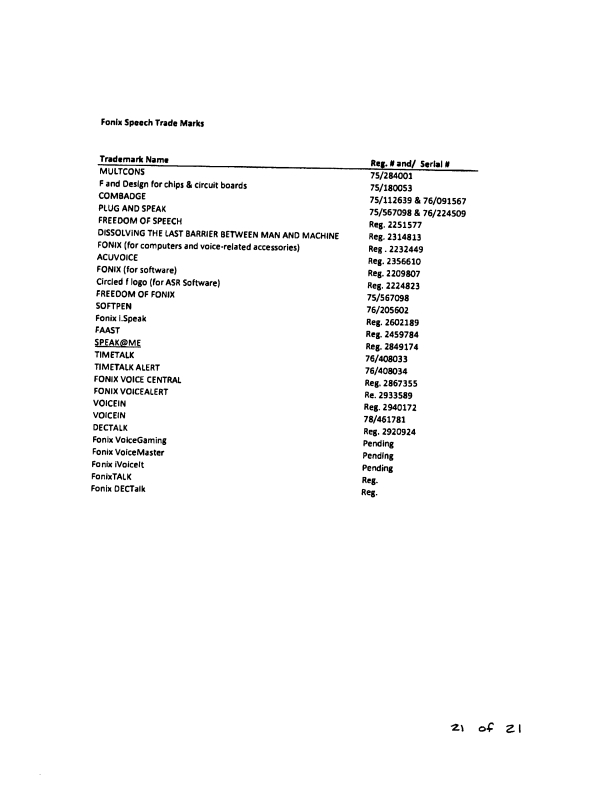

Schedule 2.1(a)

Subsidiary Assets

20

21

22

23

24

25

26

27

28

29

30

31

32

33

34

35

36

37

38

39

40

Schedule 2.2(a)

Assumed Liabilities, including Settled Liabilities

|

Fonix Corporation Liabilities to be Assumed by SpeechFX, Inc. (Post effective Form-10) as of March 31, 2011

|

||||

|

TAM Trust (Xxxxxx balance) Note Payable

|

$ | 709,000 | ||

|

Accrued interest on TAM Trust Note Payable

|

423,123 | |||

|

Accounts Payable

|

1,741,016 | |||

|

Total Liabilities to be Assumed by SpeechFX, Inc.

|

$ | 2,873,139 | ||

41