AGRO CAPITAL MANAGEMENT, CORP. CONSULTING AGREEMENT

Exhibit 10.6

AGRO CAPITAL MANAGEMENT, CORP.

This Consulting Agreement (“Agreement”) is made and entered into as of March 22, 2021 (“Effective Date”) by and between Agro Capital Management, Corp. (“Company”) and Xxxxx Xxxxxxxx (“Consultant”), residing at 0000 X 000xx Xxxxxx, Xxxxxxxxxx, XX 00000, who are hereinafter referred to as the “Parties” or a “Party” as context may require.

1. Engagement of Services. Company seeks to engage Consultant with the tasks listed in Statement of Work attached to this Agreement as Exhibit A (“Statement of Work”). A Statement of Work will become binding when both Parties have signed it and once signed, Consultant will be obligated to provide the services as listed in the Statement of Work, subject to the provisions of Section 8. The terms of this Agreement will govern the Statement of Work and services undertaken by Consultant for the benefit of Company. Consultant represents, warrants and covenants that Consultant will perform the services under this Agreement in a timely, professional and workmanlike manner and that all materials and deliverables provided to Company will comply with (i) the requirements set forth in the Statement of Work, (ii) the documentation and specifications for those materials and deliverables, (iii) any samples or documents provided by Consultant to Company.

2. Compensation; Timing. Company will pay Consultant the fee set forth in each Statement of Work for the services provided as specified in that Statement of Work. Company will reimburse Consultant’s documented, out-of-pocket expenses no later than fifteen (15) days after Company’s receipt of Consultant’s itemized invoice, except that reimbursement for expenses may be delayed until that time when Consultant furnishes adequate supporting documentation for the authorized expenses as Company may reasonably request. Upon termination of this Agreement for any reason, Consultant will be: (a) paid fees on the basis stated in the Statement of Work; and (b) reimbursed only for expenses that are properly incurred prior to termination of this Agreement and which are either expressly identified in a Statement of Work or approved in advance in writing by an authorized Company manager.

3. Independent Contractor Relationship. Consultant’s relationship with Company is that of an independent contractor, and nothing in this Agreement is intended to, or shall be construed to, create a partnership, agency, joint venture, employment or similar relationship. Consultant will not be entitled to any of the benefits that Company may make available to its employees, including, but not limited to, group health or life insurance, profit-sharing or retirement benefits. Consultant is not authorized to make any representation, contract or commitment on behalf of Company unless specifically requested or authorized in writing to do so by a Company manager. Consultant is solely responsible for, and will file, on a timely basis, all tax returns and payments required to be filed with, or made to, any federal, state or local tax authority with respect to the performance of services and receipt of fees under this Agreement. Consultant is solely responsible for, and must maintain adequate records of, expenses incurred in the course of performing services under this Agreement. No part of Consultant’s compensation will be subject to withholding by Company for the payment of any social security, federal, state or any other employee payroll taxes. Company will regularly report amounts paid to Consultant by filing Form 1099-MISC with the Internal Revenue Service as required by law.

4. Disclosure and Assignment of Work Resulting from Statement of Work.

4.1 “Innovations” and “Company Innovations” Definitions. In this Agreement, “Innovations” means all discoveries, designs, developments, improvements, inventions (whether or not protectable under patent laws), works of authorship, information fixed in any tangible medium of expression (whether or not protectable under copyright laws), trade secrets, know-how, ideas (whether or not protectable under trade secret laws), mask works, trademarks, service marks, trade names and trade dress. “Company Innovations” means Innovations that Consultant, solely or jointly with others, creates, derives, conceives, develops, makes or reduces to practice under the Statement of Work.

| Page 1 of 6 |

4.2 Disclosure and Assignment of Company Innovations. Consultant agrees to maintain adequate and current records of all Company Innovations, which records shall be and remain the property of Company. Consultant agrees to promptly disclose and describe to Company all Company Innovations. Consultant hereby does and will irrevocably assign to Company or Company’s designee all of Consultant’s right, title and interest in and to any and all Company Innovations and all associated records. To the extent any of the rights, title and interest in and to Company Innovations cannot be assigned by Consultant to Company, Consultant hereby grants to Company an exclusive, royalty-free, transferable, irrevocable, worldwide, fully paid-up license (with rights to sublicense through multiple tiers of sublicensees) to fully use, practice and exploit those non-assignable rights, title and interest, including, but not limited to, the right to make, use, sell, offer for sale, import, have made, and have sold, the Company Innovations. To the extent any of the rights, title and interest in and to the Company Innovations can neither be assigned nor licensed by Consultant to Company, Consultant hereby irrevocably waives and agrees never to assert the non-assignable and non-licensable rights, title and interest against Company, any of Company’s successors in interest, or any of Company’s customers.

4.3 Assistance. Consultant agrees to perform, during and after the term of this Agreement, all acts that Company deems necessary or desirable to permit and assist Company, at its expense, in obtaining, perfecting and enforcing the full benefits, enjoyment, rights and title throughout the world in the Company Innovations as provided to Company under this Agreement. If Company is unable for any reason to secure Consultant’s signature to any document required to file, prosecute, register or memorialize the assignment of any rights under any Company Innovations as provided under this Agreement, Consultant hereby irrevocably designates and appoints Company and Company’s duly authorized officers and agents as Consultant’s agents and attorneys-in-fact to act for and on Consultant’s behalf and instead of Consultant to take all lawfully permitted acts to further the filing, prosecution, registration, memorialization of assignment, issuance and enforcement of rights in, to and under the Company Innovations, all with the same legal force and effect as if executed by Consultant. The foregoing is deemed a power coupled with an interest and is irrevocable.

4.4 Consultant Out-of-Scope Innovations. If Consultant incorporates or permits to be incorporated any Innovations relating in any way, at the time of conception, reduction to practice, creation, derivation, development or making of the Innovation, to Company’s business or actual or demonstrably anticipated research or development but which were conceived, reduced to practice, created, derived, developed or made by Consultant (solely or jointly) either unrelated to Consultant’s work for Company under this Agreement or prior to the Effective Date (collectively, the “Out-of-Scope Innovations”) into any of the Company Innovations, then Consultant hereby grants to Company and Company’s designees a royalty-free, transferable, irrevocable, worldwide, fully paid-up license (with rights to sublicense through multiple tiers of sublicensees) to fully use, practice and exploit all patent, copyright, moral right, mask work, trade secret and other intellectual property rights relating to the Out-of-Scope Innovations. Notwithstanding the foregoing, Consultant agrees that Consultant shall not incorporate, or permit to be incorporated, any Innovations conceived, reduced to practice, created, derived, developed or made by others or any Out-of-Scope Innovations into any Company Innovations without Company’s prior written consent.

| Page 2 of 6 |

5. Confidentiality.

5.1 Definition of Confidential Information. As used in this Agreement the phrase “Confidential Information” means (a) any technical and non-technical information related to the Company’s business and current, future and proposed products and services of Company, including for example and without limitation, Company Innovations, Company Property (as defined in Section 4 (Ownership and Return of Confidential Information and Company Property)), and Company’s information concerning research, development, design details and specifications, financial information, procurement requirements, engineering and manufacturing information, customer lists, business forecasts, sales information, marketing plans and business plans, in each case whether or not marked as “confidential” or “proprietary” and (b) any information that Company has received from others that may be made known to Consultant and that Company is obligated to treat as confidential or proprietary, whether or not marked as “confidential” or “proprietary”.

5.2 Nondisclosure and Nonuse Obligations. Except as permitted in this Section, Consultant will not (i) use any Confidential Information or (ii) disseminate or in any way disclose the Confidential Information to any person, firm, business or governmental agency or department. Consultant may use the Confidential Information solely to perform under the Statement of Work for the benefit of Company. Consultant shall treat all Confidential Information with the same degree of care as Consultant accords to Consultant’s own confidential information, but in no case shall Consultant use less than reasonable care. If Consultant is not an individual, Consultant shall disclose Confidential Information only to those of Consultant’s employees who have a need to know the information as necessary for Consultant to perform this Agreement. Consultant certifies that each of its employees will have agreed, either as a condition of employment or in order to obtain the Confidential Information, to be bound by terms and conditions at least as protective as those terms and conditions applicable to Consultant under this Agreement. Consultant shall immediately give notice to Company of any unauthorized use or disclosure of the Confidential Information. Consultant shall assist Company in remedying any the unauthorized use or disclosure of the Confidential Information. Consultant agrees not to communicate any information to Company in violation of the proprietary rights of any third party.

5.3 Exclusions from Nondisclosure and Nonuse Obligations. Consultant’s obligations under Section 5.2 do not apply to any Confidential Information that Consultant can demonstrate (a) was in the public domain at or subsequent to the time the Confidential Information was communicated to Consultant by Company through no fault of Consultant; (b) was rightfully in Consultant’s possession free of any obligation of confidence at or subsequent to the time the Confidential Information was communicated to Consultant by Company; or (c) was independently developed by employees of Consultant without use of, or reference to, any Confidential Information communicated to Consultant by Company. A disclosure of any Confidential Information by Consultant (a) in response to a valid order by a court or other governmental body or (b) as otherwise required by law will not be considered to be a breach of this Agreement or a waiver of confidentiality for other purposes; provided, however, that Consultant provides prompt prior written notice thereof to Company to enable Company to seek a protective order or otherwise prevent the disclosure.

6. Ownership and Return of Confidential Information and Company Property. All Confidential Information and any materials and items (including, without limitation, software, equipment, tools, artwork, documents, drawings, papers, diskettes, tapes, models, apparatus, sketches, designs and lists) that Company furnishes to Consultant by Company, whether delivered to Consultant by Company or made by Consultant in the performance of services under this Agreement and whether or not they contain or disclose Confidential Information (collectively, the “Company Property”), are the sole and exclusive property of Company or Company’s suppliers or customers. Consultant agrees to keep all Company Property at Consultant’s premises unless otherwise permitted in writing by Company. Within five (5) days after any request by Company, Consultant shall destroy or deliver to Company, at Company’s option, (a) all Company Property and (b) all materials and items in Consultant’s possession or control that contain or disclose any Confidential Information. Consultant will provide Company a written certification of Consultant’s compliance with Consultant’s obligations under this Section.

| Page 3 of 6 |

6.1 Consultant’s Ownership of Pre-Existing Works. Company agrees that Consultant retains all right, title, and ownership to Consultant’s pre-existing works.

7. Term and Termination.

7.1 Termination by Company. Company may terminate this Agreement without cause at any time, with termination effective upon mutually agreed upon terms upon Company’s delivery to Consultant of written notice of termination.

7.2 Termination by Consultant. Consultant may terminate this Agreement without cause at any time, with termination effective upon mutually agreed upon terms upon Company’s delivery to Consultant of written notice of termination.

7.3 Effect of Expiration or Termination. Company shall pay Consultant for services properly performed under this Agreement as set forth in the Statement of Work at Exhibit A hereto. The definitions contained in this Agreement and the rights and obligations contained in this Section and Sections 4 (Disclosure and Assignment of Work Resulting from Statement of Work), 5 (Confidentiality), 6 (Ownership and Return of Confidential Information and Company Property), and 9 (General Provisions) will survive any termination or expiration of this Agreement.

8. Noninterference with Consultant’s Business. Company is aware of other demands on Consultant’s time and attention, and that Consultant will perform agreed Services at such times so as not to conflict with any other business activity or obligations in which Consultant is engaged or becomes engaged during the Term of this Agreement. Nothing in this Agreement shall obligate Consultant to engage, directly or indirectly, with any third party (i.e. customers and suppliers) of the Company. Further, Company shall not disclose to any third party, directly or indirectly, that Consultant is performing Services for Company without Consultant’s prior approval. The Company assumes any and all risk and liability related to Consultant’s work under this Agreement including accepting or declining any advice or recommendations provided by Consultant. Company agrees and accepts that Consultant has no liability, regardless of the cause of action, under this Agreement.

9. General Provisions.

9.1 Successors and Assigns. Consultant shall not assign its rights or delegate any performance under this Agreement without the prior written consent of Company. For the avoidance of doubt, Consultant may not subcontract performance of any services under this Agreement to any other contractor or consultant without Company’s prior written consent. This Agreement will be for the benefit of Company’s successors and assigns, and will be binding on Consultant’s permitted assignees. Notwithstanding the foregoing, Consultant may assign this Agreement to another entity established by Consultant such as an LLC and Company hereby agrees in advance to such assignment.

9.2 Injunctive Relief. Consultant’s obligations under this Agreement are of a unique character that gives them particular value; Consultant’s breach of any of these obligations may cause irreparable and continuing damage to Company for which money damages are insufficient, and Company is entitled to seek injunctive relief, a decree for specific performance, and all other relief as may be proper (including money damages if appropriate), without the need to post a bond.

9.3 Notices. Any notice required or permitted by this Agreement shall be in writing and shall be delivered as follows, with notice deemed given as indicated: (a) by personal delivery, when actually delivered; (b) by overnight courier, upon written verification of receipt; (c) by facsimile transmission, upon acknowledgment of receipt of electronic transmission; or (d) by certified or registered mail, return receipt requested, upon verification of receipt. Notice shall be sent to the addresses set forth above or to such other address as either Party may provide in writing.

| Page 4 of 6 |

9.4 Governing Law; Venue; & Jurisdiction. The laws of the United States of America and the State of California govern all matters arising out of or relating to this Agreement without giving effect to any conflict of law principles. ARBITRATION. The Parties agree that any claim or dispute between them or against any agent, employee, successor, or assign of the other, whether related to this agreement or otherwise, and any claim or dispute related to this agreement or the relationship or duties contemplated under this Agreement, including the validity of this arbitration clause, shall be resolved by binding arbitration by the American Arbitration Association, under the Arbitration Rules then in effect. Any award of the arbitrator(s) may be entered as a judgment in any court of competent jurisdiction. Any controversy shall be arbitrated in the State of California. Each Party in entering this Agreement irrevocably waives any argument as to the jurisdiction of the State of California and application of the laws of the State of California in such an arbitration proceeding. Further, in entering this Agreement, the Parties, and each of them irrevocably waive any right to a trial by jury as well as any argument that California is an improper venue for dispute resolution or an inconvenient forum for such.

9.5 Severability. If a court of law holds any provision of this Agreement to be illegal, invalid or unenforceable, (a) that provision shall be deemed amended to achieve an economic effect that is as near as possible to that provided by the original provision and (b) the legality, validity and enforceability of the remaining provisions of this Agreement shall not be affected.

9.6 Waiver; Modification. If either Party waives any term, provision or breach of this Agreement, such waiver shall not be effective unless it is in writing and signed by the Party. No waiver by a Party of a breach of this Agreement shall constitute a waiver of any other or subsequent breach by the either Party. This Agreement may be modified only by mutual written agreement of authorized representatives of the Parties.

9.7 Entire Agreement. This Agreement constitutes the final and exclusive agreement between the Parties relating to this subject matter and supersedes all agreements, whether prior or contemporaneous, written or oral, concerning such subject matter

IN WITNESS WHEREOF, the Parties have executed this Agreement as of the date first written above.

| The “Company” | The “Consultant” | |||

| By: | /s/ Xxxxx Xxxxxx | By: | /s/ Xxxxx Xxxxxxxx | |

| Name: | Xxxxx Xxxxxx | Name: | Xxxxx Xxxxxxxx | |

| Title: | Chief Executive Officer | Title: | Chief Financial Officer | |

| Date: | Date: | |||

| Page 5 of 6 |

Exhibit A

STATEMENT OF WORK

This Statement of Work is by and between the Parties for the following:

| 1) | Reporting to the Chief Executive Officer of the Company, Consultant will perform part-time Chief Financial Officer services to the Company. |

Description of Work Services

Chief Financial Officer part-time services related to public filings, audit support, investor communications, capital raising support, and public company listing support in general in order to move the Company to a more fully reporting entity with the potential to leverage an increasing investor base. Oversight and interaction with the Company’s third-party accounting team.

Term of Work Services

Consultant’s part-time services will continue indefinitely until terminated by either Party upon mutually agreed upon terms.

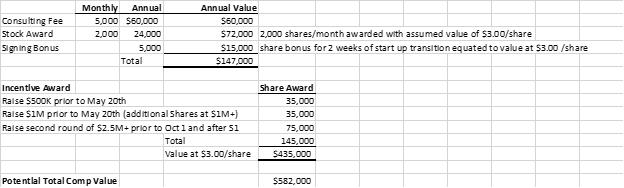

Consulting Compensation

Consulting fee will commence on April 5, 2021, following a 2-week transition period from March 22, 2021. Consulting fee will be administered each month through a Form 1099 wire transfer to Consultant’s bank account. Any consulting fee deferral related to adverse financial conditions of the Company will be accrued and owed to the Consultant. The consulting fee will be evaluated at a future date upon mutually agreed upon conditions or upon potential conversion to employment.

The Consultant will have the option to purchase all earned and vested restricted stock awards at a price of 38 cents per share. The awards will be forfeited by the Consultant if not purchased within 90 days from termination from the company or other mutually agreed upon terms.

Expenses. All direct and pre-approved travel expenses incurred by the Consultant will be reimbursed by the Company as per the Company’s expense reimbursement policy.

IN WITNESS WHEREOF, the Parties are signing this Statement of Work as of the later date below.

| Agro Capital Management, Corp. | Consultant | |||

| By: | /s/ Xxxxx Xxxxxx | By: | /s/ Xxxxx Xxxxxxxx | |

| Xxxxx Xxxxxx, CEO | Xxxxx Xxxxxxxx, CFO | |||

| Date: | Date: | |||