SECOND AMENDMENT TO LEASE AGREEMENT

Exhibit 10.8

SECOND AMENDMENT TO LEASE AGREEMENT

This Second Amendment to Lease Agreement (this “Second Amendment”) is made and intended to be effective as of September 1, 2021 (the “Effective Date”), between HARBOR BAY NLA LLC, a Delaware limited liability company (together with any of its successors or assigns, hereinafter called the “Landlord”), and PENUMBRA, INC., a Delaware corporation (together with any of its respective successors or assigns permitted by the Existing Lease (as defined below), hereinafter called the “Tenant”).

A.Landlord (as successor-in-interest to SKS Harbor Bay Associates, LLC) and Tenant are parties to that certain Lease Agreement dated as of December 17, 2015 (the “Original Lease”), as amended by that certain First Amendment to Lease Agreement dated as of July 14, 2021 (the “First Amendment” and the Original Lease, as so amended, collectively, the “Existing Lease”).

B.Landlord and Tenant have agreed to make certain amendments and modifications to the Existing Lease, all pursuant to and subject to the terms and conditions more fully set forth herein.

NOW, THEREFORE, in consideration of the recitals set forth above, the covenants and agreements contained herein, and other good and valuable consideration, the receipt, adequacy and total sufficiency of which are hereby acknowledged, Landlord and Tenant hereby agree as follows:

1.Recitals/Terms. All recitals to this Second Amendment set forth above are hereby incorporated herein. All terms used but not otherwise defined herein shall have the meanings set forth for such terms in the Existing Lease.

2.Amendments to Existing Lease. The Existing Lease is hereby modified and amended as follows:

(a)Notwithstanding anything set forth in the Basic Lease Information to the contrary, the “Expiration Date” shall be December 31, 2036. The foregoing shall have no impact whatsoever on the Extension Options set forth in Article 51 of the Existing Lease, all of which shall remain in full force and effect and available to Tenant in accordance with Article 51 and the other provisions of the Existing Lease as if the original Expiration Date was the Expiration Date as revised in the immediately preceding sentence.

(b)The first sentence of the definition of “Must-Take Space” in the Basic Lease Information of the Existing Lease is hereby deleted in its entirety and replaced as follows:

“Must-Take Space: collectively means any space in any of the Buildings (other than the Initial Premises) which becomes vacant on or before September 30, 2031 due to the expiration of earlier termination of a lease of that space to a tenant other than Tenant.”

(c)For the period prior to January 1, 2022, Section 3 of the First Amendment shall control as it relates to Base Rent for the Premises; provided, however, that with respect to the 1431 Harbor Bay Building which was made a part of the Premises as of July 14, 2021, as

1

well as any Must-Take Space which is added to the Premises in the future, Tenant shall still be entitled to one hundred fifty (150) days of Base Rent abatement as is contemplated in the Existing Lease, such Base Rent Abatement with respect to the 0000 Xxxxxx Xxx Xxxxxxxx to commence as of July 14, 2021 and expire as of December 11, 2021. Commencing as of January 1, 2022 and through the Expiration Date (as modified by Section 2 (a) above, such period being referred to herein as the “Extension Term”), Section 3 of the First Amendment shall no longer control and the paragraph entitled “Base Rent” in the Basic Lease Information of the Existing Lease (including the schedule of Base Rent) shall control but shall be deemed replaced as follows:

“The Base Rent for the Premises shall be as set forth in Exhibit K. For the avoidance of doubt, upon any Must-Take Space being added to the Premises during the Term, the Base Rent will be re-calculated from and after the date that such Must-Take Space is added, as follows: the then-applicable Base Rent payable for the then-existing Premises (using the then-applicable rate per square foot of rentable space) shall be multiplied by the applicable rentable square feet being added to the Premises, and such product shall be added to and thus be part of Base Rent going forward, and further, all of such Base Rent shall adjust upward in accordance with the schedule set forth in Exhibit K.”

(d)Notwithstanding anything set forth in the Basic Lease Information of the Existing Lease to the contrary, (i) the “Tenant Improvement Allowance” for the Must-Take Space with respect to the 0000 Xxxxxx Xxx Xxxxxxxx shall equal $131.25 on a rentable square foot basis (inclusive of the Tenant Improvement Allowance provided to Tenant with respect to the 1431 Harbor Bay Building pursuant to the terms of the First Amendment in the amount of $31.25 per rentable square foot), and (ii) the “Tenant Improvement Allowance” for the Must-Take Space with respect to the 1301 Harbor Bay Building shall equal (1) $31.25 per rentable square foot, plus (2) an amount based on an amortization of an additional allowance amount initially set at $77.93 per rentable square foot of 1301 Harbor Building Must-Take Space as of the commencement date of such Must-Take Space (by way of example only, if the 1301 Harbor Bay Building Must-Take Space commencement date is June 1, 2023, the amount set forth in clause (2) above shall equal $74.58 per rentable square foot of such Must-Take Space, or, if such 1301 Harbor Bay Building Must-Take Space commencement date is June 1, 2028, the amount set forth in clause (2) above shall equal $58.29 per rentable square foot of Must-Take Space). For the avoidance of doubt, the Tenant Improvements (as such term is defined in Section 2.1 of Exhibit C of the Existing Lease) with respect to the 1431 Harbor Bay Building Must-Take Space and the 1301 Harbor Bay Building Must-Take Space shall be performed and undertaken in accordance with, and shall in all respects (inclusive of the process for disbursement of any Tenant Improvement Allowance described above, as set forth in Section 2.2.2 of Exhibit C attached to the Existing Lease (“Section 2.2.2”)) be subject to the terms and conditions of, Exhibit C attached to the Existing Lease (except to the extent such terms expressly and specifically conflict with this Section 2(c), in which case the terms of this Section 2(c) shall control), provided that Tenant will not be required to use union-affiliated labor or any Landlord-specified contractor or vendor in the performance of any such Tenant Improvements.

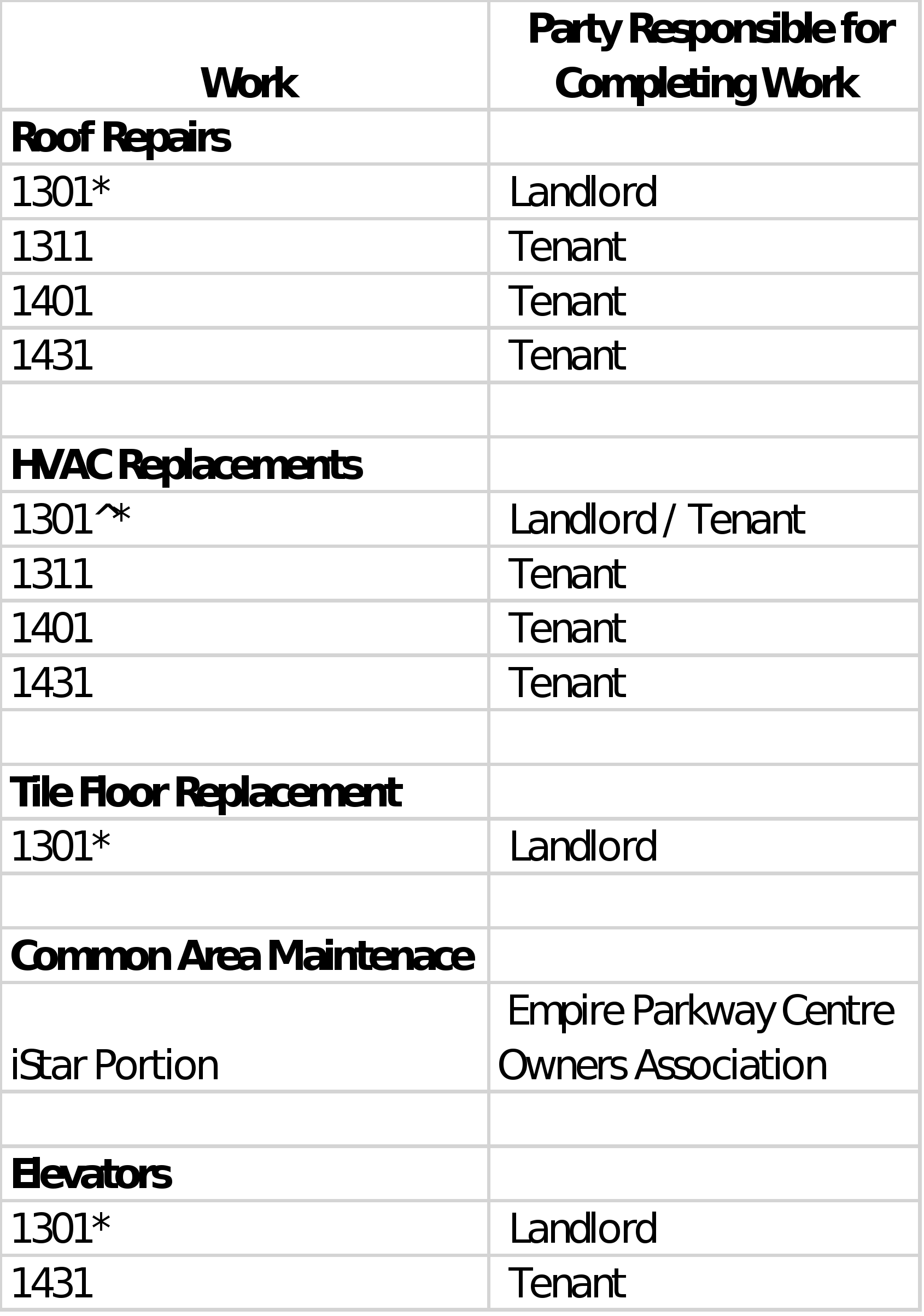

(e)Notwithstanding anything to the contrary contained in the Existing Lease, in addition to any Tenant Improvements undertaken by Tenant with respect to the 1431 Harbor Bay Building Must-Take Space, Tenant (and Landlord as and to the extent described on Exhibit S attached hereto) shall have the obligation to perform and complete (or cause to be performed or completed) the improvement work outlined in Exhibit S attached hereto (the “New Improvement Work”). Any New Improvement Work performed (or caused to be performed) by Tenant shall be undertaken and completed in accordance with Exhibit T attached hereto.

2

With respect to payment for any New Improvement Work, there shall be a total aggregate monetary allowance provided by Landlord with respect to the New Improvement Work (whether performed or caused to be performed by Landlord or Tenant) equal to $7,494,244.33 (the “New Improvement Work Allowance”). As such, the following procedures shall apply with respect to paying and being reimbursed for any New Improvement Work:

(i)Any New Improvement Work performed or caused to be performed by Tenant shall, at Tenant’s option, either be paid for by Tenant or paid directly by Landlord to either Tenant (in accordance with Section 2.2.2) or Tenant’s applicable contractor(s), provided that Landlord shall only be obligated to pay Tenant’s contractor(s) directly after receipt of invoices and within thirty (30) days following presentation of a partial (or final, as applicable) lien waiver from Tenant’s contractor(s) for all completed and paid for work to date, together with a certification from Tenant that such contractor is entitled to such payment and Tenant’s request to make such payment. Landlord will use commercially reasonable efforts to assist Tenant in obtaining any necessary approvals from any owners’ association who may retain approval rights over portions of the New Improvement Work. If Tenant elects to pay for any phase of the New Improvement Work itself, then Tenant may seek reimbursement from Landlord during the course of design and construction of such phase in accordance with Section 2.2.2 . Within thirty (30) days following Completion of a New Improvement Work project which has been paid for by Tenant, Landlord shall reimburse Tenant for any cost thereof which has not been previously disbursed by Landlord pursuant to Section 2.2.2, provided that Tenant delivers to Landlord (1) receipts of invoices therefor, (2) partial (or final, as applicable) lien waivers from Tenant’s contractor(s) for all completed and paid for work to date, and (3) a certification from Tenant that each such contractor has been paid in full.

(ii)Any amount which is paid by Landlord directly to contractor(s), or reimbursed to Tenant pursuant to Section 2(d)(i) above, shall be deducted from and reduce the remaining available New Improvement Work Allowance on a dollar for dollar basis. Further, any amounts which are reasonably expended by Landlord in connection with New Improvement Work projects which are to be performed by (or caused to be performed by) Landlord pursuant to Exhibit S shall also be deducted from and reduce the remaining available New Improvement Work Allowance on a dollar for dollar basis (although, for accounting purposes, and because Tenant is nonetheless monetarily responsible for the New Improvement Work performed (or caused to be performed) by Landlord pursuant to the Existing Lease, Landlord shall send invoices therefor, together with reasonably detailed back-up documentation/records of all such work, to Tenant with such invoices being deemed paid by Tenant from the New Improvement Work Allowance).

(iii)If there are funds available from the New Improvement Work Allowance after Completion of all New Improvement Work, then such funds shall be made available to Tenant provided that such funds are used by Tenant in connection with additional, actual improvements to the Premises (i.e., Alterations) which are reasonably approved by Landlord to the extent approval is required by the terms of the Existing Lease.

(f)Exhibit K to the Existing Lease is hereby deleted in its entirety and replaced by Exhibit K of this Second Amendment.

3.Payment of Common Area Improvements Escrow. Within thirty (30) days after the Effective Date, Landlord shall pay to Tenant the sum of $1,092,051.03, thereby releasing to Tenant in full the amount of escrow collected by Landlord from Tenant in connection with certain improvements to the Common Areas.

4.Memorandum of Lease. Within thirty (30) calendar days following the Effective Date, Landlord and Tenant shall cause the existing Memorandum of Lease for the

3

Premises to be amended, in a form to be agreed upon by Landlord and Tenant, to reflect the change in Term. Tenant shall pay all fees to record the amendment to the Memorandum of Lease and any applicable transfer taxes resulting from this Second Amendment.

5.Confirmation. Except as expressly modified by the terms and provisions of this Second Amendment, all of the terms and provisions of the Existing Lease are unchanged and continue in full force and effect and all rights, remedies, liabilities and obligations evidenced by the Existing Lease are hereby acknowledged by Tenant to be valid and subsisting and to be continued in full force and effect. The Existing Lease, as modified and amended hereby, is hereby ratified and confirmed by Landlord and Tenant, and every provision, covenant, condition, obligation, right, term and power contained in and under the Existing Lease, as modified and amended hereby, shall continue in full force and effect. All references to the Lease in the Existing Lease shall mean the Existing Lease as modified and amended by this Second Amendment. Tenant represents and warrants to Landlord that, as of the date hereof: (i) Tenant is not in default under the Existing Lease and, to Tenant’s knowledge, no event or condition exists which, with the giving of notice or the passage of time or both, would give rise to a default by Tenant under the Existing Lease, (ii) Tenant has no knowledge of a right or claim of set off, discount, deduction, defense or counterclaim or any claim that could be asserted in any action brought to enforce the Existing Lease or otherwise asserted against Landlord in connection with the Existing Lease, and (iii) there is no default by Landlord under the Existing Lease through and as of the date of this Second Amendment; the foregoing representations in clauses (ii) and (iii) notwithstanding, Landlord acknowledges that Tenant has not yet exercised the audit right set forth in Section 5.4 of the Existing Lease and reserves the right to make claims based on such exercise if Tenant does exercise such audit rights.

6.Costs and Expenses. Each party shall be responsible for and shall pay all costs and expenses incurred by such party in connection with the preparation, negotiation, execution and delivery of this Second Amendment and the amendment to the Memorandum of Lease, including the legal fees and expenses of Landlord and Tenant respectively.

7.Representations and Warranties. Tenant hereby reaffirms in their entirety all of the representations and warranties set forth in the Existing Lease and this Second Amendment, as of the Effective Date, except for any such representations or warranties that were made as of a specific date.

8.Brokerage. Tenant represents and warrants to Landlord that it has been represented on an exclusive basis by Tenant's Broker in negotiation of this Second Amendment. Landlord acknowledges that a brokerage fee is due the Tenant’s Broker from Landlord for this Second Amendment pursuant to the Tenant’s Broker Commission Agreement attached to the Existing Lease as Exhibit Q, excepting that the commission rate for the Second Amendment with respect to the Premises shall be $1.50 per rentable square foot per year for years eleven through fifteen (11-15) in the Extension Term and will be payable fifty percent (50%) upon execution and exchange of this Second Amendment, and (ii) fifty percent (50%) on October 1, 2021. For the avoidance of any doubt, said commission shall be paid on 185,360 square feet of rentable area (i.e., the Premises). The brokerage fee with respect to the Must Take Space shall remain due and payable in accordance with the Tenant’s Broker Commission Agreement. The Tenant’s Broker Commission Agreement is reattached hereto as Exhibit Q. Except as modified herein, the Broker Commission Agreement remains in full force and effect. Except for amounts owing to Tenant’s Broker as described herein, each party hereby agrees to indemnify and hold the other party harmless of and from any and all damages, losses,

4

costs, or expenses (including, without limitation, all attorneys’ fees and disbursements) by reason of any claim of or liability to any other broker or other person claiming through the indemnifying party and arising out of or in connection with the negotiation, execution, and delivery of this Second Amendment. Tenant Broker is an intended third-party beneficiary of the terms of this Section 8, which may not be modified without the written consent of Tenant’s Broker.

9.No Other Modifications. Landlord and Tenant hereby acknowledge and agree that the Existing Lease has not been modified, amended, canceled, terminated, released, superseded or otherwise rendered of no force or effect except as described herein.

10.Parties Bound. This Second Amendment shall be binding upon the parties hereto and their respective permitted successors and assigns.

11.Counterparts. This Second Amendment may be executed in counterparts, each of which shall be an original but all of which together shall constitute one agreement, binding on all of the parties hereto notwithstanding that all of the parties hereto are not signatories to the same counterpart. For purposes of this Second Amendment, each of the parties hereto agrees that a facsimile copy of the signature of the person executing this Second Amendment on either party’s behalf shall be effective as an original signature and legally binding and effective as an execution counterpart hereof. Each of the undersigned parties authorizes the assembly of one or more original copies of this Second Amendment through the combination of the several executed counterpart signature pages with one or more bodies of this Second Amendment including the Exhibits, if any, to this Second Amendment, such that this Second Amendment shall consist of the body of this Second Amendment, counterpart signature pages which collectively will contain the signatures of the undersigned parties hereto, and the Exhibits, if any, to this Second Amendment. Each such compilation of this Second Amendment shall constitute one original of this Second Amendment.

12.Xxxxxx’x Warranty. Each individual executing and delivering this Second Amendment on behalf of the party hereby warrants and represents to the other party solely in his or her capacity as an officer of the applicable signatory that he or she has been duly authorized and has the power to make such execution and delivery.

13.Captions. Article, Section and/or paragraph headings used herein are for convenience of reference only and shall not affect the construction of any provision hereof.

(This space is intentionally left blank; signature page follows)

5

6

LANDLORD: | ||||||||

HARBOR BAY NLA LLC, a Delaware limited liability company | ||||||||

By: | ||||||||

Name: | ||||||||

Title: | ||||||||

TENANT: | ||||||||

| PENUMBRA, INC., a Delaware corporation | ||||||||

By: /s/ Xxxx Xxxxxxxx | ||||||||

Name Xxxx Xxxxxxxx | ||||||||

Title: Chairman, President and CEO | ||||||||

Signature Page to Second Amendment to Lease Agreement

LANDLORD: | ||||||||

HARBOR BAY NLA LLC, a Delaware limited liability company | ||||||||

By: /s/ Xxxxxx Xxxxxxxxx | ||||||||

Name: Xxxxxx Xxxxxxxxx | ||||||||

Title: SVP | ||||||||

TENANT: | ||||||||

| PENUMBRA, INC., a Delaware corporation | ||||||||

By: | ||||||||

Name | ||||||||

Title: | ||||||||

Signature Page to Second Amendment to Lease Agreement

Exhibit K

Base Rent

| New Rent Schedule / RSF | New 1301 Rent | New 1311 Rent | New 1401 Rent | New 1431 Rent | New Total Rent | New Total Rent with Must Take Space | Date | ||||||||||||||||

| $2.0055 | $74,109 | $59,862 | $98,365 | $139,402 | $371,738 | $435,781 | 1/1/2022 | ||||||||||||||||

| $2.0055 | $74,109 | $59,862 | $98,365 | $139,402 | $371,738 | $435,781 | 2/1/2022 | ||||||||||||||||

| $2.0055 | $74,109 | $59,862 | $98,365 | $139,402 | $371,738 | $435,781 | 3/1/2022 | ||||||||||||||||

| $2.0055 | $74,109 | $59,862 | $98,365 | $139,402 | $371,738 | $435,781 | 4/1/2022 | ||||||||||||||||

| $2.0055 | $74,109 | $59,862 | $98,365 | $139,402 | $371,738 | $435,781 | 5/1/2022 | ||||||||||||||||

| $2.0055 | $74,109 | $59,862 | $98,365 | $139,402 | $371,738 | $435,781 | 6/1/2022 | ||||||||||||||||

| $2.0055 | $74,109 | $59,862 | $98,365 | $139,402 | $371,738 | $435,781 | 7/1/2022 | ||||||||||||||||

| $2.0055 | $74,109 | $59,862 | $98,365 | $139,402 | $371,738 | $435,781 | 8/1/2022 | ||||||||||||||||

| $2.0055 | $74,109 | $59,862 | $98,365 | $139,402 | $371,738 | $435,781 | 9/1/2022 | ||||||||||||||||

| $2.0055 | $74,109 | $59,862 | $98,365 | $139,402 | $371,738 | $435,781 | 10/1/2022 | ||||||||||||||||

| $2.0055 | $74,109 | $59,862 | $98,365 | $139,402 | $371,738 | $435,781 | 11/1/2022 | ||||||||||||||||

| $2.0055 | $74,109 | $59,862 | $98,365 | $139,402 | $371,738 | $435,781 | 12/1/2022 | ||||||||||||||||

| $2.0657 | $76,332 | $61,658 | $101,316 | $143,584 | $382,890 | $448,862 | 1/1/2023 | ||||||||||||||||

| $2.0657 | $76,332 | $61,658 | $101,316 | $143,584 | $382,890 | $448,862 | 2/1/2023 | ||||||||||||||||

| $2.0657 | $76,332 | $61,658 | $101,316 | $143,584 | $382,890 | $448,862 | 3/1/2023 | ||||||||||||||||

| $2.0657 | $76,332 | $61,658 | $101,316 | $143,584 | $382,890 | $448,862 | 4/1/2023 | ||||||||||||||||

| $2.0657 | $76,332 | $61,658 | $101,316 | $143,584 | $382,890 | $448,862 | 5/1/2023 | ||||||||||||||||

| $2.0657 | $76,332 | $61,658 | $101,316 | $143,584 | $382,890 | $448,862 | 6/1/2023 | ||||||||||||||||

| $2.0657 | $76,332 | $61,658 | $101,316 | $143,584 | $382,890 | $448,862 | 7/1/2023 | ||||||||||||||||

| $2.0657 | $76,332 | $61,658 | $101,316 | $143,584 | $382,890 | $448,862 | 8/1/2023 | ||||||||||||||||

| $2.0657 | $76,332 | $61,658 | $101,316 | $143,584 | $382,890 | $448,862 | 9/1/2023 | ||||||||||||||||

| $2.0657 | $76,332 | $61,658 | $101,316 | $143,584 | $382,890 | $448,862 | 10/1/2023 | ||||||||||||||||

| $2.0657 | $76,332 | $61,658 | $101,316 | $143,584 | $382,890 | $448,862 | 11/1/2023 | ||||||||||||||||

| $2.0657 | $76,332 | $61,658 | $101,316 | $143,584 | $382,890 | $448,862 | 12/1/2023 | ||||||||||||||||

| $2.1276 | $78,622 | $63,508 | $104,356 | $147,891 | $394,377 | $462,313 | 1/1/2024 | ||||||||||||||||

| $2.1276 | $78,622 | $63,508 | $104,356 | $147,891 | $394,377 | $462,313 | 2/1/2024 | ||||||||||||||||

| $2.1276 | $78,622 | $63,508 | $104,356 | $147,891 | $394,377 | $462,313 | 3/1/2024 | ||||||||||||||||

| $2.1276 | $78,622 | $63,508 | $104,356 | $147,891 | $394,377 | $462,313 | 4/1/2024 | ||||||||||||||||

| $2.1276 | $78,622 | $63,508 | $104,356 | $147,891 | $394,377 | $462,313 | 5/1/2024 | ||||||||||||||||

| $2.1276 | $78,622 | $63,508 | $104,356 | $147,891 | $394,377 | $462,313 | 6/1/2024 | ||||||||||||||||

| $2.1276 | $78,622 | $63,508 | $104,356 | $147,891 | $394,377 | $462,313 | 7/1/2024 | ||||||||||||||||

| $2.1276 | $78,622 | $63,508 | $104,356 | $147,891 | $394,377 | $462,313 | 8/1/2024 | ||||||||||||||||

| $2.1276 | $78,622 | $63,508 | $104,356 | $147,891 | $394,377 | $462,313 | 9/1/2024 | ||||||||||||||||

| $2.1276 | $78,622 | $63,508 | $104,356 | $147,891 | $394,377 | $462,313 | 10/1/2024 | ||||||||||||||||

Exhibit K

| $2.1276 | $78,622 | $63,508 | $104,356 | $147,891 | $394,377 | $462,313 | 11/1/2024 | ||||||||||||||||

| $2.1276 | $78,622 | $63,508 | $104,356 | $147,891 | $394,377 | $462,313 | 12/1/2024 | ||||||||||||||||

| $2.1915 | $80,981 | $65,413 | $107,486 | $152,328 | $406,208 | $476,198 | 1/1/2025 | ||||||||||||||||

| $2.1915 | $80,981 | $65,413 | $107,486 | $152,328 | $406,208 | $476,198 | 2/1/2025 | ||||||||||||||||

| $2.1915 | $80,981 | $65,413 | $107,486 | $152,328 | $406,208 | $476,198 | 3/1/2025 | ||||||||||||||||

| $2.1915 | $80,981 | $65,413 | $107,486 | $152,328 | $406,208 | $476,198 | 4/1/2025 | ||||||||||||||||

| $2.1915 | $80,981 | $65,413 | $107,486 | $152,328 | $406,208 | $476,198 | 5/1/2025 | ||||||||||||||||

| $2.1915 | $80,981 | $65,413 | $107,486 | $152,328 | $406,208 | $476,198 | 6/1/2025 | ||||||||||||||||

| $2.1915 | $80,981 | $65,413 | $107,486 | $152,328 | $406,208 | $476,198 | 7/1/2025 | ||||||||||||||||

| $2.1915 | $80,981 | $65,413 | $107,486 | $152,328 | $406,208 | $476,198 | 8/1/2025 | ||||||||||||||||

| $2.1915 | $80,981 | $65,413 | $107,486 | $152,328 | $406,208 | $476,198 | 9/1/2025 | ||||||||||||||||

| $2.1915 | $80,981 | $65,413 | $107,486 | $152,328 | $406,208 | $476,198 | 10/1/2025 | ||||||||||||||||

| $2.1915 | $80,981 | $65,413 | $107,486 | $152,328 | $406,208 | $476,198 | 11/1/2025 | ||||||||||||||||

| $2.1915 | $80,981 | $65,413 | $107,486 | $152,328 | $406,208 | $476,198 | 12/1/2025 | ||||||||||||||||

| $2.2572 | $83,410 | $67,375 | $110,711 | $156,898 | $418,394 | $490,474 | 1/1/2026 | ||||||||||||||||

| $2.2572 | $83,410 | $67,375 | $110,711 | $156,898 | $418,394 | $490,474 | 2/1/2026 | ||||||||||||||||

| $2.2572 | $83,410 | $67,375 | $110,711 | $156,898 | $418,394 | $490,474 | 3/1/2026 | ||||||||||||||||

| $2.2572 | $83,410 | $67,375 | $110,711 | $156,898 | $418,394 | $490,474 | 4/1/2026 | ||||||||||||||||

| $2.2572 | $83,410 | $67,375 | $110,711 | $156,898 | $418,394 | $490,474 | 5/1/2026 | ||||||||||||||||

| $2.2572 | $83,410 | $67,375 | $110,711 | $156,898 | $418,394 | $490,474 | 6/1/2026 | ||||||||||||||||

| $2.2572 | $83,410 | $67,375 | $110,711 | $156,898 | $418,394 | $490,474 | 7/1/2026 | ||||||||||||||||

| $2.2572 | $83,410 | $67,375 | $110,711 | $156,898 | $418,394 | $490,474 | 8/1/2026 | ||||||||||||||||

| $2.2572 | $83,410 | $67,375 | $110,711 | $156,898 | $418,394 | $490,474 | 9/1/2026 | ||||||||||||||||

| $2.2572 | $83,410 | $67,375 | $110,711 | $156,898 | $418,394 | $490,474 | 10/1/2026 | ||||||||||||||||

| $2.2572 | $83,410 | $67,375 | $110,711 | $156,898 | $418,394 | $490,474 | 11/1/2026 | ||||||||||||||||

| $2.2572 | $83,410 | $67,375 | $110,711 | $156,898 | $418,394 | $490,474 | 12/1/2026 | ||||||||||||||||

| $2.3249 | $85,913 | $69,396 | $114,032 | $161,605 | $430,946 | $505,184 | 1/1/2027 | ||||||||||||||||

| $2.3249 | $85,913 | $69,396 | $114,032 | $161,605 | $430,946 | $505,184 | 2/1/2027 | ||||||||||||||||

| $2.3249 | $85,913 | $69,396 | $114,032 | $161,605 | $430,946 | $505,184 | 3/1/2027 | ||||||||||||||||

| $2.3249 | $85,913 | $69,396 | $114,032 | $161,605 | $430,946 | $505,184 | 4/1/2027 | ||||||||||||||||

| $2.3249 | $85,913 | $69,396 | $114,032 | $161,605 | $430,946 | $505,184 | 5/1/2027 | ||||||||||||||||

| $2.3249 | $85,913 | $69,396 | $114,032 | $161,605 | $430,946 | $505,184 | 6/1/2027 | ||||||||||||||||

| $2.3249 | $85,913 | $69,396 | $114,032 | $161,605 | $430,946 | $505,184 | 7/1/2027 | ||||||||||||||||

| $2.3249 | $85,913 | $69,396 | $114,032 | $161,605 | $430,946 | $505,184 | 8/1/2027 | ||||||||||||||||

| $2.3249 | $85,913 | $69,396 | $114,032 | $161,605 | $430,946 | $505,184 | 9/1/2027 | ||||||||||||||||

| $2.3249 | $85,913 | $69,396 | $114,032 | $161,605 | $430,946 | $505,184 | 10/1/2027 | ||||||||||||||||

| $2.3249 | $85,913 | $69,396 | $114,032 | $161,605 | $430,946 | $505,184 | 11/1/2027 | ||||||||||||||||

| $2.3249 | $85,913 | $69,396 | $114,032 | $161,605 | $430,946 | $505,184 | 12/1/2027 | ||||||||||||||||

| $2.3947 | $88,490 | $71,478 | $117,453 | $166,453 | $443,874 | $520,352 | 1/1/2028 | ||||||||||||||||

| $2.3947 | $88,490 | $71,478 | $117,453 | $166,453 | $443,874 | $520,352 | 2/1/2028 | ||||||||||||||||

| $2.3947 | $88,490 | $71,478 | $117,453 | $166,453 | $443,874 | $520,352 | 3/1/2028 | ||||||||||||||||

Exhibit K

| $2.3947 | $88,490 | $71,478 | $117,453 | $166,453 | $443,874 | $520,352 | 4/1/2028 | ||||||||||||||||

| $2.3947 | $88,490 | $71,478 | $117,453 | $166,453 | $443,874 | $520,352 | 5/1/2028 | ||||||||||||||||

| $2.3947 | $88,490 | $71,478 | $117,453 | $166,453 | $443,874 | $520,352 | 6/1/2028 | ||||||||||||||||

| $2.3947 | $88,490 | $71,478 | $117,453 | $166,453 | $443,874 | $520,352 | 7/1/2028 | ||||||||||||||||

| $2.3947 | $88,490 | $71,478 | $117,453 | $166,453 | $443,874 | $520,352 | 8/1/2028 | ||||||||||||||||

| $2.3947 | $88,490 | $71,478 | $117,453 | $166,453 | $443,874 | $520,352 | 9/1/2028 | ||||||||||||||||

| $2.3947 | $88,490 | $71,478 | $117,453 | $166,453 | $443,874 | $520,352 | 10/1/2028 | ||||||||||||||||

| $2.3947 | $88,490 | $71,478 | $117,453 | $166,453 | $443,874 | $520,352 | 11/1/2028 | ||||||||||||||||

| $2.3947 | $88,490 | $71,478 | $117,453 | $166,453 | $443,874 | $520,352 | 12/1/2028 | ||||||||||||||||

| $2.4665 | $91,144 | $73,622 | $120,977 | $171,446 | $457,190 | $535,953 | 1/1/2029 | ||||||||||||||||

| $2.4665 | $91,144 | $73,622 | $120,977 | $171,446 | $457,190 | $535,953 | 2/1/2029 | ||||||||||||||||

| $2.4665 | $91,144 | $73,622 | $120,977 | $171,446 | $457,190 | $535,953 | 3/1/2029 | ||||||||||||||||

| $2.4665 | $91,144 | $73,622 | $120,977 | $171,446 | $457,190 | $535,953 | 4/1/2029 | ||||||||||||||||

| $2.4665 | $91,144 | $73,622 | $120,977 | $171,446 | $457,190 | $535,953 | 5/1/2029 | ||||||||||||||||

| $2.4665 | $91,144 | $73,622 | $120,977 | $171,446 | $457,190 | $535,953 | 6/1/2029 | ||||||||||||||||

| $2.4665 | $91,144 | $73,622 | $120,977 | $171,446 | $457,190 | $535,953 | 7/1/2029 | ||||||||||||||||

| $2.4665 | $91,144 | $73,622 | $120,977 | $171,446 | $457,190 | $535,953 | 8/1/2029 | ||||||||||||||||

| $2.4665 | $91,144 | $73,622 | $120,977 | $171,446 | $457,190 | $535,953 | 9/1/2029 | ||||||||||||||||

| $2.4665 | $91,144 | $73,622 | $120,977 | $171,446 | $457,190 | $535,953 | 10/1/2029 | ||||||||||||||||

| $2.4665 | $91,144 | $73,622 | $120,977 | $171,446 | $457,190 | $535,953 | 11/1/2029 | ||||||||||||||||

| $2.4665 | $91,144 | $73,622 | $120,977 | $171,446 | $457,190 | $535,953 | 12/1/2029 | ||||||||||||||||

| $2.5405 | $93,879 | $75,831 | $124,606 | $176,590 | $470,906 | $552,033 | 1/1/2030 | ||||||||||||||||

| $2.5405 | $93,879 | $75,831 | $124,606 | $176,590 | $470,906 | $552,033 | 2/1/2030 | ||||||||||||||||

| $2.5405 | $93,879 | $75,831 | $124,606 | $176,590 | $470,906 | $552,033 | 3/1/2030 | ||||||||||||||||

| $2.5405 | $93,879 | $75,831 | $124,606 | $176,590 | $470,906 | $552,033 | 4/1/2030 | ||||||||||||||||

| $2.5405 | $93,879 | $75,831 | $124,606 | $176,590 | $470,906 | $552,033 | 5/1/2030 | ||||||||||||||||

| $2.5405 | $93,879 | $75,831 | $124,606 | $176,590 | $470,906 | $552,033 | 6/1/2030 | ||||||||||||||||

| $2.5405 | $93,879 | $75,831 | $124,606 | $176,590 | $470,906 | $552,033 | 7/1/2030 | ||||||||||||||||

| $2.5405 | $93,879 | $75,831 | $124,606 | $176,590 | $470,906 | $552,033 | 8/1/2030 | ||||||||||||||||

| $2.5405 | $93,879 | $75,831 | $124,606 | $176,590 | $470,906 | $552,033 | 9/1/2030 | ||||||||||||||||

| $2.5405 | $93,879 | $75,831 | $124,606 | $176,590 | $470,906 | $552,033 | 10/1/2030 | ||||||||||||||||

| $2.5405 | $93,879 | $75,831 | $124,606 | $176,590 | $470,906 | $552,033 | 11/1/2030 | ||||||||||||||||

| $2.5405 | $93,879 | $75,831 | $124,606 | $176,590 | $470,906 | $552,033 | 12/1/2030 | ||||||||||||||||

| $2.6167 | $96,695 | $78,106 | $128,344 | $181,887 | $485,033 | $568,591 | 1/1/2031 | ||||||||||||||||

| $2.6167 | $96,695 | $78,106 | $128,344 | $181,887 | $485,033 | $568,591 | 2/1/2031 | ||||||||||||||||

| $2.6167 | $96,695 | $78,106 | $128,344 | $181,887 | $485,033 | $568,591 | 3/1/2031 | ||||||||||||||||

| $2.6167 | $96,695 | $78,106 | $128,344 | $181,887 | $485,033 | $568,591 | 4/1/2031 | ||||||||||||||||

| $2.6167 | $96,695 | $78,106 | $128,344 | $181,887 | $485,033 | $568,591 | 5/1/2031 | ||||||||||||||||

| $2.6167 | $96,695 | $78,106 | $128,344 | $181,887 | $485,033 | $568,591 | 6/1/2031 | ||||||||||||||||

| $2.6167 | $96,695 | $78,106 | $128,344 | $181,887 | $485,033 | $568,591 | 7/1/2031 | ||||||||||||||||

| $2.6167 | $96,695 | $78,106 | $128,344 | $181,887 | $485,033 | $568,591 | 8/1/2031 | ||||||||||||||||

Exhibit K

| $2.6167 | $96,695 | $78,106 | $128,344 | $181,887 | $485,033 | $568,591 | 9/1/2031 | ||||||||||||||||

| $2.6167 | $96,695 | $78,106 | $128,344 | $181,887 | $485,033 | $568,591 | 10/1/2031 | ||||||||||||||||

| $2.6167 | $96,695 | $78,106 | $128,344 | $181,887 | $485,033 | $568,591 | 11/1/2031 | ||||||||||||||||

| $2.6167 | $96,695 | $78,106 | $128,344 | $181,887 | $485,033 | $568,591 | 12/1/2031 | ||||||||||||||||

| $2.6952 | $99,596 | $80,449 | $132,195 | $187,344 | $499,584 | $585,648 | 1/1/2032 | ||||||||||||||||

| $2.6952 | $99,596 | $80,449 | $132,195 | $187,344 | $499,584 | $585,648 | 2/1/2032 | ||||||||||||||||

| $2.6952 | $99,596 | $80,449 | $132,195 | $187,344 | $499,584 | $585,648 | 3/1/2032 | ||||||||||||||||

| $2.6952 | $99,596 | $80,449 | $132,195 | $187,344 | $499,584 | $585,648 | 4/1/2032 | ||||||||||||||||

| $2.6952 | $99,596 | $80,449 | $132,195 | $187,344 | $499,584 | $585,648 | 5/1/2032 | ||||||||||||||||

| $2.6952 | $99,596 | $80,449 | $132,195 | $187,344 | $499,584 | $585,648 | 6/1/2032 | ||||||||||||||||

| $2.6952 | $99,596 | $80,449 | $132,195 | $187,344 | $499,584 | $585,648 | 7/1/2032 | ||||||||||||||||

| $2.6952 | $99,596 | $80,449 | $132,195 | $187,344 | $499,584 | $585,648 | 8/1/2032 | ||||||||||||||||

| $2.6952 | $99,596 | $80,449 | $132,195 | $187,344 | $499,584 | $585,648 | 9/1/2032 | ||||||||||||||||

| $2.6952 | $99,596 | $80,449 | $132,195 | $187,344 | $499,584 | $585,648 | 10/1/2032 | ||||||||||||||||

| $2.6952 | $99,596 | $80,449 | $132,195 | $187,344 | $499,584 | $585,648 | 11/1/2032 | ||||||||||||||||

| $2.6952 | $99,596 | $80,449 | $132,195 | $187,344 | $499,584 | $585,648 | 12/1/2032 | ||||||||||||||||

| $2.7761 | $102,584 | $82,863 | $136,161 | $192,965 | $514,572 | $603,227 | 1/1/2033 | ||||||||||||||||

| $2.7761 | $102,584 | $82,863 | $136,161 | $192,965 | $514,572 | $603,227 | 2/1/2033 | ||||||||||||||||

| $2.7761 | $102,584 | $82,863 | $136,161 | $192,965 | $514,572 | $603,227 | 3/1/2033 | ||||||||||||||||

| $2.7761 | $102,584 | $82,863 | $136,161 | $192,965 | $514,572 | $603,227 | 4/1/2033 | ||||||||||||||||

| $2.7761 | $102,584 | $82,863 | $136,161 | $192,965 | $514,572 | $603,227 | 5/1/2033 | ||||||||||||||||

| $2.7761 | $102,584 | $82,863 | $136,161 | $192,965 | $514,572 | $603,227 | 6/1/2033 | ||||||||||||||||

| $2.7761 | $102,584 | $82,863 | $136,161 | $192,965 | $514,572 | $603,227 | 7/1/2033 | ||||||||||||||||

| $2.7761 | $102,584 | $82,863 | $136,161 | $192,965 | $514,572 | $603,227 | 8/1/2033 | ||||||||||||||||

| $2.7761 | $102,584 | $82,863 | $136,161 | $192,965 | $514,572 | $603,227 | 9/1/2033 | ||||||||||||||||

| $2.7761 | $102,584 | $82,863 | $136,161 | $192,965 | $514,572 | $603,227 | 10/1/2033 | ||||||||||||||||

| $2.7761 | $102,584 | $82,863 | $136,161 | $192,965 | $514,572 | $603,227 | 11/1/2033 | ||||||||||||||||

| $2.7761 | $102,584 | $82,863 | $136,161 | $192,965 | $514,572 | $603,227 | 12/1/2033 | ||||||||||||||||

| $2.8593 | $105,662 | $85,349 | $140,245 | $198,753 | $530,009 | $621,306 | 1/1/2034 | ||||||||||||||||

| $2.8593 | $105,662 | $85,349 | $140,245 | $198,753 | $530,009 | $621,306 | 2/1/2034 | ||||||||||||||||

| $2.8593 | $105,662 | $85,349 | $140,245 | $198,753 | $530,009 | $621,306 | 3/1/2034 | ||||||||||||||||

| $2.8593 | $105,662 | $85,349 | $140,245 | $198,753 | $530,009 | $621,306 | 4/1/2034 | ||||||||||||||||

| $2.8593 | $105,662 | $85,349 | $140,245 | $198,753 | $530,009 | $621,306 | 5/1/2034 | ||||||||||||||||

| $2.8593 | $105,662 | $85,349 | $140,245 | $198,753 | $530,009 | $621,306 | 6/1/2034 | ||||||||||||||||

| $2.8593 | $105,662 | $85,349 | $140,245 | $198,753 | $530,009 | $621,306 | 7/1/2034 | ||||||||||||||||

| $2.8593 | $105,662 | $85,349 | $140,245 | $198,753 | $530,009 | $621,306 | 8/1/2034 | ||||||||||||||||

| $2.8593 | $105,662 | $85,349 | $140,245 | $198,753 | $530,009 | $621,306 | 9/1/2034 | ||||||||||||||||

| $2.8593 | $105,662 | $85,349 | $140,245 | $198,753 | $530,009 | $621,306 | 10/1/2034 | ||||||||||||||||

| $2.8593 | $105,662 | $85,349 | $140,245 | $198,753 | $530,009 | $621,306 | 11/1/2034 | ||||||||||||||||

| $2.8593 | $105,662 | $85,349 | $140,245 | $198,753 | $530,009 | $621,306 | 12/1/2034 | ||||||||||||||||

| $2.9451 | $108,831 | $87,909 | $144,453 | $204,716 | $545,909 | $639,950 | 1/1/2035 | ||||||||||||||||

Exhibit K

| $2.9451 | $108,831 | $87,909 | $144,453 | $204,716 | $545,909 | $639,950 | 2/1/2035 | ||||||||||||||||

| $2.9451 | $108,831 | $87,909 | $144,453 | $204,716 | $545,909 | $639,950 | 3/1/2035 | ||||||||||||||||

| $2.9451 | $108,831 | $87,909 | $144,453 | $204,716 | $545,909 | $639,950 | 4/1/2035 | ||||||||||||||||

| $2.9451 | $108,831 | $87,909 | $144,453 | $204,716 | $545,909 | $639,950 | 5/1/2035 | ||||||||||||||||

| $2.9451 | $108,831 | $87,909 | $144,453 | $204,716 | $545,909 | $639,950 | 6/1/2035 | ||||||||||||||||

| $2.9451 | $108,831 | $87,909 | $144,453 | $204,716 | $545,909 | $639,950 | 7/1/2035 | ||||||||||||||||

| $2.9451 | $108,831 | $87,909 | $144,453 | $204,716 | $545,909 | $639,950 | 8/1/2035 | ||||||||||||||||

| $2.9451 | $108,831 | $87,909 | $144,453 | $204,716 | $545,909 | $639,950 | 9/1/2035 | ||||||||||||||||

| $2.9451 | $108,831 | $87,909 | $144,453 | $204,716 | $545,909 | $639,950 | 10/1/2035 | ||||||||||||||||

| $2.9451 | $108,831 | $87,909 | $144,453 | $204,716 | $545,909 | $639,950 | 11/1/2035 | ||||||||||||||||

| $2.9451 | $108,831 | $87,909 | $144,453 | $204,716 | $545,909 | $639,950 | 12/1/2035 | ||||||||||||||||

| $3.0335 | $112,096 | $90,547 | $148,786 | $210,858 | $562,287 | $659,158 | 1/1/2036 | ||||||||||||||||

| $3.0335 | $112,096 | $90,547 | $148,786 | $210,858 | $562,287 | $659,158 | 2/1/2036 | ||||||||||||||||

| $3.0335 | $112,096 | $90,547 | $148,786 | $210,858 | $562,287 | $659,158 | 3/1/2036 | ||||||||||||||||

| $3.0335 | $112,096 | $90,547 | $148,786 | $210,858 | $562,287 | $659,158 | 4/1/2036 | ||||||||||||||||

| $3.0335 | $112,096 | $90,547 | $148,786 | $210,858 | $562,287 | $659,158 | 5/1/2036 | ||||||||||||||||

| $3.0335 | $112,096 | $90,547 | $148,786 | $210,858 | $562,287 | $659,158 | 6/1/2036 | ||||||||||||||||

| $3.0335 | $112,096 | $90,547 | $148,786 | $210,858 | $562,287 | $659,158 | 7/1/2036 | ||||||||||||||||

| $3.0335 | $112,096 | $90,547 | $148,786 | $210,858 | $562,287 | $659,158 | 8/1/2036 | ||||||||||||||||

| $3.0335 | $112,096 | $90,547 | $148,786 | $210,858 | $562,287 | $659,158 | 9/1/2036 | ||||||||||||||||

| $3.0335 | $112,096 | $90,547 | $148,786 | $210,858 | $562,287 | $659,158 | 10/1/2036 | ||||||||||||||||

| $3.0335 | $112,096 | $90,547 | $148,786 | $210,858 | $562,287 | $659,158 | 11/1/2036 | ||||||||||||||||

| $3.0335 | $112,096 | $90,547 | $148,786 | $210,858 | $562,287 | $659,158 | 12/1/2036 | ||||||||||||||||

Exhibit K

Exhibit Q

Tenant’s Broker Commission Agreement

Exhibit Q

Exhibit Q

Exhibit Q

Exhibit Q

Exhibit Q

Exhibit Q

Exhibit Q

Exhibit Q

Exhibit S

New Improvement Work1

^For the avoidance of doubt, Landlord shall be responsible for completing the work with respect to the HVAC units which do not exclusively serve Tenant’s space in the 1301 Harbor Bay Building (i.e., the units which serve the Common Areas), and Tenant shall be responsible for completing the work with respect to the HVAC units which exclusively serve Tenant’s space in the 1301 Harbor Bay Building.

*During such time as the 1301 Harbor Bay Building remains a multi-tenant building, Landlord (or Tenant with respect to the HVAC units exclusively serving Tenant’s space), as applicable, shall complete this work, and Tenant shall use amounts available from the New Improvement Work Allowance to pay for the work or reimburse Landlord therefor, as applicable; provided, however, that Landlord and Tenant acknowledge and agree that, absent Landlord’s one-time concession to provide the New Improvement Work Allowance pursuant to this Second

1 All roof work to be carried out in accordance with a schedule prepared by Tenant. Further, Landlord shall support and cooperate with Tenant in efforts to cause the Empire Parkway Centre Owners Association to engage Xxxxx Xxxxxxxx Design Works Inc. for design, and use recommended vendors for oversite, of the Common Area Maintenance project, in all such cases to the extent Landlord is permitted to do so pursuant to the guidelines of the Empire Parkway Centre Owners Association.

Exhibit S

Amendment, the cost of all of such work would otherwise be Tenant’s responsibility pursuant to the Existing Lease.

Exhibit S

Exhibit T

Work Letter for Tenant-Performed New Improvement Work

1. Tenant’s Work. Tenant shall perform any and all work associated with New Improvement Work (which is Tenant’s responsibility) (collectively, “Tenant’s New Improvement Work”) in accordance with the Construction Documents, as defined in Section 2 of this Work Letter, and shall cause Completion (as defined below) of all such Tenant’s New Improvement Work. Tenant shall obtain all necessary permits and licenses required in connection with Tenant’s New Improvement Work, and shall cause all Tenant’s New Improvement Work to be completed in accordance with applicable laws. Tenant shall comply with each of those provisions of the Existing Lease pertaining to mechanics’ liens. “Completion” means, with respect to any phase of Tenant’s New Improvement Work, (a) the construction of the applicable phase of Tenant’s New Improvement Work is completed substantially in accordance with the Construction Documents and in accordance with all applicable local, state and federal laws, codes, rules, regulations and ordinances, as evidenced by the issuance by the municipality of a certificate of occupancy (or its equivalent) permitting the occupancy of the entirety of the applicable phase of Tenant’s New Improvement Work without material condition or qualification (it being agreed that the certificate of occupancy may be a temporary certificate of occupancy so long as such temporary certificate of occupancy permits occupancy without risk of revocation due to failure to complete any “punch list” items); (b) all claims for work performed or materials provided for the construction of the Tenant’s New Improvement Work have been paid in full, as evidenced by lien releases and lien waivers (or other evidence reasonably satisfactory to Landlord) from all persons providing such work or materials; and (c) all so-called “punch list” items have been completed.

2. Preparation of Plans. All of the following may be carried out in phases, and the procedure outlined below will apply to each phase of Tenant’s New Improvement Work:

2.1 For each of Tenant’s New Improvement Work project, Tenant shall cause to be prepared a set of design intent drawings (“Design Intent Drawings”) which will not be for construction but will show the location of all full height partitions, circulation patterns, electrical/cabling plans based on furniture layout, furniture plans, finish plans and written specifications, etc. with respect to such project. Tenant will deliver the Design Intent Drawings to Landlord for Landlord’s approval. Landlord is deemed to have approved the Design Intent Drawings unless Landlord gives written objections to the Design Intent Drawings to Tenant within fifteen (15) Business Days after receipt thereof specifying in what respect the Design Intent Drawings are objected to. The sole basis for Landlord’s objection shall be that the proposed Tenant’s New Improvement Work will adversely affect the Base Building or Building Systems or fail to comply with applicable laws. If Landlord so objects, then Tenant shall submit revised Design Intent Drawings to Landlord and Landlord shall approve or disapprove in accordance with the same procedures (Landlord’s scope of such review to be limited to the changes made to address Landlord’s objections).

2.2 Tenant shall, based upon the approved Design Intent Drawings, prepare, or cause to be prepared, construction documents (“Construction Documents”) for the Tenant’s New Improvement Work. The Construction Documents will be in sufficient scope and detail to satisfy requirements for (i) obtaining permits for construction of the applicable phase of Tenant’s New Improvements Work; (ii) obtaining firm cost bids for the construction; and (iii) directing the construction of the applicable phase of Tenant’s New Improvement Work. Tenant will submit the Construction Documents to Landlord for Landlord’s approval. Landlord is deemed to have approved the Construction Documents unless Landlord gives written objections to the Construction Document to Tenant within fifteen (15) Business Days after Landlord’s receipt thereof. If Landlord objects to the Construction Documents, then Tenant shall submit revised

Exhibit T

Construction Documents to Landlord and Landlord shall approve or disapprove the revised Construction Documents in accordance with the same procedures set forth in this Section 2.2 (Landlord’s scope of such review to be limited to the changes made to address Landlord’s objections).

3. Selection of Contractors and Subcontractors. Tenant is entitled to use contractors and subcontractors of its choosing for Tenant’s New Improvement Work, and such contractors and subcontractors need not be members of any trade unions.

4. Change Orders. Tenant may authorize changes to the Construction Documents without Landlord’s consent or approval unless the change (i) materially adversely affects the Base Building or Building Systems; or (ii) does not comply with applicable laws. If Landlord’s approval or consent is required under this Section 4, such approval or consent will not be unreasonably withheld, delayed or conditioned, and is deemed given if not refused by Landlord within fifteen (15) Business Days after receipt of Tenant’s request for the same.

5. Landlord Fees. Landlord shall charge no fees (e.g. management fees, engineer fees, supervision fees, design fees, elevator fees, dock fees, security fees, after-hours access fees, etc.) in connection with Tenant’s New Improvement Work.

6. Representatives. Either Landlord or Tenant may, by written notice to the other, designate a person or company to act as its representative for all purposes of this Work Letter.

7. Time. Tenant’s construction of the Tenant’s New Improvement Work (including receipt of deliveries) shall not be not subject to any time restrictions imposed by Landlord (but may be subject to restrictions imposed by applicable laws) so that Tenant may (subject to applicable laws) perform all aspects of Tenant’s New Improvement work at any time, including, without limitation, during business hours.

8. No Removal. Tenant will not be required to remove any part of the Tenant’s New Improvement Work prior to, upon, or after the expiration or earlier termination of the Existing Lease.

Exhibit T