EXECUTION VERSION Rentokil - Bridge and Term Facilities Agreement

Exhibit 10.3

EXECUTION VERSION

Rentokil - Bridge and Term Facilities Agreement

between

Rentokil Initial plc

as Borrower

The Financial Institutions identified in this Agreement

as Arrangers

The Financial Institutions identified in this Agreement

as Original Lenders

Barclays Bank PLC as Documentation Agent

and

Skandinaviska Enskilda Xxxxxx XX (publ)

as Agent

relating to

USD 2,700,000,000 acquisition finance bridge and term facilities

| i |

Contents

| 1. | Definitions and Interpretation | 1 |

| 2. | The Facilities | 23 |

| 3. | Purpose | 26 |

| 4. | Conditions of Utilisation | 26 |

| 5. | Utilisation | 27 |

| 6. | Repayment | 28 |

| 7. | Prepayment and Cancellation | 28 |

| 8. | Interest | 35 |

| 9. | Interest Periods | 36 |

| 10. | Changes to the Calculation of Interest | 36 |

| 11. | Fees | 38 |

| 12. | Tax Gross-Up and Indemnities | 39 |

| 13. | Increased Costs | 48 |

| 14. | Other Indemnities | 51 |

| 15. | Mitigation by the Lenders | 52 |

| 16. | Costs and Expenses | 53 |

| 17. | [Clause not used] | 53 |

| 18. | Representations | 53 |

| 19. | Information Undertakings | 57 |

| 20. | [Clause not used] | 61 |

| 21. | General Undertakings | 61 |

| 22. | Events of Xxxxxxx | 00 |

| 00. | Changes to the Lenders | 69 |

| 24. | Changes to the Borrower | 74 |

| 25. | Conduct of Business by the Finance Parties | 75 |

| 26. | Sharing among the Finance Parties | 75 |

| 27. | Payment Mechanics | 76 |

| ii |

| 28. | Set-Off | 80 |

| 29. | Notices | 80 |

| 30. | Calculations and Certificates | 82 |

| 31. | Partial Invalidity | 83 |

| 32. | Remedies and Waivers | 83 |

| 33. | Amendments and Waivers | 83 |

| 34. | Role of the Agent and the Arrangers | 91 |

| 35. | Confidential Information | 100 |

| 36. | Confidentiality of Funding Rates | 103 |

| 37. | Counterparts | 105 |

| 38. | Governing Law | 105 |

| 39. | Jurisdiction | 105 |

| 40. | Waiver of trial by jury | 105 |

| 41. | USA PATRIOT Act | 105 |

| Schedule 1 : The Finance Parties | 106 |

| Part 1 : The Original Lenders | 106 |

| Part 2 : The Arrangers | 108 |

| Schedule 2 : Conditions Precedent | 109 |

| Part 1 : Conditions Precedent to signing this Agreement | 109 |

| Part 2 : Conditions Precedent to INitial UtilisatIon | 110 |

| Schedule 3 : Requests | 111 |

| Part 1 : Utilisation Request | 111 |

| Part 2 : Extension NOTICE | 112 |

| Schedule 4 : Form of Transfer Certificate | 113 |

| Schedule 5 : Form of Assignment Agreement | 116 |

| Schedule 6 : [Schedule not used] | 119 |

| Schedule 7 : Form of Compliance Certificate | 120 |

| Schedule 8 : Form of RATING Certificate | 121 |

| iii |

| Schedule 9 : Timetables | 122 |

| Schedule 10 : Form of Increase Confirmation | 123 |

| Schedule 11 : [Schedule not used] | 126 |

| Schedule 12 : LMA Form of Confidentiality Undertaking | 127 |

| Schedule 13 : Reference Rate Terms | 132 |

| Schedule 14 : Daily Non-Cumulative Compounded RFR Rate | 135 |

| iv |

This Agreement is dated 25 February 2022 and made

between:

| (1) | RENTOKIL INITIAL PLC, (the “Borrower”), registered in England and Wales as company number 5393279 and having its registered office at Compass House, Manor Royal, Xxxxxxx, Xxxx Xxxxxx, Xxxxxx Xxxxxxx, XX00 0XX; |

| (2) | THE FINANCIAL INSTITUTIONS, (the “Arrangers”) listed in Part 2 (The Arrangers) of Schedule 1 (The Finance Parties), as mandated lead arrangers; |

| (3) | THE FINANCIAL INSTITUTIONS, (the “Original Lenders”), listed in Part 1 (The Original Lenders) of Schedule 1 (The Finance Parties); |

| (4) | BARCLAYS BANK PLC as documentation agent (the “Documentation Agent”); and |

| (5) | SKANDINAVISKA ENSKILDA XXXXXX XX (PUBL), (the “Agent”), as agent of the other Finance Parties. |

IT IS AGREED as follows:

| 1. | Definitions and Interpretation |

| 1.1 | Definitions |

In this Agreement:

“Acceptable Bank” means:

| (A) | a bank or financial institution which has a rating for its long-term unsecured and non-credit enhanced debt obligations of BBB or higher by S&P or Fitch or Baa2 or higher by Moody’s or a comparable rating from an internationally recognised credit rating agency; or |

| (B) | any other bank or financial institution approved by the Agent. |

“Acquisition” means the acquisition of the Target pursuant to the terms of the Acquisition Agreement.

“Acquisition Agreement” means the agreement and plan of merger between the Borrower, Bidco, the Target, Leto Holdings I, Inc. and Leto Holdings II, LLC dated 13 December 2021.

“Acquisition Costs” means all fees, costs and expenses, stamp, registration and other Taxes properly incurred by the Borrower or any other member of the Group in connection with the Acquisition or the Transaction Documents.

“Acquisition Documents” means the Acquisition Agreement and any other document designated as a “Acquisition Document” by the Agent and the Borrower.

“Additional Business Day” means any day specified as such in the Reference Rate Terms.

“Affiliate” means, in relation to any person, a Subsidiary of that person or a Holding Company of that person or any other Subsidiary of that Holding Company.

| 1 |

“Article 55 BRRD” means Article 55 of Directive 2014/59/EU establishing a framework for the recovery and resolution of credit institutions and investment firms.

“Assignment Agreement” means an agreement substantially in the form set out in Schedule 5 (Form of Assignment Agreement) or any other form agreed between the relevant assignor and assignee.

“Authorisation” means an authorisation, consent, approval, resolution, licence, exemption, filing, notarisation or registration.

“Availability Period” means the period on and from the date of this Agreement and ending at 11.59 pm (New York City time) on the earlier to occur of:

| (A) | the date falling 90 days after the Closing Date; |

| (B) | the date on which the Acquisition Agreement is terminated in accordance with its terms; |

| (C) | if the First End Date Extension has not occurred, the Original End Date; |

| (D) | if the First End Date Extension has occurred but the Second End Date Extension has not occurred, the First Extended End Date; and |

| (E) | if the Second End Date Extension has occurred, the Second Extended End Date. |

“Available Commitment” means, in relation to a Facility, a Xxxxxx’s Commitment under that Facility minus:

| (A) | the amount of its participation in any outstanding Utilisations under that Facility; and |

| (B) | in relation to any proposed Utilisation, the amount of its participation in any Utilisations that are due to be made under that Facility on or before the proposed Utilisation Date. |

“Available Facility” means, in relation to a Facility, the aggregate for the time being of each Lender’s Available Commitment.

“Bail-In Action” means the exercise of any Write-down and Conversion Powers.

“Bail-In Legislation” means:

| (A) | in relation to an EEA Member Country which has implemented, or which at any time implements, Article 55 BRRD, the relevant implementing law or regulation as described in the EU Bail-In Legislation Schedule from time to time; |

| (B) | in relation to the United Kingdom, the UK Bail-In Legislation; and |

| (C) | in relation to any state other than such an EEA Member Country and the United Kingdom, any analogous law or regulation from time to time which requires contractual recognition of any Write-down and Conversion Powers contained in that law or regulation. |

“Beneficial Ownership Regulation” means 31 C.F.R. § 1010.230.

| 2 |

“Bidco” means Rentokil Initial US Holdings, Inc., a corporation incorporated under the laws of Delaware.

“Break Costs” means any amount specified as such in the Reference Rate Terms.

“Business Day” means a day (other than a Saturday or Sunday) on which banks are open for general business in London, Stockholm and:

| (A) | New York; or |

| (B) | (in relation to: |

| (1) | any date for payment or purchase of an amount relating to a Loan or Unpaid Sum; or |

| (2) | the determination of the first day or the last day of an Interest Period for a Loan or Unpaid Sum, or otherwise in relation to the determination of the length of such an Interest Period), |

which is an Additional Business Day relating to that Loan or Unpaid Sum.

“Cash and Cash Equivalent Investments” means, at any time:

| (A) | cash in hand or on deposit with any Acceptable Bank (irrespective of the duration of that deposit with any Acceptable Bank); |

| (B) | certificates of deposit, maturing within one year after the relevant date of calculation, issued by an Acceptable Bank or a trust company which falls within the criteria set out in the definition of “Acceptable Bank”; |

| (C) | any investment in marketable obligations issued or guaranteed by the government of the United States of America, the U.K., any Participating Member State or any member of the Organisation for Economic Co-operation and Development with a rating of at least A+ from S&P or by an instrumentality or agency of any of them having an equivalent credit rating which is: |

| (1) | maturing within one year after the relevant date of calculation; and |

| (2) | not convertible to any other security; |

| (D) | open market commercial paper not convertible to any other security: |

| (1) | for which a recognised trading market exists; |

| (2) | issued in the United States of America, the U.K., any Participating Member State or any member of the Organisation for Economic Co-operation and Development; and |

| (3) | which has a credit rating of either A-1 by S&P or Fitch or P-1 by Moody’s; |

| (E) | sterling bills of exchange eligible for rediscount at the Bank of England and accepted by an Acceptable Bank or a trust company which falls within the criteria set out in the definition of “Acceptable Bank” (or any dematerialised equivalent); |

| (F) | investments accessible within 30 days in money market funds which: |

| (1) | have a credit rating of either A-1 or higher by S&P or Fitch or P-1 or higher by Moody’s; and |

| 3 |

| (2) | invest substantially all their assets in securities of the types described in paragraphs (B) to (E) above; or |

| (G) | any other debt, security or investment approved by the Majority Lenders, |

in each case, to which any member of the Group is beneficially entitled at that time.

“Cash Pooling Balance” means any debit balance in respect of any account of any member of the Group in connection with the Group’s notional cash pooling arrangements provided that if such balances were netted-off at any time, the aggregate amount of such balances would be zero or greater.

“Central Bank Rate” has the meaning given to that term in the Reference Rate Terms.

“Central Bank Rate Adjustment” has the meaning given to that term in the Reference Rate Terms.

“Certain Funds Period” means the period commencing on the first day of the Availability Period and ending at 11.59 pm (New York City time) on the last day of the Availability Period.

“Certain Funds Utilisation” means a Loan made or to be made during the Certain Funds Period.

“Closing” means the closing of the Acquisition in accordance with section 2.01 (Closing) of the Acquisition Agreement.

“Closing Date” means the date on which Closing occurs.

“Code” means the US Internal Revenue Code of 1986.

“Commitment” means a Facility A Commitment or a Facility B Commitment

“Compliance Certificate” means a certificate substantially in the form set out in Schedule 7 (Form of Compliance Certificate).

“Compounded Reference Rate” means, in relation to any RFR Banking Day during the Interest Period of a Loan, the Daily Non-Cumulative Compounded RFR Rate for that RFR Banking Day.

“Compounding Methodology Supplement” means, in relation to the Daily Non-Cumulative Compounded RFR Rate, a document which:

| (A) | is agreed in writing by the Borrower, the Agent (in its own capacity) and the Agent (acting on the instructions of the Majority Lenders); |

| (B) | specifies a calculation methodology for that rate; and |

| (C) | has been made available to the Borrower and each Finance Party. |

“Confidential Information” means all information relating to the Borrower, the Group, the Finance Documents or a Facility of which a Finance Party becomes aware in its capacity as, or for the purpose of becoming, a Finance Party or which is received by a Finance Party in relation to, or for the purpose of becoming a Finance Party under, the Finance Documents or a Facility from either:

| (A) | any member of the Group or any of its advisers; or |

| 4 |

| (B) | another Finance Party, if the information was obtained by that Finance Party directly or indirectly from any member of the Group or any of its advisers, |

in whatever form, and includes information given orally and any document, electronic file or any other way of representing or recording information which contains or is derived or copied from such information but excludes:

| (1) | information that: |

| (a) | is or becomes public information other than as a direct or indirect result of any breach by that Finance Party of Clause 35 (Confidential Information); or |

| (b) | is identified in writing at the time of delivery as non-confidential by any member of the Group or any of its advisers; or |

| (c) | is known by that Finance Party before the date the information is disclosed to it in accordance with paragraphs (A) or (B) above or is lawfully obtained by that Finance Party after that date, from a source which is, as far as that Finance Party is aware, unconnected with the Group and which, in either case, as far as that Finance Party is aware, has not been obtained in breach of, and is not otherwise subject to, any obligation of confidentiality; and |

| (2) | any Funding Rate. |

“Confidentiality Undertaking” means a confidentiality undertaking substantially in a recommended form of the LMA as set out in Schedule 12 (LMA Form of Confidentiality Undertaking) or in any other form agreed between the Borrower and the Agent.

“Credit Rating” means a notification to the Borrower or a public announcement by a Credit Rating Agency of a long-term credit rating of the Borrower which has been solicited by the Borrower, from time to time.

“Credit Rating Agency” means S&P, Fitch and/or Moody’s.

“CSPP Eligible Issuer” means a member of the Group which is a special purpose vehicle which complies with the eligibility criteria for the European Central Bank’s corporate sector purchase programme.

“CTA” means the Corporation Tax Xxx 0000.

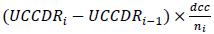

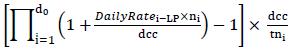

“Daily Non-Cumulative Compounded RFR Rate” means, in relation to any RFR Banking Day during an Interest Period for a Loan, the percentage rate per annum determined by the Agent (or by any other Finance Party which agrees to determine that rate in place of the Agent) in accordance with the methodology set out in Schedule 14 (Daily Non-Cumulative Compounded RFR Rate) or in any relevant Compounding Methodology Supplement.

“Daily Rate” means the rate specified as such in the Reference Rate Terms.

| 5 |

“Debt Capital Markets Issue” has the meaning given to that term in Clause 7.3(A) (Mandatory prepayment from Net Debt Capital Markets Proceeds).

“Default” means an Event of Default or any event or circumstance specified in Clause 22 (Events of Default) which would (with the expiry of a grace period or the giving of notice) be an Event of Default.

“Defaulting Lender” means any Lender:

| (A) | which has failed to make its participation in a Loan available (or has notified the Agent or the Borrower (which has notified the Agent) that it will not make its participation in a Loan available) by the Utilisation Date of that Loan in accordance with Clause 5.4 (Lenders’ participation); |

| (B) | which has otherwise rescinded or repudiated a Finance Document; or |

| (C) | with respect to which an Insolvency Event has occurred and is continuing, |

unless, in the case of paragraph (A) above:

| (1) | its failure to pay is caused by: |

| (a) | administrative or technical error; or |

| (b) | a Disruption Event; and |

payment is made within three Business Days of its due date; or

| (2) | the Lender is disputing in good faith whether it is contractually obliged to make the payment in question. |

“Disruption Event” means either or both of:

| (A) | a material disruption to those payment or communications systems or to those financial markets which are, in each case, required to operate in order for payments to be made in connection with a Facility (or otherwise in order for the transactions contemplated by the Finance Documents to be carried out) which disruption is not caused by, and is beyond the control of, any of the Parties; or |

| (B) | the occurrence of any other event which results in a disruption (of a technical or systems-related nature) to the treasury or payments operations of a Party preventing that, or any other Party: |

| (1) | from performing its payment obligations under the Finance Documents; or |

| (2) | from communicating with other Parties in accordance with the terms of the Finance Documents, |

and which (in either such case) is not caused by, and is beyond the control of, the Party whose operations are disrupted.

“EEA Member Country” means any member state of the European Union, Iceland, Liechtenstein and Norway.

| 6 |

“Eligible Institution” means any Lender or other bank, financial institution, trust, fund or other entity selected by the Borrower.

“ERISA” means the United States Employee Retirement Income Security Act of 1974, as amended, and the regulations promulgated and rulings issued thereunder.

“ERISA Affiliate” means any person treated as a single employer with the Borrower for the purpose of section 414 of the Code or section 4001 of ERISA.

“EU Bail-In Legislation Schedule” means the document described as such and published by the Loan Market Association (or any successor person) from time to time.

“Event of Default” means any event or circumstance specified as such in Clause 22 (Events of Default).

“Existing Facility Agreement” means the multicurrency revolving facility agreement between the Borrower, Skandinaviska Enskilda Xxxxxx XX (publ) as Agent and the lenders named therein originally dated 27 January 2015 as amended from time to time (including, most recently, as amended and restated pursuant to an amendment and restatement agreement dated 8 September 2021).

“Extension Notice” means a notice substantially in the form set out in Part 2 of Schedule 3 (Requests).

“Facility” means Facility A or Facility B.

“Facility A” means the term loan facility made available under this Agreement as described in Clause 2.1(A) (The Facilities).

“Facility A Commitment”:

| (A) | in relation to an Original Lender, the amount set opposite its name under the heading “Facility A Commitment” in Schedule 1 (The Original Lenders) and the amount of any other Facility A Commitment transferred to it under this Agreement or assumed by it in accordance with Clause 2.2 (Increase); |

| (B) | in relation to any other Lender, the amount of any Facility A Commitment transferred to it under this Agreement or assumed by it in accordance with Clause 2.2 (Increase), |

in each case to the extent not cancelled, reduced or transferred by it under this Agreement.

“Facility A Loan” means a loan made or to be made under Facility A or the principal amount outstanding for the time being of that loan.

“Facility B” means the term loan facility made available under this Agreement as described in Clause 2.1(B) (The Facilities).

“Facility B Commitment”:

| (A) | in relation to an Original Lender, the amount set opposite its name under the heading “Facility B Commitment” in Schedule 1 (The Original Lenders) and the amount of any other Facility B Commitment transferred to it under this Agreement or assumed by it in accordance with Clause 2.2 (Increase); |

| 7 |

| (B) | in relation to any other Lender, the amount of any Facility B Commitment transferred to it under this Agreement or assumed by it in accordance with Clause 2.2 (Increase), |

in each case to the extent not cancelled, reduced or transferred by it under this Agreement.

“Facility B Loan” means a loan made or to be made under Facility B or the principal amount outstanding for the time being of that loan.

“Facility Office” means, in respect of a Lender, the office or offices notified by that Lender to the Agent in writing on or before the date it becomes a Lender (or, following that date, by not less than five Business Days’ written notice) as the office or offices through which it will perform its obligations under this Agreement.

“FATCA” means:

| (A) | sections 1471 to 1474 of the Code or any associated regulations; |

| (B) | any treaty, law or regulation of any other jurisdiction, or relating to an intergovernmental agreement between the US and any other jurisdiction, which (in either case) facilitates the implementation of any law or regulation referred to in paragraph (A) above; or |

| (C) | any agreement pursuant to the implementation of any treaty, law or regulation referred to in paragraphs (A) or (B) above with the US Internal Revenue Service, the US government or any governmental or taxation authority in any other jurisdiction. |

“FATCA Application Date” means:

| (A) | in relation to a “withholdable payment” described in section 1473(1)(A)(i) of the Code (which relates to payments of interest and certain other payments from sources within the US), 01 July 2014; or |

| (B) | in relation to a “passthru payment” described in section 1471(d)(7) of the Code not falling within paragraph (A) above, the first date from which such payment may become subject to a deduction or withholding required by FATCA. |

“FATCA Deduction” means a deduction or withholding from a payment under a Finance Document required by FATCA.

“FATCA Exempt Party” means a Party that is entitled to receive payments free from any FATCA Deduction.

“Fee Letter” means:

| (A) | any letter or letters dated on or about the date of this Agreement between each of the Arrangers and the Borrower (or the Agent and the Borrower) setting out any of the fees referred to in Clause 11 (Fees); |

| (B) | any letter or letters setting out the fees payable to a Finance Party referred to in Clause 2.2(F) (Increase); and |

| (C) | any other letter designated as such by the Agent and the Borrower. |

“Finance Document” means this Agreement, any Fee Letter, any Increase Confirmation, any Reference Rate Supplement, any Compounding Methodology Supplement, any Extension Notice and any other document designated as such by the Agent and the Borrower.

| 8 |

“Finance Lease” means any lease or hire purchase contract, a liability under which would, in accordance with IFRS, be treated as a balance sheet liability (other than a lease or hire purchase contract which would, in accordance with IFRS, prior to 1 January 2019, have been treated as an operating lease).

“Finance Party” means the Agent, each of the Arrangers, the Documentation Agent or a Lender.

“Financial Indebtedness” means (without double counting) any indebtedness for or in respect of:

| (A) | moneys borrowed; |

| (B) | any amount raised by acceptance under any acceptance credit facility or dematerialised equivalent; |

| (C) | any amount raised pursuant to any note purchase facility or the issue of bonds, notes, debentures, loan stock or any similar instrument; |

| (D) | the amount of any liability in respect of Finance Leases; |

| (E) | receivables sold or discounted (other than any receivables to the extent they are sold or discounted on a non-recourse basis); |

| (F) | any amount raised under any other transaction (including any forward sale or purchase agreement) which is required, in accordance with IFRS, to be shown as indebtedness or borrowing in the audited consolidated financial statements of the Group (other than a lease or hire purchase contract which would, in accordance with IFRS, prior to 1 January 2019, have been treated as an operating lease); |

| (G) | for the purposes of Clause 22.5 (Cross default) only, any derivative transaction entered into in connection with protection against or benefit from fluctuation in any rate or price (and, when calculating the value of any derivative transaction, only the marked to market value (or, if any actual amount is due as a result of the termination or close-out of that derivative transaction, that amount) shall be taken into account); |

| (H) | any counter-indemnity obligation in respect of a guarantee, indemnity, bond, standby or documentary letter of credit or any other instrument issued by a bank or financial institution (but not, in any case, Trade Instruments); and |

| (I) | the amount of any liability in respect of any guarantee or indemnity for any of the items referred to in paragraphs (A) to (H) above, |

and, in any event, excluding:

| (1) | indebtedness owing by one member of the Group to another member of the Group; |

| (2) | (for the purposes of Clause 22.5 (Cross default)) indebtedness in respect of self-insurance liabilities except to the extent of such liability as shown in the audited consolidated financial statements of the Group; |

| 9 |

| (3) | indebtedness relating to the supply of goods and services to any member of the Group in the ordinary course of business provided the amount of any indebtedness is not outstanding for more than 150 days after its customary date of payment; and |

| (4) | any accrual deficit of any member of the Group in respect of defined benefit pension schemes other than where such deficit is funded by any moneys borrowed. |

“First End Date Extension” means the extension of the Original End Date to the First Extended End Date pursuant to Section 10.01(b)(i) of the Acquisition Agreement.

“First Extended End Date” means 13 December 2022.

“Fitch” means Fitch Ratings Ltd or any successor to its rating business.

“Funding Rate” means any individual rate notified by a Lender to the Agent pursuant to Clause 10.3(A)(2) (Cost of funds).

“GAAP” means generally accepted accounting principles in England and Wales including IFRS.

“Group” means the Borrower and its Subsidiaries for the time being.

“Holding Company” means, in relation to a person, any other person in respect of which it is a Subsidiary.

“IFRS” means UK-adopted international accounting standards within the meaning of the section 474(1) of the Companies Xxx 0000 to the extent applicable to the relevant financial statements.

“Impaired Agent” means the Agent at any time when:

| (A) | it has failed to make (or has notified a Party that it will not make) a payment required to be made by it under the Finance Documents by the due date for payment; |

| (B) | the Agent otherwise rescinds or repudiates a Finance Document; |

| (C) | (if the Agent is also a Lender) it is a Defaulting Lender under paragraph (A) or (B) of the definition of “Defaulting Lender”; or |

| (D) | an Insolvency Event has occurred and is continuing with respect to the Agent; |

unless, in the case of paragraph (A) above:

| (1) | its failure to pay is caused by: |

| (a) | administrative or technical error; or |

| (b) | a Disruption Event; and |

payment is made within three Business Days of its due date; or

| (2) | the Agent is disputing in good faith whether it is contractually obliged to make the payment in question. |

| 10 |

“Increase Confirmation” means a confirmation substantially in the form of Schedule 10 (Form of Increase Confirmation).

“Increase Lender” has the meaning given to that term in Clause 2.2 (Increase).

“Indebtedness for Moneys Borrowed” means:

| (A) | any indebtedness (whether being principal, premium, interest of other amounts) for or in respect of any notes, bonds, debentures, debenture stock, loan stock or other securities other than indebtedness which is owed to an entity within the Group; |

| (B) | any borrowed money other than money borrowed by one entity within the Group from another entity within the Group; or |

| (C) | any liability under or in respect of any acceptance or acceptance credit, |

provided that Indebtedness for Moneys Borrowed shall not include any Cash Pooling Balance.

“Initial Facility A Termination Date” means the date falling 18 Months after the date of this Agreement.

“Insolvency Event” means, in relation to a Finance Party, that the Finance Party:

| (A) | is dissolved (other than pursuant to a consolidation, amalgamation or merger); |

| (B) | becomes insolvent or is unable to pay its debts or fails or admits in writing its inability generally to pay its debts as they become due; |

| (C) | makes a general assignment, arrangement or composition with or for the benefit of its creditors; |

| (D) | has exercised in respect of it one or more of the stabilisation powers pursuant to Part 1 of the Banking Xxx 0000 and/or has instituted against it a bank insolvency proceeding pursuant to Part 2 of the Banking Act 2009 or a bank administration proceeding pursuant to Part 3 of the Banking Xxx 0000; |

| (E) | has a resolution passed for its winding-up, official management or liquidation (other than pursuant to a consolidation, amalgamation or merger); |

| (F) | seeks or becomes subject to the appointment of an administrator, provisional liquidator, conservator, receiver, trustee, custodian or other similar official for it or for all or substantially all its assets (other than, for so long as it is required by law or regulation not to be publicly disclosed); |

| (G) | has a secured party take possession of all or substantially all its assets or has a distress, execution, attachment, sequestration or other legal process levied, enforced or sued on or against all or substantially all its assets and such secured party maintains possession, or any such process is not dismissed, discharged, stayed or restrained, in each case within 30 days thereafter; |

| (H) | causes or is subject to any event with respect to it which, under the applicable laws of any jurisdiction, has an analogous effect to any of the events specified in paragraphs (A) to (G) above; or |

| 11 |

| (I) | takes any action in furtherance of, or indicating its consent to, approval of, or acquiescence in, any of the foregoing acts. |

“Interest Payment” means the aggregate amount of interest that is, or is scheduled to become, payable under any Finance Document.

“Interest Period” means, in relation to a Loan, each period determined in accordance with Clause 9 (Interest Periods) and, in relation to an Unpaid Sum, each period determined in accordance with Clause 8.3 (Default interest).

“ITA” means the Income Tax Xxx 0000.

“Legal Opinions” means any legal opinion delivered to the Agent under Clause 4.1 (Initial conditions precedent).

“Legal Reservations” means:

| (A) | the principle that equitable remedies may be granted or refused at the discretion of a court; |

| (B) | the limitation on enforcement by laws relating to bankruptcy, insolvency, liquidation, reorganisation, court schemes, moratoria and administration and other laws generally affecting the rights of creditors; |

| (C) | the time barring of claims, |

| (D) | the possibility that an undertaking to assume liability for or indemnify a person against non-payment of stamp duty may be void; |

| (E) | defences of set-off or counterclaim; |

| (F) | similar principles and similar matters under the laws of any jurisdiction in which relevant obligations may have to be performed; and |

| (G) | any other matters which are set out as qualifications or reservations as to matters of law of general application in the Legal Opinions. |

“Lender” means:

| (A) | any Original Lender; and |

| (B) | any bank, financial institution, trust, fund or other entity which has become a Party as a “Lender” in accordance with Clause 2.2 (Increase) or Clause 23 (Changes to the Lenders), |

which in each case has not ceased to be a Party as such in accordance with the terms of this Agreement.

“LMA” means the Loan Market Association.

“Loan” means a Facility A Loan or a Facility B Loan.

“Lookback Period” means the number of days specified as such in the Reference Rate Terms.

12

“Major Default” means with respect to the Borrower and Bidco (and not, for the avoidance of doubt, with respect to any other member of the Group or the Target Group or any procurement obligation in respect of any other member of the Group or the Target Group):

| (A) | any circumstances constituting a Default under any of: |

| (1) | Clause 22.1 (Non-payment) other than with respect to any payment claim in respect of any amount other than principal, interest or fees; |

| (2) | Clause 22.4 (Misrepresentation) in relation to any Major Representation; |

| (3) | Clause 22.6 (Insolvency); |

| (4) | Clause 22.7 (Insolvency proceedings); |

| (5) | Clause 22.8 (Creditors’ process) unless such litigation is frivolous or vexatious or has an aggregate value of less than £50,000,000; |

| (6) | Clause 22.9 (United States Bankruptcy Laws); |

| (7) | Clause 22.10 (Unlawfulness); and |

| (8) | Clause 22.11 (Repudiation); and |

| (B) | any breach of a Major Undertaking. |

“Major Representation” means a representation or warranty with respect to the Borrower and Bidco (and not, for the avoidance of doubt, with respect to any other member of the Group or the Target Group or any procurement obligation in respect of any other member of the Group or the Target Group) under any of:

| (A) | Clause 18.1 (Status); |

| (B) | Clause 18.2 (Binding obligations); |

| (C) | Clause 18.3 (Non-conflict with other obligations); |

| (D) | Clause 18.4 (Power and authority); |

| (E) | Clause 18.5 (Authorisations); |

| (F) | Clause 18.12 (Pari passu ranking); |

| (G) | Clause 18.14 (Sanctions); and |

| (H) | Clause 18.17 (Acquisition). |

“Major Undertaking” means an undertaking to the extent made by the Borrower with respect to itself and Bidco (and not, for the avoidance of doubt, with respect to any other member of the Group or the Target Group or any procurement obligation in respect of any other member of the Group or the Target Group) under any of:

| (A) | Clause 21.2 (Compliance with laws); |

| (B) | Clause 21.3 (Negative pledge); |

13

| (C) | Clause 21.4 (Disposals); |

| (D) | Clause 21.6 (Financial Indebtedness); |

| (E) | Clause 21.8 (Pari Passu); |

| (F) | Clause 21.9 (Merger); |

| (G) | Clause 21.11 (Sanctions); |

| (H) | Clause 21.12 (Acquisition undertakings); and |

| (I) | Clause 21.13(A) (US Provisions). |

“Majority Lenders” means:

| (A) | in respect of any matter which relates to a Facility: |

| (1) | (where there are two or fewer Lenders under that Facility) all Lenders under that Facility; and |

| (2) | (where there are three or more Lenders under that Facility) two or more Lenders under that Facility whose Commitments aggregate more than 662/3% of the Total Facility A Commitments or the Total Facility B Commitments (as applicable) (or, if the Total Facility A Commitments or the Total Facility B Commitments (as applicable) have been reduced to zero, aggregated more than 662/3% of the Total Facility A Commitments or the Total Facility B Commitments (as applicable) immediately prior to the reduction); and |

| (B) | in respect of any other matter: |

| (1) | (where there are two or fewer Lenders) all Lenders; |

| (2) | (where there are three or more Lenders) two or more Lenders whose Commitments aggregate more than 662/3% of the Total Commitments (or, if the Total Commitments have been reduced to zero, aggregated more than 662/3% of the Total Commitments immediately prior to the reduction). |

“Margin” means:

| (A) | in relation to any Facility A Loan, for each period set out below, the percentage rate per annum specified opposite that period: |

| Period | Margin (per cent. per annum) |

| from and including the date of this Agreement to and including 30 June 2022 | 0.30 |

| from and including 01 July 2022 to and including 30 September 2022 | 0.40 |

| from and including 01 October 2022 to and including 31 December 2022 | 0.55 |

| from and including 01 January 2023 to and including 31 March 2023 | 0.70 |

| from and including 01 April 2023 to and including 30 June 2023 | 0.90 |

| from and including 01 July 2023 to and including 30 September 2023 | 1.10 |

| thereafter | 1.40 |

| (B) | in relation to any Facility B Loan: |

| (1) | subject to the other provisions of this paragraph (B), from the date of this Agreement until the date of receipt of the first Rating Certificate after the date of this Agreement, 0.60 per cent. per annum; and |

| (2) | thereafter (subject to the other provisions of this paragraph (B)), the percentage rate per annum set out below opposite the then applicable Credit Rating of the Borrower: |

| Credit Rating | Margin (per cent. per annum) | ||

| Fitch | S&P | Moody’s | |

| BBB + or higher | BBB + or higher | Baa1 or higher | 0.50 |

| BBB | BBB | Baa2 | 0.60 |

| BBB- | BBB- | Baa3 | 0.80 |

| BB+ or lower | BB+ or lower | Ba1 or lower | 1.00 |

| (3) | If the Credit Rating(s) given to the Borrower by any Credit Rating Agency is such that a different Margin is applicable to each rating, the applicable Margin will be the average of the Margins applicable to the Credit Ratings. |

| (4) | Any change in the Margin will, subject to paragraph (5) below, take effect on the date which is five Business Days after the receipt by the Agent of the Rating Certificate. |

| (5) | Notwithstanding any other provision of this paragraph (B), at any time when: |

| (a) | an Event of Default is continuing; |

| (b) | the Borrower has no Credit Rating; or |

| (c) | the Borrower is in breach of its obligations under Clause 19.6 (Credit Rating), |

the Margin for each Loan under Facility B shall be 1.00 per cent. per annum.

“Margin Regulations” means Regulations U and X issued by the Board of Governors of the United States Federal Reserve System.

“Market Disruption Rate” means the rate (if any) specified as such in the applicable Reference Rate Terms.

“Material Adverse Effect” means a material adverse effect on:

| (A) | the ability of the Borrower to perform its payment obligations under any Finance Document; or |

| (B) | the validity or enforceability of any Finance Document. |

14

“Material Subsidiary” means, at any time, a Subsidiary of the Borrower:

| (A) | whose operating profits (or, if the Subsidiary in question prepares audited consolidated accounts, whose total consolidated operating profits) attributable to the Borrower represent not less than ten per cent. of the consolidated operating profits of the Borrower and its Subsidiaries taken as a whole, all as calculated by reference to the then latest audited accounts (unconsolidated or, as the case may be, consolidated) of the Subsidiary and the then latest audited consolidated accounts of the Borrower and its Subsidiaries, provided that in the case of a Subsidiary acquired after the end of the financial period to which the latest relevant financial statements relate, the reference to the latest financial statements for the purposes of the calculation above shall, until financial statements for the financial period in which the acquisition is made are published, be deemed to be a reference to such first-mentioned financial statements as if such Subsidiary had been shown in such statements by reference to its own latest financial statements, adjusted as deemed appropriate by the Borrower; |

| (B) | any Subsidiary which has Indebtedness for Moneys Borrowed outstanding (or available under a committed bank facility) in an amount of at least £25,000,000 (or its equivalent in any other currency); or |

| (C) | to which is transferred the whole or substantially the whole of the undertaking and assets of a Subsidiary of the Borrower which immediately before the transfer is a Material Subsidiary, |

provided that no member of the Target Group shall be a Material Subsidiary for the period of three Months following the Closing Date.

“Month” means, in relation to an Interest Period (or any other period for the accrual of commission or fees), a period starting on one day in a calendar month and ending on the numerically corresponding day in the next calendar month, subject to adjustment in accordance with the rules specified as Business Day Conventions in the Reference Rate Terms.

“Moody’s” means Xxxxx’x Investors Service Limited or any successor to its rating business.

“Net Debt” means, at any time for the purposes of Clause 21.4 (Disposals), Total Borrowings (at that time) less any Cash and Cash Equivalent Investments (at that time).

“Net Disposal Proceeds” means any amount of Cash and Cash Equivalent Investments received by the Group as consideration for a Restricted Disposal (whether by way of share or asset sale) after deducting:

| (A) | any fees and transaction costs properly incurred in connection with that Restricted Disposal; |

| (B) | any Taxes paid as a result of that Restricted Disposal; and |

| (C) | any Taxes reasonably estimated by the directors of the Borrower to be payable as a result of that Restricted Disposal. |

“New Lender” has the meaning given to that term in Clause 23 (Changes to the Lenders).

“Original End Date” means 13 September 2022.

15

“Original Financial Statements” means the audited consolidated financial statements of the Borrower for the financial year ended 31 December 2020.

“Participating Member State” means any member state of the European Union that has the euro as its lawful currency in accordance with legislation of the European Union relating to Economic and Monetary Union.

“Party” means a party to this Agreement.

“Permitted Guarantee” means any guarantee or guarantees issued by Rentokil Initial 1927 plc in an amount not exceeding £10,000,000 (or its equivalent in any other currency) in aggregate.

“Permitted Reorganisation” means a solvent re-organisation or restructuring of the Group which results in the Borrower becoming a Subsidiary of a new Holding Company which has substantially the same shareholders as the Borrower had prior to the relevant re-organisation or restructuring.

“Permitted Transaction” means:

| (A) | an intra-Group re-organisation on a solvent basis; |

| (B) | the Acquisition; or |

| (C) | any other transaction agreed by the Majority Lenders. |

“Plan” means an employee benefit pension plan as defined in section 3(2) of ERISA subject to Title IV of ERISA:

| (A) | maintained by the Borrower or any ERISA Affiliate; or |

| (B) | to which the Borrower or any ERISA Affiliate is required to make any payment or contribution. |

“Qualifying Lender” has the meaning given to it in Clause 12 (Tax Gross-Up and Indemnities).

“Rating Certificate” means a certificate from the Borrower (signed by an authorised signatory of the Borrower) substantially in the form of Schedule 8 (Form of Rating Certificate) which confirms the then current Credit Rating of the Borrower.

“Reference Rate Supplement” means a document which:

| (A) | is agreed in writing by the Borrower, the Agent (in its own capacity) and the Agent (acting on the instructions of the Majority Lenders); |

| (B) | specifies the relevant terms which are expressed in this Agreement to be determined by reference to Reference Rate Terms; and |

| (C) | has been made available to the Borrower and each Finance Party. |

“Reference Rate Terms” means the terms set out in Schedule 13 (Reference Rate Terms) or in any Reference Rate Supplement.

16

“Related Fund” in relation to a fund (the “first fund”), means a fund which is managed or advised by the same investment manager or investment adviser as the first fund or, if it is managed by a different investment manager or investment adviser, a fund whose investment manager or investment adviser is an Affiliate of the investment manager or investment adviser of the first fund.

“Relevant Market” means the market specified as such in the Reference Rate Terms.

“Relevant Nominating Body” means any applicable central bank, regulator or other supervisory authority or a group of them, or any working group or committee sponsored or chaired by, or constituted at the request of, any of them or the Financial Stability Board.

“Relevant Testing Date” means 31 December and 30 June of each year.

“Repeating Representations” means each of the representations set out in Clause 18 (Representations) other than Clause 18.5 (Authorisations), Clause 18.7 (Deduction of Tax), Clause 18.8 (No filing or stamp taxes), Clause 18.9 (No default), Clause 18.10 (No misleading information) and Clause 18.11 (Financial statements).

“Reportable Event” means, with respect to any Plan:

| (A) | an event specified as such in section 4043 of ERISA or any related regulation, other than an event in relation to which the requirement to give notice of that event is waived by any regulation; or |

| (B) | a failure to meet the minimum funding standard under section 412 or 430 of the Code or section 302 of ERISA, whether or not waived. |

“Reporting Day” means the day (if any) specified as such in the Reference Rate Terms.

“Reporting Time” means the relevant time (if any) specified as such in the Reference Rate Terms.

“Representative” means any delegate, agent, manager, administrator, nominee, attorney, trustee or custodian.

“Resolution Authority” means any body which has authority to exercise any Write-down and Conversion Powers.

“Restricted Disposal” means any disposal where the nature of the business or asset being disposed of would result in the relevant transaction being a Class 1 Transaction (as such term is defined in the U.K. Listing Rules).

“RFR” means the rate specified as such in the Reference Rate Terms.

“RFR Banking Day” means any day specified as such in the Reference Rate Terms.

“S&P” means S&P Global Ratings UK Limited or any successor to its rating business.

“Sanctions” means:

| (A) | United Nations sanctions imposed pursuant to any United Nations Security Council Resolution; |

17

| (B) | US sanctions administered or enforced by the US, including the Office of Foreign Assets Control of the US Department of the Treasury and the Department of State; |

| (C) | EU restrictive measures implemented pursuant to any EU Council or Commission regulation or decision adopted pursuant to a common position in furtherance of the EU’s Common Foreign and Security Policy; and |

| (D) | UK sanctions (i) enacted by statutory instrument pursuant to the United Nations Xxx 0000 or the Xxxxxxxx Xxxxxxxxxxx Xxx 0000; and/or (ii) administered or enforced by the UK, including Her Majesty’s Treasury. |

“Second End Date Extension” means that the Original End Date has been extended to the Second Extended End Date pursuant to Section 10.01(b)(i) of the Acquisition Agreement.

“Second Extended End Date” means 13 March 2023.

“Security” means a mortgage, charge, pledge, lien or other security interest securing any obligation of any person or any other agreement or arrangement having a similar effect.

“Shareholder Notice Date” means the date notice is given to the shareholders of the Target of a shareholder meeting to approve the Acquisition.

“Specified Time” means a day or time determined in accordance with Schedule 9 (Timetables).

“Subsidiary” means:

| (A) | a subsidiary within the meaning of section 1159 of the Companies Xxx 0000; and |

| (B) | in relation to the financial statements of the Borrower, a subsidiary undertaking within the meaning of section 1162 of the Companies Xxx 0000. |

“Target” means Terminix Global Holdings, Inc., a corporation incorporated under the laws of Delaware.

“Target Group” means the Target and its subsidiaries for the time being.

“Tax” means any tax, levy, impost, duty or other charge or withholding of a similar nature (including any penalty or interest payable in connection with any failure to pay or any delay in paying any of the same).

“Termination Date” means:

| (A) | in relation to Facility A and subject to Clause 2.4 (Extension option), the Initial Facility A Termination Date; |

| (B) | in relation to Facility B, the third anniversary of the first Utilisation Date, |

or if, in each case, that date is not a Business Day, the preceding Business Day.

“Total Borrowings” means, in respect of the Group, at any time, the aggregate of the following liabilities calculated at the nominal, principal or other amount at which the liabilities would be carried in a consolidated balance sheet of the Borrower drawn up at that time:

| (A) | any moneys borrowed; |

18

| (B) | any acceptance under any acceptance credit (including any dematerialised equivalent); |

| (C) | any bond, note, debenture, loan stock or similar instrument; |

| (D) | any Finance Lease; |

| (E) | any moneys owing in connection with the sale or discounting of receivables (except to the extent that there is no recourse); |

| (F) | any indebtedness arising from any deferred payment agreements arranged primarily as a method of raising finance or financing the acquisition of an asset; |

| (G) | any indebtedness arising in connection with any other transaction (including any forward sale or purchase agreement) which is required, in accordance with IFRS, to be shown as an indebtedness or borrowing in the audited consolidated financial statements of the Group; and |

| (H) | any indebtedness of any person of a type referred to in paragraphs (A) to (G), above, which is the subject of a guarantee, indemnity or similar assurance against financial loss given by a member of the Group, |

and, in any event, excluding any accrual deficit of any member of the Group in respect of defined benefit pension schemes other than where such deficit is funded by any moneys borrowed.

“Total Commitments” means the aggregate of the Total Facility A Commitments and the Total Facility B Commitments, being USD 2,700,000,000 at the date of this Agreement.

“Total Facility A Commitments” means the aggregate of the Facility A Commitments, being USD 2,000,000,000 at the date of this Agreement.

“Total Facility B Commitments” means the aggregate of the Facility B Commitments, being USD 700,000,000 at the date of this Agreement.

“Trade Instruments” means any performance bonds, or advance payment bonds or documentary letters of credit issued in respect of the obligations of any member of the Group arising in the ordinary course of trading of that member of the Group (and which does not have the commercial effect of borrowing).

“Transaction Documents” means the Finance Documents and the Acquisition Documents.

“Transfer Certificate” means a certificate substantially in the form set out in Schedule 4 (Form of Transfer Certificate) or any other form agreed between the Agent and the Borrower.

“Transfer Date” means, in relation to an assignment or a transfer, the later of:

| (A) | the proposed Transfer Date specified in the relevant Assignment Agreement or Transfer Certificate; and |

| (B) | the date on which the Agent executes the relevant Assignment Agreement or Transfer Certificate. |

“UK Bail-In Legislation” means Part I of the United Kingdom Banking Act 2009 and any other law or regulation applicable in the United Kingdom relating to the resolution of unsound or failing banks, investment firms or other financial institutions or their affiliates (otherwise than through liquidation, administration or other insolvency proceedings).

19

“Unpaid Sum” means any sum due and payable but unpaid by the Borrower under the Finance Documents.

“US” or “U.S.” means the United States of America.

“U.S. Bankruptcy Law” means the United States Bankruptcy Code, as amended, or any other United States Federal or State bankruptcy, insolvency or similar law.

“US Tax Obligor” means the Borrower at any time when some or all of its payments under the Finance Documents are from sources within the US for US federal income tax purposes.

“USA Patriot Act” means the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, Public Law 107-56).

“Utilisation” means a utilisation of a Facility.

“Utilisation Date” means the date of a Utilisation, being the date on which the relevant Loan under a Facility is to be made.

“Utilisation Request” means a notice substantially in the form set out in Part 1 of Schedule 3 (Requests).

“VAT” means:

| (A) | any value added tax imposed by the Value Added Tax Xxx 0000; and |

| (B) | any tax imposed in compliance with the Council Directive of 28 November 2006 on the common system of value added tax (EC Directive 2006/112); and |

| (C) | any other tax of a similar nature, whether imposed in the United Kingdom or in a member state of the European Union in substitution for, or levied in addition to, such tax referred to in paragraphs (A) or (B) above, or imposed elsewhere. |

“Write-down and Conversion Powers” means:

| (A) | in relation to any Bail-In Legislation described in the EU Bail-In Legislation Schedule from time to time, the powers described as such in relation to that Bail-In Legislation in the EU Bail-In Legislation Schedule; and |

| (B) | in relation to the UK Bail-In Legislation, any powers under that UK Bail-In Legislation to cancel, transfer or dilute shares issued by a person that is a bank or investment firm or other financial institution or affiliate of a bank, investment firm or other financial institution, to cancel, reduce, modify or change the form of a liability of such a person or any contract or instrument under which that liability arises, to convert all or part of that liability into shares, securities or obligations of that person or any other person, to provide that any such contract or instrument is to have effect as if a right had been exercised under it or to suspend any obligation in respect of that liability or any of the powers under that UK Bail-In Legislation that are related to or ancillary to any of those powers; and |

20

| (C) | in relation to any other applicable Bail-In Legislation: |

| (1) | any powers under that Bail-In Legislation to cancel, transfer or dilute shares issued by a person that is a bank or investment firm or other financial institution or affiliate of a bank, investment firm or other financial institution, to cancel, reduce, modify or change the form of a liability of such a person or any contract or instrument under which that liability arises, to convert all or part of that liability into shares, securities or obligations of that person or any other person, to provide that any such contract or instrument is to have effect as if a right had been exercised under it or to suspend any obligation in respect of that liability or any of the powers under that Bail-In Legislation that are related to or ancillary to any of those powers; and |

| (2) | any similar or analogous powers under that Bail-In Legislation. |

| 1.2 | Construction |

| (A) | Unless a contrary indication appears, any reference in any Finance Document to: |

| (1) | the “Agent”, any “Arranger”, any “Finance Party”, any “Lender”, the “Documentation Agent” or any “Party” shall be construed so as to include its successors in title, permitted assigns and permitted transferees to, or of, its rights and/or obligations under the Finance Documents; |

| (2) | “assets” includes present and future properties, revenues and rights of every description; |

| (3) | a Lender’s “cost of funds” in relation to its participation in a Loan is a reference to the average cost (determined either on an actual or a notional basis) which that Xxxxxx would incur if it were to fund, from whatever source(s) it may reasonably select, an amount equal to the amount of that participation in that Loan for a period equal in length to the Interest Period of that Loan; |

| (4) | a “Finance Document” or any other agreement or instrument is a reference to that Finance Document or other agreement or instrument as amended, novated, supplemented, extended or restated; |

| (5) | a “group of Lenders” includes all the Lenders; |

| (6) | “indebtedness” includes any obligation (whether incurred as principal or as surety) for the payment or repayment of money, whether present or future, actual or contingent; |

| (7) | a “person” includes any individual, firm, company, corporation, government, state or agency of a state or any association, trust, joint venture, consortium, partnership or other entity (whether or not having separate legal personality); |

| (8) | a “regulation” includes any regulation, rule, official directive, request or guideline (whether or not having the force of law but, if not having the force of law, being of a type with which any person to which it applies is accustomed to comply) of any governmental, intergovernmental or supranational body, agency, department or of any regulatory, self-regulatory or other authority or organisation; |

| (9) | a provision of law is a reference to that provision as amended or re-enacted; and |

21

| (10) | a time of day is a reference to London time. |

| (B) | Clause and schedule headings are for ease of reference only. |

| (C) | Unless a contrary indication appears, a term used in any other Finance Document or in any notice given under or in connection with any Finance Document has the same meaning in that Finance Document or notice as in this Agreement. |

| (D) | A Default is “continuing” if it has not been remedied or waived. |

| (E) | Except as provided to the contrary in this Agreement, an accounting term used in this Agreement is to be construed in accordance with the principles applied in connection with the Original Financial Statements. |

| (F) | A reference in this Agreement to a page or screen of an information service displaying a rate shall include: |

| (1) | any replacement page of that information service which displays that rate; and |

| (2) | the appropriate page of such other information service which displays that rate from time to time in place of that information service, |

and, if such page or service ceases to be available, shall include any other page or service displaying that rate specified by the Agent after consultation with the Borrower.

| (G) | A reference in this Agreement to a Central Bank Rate shall include any successor rate to, or replacement rate for, that rate. |

| (H) | Any Reference Rate Supplement overrides anything in: |

| (1) | Schedule 13 (Reference Rate Terms); or |

| (2) | any earlier Reference Rate Supplement. |

| (I) | A Compounding Methodology Supplement relating to the Daily Non-Cumulative Compounded RFR Rate overrides anything relating to that rate in: |

| (1) | Schedule 14 (Daily Non-Cumulative Compounded RFR Rate); or |

| (2) | any earlier Compounding Methodology Supplement. |

| (J) | The determination of the extent to which a rate is “for a period equal in length” to an Interest Period shall disregard any inconsistency arising from the last day of that Interest Period being determined pursuant to the terms of this Agreement. |

| 1.3 | Currency symbols and definitions |

“$”, “USD” and “dollars” denote the lawful currency of the United States of America. “£” and “sterling” denote the lawful currency of the United Kingdom.

22

| 1.4 | Third party rights |

| (A) | Unless expressly provided to the contrary in a Finance Document a person who is not a Party has no right under the Contracts (Rights of Third Parties) Xxx 0000 (the “Third Parties Act”) to enforce or to enjoy the benefit of any term of this Agreement. |

| (B) | Notwithstanding any term of any Finance Document, the consent of any person who is not a Party is not required to rescind or vary this Agreement at any time. |

| 2. | The Facilities |

| 2.1 | The Facilities |

Subject to the terms of this Agreement, the Lenders make available to the Borrower:

| (A) | a USD term loan facility in an aggregate amount equal to the Total Facility A Commitments; and |

| (B) | a USD term loan facility in an aggregate amount equal to the Total Facility B Commitments. |

| 2.2 | Increase |

| (A) | The Borrower may by giving prior notice to the Agent by no later than the date falling five Business Days after the effective date of a cancellation of: |

| (1) | the Available Commitments of a Defaulting Lender in accordance with Clause 7.11 (Right of cancellation in relation to a Defaulting Lender); or |

| (2) | the Commitments of a Lender in accordance with: |

| (a) | Clause 7.1 (Illegality); or |

| (b) | Clause 7.8 (Right of replacement or repayment and cancellation in relation to a single Lender), |

request that the Commitments relating to any Facility be increased (and the Commitments relating to that Facility shall be so increased) in an aggregate amount of up to the amount of the Available Commitments or Commitments relating to that Facility so cancelled as follows:

| (i) | the increased Commitments will be assumed by one or more Eligible Institutions (each an “Increase Lender”) each of which confirms in writing (whether in the relevant Increase Confirmation or otherwise) its willingness to assume and does assume all the obligations of a Lender corresponding to that part of the increased Commitments which it is to assume, as if it had been an Original Lender in respect of those Commitments; |

| (ii) | the Borrower and any Increase Lender shall assume obligations towards one another and/or acquire rights against one another as the Borrower and the Increase Lender would have assumed and/or acquired had the Increase Lender been an Original Lender in respect of that part of the increased Commitments which it is to assume; |

23

| (iii) | each Increase Lender shall become a Party as a “Lender” and any Increase Lender and each of the other Finance Parties shall assume obligations towards one another and acquire rights against one another as that Increase Lender and those Finance Parties would have assumed and/or acquired had the Increase Lender been an Original Lender in respect of that part of the increased Commitments which it is to assume; |

| (iv) | the Commitments of the other Lenders shall continue in full force and effect; and |

| (v) | any increase in the Commitments relating to any Facility shall take effect on the date specified by the Borrower in the notice referred to above or any later date on which the conditions set out in Clause 2.2(B) below are satisfied. |

| (B) | An increase in the Commitments relating to a Facility will only be effective on: |

| (1) | the execution by the Agent of an Increase Confirmation from the relevant Increase Lender; and |

| (2) | in relation to an Increase Lender which is not a Lender immediately prior to the relevant increase the Agent being satisfied that it has complied with all necessary “know your customer” or other similar checks under all applicable laws and regulations in relation to the assumption of the increased Commitments by that Increase Lender. The Agent shall promptly notify the Borrower and the Increase Lender upon being so satisfied. |

| (C) | Each Increase Lender, by executing the Increase Confirmation, confirms (for the avoidance of doubt) that the Agent has authority to execute on its behalf any amendment or waiver that has been approved by or on behalf of the requisite Lender or Lenders in accordance with this Agreement on or prior to the date on which the increase becomes effective in accordance with this Agreement and that it is bound by that decision to the same extent as it would have been had it been an Original Lender. |

| (D) | The Borrower shall promptly on demand pay the Agent the amount of all costs and expenses (including legal fees) reasonably and properly incurred by it in connection with any increase in Commitments under this Clause 2.2. |

| (E) | The Increase Lender shall, on the date upon which the increase takes effect, pay to the Agent (for its own account) a fee in an amount equal to the fee which would be payable under Clause 23.4 (Assignment or transfer fee) if the increase was a transfer pursuant to Clause 23.6 (Procedure for transfer) and if the Increase Lender was a New Lender. |

| (F) | The Borrower may pay to the Increase Lender a fee in the amount and at the times agreed between the Borrower and the Increase Lender in a Fee Letter. |

| (G) | Neither the Agent nor any Lender shall have any obligation to find an Increase Lender and in no event shall any Lender whose Commitment is replaced by an Increase Lender be required to pay or surrender any of the fees received by such Lender pursuant to the Finance Documents. |

24

| (H) | Clause 23.5 (Limitation of responsibility of Existing Lenders) shall apply mutatis mutandis in this Clause 2.2 in relation to an Increase Lender as if references in that Clause 23.5 (Limitation of responsibility of Existing Lenders) to: |

| (1) | an “Existing Lender” were references to all the Lenders immediately prior to the relevant increase; |

| (2) | the “New Lender” were references to that “Increase Lender”; and |

| (3) | a “re-transfer” and “re-assignment” were references to respectively a “transfer” and “assignment”. |

| 2.3 | Finance Parties’ rights and obligations |

| (A) | The obligations of each Finance Party under the Finance Documents are several. Failure by a Finance Party to perform its obligations under the Finance Documents does not affect the obligations of any other Party under the Finance Documents. No Finance Party is responsible for the obligations of any other Finance Party under the Finance Documents. |

| (B) | The rights of each Finance Party under or in connection with the Finance Documents are separate and independent rights and any debt arising under the Finance Documents to a Finance Party from the Borrower is a separate and independent debt in respect of which a Finance Party shall be entitled to enforce its rights in accordance with paragraph (C) below. The rights of each Finance Party include any debt owing to that Finance Party under the Finance Documents and, for the avoidance of doubt, any part of a Loan or any other amount owed by the Borrower which relates to a Finance Party’s participation in a Facility or its role under a Finance Document (including any such amount payable to the Agent on its behalf) is a debt owing to that Finance Party by the Borrower. |

| (C) | A Finance Party may, except as specifically stated in the Finance Documents, separately enforce its rights under or in connection with the Finance Documents. |

| 2.4 | Extension option |

| (A) | The Borrower may, by giving an Extension Notice to the Agent, extend the Termination Date of Facility A to the date falling three Months after the Initial Facility A Termination Date, or if that extended date is not a Business Day, the preceding Business Day. |

| (B) | An Extension Notice may only be given by the Borrower not more than 60 days and not less than 30 days before the Initial Facility A Termination Date. |

| (C) | Three Business Days after the delivery of an Extension Notice (the “Extension Notice Effective Date”), the Termination Date in respect of Facility A shall be automatically extended to the date referred to in paragraph (A) above provided that: |

| (1) | on the date of the Extension Notice and on the Extension Notice Effective Date where any such date occurs during the Certain Funds Period: |

| (a) | no Major Default has occurred and is continuing; |

| (b) | the Major Representations (other than the representation set out in Clause 18.14 (Sanctions)) are true in all material respects; and |

25

| (c) | the representation set out in Clause 18.14 (Sanctions)) is true; and |

| (2) | on the date of the Extension Notice and on the Extension Notice Effective Date where any such date occurs following the end of the Certain Funds Period: |

| (a) | no Event of Default has occurred and is continuing; |

| (b) | the Repeating Representations (other than the representation set out in Clause 18.14 (Sanctions)) are true in all material respects; and |

| (c) | the representation set out in Clause 18.14 (Sanctions)) is true. |

| (D) | The Agent shall promptly notify the Lenders of receipt by it of an Extension Notice. |

| 3. | Purpose |

| 3.1 | Purpose |

The Borrower shall apply, directly or indirectly, all amounts borrowed by it under the Facilities towards:

| (A) | payment of the consideration payable pursuant to the Acquisition; and |

| (B) | payment of the Acquisition Costs; and |

| (C) | refinancing any financial indebtedness of the Target Group. |

| 3.2 | Monitoring |

No Finance Party is bound to monitor or verify the application of any amount borrowed pursuant to this Agreement.

| 4. | Conditions of Utilisation |

| 4.1 | Initial conditions precedent |

| (A) | The Borrower may not deliver a Utilisation Request unless the Agent has received all of the documents and other evidence listed in Part 1 and Part 2 of Schedule 2 (Conditions Precedent), subject to paragraph (B) below, in form and substance satisfactory to the Agent. The Agent shall notify the Borrower and the Lenders promptly upon being so satisfied. |

| (B) | Other than to the extent that the Majority Lenders notify the Agent in writing to the contrary before the Agent gives the notification described in Clause 4.1(A), the Lenders authorise (but do not require) the Agent to give that notification. The Agent shall not be liable for any damages, costs or losses whatsoever as a result of giving any such notification. |

| 4.2 | Utilisations during the Certain Funds Period |

| (A) | Subject to Clause 4.1 (Initial conditions precedent), during the Certain Funds Period, the Lenders will only be obliged to comply with Clause 5.4 (Xxxxxxx' participation) in relation to a Certain Funds Utilisation if, on the date of the Utilisation Request and on the proposed Utilisation Date: |

| (1) | no Major Default is continuing or would result from the proposed Utilisation; and |

26

| (2) | all the Major Representations are true in all material respects. |

| (B) | During the Certain Funds Period (save in circumstances where, pursuant to paragraph (A) above, a Lender is not obliged to comply with Clause 5.4 (Xxxxxxx' participation) and subject as provided in Clause 7.1 (Illegality) and Clause 7.2 (Change of control)), none of the Finance Parties shall be entitled to: |

| (1) | cancel any of its Commitments to the extent to do so would prevent or limit the making of a Certain Funds Utilisation; |

| (2) | rescind, terminate or cancel this Agreement or any of the Facilities or exercise any similar right or remedy or make or enforce any claim under the Finance Documents it may have to the extent to do so would prevent or limit the making of a Certain Funds Utilisation; |

| (3) | refuse to participate in the making of a Certain Funds Utilisation; |

| (4) | exercise any right of set-off or counterclaim in respect of a Utilisation to the extent to do so would prevent or limit the making of a Certain Funds Utilisation; or |

| (5) | cancel, accelerate or cause repayment or prepayment of any amounts owing under this Agreement or under any other Finance Document to the extent to do so would directly or indirectly prevent or limit the making of a Certain Funds Utilisation; |

provided that immediately upon the expiry of the Certain Funds Period all such rights, remedies and entitlements shall be available to the Finance Parties notwithstanding that they may not have been used or been available for use during the Certain Funds Period.

| 4.3 | Maximum number of Loans |

The Borrower may not deliver a Utilisation Request if as a result of the proposed Utilisation:

| (A) | more than six Facility A Loans would be outstanding; or |

| (B) | more than one Facility B Loans would be outstanding. |

| 5. | Utilisation |

| 5.1 | Delivery of a Utilisation Request |

The Borrower may utilise a Facility by delivery to the Agent of a duly completed Utilisation Request in relation to that Facility not later than the Specified Time.

| 5.2 | Completion of a Utilisation Request |

| (A) | Each Utilisation Request is irrevocable and will not be regarded as having been duly completed unless: |

| (1) | it identifies the Facility to be utilised; |

27

| (2) | the proposed Utilisation Date is a Business Day within the Availability Period for that Facility; |

| (3) | the currency and amount of the Utilisation comply with Clause 5.3 (Currency and amount); and |

| (4) | the proposed Interest Period complies with Clause 9 (Interest Periods). |

| (B) | Only one Loan may be requested in each Utilisation Request. |

| 5.3 | Currency and amount |

| (A) | The currency specified in a Utilisation Request must be dollars. |

| (B) | The amount of the proposed Loan under a Facility must be an amount which is not more than the Available Facility and which is a minimum of: |

| (1) | USD 10,000,000 for Facility A or, if less, the Available Facility; or |

| (2) | for Facility B, the Available Facility. |

| 5.4 | Lenders’ participation |

| (A) | If the conditions set out in this Agreement have been met, each Lender shall make its participation in each Loan available by the Utilisation Date through its Facility Office. |

| (B) | The amount of each Lender’s participation in each Loan will be equal to the proportion borne by its Available Commitment to the Available Facility immediately prior to making the Loan. |

| (C) | The Agent shall notify each Lender of the amount of each Loan, the amount of its participation in that Loan by the Specified Time. |

| 5.5 | Cancellation of Commitments |

The Commitments under a Facility which, at that time, are unutilised shall be immediately cancelled at the end of the Availability Period for that Facility.

| 6. | Repayment |

| 6.1 | Repayment of Loans |

The Borrower shall repay the aggregate amount of each Loan under a Facility in full on the Termination Date for that Facility.

| 7. | Prepayment and Cancellation |

| 7.1 | Illegality |

If, in any applicable jurisdiction, it becomes unlawful for any Lender to perform any of its obligations as contemplated by this Agreement or to fund, issue or maintain its participation in any Utilisation or it becomes unlawful for any Affiliate of a Lender for that Lender to do so:

| (A) | that Xxxxxx shall promptly notify the Agent upon becoming aware of that event; |

28

| (B) | upon the Agent notifying the Borrower, each Available Commitment of that Lender will be immediately cancelled; and |

| (C) | to the extent that the Lender’s participation has not been transferred pursuant to Clause 7.8(D) (Right of replacement or repayment and cancellation in relation to a single Lender), the Borrower shall repay that Xxxxxx’s participation in the Utilisations made to the Borrower on the last day of the Interest Period for each Utilisation occurring after the Agent has notified the Borrower or, if earlier, the date specified by the Lender in the notice delivered to the Agent (being no earlier than the last day of any applicable grace period permitted by law) and that Xxxxxx’s corresponding Commitments shall be cancelled in the amount of the participations repaid. |

| 7.2 | Change of control |

| (A) | If any person or group of persons acting in concert gains control of the Borrower other than by way of a Permitted Reorganisation the Borrower shall promptly notify the Agent upon becoming aware of that event. |

| (B) | After the delivery of a notification under Clause 7.2(A) above: |

| (1) | a Lender shall not be obliged to fund a Utilisation; and |

| (2) | the Agent (on behalf of the Lenders) and the Borrower shall negotiate in good faith for a period of not less than 45 days with a view to resolving any concerns of the Lenders arising from that change of control and the continuation of the Facilities (on the same or alternative terms). If, at the expiry of that 45 day period, the concerns of the Lenders arising from the change of control have not been resolved to the satisfaction of the Lenders, then, if a Lender so requires, the Agent shall, within five days after the end of the 45 day period, by notice to the Borrower: |

| (a) | cancel the Commitments of that Xxxxxx; and |

| (b) | declare that Xxxxxx’s share in all outstanding Utilisations, together with accrued interest and all other amounts accrued under the Finance Documents in respect of that Xxxxxx’s share, to be immediately due and payable. |

Any such notice shall take effect in accordance with its terms.

| (C) | For the purpose of Clause 7.2(A) above “control” has the meaning given to it section 450 of the Corporation Tax Xxx 0000. |