SECURITY AGREEMENT

Exhibit (d)(8)

This Security Agreement (this “Agreement”), dated as of December 21, 2007, among, Xxxxxxx Acquisition, Inc., (the “Pledgor”) a Delaware corporation and a wholly owned subsidiary of VimpelCom Finance B.V. (“Parent”) and Golden Telecom, Inc., a Delaware corporation (the “Secured Party”). Capitalized terms used herein and not otherwise defined shall have the meanings as set forth in the Merger Agreement (as defined below).

RECITALS

WHEREAS, the Secured Party, Pledgor and Parent have entered into that certain Merger Agreement (as defined below) pursuant to which Pledgor will commence (within the meaning of Rule 14d-2 under the Exchange Act) an offer (as it may be amended from time to time as permitted under the Merger Agreement, the “Offer”) to purchase for cash all of the issued and outstanding shares of the Secured Party’s common stock, par value $.01 per share (the “Common Stock”).

WHEREAS, following the consummation of the Offer, the parties intend that Pledgor be merged with and into the Secured Party (the “Merger”), with the Secured Party surviving the Merger.

WHEREAS, pursuant to the terms of the Merger Agreement, the Pledgor has agreed to have the amount of $80,000,000 credited to an Account (as defined below) to be established by the Bank (as defined below) pursuant to the terms and conditions of the Account Control Agreement (as defined below).

WHEREAS, pursuant to the terms of the Account Control Agreement, Pledgor has granted Secured Party control of the Account (as defined below).

WHEREAS, pursuant to the terms of the Merger Agreement, Pledgor has agreed to grant Secured Party a security interest in the financial assets in the Account.

AGREEMENT

Section 1. Defined Terms.

“Account” shall have the meaning assigned to it in the Account Control Agreement or any successor account.

“Account Control Agreement” means the Account Control Agreement, dated as of December 21, 2007, by and among the Secured Party, Pledgor and Bank, as it may be amended or modified from time to time in accordance with the terms thereof.

“Bank” shall have the meaning assigned to it in the Account Control Agreement.

“Merger Agreement” means the Agreement and Plan of Merger, dated as of December 21, 2007, by and among the Secured Party, Pledgor and Parent, as it may be amended or modified from time to time in accordance with the terms thereof.

“Secured Obligation” means the obligation of Pledgor to pay the Reverse Termination Fee to the Secured Party in accordance with the terms set forth in Sections 9.2(c) 9.2(d) and 9.2(e) of the Merger Agreement.

“UCC” means the Uniform Commercial Code as in effect from time to time in the State of Delaware.

Section 2. Grant of Security Interest.

(a) As security for the prompt and complete payment and performance in full of the Secured Obligation, Pledgor hereby grants to the Secured Party a security interest in Pledgor’s right, title and interest in, to and under the following, in each case, whether now owned or existing or hereafter acquired or arising, and wherever located (all of which being hereinafter collectively called the “Collateral”):

(i) the Account and all securities or other property from time to time credited to the Account; and

(ii) all proceeds, distributions, collections, additions, substitutions, replacements, rents and profits of or in respect of such securities or other property described in clause (i) above.

(b) The Secured Party’s security interest in the Collateral shall be terminated upon termination of the Agreement in accordance with Section 9 hereof.

Section 3. Notice of Issuance of an Entitlement Order.

(a) The Secured Party shall provide Pledgor with written notice (as provided in Section 8), at least ten (10) calendar days in advance of the issuance of an Entitlement Order (as defined in the Account Control Agreement) to the Bank (as defined in the Account Control Agreement) pursuant to Section 3 of the Account Control Agreement.

(b) The Secured Party agrees that upon issuance of an Entitlement Order by Secured Party to the Bank, a copy of such Entitlement Order will be simultaneously sent by Secured Party to Pledgor in accordance with the notice provisions of Section 8.

Section 4. Governing Law.

(a) This Agreement shall be governed by the laws of the State of Delaware.

Section 5. Representations and Warranties of the Pledgor. Pledgor hereby represents and warrants to the Secured Party, which representations and warranties shall survive execution and delivery of this Agreement, as follows:

2

(a) Validity, Perfection and Priority. The security interests in the Collateral granted to the Secured Party constitute valid and continuing security interests in the Collateral. Upon the execution of this Agreement and the filing of the financing statement, a copy of which is attached hereto as Exhibit A (the “Financing Statement”), the security interests in the Collateral granted to the Secured Party hereunder will constitute perfected security interests in the Collateral superior and prior to all liens, rights or claims of all other persons. Other than the filing of the Financing Statement, all actions and consents, including all filings, notices, registrations and recordings necessary or desirable to create, perfect or ensure that the security interests granted to the Secured Party hereunder are superior and prior to all liens, rights or claims of all other persons or for the exercise of remedies in respect of the Collateral have been made or obtained.

(b) No Liens; Other Financing Statements. Except for the pledge and security interest granted hereunder, Pledgor owns and will continue to own each item of the Collateral free and clear of any and all liens, rights or claims of all other persons, and Pledgor shall defend the Collateral against all claims and demands of all persons at any time claiming the same or any interest therein by or through any of Pledgor or its affiliates adverse to the Secured Party. No financing statement or other evidence of any lien covering or purporting to cover any of the Collateral is on file in any public office other than financing statements filed or to be filed in connection with the security interests granted to the Secured Party.

(c) Account. The Account is a “securities account” (as defined in Section 8-501 of the UCC). The Pledgor is the sole entitlement holder of the Account and Pledgor has not consented to, and is not otherwise aware of, any Person having “control” (within the meaning of Section 8-106 of the UCC) over, or any other interest in, the Account or any securities or other property credited thereto.

(d) Accuracy and Completeness. All information supplied by Pledgor with respect to any of the Collateral is accurate and complete in all material respects.

Section 6. Covenants of the Pledgor. Pledgor covenants and agrees with the Secured Party that, from and after the date of this Agreement until the Secured Obligation has been indefeasibly performed and paid in full or this Agreement is terminated pursuant to Section 9 hereof:

(a) Further Assurances. At any time and from time to time, upon the request of the Secured Party, and at the sole expense of Pledgor, Pledgor will promptly and duly execute and deliver any and all such further instruments, endorsements, powers of attorney and other documents, make such filings, give such notices and take such further action as the Secured Party may reasonably deem necessary in obtaining the full benefits of this Agreement and of the rights, remedies and powers herein granted, including, without limitation, the following:

(i) the filing of any financing statements, in form acceptable to the Secured Party under the Uniform Commercial Code in effect in any jurisdiction with

3

respect to the Liens and security interests granted hereby. Pledgor also hereby authorizes the Secured Party and its counsel to file any financing or continuation statements and amendments thereto, in all jurisdictions and with all filing offices as the Secured Party may determine, in its sole reasonable discretion, are necessary or advisable to perfect the security interest granted by this Agreement. Such financing statements may describe the collateral in the same manner as described in this Agreement or may contain an indication or description of collateral that describes such property in any other manner as the Secured Party may determine is necessary, advisable or prudent to ensure the perfection of the security interest in the Collateral. Pledgor will pay or reimburse the Secured Party for all filing fees and related expenses;

(ii) the making or reimbursement of the Secured Party for making all searches deemed necessary by the Secured Party to establish and determine the priority of the security interests of the Secured Party or to determine the presence or priority of other secured parties; and

(iii) furnishing to the Secured Party from time to time statements and schedules further identifying and describing the Collateral and such other reports in connection with the Collateral as the Secured Party may reasonably request, all in reasonable detail and in form satisfactory to the Secured Party.

(b) Change of Name; Identity or Corporate Structure. Pledgor will not change its name until (i) it has given to the Secured Party not less than 20 days’ prior written notice of its intention to do so, clearly describing such new name and providing such other information in connection therewith as the Secured Party may reasonably request, and (ii) with respect to such new name, it will have taken all action satisfactory to the Secured Party as the Secured Party may reasonably request to maintain the security interest of the Secured Party in the Collateral intended to be granted hereby at all times fully perfected with the same or better priority and in full force and effect.

(c) Taxes. Pledgor will pay promptly when due all taxes, assessments and governmental charges or levies imposed upon, and all claims against, the Collateral.

(d) Sales, Transfers or Assignments. Pledgor will not sell, transfer or assign (by operation of law or otherwise) any Collateral, except in connection with directing investments in the Account in accordance with the terms of the Account Control Agreement.

(e) No Impairment. Pledgor will not take or permit to be taken any action which could impair the Secured Party’s security interest in the Collateral.

(f) Notice. Pledgor will advise the Secured Party promptly, in reasonable detail, in accordance with the provisions hereof (a) of any lien on, or claim asserted against, any of the Collateral and (b) of the occurrence of any other event which could reasonably be expected to have a material adverse effect on the Collateral or on the liens created hereunder.

4

(g) Negative Pledge. Pledgor will not create, incur or permit to exist any pledge of or any lien or claim on or to any of the Collateral, and will defend the Collateral against, and will take such other action as is necessary to remove, any lien or claim on or to any of the Collateral, other than the liens created hereby, and Pledgor will defend the right, title and interest of the Secured Party against the claims and demands of all Persons whomsoever, and Pledgor will not authorize the filing of any financing statement with respect to any Collateral unless the Secured Party is listed as secured party thereon.

Section 7. Successors; Assignment.

(a) Successors. The terms of this Agreement shall be binding upon, and shall be for the benefit of, the parties hereto and their respective corporate successors or heirs and personal representatives who obtain such rights solely by operation of law.

(b) Assignment by Pledgor. Neither the Secured Party nor the Pledgor shall assign any right, title or interest hereunder.

(c) Successor Account. The terms of this Agreement shall be binding on and shall apply to any successor account to the Account.

Section 8. Notices. Any notice, request or other communication required or permitted to be given under this Agreement shall be in writing and deemed to have been properly given when delivered in person, or when sent by telecopy or other electronic means and electronic confirmation of error free receipt is received or two days after being sent by certified or registered United States mail, return receipt requested, postage prepaid, addressed to the party at the address set forth below.

Pledgor:

XXXXXXX ACQUISITION, INC.

0 Xxxxxxxxxxxxxxxxxxx Xx.

Xxxxxx, Xxxxxx 000000

Attention: Xxxxx Shmatova

Secured Party:

GOLDEN TELECOM, INC.

REPRESENTATION OFFICE OF GOLDEN TELESERVICES, INC.

0 Xxxxxxxxxxxxxx Xxxxxx

Xxxxxx, Xxxxxx 000000

Attention: Xxxx-Xxxxxx Xxxxxxxxx

Any party may change its address for notices in the manner set forth above.

Section 9. Termination. This Agreement and the security interest created hereunder will continue in effect until the Secured Party has notified the Pledgor and the Bank

5

that the Account Control Agreement has been terminated, and upon such termination, this Agreement shall automatically terminate. The Secured Party will promptly (and no later than two business days) provide to the Pledgor and the Bank a notice of termination pursuant to Section 10 of the Account Control Agreement upon the occurrence of any of the following events: (i) the Secured Obligation has been paid in full in cash, (ii) the thirtieth (30th) day after the date the Merger Agreement has been terminated pursuant to the provisions of the Merger Agreement, unless during such thirty (30) day period, the Secured Party has initiated a Proceeding against the Pledgor claiming entitlement to the Reverse Termination Fee, in which case this Agreement and such security interest shall terminate when such Proceeding is finally judicially adjudicated or settled, and (iii) the Acceptance Date, provided that in the case of clause (iii), the Bank has received an irrevocable instruction from the Pledgor countersigned by the Secured Party directing the Bank to transfer all of the funds in the Account to the paying agent appointed for the Offer for payment to holders of shares of Common Stock validly tendered into the Offer and not withdrawn.

Section 10. Counterparts. This Agreement may be executed in any number of counterparts, all of which shall constitute one and the same instrument, and any party hereto may execute this Agreement by signing and delivering one or more counterparts.

Section 11. Entire Agreement. This Agreement (including the exhibits hereto), the Account Control Agreement (including the exhibits thereto) and the Merger Agreement (including the schedules and exhibits thereto) embody the entire agreement and understanding in respect of the subject matter contained herein. Without limiting the generality of the foregoing sentence, Section 9.4 of the Merger Agreement (Limitation of Liability) shall be applicable to this Agreement and the transactions contemplated hereby.

6

| XXXXXXX ACQUISITION, INC, as the “Pledgor” | ||

| By: | /s/ Xxxxx Shmatova | |

| Name: | Xxxxx Shmatova | |

| Title: | President | |

| GOLDEN TELECOM, INC., as the Secured Party | ||

| By: | /s/ Xxxx-Xxxxxx Xxxxxxxxx | |

| Name: | Xxxx-Xxxxxx Xxxxxxxxx | |

| Title: | Chief Executive Officer | |

7

Exhibit A

UCC-1 Financing Statements

[SEE ATTACHED UCC-1 FINANCING STATEMENTS]

8

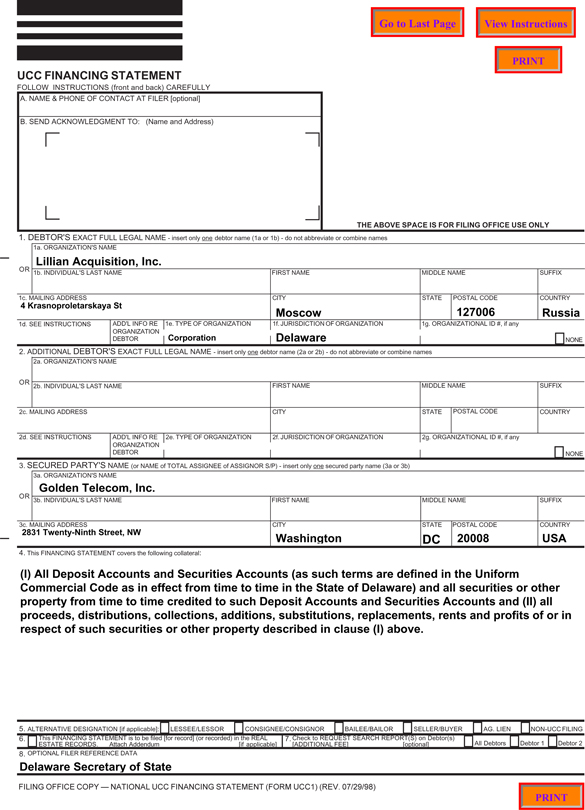

UCC FINANCING STATEMENT

FOLLOW INSTRUCTIONS (front and back) CAREFULLY A. NAME & PHONE OF CONTACT AT FILER [optional]

B. SEND ACKNOWLEDGMENT TO: (Name and Address)

THE ABOVE SPACE IS FOR FILING OFFICE USE ONLY

names

1. DEBTOR’S EXACT FULL LEGAL NAME—insert only one debtor name (1a or 1b)—do not abbreviate or combine names 1a. ORGANIZATION’S NAME

Xxxxxxx Acquisition, Inc.

OR

1b. INDIVIDUAL’S LAST NAME FIRST NAME MIDDLE NAME SUFFIX

1c. MAILING ADDRESS CITY STATE POSTAL CODE COUNTRY

4 Krasnoproletarskaya St

Moscow 127006 Russia

1d. SEE INSTRUCTIONS ADD’L INFO RE 1e. TYPE OF ORGANIZATION 1f. JURISDICTION OF ORGANIZATION 1g. ORGANIZATIONAL ID #, if any ORGANIZATION

DEBTOR Corporation Delaware NONE

2. ADDITIONAL DEBTOR’S EXACT FULL LEGAL NAME—insert only one debtor name (2a or 2b)—do not abbreviate or combine names 2a. ORGANIZATION’S NAME

OR

2b. INDIVIDUAL’S LAST NAME FIRST NAME MIDDLE NAME SUFFIX

2c. MAILING ADDRESS CITY STATE POSTAL CODE COUNTRY

2d. SEE INSTRUCTIONS ADD’L INFO RE 2e. TYPE OF ORGANIZATION 2f. JURISDICTION OF ORGANIZATION 2g. ORGANIZATIONAL ID #, if any ORGANIZATION

DEBTOR NONE

3. SECURED PARTY’S NAME (or NAME of TOTAL ASSIGNEE of ASSIGNOR S/P)—insert only one secured party name (3a or 3b) 3a. ORGANIZATION’S NAME

Golden Telecom, Inc.

OR

3b. INDIVIDUAL’S LAST NAME FIRST NAME MIDDLE NAME SUFFIX

3c. MAILING ADDRESS CITY STATE POSTAL CODE COUNTRY

0000 Xxxxxx-Xxxxx Xxxxxx, XX

Xxxxxxxxxx XX 00000 XXX

4. This FINANCING STATEMENT covers the following collateral:

(I) All Deposit Accounts and Securities Accounts (as such terms are defined in the Uniform Commercial Code as in effect from time to time in the State of Delaware) and all securities or other property from time to time credited to such Deposit Accounts and Securities Accounts and (II) all proceeds, distributions, collections, additions, substitutions, replacements, rents and profits of or in respect of such securities or other property described in clause (I) above.

5. ALTERNATIVE DESIGNATION [if applicable]: LESSEE/LESSOR CONSIGNEE/CONSIGNOR BAILEE/XXXXXX SELLER/BUYER AG. LIEN NON-UCC FILING

6. This FINANCING STATEMENT is to be filed [for record] (or recorded) in the REAL 7. Check to REQUEST SEARCH REPORT(S) on Debtor(s)

ESTATE RECORDS. Attach Addendum [if applicable] [ADDITIONAL FEE] [optional] All Debtors Debtor 1 Debtor 2

8. OPTIONAL FILER REFERENCE DATA

Delaware Secretary of State

FILING OFFICE COPY — NATIONAL UCC FINANCING STATEMENT (FORM UCC1) (REV. 07/29/98)

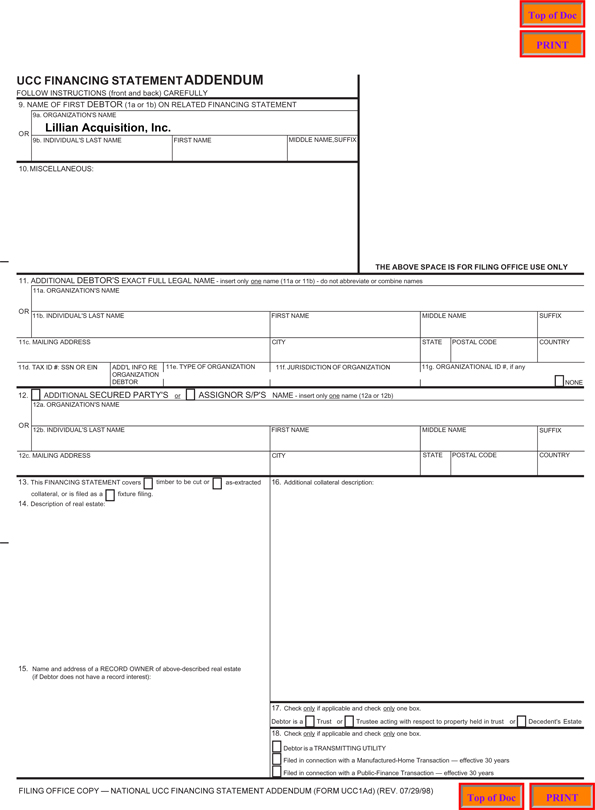

UCC FINANCING STATEMENT ADDENDUM

FOLLOW INSTRUCTIONS (front and back) CAREFULLY

9. NAME OF FIRST DEBTOR (1a or 1b) ON RELATED FINANCING STATEMENT

9a. ORGANIZATION’S NAME

Xxxxxxx Acquisition, Inc.

OR

9b. INDIVIDUAL’S LAST NAME FIRST NAME MIDDLE NAME,SUFFIX

10. MISCELLANEOUS:

THE ABOVE SPACE IS FOR FILING OFFICE USE ONLY

11. ADDITIONAL DEBTOR’S EXACT FULL LEGAL NAME—insert only one name (11a or 11b)—do not abbreviate or combine names 11a. ORGANIZATION’S NAME

OR

11b. INDIVIDUAL’S LAST NAME FIRST NAME MIDDLE NAME SUFFIX

11c. MAILING ADDRESS CITY STATE POSTAL CODE COUNTRY

11d. TAX ID #: SSN OR EIN ADD’L INFO RE 11e. TYPE OF ORGANIZATION 11f. JURISDICTION OF ORGANIZATION 11g. ORGANIZATIONAL ID #, if any ORGANIZATION

DEBTOR NONE

12. ADDITIONAL SECURED PARTY’S or ASSIGNOR S/P’S NAME—insert only one name (12a or 12b) 12a. ORGANIZATION’S NAME

OR

12b. INDIVIDUAL’S LAST NAME FIRST NAME MIDDLE NAME SUFFIX

12c. MAILING ADDRESS CITY STATE POSTAL CODE COUNTRY

13. This FINANCING STATEMENT covers timber to be cut or as-extracted 16. Additional collateral description:

collateral, or is filed as a fixture filing. 14. Description of real estate:

15. Name and address of a RECORD OWNER of above-described real estate (if Debtor does not have a record interest):

17. Check only if applicable and check only one box.

Debtor is a Trust or Trustee acting with respect to property held in trust or Decedent’s Estate

18. Check only if applicable and check only one box.

Debtor is a TRANSMITTING UTILITY

Filed in connection with a Manufactured-Home Transaction — effective 30 years

Filed in connection with a Public-Finance Transaction — effective 30 years

FILING OFFICE COPY — NATIONAL UCC FINANCING STATEMENT ADDENDUM (FORM UCC1Ad) (REV. 07/29/98)