Certain confidential information contained in this document, marked by brackets, has been omitted because it is both (i) not material and (ii) would be competitively harmful if publicly disclosed.] COAL SALES AGREEMENT between THE FALKIRK MINING...

Exhibit 10.1

[Certain confidential information contained in this document, marked by brackets, has been omitted because it is both (i) not material and (ii) would be competitively harmful if publicly disclosed.]

between

THE FALKIRK MINING COMPANY

and

RAINBOW ENERGY CENTER, LLC

dated as of June 30, 2021

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

ANNEXES

Annex A Riverdale Coal Field and Xxxxxxxxx Coal Field

Annex B Sublease Agreement

Annex C Adjustment of Fixed General and Administrative Costs

Annex D Adjustment of Agreed Profit

Annex E Guaranty

i

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

SCHEDULES

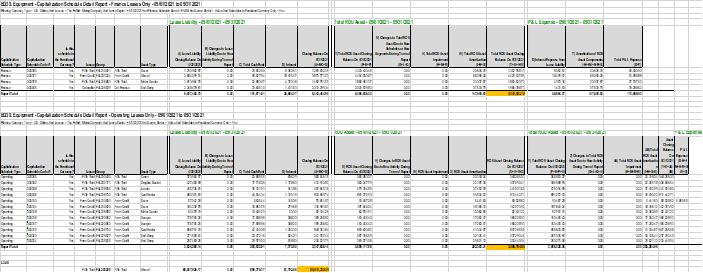

Schedule 3.1(b)(ii) GRE-Arranged Loans and Leases

Schedule 3.1(b)(iii) Falkirk Receivables

Schedule 3.1(b)(v) Description of Falkirk Receivable Owed by GRE

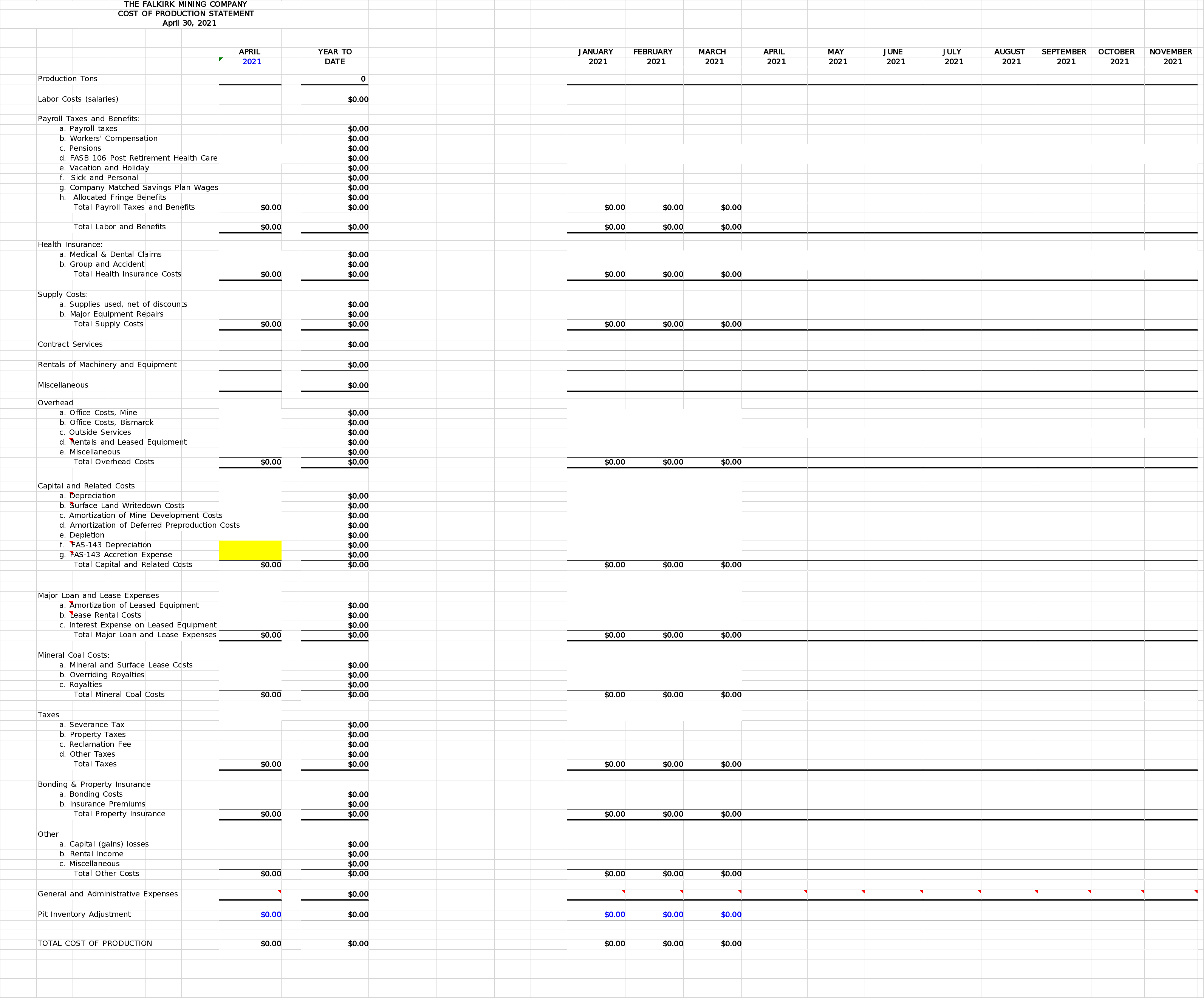

Schedule 6.1 Form Monthly Cost of Production Report

Schedule 10.1(a)(i) Falkirk Real Property

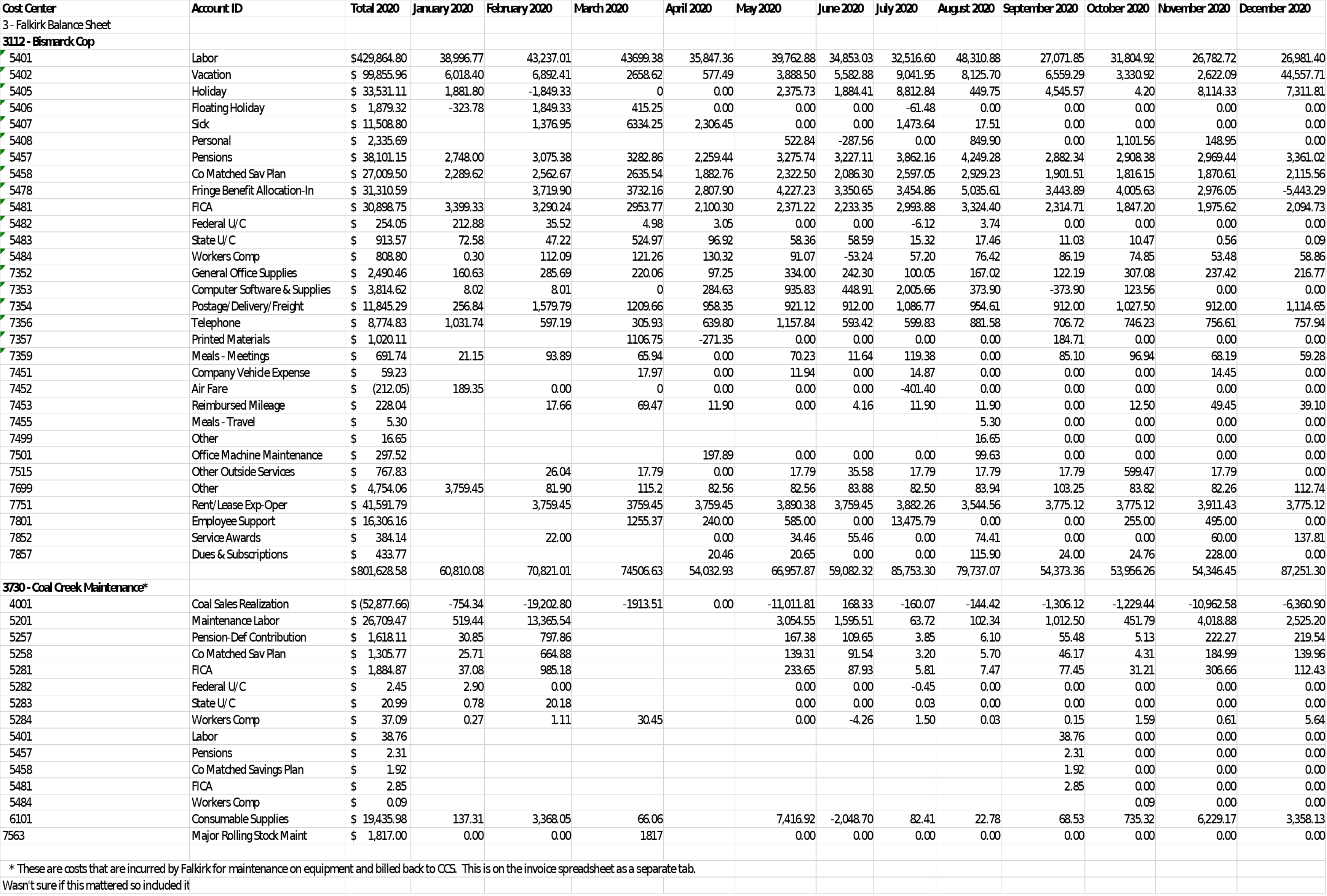

Schedule 12.1(b) Costs of Affiliates

ii

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

OTHER AGREEMENTS

Funding Agreement

Guaranty

Human Resources Services Agreement

Mortgage

Option Agreement

Option to Lease Pore Space

Pipeline Easement

Pore Space Lease Agreement

Right of First Refusal Agreement

iii

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

THIS COAL SALES AGREEMENT (this “Agreement”) is made as of June 30, 2021, but effective for all purposes as of the Effective Date, is between THE FALKIRK MINING COMPANY, an Ohio corporation qualified to do business in North Dakota (“Falkirk”), and RAINBOW ENERGY CENTER, LLC, a North Dakota limited liability company (“Rainbow”).

RECITALS

A.Rainbow has agreed to purchase from Great River Energy (together with its Affiliates or predecessors in interest, “GRE”) a coal-fired electric generating station called Coal Creek Station (“Coal Creek Station”) that has two 605 megawatt generating units and is located in Township 145 North, Range 82 West near the Missouri River approximately 50 miles north of Bismarck, between the cities of Xxxxxxxx and Underwood, XxXxxx County, North Dakota.

B.Falkirk, a wholly owned subsidiary of The North American Coal Corporation (“North American Coal”), developed a coal mine to supply the fuel requirements of Coal Creek Station from the Xxxxxxxxx Coal.

C.Falkirk and GRE first entered into a Coal Sales Agreement dated as of July 1, 1974 (as amended and restated, the “GRE CSA”), for Falkirk supplying the coal requirements of Coal Creek Station from the Xxxxxxxxx Coal, and in connection therewith, entered into a Funding Agreement (“GRE Funding Agreement”), Option Agreement, Mortgage and related documents, all as amended (together with the GRE CSA, the “GRE-Falkirk Agreements”).

D.On the Effective Date, the GRE-Falkirk Agreements will be terminated and Falkirk and GRE will enter into a termination agreement and release of claims under the GRE-Falkirk Agreements (the “Release”).

E.Commencing on the Effective Date, Rainbow and Falkirk wish to have Falkirk continue to supply the coal requirements of Coal Creek Station, hereinafter referred to as “Rainbow Station,” and are entering into this Agreement and certain other agreements referenced below in connection therewith.

F.Rainbow and Falkirk acknowledge the material benefits of Rainbow purchasing Coal Creek Station from GRE and keeping it operational as long as practicable.

AGREEMENT

Falkirk and Rainbow hereby agree as follows:

ARTICLE 1

DEFINITIONS

1.1.Definitions. As used in this Agreement, the following terms have the following meanings:

1

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

“Affiliate” means, with respect to any Person, each other Person that owns or controls, directly or indirectly the Person, any Person that controls or is controlled by or is under common control with the Person.

“Agreed Profit” has the meaning given to such term in Section 4.4.

“Annual Mining Plan” has the meaning given to such term in Section 2.3(b)(i).

“Applicable Law” means any law (including common law), statute, regulation, ordinance, rule, code, order or governmental requirement of, enacted, promulgated, entered into or imposed by, any Governmental Authority. For clarity, Applicable Law does not include executive orders unless they are grounded in a federal statutory mandate specifically giving the President the authority to make law on that topic, or in a Congressional delegation of authority.

“ASC 715” means FASB Accounting Standards Codification 715, Compensation – Retirement Benefits.

“Bankruptcy Event” means, with respect to a Party: (i) the Party or its controlling Affiliate commences a voluntary case under any chapter of the United States Bankruptcy Code or consents to (or fails to contest in a timely manner) the commencement of an involuntary case against it under the United States Bankruptcy Code; (ii) the insolvency of the Party or its controlling Affiliate (other than as a result of a Party withholding payment of amounts due hereunder); (iii) the filing of a voluntary or involuntary petition in bankruptcy with respect to the Party or its controlling Affiliate; (iv) the appointment of a receiver or trustee for the benefit of creditors of the Party or its controlling Affiliate; and (v) the execution by the Party or its controlling Affiliate of an assignment for the benefit of creditors.

“Banks” has the meaning given such term in Section 3.4.

“Business Day” means any day that is not a Saturday, Sunday or a day on which commercial banks in the State of North Dakota are required or permitted to be closed.

“CapX Cap” has the meaning given such term in Section 2.3(c)(iv).

“Coal Creek Station” has the meaning given such term in the Recitals.

“Commission” has the meaning given to such term in Section 3.4.

“Commission LOC” has the meaning given to such term in Section 3.4.

“Confidential Information” has the meaning given to such term in Section 13.1(a).

“Cost of Production” has the meaning given to such term in Section 4.2.

2

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

“CPI-U” means the Consumer Price Index – All Urban Consumers (CPI-U), U.S. city average all items, Series ID: CUUR0000SA0 on the base 1982-1984=100, published by the Bureau of Labor Statistics of the United States Department of Labor, provided that if at any time during the Term the base of the CPI-U is revised from such base or a new base is adopted, then for the purposes hereof, the published index will be adjusted so as to be in the correct relationship to the applicable base set forth in such definition, and if the CPI-U or any equivalent of such index ceases to be published by any federal agency, such index will be replaced by that index which, after necessary adjustment, if any, provides the most reasonable substitute upon which the Parties mutually agree.

“Early Termination Option” has the meaning given to such term in Section 9.3(a).

“Earned Surplus” has the meaning given to such term in Section 6.4(f).

“Effective Date” means the date on which (i) the conditions precedent thereto set forth in Section 3.4 and in Section 3.5 have been satisfied, (ii) Rainbow’s purchase of Coal Creek Station has closed and (iii) the Release has been executed and delivered.

“Emergency” means a sudden and unexpected occurrence, the nature of which Falkirk reasonably determines (based on information then available) requires prompt action in order to preserve or protect life or property, prevent damage, maintain production, prevent disruption in deliveries, or comply with Applicable Laws, and which Falkirk determines, based on the information known to Falkirk at the time, does not afford Falkirk sufficient time to obtain advance approval from Rainbow of such remedial or preventative action.

“Enforcement Exceptions” means enforceability may be limited by applicable bankruptcy, insolvency, reorganization or other Laws affecting the enforcement of creditor’s rights generally, and the availability of equitable remedies is subject to the discretion of the court before which any such proceeding may be brought.

“Falkirk’s Mine” means all mining areas developed or to be developed by Falkirk in the Xxxxxxxxx Coal.

[****] has the meaning given such term in Section 10.1(a)(ii).

“Falkirk Real Property” has the meaning given such term in Section 10.1(a)(i).

“Funding Agreement” means the Funding Agreement dated as of the date hereof, between the Parties, or any replacement thereof.

“GAAP” means United States generally accepted accounting principles consistently applied.

“GRE” has the meaning given such term in the Recitals.

“GRE CSA” has the meaning given such term in the Recitals.

3

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

“GRE-Falkirk Agreements” has the meaning given such term in the Recitals.

“GRE Funding Agreement” has the meaning given such term in the Recitals.

“Guaranty” has the meaning given such term in Section 3.5.

“Guaranty LOC” has the meaning given such term in Section 3.5.

“HR Services” has the meaning given to such term in Section 4.3(e).

“HR Services Agreement” has the meaning given to such term in Section 4.3(e).

“Leases” has the meaning given to such term in Section 3.1(a).

“Life-of-Mine Plan” has the meaning given to such term in Section 2.3(a)(i).

“Loans” has the meaning given to such term in Section 3.1(a).

“Mortgage” means the Mortgage, Assignment of Leases, Rents and As-Extracted Collateral, Security Agreement, Financing Statement and Fixture Filing dated as of the date hereof, as amended, modified, supplemented, extended or restated from time to time.

“ND SMCRA” has the meaning given such term in Section 3.4.

“North American Coal” has the meaning given such term in the Recitals.

“Operating Contracts” has the meaning given such term in Section 6.4(g)

“Option Agreement” means the Option Agreement dated as of the date hereof between the Parties and an escrow agent that will be mutually agreed to and appointed by the Parties prior to the Effective Date.

“Option Properties” has the meaning given such term in Section 2.1(d).

“Parties” means Falkirk and Rainbow.

“Person” means any individual, sole proprietorship, partnership, limited liability company, joint venture, company, trust, unincorporated organization, association, corporation, institution, public benefit corporation, firm, joint stock company, estate, entity or government agency.

“Post-Production Costs” has the meaning given such term in Section 5.4.

“Post-Production Period” has the meaning given such term in Section 9.1(b).

“Production Period” has the meaning given such term in Section 9.1(a).

“Rainbow Entity” has the meaning given such term in Section 10.1(a).

4

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

“Rainbow Mine Representative” has the meaning given in Section 6.1.

“Rainbow Station” has the meaning given such term in the Recitals.

“Release” has the meaning given such term in the Recitals.

“REMC” means REMC Assets, LP, a North Dakota limited partnership and the owner of Rainbow.

“Right of First Refusal Agreement” means the Right of First Refusal Agreement dated as of the date hereof, among Rainbow, Falkirk and North American Coal.

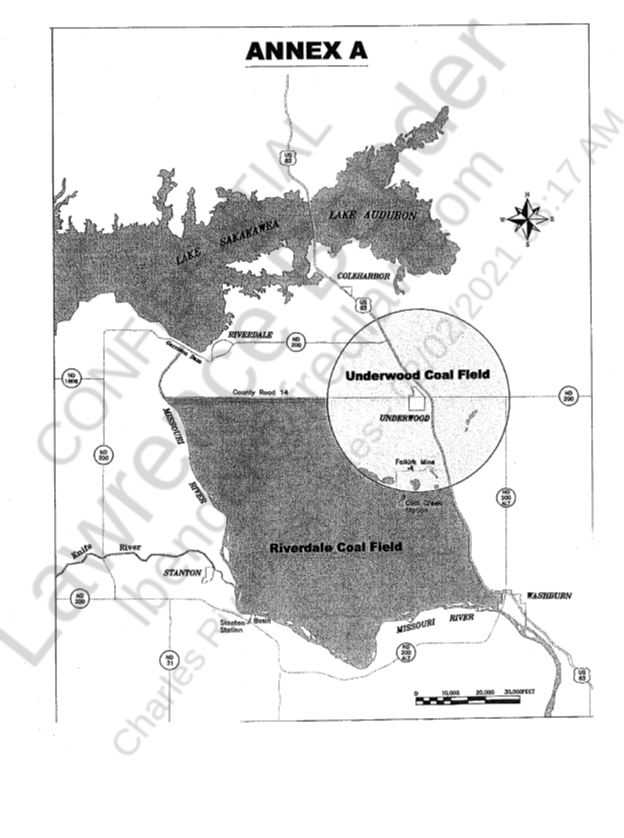

“Riverdale Coal Field” means that area bounded by the Missouri River to the west and south, County Road 14 to the north and Highway 83 to the east, as delineated in Annex A.

“Spiritwood Station” means GRE’s 99 megawatt heat and power plant located near Jamestown, North Dakota.

“Sublease Agreement” means the Sublease Agreement dated as of December 15, 1993, by and between Falkirk and North American Coal Royalty Company, which is attached hereto as Annex B.

“Term” has the meaning given such term in Section 9.1.

“Tier 1 Agreed Profit” has the meaning given such term in Section 4.4(b)(i).

“Tier 2 Agreed Profit” has the meaning given such term in Section 4.4(b)(ii).

“Ton” means a net ton of 2,000 pounds.

“Transaction Documents” means, collectively, this Agreement, the Option Agreement, the Guaranty, the Pore Space Option, the Right of First Refusal, the Funding Agreement, the Mortgage, and any other future agreement between Falkirk and Rainbow which contains a clause providing that “this Agreement shall constitute a Transaction Document as defined in the Coal Sales Agreement between the Parties”, all as amended, modified, supplemented, extended or restated from time to time.

“Xxxxxxxxx Coal” means all coal within the Xxxxxxxxx Coal Field and the Riverdale Coal Field that (i) Falkirk, North American Coal and other Affiliates of Falkirk has under lease or owned in fee as of the date of this Agreement, and (ii) after the date of this Agreement, that which Falkirk acquires in fee or by leasehold in accordance with Section 8.1.

“Underwood Coal Field” means that area located within a radius of five miles from the center of Underwood, North Dakota, as delineated in Annex A.

5

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

“Year” means a calendar year.

ARTICLE 2

REQUIREMENTS; MINING PLAN

2.1.Requirements. During the Production Period:

(a)Requirements. Rainbow hereby agrees to purchase and accept from Falkirk, and, subject to Section 2.1(c), Falkirk hereby agrees to sell and deliver to Rainbow, in accordance with the terms of this Agreement, the coal requirements of Rainbow Station and any affiliated projects located on the Rainbow Station site that utilize coal as a feedstock. Notwithstanding anything in this Agreement to the contrary, Rainbow shall not have a minimum purchase obligation with respect to the coal supplied and sold by Falkirk and this Agreement shall not constitute or be interpreted as a “take-or-pay” or “minimum take” contract.

(b)Exclusivity by Rainbow. Rainbow will purchase coal only from Falkirk as fuel for Rainbow Station. Rainbow agrees it will operate Rainbow Station exclusively on Falkirk’s coal, and not on natural gas or any other fuel. For the avoidance of doubt, Rainbow shall not be prohibited from constructing and operating additional facilities at or near the Rainbow Station site which utilize fuel sources other than coal.

(c)Production Capability. The quantity of coal to be mined and delivered by Falkirk will not exceed the production capability of Falkirk’s Mine. When any increase in Rainbow’s coal requirements occurs which necessitates the acquisition by Falkirk of additional equipment or real property interests, Falkirk will not be obligated to supply such increased requirements until such time as it is reasonably capable to acquire and install such additional equipment, acquire such real property interests and do all other things necessary to supply such increased requirements.

(d)Nominations; Scheduled Deliveries; Option Properties. Within fifteen days after the date hereof, and by April 1 of each Year commencing in 2022, Rainbow shall deliver to Falkirk a non-binding notice setting forth the approximate number of Tons of coal it intends to consume the next Year, along with an annual projection of Tons it intends to consume in each of the following four Years and a listing of Falkirk Real Property that Rainbow desires to purchase from Falkirk, by legal description, including township, range and section number (“Option Properties”). Such nomination shall include Rainbow’s best estimate of the number of Years remaining in the Production Period, if then known. Scheduled deliveries will be in approximately equal monthly amounts. Rainbow has the right to reduce planned shipments, including but not limited to, for and during shutdowns of a unit or units of Rainbow Station. In the event Rainbow so reduces planned shipments, the Parties shall meet and attempt in good faith to agree to actions Falkirk will take to reduce Cost of Production during the period of reduced shipments.

6

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

2.2.Description of Coal. During the Production Period:

(a)Source; Size. The coal to be sold and delivered hereunder will be from Falkirk’s Mine and will be crushed mine-run coal having a top size of one and one-half inches (1-1/2”) or such larger size as Rainbow may specify in a written notice to Falkirk. Exposed coal from different locations in Falkirk’s Mine will be blended as requested by Rainbow to the extent feasible.

(b)Contamination. Falkirk will deliver the coal so as to be reasonably free from contamination but Falkirk makes no representations or warranties as to the inherent quality and characteristics of the Xxxxxxxxx Coal.

(c)Overburden Removal. Falkirk will consult with Rainbow from time to time in advance of removing overburden as to the areas in which such removal will occur so that to the extent practicable the blend of coal delivered under this Agreement will be most suitable for consumption at Rainbow Station.

(d)Quality. The Parties agree that the quality of coal delivered to Rainbow Station has a major impact on the operation and production economics of Rainbow Station, and periodically, or at the request of Rainbow, the Parties will meet to discuss the quality of delivered coal and to determine what corrective actions, if any, are necessary to improve delivered coal quality.

(e)Point of Delivery. Unless otherwise agreed to in writing by Rainbow and Falkirk, delivery of coal for use at Rainbow Station will be made f.o.b. the bottom of Falkirk’s silo at the tail pulley of Rainbow’s conveyor belt, in the area adjacent to Rainbow Station.

2.3.Mining Plans.

(a)Life-of-Mine Plan.

(i)Within ninety days of Rainbow’s delivery of an initial nomination, Falkirk will prepare and provide to Rainbow in writing a mining plan covering the life-of-mine requirements (the “Life‑of‑Mine Plan”) for the development, construction, and operation of Falkirk’s Mine, to furnish from Falkirk’s Mine the coal requirements of Rainbow under this Agreement. The Life‑of‑Mine Plan will be based on the principle of recovering the most economic reserves from within Falkirk’s Mine over the Production Period. The Life‑of‑Mine Plan will be prepared in accordance with sound engineering and design practices and Applicable Laws and will include, but not be limited to, production schedules, staffing and equipment requirements, estimated costs per Ton using the cost categories identified in Article 4, a property acquisition plan, schedule and estimated budget, method of operation, anticipated coal quality characteristics, reclamation and permitting schedules, estimated capital budget containing estimates of all capital expenditures, commitments, and Loan/Lease requirements,

7

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

operating cost estimates, mine projection maps, mine progression and reserve studies, and other documentation reasonably requested by Rainbow. Falkirk will permit Rainbow's representatives to participate in the development of the Life‑of‑Mine Plan and any revisions thereto.

(ii)Upon receipt of the Life‑of‑Mine Plan, Rainbow will review it for reasonableness and completeness. Within sixty days of receipt of the Life-of-Mine Plan, Rainbow will meet with Falkirk to jointly review the proposed Life-of-Mine Plan. Within forty-five days of the conclusion of such review, Rainbow will provide notice to Falkirk of Rainbow's approval of, or Rainbow's suggested modifications to, the proposed Life-of-Mine Plan. If Rainbow suggests modifications to the proposed Life-of-Mine Plan, Rainbow will advise Falkirk of the reasons for such modifications, and Rainbow and Falkirk will meet promptly and attempt in good faith to resolve their differences with respect to the proposed Life-of-Mine Plan. If Rainbow requires a change to the plan to which Falkirk objects, Falkirk shall deliver a written explanation of its reasons for objecting within ten days of Rainbow’s requirement. If Rainbow and Falkirk are unable to resolve such differences within fifteen days after Rainbow proposes such modifications, Falkirk will revise and resubmit the proposed Life-of-Mine Plan as requested by Rainbow, and Falkirk is released from any performance failures or liabilities associated with the required change.

(b)Annual Mining Plan.

(i)On or before August 1 of each Year during the Term, Falkirk will provide to Rainbow in writing a detailed mining plan covering the operation of Falkirk’s Mine for the next Year (the “Annual Mining Plan”) that conforms substantially to the Life-of-Mine Plan. If Rainbow and Falkirk agree that current circumstances require that the Annual Mining Plan differ in any material respect from the Life-of-Mine Plan, Falkirk will review and revise, if necessary, the Life‑of‑Mine Plan based on the then‑current circumstances including the designation of annual deliveries provided by Rainbow in the notice given pursuant to Section 2.1(d). Falkirk will provide documentation of such revised Life-of-Mine Plan consistent with the requirements of Section 2.1(a).

(ii)Such Annual Mining Plan will include, but not be limited to, the following items for activities during the following Year: maps showing planned mine progression, location of infrastructure, and capital project locations; mining operations schedules showing acres disturbed, overburden removed, coal recovered by seam, anticipated coal quality by seam, equipment working schedules, and labor requirements; a reclamation plan showing areas to be regraded, planted or otherwise subject to reclamation activities and a permitting and bonding schedule; an estimated capital budget containing detailed, itemized estimates of all capital expenditures, commitments, and Loan/Lease requirements, including indicative terms for any proposed acquisition of capital assets by

8

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

Falkirk; an estimate of all operating costs and expenses in such detail as required to estimate the Cost of Production, along with estimated employee headcounts and such other information as Rainbow may reasonably request; an estimated monthly cash flow statement containing estimates of the cash requirements for capital and operating budgets; a projection of the next four years of operations in such detail as directed by Rainbow, which will include assumptions as to coal stockpile size(s) and location(s); and such other information as directed by Rainbow.

(iii)Approval of Annual Mining Plan. Within sixty days after receipt by Rainbow of an Annual Mining Plan, and, if applicable, a revised Life-of-Mine Plan, Rainbow will give Falkirk notice of Rainbow's approval or disapproval of such Annual Mining Plan (including specific approval of any acquisition of capital assets by Falkirk) and, if applicable, revised Life-of-Mine Plan. If Rainbow does not give Falkirk such notice within sixty days after Rainbow's receipt thereof, Rainbow will be deemed to have approved such mining plan(s). If Rainbow disapproves an Annual Mining Plan or any portion(s) thereof, Rainbow will advise Falkirk of the reasons for such disapproval, and Rainbow and Falkirk will meet promptly, but no more than ten Business Days after such disapproval was expressed, and attempt in good faith to resolve their differences with respect to the Annual Mining Plan. If Falkirk objects to a disapproval, it shall promptly deliver a written explanation of its reasons for objecting. If Rainbow and Falkirk are unable to resolve such differences within such ten Business Days, Falkirk will adopt such changes to the Annual Mining Plan as requested by Rainbow, Falkirk will submit a revised Annual Mining Plan within ten Business Days following the failure of Rainbow and Falkirk to resolve such differences and Falkirk will be released from any performance failures or liabilities associated with the matter to which Falkirk objected.

(c)Falkirk’s Mine Operation.

(i)Falkirk will consult with and keep Rainbow advised of the status of Falkirk's activities related to Falkirk’s Mine during the Term in such manner as Rainbow may reasonably request.

(ii)Rainbow and Falkirk will meet quarterly (or at such other times as needed or requested by either Party) to review the status of Falkirk's activities related to Falkirk’s Mine during the Term.

(iii)Falkirk will not make any capital expenditures unless they are reflected in a capital budget approved by Rainbow as part of an Annual Mining Plan or unless otherwise specifically approved by Rainbow; provided, however, Falkirk will have the right during any year to make capital expenditures required in the event of an Emergency without advance approval by Rainbow. Provided, however, if the nature of the Emergency and the time elements involved do not allow sufficient time to obtain Rainbow's approval of such capital expenditure

9

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

before it is incurred, Falkirk will subsequently and promptly (but not later than two Business Days after such occurrence) give Rainbow notice thereof.

(iv)Falkirk will have the right, without the specific written approval of Rainbow, to exceed the amount for any specific capital expenditure in any budget approved by Rainbow by up to five percent, provided that in no event will any such excess expenditure exceed $[****] (the “CapX Cap”) (subject to adjustment pursuant to Section 4.2(c)(iii)) or such other amount as mutually agreed to by the Parties in any year. If Falkirk desires Rainbow's approval to exceed a specific line item, budgeted, capital expenditure by more than five percent or more than the CapX Cap or such other amount as mutually agreed to by the Parties in any Year, Falkirk will make such request by written notice as soon as practicable, and if Rainbow neither approves nor disapproves such request within fifteen Business Days after Falkirk's delivery thereof, Rainbow will be deemed to have approved such request.

(v)Except in the event of an Emergency, no material modification of or material deviation from the approved Annual Mining Plan will be made without the written approval of Rainbow, which approval will not be unreasonably withheld.

(vi)Rainbow shall have the right but not the obligation to have at Falkirk Mine a Rainbow representative to observe operations at Falkirk Mine. The Rainbow representative shall be selected by Rainbow and any costs incurred for the Rainbow representative shall be paid for by Rainbow and not Falkirk.

ARTICLE 3

LOANS AND LEASES; RECLAMATION BONDING

3.1.Certain Background Information.

(a)Defined. In order to meet its coal supply obligations, Falkirk has required and will require loans for the acquisition of mineral coal and surface lands and loans or leases for the construction and equipping of Falkirk’s Mine (“Loans” and/or “Leases”). Advances (within the meaning of the Funding Agreement) will be deemed to be Loans and Leases under this Agreement.

(b)GRE-Arranged Loans and Leases. Pursuant to the GRE-Falkirk Agreements:

(i)Prior to the Effective Date, from time to time since first entering into the GRE CSA, GRE arranged for Loans and Leases for Falkirk.

(ii)The outstanding Loans and Leases arranged by GRE for Falkirk as of May 31, 2021 are described on Schedule 3.1(b)(ii). By the fifteenth day of

10

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

each month prior to the Effective Date, and within fifteen days after the Effective Date, Falkirk shall deliver to Rainbow an updated version of Scheduled 3.1(b)(ii).

(iii)The outstanding receivables owed by GRE to Falkirk as of May 31, 2021 are described on Schedule 3.1(b)(iii). By the fifteenth day of each month prior to the Effective Date, and within fifteen days after the Effective Date, Falkirk shall deliver to Rainbow an updated version of Scheduled 3.1(b)(iii).

(iv)In connection with the transactions contemplated hereby, Rainbow has assumed the Loans and Leases so arranged by GRE for Falkirk.

(v)In connection with the transaction contemplated hereby, Rainbow has assumed payment responsibility for the receivables owed to Falkirk as reflected on Schedule 3.1(b)(v). Schedule 3.1(b)(v) shall be identical to the version of Section 3.1(b)(iii) that is delivered after the Effective Date, except that it will exclude any receivables owed by GRE to Falkirk in respect of the Falkirk pension plan.

3.2.Rainbow-Arranged Loans and Leases.

(a)Use of Falkirk Excess Cash. Falkirk will use any cash in its accounts, except an amount equal to its Earned Surplus and any proceeds from the sale of land pursuant to Section 10.1(a), for one or more of the purposes set forth in Section 3.1(a) before requesting additional Loans and Leases.

(b)Rainbow-Arranged. From the Effective Date through the end of the Post-Production Period, Rainbow agrees to arrange for Loans and Leases in amounts sufficient for continued equipping and operating Falkirk’s Mine to the capacity required for producing the quantity of coal to be furnished under this Agreement and in accordance with the approved Annual Mining Plans.

(i)Rainbow will (A) provide Loans and Leases directly to Falkirk, (B) arrange for Loans and Leases for the benefit of Falkirk directly from third persons with Rainbow, (C) direct Falkirk to borrow or lease from third persons or (D) combine Rainbow’s Loans and Leases with those of third persons. So long as this Agreement is in effect, Rainbow will be responsible for and will provide, arrange for or direct such continued or additional Loans and Leases as may be necessitated by replacement of or addition to Falkirk’s mineral coal and surface lands, equipment, by the expiration of any lease of equipment to Falkirk prior to the expiration of the Term or by the need for additional working capital, in each case to equip Falkirk’s Mine to the capacity required for producing the quantity of coal to be furnished hereunder in accordance with Rainbow’s then requirements.

(ii)If Falkirk proposes to acquire a piece of replacement equipment that has not been approved in an Annual Mining Plan and has an acquisition cost in excess of $[****], Rainbow and Falkirk will meet to discuss whether such

11

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

acquisition is preferred or whether an alternative lease of such equipment is preferred.

(iii)If the Loans and Leases are arranged with third persons, Rainbow has the right subsequently to discharge the Loans and Leases and substitute itself as lender or lessor for the balance of the term of such Loans and Leases.

(iv)Any Loans and Leases provided, arranged for or directed by Rainbow in the exercise of its rights and obligations under this Section 3.2 will not be less favorable to Falkirk than Loans and Leases for the same term which could be obtained by Falkirk directly. If Falkirk has any objection under the previous sentence to financing proposed by Rainbow, it will notify Rainbow of such objection thirty days before Rainbow becomes committed to such financing.

(v)In connection with any financing pursuant to this Section 3.2, and pursuant to the Funding Agreement, Falkirk will create a security interest in any or all assets of Falkirk in favor of Rainbow, or as directed in writing by Rainbow, any other lender to Falkirk and/or any guarantor of any Loan to Falkirk and/or any lender or guarantor of any lender to Rainbow with respect to funds which Rainbow makes available to Falkirk under this Section 3.2, all as directed by Rainbow.

(c)Negative Pledge. Falkirk will not incur any debt or pledge or encumber any assets owned by it in fee or any leasehold interests which it may hold except as has been approved in writing by Rainbow in each instance.

(d)Failure to Arrange Loans and Leases. If Rainbow fails to make arrangements for any Loans or Leases requested by Falkirk and in consequence Falkirk is unable to produce the tonnage of coal required by Article 2, Falkirk will be deemed to have fulfilled its obligations under Article 2 hereof if it produces and sells to Rainbow the quantity of coal which can be produced from time to time from Falkirk’s Mine developed with the funds or arrangements so provided or arranged by Rainbow.

3.3.Credit Documents. In connection with any Loans or Leases arranged by Rainbow, Falkirk will enter into such credit documents as Rainbow or Rainbow’s financing sources may reasonably require from time to time, including credit documents related to any financing provided or to be provided, the granting of liens, mortgages or other security interests, the making of affirmative or negative covenants, the making of representation and warranties, the issuing of note or notes, related to defaults and remedies on such default or such other matters related to any or all such Loans or Leases as Rainbow or (at its direction) Rainbow’s financing sources may require from time to time.

3.4.Reclamation Bonding. Falkirk holds the North Dakota Public Service Commission (“Commission”) mine permit for Falkirk’s Mine. Under the North Dakota version of the Surface Mining Control and Reclamation Act (N.D. Century Code Title 38 Chapter 14.1 or “ND SMCRA”), the mine permit holder is obligated to conduct mine reclamation and to post a

12

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

performance bond to ensure that if the permit holder fails to conduct such reclamation, the Commission can cause it to occur. Notwithstanding ND SMCRA, Falkirk and Rainbow have agreed as a matter of contract that Rainbow is solely responsible to pay for mine reclamation as required under ND SMCRA.

As of the date hereof, the Commission estimate of the cost to complete final mine reclamation is $[****], and the Commission requires a performance bond in that amount. In the future, the Commission may require a higher amount of performance bond. Throughout the Term, Rainbow will continually provide a sufficient performance bond as required by the Commission, and its applicable laws and regulations, to ensure for final mine reclamation under the mine permit.

Initially, Rainbow and the Commission have agreed that Rainbow shall meet its obligation to provide such performance bond as follows: BNC National Bank and Bank of North Dakota (the “Banks”) shall issue a letter of credit in favor of the Commission equal to the Commission estimate of the cost to complete final mine reclamation (the “Commission LOC”). The Commission will be able to draw in whole or part on the Commission LOC if Falkirk fails to perform final mine reclamation, resulting in permit forfeiture. Rainbow will cause the Banks to deliver the Commission LOC to the Commission, and the Commission shall accept the Commission LOC as the required performance bond, on or before the Effective Date. Falkirk will cooperate with Rainbow in providing certain Falkirk Real Property as security to the Banks. The Banks’ delivery of the Commission LOC to the Commission, and the Commission’s acceptance of the Commission LOC as the required performance bond, is a condition precedent to Falkirk’s obligations under this Agreement, and the Effective Date shall not occur until such delivery and acceptance has occurred.

Thereafter, Rainbow will meet its obligation to provide the performance bond to the Commission in such manner as is acceptable to the Commission from time-to-time. In the event that Rainbow fails to provide such performance bond in a timely manner as determined by the Commission, Falkirk may immediately execute on the Guaranty and the Guaranty LOC in accordance with their terms and the terms of this Agreement.

In the event that the Commission, the North Dakota Department of Trust Lands and the U.S. Department of the Interior, Office of Surface Mining, Reclamation and Enforcement agree in the future that Falkirk Real Property (including any Falkirk Real Property acquired and held by Rainbow or Rainbow Entity pursuant to the terms of this Agreement) can be posted as collateral for the applicable performance bonding requirements, Falkirk and/or Rainbow or Rainbow Entity will attempt in good faith to agree to pledge Falkirk Real Property to meet all or part of the collateral requirements associated with the performance bond requirement associated with the mine permit for Falkirk’s Mine. In the event that Falkirk Real Property is so pledged, the Advances, as defined in the Funding Agreement, related thereto shall be deemed to be repaid during the applicable pledge period, but shall be reinstituted should such property cease being pledged.

3.5 Guaranty and Guaranty LOC. The Parties acknowledge that the Commission will not permit Falkirk to draw on the Commission LOC in the event that Rainbow fails to

13

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

perform under a Transaction Document and such failure prevents Falkirk from performing reclamation. In order to provide a source of funds to Falkirk in the event of such a failure, Rainbow shall cause REMC to execute and deliver to Falkirk on the date hereof, a payment and performance guaranty in substantially the form attached hereto as Annex E, obligating REMC to pay amounts due and perform obligations owing to Falkirk under the Transaction Documents (the “Guaranty”). The Guaranty obligates REMC, after the occurrence of a failure to maintain a required amount of “Net Tangible Asset Value,” as defined in the Guaranty, to cause a Bank to provide a letter of credit in favor of Falkirk in the amount of the shortfall in Net Tangible Asset Value (the “Guaranty LOC”). REMC’s execution and delivery to Falkirk of the Guaranty on the date hereof, and its demonstration to Falkirk’s satisfaction that REMC will, as of the Effective Date, have the required amount of Net Tangible Asset Value is a condition precedent to Falkirk’s obligations under this Agreement, and the Effective Date shall not occur until such execution, delivery and demonstration has occurred. REMC’s failure to maintain and perform under the Guaranty or REMC’s failure to maintain the Net Tangible Asset Value minimum under the Guaranty accompanied by REMC’s failure to maintain and perform under the Guaranty LOC, will constitute a breach of this Agreement that has a material adverse effect on Falkirk.

ARTICLE 4

PRICE FOR COAL

4.1.Determination of Price. Rainbow will pay for the Xxxxxxxxx Coal sold and delivered during the Production Period at a price which annually equals the Cost of Production plus the Agreed Profit.

4.2.Cost of Production. Except as otherwise expressly stated herein, “Cost of Production” for the purposes of this Agreement means the costs actually incurred by Falkirk in the mining, processing and delivery of Xxxxxxxxx Coal under this Agreement. Such costs will be determined and allocated in accordance with GAAP (except as otherwise expressly stated in this Section 4.2), consistently applied and will include the following, subject to Section 4.3:

(a)Production, Maintenance and Delivery Costs. All production, maintenance and delivery costs including without limitation the following types of costs, but excluding any costs which are general and administrative costs defined in, and subject to the fixed charge under Section 4.2(c):

(i)Labor costs, which include wages and the costs of all related payroll taxes, benefits, post-retirement medical benefits and fringes including welfare and defined contribution plans, worker’s compensation coverage, group insurance, vacations and other comparable benefits of corporate officers and employees of Falkirk located at Falkirk’s Mine and employees of Affiliates of Falkirk located in North Dakota, whose labor costs are properly charged directly to Falkirk’s Mine.

(ii)Supplies and major repairs, including materials utilized in the operation of Falkirk’s Mine.

14

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

(iii)Contract services.

(iv)Rental of machinery and equipment, but excluding any payments under leases as specified in Section 4.2(d)(i).

(v)Miscellaneous costs, including membership costs for membership by Falkirk and Falkirk employees in one national industry association or trade group (such as the National Mining Association or similar group), or such other industry associations as specifically approved by Rainbow, in writing, to be charged to the Cost of Production.

(vi)Reasonable and necessary services by other than Affiliates of Falkirk.

(vii)Insurance.

(viii)Taxes and fees, but not including income taxes, imposed by any governmental authority.

(ix)Overhead costs, which include travel, telephone, internet, wifi, postage, office machine costs and other office maintenance costs, business expenses and training costs for employees of Falkirk and employees of Affiliates of Falkirk located in North Dakota whose costs are properly charged directly to Falkirk’s Mine.

(x)Development costs, which will be amortized ratably.

(xi)Reclamation and other costs, including labor and supplies, required to comply with regulations of federal, state or local governments not otherwise included as an element of cost herein.

In the event the Parties dispute whether a cost is a properly charged Cost of Production, the Parties shall analyze the treatment by Falkirk and GRE of similar costs included on pre-Effective Date invoices under the GRE CSA as a component of resolving the dispute.

(b)Coal and Surface Costs. Coal and surface costs:

(i)The tonnage royalty under leases (including a proration of lease bonus payments, rental payments and other capitalized leasehold expenses), appraisals, easements, surface damage payments, third party xxxxxxx costs, lease renewal payments, drilling and exploration payments, recording fees, property taxes (including reimbursement to private owners if industrial taxes are greater than agricultural taxes), current delay rental on surface and coal lands and all other current expense of maintaining leaseholds, including reasonable attorneys’ fees and other legal expenses for abstracts and title opinions and for land and lease title curative or research activities but excluding royalty payments made by

15

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

Falkirk under the Sublease Agreement to any Affiliate of Falkirk and any other overriding or other royalties payable by Falkirk to any Affiliate of Falkirk;

(ii)Depletion of the capital cost of any coal acquired by Falkirk in fee, based upon estimated reserves; and

(iii)[****] ($[****]) per Ton of either fee or leasehold coal mined from the Xxxxxxxxx Coal Field only as required by agreements in existence prior to the Effective Date, which shall be paid by Falkirk to CSTL LLC, a Delaware limited liability company, or its successors and assigns.

Provided, however, that Falkirk shall credit against the amounts described in clauses (i), (ii) and (iii) above an amount equal to all third party lease income derived from Falkirk Real Property (e.g., consideration for entering into and holding easement, access and lease agreements, farming and grazing rents) and any interest income on cash posted by Rainbow to satisfy its obligation to post a performance bond in favor of the Commission as required in Section 3.4.

(c)General and Administrative Costs. General and administrative costs:

(i)The sum of $[****] (which will be adjusted as set forth in Section 4.2(c)(iii)) will be added for general and administrative costs, prorated for partial years during the Production Period and Post-Production Period.

(ii)General and administrative costs that are to be covered by such amount (and will not be otherwise included in the Cost of Production) are:

(A)General accounting and billing expense for those functions performed at other than Falkirk’s Mine,

(B)except as otherwise provided in Sections 4.2(a)(i) and 4.2(a)(ix), salaries and related expenses, such as payroll taxes, pensions and worker’s compensation, of corporate officers and employees of Falkirk and officers and employees of Affiliates of Falkirk, unless such expenses (other than pension) relate to periods of time when such officers or employees were employees of Falkirk or are specifically approved by Rainbow, in writing, to be charged to the Cost of Production or are subject to Sections 4.2(a)(i) or 4.2(a)(ix),

(C)reasonable travel, telephone, postage and office maintenance expense for persons or services included in general and administrative costs,

(D)memberships and contributions of Affiliates of Falkirk, audit expense of Falkirk and Affiliates of Falkirk, legal expense of Falkirk and Affiliates of Falkirk, except (x) legal expense that is connected with

16

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

financing of Falkirk and capitalized as part of the financing, and (y) reasonable legal expense associated with the acquisition and maintenance of coal leases or surface lands owned or held by Falkirk, or such other legal expenses that are specifically approved by Rainbow, in writing, to be charged to the Cost of Production, and

(E)insurance expense incurred by Affiliates of Falkirk (other than premiums and deductibles paid by North American Coal but attributable to Falkirk coverage under the North American Coal corporate policy).

(iii)The amount set forth in Section 4.2(c)(i) for general and administrative costs and the CapX Cap will be adjusted annually, beginning on January 1, 2022 for the Year 2022, and on January 1 of each Year thereafter in the percentage by which the CPI-U for December of the previous Year differs from the CPI-U for October of 2021. An example calculation illustrating such annual adjustment calculation is set forth in Annex C.

(d)Capital-Related Costs. Capital-related costs:

(i)Rent paid to a lessor or owner of a lessor under Leases (including interest thereon, if any) as the same will become due and payable, excluding, however, any amounts becoming due and payable pursuant to any default, acceleration or optional payment provision of any Lease that is not triggered by an act, omission or decision of Rainbow.

(ii)Depreciation and/or amortization to which Falkirk is entitled, the rates of which will be determined by Falkirk in accordance with GAAP from time to time. The Parties agree that the initial assumption for the useful life of life-of-mine assets will be based on a ten-year Production Period and the equipment’s projected operational period, if any, during the Post-Production Period, to be assessed for change periodically in accordance with GAAP. No depreciation or amortization will be included in the Cost of Production with respect to items of property for which a lessor under a Lease has taken depreciation or amortization and included the same in computing the rent under such Lease. Unless the Parties mutually agree otherwise or GAAP otherwise requires, the rates of such depreciation and/or amortization will be limited to a straight-line basis over the anticipated useful service life of the assets and will not exceed the maximum deduction allowable under applicable federal income tax laws and regulations. Rainbow will be entitled to the correction from time to time in accordance with GAAP of anticipated useful service lives to conform to experience.

(iii)Net gains or losses on the dispositions of capital assets will be credited or charged, as the case may be, to the Cost of Production.

17

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

(iv)Transactions between Falkirk and any one or more of its Affiliates involving capital assets (including contributions to the capital of Falkirk) will be reflected in Falkirk’s accounts at cost to the Affiliates of the assets involved, less accrued depreciation, as shown by the accounts of the transferring company, or fair market value if it is greater than depreciated cost.

(e)Certain Tax Matters.

(i)The amount of any investment tax credit under Section 38 of the United States Internal Revenue Code or similar subsequent provisions of said Code which is realized by Falkirk will be credited to current Cost of Production. Falkirk will claim such investment tax credits, or similar subsequent tax benefits, at the times and in the amounts that will produce the greatest tax savings to Falkirk and resulting credits to Rainbow.

(ii)Falkirk shall be entitled to depletion tax benefits associated with the severance and sale of Xxxxxxxxx Coal.

(f)Interest; Loan and Lease Expense. The amount of interest, Loan and Lease commitment fees currently due and payable and amortization of other expenses incurred in connection with Falkirk obtaining Loans and Leases (to the extent not otherwise provided for under Section 4.2(d)), accrued by Falkirk with respect to the Loans and Leases less interest or dividends received by Falkirk on its investments.

4.3.Certain Agreements Regarding Costs and Related Matters.

(a)Computation. The Cost of Production will be computed on a Yearly basis. The Cost of Production will be determined on a cents per Ton basis by dividing the annual Cost of Production by the number of Tons produced by Falkirk hereunder in such Year. In the event that Falkirk or Rainbow identifies an opportunity to sell Xxxxxxxxx Coal to any third party at a profit or at a third party sale price that would lower the average per Ton Cost of Production for all Tons mined, the Parties shall meet to discuss whether Falkirk should agree to such third-party sales and, if so, any appropriate modification to this Agreement associated therewith. If the Parties are unable to agree to terms of third party sales, Falkirk shall have the right to sell to such third parties provided (i) it can still meet its obligations to Rainbow hereunder and (ii) Falkirk shall credit the Cost of Production associated with such third party sales to Rainbow on a monthly basis, and shall split with Rainbow 50%/50% the revenue associated with such third party sales, less the Cost of Production associated with such sales.

(b)Falkirk Affiliates. If any Costs of Production or Post-Production Period costs are incurred by an Affiliate of Falkirk and charged to Falkirk, they will be included only at the cost to such Affiliate without addition for any overhead, loading, intercompany or intracompany profit or service charge. Except as expressly set forth in this Agreement and specifically approved by Rainbow, Rainbow will not be charged for any costs incurred by Affiliates of Falkirk. In determining costs, Falkirk will give

18

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

Rainbow the proportionate benefit of volume purchases participated in by Falkirk and Affiliates of Falkirk.

(c)Falkirk Breach. If Falkirk fails to comply with its obligations under this Agreement for a reason unrelated to Rainbow’s failure to comply with its obligations under this Agreement, and such failure results in incremental Cost of Production, Rainbow will not be obligated to pay the first $[****] in such incremental Cost of Production per Year.

(d)Certain Fines and Penalties. Costs of Production and Post-Production Costs will exclude fines and penalties imposed against Falkirk for violation of Applicable Laws by any governmental agency, administration, commission or body, with the exception of activities or conduct of Rainbow or activities or conduct of Falkirk that were specifically directed or otherwise approved by Rainbow.

(e)Administrative Support Services to Rainbow. Upon one hundred twenty days’ advance written notice by Rainbow, or at such other time agreed to in writing by the Parties, Falkirk agrees to provide certain administrative support services to Rainbow with respect to the employees of Rainbow working at Rainbow Station (“HR Services”), substantially in accordance with the form of Benefits and Human Resources Consulting Services Agreement reviewed by the Parties prior to the date hereof (the “HR Services Agreement”). Rainbow and Falkirk shall work together to attempt to streamline the administration and reduce the cost of HR Services. The specific scope of HR Services provided by Falkirk and the compensation paid to Falkirk for such services shall be detailed in and governed by the HR Services Agreement.

4.4.Agreed Profit. The “Agreed Profit” per Ton of coal delivered to Rainbow under this Agreement during the Production Period will be an amount determined as follows:

(a)Through May 31, 2024. From the Effective Date through May 31, 2024, it will be $[****] per Ton, and such amount will not be subject to adjustment.

(b)June 1, 2024 and On. From and after June 1, 2024, it will be an amount determined as follows:

(i)For all Tons of coal up to and including 5,600,000 Tons sold and delivered by Falkirk to Rainbow hereunder in any Year (prorated for partial years including 2024), the Agreed Profit expressed in January 1, 2021 dollars, will be $[****] per Ton as adjusted pursuant to Section 4.4(c) (“Tier 1 Agreed Profit”).

(ii)For all Tons of coal in excess of 5,600,000 Tons sold and delivered by Falkirk to Rainbow hereunder in any Year (prorated for partial years including 2024), the Agreed Profit, expressed in January 1, 2021 dollars, will be $[****] per Ton as adjusted pursuant to Section 4.4(c) (“Tier 2 Agreed Profit”).

19

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

(iii)For the partial year June 1, 2024 through December 31, 2024, the per Ton Agreed Profit shall be Tier 1 Agreed Profit for Tons delivered up to 3,266,667 Tons (5,600,000 Tons x 7 months / 12 months) and Tier 2 Agreed Profit as to any additional Tons.

(iv)Commencing on January 1, 0000, Xxxxxxx shall invoice Rainbow monthly for Agreed Profit on the basis of applying Tier 1 Agreed Profit to nominated Tons up to and including 5,600,000 Tons on an annualized basis and applying Tier 2 Agreed Profit to Tons in excess of 5,600,000 Tons on an annualized basis ratably over the course of the Year. For example, if Rainbow were to nominate 8,000,000 Tons for 2025 (5,600,000 Tier 1 Tons and 2,400,000 Tier 2 Tons) and Rainbow took delivery of 1/12 of such tonnage in January 2025, the January 2025 invoice would apply Tier 1 Agreed Profit to 466,667 Tons (1/12 of 5,600,000 Tons) and Tier 2 Agreed Profit to 200,000 Tons (1/12 of 2,400,000 Tons), producing a blended rate of Agreed Profit.

(v)If necessary, the Parties will agree to a true-up mechanism as to each Year after 2024 to ensure that Tier 1 Agreed Profit is applied to 5,600,000 Tons in such Year and that Tier 2 Agreed Profit is applied to Tons in excess of 5,600,000 Tons in such Year.

(c)Certain Adjustments for June 1, 2024 and On. The per Ton amounts set forth in Section 4.4(b) for periods from and after June 1, 2024 (but not the amount set forth in Section 4.4(a)) will be subject to adjustment starting as of June 1, 2024 based upon the change in the CPI-U for the twelve months ending in June of the previous year. An example calculation illustrating such annual adjustment calculation is set forth in Annex D.

ARTICLE 5

POST-PRODUCTION PERIOD

5.1.Falkirk Duties. Unless this Agreement is terminated earlier than the first day of the Post-Production Period, Falkirk will perform all work and services required during the Post‑Production Period in connection with the final closing of Falkirk’s Mine and completion of final reclamation work.

5.2.Post-Production Period Cost Minimization, Planning and Budgeting and Payments. With respect to the Post-Production Period:

(a)Minimization. In consultation and coordination with Rainbow, through the Annual Mining Plan process and otherwise, Falkirk agrees to use commercially reasonable efforts to minimize post-mining reclamation costs.

(b)Plans and Budgets; Payments. Within 90 days of a written request by Rainbow, Falkirk will submit to Rainbow for its review and written approval the proposed plans and budgets for Falkirk’s reclamation activities. Rainbow will not

20

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

unreasonably delay, condition or withhold its approval of such plans and budgets. In order to permit Falkirk to complete mine reclamation as required under ND SMCRA, Rainbow will pay amounts as invoiced by Falkirk, but shall provide written notice in the event that it disputes the validity of all or a portion of any invoice. In the event of such a dispute, the Parties shall attempt in good faith for a period of thirty days to resolve such dispute. In the event the Parties are unable to so resolve the dispute, the Parties shall conduct arbitration pursuant to Section 14.5. In the event Falkirk ultimately repays an amount paid by Rainbow but found not to be owing to Falkirk, Falkirk will refund such amount with interest from the date of payment by Rainbow to the date of reimbursement by Falkirk, accruing at a per annum rate of five percent. The reclamation costs payable under this Section 5.2(b) shall be determined in accordance with the principles for determining the Cost of Production under Section 4.2. After Rainbow’s written approval of such plans and budgets (or portions thereof), Falkirk will seek Rainbow’s prior written approval of any material changes to or from such plans and budgets. Falkirk will submit such reports regarding Falkirk’s activities and reclamation costs incurred as Rainbow may reasonably request from time to time. The Post-Production Costs payable under this Section 5.2(b) will be invoiced by Falkirk to Rainbow in accordance with Section 6.2. Rainbow or Rainbow’s representative has the right at any time on notice in writing to Falkirk to examine the records and books of account of Falkirk and any Affiliate of Falkirk relating to the Post-Production Costs to be borne by Rainbow under this Section 5.2(b).

(c)Exceptions. Reasonable bases for objection to an invoiced amount include the following: Rainbow believes in good faith, reasonably and based on objective data, that particular invoiced amounts are (A) not reasonable and verifiable, (B) not reasonably required to comply with applicable reclamation laws, (C) not related to or incurred in connection with surfaces disturbed by or in connection with Xxxxxxxxx Coal produced by Falkirk and sold hereunder or under the GRE CSA or (D) not incurred pursuant to and in accordance with plans and budgets (or portions thereof) approved in writing by Rainbow or GRE. Further, if Falkirk fails to comply with its obligations under this Agreement for a reason unrelated to Rainbow’s failure to comply with its obligations under this Agreement, and such failure results in incremental Cost of Production, Rainbow will not be obligated to pay the first $[****] in such incremental Cost of Production per Year.

5.3.Post-Production Period Payment Obligations for Retiree Medical Obligations

(a)Post-retirement medical benefits:

(i)Upon termination of coal deliveries hereunder, Rainbow shall pay for Falkirk’s unfunded accumulated post-retirement medical benefits obligation with respect to Falkirk employees, as determined in accordance with ASC 715, only to the extent that such costs are properly allocable to work performed by a Falkirk employee in connection with coal mined, processed and delivered to the

21

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

Rainbow Station, Spiritwood Station or to other locations specified by Rainbow or previously specified by GRE pursuant to this Agreement or the GRE CSA, or reclamation of surfaces disturbed by or in connection therewith. On or before September 1 of each Year until Falkirk ceases to accrue any additional employee post-retirement medical benefits obligation, Falkirk shall notify Rainbow of its unfunded accumulated post-retirement medical benefits obligation as of January 1 of such Year, as determined by the actuarial firm designated by Falkirk. Together with such notice, Falkirk shall provide Rainbow with reasonably detailed information regarding the actuary’s determination of such obligation. Within thirty (30) days after Rainbow’s receipt of such notice from Falkirk, Rainbow shall approve or disapprove the increase, if any, in Falkirk’s unfunded accumulated post-retirement medical benefits obligation for such Year. Such approval by Rainbow shall not be unreasonably withheld. In the event of any changes in ASC 715 or the interpretation thereof, Falkirk shall consult with Rainbow before implementing any change in the manner in which the unfunded accumulated post-retirement medical benefits obligation is determined.

(ii)The Parties acknowledge that the amount of Falkirk’s unfunded accumulated post-retirement medical benefits obligation is dependent, in part, on the portion of the post-retirement medical benefits that Falkirk elects to pay as an employer contribution. Accordingly, on or before September 1 of each Year, Falkirk shall notify Rainbow of the proposed percentage increase, if any, in Falkirk’s post-retirement medical benefits employer contributions for the following Year. Within thirty days of Rainbow’s receipt of such notice from Falkirk, Rainbow shall approve or disapprove the percentage increase, if any, in Falkirk’s proposed post-retirement medical benefits employer contributions for the Year under consideration from the amount of such contributions by Falkirk for the immediately preceding Year. Such approval by Rainbow shall not be unreasonably withheld. Falkirk agrees to provide such supporting information, as well as such access to its books and records, as Rainbow may reasonably request in order to review the proposed percentage increase, if any, in Falkirk’s post-retirement medical benefits employer contributions.

(iii)The Parties acknowledge that the amount of Falkirk’s unfunded accumulated post-retirement medical benefits obligation is dependent, in part, on the post-retirement benefits plans that Falkirk elects to offer to its employees. Accordingly, Falkirk agrees that, without the prior written approval of Rainbow, it shall not make any modifications in the provisions of Falkirk’s current post-retirement medical benefits plans that would cause an increase in the amount which Rainbow is required to pay for Falkirk’s unfunded accumulated post-retirement medical benefits obligation, except for any modifications required by Applicable Laws. Such approval by Rainbow shall not be unreasonably withheld.

(iv)Subject to Section 5.3(a)(i) hereof, Falkirk shall record on its books an account receivable from Rainbow in an amount equal to Falkirk’s

22

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

unfunded accumulated post-retirement medical benefits obligations. Upon request of Falkirk from time to time, Rainbow shall provide to Falkirk the funds necessary for Falkirk to pay the actual costs of Falkirk’s post-retirement medical benefits obligation for the Year under consideration.

(v)Disputes, if any, arising from this Section 5.3(a) shall be resolved by mutual agreement of the Parties or by arbitration pursuant to Section 14.5 hereof; provided, however, Rainbow shall be obligated to pay the undisputed portion of the post-retirement medical benefits obligation for the Year(s) under consideration. If a dispute involves a determination of whether or not Rainbow has unreasonably withheld its approval under this Section 5.3(a) with respect to Falkirk’s post-retirement medical benefits obligation (other than benefits provided by Falkirk under a collective bargaining agreement), such approval shall be deemed reasonably withheld if Falkirk is proposing to offer a post-retirement medical benefits program that provides net benefits in excess of the average post-retirement medical benefits program offered by other coal mining companies in North Dakota.

(b)This Section 5.3, as well as the other provisions of this Agreement that by their nature extend beyond the termination of this Agreement, shall survive the termination of this Agreement and shall remain in effect until all obligations are satisfied. Such other provisions include, without limitation, Section 2.1 (Requirements), Article 3 (Loans; Leases), Article 4 (Price for Coal), Article 5 (Post-Production), Section 6.1 (Reports and Audit), Article 12 (Representations and Warranties), Section 13.1 (Confidential Information), Section 14.2 (Assignment), Section 14.3 (Notices), Section 14.4 (Effect of Waiver), and Section 14.5 (Arbitration). Further, if the Effective Date shall have occurred prior to termination of this Agreement, the Guaranty, the Funding Agreement and the Mortgage shall continue until the latest to occur of (i) completion of all post-mining reclamation activities, and (ii) satisfaction of all obligations owed by Falkirk to Rainbow and all obligations owed by Rainbow to Falkirk, including those obligations described in this Section 5.3.

5.4.General and Administrative Costs; Reclamation Fee.

(a)General and Administrative Costs. During the Post-Production Period (but not more than a ten year period commencing with date on which the Production Period ends), and with respect to the twelve month period on each anniversary date thereof, Falkirk will be entitled to general and administrative costs in the amount referenced in Section 4.2(c)(i), as adjusted during the Production Period and throughout the Post-Production Period in accordance with Section 4.2(c)(iii), in an amount equal to:

(i)such adjusted general and administrative costs amount, times

(ii)a percentage equal to 100% less 10% for each such anniversary dates to be reached as of the end of such twelve month period (e.g., for the second twelve month period, it would be 100% less 10%, or 90% of the full charge, and

23

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

for the third twelve month period, it would 100% less 20%, or 80% of the full charge).

(b)Reclamation Fee. During the Post-Production Period (but not more than a ten year period commencing with date on which the Production Period ends), and with respect to the twelve month period on each anniversary date thereof, Falkirk will be entitled an annual amount for a reclamation fee equal to:

(i)$[****] adjusted annually, beginning on January 1, 2026 for the Year 2026, and on January 1 of each Year thereafter in the manner provided in Section 4.2(c)(iii), including throughout the Post-Production Period, times

(ii)a percentage equal to 100% less 10% for each such anniversary dates to be reached as of the end of such twelve month period (e.g., for the second twelve month period, it would be 100% less 10%, or 90% of such fee, for the third twelve month period, it would 100% less 20%, or 80% of such fee).

ARTICLE 6

CERTAIN OPERATIONAL MATTERS

6.1.Reports and Audit. On or before August 1 of each Year, Falkirk will furnish to Rainbow an estimate of the price of coal hereunder during the succeeding Year. On or before the twenty-fifth day of each month, Falkirk will furnish to Rainbow a detailed statement of the Cost of Production at Falkirk’s Mine for the preceding calendar month. Such statement initially will be in the form attached hereto as Schedule 6.1 and thereafter in such form to be agreed upon from time to time by the Parties. From time to time (but not more frequently than semiannually) Falkirk will furnish to Rainbow estimates in the form requested by Rainbow of future expenditures that will be a part of the Cost of Production or Post-Production Costs. Rainbow has the right at any time on notice in writing to Falkirk to examine the records and books of account of Falkirk and any Affiliate of Falkirk relating to the items and allocations of cost and production included in the computation of amounts payable by Rainbow hereunder. Payment or payments under Section 6.2 will not be deemed a waiver of any rights of Rainbow that the price or other amounts payable hereunder be corrected. Rainbow shall, at all times and without notice to Falkirk, have the right to have a designated representative of Rainbow (the “Rainbow Mine Representative”) present at Falkirk’s Mine and Falkirk’s offices located thereon. Rainbow shall advise Falkirk of the name and telephone number of the Rainbow Mine Representative and shall provide notice to Falkirk in the event of a change to the Rainbow Mine Representative. Rainbow agrees to defend and hold harmless Falkirk from and against any and all claims, damages or losses arising out of or incurred in connection with the Rainbow Mine Representative’s presence at Falkirk’s Mine, except to the extent any such claims, damages or losses arise out of or incurred in connection with the negligence or intentional misconduct of any employee, representative or agent of Falkirk or any other third-party present at Falkirk’s Mine.

6.2.Billing and Accounts. The monthly billing of coal sold and delivered hereunder or reclamation performed in a calendar month will be paid by the twenty-fifth day of the calendar month following the month of delivery. The billing of coal sold and delivered in each calendar

24

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

month will be based on the actual Cost of Production for the month plus the Agreed Profit or reclamation fee, as applicable, and fixed general and administrative costs as determined in accordance with this Agreement.

6.3.Weights.

(a)Scales. Unless otherwise agreed to in writing by Rainbow and Falkirk, the weight of the coal delivered to Rainbow Station hereunder will be determined by Falkirk on scales on silo conveyor belts adjacent to Rainbow Station near the point where delivery of coal is made. The make of scale to be used and the method(s) of installation will be subject to the agreement of Rainbow. Rainbow has the right to have representatives present at any and all times to observe the weighing of coal delivered hereunder. The accuracy of the scales will be tested and, if necessary, the scales will be corrected at least once every two weeks. Falkirk will permit Rainbow’s representatives to monitor the testing and correcting of said scales; provided, however, if Rainbow and Falkirk are not able to agree on such tests or adjustments or the methods thereof, the scale or methods of weighing will be tested and adjusted to a condition of accuracy by the appropriate North Dakota state department or agency, and the costs of such tests and adjustments will be shared equally between Falkirk and Rainbow.

(b)Adjustments to Quantities. If it is determined that the scale used to weigh coal delivered hereunder has been inaccurate, adjustment of the quantities of coal delivered hereunder will be made for half the period since the scale was last adjusted to an accurate condition.

6.4.Conduct.

(a)General Obligations.

(i)Falkirk will conduct its mining operations hereunder in a careful, good and workmanlike manner according to North Dakota surface mining practices prevalent in the field and with efficient and economical management and will conduct its mining operations in compliance with Applicable Laws, including those relating to mining operations and use of mining premises, air and water pollution and other environmental laws, rules and regulations. Falkirk will have no liability for violations of Applicable Laws by Rainbow. Rainbow will not be entitled to claim damages for breach of this Section 6.4(a)(i) unless it has given Falkirk written notice of a claim of breach and Falkirk has failed to cure the same within 90 days or discontinue conduct that cannot be cured within ninety days.

(ii)Falkirk will diligently attempt and use commercially reasonable efforts to undertake its obligations under this Agreement in an economical and efficient manner.

(b)Compliance with Reclamation Applicable Laws. Without limiting the generality of the foregoing, Falkirk will comply with all Applicable Laws and applicable

25

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

terms of surface and coal leases with respect to reclamation of all surface disturbed by or in connection with mining. Falkirk is aware that Rainbow’s water permit from the state of North Dakota involves in several respects the operations of Falkirk in the conduct of its mining and reclamation and Falkirk agrees to use commercially reasonable efforts needed to assist Rainbow to comply with the conditions of its said water permit. Falkirk will supply Rainbow with all available information requested by Rainbow in order to permit such compliance. Rainbow will supply water to Falkirk from its water supply facilities as needed for mining and final mine reclamation.

(c)Management. Falkirk will notify Rainbow of the names of the persons principally responsible for the operation of Falkirk’s Mine on a semi-annual basis. Falkirk will consider and discuss with Rainbow any comments it makes with respect to such persons, but Falkirk shall have absolute discretion with respect to employee advancement and disciplinary decisions.

(d)Inspection. Subject to Falkirk’s safety and other mine site rules, and after reasonable advance notice, Rainbow has the right and privilege at any time of entering Falkirk’s Mine in order to inspect or survey the same.

(e)Movable Property. Falkirk will not without the prior written consent of Rainbow use any movable property except in the performance of this Agreement. Certain Falkirk light vehicles are licensed for on-road use and are used on-road and off of Falkirk’s Mine for Falkirk business needs.

(f)Dividends. Falkirk will not declare dividends on its stock except out of Earned Surplus and in compliance with the Funding Agreement. “Earned Surplus” means without duplication net income for the most recent fiscal period and/or retained income since incorporation less dividends previously paid, as determined in accordance with GAAP and as certified to annually by Falkirk’s independent public accountants.

(g)Operating Contracts. Falkirk may determine that it is appropriate to enter into contracts with third parties to provide services to Falkirk in connection with performance of Falkirk's obligations hereunder (“Operating Contracts”). Falkirk's entry into any such Operating Contracts will not relieve Falkirk of any of its obligations under this Agreement. Falkirk shall provide Rainbow reasonable advance notice in the event Falkirk intends to enter into an Operating Contract with total annual consideration to the third party thereto in excess of $[****]. Rainbow will have the opportunity to review and comment on such Operating Contracts prior to Falkirk's execution thereof, and will provide comments as promptly as reasonably practicable, taking into consideration Falkirk's obligation to timely perform Falkirk's obligations hereunder.

6.5.Insurance.

(a)Falkirk Insurance Policies. Falkirk shall procure or cause to be procured and maintain or cause to be maintained in full force and effect commencing on the Effective Date all insurance coverages specified in this Agreement. All insurance

26

[****]=[CONFIDENTIAL PORTION HAS BEEN OMITTED BECAUSE IT (I) IS NOT MATERIAL AND (II) WOULD BE COMPETITIVELY HARMFUL IF PUBLICLY DISCLOSED]

coverages shall be in accordance with the terms of this Section 6.5 using companies authorized to do business in North Dakota. The insurance shall be of such available types, limits, coverages and amounts, deductible amounts and with such insurers as are consistent with the performance standard in Section 6.4(a), and the policies shall be applicable to Falkirk’s Mine, its assets and the operation of Falkirk’s Mine or operations incidental to Falkirk’s Mine and the personnel at Falkirk’s Mine or utilized in connection therewith. Such insurance shall include the following:

(i)Property Insurance. All-risk property insurance including coverage for physical damage to equipment with a limit of not less than $[****] valuation for all property.

(ii)Workers’ Compensation. The workers’ compensation policy shall include coverage for the statutory limits in North Dakota.