EX-4.14 18 dex414.htm LEASE AGREEMENT LEASE Canada Lands Company CLC Limited Inex Pharmaceuticals Corporation GLEN LYON Business Park Page(s)

Exhibit 4.14

LEASE

Canada Lands Company CLC Limited

Inex Pharmaceuticals Corporation

▇▇▇▇ ▇▇▇▇ Business Park

TABLE OF CONTENTS

| Page(s) | ||||||

| ARTICLE 1 | GRANT OF LEASE | 2 | ||||

| 1.1 | Demise | 2 | ||||

| 1.2 | Covenants | 2 | ||||

| 1.3 | Quiet Enjoyment | 2 | ||||

| 1.4 | Use of Common Areas | 2 | ||||

| 1.5 | Use of Premises | 2 | ||||

| 1.6 | Area of Building | 2 | ||||

| 1.7 | Consent | 2 | ||||

| 1.8 | Compliance with Laws | 3 | ||||

| 1.9 | Waste and Nuisance | 3 | ||||

| 1.10 | Occupancy | 4 | ||||

| 1.11 | Abandonment | 4 | ||||

| 1.12 | Term | 4 | ||||

| 1.13 | Parking | 4 | ||||

| ARTICLE 2 | RENT | 4 | ||||

| 2.1 | Payment for Rent | 4 | ||||

| 2.2 | Early Occupancy | 5 | ||||

| 2.3 | Delayed Occupancy | 5 | ||||

| 2.4 | Payment of Annual Rent | 6 | ||||

| 2.5 | Payment of Operating Costs | 6 | ||||

| 2.6 | Payment of Other Charges | 7 | ||||

| ARTICLE 3 | OPERATION AND MAINTENANCE OF THE PROJECT AND THE PREMISES | 7 | ||||

| 3.1 | Standards and Condition of Premises | 7 | ||||

| 3.2 | Services to Premises | 7 | ||||

| 3.3 | Building, Land and Project Services | 8 | ||||

| 3.4 | Maintenance Repairs and Replacement | 8 | ||||

| 3.5 | Landlord Services to Premises | 10 | ||||

| 3.6 | Additional Services | 10 | ||||

| 3.7 | Alterations by Landlord | 10 | ||||

| 3.8 | Access by Landlord | 11 | ||||

| 3.9 | Name of Building | 11 | ||||

| 3.10 | Floor Loads | 11 | ||||

| 3.11 | Failure to Maintain Premises | 11 | ||||

| 3.12 | Alterations by Tenant | 12 | ||||

| 3.13 | Builders’ Liens | 13 | ||||

| 3.14 | Signs | 13 | ||||

| 3.15 | Tenant’s Property | 13 | ||||

| 3.16 | Leasehold Improvements | 14 |

-i-

TABLE OF CONTENTS

(continued)

| Page(s) | ||||||

| ARTICLE 4 | TAXES | 14 | ||||

| 4.1 | Landlord’s Taxes | 14 | ||||

| 4.2 | Allocation | 14 | ||||

| 4.3 | Tenant’s Taxes | 14 | ||||

| 4.4 | Right to Contest | 15 | ||||

| 4.5 | Additional Taxes | 15 | ||||

| 4.6 | Evidence of Payment | 15 | ||||

| ARTICLE 5 | INSURANCE | 15 | ||||

| 5.1 | Landlord’s Insurance | 15 | ||||

| 5.2 | Tenant’s Insurance | 16 | ||||

| 5.3 | Use of Proceeds | 17 | ||||

| 5.4 | Landlord May Place Insurance | 17 | ||||

| 5.5 | Increase in Insurance Premiums | 18 | ||||

| 5.6 | Cancellation of Insurance | 18 | ||||

| ARTICLE 6 | DAMAGE | 19 | ||||

| 6.1 | Limited Damage to Premises | 19 | ||||

| 6.2 | Major Damage to Premises | 19 | ||||

| 6.3 | Abatement | 19 | ||||

| 6.4 | Major Damage to Building | 19 | ||||

| 6.5 | Reconstruction by Landlord | 20 | ||||

| 6.6 | Architect’s Certificate | 20 | ||||

| 6.7 | Limitation of Liability | 20 | ||||

| ARTICLE 7 | INJURY TO PERSON OR PROPERTY | 20 | ||||

| 7.1 | Indemnity of Landlord | 20 | ||||

| 7.2 | Environmental Matter | 22 | ||||

| ARTICLE 8 | ASSIGNMENT AND SUBLETTING BY TENANT | 22 | ||||

| 8.1 | Conditions | 22 | ||||

| 8.2 | Assignment and Subletting | 23 | ||||

| 8.3 | Right to Assign or Sublet | 23 | ||||

| 8.4 | Corporate Tenant | 24 | ||||

| ARTICLE 9 | SALE AND MORTGAGE BY LANDLORD | 24 | ||||

| 9.1 | Transfers | 24 | ||||

| 9.2 | Subordination | 24 |

-ii-

TABLE OF CONTENTS

(continued)

| Page(s) | ||||||

| 9.3 | Execution of Instruments | 25 | ||||

| 9.4 | Status Statement | 25 | ||||

| ARTICLE 10 | EXPROPRIATION | 25 | ||||

| 10.1 | Definitions | 25 | ||||

| 10.2 | Total Taking of Premises | 26 | ||||

| 10.3 | Partial Taking of Premises | 26 | ||||

| 10.4 | Partial Taking of Building or Premises | 26 | ||||

| 10.5 | Surrender | 26 | ||||

| 10.6 | Awards | 26 | ||||

| ARTICLE 11 | RULES AND REGULATIONS | 27 | ||||

| 11.1 | General Purpose | 27 | ||||

| 11.2 | Loading and Delivery | 27 | ||||

| 11.3 | Construction Procedures | 27 | ||||

| 11.4 | Repugnancy | 28 | ||||

| 11.5 | Observance | 28 | ||||

| 11.6 | Non-Compliance | 28 | ||||

| ARTICLE 12 | COMMUNICATION | 28 | ||||

| 12.1 | Notices | 28 | ||||

| 12.2 | Authority for Action | 28 | ||||

| 12.3 | Withholding of Consent | 29 | ||||

| ARTICLE 13 | DEFAULT | 29 | ||||

| 13.1 | Force Majeure | 29 | ||||

| 13.2 | Events of Default | 29 | ||||

| 13.3 | Interest and Cost | 30 | ||||

| 13.4 | Landlord’s Right to Perform Covenants | 30 | ||||

| 13.5 | Waiver of Exemption and Redemption | 30 | ||||

| 13.6 | Termination | 31 | ||||

| 13.7 | Payments | 31 | ||||

| 13.8 | Remedies Cumulative | 31 | ||||

| ARTICLE 14 | OPTIONS | 31 | ||||

| 14.1 | Early Termination | 31 | ||||

| 14.2 | First Option to Renew | 32 | ||||

| 14.3 | Second Option to Renew | 32 | ||||

| 14.4 | Right of First Refusal | 33 |

-iii-

TABLE OF CONTENTS

(continued)

| Page(s) | ||||||

| 14.5 | Option to Lease Adjoining Space | 33 | ||||

| ARTICLE 15 | SURRENDER AND TERMINATION | 34 | ||||

| 15.1 | Surrender of Possession | 34 | ||||

| 15.2 | Tenant’s Property | 34 | ||||

| 15.3 | Merger | 34 | ||||

| 15.4 | Payments After Expiration or Termination | 35 | ||||

| 15.5 | Holding Over | 35 | ||||

| ARTICLE 16 | AMENDMENT AND WAIVER | 35 | ||||

| 16.1 | Amendment or Modification | 35 | ||||

| 16.2 | No Implied Surrender or Waiver | 35 | ||||

| ARTICLE 17 | INTERPRETATION | 36 | ||||

| 17.1 | Time | 36 | ||||

| 17.2 | Obligations as Covenants | 36 | ||||

| 17.3 | Severability | 36 | ||||

| 17.4 | Governing Law | 36 | ||||

| 17.5 | Grammatical Conformance | 36 | ||||

| 17.6 | Headings and Captions | 36 | ||||

| 17.7 | Extended Meanings | 37 | ||||

| ARTICLE 18 | CONTRACTUAL | 37 | ||||

| 18.1 | Entire Agreement | 37 | ||||

| 18.2 | Relationship of Parties | 37 | ||||

| 18.3 | Joint and Several Liability | 37 | ||||

| 18.4 | Successors | 37 | ||||

| 18.5 | Registration | 37 | ||||

| 18.6 | Division of Project | 37 | ||||

| 18.7 | Lease Letter of Credit | 38 | ||||

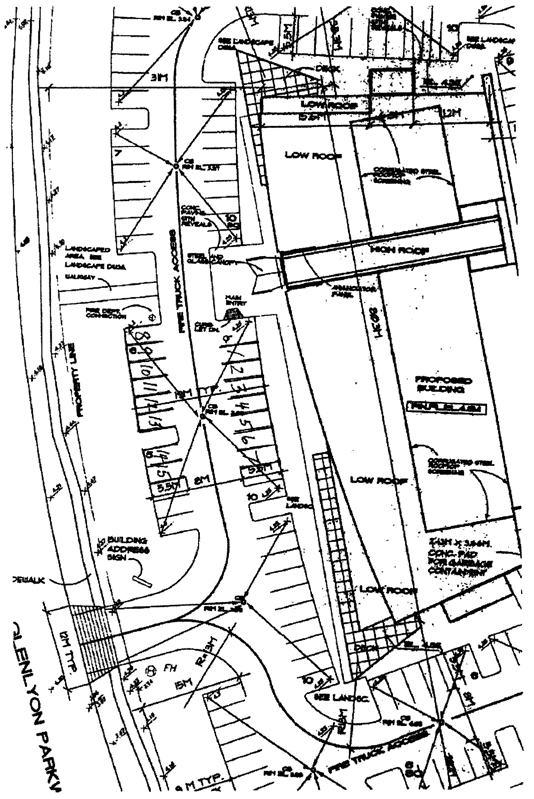

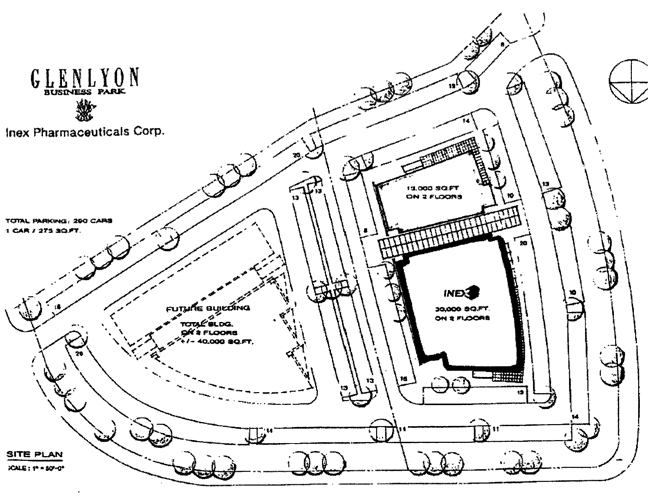

| SCHEDULE 1A | PLAN OF PREMISES | |||||

| SCHEDULE 1B | PLAN OF LAND | |||||

| SCHEDULE 1C | SKETCH PLAN OF RESERVED PARKING STALLS | |||||

| SCHEDULE 2 | PROJECT SUPPLEMENT | |||||

| SCHEDULE 3 |

-iv-

LEASE

By this Agreement dated the day of , 199

CANADA LANDS COMPANY CLC LIMITED, as LANDLORD, upon and In consideration of the covenants, terms, and conditions contained in this LEASE, hereby demises and leases to INEX PHARMACEUTICALS CORPORATION, as TENANT, those PREMISES shown outlined in red on Schedule 1A attached hereto, located in the BUILDING constructed (or being constructed) on the LAND.

The LAND is agreed to contain a total area of approximately 2.7 acres (approximately 10,926 square metres) and is legally described as:

| PID: | [PID to be inserted] |

| [Legal description to be inserted] |

The PREMISES are agreed to contain a Rentable Area of approximately 34,400 square feet (approximately 3,196 square metres).

The BUILDING is agreed to contain a Rentable Area of approximately 49,400 square feet (approximately 4,589 square metres).

For a TERM of 15 years (or otherwise as provided in this Lease).

From a COMMENCEMENT DATE of October 15, 1997 and expiring on October 14, 2012 (unless the Commencement Date is delayed pursuant to the provisions hereof).

For an ANNUAL RENT equal to the product of $14.25 multiplied by the Rentable Area of the Premises (such amount to be $490,200 if the Rentable Area of the Premises is 34,400 square feet) during the first ten years of the TERM with review and adjustment on or about the commencement of the first year of the TERM as set out in Section 1.6 hereof and at the end of the tenth year of the TERM as set out in Section 2.1(b) hereof and other payments in accordance with this LEASE.

Use of Premises

For a pharmaceutical business of Tenant. Tenant shall not carry on business from the Premises other than with a name employing the name “Inex Pharmaceuticals” including names of companies affiliated with Tenant, without the prior written consent of Landlord, such consent not to be unreasonably withheld.

The following appendices are attached to and form part of this Lease:

Schedule 1A - Plan of Premises

Schedule 1B - Plan of Land

Schedule 1C - Sketch Plan of Reserved Parking Stalls

Schedule 2 - Project Supplement with definitions

Schedule 3 - Copy of Offer to Lease.

ARTICLE 1

GRANT OF LEASE

1.1 Demise. Landlord leases the Premises to Tenant, and Tenant leases the Premises from Landlord, to have and to hold during the Term, subject to the provisions hereof.

1.2 Covenants. Landlord covenants to keep, observe and perform all of the terms and conditions to be kept, observed and performed by Landlord under this Lease. Tenant covenants to pay the Rent when due, and to keep, observe and perform all of the terms and conditions to be kept, observed and performed by Tenant under this Lease.

1.3 Quiet Enjoyment. Provided Tenant pays the Rent when due and keeps, observes and performs all of the terms and conditions to be kept and observed and performed by Tenant under this Lease, Tenant may peaceably possess and enjoy the Premises during the Term, without any interruption or disturbance from Landlord or any person or persons lawfully claiming by, from or under Landlord.

1.4 Use of Common Areas. Tenant, its employees, customers, invitees and others requiring communication with Tenant in connection with the operation of its business shall have the use in common with others entitled thereto of the:

(a) Common Areas of the Building and Land, provided that the Common Areas of the Building and Land shall at all times be subject to the exclusive control of Landlord, reasonably exercised; and

(b) Common Areas of the Project, to the full extent of Landlord’s rights thereto under all applicable documents and rules and subject to any restrictions or limitations thereunder.

1.5 Use of Premises. The Premises shall be used and occupied for the use and purpose identified on page 1 of this Lease, or for such other purpose as Landlord may specifically authorize in writing.

1.6 Area of Building. The Total Area of the Land, the Rentable Area of the Premises and the Rentable Area of the Building are agreed to be as stated on page 1 of this Lease. Tenant understands and agrees that Landlord may recalculate these areas from time to time, and will recalculate them when the Building is sufficiently completed, and that upon any such recalculation being made, the Annual Rent, Building Share and Project Share shall be recalculated.

1.7 Consent. Unless otherwise provided, whenever consent or approval of Landlord or Tenant is required under the provisions of this Lease, such consent or approval shall not be unreasonably withheld or delayed.

2

1.8 Compliance with Laws. Tenant shall, at all times, use and occupy the Premises in accordance and compliance with all laws, by-laws, regulations, directions and orders of every governmental authority having jurisdiction and with all requirements of the insurers of the Project, their advisory organizations, and Tenant’s insurers, and shall not commit, suffer or permit any act or omission which shall breach any thereof. Subject to such approvals of Landlord as are required pursuant to this Lease, Tenant shall forthwith and at its own expense make any changes required from time to time by any such governmental authority, insurer, or insurers’ advisory organization if the requirement arises from Tenant’s use of or activities at the Premises or the nature of Tenant’s business. The foregoing provisions of this Section 1.8 notwithstanding, Tenant’s covenant to comply with all requirements of insurers shall be limited to circumstances in which the Tenant’s failure to comply with any requirement would result in cancellation of any Insurance coverage or an increase in any insurance premium, and shall be satisfied by Tenant’s payment of such increased premiums. Nothing herein shall be construed to affect Tenant’s obligations to pay a share of Building Costs or Project Costs in connection with work performed by Landlord or others as required from time to time by any such governmental authority, insurer, or insurers’ advisory organization.

1.9 Waste and Nuisance.

(a) Tenant shall not commit or permit any waste, including waste as it is defined in the Waste Management Act, S.B.C. 1979 c.41, as amended from time to time, to be brought upon, kept, or used in or about the Premises, the Building, or the Project by Tenant, its agents, employees, contractors or invitees, without the prior written consent of Landlord.

(b) Tenant shall not commit or permit any damage to the Premises, the Building, or the Project, including the Leasehold improvements and trade fixtures therein.

(c) Tenant shall not commit or permit any nuisance in or around the Premises, the Building, or the Project or any use or manner of use causing annoyance to other persons.

(d) Except only as may be otherwise permitted under Subsection 1.9(h) below, Tenant shall not use or permit to be used any part of the Premises, the Building, or the Project for any trade or business which is, in the reasonable opinion of Landlord, dangerous, noxious or offensive.

(e) Except only as may be otherwise permitted under Subsection 1.9(h) below, Tenant shall not cause or suffer or permit any waste, oil or grease or any harmful, objectionable, dangerous, poisonous or explosive matter or substance to be discharged into the Premises, the Building, or the Project.

(f) Tenant shall not place any objects on or otherwise howsoever obstruct the heating or air conditioning vents within the Premises or the Building.

(g) Tenant shall keep the Premises free of debris, anything which could create a fire hazard (through undue load on electrical circuits or otherwise) or cause undue vibration, heat or noise.

3

(h) Except as necessary to the ordinary operation of Tenant’s business conducted in compliance with all applicable laws, rules and regulations, Tenant shall keep the Premises free of rodents, vermin and anything of a dangerous, noxious or offensive nature. Tenant shall at all times keep Landlord informed of the presence in the Premises of any rodents or vermin or anything of a dangerous, noxious or offensive nature necessary to the ordinary operation of Tenant’s business conducted in compliance with all applicable laws, rules and regulations, and Tenant shall ensure that they are at all times confined within the Premises, stored and used in compliance with all applicable laws, rules and regulations, and do not cause any nuisance or annoyance to other persons.

1.10 Occupancy. INTENTIONALLY DELETED

1.11 Abandonment. INTENTIONALLY DELETED

1.12 Term. The Term shall commence on October 15, 1997 (the “Commencement Date”) (unless the Commencement Date is delayed pursuant to the provisions hereof) and shall continue for a period of 15 years from and after the Commencement Date, unless earlier terminated by the Tenant under Section 14.1, renewed by the Tenant under Section 14.2 or 14.3, or otherwise earlier terminated hereunder.

1.13 Parking. At no additional cost to Tenant beyond the Rent provided for hereunder, Landlord shall make available to Tenant throughout the Term a number of parking stalls, located in the parking area of the Building, equal to the greater of:

(a) the quotient of Rentable Area of the Premises divided by 300; and

(b) the product of Building Share multiplied by the total number of parking stalls in the parking area of the Building.

The foregoing notwithstanding, Landlord will in no event be obligated to make available to Tenant more than the total number of parking stalls located in the parking area of the Building if the total number is at least 153. Among the parking stalls made available to Tenant as provided in this Section 1.13 shall be 15 reserved parking stalls located as outlined on the sketch plan attached hereto as Schedule 1 C. Landlord shall not be responsible for supervising or policing any of the parking stalls made available to Tenant. Tenant shall use the parking stalls made available to it only for parking by its employees, agents and invitees, only in a manner suitable for parking stalls in a first class building similar to the Building, and only in conformity with any rules and regulations made hereunder, and shall not permit or suffer any other use of the parking stalls.

ARTICLE 2

RENT

2.1 Payment for Rent.

(a) Except as may be otherwise be explicitly provided herein, Tenant acknowledges and agrees that the Annual Rent shall be completely triple net to Landlord, that the Landlord shall not be responsible for any costs, charges, expenses or outlays of any nature

4

whatsoever arising from or relating to the Premises, the Building, or the Project, and Tenant shall, to the complete indemnification of Landlord, pay all costs for the Premises, Building Share of Building Costs, Project Share of Project Costs and Other Charges as provided in this Lease;

(b) Unless this Lease has then been terminated pursuant to its terms, the Annual Rent during the 11th to 15th years of the Term, inclusive, shall be the greater of:

(i) the effective fair market rent for the Premises as of the commencement of the 11th year of the Term, when compared to premises of similar size, quality and location In office buildings of a similar size, quality and location in the Greater Vancouver Regional District (but excluding any consideration for the Special Tenant Improvements); and

(ii) the Annual Rent during the 10th year of the Term.

The effective fair market rent referred to above shall be determined by mutual agreement of the parties, or, failing agreement thereon prior to the date 10 months before the conclusion of the 10th year of the Term, by arbitration under the Commercial Arbitration Act of British Columbia, if the matter is being determined by arbitration but has not been determined at the commencement of the 11th year of the Term, Tenant shall continue to pay, when due, the instalments of Annual Rent payable during the 10th year of the Term, together with all other payments which comprise Rent, and Tenant shall pay the deficiency (if any) without interest within 10 days of the adjusted Annual Rent being agreed or determined;

(c) All amounts payable by Tenant to Landlord under this Lease (without limitation, including Building Share of Building Costs, Project Share of Project Costs and Other Charges) shall constitute and be deemed to be Rent and shall be payable and recoverable as Rent, and shall be payable, when due, in legal tender of Canada, without abatement, deduction or rights of set-off, and without demand or, where so specified, upon notice or invoice, at such place as Landlord from time to time may designate, and Landlord shall have all rights against Tenant for default in any payment as in the case of arrears of Annual Rent. Tenant’s obligation to pay Rent shall survive the expiration or earlier termination of this Lease, until fully discharged; and

(d) Tenant shall make payments required under this Lease within the period of time specified, or if a time period is not specified, within a reasonable period of time.

2.2 Early Occupancy. INTENTIONALLY DELETED

2.3 Delayed Occupancy.

(a) Landlord and Tenant will use reasonable efforts to work jointly to ensure that the Landlord’s Improvements and Tenant’s Improvements are completed in the most efficient and expeditious manner.

(b) Landlord will endeavour to have the Building sufficiently constructed by June 9, 1997 so that it is sufficiently watertight and complete to permit commencement of construction of tenant improvement architectural trade installations and finishes and to allow a continuity of construction from then on. If the Building is not in such condition by June 9, 1997,

5

then anything to the contrary In this Lease notwithstanding, the Commencement Date will be delayed one day for each day after June 9, 1997 until Landlord achieves such condition. This subsection (b) supersedes Section 10.1(c) of the Offer to Lease which shall hereafter be of no force or effect.

(c) if, after Landlord’s construction of the Building to the condition referred to in subsection (b) above and before the Commencement Date, Landlord’s construction of Landlord’s improvements is delayed by force majeure as described in paragraph 13.1 herein, as a direct result of such delay Tenant’s completion of Tenant’s Improvements is delayed beyond the Commencement Date, then anything to the contrary in this Lease notwithstanding, the Commencement Date will be delayed one day for each day that Tenant is so delayed.

2.4 Payment of Annual Rent. Annual Rent shall be paid to Landlord In equal monthly installments payable in advance on the first day of each calendar month, with the first instalment (prorated to cover the number of days then remaining in the calendar month) to be paid on the Commencement Date (and the last instalment to be prorated to cover the number of days then remaining in the Term). The Deposit, as such term is defined In the Offer to Lease, shall be applied as provided in the Offer to Lease.

2.5 Payment of Operating Costs.

(a) Tenant shall pay Building Share of Building Costs and Project Share of Project Costs as next provided;

(b) On or about the Commencement Date, and the beginning of each Fiscal Year thereafter, Landlord shall compute and deliver to Tenant bona fide estimates of Building Share of Building Costs and Project Share of Project Costs for the appropriate period and, without further notice, Tenant shall pay to Landlord equal monthly instalments of such estimates simultaneously with instalments of Annual Rent during such period;

(c) Unless delayed by causes beyond Landlord’s reasonable control, Landlord shall deliver to Tenant within 120 days after the end of each Fiscal Year and after the expiry of the Term a statement certified to be correct by Landlord (the ‘Statement”), setting out in reasonable detail the amount of Building Costs and Project Costs and the calculation of Building Share of Building Costs and Project Share of Project Costs for such Fiscal Year. If the aggregate of the instalments of Building Share of Building Costs and Project Share of Project Costs actually paid by Tenant to Landlord during such Fiscal Year differs from the total amount of Building Share of Building Costs and Project Share of Project Costs set forth on the Statement, Tenant shall pay to Landlord or Landlord shall credit to Tenant the difference without interest within 30 days after the date of delivery of the Statement;

(d) If Tenant disagrees with the accuracy of the information set forth in the Statement, Tenant shall nevertheless make payment or be credited in accordance with the Statement, but Tenant shall, within 30 days of delivery of the Statement, advise Landlord of such disagreement and Landlord shall, within 30 days of such notice of disagreement provide Tenant with evidence and receipts in reasonable detail supporting such Statement. If Tenant thereafter gives Landlord notice of its continuing disagreement, the disagreement shall immediately be

6

referred by Landlord for prompt decision by a public accountant, architect, insurance broker or other professional consultant who is, in the opinion of Landlord, acting reasonably, qualified to assess and determine the matter and who shall be deemed to be acting as an expert and not as an arbitrator and whose determination shall be final and binding on Landlord and Tenant, unless within 30 days of the determination either party elects to submit the matter to arbitration pursuant to applicable law. The cost of the expert and of any arbitration shall be borne equally by Landlord and Tenant. Any adjustment required to any previous payment or credit made by Tenant or Landlord by reason of any final decision shall be made, without interest, within 30 days thereof;

(e) Neither party may claim a re-adjustment of Operating Costs for a period based upon any error or computation or allocation except by notice delivered to the other party within 6 months after the date of delivery of the Statement; and

(f) If the Term expires or this Lease is otherwise terminated on a date other than the last day of a Fiscal Year, Building Share of Building Costs and Project Share of Project Costs shall be adjusted on a per diem basis, based on and calculated at the time of delivery of the Statement next delivered after such date. If the aggregate of the instalments of Building Share of Building Costs and Project Share of Project Costs actually paid by Tenant to Landlord during the period up to and including the expiry or earlier termination date differs from the total amount of Building Share of Building Costs and Project Share of Project Costs payable for the period up to such date, Tenant shall pay to Landlord or Landlord shall refund to Tenant the difference without interest within 30 days after the date of delivery of the Statement, subject to the provisions of Section 2.5(d) above.

2.6 Payment of Other Charges. Tenant shall make all payments of Other Charges to Landlord, or third parties, as applicable, which pursuant hereto are the responsibility of Tenant.

ARTICLE 3

OPERATION AND MAINTENANCE OF THE PROJECT AND THE PREMISES

3.1 Standards and Condition of Premises. During the Term, Tenant shall (subject to fair wear and tear, provided that nothing herein shall require Landlord to remedy such fair wear and tear) operate and maintain the Premises and all improvements therein in good order and condition, in accordance with all applicable laws and regulations, and with standards of efficient and prudent property operation and management from time to time prevailing for buildings and land in a project similar in use, type and location.

3.2 Services to Premises. Except as hereinafter set out, Tenant shall, at its sole cost, provide all services in the Premises, including without limitation:

(a) hot and cold running water and necessary supplies In washrooms sufficient for the normal use thereof.

(b) heat, ventilation and air conditioning as required for the comfortable use and occupancy of the Premises during Normal Business Hours;

7

(c) maintenance services of repairing, replacing, repainting and redecorating the Premises at reasonable intervals as needed to maintain the Premises in good condition, reasonable wear and tear excepted;

(d) janitorial services, Including window washing, dry-cleaning of drapes and shampooing of carpets, to keep the Premises In a clean and tidy condition;

(e) replacement of building standard fluorescent tubes, light bulbs, ballasts, and starters as required from time to time as a result of normal usage; and

(f) electric power for normal lighting and small business office equipment, water and any other utilities used In connection with the Premises, subject to Landlord’s obligation to ensure that such utilities are available to the Premises. (The parties acknowledge and agree that, except for the original installation of such utilities, the costs of making such utilities available to the Premises will be shared by Tenant and other tenants in the Building as Building Costs.)

The foregoing notwithstanding, Landlord may elect from time to time to provide any or all of such services if in Landlord’s opinion, reasonably exercised, Tenant is not providing such service adequately, in which event (i) Tenant shall not interfere with Landlord’s provision of such services, (ii) Landlord may elect to include the costs of such services In Building Costs or allocate them specifically to the Premises, and (iii) Tenant shall pay all costs of such services allocated specifically to the Premises and Building Share of such costs included In Building Costs. Landlord shall ensure the installation of facilities to provide natural gas, electricity, water and telephone services to the Premises and Landlord shall determine in its sole discretion exercised reasonably whether any or all of such services shall be separately metered. Landlord shall ensure that sanitary sewers are available in the Premises and that storm sewers are available at the Building and the Land.

3.3 Building, Land and Project Services.

(a) Landlord shall provide to the Building and the Land such other services as Landlord in its sole discretion exercised reasonably deems appropriate from time to time, Services including without limitation signs, decor, medians, islands, utilities, service centres dedicated to the Building, pedestrian and vehicular pathways, and landscaping and Tenant shall pay, in respect thereof, Building Share of Building Costs.

(b) Landlord or other parties responsible for the Common Areas of the Project shall provide to the Project such other services as Landlord or such parties in their sole discretion exercised reasonably deems appropriate from time to time, including without limitation signs, decor, open area space, medians, islands, parks, ponds, creeks, utilities, service centres, pedestrian and vehicular pathways, and landscaping and Tenant shall pay, in respect thereof, Project Share of Project Costs.

3.4 Maintenance Repairs and Replacement. Subject to the other provisions of this Lease and except for reasonable wear and tear and damage not covered by insurance normally maintained by prudent landlords, Landlord shall keep in a good and substantial state of repair the exterior walls, roof, foundations, floor slabs and bearing structure of the Building. Unless and

8

until Landlord exercises its right under Section 3.2 to perform any or all of the following on Tenant’s behalf and at Tenant’s expense, Tenant shall operate, maintain, repair and replace everything in the Premises, including without limitation all Leasehold Improvements, all trade fixtures and glass in the Premises, the systems, facilities, and equipment necessary for the proper operation of the Premises and for the provision of all services to the Premises and without limiting the generality of the foregoing, Tenant shall at its own expense:

(a) maintain in good operating condition to Landlord’s satisfaction the water, sewer and gas and all other mechanical systems within the Premises;

(b) maintain service contracts for the inspection and maintenance of the heating, ventilating and air conditioning units serving the Premises (whether or not located within the Premises) and file copies of such contracts with Landlord;

(c) repair or replace to Landlord’s satisfaction all glass, locks and doors (including overhead doors) in or upon the Premises which become damaged or broken; and

(d) replace and maintain all light fixtures, bulbs, tubes, ballasts, starters and fuses as is necessary from time to time;

provided that:

(e) if all or part of such systems, facilities and equipment are destroyed, damaged or impaired, Tenant shall have a reasonable time in which to complete the necessary repair or replacement, and during that time shall be required to maintain all such services as are reasonably possible In the circumstances;

(f) following initial Installation and any significant alteration of partitioning or installations, proper operation of heating and air handling systems will require balancing and rebalancing and Tenant shall have a reasonable time in which to complete the necessary balancing and rebalancing;

(g) Tenant may temporarily discontinue such services to the Premises or any of them at such times as may be necessary due to causes (except lack of funds) beyond the reasonable control of Tenant;

(h) Tenant shall use reasonable diligence in carrying out its obligations under this Article;

(i) Landlord shall be responsible for repairing at its expense any Structural Defects to the Building adversely affecting the Premises and any other damage directly caused by such Structural Defects that Tenant would otherwise be responsible to repair;

(j) nothing herein shall obligate Tenant to make any repairs, changes or alterations or to add any equipment or device rendered necessary by the Building not having been constructed In accordance with the law as it existed at the date of initial construction; and

(k) nothing contained herein shall derogate from the provisions of Article 7.

9

Tenant will notify Landlord immediately upon Tenant becoming aware of any defect in the Premises, the Building, or the Project or of any other condition which may cause damage to the Premises, the Building, or the Project.

3.5 Landlord Services to Premises. If Landlord elects to provide, on behalf of Tenant, any services to be provided pursuant to Section 3.2 and 3.4 hereof:

(a) Landlord shall not be liable for damage to any person or property, fixtures, furnishings, or equipment or claims for loss of business, or other loss or damage suffered or caused by failure of the mechanical or electrical systems of the Building or the Project, including without limitation interruption in the supply of power or other services, malfunction of any sprinkler system, bursting or leaking of sewer pipes or of gas, steam, or water, or leakage of any type, unless caused by the gross negligence, wilful misconduct, or wilful omission of Landlord or those for whom it is in law responsible;

(b) no reduction or discontinuance of services under this Article shall be construed as an eviction of Tenant or a breach of the covenant of quiet enjoyment, or release Tenant from any of its obligations under this Lease; and

(c) Landlord shall be deemed to have observed and performed the terms and conditions to be performed by Landlord under this Lease, including those relating to the provision of utilities and services, if in so doing Landlord acts in accordance with a directive, policy or request of a government or quasi-governmental authority serving the public interest In the fields of energy, conservation or security.

3.6 Additional Services. If from time to time requested in writing by Tenant and to the extent that it is reasonably able to do so, Landlord shall provide services in addition to those set out in this Article:

(a) in the Premises or in respect of any permitted improvements, installations, alterations, additions, changes, repairs or replacements to any part of the Premises, provided that Tenant shall be solely responsible for the cost thereof and Tenant shall within 30 days of receipt of an invoice for any such additional service pay Landlord the cost thereof plus a fee of 10% thereon; and

(b) in the Project, and the cost thereof shall:

(i) be the sole responsibility of Tenant where only Tenant derives benefit therefrom, payable as set out in (a) hereof; and

(ii) form part of the Project Costs where the service is for the benefit of all tenants of the Project.

3.7 Alterations by Landlord. Landlord may from time to time make repairs, replacements, changes or additions to the structure, systems, facilities and equipment in the Building or the Project, including the Premises, where necessary to serve the Building or the Project; provided that in doing so, Landlord shall not disturb or interfere with Tenant’s use of the Premises and operation of its business any more than is reasonably necessary in the circumstances and shall repair any damage to the Premises caused thereby.

10

3.8 Access by Landlord. Tenant shall permit Landlord to enter the Premises during Normal Business Hours where such entry will not unreasonably disturb or interfere with Tenant’s use of the Premises and operation of its business, and at any time in the event of an emergency, to examine, inspect, and during the 270 days preceding the expiration of this Lease, show the Premises to persons wishing to lease them, to provide services or make repairs, replacements, changes or alterations as set out in this Lease, and to take such steps as Landlord may deem necessary for the safety, improvement or preservation of the Premises, the Building, or the Project. Except in the case of an emergency, Landlord shall, whenever entering the Premises under Section 3.7 or this Section 3.8, give reasonable notice to Tenant prior to such entry, and to the extent possible identify the individual or individuals who will enter the Premises and such individuals’ employer, and shall use its reasonable efforts to observe security and safety measures reasonably requested by Tenant from time to time, but such entry shall not be construed as an eviction of Tenant or a breach of the covenant of quiet enjoyment and shall not release Tenant from any of its obligations under this Lease.

3.9 Name of Building. Landlord may determine and specify one or more names, numbers, or like designations, by which any or all of the Premises, the Building, or the Project (or any component thereof) shall be known and identified. Landlord shall have the right from time to time, on 30 days’ notice to Tenant, to change any such name, number or designation of the Premises, the Building or the Project, without liability to Tenant. The foregoing provisions of this Section 3.9 notwithstanding, Landlord will not name or rename the Building without Tenant’s consent, which Tenant shall not withhold unreasonably.

3.10 Floor Loads. Tenant shall not place (or cause or permit to be placed) a load upon any portion of any floor of the Building which exceeds the floor load that the area of such floor being loaded was designed to carry having regard to the loading of adjacent areas and that which is allowed by code. Landlord reserves the right to prescribe the weight and position of all safes and heavy installation which Tenant wishes to place in the Premises so as to distribute properly the weight thereof and Tenant shall pay for all costs incurred by Landlord and Landlord’s Architect in making such assessment. Tenant shall not cause or permit any excessive vibration in the Building. Tenant shall repair any damage done in the Building by reason of any excessive weight placed In the Building or excessive vibration caused in the Building.

3.11 Failure to Maintain Premises. If Tenant fails to perform any obligation under this Article, then on not less than 10 days’ notice to Tenant, (except in the event of an emergency as determined by Landlord, acting reasonably, in which case entry may be made immediately) Landlord may enter the Premises and perform or cause performance of such obligation without liability to Tenant for any loss or damage to Tenant thereby occasioned, and Tenant shall pay Landlord for all Outlays plus 20% of such for overhead and supervision, within 10 days of receipt of an invoice therefor, and the entry and performance of such obligations by Landlord shall not be construed as an eviction of Tenant or a breach of the covenant of quiet enjoyment and shall not release Tenant from any of its obligations under this Lease. Tenant shall not be entitled to any compensation for any inconvenience, nuisance or discomfort occasioned by such entry.

11

3.12 Alterations by Tenant.

(a) Tenant may from time to time at its own expense make changes, additions and improvements in the Premises to better adapt the Premises to its business, provided that any such change, addition or improvement shall:

(i) comply with the requirements of all governmental or quasi-governmental authorities having jurisdiction;

(ii) be made only with the prior written consent of Landlord, not to be unreasonably withheld;

(iii) comply with requirements pertaining to Landlord as an owner of property in GLENLYON Business Park, including without limitation any requirements of a Business Park Management Agreement and be equal to or exceed the standard of the Building when constructed; and

(iv) be carried out only by contractors approved in writing by Landlord, which persons shall, if required by Landlord, deliver to Landlord before commencement of the work, an authorised building permit from the applicable municipality, performance and payment bonds, and proof of workers’ compensation and public liability and property damage insurance coverage, with Landlord named as an additional insured, with companies and in amounts and with coverages and in form reasonably satisfactory to Landlord, and which shall remain in effect during the entire period in which the work will be carried out and for a reasonable period of time thereafter;

(b) Subject to compliance with such reasonable rules and regulations as Landlord may make from time to time, Tenant and its contractors shall have access to the Premises for purposes of undertaking the work approved pursuant to subsection (a), provided such work shall be undertaken and completed with all reasonable diligence;

(c) except to the extent that Landlord, acting reasonably, otherwise requires or directs, such work shall be done by contractors selected by Tenant, provided that there shall be no conflict caused thereby with any union or other contract to which Landlord or any of its contractors may be a party, and if Tenant’s contractors or workmen cause such conflict, Tenant shall forthwith remove them from the Premises;

(d) INTENTIONALLY DELETED

(e) Landlord shall have no responsibility or liability whatsoever with respect to any such work or attendant materials left or installed in the Premises and for any delays resulting therefrom, and shall be reimbursed for any Outlays. Tenant shall be solely responsible for the removal of any and all construction refuse or debris resulting from such work. To the extent such removal requires the use of or occurs within any Building Common Areas, it shall occur only after Normal Business Hours; and

(f) Tenant shall bear any increase in Taxes, fire or casualty Insurance premiums for any or all of the Premises, the Building, or the Project attributable to such change, addition or improvement. Tenant shall promptly repair at its own expense all damage to the Premises, the Building, or the Project, without limitation including the property of others, resulting from such changes, additions or improvements.

12

3.13 Builders’ Liens. Tenant shall pay before delinquency all costs for work done or caused to be done by Tenant in the Premises which could result in any lien or encumbrance on Landlord’s Interest in the Project or any part thereof, including without limitation the Building, and shall keep the title to the Project and every part thereof, including without limitation the Building, free and clear of any lien, certificate of lis pendens or encumbrance in respect of such work, and shall indemnify and hold harmless Landlord against all Outlays. Tenant shall immediately notify Landlord of any such lien, claim of lien or other action of which it has or reasonably should have knowledge and which affects the title to the Project or any part thereof, including without limitation the Building, and shall cause the same to be removed within 15 days (or such additional time as Landlord may allow in writing), failing which Landlord may take such action as Landlord deems necessary to remove the same and Tenant shall pay Landlord for all Outlays within 10 days of receipt of an invoice therefor.

3.14 Signs. Tenant shall, at Tenant’s cost, have the right to install prominent signage on the exterior of the Building, subject to any rules or regulations issued hereunder or other guidelines for GLENLYON Business Park (which may include, without limitation, any rules, regulations or guidelines requiring signs to conform to a uniform pattern of identification or signs in the Project) and subject to the approval of Landlord and the City of Burnaby, such approval of Landlord not to be unreasonably withheld. Tenant shall not inscribe or affix any sign, lettering or design in the Premises which is visible from the exterior of the Premises or the Project.

3.15 Tenant’s Property.

(a) Tenant may install in the Premises its usual trade fixtures and personal property in a proper manner, provided that no such installation shall interfere with or damage the mechanical or electrical systems or the structure of the Building. If Tenant is not in default hereunder, Tenant’s Property installed in the Premises by Tenant may be removed from the Premises:

(i) from time to time in the ordinary course of Tenant’s business; and

(ii) during a reasonable period prior to the expiration of the Term,

provided that Tenant shall promptly repair at its own expense any damage to the Building, the Premises or the Project resulting from such installation or removal; and

(b) For purposes of this Lease the expression “Tenant’s Property” (whether owned or leased by Tenant and whether or not affixed to the Premises) shall mean personal property, trade fixtures and fittings, furniture and furnishings, supplies, inventories and merchandise, and equipment and systems from time to time installed, provided and used by Tenant in the Premises for the conduct of its business and shall include Special Tenant Improvements.

13

3.16 Leasehold Improvements.

(a) Provided that nothing in this Section shall inhibit Tenant’s rights pursuant to Section 3.12 to make alterations or pursuant to Section 3.15 to install and replace Tenant’s Property, all Leasehold Improvements in or about the Premises shall upon the completion thereof forthwith become the absolute property of Landlord without compensation therefor, but without Landlord having or thereby accepting any responsibility in respect of the maintenance, repair, replacement or removal thereof (other than pursuant to Articles 5 and 6 hereof) which shall be Tenant’s responsibility; and

(b) For purposes of this Lease the expression “Leasehold Improvements* shall include, without limitation, all improvements, installations, alterations and additions from time to time made, erected or installed in any part of the Premises by or on behalf of Tenant, or any previous or other occupant of the Premises including, without limitation, all partitioning, doors and hardware, heating, air conditioning, ventilation, mechanical, electrical and utility installations, light fixtures, floor and window coverings, decorations, finishes and fixtures, howsoever affixed and whether movable or immovable, excepting only Tenant’s Property.

ARTICLE 4

TAXES

4.1 Landlord’s Taxes. Landlord shall, where a separate assessment cannot be obtained for the Building and the Land or the Common Areas of the Project, pay Taxes of Building and Taxes of Common Areas of the Project, as applicable, before delinquency on the understanding that Tenant shall pay to Landlord Building Share of Taxes of Building and Project Share of Taxes of Common Areas of the Project. Landlord may, to the fullest extent permitted by law and provided It diligently prosecutes any contest or appeal of Taxes, defer payment of Taxes or defer compliance with any statute, by-law, or regulation in connection with the levying and payment of Taxes. Landlord will use reasonable efforts to obtain a separate assessment for the Building and the Land and at Tenant’s reasonable written request, Landlord will appeal Taxes.

4.2 Allocation. If there are not separate assessments of Taxes for the components of the Project, including the Building and the Land and Common Areas of the Project, Landlord shall allocate Taxes to the Building and the Land and Common Areas of the Project on an equitable basis having regard, without limitation, to the various uses and values of the components, comprising the assessment, any separate assessments that may have been rendered by the taxing authority, and any assessment principles known, or prescribed by any lawful taxing authority.

4.3 Tenant’s Taxes. Tenant shall pay directly to the appropriate authorities and before delinquency every tax, assessment, licence fee, excise fee and other charge (excluding income tax), however described, which Is imposed, levied, assessed or charged by any governmental or quasi-governmental authority having jurisdiction and which is payable In respect of the Term or upon or on account of:

(a) separate assessments of or in respect of the Premises;

14

(b) operations at, occupancy of, or conduct of business in or from the Premises by or with the knowledge of Tenant;

(c) Tenant’s Property or fixtures or personal property in the Premises which do not belong to Landlord; and

(d) the Rent paid or payable by Tenant to Landlord for the Premises or for the use and occupancy of all or any part thereof, excluding Landlord’s income taxes and other taxes personal to Landlord.

4.4 Right to Contest. Tenant shall have the right to contest in good faith the validity or amount of any tax, assessment, licence fee, excise fee or other charge which it is responsible to pay under Section 4.3 or 4.5, provided that no contest by Tenant may involve the possibility of forfeiture, sale or disturbance of Landlord’s interest in any part of the Premises, the Building or the Project and that upon the final determination of any contest by Tenant, Tenant shall immediately pay and satisfy the amount found to be due, together with all costs, penalties and interest relating thereto or arising therefrom.

4.5 Additional Taxes. If by reason of any act or election of Tenant, or any subtenant, licensee or occupant of the Premises (except Landlord after election by Landlord of any right to sublease pursuant to this Lease), the Project, the Building, or the Premises or any part thereof shall be assessed an increased rate or assessment, the Tenant shall pay before delinquency the amount by which the resulting Taxes exceed those which would otherwise have been payable.

4.6 Evidence of Payment. Tenant shall provide to Landlord, within 7 days of making such payment, evidence of payment of Taxes and all taxes payable under this Article 4.

ARTICLE 5

INSURANCE

5.1 Landlord’s Insurance.

(a) During the Term, Landlord will (subject to participation by Tenant by payment of Building Share of Building Costs) maintain Insurance on, or self insure, the Building and the Land, and Landlord may maintain (subject to participation by Tenant by payment of Project Share of Project Costs) insurance on the interest of Landlord in the Project, and which Include Landlord as the named insured but excluding Tenant’s Property, with coverage and in amounts and in respect of risks which are from time to time acceptable to a prudent owner of a project similar in use, type, and location and from time to time insurable at reasonable premiums. Landlord shall request from its insurer an endorsement that all policies for such insurance shall contain a waiver by the insurer of any right of subrogation against Tenant and its officers, directors, partners and employees. Landlord agrees to make available all proceeds from such policies for the expeditious repair or replacement of the insured property. Landlord shall review the insurance in consultation with an Independent, professional insurance broker not less frequently than every three years and may on the recommendation of such insurance broker effect insurance subject to reasonable deductibles to be borne by the insured in the event of a claim arising. Nothing herein shall preclude Landlord effecting so-called ‘all risks” property insurance, or effecting blanket insurance in respect of the Project and any other properties of

15

which Landlord is the owner or tenant, or in which Landlord has an insurable interest. Landlord shall allocate (in circumstances where the insurer or the Insurer’s agent fails to do so) the cost of premiums to the Building and Land, Common Areas of the Project and any other of the Project Components (and such other properties as may be appropriate), taking into consideration values of the subject Project Components, and any other properties so included, and the recommendation of Landlord’s insurance broker;

(b) Provided that:

(i) if in the opinion of Landlord any Leasehold Improvements do not constitute a finishing of the Premises in a manner which would have general utility but are specially or peculiarly adapted for Tenant’s use, or if the insuring of any of the Leasehold Improvements in the Premises involves, or would in the opinion of Landlord’s insurance broker involve, a premium exceeding that for the insuring of Leasehold Improvements normal in the Premises, or any special stipulations or conditions of a policy of insurance are imposed or involved in the insurance thereof, Landlord may from time to time elect, by written notice to Tenant, not to insure or cause to be insured any such Leasehold Improvements, in which event Tenant shall, and Landlord shall not, be required to insure such Leasehold Improvements; and

(ii) if from time to time the insuring of the Leasehold Improvements in the Premises (other than those which Landlord may have elected not to insure or cause to be insured as aforesaid) requires a premium or an allocated part of a premium, as established either by the insurer or by the estimate of Landlord’s insurance broker, which exceeds the average premium cost per unit for insuring Leasehold Improvements normal to the Premises, Landlord may from time to time charge the excess premium cost to Tenant and Tenant shall make prompt payment therefor upon receipt of invoices from Landlord; and

(c) Upon the request of Tenant from time to time Landlord will furnish a statement as to the perils in respect of which and the amounts to which the Premises and the Leasehold Improvements In the Premises have been insured, and Tenant shall be entitled at reasonable times upon reasonable notice to Landlord to inspect copies of the relevant portions of all policies of insurance in effect and a copy of any relevant opinions of Landlord’s insurance broker.

5.2 Tenant’s Insurance. During the Term Tenant shall maintain at its own expense:

(a) In the event Landlord does not maintain insurance pursuant to Section 5.1 hereof, insurance on the Premises and all property and interest of Landlord in the Premises Including without limitation, Leasehold Improvements, with coverage and in amounts and in respect of all perils including risks which are from time to time designated by Landlord, and which reflect Landlord as the named insured and provide that any proceeds recoverable in the event of loss shall be payable to Landlord to rebuild the Premises;

(b) comprehensive general public liability insurance (including bodily injury, death and property damage) on an occurrence basis with respect to the business carried on or in or from the Premises and Tenant’s use and occupancy thereof, which insurance shall contain a cross liability clause, and include Landlord as a named insured and shall protect Landlord in

16

respect of claims by or through Tenant as if Landlord was separately insured; and shall be for not less than $5,000,000 inclusive limits for personal injury or property damage in respect of each occurrence, or such higher limits as Landlord’s insurance broker may reasonably require from time to time;

(c) insurance in respect of fire and other perils as are from time to time defined in the usual endorsement covering Tenant’s Property and such Leasehold Improvements (if any) as Landlord may have elected not to insure Tenant or not to require to insure pursuant to 5,2(a) hereof, which insurance shall include Landlord as a named insured as its interest may appear with respect to insured Leasehold Improvements and provide that any proceeds recoverable in the event of loss to Leasehold Improvements shall be payable to Landlord (but Landlord agrees to make available such proceeds towards the repair or replacement of the insured property if this Lease is not terminated pursuant to any other provision hereof);

(d) whichever of business interruption insurance or extra expense insurance is applicable to Tenant, in an amount satisfactory to Landlord acting reasonably; and

(e) such other insurance of the Premises, its appurtenances, and the business conducted as would, in the opinion of Landlord acting reasonably, be carried by a prudent operator of premises similar in use, type, and location.

All such policies of insurance shall provide Landlord with 30 days’ notice of material amendment or cancellation and waive any right of subrogation against Landlord and its directors, officers and employees.

5.3 Use of Proceeds. Tenant agrees that in the event of damage or destruction to the Premises covered by insurance required to be taken out by the Tenant pursuant to Section 5.2 or otherwise, Tenant shall use the proceeds of such insurance for the purpose of repairing or restoring such damage or destruction. In the event of damage to or destruction of the Premises entitling Landlord to terminate this Lease pursuant to the terms hereof, then, if the Premises have been damaged or destroyed, Tenant shall pay to Landlord all of its insurance proceeds relating to any Leasehold Improvements in the Premises which Tenant was required to insure and if any part of the Premises has not been damaged or destroyed, Tenant shall deliver to Landlord, In accordance with the provisions of this Lease, all Leasehold Improvements contained therein and the Premises.

5.4 Landlord May Place Insurance. If requested by Landlord, Tenant shall from time to time promptly deliver to Landlord evidence that insurance has been taken out pursuant to Section 5.2, or should any such insurance not be approved by either Landlord or a mortgagee, and Tenant shall not diligently rectify the deficiency within 2 business days after notice by Landlord to Tenant (stating, if Landlord or the mortgagee does not approve of such insurance, the reasons therefor), Landlord shall have the right, without assuming any obligation in connection herewith, to effect such insurance at the sole cost of Tenant and Tenant shall pay Landlord for all Outlays within 10 days of receipt of an invoice therefor.

17

5.5 Increase in Insurance Premiums. Tenant shall not permit, keep, use, sell or offer for sale in or upon the Premises or Project any article which may be prohibited by any fire insurance policy in force from time to time covering the Premises, the Building, or the Project. If (a) the occupancy of the Premises, (b) the conduct of business in the Premises, or (c) any acts or omissions of Tenant in the Project or any part thereof, including the Premises causes or results in any increase in premiums for the Insurance carried from time to time by:

(a) Tenant, Tenant shall pay the Insurer for such increase within the time provided in an invoice for such additional premiums received from the insurer and forthwith provide Landlord with evidence of payment thereof; and

(b) Landlord with respect to any of the Premises, the Building, or Project, Tenant shall pay Landlord for any such increase within 10 days of receipt of an invoice for such additional premiums from Landlord.

In determining whether increased premiums are caused by or result from the use or occupancy of the Premises, a schedule issued by the organization computing the insurance rate on the Building or the Project showing the various components of such rate, shall be conclusive evidence of the several items and charges which make up such rate. Tenant shall comply promptly with all requirements of the insurer’s advisory organizations now or hereafter in effect or of the insurers pertaining to or affecting any of the Premises, the Building and the Project.

5.6 Cancellation of Insurance. If any insurance policy upon the Project or any part thereof, including either or both of the Premises and the Building, shall be cancelled or shall be threatened by the insurer to be cancelled, or the coverage thereunder reduced in any way by the insurer by reason of the use or occupancy of or any article, material or equipment brought upon or stored or maintained in the Premises or any part thereof by Tenant or by any assignee or subtenant of Tenant, or by anyone permitted by Tenant to be upon the Premises, (other than Landlord or an agent, representative or designate of Landlord), and if Tenant fails to remedy the condition giving rise to cancellation, threatened cancellation, or reduction of coverage within 2 business days after notice thereof by Landlord, Landlord may, at its option, either (a) re-enter and take possession of the Premises forthwith by leaving upon the Premises a notice in writing of its intention so to do and thereupon Landlord shall have the same rights and remedies as are contained in this writing of its intentions so to do and thereupon Landlord shall have the same rights and remedies as are contained in this Lease for events of default, or (b) enter upon the Premises and remedy the condition giving rise to such cancellation, threatened cancellation or reduction, without limitation or restriction including removal of any offending article, and in such event Tenant shall pay Landlord for all Outlays within 10 days of receipt of an invoice therefor, and Landlord shall not be liable for any damage or injury caused to any property of Tenant or of others located on the Premises as a result of such entry. Subject to this Section, any such entry by Landlord shall not be construed as an eviction of Tenant or a breach of the covenant of quiet enjoyment and shall not release Tenant from any of its obligations under this Lease.

18

ARTICLE 6

DAMAGE

6.1 Limited Damage to Premises. If all or part of the Premises are rendered untenantable by damage from fire or other casualty which, in the reasonable opinion of the Architect provided within 30 days after the fire or other casualty, can be substantially repaired under applicable laws and governmental regulations within 270 days from the date of such casualty (employing normal construction methods without overtime or other premium), Landlord shall forthwith at its expense repair such damage exclusive of damage to Tenant’s Property. If the fire or other casualty occurs during the last 18 months of the Term or the last 18 months prior to the expiration of the 10th year of the Term and In the reasonable opinion of the Architect the repairs will take more than six months to complete, Tenant may elect to terminate this Lease as of the date of such casualty by notice delivered to Landlord not more than 10 working days after receipt of the Architect’s opinion, in which event Landlord shall not be obligated to repair such damage.

6.2 Major Damage to Premises. If all or part of the Premises are rendered untenantable by damage from fire or other casualty whether to the Premises or the Building which, in the reasonable opinion of the Architect, cannot be substantially repaired under applicable laws and governmental regulations within 270 days from the date of such casualty (employing normal construction methods without overtime or other premium), then either Landlord or Tenant may elect to terminate this Lease as of the date of such casualty by notice delivered to the other not more than 10 working days after receipt of the Architect’s opinion, failing which, Landlord shall forthwith at its expense, repair such damage exclusive of damage to Tenant’s Property.

6.3 Abatement. The Rent payable by Tenant hereunder shall be proportionately reduced to the extent that the Premises are untenantable by Tenant for its business, from the date of such casualty until the earlier of:

(a) 5 days after completion by Landlord of the repairs to the Premises (or part thereof rendered untenantable) or the end of such extended period as in the opinion of the Architect, Tenant, acting diligently and expeditiously, would reasonably require to repair other improvements which Tenant may have installed, including without limitation Special Tenant Improvements (to the extent same may have been damaged); or

(b) the date Tenant again uses the Premises (or part thereof rendered untenantable) in its business;

provided however that Rent payable by Tenant hereunder shall not be reduced if the damage is caused by any act or omission of Tenant, its agents, servants, employees or any other person entering upon the Premises under express or implied invitation of Tenant, unless Landlord is entitled to be, and is, reimbursed for such Rent by the receipt of insurance proceeds.

6.4 Major Damage to Building. If all or a part of the Building is rendered untenantable by damage from fire or other casualty to such a material or substantial extent that, in the opinion of Landlord, the Building should be totally or partially demolished, whether or not to be reconstructed in whole or in part, either Landlord or Tenant may elect to terminate this Lease as of the date of such casualty by notice delivered to the other not more than 60 days after the date of such casualty, and thereupon Tenant shall vacate the Premises expeditiously and as soon as is reasonably practicable.

19

6.5 Reconstruction by Landlord. If all or any part of the Premises are at any time rendered untenantable as set out in this Article, and neither Landlord nor Tenant elects to terminate this Lease in accordance with the rights granted herein, Landlord shall, following such destruction or damage, commence diligently to reconstruct, rebuild or repair that part of the Premises or the Building which was damaged or destroyed, but only to the extent required above. If Landlord elects to repair, reconstruct or rebuild according to plans and specifications and working drawings other than those used in the original construction of the Premises, the nature, quality and functionality of the facilities and services in the Premises as repaired or re-built will be reasonably similar to those in the Premises prior to the damage or destruction, having regard, however, to the age of the Premises at such time.

6.6 Architect’s Certificate. Whenever for any purpose of this Article an opinion or certificate of the Architect Is required, the same shall be given in writing to both Landlord and Tenant. Landlord covenants that it shall request such opinion or certificate promptly following the event which gives need for same and shall cause the Architect to act diligently and expeditiously. The certificate of the Architect shall bind the parties:

(a) as to whether or not the Premises are untenantable and the extent of such untenantability; and

(b) with respect to the time required for and the date upon which the Landlord’s work or Tenant’s work of reconstruction or repair Is commenced or completed or substantially completed and the date when the Premises are rendered tenantable.

If either Landlord or Tenant wishes to make representations or reasonable objections to the Architect regarding the Architect’s opinions in the certificate, the parties shall have an opportunity to do so forthwith and the certificate will not be binding until the Architect has considered the representations or objections and amended the certificate if the Architect deems such amendment appropriate.

6.7 Limitation of Liability. Except as specifically provided in this Article, there shall be no reduction or abatement of Rent and Landlord shall have no liability to Tenant by reason of any injury to or interference with Tenant’s business or property arising from fire or other casualty, howsoever caused, or from the making of any repairs resulting therefrom in or to any portion of the Building, Premises, or Project.

ARTICLE 7

INJURY TO PERSON OR PROPERTY

7.1 Indemnity of Landlord. Tenant agrees that:

(a) Except only to the extent caused by Landlord’s gross negligence, willful misconduct, or willful omission, Landlord shall not be liable for any bodily injury to or death of, or loss or damage to any property belonging to, Tenant or its employees, invitees or licensees or any other person in, on or about the Premises, the Building, or the Project or for any interruption of any business carried on in the Premises and, without limiting the generality of the foregoing, in no event shall Landlord be liable:

(i) for bodily Injury or death of anyone which results from fire, explosion, earthquake, flood, falling plaster, steam, gas, electricity, water, rain, snow, dampness or leaks from any part of the Premises or the Building or from the pipes, appliances, electrical system, plumbing works, roof, subsurface or other part or parts of the Premises , the Building, or the Project or the streets, lanes and other properties adjacent thereto; or

20

(ii) for any damage, injury or death caused by anything done or committed by Tenant or any of its servants or agents or by any other person in the Premises; or

(iii) for the non-observance or the violation of any provision of any of the rules and regulations of Landlord in effect from time to time or of any lease by another tenant of premises In the Building or the Project or of any concessionaire, employee, license, agent, customer, officer, contractor or other invitee of any of them, or by anyone else;

(iv) for any act or omission (including theft, malfeasance or negligence) on the part of any agent, contractor or person from time to time employed by Tenant to perform janitorial services, security services, supervision or any other work in or about the Premises; or

(v) for loss or damage, however caused, to money, securities, negotiable instruments, papers or other valuables of Tenant or any of its servants or agents;

(b) Tenant releases and discharges Landlord from any and all actions, causes of action, claims, damages, demands, expenses and liabilities which Tenant now or hereafter may have, suffer or Incur which arise from any matter for which Landlord is not liable pursuant to subsection (a) above, notwithstanding that negligence or other conduct of Landlord or anyone for whose conduct the Landlord is responsible may have caused or contributed to such matter; and

(c) Tenant shall and does hereby indemnify and save harmless Landlord in respect of:

(i) all claims for bodily injury or death, property damage or other loss or damage arising from the conduct of any work by or any act or omission of Tenant or any assignee, subtenant, agent, employee, contractor, invitee or licensee of Tenant, and in respect of all costs, expenses and liabilities incurred by Landlord in connection with or arising out of all such claims, without limitation including the expenses of any action or proceeding pertaining thereto;

(ii) any loss, cost, expense or damage suffered or incurred by Landlord arising from any breach by Tenant of any of its obligations under this Lease; and

(iii) all costs, expenses and Outlays that may be incurred or paid by Landlord in enforcing against Tenant the covenants, agreements, obligations and representations of the Tenant set out in this Lease.

21

7.2 Environmental Matter. Any other provision of this Lease to the contrary notwithstanding, Tenant shall be liable to Landlord for and does hereby hold harmless and indemnify Landlord, its officers, employees and agents and the successors and permitted assigns of Landlord from and against all losses, costs, liabilities, claims, damages, expenses, demands, suits, actions or other proceedings, judgments, penalties and fines (including, without limiting the generality of the foregoing, direct losses, costs, damages and expenses of Landlord, including any reduction in the market value of any or all of the Premises, the Building and the Project, damages for loss, or restriction in the use of rentable space, or of an amenity of the Premises, the Building, or the Project, damages arising from any adverse impact on marketing of space, and sums paid in settlement of claims, legal fees, solicitor-client costs, consultant fees and expert fees) which arise during or after the Term and are in any manner based upon, arise out of or are connected with the presence or suspected presence of any waste, as that term is defined in the Waste Management Act, S.B.C. 1979 c.41, as amended from time to time, toxic or hazardous substances in, on or under the Premises, the Building, or the Project or any other contamination, Including that resulting from waste, an unhealthful, hazardous or dangerous condition, caused by, contributed to or aggravated by the Tenant’s violation of any laws, ordinances, regulations or requirements pertaining to solid or other wastes, chemicals, oil and gas, toxic, corrosive or hazardous materials, air, water (surface or ground water) or noise pollution and the storage, handling, use or disposal of such matter (except to the extent the waste, toxic or hazardous substances or any other contaminants are present as a result of the negligence or wilful misconduct of Landlord), including, without limitation, costs incurred in connection with any investigation of site conditions or any clean-up, remedial, removal or restoration work required by any federal, provincial or municipal government agency.

ARTICLE 8

ASSIGNMENT AND SUBLETTING BY TENANT

8.1 Conditions.

(a) Except as specifically provided In this Article, Tenant shall not assign or transfer this Lease or any interest herein, or In any way part with possession of all or any part of the Premises, or permit all or any part of the Premises to be used or occupied by any other person whether by operation of law or otherwise. Any assignment, transfer, or subletting or purported assignment, transfer, or subletting except as specifically provided herein shall be null and void and of no force or effect and shall render null and void any and all options or rights to renew this Lease, any options or rights to additional space and any options or rights to parking space.

(b) If and whenever Tenant shall wish or purport to assign this Lease or any interest herein, or sublet all or part of the Premises, Tenant shall furnish Landlord all information, particulars and documents in respect of such purported assignment or sublet as Landlord may reasonably require.

(c) The rights and interests of Tenant under this Lease shall not be assignable without Landlord’s prior written consent, which consent shall not be unreasonably withheld.

(d) Landlord may reasonably withhold its consent to an assignment of this Lease or a sublease of all or part of the Premises by Tenant:

(i) INTENTIONALLY DELETED;

22

(ii) to an assignee, subtenant, occupier, or other person whatsoever, inconsistent, in the opinion of Landlord, with the character of the Premises, the Building, the Project, or its other tenants;

(iii) if either or both of Sections 8.3 and 8.4 has or have not been fully complied with; or

(iv) to any assignee or subtenant which does not propose to occupy and use the Premises for the conduct therein of its own business.

(e) No assignment, transfer, or subletting or use or occupation of the Premises by any other person whether or not permitted under this Article shall in any way release or relieve Tenant of its obligations under this Lease unless such release or relief is specifically granted by Landlord to Tenant in writing.

(f) Landlord’s consent to an assignment, transfer, or subletting or use or occupation of the Premises by any other person shall not be deemed to be a precedent or a consent to any subsequent assignment, transfer, subletting, use, or occupation.

(g) Landlord’s expenses and Outlays incurred in the consideration of any assignment or subletting, or any request therefor, and any documentation attendant on any consent of Landlord, shall be borne by Tenant.

8.2 Assignment and Subletting. Tenant shall not assign or mortgage this Lease or sublet the whole or any part of the Premises unless it shall have first requested and obtained the consent in writing of Landlord thereto. Any request for such consent shall be in writing and shall be accompanied by a true copy of any offer to take an assignment or sublease which Tenant may have received as well as a copy of the proposed assignment or sublease or mortgage and the Tenant shall furnish to the Landlord all information available to the Tenant or requested by the Landlord as to the business and financial responsibility and standing of the proposed assignee or subtenant.

8.3 Right to Assign or Sublet. Section 8.2 above notwithstanding, Tenant shall have the following rights to assign or sublet all or a portion of the Premises (together with any of the renewal rights set forth in Sections 14.2 and 14.3 which have not then yet been exercised but excluding the rights set forth in Sections 14.4 and 14.5) at any time during the Term or either of the First Extended Term and the Second Extended Term:

(a) Tenant shall have the right to sublet all or a portion of the Premises at any time during the Term or either of the First Extended Term and the Second Extended Term, subject to the approval of the Landlord, such approval not to be unreasonably withheld and provided Tenant shall continue to be bound for its obligations under this Lease, and provided that upon Tenant notifying Landlord of Tenant’s intent to assign any of its interest in the Lease to a third party, Landlord shall have the right to terminate this Lease and relieve the Tenant from its obligations hereunder (except that Landlord shall not have the right to terminate this Lease if the proposed assignment is part of a transaction whereby Tenant is selling all or substantially all of its business as carried on in the Building to a bona fide third party, or the proposed assignment is to a third party that requires the Special Tenant Improvements in the operation of its business); and

23

(b) Tenant shall have the right to assign or sublet all or a portion of the Premises at any time during the Term or either of the First Extended Term and the Second Extended Term without Landlord’s approval, provided that the assignee or sublessee is a company affiliated with or related to Tenant, and Tenant shall continue to be bound by its obligations under this Lease.