FIRST AMENDING AGREEMENT (May 31, 2007 Note Agreement)

Exhibit 99.8

FIRST AMENDING AGREEMENT

(May 31, 2007 Note Agreement)

THIS FIRST AMENDING AGREEMENT dated as of December 2, 2010 (this “Agreement”) to the Note Purchase Agreement dated as of May 31, 2007 (the “Note Agreement”) among Penn West Petroleum Ltd. (the “Company”) and the Purchasers listed in Schedule A attached thereto as holders (the “holders”) of the outstanding senior guaranteed notes (the “Notes”) of the Company issued thereunder.

1. The Company is effecting a reorganization of the Trust and its Subsidiaries on January 1, 2011 in accordance with the provisions of Section 23.1(b) of the Note Agreement, all as more fully described in the Plan of Arrangement as defined in the Arrangement Agreement dated November 10, 2010 among the Trust, the Company and certain Subsidiaries of the Trust (the “Reorganization”).

2. The Company and the holders wish to effect certain amendments to the Note Agreement in connection with such Reorganization as provided herein, to take effect on the Effective Date.

NOW THEREFORE, upon the satisfaction of the conditions precedent to the effectiveness of this Agreement set forth in Article 4 hereof, and for other good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the parties hereto agree with each other as follows:

ARTICLE 1

INTERPRETATION

1.1 Defined Terms. Capitalized terms used herein without express definition shall have the same meanings herein as are ascribed thereto in the Note Agreement.

1.2 Sections. The division of this Agreement into Sections and the insertion of headings are for convenience of reference only and shall not affect the construction or interpretation of this Agreement. The terms “this Agreement”, “hereof”, “hereunder” and similar expressions refer to this Agreement and not to any particular Section or other portion hereof and include any agreements supplemental hereto.

1.3 Governing Law. This Agreement shall be construed and enforced in accordance with, and the rights of the parties shall be governed by, the law of the Province of Alberta excluding choice of law principles of the law of such Province that would permit the application of the laws of a jurisdiction other than such Province.

ARTICLE 2

AMENDMENTS TO NOTE AGREEMENT

2.1 Prepayment Put on Change of Control. Section 8 of the Note Agreement is amended by adding the following Section 8.8 at the end of the Article:

“8.8. Prepayment Offer Without Make-Whole on Change in Control.

(a) Notice of Change in Control. The Company will, within 5 Business Days after any Responsible Officer has knowledge of the occurrence of any Change in Control, give written notice of such Change in Control to each holder of Notes. Such notice shall refer to this Section 8.8, shall contain and constitute an offer to prepay Notes as described in Section 8.8(b) and shall be accompanied by the certificate described in Section 8.8(e).

(b) Offer to Prepay Notes. The offer to prepay Notes contemplated by Section 8.8(a) shall be an offer to prepay, in accordance with and subject to this Section 8.8, all, but not less than all, the Notes held by each holder (in this case only, “holder” in respect of any Note registered in the name of a nominee for a disclosed beneficial owner shall mean such beneficial owner) on a date specified in such offer (the “Proposed Prepayment Date”), which date shall be not less than 30 Business Days and not more than 120 Business Days after the date of such offer (if the Proposed Prepayment Date shall not be specified in such offer, the Proposed Prepayment Date shall be the first Business Day after the 45th Business Day after the date of such offer).

(c) Acceptance/Rejection. A holder of Notes may accept the offer to prepay made pursuant to this Section 8.8 by causing a notice of such acceptance to be delivered to the Company not later than 15 Business Days after receipt by such holder of the most recent offer of prepayment, but in any event at least 10 Business Days prior to the Proposed Prepayment Date. A failure by a holder of Notes to respond to an offer to prepay made pursuant to this Section 8.8 shall be deemed to constitute a rejection of such offer by such holder.

(d) Prepayment. Prepayment of the Notes to be prepaid pursuant to this Section 8.8 shall be at 100% of the principal amount of such Notes, together with interest on such Notes accrued to the date of prepayment, but without the applicable Make-Whole Amounts or other premium.

(e) Officer’s Certificate. Each offer to prepay the Notes pursuant to this Section 8.8 shall be accompanied by a certificate, signed by a Senior Financial Officer of the Company and dated the date of such offer, specifying: (i) the Proposed Prepayment Date; (ii) that such offer is made pursuant to this Section 8.8; (iii) the principal amount of each Note offered to be prepaid; (iv) the interest that would be due on each Note offered to be prepaid, accrued to the Proposed Prepayment Date; (v) that the conditions of this Section 8.8 have been fulfilled; and (vi) in reasonable detail, the nature and date of the Change in Control.

(f) Certain Definitions.

(i) “Change in Control” means any circumstance arising after the date hereof in which a Person or a combination of Persons, acting jointly or in concert (within the meaning of Multi Lateral Instrument 62 104 — Take Over Bids and Issuer Bids of the Canadian Securities Administrator), acquires, prior to a Reorganization, Trust Units and, after a Reorganization, Equity Interests of the New Parent which, in either case, together with all other Trust Units or Equity Interests, as applicable, held by such Persons, constitute in the aggregate more than 35% of all outstanding Trust Units or Equity Interests, as applicable (regardless of whether such Person or Persons are owned or controlled by the same Persons which owned or controlled such Trust Units or Equity Interests, as applicable).

- 2 -

(ii) “Equity Interests” means in the case of a corporation, shares of capital stock of any class or series, including warrants, rights, participating interests or options to purchase or otherwise acquire any class or series of capital stock or securities exchangeable for or convertible into any class or series of capital stock, and in the case of any other Person or entity shall mean any class or series of partnership interests, units, membership interests or like interests constituting equity, and in the case of each of the foregoing, any part or portion thereof or participation in any of the foregoing.

(iii) “New Parent” means any Person or Persons who acquires, directly or indirectly, all of the trust units or all of the assets of the Trust in connection with a Reorganization and whose Equity Interests are issued to the holders of such trust units in exchange for and in replacement of the trust units of the Trust in connection with a Reorganization.”

2.2 Ownership of the Company and Restricted Subsidiaries. Section 9.15 of the Note Agreement is deleted and replaced with the following:

“9.15 Ownership of the Company and Restricted Subsidiaries.

The Company will ensure that at all times the Company and each Restricted Subsidiary, or their respective successors as permitted by Section 10.2, are directly or indirectly wholly-owned Subsidiaries of the Trust, or are Joint Venture Development Entities.”

2.3 Amendments to Financial Covenants. Section 10.5 of the Note Agreement is deleted in its entirety and replaced with the following:

(a) Consolidated Total Debt to Consolidated Total Capitalization. The Company will not permit Consolidated Total Debt to exceed 55% of Consolidated Total Capitalization as at the end of any fiscal quarter of the Trust, except that upon the consummation of a Material Acquisition and for a period extending to and including the end of the second full fiscal quarter of the Trust after the completion of the applicable Material Acquisition, the Company will not permit Consolidated Total Debt to exceed 60% of Consolidated Total Capitalization so long as the Trust would have continued to comply with the 55% threshold set out above as though such Material Acquisition had not been made during such period, and the Company provides evidence of such compliance in its compliance certificate delivered pursuant to Section 7.2(a) relating to each applicable fiscal quarter.

(b) Total Debt. The Company will not permit Consolidated Total Debt as at the end of any fiscal quarter of the Trust to exceed 400% of Consolidated EBITDA for the 12 months ending on the last day of such fiscal quarter.

(c) Senior Debt. The Company will not permit Consolidated Senior Debt as at the end of any fiscal quarter of the Trust to exceed 300% of Consolidated EBITDA for the 12 months ending on the last day of such fiscal quarter, except that upon the consummation of a Material Acquisition and for a period extending to and including the end of the second full fiscal quarter of the Trust after the completion of the applicable Material Acquisition, the Company will not permit Consolidated Senior Debt to exceed

- 3 -

350% of Consolidated EBITDA so long as the Trust would have continued to comply with the 300% threshold set out above as though such Material Acquisition had not been made during such period, and the Company provides evidence of such compliance in its compliance certificate delivered pursuant to Section 7.2(a) relating to each applicable fiscal quarter.”

2.4 Other Amendments.

(a) Section 10.7 of the Note Agreement is amended by replacing “own” with “directly own”.

(b) Section 10.10(c) of the Note Agreement is amended by replacing the term “Consolidated Total Assets” in the third line thereof with the term “Consolidated Tangible Assets”.

(c) Section 23.3 of the Note Agreement is deleted in its entirety and replaced with the following:

“23.3 Accounting Terms; Changes in GAAP.

(a) All accounting terms used herein which are not expressly defined in this Agreement have the meanings respectively given to them in accordance with GAAP. Except as otherwise specifically provided herein, all computations made pursuant to this Agreement shall be made in accordance with GAAP, and all financial statements shall be prepared in accordance with GAAP. If GAAP is changed such that unitholders’ equity of the Trust as shown on the consolidated balance sheet of the Trust as at the date hereof is recharacterized as a non-equity item, then Consolidated Unitholders’ Equity will be determined on the basis of GAAP as in effect immediately prior to such recharacterization and, for certainty, such unitholders’ equity as so recharacterized shall not be included as part of Consolidated Total Debt. In addition, if GAAP is changed to reclassify operating leases to capital leases, then the accounting treatment of all such leases will be determined based on GAAP in effect immediately prior to such reclassification.

(b) For purposes of determining compliance with the financial covenants contained in this Agreement, any election by the Company to measure an item of Debt using fair value (as permitted by Statement of Financial Accounting Standards No. 159, International Accounting Standard 39 or any similar accounting standard) shall be disregarded and such determination shall be made as if such election had not been made.

(c) If the Company or the Required Holders determine at any time that any amount required to be determined hereunder would be materially different if such amount were determined in accordance with:

(i) GAAP applied by the Company in respect of its financial statements on the date hereof (“Old GAAP”), rather than

(ii) GAAP subsequently in effect in Canada and applied by the Company in respect of its financial statements (including the adoption of IFRS) and utilized for purposes of determining such amount,

then written notice of such determination shall be delivered by the Company to the holders, in the case of a determination by the Company, or by the Required Holders to the Company and the other holders, in the case of a determination by the Required Holders.

- 4 -

(d) If the Company adopts a change in an accounting policy in the preparation of its financial statements in order to conform to accounting recommendations, guidelines, or similar pronouncements, or legislative requirements, and such change could reasonably be expected to adversely affect (i) the rights of, or the protections afforded to, the holders hereunder or (ii) the position of either the Company or of the holders hereunder, the Company shall so notify the holders, describing the nature of the change and its effect on the current and immediately prior year’s financial statements in accordance with Old GAAP and in detail sufficient for the holders to make the determination required of them in the following sentence. If either the Company or the Required Holders determine at any time that such change in accounting policy results in an adverse change either (A) in the rights of, or protections afforded to, the holders intended to be derived, or provided for, hereunder or (B) in the position of either the Company or of the holders hereunder, written notice of such determination shall be delivered by the Company to the holders, in the case of a determination by the Company, or by the Required Holders to the Company and the other holders, in the case of a determination by the Required Holders.

(e) The written notice to be provided pursuant to Section 23.3(c) or Section 23.3(d) by the Company or the holders (as the case may be) shall include a proposal with respect to the change in Old GAAP or such change in accounting policy, as the case may be, on how to preserve and protect the intended rights of, or protections afforded to, the holders on the date hereof or the position of the Company or the holders (as the case may be) and thereafter the Company and the holders shall in good faith negotiate to execute and deliver an amendment or amendments to this Agreement in order to preserve and protect the intended rights of, or protections afforded to, the holders on the date hereof or the position of the Company or the holders (as the case may be); provided that, until this Agreement has been amended in accordance with the foregoing, then for all purposes hereof, the applicable changes from Old GAAP or in accounting (as the case may be) shall be disregarded hereunder and any amount required to be determined hereunder shall, nevertheless, continue to be determined under Old GAAP and the Company’s prior accounting policy. For the purposes of this Section 23.3(e), the Company and the holders acknowledge that the amendment or amendments to this Agreement are to provide substantially the same rights and protections to the holders as is intended by this Agreement on the date hereof. Until the Company and the Required Holders mutually agree (in their respective sole discretions, without any obligation to so agree) on such amendment or amendments to the Agreement, the Company shall continue to determine amounts required under this Agreement in accordance with Old GAAP and, for all purposes hereof, the applicable changes from Old GAAP or in accounting (as the case may be) shall be disregarded hereunder and any amount required to be determined hereunder shall, nevertheless, continue to be determined under Old GAAP and the Company’s prior accounting policy.”

2.5 Additions to Defined Terms. Schedule B to the Note Agreement is amended by inserting the following defined terms in their proper alphabetical order:

“Canetic Convertible Debentures” means the 6.5% convertible unsecured subordinated debentures maturing on December 31, 2011 issued pursuant to the Canetic Debenture Indenture, to a maximum of Cdn.$229,649,000 in principal amount.

- 5 -

“Canetic Debenture Indenture” means in the case of the Canetic Convertible Debentures due December 31, 2011, the trust indenture dated December 17, 2002 originally among Acclaim Energy Inc., Acclaim Energy Trust and Computershare Trust Company of Canada, as amended and supplemented to the date hereof.

“Canetic LP” means Penn West PROP Limited Partnership, a limited partnership under the laws of Alberta, and its successors and permitted assigns.

“Canetic LP Partnership Agreement” means the limited partnership agreement dated August 29, 2006, in respect of the formation of Canetic LP, as amended, restated, supplemented, modified or replaced from time to time.

“Consolidated EBITDA” means, on a consolidated basis for any period, the aggregate of the net income of the Trust for any such period determined in accordance with GAAP,

| (a) | plus, to the extent deducted in the determination thereof, the sum of: |

(i) depreciation, depletion, amortization and accretion;

(ii) interest expense;

(iii) the all-in costs of funds of any accounts receivable securitization program;

(iv) all provisions for any federal, provincial or other income and capital taxes;

(v) the non-cash amounts (including non-cash losses) relating to foreign exchange transactions, hedging transactions, Trust Unit rights, and deferred non-cash taxes, and any other non-cash amounts which are added back in accordance with GAAP in the statement of cash flows of the Trust; and

(vi) any extraordinary or nonrecurring losses; and

| (b) | minus, to the extent added in the determination thereof, the sum of: |

(i) all non-cash amounts such as non-cash income and unrealized gains relating to hedging transactions; and

(ii) any extraordinary or nonrecurring gains.

Consolidated EBITDA will be adjusted for Material Acquisitions and to include or exclude, as applicable, Consolidated EBITDA associated with any acquisition or disposition (the net proceeds of which are greater than Cdn.$50,000,000 or its equivalent in the relevant currency of payment) made within the applicable period, as if that acquisition or disposition had been made at the beginning of such period (in a manner satisfactory to the Required Holders, acting reasonably).

“Consolidated Senior Debt” means with respect to the Trust and its Subsidiaries as of the date of any determination thereof, all indebtedness and obligations in respect of amounts borrowed which, in accordance with GAAP, on a consolidated basis, would be

- 6 -

recorded in the Trust’s consolidated financial statements (including the notes thereto), and in any event including, without duplication:

| (a) | the stated amount of letters of credit, letters of guarantee or surety bonds supporting obligations which would otherwise constitute Consolidated Senior Debt within the meaning of this definition; |

| (b) | proceeds from any accounts receivable securitization program; |

| (c) | obligations secured by any purchase money security interest (but excluding operating leases); |

| (d) | Capital Lease Obligations; |

| (e) | sale-leaseback obligations; |

| (f) | obligations secured by any Lien existing on property owned, whether or not the obligations secured thereby will have been assumed; and |

| (g) | guarantees in respect of obligations of another Person, including the types of obligations described in (a) through (f) above, |

excluding, to the extent included, the amount of any Subordinated Debt and Convertible Debentures then outstanding.

“IFRS” means International Financial Reporting Standards including International Accounting Standards and Interpretations together with their accompanying documents which are set by the International Accounting Standards Board, the independent standard-setting body of the International Accounting Standards Committee Foundation (the “IASC Foundation”), and the International Financial Reporting Interpretations Committee, the interpretative body of the IASC Foundation but only to the extent the same are adopted by the Canadian Institute of Chartered Accountants (“CICA”) as GAAP in Canada and then subject to such modifications thereto as are agreed by CICA.

“Joint Venture Development Entity” means, as to the Trust, any other Person in which the Trust directly or indirectly owns 50% or more of the outstanding equity and voting interests of such Person, and another Person at arms’ length to the Trust owns all of the remaining outstanding equity and voting interests, and either (A) the Trust controls the Person, or (B) each of the two owners have equal voting rights in the Person such that neither owner controls the Person; provided that each of the following conditions is met:

(a) for the purposes of any determination of Priority Debt, the entire amount of the Indebtedness of the Joint Venture Development Entity is included as Indebtedness regardless of whether or not only a proportionate share thereof is attributable to the interest of the Trust therein, or whether or not the application of GAAP or IFRS would provide for any contrary determination;

(b) for the purposes of all other financial determinations under this Agreement (including, without limitation, the covenants contained in Sections 10.5, 10.7 and 10.10 using the amounts of Consolidated Senior Debt, Consolidated Total Debt, Consolidated EBITDA, Consolidated Tangible Assets,

- 7 -

Consolidated Total Capitalization, Consolidated Unitholders’ Equity and Subordinated Debt), such determinations are made on the basis of proportionate accounting for the interest of the Trust in the Joint Venture Development Entity, regardless of whether the application of GAAP or IFRS would provide for any contrary determination;

(c) not more than Cdn.$50,000,000 in aggregate of the net income of all Joint Venture Development Entities that are not Restricted Subsidiaries is included in any determination of Consolidated EBITDA for any 12 month period;

(d) unless it is a Restricted Subsidiary, the Joint Venture Development Entity is not at any time liable for any Indebtedness that would form part of Consolidated Total Debt other than Indebtedness for working capital purposes where the principal amount of the aggregate working capital Indebtedness of all Joint Venture Development Entities that are not Restricted Subsidiaries does not at any time exceed Cdn.$50,000,000 (for the purposes of this determination, the entire amount of the working capital Indebtedness of the Joint Venture Development Entities shall be included as Indebtedness regardless of whether or not only a proportionate share thereof is attributable to the interest of the Trust therein, or whether or not the application of GAAP or IFRS would provide for any contrary determination);

(e) all of the Trust’s interest in each Joint Venture Development Entity that is a Restricted Subsidiary is either owned directly by the Trust, or indirectly through Subsidiaries of the Trust, each of which is at all relevant times a Restricted Subsidiary, or a combination thereof;

(f) a “Material Acquisition” does not include any acquisition by a Joint Venture Development Entity;

(g) the Trust, the Company or any Restricted Subsidiary has not made any contributions of capital or other form of equity investment in any Joint Venture Development Entities other than:

| (i) | (A) initial contributions of capital to all Joint Venture Development Entities consisting of assets (other than current assets not directly related to such contributed assets) of the Trust, the Company or any Restricted Subsidiary with any such assets so contributed valued at the book value thereof (determined in accordance with GAAP as at the effective date of the contribution of the assets in question), not exceeding the greater of (x) Cdn.$1,500,000,000 and (y) 10% of Consolidated Tangible Assets (to a maximum of Cdn.$2,500,000,000) in the aggregate, and (B) any ongoing capital contributions of cash or cash equivalents by the Trust, the Company or any Restricted Subsidiary to fund ongoing capital expenditures of Joint Venture Development Entities that are Restricted Subsidiaries, provided that such capital expenditures directly relate to |

- 8 -

| the then existing oil and gas properties of such Joint Venture Development Entity or any oil and gas properties which are adjacent to, or in the same or similar geographical or geological area as, such then existing oil and gas properties which have been acquired by such Joint Venture Development Entity; and |

| (ii) | contributions of capital made by the other owner of the Joint Venture Development Entity on behalf of the Trust, the Company or any Restricted Subsidiary which (A) are not funded or financed by the Trust, the Company or any Restricted Subsidiary, (B) are not directly or indirectly supported by any form of financial assistance by the Trust, the Company or any Restricted Subsidiary, and (C) do not give rise to any indebtedness of the Trust, the Company or any Restricted Subsidiary; and |

(h) concurrently with the delivery of the certificate required by Section 7.2(a), the Company completes and includes as part of such certificate the form of exhibit attached hereto as Exhibit 1.

“Outside Maturity Date” is defined in the definition of Convertible Debentures.

“Subordinated Debt” means all indebtedness for borrowed money created, incurred, assumed or guaranteed by the Trust, the Company or a Restricted Subsidiary and which is owing to a Person or Persons other than the Trust, the Company or a Restricted Subsidiary, provided the holders of such debt enter into a subordination and postponement agreement with the holders of the Note, which indebtedness has all of the following characteristics:

(a) an initial final maturity in respect of repayment of principal extending beyond the Outside Maturity Date at the time such Subordinated Debt is created, incurred, assumed or guaranteed, except to the extent that the Subordinated Debt is incurred to fund all or a portion of the cost of a Material Acquisition;

(b) no scheduled cash principal payments thereunder prior to the Outside Maturity Date at the time such Subordinated Debt is created, incurred, assumed or guaranteed, except to the extent that the Subordinated Debt is incurred to fund all or a portion of the cost of a Material Acquisition;

(c) such indebtedness shall be unsecured;

(d) upon the occurrence and during the continuance of any Default or Event of Default or the commencement of any proceedings in relation to dissolution, winding up, liquidation, receivership, insolvency or bankruptcy of the Trust, the Company or a Restricted Subsidiary, as applicable, such indebtedness shall be postponed, subordinate and junior in right of payment to all payment obligations under this Agreement or any guarantee thereof;

- 9 -

(e) upon the occurrence of any Default or Event of Default, such indebtedness shall have a standstill period of not less than six months; and

(f) such indebtedness shall not have any covenants, events of default or other terms and conditions (except for pricing) which are more restrictive than those contained in this Agreement,

but (i) does not in any event include Convertible Debentures, and (ii) shall, notwithstanding the foregoing, be deemed to include the Vault Convertible Debentures for all purposes of this Agreement as long as the Vault Convertible Debentures continue to have the characteristics listed above, other than the requirement to have an initial maturity date which is later than the Outside Maturity Date.

“Vault Convertible Debentures” means the 7.2% convertible unsecured debentures maturing May 31, 2011 issued pursuant to the Vault Debenture Indenture, to a maximum of Cdn.$26,221,000 in principal amount.

“Vault Debenture Indenture” means the trust indenture dated May 2, 2006 among Vault Energy Trust, Vault Energy Inc. and Canadian Western Trust Company, as amended and supplemented to the date hereof, governing the terms and conditions of the Vault Convertible Debentures.

2.6 Amendments to Existing Defined Terms. Schedule B to the Note Agreement is further amended as follows:

| (a) | by deleting the definition of “Consolidated Total Debt” in its entirety and replacing it with the following: |

“Consolidated Total Debt” means with respect to the Trust and its Subsidiaries as of the date of any determination thereof, Consolidated Senior Debt plus consolidated Subordinated Debt.

| (b) | by adding the following paragraph to the end of the definition of “Convertible Debentures”: |

“Notwithstanding the foregoing definition, (1) the Canetic Convertible Debentures as outstanding on the date hereof shall be deemed to be Convertible Debentures for all purposes of this Agreement as long as they continue to have the characteristics listed above, other than the requirement to have an initial maturity date which is later than the Outside Maturity Date, and (2) the Vault Convertible Debentures as outstanding on the date hereof shall be deemed not to be Convertible Debentures for all purposes of this Agreement.”

- 10 -

| (c) | by deleting the definition of “Current Financial Covenant Testing” in its entirety and replacing it with the following: |

“Current Financial Covenant Testing” means, as at any date of determination, a calculation of compliance with the covenants contained in Sections 10.5, 10.6, 10.7 and 10.10 using the amounts of Consolidated Senior Debt, Consolidated Total Debt, Consolidated EBITDA, Consolidated Tangible Assets, Consolidated Total Capitalization, Consolidated Unitholders’ Equity, Priority Debt and Subordinated Debt as at such date (after giving effect to the transaction or transactions that occasioned the requirement for such testing herein).

| (d) | by deleting the definition of “Material Contracts” in its entirety and replacing it with the following: |

“Material Contracts” means the Partnership Agreement and the Canetic LP Partnership Agreement, each as amended, restated, supplemented, modified or replaced from time to time to the date hereof and thereafter as permitted hereby.

| (e) | by deleting the definition of “Subsidiary” in its entirety and replacing it with the following: |

“Subsidiary” means:

(a) as to any Person, any other Person in which such first Person or one or more of its Subsidiaries or such first Person and one or more of its Subsidiaries owns sufficient equity or voting interests to enable it or them (as a group) ordinarily, in the absence of contingencies, to elect a majority of the directors (or Persons performing similar functions) of such second Person, and any trust or partnership if more than a 50% interest in the profits or capital thereof is owned by such first Person or one or more of its Subsidiaries or such first Person and one or more of its Subsidiaries (unless such trust or partnership can and does ordinarily take major business actions without the prior approval of such Person or one or more of its Subsidiaries), and

(b) a Joint Venture Development Entity, unless (in the case of a Joint Venture Development Entity that is owned 50% by the Trust and 50% by an arms’ length party such that both owners have equal voting rights and neither owner controls the entity) excluded from being a Subsidiary under this paragraph (b) by notice in writing by the Company to the holders.

Unless the context otherwise clearly requires, any reference to a “Subsidiary” (including without limitation in the context of a reference to “the Company, the Trust and its Subsidiaries” and similar phrasing) is a reference to a Subsidiary of the Trust.

ARTICLE 3

ADDITIONAL TERMS AND COVENANTS

3.1 Interpretation of Financing Agreements. As and from the time of completion of the Reorganization, the Financing Agreements shall be read and interpreted in a manner that ensures that all

- 11 -

of the obligations of the Trust and its Subsidiaries under the applicable Financing Agreements prior to the implementation of the Reorganization on January 1, 2011 continue as obligations of their respective ultimate successors and assigns following the implementation of the Reorganization on and after January 1, 2011, without interruption. Accordingly, from and after January 1, 2011 all provisions of the Financing Agreements (including the amendments effected hereby) shall be read mutatis mutandis to give effect to the foregoing. Without limiting the generality of the foregoing, from and after January 1, 2011:

| (a) | all references in the Financing Agreements to the Trust shall be interpreted as being references to the Company as a successor entity to the Trust, except in instances where the references to the Trust are superfluous, such as references to “the Company and the Trust”, or “the Company shall cause the Trust” or similar duplicative references, in which case the references to the Trust shall be ignored; |

| (b) | all references to Subsidiaries of the Trust in the Financing Agreements shall be interpreted as being references to Subsidiaries of the Company; |

| (c) | any references to trust units of the Trust in the Financing Agreements shall be interpreted as being references to common shares in the capital of the Company, and any references to unitholders of the Trust shall be interpreted as being references to shareholders of the Company; and |

| (d) | all references to New Issuer in the Financing Agreements shall be interpreted as being references to the Company. |

ARTICLE 4

CONDITIONS PRECEDENT

4.1 Conditions Precedent. This Agreement shall be effective on January 1, 2011 (the “Effective Date”) provided that all of the following conditions have been met:

| (a) | this Agreement shall have been executed and delivered by the Company and the Required Holders; |

| (b) | the Consent and Acknowledgement of Guarantors substantially in the form attached hereto shall have been executed and delivered by the Trust and each Subsidiary Guarantor; |

| (c) | an amendment to the Bank Facility and to each of the other note purchase agreements to which the Company is a party giving effect to the Reorganization and permitting the inclusion of Joint Venture Development Entities as “Subsidiaries” and “Restricted Subsidiaries” (as those terms are defined in the Bank Facility) on substantially the same basis as herein provided, shall have become effective prior to the date of this Agreement or concurrently herewith; |

| (d) | the representations and warranties contained in Article 5 of this Agreement shall be true on and as of the Effective Date; |

| (e) | the Reorganization shall have been completed on the Effective Date as described in the Plan of Arrangement as defined in the Arrangement Agreement dated November 10, 2010 among the Trust, the Company and certain Subsidiaries of the Trust, and in accordance with Section 23.1(b) of the Note Agreement (having regard to the manner in |

- 12 -

| which the Reorganization is being effected); and in particular, the “Company” under the Note Agreement on and after the Effective Date shall be the publicly trading continuing corporation resulting from a statutory amalgamation of the Company with certain other wholly-owned Subsidiaries of the Trust under the Business Corporations Act (Alberta); |

| (f) | all corporate and other proceedings taken or to be taken in connection with the transactions contemplated hereby and all documents incident thereto shall be satisfactory in substance and form to the holders, and the holders shall have received all such counterparts or certified or other copies of such documents as they may reasonably request; |

| (g) | the holders shall have received an opinion of Burnet, Xxxxxxxxx & Xxxxxx LLP, counsel to the Company, dated the Effective Date and satisfactory to the Required Holders, as to the Company, each Restricted Subsidiary that continues as a successor to the Subsidiary Guarantors on the date hereof, the Note Agreement and each Note, as amended by this Agreement, the Subsidiary Guarantees, and as to such other matters as the Required Holders may reasonably request; and |

| (h) | the holders shall have received from Xxxxxxx Xxxxx LLP, who is acting as special counsel for them in connection with this Agreement, a favourable opinion satisfactory to such holders as to such matters incident to the matters contemplated in this Agreement as they may reasonably request. |

The Company agrees to extend the benefit of Section 2.1 to all holders of Notes, effective January 1, 2011, whether or not they are a signatory to this Agreement

ARTICLE 5

REPRESENTATIONS AND WARRANTIES

5.1 Representations, Warranties. To induce the holders to execute and deliver this Agreement, the Company represents, covenants and warrants to each holder (which representations, covenants and warranties shall survive the execution and delivery of this Agreement) that:

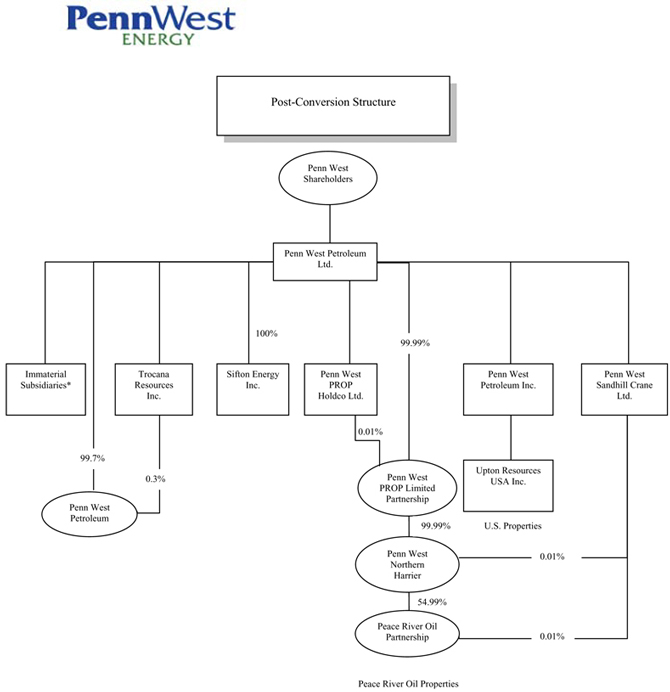

| (a) | Schedule 5.1 contains an organizational chart of the Company and its Subsidiaries as at the Effective Date and a complete and correct list of its Subsidiaries and the Restricted Subsidiaries as at the Effective Date, showing, as to each Subsidiary, the correct name thereof, the jurisdiction of its organization, its predecessor entities in existence as at the date of this Agreement (if applicable), and the percentage of shares of each class of its capital stock or similar equity interests outstanding owned by the Company and each Subsidiary; |

| (b) | all of the outstanding shares of capital stock or similar equity interests of each Restricted Subsidiary shown in Schedule 5.1 as being owned by the Company and its Subsidiaries as at the Effective Date have been validly issued, are fully paid and nonassessable and are owned by the Company or another Subsidiary free and clear of any Lien (except as otherwise disclosed in such Schedule 5.1); |

| (c) | as at the Effective Date each Restricted Subsidiary identified in Schedule 5.1 is a corporation, partnership, trust or other legal entity duly organized, validly existing and, where legally applicable, in good standing under the laws of its jurisdiction of organization, and is duly qualified as a foreign corporation, partnership, trust or other |

- 13 -

| legal entity and, where legally applicable, is in good standing in each jurisdiction in which such qualification is required by law, other than those jurisdictions as to which the failure to be so qualified or in good standing would not, individually or in the aggregate, reasonably be expected to have a Material Adverse Effect. As at the Effective Date each such Restricted Subsidiary has the corporate or other power and authority to own or hold under lease the properties it purports to own or hold under lease and to transact the business it transacts and proposes to transact; |

| (d) | this Agreement and the Consent and Acknowledgement of Guarantors attached hereto have been duly authorized, executed and delivered by each party thereto other than the holders; |

| (e) | the Note Agreement and each Note, as amended by this Agreement, constitutes a legal, valid and binding obligation of the Company, enforceable against it in accordance with its terms; |

| (f) | the execution, delivery and performance of this Agreement (i) are within the corporate powers of the Company; (ii) do not require the authorization, consent or approval of any governmental authority or regulatory body or any agency, department or division of any thereof; (iii) do not and will not (A) contravene or conflict with (1) any law, statute, rule or regulation, (2) any provision of its articles or by-laws, (3) any judgment, order or decree of any court, tribunal or arbitrator, or any public, governmental or regulatory agency, authority or body to which it or any of its material assets is subject, or (4) any term, condition or provision of any indenture, agreement or other instrument to which it, the Trust or its Subsidiaries is a party or by which it, the Trust or any of its Subsidiaries’ properties or assets are or may be bound; or (B) result in a breach of or constitute (alone or with due notice or lapse of time or both) a default under any indenture, agreement or other instrument referred to in clause (iii)(A)(4) of this clause (f); and |

| (g) | no Default or Event of Default has occurred and is continuing or existed immediately prior to the date of this Agreement or the Effective Date, or will exist immediately after. |

ARTICLE 6

MISCELLANEOUS

6.1 Agreement Part of Note Agreement. This Agreement shall be construed in connection with and as part of the Note Agreement, and except as modified and expressly amended by this Agreement, all terms, conditions and covenants contained in the Note Agreement and the Notes are hereby ratified and shall be and remain in full force and effect. For certainty, nothing herein shall be construed as a novation of the Notes or the indebtedness or obligations represented thereby or by the Note Agreement as amended by this Agreement, and the terms of the Notes shall not be and shall not be deemed to be, rescinded, converted or substituted.

6.2 Notices. Any and all notices, certificates and other instruments executed and delivered after the execution and delivery of this Agreement may refer to the Note Amendment without making specific reference to this Agreement but nevertheless all such references shall include this Agreement unless the context otherwise requires.

6.3 Counterparts. This Agreement may be executed in any number of counterparts, and by facsimile and pdf, all of which together shall constitute one instrument.

- 14 -

IN WITNESS WHEREOF the undersigned has caused this Agreement to be executed as of the day and year first above written.

| PENN WEST PETROLEUM LTD. | ||

| Per: | (Signed) “Xxxx Xxxxxxxx” | |

| Xxxx Xxxxxxxx Executive Vice President and Chief Financial Officer | ||

| Per: | (Signed) “Xxxxx Xxxx” | |

| Xxxxx Xxxx General Counsel and Senior Vice President, Stakeholder Relations | ||

Signature Page to

First Amending Agreement

(May 31, 2007 Note Agreement)

- 15 -

The foregoing Agreement is hereby accepted as of the date first above written.

[NOTEHOLDER SIGNATURE PAGES]

Signature Page to

First Amending Agreement

(May 31, 2007 Note Agreement)

CONSENT AND ACKNOWLEDGEMENT OF GUARANTORS

(First Amending Agreement to May 31, 2007 Note Agreement)

The undersigned Guarantors hereby consent to the terms of the above Agreement and the transactions contemplated thereby and confirm that the guarantees and other security documents granted by each of the undersigned to or for the benefit of the holders of Notes are in full force and effect. Without limiting the generality of the foregoing, the undersigned acknowledge that the “Guaranteed Obligations” guaranteed by the undersigned pursuant to the respective guarantees executed by each of the undersigned include, without limitation, all obligations of the Company to the holders of Notes under the Note Agreement as so amended, and all Notes now outstanding or hereafter issued under the Note Agreement. For certainty, each reference to “Note Purchase Agreement” in each such guarantee executed by the undersigned shall include the Note Agreement as defined in this Agreement, as amended by this Agreement, and as hereafter further amended, further restated, or supplemented, modified or replaced from time to time.

Dated as of December 2, 2010.

| TROCANA RESOURCES INC. | ||||||||

| PENN WEST PETROLEUM, by its managing partner, Penn West Petroleum Ltd. | ||||||||

| By: | (Signed) “Xxxxx Xxxx” |

By: | (Signed) “Xxxxx Xxxx” | |||||

| Xxxxx Xxxx | Xxxxx Xxxx | |||||||

| General Counsel and Senior Vice President, Stakeholder Relations | General Counsel and Senior Vice President, Stakeholder Relations | |||||||

| PETROFUND VENTURES TRUST, by its Trustee, Penn West Petroleum Ltd. | PETROFUND ENERGY TRUST, by its Trustee, Penn West Petroleum Ltd. | |||||||

| By: | (Signed) “Xxxx Xxxxxxxx” |

By: | (Signed) “Xxxx Xxxxxxxx” | |||||

| Xxxx Xxxxxxxx | Xxxx Xxxxxxxx | |||||||

| Executive Vice President and Chief Financial Officer | Executive Vice President and Chief Financial Officer | |||||||

| By: | (Signed) “Xxxxx Xxxx” |

By: | (Signed) “Xxxxx Xxxx” | |||||

| Xxxxx Xxxx | Xxxxx Xxxx | |||||||

| General Counsel and Senior Vice President, Stakeholder Relations | General Counsel and Senior Vice President, Stakeholder Relations | |||||||

Signature Page to

Consent and Acknowledgement of Guarantors for First Amending Agreement

(May 31, 2007 Note Agreement)

| CANETIC ABC COMMERCIAL TRUST, by its Trustee, Penn West Petroleum Ltd. | PENN WEST PROP LIMITED PARTNERSHIP, by its general partner, Penn West Petroleum Ltd. | |||||||

| By: | (Signed) “Xxxx Xxxxxxxx” |

By: | (Signed) “Xxxx Xxxxxxxx” | |||||

| Xxxx Xxxxxxxx | Xxxx Xxxxxxxx | |||||||

| Executive Vice President and Chief Financial Officer | Executive Vice President and Chief Financial Officer | |||||||

| By: | (Signed) “Xxxxx Xxxx” |

By: | (Signed) “Xxxxx Xxxx” | |||||

| Xxxxx Xxxx | Xxxxx Xxxx | |||||||

| General Counsel and Senior Vice President, Stakeholder Relations | General Counsel and Senior Vice President, Stakeholder Relations | |||||||

| CANETIC SASKATCHEWAN TRUST, by its Trustee, Penn West Petroleum Ltd. | PENN WEST ENERGY TRUST, by its Administrator, Penn West Petroleum Ltd. | |||||||

| By: | (Signed) “Xxxx Xxxxxxxx” |

By: | (Signed) “Xxxx Xxxxxxxx” | |||||

| Xxxx Xxxxxxxx | Xxxx Xxxxxxxx | |||||||

| Executive Vice President and Chief Financial Officer | Executive Vice President and Chief Financial Officer | |||||||

| By: | (Signed) “Xxxxx Xxxx” |

By: | (Signed) “Xxxxx Xxxx” | |||||

| Xxxxx Xxxx | Xxxxx Xxxx | |||||||

| General Counsel and Senior Vice President, Stakeholder Relations | General Counsel and Senior Vice President, Stakeholder Relations | |||||||

- 2 -

| PENN WEST PROP HOLDCO LTD. | ||

| By: | (Signed) “Xxxx Xxxxxxxx” | |

| Xxxx Xxxxxxxx | ||

| Executive Vice President and Chief Financial Officer | ||

| By: | (Signed) “Xxxxx Xxxx” | |

| Xxxxx Xxxx | ||

| General Counsel and Senior Vice President, Stakeholder Relations | ||

Signature Page to

Consent and Acknowledgement of Guarantors for First Amending Agreement

(May 31, 2007 Note Agreement)

- 3 -

EXHIBIT 1 TO FIRST AMENDING AGREEMENT

OPERATING JV DEVELOPMENT ENTITIES

| Name of |

Partners | Penn West Percentage Ownership |

Restricted or Unrestricted? |

Capital Contributions |

Penn West Proportion in respect of each Joint Venture Development Entity: | |||||||||||||||||||||||||||||||||||

| Consolidated Total Debt |

Consolidated Senior Debt |

Consolidated EBITDA |

Unitholders’ Equity |

Consolidated Tangible Net Worth |

Consolidated Tangible Assets |

|||||||||||||||||||||||||||||||||||

| Total: |

|

|||||||||||||||||||||||||||||||||||||||

SCHEDULE 5.1 TO FIRST AMENDING AGREEMENT

Penn West Petroleum and Subsidiaries

| Jurisdiction of |

Designation |

|||||

| Penn West Petroleum Ltd., successor to the assets of Petrofund Ventures Trust, Petrofund Energy Trust, Canetic ABC Commercial Trust and Canetic Saskatchewan Trust, |

Alberta | n/a | Public | |||

| 1262814 Alberta ULC |

Alberta | Restricted | 100% owned by Canetic ABC AcquisitionCo Ltd. | |||

| 1290775 Alberta ULC |

Alberta | Restricted | 100% owned by Penn West Petroleum Ltd. | |||

| 1295739 Alberta Ltd. |

Alberta | Restricted | 100% owned by Penn West Petroleum Ltd. | |||

| 1329813 Alberta Ltd. |

Alberta | Restricted | 100% owned by Penn West Petroleum Ltd. | |||

| 000000 Xxxxxxx Ltd. |

Alberta | Restricted | 100% owned by Penn West Petroleum Ltd. | |||

| Canetic ABC AcquisitionCo Ltd. |

Alberta | Restricted | 100% owned by Canetic ABC Holdings Ltd | |||

| Canetic ABC Holdings Ltd. |

Alberta | Restricted | 100% owned by Penn West Petroleum Ltd. | |||

| Canetic Tech Holdco Inc. |

Alberta | Restricted | 100% owned by Penn West Petroleum Ltd. | |||

| Peace River Oil Partnership |

Alberta | Restricted | General partner interests owned by Penn West Northern Harrier Partnership (54.99%), Penn West Sandhill Crane Ltd. (0.01%) and an unrelated third party (45.00%) | |||

| Penn West Northern Harrier Partnership |

Alberta | Restricted | General partner interests owned by Penn West PROP Limited Partnership (99.99%) and Penn West Sandhill Crane Ltd. (0.01%) | |||

| Name |

Jurisdiction of |

Designation |

Ownership | |||

| Penn West Petroleum Inc. |

Delaware | Restricted | 100% owned by Penn West Petroleum Ltd. | |||

| Penn West Petroleum |

Alberta | Restricted | General partner interests owned by Penn West Petroleum Ltd. (99.97%), and Trocana Resources Inc. (0.03%) | |||

| Penn West PROP HoldCo Ltd. |

Alberta | Restricted | 100% owned by Penn West Petroleum Ltd. | |||

| Penn West PROP Limited Partnership |

Alberta | Restricted | 99.99% limited partner interest owned by Penn West Petroleum Ltd. 0.01% general partner interest owned by Penn West PROP Holdco Ltd. | |||

| Penn West Reece Acquisition Ltd. |

Alberta | Restricted | 100% owned by Penn West Petroleum Ltd. | |||

| Penn West Sandhill Crane Ltd. |

Alberta | Restricted | 100% owned by Penn West Petroleum Ltd. | |||

| Trocana Resources Inc. |

Alberta | Restricted | 100% owned by Penn West Petroleum Ltd. | |||

| Upton Resources USA Inc. |

Montana | Restricted | 100% owned by Penn West Petroleum Inc. | |||

| Sifton Energy Inc. |

Alberta | Restricted | 100% owned by Penn West Petroleum Ltd. | |||

List of Unrestricted Subsidiaries as of the Conversion Date

NIL

| * | Immaterial Subsidiaries include Penn West Reece Acquisition Ltd., Canetic Tech HoldCo Inc., 977291 Alberta Ltd., 1329813 Alberta Ltd., 1295739 Alberta Ltd., 1290775 Alberta ULC, Canetic ABC Holdings Ltd., Canetic ABC AcquisitionCo Ltd. and 1262814 Alberta ULC. |