FLAGSTAR BANCORP, INC. Executive Long-Term Incentive Program Award Agreement II

FLAGSTAR BANCORP, INC.

This Award Agreement (this “Agreement”) is made effective (DATE) (the “Grant Date”), by and between Flagstar Bancorp, Inc., a Michigan corporation (the “Company”), and (NAME) (the “Executive”). Capitalized terms that are used in this Agreement but not defined herein shall have the meanings given to them in the Plan.

WHEREAS, the Company has adopted the Flagstar Bancorp, Inc. 2016 Stock Award and Incentive Plan (the “Plan”); and

WHEREAS, the Company has adopted the Flagstar Bancorp, Inc. Executive Long-Term Incentive Program II (the “Program”); and

WHEREAS, the Compensation Committee (the “Committee”) of the Board of Directors of the Company (the “Board”) and the Board have approved the selection of the Executive to receive an award of Restricted Stock Units (“RSUs”) under the Program, as evidenced by this Agreement.

NOW, THEREFORE, the Company and the Executive hereby agree as follows:

Section 1. Award of RSUs. The Company hereby awards to the Executive, as of the Grant Date, (#######) RSUs under the Plan, on the terms and conditions set forth in this Agreement, the Program and the Plan. Each RSU represents the conditional right to receive one share of Stock. The Executive shall have no voting or other rights with respect to shares of Stock that are potentially issuable in settlement of the RSUs.

Section 2. Performance Hurdle, Service Vesting and QR Review.

(a) | The “Performance Hurdle” will be attained if, for any period of ninety (90) consecutive calendar days beginning after the Grant Date, the volume-weighted average price per share of the Stock over such period is $40.00 or more. The last calendar day of the ninety (90) day period will be the “Performance Hurdle Date.” In the event that the Performance Hurdle is not attained on or before the tenth anniversary of the Grant Date, the outstanding RSUs shall be forfeited without payment. |

(b) | To vest in any RSUs under this Agreement, the Executive must be employed by, or providing services as a member of the Board to, the Company or an Affiliate continuously through the fourth anniversary of the Grant Date, except if earlier there occurs (i) the Executive’s death or Disability, or (ii) a Change in Control (as defined below), in which case the Executive must meet the terms and conditions specified in Section 5 in order to vest in the RSUs. The date upon which the RSUs vest under this Section 2(b) is the “Service Vesting Date.” |

(c) | Fifty percent (50%) of the RSUs (the “QR RSUs”) will be subject to the Quality Review (as defined below) that will be performed on each of the first, second, third and fourth anniversaries of the Grant Date (each a “Measurement Period”). If the Board determines that the results of the Quality Review performed for each of the Measurement Periods are satisfactory, one hundred (100%) of the amount of QR RSUs payable on the Payout Date (as defined below, and subject to Section 5 and 6) will be paid to the Executive in Stock (subject to Sections 2(a) and (b)).Fifty percent (50%) of the RSUs will be paid to the Executive in Stock on the Payout Date (subject to Sections 5 and 6) without regard to any Quality Review (subject to Sections 2(a) and (b)). With respect to each Measurement Period, if the Board determines that the results of the Quality Review performed for that Measurement Period are unsatisfactory, 25% of the QR RSUs that would have paid out on the Payout Date will be forfeited by the Executive without payment. “Quality Review” means the review of the factors described in Attachment A. |

Section 3. Termination for Cause. If the Executive’s employment with the Company is terminated for Cause, whether prior to or after the Performance Hurdle Date, the Executive will forfeit all unvested RSUs as well as any RSUs that had vested but were not yet paid out pursuant to Section 2 or Section 4. For purposes of this Agreement, “Cause” shall mean the Executive’s (i) engaging in willful or gross misconduct or willful or gross neglect of duties, (ii) repeatedly and willfully failing to adhere to the directions of the Board or the written policies and practices of the Company or an Affiliate, (iii) commission of or plea of nolo

contendere to a felony, a crime of moral turpitude, or any crime involving the Company or an Affiliate that causes damage to the property or business of the Company or an Affiliate, (iv) fraud, misappropriation, dishonesty, or embezzlement in each case which causes damage to the property or business of the Company or an Affiliate, (v) material breach of the Executive’s employment agreement (if any) with the Company or an Affiliate (other than a termination of employment by the Executive), (vi) loss of any license or registration that is necessary for the Executive to perform his duties for the Company or an Affiliate, or (vii) unlawful act that causes damage to the property or business of the Company or an Affiliate, all as determined in the sole discretion of the Committee. Before the Committee determines that “Cause” has occurred under clause (i), (ii), (v), or (vii) above, the Committee will provide to the Executive in writing, in reasonable detail, the reasons for the determination that such “Cause” exists, and afford the Executive a reasonable opportunity to remedy any such breach, action or inaction, if such breach action or inaction, is capable of being remedied. In addition, Executive’s employment and service will be deemed to have terminated for Cause if, within twelve (12) months after the Executive’s employment or service has terminated, facts and circumstances are discovered that would have justified a termination for Cause. For purposes of this Agreement, no act or failure to act on the Executive’s part will be considered “willful” unless it is done, or omitted to be done, by him or her in bad faith or without reasonable belief that his or her action or omission was in the best interests of the Company or an Affiliate. Any act, or failure to act, based upon authority given pursuant to a resolution duly adopted by the Board or based upon the advice of counsel for the Company or an Affiliate will be conclusively presumed to be done, or omitted to be done, in good faith and in the best interests of the Company or an Affiliate.

Section 4. Vesting; Quality Review and Payment.

On or within 30 days following the Performance Hurdle Date, the Compensation Committee or a duly authorized committee that satisfies the requirements of Code Section 162(m) shall certify that the Performance Hurdle has been attained. If so certified, subject to the terms and conditions set forth in the Program and this Agreement, the RSUs will vest and be paid out in Stock on the later of (i) the Service Vesting Date or (ii) the date of certification of achievement of the Performance Hurdle (the “Payout Date”), subject to accelerated vesting and payout in accordance with Section 5 and Section 6.

Section 5. Death or Disability. Regardless of whether the Performance Hurdle has been attained on or before the date of the Executive’s death or termination due to Disability (a “Trigger Event” and the date on which any such Trigger Event occurs, a “Trigger Date”), one hundred percent (100%) of the RSUs (to the extent not yet vested and not previously forfeited) will immediately vest and be paid within 60 days after a Trigger Date, without regard to any Quality Review.

Section 6. Change in Control. If the Performance Hurdle has been attained on or before the date of a Change in Control (a “Trigger Event” and the date which any such Trigger Event occurs, a “Trigger Date”), one hundred percent (100%) of the RSUs (to the extent not yet vested and not previously forfeited) will immediately vest and be paid within five business days, without regard to any Quality Review. If the Performance Hurdle has not been attained on or before the Trigger Date of a Change in Control, one hundred percent (100%) of the RSUs under this Agreement will be forfeited. If the Trigger Event giving rise to the acceleration is a Change in Control that is not a change in the ownership or effective control of a corporation or in the ownership of a substantial portion of the assets of corporation within the meaning of Section 1.409A-3(i)(5) of the Treasury Regulations (a “409A Change in Control”), then any payment that constitutes a deferral of compensation for purposes of Section 409A of the Internal Revenue Code and that would have been made on any Payout Date will not be paid until the earliest to occur of (i) the date on which the payment would otherwise have been made in absence of the Change in Control, (ii) the termination of the Executive’s employment with the Company for any reason other than Cause, and (iii) a 409A Change in Control.

For purposes of this Agreement, “Change in Control” is defined as (i) the occurrence of a “Change in Control” as defined by the Plan, (ii) MatlinPatterson Global Advisors LLC or its affiliates ceasing to be the beneficial owner, either directly or indirectly, of at least thirty percent (30%) of the Stock, or (iii) a person or entity other than XX Xxxxxx Investments L.P. or its affiliates (together, “MatlinPatterson”) becomes entitled, under an agreement to which the Company is a party, to appoint to the Board a number of directors equal to or greater than the number of directors MatlinPatterson is then entitled to appoint under an agreement to which the Company is a party.

Section 7. Withholding Taxes. The Executive shall be required to pay to the Company, and the Company shall have the right to deduct from any compensation paid to the Executive pursuant to the Plan, the minimum amount required to be withheld for federal, state and local taxes, domestic or foreign, including payroll taxes, in respect of the RSUs and to take all such other action as the Committee deems necessary to satisfy all obligations for the payment of such withholding taxes. The Company shall determine the amount of such withholding. Unless otherwise determined by the Committee, in its sole discretion, Executive may satisfy any such tax withholding obligation by any one or a combination of the following means:

(a) | Executive tendering a cash payment or check payable to the Company; and/or |

(b) | The Company withholding shares of Common Stock from the shares of Common Stock otherwise issuable to the Executive as a result of the vesting of the RSUs or the Executive tendering previously acquired shares (the fair market |

value of such withheld or tendered shares to be applied to the applicable tax and withholding obligations); provided, however, that shares of Common Stock may be withheld or received upon a tender by Executive with a value exceeding the minimum statutory amount of tax required to be withheld by law only in accordance with a procedure or policy adopted by the Committee and in effect at the time of vesting.

Section 8. Code Section 280G. If a Change in Control occurs and payments are made under this Agreement, and the aggregate of the RSUs awarded to the Executive that vest under this Agreement, and all payments under any other agreement, plan, program or policy of the Company in connection with such Change in Control (“Total Payments”) will be subject to an excise tax under the provisions of Code Section 4999 (“Excise Tax”), the Total Payments shall be reduced so that the maximum amount of the Total Payments (after reduction) will be one dollar ($1.00) less than the amount that would cause the Total Payments to be subject to the Excise Tax; provided, however, that the Total Payments shall only be reduced to the extent the after-tax value of amounts received by the Executive after application of the above reduction would exceed the after-tax value of the Total Payments received by the Executive without application of such reduction. In making any determination as to whether the Total Payments would be subject to an Excise Tax, consideration shall be given to whether any portion of the Total Payments could reasonably be considered, based on the relevant facts and circumstances, to be reasonable compensation for services rendered (whether before or after the consummation of the applicable Change in Control). If applicable, the particular payments that are to be reduced shall be subject to the mutual agreement of the Executive and the Company, with a view to maximizing the value of the payments to the Executive that are not reduced.

Section 9. Transferability of RSUs. The Executive may not sell, transfer, pledge, assign or otherwise alienate or hypothecate the RSUs, other than by will or the laws of descent and distribution. Any effort to assign or transfer the RSUs or the rights under this Agreement will be wholly ineffective, and will be grounds for termination by the Board of all rights of the Executive under this Agreement.

Section 10. No Right to Continued Service. Neither this Agreement nor the Plan shall confer upon the Executive any right to continue as an employee of the Company or an Affiliate. Further, nothing in this Agreement or the Plan shall be construed to limit the right of the Company to terminate the Executive’s employment at any time, with or without cause.

Section 11. Adjustments. In the event that any change in the outstanding shares of Stock (including an exchange in Stock for stock or other securities of another corporation) occurs by reason of a Stock dividend or split, recapitalization, merger, consolidation, combination, exchange in shares or other similar corporate changes, other than for consideration received by the Company, the number of shares of RSUs awarded hereunder, and the Performance Hurdle, shall be appropriately adjusted by the Committee, in good faith, in its sole and absolute discretion, whose determination shall be conclusive, final and binding; provided, however, that fractional shares shall be rounded to the nearest whole share. In the event of any other change in the Stock, the Committee shall determine, in good faith, in its sole discretion whether such change equitably requires a change in the number or type of the shares of stock subject to the RSUs awarded hereunder, or in the Performance Hurdle, and any adjustment made by the Committee shall be conclusive, final, and binding.

Section 12. Restrictive Covenants. The Executive acknowledges and agrees that the services provided by the Executive to the Company and its Affiliates are of a special, unique and extraordinary nature, and that the restrictions contained in this Section are necessary to prevent the use and disclosure of Confidential Information and to protect other legitimate business interests of the Company and its Affiliates. The Executive acknowledges that all of the restrictions in this Section are reasonable in all respects, including duration, territory and scope of activity. In the event a court of competent jurisdiction determines as a matter of law that any of the terms of this Section 11 are unreasonable or overbroad, the Company and the Executive expressly allow such court to reform this Agreement to the extent necessary to make it reasonable as a matter of law and to enforce it as so reformed. The Executive agrees that the restrictions contained in this Section shall be construed as separate agreements independent of any other provision of this Agreement or any other agreement between the Executive and the Company or its Affiliates.

(a) Confidentiality. In the course of the Executive’s performing his duties for the Company and its Affiliates, the Company expects to provide the Executive with various proprietary, confidential and trade secret information of the Company and its Affiliates. Such proprietary, confidential and trade secret information may include, but not be limited to, any database of customer accounts; any customer, supplier and distributor list; customer profiles; information regarding sales and marketing activities and strategies; trade secrets; data regarding technology, products and services; information regarding pricing, pricing techniques and procurement; financial data and forecasts regarding the Company and customers, suppliers and distributors of the Company; software programs and intellectual property (collectively, “Confidential Information”). All Confidential Information shall be and remain the sole property of the Company and its assigns, and the Company shall be and remain the sole owner of all patents, copyrights, trademarks, names and other rights in connection therewith and without regard to whether the Company is at any particular time developing or marketing the same. The Executive acknowledges that the Confidential Information is a valuable, special and unique asset of the Company and its Affiliates and that his access to and knowledge of the Confidential Information

is essential to the performance of his duties as an employee of the Company and its Affiliates. In light of the competitive nature of the business in which the Company and its Affiliates are engaged, the Executive agrees that he will, both during his employment or service with the Company and its Affiliates and thereafter, maintain the strict confidentiality of all Confidential Information known or obtained by him or to which he has access in connection with his employment by or service with the Company and that he will not (i) disclose any Confidential Information to any person or entity (other than in proper performance of his duties hereunder) or (ii) make any use of any Confidential Information for his own purposes or for the direct or indirect benefit of any person or entity other than the Company or its Affiliates. Confidential Information shall not be deemed to include information that (w) becomes generally available to the public through no fault of the Executive, (x) is previously known by the Executive prior to his receipt of such information from the Company, (y) becomes available to the Executive on a non-confidential basis from a source which, to the Executive’s knowledge, is not prohibited from disclosing such information by legal, contractual or fiduciary obligation to the Company or (z) is required to be disclosed in order to comply with any applicable law or court order. Nothing in this Confidentiality provision prohibits Grantee from reporting possible violations of federal law or regulation to any governmental agency or entity, including but not limited to the Department of Justice, the Securities and Exchange Commission, the Congress, and any agency Inspector General, or making other disclosures that are protected under the whistleblower provisions of federal law or regulation. Grantee does not require prior authorization to make any such reports or disclosures and is not required to notify the company such reports or disclosures have been made. Immediately upon termination of the Executive’s employment or at any other time upon the Company’s request, the Executive will return to the Company all memoranda, notes and data, computer software and hardware, records or other documents compiled by the Executive or made available to the Executive during the Executive’s employment with the Company concerning the Business of the Company, including without limitation, all files, records, documents, lists, equipment, supplies, promotional materials, keys, phone or credit cards and similar items and all copies thereof or extracts therefrom. Notwithstanding the foregoing, in certain limited circumstances described in the Company’s Confidentiality Guidelines, Grantee may disclose Confidential Information that consists of materials that would otherwise be subject to trade secret protection.

(b) No Competition. During the Executive’s employment with the Company or its Affiliates and for a period of one (1) year following termination of the Executive’s employment for any reason, but only if at least a portion of the RSUs has vested, the Executive agrees that the Executive shall not, on behalf of the Executive or for others, directly or indirectly (whether as employee, consultant, investor, partner, sole proprietor or otherwise), be employed by, perform any services for, or hold any ownership interest in any business engaged in the business of obtaining funds in the form of deposits and wholesale borrowings and investing those funds in single-family mortgages and other types of loans (the “Business of the Company”) in any state of the United States where the Company is doing business. In addition, to the extent the one-year period following termination has elapsed, but the Executive is still entitled to payouts under this Agreement, the one-year period shall be extended until the final payout of the RSUs. The parties agree that this provision shall not prohibit the ownership by the Executive, solely as an investment, of securities of a person engaged in the Business of the Company if (i) the Executive is not an “affiliate” (as such term is defined in Rule 12b-2 of the regulations promulgated under the Exchange Act) of the issuer of such securities, (ii) such securities are publicly traded on a national securities exchange and (iii) the Executive does not, directly or indirectly, beneficially own more than two percent (2%) of the class of which such securities are a part.

(c) No Solicitation of Employees. The Executive agrees that, both during the Executive’s employment with the Company and for a period of one (1) year following termination of the Executive’s employment with the Company for any reason, the Executive will not, directly or indirectly, on behalf of the Executive or any other person or entity, hire, engage or solicit to hire for employment or consulting or other provision of services, any person who is actively employed (or in the six (6) months preceding the Executive’s termination of employment with the Company was actively employed) by the Company, except for rehire by the Company. This includes, but is not limited to, inducing or attempting to induce, or influence or attempting to influence, any person employed by the Company to terminate his or her employment with the Company.

(d)No Solicitation of Customers. The Executive agrees that, both during the Executive’s employment with the Company and for a period of one (1) year following termination of the Executive’s employment with the Company and its Affiliates for any reason, the Executive will not directly, on behalf of any competitor of the Company in the Business of the Company, solicit the business of any entity within the United States who is known by the Executive to be a customer of the Company or its Affiliates.

(e)Survival. The obligations and provisions contained in this Section shall survive the Executive’s separation from service and this Agreement and shall be fully enforceable thereafter.

Section 13. Company Policies; Forfeiture.

(a) The Executive agrees that the grant of RSUs and the shares of Stock issued upon vesting of the RSUs will be subject to any applicable clawback or recoupment policies, xxxxxxx xxxxxxx policies, policies related to confidential information and assignment

of intellectual property, stock ownership guidelines and other policies that may be implemented or amended by the Company, from time to time. This provision may be modified pursuant to any applicable laws or regulations.

(b) Notwithstanding anything to the contrary in this Agreement, the Executive agrees that during the Executive’s employment or other service with the Company or an Affiliate and thereafter, if the Executive violates any of the restrictive covenants under Section 11 above, irrespective of whether the restrictive covenant is enforceable under applicable law, immediately upon demand by the Company, in addition to any other remedy that may apply under any employment agreement, the law or otherwise, the Executive shall return to the Company the RSUs under this Agreement and the proceeds resulting from a sale of Stock received under this Agreement during the twelve- (12-) month period ending on the Executive’s date of termination.

Section 14. Notices. Any notice required by the terms of this Agreement shall be given in writing and shall be deemed effective upon personal delivery, upon deposit with the United States Postal Service, by registered or certified mail, with postage and fees prepaid or upon deposit with a reputable overnight courier. Notice shall be addressed to the Company at its principal executive office and to the Executive at the address most recently provided by the Executive to the Company.

Section 15. Entire Agreement; Amendments. This Agreement constitutes the entire contract between the parties hereto with regard to the subject matter hereof. This Agreement supersedes any other agreements, representations or understandings (whether oral or written and whether express or implied) which relate to the subject matter hereof. The Board shall have authority, subject to the express provisions of this Agreement, to interpret this Agreement, to establish, amend, and rescind any rules and regulations relating to this Agreement, to modify the terms and provisions of this Agreement, and to make all other determinations in the judgment of the Board necessary or desirable for the administration of this Agreement. The Board may correct any defect or supply any omission or reconcile any inconsistency in this Agreement in the manner and to the extent it shall deem necessary or desirable to carry it into effect. All action by the Board under the provisions of this Section shall be final, conclusive, and binding for all purposes. Except as otherwise provided in this Section, any amendment of this Agreement that materially adversely affects the Executive shall require the written consent of the Executive.

Section 16. Successors and Assigns. This Agreement and the award of RSUs hereunder are personal to the Executive and shall not be assignable by the Executive other than by will or the laws of descent and distribution, without the written consent of the Company. This Agreement shall inure to the benefit of and be enforceable by the Executive’s legal representatives. This Agreement shall inure to the benefit of and be binding upon the Company and its successors. It shall not be assignable by the Company except in connection with the sale or other disposition of all or substantially all the assets or business of the Company.

Section 17. No Impact on Other Benefits. The value of the Executive’s RSUs is not part of the Executive’s compensation for purposes of calculating any severance, retirement, welfare, insurance or similar employee benefit.

Section 18. Severability. If any provision of this Agreement for any reason should be found by any court of competent jurisdiction to be invalid, illegal or unenforceable, in whole or in part, such declaration shall not affect the validity, legality or enforceability of any remaining provision or portion hereof, which remaining provision or portion hereof shall remain in full force and effect as if this Agreement had been adopted with the invalid, illegal or unenforceable provision or portion hereof eliminated.

Section 19. Governing Law. This Agreement shall be governed by, and construed in accordance with, the laws of the State of Michigan, as such, laws are applied to contracts entered into and performed in such State, without giving effect to the choice of law provisions thereof. The jurisdiction and venue for any disputes arising under, or any action brought to enforce the terms of, this Agreement shall be resolved exclusively in the courts of the State of Michigan, including the Federal Courts located therein (should Federal jurisdiction exist).

Section 20. Code Section 409A. Notwithstanding anything herein to the contrary, this Agreement and the award of RSUs hereunder are intended to comply with the requirements of Code Section 409A, and shall be interpreted and administered in accordance with such intent. Should any provision of this Agreement be found not to comply with, or otherwise not be exempt from, the provisions of Code Section 409A, such provision shall be modified and given effect (retroactively if necessary), in the sole discretion of the Committee, and without the consent of the Executive, in such manner as the Committee determines to be necessary or appropriate to comply with, or to effectuate an exemption from, Code Section 409A. The QR RSUs that relate to each separate Measurement Period each shall be deemed a separate payment, and the RSUs other than the QR RSUs shall be deemed a separate payment, within the meaning of Code Section 409A. Any payment or distribution that constitutes a deferral of compensation subject to Code Section 409A and payable upon the Executive’s termination of employment or other similar event shall not be made unless the Executive has experienced a “separation from service” as defined under Code Section 409A. Any payment that constitutes a deferral of compensation subject to Section 409A that is to be made upon or within six months following a “separation from service” to the Executive, if at the time of such separation the Executive is a “specified employee” as defined under Code Section 409A, instead shall accrue without interest and shall be paid on the first business day after the end

of such six-month period, or, if earlier, within 15 days after the appointment of the personal representative or executor of the Grantee’s estate following the Executive’s death. Notwithstanding anything in this Agreement to the contrary, the Executive shall be solely responsible for the tax consequences of the RSUs, and in no event shall the Company have any responsibility or liability if any payment under this Agreement is subject to and/or fails to comply with the requirements of Code Section 409A. In all events, the Company will settle and pay out any RSUs not later than two and one-half (2½) months following the end of the year in which the Executive’s right to the RSUs is no longer subject to a substantial risk of forfeiture, subject to any earlier payment date required to comply with Section 409A or specified in this Agreement.

Section 21. Headings. The headings and captions in this Agreement shall not be construed to limit or modify the terms or meaning of this Agreement.

Section 22. No Limitation on the Company’s Rights. The awarding of RSUs under this Agreement shall not and will not in any way affect the rights or powers of the Company or its Affiliates to make adjustments, reclassifications or changes in its capital or business structure or to merge, consolidate, reincorporate, dissolve, liquidate, sell or transfer all or any part of its business or assets.

Section 23. Counterparts. This Agreement may be executed simultaneously in two or more counterparts, each of which shall be deemed an original and all of which together shall constitute but one and the same instrument.

Section 24. Acceptance. As a condition of receiving this Award, the Executive agrees that the Committee, and to the extent that authority is afforded to the Board, the Board, shall have full and final authority to construe and interpret this Agreement, and to make all other decisions and determinations as may be required under this Agreement as they may deem necessary or advisable for administration of this Agreement, and that all such interpretations, decisions and determinations shall be final and binding on the Executive, the Company and all other interested persons. Any dispute regarding the interpretation of this Agreement shall be submitted by the Executive or the Company to the Committee for review. The resolution of such dispute by the Committee shall be final and binding on the Executive and the Company.

This Agreement is executed by the Company and the Executive as of the date and year first written above.

EXECUTIVE | FLAGSTAR BANCORP, INC. | |

___________________________________________ | By: | ___________________________________________ |

(Executive Name) | Its: | ___________________________________________ |

ATTACHMENT A

Quality Review for the Executive Long-Term Incentive Program

In conducting its Quality Review on each of the first, second, third and fourth anniversaries of the Grant Date (each, a “Measurement Period”) for the QR RSUs, the Board of Directors of the Company will measure performance relative to the Company peer group (listed below) with respect to the following two metrics:

Asset Quality: NPA Ratio (Non-Performing Assets / Total Assets)

Liquidity: Core Deposit Ratio (Total Deposits less Certificates of Deposits > $250,000 and excluding Brokered Deposits / Total Assets)

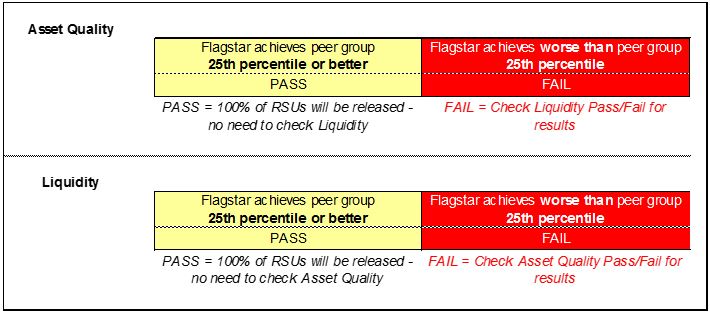

These metrics are measured on a pass/fail basis using the scale below. The Quality Review will be based on the publicly available metrics of the Company and the Company peer group as of the 12 month period ending on the last day of the most recently completed calendar quarter immediately preceding the applicable Measurement Period. If the Company has “passed” one or both of the metrics, then the Quality Review for the applicable Measurement Period is satisfactory and all QR RSUs subject to that Measurement Period will be paid out in accordance with the terms of the Program. If the Company has “failed” both metrics, then the Quality Review for the applicable Measurement Period is not satisfactory and accordingly, the QR RSUs subject to that Measurement Period shall be forfeited without payment.

Peer Group:

- | Associated Banc-Corp | - | Old National Bancorp |

- | BankUnited | - | TCF Financial |

- | BOK Financial Corp. | - | Texas Capital BancShares |

- | Chemical Financial | - | Trustmark |

- | Commerce Bancshares | - | UMB Financial |

- | First Horizon National Corp. | - | Umpqua Holdings |

- | First Midwest Bancorp | - | Washington Federal |

- | Hilltop Holdings | - | Western Alliance Bancorp |

- | HomeStreet | - | Xxxxxxx Financial |

- | MB Financial | - | Wintrust Financial Corp. |